UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2020

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission file number: 000-12536

China Recycling Energy Corporation

(Exact name of registrant as specified in its charter)

| Nevada | 90-0093373 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) | |

| 4/F, Tower C Rong Cheng Yun Gu Building Keji 3rd Road, Yanta District Xi An City, Shaan Xi Province China |

710075 | |

| (Address of principal executive offices) | (Zip Code) |

(011) 86-29-8765-1098

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.001 par value | CREG | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer a smaller reporting company, or an emerging growth company. See the definitions of the “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ | |

| Non-Accelerated Filer | ☐ | Smaller reporting company | ☒ | |

| Emerging Growth Company | ☐ | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2020, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the common stock outstanding held by non-affiliates of the registrant, computed by reference to the closing sales price for the common stock of $2.25, as reported on the Nasdaq Capital Market, was approximately $6.2 million.

As of April 15, 2021, there were 3,177,050 shares of the registrant’s common stock outstanding.

CHINA RECYCLING ENERGY CORPORATION

FORM 10-K

TABLE OF CONTENTS

| i |

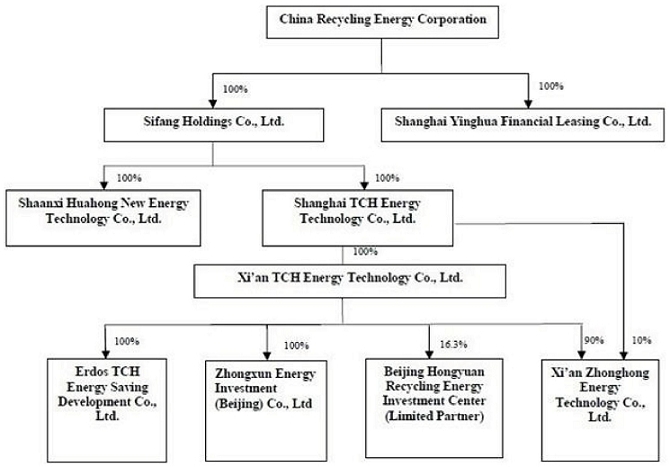

When we use the terms “we,” “us,” “our” and “the Company,” we mean China Recycling Energy Corporation, a Nevada corporation, and its wholly-owned subsidiaries, Shanghai Yinghua Financial Leasing Co., Ltd. (“Yinghua”) and Sifang Holdings Co., Ltd. (“Sifang”), and Sifang’s wholly-owned subsidiaries, Huahong New Energy Technology Co., Ltd. (“Huahong”) and Shanghai TCH, Shanghai TCH’s wholly-owned subsidiaries, Xi’an TCH Energy Technology Company, Ltd. (“Xi’an TCH”), Xi’an TCH’s wholly-owned subsidiary Erdos TCH Energy Saving Development Co., Ltd. (“Erdos TCH”) and Zhongxun Energy Investment (Beijing) Co., Ltd (“Zhongxun”) and Xi’an TCH’s 90% and Shanghai TCH’s 10% owned subsidiary Xi’an Zhonghong New Energy Technology Co., Ltd.

General

We are currently engaged in the recycling energy business, providing energy savings and recycling products and services. We are a leading developer of waste energy recycling projects for industrial applications in China, and we believe we are the only developer to use a Build-Operate-Transfer (“BOT”) model to provide energy saving and recovery facilities for multiple energy intensive industries in China. Our waste energy recycling projects allow customers which use substantial amounts of electricity to recapture previously wasted pressure, heat, and gas from their manufacturing processes to generate electricity. We currently offer waste energy recycling systems to companies for use in iron and steel, nonferrous metal, cement, coal and petrochemical plants. We construct our projects at our customer’s facility and the electricity produced is used on-site by the customer. While some of our competitors offer projects targeting one or two verticals, we serve multiple verticals.

We develop fully customized projects across several verticals to better meet customer’s energy recovery needs. Our waste pressure-to-energy solution primarily consists of the Blast Furnace Top Gas Recovery Turbine Unit (“TRT”), a system that utilizes high pressure gas emitted from the blast furnace top to drive turbine units and generate electricity. Our waste heat-to-energy solution primarily consists of heat power generation projects for applications in cement, steel, coking coal, and nonferrous metal industries, which collect the residual heat from various manufacturing processes, e.g. the entrance and exit ends of the cement rotary kilns, to generate electricity. Our waste gas-to-energy solution primarily consists of the Waste Gas Power Generation system (“WGPG”) and the Combined Cycle Power Plant (the “CCPP”). A WGPG system utilizes flammable waste gas from coal mining, petroleum exploitation, refinery processing or other sources as a fuel source to generate electricity through the use of a gas turbine. A CCPP system employs more than one power generating cycle to utilize the waste gas, which not only generates electricity by burning the flammable waste gas in a gas turbine (as a WGPG) but also uses the waste heat from burning the gas to make steam to generate additional electricity via a steam turbine.

We provide a clean-technology and energy-efficient solution aimed at reducing the air pollution and energy shortage problems in China. Our projects capture industrial waste energy to produce low-cost electricity, enabling industrial manufacturers to reduce their energy costs, lower their operating costs, and extend the life of primary manufacturing equipment. In addition, our waste energy recycling projects allow our industrial customers to reduce their reliance on China’s centralized national power grid, which is prone to black-outs or brown-outs or is completely inaccessible from certain remote areas. Our projects generally produce lower carbon dioxide emissions and other pollutants, and are hence more environmentally friendly than other forms of power generation.

| 1 |

Since 2007, we have primarily used the BOT model to serve our customers. For each project, we design, finance, construct and install the waste energy recycling projects for our customers, operate the projects for five to 20 years, and then transfer the projects to the owners. The BOT model creates a win-win solution for both our customers and us. We provide the capital expenditure financing in exchange for attractive returns on each project; our customers can focus their capital resources on their core businesses, do not need to invest additional capitals to comply with government environmental regulations, reduce noise and emissions and reduce their energy costs. We in turn efficiently recapture our costs through the stream of lease payments.

We are headquartered in China. Our principal executive offices are located at 4/F, Tower C, Rong Cheng Yun Gu Building, Keji 3rd Road, Yanta District, Xi’an City, Shaanxi Province, China, and our telephone number at this location is +86-29-8765-1098.

Company Overview and History

The Company was incorporated on May 8, 1980 as Boulder Brewing Company under the laws of the State of Colorado. On September 6, 2001, the Company changed its state of incorporation to the State of Nevada. In 2004, the Company changed its name from Boulder Brewing Company to China Digital Wireless, Inc. and on March 8, 2007, again changed its name from China Digital Wireless, Inc. to its current name, China Recycling Energy Corporation. The Company, through its subsidiaries, provides energy saving solutions and services, including selling and leasing energy saving systems and equipment to customers, project investment, investment management, economic information consulting, technical services, financial leasing, purchase of financial leasing assets, disposal and repair of financial leasing assets, consulting and ensuring of financial leasing transactions in the Peoples Republic of China (“PRC”).

Our business is primarily conducted through our wholly-owned subsidiaries, Yinghua and Sifeng, Sifeng’s wholly-owned subsidiaries, Huahong and Shanghai TCH, Shanghai TCH’s wholly-owned subsidiaries, Xi’an TCH, Xi’an TCH’s wholly-owned subsidiary Erdos TCH and Xi’an TCH’s 90% owned and Shanghai TCH’s 10% owned subsidiary Xi’an Zhonghong New Energy Technology Co., Ltd., and Zhongxun. Shanghai TCH was established as a foreign investment enterprise in Shanghai under the laws of the PRC on May 25, 2004, and currently has registered capital of $29.80 million. Xi’an TCH was incorporated in Xi’an, Shaanxi Province under the laws of the PRC in November 2007. Erdos TCH was incorporated in April 2009. Huahong was incorporated in February 2009. Xi’an Zhonghong New Energy Technology Co., Ltd. was incorporated in July 2013. Xi’an TCH owns 90% and Shanghai TCH owns 10% of Zhonghong. Zhonghong provides energy saving solutions and services, including constructing, selling and leasing energy saving systems and equipment to customers. Zhongxun was incorporated in March 2014 and is a wholly owned subsidiary of Xi’an TCH.

The Company is in the process of transforming and expanding into an energy storage integrated solution provider. We plan to pursue disciplined and targeted expansion strategies for market areas we currently do not serve. We actively seek and explore opportunities to apply energy storage technologies to new industries or segments with high growth potential, including industrial and commercial complexes, large scale photovoltaic (PV) and wind power stations, remote islands without electricity, and smart energy cities with multi-energy supplies. By supporting and motivating all kinds of the electric power market to participate in resource development and utilization of demand response, we plan to provide services including peak shaving with compensation and frequency modulation. We intend to gradually form motor load performance for peak and low-hours, which will account for about 3% of the annual maximum power load on the demand side and to ensure the electricity supply and demand balance for situations of non-severe power shortages.

| 2 |

Our Projects

We design, finance, construct, operate and eventually transfer waste energy recycling projects to meet the energy saving and recovery needs of our customers. Our waste energy recycling projects use the pressure, heat or gas, which is generated as a byproduct of a variety of industrial processes, to create electricity. The residual energy from industrial processes, which was traditionally wasted, may be captured in a recovery process and utilized by our waste energy recycling projects to generate electricity burning additional fuel and additional emissions. Among a wide variety of waste-to-energy technologies and solutions, we primarily focus on waste pressure to energy systems, waste heat to energy systems and waste gas power generation systems. We do not manufacture the equipment and materials that are used in the construction of our waste energy recycling projects. Rather, we incorporate standard power generating equipment into a fully integrated onsite project for our customers.

Waste Pressure to Energy Systems

TRT is a power generating system utilizing the exhaust pressure and heat from industrial processes in the iron, steel, petrochemical, chemical and non-ferrous metals industries, often from blast furnace gases in the metal production industries. Without TRT power systems, blast furnace gas is treated by various de-pressurizing valves to decrease its pressure and temperature before the gas is transmitted to end users. No electricity is generated during the process and noise and heat pollution is released. In a TRT system, the blast furnace gas produced during the smelting process is directed through the system to decrease its pressure and temperature. The released pressure and heat is then utilized to drive the turbine unit to generate electricity, which is then transmitted back to the producer. We believe our projects are superior to those of our competitors due to the inclusion of advanced dry-type de-dusting technology, joined turbine systems, and automatic power grid synchronization.

Waste Heat to Energy Systems

Waste heat to energy systems utilize waste heat generated in industrial production to generate electricity. The waste heat is trapped to heat a boiler to create steam and power a steam turbine. Our waste heat to energy systems have used waste heat from cement production and from metal production. We invested in and have built two cement low temperature heat power generation systems. These projects can use about 35% of the waste heat generated by the cement kiln and generate up to 50% of the electricity needed to operate the cement plant.

Waste Gas to Energy Systems

Our Waste Gas to Energy Systems primarily include Waste Gas Power Generation (“WGPG”) systems and Combined Cycle Power Plant (“CCPP”) systems. WGPG uses the flammable waste gases emitted from industrial production processes such as blast furnace gas, coke furnace gas, and oil gas, to power gas-fired generators to create energy. A CCPP system employs more than one power generating cycle to utilize the waste gas, which is more efficient because it not only generates electricity by burning the flammable waste gas in a gas-fired generator (WGPG) but also uses the waste heat from burning the gas to make steam to generate additional electricity via a steam generator (CCPP).

| 3 |

Shanghai TCH and its Subsidiaries

Shanghai TCH was established as a foreign investment enterprise in Shanghai under the laws of the PRC on May 25, 2004 and has a registered capital of $29.80 million. Xi’an TCH was incorporated in Xi’an, Shaanxi Province under the laws of the PRC on November 8, 2007. In February 2009, Huahong was incorporated in Xi’an, Shaanxi province. Erdos TCH was incorporated in April 2009 in Erdos, Inner Mongolia Autonomous Region. On July 19, 2013, Xi’an TCH formed Xi’an Zhonghong New Energy Technology Co., Ltd (“Zhonghong”). Xi’an TCH owns 90% and Shanghai TCH owns 10% of Zhonghong, which provides energy saving solutions and services, including constructing, selling and leasing energy saving systems and equipment to customers.

As of December 31, 2020, Erdos TCH leased power and steam generating systems from waste heat from metal refining to Erdos (a total of five systems) and charges Erdos a leasing fee based on actual electricity generated.

Erdos TCH – Joint Venture

On April 14, 2009, the Company formed Erdos TCH as a joint venture (the “JV” or “Erdos TCH”) with Erdos Metallurgy Co., Ltd. (“Erdos”) to recycle waste heat from Erdos’ metal refining plants to generate power and steam to be sold back to Erdos. The JV has a term of 20 years with a total investment for the project estimated at $79 million (RMB 500 million) and an initial investment of $17.55 million (RMB 120 million). Erdos contributed 7% of the total investment for the project, and Xi’an TCH contributed 93%. According to Xi’an TCH and Erdos’ agreement on profit distribution, Xi’an TCH and Erdos will receive 80% and 20%, respectively, of the profit from the JV until Xi’an TCH receives the complete return of its investment. Xi’an TCH and Erdos will then receive 60% and 40%, respectively, of the profit from the JV. On June 15, 2013, Xi’an TCH and Erdos entered into a share transfer agreement, pursuant to which Erdos transferred and sold its 7% ownership interest in the JV to Xi’an TCH for $1.29 million (RMB 8 million), plus certain accumulated profits as described below. Xi’an TCH paid the $1.29 million in July 2013 and, as a result, became the sole stockholder of Erdos TCH. In addition, Xi’an TCH is required to pay Erdos accumulated profits from inception up to June 30, 2013 in accordance with the supplementary agreement entered on August 6, 2013. In August 2013, Xi’an TCH paid 20% of the accumulated profit (calculated under PRC GAAP) of $226,000 to Erdos. Erdos TCH currently has two power generation systems in Phase I with a total of 18 MW power capacity, and three power generation systems in Phase II with a total of 27 MW power capacity. The power generation systems were built in 2009, and it is now 12 years old. The equipment is obsolete and the efficiency of the power generation systems is declining year by year. The current power generation efficiency can only reach 30%, and the equipment needs to be upgraded. The Company plans to upgrade these five power generation systems in the next six months starting April 2021. The total project cost is about $40,000,000.

| 4 |

After considering the challenging economic conditions facing Erdos, and to maintain the long-term cooperative relationship between the parties, which we believe will continue to produce long-term benefits, on April 28, 2016, Erdos TCH and Erdos entered into a supplemental agreement, effective May 1, 2016. Under the supplemental agreement, Erdos TCH cancelled monthly minimum lease payments from Erdos, and agreed to charge Erdos based on actual electricity sold at RMB 0.30 / KWH, which such price will be adjusted annually based on prevailing market conditions.

The Company evaluated the modified terms for payments based on actual electricity sold as minimum lease payments as defined in ASC 840-10-25-4, since lease payments that depend on a factor directly related to the future use of the leased property are contingent rentals and, accordingly, are excluded from minimum lease payments in their entirety. The Company wrote off the net investment receivables of these leases at the lease modification date.

Pucheng Biomass Power Generation Projects

On June 29, 2010, Xi’an TCH entered into a Biomass Power Generation (“BMPG”) Project Lease Agreement with PuchengXinHeng Yuan Biomass Power Generation Co., Ltd. (“Pucheng”), a limited liability company incorporated in China. Under this lease agreement, Xi’an TCH leased a set of 12MW BMPG systems to Pucheng at a minimum of $279,400 (RMB 1,900,000) per month for a term of 15 years. (“Pucheng Phase I”).

On September 11, 2013, Xi’an TCH entered into a BMPG Asset Transfer Agreement (the “Pucheng Transfer Agreement”) with Pucheng Xin Heng Yuan Biomass Power Generation Corporation (“Pucheng”), a limited liability company incorporated in China. The Pucheng Transfer Agreement provided for the sale by Pucheng to Xi’an TCH of a set of 12 MW BMPG systems with the completion of system transformation for a purchase price of RMB 100 million ($16.48 million) in the form of 8,766,547 shares of common stock of the Company at $1.87 per share (the share and per share numbers were not adjusted for the Reverse Stock Split). Also on September 11, 2013, Xi’an TCH also entered into a BMPG Project Lease Agreement with Pucheng (the “Pucheng Lease”). Under the Pucheng Lease, Xi’an TCH leases this same set of 12 MW BMPG system to Pucheng, and combines this lease with the lease for the 12 MW BMPG station of Pucheng Phase I project, under a single lease to Pucheng for RMB 3.8 million ($0.63 million) per month (the “Pucheng Phase II Project”). The term for the consolidated lease is from September 2013 to June 2025. The lease agreement for the 12 MW station from Pucheng Phase I project terminated upon the effective date of the Pucheng Lease. The ownership of two 12 MW BMPG systems will transfer to Pucheng at no additional charge when the Pucheng Lease expires.

Shenqiu Yuneng Biomass Power Generation Projects

On May 25, 2011, Xi’an TCH entered into a Letter of Intent with Shenqiu YuNeng Thermal Power Co., Ltd. (“Shenqiu”) to reconstruct and transform a Thermal Power Generation System owned by Shenqiu into a 75T/H BMPG System for $3.57 million (RMB 22.5 million). The project commenced in June 2011 and was completed in the third quarter of 2011. On September 28, 2011, Xi’an TCH entered into a Biomass Power Generation Asset Transfer Agreement with Shenqiu (the “Shenqiu Transfer Agreement”). Pursuant to the Shenqiu Transfer Agreement, Shenqiu sold Xi’an TCH a set of 12 MW BMPG systems (after Xi’an TCH converted the system for BMPG purposes). As consideration for the BMPG systems, Xi’an TCH paid Shenqiu $10.94 million (RMB 70 million) in cash in three installments within six months upon the transfer of ownership of the systems. By the end of 2012, all the consideration was paid. On September 28, 2011, Xi’an TCH and Shenqiu also entered into a Biomass Power Generation Project Lease Agreement (the “2011 Shenqiu Lease”). Under the 2011 Shenqiu Lease, Xi’an TCH agreed to lease a set of 12 MW BMPG systems to Shenqiu at a monthly rental rate of $286,000 (RMB 1.8 million) for 11 years. Upon expiration of the 2011 Shenqiu Lease, ownership of this system will transfer from Xi’an TCH to Shenqiu at no additional cost. In connection with the 2011 Shenqiu Lease, Shenqiu paid one month’s rent as a security deposit to Xi’an TCH, in addition to providing personal guarantees.

| 5 |

On October 8, 2012, Xi’an TCH entered into a Letter of Intent for technical reformation of Shenqiu Project Phase II with Shenqiu for technical reformation to enlarge the capacity of the Shenqiu Project Phase I (the “Shenqiu Phase II Project”). The technical reformation involved the construction of another 12 MW BMPG system. After the reformation, the generation capacity of the power plant increased to 24 MW. The project commenced on October 25, 2012 and was completed during the first quarter of 2013. The total cost of the project was $11.1 million (RMB 68 million). On March 30, 2013, Xi’an TCH and Shenqiu entered into a BMPG Project Lease Agreement (the “2013 Shenqiu Lease”). Under the 2013 Shenqiu Lease, Xi’an TCH agreed to lease the second set of 12 MW BMPG systems to Shenqiu for $239,000 (RMB 1.5 million) per month for 9.5 years. When the 2013 Shenqiu Lease expires, ownership of this system will transfer from Xi’an TCH to Shenqiu at no additional cost.

On January 4, 2019, Xi’an Zhonghong, Xi’an TCH, and Mr. Chonggong Bai, a resident of China, entered into a Projects Transfer Agreement (the “Agreement”), pursuant to which Xi’an TCH transferred two Biomass Power Generation Projects in Shenqiu (“Shenqiu Phase I and II Projects”) to Mr. Bai for RMB 127,066,000 ($18.55 million). Mr. Bai agreed to transfer all the equity shares of his wholly owned company, Xi’an Hanneng Enterprises Management Consulting Co. Ltd. (“Xi’an Hanneng”) to Beijing Hongyuan Recycling Energy Investment Center, LLP (the “HYREF”) as repayment for the loan made by Xi’an Zhonghong to HYREE as consideration for the transfer of the Shenqiu Phase I and II Projects (See Note 10). The transfer was completed on February 15, 2019.

Yida Coke Oven Gas Power Generation Projects

On June 28, 2014, Xi’an TCH entered into an Asset Transfer Agreement (the “Transfer Agreement”) with Qitaihe City Boli Yida Coal Selection Co., Ltd. (“Yida”), a limited liability company incorporated in China. The Transfer Agreement provided for the sale to Xi’an TCH of a 15 MW coke oven WGPG station, which was converted from a 15 MW coal gangue power generation station from Yida. As consideration for the Transfer Asset, Xi’an TCH paid Yida RMB 115 million ($18.69 million) in the form of the common stock shares of the Company at the average closing price per share of the Stock for the 10 trading days prior to the closing date of the transaction. The exchange rate between US Dollar and Chinese RMB in connection with the stock issuance was the rate equal to the middle rate published by the People’s Bank of China on the closing date of the assets transfer.

On June 28, 2014, Xi’an TCH also entered into a Coke Oven Gas Power Generation Project Lease Agreement (the “Lease Agreement”) with Yida. Under the Lease Agreement, Xi’an TCH leased the Transfer Asset to Yida for RMB 3 million ($0.49 million) per month, and the term of the lease is from June 28, 2014 to June 27, 2029. Yida will also provide an RMB 3 million ($0.49 million) security deposit (without interest) for the lease. Xi’an TCH will transfer the Transfer Asset back to Yida at no cost at the end of the lease term.

| 6 |

On June 22, 2016, Xi’an TCH entered into a Coal Oven Gas Power Generation Project Repurchase Agreement (the “Repurchase Agreement”) with Yida. Under the Repurchase Agreement, Xi’an TCH agreed to transfer to Yida all the project assets for RMB 112,000,000 ($16.89 million) (the “Transfer Price”) with Yida’s retention of ownership of the Shares. Yida agreed to make the following payments: (i) the outstanding monthly leasing fees for April and May 2016 of RMB 6,000,000 ($0.90 million) to Xi’an TCH within 5 business days from the execution of the Repurchase Agreement; (ii) a payment of RMB 50,000,000 ($7.54 million) of the Transfer Price to Xi’an TCH within 5 business days from the execution of the Repurchase Agreement; and (iii) a payment of the remaining RMB 62,000,000 ($9.35 million) of the Transfer Price to Xi’an TCH within 15 business days from the execution of the Repurchase Agreement. Under the Repurchase Agreement, ownership of the project assets was transferred from Xi’an TCH to Yida within 3 business days after Xi’an TCH received the full Transfer Price and the outstanding monthly leasing fees. In July 2016, the Company received the full payment of the Transfer Price and title to the system was transferred at that time. The Company recorded a $0.42 million loss from this transaction in 2016.

The Fund Management Company and the HYREF Fund

On June 25, 2013, Xi’an TCH and Hongyuan Huifu Venture Capital Co. Ltd (“Hongyuan Huifu”) jointly established Hongyuan Recycling Energy Investment Management Beijing Co., Ltd (the “Fund Management Company”) with registered capital of RMB 10 million ($1.45 million). With respect to the Fund Management Company, voting rights and dividend rights are allocated 80% and 20% between Hongyuan Huifu and Xi’an TCH, respectively.

The Fund Management Company is the general partner of Beijing Hongyuan Recycling Energy Investment Center, LLP (the “HYREF Fund”), a limited liability partnership established July 18, 2013 in Beijing. The Fund Management Company made an initial capital contribution of RMB 5 million ($830,000) to the HYREF Fund. An initial amount of RMB 460 million ($77 million) was fully subscribed by all partners for the HYREF Fund. The HYREF Fund has three limited partners: (1) China Orient Asset Management Co., Ltd., which made an initial capital contribution of RMB 280 million ($46.67 million) to the HYREF Fund and is a preferred limited partner; (2) Hongyuan Huifu, which made an initial capital contribution of RMB 100 million ($16.67 million) to the HYREF Fund and is an ordinary limited partner; and (3) the Company’s wholly-owned subsidiary, Xi’an TCH, which made an initial capital contribution of RMB 75 million ($12.5 million) to the HYREF Fund and is a secondary limited partner. The term of the HYREF Fund’s partnership is six years from the date of its establishment, expiring on July 18, 2019. The term is four years from the date of contribution for the preferred limited partner, and four years from the date of contribution for the ordinary limited partner. The size of the HYREF Fund is RMB 460 million ($76.66 million). The HYREF Fund was formed for the purpose of investing in Xi’an Zhonghong New Energy Technology Co., Ltd., a then 90% owned subsidiary of Xi’an TCH, for the construction of two coke dry quenching (“CDQ”) waste heat power generation (“WHPG”) stations with Jiangsu Tianyu Energy and Chemical Group Co., Ltd. (“Tianyu”) and one CDQ WHPG station with Boxing County Chengli Gas Supply Co., Ltd. (“Chengli”).

Chengli Waste Heat Power Generation Projects

On July 19, 2013, Xi’an TCH formed a new company, “Xi’an Zhonghong New Energy Technology Co., Ltd.” (“Zhonghong”), with registered capital of RMB 30 million ($4.85 million). Xi’an TCH paid RMB 27 million ($4.37 million) and owns 90% of Zhonghong. Zhonghong is engaged to provide energy saving solution and services, including constructing, selling and leasing energy saving systems and equipment to customers. On December 29, 2018, Shanghai TCH entered into a Share Transfer Agreement with HYREF, pursuant to which HYREF transferred its 10% ownership in Xi’an Zhonghong to Shanghai TCH for RMB 3 million ($0.44 million). The transfer was completed on January 22, 2019. The Company owns 100% of Xi’an Zhonghong after the transaction.

| 7 |

On July 24, 2013, Zhonghong entered into a Cooperative Agreement of CDQ and CDQ WHPG Project (Coke Dry Quenching Waste Heat Power Generation Project) with Boxing County Chengli Gas Supply Co., Ltd. (“Chengli”). The parties entered into a supplement agreement on July 26, 2013. Pursuant to these agreements, Zhonghong will design, build and maintain a 25 MW CDQ system and a CDQ WHPG system to supply power to Chengli, and Chengli will pay energy saving fees (the “Chengli Project”).

On December 29, 2018, Xi’an Zhonghong, Xi’an TCH, HYREF, Guohua Ku, and Mr. Chonggong Bai entered into a CDQ WHPG Station Fixed Assets Transfer Agreement, pursuant to which Xi’an Zhonghong transferred Chengli CDQ WHPG station as the repayment for the loan of RMB 188,639,400 ($27.54 million) to HYREF. Xi’an Zhonghong, Xi’an TCH, Guohua Ku and Chonggong Bai also agreed to buy back the CDQ WHPG Station when conditions under the Buy Back Agreement are met (see Note 9). The transfer of the Station was completed January 22, 2019, the Company recorded $624,133 loss from this transfer. Since the original terms of Buy Back Agreement are still valid, and the Buy Back possibility could occur; therefore, the loan principal and interest and the corresponding asset of Chengli CDQ WHPG station cannot be derecognized due to the existence of Buy Back clauses (see Note 5 for detail).

Tianyu Waste Heat Power Generation Project

On July 19, 2013, Zhonghong entered into a Cooperative Agreement (the “Tianyu Agreement”) for Energy Management of CDQ and CDQ WHPG Projects with Jiangsu Tianyu Energy and Chemical Group Co., Ltd. (“Tianyu”). Pursuant to the Tianyu Agreement, Zhonghong will design, build, operate and maintain two sets of 25 MW CDQ systems and CDQ WHPG systems for two subsidiaries of Tianyu – Xuzhou Tian’an Chemical Co., Ltd. (“Xuzhou Tian’an”) and Xuzhou Huayu Coking Co., Ltd. (“Xuzhou Huayu”) – to be located at Xuzhou Tian’an and Xuzhou Huayu’s respective locations (the “Tianyu Project”). Upon completion of the Tianyu Project, Zhonghong will charge Tianyu an energy saving fee of RMB 0.534 ($0.087) per kilowatt hour (excluding tax). The term of the Tianyu Agreement is 20 years. The construction of the Xuzhou Tian’an Project is anticipated to be completed by the second quarter of 2020. The Xuzhou Huayu Project has been on hold due to a conflict between Xuzhou Huayu Coking Co., Ltd. and local residents on certain pollution-related issues.

On January 4, 2019, Xi’an Zhonghong, Xi’an TCH, and Mr. Chonggong Bai entered into a Projects Transfer Agreement (the “Agreement”), pursuant to which Xi’an Zhonghong transferred a CDQ WHPG station (under construction) located in Xuzhou City for Xuzhou Huayu Coking Co., Ltd. (“Xuzhou Huayu Project”) to Mr. Bai for RMB 120,000,000 ($17.52 million). Mr. Bai agreed that as consideration for the transfer of the Xuzhou Huayu Project to him (Note 9), he would transfer all the equity shares of his wholly owned company, Xi’an Hanneng, to HYREF as repayment for the loan made by Xi’an Zhonghong to HYREF. The transfer of the project was completed on February 15, 2019. The Company recorded $397,033 loss from this transfer during the year ended December 31, 2019. On January 10, 2019, Mr. Chonggong Bai transferred all the equity shares of his wholly owned company, Xi’an Hanneng, to HYREF as repayment for the loan. Xi’an Hanneng was expected to own 47,150,000 shares of Xi’an Huaxin New Energy Co., Ltd for the repayment of Huayu system and Shenqiu system. As of September 30, 2019, Xi’an Hanneng already owned 29,948,000 shares of Huaxin, but was not able to obtain the remaining 17,202,000 shares due to halted trading of Huaxin stock by NEEQ for not filing its 2018 annual report. On December 20, 2019, Mr. Bai and all the related parties agreed to have Mr. Bai instead pay in cash for the transfer price of Huayu (see Note 9 for detail).

| 8 |

On January 10, 2020, Zhonghong, Tianyu and Huaxin signed a transfer agreement to transfer all assets under construction and related rights and interests of Xuzhou Tian’an Project to Tianyu for RMB 170 million including VAT ($24.37 million) in three installment payments. The 1st installment payment of RMB 50 million ($7.17 million) to be paid within 20 working days after the contract is signed. The 2nd installment payment of RMB 50 million ($7.34 million) is to be paid within 20 working days after completion of the project construction but no later than July 31, 2020. The final installment payment of RMB 70 million ($10.28 million) was to be paid before December 31, 2020. In December, 2020, the Company received the payment in full for Tian’an Project.

Zhongtai Waste Heat Power Generation Energy Management Cooperative Agreement

On December 6, 2013, Xi’an TCH entered into a CDQ and WHPG Energy Management Cooperative Agreement (the “Zhongtai Agreement”) with Xuzhou Zhongtai Energy Technology Co., Ltd. (“Zhongtai”), a limited liability company incorporated in Jiangsu Province, China.

Pursuant to the Zhongtai Agreement, Xi’an TCH was to design, build and maintain a 150 ton per hour CDQ system and a 25 MW CDQ WHPG system and sell the power to Zhongtai, and Xi’an TCH is also to build a furnace to generate steam from the smoke pipeline’s waste heat and sell the steam to Zhongtai.

The construction period of the Project was expected to be 18 months from the date when conditions are ready for construction to begin. Zhongtai is to start to pay an energy saving service fee from the date when the WHPG station passes the required 72-hour test run. The payment term is 20 years. For the first 10 years, Zhongtai shall pay an energy saving fee at RMB 0.534 ($0.089) per kilowatt hour (KWH) (including value added tax) for the power generated from the system. For the second 10 years, Zhongtai shall pay an energy saving fee at RMB 0.402 ($0.067) per KWH (including value added tax). During the term of the contract the energy saving fee shall be adjusted at the same percentage as the change of local grid electricity price. Zhongtai shall also pay an energy saving fee for the steam supplied by Xi’an TCH at RMB 100 ($16.67) per ton (including value added tax). Zhongtai and its parent company will provide guarantees to ensure Zhongtai will fulfill its obligations under the Agreement. Upon the completion of the term, Xi’an TCH will transfer the systems to Zhongtai for RMB 1 ($0.16). Zhongtai shall provide waste heat to the systems for no less than 8,000 hours per year and waste gas volume no less than 150,000 Normal Meter Cubed (Nm3) per hour, with a temperature no less than 950°C. If these requirements are not met, the term of the Agreement will be extended accordingly. If Zhongtai wants to terminate the Zhongtai Agreement early, it shall provide Xi’an TCH with a 60 day notice and pay the termination fee and compensation for the damages to Xi’an TCH according to the following formula: (1) if it is less than five years into the term when Zhongtai requests termination, Zhongtai shall pay: Xi’an TCH’s total investment amount plus Xi’an TCH’s annual investment return times five years minus the years in which the system has already operated; or 2) if it is more than five years into the term when Zhongtai requests the termination, Zhongtai shall pay: Xi’an TCH’s total investment amount minus total amortization cost (the amortization period is 10 years).

| 9 |

In March 2016, Xi’an TCH entered into a Transfer Agreement of CDQ and a CDQ WHPG system with Zhongtai and Xi’an Huaxin (the “Transfer Agreement”). Under the Transfer Agreement, Xi’an TCH agreed to transfer to Zhongtai all of the assets associated with the CDQ Waste Heat Power Generation Project (the “Project”), which is under construction pursuant to the Zhongtai Agreement. Additionally, Xi’an TCH agreed to transfer to Zhongtai the Engineering, Procurement and Construction (“EPC”) Contract for the CDQ Waste Heat Power Generation Project which Xi’an TCH had entered into with Xi’an Huaxin in connection with the Project. Xi’an Huaxin will continue to construct and complete the Project and Xi’an TCH agreed to transfer all its rights and obligations under the EPC Contract to Zhongtai. As consideration for the transfer of the Project, Zhongtai agreed to pay to Xi’an TCH RMB 167,360,000 ($25.77 million) including (i) RMB 152,360,000 ($23.46 million) for the construction of the Project; and (ii) RMB 15,000,000 ($2.31 million) as payment for partial loan interest accrued during the construction period. Those amounts have been, or will be, paid by Zhongtai to Xi’an TCH according to the following schedule: (a) RMB 50,000,000 ($7.70 million) was to be paid within 20 business days after the Transfer Agreement was signed; (b) RMB 30,000,000 ($4.32 million) was to be paid within 20 business days after the Project was completed, but no later than July 30, 2016; and (c) RMB 87,360,000 ($13.45 million) was to be paid no later than July 30, 2017. Xuzhou Taifa Special Steel Technology Co., Ltd. (“Xuzhou Taifa”) guaranteed the payments from Zhongtai to Xi’an TCH. The ownership of the Project was conditionally transferred to Zhongtai following the initial payment of RMB 50,000,000 ($7.70 million) by Zhongtai to Xi’an TCH and the full ownership of the Project will be officially transferred to Zhongtai after it completes all payments pursuant to the Transfer Agreement. The Company recorded a $2.82 million loss from this transaction in 2016. In 2016, Xi’an TCH had received the first payment of $7.70 million and the second payment of $4.32 million. However, the Company received a repayment commitment letter from Zhongtai on February 23, 2018, in which Zhongtai committed to pay the remaining payment of RMB 87,360,000 ($13.45 million) no later than the end of July 2018; in July 2018, Zhongtai and the Company reached a further oral agreement to extend the repayment term of RMB 87,360,000 ($13.45 million) by another two to three months. In January 2020, Zhongtai paid RMB 10 million ($1.41 million); in March 2020, Zhongtai paid RMB 20 million ($2.82 million); in June 2020, Zhongtai paid RMB 10 million ($1.41 million); and in December 2020, Zhongtai paid RMB 30 million ($4.28 million), which was payment in full. Accordingly, the Company reversed bad debt expense of $5.80 million which was recorded earlier.

Formation of Zhongxun

On March 24, 2014, Xi’an TCH incorporated a new subsidiary, Zhongxun Energy Investment (Beijing) Co., Ltd (“Zhongxun”) with registered capital of $5,695,502 (RMB 35,000,000), to be paid no later than October 1, 2028. Zhongxun is 100% owned by Xi’an TCH and is mainly engaged in project investment, investment management, economic information consulting, and technical services. Zhongxun has not yet commenced operations as of the date of this report.

Formation of Yinghua

On February 11, 2015, the Company incorporated a new subsidiary, Shanghai Yinghua Financial Leasing Co., Ltd (“Yinghua”) with registered capital of $30,000,000, to be paid within 10 years from the date the business license is issued. Yinghua is 100% owned by the Company and is mainly engaged in financial leasing, purchase of financial leasing assets, disposal and repair of financial leasing assets, consulting and ensuring of financial leasing transactions, and related factoring business. Yinghua has not yet commenced operations as of the date of this report.

| 10 |

Summary of Sales-Type Lease at December 31, 2020 Status at December 31, 2020

As of December 31, 2020, Xi’an TCH had the following sales-type leases: BMPG systems to Pucheng Phase I and II (15 and 11-year terms, respectively). On February 15, 2019, Xi’an TCH transferred the Shenqiu Phase I and II Projects to Mr. Chonggong Bai.

Asset Repurchase Agreement

During the years ended December 31, 2020 and 2019, the Company entered into or completed the following Asset Repurchase Agreements:

On November 16, 2015, Xi’an TCH entered into a Transfer Agreement of CDQ and a CDQ WHPG system with Rongfeng and Xi’an Huaxin New Energy Co., Ltd., a limited liability company incorporated in China (“Xi’an Huaxin”). The Transfer Agreement provided for the sale to Rongfeng of the CDQ Waste Heat Power Generation Project (the “Project”) from Xi’an TCH. Additionally, Xi’an TCH agreed to transfer to Rongfeng the Engineering, Procurement and Construction (“EPC”) Contract for the CDQ Waste Heat Power Generation Project which Xi’an TCH had entered into with Xi’an Huaxin in connection with the Project. As consideration for the transfer of the Project, Rongfeng will pay to Xi’an TCH an aggregate purchase price of RMB 165,200,000 ($25.45 million), whereby (a) RMB 65,200,000 ($10.05 million) will be paid by Rongfeng to Xi’an TCH within 20 business days after the Transfer Agreement is signed, (b) RMB 50,000,000 ($7.70 million) will be paid by Rongfeng to Xi’an TCH within 20 business days after the Project is completed, but no later than March 31, 2016 and (c) RMB 50,000,000 ($7.70 million) will be paid by Rongfeng to Xi’an TCH no later than September 30, 2016. Mr. Cheng Li, the largest stockholder of Rongfeng, has personally guaranteed the payments. The ownership of the Project was conditionally transferred to Rongfeng within 3 business days following the initial payment of RMB 65,200,000 ($10.05 million) by Rongfeng to Xi’an TCH and the full ownership of the Project has been officially transferred to Rongfeng after it completes the entire payment pursuant to the Transfer Agreement. The Company recorded a $3.78 million loss from this transaction in 2015. The Company received full payment of $25.45 million in 2016.

In March 2016, Xi’an TCH entered into a Transfer Agreement of CDQ and a CDQ WHPG system with Zhongtai and Xi’an Huaxin (the “Transfer Agreement”). Under the Transfer Agreement, Xi’an TCH agreed to transfer to Zhongtai all of the assets associated with the CDQ Waste Heat Power Generation Project (the “Project”), which is under construction pursuant to the Zhongtai Agreement. Xi’an Huaxin will continue to construct and complete the Project and Xi’an TCH agreed to transfer all its rights and obligation under the “EPC” Contract to Zhongtai. As consideration for the transfer of the Project, Zhongtai agreed to pay to Xi’an TCH an aggregate transfer price of RMB 167,360,000 ($25.77 million) including payments of: (i) RMB 152,360,000 ($23.46 million) for the construction of the Project; and (ii) RMB 15,000,000 ($2.31 million) as payment for partial loan interest accrued during the construction period. Those amounts have been, or will be, paid by Zhongtai to Xi’an TCH according to the following schedule: (a) RMB 50,000,000 ($7.70 million) was paid within 20 business days after the Transfer Agreement was signed; (b) RMB 30,000,000 ($4.32 million) will be paid within 20 business days after the Project is completed, but no later than July 30, 2016; and (c) RMB 87,360,000 ($13.45 million) will be paid no later than July 30, 2017. Xuzhou Taifa Special Steel Technology Co., Ltd. (“Xuzhou Taifa”) has guaranteed the payments from Zhongtai to Xi’an TCH. The ownership of the Project was conditionally transferred to Zhongtai following the initial payment of RMB 50,000,000 ($7.70 million) by Zhongtai to Xi’an TCH and the full ownership of the Project will be officially transferred to Zhongtai after it completes all payments pursuant to the Transfer Agreement. Xi’an TCH received the first payment of $7.70 million and the second payment of $4.32 million in 2016. The Company recorded a $2.82 million loss from this transaction. In January 2020, Zhongtai paid RMB 10 million ($1.41 million); in March 2020, Zhongtai paid RMB 20 million ($2.82 million); in June 2020, Zhongtai paid RMB 10 million ($1.41 million); in December 2020, Zhongtai paid RMB 30 million ($4.62 million.). The company received full payment of $25.77 million in 2020.

| 11 |

On December 22, 2020, Shanghai TCH entered into an Equity Acquisition Agreement with Xi’an Taiying Energy Saving Technology Co., Ltd., a PRC company (“Xi’an Taiying”) and its three shareholders to purchase all of the issued and outstanding shares of stock of Xi’an Taiying. The purchase price for said shares shall consist of (i) 619,525 shares of common stock at an issuance price of $4.37 per share, (ii) 60,000,000 shares of Series A convertible stock and (iii) a cash payment of RMB 1,617,867,026 (approximately $247 million at a conversion rate of 1:6.55). The shares shall be issued within 15 business days after approval by the Board of Directors and/or shareholders of the Company and Nasdaq approval and the cash shall be paid in three tranches – RMB 390 million (approximately $59.5 million) within 10 days after the agreement is executed, RMB 300 million (approximately $45.8 million) by March 31, 2021 and RMB 927,867,026 (approximately $141.7 million) within 10 days after the shares of Xi’an Taiying are registered to Buyer. As of the date of this report, the Company has not obtained and there is no assurance that the Company will be able to obtain necessary approval to proceed with the transaction. In addition, the Company is currently renegotiating the payment terms with the sellers.

Industry and Market Overview

Overview of Waste-to-Energy Industry

The waste energy recycling industry concentrates mostly on power-intensive manufacturing and production processes, such as iron, steel and nonferrous metal production, cement production, and coal and petrochemical plants. Our waste energy recycling projects allow customers to recapture previously wasted pressure, heat, and gas from their manufacturing and production processes and use this waste to generate electricity. Waste energy recycling projects are installed at a customer’s facility and the electricity produced can be used on-site to lower energy costs and create a more efficient production process. The industry verticals at the vanguard of this trend are metallurgical production (including iron & steel), cement, coal mining, coke production and petrochemicals.

The industry also includes the conversion of biomass to electricity. For thousands of years, biomass, biological material derived from living organisms like plants and their byproducts, was burned to produce heat so as to convert it to energy. A number of non- combustion methods are now available to convert raw biomass into a variety of gaseous, liquid, or solid fuels that can be used directly in a power plant to generate electricity.

Waste-to-Energy Industry Growth

China has experienced rapid economic growth and industrialization in recent years, increasing the demand for electricity. In the PRC, growth in energy consumption has exceeded growth in gross domestic product, causing a shortage of electricity with blackouts and brownouts over much of the country. Much of the energy demand has been due to the expansion of energy intensive industrial sectors such as steel, cement, and chemicals. China’s increasing modernization and industrialization has made it the world’s largest consumer of energy.

One result of this massive increase in electric generation capacity has been the rise of harmful emissions. China has surpassed the United States to become the world’s largest emitter of greenhouse gases, and the country faces enormous challenges from the pollution brought about by its consumption of conventional energy. On September 12, 2013, the State Council has released the Action Plan for Air Pollution Prevention and Control. The action plan has proposed that in five years, China will witness the overall improvement of air quality and dramatic drop of seriously polluted days. China will strive to gradually eliminate the seriously polluted weather and notably better the national air quality in another five years or longer.

| 12 |

Description of WGPG (Waste Gas Power Generation)

During the process of industrial production, some by-products, such as blast furnace gas, coke furnace gas, oil gas, and others are created with certain high intensive thermal energy. The waste gas can be collected and used as a fuel by gas turbine system to generate power energy.

Gas turbines are a set of hi-tech equipment and devices that is crucial to the energy development strategy of China. Gas turbine, which uses flammable gas as fuel and combines with recycling power generating technology, has many merits. These include high efficiency power generation, low investment, short construction periods, small land usage, water savings, environment protection and more. We believe the market prospect of the gas turbine industry is promising.

Through years of research, development and experimental applications, this gas-to-energy system has started to be applied into some high energy intensive industrial plants, such as in the course of iron-smelting in metallurgy plants. Metallurgical enterprises, as the biggest industrial energy user in China, consume 13%-15% of the nation’s electricity. Electricity consumed by the iron-smelting industry accounts for 40% of that consumed by metallurgical enterprises. If all top furnaces in the iron-smelting industry are equipped with gas recovery systems, electricity consumption may decrease by 30-45%. Furthermore, environmental pollution will be reduced while energy efficiency is improved in those heavy industries.

Stringent Environmental Standards and Increasing Government Supports

Since energy is a major strategic issue affecting the development of the Chinese economy, the Chinese government has promoted the development of recycling and encouraged enterprises to use waste energy recycling projects of the type we sell and service. Similar to previous five year periods, the China National Environment Protection Plan, for the 13th five year period (2016-2020), is focused on high energy consumption industries, including specific programs to support the building of waste energy recycling projects for application in iron, steel and nonferrous metal plants and in cement production lines. Given the worsening environment and insufficient energy supply in China, the Chinese government has implemented policies to curb pollution and reduce wasteful energy usage. The Renewable Energy Law, strict administrative measures to restrict investment and force consolidation in energy wasting industries, and the requirement to install energy-saving and environment protecting equipment whenever possible are just some ways the government is emphasizing the need to reduce emissions and to maximize energy creation. Local government officials, who sometimes flout central government policies for the sake of local GDP growth, are now required to tie emission, energy usage and pollution to GDP growth. If local emissions of pollutants grow faster than the local GDP, these local officials face the risk of losing their jobs. Such determination and strict enforcement by the central and local governments provide a good backdrop and growth opportunity for CREG’s business activities.

| 13 |

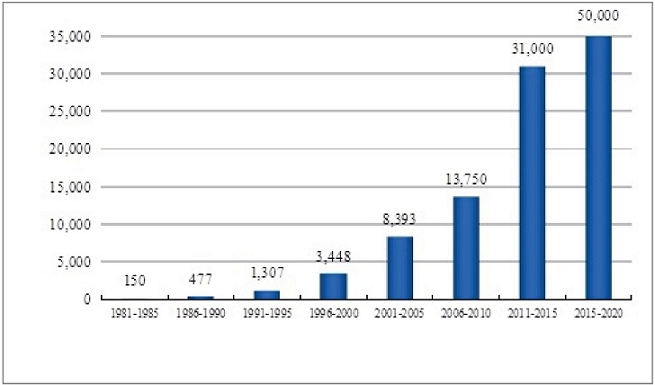

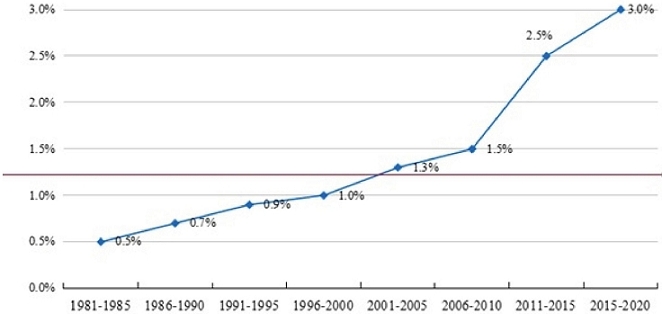

The following tables show the funds invested, or expected to be invested, in the environmental protection industry by the Chinese government.

Source: China National Environmental Protection Plan in the 13th Five Year Plan (2016-2020).

| 14 |

In recent years, China attaches great importance to the problem of environmental pollution, and has invested a lot of manpower and capital cost in air pollution control. It is estimated that in 2020, the total output value of China’s environmental protection industry will reach nearly RMB 10 trillion.

The 13th Five-Year Plan (2016-2020) covers a crucial period in China’s economic and social development. Environmental protection and low-carbon development will be one of the top priority considerations during this period. The government, private enterprises and the public sector will seek to jointly implement the strictest environmental protection system to realize environmental improvement, control carbon emissions, honor climate commitments and deeply participate into global climate governance. China aims to hit the CO2 emissions peak by around 2030 and reduce CO2 emissions per unit of the GDP by 60 percent to 65 percent from the 2005 level on or before 2030.

Waste-to-Energy is a Cost-Effective Means to Meet Rising Energy Needs

According to the International Energy Agency, China will need to increase its electricity generating capacity to meet its future needs. This demand may mean price increases for electricity in China. With the need for more energy, in particular energy that does not cause additional emissions, and the relative low price of the waste-to-energy production we provide, we believe that our markets will continue to expand.

| 15 |

Since China has been experiencing a dramatic surge in its energy consumption as well as widespread energy shortages, recycling energy is not only an attractive alternative to other sources of energy as part of a national diversification strategy to avoid dependence on any one energy source or politically sensitive energy supplies, but also a proven solution to make the use of energy more efficient. Under current economic conditions and current tax and regulatory regimes, waste energy recycling projects generally can create price- competitive electricity compared to electricity generated from fossil fuels or other renewable sources. Our customers can reduce energy costs significantly by installing our waste energy recycling projects. Compared to electricity from the national grid, the generating cost from recycling energy is lower, which means our customers can leverage the waste-to-energy projects to generate low-cost electricity, reducing energy costs for the manufacturing process. The current national grid electricity rate ranges from RMB 0.45-0.50/kWh and our operated recycling rate ranges from 0.35-0.45/kWh subject to project type, generating scale and local situation.

Customers of our energy recycling projects may also qualify for credits from the Clean Development Mechanism (“CDM”). The CDM is an international arrangement under the Kyoto Protocol allowing industrialized countries with a greenhouse gas reduction commitment to invest in ventures that reduce emissions in developing countries as an alternative to more expensive emission reductions in their own countries. In 2005, China’s government promulgated “Measures for Operation and Management of Clean Development Mechanism Projects in China” (“China CDM Measures”) to facilitate the application and operation of CDM project activities in China. Our energy recycling solutions are of a kind which falls into the beneficial categories accredited by the China CDM Measures. If our customers can get approval from the Chinese government and successfully register their projects in the United Nations’ CDM Executive Board, they can receive additional revenue income through exchanging their Certified Emission Reductions (“CER”) credits with investors in industrialized countries.

Trends in Industries We Principally Service

Iron, Steel and Nonferrous Metal Industry

As the biggest iron and steel producer in the world and one of the highest CO2 emission sectors, China’s iron and steel industry is undergoing a low-carbon transition accompanied by remarkable technological progress and investment adjustment, in response to the macroeconomic climate and policy intervention.

Environmental pollution, shortage of resources and energy shortage have been identified in China as three major challenges for China’s nonferrous metal industry. China aims to save 1.7 million tons of coal and 6 billion kWh of electricity per year, as well as reduce sulfur dioxide by 850,000 tons annually as part of the industrial upgrading for the nonferrous metallurgy sector and, at the same time, to improve the utilization efficiency for resources. In China, the utilization rate for the nonferrous metal mineral resources is 60%, which is 10 to 15% lower than developed countries. The utilization rate for associated nonferrous metals is only 40%, which is 20% lower than developed nations. In addition, parts of nonferrous mines located in different cities are disorganized with random mining, causing severe wastes of resources.

| 16 |

Coal and Petrochemicals

Flammable waste gases emitted from industrial production processes, such as blast furnace gas, coke furnace gas, oil or gas can be used to power gas-fired generators to create energy. Two large producers of these waste gases are coal mining and petrochemical refining. The PRC is the largest coal producer and consumer in the world. Coal is the dirtiest fossil fuel and a major cause of methane gas emissions, a greenhouse gas 21 times more potent than carbon dioxide. Methane gas is found naturally in coal beds. In the 1950s, China began recovering methane to make mines safer. Now, as then, most of the captured methane is released into the air but it could be used as a clean energy source using waste energy recycling technologies.

Biomass Waste-to-Energy Industry

In China, agricultural waste and biogas are two main sources for biomass waste. China has more than 600 million tons of wasted straw produced every year. It also has 19 billion tons of forest biomass, of which 300 million tons can be utilized as an energy source. The straw burning power industry will grow faster in China with supportive policies, development of new technologies and the formation of raw material collection and storage systems, according to the National Development and Reform Commission. Electricity generated from straw has a preferential price of RMB 0.25 per kWh higher than coal-fueled power when sold to the state grid. In addition, straw power plants enjoy a series of preferential policies including tax exemption.

Biogas technology captures methane gases emitted from compostable materials and burns it to power a turbine to produce electricity. The waste that is usually disposed of in landfills is converted into liquid or gaseous fuels. By utilizing the resource from waste cellulosic or organic materials, biomass energy can be generated through the fermentation process.

Our Strategies

Maintain Core Verticals to Increase Market Share in China

We focus on waste-to-energy projects for specific verticals, such as steel, cement, nonferrous metal and coal mining. We plan to continue our focus on such core verticals and leverage our expertise to expand our market share. We intend to expand our waste-to-energy power generating capacity rapidly in order to meet the anticipated growth of demand in China’s energy efficiency industrial applications and to gain market share. We continually identify potential customers in our core verticals.

Expand to New Business of Energy Storage with Future High Growth Potentials

We are in the process of transforming into an energy storage integrated solution provider. We plan to pursue disciplined and targeted expansion strategies for market areas that we currently do not serve. We are actively seeking and exploring opportunities to apply energy storage technologies to new industries or segments with high growth potential, including industrial and commercial complexes, large scale photovoltaic (PV) and wind power stations, remote islands without electricity, and smart energy cities with multi-energy supplies. By supporting and motivating all kinds of the electric power market to participant in resource development and utilization of demand response, we plan to provide services including peak shaving with compensation and frequency modulation. We intend to gradually form motor load performance for peak and low-hours, which will account for about 3% of the annual maximum power load on the demand side and to ensure the electricity supply and demand balance for situations of non-severe power shortages.

| 17 |

User-side energy storage is the outlet of distributed (and renewable) energy power output with high viscosity, high assets resale value, and stable cash flow income. Resource integration layout in 2020 will form an ecological chain of supply-transmission- distribution-consumption by integrating power generation assets that have high efficiency and low valuation. In this system, energy storage will play an important role to realize long distance transmission, reduce transmission loss, enhance the stability of the power supply, and provide users with multiple energy pricing mechanisms and comprehensive service. With the large-scale operation of energy storage projects in China and the Asia-pacific region, technology will gradually be improved and prices will decrease, which will provide the opportunity for vertical integration with teams in the industry that have a long time experience in the energy storage industry and technical reserves.

Continually Enhance Research and Development Efforts

We plan to devote resources to research and development in order to enhance our waste-to-energy design and engineering capabilities. We anticipate that our in-house design and engineering team will provide additional competitive advantages, including flexibility to quickly design and evaluate new technologies or applications in response to changing market trends.

Selectively Acquire Waste-to-Energy Power Plants

While we have experienced substantial organic growth, we plan to pursue a disciplined acquisition strategy to accelerate our growth. Our strategy will focus on obtaining additional power generating capacity, research and development capabilities and access to new markets and customers.

Our Business Models

We have sold our products to our customers under two models: the BOT model and the operating lease model, although we emphasize the BOT model which we believe is more economically beneficial to us and to our customers.

| 18 |

BOT Model

We primarily engage in the BOT model to provide waste-to-energy solutions to our customers:

“Build”

We work directly with customers for each of our waste-to-energy projects. Our working process starts with a team of engineers that assesses and analyzes the specific needs of the customer to establish the design layout, equipment procurement list and capital expenditure budget for the project. Our sales team works closely with our engineering staff to present and negotiate the model with the customer.

After the signing of a contract, we finance the entire capital expenditure budget ourselves and commence the construction and installation of the project. We do not manufacture the equipment and materials that are used in the construction of the waste-to-energy power generation facility. Rather, we incorporate standard power generating equipment into a fully integrated on-site waste energy recycling project for our customer. The construction and installation period ranges from three to 12 months subject to the project type, size and complexity.

We usually engage an EPC general contractor, who is experienced in power plant and waste energy recycling project construction, to take charge of equipment procurement, project construction and installation. Our team of five engineers participates in and monitors the equipment purchase process; this team also oversees the construction and installation activities to ensure that they are completed on time and meet our rigorous standards and specifications.

“Operate”

After the project has been installed at the customer site and passed a series of stringent tests, we, currently, outsource the operation to a third-party vendor. The operation period ranges from five to 20 years subject to the terms of each contract.

During the operation period, the customer can purchase all the electricity at a below-market price. We collect energy-saving- based lease payments from the customer; the lease term is equivalent to the operation period, ranging from five to 20 years, and the payments are based on the sale by us as lessor to our customers as lessee of energy generated by the waste energy recycling project at below-market rates. The customer’s payments are based on a minimum operation schedule agreed upon by us with our customer, and are collateralized by assets of the customer and/or third party guarantees. To reduce risk, we offer leasing services across a wide variety of industries and only target larger manufacturers or state-owned enterprises. Operation in excess of the minimum schedule enables us to receive additional revenues from the excess energy generated and sold to the customer.

“Transfer”

Based on the specific terms for each project, we eventually transfer the waste energy recycling project to the customer at no cost or a nominal cost upon the completion of the operation/lease period.

| 19 |

Why BOT

Waste-to-energy projects are capital intensive, which requires the manufacturers to invest a considerable amount of cash to purchase equipment during the construction period. As a BOT service provider, we fund all contracted projects on our own or jointly with our customers; such financing arrangements can help our customers by removing or reducing the heavy capital expenditure burden required by specific projects, thereby allowing them to concentrate on their core business. While technologically mature in advanced countries, waste-to-energy projects are still new to most of China’s industrial companies and require intensive technology or know-how with respect to energy recycling and power generation. It is time-consuming or not feasible for industrial manufacturers to equip themselves with adequate expertise and technicians. Our specific sector knowledge and rich project experience allow us to construct, operate and maintain the power plants efficiently and to respond to operational issues in a timely and cost-efficient manner.

In exchange for upfront capital investment, we require secured power generating capacity during the operation period and guaranteed attractive internal rates of return from each project. Our operation period ranges from five to 20 years, during which we are entitled to sell the recycled electricity to those customers at a predetermined rate. Such electricity sales are secured by long-term electricity production agreements with guarantees, which result in minimum annual payments. We employ a process of stringent and systematic internal scrutiny on new customer development so as to minimize operational and default risk; for some smaller or non-SOE businesses, we require property collateral, management or third party guarantees, and/or prepayment of three months. As such, our cash inflow schedule from each in-operation project is fixed and predictable providing clear financial visibility. Our payback period is generally two to three years, depending on the project size.

In our experience, this BOT model is well received by our existing and potential customers in China. The insufficient supply of BOT vendors to the market is wholly due to the funding limitations of most of the recycling energy solution providers. Not all of our competitors have the ability to access sufficient capital on a timely basis.

Operating Lease Model

In the past, we also recorded rental income from two separate one-year operating leases. Under the operating leases, we leased waste-energy systems and subleased the systems to a customer for a greater amount. We choose not to renew our lease agreements, and we do not generally expect any revenue in the future through such model.

Contractor and Equipment Suppliers

We generally conduct our project construction through an EPC general contractor. We select the EPC general contractor for each project through a bidding process; then we sign a contract with the selected contractor for that project. The general contractor may outsource parts of our project construction to subcontractors according to the complexity and economics of the project. The general contractor is responsible for purchasing equipment to satisfy the requirements of the project we design for our customer. We generally do not purchase equipment directly from the equipment suppliers, but our general contractors obtain our consent before selecting the equipment suppliers. Our engineering department is involved in the equipment supplier selection process together with our general contractors and makes sure our stringent standards and requirements have been appropriately applied in selection of the equipment. We currently have engaged Shaanxi Huaxin Energy Engineering Co., Ltd. for our projects under construction, and we also maintain relationships with many other quality general contractors in China, including Wuxi Guolian, CITIC Heavy Industries Co., Ltd., A-Power Energy Generation Systems, Ltd.

| 20 |

As mentioned above, we do not manufacture the equipment and materials that are used in the construction of our waste energy recycling projects. Rather, we incorporate standard power generating equipment into a fully integrated onsite system. The key equipment used in our projects are the boilers and turbine generators, which represent the majority of equipment cost for each project. Though we do not place the direct procurement orders, we believe we maintain good relationships with those power generation equipment suppliers, and these relationships help provide cost-effective equipment purchasing by the general contractor for our intended projects and ensure the timely completion of these projects. We have well-established business relationships with most of the suppliers from whom our general contractors procure equipment, including Hangzhou Boiler Plant, Beijing Zhongdian Electric Machinery, Chengdu Engine Group, Shanghai Electric Group, China Aviation Gas Turbine Co. Ltd and Xuji Electric. Therefore, we believe that we have a strong position and support in equipment supply and installation, which benefits us, the general contractors and our customers.

Main Customers

Our customers are mainly mid- to large-size enterprises in China involving high energy-consuming businesses. Following our selection process described in the next paragraph, we conduct stringent evaluation procedures to identify and qualify potential customers and projects. To lower our investment and operational risk, we target companies with geographic or industry competitive advantages, with strong reputations and in good financial condition. Generally, our targets include steel and nonferrous metal mills with over 3 million tons of production capacity per year, cement plants with over 2 million tons of production capacity per year that utilize new- suspension-line process, and coking plants with over 600 tons production capacity per year. Our existing customers operate in Shanxi province, Shaan’xi province, Shandong province, Jiangsu province and the Inner Mongolia Autonomic Region in China.

Marketing and Sales

We market and sell our projects nationwide through our direct sales force of two employees based in Xi’an, China. Our marketing programs include industrial conferences, trade fairs, sales training, and trade publication advertising. Our sales and marketing group works closely with our research and development and engineering departments to coordinate our project development activities, project launches and ongoing demand and supply planning. We market our projects directly to the industrial manufacturers who can utilize our energy recovery projects in their manufacturing processes, including steel, cement, nonferrous metal, coal and petrochemical industries.

Our management team has long-standing relationships with our existing customers and those companies that we consider to be potential customers. We also maintain relationships with municipal governments, which often sponsor or subsidize potential customers that can utilize our projects.

| 21 |

Geographic Distribution of Sales

Sales outside the U.S. accounted for 100% of revenue in 2020 and 2019.

Seasonality

For the most part, the Company’s business and sales are not subject to any seasonality factors.

Intellectual Property Rights

Licenses

From time to time, we enter into license agreements with third parties under which we obtain or grant rights to patented or proprietary technology.

Research and Development

We believe that our research and development (“R&D”) efforts are among the best in the waste heat, gas and pressure to energy industry, particularly with regards to practical usage and application.

To develop new and practical solutions for our customers, our R&D team also has the support of our on-site and project engineers who provide feedback and numerous ideas to the R&D team from their daily experiences with installation and operation of various waste gas, heat or pressure to energy projects. Our cooperative relationship with the Shanghai Electric Distributed Energy Sources Technology Co., Ltd. gives us access to the latest developments in energy and waste-to-energy technologies as well as technical support of the R&D teams of the R & D team of Distributed Energy Sources of Central Research Institute of Shanghai Electric Group.

Government and Environmental Management System

We hold all licenses that the various levels of Chinese government require for our operations.

Competition

In the past, waste energy recycling projects have been installed mainly by the industrial plants themselves. These plants hire general contractors to purchase waste energy recycling equipment manufactured by third parties and with design support from government design institutes, which usually charge a one-time design fee, construct the projects on-site. Pressure has increased on Chinese producers to become more energy-efficient, but many mid-sized companies do not have the special technical expertise or the capital to install and operate such waste energy recycling projects. Many companies have begun to outsource these functions to third- party providers, creating an opportunity in a growing market.

| 22 |

We are a leading developer of industrial waste energy recycling projects in China. To our knowledge, we are the only non-state owned enterprise primarily using a BOT model to provide energy saving and recovery systems for various energy intensive industries, such as cement, steel and metallurgy industries. We face competition from an array of market participants.

Our main competitors as third-party providers are state owned research institutes or their wholly owned construction companies; however, smaller private companies occasionally employ a BOT model to provide waste-to-energy systems. The state-owned enterprises include Equipment and System Engineer Co., Ltd. of Hangzhou Steam Turbine & Power Group (Hangzhou Turbine) and Energy Saving Development Co., Ltd of China National Material Group, Sinoma Development Co., Ltd. The private companies include China Senyuan Electronic Co., Ltd., Dalian East New Energy Development Co. Ltd., Top Resource Conservation Engineering Co., Ltd. and Nanjing Kaisheng Kaineng Environmental Energy.

We believe that there is a larger market in the waste-to-energy industry in China for systems constructed on the “Engineering Procurement Construction” or “EPC” model in which customers purchase the services of a contractor to construct a system for the customer at the customer’s expense. Service providers include Dalian East New Energy Development, Nanjing Kaisheng Cement Technology and Engineering Co., Ltd., Jiangxi Sifang Energy Co., Ltd., Beijing Century Benefits Co., Ltd., Beijing Shineng Zhongjin Energy Technology Co., Ltd., Kunming Sunwise Co., Ltd. and China Everbright International Ltd. We compete with EPC providers for waste-to-energy projects when potential customers are able to obtain external financing or have the necessary capital.

We believe that we offer advantages over our competitors in several ways:

| ● | Our management team has over 20 years of industry experience and expertise; | |

| ● | We have the capabilities to provide TRT, CHPG and WGPG systems, while our competitors usually concentrate on one type or another; | |

| ● | We have the capabilities and experience in undertaking large scale projects; and | |

| ● | We provide BOT or capital lease services to the customers, while our competitors usually use an EPC (engineering, procurement and construction) or turnkey contract model. |

| 23 |

Employees

As of December 31, 2020, we had 16 employees:

Management: 4 Employees

Administration: 4 Employees

Marketing: 2 Employees

Accounting & Finance: 4 Employees

Project Officer: 2 Employees

All of our personnel are employed full-time and none of them are represented under collective bargaining agreements. We consider our relations with our employees to be good.

Costs and Effects of Compliance with Environmental Laws