UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3785

Fidelity Advisor Series I

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

|

Date of fiscal year end: |

October 31 |

|

|

|

|

Date of reporting period: |

April 30, 2015 |

Item 1. Reports to Stockholders

(Fidelity Investment logo)(registered trademark)

Value

Fund - Class A, Class T, Class B

and Class C

Semiannual Report

April 30, 2015

(Fidelity Cover Art)

Contents

|

Shareholder Expense Example |

An example of shareholder expenses. |

|

|

Investment Changes |

A summary of major shifts in the fund's investments over the past six months. |

|

|

Investments |

A complete list of the fund's investments with their market values. |

|

|

Financial Statements |

Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

|

|

Notes |

Notes to the financial statements. |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2015 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2014 to April 30, 2015).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Semiannual Report

Shareholder Expense Example - continued

|

|

Annualized |

Beginning |

Ending |

Expenses Paid |

|

Class A |

1.25% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,057.70 |

$ 6.38 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,018.60 |

$ 6.26 |

|

Class T |

1.50% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,055.90 |

$ 7.65 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,017.36 |

$ 7.50 |

|

Class B |

2.00% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,053.80 |

$ 10.18 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,014.88 |

$ 9.99 |

|

Class C |

2.00% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,053.50 |

$ 10.18 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,014.88 |

$ 9.99 |

|

Institutional Class |

1.00% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,058.80 |

$ 5.10 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,019.84 |

$ 5.01 |

A 5% return per year before expenses

B Annualized expense ratio reflects expenses net of applicable fee waivers.

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Semiannual Report

Investment Changes (Unaudited)

|

Top Ten Stocks as of April 30, 2015 |

||

|

|

% of fund's |

% of fund's net assets |

|

Sempra Energy |

1.5 |

1.6 |

|

Edison International |

1.4 |

1.5 |

|

NiSource, Inc. |

1.4 |

1.3 |

|

PPL Corp. |

1.3 |

1.3 |

|

AECOM Technology Corp. |

1.2 |

1.4 |

|

Broadcom Corp. Class A |

1.2 |

1.2 |

|

Capital One Financial Corp. |

1.1 |

0.7 |

|

Rock-Tenn Co. Class A |

0.9 |

0.6 |

|

QUALCOMM, Inc. |

0.9 |

0.3 |

|

Jazz Pharmaceuticals PLC |

0.9 |

0.9 |

|

|

11.8 |

|

|

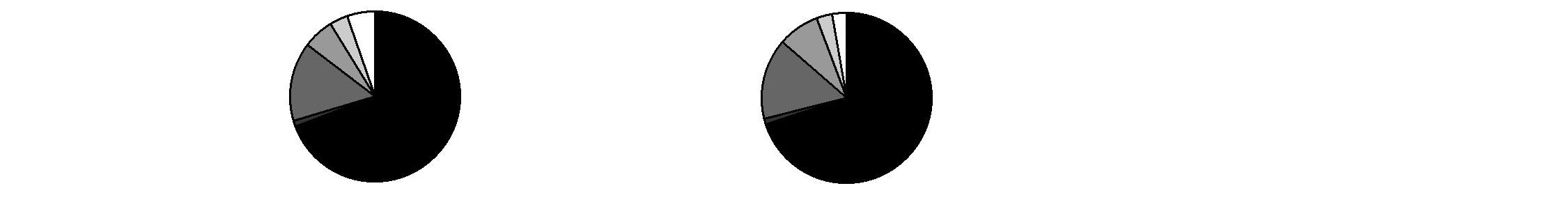

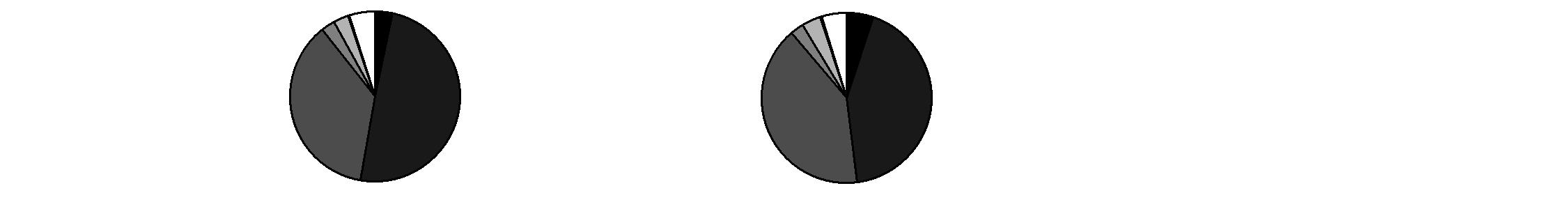

Top Five Market Sectors as of April 30, 2015 |

||

|

|

% of fund's |

% of fund's net assets |

|

Financials |

28.7 |

28.8 |

|

Information Technology |

12.0 |

12.6 |

|

Consumer Discretionary |

11.9 |

12.0 |

|

Industrials |

11.7 |

10.0 |

|

Utilities |

9.3 |

9.8 |

|

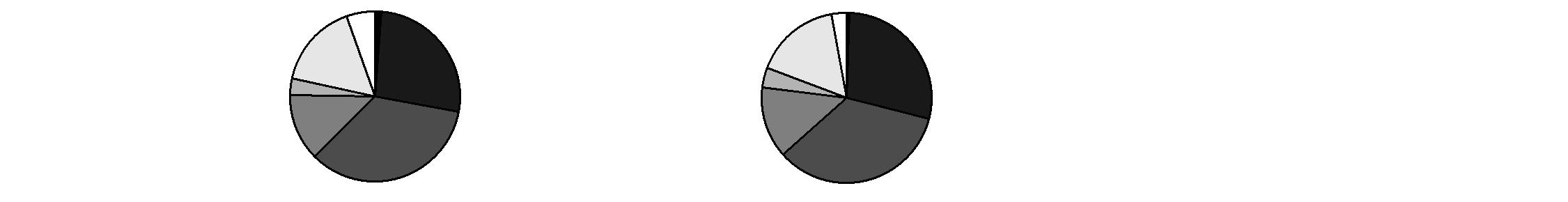

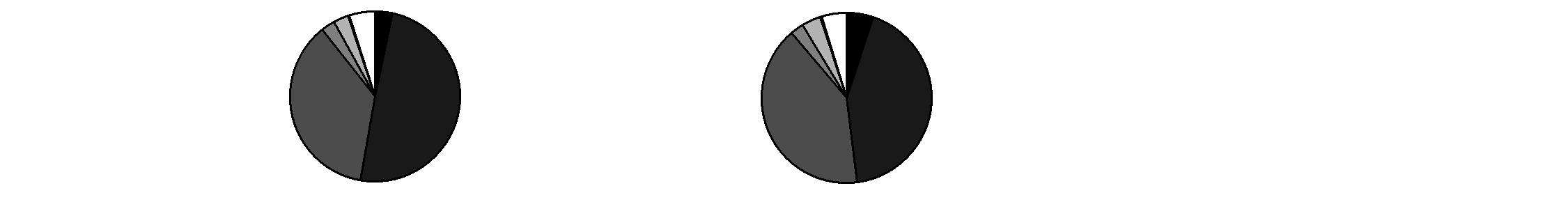

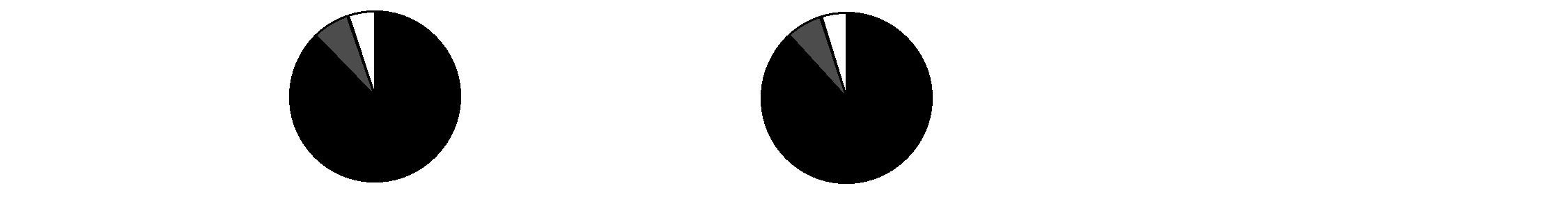

Asset Allocation (% of fund's net assets) |

|||||||

|

As of April 30, 2015* |

As of October 31, 2014** |

||||||

|

Stocks and |

|

|

Stocks and |

|

||

|

Other Investments 0.1% |

|

|

Other Investments 0.2% |

|

||

|

Short-Term |

|

|

Short-Term |

|

||

|

* Foreign investments |

17.9% |

|

** Foreign investments |

18.8% |

|

||

Semiannual Report

Investments April 30, 2015 (Unaudited)

Showing Percentage of Net Assets

|

Common Stocks - 96.1% |

|||

|

Shares |

Value |

||

|

CONSUMER DISCRETIONARY - 11.9% |

|||

|

Auto Components - 2.1% |

|||

|

Delphi Automotive PLC |

3,613 |

$ 299,879 |

|

|

Tenneco, Inc. (a) |

4,500 |

263,025 |

|

|

The Goodyear Tire & Rubber Co. |

25,240 |

715,933 |

|

|

Visteon Corp. (a) |

8,633 |

875,386 |

|

|

|

2,154,223 |

||

|

Automobiles - 0.3% |

|||

|

Harley-Davidson, Inc. |

5,900 |

331,639 |

|

|

Diversified Consumer Services - 1.4% |

|||

|

H&R Block, Inc. |

10,412 |

314,859 |

|

|

Houghton Mifflin Harcourt Co. (a) |

40,278 |

920,755 |

|

|

Service Corp. International |

7,428 |

205,607 |

|

|

|

1,441,221 |

||

|

Hotels, Restaurants & Leisure - 0.3% |

|||

|

DineEquity, Inc. |

2,700 |

260,361 |

|

|

Wyndham Worldwide Corp. |

500 |

42,700 |

|

|

|

303,061 |

||

|

Household Durables - 2.0% |

|||

|

Helen of Troy Ltd. (a) |

3,175 |

278,162 |

|

|

Jarden Corp. (a) |

11,938 |

610,987 |

|

|

KB Home (d) |

23,621 |

342,268 |

|

|

Qingdao Haier Co. Ltd. |

35,200 |

153,845 |

|

|

Whirlpool Corp. |

3,740 |

656,744 |

|

|

|

2,042,006 |

||

|

Leisure Products - 1.0% |

|||

|

Mattel, Inc. |

15,890 |

447,462 |

|

|

Vista Outdoor, Inc. (a) |

12,700 |

555,752 |

|

|

|

1,003,214 |

||

|

Media - 1.9% |

|||

|

Liberty Broadband Corp. Class C (a) |

5,608 |

304,290 |

|

|

Live Nation Entertainment, Inc. (a) |

34,903 |

874,669 |

|

|

Omnicom Group, Inc. |

4,650 |

352,284 |

|

|

Sinclair Broadcast Group, Inc. Class A |

8,330 |

255,231 |

|

|

Starz Series A (a) |

3,000 |

117,990 |

|

|

|

1,904,464 |

||

|

Multiline Retail - 0.6% |

|||

|

Kohl's Corp. |

8,135 |

582,873 |

|

|

Specialty Retail - 1.6% |

|||

|

Advance Auto Parts, Inc. |

2,092 |

299,156 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

CONSUMER DISCRETIONARY - continued |

|||

|

Specialty Retail - continued |

|||

|

AutoZone, Inc. (a) |

551 |

$ 370,636 |

|

|

Chico's FAS, Inc. |

22,007 |

371,038 |

|

|

GameStop Corp. Class A |

7,700 |

296,758 |

|

|

The Men's Wearhouse, Inc. |

5,886 |

333,089 |

|

|

|

1,670,677 |

||

|

Textiles, Apparel & Luxury Goods - 0.7% |

|||

|

Fossil Group, Inc. (a) |

3,226 |

270,919 |

|

|

Gildan Activewear, Inc. |

9,000 |

285,255 |

|

|

Japan Tobacco, Inc. |

5,200 |

181,588 |

|

|

|

737,762 |

||

|

TOTAL CONSUMER DISCRETIONARY |

12,171,140 |

||

|

CONSUMER STAPLES - 3.1% |

|||

|

Beverages - 0.9% |

|||

|

C&C Group PLC |

55,677 |

225,608 |

|

|

Coca-Cola Enterprises, Inc. |

1,988 |

88,287 |

|

|

Cott Corp. |

38,046 |

331,381 |

|

|

Molson Coors Brewing Co. Class B |

3,375 |

248,096 |

|

|

|

893,372 |

||

|

Food Products - 1.6% |

|||

|

Bunge Ltd. |

4,747 |

409,998 |

|

|

ConAgra Foods, Inc. |

5,500 |

198,825 |

|

|

Darling International, Inc. (a) |

18,000 |

245,880 |

|

|

Dean Foods Co. |

10,870 |

176,638 |

|

|

Greencore Group PLC |

41,284 |

224,031 |

|

|

The J.M. Smucker Co. |

3,480 |

403,402 |

|

|

|

1,658,774 |

||

|

Household Products - 0.2% |

|||

|

Svenska Cellulosa AB (SCA) (B Shares) |

6,700 |

169,476 |

|

|

Personal Products - 0.4% |

|||

|

Coty, Inc. Class A |

7,278 |

174,017 |

|

|

Nu Skin Enterprises, Inc. Class A |

5,000 |

282,750 |

|

|

|

456,767 |

||

|

TOTAL CONSUMER STAPLES |

3,178,389 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

ENERGY - 5.3% |

|||

|

Energy Equipment & Services - 1.2% |

|||

|

BW Offshore Ltd. |

107,145 |

$ 79,823 |

|

|

Dril-Quip, Inc. (a) |

4,500 |

358,740 |

|

|

FMC Technologies, Inc. (a) |

3,270 |

144,207 |

|

|

Halliburton Co. |

4,158 |

203,534 |

|

|

Odfjell Drilling A/S |

28,835 |

25,668 |

|

|

Rowan Companies PLC |

6,763 |

143,308 |

|

|

SBM Offshore NV (a)(d) |

20,700 |

267,317 |

|

|

|

1,222,597 |

||

|

Oil, Gas & Consumable Fuels - 4.1% |

|||

|

Boardwalk Pipeline Partners, LP |

14,200 |

248,642 |

|

|

Cobalt International Energy, Inc. (a) |

28,100 |

300,670 |

|

|

Energen Corp. |

3,499 |

249,024 |

|

|

Energy XXI (Bermuda) Ltd. (d) |

18,400 |

80,408 |

|

|

EQT Corp. |

1,710 |

153,797 |

|

|

Golar LNG Ltd. |

6,900 |

248,366 |

|

|

Imperial Oil Ltd. |

4,200 |

185,127 |

|

|

Kinder Morgan, Inc. |

5,580 |

239,661 |

|

|

Marathon Petroleum Corp. |

1,892 |

186,494 |

|

|

Markwest Energy Partners LP |

3,600 |

242,856 |

|

|

Newfield Exploration Co. (a) |

10,157 |

398,561 |

|

|

Northern Oil & Gas, Inc. (a)(d) |

12,009 |

106,160 |

|

|

Scorpio Tankers, Inc. |

14,955 |

139,680 |

|

|

Stone Energy Corp. (a) |

20,890 |

356,592 |

|

|

Tesoro Corp. |

5,508 |

472,752 |

|

|

Whiting Petroleum Corp. (a) |

14,828 |

562,129 |

|

|

|

4,170,919 |

||

|

TOTAL ENERGY |

5,393,516 |

||

|

FINANCIALS - 28.5% |

|||

|

Banks - 6.0% |

|||

|

Bank of Ireland (a) |

212,097 |

81,157 |

|

|

Barclays PLC sponsored ADR |

15,825 |

249,086 |

|

|

BOK Financial Corp. |

400 |

26,076 |

|

|

CIT Group, Inc. |

12,454 |

560,804 |

|

|

Citigroup, Inc. |

5,812 |

309,896 |

|

|

EFG Eurobank Ergasias SA (a) |

811,600 |

123,550 |

|

|

First Citizen Bancshares, Inc. (a) |

2,787 |

669,828 |

|

|

First Niagara Financial Group, Inc. |

39,680 |

360,890 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

FINANCIALS - continued |

|||

|

Banks - continued |

|||

|

Hilltop Holdings, Inc. (a) |

12,274 |

$ 246,830 |

|

|

Investors Bancorp, Inc. |

23,370 |

276,701 |

|

|

JPMorgan Chase & Co. |

10,969 |

693,899 |

|

|

M&T Bank Corp. |

3,079 |

368,464 |

|

|

PNC Financial Services Group, Inc. |

4,011 |

367,929 |

|

|

Prosperity Bancshares, Inc. |

4,800 |

256,032 |

|

|

Regions Financial Corp. |

3,600 |

35,388 |

|

|

TSB Banking Group PLC |

26,100 |

133,894 |

|

|

U.S. Bancorp |

18,579 |

796,482 |

|

|

Wells Fargo & Co. |

7,429 |

409,338 |

|

|

Zions Bancorporation |

4,600 |

130,341 |

|

|

|

6,096,585 |

||

|

Capital Markets - 4.7% |

|||

|

American Capital Ltd. (a) |

8,130 |

122,682 |

|

|

Ameriprise Financial, Inc. |

1,472 |

184,412 |

|

|

Apollo Global Management LLC Class A |

10,978 |

250,957 |

|

|

Ares Capital Corp. |

21,988 |

374,236 |

|

|

Artisan Partners Asset Management, Inc. |

5,100 |

228,429 |

|

|

E*TRADE Financial Corp. (a) |

16,759 |

482,492 |

|

|

Fortress Investment Group LLC |

29,972 |

243,373 |

|

|

Franklin Resources, Inc. |

4,100 |

211,396 |

|

|

Invesco Ltd. |

20,380 |

844,140 |

|

|

Julius Baer Group Ltd. |

2,740 |

143,414 |

|

|

KKR & Co. LP |

16,212 |

364,932 |

|

|

NorthStar Asset Management Group, Inc. |

11,295 |

237,534 |

|

|

The Blackstone Group LP |

13,414 |

549,437 |

|

|

UBS Group AG |

13,768 |

275,048 |

|

|

Virtus Investment Partners, Inc. |

1,700 |

227,154 |

|

|

|

4,739,636 |

||

|

Consumer Finance - 2.5% |

|||

|

Capital One Financial Corp. |

13,306 |

1,075,790 |

|

|

Discover Financial Services |

6,600 |

382,602 |

|

|

Navient Corp. |

37,677 |

736,209 |

|

|

Springleaf Holdings, Inc. (a) |

7,790 |

389,500 |

|

|

|

2,584,101 |

||

|

Diversified Financial Services - 1.4% |

|||

|

Berkshire Hathaway, Inc. Class B (a) |

6,558 |

926,055 |

|

|

Cerved Information Solutions SpA |

16,325 |

118,443 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

FINANCIALS - continued |

|||

|

Diversified Financial Services - continued |

|||

|

Element Financial Corp. (a) |

11,700 |

$ 167,766 |

|

|

The NASDAQ OMX Group, Inc. |

5,022 |

244,220 |

|

|

|

1,456,484 |

||

|

Insurance - 5.7% |

|||

|

ACE Ltd. |

4,500 |

481,455 |

|

|

AFLAC, Inc. |

5,438 |

342,812 |

|

|

Allied World Assurance Co. |

5,321 |

218,906 |

|

|

Allstate Corp. |

5,658 |

394,136 |

|

|

AMBAC Financial Group, Inc. (a) |

19,801 |

455,621 |

|

|

Brown & Brown, Inc. |

12,800 |

408,960 |

|

|

Greenlight Capital Re, Ltd. (a) |

6,627 |

201,395 |

|

|

Intact Financial Corp. |

3,434 |

264,502 |

|

|

Old Republic International Corp. |

20,611 |

315,142 |

|

|

Principal Financial Group, Inc. |

8,200 |

419,184 |

|

|

ProAssurance Corp. |

5,413 |

243,314 |

|

|

Progressive Corp. |

5,360 |

142,898 |

|

|

Prudential PLC |

11,148 |

277,558 |

|

|

Reinsurance Group of America, Inc. |

6,027 |

552,194 |

|

|

StanCorp Financial Group, Inc. |

3,898 |

280,968 |

|

|

The Chubb Corp. |

500 |

49,175 |

|

|

Third Point Reinsurance Ltd. (a) |

4,108 |

55,376 |

|

|

Torchmark Corp. |

7,188 |

403,319 |

|

|

Validus Holdings Ltd. |

8,376 |

350,368 |

|

|

|

5,857,283 |

||

|

Real Estate Investment Trusts - 6.3% |

|||

|

Alexandria Real Estate Equities, Inc. |

4,931 |

455,526 |

|

|

American Capital Agency Corp. |

21,126 |

435,935 |

|

|

American Realty Capital Properties, Inc. |

39,800 |

359,394 |

|

|

American Tower Corp. |

5,536 |

523,318 |

|

|

Annaly Capital Management, Inc. |

7,900 |

79,553 |

|

|

Brandywine Realty Trust (SBI) |

1,950 |

28,431 |

|

|

Douglas Emmett, Inc. |

4,600 |

131,100 |

|

|

Equity Commonwealth (a) |

1,800 |

45,378 |

|

|

Equity Lifestyle Properties, Inc. |

13,252 |

699,971 |

|

|

Eurobank Properties Real Estate Investment Co. |

50,742 |

403,288 |

|

|

Extra Space Storage, Inc. |

8,391 |

553,219 |

|

|

iStar Financial, Inc. (a)(d) |

24,025 |

325,299 |

|

|

Lamar Advertising Co. Class A |

9,246 |

535,898 |

|

|

MFA Financial, Inc. |

25,860 |

200,932 |

|

|

NorthStar Realty Finance Corp. |

22,005 |

412,814 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

FINANCIALS - continued |

|||

|

Real Estate Investment Trusts - continued |

|||

|

Sun Communities, Inc. |

10,113 |

$ 627,613 |

|

|

WP Glimcher, Inc. |

41,730 |

625,950 |

|

|

|

6,443,619 |

||

|

Real Estate Management & Development - 1.6% |

|||

|

Brookfield Asset Management, Inc. Class A |

2,700 |

145,395 |

|

|

Forest City Enterprises, Inc. Class A (a) |

28,635 |

680,368 |

|

|

Kennedy Wilson Europe Real Estate PLC |

12,391 |

211,582 |

|

|

Kennedy-Wilson Holdings, Inc. (a) |

12,086 |

299,491 |

|

|

Realogy Holdings Corp. (a) |

6,100 |

289,201 |

|

|

|

1,626,037 |

||

|

Thrifts & Mortgage Finance - 0.3% |

|||

|

TFS Financial Corp. |

17,700 |

258,774 |

|

|

TOTAL FINANCIALS |

29,062,519 |

||

|

HEALTH CARE - 6.8% |

|||

|

Biotechnology - 0.3% |

|||

|

AMAG Pharmaceuticals, Inc. (a) |

3,300 |

168,201 |

|

|

United Therapeutics Corp. (a) |

800 |

127,752 |

|

|

|

295,953 |

||

|

Health Care Equipment & Supplies - 1.1% |

|||

|

Boston Scientific Corp. (a) |

24,462 |

435,913 |

|

|

DENTSPLY International, Inc. |

2,156 |

109,956 |

|

|

St. Jude Medical, Inc. |

2,000 |

140,100 |

|

|

The Cooper Companies, Inc. |

600 |

106,842 |

|

|

Zimmer Holdings, Inc. |

2,500 |

274,600 |

|

|

|

1,067,411 |

||

|

Health Care Providers & Services - 2.5% |

|||

|

Accretive Health, Inc. (a) |

12,827 |

72,088 |

|

|

Cardinal Health, Inc. |

5,088 |

429,122 |

|

|

Cigna Corp. |

3,600 |

448,704 |

|

|

Community Health Systems, Inc. (a) |

5,207 |

279,512 |

|

|

Express Scripts Holding Co. (a) |

2,500 |

216,000 |

|

|

HCA Holdings, Inc. (a) |

5,234 |

387,368 |

|

|

Humana, Inc. |

2,100 |

347,760 |

|

|

Laboratory Corp. of America Holdings (a) |

1,200 |

143,472 |

|

|

Omnicare, Inc. |

1,100 |

96,778 |

|

|

Universal Health Services, Inc. Class B |

1,400 |

163,730 |

|

|

|

2,584,534 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

HEALTH CARE - continued |

|||

|

Health Care Technology - 0.3% |

|||

|

CompuGroup Medical AG |

11,205 |

$ 320,281 |

|

|

Life Sciences Tools & Services - 0.2% |

|||

|

Agilent Technologies, Inc. |

4,945 |

204,575 |

|

|

Pharmaceuticals - 2.4% |

|||

|

Actavis PLC (a) |

400 |

113,144 |

|

|

Cardiome Pharma Corp. (a) |

5,942 |

49,497 |

|

|

Jazz Pharmaceuticals PLC (a) |

5,233 |

935,137 |

|

|

Mallinckrodt PLC (a) |

1,100 |

124,498 |

|

|

Perrigo Co. PLC |

1,500 |

274,920 |

|

|

Teva Pharmaceutical Industries Ltd. sponsored ADR |

7,083 |

427,955 |

|

|

The Medicines Company (a) |

10,759 |

275,538 |

|

|

Theravance, Inc. |

14,170 |

230,263 |

|

|

|

2,430,952 |

||

|

TOTAL HEALTH CARE |

6,903,706 |

||

|

INDUSTRIALS - 11.7% |

|||

|

Aerospace & Defense - 2.4% |

|||

|

Aerojet Rocketdyne Holdings, Inc. (a)(d) |

25,469 |

500,721 |

|

|

Curtiss-Wright Corp. |

9,470 |

691,878 |

|

|

L-3 Communications Holdings, Inc. |

3,337 |

383,455 |

|

|

Meggitt PLC |

28,600 |

231,127 |

|

|

Orbital ATK, Inc. |

4,800 |

351,168 |

|

|

Textron, Inc. |

7,218 |

317,448 |

|

|

|

2,475,797 |

||

|

Air Freight & Logistics - 0.8% |

|||

|

FedEx Corp. |

2,380 |

403,577 |

|

|

Hub Group, Inc. Class A (a) |

6,733 |

268,647 |

|

|

UTi Worldwide, Inc. (a) |

11,708 |

105,723 |

|

|

|

777,947 |

||

|

Airlines - 0.2% |

|||

|

American Airlines Group, Inc. |

5,200 |

251,082 |

|

|

Building Products - 0.6% |

|||

|

Allegion PLC |

10,578 |

646,845 |

|

|

Commercial Services & Supplies - 0.7% |

|||

|

ADT Corp. (d) |

10,449 |

392,882 |

|

|

Regus PLC |

72,600 |

277,283 |

|

|

West Corp. |

269 |

8,326 |

|

|

|

678,491 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

INDUSTRIALS - continued |

|||

|

Construction & Engineering - 1.8% |

|||

|

AECOM Technology Corp. (a) |

39,162 |

$ 1,235,943 |

|

|

Astaldi SpA |

26,338 |

228,969 |

|

|

Jacobs Engineering Group, Inc. (a) |

8,100 |

347,166 |

|

|

|

1,812,078 |

||

|

Electrical Equipment - 1.3% |

|||

|

Babcock & Wilcox Co. |

14,361 |

464,148 |

|

|

EnerSys |

3,400 |

230,860 |

|

|

OSRAM Licht AG |

4,421 |

232,915 |

|

|

Regal Beloit Corp. |

5,300 |

414,460 |

|

|

|

1,342,383 |

||

|

Machinery - 1.9% |

|||

|

AGCO Corp. |

8,000 |

412,080 |

|

|

Deere & Co. |

3,370 |

305,052 |

|

|

Manitowoc Co., Inc. |

13,613 |

268,584 |

|

|

Melrose PLC |

52,072 |

211,308 |

|

|

Sulzer AG (Reg.) |

2,050 |

228,756 |

|

|

TriMas Corp. (a) |

5,682 |

160,062 |

|

|

Valmet Corp. |

2,951 |

34,200 |

|

|

Valmont Industries, Inc. |

2,192 |

276,236 |

|

|

|

1,896,278 |

||

|

Marine - 0.0% |

|||

|

Ultrapetrol (Bahamas) Ltd. (a) |

37,800 |

46,872 |

|

|

Road & Rail - 0.6% |

|||

|

CSX Corp. |

6,800 |

245,412 |

|

|

Daqin Railway Co. Ltd. (A Shares) |

102,400 |

230,626 |

|

|

TransForce, Inc. |

5,864 |

132,444 |

|

|

|

608,482 |

||

|

Trading Companies & Distributors - 1.4% |

|||

|

AerCap Holdings NV (a) |

13,995 |

653,287 |

|

|

MRC Global, Inc. (a) |

23,769 |

347,027 |

|

|

Noble Group Ltd. |

209,900 |

137,215 |

|

|

WESCO International, Inc. (a) |

3,606 |

260,137 |

|

|

|

1,397,666 |

||

|

TOTAL INDUSTRIALS |

11,933,921 |

||

|

INFORMATION TECHNOLOGY - 12.0% |

|||

|

Communications Equipment - 1.5% |

|||

|

Harris Corp. |

2,800 |

224,672 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

INFORMATION TECHNOLOGY - continued |

|||

|

Communications Equipment - continued |

|||

|

Plantronics, Inc. |

6,175 |

$ 328,942 |

|

|

QUALCOMM, Inc. |

13,905 |

945,540 |

|

|

|

1,499,154 |

||

|

Electronic Equipment & Components - 1.7% |

|||

|

Ingram Micro, Inc. Class A (a) |

27,803 |

699,523 |

|

|

Jabil Circuit, Inc. |

13,595 |

306,159 |

|

|

SYNNEX Corp. |

700 |

53,550 |

|

|

TE Connectivity Ltd. |

5,265 |

350,386 |

|

|

TTM Technologies, Inc. (a) |

39,781 |

371,952 |

|

|

|

1,781,570 |

||

|

Internet Software & Services - 0.3% |

|||

|

Google, Inc. Class C (a) |

501 |

269,207 |

|

|

IT Services - 1.5% |

|||

|

CGI Group, Inc. Class A (sub. vtg.) (a) |

2,831 |

119,153 |

|

|

EVERTEC, Inc. |

10,700 |

221,811 |

|

|

Global Payments, Inc. |

2,641 |

264,839 |

|

|

Leidos Holdings, Inc. |

5,600 |

233,184 |

|

|

Total System Services, Inc. |

8,947 |

353,943 |

|

|

Unisys Corp. (a) |

15,285 |

332,754 |

|

|

|

1,525,684 |

||

|

Semiconductors & Semiconductor Equipment - 2.3% |

|||

|

Broadcom Corp. Class A |

27,032 |

1,194,950 |

|

|

MagnaChip Semiconductor Corp. (a) |

7,700 |

42,196 |

|

|

Marvell Technology Group Ltd. |

34,000 |

476,340 |

|

|

Maxim Integrated Products, Inc. |

5,800 |

190,414 |

|

|

PMC-Sierra, Inc. (a) |

23,973 |

202,092 |

|

|

Teradyne, Inc. |

13,200 |

240,900 |

|

|

|

2,346,892 |

||

|

Software - 3.0% |

|||

|

Activision Blizzard, Inc. |

13,872 |

316,490 |

|

|

Cadence Design Systems, Inc. (a) |

18,600 |

346,890 |

|

|

Comverse, Inc. (a) |

3,963 |

97,094 |

|

|

Constellation Software, Inc. |

309 |

121,141 |

|

|

Constellation Software, Inc. rights 9/15/15 (a) |

31 |

9 |

|

|

Interactive Intelligence Group, Inc. (a)(d) |

6,000 |

263,880 |

|

|

Oracle Corp. |

12,789 |

557,856 |

|

|

Parametric Technology Corp. (a) |

9,800 |

375,732 |

|

|

Progress Software Corp. (a) |

3,600 |

95,040 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

INFORMATION TECHNOLOGY - continued |

|||

|

Software - continued |

|||

|

Symantec Corp. |

21,735 |

$ 541,745 |

|

|

Synopsys, Inc. (a) |

8,300 |

389,104 |

|

|

|

3,104,981 |

||

|

Technology Hardware, Storage & Peripherals - 1.7% |

|||

|

EMC Corp. |

7,966 |

214,365 |

|

|

NCR Corp. (a) |

23,703 |

650,410 |

|

|

Samsung Electronics Co. Ltd. |

530 |

693,801 |

|

|

Western Digital Corp. |

2,100 |

205,254 |

|

|

|

1,763,830 |

||

|

TOTAL INFORMATION TECHNOLOGY |

12,291,318 |

||

|

MATERIALS - 7.2% |

|||

|

Chemicals - 4.4% |

|||

|

Agrium, Inc. |

7,122 |

737,878 |

|

|

Airgas, Inc. |

2,183 |

221,094 |

|

|

Ashland, Inc. |

2,486 |

314,131 |

|

|

Axalta Coating Systems |

7,700 |

236,236 |

|

|

Axiall Corp. |

4,406 |

179,765 |

|

|

Cabot Corp. |

3,150 |

134,631 |

|

|

CF Industries Holdings, Inc. |

2,200 |

632,434 |

|

|

Cytec Industries, Inc. |

5,056 |

279,546 |

|

|

Eastman Chemical Co. |

6,924 |

527,747 |

|

|

LyondellBasell Industries NV Class A |

1,820 |

188,406 |

|

|

Methanex Corp. |

12,604 |

758,538 |

|

|

Sociedad Quimica y Minera de Chile SA (PN-B) sponsored ADR |

6,900 |

150,696 |

|

|

Tronox Ltd. Class A |

8,700 |

182,265 |

|

|

|

4,543,367 |

||

|

Containers & Packaging - 1.5% |

|||

|

Avery Dennison Corp. |

4,820 |

267,944 |

|

|

Rock-Tenn Co. Class A |

15,400 |

969,892 |

|

|

Sonoco Products Co. |

7,301 |

326,282 |

|

|

|

1,564,118 |

||

|

Metals & Mining - 1.3% |

|||

|

Compass Minerals International, Inc. |

7,640 |

674,841 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

MATERIALS - continued |

|||

|

Metals & Mining - continued |

|||

|

Steel Dynamics, Inc. |

12,900 |

$ 285,477 |

|

|

SunCoke Energy, Inc. |

18,576 |

325,637 |

|

|

|

1,285,955 |

||

|

TOTAL MATERIALS |

7,393,440 |

||

|

TELECOMMUNICATION SERVICES - 0.3% |

|||

|

Diversified Telecommunication Services - 0.1% |

|||

|

CenturyLink, Inc. |

627 |

22,547 |

|

|

Frontier Communications Corp. |

13,280 |

91,101 |

|

|

|

113,648 |

||

|

Wireless Telecommunication Services - 0.2% |

|||

|

RingCentral, Inc. (a) |

12,000 |

206,760 |

|

|

T-Mobile U.S., Inc. (a) |

902 |

30,704 |

|

|

|

237,464 |

||

|

TOTAL TELECOMMUNICATION SERVICES |

351,112 |

||

|

UTILITIES - 9.3% |

|||

|

Electric Utilities - 5.1% |

|||

|

Edison International |

23,137 |

1,409,969 |

|

|

Exelon Corp. |

12,329 |

419,433 |

|

|

ITC Holdings Corp. |

24,478 |

881,208 |

|

|

NextEra Energy, Inc. |

5,316 |

536,544 |

|

|

OGE Energy Corp. |

19,870 |

649,352 |

|

|

PPL Corp. |

38,943 |

1,325,230 |

|

|

|

5,221,736 |

||

|

Gas Utilities - 0.8% |

|||

|

National Fuel Gas Co. |

12,488 |

804,852 |

|

|

Independent Power and Renewable Electricity Producers - 0.3% |

|||

|

Dynegy, Inc. (a) |

11,115 |

369,796 |

|

|

Multi-Utilities - 3.1% |

|||

|

CMS Energy Corp. |

6,200 |

210,366 |

|

|

NiSource, Inc. |

31,679 |

1,375,502 |

|

|

Sempra Energy |

14,562 |

1,546,043 |

|

|

|

3,131,911 |

||

|

TOTAL UTILITIES |

9,528,295 |

||

|

TOTAL COMMON STOCKS (Cost $88,035,791) |

98,207,356 |

||

|

Nonconvertible Preferred Stocks - 0.1% |

|||

|

Shares |

Value |

||

|

FINANCIALS - 0.1% |

|||

|

Banks - 0.1% |

|||

|

Itau Unibanco Holding SA sponsored ADR |

9,677 |

|

$ 124,059 |

|

U.S. Treasury Obligations - 0.1% |

||||

|

|

Principal Amount (h) |

|

||

|

U.S. Treasury Bills, yield at date of purchase 0.01% to 0.05% 6/4/15 to 6/25/15 (g) |

|

$ 60,000 |

60,000 |

|

|

Preferred Securities - 0.1% |

||||

|

|

||||

|

FINANCIALS - 0.1% |

||||

|

Diversified Financial Services - 0.1% |

||||

|

Baggot Securities Ltd. 10.24% (e)(f) (Cost $153,576) |

EUR |

100,000 |

120,073 |

|

|

Money Market Funds - 4.6% |

|||

|

Shares |

|

||

|

Fidelity Cash Central Fund, 0.15% (b) |

4,101,958 |

4,101,958 |

|

|

Fidelity Securities Lending Cash Central Fund, 0.17% (b)(c) |

570,995 |

570,995 |

|

|

TOTAL MONEY MARKET FUNDS (Cost $4,672,953) |

4,672,953 |

||

|

TOTAL INVESTMENT PORTFOLIO - 101.0% (Cost $93,091,589) |

103,184,441 |

||

|

NET OTHER ASSETS (LIABILITIES) - (1.0)% |

(1,031,228) |

||

|

NET ASSETS - 100% |

$ 102,153,213 |

||

|

Futures Contracts |

|||||

|

|

Expiration Date |

Underlying Face Amount at Value |

Unrealized Appreciation/ |

||

|

Purchased |

|||||

|

Equity Index Contracts |

|||||

|

7 CME E-mini S&P MidCap 400 Index Contracts (United States) |

June 2015 |

$ 1,047,550 |

$ (18,948) |

||

|

The face value of futures purchased as a percentage of net assets is 1% |

|

Currency Abbreviations |

||

|

EUR |

- |

European Monetary Unit |

|

Legend |

|

(a) Non-income producing |

|

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

|

(c) Investment made with cash collateral received from securities on loan. |

|

(d) Security or a portion of the security is on loan at period end. |

|

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $120,073 or 0.1% of net assets. |

|

(f) Security is perpetual in nature with no stated maturity date. |

|

(g) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $60,000. |

|

(h) Amount is stated in United States dollars unless otherwise noted. |

|

Affiliated Central Funds |

|

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

|

Fund |

Income earned |

|

Fidelity Cash Central Fund |

$ 2,904 |

|

Fidelity Securities Lending Cash Central Fund |

5,770 |

|

Total |

$ 8,674 |

|

Other Information |

|

The following is a summary of the inputs used, as of April 30, 2015, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

|

Valuation Inputs at Reporting Date: |

||||

|

Description |

Total |

Level 1 |

Level 2 |

Level 3 |

|

Investments in Securities: |

||||

|

Equities: |

||||

|

Consumer Discretionary |

$ 12,171,140 |

$ 11,989,552 |

$ 181,588 |

$ - |

|

Consumer Staples |

3,178,389 |

2,559,274 |

619,115 |

- |

|

Energy |

5,393,516 |

5,020,708 |

372,808 |

- |

|

Financials |

29,186,578 |

27,418,644 |

1,767,934 |

- |

|

Health Care |

6,903,706 |

6,583,425 |

320,281 |

- |

|

Industrials |

11,933,921 |

10,489,363 |

1,444,558 |

- |

|

Information Technology |

12,291,318 |

12,291,318 |

- |

- |

|

Materials |

7,393,440 |

7,393,440 |

- |

- |

|

Telecommunication Services |

351,112 |

351,112 |

- |

- |

|

Utilities |

9,528,295 |

9,528,295 |

- |

- |

|

U.S. Government and Government Agency Obligations |

60,000 |

- |

60,000 |

- |

|

Preferred Securities |

120,073 |

- |

120,073 |

- |

|

Money Market Funds |

4,672,953 |

4,672,953 |

- |

- |

|

Total Investments in Securities: |

$ 103,184,441 |

$ 98,298,084 |

$ 4,886,357 |

$ - |

|

Derivative Instruments: |

||||

|

Liabilities |

||||

|

Futures Contracts |

$ (18,948) |

$ (18,948) |

$ - |

$ - |

|

Value of Derivative Instruments |

|

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of April 30, 2015. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements. |

|

Primary Risk Exposure / |

Value |

|

|

|

Asset |

Liability |

|

Equity Risk |

||

|

Futures Contracts (a) |

$ - |

$ (18,948) |

|

Total Value of Derivatives |

$ - |

$ (18,948) |

|

(a) Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. Only the period end receivable or payable for daily variation margin and net unrealized appreciation (depreciation) are presented in the Statement of Assets and Liabilities. |

|

Other Information |

|

Distribution of investments by country or territory of incorporation, as a percentage of total net assets, is as follows (Unaudited): |

|

United States of America |

82.1% |

|

Canada |

3.2% |

|

Bermuda |

3.1% |

|

Ireland |

2.6% |

|

Switzerland |

1.7% |

|

United Kingdom |

1.1% |

|

Netherlands |

1.1% |

|

Others (Individually Less Than 1%) |

5.1% |

|

|

100.0% |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements

Statement of Assets and Liabilities

|

|

April 30, 2015 (Unaudited) |

|

|

|

|

|

|

Assets |

|

|

|

Investment in securities, at value (including securities loaned of $551,092) - See accompanying schedule: Unaffiliated issuers (cost $88,418,636) |

$ 98,511,488 |

|

|

Fidelity Central Funds (cost $4,672,953) |

4,672,953 |

|

|

Total Investments (cost $93,091,589) |

|

$ 103,184,441 |

|

Cash |

|

74,635 |

|

Receivable for investments sold |

|

772,928 |

|

Receivable for fund shares sold |

|

100,710 |

|

Dividends receivable |

|

70,091 |

|

Distributions receivable from Fidelity Central Funds |

|

2,343 |

|

Prepaid expenses |

|

65 |

|

Receivable from investment adviser for expense reductions |

|

3,495 |

|

Other receivables |

|

13,091 |

|

Total assets |

|

104,221,799 |

|

|

|

|

|

Liabilities |

|

|

|

Payable for investments purchased |

$ 1,146,991 |

|

|

Payable for fund shares redeemed |

163,071 |

|

|

Accrued management fee |

51,134 |

|

|

Distribution and service plan fees payable |

35,641 |

|

|

Payable for daily variation margin for derivative instruments |

11,340 |

|

|

Other affiliated payables |

22,057 |

|

|

Other payables and accrued expenses |

67,357 |

|

|

Collateral on securities loaned, at value |

570,995 |

|

|

Total liabilities |

|

2,068,586 |

|

|

|

|

|

Net Assets |

|

$ 102,153,213 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 96,954,790 |

|

Undistributed net investment income |

|

87,179 |

|

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions |

|

(4,963,056) |

|

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies |

|

10,074,300 |

|

Net Assets |

|

$ 102,153,213 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Assets and Liabilities - continued

|

|

April 30, 2015 (Unaudited) |

|

|

|

|

|

|

Calculation of Maximum Offering Price Class A: |

|

$ 22.65 |

|

|

|

|

|

Maximum offering price per share (100/94.25 of $22.65) |

|

$ 24.03 |

|

Class T: |

|

$ 22.45 |

|

|

|

|

|

Maximum offering price per share (100/96.50 of $22.45) |

|

$ 23.26 |

|

Class B: |

|

$ 21.70 |

|

|

|

|

|

Class C: |

|

$ 21.63 |

|

|

|

|

|

|

|

|

|

Institutional Class: |

|

$ 22.84 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Operations

|

Six months ended April 30, 2015 (Unaudited) |

||

|

|

|

|

|

Investment Income |

|

|

|

Dividends |

|

$ 858,496 |

|

Interest |

|

955 |

|

Income from Fidelity Central Funds |

|

8,674 |

|

Total income |

|

868,125 |

|

|

|

|

|

Expenses |

|

|

|

Management fee |

$ 268,052 |

|

|

Performance adjustment |

10,036 |

|

|

Transfer agent fees |

112,401 |

|

|

Distribution and service plan fees |

205,347 |

|

|

Accounting and security lending fees |

19,060 |

|

|

Custodian fees and expenses |

35,407 |

|

|

Independent trustees' compensation |

188 |

|

|

Registration fees |

52,506 |

|

|

Audit |

35,012 |

|

|

Legal |

156 |

|

|

Miscellaneous |

316 |

|

|

Total expenses before reductions |

738,481 |

|

|

Expense reductions |

(45,772) |

692,709 |

|

Net investment income (loss) |

|

175,416 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: |

|

|

|

Investment securities: |

|

|

|

Unaffiliated issuers |

5,159,676 |

|

|

Foreign currency transactions |

(1,000) |

|

|

Futures contracts |

85,793 |

|

|

Total net realized gain (loss) |

|

5,244,469 |

|

Change in net unrealized appreciation (depreciation) on: Investment securities |

(60,938) |

|

|

Assets and liabilities in foreign currencies |

1,119 |

|

|

Futures contracts |

(18,260) |

|

|

Total change in net unrealized appreciation (depreciation) |

|

(78,079) |

|

Net gain (loss) |

|

5,166,390 |

|

Net increase (decrease) in net assets resulting from operations |

|

$ 5,341,806 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Changes in Net Assets

|

|

Six months ended April 30, 2015 (Unaudited) |

Year ended |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

|

|

|

Net investment income (loss) |

$ 175,416 |

$ 196,915 |

|

Net realized gain (loss) |

5,244,469 |

13,157,647 |

|

Change in net unrealized appreciation (depreciation) |

(78,079) |

(2,483,169) |

|

Net increase (decrease) in net assets resulting |

5,341,806 |

10,871,393 |

|

Distributions to shareholders from net investment income |

(153,278) |

(112,252) |

|

Distributions to shareholders from net realized gain |

(63,887) |

(142,925) |

|

Total distributions |

(217,165) |

(255,177) |

|

Share transactions - net increase (decrease) |

3,892,685 |

3,929,186 |

|

Total increase (decrease) in net assets |

9,017,326 |

14,545,402 |

|

|

|

|

|

Net Assets |

|

|

|

Beginning of period |

93,135,887 |

78,590,485 |

|

End of period (including undistributed net investment income of $87,179 and undistributed net investment income of $65,041, respectively) |

$ 102,153,213 |

$ 93,135,887 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class A

|

|

Six months ended |

Years ended October 31, |

||||

|

|

(Unaudited) |

2014 |

2013 |

2012 |

2011 |

2010 |

|

Selected Per-Share Data |

|

|

|

|

|

|

|

Net asset value, beginning of period |

$ 21.48 |

$ 18.90 |

$ 14.08 |

$ 12.25 |

$ 12.12 |

$ 9.81 |

|

Income from Investment Operations |

|

|

|

|

|

|

|

Net investment income (loss) E |

.06 |

.09 |

.11 |

.07 |

.03 |

.06H |

|

Net realized and unrealized gain (loss) |

1.18 |

2.58 |

4.82 |

1.79 |

.17 |

2.29 |

|

Total from investment operations |

1.24 |

2.67 |

4.93 |

1.86 |

.20 |

2.35 |

|

Distributions from net investment income |

(.05) |

(.04) |

(.11) |

(.03) |

(.06) |

(.03) |

|

Distributions from net realized gain |

(.02) |

(.04) |

- |

- |

(.01) |

(.01) |

|

Total distributions |

(.07) |

(.09) J |

(.11) |

(.03) |

(.07) |

(.04) |

|

Net asset value, end of period |

$ 22.65 |

$ 21.48 |

$ 18.90 |

$ 14.08 |

$ 12.25 |

$ 12.12 |

|

Total ReturnB, C, D |

5.77% |

14.15% |

35.30% |

15.22% |

1.65% |

23.99% |

|

Ratios to Average Net Assets F, I |

|

|

|

|

|

|

|

Expenses before reductions |

1.33%A |

1.29% |

1.31% |

1.35% |

1.29% |

1.33% |

|

Expenses net of fee waivers, if any |

1.25%A |

1.25% |

1.25% |

1.25% |

1.25% |

1.25% |

|

Expenses net of all reductions |

1.25%A |

1.25% |

1.23% |

1.25% |

1.24% |

1.24% |

|

Net investment income (loss) |

.53%A |

.42% |

.69% |

.51% |

.21% |

.51%H |

|

Supplemental Data |

|

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 51,980 |

$ 45,759 |

$ 38,397 |

$ 27,817 |

$ 29,635 |

$ 37,972 |

|

Portfolio turnover rate G |

65%A |

78% |

103% |

77% |

96% |

152% |

|

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown. D Total returns do not include the effect of the sales charges. E Calculated based on average shares outstanding during the period. F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. G Amount does not include the portfolio activity of any underlying Fidelity Central Funds. H Investment income per share reflects a large, non-recurring dividend which amounted to $.04 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .13%. I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. J Total distributions of $.09 per share is comprised of distributions from net investment income of $.041 and distributions from net realized gain of $.044 per share. |

||||||

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class T

|

|

Six months ended |

Years ended October 31, |

||||

|

|

(Unaudited) |

2014 |

2013 |

2012 |

2011 |

2010 |

|

Selected Per-Share Data |

|

|

|

|

|

|

|

Net asset value, beginning of period |

$ 21.27 |

$ 18.72 |

$ 13.95 |

$ 12.15 |

$ 12.03 |

$ 9.74 |

|

Income from Investment Operations |

|

|

|

|

|

|

|

Net investment income (loss) E |

.03 |

.03 |

.07 |

.03 |

(.01) |

.03H |

|

Net realized and unrealized gain (loss) |

1.16 |

2.56 |

4.78 |

1.80 |

.17 |

2.27 |

|

Total from investment operations |

1.19 |

2.59 |

4.85 |

1.83 |

.16 |

2.30 |

|

Distributions from net investment income |

- |

- |

(.08) |

(.03) |

(.04) |

(.01) |

|

Distributions from net realized gain |

(.01) |

(.04) |

- |

- |

(.01) |

(.01) |

|

Total distributions |

(.01) |

(.04) |

(.08) |

(.03) |

(.04) K |

(.01) J |

|

Net asset value, end of period |

$ 22.45 |

$ 21.27 |

$ 18.72 |

$ 13.95 |

$ 12.15 |

$ 12.03 |

|

Total ReturnB, C, D |

5.59% |

13.88% |

34.94% |

15.05% |

1.35% |

23.66% |

|

Ratios to Average Net Assets F, I |

|

|

|

|

|

|

|

Expenses before reductions |

1.61%A |

1.57% |

1.58% |

1.61% |

1.56% |

1.59% |

|

Expenses net of fee waivers, if any |

1.50%A |

1.50% |

1.50% |

1.50% |

1.50% |

1.50% |

|

Expenses net of all reductions |

1.50%A |

1.50% |

1.48% |

1.50% |

1.49% |

1.49% |

|

Net investment income (loss) |

.28%A |

.17% |

.44% |

.26% |

(.04)% |

.26% H |

|

Supplemental Data |

|

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 19,314 |

$ 18,558 |

$ 17,319 |

$ 12,727 |

$ 12,866 |

$ 17,908 |

|

Portfolio turnover rate G |

65% A |

78% |

103% |

77% |

96% |

152% |

|

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown. D Total returns do not include the effect of the sales charges. E Calculated based on average shares outstanding during the period. F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. G Amount does not include the portfolio activity of any underlying Fidelity Central Funds. H Investment income per share reflects a large, non-recurring dividend which amounted to $.04 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (.12)%. I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. J Total distributions of $.01 per share is comprised of distributions from net investment income of $.008 and distributions from net realized gain of $.005 per share. K Total distributions of $.04 per share is comprised of distributions from net investment income of $.035 and distributions from net realized gain of $.009 per share. |

||||||

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class B

|

|

Six months ended |

Years ended October 31, |

||||

|

|

(Unaudited) |

2014 |

2013 |

2012 |

2011 |

2010 |

|

Selected Per-Share Data |

|

|

|

|

|

|

|

Net asset value, beginning of period |

$ 20.60 |

$ 18.18 |

$ 13.54 |

$ 11.85 |

$ 11.75 |

$ 9.54 |

|

Income from Investment Operations |

|

|

|

|

|

|

|

Net investment income (loss) E |

(.02) |

(.07) |

(.01) |

(.03) |

(.07) |

(.03) H |

|

Net realized and unrealized gain (loss) |

1.13 |

2.49 |

4.65 |

1.74 |

.17 |

2.24 |

|

Total from investment operations |

1.11 |

2.42 |

4.64 |

1.71 |

.10 |

2.21 |

|

Distributions from net investment income |

- |

- |

- |

(.02) |

- |

- |

|

Distributions from net realized gain |

(.01) |

- |

- |

- |

- |

- |

|

Total distributions |

(.01) |

- |

- |

(.02) |

- |

- |

|

Net asset value, end of period |

$ 21.70 |

$ 20.60 |

$ 18.18 |

$ 13.54 |

$ 11.85 |

$ 11.75 |

|

Total ReturnB, C, D |

5.38% |

13.31% |

34.27% |

14.41% |

.85% |

23.17% |

|

Ratios to Average Net Assets F, I |

|

|

|

|

|

|

|

Expenses before reductions |

2.18%A |

2.13% |

2.11% |

2.13% |

2.05% |

2.08% |

|

Expenses net of fee waivers, if any |

2.00%A |

2.00% |

2.00% |

2.00% |

2.00% |

2.00% |

|

Expenses net of all reductions |

2.00%A |

2.00% |

1.98% |

2.00% |

1.99% |

1.99% |

|

Net investment income (loss) |

(.22)% A |

(.33)% |

(.06)% |

(.24)% |

(.54)% |

(.24)% H |

|

Supplemental Data |

|

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 1,183 |

$ 1,417 |

$ 2,116 |

$ 2,480 |

$ 3,482 |

$ 4,937 |

|

Portfolio turnover rate G |

65% A |

78% |

103% |

77% |

96% |

152% |

|

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown. D Total returns do not include the effect of the contingent deferred sales charge. E Calculated based on average shares outstanding during the period. F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. G Amount does not include the portfolio activity of any underlying Fidelity Central Funds. H Investment income per share reflects a large, non-recurring dividend which amounted to $.04 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (.62)%. I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. |

||||||

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class C

|

|

Six months ended |

Years ended October 31, |

||||

|

|

(Unaudited) |

2014 |

2013 |

2012 |

2011 |

2010 |

|

Selected Per-Share Data |

|

|

|

|

|

|

|

Net asset value, beginning of period |

$ 20.54 |

$ 18.13 |

$ 13.51 |

$ 11.83 |

$ 11.73 |

$ 9.53 |

|

Income from Investment Operations |

|

|

|

|

|

|

|

Net investment income (loss) E |

(.02) |

(.07) |

(.01) |

(.03) |

(.07) |

(.03) H |

|

Net realized and unrealized gain (loss) |

1.12 |

2.48 |

4.64 |

1.73 |

.17 |

2.23 |

|

Total from investment operations |

1.10 |

2.41 |

4.63 |

1.70 |

.10 |

2.20 |

|

Distributions from net investment income |

- |

- |

(.01) |

(.02) |

- |

- |

|

Distributions from net realized gain |

(.01) |

- |

- |

- |

- |

- |

|

Total distributions |

(.01) |

- |

(.01) |

(.02) |

- |

- |

|

Net asset value, end of period |

$ 21.63 |

$ 20.54 |

$ 18.13 |

$ 13.51 |

$ 11.83 |

$ 11.73 |

|

Total ReturnB, C, D |

5.35% |

13.29% |

34.32% |

14.36% |

.85% |

23.08% |

|

Ratios to Average Net Assets F, I |

|

|

|

|

|

|

|

Expenses before reductions |

2.12%A |

2.06% |

2.08% |

2.10% |

2.04% |

2.08% |

|

Expenses net of fee waivers, if any |

2.00%A |

2.00% |

2.00% |

2.00% |

2.00% |

2.00% |

|

Expenses net of all reductions |

2.00%A |

2.00% |

1.98% |

1.99% |

1.99% |

1.99% |

|

Net investment income (loss) |

(.22)%A |

(.33)% |

(.06)% |

(.24)% |

(.54)% |

(.24)% H |

|

Supplemental Data |

|

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 18,604 |

$ 17,390 |

$ 14,354 |

$ 9,283 |

$ 8,976 |

$ 9,497 |

|

Portfolio turnover rate G |

65%A |

78% |

103% |

77% |

96% |

152% |

|

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown. D Total returns do not include the effect of the contingent deferred sales charge. E Calculated based on average shares outstanding during the period. F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. G Amount does not include the portfolio activity of any underlying Fidelity Central Funds. H Investment income per share reflects a large, non-recurring dividend which amounted to $.04 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (.62)%. I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. |

||||||

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Institutional Class

|

|

Six months ended |

Years ended October 31, |

||||

|

|

(Unaudited) |

2014 |

2013 |

2012 |

2011 |

2010 |

|

Selected Per-Share Data |

|

|

|

|

|

|

|

Net asset value, beginning of period |

$ 21.70 |

$ 19.09 |

$ 14.22 |

$ 12.34 |

$ 12.21 |

$ 9.88 |

|

Income from Investment Operations |

|

|

|

|

|

|

|

Net investment income (loss) D |

.09 |

.14 |

.16 |

.10 |

.06 |

.09 G |

|

Net realized and unrealized gain (loss) |

1.18 |

2.60 |

4.86 |

1.81 |

.18 |

2.31 |

|

Total from investment operations |

1.27 |

2.74 |

5.02 |

1.91 |

.24 |

2.40 |

|

Distributions from net investment income |

(.11) |

(.09) |

(.15) |

(.03) |

(.10) |

(.06) |

|

Distributions from net realized gain |

(.02) |

(.04) |

- |

- |

(.01) |

(.01) |

|

Total distributions |

(.13) |

(.13) |

(.15) |

(.03) |

(.11) |

(.07) |

|

Net asset value, end of period |

$ 22.84 |

$ 21.70 |

$ 19.09 |

$ 14.22 |

$ 12.34 |

$ 12.21 |

|

Total ReturnB, C |

5.88% |

14.46% |

35.65% |

15.56% |

1.93% |

24.36% |

|

Ratios to Average Net Assets E, H |

|

|

|

|

|

|

|

Expenses before reductions |

1.04%A |

.97% |

.96% |

.99% |

.97% |

1.03% |

|

Expenses net of fee waivers, if any |

1.00%A |

.97% |

.96% |

.99% |

.97% |

1.00% |

|

Expenses net of all reductions |

1.00%A |

.97% |

.94% |

.99% |

.96% |

.99% |

|

Net investment income (loss) |

.78%A |

.69% |

.98% |

.76% |

.49% |

.76% G |

|

Supplemental Data |

|

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 11,072 |

$ 10,011 |

$ 6,405 |

$ 4,080 |

$ 4,869 |

$ 5,894 |

|

Portfolio turnover rateF |

65% A |

78% |

103% |

77% |

96% |

152% |

|