QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material Pursuant to §240.14a-12 |

|

Nortech Systems, Inc. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

||||

Nortech Systems Incorporated

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be Held May 13, 2004

TO THE SHAREHOLDERS OF NORTECH SYSTEMS INCORPORATED:

The Annual Meeting of Shareholders of Nortech Systems Incorporated (the "Company") will be held at the Wayzata Country Club, 200 West Wayzata Boulevard, Wayzata, Minnesota, on May 13, 2004, at 4:00 p.m., for the following purposes:

- 1.

- To

consider and act upon the Board of Directors' recommendation to fix the number of directors of the Company at five;

- 2.

- To

elect a Board of Directors to serve for a one-year term and until their successors are elected and qualify;

- 3.

- To transact such other business as may properly come before the meeting or any adjournment thereof.

Only shareholders of record at the close of business on March 26, 2004, will be entitled to notice of and to vote at the meeting or any adjournment thereof.

YOU ARE CORDIALLY INVITED TO ATTEND THE MEETING. WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE. IF YOU ATTEND THE MEETING, YOU MAY REVOKE THE PROXY AND VOTE YOUR SHARES IN PERSON.

Your attention is called to the accompanying Proxy Statement.

| By Order of the Board of Directors | ||

Bert M. Gross Secretary |

April 12, 2004

Nortech Systems Incorporated

ANNUAL MEETING OF SHAREHOLDERS, MAY 13, 2004

This Proxy Statement is furnished to shareholders of NORTECH SYSTEMS INCORPORATED, a Minnesota corporation (the "Company"), in connection with the solicitation on behalf of the Company's Board of Directors of proxies for use at the annual meeting of shareholders to be held on May 13, 2004, and at any adjournment thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders.

The address of the principal executive office of the Company is 1120 Wayzata Boulevard East, Suite 201, Wayzata, Minnesota 55391. This Proxy Statement and form of Proxy are being mailed to shareholders of the Company on April 12, 2004.

SOLICITATION AND REVOCATION OF PROXIES

The costs and expenses of solicitation of proxies will be paid by the Company. In addition to the use of the mails, proxies may be solicited by directors, officers and regular employees of the Company personally or by telegraph, telephone or letter with extra compensation. The Company will reimburse brokers and other custodians, nominees or fiduciaries for their expenses in forwarding proxy material to principals and obtaining their proxies.

Proxies in the form enclosed are solicited on behalf of the Board of Directors. Any shareholder giving a proxy in this form may revoke it at any time before it is exercised. Such proxies, if received in time for voting and not revoked, will be voted at the annual meeting in accordance with the specifications indicated on the proxy.

Only shareholders of record of the Company's 2,582,094 shares of Common Stock outstanding as of the close of business on March 26, 2004, will be entitled to execute proxies or to vote. Each share of Common Stock is entitled to one vote. A majority of the outstanding shares must be represented at the meeting, in person or by proxy, to transact business.

The bylaws of the Company provide for a Board of Directors consisting of one or more members, and further provide that the shareholders at each annual meeting shall determine the number of directors. The Company's Board of Directors recommends that the number of directors be set at five and it is intended that the proxies accompanying this statement will be voted at the 2004 meeting to establish a Board of Directors consisting of five members. All of the nominees are presently directors

1

of the Company. Proxies solicited by the Board of Directors will, unless otherwise directed, be voted for the election of the following five nominees:

MICHAEL J. DEGEN

MYRON KUNIN

KENNETH LARSON

RICHARD W. PERKINS

C. TRENT RILEY

Following is information regarding the nominees:

| Name |

Age |

Position |

||

|---|---|---|---|---|

| Michael J. Degen | 59 | President and Chief Executive Officer and Director | ||

| Myron Kunin | 75 | Chairman | ||

| Kenneth Larson | 63 | Director | ||

| Richard W. Perkins | 73 | Director | ||

| C. Trent Riley | 64 | Director |

From 1998 until his retirement on December 31, 2000, Mr. Degen was the Managing Director, Worldwide Operations, of The Toro Company, a manufacturer of lawn mowers, snow throwers and other products. From 1995 to 1998, he was the Managing Director, Worldwide Parts, of The Toro Company. He has been a director of the Company since May, 1998, and was elected President and Chief Executive Officer of the Company on May 1, 2002.

Mr. Kunin has served since 1983 as Chairman of the Board of Directors of Regis Corporation, the world's largest owner, operator and franchisor of hair care salons. He has been a director of the Company since 1990.

Mr. Larson served as President and Chief Operating Officer of Polaris Industries from 1988 to 1998. He is the Chairman of Restaurant Technologies, Inc., an installer of automated cooking oil systems for the fast food restaurant industry. He is a director of Featherlite, Inc., and Bellacore.com, Inc.. He has been a director of the Company since July, 2002.

Mr. Perkins has served since 1985 as President, Chief Executive Officer and a director of Perkins Capital Management, Inc., a registered investment advisor. He is also a director of iNTELEFILM Corporation, CNS, Inc., PW Eagle, Inc., Lifecore Biomedical, Inc., Synovis Life Technologies, Inc., Teledigital, Inc., Two Way TV (US) Inc., and Vital Images, Inc. He has been a director of the Company since 1993.

Mr. Riley has served since 1996 as President of Riley Dettman & Kelsey LLC, management consultants. He has been a director of the Company since August, 2001.

There were six meetings and one written action of the Board of Directors during the last fiscal year. All directors attended all meetings of the Board (except for Mr. Kunin who was unable to attend one meeting) and committees of the Board on which such director served.

The Board of Directors has established a Nominating and Corporate Governance Committee, a Compensation Committee, and an Audit Committee. The members of each committee are Messrs. Larson, Perkins and Riley. The Board of Directors has determined that Messrs. Larson, Perkins and Riley are independent directors under the rules established by the Securities and Exchange Commission and the Marketplace Rules of The NASDAQ Stock Market ("NASDAQ"). Further, the

2

Board has determined that Mr. Perkins is an "audit committee financial expert" as defined by applicable regulations of the Securities and Exchange Commission. The Audit Committee met four times, the Compensation Committee met twice, and the Nominating and Corporate Governance Committee did not meet in the last fiscal year.

The Executive Officers of the Company are as follows:

| Name |

Age |

Position |

||

|---|---|---|---|---|

| Michael J. Degen | 59 | President, Chief Executive Officer and Director | ||

| Gregory D. Tweed | 53 | Executive Vice President and Chief Operating Officer | ||

| Garry M. Anderly | 57 | Senior Vice President, Corporate Finance and Treasurer | ||

| Peter L. Kucera | 58 | Vice President, Corporate Quality | ||

| Donald E. Horne | 55 | Vice President, Global Supply Chain Management |

Mr. Degen has been President and Chief Executive Officer since May, 2002.

Mr. Tweed has been Executive Vice President and Chief Operating Officer of the Company since May, 1996. From 1993 to May, 1996, he was Senior Vice President and General Manager of the Company.

Mr. Anderly has been Senior Vice President, Corporate Finance and Treasurer of the Company since May, 1996. He was Vice President of Finance and Administration from 1991 to May, 1996.

Mr. Kucera has been Vice President, Corporate Quality of the Company since 1991.

Mr. Horne has been Vice President, Global Supply Chain Management of the Company since February, 2003. From 1997 until February, 2003, he was Vice President, Corporate Procurement.

The Board of Directors of the Company has restated the charter for the Audit Committee, a copy of which is included as Appendix A to this Proxy Statement. The charter charges the Committee with the responsibility for, among other things, reviewing the Company's audited financial statements and the financial reporting process. In carrying out that responsibility, the committee has reviewed and discussed with management the Company's audited financial statements as of and for the year ended December 31, 2003. The Committee has also discussed with the independent auditors the matters required to be discussed by Statement of Auditing Standards 61 (Communications with Audit Committees). In addition, the Committee has reviewed the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), which were received from the Company's independent accountants, and has discussed the independent accountants' independence with them. Based on these reviews and discussions, the Committee recommended to the Board of Directors that the Company's audited financial statements be included in the Company's Annual Report on Form 10-K for the Company's fiscal year ended December 31, 2003.

The members of the Audit Committee are "independent" under the rules of the Securities and Exchange Commission and the NASDAQ listing standards.

| Richard W. Perkins, Chair Kenneth Larson, C. Trent Riley Members of the Audit Committee |

3

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee is composed of the independent outside directors whose names appear following this report. Compensation for executive officers includes three elements: base salaries, bonuses, and options to acquire Common Stock. Salaries are based on factors such as the individual's level of responsibility and the amount of salary paid to executives with similar responsibilities in comparable companies. Bonuses are awarded based on a combination of the executives' success in meeting certain preestablished individual goals and the Company's performance in meeting certain financial goals. Stock options are designed to increase the incentive for an executive's interest in the Company's long-term success as measured by the market value of its stock and to align the interests of the executives with those of the Company's shareholders.

The chief executive officer's base compensation for 2003 was established under an employment agreement executed in 2002. His bonus was based upon the Company's financial performance in a difficult economic environment. Further, it was determined that the total compensation of the chief executive officer was comparable to compensation of chief executive officers of comparable companies. The base compensation of the other executive officers was set at the level necessary to attract and retain executives performing the functions being performed by such executives, and their bonuses were based upon meeting the goals referred to above.

The Compensation Committee has adopted a charter which is included as Appendix B to this Proxy Statement.

| Kenneth Larson, Chair C. Trent Riley Richard W. Perkins Members of the Compensation Committee |

4

The following table shows, for the fiscal years ended December 31, 2003, 2002 and 2001, the cash compensation paid by the Company, as well as certain other compensation paid or accrued for those years, to the Company's chief executive officer, and each of the other executive officers whose total annual compensation in 2003 exceeded $100,000.

| |

|

|

|

Long-Term Compensation Awards |

|

|||||

|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position |

|

|

|

All Other Compensation ($)(2) |

||||||

| Year |

Salary($) |

Bonus($) |

Options(#) |

|||||||

| Michael J. Degen President, Chief Executive Officer and Director(1) |

2003 2002 |

174,990 104,712 |

24,500 67,242 |

50,000 0 |

0 0 |

|||||

Gregory E. Tweed Executive Vice President and Chief Operating Officer |

2003 2002 2001 |

143,000 134,596 131,560 |

20,020 83,545 53,200 |

6,000 0 0 |

14,850 15,560 0 |

|||||

Garry Anderly Senior Vice President, Corporate Finance and Treasurer |

2003 2002 2001 |

124,010 117,957 115,773 |

17,980 72,685 43,700 |

6,000 0 0 |

0 8,906 0 |

|||||

Peter Kucera Vice President, Corporate Quality |

2003 2002 2001 |

92,997 89,864 88,733 |

13,671 54,826 33,719 |

6,000 0 0 |

0 0 0 |

|||||

Donald E. Horne Vice President, Global Supply Chain Management |

2003 2002 2001 |

90,002 86,579 85,342 |

13,050 52,881 32,430 |

6,000 0 0 |

0 0 0 |

- (1)

- Mr. Degen

was elected President and Chief Executive Officer effective May 1, 2002. Prior to that date he was not employed by the company.

- (2)

- Represents compensation paid to the named executive officers for unused vacation.

STOCK OPTION GRANTS IN LAST FISCAL YEAR

The following table provides information on stock option grants in fiscal 2003 by the Company to each of the named executive officers.

| |

|

|

|

|

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Number of Securities Underlying Options Granted(1) |

Percent of Total Options Granted to Employees in Fiscal Year |

|

|

|||||||||

| Name |

Exercise Price ($/Share) |

Expiration Date |

|||||||||||

| 5%($)(2) |

10%($)(2) |

||||||||||||

| Michael J. Degen | 50,000 | 39.3 | % | $ | 7.22 | February 11, 2013 | 227,033 | 575,326 | |||||

| Gregory D. Tweed | 6,000 | 4.7 | % | 8.00 | December 10, 2013 | 30,187 | 76,498 | ||||||

| Garry Anderly | 6,000 | 4.7 | % | 8.00 | December 10, 2013 | 30,187 | 76,498 | ||||||

| Peter Kucera | 6,000 | 4.7 | % | 8.00 | December 10, 2013 | 30,187 | 76,498 | ||||||

| Donald E. Horne | 6,000 | 4.7 | % | 8.00 | December 10, 2013 | 30,187 | 76,498 | ||||||

- (1)

- All options granted in fiscal 2003 are exercisable 20% after the first anniversary of the grant date, 40% after the second anniversary, 60% after the third anniversary, 80% after the fourth anniversary, and 100% after the fifth anniversary.

5

- (2)

- The hypothetical potential appreciation shown in these columns reflects the required calculations at annual rates of 5% and 10% set by the Securities and Exchange Commission, and therefore is not intended to represent either historical appreciation or anticipated future appreciation of the Company's Common Stock Price.

STOCK OPTION EXERCISES AND OPTION VALUES

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table contains information concerning stock options exercised during 2003 and stock options unexercised at the end of 2003 with respect to each of the Named Executive Officers.

| |

|

|

Number of Unexercised Options/at Fiscal Year-End (#) |

Value of Unexercised In-the-Money Options/at Fiscal Year-End ($)(1) |

||||

|---|---|---|---|---|---|---|---|---|

| Name |

Shares Acquired on Exercise(#) |

Value Realized($) |

Exercisable/ Unexercisable |

Exercisable/ Unexercisable |

||||

| Michael J. Degen | 0 | 0 | 6,000/50,000 | 20,410/44,500 | ||||

| Gregory D. Tweed | 0 | 0 | 42,400/9,600 | 137,346/12,624 | ||||

| Garry Anderly | 0 | 0 | 32,400/9,600 | 108,746/12,624 | ||||

| Peter Kucera | 0 | 0 | 17,400/9,600 | 63,346/12,624 | ||||

| Donald E. Horne | 0 | 0 | 2,400/9,600 | 17,946/12,624 |

- (1)

- Value of unexercised in-the-money options is determined by multiplying the difference between the exercise price per share and $8.11, the closing price per share on December 31, 2003, by the number of shares subject to such options.

EQUITY COMPENSATION PLAN INFORMATION

The following table shows the total number of outstanding options and shares available for other future issuances of options under the Company's equity compensation plans as of December 31, 2003.

| |

A |

B |

C |

|||||

|---|---|---|---|---|---|---|---|---|

| Plan Category(1) |

Securities To Be Issued Upon Exercise of Outstanding Options, Warrants and Rights |

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights |

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding securities reflected in column A) |

|||||

| Equity Compensation Plans Approved by Security Holders | 266,000 | (1) | $ | 6.10 | 214,500 | (2) | ||

| Equity Compensation Plans Not approved by Security Holders | 0 | 0 | 0 | |||||

| Total | 266,000 | $ | 6.10 | 214,500 | ||||

- (1)

- Represents

shares issuable upon the exercise of outstanding options granted under the Company's 1992 and 2003 Stock Option Plans.

- (2)

- Represents shares remaining available under the Company's 2003 Stock Option Plan.

6

During 2002, the company established a Nonqualified Supplemental Executive Retirement Plan (the "Plan") for its Named Executive Officers ("Executives"). Pursuant to the Plan, the Company will pay a bonus to Executives equal to 10% of the Executives' base annual salary, as well as an additional bonus to cover federal and state income taxes incurred by the Executives. The Executives are required to purchase life insurance and retain ownership of the life insurance policy once it is purchased. The Plan provides a five-year vesting schedule in which the Executives vest in their bonus at a rate of 20% each year. Should an Executive terminate employment prior to the fifth year of vesting, that Executive must reimburse the Company for any unvested amounts.

During 2002, the Company entered into Change of Control Agreements (the "Agreement(s)") with the Executives. The Agreements provide an inducement for each Executive to remain as an employee of the Company in the event of any proposed or anticipated change of control in the organization, including facilitating an orderly transition, and to provide economic security for the Executive after a change in control has occurred. In the event of an involuntary termination after a change of control, each Executive would receive his base salary, annual bonus at time of termination, and continued participation in health, disability and life insurance plans for a period of three years. Each Executive would also receive professional outplacement services up to $10,000. Each Agreement remains in full force until the Executive terminates employment or the Company terminates the employment of the Executive.

The Company has entered into an employment agreement with Mr. Degen, its Chief Executive Officer, effective October 1, 2002, and continuing for three years thereafter, providing (a) for a base salary of $175,000 per year, subject to increases related to the Company's general executive pay schedule during the term of the agreement, (b) that he will participate in any incentive plan for which the Company determines he is eligible and (c) that if Mr. Degen becomes unable to perform his duties because of illness or other incapacity during the term of the agreement, his compensation and his medical, dental and life insurance shall be continued for a period of 24 months. The agreement also provides that if Mr. Degen initiates the termination of employment, he will not for a period of two years following his termination of employment, anywhere in the United States or Mexico, engage in or in any business, or be connected with or employed by any organization, in direct competition with the Company's business.

For their services as directors during the last fiscal year, the independent directors (Mssrs. Larson, Perkins and Riley) each received $6,000 plus $500 for each day in which they attended a board or committee meeting. The non-employee directors were also awarded options to purchase the Company's Common Stock in the following amounts:

| Myron Kunin | 6,000 shares | |

| Kenneth Larson | 7,000 shares | |

| Richard Perkins | 13,000 shares | |

| Trent Riley | 9,000 shares |

Each of the above-named directors received a base grant for 6,000 shares. In addition, the independent directors were granted additional options based on their length of service as directors. The exercise price for all such options is $8.00 per share.

7

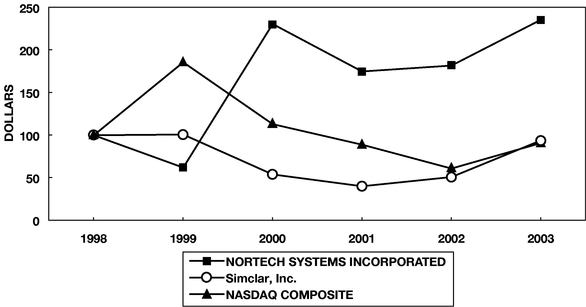

COMPARATIVE STOCK PRICE PERFORMANCE

The graph below compares total shareholder return on the Company's Common Stock for the last five fiscal years with the total return on Simclar, Inc. (formerly Techdyne, Inc.) (a peer issuer) and the NASDAQ Composite Index for the same periods. The graph assumes $100 invested on December 31, 1998.

Nortech Systems Incorporated

Comparative Stock Price Performance

| |

1998 |

1999 |

2000 |

2001 |

2002 |

2003 |

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Nortech Systems Incorporated | 100 | 62 | 231 | 175 | 182 | 236 | ||||||

| Simclar, Inc. | 100 | 101 | 54 | 40 | 51 | 94 | ||||||

| NASDAQ Composite | 100 | 186 | 113 | 89 | 61 | 91 |

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

The Company has established a Nominating and Corporate Governance Committee of the Board of Directors. This Committee has adopted a charter, which is included as Appendix C to this Proxy Statement. The Company intends to make a copy of the charter available on its website (www.nortechsys.com) in the near future. All the members of this Committee are independent as defined in the NASDAQ Marketplace Rules.

Shareholder Nominees

The Committee has adopted a policy of considering director candidates recommended by shareholders. Any shareholder desiring to submit such a recommendation should transmit the candidate's name and qualifications in a letter addressed to:

Nominating

and Corporate Governance Committee

Nortech Systems Incorporated

1120 Wayzata Boulevard, Suite 201

Wayzata, MN 55391

8

Director Qualifications

The Committee has not established specific qualifications for potential directors. The principal general qualification of a director is the ability to act effectively on behalf of all of the shareholders.

Identifying and Evaluating Nominees for Directors

The Nominating and Corporate Governance Committee uses a variety of methods for identifying and evaluating nominees for directors. The Committee periodically assesses the appropriate size of the board and whether any vacancies are anticipated. If vacancies are anticipated or if the Committee determines that the number of directors should be increased, the Committee considers possible director candidates. Candidates may come to the Committee's attention through present board members, shareholders or other persons. All candidates will be evaluated by the Committee and the Committee's recommendations will then be transmitted to the entire board. Assessment of candidates will include a variety of issues, including diversity, age, skills and experience in the fields of accounting, marketing, technology, international manufacturing, and understanding of the Company's industry.

SECURITY HOLDERS COMMUNICATIONS WITH THE BOARD

Security holders may send communications to the Company's board of directors, or to any individual board member, by means of a letter to such individual board member or the entire board addressed to:

Board

of Directors (or named board member)

Nortech Systems Incorporated

1120 Wayzata Boulevard, Suite 201

Wayzata, MN 55391

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth as of April 1, 2004, the ownership of Common Stock of the Company by each shareholder who is known by the Company to own beneficially more than 5% of the outstanding shares of the Company, by each director and by each executive officer identified in the Summary Compensation Table, and by all executive officers and directors as a group. The parties listed in the table have the voting and investment powers with respect to the shares indicated.

| Name of Beneficial Owner |

Number of Shares Beneficially Owned(1) |

Percent of Class |

|||

|---|---|---|---|---|---|

| Myron Kunin | 1,235,845 | 47.9 | % | ||

| Michael J. Degen | 17,000 | * | |||

| Richard W. Perkins | 34,000 | 1.3 | % | ||

| Gregory D. Tweed | 59,800 | 2.3 | % | ||

| Garry M. Anderly | 39,800 | 1.5 | % | ||

| Peter Kucera | 24,800 | * | |||

| Donald E. Horne | 4,800 | * | |||

| C. Trent Riley | 9,000 | * | |||

| Kenneth Larson | 4,000 | * | |||

| All executive officers and directors as a group (nine persons) | 1,427,055 | (2) | 55.27 | % |

- (1)

- Includes the following shares not currently outstanding but deemed beneficially owned because of the right to acquire such shares pursuant to options exercisable within sixty (60) days: 52,300 shares by Mr. Tweed, 34,800 shares by Mr. Anderly, 16,000 shares by Mr. Perkins, 7,000 shares by

9

Mr. Kunin, 16,000 shares by Mr. Degen, 19,800 shares by Mr. Kucera, 3,000 shares by Mr. Larson, 7,000 shares by Mr. Riley, and 4,800 shares by Mr. Horne.

- (2)

- Includes

160,700 shares subject to options exercisable within sixty (60) days.

- *

- Less than one percent (1%).

The Company will mail its annual report for the year 2003 on or about April 12, 2004, to all shareholders of the Company of record on March 26, 2004.

The Board of Directors has engaged KPMG LLP, as independent accountants of the Company for 2004, pursuant to an engagement letter dated December 10, 2003. Members of the firm are expected to be present at the annual meeting of shareholders and available to respond to appropriate questions and will have the opportunity to make a statement if they desire to do so.

Fees incurred by the Company for services of KPMG LLP

The following table shows the fees paid or accrued by the Company for the audit and other services provided by KPMG LLP for fiscal years 2003 and 2002.

| |

2003 |

2002 |

||||

|---|---|---|---|---|---|---|

| Audit Fees | $ | 113,000 | $ | 83,883 | ||

| Audit-Related Fees | $ | 0 | 0 | |||

| Tax Fees | $ | 0 | 0 | |||

| All Other Fees | $ | 0 | 0 | |||

The audit committee has established a policy for pre-approving the services provided by the Company's independent auditors in accordance with the auditor independence rules of the SEC. This policy requires the review and pre-approval by the audit committee of all audit and permissible non-audit services provided by the independent auditors and an annual review of the financial plan for audit fees.

The presence in person or by proxy of the holders of a majority of the voting power of the shares of Common Stock issued, outstanding and entitled to vote at a meeting for the transaction of business is required to constitute a quorum. The election of each director will be decided by plurality votes. As a result, any shares not voted for director (whether by withholding authority, broker non-vote or otherwise) have no impact on the election of directors except to the extent the failure to vote for an individual results in another individual receiving a larger number of votes.

Any proposal by a shareholder for the annual shareholders' meeting in May, 2005, must be received by the secretary of the Company at 1120 Wayzata Boulevard East, Suite 201, Wayzata, Minnesota 55391, not later than the close of business on December 16, 2004. Proposals received by that date will be included in the 2005 proxy statement if the proposals are proper for consideration at an annual meeting and are required for inclusion in the proxy statement by, and conform to, the rules of the Securities and Exchange Commission.

The Company's bylaws provide that a shareholder may nominate a director for election at the annual meeting or may present from the floor a proposal that is not included in the proxy statement if proper written notice is received by the secretary of the Company at its principal offices in Wayzata,

10

Minnesota, at least 120 days in advance of the date of the proxy statement for the prior year's annual meeting. For the 2005 annual meeting, director nominations and shareholder proposals must be received on or before December 16, 2004. Shareholder proposals that are received by the Company after that date may not be presented in any manner at the 2005 annual meeting.

The management does not know of any other matters that may be presented for consideration at the annual meeting of shareholders. If any other matters are properly presented at the meeting, the persons named in the accompanying proxy will vote upon them in accordance with their best judgment.

| By Order of the Board of Directors | ||

BERT M. GROSS Secretary |

Minneapolis,

Minnesota

April 12, 2004

11

NORTECH SYSTEMS INCORPORATED

Audit Committee Charter

Purpose

The purpose of the Audit Committee (the "Committee") of Nortech Systems Incorporated (the "Company") is to represent and assist the Board of Directors (the "Board") in its oversight of (1) the integrity of the financial reporting of the Company, (2) the independence, qualifications and performance of the Company's independent auditor, (3) the performance of the Company's internal audit function, and (4) the Company's compliance with legal and regulatory requirements. The Committee also prepares the report required by the rules of the Securities and Exchange Commission (SEC) to be included in the Company's annual proxy statement.

Members

The Committee shall consist of at least three members of the Board who satisfy the independence requirements under the rules of the National Association of Securities Dealers, Inc. (NASD) and the SEC, as such requirements are interpreted by the Board in its business judgment. The Board shall designate one member as Chairperson or delegate authority to designate a Chairperson to the Committee. Each member of the Committee shall be financially literate and at least one member of the Committee shall be an "audit committee financial expert" as defined by the SEC.

Outside Advisors

The Committee shall have the authority to retain such outside legal, accounting or other consultants or advisors as it determines appropriate to assist it in the performance of its functions, or to advise or inform the Committee. The Committee may also meet with investment bankers and financial analysts. The Committee may request any officer or employee of the Company or the Company's outside counsel or independent auditor to attend a meeting of the Committee or to meet with any members of, or consultants to, the Committee. The Company shall provide for appropriate funding, as determined by the Committee, for payment of compensation to the independent auditor and to any advisors retained by the Committee.

Duties and Responsibilities

On behalf of the Board, the Committee shall, among its duties and responsibilities:

- 1.

- Review

and discuss the annual audited financial statements with management and the independent auditor, including the Company's disclosures under Management's Discussion and Analysis

of Financial Condition and Results of Operations, significant issues and judgments regarding accounting and auditing principles and practices, and the effect of regulatory and accounting initiatives

on the Company's financial statements, and recommend to the Board whether the financial statements should be included in the Form 10-K. The review of the annual audited financial

statements also includes a review of any transactions as to which management obtained a letter pursuant to Statement on Auditing Standards No. 50.

- 2.

- Review

and discuss with management and the independent auditor the Company's quarterly financial statements prior to filing the Form 10-Q, including the results of

the independent auditor's review of them and the Company's disclosures under Management's Discussion and Analysis of Financial Condition and Results of Operations.

- 3.

- Review major changes to the Company's auditing and accounting principles and practices as suggested by the independent auditor, internal auditors or management.

A-1

- 4.

- Meet

separately, periodically, with management, with internal auditors (or other personnel responsible for the internal audit function) and with the Company's independent auditors.

- 5.

- The

Committee shall be directly responsible, in its capacity as a committee of the Board, for the appointment, compensation and oversight of the work of the independent auditor for the

purpose of preparing or issuing an audit report or related work. In this regard, the Committee shall appoint, retain, compensate, evaluate, and terminate when appropriate, the independent auditor,

which shall report directly to the Committee.

- 6.

- Preapprove

all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed for the Company by its independent auditor and

establish policies and procedures for the engagement of the independent auditor to provide auditing and permitted non-audit services.

- 7.

- Obtain

and review, at least annually, a report by the independent auditor describing: the independent auditor's internal quality-control procedures; and any material issues raised by

the most recent internal quality-control review, or peer review, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more

independent audits carried out by the independent auditor, and any steps taken to deal with any such issues; and (to assess the auditor's independence) all relationships between the independent

auditor and the Company.

- 8.

- Receive

at least annually and discuss with the independent auditor the auditor's report regarding its independence.

- 9.

- Meet

with the independent auditor prior to the audit to review the scope and planning of the audit.

- 10.

- Review

with the independent auditor the results of the annual audit examination, and any issues the auditor may have encountered in the course of its audit work and management's

response. This review should include, among other things, any management letter, any restrictions on the scope of activities or access to required information, and changes required in the planned

scope of the internal audit.

- 11.

- Discuss

the Company's earnings press releases and corporate policies with respect to earnings releases and financial information and earnings guidance provided to analysts and rating

agencies.

- 12.

- Discuss

policies with respect to risk assessment and risk management.

- 13.

- Review

the adequacy and effectiveness of the Company's internal controls, including any significant deficiencies in internal controls and significant changes in such controls reported

to the Committee by the independent auditor, the internal auditor or management, and review the adequacy and effectiveness of the Company's disclosure controls and procedures.

- 14.

- Review

with the independent auditor and the internal auditor the scope and results of the internal audit program, including responsibilities and staffing, and review the appointment

and replacement of the director of the internal audit department.

- 15.

- Review

candidates for the positions of chief financial officer and controller of the Company.

- 16.

- Establish

procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and the

confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

- 17.

- Establish policies for hiring employees and former employees of the independent auditor.

A-2

- 18.

- Advise

the Board with respect to the Company's policies and procedures regarding compliance with applicable laws and regulations and with the Company's Code of Business Conduct and

Ethics.

- 19.

- Review

with the Company's General Counsel and independent auditor (1) legal matters that may have a material impact on the financial statements, (2) accounting or

compliance policies, and (3) any material reports or inquiries received from regulators, governmental agencies or employees that raise material issues regarding the Company's financial

statements and accounting or compliance policies.

- 20.

- Review

all related party transactions for potential conflict of interest situations and review and approve all related party transactions required to be disclosed under

Item 404 of SEC Regulation S-K.

- 21.

- Review

this Charter annually and recommend any changes to the Board for approval.

- 22.

- Review the Committee's own performance annually.

Meetings

The Committee shall meet at least four times per year, either in person or telephonically, and at such times and places as the Committee shall determine. The Committee shall meet with the chief financial officer, the controller, the director of the internal audit department and the independent auditor in separate executive sessions periodically. The Committee shall report regularly to the Board.

A-3

NORTECH SYSTEMS INCORPORATED

Compensation Committee Charter

1. Members. The Board of Directors of Nortech Systems Incorporated (the "Company") has established a Compensation Committee (the "Committee") of at least three members, consisting entirely of independent directors, and designates one member as Chairperson. For purposes hereof, an "independent" director is a director who meets definition of "independence," as determined by the Securities and Exchange Commission (SEC) and the National Association of Securities Dealers, Inc. (NASD). Additionally, members of the Committee must qualify as "non-employee directors" for purposes of Rule 16b-3 under the Securities Exchange Act of 1934, as amended, and as "outside directors" for purposes of Section 162(m) of the Internal Revenue Code.

2. Purposes, Duties, and Responsibilities. The purpose of the Committee is to discharge the responsibilities of the Board relating to compensation of the Company's senior executive officers and produce the annual report on executive compensation for inclusion in the Company's proxy statement. The duties and responsibilities of the Committee are to:

- (a)

- Oversee

the Company's senior executive officers' compensation structure, policies and programs, and assess whether the Company's compensation structure establishes appropriate

incentives for such officers.

- (b)

- Make

recommendations to the Board with respect to the Company's incentive-compensation and equity-based compensation plans.

- (c)

- Review

and approve corporate goals and objectives relevant to the compensation of the Chief Executive Officer (CEO), evaluate the CEO's performance in light of those goals and

objectives, and set the CEO's compensation level based on this evaluation.

- (d)

- Make

recommendations to the Board with respect to the compensation of other senior executive officers.

- (e)

- Approve

stock option and other stock incentive awards for employees.

- (f)

- Review

the compensation of directors for service on the Board and its committees and recommend changes in compensation to the Board.

- (g)

- Review

periodically succession plans relating to positions held by senior executive officers, and make recommendations to the Board regarding the selection of individuals to fill

these positions.

- (h)

- Annually

evaluate the performance of the Committee and the adequacy of the Committee's charter.

- (i)

- Perform such other duties and responsibilities as are consistent with the purpose of the Committee and as the Board or the Committee deems appropriate.

3. Subcommittees. The Committee may delegate any of the foregoing duties and responsibilities to a subcommittee of the Committee consisting of not less than two members of the committee.

4. Outside Advisors. The Committee will have the authority to retain at the expense of the Company such outside counsel, experts, and other advisors as it determines appropriate to assist it in the full performance of its functions, including sole authority to retain and terminate any compensation consultant used to assist the committee in the evaluation of director, CEO or senior executive compensation, and to approve the consultant's fees and other retention terms.

B-1

5. Meetings. The Committee will meet as often as may be deemed necessary or appropriate, in its judgment, either in person or telephonically, and at such times and places as the Committee determines. The majority of the members of the Committee constitute a quorum. The Committee will report regularly to the full Board with respect to its activities.

B-2

NORTECH SYSTEMS INCORPORATED

Nominating and Corporate Governance Committee Charter

Purposes

The purposes of the Nominating and Corporate Governance Committee (the "Committee") of the Board of Directors (the "Board") of Nortech Systems Incorporated (the "Company") are to:

- 1.

- Advise

the Board concerning appropriate composition of the Board and its committees;

- 2.

- Identify

individuals qualified to become Board members;

- 3.

- Recommend

to the Board the persons to be nominated by the Board for election as directors at the annual meeting of stockholders;

- 4.

- Develop

and recommend to the Board a set of corporate governance guidelines applicable to the Company and assist the Board in complying with them;

- 5.

- Review

and resolve conflicts of interest situations and, if necessary, grant waivers to the Company's Code of Ethics; and

- 6.

- Oversee the evaluation of the Board and management.

Composition

The Committee shall be composed of at least three, but not more than five, members of the Board who are Independent Directors (as defined by the rules of the Securities and Exchange Commission and the National Association of Securities Dealers), one of whom shall serve as chairperson. The Committee and its chairperson shall be nominated and elected by the Board, upon the recommendation of the Committee. The Board may remove members of the Committee with or without cause.

Responsibilities

- 1.

- Review

with the Board on an annual basis the appropriate skills and characteristics required on the Board in the context of the strategic direction of the Company.

- 2.

- Manage

the process whereby the full Board annually assesses its performance, and then report the results of this evaluation to the Board along with any recommendations for

improvements.

- 3.

- Manage

the process whereby the current Board members are evaluated individually by the Board at the time they are considered for re-nomination, and provide advice to

individual Board members based on these evaluations.

- 4.

- Upon

receiving the resignation letter required from any director who makes a principal occupation change (including retirement), and after considering advice from the chairperson of

the Board and the CEO, recommend to the full Board whether to accept the resignation.

- 5.

- Recommend

for Board approval a definition of what constitutes an independent director. The definition should be in compliance with relevant standards by regulators and listing bodies.

- 6.

- Investigate

any potential conflict of interest by a director as assigned to it by the Board.

- 7.

- Recommend to the Board the existing Board members to be re-nominated, after considering the appropriate skills and characteristics required on the Board, the current makeup of the Board, the results of the individual evaluations of the directors, and the wishes of existing Board members to be re-nominated.

C-1

- 8.

- Prepare

a description of specific, minimum qualifications that must be met by a Committee recommended nominee, including specific qualities or skills that are necessary for one or more

of the Company's directors to possess.

- 9.

- Establish

procedures for identifying and evaluating nominees for director, including nominees appropriately recommended by stockholders, and any differences in the manner in which the

Committee evaluates appropriate nominees from stockholders and nominees identified by the Committee.

- 10.

- After

a review of Board candidates and after considering the advice of the chairperson of the Board and the CEO, designate which candidates are to be interviewed. Candidates at a

minimum are interviewed by the chairperson of the governance and nominating committee, the chairperson of the Board, and the CEO, but may be interviewed by other directors.

- 11.

- After

the interviews, recommend for Board approval any new directors to be nominated.

- 12.

- Design

an orientation program for new directors and consult with them on their progress.

- 13.

- Recommend

committee assignments, including committee chairpersonships, to the full Board for approval. This is done after receiving advice from the chairperson of the Board and the

CEO and with consideration of the desires of individual Board members.

- 14.

- Review

annually the corporate governance guidelines and committee charters and recommend to the Board any needed changes.

- 15.

- Keep

abreast of the developments in the corporate governance field that might affect the company.

- 16.

- Conduct

an annual performance evaluation of the Committee.

- 17.

- Consider the necessity for, and if deemed advisable establish, procedures for stockholders to send communications to the Board, including a process for determining which communications will be relayed to Board members.

This Committee has the power to delegate aspects of its work to subcommittees, with Board approval. Furthermore, the Board may allocate any of the responsibilities of this Committee to a separate committee, provided that the committee is composed of independent directors. Any such committee must have a published committee charter.

Procedures

1. Meetings

The Committee shall meet as often as it deems necessary in order to perform its responsibilities but in no event less than two times each fiscal year. The Committee shall keep such records of its meetings as it shall deem appropriate.

2. Reports to the Board

The Committee shall report regularly to the Board.

3. Charter

The Committee shall, from time to time as it deems appropriate, review and reassess the adequacy of this Charter and recommend any proposed changes to the Board for approval.

4. Independent Advisors

The Committee shall have the authority to engage such independent legal and other advisors and consultants as it deems necessary or appropriate to carry out its responsibilities. Such independent

C-2

advisors and consultants may be the regular advisors and consultants to the Company. The Committee is empowered, without further action by the Board, to cause the Company to pay the compensation of such advisors and consultants as established by the Committee.

5. Investigations

The Committee shall have the authority to conduct or authorize investigations into any matters within the scope of its responsibilities as it shall deem appropriate, including the authority to request any officer, employee or advisor of the Company to meet with the Committee or any advisors engaged by the Committee.

6. Action

A majority of the members of the Committee shall constitute a quorum. The Committee shall act on the affirmative vote of a majority of members present at a meeting at which a quorum is present. Without a meeting, the Committee may act by unanimous written consent of all members.

C-3

NORTECH SYSTEMS INCORPORATED

PROXY FOR ANNUAL MEETING OF SHAREHOLDERS

May 13, 2004

| NORTECH SYSTEMS INCORPORATED | proxy | |

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS and will be voted as directed herein. If no direction is given, this proxy will be voted FOR the proposal to fix the number of directors at five and FOR all the nominees listed in paragraph 2.

The undersigned hereby appoints Michael J. Degen and Garry Anderly and either of them, proxies for the undersigned, with full power of substitution, to represent the undersigned and to vote all of the shares of the Common Stock of Nortech Systems Incorporated (the Company) which the undersigned is entitled to vote at the annual meeting of shareholders of the Company to be held on May 13, 2004, and at any and all adjournments thereof.

(Continued, and TO BE COMPLETED AND SIGNED on the reverse side)

- Please detach here -

1. |

To fix the number of directors of the Company at five. |

o For |

o Against |

o Abstain |

2. |

Election of directors: |

01 Michael J. Degen 02 Kenneth Larson 03 Myron Kunin |

04 Richard W. Perkins 05 C. Trent Riley |

o |

Vote FOR all nominees (except as marked) |

o |

Vote WITHHELD from all nominees |

|||||||

(Instructions: To withhold authority to vote for any indicated nominee, write the number(s) of the nominee(s) in the box provided to the right.) |

||||||||||||||

3. |

In their discretion, on such other matters as may properly come before the meeting. |

o For |

o Against |

o Abstain |

| Date | , 2004 | |||||

Where stock is registered jointly in the names of two or more persons ALL should sign. Signature(s) should correspond exactly with the name(s) as shown above. Please sign and date and return promptly in the enclosed envelope. No postage need be affixed if mailed in the United States. |

||||||

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS To be Held May 13, 2004

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS, MAY 13, 2004

SOLICITATION AND REVOCATION OF PROXIES

VOTING RIGHTS

ELECTION OF DIRECTORS

DIRECTORS MEETINGS

EXECUTIVE OFFICERS

REPORT OF AUDIT COMMITTEE

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

SUMMARY COMPENSATION TABLE

STOCK OPTION GRANTS IN LAST FISCAL YEAR

STOCK OPTION EXERCISES AND OPTION VALUES

EQUITY COMPENSATION PLAN INFORMATION

EMPLOYMENT ARRANGEMENTS

DIRECTOR COMPENSATION

COMPARATIVE STOCK PRICE PERFORMANCE

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

SECURITY HOLDERS COMMUNICATIONS WITH THE BOARD

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

INDEPENDENT ACCOUNTANTS

QUORUM AND VOTE REQUIRED

SHAREHOLDER PROPOSALS

OTHER MATTERS

Appendix A

NORTECH SYSTEMS INCORPORATED Audit Committee Charter

Appendix B

NORTECH SYSTEMS INCORPORATED Compensation Committee Charter

Appendix C

NORTECH SYSTEMS INCORPORATED Nominating and Corporate Governance Committee Charter