cah-20210630FALSEJune 30, 20212021FY0000721371--06-3000007213712020-07-012021-06-30iso4217:USD00007213712020-12-31xbrli:shares00007213712021-07-3100007213712019-07-012020-06-3000007213712018-07-012019-06-30iso4217:USDxbrli:shares00007213712021-06-3000007213712020-06-300000721371us-gaap:CommonStockMember2018-06-300000721371us-gaap:RetainedEarningsMember2018-06-300000721371us-gaap:TreasuryStockMember2018-06-300000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-06-300000721371us-gaap:NoncontrollingInterestMember2018-06-3000007213712018-06-300000721371us-gaap:RetainedEarningsMember2018-07-012019-06-300000721371us-gaap:NoncontrollingInterestMember2018-07-012019-06-300000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-07-012019-06-300000721371us-gaap:CommonStockMember2018-07-012019-06-300000721371us-gaap:TreasuryStockMember2018-07-012019-06-300000721371us-gaap:CommonStockMember2019-06-300000721371us-gaap:RetainedEarningsMember2019-06-300000721371us-gaap:TreasuryStockMember2019-06-300000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-06-300000721371us-gaap:NoncontrollingInterestMember2019-06-3000007213712019-06-300000721371us-gaap:NoncontrollingInterestMember2019-07-012020-06-300000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-07-012020-06-300000721371us-gaap:CommonStockMember2019-07-012020-06-300000721371us-gaap:TreasuryStockMember2019-07-012020-06-300000721371us-gaap:RetainedEarningsMember2019-07-012020-06-300000721371us-gaap:CommonStockMember2020-06-300000721371us-gaap:RetainedEarningsMember2020-06-300000721371us-gaap:TreasuryStockMember2020-06-300000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-300000721371us-gaap:NoncontrollingInterestMember2020-06-300000721371us-gaap:NoncontrollingInterestMember2020-07-012021-06-300000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-07-012021-06-300000721371us-gaap:CommonStockMember2020-07-012021-06-300000721371us-gaap:TreasuryStockMember2020-07-012021-06-300000721371us-gaap:RetainedEarningsMember2020-07-012021-06-300000721371us-gaap:CommonStockMember2021-06-300000721371us-gaap:RetainedEarningsMember2021-06-300000721371us-gaap:TreasuryStockMember2021-06-300000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-06-300000721371us-gaap:NoncontrollingInterestMember2021-06-300000721371us-gaap:AllowanceForCreditLossMember2021-06-300000721371us-gaap:AllowanceForCreditLossMember2020-06-300000721371srt:MinimumMember2020-07-012021-06-300000721371srt:MaximumMember2020-07-012021-06-300000721371us-gaap:AllowanceForLossesOnFinanceReceivablesMember2021-06-300000721371us-gaap:AllowanceForLossesOnFinanceReceivablesMember2020-06-30xbrli:pure0000721371us-gaap:CustomerConcentrationRiskMembercah:CVSCaremarkCorporationMemberus-gaap:SalesRevenueNetMembercah:PharmaceuticalMember2020-07-012021-06-300000721371us-gaap:CustomerConcentrationRiskMembercah:CVSCaremarkCorporationMemberus-gaap:SalesRevenueNetMembercah:PharmaceuticalMember2019-07-012020-06-300000721371us-gaap:CustomerConcentrationRiskMembercah:CVSCaremarkCorporationMemberus-gaap:SalesRevenueNetMembercah:PharmaceuticalMember2018-07-012019-06-300000721371cah:CVSCaremarkCorporationMembercah:PharmaceuticalMember2021-06-300000721371cah:CVSCaremarkCorporationMembercah:PharmaceuticalMember2020-06-300000721371us-gaap:CustomerConcentrationRiskMembercah:OptumRxMemberus-gaap:SalesRevenueNetMembercah:PharmaceuticalMember2020-07-012021-06-300000721371us-gaap:CustomerConcentrationRiskMembercah:OptumRxMemberus-gaap:SalesRevenueNetMembercah:PharmaceuticalMember2019-07-012020-06-300000721371us-gaap:CustomerConcentrationRiskMembercah:OptumRxMemberus-gaap:SalesRevenueNetMembercah:PharmaceuticalMember2018-07-012019-06-300000721371cah:OptumRxMembercah:PharmaceuticalMember2021-06-300000721371cah:OptumRxMembercah:PharmaceuticalMember2020-06-30cah:organization0000721371us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercah:GroupPurchasingOrganizationsMember2020-07-012021-06-300000721371us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercah:GroupPurchasingOrganizationsMember2019-07-012020-06-300000721371us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercah:GroupPurchasingOrganizationsMember2018-07-012019-06-300000721371us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2020-07-012021-06-300000721371us-gaap:BuildingAndBuildingImprovementsMembersrt:MaximumMember2020-07-012021-06-300000721371us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2020-07-012021-06-300000721371srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2020-07-012021-06-300000721371us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2020-07-012021-06-300000721371srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2020-07-012021-06-300000721371us-gaap:LandBuildingsAndImprovementsMember2021-06-300000721371us-gaap:LandBuildingsAndImprovementsMember2020-06-300000721371us-gaap:MachineryAndEquipmentMember2021-06-300000721371us-gaap:MachineryAndEquipmentMember2020-06-300000721371us-gaap:FurnitureAndFixturesMember2021-06-300000721371us-gaap:FurnitureAndFixturesMember2020-06-30cah:segment0000721371cah:CordisDivestitureMember2021-06-300000721371cah:TotalOpioidLitigationMember2020-07-012021-06-300000721371cah:TotalOpioidLitigationMember2019-07-012020-06-300000721371us-gaap:ShippingAndHandlingMember2020-07-012021-06-300000721371us-gaap:ShippingAndHandlingMember2019-07-012020-06-300000721371us-gaap:ShippingAndHandlingMember2018-07-012019-06-300000721371cah:CordisDivestitureMemberus-gaap:SubsequentEventMember2021-08-022021-08-020000721371cah:CordisDivestitureMember2020-07-012021-06-300000721371cah:NaviHealthMember2018-08-012018-08-310000721371cah:NaviHealthMember2018-07-012019-06-300000721371cah:NaviHealthMember2018-08-010000721371cah:NaviHealthMember2019-07-012020-06-300000721371us-gaap:EmployeeSeveranceMember2019-06-300000721371us-gaap:FacilityClosingMember2019-06-300000721371us-gaap:EmployeeSeveranceMember2019-07-012020-06-300000721371us-gaap:FacilityClosingMember2019-07-012020-06-300000721371us-gaap:EmployeeSeveranceMember2020-06-300000721371us-gaap:FacilityClosingMember2020-06-300000721371us-gaap:EmployeeSeveranceMember2020-07-012021-06-300000721371us-gaap:FacilityClosingMember2020-07-012021-06-300000721371us-gaap:EmployeeSeveranceMember2021-06-300000721371us-gaap:FacilityClosingMember2021-06-300000721371cah:PharmaceuticalMember2019-06-300000721371cah:MedicalMemberMember2019-06-300000721371cah:PharmaceuticalMember2019-07-012020-06-300000721371cah:MedicalMemberMember2019-07-012020-06-300000721371cah:PharmaceuticalMember2020-06-300000721371cah:MedicalMemberMember2020-06-300000721371cah:PharmaceuticalMember2020-07-012021-06-300000721371cah:MedicalMemberMember2020-07-012021-06-300000721371cah:CordisDivestitureMembercah:PharmaceuticalMember2021-06-300000721371cah:CordisDivestitureMembercah:MedicalMemberMember2021-06-300000721371cah:PharmaceuticalMember2021-06-300000721371cah:MedicalMemberMember2021-06-300000721371cah:IPRDTrademarksandOtherMember2021-06-300000721371us-gaap:CustomerRelationshipsMember2021-06-300000721371us-gaap:CustomerRelationshipsMember2020-07-012021-06-300000721371cah:TrademarksAndPatentsMember2021-06-300000721371cah:TrademarksAndPatentsMember2020-07-012021-06-300000721371us-gaap:DevelopedTechnologyRightsMember2021-06-300000721371us-gaap:DevelopedTechnologyRightsMember2020-07-012021-06-300000721371cah:IPRDTrademarksandOtherMember2020-06-300000721371us-gaap:CustomerRelationshipsMember2020-06-300000721371cah:TrademarksAndPatentsMember2020-06-300000721371us-gaap:DevelopedTechnologyRightsMember2020-06-300000721371srt:MinimumMember2021-06-300000721371srt:MaximumMember2021-06-300000721371us-gaap:OtherAssetsMember2021-06-300000721371us-gaap:OtherAssetsMember2020-06-300000721371us-gaap:AccruedLiabilitiesMember2021-06-300000721371us-gaap:AccruedLiabilitiesMember2020-06-300000721371us-gaap:OtherLiabilitiesMember2021-06-300000721371us-gaap:OtherLiabilitiesMember2020-06-300000721371us-gaap:PropertyPlantAndEquipmentMember2021-06-300000721371us-gaap:PropertyPlantAndEquipmentMember2020-06-300000721371cah:ASC842Member2020-07-012021-06-300000721371cah:ASC842Member2019-07-012019-07-0100007213712019-07-012019-07-010000721371cah:OperatingLeaseMember2021-06-300000721371cah:FinanceLeaseMember2021-06-300000721371cah:A2.616Notesdue2022Member2021-06-300000721371cah:A2.616Notesdue2022Member2020-06-300000721371cah:A3.2Notesdue2022Member2021-06-300000721371cah:A3.2Notesdue2022Member2020-06-300000721371cah:FloatingRateNotesdue2022Member2021-06-300000721371cah:FloatingRateNotesdue2022Member2020-06-300000721371cah:A3.2Notesdue2023Member2021-06-300000721371cah:A3.2Notesdue2023Member2020-06-300000721371cah:A3.079Notesdue2024Member2021-06-300000721371cah:A3.079Notesdue2024Member2020-06-300000721371cah:A3.5Notesdue2025Member2021-06-300000721371cah:A3.5Notesdue2025Member2020-06-300000721371cah:A3.75Notesdue2026Member2021-06-300000721371cah:A3.75Notesdue2026Member2020-06-300000721371cah:A3.41Notesdue2027Member2021-06-300000721371cah:A3.41Notesdue2027Member2020-06-300000721371cah:A4.6Notesdue2043Member2021-06-300000721371cah:A4.6Notesdue2043Member2020-06-300000721371cah:A4.5Notesdue2044Member2021-06-300000721371cah:A4.5Notesdue2044Member2020-06-300000721371cah:A4.9Notesdue2045Member2021-06-300000721371cah:A4.9Notesdue2045Member2020-06-300000721371cah:A4.368Notesdue2047Member2021-06-300000721371cah:A4.368Notesdue2047Member2020-06-300000721371cah:A7.0Debenturesduefiscal2027Member2021-06-300000721371cah:A7.0Debenturesduefiscal2027Member2020-06-300000721371cah:AllegianceCorporationMembercah:A7.0Debenturesduefiscal2027Member2021-06-300000721371cah:A3.2Notesdue2022Member2020-07-012021-06-300000721371cah:A2.616Notesdue2022Member2021-04-012021-06-300000721371cah:A32Notes2616NotesMember2020-07-012021-06-300000721371cah:FloatingRateNotesdue2022Member2020-07-012021-06-300000721371cah:A2.616Notesdue2022Member2020-07-012021-06-300000721371cah:FloatingRateNotes2616NotesMember2020-07-012021-06-300000721371cah:A4.625Notesdue2021Member2019-07-012020-06-300000721371cah:A2.616Notesdue2022Member2019-07-012020-06-300000721371cah:A3.2Notesdue2022Member2019-07-012020-06-300000721371cah:FloatingRateNotesdue2022Member2019-07-012020-06-300000721371cah:A3.41Notesdue2027Member2019-07-012020-06-300000721371cah:A4.6Notesdue2043Member2019-07-012020-06-300000721371cah:A4.9Notesdue2045Member2019-07-012020-06-300000721371cah:A4.368Notesdue2047Member2019-07-012020-06-300000721371cah:A2.616Notes3.2Notes3.41Notes4.6Notes4.9Notesand4.368NotesMember2019-07-012020-06-300000721371cah:A24NotesDue2019Member2019-07-012020-06-300000721371cah:A2.616Notesdue2022Member2018-07-012019-06-300000721371cah:A3.2Notesdue2022Member2018-07-012019-06-300000721371cah:FloatingRateNotesdue2022Member2018-07-012019-06-300000721371cah:A3.41Notesdue2027Member2018-07-012019-06-300000721371cah:A1.948Notesdue2019Member2018-07-012019-06-300000721371us-gaap:CommercialPaperMember2021-06-300000721371us-gaap:RevolvingCreditFacilityMember2021-06-300000721371cah:ShortTermCreditFacilitiesMembercah:CommittedReceivablesSalesFacilityProgramMember2021-06-300000721371us-gaap:LetterOfCreditMember2021-06-300000721371us-gaap:LetterOfCreditMember2020-06-300000721371cah:CommittedReceivablesSalesFacilityProgramMember2020-07-012021-06-300000721371cah:CommittedReceivablesSalesFacilityProgramMember2020-06-300000721371cah:CommittedReceivablesSalesFacilityProgramMember2021-06-300000721371cah:CommittedReceivablesSalesFacilityProgramMemberus-gaap:LetterOfCreditMember2021-06-300000721371cah:CommittedReceivablesSalesFacilityProgramMemberus-gaap:LetterOfCreditMember2020-06-300000721371us-gaap:CommercialPaperMember2020-06-300000721371cah:ShortTermCreditFacilitiesMember2020-06-300000721371cah:NewYorkOpioidStewardshipActMember2021-06-300000721371cah:NewYorkOpioidStewardshipActMember2020-07-012021-06-300000721371us-gaap:SubsequentEventMembercah:OpioidLawsuitsMember2021-08-100000721371us-gaap:SubsequentEventMembercah:OpioidLawsuitsStateDomain2021-08-10cah:StateAG0000721371cah:TotalOpioidLitigationMember2021-06-300000721371us-gaap:AccruedLiabilitiesMembercah:TotalOpioidLitigationMember2021-06-30cah:lawsuit0000721371cah:PrivatePartiesMemberus-gaap:SubsequentEventMembercah:OpioidLawsuitsMember2021-08-100000721371cah:ClassActionLawsuitsMembercah:PrivatePartiesMemberus-gaap:SubsequentEventMembercah:OpioidLawsuitsMember2021-08-100000721371cah:ProductLiabilityLawsuitsMemberus-gaap:SubsequentEventMember2021-08-102021-08-10cah:plaintiff0000721371cah:ProductLiabilityLawsuitsMembercah:AlamedaCountyMemberus-gaap:SubsequentEventMember2021-08-102021-08-100000721371cah:ProductLiabilityLawsuitsMemberus-gaap:SubsequentEventMember2021-08-102021-08-100000721371cah:OtherJurisdictionsMembercah:ProductLiabilityLawsuitsMemberus-gaap:SubsequentEventMember2021-08-102021-08-100000721371cah:ProductLiabilityLawsuitsMemberus-gaap:SubsequentEventMember2021-07-012021-07-310000721371cah:DOJInvestigationMember2020-07-012021-06-300000721371cah:NetOperatingLossCarrybackMember2020-07-012021-06-300000721371cah:NetOperatingLossCarrybackMember2021-06-300000721371cah:TotalOpioidLitigationMember2020-06-300000721371us-gaap:InternalRevenueServiceIRSMember2021-06-300000721371us-gaap:StateAndLocalJurisdictionMember2021-06-300000721371us-gaap:ForeignCountryMember2021-06-3000007213712019-04-012019-06-300000721371cah:CareFusionMember2021-06-300000721371cah:CareFusionMember2020-06-300000721371cah:PatientRecoveryBusinessMember2021-06-300000721371cah:PatientRecoveryBusinessMember2020-06-300000721371us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-06-300000721371us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2021-06-300000721371us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-06-300000721371us-gaap:FairValueMeasurementsRecurringMember2021-06-300000721371us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-06-300000721371us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-06-300000721371us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-06-300000721371us-gaap:FairValueMeasurementsRecurringMember2020-06-300000721371us-gaap:FairValueMeasurementsNonrecurringMember2021-06-300000721371us-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2021-06-300000721371us-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2020-06-300000721371us-gaap:OtherAssetsMemberus-gaap:CrossCurrencyInterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMember2021-06-300000721371us-gaap:OtherAssetsMemberus-gaap:CrossCurrencyInterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMember2020-06-300000721371us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:CrossCurrencyInterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMember2021-06-300000721371us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:CrossCurrencyInterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMember2020-06-300000721371us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2021-06-300000721371us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2020-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMemberus-gaap:CashFlowHedgingMember2021-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMemberus-gaap:CashFlowHedgingMember2020-06-300000721371us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMembercah:DeferredIncomeTaxesandOtherLiabilitiesMember2021-06-300000721371us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMembercah:DeferredIncomeTaxesandOtherLiabilitiesMember2020-06-300000721371us-gaap:CommodityContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMemberus-gaap:CashFlowHedgingMember2021-06-300000721371us-gaap:CommodityContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMemberus-gaap:CashFlowHedgingMember2020-06-300000721371us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2021-06-300000721371us-gaap:InterestRateSwapMember2021-06-300000721371us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2020-06-300000721371us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2019-06-300000721371us-gaap:FairValueHedgingMember2020-07-012021-06-300000721371us-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2021-06-300000721371us-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2020-06-300000721371us-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2020-07-012021-06-300000721371us-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2019-07-012020-06-300000721371us-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2018-07-012019-06-300000721371cah:FixedRateDebtMemberus-gaap:InterestExpenseMemberus-gaap:FairValueHedgingMember2020-07-012021-06-300000721371cah:FixedRateDebtMemberus-gaap:InterestExpenseMemberus-gaap:FairValueHedgingMember2019-07-012020-06-300000721371cah:FixedRateDebtMemberus-gaap:InterestExpenseMemberus-gaap:FairValueHedgingMember2018-07-012019-06-300000721371us-gaap:CashFlowHedgingMember2020-06-300000721371us-gaap:CashFlowHedgingMember2021-06-300000721371us-gaap:CashFlowHedgingMember2020-07-012021-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2021-06-300000721371us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMember2020-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2020-06-300000721371us-gaap:CommodityContractMemberus-gaap:CashFlowHedgingMember2020-06-300000721371us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMember2020-07-012021-06-300000721371us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMember2019-07-012020-06-300000721371us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMember2018-07-012019-06-300000721371us-gaap:CommodityContractMemberus-gaap:CashFlowHedgingMember2020-07-012021-06-300000721371us-gaap:CommodityContractMemberus-gaap:CashFlowHedgingMember2019-07-012020-06-300000721371us-gaap:CommodityContractMemberus-gaap:CashFlowHedgingMember2018-07-012019-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2020-07-012021-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2019-07-012020-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2018-07-012019-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:SalesMember2020-07-012021-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:SalesMember2019-07-012020-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:SalesMember2018-07-012019-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:CostOfSalesMember2020-07-012021-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:CostOfSalesMember2019-07-012020-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:CostOfSalesMember2018-07-012019-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:CashFlowHedgingMember2020-07-012021-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:CashFlowHedgingMember2019-07-012020-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:CashFlowHedgingMember2018-07-012019-06-300000721371us-gaap:ForwardContractsMemberus-gaap:InterestExpenseMemberus-gaap:CashFlowHedgingMember2020-07-012021-06-300000721371us-gaap:ForwardContractsMemberus-gaap:InterestExpenseMemberus-gaap:CashFlowHedgingMember2019-07-012020-06-300000721371us-gaap:ForwardContractsMemberus-gaap:InterestExpenseMemberus-gaap:CashFlowHedgingMember2018-07-012019-06-300000721371us-gaap:CommodityContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:CashFlowHedgingMember2020-07-012021-06-300000721371us-gaap:CommodityContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:CashFlowHedgingMember2019-07-012020-06-300000721371us-gaap:CommodityContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:CashFlowHedgingMember2018-07-012019-06-30iso4217:JPY0000721371us-gaap:CurrencySwapMember2020-06-30iso4217:EUR0000721371us-gaap:CurrencySwapMember2019-09-300000721371us-gaap:ForeignExchangeContractMember2020-07-012021-06-300000721371us-gaap:ForeignExchangeContractMember2019-07-012020-06-300000721371us-gaap:NondesignatedMember2020-07-012021-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2021-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2020-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2020-07-012021-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2019-07-012020-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2018-07-012019-06-300000721371us-gaap:FairValueInputsLevel2Member2021-06-300000721371us-gaap:FairValueInputsLevel2Member2020-06-300000721371us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMember2021-06-300000721371us-gaap:CurrencySwapMemberus-gaap:CashFlowHedgingMember2021-06-300000721371us-gaap:CurrencySwapMemberus-gaap:CashFlowHedgingMember2020-06-300000721371us-gaap:CommodityContractMemberus-gaap:CashFlowHedgingMember2021-06-300000721371us-gaap:CommonClassAMember2021-06-300000721371us-gaap:CommonClassBMember2021-06-300000721371us-gaap:CommonClassAMember2020-07-012021-06-300000721371us-gaap:TreasuryStockMember2017-07-012020-06-300000721371us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2019-06-300000721371us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2019-06-300000721371us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2019-07-012020-06-300000721371us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2019-07-012020-06-300000721371us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2020-06-300000721371us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2020-06-300000721371us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2020-06-300000721371us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2020-07-012021-06-300000721371us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2020-07-012021-06-300000721371us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2021-06-300000721371us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2021-06-300000721371us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-06-300000721371us-gaap:OperatingSegmentsMembercah:PharmaceuticalMember2020-07-012021-06-300000721371us-gaap:OperatingSegmentsMembercah:PharmaceuticalMember2019-07-012020-06-300000721371us-gaap:OperatingSegmentsMembercah:PharmaceuticalMember2018-07-012019-06-300000721371cah:MedicalMemberMemberus-gaap:OperatingSegmentsMember2020-07-012021-06-300000721371cah:MedicalMemberMemberus-gaap:OperatingSegmentsMember2019-07-012020-06-300000721371cah:MedicalMemberMemberus-gaap:OperatingSegmentsMember2018-07-012019-06-300000721371us-gaap:OperatingSegmentsMember2020-07-012021-06-300000721371us-gaap:OperatingSegmentsMember2019-07-012020-06-300000721371us-gaap:OperatingSegmentsMember2018-07-012019-06-300000721371us-gaap:CorporateNonSegmentMember2020-07-012021-06-300000721371us-gaap:CorporateNonSegmentMember2019-07-012020-06-300000721371us-gaap:CorporateNonSegmentMember2018-07-012019-06-300000721371cah:PharmaceuticalDistributionandSpecialtyMemberus-gaap:OperatingSegmentsMembercah:PharmaceuticalMember2020-07-012021-06-300000721371cah:PharmaceuticalDistributionandSpecialtyMemberus-gaap:OperatingSegmentsMembercah:PharmaceuticalMember2019-07-012020-06-300000721371cah:PharmaceuticalDistributionandSpecialtyMemberus-gaap:OperatingSegmentsMembercah:PharmaceuticalMember2018-07-012019-06-300000721371cah:NuclearPrecisionHealthServicesMemberus-gaap:OperatingSegmentsMembercah:PharmaceuticalMember2020-07-012021-06-300000721371cah:NuclearPrecisionHealthServicesMemberus-gaap:OperatingSegmentsMembercah:PharmaceuticalMember2019-07-012020-06-300000721371cah:NuclearPrecisionHealthServicesMemberus-gaap:OperatingSegmentsMembercah:PharmaceuticalMember2018-07-012019-06-300000721371cah:MedicalMemberMembercah:MedicaldistributionandproductsMemberus-gaap:OperatingSegmentsMember2020-07-012021-06-300000721371cah:MedicalMemberMembercah:MedicaldistributionandproductsMemberus-gaap:OperatingSegmentsMember2019-07-012020-06-300000721371cah:MedicalMemberMembercah:MedicaldistributionandproductsMemberus-gaap:OperatingSegmentsMember2018-07-012019-06-300000721371cah:CardinalHealthAtHomeSolutionsMembercah:MedicalMemberMemberus-gaap:OperatingSegmentsMember2020-07-012021-06-300000721371cah:CardinalHealthAtHomeSolutionsMembercah:MedicalMemberMemberus-gaap:OperatingSegmentsMember2019-07-012020-06-300000721371cah:CardinalHealthAtHomeSolutionsMembercah:MedicalMemberMemberus-gaap:OperatingSegmentsMember2018-07-012019-06-300000721371country:US2020-07-012021-06-300000721371country:US2019-07-012020-06-300000721371country:US2018-07-012019-06-300000721371us-gaap:NonUsMember2020-07-012021-06-300000721371us-gaap:NonUsMember2019-07-012020-06-300000721371us-gaap:NonUsMember2018-07-012019-06-300000721371cah:SterileSurgicalGownRecallMemberDomain2019-07-012020-06-300000721371cah:NaviHealthMember2019-07-012020-06-300000721371us-gaap:OperatingSegmentsMembercah:PharmaceuticalMember2021-06-300000721371us-gaap:OperatingSegmentsMembercah:PharmaceuticalMember2020-06-300000721371us-gaap:OperatingSegmentsMembercah:PharmaceuticalMember2019-06-300000721371cah:MedicalMemberMemberus-gaap:OperatingSegmentsMember2021-06-300000721371cah:MedicalMemberMemberus-gaap:OperatingSegmentsMember2020-06-300000721371cah:MedicalMemberMemberus-gaap:OperatingSegmentsMember2019-06-300000721371us-gaap:CorporateNonSegmentMember2021-06-300000721371us-gaap:CorporateNonSegmentMember2020-06-300000721371us-gaap:CorporateNonSegmentMember2019-06-300000721371country:US2021-06-300000721371country:US2020-06-300000721371country:US2019-06-300000721371us-gaap:NonUsMember2021-06-300000721371us-gaap:NonUsMember2020-06-300000721371us-gaap:NonUsMember2019-06-300000721371cah:A2011LtipMember2021-06-300000721371cah:AwardsOtherThanStockOptionsMembercah:A2011LtipMember2021-06-300000721371cah:A2011LtipMemberus-gaap:EmployeeStockOptionMember2021-06-300000721371us-gaap:RestrictedStockUnitsRSUMember2020-07-012021-06-300000721371us-gaap:RestrictedStockUnitsRSUMember2019-07-012020-06-300000721371us-gaap:RestrictedStockUnitsRSUMember2018-07-012019-06-300000721371us-gaap:EmployeeStockOptionMember2020-07-012021-06-300000721371us-gaap:EmployeeStockOptionMember2019-07-012020-06-300000721371us-gaap:EmployeeStockOptionMember2018-07-012019-06-300000721371us-gaap:PerformanceSharesMember2020-07-012021-06-300000721371us-gaap:PerformanceSharesMember2019-07-012020-06-300000721371us-gaap:PerformanceSharesMember2018-07-012019-06-300000721371us-gaap:RestrictedStockUnitsRSUMember2019-06-300000721371us-gaap:RestrictedStockUnitsRSUMember2020-06-300000721371us-gaap:RestrictedStockUnitsRSUMember2021-06-300000721371us-gaap:EmployeeStockOptionMember2021-06-300000721371us-gaap:EmployeeStockOptionMember2020-06-300000721371us-gaap:EmployeeStockOptionMember2019-06-300000721371srt:MaximumMemberus-gaap:EmployeeStockOptionMember2020-07-012021-06-30cah:vestingPeriods0000721371us-gaap:PerformanceSharesMembersrt:MinimumMember2020-07-012021-06-300000721371us-gaap:PerformanceSharesMembersrt:MaximumMember2020-07-012021-06-300000721371us-gaap:PerformanceSharesMember2019-06-300000721371us-gaap:PerformanceSharesMember2020-06-300000721371us-gaap:PerformanceSharesMember2021-06-300000721371us-gaap:AllowanceForCreditLossMember2020-07-012021-06-300000721371us-gaap:AllowanceForLossesOnFinanceReceivablesMember2020-07-012021-06-300000721371us-gaap:SalesReturnsAndAllowancesMember2020-06-300000721371us-gaap:SalesReturnsAndAllowancesMember2020-07-012021-06-300000721371us-gaap:SalesReturnsAndAllowancesMember2021-06-300000721371us-gaap:AllowanceForLoanAndLeaseLossesMember2020-06-300000721371us-gaap:AllowanceForLoanAndLeaseLossesMember2020-07-012021-06-300000721371us-gaap:AllowanceForLoanAndLeaseLossesMember2021-06-300000721371us-gaap:AllowanceForCreditLossMember2019-06-300000721371us-gaap:AllowanceForCreditLossMember2019-07-012020-06-300000721371us-gaap:AllowanceForLossesOnFinanceReceivablesMember2019-06-300000721371us-gaap:AllowanceForLossesOnFinanceReceivablesMember2019-07-012020-06-300000721371us-gaap:SalesReturnsAndAllowancesMember2019-06-300000721371us-gaap:SalesReturnsAndAllowancesMember2019-07-012020-06-300000721371us-gaap:AllowanceForLoanAndLeaseLossesMember2019-06-300000721371us-gaap:AllowanceForLoanAndLeaseLossesMember2019-07-012020-06-300000721371us-gaap:AllowanceForCreditLossMember2018-06-300000721371us-gaap:AllowanceForCreditLossMember2018-07-012019-06-300000721371us-gaap:AllowanceForLossesOnFinanceReceivablesMember2018-06-300000721371us-gaap:AllowanceForLossesOnFinanceReceivablesMember2018-07-012019-06-300000721371us-gaap:SalesReturnsAndAllowancesMember2018-06-300000721371us-gaap:SalesReturnsAndAllowancesMember2018-07-012019-06-300000721371us-gaap:AllowanceForLoanAndLeaseLossesMember2018-06-300000721371us-gaap:AllowanceForLoanAndLeaseLossesMember2018-07-012019-06-300000721371cah:PricingDisputesMember2020-07-012021-06-300000721371cah:PricingDisputesMember2019-07-012020-06-300000721371cah:PricingDisputesMember2018-07-012019-06-300000721371cah:PriorYearRecoveriesMember2020-07-012021-06-300000721371cah:PriorYearRecoveriesMember2019-07-012020-06-300000721371cah:PriorYearRecoveriesMember2018-07-012019-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2021

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission File Number: 1-11373

Cardinal Health, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Ohio | | | | | | 31-0958666 |

(State or other jurisdiction of

incorporation or organization) | | (IRS Employer

Identification No.) |

| | | | | | |

| 7000 Cardinal Place | , | Dublin | , | Ohio | | 43017 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | | |

| | | | (614) | | 757-5000 |

| (Registrant’s telephone number, including area code) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common shares (without par value) | CAH | New York Stock Exchange |

| | |

| Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | þ | | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ | |

| | | Emerging growth company | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act o |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

|

| þ | | | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The aggregate market value of voting stock held by non-affiliates on December 31, 2020, was the following: $15,693,865,917.

The number of the registrant’s common shares, without par value, outstanding as of July 31, 2021, was the following: 290,441,408.

Documents Incorporated by Reference:

Portions of the registrant’s Definitive Proxy Statement to be filed for its 2021 Annual Meeting of Shareholders are incorporated by reference into the sections of this Form 10-K addressing the requirements of Part III of Form 10-K.

| | |

Cardinal Health Fiscal 2021 Form 10-K |

Table of Contents

| | | | | | | | |

1 | Cardinal Health | Fiscal 2021 Form 10-K | |

Introduction

References to Cardinal Health and Fiscal Years

As used in this report, "we," "our," "us," "Cardinal Health" and similar pronouns refer to Cardinal Health, Inc. and its majority-owned subsidiaries, unless the context requires otherwise. Our fiscal year ends on June 30. References to fiscal 2022, 2021, 2020, 2019, 2018 and 2017 are to the fiscal years ended June 30, 2022, 2021, 2020, 2019, 2018 and 2017, respectively. Except as otherwise specified, information in this report is provided as of June 30, 2021.

Non-GAAP Financial Measures

In this report, including in the "Fiscal 2021 Overview" section of Management's Discussion and Analysis of Financial Condition and Results of Operations ("MD&A"), we use financial measures that are derived from consolidated financial data but are not presented in our financial statements that are prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). These measures are considered “non-GAAP financial measures” under the Securities and Exchange Commission (“SEC”) rules. The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures are included in the “Explanation and Reconciliation of Non-GAAP Financial Measures” section following MD&A in this report.

Management's Discussion and Analysis of Financial Condition and Results of Operations

Our MD&A within this Form 10-K generally discusses fiscal 2021 and fiscal 2020 items and year-to-year comparisons between fiscal 2021 and fiscal 2020. Fiscal 2019 items and discussions of year-to-year comparisons between fiscal 2020 and fiscal 2019 that are not included in this Form 10-K can be found in Management’s Discussion and Analysis of Financial Condition and Results of Operations in our Annual Report on Form 10-K for the fiscal year ended June 30, 2020 (the "Fiscal 2020 Form 10-K").

Important Information Regarding Forward-Looking Statements

This report (including information incorporated by reference) includes forward-looking statements addressing expectations, prospects, estimates and other matters that are dependent upon future events or developments. Many forward-looking statements appear in MD&A and Risk Factors, but there are others throughout this report, which may be identified by words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “will,” “should,” “could,” “would,” “project,” “continue,” “likely,” and similar expressions, and include statements reflecting future results or guidance, statements of outlook and expense accruals. These matters are subject to risks and uncertainties that could cause actual results to differ materially from those projected, anticipated or implied. The most significant of these risks and uncertainties are described in “Risk Factors” in this report and in Exhibit 99.1 to the Form 10-K included in this report. Forward-looking statements in this report speak only as of the date of this document. Except to the extent required by applicable law, we undertake no obligation to update or revise any forward-looking statement.

Available Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports are available free of charge on our website (www.cardinalhealth.com), under the “Investor Relations — Financial Reporting — SEC Filings” caption, as soon as reasonably practicable after we electronically file them with, or furnish them to, the SEC. The SEC also maintains a website (www.sec.gov) where you can search for annual, quarterly and current reports, proxy and information statements, and other information regarding us and other public companies.

| | | | | | | | |

2 | Cardinal Health | Fiscal 2021 Form 10-K | |

| | | | | | | | |

| MD&A | About Cardinal Health | |

Management's Discussion and Analysis of Financial Condition and Results of Operations

About Cardinal Health

Cardinal Health, Inc., an Ohio corporation formed in 1979, is a globally integrated healthcare services and products company providing customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, physician offices and patients in the home. We provide pharmaceuticals and medical products and cost-effective solutions that enhance supply chain efficiency. We connect patients, providers, payers, pharmacists and manufacturers for integrated care coordination and better patient management. We manage our business and report our financial results in two segments: Pharmaceutical and Medical.

Pharmaceutical Segment

Our Pharmaceutical segment distributes branded and generic pharmaceutical, specialty pharmaceutical and over-the-counter healthcare and consumer products in the United States. This segment also provides services to pharmaceutical manufacturers and healthcare providers for specialty pharmaceutical products; operates nuclear pharmacies and radiopharmaceutical manufacturing facilities; provides pharmacy management services to hospitals, as well as medication therapy management and patient outcomes services to hospitals, other healthcare providers and payers; and repackages generic pharmaceuticals and over-the-counter healthcare products.

Medical Segment

Our Medical segment manufactures, sources and distributes Cardinal Health branded medical, surgical and laboratory products, which are sold in the United States, Canada, Europe, Asia and other markets. In addition to distributing Cardinal Health branded products, this segment also distributes a broad range of medical, surgical and laboratory products known as national brand products and provides supply chain services and solutions to hospitals, ambulatory surgery centers, clinical laboratories and other healthcare providers in the United States and Canada. This segment also distributes medical products to patients' homes in the United States through our Cardinal Health at-Home Solutions division.

| | | | | | | | |

| Cardinal Health | Fiscal 2021 Form 10-K | 3 |

| | | | | | | | |

| MD&A | Results of Operations | |

Consolidated Results

Fiscal 2021 Overview

Revenue

Revenue for fiscal 2021 was $162.5 billion, a 6 percent increase from the prior year, primarily due to sales growth from pharmaceutical distribution and specialty solutions customers.

GAAP and Non-GAAP Operating Earnings/(Loss)

| | | | | | | | | | | | | | | | | |

| (in millions) | 2021 | | 2020 | | Change |

| GAAP operating earnings/(loss) | $ | 472 | | | $ | (4,098) | | | N.M. |

| | | | | |

| Surgical gown recall costs/(income) | (28) | | | 85 | | | |

| State opioid assessment related to prior fiscal years | 38 | | | 3 | | | |

| Restructuring and employee severance | 114 | | | 122 | | | |

| Amortization and other acquisition-related costs | 451 | | | 524 | | | |

| Impairments and (gain)/loss on disposal of assets | 79 | | | 7 | | | |

| Litigation (recoveries)/charges, net | 1,129 | | | 5,741 | | | |

| Non-GAAP operating earnings | $ | 2,255 | | | $ | 2,384 | | | (5) | % |

The sum of the components and certain computations may reflect rounding adjustments.

We had GAAP operating earnings of $472 million and a GAAP operating loss of $4.1 billion during fiscal 2021 and 2020, respectively, which includes pre-tax charges of $1.17 billion and $5.63 billion, respectively, recognized for the estimated liability associated with lawsuits and claims brought against us by states and political subdivisions relating to the distribution of prescription opioid pain medications. See further description of opioid lawsuits in the Significant Developments in Fiscal 2021 and Trends section in this MD&A and Note 7 of the "Notes to Consolidated Financial Statements." GAAP and Non-GAAP operating earnings during fiscal 2021 were adversely impacted by COVID-19, which includes an inventory reserve recorded to reduce the carrying value of certain Medical segment personal protective equipment, primarily certain categories of gloves, to net realizable value. Personal protective equipment ("PPE") refers to protective clothing, medical and non-medical grade gloves, face shields, face masks and other equipment designed to protect the wearer from injury or the spread of infection or illness. See Significant Developments in Fiscal 2021 and Trends section in this MD&A for additional information. Volume declines in our Pharmaceutical segment generics program, which includes the impact of COVID-19, also had an adverse impact. These factors were partially offset by the beneficial impact of enterprise-wide cost-savings measures, including global manufacturing efficiencies in the Medical segment, and higher contribution from branded pharmaceutical sales mix.

GAAP and Non-GAAP Diluted EPS

| | | | | | | | | | | | | | | | | |

| ($ per share) | 2021 (2) | | 2020 (2) (3) | | Change |

GAAP diluted EPS (1) | $ | 2.08 | | | $ | (12.61) | | | N.M. |

| | | | | |

| Surgical gown recall costs/(income) | (0.07) | | | 0.22 | | | |

| State opioid assessment related to prior fiscal years | 0.10 | | | 0.01 | | | |

| Restructuring and employee severance | 0.29 | | | 0.31 | | | |

| Amortization and other acquisition-related costs | 1.13 | | | 1.34 | | | |

| Impairments and (gain)/loss on disposal of assets | 0.21 | | | 0.02 | | | |

Litigation (recoveries)/charges, net (4) | 1.78 | | | 17.84 | | | |

| Loss on early extinguishment of debt | 0.04 | | | 0.04 | | | |

| (Gain)/loss on sale of equity interest in naviHealth | 0.01 | | | (1.68) | | | |

| Transitional tax benefit, net | — | | | (0.01) | | | |

Non-GAAP diluted EPS (1) | $ | 5.57 | | | $ | 5.45 | | | 2 | % |

The sum of the components and certain computations may reflect rounding adjustments.

(1)Diluted earnings/(loss) per share attributable to Cardinal Health, Inc. ("diluted EPS" or "diluted loss per share")

(2)The reconciling items are presented within this table net of tax, except for transitional tax benefit, net. See quantification of tax effect of each reconciling item in our GAAP to Non-GAAP Reconciliations in the section titled "Explanation and Reconciliation of Non-GAAP Financial Measures."

| | | | | | | | |

4 | Cardinal Health | Fiscal 2021 Form 10-K | |

| | | | | | | | |

| MD&A | Results of Operations | |

(3)For fiscal 2020, GAAP diluted loss per share attributable to Cardinal Health, Inc. and the EPS impact from the GAAP to non-GAAP per share reconciling items are calculated using a weighted average of 293 million common shares, which excludes potentially dilutive securities from the denominator due to their anti-dilutive effects resulting from our GAAP net loss for the period. Fiscal 2020 non-GAAP diluted EPS is calculated using a weighted average of 295 million common shares, which includes potentially dilutive shares.

(4)Litigation (recoveries)/charges, net, includes a tax benefit recorded during fiscal 2021 related to a net operating loss carryback. Our wholly-owned insurance subsidiary recorded a self-insurance pre-tax loss in its fiscal 2020 statutory financial statements primarily related to opioid litigation. This self-insurance pre-tax loss, which did not impact our pre-tax consolidated results, was deducted on our fiscal 2020 consolidated federal income tax return and contributed to a significant net operating loss for tax purposes. The net operating loss was carried back and adjusted our taxable income for fiscal 2015, 2016, 2017 and 2018 as permitted under the Coronavirus Aid, Relief and Economic Security (“CARES”) Act. The total benefit from the net operating loss carryback was $424 million; however, for purposes of Non-GAAP financial measures, we allocated $389 million of the benefit to litigation (recoveries)/charges, net, which is excluded from non-GAAP measures, based on the relative amount of the self-insurance pre-tax loss related to opioid litigation claims versus separate tax adjustments. The tax benefit allocated to the separate tax adjustments of $35 million is included in non-GAAP measures.

The charges we recognized in fiscal 2021 and 2020 for the estimated liability associated with lawsuits and claims brought against us by states and political subdivisions relating to the distribution of prescription opioid pain medications had a $(3.21) and $(17.54) per share after-tax impact on GAAP diluted EPS, respectively.

During fiscal 2021, GAAP and non-GAAP diluted EPS were positively impacted by $1.44 and $0.12 per share, respectively, due to a tax benefit from the net operating loss carryback primarily related to a self-insurance pre-tax loss, as further described in Significant Developments in Fiscal 2021 and Trends section in this MD&A and Note 7 of the "Notes to Consolidated Financial Statements." GAAP diluted EPS during fiscal 2020 was favorably impacted by a $1.68 per share gain from the sale of the remainder of our equity interest in naviHealth described further in Note 2 of the "Notes to Consolidated Financial Statements." Cash and Equivalents

Our cash and equivalents balance was $3.4 billion at June 30, 2021 compared to $2.8 billion at June 30, 2020. The increase in cash during fiscal 2021 was due to net cash provided by operating activities of $2.4 billion, offset by cash deployed of $573 million for dividends, $570 million for debt repayments, $400 million for capital expenditures, and $200 million for share repurchases.

| | | | | | | | |

| Cardinal Health | Fiscal 2021 Form 10-K | 5 |

| | | | | | | | |

| MD&A | Results of Operations | |

Significant Developments in Fiscal 2021 and Trends

COVID-19

The COVID-19 pandemic ("COVID-19") continues to affect the U.S. and global economies, and as previously disclosed, the pandemic began to materially affect our businesses during the third quarter of fiscal 2020. The length and severity of the pandemic and its impacts on our businesses and results of operations are uncertain.

COVID-19 had a negative impact on our consolidated operating earnings/(loss) in fiscal 2021 and fiscal 2020. We estimate that the impact on fiscal 2021 operating earnings was approximately $200 million greater than on fiscal 2020 operating earnings, and we estimate that the impact on fiscal 2020 operating earnings/(loss) was approximately $100 million.

Pharmaceutical segment profit has been negatively impacted by COVID-19 largely due to volume declines in our generics program and Nuclear and Precision Health Solutions. While fiscal 2021 volumes within our generics program were lower than levels prior to COVID-19, the impact on Pharmaceutical segment profit improved on a year-over-year basis during the fourth quarter of fiscal 2021. Similarly, in comparison to prior year, the impact of COVID-19 on Nuclear and Precision Health Solutions was positive for Pharmaceutical segment profit during the fourth quarter of fiscal 2021.

Our Medical segment experienced dramatically increased demand for certain personal protective equipment due to COVID-19. Personal protective equipment ("PPE") refers to protective clothing, medical and non-medical grade gloves, face shields, face masks and other equipment designed to protect the wearer from injury or the spread of infection or illness. The peak of this heightened demand was during the second and third quarters of fiscal 2021. This increased demand resulted in higher sales volume for certain products, increased costs to manufacture and source these products and higher inventory levels to meet customer commitments. As a result, we sought out additional sources for these products and to mitigate the impact of these cost increases, we have raised our selling prices for the affected products. During the fourth quarter of fiscal 2021, selling prices and customer demand for certain PPE decreased as compared to the peak, and we expect this decline to continue into fiscal 2022. This resulted in inventory cost above net realizable value, requiring an inventory reserve of $197 million, primarily related to certain categories of gloves, which adversely impacted Medical segment profit. Our estimates for customer demand and selling prices are inherently uncertain and if customer demand or selling prices decline in the future beyond our current assumptions, additional inventory reserves may be required that would adversely impact Medical segment profit. See Critical Accounting Policies and Sensitive Accounting Estimates section in this MD&A for additional information.

During fiscal 2021, COVID-19 benefited Medical segment profit in some ways as well. Higher volumes in our laboratory business and cost savings positively impacted Medical segment profit. Additionally, despite declining customer demand and selling prices in some categories of PPE as described above, Medical segment profit was benefited by pricing actions intended to mitigate the impact of cost increases in certain other PPE categories. In addition, while lower demand for surgical products resulting from reduced elective procedures had an adverse impact on Medical segment profit during the first nine months of fiscal 2021, demand improved during the fourth quarter of fiscal 2021 and was a positive contributor to year-over-year segment profit.

We currently anticipate that the negative impact of the COVID-19 pandemic on operating earnings will be less in fiscal 2022 than it was in fiscal 2021, which includes the inventory reserve of $197 million described above. As a result, in comparison to prior year, we expect the COVID-19 impact for fiscal 2022 will be positive. However, we cannot estimate the length or severity of the COVID-19 pandemic or of the related U.S. or global economic consequences on our businesses and results of operations, including whether and when historic economic and operating conditions will resume, or its impact on our business, financial position, results of operations or cash flow. Its impact may be greater or less than we anticipate.

Opioid Lawsuits

In July 2021, we announced that we and two other national distributors have negotiated a proposed settlement agreement (the “Proposed Settlement Agreement”) and settlement process that, if all conditions are satisfied (including Boards of Directors' approval), would result in the settlement of the vast majority of opioid lawsuits filed by state and local governmental entities.

West Virginia subdivisions and Native American tribes are not a part of this settlement process and we have been involved in separate negotiations with these groups. The settlement process does not contemplate participation by any non-governmental or non-political entities or individuals. In connection with the negotiations of the Proposed Settlement Agreement, we and the two other national distributors entered into a settlement with the State of New York and its participating subdivisions. If the Proposed Settlement Agreement becomes effective, New York and its participating subdivisions will become a part of it.

| | | | | | | | |

6 | Cardinal Health | Fiscal 2021 Form 10-K | |

| | | | | | | | |

| MD&A | Results of Operations | |

The Proposed Settlement Agreement is subject to contingencies and will not become effective unless and until the Boards of Directors of the three distributors each make separate independent determinations that (1) following a sign-on period, a sufficient number of states have agreed to the Proposed Settlement Agreement (the “Settling States”); and, subsequently, (2) following a notice period, that a sufficient number of states and political subdivisions, including those that have not sued, have agreed to the Agreement (or otherwise had their claims foreclosed) to proceed to effectiveness. Prior to the second determination, the Settling States will also have an opportunity to make a determination as to whether a sufficient number of political subdivisions have agreed to the Proposed Settlement Agreement (or otherwise had their claims foreclosed) to proceed with the Proposed Settlement Agreement. This process is currently contemplated to end in February 2022, although it may be extended by agreement. It is possible that a sufficient number of states and subdivisions will not agree to the Proposed Settlement Agreement or that other required contingencies will not be satisfied.

If these conditions are satisfied, the Proposed Settlement Agreement would become effective 60 days after the distributors determine that there is sufficient participation among political subdivisions. During this 60-day period, the Settling States and the distributors would cooperate to obtain consent judgments in each participating state embodying the terms of the Settlement.

The Proposed Settlement Agreement includes a cash component, pursuant to which the Company would pay up to $6.37 billion, the majority of which would be paid over 18 years. The exact payment amount will depend on several factors, including the participation rate of states and political subdivisions, the extent to which states take action to foreclose opioid lawsuits by political subdivisions (e.g., laws barring opioid lawsuits by political subdivisions), and the extent to which political subdivisions in Settling States file additional opioid lawsuits against the Company after the Proposed Settlement Agreement becomes effective.

The Proposed Settlement Agreement also includes injunctive relief terms relating to settling distributors’ controlled substance anti-diversion programs, including with respect to: (1) governance; (2) independence and training of the personnel operating our controlled substances monitoring program; (3) due diligence for new and existing customers; (4) ordering limits for certain products; and (5) suspicious order monitoring. A monitor will be selected to oversee compliance with these provisions for a period of five years. In addition, we and the two other national distributors will engage a third-party vendor to act as a clearinghouse for data aggregation and reporting; distributors will fund the clearinghouse for ten years.

Additionally, a trial before a judge in West Virginia in the Cabell County and City of Huntington cases concluded in July 2021 and the judge has not yet issued a decision. In addition, a trial in the case brought by the Ohio Attorney General is scheduled to begin in September 2021 and a trial in the case brought by the Washington Attorney General is scheduled to begin in November 2021. The Ohio Attorney General has issued a press release indicating support for the Proposed Settlement Agreement; however, the Washington Attorney General has issued a press release stating that Washington will not agree to the Proposed Settlement Agreement.

In connection with the opioid lawsuits and settlement negotiations, we have recorded total pre-tax charges of $1.17 billion and $5.63 billion in litigation charges/(recoveries), net in the years ended June 30, 2021 and 2020, respectively. In total, we have $6.73 billion accrued at June 30, 2021, of which $405 million is included in other accrued liabilities, as we expect to make our first annual settlement payment into escrow on or before September 30, 2021, and the remainder is included in deferred income taxes and other liabilities in the consolidated balance sheets. Because loss contingencies are inherently unpredictable and unfavorable developments or resolutions can occur, the assessment is highly subjective and requires judgments about future events. We regularly review these opioid litigation matters to determine whether our accrual is adequate. The amount of ultimate loss may differ materially from this accrual. See Note 7 of the "Notes to Consolidated Financial Statements" for additional information. Tax Effect of Opioid Litigation Charges

The net tax benefits associated with the opioid litigation charges are $228 million and $488 million for fiscal 2021 and 2020, respectively. Our tax benefits are estimates, which reflect our current assessment of the estimated future deductibility of the amount that may be paid under the accrual taken in connection with the opioid litigation and are net of unrecognized tax benefits of $219 million and $469 million, respectively. The fiscal 2021 net tax benefit and unrecognized tax benefits were primarily due to our assessment of the specific terms of the Proposed Settlement Agreement. Our assumptions and estimates around this benefit and uncertain tax position require significant judgment and the actual amount of tax benefit may differ materially from these estimates. See Note 8 of the "Notes to Consolidated Financial Statements" for additional information.

Tax Effects of Self-Insurance Pre-Tax Loss During fiscal 2021, our wholly-owned insurance subsidiary recorded a self-insurance pre-tax loss in its fiscal 2020 statutory financial statements primarily related to opioid litigation. This self-insurance pre-tax loss, which did not impact our pre-tax consolidated results, was deducted on our fiscal 2020 consolidated federal income tax return and contributed to a significant net operating loss for tax purposes. The net operating loss was carried back and applied to adjust our taxable income for fiscal 2015, 2016, 2017, and 2018 as permitted under the CARES Act enacted by the United States Congress in March 2020.

| | | | | | | | |

| Cardinal Health | Fiscal 2021 Form 10-K | 7 |

| | | | | | | | |

| MD&A | Results of Operations | |

Accordingly, our provision for income taxes during fiscal 2021 included a $424 million benefit from the net operating loss carryback primarily to reflect the difference between the federal statutory income tax rate during the fiscal years from 2015 to 2018 (35 percent for fiscal 2015, 2016, and 2017 and 28 percent for fiscal 2018) and the current federal statutory income tax rate of 21 percent.

We have filed for a U.S. federal income tax refund of $974 million as a result of the net operating loss carryback under the CARES Act, which we expect to receive within 12 months, and accordingly have recorded a current asset on our consolidated balance sheet at June 30, 2021. We also increased our non-current deferred tax liability by approximately $700 million during fiscal 2021 related to this matter.

We have recorded these amounts based on management's judgment and our current understanding of tax law; however, it is possible that the tax authorities could challenge these tax benefits or that the tax law could change. The actual amount or timing of the tax benefit may differ from these expectations. See Note 8 of the "Notes to Consolidated Financial Statements" for additional information.

On March 12, 2021, we announced that we signed a definitive agreement to sell our Cordis business to Hellman & Friedman for proceeds of $927 million in cash, subject to customary purchase price adjustments, and we retained certain working capital accounts and product liability for lawsuits and claims related to inferior vena cava ("IVC") filters in the U.S. and Canada as described in Note 7 of the “Notes to Consolidated Financial Statements.” The transaction closed on August 2, 2021, and we received proceeds of $927 million, net of cash transferred. In connection with the closing, we entered into a Transition Services Agreement ("TSA") with the buyer to provide support functions for a period of up to twenty-four months following the sale. See Note 2 of the "Notes to Consolidated Financial Statements" for additional information. During fiscal 2021, we recognized a $60 million pre-tax write-down of the net assets held for sale in impairment and (gain)/loss on disposal of assets in the consolidated statement of earnings/(loss). We recorded a net tax expense of $9 million associated with the impact of the write-down and the required tax adjustments related to held for sale accounting.

In connection with the divestiture, during fiscal 2021 we recognized costs of $28 million associated with exit or disposal activities. We expect to record up to $100 million of additional costs associated with these activities, primarily during fiscal 2022. These costs are recorded in restructuring and employee severance in our consolidated statements of earnings/(loss). We expect these charges to consist of approximately $83 million of professional, project management and other service fees to support the divestiture; $19 million of employee-related costs; and additional expenses from facility exits and other restructuring activities.

We expect the divestiture of the Cordis business will decrease annual Medical segment revenue by approximately $800 million and adversely impact Medical segment profit by approximately $80 million. The divestiture of our Cordis business is subject to risks and uncertainties that may further adversely impact Medical segment profit. For example, the TSA period may be extended beyond our current expectations or could have unintended consequences, and the costs associated with the exit or disposal activities and stranded costs could be greater than anticipated.

The performance of our Pharmaceutical segment generics program adversely impacted the year-over-year comparison of Pharmaceutical segment profit in fiscal 2021 due to volume declines in our generics program, including the impact of COVID-19. The Pharmaceutical segment generics program includes, among other things, the impact of generic pharmaceutical product launches, customer volumes, pricing changes and the Red Oak Sourcing, LLC venture ("Red Oak Sourcing") with CVS Health Corporation ("CVS Health"). In August 2021, we amended our agreement with CVS Health to extend the term of the Red Oak Sourcing agreement through June 2029. The frequency, timing, magnitude and profit impact of generic pharmaceutical customer volumes, pricing changes, customer contract renewals, and branded and generic pharmaceutical manufacturer pricing changes remain uncertain as does their impact on Pharmaceutical segment profit and consolidated operating earnings in fiscal 2022.

Medical Segment

In the fourth quarter of fiscal 2021, our Medical segment experienced increased supply chain costs, primarily related to transportation, labor and commodities. While we are taking actions to mitigate the impact of these and other sourcing cost increases primarily through cost-savings measures, including global manufacturing efficiencies, we expect these increased costs to adversely impact Medical segment profit in fiscal 2022.

| | | | | | | | |

8 | Cardinal Health | Fiscal 2021 Form 10-K | |

| | | | | | | | |

| MD&A | Results of Operations | |

Information Technology Investments

Our Pharmaceutical segment is in a multi-year project to implement a replacement of certain finance and operating systems. Within the Medical segment, Cardinal Health at-Home Solutions is also investing in a system transformation. We expect that these investments will result in increased project-related expenses and depreciation related to capital expenditures, which will negatively impact operating earnings and segment profit in fiscal 2022 and beyond.

| | | | | | | | |

| Cardinal Health | Fiscal 2021 Form 10-K | 9 |

| | | | | | | | |

| MD&A | Results of Operations | |

Results of Operations

Revenue

| | | | | | | | | | | | | | | | | |

| Revenue | |

| (in millions) | 2021 | | 2020 | | Change |

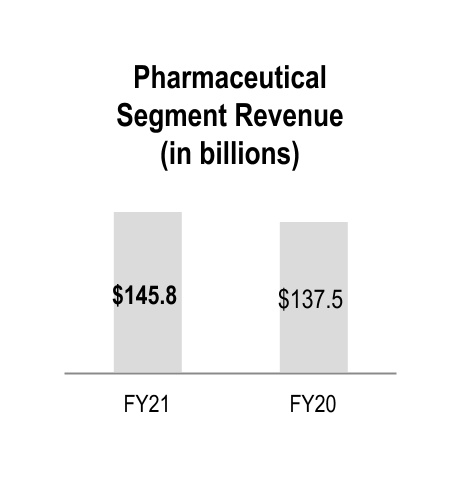

| Pharmaceutical | $ | 145,796 | | | $ | 137,495 | | | 6 | % |

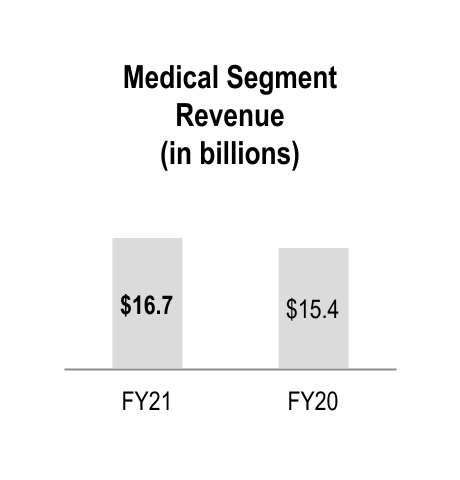

| Medical | 16,687 | | | 15,444 | | | 8 | % |

| Total segment revenue | 162,483 | | | 152,939 | | | 6 | % |

| Corporate | (16) | | | (17) | | | N.M. |

| Total revenue | $ | 162,467 | | | $ | 152,922 | | | 6 | % |

Fiscal 2021 Compared to Fiscal 2020

Pharmaceutical Segment

Fiscal 2021 Pharmaceutical segment revenue grew by $8.3 billion primarily due to sales growth from pharmaceutical distribution and specialty solutions customers, which together increased revenue by $8.1 billion.

Medical Segment

Fiscal 2021 Medical segment revenue increased primarily within products and distribution, which increased revenue by $1.1 billion, primarily due to a net benefit from COVID-19, including the positive impact of PPE and higher volumes in our laboratory business.

Cost of Products Sold

Cost of products sold for fiscal 2021 increased $9.6 billion (7 percent) due to the factors affecting the changes in revenue and gross margin.

| | | | | | | | |

10 | Cardinal Health | Fiscal 2021 Form 10-K | |

| | | | | | | | |

| MD&A | Results of Operations | |

| | | | | | | | | | | | | | | | | |

| Consolidated Gross Margin | | |

| (in millions) | 2021 | | 2020 | | Change |

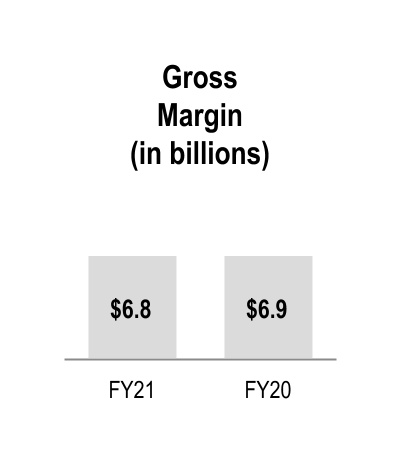

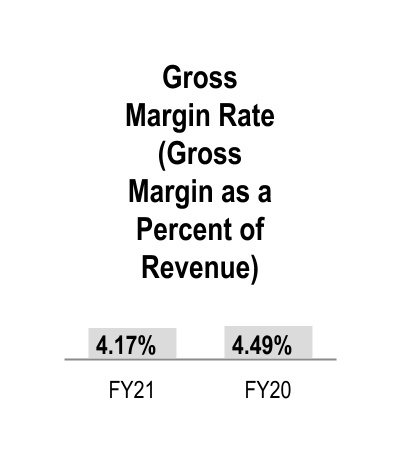

| Gross margin | $ | 6,778 | | | $ | 6,868 | | | (1) | % |

Fiscal 2021 Compared to Fiscal 2020

Fiscal 2021 consolidated gross margin decreased primarily due to the adverse impact of COVID-19, which includes an inventory reserve recorded to reduce the carrying value of certain Medical segment PPE, primarily certain categories of gloves, to net realizable value, partially offset by higher volumes in our laboratory business. For additional information regarding inventory reserves, see Significant Developments in Fiscal 2021 and Trends section in this MD&A. Volume declines in our Pharmaceutical segment generics program, which includes the impact of COVID-19, also had an adverse impact. These factors were partially offset by higher contribution from branded pharmaceutical sales mix and the beneficial comparison of the current year insurance recoveries with the prior-year charge in connection with a voluntary recall for certain surgical gowns and a voluntary recall and field actions for surgical procedure packs containing affected gowns (together, the "Recalls").

Gross margin rate declined during fiscal 2021 mainly due to changes in pharmaceutical distribution product sales mix and an inventory reserve recorded to reduce the carrying value of certain Medical segment PPE to net realizable value. While branded pharmaceutical sales contributed positively to gross margin dollars during fiscal 2021, they had a dilutive impact on our overall gross margin rate.

| | | | | | | | |

| Cardinal Health | Fiscal 2021 Form 10-K | 11 |

| | | | | | | | |

| MD&A | Results of Operations | |

Distribution, Selling, General and Administrative ("SG&A") Expenses

| | | | | | | | | | | | | | | | | |

| SG&A Expenses | |

| (in millions) | 2021 | | 2020 | | Change |

| SG&A expenses | $ | 4,533 | | | $ | 4,572 | | | (1) | % |

Fiscal 2021 Compared to Fiscal 2020

Fiscal 2021 SG&A expenses decreased primarily due to the beneficial impact of enterprise-wide cost-savings measures. The year-over-year comparison was also favorably impacted by the $37 million charge in connection with the Recalls recognized during fiscal 2020. These factors were partially offset by information technology investments and the $41 million assessment on prescription opioid medications that were sold or distributed in New York state in calendar years 2017 and 2018. See Note 7 of the "Notes to Consolidated Financial Statements" for additional information on the New York Opioid Stewardship Act.

| | | | | | | | |

12 | Cardinal Health | Fiscal 2021 Form 10-K | |

| | | | | | | | |

| MD&A | Results of Operations | |

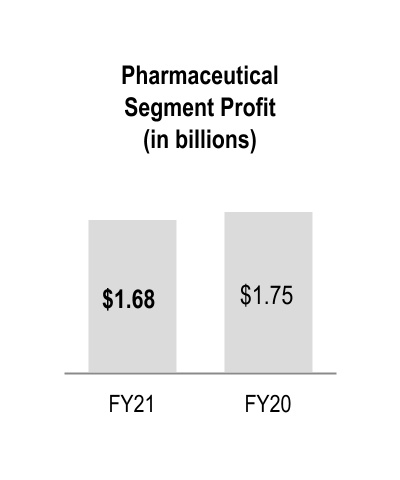

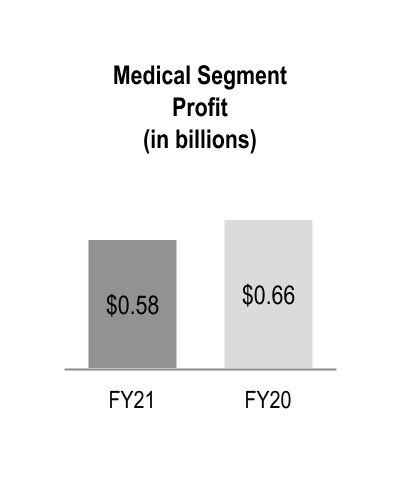

We evaluate segment performance based on segment profit, among other measures. See Note 13 of the "Notes to Consolidated Financial Statements" for additional information on segment profit. | | | | | | | | | | | | | | | | | |

| Segment Profit and Operating Earnings | |

| (in millions) | 2021 | | 2020 | | Change |

| Pharmaceutical | $ | 1,684 | | | $ | 1,753 | | | (4) | % |

| Medical | 577 | | | 663 | | | (13) | % |

| Total segment profit | 2,261 | | | 2,416 | | | (6) | % |

| Corporate | (1,789) | | | (6,514) | | | N.M. |

| Total consolidated operating earnings/(loss) | $ | 472 | | | $ | (4,098) | | | N.M. |

Fiscal 2021 Compared to Fiscal 2020

Pharmaceutical Segment Profit

Fiscal 2021 Pharmaceutical segment profit was adversely impacted due to volume declines in our generics program, including the impact of COVID-19, partially offset by higher contribution from branded pharmaceutical sales mix.

Pharmaceutical segment financial results do not include the $1.17 billion and $5.63 billion charges associated with the opioid litigation during fiscal 2021 and 2020, respectively. See Significant Developments in Fiscal 2021 and Trends section in this MD&A and Note 7 of the "Notes to Consolidated Financial Statements" for additional information. In addition, Pharmaceutical segment financial results do not include the $41 million assessment on prescription opioid medications that were sold or distributed in New York state in calendar years 2017 and 2018. See Note 7 of the "Notes to Consolidated Financial Statements" for additional information on the New York Opioid Stewardship Act. Medical Segment Profit

Fiscal 2021 Medical segment profit decreased largely due to the adverse impact of COVID-19, which primarily includes an inventory reserve recorded to reduce the carrying value of certain PPE, primarily certain categories of gloves, to net realizable value, partially offset by higher volumes in our laboratory business. In addition, enterprise-wide cost-savings measures, including global manufacturing efficiencies, had a positive impact on Medical segment profit.

Corporate

The changes in Corporate during fiscal 2021 are due to the factors discussed in the Other Components of Consolidated Operating Earnings/(Loss) section that follows.

| | | | | | | | |

| Cardinal Health | Fiscal 2021 Form 10-K | 13 |

| | | | | | | | |

| MD&A | Results of Operations | |

Other Components of Consolidated Operating Earnings/(Loss)

In addition to revenue, gross margin, and SG&A expenses discussed previously, consolidated operating earnings/(loss) were impacted by the following:

| | | | | | | | | | | |

| (in millions) | 2021 | | 2020 |

| Restructuring and employee severance | $ | 114 | | | $ | 122 | |

| Amortization and other acquisition-related costs | 451 | | | 524 | |

| Impairments and (gain)/loss on disposal of assets, net | 79 | | | 7 | |

| Litigation (recoveries)/charges, net | 1,129 | | | 5,741 | |

Restructuring and Employee Severance

In fiscal 2021, restructuring costs were primarily related to the implementation of certain enterprise-wide cost-savings measures and the divestiture of our Cordis business. In fiscal 2020, restructuring costs were primarily related to the implementation of certain enterprise-wide cost-savings measures.

Amortization and Other Acquisition-Related Costs

Amortization of acquisition-related intangible assets was $428 million and $512 million for fiscal 2021 and 2020, respectively.

Impairments and (Gain)/Loss on Disposal of Assets, Net

During fiscal 2021, we recognized a $60 million pre-tax write-down of the assets held for sale from the divestiture of our Cordis business. See the Significant Developments in Fiscal 2021 and Trends section in this MD&A and Note 2 of the "Notes to Consolidated Financial Statements" for additional information. Litigation (Recoveries)/Charges, Net

During fiscal 2021 and 2020, we recognized pre-tax charges of $1.17 billion and $5.63 billion, respectively, associated with certain opioid matters. See Significant Developments in Fiscal 2021 and Trends section in this MD&A and Note 7 of the "Notes to Consolidated Financial Statements" for additional information. During fiscal 2021 and 2020, we recognized $56 million and $103 million, respectively, of estimated losses and legal defense costs associated with the IVC filter product liability claims.

During fiscal 2021 and 2020, we recognized income of $112 million and $16 million, respectively, for recoveries in class action antitrust lawsuits in which we were a class member.

Other Components of Earnings/(Loss) Before Income Taxes

In addition to the items discussed above, earnings/(loss) before income taxes was impacted by the following:

| | | | | | | | | | | | | | | | | |

| | |

| (in millions) | 2021 | | 2020 | | Change |

| Other (income)/expense, net | $ | (47) | | | $ | (1) | | | N.M. |

| Interest expense, net | 180 | | | 238 | | | (24) | % |

| Loss on early extinguishment of debt | 14 | | | 16 | | | N.M. |

| (Gain)/Loss on sale of equity interest in naviHealth | 2 | | | (579) | | | N.M. |

Other (Income)/Expense, Net

During fiscal 2021, other (income)/expense, net was favorable compared to the prior-year period primarily due to an increase in the value of our deferred compensation plan investments, which offsets fluctuations included within SG&A expenses and is discussed further in Note 9 of the "Notes to Consolidated Financial Statements," gains on investments in non-marketable equity securities, and fluctuations in foreign exchange rates. Interest Expense, Net

Fiscal 2021 interest expense decreased from fiscal 2020 primarily due to lower debt outstanding and lower short-term interest rates.

Loss On Early Extinguishment Of Debt

During fiscal 2021 and 2020, we recognized losses of $14 million and $16 million, respectively, in connection with the redemption and early debt repurchases as described further in Note 6 of the "Notes to Consolidated Financial Statements." (Gain)/Loss on Sale of Equity Interest in naviHealth

During fiscal 2020, we recognized a pre-tax gain of $579 million from the sale of our equity interest in a partnership that owned naviHealth, as described further in Note 2 of the "Notes to Consolidated Financial Statements." | | | | | | | | |

14 | Cardinal Health | Fiscal 2021 Form 10-K | |

| | | | | | | | |

| MD&A | Results of Operations | |

Provision for Income Taxes

Fluctuations in the effective tax rates are primarily due to the impact of opioid litigation in fiscal 2021 and 2020, as well as the impact of the carryback claim filed in accordance with the CARES Act provision in fiscal year 2021.

A reconciliation of the provision based on the federal statutory income tax rate to our effective income tax rate from continuing operations is as follows (see Note 8 of the "Notes to Consolidated Financial Statements" for additional information): | | | | | | | | | | | |

| | 2021 (1) | | 2020 (1) |

| Provision at Federal statutory rate | 21.0 | % | | 21.0 | % |

| State and local income taxes, net of federal benefit | 3.2 | | | 2.5 | |

| Tax effect of foreign operations | 0.7 | | | — | |

Nondeductible/nontaxable items (2) | 1.6 | | | 0.2 | |

| | | |

| Cordis Disposition | 7.0 | | | — | |

Withholding Taxes (2) | 9.0 | | | (0.3) | |

| Change in Valuation Allowances | (1.4) | | | 1.5 | |

US Taxes on International Income (2)(3) | (6.7) | | | 0.2 | |

Impact of Resolutions with IRS and other related matters (2) | (13.6) | | | (0.4) | |

| | | |

| | | |

| | | |

| Opioid litigation | 17.7 | | | (23.2) | |

| Loss Carryback Claims | (129.9) | | | — | |

Other (2) | 1.7 | | | 0.6 | |

| Effective income tax rate | (89.7) | % | | 2.1 | % |

(1) The table represents the following: fiscal 2021 is pretax income with tax benefit and fiscal 2020 is pretax loss with tax benefit.

(2) Certain prior year amounts have been reclassified to conform to current year presentation.