UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2016

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission File Number: 1-11373

Cardinal Health, Inc.

(Exact name of registrant as specified in its charter)

Ohio | 31-0958666 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

7000 Cardinal Place, Dublin, Ohio | 43017 |

(Address of principal executive offices) | (Zip Code) |

(614) 757-5000 | |

(Registrant’s telephone number, including area code) | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ | Accelerated filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The number of the registrant’s common shares, without par value, outstanding as of April 27, 2016, was the following: 325,815,306.

Cardinal Health Q3 Fiscal 2016 Form 10-Q |

Table of Contents

Page | |

Unregistered Sales of Equity Securities and Use of Proceeds | |

Forward-Looking Statements

This Form 10-Q (including information incorporated by reference) includes "forward-looking statements" addressing expectations, prospects, estimates and other matters that are dependent upon future events or developments. Many forward-looking statements appear in Management’s Discussion and Analysis of Financial Condition and Results of Operations ("MD&A"), but there are others in the document, which may be identified by the words such as "expect," "anticipate," "intend," "plan," "believe," "will," "should," "could," "would," "project," "continue," "likely," and similar expressions, and include statements reflecting future results, trends or guidance, statements of outlook and expense accruals. The matters discussed in these forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from those made, projected or implied in the forward-looking statements. The most significant of these risks, uncertainties and other factors are described in Exhibit 99.1 to this Form 10-Q and in "Risk Factors" of our Annual Report on Form 10-K for the fiscal year ended June 30, 2015 (our “2015 Form 10-K”). Forward-looking statements in this document speak only as of the date of this document. Except to the extent required by applicable law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

About Cardinal Health

Cardinal Health, Inc. is an Ohio corporation formed in 1979. As used in this report, “we,” “our,” “us,” and similar pronouns refer to Cardinal Health, Inc. and its subsidiaries, unless the context requires otherwise. We are a healthcare services and products company that improves the cost-effectiveness of health care. We help pharmacies, hospitals, and other healthcare providers focus on patient care while reducing costs, enhancing efficiency, and improving quality. We also provide medical products to patients in the home. We manage our business and report our financial results in two segments: Pharmaceutical and Medical.

Non-GAAP Financial Measures

We use "non-GAAP financial measures" in the "Overview of Consolidated Results" section of MD&A. These measures are derived from our condensed consolidated financial data but are not presented in our financial statements prepared in accordance with U.S. generally accepted accounting principles ("GAAP"). The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures are included in the “Explanation and Reconciliation of Non-GAAP Financial Measures” section following MD&A. The remaining sections of MD&A refer to GAAP measures only.

1 | Cardinal Health | Q3 Fiscal 2016 Form 10-Q | |

MD&A | Overview | |

Management's Discussion and Analysis of Financial Condition and Results of Operations

The discussion and analysis presented below is concerned with material changes in financial condition and results of operations between the periods specified in our condensed consolidated balance sheets at March 31, 2016 and June 30, 2015, and in our condensed consolidated statements of earnings for the three and nine months ended March 31, 2016 and 2015. All comparisons presented are with respect to the prior-year period, unless stated otherwise. This discussion and analysis should be read in conjunction with MD&A included in our 2015 Form 10-K.

Overview of Consolidated Results

Revenue

Revenue for the three and nine months ended March 31, 2016 was $30.7 billion and $90.2 billion, respectively, a 21 percent and 20 percent increase from the prior-year periods due primarily to sales growth from existing and new pharmaceutical distribution customers and from acquisitions.

Cardinal Health | Q3 Fiscal 2016 Form 10-Q | 2 | |

MD&A | Overview | |

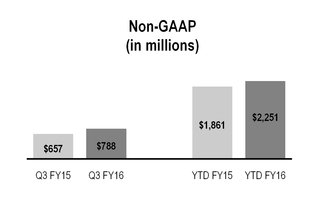

GAAP and Non-GAAP Operating Earnings

GAAP and Non-GAAP Operating Earnings | Three Months Ended March 31 | Nine Months Ended March 31 | |||||||||||||||||||

(in millions) | 2016 | 2015 | Change | 2016 | 2015 | Change | |||||||||||||||

GAAP | $ | 656 | $ | 591 | 11 | % | $ | 1,839 | $ | 1,603 | 15 | % | |||||||||

LIFO charges/(credits) | 12 | — | 51 | — | |||||||||||||||||

Restructuring and employee severance | 6 | 7 | 19 | 33 | |||||||||||||||||

Amortization and other acquisition-related costs | 108 | 77 | 327 | 190 | |||||||||||||||||

Impairments and (gain)/loss on disposal of assets | — | (1 | ) | 17 | (19 | ) | |||||||||||||||

Litigation (recoveries)/charges, net | 5 | (18 | ) | (3 | ) | 54 | |||||||||||||||

Non-GAAP | $ | 788 | $ | 657 | 20 | % | $ | 2,251 | $ | 1,861 | 21 | % | |||||||||

The sum of the components may not equal the total due to rounding.

During the three and nine months ended March 31, 2016, GAAP operating earnings increased 11 percent to $656 million and 15 percent to $1.8 billion, respectively. Non-GAAP operating earnings increased 20 percent to $788 million and 21 percent to $2.3 billion for the three and nine months ended March 31, 2016, respectively. The increases in both GAAP and non-GAAP operating earnings were due to sales growth from existing and new pharmaceutical distribution customers, performance under our Pharmaceutical segment generics program, and acquisitions, offset in part by the adverse impact of customer pricing changes. GAAP operating earnings were negatively impacted by increased acquisition-related amortization and last-in, first-out ("LIFO") charges for both the three and nine month periods ended March 31, 2016, which for the nine month period was offset in part by the change in litigation (recoveries)/charges, net.

3 | Cardinal Health | Q3 Fiscal 2016 Form 10-Q | |

MD&A | Overview | |

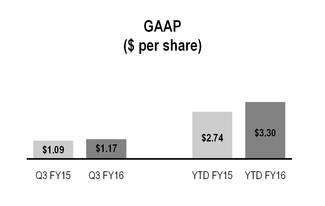

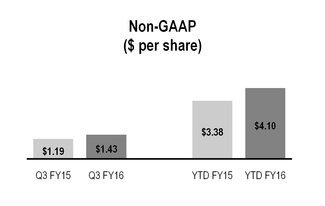

GAAP and Non-GAAP Diluted EPS

GAAP and Non-GAAP Diluted EPS | Three Months Ended March 31 | Nine Months Ended March 31 | |||||||||||||||||||

($ per share) | 2016 | 2015 | Change | 2016 | 2015 | Change | |||||||||||||||

GAAP | $ | 1.17 | $ | 1.09 | 7 | % | $ | 3.30 | $ | 2.74 | 20 | % | |||||||||

LIFO charges/(credits) | 0.02 | — | 0.10 | — | |||||||||||||||||

Restructuring and employee severance | 0.01 | 0.01 | 0.04 | 0.06 | |||||||||||||||||

Amortization and other acquisition-related costs | 0.21 | 0.15 | 0.64 | 0.36 | |||||||||||||||||

Impairments and (gain)/loss on disposal of assets | — | — | 0.03 | (0.03 | ) | ||||||||||||||||

Litigation (recoveries)/charges, net | 0.01 | (0.07 | ) | — | 0.14 | ||||||||||||||||

Loss on extinguishment of debt | — | — | — | 0.11 | |||||||||||||||||

Non-GAAP | $ | 1.43 | $ | 1.19 | 20 | % | $ | 4.10 | $ | 3.38 | 21 | % | |||||||||

The sum of the components may not equal the total due to rounding.

During the three and nine months ended March 31, 2016, GAAP diluted earnings per share attributable to Cardinal Health, Inc. ("diluted EPS") increased 7 percent to $1.17 and 20 percent to $3.30, respectively. Non-GAAP diluted EPS increased 20 percent to $1.43 and 21 percent to $4.10 during the three and nine months ended March 31, 2016, respectively. GAAP and non-GAAP diluted EPS increased primarily due to the factors impacting GAAP and non-GAAP operating earnings. The increase in GAAP diluted EPS during the nine months ended March 31, 2016 was also due in part to the prior-year loss on extinguishment of debt.

Cash and Equivalents

Our cash and equivalents balance was $2.6 billion at March 31, 2016 compared to $4.6 billion at June 30, 2015. The decrease in cash and equivalents during the nine months ended March 31, 2016 was driven by $3.4 billion deployed for acquisitions, $386 million paid in dividends, $300 million paid for share repurchases, and $284 million in capital expenditures, offset in part by cash provided by operating activities of $2.3 billion.

4 | Cardinal Health | Q3 Fiscal 2016 Form 10-Q | |

MD&A | Overview | |

Significant Developments

Cordis

On October 2, 2015, we completed the acquisition of the Cordis business ("Cordis") from Ethicon, Inc., a wholly-owned subsidiary of Johnson & Johnson, for $1.9 billion using cash on hand and proceeds from our debt offering in June 2015. The acquisition of Cordis, a global manufacturer and distributor of interventional cardiology devices and endovascular solutions with operations in more than 50 countries, expands our Medical segment's portfolio of self-manufactured products and its geographic scope.

naviHealth

On August 26, 2015, we acquired a 71 percent ownership interest in naviHealth Group Holdings, L.P. ("naviHealth") for $238 million, net of cash acquired of $53 million. We funded the acquisition with cash on hand. The acquisition of naviHealth, a leader in post-acute care management solutions, expands our ability to serve health plans, health systems, and providers. We consolidate the results of naviHealth in our condensed consolidated financial statements and report its results in our Medical segment. The portion of naviHealth net earnings attributable to third-party interest holders is reported as a reduction to net earnings in the condensed consolidated statements of earnings.

Harvard Drug

On July 2, 2015, we completed the acquisition of The Harvard Drug Group ("Harvard Drug") for $1.1 billion using cash on hand and proceeds from our debt offering in June 2015. The acquisition of Harvard Drug, a distributor of generic pharmaceuticals, over-the-counter healthcare and related products to retail, institutional, and alternate care customers, enhances our Pharmaceutical segment's generic pharmaceutical distribution and related services businesses. Harvard Drug also manufactures and repackages generic pharmaceuticals and over-the-counter healthcare products.

Refer to Note 2 of the "Notes to Condensed Consolidated Financial Statements" for additional information on acquisitions.

5 | Cardinal Health | Q3 Fiscal 2016 Form 10-Q | |

MD&A | Results of Operations | |

Results of Operations

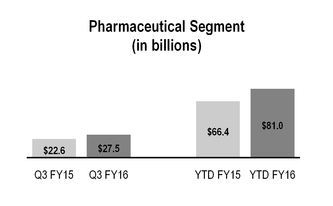

Revenue

Three Months Ended March 31 | Nine Months Ended March 31 | ||||||||||||||||||||

(in millions) | 2016 | 2015 | Change | 2016 | 2015 | Change | |||||||||||||||

Pharmaceutical | $ | 27,527 | $ | 22,605 | 22 | % | $ | 80,954 | $ | 66,440 | 22 | % | |||||||||

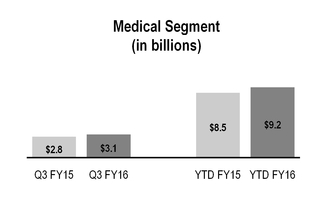

Medical | 3,138 | 2,774 | 13 | % | 9,220 | 8,540 | 8 | % | |||||||||||||

Total segment revenue | 30,665 | 25,379 | 21 | % | 90,174 | 74,980 | 20 | % | |||||||||||||

Corporate | (3 | ) | (4 | ) | N.M. | (12 | ) | 3 | N.M. | ||||||||||||

Total revenue | $ | 30,662 | $ | 25,375 | 21 | % | $ | 90,162 | $ | 74,983 | 20 | % | |||||||||

Pharmaceutical Segment

Pharmaceutical segment revenue growth for the three and nine months ended March 31, 2016 compared to the prior-year periods was primarily due to sales growth from existing and new pharmaceutical distribution customers, which increased revenue by $4.5 billion and $13.1 billion, respectively, including the impact of branded pharmaceutical price appreciation. Acquisitions also contributed to revenue growth ($630 million and $1.9 billion, respectively).

Medical Segment

Medical segment revenue growth for the three and nine months ended March 31, 2016 compared to the prior-year periods was primarily due to acquisitions, net of divestitures, which contributed $218 million and $435 million, respectively, and growth from existing businesses.

Cost of Products Sold

As a result of the same factors affecting the change in consolidated revenue, consolidated cost of products sold increased $5.1 billion (21 percent) and $14.6 billion (21 percent) compared to the prior-year periods. In addition, we incurred $12 million and $51 million in LIFO charges during the three and nine months ended March 31, 2016, respectively. See the "Gross Margin" section for additional drivers impacting cost of products sold.

Cardinal Health | Q3 Fiscal 2016 Form 10-Q | 6 | |

MD&A | Results of Operations | |

Gross Margin

Three Months Ended March 31 | Nine Months Ended March 31 | ||||||||||||||||||||

(in millions) | 2016 | 2015 | Change | 2016 | 2015 | Change | |||||||||||||||

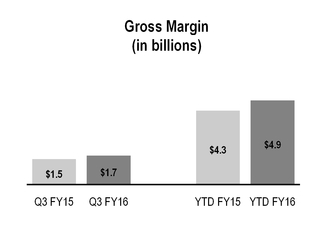

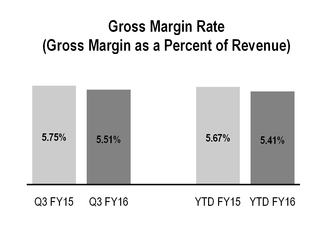

Gross margin | $ | 1,689 | $ | 1,459 | 16 | % | $ | 4,877 | $ | 4,254 | 15 | % | |||||||||

Gross margin increased during the three and nine months ended March 31, 2016 compared to the prior-year periods by $230 million (16 percent) and $623 million (15 percent), respectively.

Gross margin during the three and nine months ended March 31, 2016, was positively impacted by sales growth from existing and new pharmaceutical distribution customers ($139 million and $409 million, respectively) and acquisitions, net of divestitures ($174 million and $393 million, respectively).

Gross margin rate contracted during both the three and nine months ended March 31, 2016, primarily due to the onboarding of a new mail order customer starting in October 2015. In addition, gross margin rate was favorably impacted by performance under our generics program and adversely impacted by customer pricing changes. Gross margin rate contraction also includes the negative impact of LIFO charges of $12 million and $51 million during the three and nine months ended March 31, 2016, respectively. See Note 1 of the "Notes to Condensed Consolidated Financial Statements" for additional information on the LIFO inventory method.

Distribution, Selling, General, and Administrative ("SG&A") Expenses

Three Months Ended March 31 | Nine Months Ended March 31 | ||||||||||||||||||||

(in millions) | 2016 | 2015 | Change | 2016 | 2015 | Change | |||||||||||||||

SG&A expenses | $ | 914 | $ | 803 | 14 | % | $ | 2,678 | $ | 2,393 | 12 | % | |||||||||

The increase in SG&A expenses during the three and nine months ended March 31, 2016 over the prior-year periods was driven by acquisitions, net of divestitures ($110 million and $246 million, respectively).

7 | Cardinal Health | Q3 Fiscal 2016 Form 10-Q | |

MD&A | Results of Operations | |

Segment Profit

We evaluate segment performance based on segment profit, among other measures. See Note 13 of the "Notes to Condensed Consolidated Financial Statements" for additional information on segment profit.

Three Months Ended March 31 | Nine Months Ended March 31 | ||||||||||||||||||||

(in millions) | 2016 | 2015 | Change | 2016 | 2015 | Change | |||||||||||||||

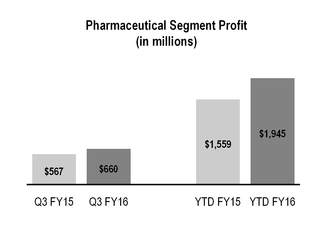

Pharmaceutical | $ | 660 | $ | 567 | 16 | % | $ | 1,945 | $ | 1,559 | 25 | % | |||||||||

Medical | 128 | 102 | 26 | % | 335 | 330 | 1 | % | |||||||||||||

Total segment profit | 788 | 669 | 18 | % | 2,280 | 1,889 | 21 | % | |||||||||||||

Corporate | (132 | ) | (78 | ) | N.M. | (441 | ) | (286 | ) | N.M. | |||||||||||

Total consolidated operating earnings | $ | 656 | $ | 591 | 11 | % | $ | 1,839 | $ | 1,603 | 15 | % | |||||||||

Pharmaceutical Segment Profit

The increase in Pharmaceutical segment profit during the three and nine months ended March 31, 2016 over the prior-year periods was due to sales growth from existing and new pharmaceutical distribution customers and performance under our generics program, partially offset by the adverse impact of customer pricing changes. Acquisitions also contributed to Pharmaceutical segment profit growth. LIFO charges/(credits) are not allocated to segment profit as explained in Note 13 of the "Notes to Condensed Consolidated Financial Statements."

Medical Segment Profit

The increase in Medical segment profit during the three and nine months ended March 31, 2016 compared to the prior-year periods was primarily due to the impact of acquisitions, net of divestitures, which included the unfavorable impact on cost of products sold from

the fair value step up of inventory acquired with Cordis. Cardinal Health brand products also contributed to Medical segment profit growth during the three and nine months ended March 31, 2016. The increase in Medical segment profit during the nine months ended March 31, 2016 was partially offset by a decline in the results from our Canada business.

Corporate

As discussed further in sections that follow, the principal drivers for the change in Corporate during the three and nine months ended March 31, 2016 compared to the prior-year periods were increased amortization and other acquisition-related costs primarily due to amortization and costs incurred in connection with the acquisitions of Cordis and Harvard Drug. Corporate was also adversely impacted by LIFO charges previously discussed under "Gross Margin".

Cardinal Health | Q3 Fiscal 2016 Form 10-Q | 8 | |

MD&A | Results of Operations | |

Other Components of Consolidated Operating Earnings

In addition to revenue, gross margin, and SG&A expenses discussed previously, consolidated operating earnings were impacted by the following:

Three Months Ended March 31 | Nine Months Ended March 31 | ||||||||||||||

(in millions) | 2016 | 2015 | 2016 | 2015 | |||||||||||

Restructuring and employee severance | $ | 6 | $ | 7 | $ | 19 | $ | 33 | |||||||

Amortization and other acquisition-related costs | 108 | 77 | 327 | 190 | |||||||||||

Impairments and (gain)/loss on disposal of assets, net | — | (1 | ) | 17 | (19 | ) | |||||||||

Litigation (recoveries)/charges, net | 5 | (18 | ) | (3 | ) | 54 | |||||||||

Amortization and Other Acquisition-Related Costs

Amortization of acquisition-related intangible assets was $88 million and $48 million for the three months ended March 31, 2016 and 2015, respectively, and $255 million and $139 million for the nine months ended March 31, 2016 and 2015, respectively. The increase in amortization of acquisition-related intangible assets during both periods is largely due to the acquisitions of Cordis and Harvard Drug. Transaction and integration costs associated with the acquisition of Cordis were $13 million and $54 million during the three and nine months ended March 31, 2016, respectively.

Litigation (Recoveries)/Charges, Net

During the nine months ended March 31, 2016, we received and recognized income of $13 million from settlements of class action antitrust claims in which we were a class member.

During the nine months ended March 31, 2015, we incurred litigation charges of $61 million related to government investigations and related matters.

Earnings Before Income Taxes

In addition to the items discussed above, earnings before income taxes was impacted by the following:

Three Months Ended March 31 | Nine Months Ended March 31 | ||||||||||||||||||||

(in millions) | 2016 | 2015 | Change | 2016 | 2015 | Change | |||||||||||||||

Other (income)/expense, net | $ | — | $ | (2 | ) | N.M. | $ | 5 | $ | (6 | ) | N.M. | |||||||||

Interest expense, net | 44 | 35 | 28 | % | 134 | 105 | 28 | % | |||||||||||||

Loss on extinguishment of debt | — | — | N.M. | — | 60 | N.M. | |||||||||||||||

Interest Expense, Net

Interest expense increased during both the three and nine months ended March 31, 2016, primarily as a result of the additional $1.5 billion of debt issued in June 2015 to fund the Harvard Drug and Cordis acquisitions.

Loss on Extinguishment of Debt

In December 2014, we redeemed certain debt resulting in a loss on the extinguishment of debt of $60 million ($37 million, net of tax).

Provision for Income Taxes

During the three months ended March 31, 2016 and 2015, the effective tax rate was 36.9 percent and 34.6 percent, respectively. The effective tax rate for the three months ended March 31, 2015 included net favorable items discrete to the quarter. During the nine months ended March 31, 2016 and 2015, the effective tax rate was 35.5 percent and 36.3 percent, respectively.

9 | Cardinal Health | Q3 Fiscal 2016 Form 10-Q | |

MD&A | Liquidity and Capital Resources | |

Liquidity and Capital Resources

We currently believe that, based on available capital resources (cash on hand and committed credit facilities) and projected operating cash flow, we have adequate capital resources to fund working capital needs; currently anticipated capital expenditures; currently anticipated business growth and expansion; contractual obligations; tax payments; and current and projected debt service requirements, dividends, and share repurchases. If we decide to engage in one or more additional acquisitions, depending on the size and timing of such transactions, we may need to access capital markets for additional financing.

Cash and Equivalents

Our cash and equivalents balance was $2.6 billion at March 31, 2016 compared to $4.6 billion at June 30, 2015. The decrease in cash and equivalents during the nine months ended March 31, 2016 was driven by $3.4 billion deployed for acquisitions, $386 million paid in dividends, $300 million paid for share repurchases, and $284 million in capital expenditures, offset in part by cash provided by operating activities of $2.3 billion. At March 31, 2016, our cash and equivalents were held in cash depository accounts with major banks or invested in high quality, short-term liquid investments.

The cash and equivalents balance at March 31, 2016 included $452 million of cash held by subsidiaries outside of the United States.

Although the vast majority of this cash is available for repatriation, permanently bringing the money into the United States could trigger U.S. federal, state and local income tax obligations. As a U.S. parent company, we may temporarily access cash held by our foreign subsidiaries without becoming subject to U.S. federal, state, and local income tax through intercompany loans.

Changes in working capital, which impact operating cash flow, can vary significantly depending on factors such as the timing of customer payments, inventory purchases and payments to vendors in the regular course of business, as well as fluctuating working capital needs driven by customer and product mix.

Other Financing Arrangements

Credit Facilities and Commercial Paper

In addition to cash and equivalents and operating cash flow, other sources of liquidity include a $1.5 billion revolving credit facility and a $950 million committed receivables sales facility program. We also have a commercial paper program of up to $1.5 billion, backed by the revolving credit facility. At March 31, 2016, we had no amounts outstanding under the revolving credit facility. Availability on the revolving credit facility was reduced by outstanding letters of credit of $14 million at March 31, 2016. We also had standby letters of credit of $40 million issued under the committed receivables sales facility program at March 31, 2016.

Our revolving credit facility and committed receivables sales facility program require us to maintain a consolidated interest coverage ratio of at least 4-to-1 and consolidated leverage ratio of no more than 3.25-to-1. As of March 31, 2016, we were in compliance with these financial covenants.

Available-for-Sale Securities

At March 31, 2016, we held $205 million of marketable securities, which are classified as available-for-sale.

Capital Deployment

Capital Expenditures

Capital expenditures during the nine months ended March 31, 2016 and 2015 were $284 million and $139 million, respectively.

We now expect capital expenditures to be between $450 million and $480 million for the fiscal year ending June 30, 2016.

Dividends

On February 2, 2016, our Board of Directors approved a quarterly dividend of $0.3870 per share, or $1.55 per share on an annualized basis, payable on April 15, 2016 to shareholders of record on April 1, 2016.

Share Repurchases

Our Board of Directors has approved a $2.0 billion share repurchase program, which expires on December 31, 2016. During the three and nine months ended March 31, 2016, we repurchased $300 million of our common shares. We funded the repurchases with available cash. At March 31, 2016, we had $393 million remaining under this repurchase authorization.

Acquisitions

On July 2, 2015, August 26, 2015, and October 2, 2015, we acquired Harvard Drug, naviHealth, and Cordis for $1.1 billion, $238 million, and $1.9 billion, respectively.

Cardinal Health | Q3 Fiscal 2016 Form 10-Q | 10 | |

MD&A | Other | |

Other Items

The MD&A in our 2015 Form 10-K addresses our contractual obligations, critical accounting policies and sensitive accounting estimates, and the absence of off-balance sheet arrangements, as of and for the fiscal year ended June 30, 2015. There have been no subsequent material changes outside of the ordinary course of business to those items.

Explanation and Reconciliation of Non-GAAP Financial Measures

The "Overview of Consolidated Results" section within MD&A in this Form 10-Q contains financial measures that are not calculated in accordance with GAAP. In general, the measures exclude items and charges that we do not believe reflect our core business and relate more to strategic, multi-year corporate activities, or the items and charges relate to activities or actions that may have occurred over multiple or in prior periods without predictable trends. We use these non-GAAP financial measures internally to evaluate our performance, evaluate our financial position, engage in financial and operational planning, and determine incentive compensation.

We provide these non-GAAP financial measures to investors as supplemental metrics to assist readers in assessing the effects of items and events on our financial and operating results and in comparing our performance to that of our competitors. However, the non-GAAP financial measures used by us may be calculated

differently from, and therefore may not be comparable to, similarly titled measures used by other companies.

The non-GAAP financial measures disclosed by us should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations to those financial measures should be carefully evaluated.

Following are definitions of the non-GAAP financial measures presented in this Form 10-Q and reconciliations of the differences between the non-GAAP financial measures and their most directly comparable GAAP financial measures. For all other definitions, refer to our 2015 Form 10-K.

Definitions

Non-GAAP operating earnings: operating earnings excluding (1) LIFO charges/(credits), (2) restructuring and employee severance, (3) amortization and other acquisition-related costs, (4) impairments and (gain)/loss on disposal of assets, and (5) litigation (recoveries)/charges, net.

Non-GAAP net earnings attributable to Cardinal Health, Inc.: net earnings attributable to Cardinal Health, Inc. excluding (1) LIFO charges/(credits), (2) restructuring and employee severance, (3) amortization and other acquisition-related costs, (4) impairments and (gain)/loss on disposal of assets, (5) litigation (recoveries)/charges, net, and (6) loss on extinguishment of debt, each net of tax.

Non-GAAP diluted EPS attributable to Cardinal Health, Inc. or "Non-GAAP diluted EPS": non-GAAP net earnings attributable to Cardinal Health, Inc. divided by diluted weighted-average shares outstanding.

11 | Cardinal Health | Q3 Fiscal 2016 Form 10-Q | |

Explanation and Reconciliation of Non-GAAP Financial Measures | ||

GAAP to Non-GAAP Reconciliations

Net Earnings | Diluted EPS | ||||||||||||||

Net Earnings | attributable | Diluted EPS | attributable | ||||||||||||

Operating | attributable | to Cardinal | attributable | to Cardinal | |||||||||||

Operating | Earnings | to Cardinal | Health, Inc. | to Cardinal | Health, Inc. | ||||||||||

Earnings | Growth Rate | Health, Inc. | Growth Rate | Health, Inc. | Growth Rate | ||||||||||

(in millions, except per common share amounts) | Three Months Ended March 31, 2016 | ||||||||||||||

GAAP | $ | 656 | 11 | % | $ | 386 | 6 | % | $ | 1.17 | 7 | % | |||

LIFO charges/(credits) | 12 | 8 | 0.02 | ||||||||||||

Restructuring and employee severance | 6 | 4 | 0.01 | ||||||||||||

Amortization and other acquisition-related costs | 108 | 71 | 0.21 | ||||||||||||

Impairments and (gain)/loss on disposal of assets | — | — | — | ||||||||||||

Litigation (recoveries)/charges, net | 5 | 3 | 0.01 | ||||||||||||

Non-GAAP | $ | 788 | 20 | % | $ | 472 | 19 | % | $ | 1.43 | 20 | % | |||

Three Months Ended March 31, 2015 | |||||||||||||||

GAAP | $ | 591 | 16 | % | $ | 365 | 16 | % | $ | 1.09 | 20 | % | |||

Restructuring and employee severance | 7 | 4 | 0.01 | ||||||||||||

Amortization and other acquisition-related costs | 77 | 48 | 0.15 | ||||||||||||

Impairments and (gain)/loss on disposal of assets | (1 | ) | — | — | |||||||||||

Litigation (recoveries)/charges, net | (18 | ) | (21 | ) | (0.07 | ) | |||||||||

Non-GAAP | $ | 657 | 17 | % | $ | 396 | 13 | % | $ | 1.19 | 18 | % | |||

Nine Months Ended March 31, 2016 | |||||||||||||||

GAAP | $ | 1,839 | 15 | % | $ | 1,095 | 19 | % | $ | 3.30 | 20 | % | |||

LIFO charges/(credits) | 51 | 31 | 0.10 | ||||||||||||

Restructuring and employee severance | 19 | 12 | 0.04 | ||||||||||||

Amortization and other acquisition-related costs | 327 | 212 | 0.64 | ||||||||||||

Impairments and (gain)/loss on disposal of assets | 17 | 10 | 0.03 | ||||||||||||

Litigation (recoveries)/charges, net | (3 | ) | — | — | |||||||||||

Non-GAAP | $ | 2,251 | 21 | % | $ | 1,361 | 20 | % | $ | 4.10 | 21 | % | |||

Nine Months Ended March 31, 2015 | |||||||||||||||

GAAP | $ | 1,603 | 7 | % | $ | 920 | (1 | )% | $ | 2.74 | 2 | % | |||

Restructuring and employee severance | 33 | 21 | 0.06 | ||||||||||||

Amortization and other acquisition-related costs | 190 | 121 | 0.36 | ||||||||||||

Impairments and (gain)/loss on disposal of assets | (19 | ) | (9 | ) | (0.03 | ) | |||||||||

Litigation (recoveries)/charges, net | 54 | 46 | 0.14 | ||||||||||||

Loss on extinguishment of debt | — | 37 | 0.11 | ||||||||||||

Non-GAAP | $ | 1,861 | 11 | % | $ | 1,136 | 9 | % | $ | 3.38 | 12 | % | |||

The sum of the components may not equal the total due to rounding.

We apply varying tax rates depending on the item's nature and tax jurisdiction where it is incurred.

Cardinal Health | Q3 Fiscal 2016 Form 10-Q | 12 | |

Other | ||

Quantitative and Qualitative Disclosures About Market Risk

There have been no material changes in the quantitative and qualitative market risk disclosures included in our 2015 Form 10-K since the end of fiscal 2015 through March 31, 2016.

Controls and Procedures

Evaluation of Disclosure Controls and Procedures

We evaluated, with the participation of our principal executive officer and principal financial officer, the effectiveness of our disclosure controls and procedures (as defined in Rule 13a-15(e) under the Securities Exchange Act of 1934 (the "Exchange Act")) as of March 31, 2016. Based on this evaluation, our principal executive officer and principal financial officer have concluded that as of March 31, 2016, our disclosure controls and procedures were effective to provide reasonable assurance that information required to be disclosed in our reports under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the U.S. Securities and Exchange Commission ("SEC") rules and forms and that such information is accumulated and communicated to management as appropriate to allow timely decisions regarding required disclosure.

Changes in Internal Control Over Financial Reporting

There were no changes in our internal control over financial reporting during the quarter ended March 31, 2016 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Legal Proceedings

The legal proceedings described in Note 7 of the "Notes to Condensed Consolidated Financial Statements" are incorporated in this "Legal Proceedings" section by reference.

Risk Factors

You should carefully consider the information in this Form 10-Q and the risk factors discussed in "Risk Factors" and other risks discussed in our 2015 Form 10-K and our filings with the SEC since June 30, 2015. These risks could materially and adversely affect our results of operations, financial condition, liquidity, and cash flows. Our business also could be affected by risks that we are not presently aware of or that we currently consider immaterial to our operations.

Unregistered Sales of Equity Securities and Use of Proceeds

Issuer Purchases of Equity Securities

Period | Total Number of Shares Purchased (1) | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Program (2) | Approximate Dollar Value of Shares That May Yet be Purchased Under the Program (2) (in millions) | |||||||||

January 2016 | 204 | $ | 85.71 | — | $ | 693 | |||||||

February 2016 | 2,078,240 | 79.62 | 2,077,905 | 528 | |||||||||

March 2016 | 1,638,476 | 82.11 | 1,638,279 | 393 | |||||||||

Total | 3,716,920 | $ | 80.72 | 3,716,184 | $ | 393 | |||||||

(1) | Reflects 204, 335 and 197 common shares purchased in January, February and March 2016, respectively, through a rabbi trust as investments of participants in our Deferred Compensation Plan. |

(2) | On October 29, 2013, our Board of Directors approved a $1.0 billion share repurchase program and on August 6, 2014, the Board of Directors authorized an additional $1.0 billion under the program, for a total of $2.0 billion. This program expires on December 31, 2016. During the three months ended March 31, 2016, we repurchased 3.7 million common shares under this program. |

13 | Cardinal Health | Q3 Fiscal 2016 Form 10-Q | |

Financial Statements | ||

Condensed Consolidated Statements of Earnings

(Unaudited)

Three Months Ended March 31 | Nine Months Ended March 31 | ||||||||||||||

(in millions, except per common share amounts) | 2016 | 2015 | 2016 | 2015 | |||||||||||

Revenue | $ | 30,662 | $ | 25,375 | $ | 90,162 | $ | 74,983 | |||||||

Cost of products sold | 28,973 | 23,916 | 85,285 | 70,729 | |||||||||||

Gross margin | 1,689 | 1,459 | 4,877 | 4,254 | |||||||||||

Operating expenses: | |||||||||||||||

Distribution, selling, general, and administrative expenses | 914 | 803 | 2,678 | 2,393 | |||||||||||

Restructuring and employee severance | 6 | 7 | 19 | 33 | |||||||||||

Amortization and other acquisition-related costs | 108 | 77 | 327 | 190 | |||||||||||

Impairments and (gain)/loss on disposal of assets, net | — | (1 | ) | 17 | (19 | ) | |||||||||

Litigation (recoveries)/charges, net | 5 | (18 | ) | (3 | ) | 54 | |||||||||

Operating earnings | 656 | 591 | 1,839 | 1,603 | |||||||||||

Other (income)/expense, net | — | (2 | ) | 5 | (6 | ) | |||||||||

Interest expense, net | 44 | 35 | 134 | 105 | |||||||||||

Loss on extinguishment of debt | — | — | — | 60 | |||||||||||

Earnings before income taxes | 612 | 558 | 1,700 | 1,444 | |||||||||||

Provision for income taxes | 226 | 193 | 604 | 524 | |||||||||||

Net earnings | 386 | 365 | 1,096 | 920 | |||||||||||

Less: Net earnings attributable to noncontrolling interests | — | — | (1 | ) | — | ||||||||||

Net earnings attributable to Cardinal Health, Inc. | $ | 386 | $ | 365 | $ | 1,095 | $ | 920 | |||||||

Earnings per common share attributable to Cardinal Health, Inc.: | |||||||||||||||

Basic | $ | 1.18 | $ | 1.10 | $ | 3.33 | $ | 2.77 | |||||||

Diluted | 1.17 | 1.09 | 3.30 | 2.74 | |||||||||||

Weighted-average number of common shares outstanding: | |||||||||||||||

Basic | 328 | 330 | 328 | 332 | |||||||||||

Diluted | 331 | 334 | 331 | 336 | |||||||||||

Cash dividends declared per common share | $ | 0.3870 | $ | 0.3425 | $ | 1.1610 | $ | 1.0275 | |||||||

See notes to condensed consolidated financial statements.

Cardinal Health | Q3 Fiscal 2016 Form 10-Q | 14 | |

Financial Statements | ||

Condensed Consolidated Statements of Comprehensive Income

(Unaudited)

Three Months Ended March 31 | Nine Months Ended March 31 | ||||||||||||||

(in millions) | 2016 | 2015 | 2016 | 2015 | |||||||||||

Net earnings | $ | 386 | $ | 365 | $ | 1,096 | $ | 920 | |||||||

Other comprehensive income/(loss): | |||||||||||||||

Foreign currency translation adjustments | 16 | (53 | ) | (57 | ) | (117 | ) | ||||||||

Net unrealized gain/(loss) on derivative instruments, net of tax | (3 | ) | 2 | (4 | ) | (6 | ) | ||||||||

Total other comprehensive income/(loss), net of tax | 13 | (51 | ) | (61 | ) | (123 | ) | ||||||||

Total comprehensive income | 399 | 314 | 1,035 | 797 | |||||||||||

Less: Comprehensive income attributable to noncontrolling interests | — | — | (1 | ) | — | ||||||||||

Total comprehensive income attributable to Cardinal Health, Inc. | $ | 399 | $ | 314 | $ | 1,034 | $ | 797 | |||||||

See notes to condensed consolidated financial statements.

15 | Cardinal Health | Q3 Fiscal 2016 Form 10-Q | |

Financial Statements | ||

Condensed Consolidated Balance Sheets

(Unaudited)

(in millions) | March 31, 2016 | June 30, 2015 | |||||

Assets | |||||||

Current assets: | |||||||

Cash and equivalents | $ | 2,598 | $ | 4,616 | |||

Trade receivables, net | 7,292 | 6,523 | |||||

Inventories, net | 10,910 | 9,211 | |||||

Prepaid expenses and other | 1,491 | 1,402 | |||||

Total current assets | 22,291 | 21,752 | |||||

Property and equipment, net | 1,683 | 1,506 | |||||

Goodwill and other intangibles, net | 9,150 | 6,018 | |||||

Other assets | 931 | 866 | |||||

Total assets | $ | 34,055 | $ | 30,142 | |||

Liabilities, Redeemable Noncontrolling Interests, and Shareholders’ Equity | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 17,340 | $ | 14,368 | |||

Current portion of long-term obligations and other short-term borrowings | 351 | 281 | |||||

Other accrued liabilities | 1,694 | 2,594 | |||||

Total current liabilities | 19,385 | 17,243 | |||||

Long-term obligations, less current portion | 5,195 | 5,211 | |||||

Deferred income taxes and other liabilities | 2,628 | 1,432 | |||||

Redeemable noncontrolling interests | 117 | — | |||||

Shareholders’ equity: | |||||||

Preferred shares, without par value: | |||||||

Authorized—500 thousand shares, Issued—none | — | — | |||||

Common shares, without par value: | |||||||

Authorized—755 million shares, Issued—364 million shares at March 31, 2016 and June 30, 2015 | 2,995 | 3,003 | |||||

Retained earnings | 6,231 | 5,521 | |||||

Common shares in treasury, at cost: 38 million shares and 36 million shares at March 31, 2016 and June 30, 2015, respectively | (2,429 | ) | (2,245 | ) | |||

Accumulated other comprehensive loss | (84 | ) | (23 | ) | |||

Total Cardinal Health, Inc. shareholders' equity | 6,713 | 6,256 | |||||

Noncontrolling interests | 17 | — | |||||

Total shareholders’ equity | 6,730 | 6,256 | |||||

Total liabilities, redeemable noncontrolling interests, and shareholders’ equity | $ | 34,055 | $ | 30,142 | |||

Cardinal Health | Q3 Fiscal 2016 Form 10-Q | 16 | |

Financial Statements | ||

Condensed Consolidated Statements of Cash Flows

(Unaudited)

Nine Months Ended March 31 | |||||||

(in millions) | 2016 | 2015 | |||||

Cash flows from operating activities: | |||||||

Net earnings | $ | 1,096 | $ | 920 | |||

Adjustments to reconcile net earnings to net cash provided by operating activities: | |||||||

Depreciation and amortization | 465 | 336 | |||||

Loss on extinguishment of debt | — | 60 | |||||

Gain on sale of other investments | — | (5 | ) | ||||

Impairments and (gain)/loss on disposal of assets, net | 17 | (19 | ) | ||||

Share-based compensation | 82 | 80 | |||||

Provision for bad debts | 51 | 42 | |||||

Change in fair value of contingent consideration obligation | (16 | ) | — | ||||

Change in operating assets and liabilities, net of effects from acquisitions: | |||||||

Increase in trade receivables | (721 | ) | (718 | ) | |||

Increase in inventories | (1,457 | ) | (850 | ) | |||

Increase in accounts payable | 2,839 | 1,657 | |||||

Other accrued liabilities and operating items, net | (26 | ) | 169 | ||||

Net cash provided by operating activities | 2,330 | 1,672 | |||||

Cash flows from investing activities: | |||||||

Acquisition of subsidiaries, net of cash acquired | (3,383 | ) | (319 | ) | |||

Additions to property and equipment | (284 | ) | (139 | ) | |||

Purchase of available-for-sale securities and other investments | (150 | ) | (134 | ) | |||

Proceeds from sale of available-for-sale securities and other investments | 99 | 129 | |||||

Proceeds from maturities of available-for-sale securities | 37 | 24 | |||||

Proceeds from divestitures and disposal of held for sale assets | — | 53 | |||||

Net cash used in investing activities | (3,681 | ) | (386 | ) | |||

Cash flows from financing activities: | |||||||

Payment of contingent consideration obligation | (23 | ) | (3 | ) | |||

Net change in short-term borrowings | 34 | (9 | ) | ||||

Purchase of noncontrolling interests | (10 | ) | — | ||||

Reduction of long-term obligations | (5 | ) | (1,221 | ) | |||

Proceeds from long-term obligations, net of issuance costs | — | 1,182 | |||||

Net proceeds/(tax withholdings) from share-based compensation | (3 | ) | 59 | ||||

Excess tax benefits from share-based compensation | 33 | 56 | |||||

Dividends on common shares | (386 | ) | (346 | ) | |||

Purchase of treasury shares | (300 | ) | (686 | ) | |||

Net cash used in financing activities | (660 | ) | (968 | ) | |||

Effect of exchange rate changes on cash and equivalents | (7 | ) | — | ||||

Net increase/(decrease) in cash and equivalents | (2,018 | ) | 318 | ||||

Cash and equivalents at beginning of period | 4,616 | 2,865 | |||||

Cash and equivalents at end of period | $ | 2,598 | $ | 3,183 | |||

See notes to condensed consolidated financial statements.

17 | Cardinal Health | Q3 Fiscal 2016 Form 10-Q | |

Notes to Financial Statements | ||

Notes to Condensed Consolidated Financial Statements

1. Basis of Presentation and Summary of Significant Accounting Policies

Basis of Presentation

Our condensed consolidated financial statements include the accounts of all majority-owned or controlled subsidiaries, and all significant intercompany transactions and amounts have been eliminated. References to "we," "our," and similar pronouns in this Quarterly Report on Form 10-Q for the quarter ended March 31, 2016 (this "Form 10-Q") refer to Cardinal Health, Inc. and its majority-owned or controlled subsidiaries unless the context requires otherwise. The results of businesses acquired or disposed of are included in the condensed consolidated financial statements from the effective date of the acquisition or up to the date of disposal, respectively.

Our condensed consolidated financial statements have been prepared in accordance with the U.S. Securities and Exchange Commission ("SEC") instructions to Quarterly Reports on Form 10-Q and include all of the information and disclosures required by accounting principles generally accepted in the United States ("GAAP") for interim financial reporting. The preparation of financial statements in conformity with GAAP requires us to make estimates and assumptions that affect amounts reported in the condensed consolidated financial statements and accompanying notes. Actual amounts may differ from these estimated amounts. In addition, operating results presented for this fiscal 2016 interim period are not necessarily indicative of the results that may be expected for the full fiscal year ending June 30, 2016.

These condensed consolidated financial statements are unaudited and are presented pursuant to the rules and regulations of the SEC. Accordingly, the condensed consolidated financial statements included in this Form 10-Q should be read in conjunction with the audited consolidated financial statements and related notes contained in our Annual Report on Form 10-K for the fiscal year ended June 30, 2015 (the "2015 Form 10-K"). In our opinion, all adjustments necessary for a fair presentation of the condensed consolidated financial statements have been included. Except as disclosed elsewhere in this Form 10-Q, all such adjustments are of a normal and recurring nature.

Inventories

A substantial portion of our inventories are valued at the lower of cost, using the last-in, first-out ("LIFO") method, or market. These inventories are included within the core pharmaceutical distribution facilities of our Pharmaceutical segment (“distribution facilities”) and are primarily merchandise inventories. The LIFO method presumes that the most recent inventory purchases are the first items sold, so LIFO helps us better match current costs and revenue. We believe that the average cost method of inventory valuation provides a reasonable approximation of the current cost of replacing inventory within these distribution facilities. As such, the LIFO reserve is the difference between (a) inventory at the lower of LIFO cost or market

and (b) inventory at replacement cost determined using the average cost method of inventory valuation.

Interim LIFO calculations are based on our estimates of the expected year-end inventory levels and costs, as the actual valuation of inventory under the LIFO method is computed at the end of the fiscal year based on the inventory levels, inventory mix and inventory cost inflation and deflation at that time. Based upon the year-to-date balance and expectations for the remainder of the fiscal year, we recorded LIFO charges of $12 million and $51 million for the three and nine months ended March 31, 2016, respectively, which are included in cost of products sold in the condensed consolidated financial statements.

Recent Financial Accounting Standards

In March 2016, the Financial Accounting Standards Board ("FASB") issued amended accounting guidance that will change the accounting for certain aspects of share-based compensation to employees. The guidance requires all income tax effects of share-based awards to be recognized in the statement of earnings as awards vest or are settled. Additionally, the guidance increases the amount employers can withhold in shares to cover employee income taxes without requiring liability classification and allows a policy election for accounting for forfeitures. This guidance will be effective for us in the first quarter of fiscal 2018, with early adoption permitted. We are currently evaluating the impact of the adoption on our consolidated financial statements.

Also in March 2016, the FASB issued amended accounting guidance that eliminates the requirement for investors to retrospectively apply the equity method of accounting when an investment that was accounted for by another method qualifies for use of the equity method as a result of an increase in ownership interest or degree of influence. This guidance will be effective for us in the first quarter of fiscal 2018, with early adoption permitted. We do not expect the adoption of this guidance to have a material impact on our consolidated financial statements.

In February 2016, the FASB issued amended accounting guidance that requires lessees to recognize most leases on the balance sheet as a lease liability and corresponding right-of-use asset. This guidance will be effective for us in the first quarter of fiscal 2020, with early adoption permitted. We are currently evaluating the impact of the adoption on our consolidated financial statements.

In January 2016, the FASB issued amended accounting guidance intended to improve the recognition and measurement of financial instruments. The amended guidance primarily changes the accounting for equity investments, financial liabilities under the fair value option, the method for assessing the realizability of deferred tax assets related to available-for-sale securities, and the presentation and disclosure requirements for financial instruments. This classification and measurement guidance will be effective for us in the first quarter of fiscal 2019, with early adoption permitted. We are currently evaluating the impact of the adoption on our consolidated financial statements.

Cardinal Health | Q3 Fiscal 2016 Form 10-Q | 18 | |

Notes to Financial Statements | ||

In November 2015, the FASB issued amended accounting guidance that simplifies the accounting for income taxes. Under this amended guidance, deferred tax assets and liabilities must be classified as noncurrent on the balance sheet instead of separating deferred tax items into current and noncurrent amounts. We adopted this guidance on a prospective basis in the second quarter of fiscal 2016. The adoption of this guidance had no impact on our condensed consolidated statements of earnings, comprehensive income or cash flows.

In September 2015, the FASB issued amended accounting guidance that eliminates the requirement that an acquirer in a business combination account for measurement-period adjustments on a retrospective basis. Under this amended guidance, the acquirer will recognize a measurement-period adjustment during the period in which it determines the amount of the adjustment. We adopted this guidance in the second quarter of fiscal 2016. The adoption of this guidance did not materially impact our condensed consolidated financial statements.

In May 2014, the FASB issued amended accounting guidance related to revenue recognition. This guidance is based on the principle that revenue is recognized in an amount that reflects the consideration to which an entity expects to be entitled in exchange for the transfer of goods or services to customers. The guidance also requires additional disclosure about the nature, amount, timing, and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments and changes in judgments and assets recognized from costs incurred to obtain or fulfill a contract. In July 2015, the FASB deferred the effective date for one year beyond the originally specified effective date. This amendment will be effective for us in the first quarter of fiscal 2019. We are in the process of assessing any differences between the amended and existing guidance that could impact our consolidated financial statements and continuing to evaluate the options for adoption.

In April 2014, the FASB issued amended accounting guidance related to the reporting of discontinued operations and disclosures of disposals of components of an entity. The amended guidance changes the thresholds for disposals to qualify as discontinued operations and requires additional disclosures. We adopted this guidance in the first quarter of fiscal 2016. The adoption of this guidance did not impact our condensed consolidated financial statements.

2. Acquisitions

During the nine months ended March 31, 2016, we completed several acquisitions, the most significant of which are described in more detail below. The pro forma results of operations and the results of operations for acquired businesses since the acquisition dates have not been separately disclosed because the effects were not significant compared to the condensed consolidated financial statements, individually or in the aggregate.

Cordis

On October 2, 2015, we acquired the Cordis business ("Cordis") from Ethicon, Inc., a wholly-owned subsidiary of Johnson & Johnson, for $1.9 billion using cash on hand and proceeds from our debt offering

in June 2015. The acquisition of Cordis, a global manufacturer and distributor of interventional cardiology devices and endovascular solutions with operations in more than 50 countries, expands our Medical segment's portfolio of self-manufactured products and its geographic scope. We closed the Cordis acquisition in 20 principal countries on October 2, 2015, and acquired control of, as described in GAAP, and the rights to, the net economic benefit from the entire Cordis business in the other countries at that time. We are in the process of transitioning legal ownership in the remaining non-principal countries, which we expect to complete by the end of calendar 2017. The results for the entire Cordis business in all countries are included in the condensed consolidated financial statements beginning October 2, 2015.

Transaction and integration costs associated with the acquisition of Cordis were $13 million and $54 million during the three and nine months ended March 31, 2016, respectively, and are included in amortization and other acquisition-related costs in the condensed consolidated statements of earnings.

naviHealth

On August 26, 2015, we acquired a 71 percent ownership interest in naviHealth Group Holdings, L.P. ("naviHealth") for $238 million, net of cash acquired of $53 million. We funded the acquisition with cash on hand. The acquisition of naviHealth, a leader in post-acute care management solutions, expands our ability to serve health plans, health systems, and providers. We consolidate the results of naviHealth in our condensed consolidated financial statements and report its consolidated results in our Medical segment. The terms of the agreement provide us with the option to acquire any remaining noncontrolling interests at any time after the two-year anniversary of the closing. The third-party noncontrolling interest holders also hold an option, which allows them to sell their noncontrolling interests to us at any time after the two-year anniversary of the closing, or earlier if a trigger event occurs. Refer to Note 10 for further information on the redeemable noncontrolling interests.

Harvard Drug

On July 2, 2015, we completed the acquisition of The Harvard Drug Group ("Harvard Drug") for $1.1 billion using cash on hand and proceeds from our debt offering in June 2015. The acquisition of Harvard Drug, a distributor of generic pharmaceuticals, over-the-counter healthcare and related products to retail, institutional, and alternate care customers, enhances our Pharmaceutical segment's generic pharmaceutical distribution and related services businesses. Harvard Drug also manufactures and repackages generic pharmaceuticals and over-the-counter healthcare products.

Fair Value of Assets Acquired and Liabilities Assumed

The allocation of the purchase price for the acquisitions of Cordis, naviHealth, and Harvard Drug are not yet finalized and are subject to adjustment as we complete the valuation analysis for these acquisitions. The purchase prices are also subject to adjustment based on working capital requirements as set forth in the acquisition agreements.

19 | Cardinal Health | Q3 Fiscal 2016 Form 10-Q | |

Notes to Financial Statements | ||

The following table summarizes the estimated fair values of the assets acquired and liabilities assumed as of the acquisition dates for Cordis, naviHealth, and Harvard Drug:

(in millions) | Cordis | naviHealth | Harvard Drug | ||||||||

Identifiable intangible assets: | |||||||||||

Customer relationships (1) | $ | 230 | $ | 38 | $ | 470 | |||||

Trade names (2) | 130 | 16 | 130 | ||||||||

Developed technology (3) | 400 | 61 | — | ||||||||

In-process research and development (4) | 55 | — | — | ||||||||

Total identifiable intangible assets acquired | 815 | 115 | 600 | ||||||||

Cash and equivalents | — | 53 | 44 | ||||||||

Trade receivables | — | 34 | 67 | ||||||||

Inventories | 220 | — | 49 | ||||||||

Prepaid expenses and other | 4 | 14 | 11 | ||||||||

Property and equipment | 97 | 5 | 16 | ||||||||

Other assets | 17 | 1 | 1 | ||||||||

Accounts payable | (95 | ) | (2 | ) | (48 | ) | |||||

Other accrued liabilities | (13 | ) | (93 | ) | (36 | ) | |||||

Deferred income taxes and other liabilities | — | (43 | ) | (104 | ) | ||||||

Redeemable noncontrolling interests | — | (119 | ) | — | |||||||

Total identifiable net assets/(liabilities) acquired | 1,045 | (35 | ) | 600 | |||||||

Goodwill | 828 | 326 | 549 | ||||||||

Total net assets acquired | $ | 1,873 | $ | 291 | $ | 1,149 | |||||

(1) | The weighted-average useful lives of customer relationships range from 4 to 13 years. |

(2) | The weighted-average useful lives of trade names range from 10 to 17 years. |

(3) | The weighted-average useful life of developed technology is 10 years. |

(4) | Acquired in-process research and development ("IPR&D") intangible assets have an indefinite life. |

3. Restructuring and Employee Severance

The following tables summarize restructuring and employee severance costs:

Three Months Ended March 31 | |||||||

(in millions) | 2016 | 2015 | |||||

Employee-related costs (1) | $ | 6 | $ | 3 | |||

Facility exit and other costs (2) | — | 4 | |||||

Total restructuring and employee severance | $ | 6 | $ | 7 | |||

Nine Months Ended March 31 | |||||||

(in millions) | 2016 | 2015 | |||||

Employee-related costs (1) | $ | 11 | $ | 24 | |||

Facility exit and other costs (2) | 8 | 9 | |||||

Total restructuring and employee severance | $ | 19 | $ | 33 | |||

(1) | Employee-related costs primarily consist of termination benefits provided to employees who have been involuntarily terminated and duplicate payroll costs during transition periods. |

(2) | Facility exit and other costs primarily consist of lease termination costs, accelerated depreciation, equipment relocation costs, project consulting fees, and costs associated with restructuring our delivery of information technology infrastructure services. |

The following table summarizes activity related to liabilities associated with restructuring and employee severance:

(in millions) | Employee- Related Costs | Facility Exit and Other Costs | Total | ||||||||

Balance at June 30, 2015 | $ | 22 | $ | — | $ | 22 | |||||

Additions | 12 | 1 | 13 | ||||||||

Payments and other adjustments | (18 | ) | — | (18 | ) | ||||||

Balance at March 31, 2016 | $ | 16 | $ | 1 | $ | 17 | |||||

4. Goodwill and Other Intangible Assets

Goodwill

The following table summarizes the changes in the carrying amount of goodwill by segment and in total:

(in millions) | Pharmaceutical | Medical | Total | ||||||||

Balance at June 30, 2015 | $ | 2,199 | $ | 2,871 | $ | 5,070 | |||||

Goodwill acquired, net of purchase price adjustments | 655 | 1,183 | 1,838 | ||||||||

Foreign currency translation adjustments and other | (14 | ) | (6 | ) | (20 | ) | |||||

Balance at March 31, 2016 | $ | 2,840 | $ | 4,048 | $ | 6,888 | |||||

The increase in the Pharmaceutical segment goodwill is primarily due to the Harvard Drug acquisition. Goodwill recognized in connection with this acquisition primarily represents the expected benefits from synergies of integrating this business, the existing workforce of the acquired entity, and the expected growth from new customers.

The increase in the Medical segment goodwill is primarily due to the Cordis and naviHealth acquisitions. Goodwill recognized in connection with the Cordis acquisition primarily represents the expected benefits from synergies of integrating the business, the existing workforce of the acquired entity, the expected growth from new customers, and the expected growth from existing technology. Goodwill recognized in connection with the naviHealth acquisition primarily represents the existing workforce of the acquired entity, expected growth from new customers, new service offerings, and the expected growth from existing technology.

See Note 2 for further discussion of these acquisitions.

Cardinal Health | Q3 Fiscal 2016 Form 10-Q | 20 | |

Notes to Financial Statements | ||

Other Intangible Assets

The following tables summarize other intangible assets by class at:

March 31, 2016 | |||||||||||||

(in millions) | Gross Intangible | Accumulated Amortization | Net Intangible | Weighted Average Remaining Amortization Period (Years) | |||||||||

Indefinite-life intangibles: | |||||||||||||

IPR&D, trademarks and other | $ | 69 | $ | — | $ | 69 | N/A | ||||||

Total indefinite-life intangibles | 69 | — | 69 | N/A | |||||||||

Definite-life intangibles: | |||||||||||||

Customer relationships | 1,859 | 677 | 1,182 | 9 | |||||||||

Trademarks, trade names, and patents | 512 | 125 | 387 | 14 | |||||||||

Developed technology and other | 796 | 172 | 624 | 9 | |||||||||

Total definite-life intangibles | 3,167 | 974 | 2,193 | 10 | |||||||||

Total other intangible assets | $ | 3,236 | $ | 974 | $ | 2,262 | N/A | ||||||

June 30, 2015 | |||||||||||

(in millions) | Gross Intangible | Accumulated Amortization | Net Intangible | ||||||||

Indefinite-life intangibles: | |||||||||||

Trademarks and other | $ | 14 | $ | — | $ | 14 | |||||

Total indefinite-life intangibles | 14 | — | 14 | ||||||||

Definite-life intangibles: | |||||||||||

Customer relationships | 1,103 | 501 | 602 | ||||||||

Trademarks, trade names, and patents | 237 | 91 | 146 | ||||||||

Developed technology and other | 320 | 134 | 186 | ||||||||

Total definite-life intangibles | 1,660 | 726 | 934 | ||||||||

Total other intangible assets | $ | 1,674 | $ | 726 | $ | 948 | |||||

Total amortization of intangible assets was $88 million and $48 million for the three months ended March 31, 2016 and 2015, respectively, and $255 million and $140 million for the nine months ended March 31, 2016 and 2015, respectively. Estimated annual amortization of intangible assets for the remainder of fiscal 2016 through 2020 is as follows: $94 million, $371 million, $334 million, $268 million, and $238 million.

5. Available-for-Sale Securities

We invest in marketable securities, which are classified as available-for-sale and are carried at fair value in the condensed consolidated balance sheets. We held the following investments in marketable securities at fair value at:

(in millions) | March 31, 2016 | June 30, 2015 | |||||

Current available-for-sale securities: | |||||||

Commercial paper | $ | — | $ | 4 | |||

Treasury bills | — | 12 | |||||

International bonds | 1 | 2 | |||||

Corporate bonds | 51 | 34 | |||||

U.S. agency bonds | 2 | 5 | |||||

Asset-backed securities | 36 | 8 | |||||

International equity securities | 2 | — | |||||

U.S. agency mortgage-backed securities | 13 | 26 | |||||

Total current available-for-sale securities | 105 | 91 | |||||

Long-term available-for-sale securities: | |||||||

Corporate bonds | 40 | 33 | |||||

U.S. agency bonds | 30 | 18 | |||||

Asset-backed securities | 13 | 41 | |||||

U.S. agency mortgage-backed securities | 17 | 10 | |||||

Total long-term available-for-sale securities | 100 | 102 | |||||

Total available-for-sale securities | $ | 205 | $ | 193 | |||

Gross unrealized gains and losses were immaterial at March 31, 2016 and June 30, 2015. During the three and nine months ended March 31, 2016 and 2015, gross realized gains and losses were immaterial and we did not recognize any other-than-temporary impairments. At March 31, 2016, the weighted-average effective maturity of our current and long-term investments was approximately 6 months and 16 months, respectively.

6. Income Taxes

Fluctuations in our provision for income taxes as a percentage of pretax earnings (“effective tax rate”) are due to changes in international and U.S. state effective tax rates resulting from our business mix and discrete items.

During the three months ended March 31, 2016 and 2015, the effective tax rate was 36.9 percent and 34.6 percent, respectively. The effective tax rate for the three months ended March 31, 2015 included net favorable items discrete to the quarter.

During the nine months ended March 31, 2016 and 2015, the effective tax rate was 35.5 percent and 36.3 percent, respectively.

At both March 31, 2016 and June 30, 2015, we had $542 million of unrecognized tax benefits. The March 31, 2016 and June 30, 2015 balances include $356 million and $357 million of unrecognized tax benefits, respectively, that if recognized, would have an impact on the effective tax rate.

At March 31, 2016 and June 30, 2015, we had $158 million and $169 million, respectively, accrued for the payment of interest and penalties related to unrecognized tax benefits, which we recognize in the provision for income taxes in the condensed consolidated statements of earnings. These balances are gross amounts before any tax benefits and are included in deferred income taxes and other liabilities in the condensed consolidated balance sheets.

It is reasonably possible that there could be a change in the amount of unrecognized tax benefits within the next 12 months due to

21 | Cardinal Health | Q3 Fiscal 2016 Form 10-Q | |

Notes to Financial Statements | ||

activities of the U.S. Internal Revenue Service or other taxing authorities, possible settlement of audit issues, reassessment of existing unrecognized tax benefits or the expiration of statutes of limitations. We estimate that the range of the possible change in unrecognized tax benefits within the next 12 months is a net decrease of zero to $195 million, exclusive of penalties and interest.

We file income tax returns in the U.S. federal jurisdiction, various U.S. state and local jurisdictions, and various foreign jurisdictions. With few exceptions, we are subject to audit by taxing authorities for fiscal years 2006 through the current fiscal year.

We are a party to a tax matters agreement with CareFusion Corporation ("CareFusion"), which has been acquired by Becton, Dickinson and Company. Under the tax matters agreement, CareFusion is obligated to indemnify us for certain tax exposures and transaction taxes prior to our fiscal 2010 spin-off of CareFusion. The indemnification receivable was $225 million and $219 million at March 31, 2016, and June 30, 2015, respectively, and is included in other assets in the condensed consolidated balance sheets.

7. Commitments, Contingent Liabilities and Litigation

Commitments

Generic Sourcing Venture With CVS Health Corporation

In July 2014, we established Red Oak Sourcing, LLC ("Red Oak Sourcing"), a U.S.-based generic pharmaceutical sourcing venture with CVS Health Corporation (“CVS Health”) with an initial term of 10 years. Both companies have contributed sourcing and supply chain expertise to the 50/50 venture and have committed to source generic pharmaceuticals through arrangements negotiated by the venture. Red Oak Sourcing negotiates generic pharmaceutical supply contracts on behalf of both companies. We are required to pay 39 quarterly payments of $25.6 million to CVS Health which commenced in October 2014. Due to the achievement of a milestone, the quarterly payment to CVS Health increased by $10 million beginning in the first quarter of fiscal 2016. In addition, if an additional milestone is achieved, the quarterly payment will increase in fiscal 2017 by a further $10 million resulting in a maximum quarterly payment of $45.6 million if all milestones are met.

Legal Proceedings

We become involved from time to time in disputes, litigation, and regulatory matters incidental to our business.

We may be named from time to time in qui tam actions, which are initiated by private third parties purporting to act on behalf of federal or state governments, that allege that false claims have been submitted or have been caused to be submitted for payment by the government. After a private party has filed a qui tam action, the government must investigate the private party's claim and determine whether to intervene in and take control over the litigation. These actions may remain under seal while the government makes this determination. If the government declines to intervene, the private party may nonetheless continue to pursue the litigation on his or her own on behalf of the government.

From time to time, we receive subpoenas or requests for information from various government agencies relating to our business or to the business of a customer, supplier, or other industry participant. Most of these matters are resolved without incident; however, such subpoenas or requests can lead to the assertion of claims, or the commencement of legal proceedings, against us.

In addition, we may suspect that products we manufacture, market or distribute do not meet product specifications, published standards, or regulatory requirements. In such circumstances, we investigate and take appropriate corrective action. Such actions can lead to product recalls, costs to repair or replace affected products, temporary interruptions in product sales, and action by regulators.

We accrue for contingencies related to disputes, litigation, and regulatory matters if it is probable that a liability has been incurred and the amount of the loss can be reasonably estimated. Because these matters are inherently unpredictable and unfavorable developments or resolutions can occur, assessing contingencies is highly subjective and requires judgments about future events. We regularly review contingencies to determine whether our accruals and related disclosures are adequate. The amount of ultimate loss may differ from these estimates.

With respect to the matters described below, we are unable to estimate a range of reasonably possible loss for matters for which there is no accrual, or additional loss for matters for which we have recorded an accrual, since damages or fines have not been specified or the proceedings are at stages where significant uncertainty exists as to legal or factual issues and as to whether such matters will proceed to trial. We do not believe, based on currently available information, that the outcomes of these matters will have a material adverse effect on our financial position, results of operations, or cash flows, though for a particular period, the outcome of one or more of these matters could be material to our results of operations.

We recognize income from the favorable outcome of litigation when we receive the associated cash or assets.

We recognize estimated loss contingencies for litigation and regulatory matters and income from favorable resolution of litigation in litigation (recoveries)/charges, net in our condensed consolidated statements of earnings.

DEA Investigation and Related Matters

In February 2012, the U.S. Drug Enforcement Administration (the "DEA") issued an order to show cause and immediate suspension of our Lakeland, Florida distribution center's registration to distribute controlled substances, asserting that we failed to maintain required controls against the diversion of controlled substances. In May 2012, we entered into a settlement agreement with the DEA that resolved the administrative aspects of the DEA's action but did not resolve potential liability for civil fines in Florida or elsewhere for the conduct covered by the settlement agreement. In that regard, we are continuing to discuss a settlement with the U.S. Department of Justice. Our total accrual for this matter at March 31, 2016 and June 30, 2015 was $44 million and $41 million, respectively, which is included in other accrued liabilities in the condensed consolidated balance sheets.

Cardinal Health | Q3 Fiscal 2016 Form 10-Q | 22 | |

Notes to Financial Statements | ||

State of West Virginia vs. Cardinal Health, Inc.

Since June 2012, the West Virginia Attorney General has filed complaints against a number of pharmaceutical wholesale distributors, including us and Harvard Drug. The complaints, which were filed in the Circuit Court of Boone County, West Virginia, allege, among other things, that the distributors failed to maintain effective controls to guard against diversion of controlled substances in West Virginia, failed to report suspicious orders of controlled substances in accordance with the West Virginia Uniform Controlled Substances Act, and were negligent in distributing controlled substances to pharmacies that serve individuals who abuse controlled substances. The complaints seek, among other things, injunctive and other equitable relief and monetary damages. We are vigorously defending ourselves in this matter.

Antitrust Litigation Proceeds

We received and recognized income resulting from settlements of class action antitrust claims, in which we were a class member, of zero and $14 million during the three months ended March 31, 2016 and 2015, respectively, and $13 million and $14 million during the nine months ended March 31, 2016 and 2015, respectively.

8. Fair Value Measurements

The following tables present the fair values for assets and (liabilities) measured on a recurring basis at:

March 31, 2016 | |||||||||||||||

(in millions) | Level 1 | Level 2 | Level 3 | Total | |||||||||||

Assets: | |||||||||||||||

Cash equivalents (1) | $ | 706 | $ | — | $ | — | $ | 706 | |||||||

Forward contracts (2) | — | 26 | — | 26 | |||||||||||

Available-for-sale securities (3) | — | 205 | — | 205 | |||||||||||

Other investments (4) | 111 | — | — | 111 | |||||||||||

Liabilities: | |||||||||||||||

Contingent Consideration (5) | — | — | (21 | ) | (21 | ) | |||||||||

June 30, 2015 | |||||||||||||||

(in millions) | Level 1 | Level 2 | Level 3 | Total | |||||||||||

Assets: | |||||||||||||||

Cash equivalents (1) | $ | 1,809 | $ | — | $ | — | $ | 1,809 | |||||||

Forward contracts (2) | — | 5 | — | 5 | |||||||||||

Available-for-sale securities (3) | — | 193 | — | 193 | |||||||||||

Other investments (4) | 111 | — | — | 111 | |||||||||||

Liabilities: | |||||||||||||||

Contingent Consideration (5) | — | — | (53 | ) | (53 | ) | |||||||||

(1) | Cash equivalents are comprised of highly liquid investments purchased with a maturity of three months or less. The carrying value of these cash equivalents approximates fair value due to their short-term maturities. |

(2) | The fair value of interest rate swaps, foreign currency contracts, and commodity contracts is determined based on the present value of expected future cash flows considering the risks involved, including non-performance risk, and using discount rates appropriate for the respective maturities. Observable Level 2 inputs are used to determine the present value of expected future cash flows. The fair value of these derivative contracts, which are subject to master netting arrangements under certain circumstances, is presented on a gross basis in the condensed consolidated balance sheets. |

(3) | We invest in marketable securities, which are classified as available-for-sale and are carried at fair value in the condensed consolidated balance sheets. Observable Level 2 inputs such as quoted prices for similar securities, interest rate spreads, yield curves, and credit risk are used to determine the fair value. See Note 5 for additional information regarding available-for-sale securities. |

(4) | The other investments balance includes investments in mutual funds, which are used to offset fluctuations in deferred compensation liabilities. These mutual funds primarily invest in the equity securities of companies with large market capitalization and high quality fixed income debt securities. The fair value of these investments is determined using quoted market prices. |