Exhibit 10(h)

ASSIGNMENT OF MEMBERSHIP INTEREST

THIS ASSIGNMENT OF MEMBERSHIP INTEREST (this “Assignment”) is made this 21st day of October 2019, by NOBILITY HOMES, INC., a Florida corporation (hereinafter referred to as “Transferor”) to THOMAS W. TREXLER (hereinafter referred to as “Transferee”).

WITNESSETH:

WHEREAS, Transferor is the owner and holder of Six Thousand Three Hundred Ninety-Seven (6,397) (63.97%) of the Class A Membership Units of NOBILITY PARKS I, LLC, a Florida limited liability company (hereinafter referred to as the “Company”); and

WHEREAS, Transferor desires to assign Four Thousand Seven Hundred Two and One-Half (4,702.50) (47.025%) of the Class A Membership Units in the Company, and any and all interest Transferor may have related thereto and in the Company (the “Membership Interest”) to the Transferee.

NOW, THEREFORE, in consideration of the premises hereof and of the mutual covenants and conditions herein set forth, the parties hereto agree as follows:

1. The recitals set forth above in the “Whereas” clauses are true and correct and are incorporated herein by reference.

2. Transferor hereby conveys to Transferee all of its right, title and interest to the Membership Interest. Transferor shall execute this Assignment and other appropriate documents as are necessary to effectuate a transfer of the Membership Interest to the Transferee and the consideration shall be as set forth in Paragraph 3 below, Transferor hereby authorizes an officer for Company to execute any other documents on its behalf to effectuate the above transfer.

3. The consideration paid to the Transferor by Transferee for the transfer of its Membership Interest shall be One Million One Hundred Ten Thousand Sixteen and 40/100 Dollars ($1,110,016.40), to be paid by wire transfer after execution of this Assignment by both parties.

4. Transferor warrants that it is the legal and beneficial owner of the Membership Interest and that the Membership Interest is free and clear from any and all encumbrances.

5. Transferor hereby represents that Transferor has the authority and power to execute this Assignments and is the authorized officer, and President and owner of Transferor.

6. Transferor agrees to indemnify Transferee for the accuracy of all representations and warranties in this Assignment, and any and all amounts which Transferor may owe Transferee related to said representations and warranties.

Page 1 of 3

7. Transferor instructs legal counsel of record to make the appropriate changes in the Company’s records at his or her office or as may be required in any state or federal filing.

8. This Assignment may be executed in any number of counterparts, including by facsimile or e-mail, each of which, when executed, shall be deemed to be an original and all of which together shall be deemed to be one and the same instrument,

9. Transferee hereby agrees to be bound by the Operating Agreements of the Company, and all its respective terms and conditions.

10, This transfer shall be effective as of October 21, 2019.

IN WITNESS WHEREOF, Transferor and Transferee have executed this Assignment in manner and form sufficient to bind them as of the day and year first above written.

| “Transferor” | ||

| NOBILITY HOMES, INC. | ||

| a Florida corporation | ||

| By: | /s/ Terry E. Trexler | |

| Terry E. Trexler, President | ||

| “Transferee” | ||

| /s/ Thomas W. Trexler | ||

| THOMAS W. TREXLER | ||

Page 2 of 3

CONSENT OF VOTING MEMBERS

Pursuant to Section 9 of the Company’s Operating Agreement the undersigned, representing the Company as the sole voting member, hereby approves of the foregoing Assignment of Membership Interest from NOBILITY HOMES, INC., a Florida corporation, to THOMAS W. TREXLER.

| NOBILITY HOMES, INC. | ||

| a Florida corporation | ||

| By: | /s/ Terry E. Trexler | |

| Terry E. Trexler, President | ||

Page 3 of 3

ASSIGNMENT OF MEMBERSHIP INTEREST

THIS ASSIGNMENT OF MEMBERSHIP INTEREST (this “Assignment”) is made this 21st day of October 2019, by NOBILITY HOMES, INC., a Florida corporation (hereinafter referred to as “Transferor”) to WILLIAM STARKEY (hereinafter referred to as “Transferee”).

WITNESSETH:

WHEREAS, Transferor is the owner and holder of Six Thousand Three Hundred Ninety-Seven (6,397) (63.97%) of the Class A Membership Units of NOBILITY PARKS I, LLC, a Florida limited liability company (hereinafter referred to as the “Company”); and

WHEREAS, Transferor desires to assign Eight Hundred Forty-Seven and Three Tenths (847.3) (8.473%) of the Class A Membership Units in the Company, and any and all interest Transferor may have related thereto and in the Company (the “Membership Interest”) to the Transferee.

NOW, THEREFORE, in consideration of the premises hereof and of the mutual covenants and conditions herein set forth, the parties hereto agree as follows:

1. The recitals set forth above in the “Whereas” clauses are true and correct and are incorporated herein by reference.

2. Transferor hereby conveys to Transferee all of its right, title and interest to the Membership Interest. Transferor shall execute this Assignment and other appropriate documents as are necessary to effectuate a transfer of the Membership Interest to the Transferee and the consideration shall be as set forth in Paragraph 3 below, Transferor hereby authorizes an officer for Company to execute any other documents on its behalf to effectuate the above transfer.

3. The consideration paid to the Transferor by Transferee for the transfer of its Membership Interest shall be Two Hundred Thousand Three and 60/100 Dollars ($200,003.60), to be paid by wire transfer after execution of this Assignment by both parties.

4. Transferor warrants that it is the legal and beneficial owner of the Membership Interest and that the Membership Interest is free and clear from any and all encumbrances.

5. Transferor hereby represents that Transferor has the authority and power to execute this Assignments and is the authorized officer, and President and owner of Transferor.

6. Transferor agrees to indemnify Transferee for the accuracy of all representations and warranties in this Assignment, and any and all amounts which Transferor may owe Transferee related to said representations and warranties.

7. Transferor instructs legal counsel of record to make the appropriate changes in the Company’s records at his or her office or as may be required in any state or federal filing.

Page 1 of 3

8. This Assignment may be executed in any number of counterparts, including by facsimile or e-mail, each of which, when executed, shall be deemed to be an original and all of which together shall be deemed to be one and the same instrument,

9. Transferee hereby agrees to be bound by the Operating Agreements of the Company, and all its respective terms and conditions.

10, This transfer shall be effective as of October 21, 2019.

IN WITNESS WHEREOF, Transferor and Transferee have executed this Assignment in manner and form sufficient to bind them as of the day and year first above written.

| “Transferor” | ||

| NOBILITY HOMES, INC. | ||

| a Florida corporation | ||

| By: | /s/ Terry E. Trexler | |

| Terry E. Trexler, President | ||

| “Transferee” | ||

| /s/ William Starkey | ||

| WILLIAM STARKEY | ||

Page 2 of 3

CONSENT OF VOTING MEMBERS

Pursuant to Section 9 of the Company’s Operating Agreement the undersigned, representing the Company as the sole voting member, hereby approves of the foregoing Assignment of Membership Interest from NOBILITY HOMES, INC., a Florida corporation, to WILLIAM STARKEY.

| NOBILITY HOMES, INC. | ||

| a Florida corporation | ||

| By: | /s/ Terry E. Trexler | |

| Terry E. Trexler, President | ||

Page 3 of 3

ASSIGNMENT OF MEMBERSHIP INTEREST

THIS ASSIGNMENT OF MEMBERSHIP INTEREST (this “Assignment”) is made this 21st day of October 2019, by NOBILITY HOMES, INC., a Florida corporation (hereinafter referred to as “Transferor”) to TERRI LYNN YANCEY (hereinafter referred to as “Transferee”).

WITNESSETH:

WHEREAS, Transferor is the owner and holder of Six Thousand Three Hundred Ninety-Seven (6,397) (63.97%) of the Class A Membership Units of NOBILITY PARKS I, LLC, a Florida limited liability company (hereinafter referred to as the “Company”); and

WHEREAS, Transferor desires to assign Four Hundred Twenty-Three and Six-Tenths (423.65) (4.236%) of the Class A Membership Units in the Company, and any and all interest Transferor may have related thereto and in the Company (the “Membership Interest”) to the Transferee.

NOW, THEREFORE, in consideration of the premises hereof and of the mutual covenants and conditions herein set forth, the parties hereto agree as follows:

1. The recitals set forth above in the “Whereas” clauses are true and correct and are incorporated herein by reference.

2. Transferor hereby conveys to Transferee all of its right, title and interest to the Membership Interest. Transferor shall execute this Assignment and other appropriate documents as are necessary to effectuate a transfer of the Membership Interest to the Transferee and the consideration shall be as set forth in Paragraph 3 below, Transferor hereby authorizes an officer for Company to execute any other documents on its behalf to effectuate the above transfer.

3. The consideration paid to the Transferor by Transferee for the transfer of its Membership Interest shall be Ninety-Nine Thousand Nine Hundred Ninety and No/100 Dollars ($99,990.00), to be paid by wire transfer after execution of this Assignment by both parties.

4. Transferor warrants that it is the legal and beneficial owner of the Membership Interest and that the Membership Interest is free and clear from any and all encumbrances.

5. Transferor hereby represents that Transferor has the authority and power to execute this Assignments and is the authorized officer, and President and owner of Transferor.

6. Transferor agrees to indemnify Transferee for the accuracy of all representations and warranties in this Assignment, and any and all amounts which Transferor may owe Transferee related to said representations and warranties.

7. Transferor instructs legal counsel of record to make the appropriate changes in the Company’s records at his or her office or as may be required in any state or federal filing.

Page 1 of 3

8. This Assignment may be executed in any number of counterparts, including by facsimile or e-mail, each of which, when executed, shall be deemed to be an original and all of which together shall be deemed to be one and the same instrument,

9. Transferee hereby agrees to be bound by the Operating Agreements of the Company, and all its respective terms and conditions.

10, This transfer shall be effective as of October 21, 2019.

IN WITNESS WHEREOF, Transferor and Transferee have executed this Assignment in manner and form sufficient to bind them as of the day and year first above written.

| “Transferor” | ||

| NOBILITY HOMES, INC. | ||

| a Florida corporation | ||

| By: | /s/ Terry E. Trexler | |

| Terry E. Trexler, President | ||

| “Transferee” | ||

| /s/ Terri Lynn Yancey | ||

| TERRI LYNN YANCEY | ||

Page 2 of 3

CONSENT OF VOTING MEMBERS

Pursuant to Section 9 of the Company’s Operating Agreement the undersigned, representing the Company as the sole voting member, hereby approves of the foregoing Assignment of Membership Interest from NOBILITY HOMES, INC., a Florida corporation, to TERRI LYNN YANCEY.

| NOBILITY HOMES, INC. | ||

| a Florida corporation | ||

| By: | /s/ Terry E. Trexler | |

| Terry E. Trexler, President | ||

Page 3 of 3

ASSIGNMENT OF MEMBERSHIP INTEREST

THIS ASSIGNMENT OF MEMBERSHIP INTEREST (this “Assignment”) is made this 21st day of October 2019, by NOBILITY HOMES, INC., a Florida corporation (hereinafter referred to as “Transferor”) to LISA LEE TREXLER TRUST U/A/D 9/24/71, AS AMENED, GLORIA JEAN ETHEREDGE, TRUSTEE (hereinafter referred to as “Transferee”).

WITNESSETH:

WHEREAS, Transferor is the owner and holder of Six Thousand Three Hundred Ninety-Seven (6,397) (63.97%) of the Class A Membership Units of NOBILITY PARKS I, LLC, a Florida limited liability company (hereinafter referred to as the “Company”); and

WHEREAS, Transferor desires to assign Four Hundred Twenty-Three and Six-Tenths (423.65) (4.236%) of the Class A Membership Units in the Company, and any and all interest Transferor may have related thereto and in the Company (the “Membership Interest”) to the Transferee.

NOW, THEREFORE, in consideration of the premises hereof and of the mutual covenants and conditions herein set forth, the parties hereto agree as follows:

1. The recitals set forth above in the “Whereas” clauses are true and correct and are incorporated herein by reference.

2. Transferor hereby conveys to Transferee all of its right, title and interest to the Membership Interest. Transferor shall execute this Assignment and other appropriate documents as are necessary to effectuate a transfer of the Membership Interest to the Transferee and the consideration shall be as set forth in Paragraph 3 below, Transferor hereby authorizes an officer for Company to execute any other documents on its behalf to effectuate the above transfer.

3. The consideration paid to the Transferor by Transferee for the transfer of its Membership Interest shall be Ninety-Nine Thousand Nine Hundred Ninety and No/100 Dollars ($99,990.00), to be paid by wire transfer after execution of this Assignment by both parties.

4. Transferor warrants that it is the legal and beneficial owner of the Membership Interest and that the Membership Interest is free and clear from any and all encumbrances.

5. Transferor hereby represents that Transferor has the authority and power to execute this Assignments and is the authorized officer, and President and owner of Transferor.

6. Transferor agrees to indemnify Transferee for the accuracy of all representations and warranties in this Assignment, and any and all amounts which Transferor may owe Transferee related to said representations and warranties.

7. Transferor instructs legal counsel of record to make the appropriate changes in the Company’s records at his or her office or as may be required in any state or federal filing.

Page 1 of 3

8. This Assignment may be executed in any number of counterparts, including by facsimile or e-mail, each of which, when executed, shall be deemed to be an original and all of which together shall be deemed to be one and the same instrument,

9. Transferee hereby agrees to be bound by the Operating Agreements of the Company, and all its respective terms and conditions.

10, This transfer shall be effective as of October 21, 2019.

IN WITNESS WHEREOF, Transferor and Transferee have executed this Assignment in manner and form sufficient to bind them as of the day and year first above written.

| “Transferor” | ||

| NOBILITY HOMES, INC. | ||

| a Florida corporation | ||

| By: | /s/ Terry E. Trexler | |

| Terry E. Trexler, President | ||

| “Transferee” | ||

| LISA LEE TREXLER TRUST U/A/D 9/24/71, AS AMENDED, GLORIA JEAN ETHEREDGE, TRUSTEE | ||

| /s/ Gloria Jean Etheredge | ||

| Gloria Jean Etheredge, Trustee | ||

Page 2 of 3

CONSENT OF VOTING MEMBERS

Pursuant to Section 9 of the Company’s Operating Agreement the undersigned, representing the Company as the sole voting member, hereby approves of the foregoing Assignment of Membership Interest from NOBILITY HOMES, INC., a Florida corporation, to LISA LEE TREXLER TRUST U/A/D 9/24/71, AS AMENDED, GLORIA JEAN ETHEREDGE, TRUSTEE.

| NOBILITY HOMES, INC. | ||

| a Florida corporation | ||

| By: | /s/ Terry E. Trexler | |

| Terry E. Trexler, President | ||

Page 3 of 3

UNANIMOUS CONSENT ACTION

OF THE INDEPENDENT DIRECTORS OF

NOBILITY HOMES, INC.,

A FLORIDA CORPORATION

The undersigned, as the sole Independent Director of Nobility Homes, Inc., a Florida corporation (the “Corporation”), unanimously agree, adopt, consent to, and order the following corporate actions:

1. The undersigned waive all formal requirements, including the necessity of holding a formal or informal meeting and any requirement that notice of such meeting be given.

2. The undersigned adopt the following corporate actions:

WHEREAS, the Corporation has been approached with an offer to purchase its 63.97% ownership in Nobility Parks I, LLC, a Florida limited liability company, (“NPI”) for $1,510,000; and

WHEREAS, the sole Independent Director has been asked to evaluate the fairness of the offer on behalf of the Corporation since all other directors may or do have a conflict with respect to the transaction; and

WHEREAS, NPI owns a 49% interest in Walden Wood South, LLC (“Walden”) and Walden’s sole asset is a Manufactured Home Community in Homosassa, Florida; and

WHEREAS, Albright and Associates of Ocala, Inc. has completed an appraisal of Walden, attached hereafter as Exhibit A, which concludes a gross value of $4,504,000 for Walden’s asset without consideration of any discount associated with a non-controlling minor interest in Walden; and

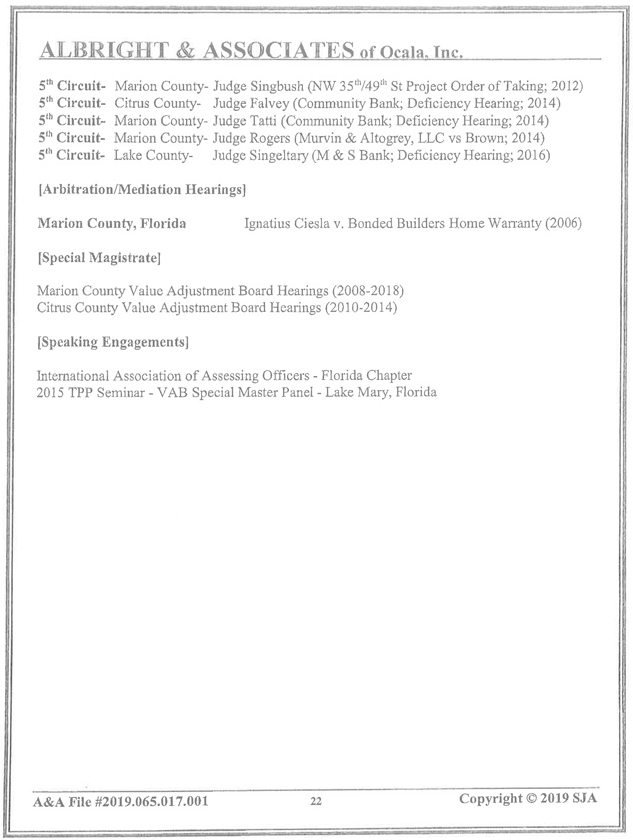

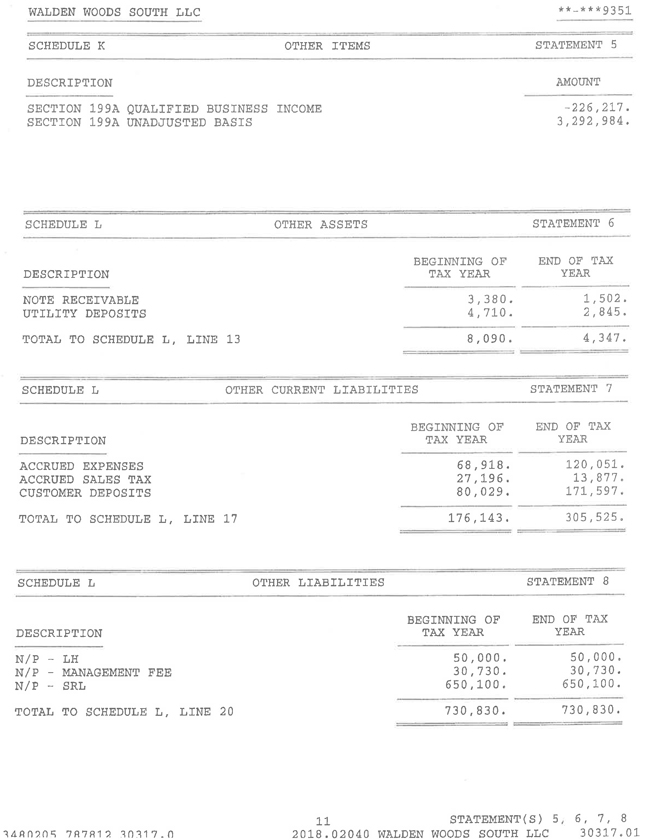

WHEREAS, an examination of the financial statement, attached as Exhibit B, shows two material liabilities: (1) a $3,800,000 note and mortgage to Terry E. Trexler related to the original purchase by him, and (2) $700,000 owed to Stoneridge Landing, Ltd. and Lake Harris Landing, Ltd.; and

WHEREAS, based on the appraisal and existing liabilities, the existing net equity of Walden is approximately zero, so based on these facts, the purchase price of $1,510,000 is well in excess of fair value; and

WHEREAS, the price offered is the original amount invested by the Corporation, representing an overall ownership of 31.35% (63.97% times 49%) of Walden.

RESOLVED, that the Independent Director hereby concludes that based on the above facts, the purchase price of $1,510,000 in the above offer is a fair value for the Corporation’s ownership in NPI.

Page 1 of 2

FURTHER RESOLVED, that the President is hereby directed and authorized to carry out the purpose or intent of the foregoing resolution and to do or cause to be done any and all such acts and things by or on behalf of the Corporation.

IN WITNESS WHEREOF, the undersigned, constituting all of the Independent Directors of the Corporation, have executed the foregoing corporate action for the purpose of giving their consent to it as of the 21st day of October 2019.

| /s/ Robert P. Saltsman |

| ROBERT P. SALTSMAN |

Page 2 of 2

EXHIBIT A ALBRIGHT & ASSOCIATES of Ocala, Inc. Walden Woods South 10522 S. Pebbleshire Dr Homosassa, Florida Restricted Appraisal Report A&A File #2019.065.017.001 Certified to: Mr. Bob Saltsman Nobility Homes 3741 SW7th St Ocala, FL 34474 Certified by: Stephen J. Albright, Jr., MAI State-Certified General Real Estate Appraiser RZ2392 Copyright © 2019, Stephen J. Albright, Jr., MAI All Rights Reserved Albright & Associates of Ocala, Inc. 207 SE 8th Street, Ocala, FL 34471 This appraisal report is confidential and is protected by copyright; no part hereof may be reproduced, stored or introduced to a retrieval system or transmitted in any form or by any means (electronic, mechanical, photocopying, recording or otherwise) without the prior written permission of the copyright owner, identified author and client of the report. A&A File #2019.065.017.001 Copyright © 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. Mr. Bob Saltsman September 10, 2019 Nobility Homes 3741 SW 7th St Ocala, FL 34474 Re: Walden Woods South @ 10522 S, Pebbleshire Dr, Homosassa, Florida Dear Mr. Saltsman: Pursuant to your request, an appraisal has been prepared of the above captioned property documented by the enclosed text. The subject property consists of the Walden Woods South mobile home park (age-restricted) in Homosassa, Florida. The park includes 236 spaces along with significant amenities. The park has not achieved stabilized occupancy but is anticipated to do so within the next four years (requiring significant capital expense for lot infrastructure and advertising). As a professional discipline, the appraisal practice requires conformance with stringent ethics and standards which are noted, summarized or cited by reference herein. To that end, opinions and conclusions of this report were prepared in conformance with my interpretation of generally accepted appraisal practices and requirements of the Code of Professional Ethics and Standards of Professional Practice of the Appraisal Institute as well as the Uniform Standards of Professional Appraisal Practice (USPAP) of the Appraisal Standards Board of the Appraisal Foundation. This assignment is published as a Restricted Appraisal Report format. By definition, the Restricted Appraisal Report sets forth only a synopsis of the appraiser’s opinions and conclusions. It does not include detailed presentation pertaining to the facts, data, reasoning and analyses used within the appraisal process to develop the opinions and conclusions. The depth and breadth of my presentation, by prior agreement, caters specifically to the needs of the client who is the intended user of this appraisal report. Further, much of the supporting documentation pertaining to my analyses, opinions and conclusions has been retained in my file memorandum and is, by reference, considered an integral part of this appraisal report, The abbreviated format of this restricted appraisal report presumes a certain level of familiarity by the reader with: 1. Physical characteristics of the subject property. 2. Economic and environmental influences which primarily impact the subject, 3. Appraisal process. Accordingly, I am not responsible for the unauthorized distribution or use of this restricted appraisal report. You are advised of special conditions of this appraisal including the following: Intended User: Mr. Bob Saltsman of Nobility Homes A&A File #2019.065.017.001 2 Copyright © 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. Intended Use: asset evaluation Effective Valuation Date: July 16, 2019 Objective/Purpose: form an opinion of market value Interest Appraised: leased fee estate The appraisal is limited to valuation of real estate, excluding personalty, furnishings, equipment, inventory and goodwill of the business, if any. Based on prevailing economic conditions in all aspects to the extent possible, taking into account all relevant global, national, regional, neighborhood and local environmental influences, in consideration of the physical characteristics impacting upon the subject property, weighing the best market evidence available as has been set forth in this report, I have formed an opinion of market value of the subject property identified within this report, with a reasonable degree of appraisal certainty, with respect to the interest identified, according to the program of property utilization that is consistent with our opinion of highest and best use, and predicated on the Certification, General Assumptions, Extraordinary Assumptions well as the Hypothetical Conditions, expressed in this appraisal report, as of the effective valuation date reported for this assignment, of: Opinion of Market Value $4,504,000 Respectfully submitted, ALBRIGHT & ASSOCIATES of Ocala, Inc. Stephen J. Albright, Jr., MAI State-Certified General Real Estate Appraiser RZ2392 A&A File #2019.065.017.001 3 Copyright © 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. Contents Title Page 1 Letter of Transmittal 2 Contents 4 Executive Summary 5 Certification 6 General Assumptions 8 Extraordinary Assumptions 10 Hypothetical Conditions 10 Identification and Location 11 Apparent Owner of Record 11 Relevant Dates of Appraisal Process 11 Type and Definition of Value 11 Intended User and Intended Use of Appraisal 11 Scope of Work 12 Interest Appraised 12 Legal Description 13 Property Assessment 13 History of Title 13 Public and Private Utilities and Services 14 Comprehensive Plan, Land Use and Zoning 14 Description and Analysis of Region 14 Description and Analysis of Neighborhood 14 Description and Analysis of Site 15 Description and Analysis of Improvements 15 Economic Life and Depreciation Analysis 15 Highest and Best Use 15 Reasonable Exposure Time 16 Valuation Methodology 16 Income Capitalization Approach 17 Reconciliation 18 Addendum A&A File #2019.065.017.001 4 Copyright 2019 SJA

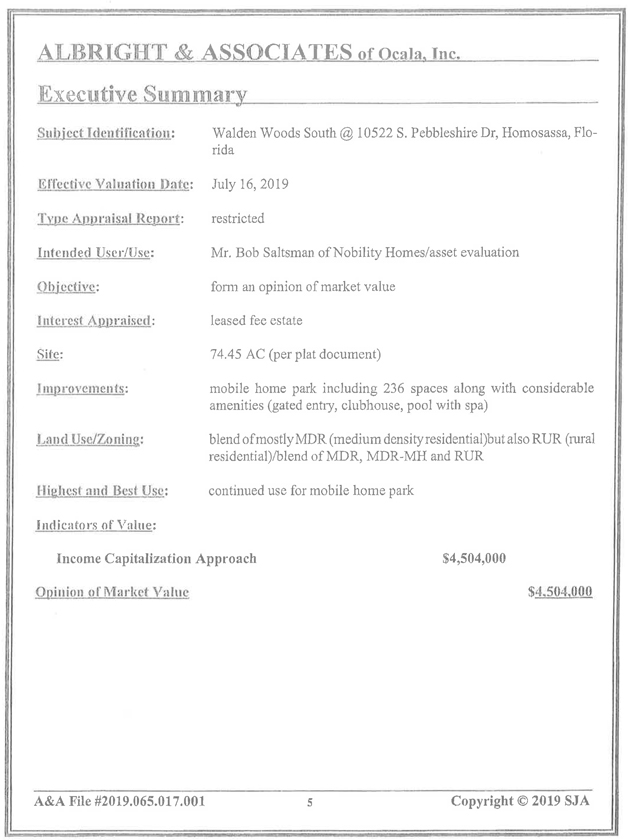

ALBRIGHT & ASSOCIATES of Ocala, Inc. Executive Summary Subject Identification: Walden Woods South @ 10522 S. Pebbleshire Dr, Homosassa, Florida Effective Valuation Date: July 16, 2019 Type Appraise Report: restricted Intended User/Use: Mr. Bob Saltsman of Nobility Homes/asset evaluation Objective: form an opinion of market value Interest Appraised: leased fee estate Site: 74.45 AC (per plat document) Improvements: mobile home park including 236 spaces along with considerable amenities (gated entry, clubhouse, pool with spa) Land Use/Zoning: blend of mostly MDR (medium density residential)but also RUR (rural residential)/blend of MDR, MDR-MH and RUR Highest and Best Use: continued use for mobile home park Indicators of Value: Income Capitalization Approach $4,504,000 Opinion of Market Value $4,504,000 A&A File #2019.065.017.001 5 Copyright © 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. Certification The undersigned certifies that, to the best of my knowledge and belief: 1. The statements of fact contained in this report are true and correct. 2. The reported analyses, opinions and conclusions are limited only by the reported assumptions and hypothetical conditions and are my personal, impartial and unbiased professional analyses, opinions and conclusions. 3. I have no present or prospective interest in the property that is the subject of this report and no personal interest with respect to the parties involved. 4. I have no bias with respect to the property that is the subject of this report or to the parties involved in this assignment. 5. My engagement in this assignment was not contingent on developing or reporting predetermined results. 6. My compensation for completing this assignment is not contingent upon the development or reporting of a predetermined value or direction in value that favors the cause of the client, the amount of the value opinion, the attainment of a stipulated result, or the occurrence of a subsequent event directly related to the intended use of this appraisal. 7. To the best of my knowledge and belief, the reported analyses, opinions and conclusions were developed, and this report has been prepared, in conformity with the requirements of the Code of Professional Ethics and the Standards of Professional Practice of the Appraisal Institute as well as the Uniform Standards of Professional Appraisal Practice, 8. The use of this report is subject to the requirements of the Appraisal Institute relating to review by its duly authorized representatives. 9. An on-site interior and exterior inspection of the subject property was made by the undersigned. 10. No person added significant real property appraisal assistance except as specified. 11. USPAP requires appraisers, prior to accepting assignments, to possess experience and skill necessary for completion, or: A. Disclose lack of knowledge and/or experience before assignment acceptance. A&A File #2019.065.017.001 6 Copyright © 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. B. Take necessary and appropriate steps to complete assignment competently. C. Describe lack of knowledge and/or experience in appraisal report, D. Describe steps taken to complete assignment competently in appraisal report. Stephen J. Albright, Jr. has performed appraisals of numerous mobile home parks in the north central Florida market for a combination of private- and public-sector clients for more than 25 years. 12. This Certification was prepared in conformance with the Uniform Standards of Professional Appraisal Practice of the Appraisal Standards Board of the Appraisal Foundation as well as the Supplemental Standards of Professional Practice of the Appraisal Institute, 13. At the date of this report, I, Stephen J. Albright, Jr., have completed the continuing education program for Designated Members of the Appraisal Institute. 14. I have performed no professional services associated with the property that is the subject of this report within the three-year period immediately preceding acceptance of the assignment. Stephen J. Albright, Jr., MAI State-Certified General Real Estate Appraiser RZ2392 A&A File #2019.065.017.001 7 Copyright © 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. General Assumptions The following are general assumptions upon which this appraisal is predicated. That is, these conditions are taken to be true. 1. This report is the work product of Albright & Associates of Ocala, Inc. and is protected by copyright. Violators will be prosecuted to the fullest extent of the law. Consideration for this appraisal report is full payment of our fee by the client. Liability for this appraisal report is limited only to the extent of fees paid for services rendered, No change of any item in the appraisal report shall be made by anyone other than the appraisers who shall have no responsibility for unauthorized changes, 2. Disclosure of the report content is governed by the bylaws and regulations of the Appraisal Institute. 3. The appraiser assumes no responsibility for legal matters affecting the property appraised or its title. While title of the subject property is assumed good and marketable, the appraiser renders no such opinion thereof. 4. The appraiser is not required to give testimony, or to appear in court, as a result of having performed the appraisal of the identified subject property, unless prior arrangements have been made. 5. No party shall use or rely upon this appraisal, or Data Book (if one is prepared pursuant to this assignment), or any part of its content (i.e. value opinions, appraiser identity, professional designations, reference to professional appraisal organizations or appraiser’s firm affiliation), for any purposes, except the client and/or intended users specifically identified herein. Other parties seeking to use or rely on this appraisal must first obtain the written consent of the appraiser before any of the warranties or representations contained in the appraisal report, expressed or implied, shall inure to the benefit of any other party. Violation of this condition renders these findings null and void. Moreover, this report is to be used only in total presented form and cannot be taken out of context or used in any other form including, but not limited to, excerpts or fractions or redistribution thereof, as such a format change may be misleading. The appraiser assumes no liability for any part of the work product taken in fraction from the total report. Any distribution of value in the report between land and improvements applies only under the existing program of utilization. Separate valuations for land and building, outside the scope of this assignment, must not be used for any purpose and are invalid if so used. Any redistribution of value (land and/or improvements) may render the findings of this appraisal null and void. 6. Information, data and opinions furnished to the appraiser, and contained herein, were obtained from sources considered reliable and are believed to be true and correct. However, no responsibility or liability is assumed by the appraiser for accuracy of confirmed or unconfirmed data. A diligent effort was made to verify all reported data. However, as some principals reside out of the area, or are entities that could not be contacted in the time allowed for report completion, some data may not A&A File #2019.065.017.001 8 Copyright 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. have been confirmed. The appraiser has made no survey of the property. Any sketch of the land and/or of the improvements herein is intended to show approximate dimensions and to assist the reader in visualizing the subject property. The physical size of the subject property is not warranted as fully accurate. This appraisal is contingent on the findings of a qualified survey in terms of not only actual dimensions of the land and/or improvements but also any easements, encroachments or other encumbrances. The findings of such a survey may result in the need for re-evaluation of the appraisal process and value opinions associated therewith. 7. In this appraisal assignment, the existence of potentially hazardous materials or waste on, in or beneath the site (including, but not limited to, such items as urea formaldehyde foam insulation, toxic waste, Radon gas level and/or toxic mold, all of which may pose a risk to the property or its inhabitants) has been disregarded from consideration with respect to valuation analysis. The appraiser is neither qualified to detect such substances nor capable of precisely determining its potential impact on the subject property. Moreover, the appraiser assumes no responsibility for hidden or unapparent conditions of the property, subsoil or structures which would render it more or less valuable or for engineering which might be required to discover such features. Depending on the level of concern as to the property’s condition (i.e. potential on- and off-site soil contamination, ground water pollution and various environmentally-sensitive issues), it may be necessary to retain the services of an expert in this field and/or undergo a Phase I environmental audit, if either or both have not been conducted. 8. Value opinions concluded herein are warranted as accurate, subject to assumptions and hypothetical conditions stated or implicit herein as of the effective valuation date. A thorough property inspection has been conducted as of the specified date shown herein. However, the appraiser(s) are not experts in the field of construction, engineering, repair, renovation, remediation or building inspection services, as such, a professional building inspection is always recommended. 9. No responsibility is assumed by the appraiser for changes or influences, in or about the subject property and its neighborhood, which result in a change, positive or negative, to the subject and thereby to its value conclusion, subsequent to the effective inspection and/or valuation date. The value opinions are applicable only to the fixed point in time associated with the effective valuation date herein and are not applicable to any other point in time, specific or general, prior or subsequent to said date. Values expressed herein are opinions. There is no guarantee, written or implied, that the subject property will sell for this value opinion. For example, expressions of market value constitute “value in exchange” which should not be construed as liquidation value in the unforeseen eventuality that a business operation associated with the subject property proves economically unfeasible and/or the property is conveyed by conditions inconsistent with the market value definition. With respect to income-producing properties, value opinions are contingent on competency of ownership and management as the operational success of leasing real estate is inevitably linked with economic achievement of business. When values include prospective opinions, the appraiser is not responsible for unforeseen events that may alter interim market A&A File #2019.065.017.001 9 Copyright © 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. conditions. 10 . Before any loans or commitments are made which may be predicated on the value conclusions reported in this appraisal, the mortgagee should verify facts, data and value conclusions contained in this report. 11 . Notwithstanding any specification herein of flood plain status of the subject property appraised, it is recommended additional confirmation of the same be obtained prior to any contemplated loan or development, 12 . This appraisal and value findings are contingent on the impact, if any, to the subject property by the “Americans With Disabilities Act,” 13, Natural landscaping is a habitat for many living species. A good faith effort should be made to preserve maximum natural landscaping, saving all specimen trees and otherwise complying with all tree ordinances. A reasonable effort should be made to allow natural displacement (trap and release) of all habitat. This valuation is based on the assumption that the property is free from any endangered species and does not require any mitigation associated with natural habitats. Extraordinary Assumptions The following are assumptions upon which this appraisal is predicated. These assumptions are also taken to be true. Their use may have affected the appraisal results, 1. This valuation is based on the assumption that my estimates for “lease up” advertising costs ($120,000 in Year 1) and individual lot infrastructure cost ($40,000 per lot in Year 1) are accurate. Hypothetical Conditions The following are hypothetical conditions upon which this appraisal is predicated. That is, these are conditions which are contrary to those which presently exist at the effective valuation date. Their use may have affected the appraisal results. None, A&A File #2019.065.017.001 10 Copyright © 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. Identification and Location The subject is generally identified as follows. Property Identification: Walden Woods South Address: 10522 S, Pebbleshire Dr, Homosassa, Florida Apparent Owner of Record The following information from another source is believed reliable though not warranted as such. Name: Walden Woods South LLC Address: 3741 SW 7th St, Ocala, Florida 34478 Relevant Dates of Appraisal Process The following represent the most critical dates of analysis of the appraisal process. Inspection/Photography: July 16, 2019 Effective Valuation: July 16, 2019 Type and Definition of Value The purpose of the appraisal is to form an opinion of market value. Intended User and Intended Use of Appraisal The intended user of this appraisal is Mr. Bob Saltsman of Nobility Homes. The specifically designed and intended use of this appraisal is for asset evaluation. Use of this appraisal is prohibited as it relates to any function other than that identified herein. 1 Market value (value-in-exchange) is defined by Office of the Comptroller of the Currency (12CFR, Part 34) and the Appraisal Institute (The Dictionary Of Real Estate Appraisal, 6th Edition) as: The most probable price which a property should bring in a competitive and open market under all conditions requisite to a fair sale, the buyer and seller each acting prudently and knowledgeably, and assuming the price is not affected by undue stimulus. Implicit in this definition is the consummation of a sale as of a specific dale and the passing of title from seller to buyer under conditions whereby: Buyer and seller are typically motivated; . Both parties are well informed or well advised, and acting in what they consider their best interests; A reasonable time is allowed for exposure in the open market; Payment is made in terms of cash in U.S. dollars or in terms of financial arrangements comparable thereto; and The price represents the normal consideration for the property sold unaffected by special or creative financing or sales concessions granted by anyone associated with the sale. A&A File #2019.065.017.001 11 Copyright 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. Scope of Work USPAP specifically indicates that “for each appraisal and appraisal review assignment, an appraiser must: 1. Identify the problem to be solved; 2. Determine and perform the scope of work necessary to develop credible assignment results; 3. Disclose the scope of work in the report.” To that end, the problem to be solved for this assignment is to form an opinion of market value of the leased fee estate of the subject property as of current effective valuation date. The necessary scope of work to develop a credible result includes the following. Identify a current effective date of valuation (July 16, 2019). Physically inspect and photograph the subject property. Review available information regarding the subject site, improvements and historical/current financial performance. Research the subject’s environment (i.e. region and neighborhood). Analyze highest and best use of subject property. This valuation includes only the Income Capitalization Approach which happens to represent the single most reliable and relevant approach to value for the subject property (particularly considering that the subject has yet to achieve stabilized occupancy). In that regard, the exclusion of the Cost Approach and Sales Comparison Approach is not regarded as providing a result that is misleading to the intended user. @ Form an opinion of market value from market indicators. ® Prepare a restricted appraisal report, as defined in USPAP, which will include an extremely brief presentation of data and descriptions (supporting data and analysis relevant to the assignment has been retained in my files). Interest Appraised Leased fee interest2, subject to restrictions of record. 2 As defined in the Dictionary of Real Estate, 6th Edition, leased fee interest is “a freehold (ownership interest) where the possessory interest has been granted to another party by creation of a contractual landlord-tenant relationship (i.e, a lease).” A&A File #2019.065.017.001 12 Copyright © 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. Legal Description The following legal description was obtained from the public records of Citrus County, Florida. While believed accurate, it is not warranted as such. DISCRIPTION: Property Assessment The subject is included in the 2018 Citrus County Property Assessment Roll as Alternate Key No. 3424403 with a 2018 just/assessed/taxable value of $3,071,290 and tax burden of $54,860.09. History off Title The subject has been within the reported ownership for more than the past five years. As of the date of valuation, the majority of the subject lots were leased and improved with manufactured housing units. A&A File #2019.065.017.001 13 Copyright © 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. Public and Private Utilities and Services The subject is positioned in unincorporated Citrus County, In that regard, central water and sewer are provided via the private systems associated with the adjacent north Walden Woods development. Additional services include cable, telephone and internet. Comprehensive Plan, Land Use and Zoning The subject is positioned in, and governed by, the jurisdiction and comprehensive plan of, Citrus County. The future land use designation of the subject property includes a blend of mostly MDR (medium density residential)but also RUR (rural residential). The corresponding zoning includes a blend of MDR, MDR-MH and RUR (with Planned Development overlay). Description and Analysis of Region Citrus County is located in the west-central portion of the State of Florida and is bordered on the north by Marion and Levy Counties, on the south by Hernando County, on the east by Sumter County and on the west by the Gulf of Mexico. The total land area for the county is about 773 square miles, of which 582 square miles is land and 192 square miles (or about 25%) is water. Citrus County is rather sparsely populated with the main areas of population concentrated in the urban areas of Homosassa, Hernando, Inverness, Crystal River, Beverly Hills and Floral City. In conclusion, Citrus County includes a relatively sparse, but steadily growing, population base influenced by a significant level of retirees as well as seasonal tourism and recreational opportunities. The impact of the expanding population of Citrus County has represented a leading force in the prosperity of this community. The increase in population has generally led to increased demand for services in all segments of the economy. Market conditions and the economy in the subject region have not only stabilized but improved significantly subsequent to the economic downturn and ensuing national recession. In the final analysis, barring any further extended economic recession, the local real estate market should benefit from long-term growth. Description and Analysis of Neighborhood Neighborhood is defined as “...a group of complementary land uses,”3 The physical neighborhood may be the same as, or different from, the economic neighborhood. The immediate market area of the subject property is generally defined as the US Hwy 19 corridor in westerly Citrus County, Florida. The area benefits from the recreational demand associated with Crystal River and Kings Bay to the north as well as Homosassa Springs to the south. US Hwy 19 (a/k/a Suncoast Blvd) represents the primary corridor through the subject neighborhood. The northerly extreme portion of the neighborhood is located within the city limits of Crystal River. Commercial uses are common 3 Appraisal Institute (The Dictionary Of Real Estate Appraisal, 6th Edition). A&A File #2019.065.017.001 14 Copyright © 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. along the corridor and associated with numerous “nodes” of development. There remains a significant amount of vacant acreage along US Hwy 19 as well. There is also a significant residential population both east and west of the corridor. Finally, the subject property is an integral part of its defined physical neighborhood, contributing to highest and best use thereof. Description and Analysis of Site The subject includes 74.45 AC positioned at the southeast comer of West Merrivale Ln and US Hwy 19. The site includes generally level terrain with the majority of the site outside the special flood hazard area designations (scattered areas of Zone “A” are associated with on-site drainage and wetlands). In summary, the site represents a physically and functionally effective entity contributing towards ultimate highest and best use. Description and Analysis of Improvements The subject property is improved with a mobile home park identified as Walden Woods South. The park includes a total of 236 lots which benefit from gated entrance, secondary construction entrance, on-site drainage and asphalt-paved interior roads. Upon execution of a lease, each lot is improved by the developer with a considerable level of horizontal and vertical improvement at a reported cost of about $40,000 per lot. The park also benefits from a clubhouse building (with pool/spa and shuffleboard courts) as well as a park office (manufactured housing unit) with parking area. In summary, the improvements are highly functional in terms of their intended and ongoing use for a mobile home park community. Economic Life and Depreciation Analysis Economic life is the period of time during which an improvement contributes to the value of land. When this period of time ends, the improvement becomes a liability to the site to the extent of, and measured by, cost of removal. The majority of subject park improvements appear to have been constructed from 2006 to 2008 for an actual age range from 11 to 13 years. The park infrastructure and amenities were all in good condition as of the date of my inspection. Highest and Best Use As defined in the Appraisal of Real Estate, 14th Edition (published by the Appraisal Institute in 2013), highest and best use is: “The reasonably probable use of property that results in the highest value.” Application of the four categories of highest and best use to the subject supports the following conclusions. As Vacant Based upon the relevant criteria, it is my opinion that the four tests of highest and best use of the A&A File #2019.065.017.001 15 Copyright © 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. subject property, as vacant, would include mobile home park development. As Improved Based upon the relevant criteria, highest and best use, as improved, is for continued use for a mobile home park (stabilized occupancy anticipated within the next four years but requiring significant capital expense for individual lot infrastructure and advertising). Reasonable Exposure Time Reasonable exposure time is historically-oriented (time lapsed prior to sale’s closing or lease). Based upon research with respect to reasonable exposure time of the subject property type, I have formed an opinion of reasonable exposure time applicable to my opinion of market value of the subject property of 6 to 12 months. Valuation Methodology The three traditional approaches to value of real estate appraisal process are: Cost Approach, Sales Comparison Approach and Income Capitalization Approach. Per the specific scope of work of this assignment, this valuation is based upon the Income Capitalization Approach only which happens to represent the single-most reliable indicator of value for the subject property. 4 “Reasonable Marketing Time” differs from “Reasonable Exposure Time” as it is: Future-oriented, subsequent to or post-effective valuation dale; thus, if introduced, “Reasonable Marketing Time” follows Reconciliation. A&A File #2019.065.017.001 16 Copyright © 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. Income Capitalization Approach This approach forms an opinion of net operating income (NOI before debt service and depreciation) which is converted to present worth of future anticipated net benefits. As the subject has yet to achieve stabilized occupancy, discounted cash flow analysis is considered the most appropriate methodology in support of an opinion of present value of the subject property. In that regard, the following are the major variables and assumptions which form the basis of the following cash flow: absorption forecasted at 20 lots per year (resulting in 179 lot in Year 1) with stabilized occupancy to occur in Year 4 Year 1 average lot rent of $342/mo anticipated to grow at 2.5% per year lot preparation expense of $40,000/lot anticipated to grow at 2% per year Years I thru 4 require additional advertising expense to achieve stabilized occupancy ($120,000 in Year 1 with growth at 2% per year; only 50% in Year 4 during which stabilized occupancy project to occur); thereafter, management expense allocation considered sufficient to sustain such occupancy pass thru income of $40 per lot anticipated to increase at 2% per year— operating expenses at 45% Year 1, decreasing to eventual stabilization at 40% in Year 4 discount rate of 9.5% based on capitalization rate of 7% plus 2.5% annual growth reversion calculated using 5th year anticipated NOI, 7.5% terminal cap rate, 3% cost of sale and present value factor at beginning of Year 5— mid-point discounting for present value of NOI for Years 1 thru 4 Discount Rato: 9.50% INCOME: Year 1 Year 2 Year 3 Year 4 Year 5 Occupied Lot Income 5734.610 5837.113 $944.277 $1.043.016 $1.069.091 PASG Thru income $7,160 $8,119 $9,114 $10,010 $10,718 Annual Occupancy: 76% 84% 93% 100% 100% EGI: $741,776 $845.233 $953,390 $1,053,034 $1.079.310 EXPENSES: Operating 5.133.709 $363.450 $400,424 $421,214 $431.724 Marketing $120,000 $122,400 $124.048 $63,672 *0 Lot Prep 5800.000 $816.000 $832.370 $721.621 $0 Total Expenses: $1.253, 790 $1,301,850 $1.357.592 $1.206.507 $431,724 HOI: $512.023 -$-156,617 -$404,202 -$153,474 $647,586 PV FACTORS: 0.955637 0.872728 0.797012 0.727865 0.695574 PV NOI: •$489.308 •5398,503 .$322,153 ..5111,708 *0 51,321,872 PV REVERSION: $5.825.742 VAI UE INDICATOR: $4.504.(100 Indicator of Market Value $4,504,000 [via laconic Capitalization Approach] A&A File #2019.065.017.001 17 Copyright © 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. Reconciliation The Income Capitalization Approach forms the sole basis for valuation herein. Based on prevailing economic conditions, taking all relevant (area) influences and (property) characteristics into consideration, weighing the best market evidence available as has been set forth in this report, I have formed an opinion of market value of the subject property, with a reasonable degree of appraisal certainty, with respect to the interest identified, according to the program of property utilization which is consistent with the threshold of highest and best use, subject to the certification, assumptions and hypothetical conditions, expressed in this appraisal report, as of the effective valuation date identified herein, of: Opinion of Market Value $4,504,000 A&A File #2019.065.017.001 18 Copyright © 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. Addendum A&A File #2019.065.017.001 19 Copyright © 2019 SJA

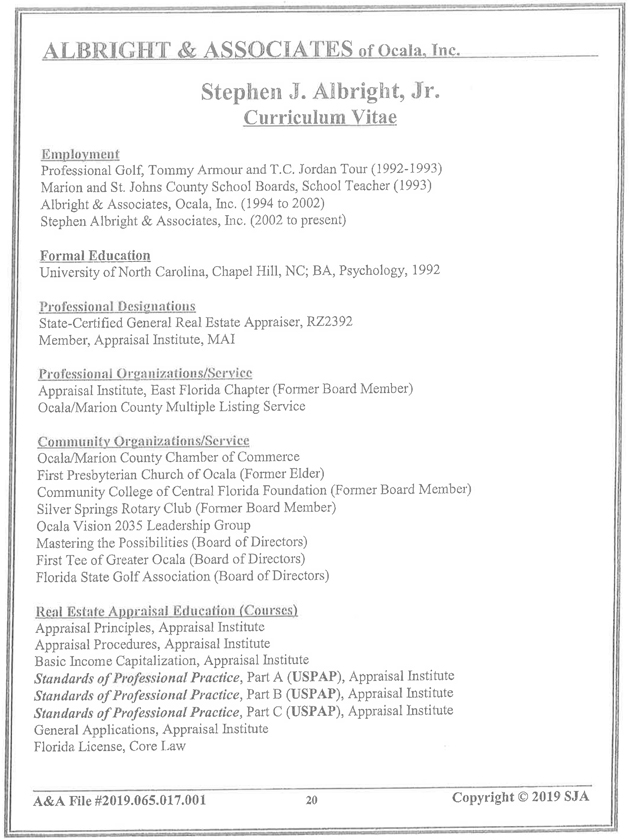

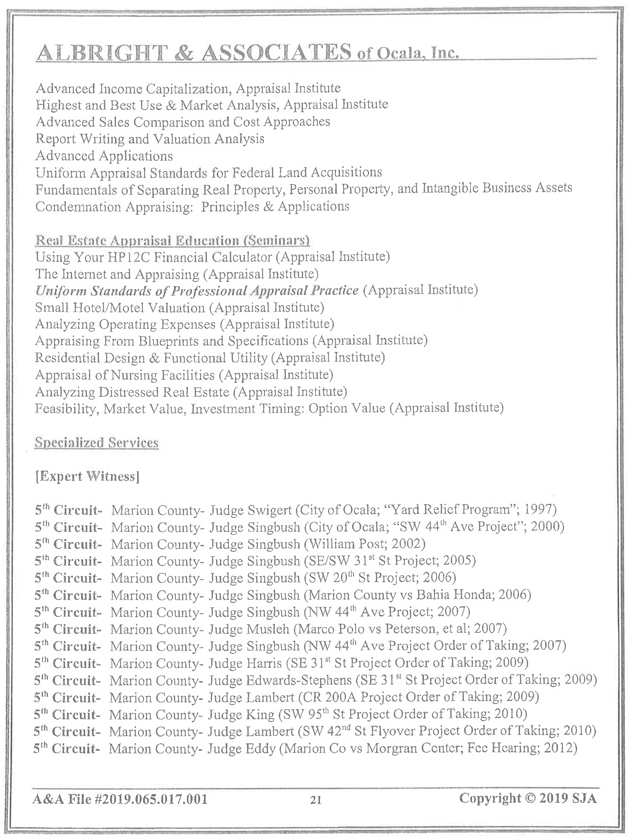

ALBRIGHT & ASSOCIATES of Ocala, Inc. Stephen J. Albright, Jr. Curriculum Vitae Employment Professional Golf, Tommy Armour and T.C. Jordan Tour (1992-1993) Marion and St. Johns County School Boards, School Teacher (1993) Albright & Associates, Ocala, Inc. (1994 to 2002) Stephen Albright & Associates, Inc. (2002 to present) Formal Education University of North Carolina, Chapel Hill, NC; BA, Psychology, 1992 Professional Designations State-Certified General Real Estate Appraiser, RZ2392 Member, Appraisal Institute, MAI Professional Organizations/Service Appraisal Institute, East Florida Chapter (Former Board Member) Ocala/Marion County Multiple Listing Service Community Organizations/Service Ocala/Marion County Chamber of Commerce First Presbyterian Church of Ocala (Former Elder) Community College of Central Florida Foundation (Former Board Member) Silver Springs Rotary Club (Former Board Member) Ocala Vision 2035 Leadership Group Mastering the Possibilities (Board of Directors) First Tee of Greater Ocala (Board of Directors) Florida State Golf Association (Board of Directors) Real Estate Appraisal Education (Courses) Appraisal Principles, Appraisal Institute Appraisal Procedures, Appraisal Institute Basic Income Capitalization, Appraisal Institute Standards of Professional Practice, Part A (USPAP), Appraisal Institute Standards of Professional Practice, Part B (USPAP), Appraisal Institute Standards of Professional Practice, Part C (USPAP), Appraisal Institute General Applications, Appraisal Institute Florida License, Core Law A&A File #2019.065.017.00 1 20 Copyright © 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. Advanced Income Capitalization, Appraisal Institute Highest and Best Use & Market Analysis, Appraisal Institute Advanced Sales Comparison and Cost Approaches Report Writing and Valuation Analysis Advanced Applications Uniform Appraisal Standards for Federal Land Acquisitions Fundamentals of Separating Real Property, Personal Property, and Intangible Business Assets Condemnation Appraising: Principles & Applications Real Estate Appraisal Education (Seminars) Using Your HP12C Financial Calculator (Appraisal Institute) The Internet and Appraising (Appraisal Institute) Uniform Standards of Professional Appraisal Practice (Appraisal Institute) Small Hotel/Motel Valuation (Appraisal Institute) Analyzing Operating Expenses (Appraisal Institute) Appraising From Blueprints and Specifications (Appraisal Institute) Residential Design & Functional Utility (Appraisal Institute) Appraisal of Nursing Facilities (Appraisal Institute) Analyzing Distressed Real Estate (Appraisal Institute) Feasibility, Market Value, Investment Timing: Option Value (Appraisal Institute) Specialized Services [Expert Witness] 5th Circuit- Marion County- Judge Swigert (City of Ocala; “Yard Relief Program”; 1997) 5th Circuit- Marion County- Judge Singbush (City of Ocala; “SW 44th Ave Project”; 2000) 5th Circuit- Marion County- Judge Singbush (William Post; 2002) 5th Circuit- Marion County- Judge Singbush (SE/SW 31st St Project; 2005) 5th Circuit- Marion County- Judge Singbush (SW 20th St Project; 2006) 5th Circuit- Marion County- Judge Singbush (Marion County vs Bahia Honda; 2006) 5th Circuit- Marion County- Judge Singbush (NW 44th Ave Project; 2007) 5th Circuit- Marion County- Judge Musleh (Marco Polo vs Peterson, et al; 2007) 5th Circuit- Marion County- Judge Singbush (NW 44th Ave Project Order of Taking; 2007) 5th Circuit- Marion County- Judge Harris (SE 31st St Project Order of Taking; 2009) 5th Circuit- Marion County- Judge Edwards-Stephens (SE 31st St Project Order of Taking; 2009) 5th Circuit- Marion County- Judge Lambert (CR 200A Project Order of Taking; 2009) 5th Circuit- Marion County- Judge King (SW 95th St Project Order of Taking; 2010) 5th Circuit- Marion County- Judge Lambert (SW 42nd St Flyover Project Order of Taking; 2010) 5th Circuit- Marion County- Judge Eddy (Marion Co vs Morgran Center; Fee Hearing; 2012) A&A File #2019.065.017.001 21 Copyright © 2019 SJA

ALBRIGHT & ASSOCIATES of Ocala, Inc. 5th Circuit- Marion County- Judge Singbush (NW 35th/49th St Project Order of Taking; 2012) 5th Circuit- Citrus County- Judge Falvey (Community Bank; Deficiency Hearing; 2014) 5th Circuit- Marion County- Judge Tatti (Community Bank; Deficiency Hearing; 2014) 5th Circuit- Marion County- Judge Rogers (Murvin & Altogrey, LLC vs Brown; 2014) 5th Circuit- Lake County- Judge Singeltary (M & S Bank; Deficiency Hearing; 2016) [Arbitration/Mediation Hearings] Marion County, Florida Ignatius Ciesla v. Bonded Builders Home Warranty (2006) [Special Magistrate] Marion County Value Adjustment Board Hearings (2008-2018) Citrus County Value Adjustment Board Hearings (2010-2014) [Speaking Engagements] International Association of Assessing Officers—Florida Chapter 2015 TPP Seminar—VAB Special Master Panel—Lake Mary, Florida A&A File #2019.065.017.001 22 Copyright © 2019 SJA

WALDEN WOODS SOUTH LLC SCHEDULE K OTHER ITEMS STATEMENT 5 DESCRIPTION AMOUNT SECTION 199A QUALIFIED BUSINESS INCOME -226,217. SECTION 199A UNADJUSTED BASIS 3,292,984. SCHEDULE L OTHER ASSETS STATEMENT 6 DESCRIPTION BEGINNING OF TAX YEAR END OF TAX YEAR NOTE RECEIVABLE 3,380. 1,502. UTILITY DEPOSITS 4,710. 2,845. TOTAL TO SCHEDULE L, LINE 13 8,090. 4,347. SCHEDULE L OTHER CURRENT LIABILITIES STATEMENT 7 DESCRIPTION BEGINNING OF TAX YEAR END OF TAX YEAR ACCRUED EXPENSES 68,918. 120,051. ACCRUED SALES TAX 27,196. 13,877. CUSTOMER DEPOSITS 80,029. 171, 597. TOTAL TO SCHEDULE L, LINE 17 176,143. 305,525. SCHEDULE L OTHER LIABILITIES STATEMENT 8 DESCRIPTION BEGINNING OF TAX YEAR END OF TAX YEAR N/P—LH 50,000. 50,000. N/P—MANAGEMENT FEE 30,730. 30,730. N/P—SRL 650,100. 650,100. TOTAL TO SCHEDULE L, LINE 20 730,830. 730, 830. 11 STATEMENT(S) 5, 6, 7, 8 2018. 02040 WALDEN WOODS SOUTH LLC 3 0317.01

EXHIBIT B Form 1035 (2018) WALDEN WOODS SOUTH LLC **-***9351 page 5 Analysis of Net Income (Loss) 1 Net income floss), Combing Scheming K. lines 1 through11.1’iuin the : . of the sum o/Schedule to line 12 though l.’Ut. and 16p | 1 -22 6,085. 2 Analysis by partner type: a General partners (i) Corporate (ii) Individual (active) (iii) Individual (passive) (iv) Partnership (v) Exempt Organization (vi) Nominee/Other b Limited partners -110,781. -115, 304. Schedule L Balance Sheets per Books Beginning of tax year End of tax year Assets (a) (b) (c) (d) 1 Cash 103,411. 48,311. 2a Trade notes and accounts receivable 6,298 b Less allowance for bad debts 6,298. 3 Inventories 641,491. 866 , 505. 4 U.S. Government obligations 5 Tax-exempt securities 6 Other current a ) assets (attach statement 7a Loans to partners (or persons related to partners) b Mortgage and real estate loans 8 Other investments (attach statement 9a Buildings and other depreciable assets b Less accumulated depreciation 10a Depletable assets . ets 3 , 292 , 984. 3,292,984. 1,369,501. 1,923,483. 1,580,465. 1,712,519. b Less accumulated 11 Land (net of any ed depletion amortization) 524,717. 524,717. 12a Intangible assets (amortizable only) b Less accumulated amortization 13 Other assets (attach statement) 14 Total assets Liabilities and Capital STATEMENT 6 8,090. 4,347. 3,201,192. 3,162,697. 15 Accounts payable 16 Morlgages, notes, bond payable 963,786. 1,070,123. bonds payable in less than 1 year 17 Other current liabilities (attach statement) 18 All nonrecourse loans 19a Loans from partners (or persons related to partners b Mortagages, notes, bonds payable In 1 year or more 20 Other liabilities (attach statement) 21 Partners’ capital accounts 22 Total liabilities and capital STATEMENT 7 176,143. 305,525. 3 ,800,000. 3,800,000. STATEMENTS STATEMENT 8 730,830. 730 ,830. -2,469,567. -2.743,781. 3,201,192. 3,162, 697. Schedule M-1 Reconciliation of Income (Loss) per Books With Income (Loss) per Return Note: The partnership may be required to file Schedule M-3. See instructions. 1 Net income (loss) per books -274,214 . 6 Income recorded on books this year not included Schedule K, lines 1 through 11 (itemize): exernpt interest $ 2 Income included on 5, 6a, 7, 8, 9a, 10, this year (itemize): 3 Guaranteed payments insurance) 4 Expanses recorded on books Schedule K. lines 1 through Schedule K, lines 1, 2, 3c, and 11, not recorded on books on Schedule a Tax-exernpt payments (other than health Books this year not included on through 13d, and 16p (itemize): 7 Deductions through included on Schedule K, lines 1 13d, and 16p, not charged against income this year (itemize): Depreciation $ 48 ,129 book in a Depreciation b Depreciation $ 47,819. 8 Add lines 6 and 7 Travel and entertainment $ 310 9 Income (loss) (Analysis of Net Income (Loss), -226,085. 5 Add lines 1 through 4 -226,085. line 1). Subtract line 8 from line 5 . Schedule 1 Schedule M-2 Analysis of Partners’ Capital Accounts Balance at beginning of year -2,469,567. 6 Distributions: a Cash b Property 2 Capital contributed: a Cash b Property 3 Net income (loss) per books 7 Other de decreases (itemize): ): .. -274,214. 4 Other increases (itemize): 5 Add lines I through 4 ze): 8 Add lines 6 and 7 9 Balance at end of year Subtract line 8 from 4 -2,743,781. from line 5 -2 , 743,781.