QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |||||

, | , | |||||

(Address of principal executive offices) | (Zip Code) | |||||

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

☑ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☐ | Smaller reporting company | |||

Emerging growth company | |||||

Cardinal Health Q1 Fiscal 2020 Form 10-Q |

Page | |

1 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

MD&A | Overview | |

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 2 | |

MD&A | Overview | |

Three Months Ended September 30, | ||||||||||

(in millions) | 2019 | 2018 | Change | |||||||

GAAP | $ | (5,264 | ) | $ | 816 | N.M. | ||||

State opioid assessment related to prior fiscal years | 5 | 29 | ||||||||

Restructuring and employee severance | 30 | 32 | ||||||||

Amortization and other acquisition-related costs | 132 | 156 | ||||||||

Impairments and (gain)/loss on disposal of assets | 1 | (511 | ) | |||||||

Litigation (recoveries)/charges, net | 5,673 | 19 | ||||||||

Non-GAAP | $ | 577 | $ | 542 | 6 | % | ||||

3 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

MD&A | Overview | |

Three Months Ended September 30, | ||||||||||

($ per share) | 2019 (1) (2) (3) | 2018 (1) (2) | Change | |||||||

GAAP | $ | (16.65 | ) | $ | 1.94 | N.M. | ||||

State opioid assessment related to prior fiscal years | 0.01 | 0.07 | ||||||||

Restructuring and employee severance | 0.08 | 0.08 | ||||||||

Amortization and other acquisition-related costs | 0.33 | 0.39 | ||||||||

Impairments and (gain)/loss on disposal of assets | — | (1.23 | ) | |||||||

Litigation (recoveries)/charges, net | 17.51 | 0.05 | ||||||||

Non-GAAP | $ | 1.27 | $ | 1.29 | (2 | )% | ||||

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 4 | |

MD&A | Overview | |

5 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

MD&A | Results of Operations | |

Three Months Ended September 30, | ||||||||||

(in millions) | 2019 | 2018 | Change | |||||||

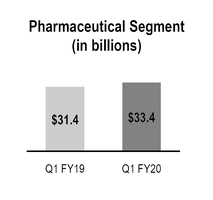

Pharmaceutical | $ | 33,428 | $ | 31,416 | 6 | % | ||||

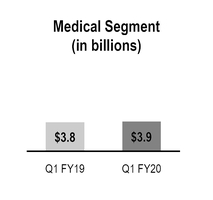

Medical | 3,917 | 3,801 | 3 | % | ||||||

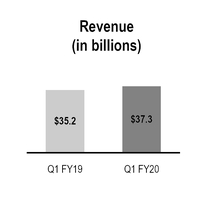

Total segment revenue | 37,345 | 35,217 | 6 | % | ||||||

Corporate | (4 | ) | (4 | ) | N.M. | |||||

Total revenue | $ | 37,341 | $ | 35,213 | 6 | % | ||||

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 6 | |

MD&A | Results of Operations | |

Three Months Ended September 30, | ||||||||||

(in millions) | 2019 | 2018 | Change | |||||||

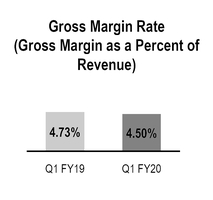

Gross margin | $ | 1,679 | $ | 1,667 | 1 | % | ||||

Three Months Ended September 30, | ||||||||||

(in millions) | 2019 | 2018 | Change | |||||||

SG&A expenses | $ | 1,107 | $ | 1,155 | (4 | )% | ||||

7 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

MD&A | Results of Operations | |

Three Months Ended September 30, | ||||||||||

(in millions) | 2019 | 2018 | Change | |||||||

Pharmaceutical | $ | 398 | $ | 409 | (3 | )% | ||||

Medical | 170 | 135 | 26 | % | ||||||

Total segment profit | 568 | 544 | 4 | % | ||||||

Corporate | (5,832 | ) | 272 | N.M | ||||||

Total consolidated operating earnings/(loss) | $ | (5,264 | ) | $ | 816 | N.M | ||||

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 8 | |

MD&A | Results of Operations | |

Three Months Ended September 30, | |||||||

(in millions) | 2019 | 2018 | |||||

Restructuring and employee severance | $ | 30 | $ | 32 | |||

Amortization and other acquisition-related costs | 132 | 156 | |||||

Impairments and (gain)/loss on disposal of assets, net | 1 | (511 | ) | ||||

Litigation (recoveries)/charges, net | 5,673 | 19 | |||||

Three Months Ended September 30, | ||||||||||

(in millions) | 2019 | 2018 | Change | |||||||

Other (income)/expense, net | $ | 14 | $ | 3 | N.M. | |||||

Interest expense, net | 66 | 77 | (14 | )% | ||||||

9 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

MD&A | Liquidity and Capital Resources | |

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 10 | |

MD&A | Liquidity and Capital Resources | |

11 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

MD&A | Other Items | |

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 12 | |

MD&A | Other Items | |

13 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

Explanation and Reconciliation of Non-GAAP Financial Measures | ||

• | LIFO charges and credits are excluded because the factors that drive last-in first-out ("LIFO") inventory charges or credits, such as pharmaceutical manufacturer price appreciation or deflation and year-end inventory levels (which can be meaningfully influenced by customer buying behavior immediately preceding our fiscal year-end), are largely out of our control and cannot be accurately predicted. The exclusion of LIFO charges and credits from non-GAAP metrics facilitates comparison of our current financial results to our historical financial results and to our peer group companies’ financial results. |

• | State opioid assessments related to prior fiscal years is the portion of state assessments for prescription opioid medications that were sold or distributed in periods prior to the fiscal year of the initial assessment. This portion is excluded from non-GAAP financial measures because it is retrospectively applied to sales in prior fiscal years and inclusion would obscure analysis of the current fiscal year results of our underlying, ongoing business. Additionally, while states' laws may require us to make payments on an ongoing basis, the portion of the assessment related to sales in prior periods are contemplated to be one-time, nonrecurring items. Reversals of these accruals have occurred when certain assessments were declared unconstitutional. |

• | Restructuring and employee severance costs are excluded because they are not part of the ongoing operations of our underlying business. |

• | Amortization and other acquisition-related costs, which include transaction costs, integration costs, and changes in the fair value of contingent consideration obligations, are excluded because they are not part of the ongoing operations of our underlying business and to facilitate comparison of our current financial results to our historical financial results and to our peer group companies' financial results. Additionally, costs for amortization of acquisition-related intangible assets are non-cash amounts, which are variable in amount and frequency and are significantly impacted by the timing and size of acquisitions, so their exclusion facilitates comparison of historical, current and forecasted financial results. We also exclude other acquisition-related costs, which are directly related to an acquisition but do not meet the criteria to be recognized on the acquired entity’s initial balance sheet as part of the purchase price allocation. These costs are also significantly impacted by the timing, complexity and size of acquisitions. |

• | Impairments and gain or loss on disposal of assets are excluded because they do not occur in or reflect the ordinary course of our ongoing business operations and are inherently unpredictable in timing and amount, and in the case of impairments, are non-cash amounts, so their exclusion facilitates comparison of historical, current and forecasted financial results. |

• | Litigation recoveries or charges, net are excluded because they often relate to events that may have occurred in prior or multiple periods, do not occur in or reflect the ordinary course of our business and are inherently unpredictable in timing and amount. |

• | Loss on extinguishment of debt is excluded because it does not typically occur in the normal course of business and may obscure analysis of trends and financial performance. Additionally, the amount and frequency of this type of charge is not consistent and is significantly impacted by the timing and size of debt extinguishment transactions. |

• | Transitional tax benefit, net related to the Tax Cuts and Jobs Act is excluded because it results from the one-time impact of a very significant change in the U.S. federal corporate tax rate and, due to the significant size of the benefit, obscures analysis of trends and financial performance. The transitional tax benefit includes the initial estimate and subsequent adjustments for the re- |

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 14 | |

Explanation and Reconciliation of Non-GAAP Financial Measures | ||

15 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

Explanation and Reconciliation of Non-GAAP Financial Measures | ||

(in millions, except per common share amounts) | SG&A1 | SG&A1 Growth Rate | Operating Earnings/(Loss) | Operating Earnings Growth Rate | Earnings/(Loss) Before Income Taxes | Provision for/ (Benefit from) Income Taxes | Net Earnings/(Loss)2 | Net Earnings2 Growth Rate | Diluted EPS2,3 | Diluted EPS2 Growth Rate | ||||||||||||||||

Three Months Ended September 30, 2019 | ||||||||||||||||||||||||||

GAAP | $ | 1,107 | (4 | )% | $ | (5,264 | ) | N.M. | $ | (5,344 | ) | $ | (423 | ) | $ | (4,922 | ) | N.M. | $ | (16.65 | ) | N.M. | ||||

State opioid assessment related to prior fiscal years | (5 | ) | 5 | 5 | 1 | 4 | 0.01 | |||||||||||||||||||

Restructuring and employee severance | — | 30 | 30 | 8 | 22 | 0.08 | ||||||||||||||||||||

Amortization and other acquisition-related costs | — | 132 | 132 | 34 | 98 | 0.33 | ||||||||||||||||||||

Impairments and (gain)/loss on disposal of assets | — | 1 | 1 | — | 1 | — | ||||||||||||||||||||

Litigation (recoveries)/charges, net 4 | — | 5,673 | 5,673 | 498 | 5,175 | 17.51 | ||||||||||||||||||||

Non-GAAP | $ | 1,102 | (2 | )% | $ | 577 | 6 | % | $ | 496 | $ | 117 | $ | 378 | (4 | )% | $ | 1.27 | (2 | )% | ||||||

Three Months Ended September 30, 2018 | ||||||||||||||||||||||||||

GAAP | $ | 1,155 | 9 | % | $ | 816 | 211 | % | $ | 736 | $ | 142 | $ | 593 | 416 | % | $ | 1.94 | 439 | % | ||||||

State opioid assessment related to prior fiscal years | (29 | ) | 29 | 29 | 8 | 21 | 0.07 | |||||||||||||||||||

Restructuring and employee severance | — | 32 | 32 | 8 | 24 | 0.08 | ||||||||||||||||||||

Amortization and other acquisition-related costs | — | 156 | 156 | 36 | 120 | 0.39 | ||||||||||||||||||||

Impairments and (gain)/loss on disposal of assets | — | (511 | ) | (511 | ) | (134 | ) | (377 | ) | (1.23 | ) | |||||||||||||||

Litigation (recoveries)/charges, net | — | 19 | 19 | 5 | 14 | 0.05 | ||||||||||||||||||||

Non-GAAP | $ | 1,126 | 6 | % | $ | 542 | (11 | )% | $ | 461 | $ | 65 | $ | 396 | 14 | % | $ | 1.29 | 18 | % | ||||||

1 | Distribution, selling, general and administrative expenses. |

2 | Attributable to Cardinal Health, Inc. |

3 | First quarter fiscal 2020 GAAP diluted loss per share attributable to Cardinal Health, Inc. ("GAAP diluted EPS") and the EPS impact from the GAAP to non-GAAP per share reconciling items are calculated using a weighted average of 296 million common shares, which excludes potentially dilutive securities from the denominator due to their anti-dilutive effects resulting from our GAAP net loss for the quarter. First quarter fiscal 2020 non-GAAP diluted EPS is calculated using a weighted average of 297 million common shares, which includes potentially dilutive shares. |

4 | Litigation (recoveries)/charges, net includes a pre-tax charge of $5.63 billion ($5.14 billion after tax) recorded in the first quarter of fiscal 2020 related to the opioid litigation. |

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 16 | |

Other | |

17 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

Other | |

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 18 | |

Other | |

Period | Total Number of Shares Purchased (1) | Average Price Paid per Share (2) | Total Number of Shares Purchased as Part of Publicly Announced Programs (2, 3) | Approximate Dollar Value of Shares That May Yet be Purchased Under the Program (3) (in millions) | |||||||||

July 2019 | 1,203 | $ | 47.26 | — | $ | 1,293 | |||||||

August 2019 | 6,400,332 | 43.76 | 6,398,537 | 1,013 | |||||||||

September 2019 | 285 | 47.36 | — | 1,013 | |||||||||

Total | 6,401,820 | $ | 43.76 | 6,398,537 | $ | 1,013 | |||||||

(1) | Reflects 1,203, 1,795 and 285 common shares purchased in July, August and September 2019, respectively, through a rabbi trust as investments of participants in our Deferred Compensation Plan. |

(2) | On August 20, 2019, we entered into an accelerated share repurchase ("ASR") program to purchase common shares for an aggregate purchase price of $350 million and received an initial delivery of 6.4 million common shares using a reference price of $43.76. The program is expected to conclude in the second quarter of fiscal 2020. See Note 11 of the "Notes to Condensed Consolidated Financial Statements" for additional information. |

(3) | On February 7, 2018, our Board of Directors approved a $1.0 billion share repurchase program that expires on December 31, 2020. On November 7, 2018, our Board of Directors approved a new $1.0 billion share repurchase program that expires on December 31, 2021. As of September 30, 2019, we have $1.0 billion authorized for share repurchases remaining under these programs. The approximate dollar value of shares that may yet be purchased under these programs has been reduced by the initial delivery of 6.4 million shares under the ASR program. |

19 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

Financial Statements | ||

Three Months Ended September 30, | |||||||

(in millions, except per common share amounts) | 2019 | 2018 | |||||

Revenue | $ | $ | |||||

Cost of products sold | |||||||

Gross margin | |||||||

Operating expenses: | |||||||

Distribution, selling, general and administrative expenses | |||||||

Restructuring and employee severance | |||||||

Amortization and other acquisition-related costs | |||||||

Impairments and (gain)/loss on disposal of assets, net | ( | ) | |||||

Litigation (recoveries)/charges, net | |||||||

Operating earnings/(loss) | ( | ) | |||||

Other (income)/expense, net | |||||||

Interest expense, net | |||||||

Earnings/(loss) before income taxes | ( | ) | |||||

Provision for (benefit from) income taxes | ( | ) | |||||

Net earnings/(loss) | ( | ) | |||||

Less: Net earnings attributable to noncontrolling interests | ( | ) | ( | ) | |||

Net earnings/(loss) attributable to Cardinal Health, Inc. | $ | ( | ) | $ | |||

Earnings/(loss) per common share attributable to Cardinal Health, Inc.: | |||||||

Basic | $ | ( | ) | $ | |||

Diluted | ( | ) | |||||

Weighted-average number of common shares outstanding: | |||||||

Basic | |||||||

Diluted | |||||||

Cash dividends declared per common share | $ | $ | |||||

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 20 | |

Financial Statements | ||

Three Months Ended September 30, | |||||||

(in millions) | 2019 | 2018 | |||||

Net earnings/(loss) | $ | ( | ) | $ | |||

Other comprehensive income/(loss): | |||||||

Foreign currency translation adjustments and other | ( | ) | ( | ) | |||

Net unrealized gain/(loss) on derivative instruments, net of tax | ( | ) | ( | ) | |||

Total other comprehensive income/(loss), net of tax | ( | ) | ( | ) | |||

Total comprehensive income/(loss) | ( | ) | |||||

Less: comprehensive income attributable to noncontrolling interests | ( | ) | ( | ) | |||

Total comprehensive income/(loss) attributable to Cardinal Health, Inc. | $ | ( | ) | $ | |||

21 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

Financial Statements | ||

(in millions) | September 30, 2019 | June 30, 2019 | |||||

Assets | |||||||

Current assets: | |||||||

Cash and equivalents | $ | $ | |||||

Trade receivables, net | |||||||

Inventories, net | |||||||

Prepaid expenses and other | |||||||

Total current assets | |||||||

Property and equipment, net | |||||||

Goodwill and other intangibles, net | |||||||

Other assets | |||||||

Total assets | $ | $ | |||||

Liabilities and Shareholders’ Equity | |||||||

Current liabilities: | |||||||

Accounts payable | $ | $ | |||||

Current portion of long-term obligations and other short-term borrowings | |||||||

Other accrued liabilities | |||||||

Total current liabilities | |||||||

Long-term obligations, less current portion | |||||||

Deferred income taxes and other liabilities | |||||||

Shareholders’ equity: | |||||||

Preferred shares, without par value: | |||||||

Authorized—500 thousand shares, Issued—none | |||||||

Common shares, without par value: | |||||||

Authorized—755 million shares, Issued—327 million shares at September 30, 2019 and June 30, 2019, respectively | |||||||

Retained earnings | |||||||

Common shares in treasury, at cost: 34 million shares and 28 million shares at September 30, 2019 and June 30, 2019, respectively | ( | ) | ( | ) | |||

Accumulated other comprehensive loss | ( | ) | ( | ) | |||

Total Cardinal Health, Inc. shareholders' equity | |||||||

Noncontrolling interests | |||||||

Total shareholders’ equity | |||||||

Total liabilities and shareholders’ equity | $ | $ | |||||

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 22 | |

Financial Statements | ||

Common Shares | Treasury Shares | Accumulated Other Comprehensive Loss | Noncontrolling Interests | Total Shareholders’ Equity | |||||||||||||||||||||||||

(in millions) | Shares Issued | Amount | Retained Earnings/(Deficit) | Shares | Amount | ||||||||||||||||||||||||

Three Months Ended September 30, 2019 | |||||||||||||||||||||||||||||

Balance at June 30, 2019 | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | $ | |||||||||||||||||

Net loss | ( | ) | ( | ) | |||||||||||||||||||||||||

Other comprehensive income/(loss), net of tax | ( | ) | ( | ) | |||||||||||||||||||||||||

Employee stock plans activity, net of shares withheld for employee taxes | ( | ) | |||||||||||||||||||||||||||

Share repurchase program activity | ( | ) | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||

Dividends declared | ( | ) | ( | ) | |||||||||||||||||||||||||

Balance at September 30, 2019 | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | $ | |||||||||||||||||

Three Months Ended September 30, 2018 | |||||||||||||||||||||||||||||

Balance at June 30, 2018 | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | $ | |||||||||||||||||

Net earnings | |||||||||||||||||||||||||||||

Other comprehensive income/(loss), net of tax | ( | ) | ( | ) | |||||||||||||||||||||||||

Employee stock plans activity, net of shares withheld for employee taxes | ( | ) | |||||||||||||||||||||||||||

Share repurchase program activity | ( | ) | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||

Dividends declared | ( | ) | ( | ) | |||||||||||||||||||||||||

Other | |||||||||||||||||||||||||||||

Balance at September 30, 2018 | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | $ | |||||||||||||||||

23 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

Financial Statements | ||

Three Months Ended September 30, | |||||||

(in millions) | 2019 | 2018 | |||||

Cash flows from operating activities: | |||||||

Net earnings/(loss) | $ | ( | ) | $ | |||

Adjustments to reconcile net earnings/(loss) to net cash provided by/(used in) operating activities: | |||||||

Depreciation and amortization | |||||||

Impairments and (gain)/loss on sale of investments | |||||||

Impairments and (gain)/loss on disposal of assets, net | ( | ) | |||||

Share-based compensation | |||||||

Provision for bad debts | |||||||

Change in operating assets and liabilities, net of effects from acquisitions and divestitures: | |||||||

(Increase)/decrease in trade receivables | ( | ) | |||||

(Increase)/decrease in inventories | ( | ) | |||||

Increase/(decrease) in accounts payable | ( | ) | |||||

Other accrued liabilities and operating items, net | ( | ) | |||||

Net cash provided by/(used in) operating activities | ( | ) | |||||

Cash flows from investing activities: | |||||||

Additions to property and equipment | ( | ) | ( | ) | |||

Purchase of available-for-sale securities and other investments | ( | ) | ( | ) | |||

Proceeds from sale of available-for-sale securities and other investments | |||||||

Proceeds from divestitures, net of cash sold, and disposal of property and equipment | |||||||

Net cash provided by/(used in) investing activities | ( | ) | |||||

Cash flows from financing activities: | |||||||

Net change in short-term borrowings | ( | ) | |||||

Reduction of long-term obligations | ( | ) | ( | ) | |||

Net tax proceeds/(withholdings) from share-based compensation | ( | ) | ( | ) | |||

Dividends on common shares | ( | ) | ( | ) | |||

Purchase of treasury shares | ( | ) | ( | ) | |||

Net cash used in financing activities | ( | ) | ( | ) | |||

Effect of exchange rate changes on cash and equivalents | ( | ) | |||||

Net increase/(decrease) in cash and equivalents | ( | ) | |||||

Cash and equivalents at beginning of period | |||||||

Cash and equivalents at end of period | $ | $ | |||||

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 24 | |

Notes to Financial Statements | ||

25 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

Notes to Financial Statements | ||

Three months ended September 30, | |||||||

(in millions) | 2019 | 2018 | |||||

Employee-related costs (1) | $ | $ | |||||

Facility exit and other costs (2) | |||||||

Total restructuring and employee severance | $ | $ | |||||

(1) | Employee-related costs primarily consist of termination benefits provided to employees who have been involuntarily terminated, duplicate payroll costs and retention bonuses incurred during transition periods. |

(2) | Facility exit and other costs primarily consist of product distribution and lease contract termination costs, lease costs associated with vacant facilities, accelerated depreciation, equipment relocation costs, project consulting fees, costs associated with restructuring our delivery of information technology infrastructure services and certain other divestiture-related costs. |

(in millions) | Employee- Related Costs | Facility Exit and Other Costs | Total | ||||||||

Balance at June 30, 2019 | $ | $ | $ | ||||||||

Additions | |||||||||||

Payments and other adjustments | ( | ) | ( | ) | ( | ) | |||||

Balance at September 30, 2019 | $ | $ | $ | ||||||||

(in millions) | Pharmaceutical | Medical | Total | ||||||||

Balance at June 30, 2019 | $ | $ | $ | ||||||||

Goodwill acquired, net of purchase price adjustments | ( | ) | ( | ) | |||||||

Foreign currency translation adjustments and other | ( | ) | ( | ) | |||||||

Balance at September 30, 2019 | $ | $ | $ | ||||||||

September 30, 2019 | |||||||||||||

(in millions) | Gross Intangible | Accumulated Amortization | Net Intangible | Weighted- Average Remaining Amortization Period (Years) | |||||||||

Indefinite-life intangibles: | |||||||||||||

IPR&D, trademarks and other | $ | $ | — | $ | N/A | ||||||||

Total indefinite-life intangibles | — | N/A | |||||||||||

Definite-life intangibles: | |||||||||||||

Customer relationships | |||||||||||||

Trademarks, trade names and patents | |||||||||||||

Developed technology and other | |||||||||||||

Total definite-life intangibles | |||||||||||||

Total other intangible assets | $ | $ | $ | N/A | |||||||||

June 30, 2019 | |||||||||||

(in millions) | Gross Intangible | Accumulated Amortization | Net Intangible | ||||||||

Indefinite-life intangibles: | |||||||||||

IPR&D, trademarks and other | $ | $ | — | $ | |||||||

Total indefinite-life intangibles | — | ||||||||||

Definite-life intangibles: | |||||||||||

Customer relationships | |||||||||||

Trademarks, trade names and patents | |||||||||||

Developed technology and other | |||||||||||

Total definite-life intangibles | |||||||||||

Total other intangible assets | $ | $ | $ | ||||||||

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 26 | |

Notes to Financial Statements | ||

Three Months Ended September 30, | |||

(in millions) | 2019 | ||

Operating lease cost | $ | ||

Finance lease cost | |||

Amortization of right-of-use assets | |||

Total finance lease cost | |||

Variable lease cost | |||

Total lease cost | $ | ||

(in millions) | September 30, 2019 | ||

Operating Leases | |||

Operating lease assets | $ | ||

Current portion of operating lease liabilities | |||

Operating lease liabilities | |||

Total operating lease liabilities | |||

Finance Leases | |||

Property and equipment, net | |||

Current portion of long-term obligations | |||

Long-term obligations, less current portion | |||

Total finance lease liabilities | $ | ||

27 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

Notes to Financial Statements | ||

Three Months Ended September 30, | |||

(in millions) | 2019 | ||

Cash paid for amounts included in the measurement of lease liabilities: | |||

Operating cash flows paid for operating leases | $ | ||

Financing cash flows paid for finance lease | |||

Non-cash right-of-use assets obtained in exchange for lease obligations: | |||

New operating leases | |||

New finance leases | |||

Amended lease standard adoption impact as of July 1, 2019 (1) | |||

(1) | Includes the effect of $ |

(in millions) | Operating Leases | Finance Leases | Total | ||||||||

Years Ending September 30, | |||||||||||

Remainder of 2020 | $ | $ | $ | ||||||||

2021 | |||||||||||

2022 | |||||||||||

2023 | |||||||||||

2024 | |||||||||||

Thereafter | |||||||||||

Total future lease payments | |||||||||||

Less: leases not yet commenced (1) | |||||||||||

Less: imputed interest | |||||||||||

Total lease liabilities | $ | $ | $ | ||||||||

(1) | As of September 30, 2019, we had certain leases that were executed but did not have control of the underlying assets; therefore, the lease liabilities and right-of-use assets are not recorded in the condensed consolidated balance sheets. |

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 28 | |

Notes to Financial Statements | ||

29 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

Notes to Financial Statements | ||

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 30 | |

Notes to Financial Statements | ||

September 30, 2019 | |||||||||||||||

(in millions) | Level 1 | Level 2 | Level 3 | Total | |||||||||||

Assets: | |||||||||||||||

Other investments (1) | $ | $ | $ | $ | |||||||||||

Forward contracts (2) | |||||||||||||||

June 30, 2019 | |||||||||||||||

(in millions) | Level 1 | Level 2 | Level 3 | Total | |||||||||||

Assets: | |||||||||||||||

Other investments (1) | $ | $ | $ | $ | |||||||||||

Forward contracts (2) | |||||||||||||||

(1) | The other investments balance includes investments in mutual funds, which are used to offset fluctuations in deferred compensation liabilities. These mutual funds invest in the equity securities of companies with both large and small market capitalization and high quality fixed income debt securities. The fair value of these investments is determined using quoted market prices. |

31 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

Notes to Financial Statements | ||

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 32 | |

Notes to Financial Statements | ||

(in millions) | September 30, 2019 | June 30, 2019 | |||||

Estimated fair value | $ | $ | |||||

Carrying amount | |||||||

(in millions) | Foreign Currency Translation Adjustments | Unrealized Gain/(Loss) on Derivatives, net of tax | Accumulated Other Comprehensive Loss | ||||||||

Balance at June 30, 2019 | $ | ( | ) | $ | $ | ( | ) | ||||

Other comprehensive income/(loss), before reclassifications | ( | ) | ( | ) | |||||||

Amounts reclassified to earnings | ( | ) | ( | ) | |||||||

Other comprehensive income/(loss), net of tax | ( | ) | ( | ) | ( | ) | |||||

Balance at September 30, 2019 | $ | ( | ) | $ | $ | ( | ) | ||||

Three Months Ended September 30, | |||||

(in millions) | 2019 | 2018 | |||

Weighted-average common shares–basic | |||||

Effect of dilutive securities: | |||||

Employee stock options, restricted share units, and performance share units | |||||

Weighted-average common shares–diluted | |||||

33 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

Notes to Financial Statements | ||

Three Months Ended September 30, | |||||||

(in millions) | 2019 | 2018 | |||||

Pharmaceutical Distribution and Specialty Solutions (1) | $ | $ | |||||

Nuclear and Precision Health Solutions | |||||||

Pharmaceutical segment revenue | |||||||

Medical distribution and products (2) | |||||||

Cardinal Health at-Home Solutions | |||||||

Medical segment revenue | |||||||

Total segment revenue | |||||||

Corporate (3) | ( | ) | ( | ) | |||

Total revenue | $ | $ | |||||

(1) | Products and services offered by our Specialty Solutions division are referred to as “specialty pharmaceutical products and services". |

(2) | Comprised of all Medical segment businesses except for Cardinal Health at-Home Solutions division. |

(3) | Corporate revenue consists of the elimination of inter-segment revenue and other revenue not allocated to the segments. |

Three Months Ended September 30, | |||||||

(in millions) | 2019 | 2018 | |||||

United States | $ | $ | |||||

International | |||||||

Total segment revenue | |||||||

Corporate (1) | ( | ) | ( | ) | |||

Total revenue | $ | $ | |||||

(1) | Corporate revenue consists of the elimination of inter-segment revenue and other revenue not allocated to the segments. |

Three Months Ended September 30, | |||||||

(in millions) | 2019 | 2018 | |||||

Pharmaceutical | $ | $ | |||||

Medical | |||||||

Total segment profit | |||||||

Corporate | ( | ) | |||||

Total operating earnings/(loss) | $ | ( | ) | $ | |||

(in millions) | September 30, 2019 | June 30, 2019 | |||||

Pharmaceutical | $ | $ | |||||

Medical | |||||||

Corporate | |||||||

Total assets | $ | $ | |||||

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 34 | |

Notes to Financial Statements | ||

Three Months Ended September 30, | |||||||

(in millions) | 2019 | 2018 | |||||

Restricted share unit expense | $ | $ | |||||

Employee stock option expense | |||||||

Performance share unit expense | |||||||

Total share-based compensation | $ | $ | |||||

(in millions, except per share amounts) | Restricted Share Units | Weighted-Average Grant Date Fair Value per Share | ||||

Nonvested at June 30, 2019 | $ | |||||

Granted | ||||||

Vested | ( | ) | ||||

Canceled and forfeited | ||||||

Nonvested at September 30, 2019 | $ | |||||

(in millions, except per share amounts) | Stock Options | Weighted-Average Exercise Price per Common Share | ||||

Outstanding at June 30, 2019 | $ | |||||

Granted | ||||||

Exercised | ||||||

Canceled and forfeited | ||||||

Outstanding at September 30, 2019 | $ | |||||

Exercisable at September 30, 2019 | $ | |||||

(in millions) | September 30, 2019 | June 30, 2019 | |||||

Aggregate intrinsic value of outstanding options at period end | $ | $ | |||||

Aggregate intrinsic value of exercisable options at period end | |||||||

(in years) | September 30, 2019 | June 30, 2019 | |

Weighted-average remaining contractual life of outstanding options | |||

Weighted-average remaining contractual life of exercisable options | |||

(in millions, except per share amounts) | Performance Share Units | Weighted-Average Grant Date Fair Value per Share | ||||

Nonvested at June 30, 2019 | $ | |||||

Granted | ||||||

Vested | ( | ) | ||||

Canceled and forfeited | ( | ) | ||||

Nonvested at September 30, 2019 | $ | |||||

35 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

Exhibits | ||

Exhibit Number | Exhibit Description |

3.1 | |

3.2 | |

10.1 | |

10.2 | |

10.3 | |

31.1 | |

31.2 | |

32.1 | |

99.1 | |

101.SCH | Inline XBRL Taxonomy Extension Schema Document |

101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document |

101.DEF | Inline XBRL Taxonomy Definition Linkbase Document |

101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document |

101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document |

104 | Cover Page Interactive Data File - formatted in Inline XBRL (included as Exhibit 101) |

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 36 | |

Form 10-Q Cross Reference Index | ||

Item Number | Page | |

Part I. Financial Information | ||

Item 1 | ||

Item 2 | ||

Item 3 | ||

Item 4 | ||

Part II. Other Information | ||

Item 1 | ||

Item 1A | ||

Item 2 | ||

Item 3 | Defaults Upon Senior Securities | N/A |

Item 4 | Mine Safety Disclosures | N/A |

Item 5 | Other Information | N/A |

Item 6 | ||

N/A | Not applicable | |

37 | Cardinal Health | Q1 Fiscal 2020 Form 10-Q | |

Additional Information | ||

Cardinal Health, Inc. | ||

Date: | November 7, 2019 | /s/ MICHAEL C. KAUFMANN |

Michael C. Kaufmann | ||

Chief Executive Officer | ||

/s/ DAVID C. EVANS | ||

David C. Evans | ||

Chief Financial Officer | ||

Cardinal Health | Q1 Fiscal 2020 Form 10-Q | 38 | |