UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For

the quarterly period ended:

or

For the transition period from ________________ to ________________

Commission

file number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

4/F, Tower C

(Address of principal executive offices)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during

the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☐ | Smaller reporting company | ||

| Emerging Growth Company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of August 14, 2024, there were

SMART POWERR CORP.

FORM 10-Q

TABLE OF CONTENTS

i

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

SMART POWERR CORP.

CONSOLIDATED BALANCE SHEETS

| JUNE

30, 2024 | DECEMBER 31,

2023 | |||||||

| (UNAUDITED) | ||||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash | $ | $ | ||||||

| VAT receivable | ||||||||

| Advance to supplier | ||||||||

| Short term loan receivables | ||||||||

| Other receivables | ||||||||

| Total current assets | ||||||||

| NON-CURRENT ASSETS | ||||||||

| Right-of-use asset | ||||||||

| Plant and equipment, net | ||||||||

| Total non-current assets | ||||||||

| TOTAL ASSETS | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable | $ | $ | ||||||

| Accrued liabilities and other payables | ||||||||

| Taxes payable | ||||||||

| Accrued interest on notes | ||||||||

| Notes payable | ||||||||

| Operating lease liability | ||||||||

| Payable for purchase of | ||||||||

| Interest payable on entrusted loans | ||||||||

| Entrusted loan payable | ||||||||

| Total current liabilities | ||||||||

| NONCURRENT LIABILITIES | ||||||||

| Income tax payable | ||||||||

| Operating lease liability | - | |||||||

| Total noncurrent liabilities | ||||||||

| Total liabilities | ||||||||

| CONTINGENCIES AND COMMITMENTS | ||||||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Common stock, $ | ||||||||

| Additional paid in capital | ||||||||

| Statutory reserve | ||||||||

| Accumulated other comprehensive loss | ( | ) | ( | ) | ||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total Company stockholders’ equity | ||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | $ | ||||||

The accompanying notes are an integral part of these consolidated financial statements

1

SMART POWERR CORP.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(UNAUDITED)

| SIX

MONTHS ENDED JUNE 30, | THREE

MONTHS ENDED JUNE 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenue | ||||||||||||||||

| Contingent rental income | $ | $ | ||||||||||||||

| Interest income on sales-type leases | ||||||||||||||||

| Total operating income | ||||||||||||||||

| Operating expenses | ||||||||||||||||

| General and administrative | ||||||||||||||||

| Total operating expenses | ||||||||||||||||

| Loss from operations | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Non-operating income (expenses) | ||||||||||||||||

| Gain (loss) on note conversion | ( | ) | ( | ) | ||||||||||||

| Interest income | ||||||||||||||||

| Interest expense | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Other income, net | ||||||||||||||||

| Total non-operating income (expenses), net | ( | ) | ( | ) | ||||||||||||

| Loss before income tax | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Income tax expense | ||||||||||||||||

| Net loss | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Other comprehensive items | ||||||||||||||||

| Foreign

currency translation loss | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Comprehensive loss | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||||

The accompanying notes are an integral part of these consolidated financial statements

2

SMART POWERR CORP.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

SIX AND THREE MONTHS ENDED JUNE 30, 2024 AND 2023

(UNAUDITED)

| Common Stock | Paid in | Statutory | Other Comprehensive | Accumulated | ||||||||||||||||||||||||

| Shares | Amount | Capital | Reserves | Loss | Deficit | Total | ||||||||||||||||||||||

| Balance as of December 31, 2023 | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||

| Net loss for the period | - | ( | ) | ( | ) | |||||||||||||||||||||||

| Conversion of long-term notes into common shares | ||||||||||||||||||||||||||||

| Transfer to statutory reserves | - | ( | ) | |||||||||||||||||||||||||

| Foreign currency translation loss | - | ( | ) | ( | ) | |||||||||||||||||||||||

| Balance as of March 31, 2024 | ( | ) | ( | ) | ||||||||||||||||||||||||

| Net loss for the period | - | ( | ) | ( | ) | |||||||||||||||||||||||

| Conversion of long-term notes into common shares | ( | ) | ||||||||||||||||||||||||||

| Stock compensation expense | - | |||||||||||||||||||||||||||

| Transfer to statutory reserves | - | ( | ) | |||||||||||||||||||||||||

| Foreign currency translation loss | - | ( | ) | ( | ) | |||||||||||||||||||||||

| Balance as of June 30, 2024 | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||

| Common Stock | Paid in | Statutory | Other Comprehensive | Accumulated | ||||||||||||||||||||||||

| Shares | Amount | Capital | Reserves | Loss | Deficit | Total | ||||||||||||||||||||||

| Balance as of December 31, 2022 | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||

| Net loss for the period | - | ( | ) | ( | ) | |||||||||||||||||||||||

| Conversion of long-term notes into common shares | ||||||||||||||||||||||||||||

| Transfer to statutory reserves | - | ( | ) | |||||||||||||||||||||||||

| Foreign currency translation gain | - | |||||||||||||||||||||||||||

| Balance as of March 31, 2023 | ( | ) | ( | ) | ||||||||||||||||||||||||

| Net loss for the period | - | ( | ) | ( | ) | |||||||||||||||||||||||

| Conversion of long-term notes into common shares | ||||||||||||||||||||||||||||

| Transfer to statutory reserves | - | ( | ) | |||||||||||||||||||||||||

| Foreign currency translation gain | - | ( | ) | ( | ) | |||||||||||||||||||||||

| Balance as of June 30, 2023 | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements

3

SMART POWERR CORP.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| SIX

MONTHS ENDED JUNE 30, | ||||||||

| 2024 | 2023 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Amortization of OID and debt issuing costs of notes | ||||||||

| Operating lease expenses | ||||||||

| Loss (gain) on note conversion | ( | ) | ||||||

| Stock compensation expense | ||||||||

| Changes in assets and liabilities: | ||||||||

| Advance to supplier | ( | ) | ||||||

| Other receivables | ( | ) | ||||||

| Taxes payable | ||||||||

| Payment of lease liability | ( | ) | ( | ) | ||||

| Accrued liabilities and other payables | ||||||||

| Net cash used in operating activities | ( | ) | ( | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITY: | ||||||||

| Short term loan receivable | ( | ) | ||||||

| Net cash provided by (used in) investing activity | ( | ) | ||||||

| EFFECT OF EXCHANGE RATE CHANGE ON CASH | ( | ) | ||||||

| NET INCREASE (DECREASE) IN CASH | ( | ) | ||||||

| CASH, BEGINNING OF PERIOD | ||||||||

| CASH, END OF PERIOD | $ | $ | ||||||

| Supplemental cash flow data: | ||||||||

| Income tax paid | $ | $ | ||||||

| Interest paid | $ | $ | ||||||

| Supplemental disclosure of non-cash financing activities | ||||||||

| Right-of-use assets obtained in exchange for operating lease liabilities | $ | $ | ||||||

| Conversion of notes into common shares | $ | $ | ||||||

The accompanying notes are an integral part of these consolidated financial statements

4

SMART POWERR CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2024 (UNAUDITED) AND DECEMBER 31, 2023

1. ORGANIZATION AND DESCRIPTION OF BUSINESS

Smart Powerr Corp. (the “Company” or “SPC”) was incorporated in Nevada, and was formerly known as China Recycling Entergy Corporation. The Company, through its subsidiaries, provides energy saving solutions and services, including selling and leasing energy saving systems and equipment to customers, and project investment in the Peoples Republic of China (“PRC”).

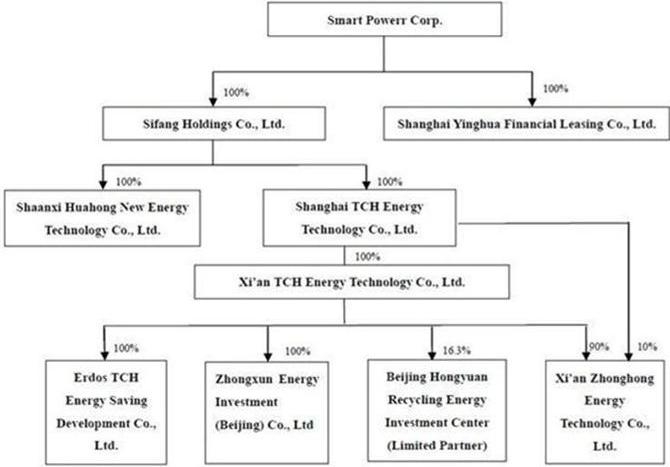

The Company’s organizational chart as of June 30, 2024 is as follows:

5

Erdos TCH – Joint Venture

On

April 14, 2009, the Company formed a joint venture (the “JV”) with Erdos Metallurgy Co., Ltd. (“Erdos”) to recycle

waste heat from Erdos’ metal refining plants to generate power and steam to be sold back to Erdos. The name of the JV was Inner

Mongolia Erdos TCH Energy Saving Development Co., Ltd. (“Erdos TCH”) with a term of

Formation of Zhongxun

On

March 24, 2014, Xi’an TCH incorporated a subsidiary, Zhongxun Energy Investment (Beijing) Co., Ltd. (“Zhongxun”) with

registered capital of $

Formation of Yinghua

On

February 11, 2015, the Company incorporated a subsidiary, Shanghai Yinghua Financial Leasing Co., Ltd. (“Yinghua”) with

registered capital of $

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying consolidated financial statements (“CFS”) are prepared in conformity with U.S. Generally Accepted Accounting Principles (“US GAAP”). The functional currency of the Company’s operating entities is Chinese Renminbi (“RMB”). The accompanying consolidated financial statements are translated from RMB and presented in U.S. dollars (“USD”).

6

Principle of Consolidation

The

CFS include the accounts of SPC and its subsidiaries, Shanghai Yinghua Financial Leasing Co., Ltd. (“Yinghua”) and Sifang

Holdings; Sifang Holdings’ wholly owned subsidiaries, Huahong New Energy Technology Co., Ltd. (“Huahong”) and Shanghai

TCH Energy Tech Co., Ltd. (“Shanghai TCH”); Shanghai TCH’s wholly-owned subsidiary, Xi’an TCH Energy Tech Co.,

Ltd. (“Xi’an TCH”); and Xi’an TCH’s subsidiaries, 1) Erdos TCH Energy Saving Development Co., Ltd (“Erdos

TCH”),

A subsidiary is an entity in which (i) the Company directly or indirectly

controls more than

Uses and Sources of Liquidity

For

the six months ended June 30, 2024 and 2023, the Company had a net loss of $

Use of Estimates

In preparing these CFS in accordance with US GAAP, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheets as well as revenues and expenses during the period reported. Actual results may differ from these estimates. On an on-going basis, management evaluates its estimates, including those allowances for bad debt, impairment loss on fixed assets and construction in progress, income taxes, and contingencies and litigation. Management bases its estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other resources.

Revenue Recognition

A) Sales-type Leasing and Related Revenue Recognition

The Company follows Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 842. The Company’s sales type lease contracts for revenue recognition fall under ASC 842. During the six and three months ended June 30, 2024 and 2023, the Company did not sell any new power generating projects.

The Company constructs and leases waste energy recycling power generating projects to its customers. The Company typically transfers legal ownership of the waste energy recycling power generating projects to its customers at the end of the lease.

7

The Company finances construction of waste energy recycling power generating projects. The sales and cost of sales are recognized at the inception of the lease, which is when control is transferred to the lessee. The Company accounts for the transfer of control as a sales type lease in accordance with ASC 842-10-25-2. The underlying asset is derecognized, and revenue is recorded when collection of payments is probable. This is in accordance with the revenue recognition principle in ASC 606 - Revenue from contracts with customers. The investment in sales-type leases consists of the sum of the minimum lease payments receivable less unearned interest income and estimated executory cost. Minimum lease payments are part of the lease agreement between the Company (as the lessor) and the customer (as the lessee). The discount rate implicit in the lease is used to calculate the present value of minimum lease payments. The minimum lease payments consist of the gross lease payments net of executory costs and contingent rentals, if any. Unearned interest is amortized to income over the lease term to produce a constant periodic rate of return on net investment in the lease. While revenue is recognized at the inception of the lease, the cash flow from the sales-type lease occurs over the course of the lease, which results in interest income and reduction of receivables. Revenue is recognized net of value-added tax.

B) Contingent Rental Income

The Company records income from actual electricity generated of each project in the period the income is earned, which is when the electricity is generated. Contingent rent is not part of minimum lease payments.

Operating Leases

The Company determines if an arrangement is a lease or contains a lease at inception. Operating lease liabilities are recognized based on the present value of the remaining lease payments, discounted using the discount rate for the lease at the commencement date. As the rate implicit in the lease is not readily determinable for an operating lease, the Company generally uses an incremental borrowing rate based on information available at the commencement date to determine the present value of future lease payments. Operating lease right-of-use (“ROU assets”) assets represent the Company’s right to control the use of an identified asset for the lease term and lease liabilities represent the Company’s obligation to make lease payments arising from the lease. ROU assets are generally recognized based on the amount of the initial measurement of the lease liability. Lease expense is recognized on a straight-line basis over the lease term.

ROU assets are reviewed for impairment when indicators of impairment are present. ROU assets from operating and finance leases are subject to the impairment guidance in ASC 360, Plant, and Equipment, as ROU assets are long-lived nonfinancial assets.

ROU assets are tested for impairment individually or as part of an asset group if the cash flows related to the ROU asset are not independent from the cash flows of other assets and liabilities. An asset group is the unit of accounting for long-lived assets to be held and used, which represents the lowest level for which identifiable cash flows are largely independent of the cash flows of other groups of assets and liabilities. The Company recognized no impairment of ROU assets as of June 30, 2024 and December 31, 2023.

Operating leases are included in operating lease ROU and operating lease liabilities (current and non-current), on the consolidated balance sheets.

Cash

Cash includes cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date.

Credit losses

On January 1, 2023, the Company adopted Accounting Standards Update 2016-13 “Financial Instruments — Credit Losses (Topic 326), Measurement of Credit Losses on Financial Instruments,” which replaces the incurred loss methodology with an expected loss methodology that is referred to as the current expected credit loss (“CECL”) methodology. The adoption of the credit loss accounting standard has no material impact on the Company’s consolidated financial statements as of January 1, 2023.

8

The Company’s other receivables in the balance sheet are within the scope of ASC Topic 326. As the Company has limited customers and debtors, the Company uses the loss-rate method to evaluates the expected credit losses on an individual basis. When establishing the loss rate, the Company makes the assessment on various factors, including historical experience, credit-worthiness of customers and debtors, current economic conditions, reasonable and supportable forecasts of future economic conditions, and other factors that may affect its ability to collect from the customers and debtors. The Company also provides specific provisions for allowance when facts and circumstances indicate that the receivable is unlikely to be collected.

Expected credit losses are recorded as allowance for credit losses on the consolidated statements of operations. After all attempts to collect a receivable have failed, the receivable is written off against the allowance. In the event the Company recovers amount that is previously reserved for, the Company will reduce the specific allowance for credit losses.

Accounts Receivable

The Company’s policy is to maintain an allowance for potential credit losses on accounts receivable. Management reviews the composition of accounts receivable and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves. As of June 30, 2024 and December 31, 2023, the Company had no accounts receivable.

Value added tax (“VAT”)

The Company is subject to VAT and related surcharges on revenue generated from sales and services. The Company records revenue net of VAT. This VAT may be offset by qualified input VAT paid by the Company to suppliers. Net VAT balance between input VAT and output VAT is recorded in the line item of VAT receivable on the unaudited consolidated balance sheets.

Advance to suppliers

Advance to suppliers consist of balances paid to suppliers for materials that have not been received. The Company reviews its advances to suppliers on a periodic basis and makes general and specific allowances when there is doubt as to the ability of a supplier to provide supplies to the Company or refund an advance.

Short term loan receivables

The Company provided loans to certain third parties for the purpose of making use of its cash.

The

Company monitors all loans receivable for delinquency and provides for estimated losses for specific receivables that are not likely

to be collected. Management periodically assesses the collectability of these loans receivable. Delinquent account balances are written-off

against the allowance for doubtful accounts after management has determined that the likelihood of collection is not probable. As of

June 30, 2024, the Company did not have any outstanding short term loan receivables; at December 31, 2023, the Company had $

Concentration of Credit Risk

Cash

includes cash on hand and demand deposits in accounts maintained within China. Balances at financial institutions and state-owned

banks within the PRC are covered by insurance up to RMB

Certain other financial instruments, which subject the Company to concentration of credit risk, consist of accounts and other receivables. The Company does not require collateral or other security to support these receivables. The Company conducts periodic reviews of its customers’ financial condition and customer payment practices to minimize collection risk on accounts receivable.

The operations of the Company are in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environments in the PRC.

9

Plant and Equipment

Plant

and equipment are stated at cost, net of accumulated depreciation. Expenditures for maintenance and repairs are expensed as incurred;

additions, renewals and betterments are capitalized. When plant and equipment are retired or otherwise disposed of, the related cost

and accumulated depreciation are removed from the respective accounts, and any gain or loss is included in operations.

| Vehicles | ||

| Office and Other Equipment |

Impairment of Long-lived Assets

In accordance with FASB ASC Topic 360, “Plant, and Equipment,” the Company reviews its long-lived assets, including plant and equipment, for impairment whenever events or changes in circumstances indicate that the carrying amounts of the assets may not be fully recoverable. If the total expected undiscounted future net cash flows are less than the carrying amount of the asset, a loss is recognized for the difference between the fair value (“FV”) and carrying amount of the asset. The Company did not record any impairment for the six and three months ended June 30, 2024 and 2023.

Accounts and other payables

Accounts and other payables represent liabilities for goods and services provided to the Company prior to the end of the financial year which are unpaid. They are classified as current liabilities if payment is due within one year or less (or in the normal operating cycle of the business if longer). Otherwise, they are presented as non-current liabilities.

Accounts and other payables are initially recognized as fair value, and subsequently carried at amortized cost using the effective interest method.

Borrowings

Borrowings are presented as current liabilities unless the Company has an unconditional right to defer settlement for at least 12 months after the financial year end date, in which case they are presented as non-current liabilities.

Borrowings are initially recognized at fair value (net of transaction costs) and subsequently carried at amortized cost. Any difference between the proceeds (net of transaction costs) and the redemption value is recognized in profit or loss over the period of the borrowings using an effective interest method.

Borrowing costs are recognized in profit or loss using the effective interest method.

Cost of Sales

Cost of sales consists primarily of the direct material of the power generating system and expenses incurred directly for project construction for sales-type leasing and sales tax and additions for contingent rental income.

Income Taxes

Income taxes are accounted for using an asset and liability method. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates, applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

The Company follows FASB ASC Topic 740, which prescribes a more-likely-than-not threshold for financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. ASC Topic 740 also provides guidance on recognition of income tax assets and liabilities, classification of current and deferred income tax assets and liabilities, accounting for interest and penalties associated with tax positions, accounting for income taxes in interim periods, and income tax disclosures.

10

Under

FASB ASC Topic 740, when tax returns are filed, it is likely that some positions taken would be sustained upon examination by the taxing

authorities, while others are subject to uncertainty about the merits of the position taken or the amount of the position that would

be ultimately sustained. The benefit of a tax position is recognized in the CFS in the period during which, based on all available evidence,

management believes it is more likely than not that the position will be sustained upon examination, including the resolution of appeals

or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not

recognition threshold are measured as the largest amount of tax benefit that is more than

Statement of Cash Flows

In accordance with FASB ASC Topic 230, “Statement of Cash Flows,” cash flows from the Company’s operations are calculated based upon the local currencies. As a result, amounts related to assets and liabilities reported on the statement of cash flows may not necessarily agree with changes in the corresponding balances on the balance sheet.

Fair Value of Financial Instruments

For certain of the Company’s financial instruments, including cash and equivalents, restricted cash, accounts receivable, other receivables, accounts payable, accrued liabilities and short-term debts, the carrying amounts approximate their FVs due to their short maturities. Receivables on sales-type leases are based on interest rates implicit in the lease.

FASB ASC Topic 820, “Fair Value Measurements and Disclosures,” requires disclosure of the FV of financial instruments held by the Company. FASB ASC Topic 825, “Financial Instruments,” defines FV, and establishes a three-level valuation hierarchy for disclosures of FV measurement that enhances disclosure requirements for FV measures. The carrying amounts reported in the consolidated balance sheets for receivables and current liabilities each qualify as financial instruments and are a reasonable estimate of their FV because of the short period of time between the origination of such instruments and their expected realization and their current market rate of interest. The three levels of valuation hierarchy are defined as follows:

| ● | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| ● | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. |

| ● | Level 3 inputs to the valuation methodology are unobservable and significant to FV measurement. |

The Company analyzes all financial instruments with features of both liabilities and equity under FASB ASC 480, “Distinguishing Liabilities from Equity,” and ASC 815, “Derivatives and Hedging.”

As of June 30, 2024 and December 31, 2023, the Company did not have any long-term debt; and the Company did not identify any assets or liabilities that are required to be presented on the balance sheet at FV.

Stock-Based Compensation

The Company accounts for share-based compensation awards to employees in accordance with FASB ASC Topic 718, “Compensation – Stock Compensation”, which requires that share-based payment transactions with employees be measured based on the grant-date FV of the equity instrument issued and recognized as compensation expense over the requisite service period.

11

The Company accounts for share-based compensation awards to non-employees in accordance with FASB ASC Topic 718 and FASB ASC Subtopic 505-50, “Equity-Based Payments to Non-employees”. Share-based compensation associated with the issuance of equity instruments to non-employees is measured at the FV of the equity instrument issued or committed to be issued, as this is more reliable than the FV of the services received. The FV is measured at the date that the commitment for performance by the counterparty has been reached or the counterparty’s performance is complete.

The Company follows ASU 2018-07, “Compensation — Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting,” which expands the scope of ASC 718 to include share-based payment transactions for acquiring goods and services from non-employees. An entity should apply the requirements of ASC 718 to non-employee awards except for specific guidance on inputs to an option pricing model and the attribution of cost. ASC 718 applies to all share-based payment transactions in which a grantor acquires goods or services to be used or consumed in a grantor’s own operations by issuing share-based payment awards.

Basic and Diluted Earnings per Share

The Company presents net income (loss) per share (“EPS”) in accordance with FASB ASC Topic 260, “Earning Per Share.” Accordingly, basic income (loss) per share is computed by dividing income (loss) available to common stockholders by the weighted average number of shares outstanding, without consideration for common stock equivalents. Diluted EPS is computed by dividing the net income by the weighted-average number of common shares outstanding as well as common share equivalents outstanding for the period determined using the treasury-stock method for stock options and warrants and the if-converted method for convertible notes. The Company made an accounting policy election to use the if-converted method for convertible securities that are eligible to receive common stock dividends, if declared. Diluted EPS reflect the potential dilution that could occur based on the exercise of stock options or warrants or conversion of convertible securities using the if-converted method.

For

the six and three months ended June 30, 2024 and 2023, the basic and diluted income (loss) per share were the same due to the anti-dilutive

features of the warrants and options. For the six and three months ended June 30, 2024 and 2023,

Foreign Currency Translation and Comprehensive Income (Loss)

The Company’s functional currency is the Renminbi (“RMB”). For financial reporting purposes, RMB were translated into U.S. Dollars (“USD” or “$”) as the reporting currency. Assets and liabilities are translated at the exchange rate in effect at the balance sheet date. Revenues and expenses are translated at the average rate of exchange prevailing during the reporting period. Translation adjustments arising from the use of different exchange rates from period to period are included as a component of stockholders’ equity as “Accumulated other comprehensive income.” Gains and losses resulting from foreign currency transactions are included in income.

The Company follows FASB ASC Topic 220, “Comprehensive Income.” Comprehensive income is comprised of net income and all changes to the statements of stockholders’ equity, except those due to investments by stockholders, changes in paid-in capital and distributions to stockholders.

Segment Reporting

FASB ASC Topic 280, “Segment Reporting,” requires use of the “management approach” model for segment reporting. The management approach model is based on the way a company’s management organizes segments within the company for making operating decisions and assessing performance. Reportable segments are based on products and services, geography, legal structure, management structure, or any other manner in which management disaggregates a company. FASB ASC Topic 280 has no effect on the Company’s CFS as substantially all of the Company’s operations are conducted in one industry segment. All of the Company’s assets are located in the PRC.

12

New Accounting Pronouncements

In November 2023, the FASB issued ASU No. 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures (“ASU 2023-07”). The amendments in ASU 2023-07 improve reportable segment disclosure requirements through enhanced disclosures about significant segment expenses that are regularly provided to the chief operating decision maker (CODM). In addition, the amendments enhance interim disclosure requirements, clarify circumstances in which an entity can disclose multiple segment measures of profit or loss, provide new segment disclosure requirements for entities with a single reportable segment, and contain other disclosure requirements. ASU 2023-07 will be effective for annual reporting periods beginning after December 15, 2023, and interim periods within annual reporting periods beginning after December 15, 2024. Early adoption is permitted. The adoption of ASU 2023-01 did not have a material impact on the Company’s consolidated financial statement presentation or disclosures.

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures (“ASU 2023-09”), which requires disclosures of incremental income tax information within the rate reconciliation and expanded disclosures of income taxes paid, among other disclosure requirements. This ASU will be effective for annual reporting periods beginning after December 15, 2024. Early adoption is permitted. ASU 2023-09 will be applied on a prospective basis with the option to apply the standard retrospectively. The Company’s management does not believe that the adoption of ASU 2023-09 will have a material impact on the Company’s consolidated financial statement presentation or disclosures.

The Company’s management does not believe that any other recently issued, but not yet effective, authoritative guidance, if currently adopted, will have a material impact on the Company’s financial statement presentation or disclosures.

3. SHORT-TERM LOAN RECEIVABLE

As

of June 30, 2024 and December 31, 2023, the Company had and $

4. ADVANCE TO SUPPLIERS

On

June 19, 2023, the Company entered a purchase agreement with Hubei Bangyu New Energy Technology Co., Ltd. (“Bangyu”). The

total contract amount was $

On

August 2, 2021, the Company entered a Research and Development (“R&D”) Cooperation Agreement with a software development

company to design, establish, upgrade and maintenance of Smart Energy Management Cloud Platform for energy storage and remote-site monitoring;

upon completion, the Company will provide such platform to its customers at a fee. Total contracted R&D cost is $

On

August 23, 2021, the Company entered a Market Research and Project Development Service Agreement with a consulting company in Xi’an

for a service period of 12 months. The consulting company will perform market research for new energy industry including photovoltaic

and energy storage, develop potential new customers and due diligence check, assisting the Company for business cooperation negotiation

and relevant agreements preparation. Total contract amount is $

13

5. ACCRUED LIABILITIES AND OTHER PAYABLES

| 2024 | 2023 | |||||||

| Education and union fund and social insurance payable | $ | $ | ||||||

| Accrued payroll and welfare | ||||||||

| Accrued litigation | ||||||||

| Other | ||||||||

| Total | $ | $ | ||||||

Accrued litigation was mainly for court enforcement fee, fee to lawyer, penalty and other fees (see Note 14).

6. TAXES PAYABLE

| 2024 | 2023 | |||||||

| Income tax | $ | $ | ||||||

| Other | ||||||||

| Total | ||||||||

| Current | ||||||||

| Noncurrent | $ | $ | ||||||

As

of June 30, 2024, income tax payable included $

7. DEFERRED TAX, NET

Deferred tax assets resulted from asset impairment loss which was temporarily non-tax deductible for tax purposes but expensed in accordance with US GAAP; interest income in sales-type leases which was recognized as income for tax purposes but not for book purpose as it did not meet revenue recognition in accordance with US GAAP; accrued employee social insurance that can be deducted for tax purposes in the future, and the difference between tax and accounting basis of cost of fixed assets which was capitalized for tax purposes and expensed as part of cost of systems in accordance with US GAAP. Deferred tax liability arose from the difference between tax and accounting basis of net investment in sales-type leases.

| 2024 | 2023 | |||||||

| Accrued expenses | $ | $ | ||||||

| Write-off Erdos TCH net investment in sales-type leases * | ||||||||

| Impairment loss of Xi’an TCH’s investment into the HYREF fund | ||||||||

| US NOL | ||||||||

| PRC NOL | ||||||||

| Total deferred tax assets | ||||||||

| Less: valuation allowance for deferred tax assets | ( |

) | ( |

) | ||||

| Deferred tax assets, net | $ | $ | ||||||

| * |

14

8. ENTRUSTED LOAN PAYABLE

Entrusted Loan Payable (HYREF Loan)

The

HYREF Fund was established in July 2013 with a total fund of RMB

The

term of this loan was for 60 months from July 31, 2013 to July 30, 2018, with interest of

Repayment of HYREF loan

1. Transfer of Chengli project as partial repayment

On

December 29, 2018, Xi’an Zhonghong, Xi’an TCH, HYREF, Guohua Ku, and Chonggong Bai entered into a CDQ WHPG Station Fixed

Assets Transfer Agreement, pursuant to which Xi’an Zhonghong transferred Chengli CDQ WHPG station as the repayment for the loan

of RMB

Xi’an TCH is a secondary limited partner of HYREF. The FV of the CDQ WHPG station applied in the transfer was determined by the parties based upon the appraisal report issued by Zhonglian Assets Appraisal Group (Shaanxi) Co., Ltd. as of August 15, 2018. However, per the discussion below, Xi’an Zhonghong, Xi’an TCH, Guohua Ku and Chonggong Bai (the “Buyers”) entered into a Buy Back Agreement, also agreed to buy back the Station when conditions under the Buy Back Agreement are met. Due to the Buy Back agreement, the loan was not deemed repaid, and therefore the Company recognized Chengli project as assets subject to buyback and kept the loan payable remained recognized under ASC 405-20-40-1 as of December 31, 2020. The Buy Back agreement was terminated in April 2021.

2. Buy Back Agreement

On December 29, 2018, Xi’an TCH, Xi’an Zhonghong, HYREF, Guohua Ku, Chonggong Bai and Xi’an Hanneng Enterprises Management Consulting Co. Ltd. (“Xi’an Hanneng”) entered into a Buy Back Agreement.

15

Pursuant

to the Buy Back Agreement, the Buyers jointly and severally agreed to buy back all outstanding capital equity of Xi’an Hanneng

which was transferred to HYREF by Chonggong Bai (see 3 below), and a CDQ WHPG station in Boxing County which was transferred to

HYREF by Xi’an Zhonghong. The buy-back price for the Xi’an Hanneng’s equity was based on the higher of (i) the

market price of the equity shares at the time of buy-back; or (ii) the original transfer price of the equity shares plus bank

interest. The buy-back price for the Station was based on the higher of (i) the FV of the Station on the date transferred; or (ii)

the loan Balance as of the date of the transfer plus interest accrued through that date. HYREF could request that the Buyers buy

back the equity shares of Xi’an Hanneng and/or the CDQ WHPG station if one of the following conditions is met: (i) HYREF holds

the equity shares of Xi’an Hanneng until December 31, 2021; (ii) Xi’an Huaxin New Energy Co., Ltd., is delisted from The

National Equities Exchange And Quotations Co., Ltd., a Chinese over-the-counter trading system (the “NEEQ”); (iii)

Xi’an Huaxin New Energy, or any of the Buyers or its affiliates has a credit problem, including not being able to issue an

auditor report or standard auditor report or any control person or executive of the Buyers is involved in crimes and is under

prosecution or has other material credit problems, to HYREF’s reasonable belief; (iv) if Xi’an Zhonghong fails to timely

make repayment on principal or interest of the loan agreement, its supplemental agreement or extension agreement; (v) the Buyers or

any party to the Debt Repayment Agreement materially breaches the Debt Repayment Agreement or its related transaction documents,

including but not limited to the Share Transfer Agreement, the Pledged Assets Transfer Agreement, the Entrusted Loan Agreement and

their guarantee agreements and supplemental agreements. Due to halted trading of Huaxin stock by NEEQ for not filing its 2018

annual report, on December 19, 2019, Xi’an TCH, Xi’an Zhonghong, Guohua Ku and Chonggong Bai jointly and severally

agreed to buy back all outstanding capital equity of Xi’an Hanneng which was transferred to HYREF by Chonggong Bai earlier.

The total buy back price was RMB

On

April 9, 2021, Xi’an TCH, Xi’an Zhonghong, Guohua Ku, Chonggong Bai and HYREF entered a Termination of Fulfillment Agreement

(termination agreement). Under the termination agreement, the original buyback agreement entered on December 19, 2019 was terminated

upon signing of the termination agreement. HYREF will not execute the buy-back option and will not ask for any additional payment

from the buyers other than keeping the CDQ WHPG station from Chengli project. The Company recorded a gain of approximately $

3. Transfer of Xuzhou Huayu Project and Shenqiu Phase I & II project to Mr. Bai for partial repayment of HYREF loan

On

January 4, 2019, Xi’an Zhonghong, Xi’an TCH, and Mr. Chonggong Bai entered into a Projects Transfer Agreement, pursuant to

which Xi’an Zhonghong transferred a CDQ WHPG station (under construction) located in Xuzhou City for Xuzhou Huayu Coking Co., Ltd.

(“Xuzhou Huayu Project”) to Mr. Bai for RMB

On February 15, 2019, Xi’an Zhonghong completed the transfer of the Xuzhou Huayu Project and Xi’an TCH completed the transfer of Shenqiu Phase I and II Projects to Mr. Bai, and on January 10, 2019, Mr. Bai transferred all the equity shares of his wholly owned company, Xi’an Hanneng, to HYREF as repayment of Xi’an Zhonghong’s loan to HYREF as consideration for the transfer of the Xuzhou Huayu Project and Shenqiu Phase I and II Projects.

Xi’an

Hanneng is a holding company and was supposed to own

16

On

December 19, 2019, Xi’an TCH, Xi’an Zhonghong, Guohua Ku and Chonggong Bai jointly and severally agreed to buy back all outstanding

capital equity of Xi’an Hanneng which was transferred to HYREF by Chonggong Bai earlier. The total buy back price was RMB

4.

The lender agreed to extend the repayment of RMB

Xi’an

TCH had investment RMB

9. NOTE PAYABLE, NET

Promissory Notes in April 2021

On

April 2, 2021, the Company entered into a Note Purchase Agreement with an institutional investor, pursuant to which the Company issued

to the Purchaser a Promissory Note of $

17

10. STOCKHOLDERS’ EQUITY

Shares Issued for Stock compensation

On

June 12, 2024, the Company issued

Warrants

| Number of Warrants | Average Exercise Price | Weighted Average Remaining Contractual Term in Years | ||||||||||

| Outstanding as of January 1, 2024 | $ | |||||||||||

| Exercisable as of January 1, 2024 | $ | |||||||||||

| Granted | - | |||||||||||

| Exchanged | - | |||||||||||

| Forfeited | - | |||||||||||

| Expired | - | |||||||||||

| Outstanding as of June 30, 2024 | $ | |||||||||||

| Exercisable as of June 30, 2024 | $ | |||||||||||

11. STOCK-BASED COMPENSATION PLAN

Options to Employees and Directors

On

June 19, 2015, the stockholders of the Company approved the China Recycling Energy Corporation Omnibus Equity Plan (the “Plan”)

at its annual meeting. The total shares of Common Stock authorized for issuance during the term of the Plan is

| Number of Shares | Average Exercise Price per Share | Weighted Average Remaining Contractual Term in Years | ||||||||||

| Outstanding as of January 1, 2024 | $ | |||||||||||

| Exercisable as of January 1, 2024 | $ | |||||||||||

| Granted | ||||||||||||

| Exercised | ||||||||||||

| Forfeited | ||||||||||||

| Outstanding as of June 30, 2024 | $ | |||||||||||

| Exercisable as of June 30, 2024 | $ | |||||||||||

18

12. INCOME TAX

The

Company’s Chinese subsidiaries are governed by the Income Tax Law of the PRC concerning privately-run enterprises, which are generally

subject to tax at

The

Company’s subsidiaries generate all of their income from their PRC operations. All of the Company’s Chinese subsidiaries’

effective income tax rate for 2023 and 2022 was

There is no income tax for companies domiciled in the Cayman Islands. Accordingly, the Company’s CFS do not present any income tax provisions related to Cayman Islands tax jurisdiction, where Sifang Holding is domiciled.

The

US parent company, SPC is taxed in the US and, as of June 30, 2024, had net operating loss (“NOL”) carry forwards for

income taxes of $

As

of June 30, 2024, the Company’s PRC subsidiaries had $

| 2024 | 2023 | |||||||

| U.S. statutory rates benefit | ( | )% | ( | )% | ||||

| Tax rate difference – current provision | ( | )% | % | |||||

| Permanent differences | % | % | ||||||

| Change in valuation allowance | % | % | ||||||

| Tax expense per financial statements | % | % | ||||||

| 2024 | 2023 | |||||||

| Income tax expense – current | $ | $ | ||||||

| Total income tax expense | $ | $ | ||||||

19

| 2024 | 2023 | |||||||

| U.S. statutory rates benefit | ( | )% | ( | )% | ||||

| Tax rate difference – current provision | ( | )% | % | |||||

| Permanent differences | - | % | % | |||||

| Change in valuation allowance | % | % | ||||||

| Tax expense per financial statements | - | % | % | |||||

| 2024 | 2023 | |||||||

| Income tax expense – current | $ | $ | ||||||

| Total income tax expense | $ | $ | ||||||

13. STATUTORY RESERVES

Pursuant to the corporate law of the PRC effective January 1, 2006, the Company is only required to maintain one statutory reserve by appropriating from its after-tax profit before declaration or payment of dividends. The statutory reserve represents restricted retained earnings.

Surplus Reserve Fund

The

Company’s Chinese subsidiaries are required to transfer

The

surplus reserve fund is non-distributable other than during liquidation and can be used to fund previous years’ losses, if any,

and may be utilized for business expansion or converted into share capital by issuing new shares to existing shareholders in proportion

to their shareholding or by increasing the par value of the shares currently held by them, provided that the remaining reserve balance

after such issue is not less than

The

maximum statutory reserve amount has not been reached for any subsidiary.

| Name of Chinese Subsidiaries | Registered Capital | Maximum Statutory Reserve Amount | Statutory reserve at June 30, 2024 | Statutory reserve at December 31, 2023 | ||||||||||||

| Shanghai TCH | $ | $ | ¥ | ¥ | ||||||||||||

| Xi’an TCH | ¥ | ¥ | ¥ | ¥ | ||||||||||||

| Erdos TCH | ¥ | ¥ | ¥ | ¥ | ||||||||||||

| Xi’an Zhonghong | ¥ | ¥ | Did not accrue yet due to accumulated deficit | Did not accrue yet due to accumulated deficit | ||||||||||||

| Shaanxi Huahong | $ | $ | Did not accrue yet due to accumulated deficit | Did not accrue yet due to accumulated deficit | ||||||||||||

| Zhongxun | ¥ | ¥ | Did not accrue yet due to accumulated deficit | Did not accrue yet due to accumulated deficit | ||||||||||||

20

Common Welfare Fund

The

common welfare fund is a voluntary fund to which the Company can transfer

14. CONTINGENCIES

China maintains a “closed” capital account, meaning companies, banks, and individuals cannot move money in or out of the country except in accordance with strict rules. The People’s Bank of China (PBOC) and State Administration of Foreign Exchange (SAFE) regulate the flow of foreign exchange in and out of the country. For inward or outward foreign currency transactions, the Company needs to make a timely declaration to the bank with sufficient supporting documents to declare the nature of the business transaction. The Company’s sales, purchases and expense transactions are denominated in RMB and all of the Company’s assets and liabilities are also denominated in RMB. The RMB is not freely convertible into foreign currencies under the current law. Remittances in currencies other than RMB may require certain supporting documentation in order to make the remittance.

The Company’s operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic and legal environments and foreign currency exchange. The Company’s results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

Litigation

1)

In November 2019, Beijing Hongyuan Recycling Energy Investment Center (“BIPC”), or Hongyuan, filed a lawsuit with the Beijing

Intermediate People’s Court against Xi’an TCH to compel Xi’an TCH to repurchase certain stock pursuant to a stock repurchase

option agreement. On April 9, 2021, the court rendered a judgment in favor of Hongyuan. Xi’an TCH filed a motion for retrial to

High People’s Court of Beijing on April 13, 2022, because Xi’an TCH paid RMB

As

of this report date, Xi’an Zhonghong is waiting for Court’s decision on retrial petition that was submitted in April 2022.

During this waiting period, BIPC entered the execution procedure, and there is a balance of RMB

2)

On June 28, 2021, Beijing No.4 Intermediate People’s Court of Beijing entered into a judgement that Xi’an Zhonghong Technology

Co., Ltd. should pay the loan principal of RMB

21

15. LEASE

On

November 20, 2017, Xi’an TCH entered into a lease for its office from December 1, 2017 through November 30, 2020. The monthly

rent was RMB

T

| June 30, 2024 | December 31, 2023 | |||||||

| Right-of-use assets, net | $ | $ | ||||||

| Current operating lease liabilities | ||||||||

| Non-current operating lease liabilities | ||||||||

| Total lease liabilities | $ | $ | ||||||

| Six Months Ended | ||||

| June 30, 2024 | ||||

| Operating lease cost – amortization of operating lease right-of-use asset | $ | |||

| Operating lease cost – interest expense on lease liability | $ | |||

| Weighted Average Remaining Lease Term - Operating leases | ||||

| Weighted Average Discount Rate - Operating leases | % | |||

| Six Months Ended | ||||

| June 30, 2023 | ||||

| Operating lease cost – amortization of operating lease right-of-use asset | $ | |||

| Operating lease cost – interest expense on lease liability | $ | |||

| Weighted Average Remaining Lease Term - Operating leases | ||||

| Weighted Average Discount Rate - Operating leases | % | |||

| Three Months Ended | ||||

| June

30, 2024 | ||||

| Operating lease cost – amortization of operating lease right-of-use asset | $ | |||

| Operating lease cost – interest expense on lease liability | $ | |||

| Three Months Ended | ||||

| June

30, 2023 | ||||

| Operating lease cost – amortization of operating lease right-of-use asset | $ | |||

| Operating lease cost – interest expense on lease liability | $ | |||

22

| For the year ended June 30, 2025, | $ | |||

| For the year ended June 30, 2026 | ||||

| For the year ended June 30, 2027 | ||||

| Total undiscounted cash flows | ||||

| Less: imputed interest | ( | ) | ||

| Present value of lease liabilities | $ |

Employment Agreement

On

May 6, 2022, the Company entered another employment agreement with Mr. Shi for 24 months with monthly salary of RMB

On

May 6, 2024, the Company entered another employment agreement with Mr. Shi for 24 months with monthly salary of RMB

16. COMMITMENTS

Lease Commitments

| Lease Commitment | ||||

| Within 1 year | $ | |||

| 2-5 years | $ | |||

| Total | $ | |||

17. SUBSEQUENT EVENTS

The Company follows the guidance in FASB ASC 855-10 for the disclosure of subsequent events. The Company evaluated subsequent events through the date the unaudited financial statements were issued and determined the Company had the following subsequent event need to be disclosed.

On

July 23, 2024, the Company entered into an Exchange Agreement with the lender. Pursuant to the Agreement, the Company and Lender partitioned

a new Promissory Notes of $

23

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This report on Form 10-Q and other reports filed by the Company from time to time with the SEC (collectively the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, Company’s management as well as estimates and assumptions made by Company’s management. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. When used in the filings, the words “may”, “will”, “should”, “would”, “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan”, or the negative of these terms and similar expressions as they relate to Company or Company’s management identify forward-looking statements. Such statements reflect the current view of Company with respect to future events and are subject to risks, uncertainties, assumptions, and other factors (including the statements in the section “results of operations” below), and any businesses that Company may acquire. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended, or planned.

Although the Company believes the expectations reflected in the forward-looking statements are based on reasonable assumptions, the Company cannot guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of annual report, which attempts to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations, and prospects.

Our financial statements are prepared in US Dollars and in accordance with accounting principles generally accepted in the United States. See “Foreign Currency Translation and Comprehensive Income (Loss)” below for information concerning the exchange rates at which Renminbi (“RMB”) were translated into US Dollars (“USD”) at various pertinent dates and for pertinent periods.

OVERVIEW

The Company was incorporated on May 8, 1980 as Boulder Brewing Company under the laws of the State of Colorado. On September 6, 2001, the Company changed its state of incorporation to the State of Nevada. In 2004, the Company changed its name from Boulder Brewing Company to China Digital Wireless, Inc. and on March 8, 2007, again changed its name from China Digital Wireless, Inc. to its current name, China Recycling Energy Corporation. On March 3, 2022, the Company changed its name to Smart Powerr Corp. The Company, through its subsidiaries, provides energy saving solutions and services, including selling and leasing energy saving systems and equipment to customers, project investment, investment management, economic information consulting, technical services, financial leasing, purchase of financial leasing assets, disposal and repair of financial leasing assets, consulting and ensuring of financial leasing transactions in the Peoples Republic of China (“PRC”).

The Company is in the process of transforming and expanding into an energy storage integrated solution provider business. We plan to pursue disciplined and targeted expansion strategies for market areas we currently do not serve. We actively seek and explore opportunities to apply energy storage technologies to new industries or segments with high growth potential, including industrial and commercial complexes, large scale photovoltaic (“PV”) and wind power stations, remote islands without electricity, and cities with multi-energy supplies.

24

For the six months ended June 30, 2024 and 2023, the Company had net loss of $689,554 and $337,346, respectively. For the three months ended June 30, 2024 and 2023, the Company had a net loss of $409,757 and $247,842, respectively. The Company had an accumulated deficit of $61.19 million as of June 30, 2024. The Company disposed all of its systems and currently holds five power generating systems through Erdos TCH, the five power generating systems are currently not producing any electricity. The Company is in the process of transforming and expanding into an energy storage integrated solution provider business. The Company plans to pursue disciplined and targeted expansion strategies for market areas the Company currently does not serve. The Company actively seeks and explores opportunities to apply energy storage technologies to new industries or segments with high growth potential, including industrial and commercial complexes, large scale photovoltaic (PV) and wind power stations, remote islands without electricity, and smart energy cities with multi-energy supplies. The Company’s cash flow forecast indicates it will have sufficient cash to fund its operations for the next 12 months from the date of issuance of these CFS.

Management also intends to raise additional funds by way of a private or public offering, or by obtaining loans from banks or others. While the Company believes in the viability of its strategy to generate sufficient revenue and in its ability to raise additional funds on reasonable terms and conditions, there can be no assurances to that effect. The ability of the Company to continue as a going concern depends upon the Company’s ability to further implement its business plan and generate sufficient revenue and its ability to raise additional funds by way of a public or private offering, or debt financing including bank loans.

Our Subsidiaries and Projects

Our business is primarily conducted through our wholly-owned subsidiaries, Yinghua and Sifang, Sifang’s wholly-owned subsidiaries, Huahong and Shanghai TCH, Shanghai TCH’s wholly-owned subsidiaries, Xi’an TCH, Xi’an TCH’s wholly-owned subsidiary Erdos TCH and Xi’an TCH’s 90% owned and Shanghai TCH’s 10% owned subsidiary Xi’an Zhonghong New Energy Technology Co., Ltd., and Zhongxun. Shanghai TCH was established as a foreign investment enterprise in Shanghai under the laws of the PRC on May 25, 2004, and currently has registered capital of $29.80 million. Xi’an TCH was incorporated in Xi’an, Shaanxi Province under the laws of the PRC in November 2007. Erdos TCH was incorporated in April 2009. Huahong was incorporated in February 2009. Xi’an Zhonghong New Energy Technology Co., Ltd. was incorporated in July 2013. Xi’an TCH owns 90% and Shanghai TCH owns 10% of Zhonghong. Zhonghong provides energy saving solutions and services, including constructing, selling and leasing energy saving systems and equipment to customers.

Zhongxun was incorporated in March 2014 and is a wholly owned subsidiary of Xi’an TCH. Zhongxun will be mainly engaged in project investment, investment management, economic information consulting, and technical services. Zhongxun has not yet commenced operations nor has any capital contribution been made as of the date of this report.

Yinghua was incorporated on February 11, 2015 by the U.S. parent company. Yinghua will be mainly engaged in financial leasing, purchase of financial leasing assets, disposal and repair of financial leasing assets, consulting and ensuring of financial leasing transactions, and related factoring business. Yinghua has not yet commenced operations nor has any capital contribution been made as of the date of this report.

25

The Company’s organizational chart as of June 30, 2024 is as follows:

Erdos TCH – Joint Venture

On April 14, 2009, the Company formed a joint venture (the “JV”) with Erdos Metallurgy Co., Ltd. (“Erdos”) to recycle waste heat from Erdos’ metal refining plants to generate power and steam to be sold back to Erdos. The name of the JV was Inner Mongolia Erdos TCH Energy Saving Development Co., Ltd. (“Erdos TCH”) with a term of 20 years. Erdos contributed 7% of the total investment of the project, and Xi’an TCH Energy Technology Co., Ltd. (“Xi’an TCH”) contributed 93%. On June 15, 2013, Xi’an TCH and Erdos entered into a share transfer agreement, pursuant to which Erdos sold its 7% ownership interest in the JV to Xi’an TCH for $1.29 million (RMB 8 million), plus certain accumulated profits. Xi’an TCH paid $1.29 million in July 2013 and, as a result, became the sole stockholder of the JV. Erdos TCH currently has two power generation systems in Phase I with a total of 18 MW power capacity, and three power generation systems in Phase II with a total of 27 MW power capacity. On April 28, 2016, Erdos TCH and Erdos entered into a supplemental agreement, effective May 1, 2016, whereby Erdos TCH cancelled monthly minimum lease payments from Erdos, and started to charge Erdos based on actual electricity sold at RMB 0.30 / KWH. The selling price of each KWH is determined annually based on prevailing market conditions. In May 2019, Erdos TCH ceased its operations due to renovations and furnace safety upgrades of Erdos, and the Company initially expected the resumption of operations in July 2020, but the resumption of operations was further delayed due to government’s mandate for Erdos to significantly lower its energy consumption per unit of GDP by implementing a comprehensive technical upgrade of its ferrosilicon production line to meet the City’s energy-saving targets. Erdos is currently researching the technical rectification scheme. Once the scheme is determined, Erdos TCH will carry out supporting technical transformation for its waste heat power station project. During this period, Erdos will compensate Erdos TCH RMB 1 million ($145,460) per month, until operations resume. The Company has not recognized any income due to the uncertainty of collection.

In addition, Erdos TCH has 30% ownership in DaTangShiDai (BinZhou) Energy Savings Technology Co., Ltd. (“BinZhou Energy Savings”), 30% ownership in DaTangShiDai DaTong Recycling Energy Technology Co., Ltd. (“DaTong Recycling Energy”), and 40% ownership in DaTang ShiDai TianYu XuZhou Recycling Energy Technology Co, Ltd. (“TianYu XuZhou Recycling Energy”). These companies were incorporated in 2012 but have not had any operations since then nor has any registered capital contribution been made.

26

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Our management’s discussion and analysis of our financial condition and results of operations are based on our consolidated financial statements (“CFS”), which were prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”). The preparation of these CFS requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements as well as the reported net sales and expenses during the reporting periods. On an ongoing basis, we evaluate our estimates and assumptions. We base our estimates on historical experience and various other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

While our significant accounting policies are more fully described in Note 2 to our CFS, we believe the following accounting policies are the most critical to assist you in fully understanding and evaluating this management discussion and analysis.

Basis of Presentation

These accompanying CFS were prepared in accordance with US GAAP and pursuant to the rules and regulations of the SEC for financial statements.

Principle of Consolidation

The CFS include the accounts of CREG and, its subsidiary, Sifang Holdings and Yinghua; Sifang Holdings’ wholly-owned subsidiaries, Huahong and Shanghai TCH; Shanghai TCH’s wholly-owned subsidiary Xi’an TCH; and Xi’an TCH’s subsidiaries, Erdos TCH, Zhonghong, and Zhongxun. Substantially all of the Company’s revenues are derived from the operations of Shanghai TCH and its subsidiaries, which represent substantially all of the Company’s consolidated assets and liabilities as of June 30, 2024. All significant inter-company accounts and transactions were eliminated in consolidation.

Use of Estimates

In preparing the CFS, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheets as well as revenues and expenses during the year reported. Actual results may differ from these estimates.

Concentration of Credit Risk

Cash includes cash on hand and demand deposits in accounts maintained within China. Balances at financial institutions within China are not covered by insurance. The Company has not experienced any losses in such accounts.

Certain other financial instruments, which subject the Company to concentration of credit risk, consist of accounts and other receivables. The Company does not require collateral or other security to support these receivables. The Company conducts periodic reviews of its customers’ financial condition and customer payment practices to minimize collection risk on accounts receivable.

The operations of the Company are located in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environments in the PRC.

27

Revenue Recognition

Sales-type Leasing and Related Revenue Recognition

The Company follows Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 842 (See Operating lease below as relates to the Company as a lessee). The Company’s sales type lease contracts for revenue recognition fall under ASC 842.

The Company constructs and leases waste energy recycling power generating projects to its customers. The Company typically transfers ownership of the waste energy recycling power generating projects to its customers at the end of the lease.

The Company finances construction of waste energy recycling power generating projects. The sales and cost of sales are recognized at the inception of the lease, which is when the control is transferred to the lessee. The Company accounts for the transfer of control as a sales type lease in accordance with ASC 842-10-25-2. The underlying asset is derecognized, and revenue is recorded when collection of payments is probable. This is in accordance with the revenue recognition principle in ASC 606 -Revenue from contracts with customers. The investment in sales-type leases consists of the sum of the minimum lease payments receivable less unearned interest income and estimated executory cost. Minimum lease payments are part of the lease agreement between the Company (as the lessor) and the customer (as the lessee). The discount rate implicit in the lease is used to calculate the present value of minimum lease payments. The minimum lease payments consist of the gross lease payments net of executory costs and contingent rentals, if any. Unearned interest is amortized to income over the lease term to produce a constant periodic rate of return on net investment in the lease. While revenue is recognized at the inception of the lease, the cash flow from the sales-type lease occurs over the course of the lease, which results in interest income and reduction of receivables. Revenue is recognized net of value-added tax.

Contingent Rental Income

The Company records income from actual electricity generated of each project in the period the income is earned, which is when the electricity is generated. Contingent rent is not part of minimum lease payments.

Foreign Currency Translation and Comprehensive Income (Loss)

The Company’s functional currency is RMB. For financial reporting purposes, RMB figures were translated into USD as the reporting currency. Assets and liabilities are translated at the exchange rate in effect on the balance sheet date. Revenues and expenses are translated at the average rate of exchange prevailing during the reporting period. Translation adjustments arising from the use of different exchange rates from period to period are included as a component of stockholders’ equity as “Accumulated other comprehensive income.” Gains and losses from foreign currency transactions are included in income. There has been no significant fluctuation in exchange rate for the conversion of RMB to USD after the balance sheet date.

The Company uses “Reporting Comprehensive Income” (codified in FASB ASC Topic 220). Comprehensive income is comprised of net income and all changes to the statements of stockholders’ equity, except those due to investments by stockholders, changes in paid-in capital and distributions to stockholders.

28

RESULTS OF OPERATIONS

Comparison of Results of Operations for the six months ended June 30, 2024 and 2023

The following table sets forth the results of our operations for the periods indicated as a percentage of net sales. Certain columns may not add due to rounding.

| 2024 | % of Sales | 2023 | % of Sales | |||||||||||||

| Sales | $ | - | - | % | $ | - | - | % | ||||||||

| Cost of sales | - | - | % | - | - | % | ||||||||||

| Gross profit | - | - | % | - | - | % | ||||||||||

| Interest income on sales-type leases | - | - | % | - | - | % | ||||||||||

| Total operating expenses | 559,237 | - | % | 459,235 | - | % | ||||||||||

| Loss from operations | (559,237 | ) | - | % | (459,235 | ) | - | % | ||||||||

| Total non-operating income (expenses), net | (116,141 | ) | - | % | 184,381 | - | % | |||||||||

| Loss before income tax | (675,378 | ) | - | % | (274,854 | ) | - | % | ||||||||

| Income tax expense | 14,176 | - | % | 62,492 | - | % | ||||||||||

| Net loss | $ | (689,554 | ) | - | % | $ | (337,346 | ) | - | % | ||||||

SALES. Total sales for the six months ended June 30, 2024 and 2023 were $0.

COST OF SALES. Cost of sales (“COS”) for the six months ended June 30, 2024 and 2023 were $0.

GROSS PROFIT. Gross profit for the six months ended June 30, 2024 and 2023 were nil with gross margin of nil.

OPERATING EXPENSES. Operating expenses consisted of general and administrative expenses (“G&A”) totaling $559,237 for the six months ended June 30, 2024, compared to $459,235 for the six months ended June 30, 2023, an increase of $100,002 or 21.78%. The increase in operating expenses was mainly due to increased stock compensation expense by approximately $139,066 and increased legal expense by approximately $13,025, which was partly offset by decreased audit expense by approximately $28,910.

NET NON-OPERATING INCOME (EXPENSES). Net non-operating expenses consisted of gain or loss on note conversion, interest income, interest expenses, and miscellaneous expenses. For the six months ended June 30, 2024, net non-operating expenses was $116,141 compared to non-operating income of $184,381 for six months ended June 30, 2023. For the six months ended June 30, 2024, we had $81,281 interest income, and $28,152 other income, which was partly offset by $21,243 loss on note conversion and $204,331 interest expense. For six months ended June 30, 2023, we had $170,441 interest income, gain on note conversion of $5,602 and other income of $228,618, which was partly offset by $220,280 interest expense on note payable.

INCOME TAX EXPENSE. Income tax expense was $14,176 for the six months ended June 30, 2024, compared with $62,492 for the six months ended June 30, 2023. The consolidated effective income tax rate for the six months ended June 30, 2024 and 2023 were 2.1% and 22.7%, respectively.

NET LOSS. Net loss for the six months ended June 30, 2024 was $689,554 compared to $337,346 for the six months ended June 30, 2023, an increase of net loss of $352,208. This increase in net loss was mainly due to increased operating expenses by $100,002, increased loss on note conversion by $26,845, decreased other income by $200,466 and decreased interest income by $89,160, which was partly offset by decreased interest expense by $15,949 and decreased income tax expense by $48,316 as described above.

29

Comparison of Results of Operations for the three months ended June 30, 2024 and 2023

The following table sets forth the results of our operations for the periods indicated as a percentage of net sales. Certain columns may not add due to rounding.

| 2024 | % of Sales | 2023 | % of Sales | |||||||||||||

| Sales | $ | - | - | % | $ | - | - | % | ||||||||

| Cost of sales | - | - | % | - | - | % | ||||||||||

| Gross profit | - | - | % | - | - | % | ||||||||||

| Interest income on sales-type leases | - | - | % | - | - | % | ||||||||||

| Total operating expenses | 350,803 | - | % | 374,407 | - | % | ||||||||||

| Loss from operations | (350,803 | ) | - | % | (374,407 | ) | - | % | ||||||||

| Total non-operating income (expenses), net | (58,954 | ) | - | % | 184,523 | - | % | |||||||||

| Loss before income tax | (409,757 | ) | - | % | (189,884 | ) | - | % | ||||||||

| Income tax expense | - | - | % | 57,958 | - | % | ||||||||||

| Net loss | $ | (409,757 | ) | - | % | $ | (247,842 | ) | - | % | ||||||

SALES. Total sales for the three months ended June 30, 2024 and 2023 were $0.

COST OF SALES. Cost of sales (“COS”) for the three months ended June 30, 2024 and 2023 were $0.

GROSS PROFIT. Gross profit for the three months ended June 30, 2024 and 2023 were $0 with gross margin of 0%.

OPERATING EXPENSES. Operating expenses consisted of general and administrative expenses (“G&A”) totaling $350,803 for the three months ended June 30, 2024, compared to $374,407 for the three months ended June 30, 2023, a decrease of $23,604 or 6.30%. The decrease in operating expenses was mainly due to decreased audit expense by approximately $73,410, decreased NASDAQ annual fee by $47,000, decreased Broadridge service fee by $9,784, decreased legal expense by approximately $8,975 and decreased other G&A expenses by $23,500, which was partly offset by increased stock compensation expense by approximately $139,066.

NET NON-OPERATING INCOME (EXPENSES). Net non-operating expenses consisted of gain or loss on note conversion, interest income, interest expenses, and miscellaneous expenses. For the three months ended June 30, 2024, net non-operating expenses was $58,954 compared to non-operating income of $184,523 for the three months ended June 30, 2023. For the three months ended June 30, 2024, we had $41,297 interest income, which was partly offset by $100,251 interest expense on note payable. For the three months ended June 30, 2023, we had $82,246 interest income, and other income of $216,333, which was partly offset by $109,176 interest expense on note payable, and loss on note conversion of $4,880.