| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to Rule 240.14a-12 | |

| ☒ | No fee required | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

LETTER FROM OUR CHAIRMAN & CEO

|

501 North Broadway St. Louis, Missouri 63102 |

April 26, 2024

Fellow Shareholders:

We cordially invite you to participate in the 2024 Annual Meeting of Shareholders of Stifel Financial Corp., which will be held virtually on Wednesday, June 5, 2024 at 9:30 a.m., Central Time. We hope that you will be able to participate.

Enclosed you will find a notice setting forth the business expected to come before the meeting and instructions for accessing this Proxy Statement and our Annual Report for the year ended December 31, 2023 on the Internet and for submitting proxy votes online. The notice also contains instructions on how to request a printed set of proxy materials.

Your vote is very important to us. Whether or not you plan to participate in the meeting directly, we hope that your shares are represented and voted.

Thank you for your investment in Stifel. I look forward to welcoming our shareholders to the Annual Meeting.

| Sincerely, |

|

|

| Ronald J. Kruszewski Chairman of the Board and Chief Executive Officer |

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

1

|

TABLE OF CONTENTS

| 1 | ||||

|

|

2 | |||

|

|

3 | |||

|

|

4 | |||

| 7 | ||||

| Corporate Responsibility: Environmental, Social and Governance |

8 | |||

| 9 | ||||

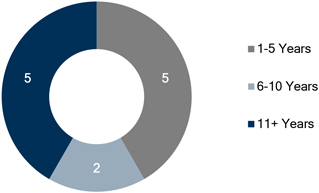

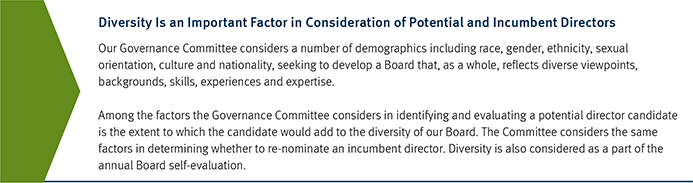

| Diversity Is an Important Factor in Consideration of Potential and Incumbent Directors |

11 | |||

|

|

12 | |||

|

|

12 | |||

| 19 | ||||

| 20 | ||||

| 22 | ||||

|

|

24 | |||

|

|

24 | |||

| 26 | ||||

| 31 | ||||

| 2023 Compensation Determinations for Named Executive Officers |

32 | |||

| 36 | ||||

| 36 | ||||

| 40 | ||||

| 42 | ||||

| Summary Compensation Table Treatment of Timing of Compensation |

47 | |||

| 47 | ||||

| 48 |

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

2

|

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS

|

TIME AND DATE:

|

Wednesday, June 5, 2024 at 9:30 a.m., Central Time

| |||||

| VIRTUAL-ONLY ACCESS:

|

The 2024 Annual Meeting of Shareholders will be virtual-only. Anyone may enter the meeting as a guest in listen-only mode, but only shareholders as of the record date and holders of valid proxies may attend and participate in the meeting, vote electronically and submit questions before and during the meeting by visiting www.meetnow.global/MT2N47N at the meeting date and time. If you plan to attend the virtual meeting, please refer to Questions & Answers about the Annual Meeting on page 64 for details.

| |||||

| ITEMS OF BUSINESS: |

Board Recommendation

|

Page Reference

| ||||

|

u Election of Directors, each as nominated by the Board of Directors (the “Board”)

|

For |

12 | ||||

|

u An advisory vote to approve executive compensation (Say on Pay)

|

For |

59 | ||||

|

u Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2024

|

For |

60 | ||||

|

u Transaction of such other business as may properly come before our 2024 Annual Meeting of Shareholders

| ||||||

|

RECORD DATE: |

You are entitled to vote if you were a shareholder at the close of business on April 8, 2024

| |||||

| VOTING BY PROXY: |

Your vote is very important. By April 26, 2024, we will have sent to certain of our shareholders a Notice of Internet Availability of Proxy Materials (Notice). The Notice includes instructions on how to access our Proxy Statement and 2023 Annual Report to Shareholders and vote online or by telephone, no later than the close of business on May 31, 2024. If you received a paper copy of the proxy card, you may mail your proxy vote in the provided envelope.

| |||||

For additional information about our Annual Meeting, see the Questions & Answers about the Annual Meeting, beginning on page 65. Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on June 5, 2024: Our Proxy Statement and 2023 Annual Report are available at www.stifel.com/investor-relations/annual-reports

| By Order of the Board of Directors, |

|

|

| Mark P. Fisher, Corporate Secretary |

| April 26, 2024 |

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

3

|

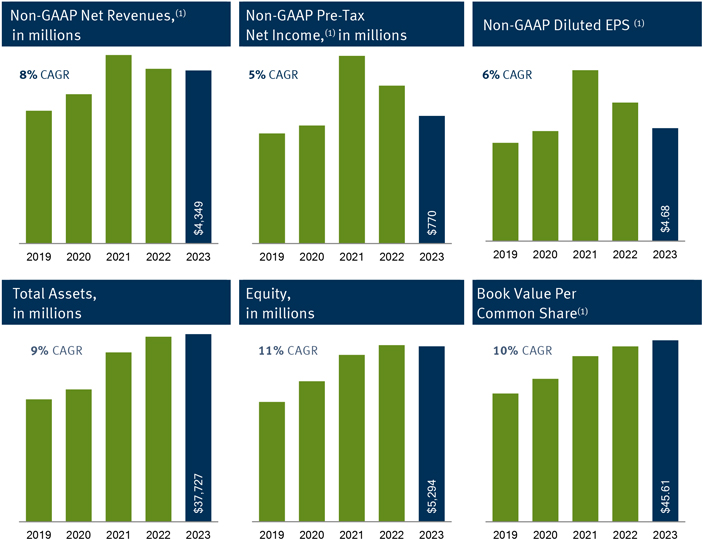

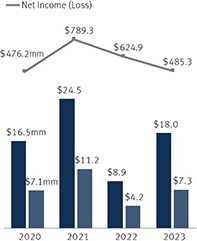

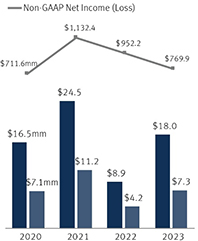

PERFORMANCE HIGHLIGHTS

We encourage you to read the following Performance Highlights as background to this Proxy Statement. Throughout this Proxy Statement, performance measures are GAAP-based unless otherwise noted. We explain why we use certain non-GAAP measures on page 47. All common share information in this Proxy Statement is adjusted for past splits.

|

|

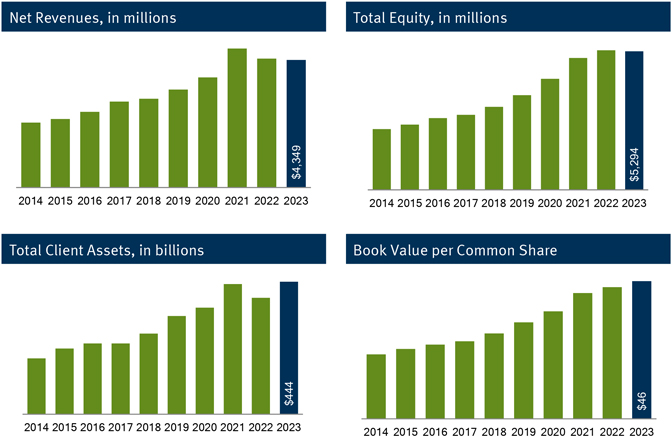

Continued Strong Performance in 2023

|

| u | Net revenues of $4.35 billion, the third highest in our history, despite a challenging environment. |

| u | Non-GAAP net income available to common shareholders of $532 million or $4.68 per diluted common share. |

| u | Record net revenues in our Global Wealth Management operating segment. |

| u | Record net interest income, up 28% over 2022. |

| u | Record asset management revenues, up 3% over 2022. |

| u | Recruited over 171 financial advisors, including 76 experienced employee advisors and 9 experienced independent advisors. |

| u | Non-GAAP Return on Common Equity (ROCE) of 11.5% and Return on Tangible Common Equity (ROTCE) of 16.6%. |

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

4

|

|

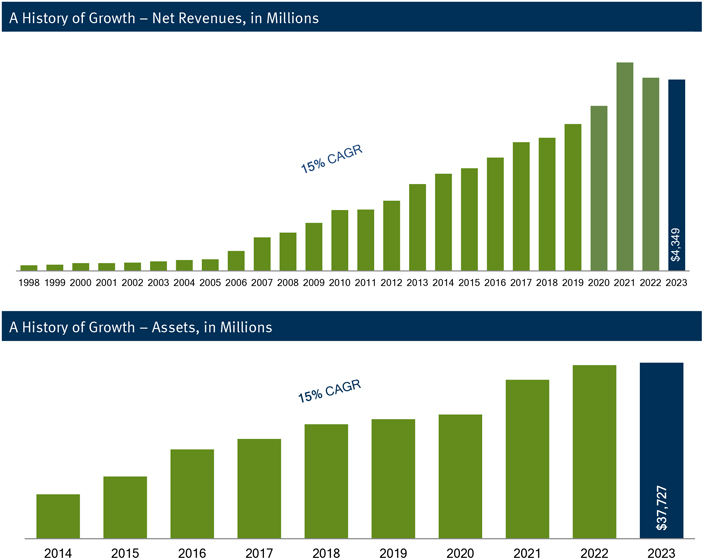

A History of Growth over Multiple Business Cycles

|

| u | Over 9,000 associates worldwide. |

| u | Over 2,300 financial advisors across the United States. |

| u | Approximately 2,200 stocks under coverage – the largest small and mid-cap equity research platform in the United States. |

| u | A balanced business model: 70% of revenues from Global Wealth Management (GWM); 30% from the Institutional Group (IG). |

| u | $5.3 billion in shareholder equity. |

| u | Low leverage of 7x. |

| u | $7.0 billion in market capitalization. |

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

5

|

| A History of Growth through Acquisitions |

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

6

|

SHAREHOLDERS’ SAY ON PAY: OUTREACH AND SHAREHOLDER INPUT

| u | Shareholders overwhelmingly support our compensation program |

| u | Last year, more than 98% of shareholders voting supported |

| u | Similarly strong support in recent years |

| u | Senior management and the Committee are committed to a high level of shareholder outreach and response to input |

| u | Ongoing communication with shareholders throughout the year |

| u | Compensation-focused dialog with top 20 institutional shareholders, over 55% of outstanding shares |

| u | Regular interface with our employees, over 26% of outstanding shares |

| u | We have responded to feedback in recent years – some of our responsive actions have been |

| u | Greater utilization of performance-based awards |

| u | Clearly articulated goals |

| u | More robust disclosure |

| u | Some of our institutional shareholders publish proxy voting guidelines, including the following: |

|

Institutional Shareholder Guidelines |

Stifel Response

|

Cross-Reference

| ||

| Incentive plans should reflect strategy and incorporate long-term shareholder value drivers, including metrics and timeframes. |

Our Committee has developed a facts-based, performance-focused framework by which it assesses executive officer performance and sets compensation against clearly stated and measured Company and business goals.

Our Performance-Based Restricted Stock Units (PRSUs) are primarily based on measuring objective, clearly stated performance goals.

|

Page 25, Incentive Assessment Framework Results

Page 42, Performance-Based Restricted Stock Units, PRSUs | ||

| Performance results should generally be achieved over a 3- to 5-year time horizon. |

PRSUs are measured over a 4-year period and vest over a 5-year period. Both periods are longer than is typical in the market, which we believe results in stronger retention.

|

Page 42, Performance-Based Restricted Stock Units, PRSUs | ||

| Peer group evaluation should be used to maintain awareness of pay levels and practices. |

Our peer group was identified by Compensation Advisory Partners LLC (CAP), our independent compensation consultant.

CAP provided the Committee with market data on executive compensation trends and executive officer compensation levels, and assisted the Committee with evaluation of pay-for-performance alignment.

|

Page 39, Independent Compensation Committee Consultant and Identification of Peer Group | ||

| Disclose the rationale behind the selection of pay vehicles and how these fit with intended incentives. |

Our key executive compensation program elements include fixed and variable compensation, and we have disclosed the rationale behind the selection of pay vehicles and how they fit with intended incentives in detail in the sections referenced to the right. | Page 40, Key Executive Compensation Program Elements

Page 41, Committee’s Perspective on Compensation Elements

Page 31, Executive Compensation Determinations for 2023

| ||

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

7

|

CORPORATE RESPONSIBILITY: ENVIRONMENTAL, SOCIAL AND GOVERNANCE

Stifel is a global banking, wealth management, and investment banking firm with a distinguished history of consistently strong results in a variety of market environments. We approached 2023 as we have confronted other turbulent market environments during our long history: with thorough analysis of risk, dedication to our clients, and principled consideration of the priorities of our stakeholders. This premise is intrinsic to our corporate mission to be our associates’ Firm of Choice, our clients’ Advisor of Choice, and our shareholders’ Investment of Choice.

Our continued support of these constituents ensures that Stifel remains a sustainable business well positioned for long-term success. Our commitment to sustainable business practices is essential to creating value for associates, clients, and shareholders. Our Corporate Responsibility (CR) report, available at https://www.stifel.com/sustainability, details how we have continued to improve our practices and increase our transparency. This approach not only fits with our “Of Choice” philosophy but also is a key contributor to our firm’s success.

Our report takes inspiration from the investor-led Sustainability Accounting Standards Board (SASB) framework to communicate our corporate responsibility activities and impacts in a relevant and structured manner. As they change over time, we will regularly evaluate SASB and other reporting frameworks on an ongoing basis to ensure they are appropriate and provide the most relevant information for our stakeholders.

Our commitment to responsible business practices in our day-to-day operations is to continuously develop, refine, and maintain our internal processes in order to promote well-being and accountability within our operations. Looking forward, we will continue to evolve and structure procedures around these considerations for all our businesses. Additionally, we strive to be a company whose people reflect a wide range of diversity of thought, experiences and backgrounds. They are simply the best talent available to maximize our contributions to the communities, firms, and clients with whom we work.

| Recent Environmental, Social, and Governance Programs and Efforts | ||||||||||

| $9 Million |

$74 million |

Good Homes | More Efficient | Data Security | 31,000 hours | |||||

| Stifel’s charitable contributions totaled over $9 million in 2023. In the past two years, our employee donation matching program totaled another $1.5 million. |

Stifel obtained over $74 million in products and services from women, minority and veteran owned suppliers. |

In 2023, Stifel was once again the number one underwriter of affordable housing transactions. | Stifel HQ is is completing a major phase of improvements, achieving a 33% increase in energy efficiency. | We continued to invest significantly in our technical services division to ensure Stifel’s clients and their information are thoroughly protected. | Stifel associates contributed over 31,000 hours of volunteering in 2023. | |||||

Stifel governance includes “responsible caretaking” with policies in place to ensure accountability. In accordance with NYSE and SEC rules, our Board of Directors is composed of two employee directors and nine independent directors, including a Lead Independent Director. Our board committees include Audit, Compensation, Corporate Governance & Nominations, and Risk Management, the members of which are 100% independent. Our firm’s corporate responsibility work, measurement, and tracking are overseen at the Board level by the Corporate Governance & Nominations Committee, which in recent years has met regularly each year to discuss topics including diversity, philanthropy, environmental policies, and community development. Each quarter this committee is presented with Corporate Responsibility program updates by the Head of Diversity and Inclusion, who manages Stifel’s CR program across our business segments. We believe our approach to responsibility is consistent with our firm’s philosophy and our commitment to long-term value creation.

Stifel takes data security seriously. Our data privacy and cybersecurity program has been designed for risk mitigation and defense, building on the National Institute of Standards and Technology (NIST) Cybersecurity Framework and the Center for Internet Security’s (CIS) Critical Security Controls. Security is inherent in every system architecture development we make. Since 2021 , Stifel has utilized the Agile SAFE methodology in the management of its information security programs. In 2023, we expanded the benefits of this approach to our infrastructure modernization initiatives, enabling increased prioritization of long-term workstreams and addressing systematic improvements with strategic rigor.

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

8

|

CORPORATE GOVERNANCE HIGHLIGHTS

| Key Facts about our Board |

We strive to maintain a well-rounded and diverse Board that balances financial industry expertise with independence, and that balances the institutional knowledge of longer-tenured directors with the fresh perspectives brought by newer directors. As summarized below, our directors bring to our Board a variety of skills and experiences developed across a broad range of industries, both in established and growth markets, and in each of the public, private and not-for-profit sectors.

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Board Membership Characteristics |

12 Directors | |||||||||||||||||||||||||

| Independence, Lead Ind. Dir. |

I | I | I | I | I | I | N | I | I | L | N | I | 83% Independent | |||||||||||||

| Audit Committee (*see page 20) |

C* | M | M | M | C* | 5 Independent Directors | ||||||||||||||||||||

| Compensation Committee |

M | M | C | 3 Independent Directors | ||||||||||||||||||||||

| Nominations & Corp. Gov. Cte. |

M | C | M | 3 Independent Directors | ||||||||||||||||||||||

| Risk Management Committee |

M | M | M | C | M | 5 Independent Directors | ||||||||||||||||||||

| Years of Board Service |

5 | 1 | 14 | 1 | 14 | 2 | 27 | 5 | 8 | 7 | 14 | 11 | Average 9 years | |||||||||||||

| Key Skills | ||||||||||||||||||||||||||

| Audit, Tax & Accounting |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 8 Directors | |||||||||||||||||

| Cybersecurity |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 8 Directors | |||||||||||||||||

| Digital |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 8 Directors | |||||||||||||||||

| Banking |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 10 Directors | |||||||||||||||

| Wealth Management |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 10 Directors | |||||||||||||||

| Institutional Banking |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 9 Directors | ||||||||||||||||

| General Management |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 12 Directors | |||||||||||||

| Gov. Regulation and Public Policy |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 8 Directors | ||||||||||||||||

| Marketing and Branding |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 7 Directors | ||||||||||||||||||

| Risk Management |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 12 Directors | |||||||||||||

| Talent & HR Management |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 8 Directors | |||||||||||||||||

| Technology |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 9 Directors | ||||||||||||||||

| Key Experiences | ||||||||||||||||||||||||||

| CEO, President or COO |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 8 Directors | |||||||||||||||||

| CFO or other Financial Expert |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 6 Directors | |||||||||||||||||||

| ESG |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 6 Directors | |||||||||||||||||||

| Complex Regulated Industries |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 11 Directors | |||||||||||||

| Government Service |

🌑 | 🌑 | 2 Directors | |||||||||||||||||||||||

| Private Co. Mgmt. & Governance |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 10 Directors | ||||||||||||||

| Public Co. Mgmt. & Governance |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 10 Directors | |||||||||||||||

| Not-for-Profit |

🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 6 Directors | ||||||||||||||||||

| Individual Characteristics | ||||||||||||||||||||||||||

| Age |

57 | 49 | 78 | 56 | 66 | 61 | 65 | 67 | 66 | 55 | 83 | 73 | Average 65 years | |||||||||||||

| Other Public Board Service |

0 | 0 | 1 | 1 | 1 | 0 | 1 | 0 | 1 | 1 | 0 | 0 | 6 Directors | |||||||||||||

| Diversity |

D | D | D | D | 40% of Ind. Dirs. | |||||||||||||||||||||

C, Chair; D, Diverse by race, gender, or sexual orientation; I, Independent; L, Lead Independent Director; M: Member; N, Not independent

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

9

|

| Name | Independence

Year Commencing |

Occupation and Career Highlights

|

Committee Membership

and Board Leadership | |||||

|

|

Adam T. Berlew |

Independent 2019 |

CMO, Equinix, Inc.; Former Executive Director, Google Cloud AI & Industry Solutions |

Compensation; Risk Management | ||||

|

|

Maryam S. Brown | Independent 2023 |

President, SoCalGas; Former Senior Counsel, Energy and Environment, Speaker of the House, US Congress | Risk Management | ||||

|

|

Michael W. Brown |

Independent 2010 |

Retired, Vice President & CFO, Microsoft Corporation |

Audit (as of Annual Meeting) | ||||

|

|

Lisa L. Carnoy | Independent 2023 |

Former CFO and Head of Operations, AlixPartners |

Audit; Risk Management | ||||

|

|

Robert E. Grady |

Independent 2010 |

Advisory Partner, Summit Partners Former Partner, The Carlyle Group |

Nominations & Corporate Governance; Risk Management, Chair | ||||

|

|

James P. Kavanaugh | Independent 2022 |

Co-Founder & CEO, World Wide Technology |

Compensation | ||||

|

|

Ronald J. Kruszewski |

Not Independent 1997 |

Chairman & CEO, Stifel Financial Corp. |

Chairman | ||||

|

|

Daniel J. Ludeman | Independent 2019 |

Former President and CEO, Wells Fargo Advisors |

Audit; Risk Management | ||||

|

|

Maura A. Markus |

Independent 2016 |

Retired, President, COO & Board Director, Bank of the West | Audit; Nominations & Corporate Governance, Chair | ||||

|

|

David A. Peacock | Independent 2017 |

CEO, Advantage Solutions, Former President, Anheuser-Busch |

Lead Independent Dir.; Compensation, Chair; Nominations & Corporate Governance | ||||

|

|

Thomas W. Weisel |

Not Independent 2010 |

Sr. Managing Director, Stifel Financial Corp.; Chairman & CEO, Thomas Weisel Partners Group, Inc. | |||||

|

|

Michael J. Zimmerman | Independent 2013 |

Vice Chairman, Continental Grain Company |

Audit, Chair (as of Annual Meeting) | ||||

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

10

|

| A Foundation of Sound Governance and Shareholder Outreach |

| u | Independent Lead Director, periodically rotated |

| u | Annual CEO evaluation by our all-independent Compensation Committee |

| u | Ongoing shareholder engagement and demonstrated responsiveness to shareholder input |

| u | The Board and its committees may engage independent advisors in their discretion |

| u | Annual election of directors |

| u | Executive sessions of independent, non-employee directors |

| u | Substantial share ownership by each of our named executive officers well in excess of our share ownership requirements |

| u | Robust risk control, led by the Board and senior executives, buttressed by processes and committees, embraced throughout the Company |

| Board Tenure of Continuing Directors |

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

11

|

ITEM 1. ELECTION OF DIRECTORS

|

|

What is being voted on: Election to the Board of our director nominees, each for a one-year term.

Board recommendation: FOR each of our director nominees, based on a review of individual qualifications and experience and contributions to our Board.

|

OUR DIRECTORS

Board of Director Nominees’ Qualifications and Experience

Our director nominees have a great diversity of experience and bring to our Board a wide variety of skills, qualifications and viewpoints that strengthen their ability to carry out their oversight role on behalf of shareholders.

| Core Qualifications and Experience | ||

|

u Integrity, business judgment and commitment

u Demonstrated management ability

u Extensive experience in the public, private or not-for-profit sectors |

u Leadership and expertise in their respective fields

u Financial literacy

u Strategic thinking

u Reputational focus

| |

| Diversity of Skills and Experiences | ||

|

u Audit, Tax and Accounting

u Cybersecurity

u Digital

u Financial Services: Banking

u Financial Services: Global Wealth Management

u Financial Services: Institutional

u General Management

u Government, Regulation and Public Policy

u Marketing and Branding

u Risk Management

|

u Talent and HR Management

u Technology

u CEO, President or COO

u CFO or other Financial Expert

u ESG

u Complex Regulated Industries

u Government Service

u Private Company Management/Governance

u Public Company Management/Governance

u Not for Profit

| |

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

12

|

| ADAM T. BERLEW |

|

|

|

u Director since 2019, age 57

u Committee Service: Compensation, Risk Management

Mr. Berlew brings decades of expertise in cloud, tech and telecom market evaluation, marketing, M&A, product management, portfolio management, process development, financial structuring and talent development.

Career Highlights

u CMO, Equinix, Inc. (2023 – present)

u VP, Atlassian (2022 – 2023)

u Executive Director, Google (2017 – 2022)

u Cloud AI & Industry Solutions (2021 – 2022)

u Americas Cloud Marketing (2017 – 2021)

u VP, Global Customer Engagement Marketing, Brocade Communications Systems (2015 – 2017)

u VP, Global Marketing and Americas Field Marketing, Equinix (2012 – 2015)

u SVP, Strategy and Corporate Development, Triumphant, Inc. (2009 – 2012)

u Director Sales & Marketing, Dell, Inc. (2002 – 2008)

Additional Professional Experience, Community Involvement and Education

u Member, Council on Foreign Relations

u Technology Advisory Board, Gridline Communications Corp.

u Board Member, US Luge Olympic Committee (2014 – present)

u M.B.A., The Wharton School, U. of Pennsylvania

u B.A., Brown University

Other Public Company Directorships Within the Past 5 Years:

u Lazard Growth Acquisition Corp. I (NASDAQ: LGACU) |

| MARYAM S. BROWN |

|

|

|

u Director since 2023, age 49

u Committee Service: Risk Management

Ms. Brown brings experience garnered from leading an organization of over 8,000 employees serving over 21 million natural gas consumers in Southern California and has 25 years’ experience in the energy industry across engineering, legal, policy and regulatory roles.

Career Highlights

u President, SoCalGas (2019 – present)

u Vice President, Federal Affairs, Sempra Energy (2016 – 2019)

u United States Congress

u Assistant to Speaker for Policy and Senior Energy and Environment Counsel (2012 – 2016)

u Chief Counsel, Energy and Power, House Committee on Energy and Commerce (2011 – 2012)

Additional Professional Experience, Community Involvement and Education

u Chair, American Gas Association Foundation

u Member, National Petroleum Council, U.S. Department of Energy

u Member, Executive Committee, California Chamber of Commerce |

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

13

|

| MICHAEL W. BROWN |

|

|

|

u Director since 2010, age 78

u Committee Service: Audit, Chair (until Annual Meeting and, thereafter, Member)

Mr. Brown is a retired executive with considerable financial and accounting expertise, including eight years of financial leadership with a leading technology company and directorships at other publicly held companies. Mr. Brown has considerable experience as a director and governor of self-regulatory organizations in the financial services industry. Mr. Brown’s deep technology experience provides the Board and senior management with keen insight and guidance concerning the Company’s cybersecurity and other technology efforts.

Career Highlights

u Microsoft Corporation, a global software company (NASDAQ: MSFT)

u Vice President and Chief Financial Officer (1994 –1997)

u Vice President – Finance and Treasurer (1989 –1994)

u Deloitte & Touche LLP, a provider of assurance, tax, and business consulting services (1971 – 1989)

Additional Professional Experience, Community Involvement and Education

u Former Chairman, NASDAQ Stock Market Board of Directors

u Former Governor, National Association of Securities Dealers

Other Public Company Directorships Within the Past 5 Years:

u VMWare, Inc. (NYSE: VMW)

u Audit Committee

u Compensation Committee

u Governance Committee |

| LISA L. CARNOY |

|

|

|

u Director since 2023, age 56

u Committee Service: Audit, Risk Management

Ms. Carnoy is known both for advising clients and building businesses. She has substantial capital markets, M&A and operational experience, with a consistent focus on increasing market share and profitability at every organization. A diversity and inclusion champion and role model, she has been named to American Banker’s list of “Most Powerful Women in Finance.”

Career Highlights

u Former Chief Financial Officer, Head of Operations, Alix Partners (2018 – 2022)

u Bank of America

u Division Executive, US Trust; Market President, New York City (2014 –2017)

u Head of Global Capital Markets (2012 –2014)

u Managing Director, Co-Head of Global Capital Markets (2010 –2012)

u Managing Director, Head of Global Equity Capital Markets (2009 –2010)

Additional Professional Experience, Community Involvement and Education

u Trustee Chair Emerita, Board of Trustees, Columbia University

u Independent Director and Treasurer, U.S. Soccer Federation

u M.B.A., Harvard Business School

u B.A., Columbia University

Other Public Company Directorships Within the Past 5 Years:

Onex Corporation (TSX: ONEX) |

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

14

|

| ROBERT E. GRADY |

|

|

|

u Director since 2010, age 66

u Committee Service: Nominations & Corporate Governance; Risk Management, Chair

Mr. Grady has extensive leadership experience in the private equity investment and the broker-dealer segments of the financial services industry. Mr. Grady also has substantial federal and state governmental experience as well as strong academic experience. Finally, Mr. Grady has considerable experience as a director of other publicly and privately held companies as well as experience in Environmental, Social and Governance.

Career Highlights

u Advisory Partner, Summit Partners (2021 – present)

u Partner, Gryphon Investors, a private equity investment firm (2015 – 2020) u Chair, NJ State Investment Council (2010 – 2014)

u Partner and MD, Carlyle Group (2000 – 2009)

u Partner and MD, Robertson Stephens & Co. (1993 – 2000)

Additional Professional Experience, Community Involvement and Education

u Member, Council on Foreign Relations

u Member, Board of Overseers, Hoover Institution, Stanford University

u Advisor to the Investment Ctte., the Daniels Fund

u Former Chair, National Venture Capital Association

u Former Deputy Asst. to Pres. George H.W. Bush

u Former Exec. Assoc. Director, Office of Management and Budget, Exec. Office of the President

u M.B.A., Stanford Graduate School of Business

u A.B., Harvard College

Other Public Company Directorships Within the Past 5 Years:

u Maxim Integrated Products (NASDAQ: MXIM) |

| JAMES P. KAVANAUGH |

|

|

|

u Director since 2022, age 61

u Committee Service: Compensation

Mr. Kavanaugh translated his drive on the field as a professional soccer player into successful leadership of WWT, a $17 billion information technology systems integrator with nearly 9,000 employees, prioritizing, practicing and executing on what is most important. He has proven experience providing the most complex technical solutions and systems intergration to firms large and small through the combined efforts of his team.

Career Highlights

u CEO and Co-Founder, WWT, World Wide Technology (1990 – present)

Additional Professional Experience, Community Involvement and Education

u Investor and board member, Privoro, a cybersecurity firm

u Member, Business Roundtable

u Co-Founder and Owner, St. Louis City SC, Major League Soccer

u Owner and Investor, St. Louis Blues, National Hockey League

u Trustee, St. Louis University

u B.A., St. Louis University |

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

15

|

| RONALD J. KRUSZEWSKI |

|

|

|

u Director since 1997, age 65

u Chairman of the Board and Chief Executive Officer

Mr. Kruszewski has extensive managerial and leadership experience in the financial services industry in addition to a comprehensive understanding and knowledge of the Company’s day-to-day operations and strategy.

Career Highlights u Stifel Financial Corp. u Chairman

u Chief Executive Officer

u President

Additional Professional Experience, Community Involvement and Education u Vice-Chairman, Board of Directors, Securities Industry and Financial Markets Association (SIFMA)

u Former Member, Federal Advisory Council, St. Louis Federal Reserve Board of Directors (2014 – 2019)

u Former Chairman, American Securities Association (ASA)

u Member, U.S. Ski and Snowboard Team Foundation Board

u Trustee, St. Louis University

u Member, Chair’s Council for Greater St. Louis, Inc.

u Former Chairman, Downtown STL, Inc.

u Responsible for Company membership in the World Economic Forum

u Member, World Presidents’ Organization – St. Louis Chapter

Other Public Company Directorships Within the Past 5 Years: FutureFuel Corp. (NYSE: FF) |

| DANIEL J. LUDEMAN |

|

|

|

u Director since 2019, age 67

u Committee Service: Audit; Risk Management

Mr. Ludeman brings over three decades of experience leading one of the nation’s largest full-service brokerage firms, with a track record of dramatically increased revenue, profits, advisors and locations. Mr. Ludeman has, since retiring from Wells Fargo, devoted himself, through leadership of Concordance Academy, to successfully re-integrating individuals from prison into society, through holistic integrated services including cognitive behavioral programs, mental health and substance abuse treatment, employment readiness, employment, housing and mentoring.

Career Highlights u Chairman and CEO, Concordance Academy of

u President and CEO, Wells Fargo Advisors

u President and CEO, Wachovia Securities, LLC

Additional Professional Experience, Community Involvement and Education u Member, Board of Directors, Urban League of Metropolitan

u Trustee Emeritus, University of Richmond

u Member, Board of Directors, Opera Theater of St.

u Member, Board of Directors, Missouri Botanical

u Member, Board of Directors, Variety, the Children’s Charity of St. Louis (2014 – present)

u United Way of Greater St Louis (2008 – 2020) |

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

16

|

| MAURA A. MARKUS |

|

|

|

u Director since 2016, age 66

u Committee Service: Audit; Nominations & Corporate Governance, Chair

Ms. Markus is a retired executive who brings over 25 years of experience in banking to the Board. Ms. Markus has been named one of American Banker’s Most Powerful Women in Banking multiple times. Through her proven service as an executive and director of leading financial service companies, Ms. Markus brings substantial knowledge and expertise to the Board of Director’s deliberations.

Career Highlights u Bank of the West, President, Chief Operating u Broadridge Financial Solutions, Inc., Director, u Citigroup (1987 – 2009) u Executive Vice President, Head of International Retail Banking (2007 – 2009) u President, Citibank N.A. (2000 – 2007) u President, Citibank Greece (1997 – 2000) u European Sales and Marketing Director

Additional Professional Experience, Community Involvement and Education u Trustee, College of Mount St. Vincent in New York u Former Board Member, Year Up San Francisco Bay Area Talent and Opportunity u Former Board Member, Catholic Charities San Francisco and New York u Former Executive Committee and Board Member, Junior Achievement New York u Financial Services Roundtable, Former Member u M.B.A., Harvard Business School u B.A., Boston College, summa cum laude

Other Public Company Directorships Within the Past 5 Years: u Broadridge Financial Solutions, Inc. (NYSE: BR) |

| DAVID A. PEACOCK |

|

|

|

u Director since 2017, age 56

u Lead Independent Director

u Committee Service: Compensation, Chair;

Mr. Peacock brings entrepreneurial, corporate, manufacturing, and marketing expertise to the Board. In addition, through his service as president of a global consumer brand, Mr. Peacock brings an in-depth knowledge and expertise in corporate governance, branding, marketing and market presence.

Career Highlights u CEO, Advantage Solutions, Inc. (2023 – present)

u Continental Grain Co., Director and COO

u Post Holdings Corp., Director (2021 – present)

u Schnucks Markets, Inc., President and COO

u Anheuser-Busch (1992-2012),

Additional Professional Experience, Community Involvement and Education u Board of Directors, Pink Ribbon Girls, which supports women with breast cancer

u Board of Trustees, Urban League of Metropolitan St. Louis

Other Public Company Directorships Within the Past 5 Years:

u Post Holdings Partnering Corp. |

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

17

|

| THOMAS W. WEISEL |

|

|

|

u Director since 2010, age 83

Mr. Weisel has extensive entrepreneurial and operational experience in the financial services industry, as evidenced by his founding and development of the investment firms of Thomas Weisel Partners Group, Inc. and Montgomery Securities prior to joining the Company.

Career Highlights u Senior Managing Director, Stifel Financial Corp. u Founder, Chairman and Chief Executive Officer, Thomas Weisel Partners Group, Inc. (1999 – 2010) u Founder, Chairman, and Chief Executive Officer, Montgomery Securities (1971 – 1997) u Lifetime Achievement Award, National Venture Capital Association (2006) u George Steinbrenner Sport Leadership Award, US Olympic Foundation (2011) u Inducted into the U.S. Ski and Snowboard Hall of Fame (Class of 2017)

Additional Professional Experience, Community Involvement and Education u Trustee, The Sports Neurology Clinic, Inc. u Trustee, Maui Greens, Inc. u Member and former Chairman, U.S. Ski and Snowboarding Team Foundation u Member and former Chairman, USA Cycling Foundation Board u Former Member, Board of Trustees, San Francisco Museum of Modern Art u Former Chairman and Board Member, Empower America u Former Chairman, Capital Campaign for California School of Arts & Crafts u Former Member, Board of Directors, Stanford Endowment Management Board u Former Member, Advisory Board, Harvard Business School u Former Board Member, NASDAQ u Former Trustee, Museum of Modern Art in New York |

| MICHAEL J. ZIMMERMAN |

|

|

|

u Director since 2013, age 73 u Committee Service: Audit, Chair (as of Annual Meeting and until then, Deputy Chair)

Mr. Zimmerman’s experience within the financial services industry and his understanding of investment banking provide valuable judgment and insights. This background, together with perspectives applied as an independent director and audit committee member of a publicly held company, brings knowledge and a skill set integral to our Board.

Career Highlights u Continental Grain Company, a diversified international agribusiness and investment firm u Director (2020 – present) u Vice Chairman (2012 – present) u Executive Vice President and Chief Financial Officer (1999 – 2012) u Senior Vice President, Investments and Strategy (1996 – 1999) u Managing Director, Salomon Brothers, Inc.

Additional Professional Experience, Community Involvement and Education u Member of Board of Directors and Audit Committee Chairman, Energy Trading Innovations LLC and Castleton Commodities International, LLC u Trustee, Mount Sinai Health System, a non-profit health care organization u Chairman, Investment Committee, U.S. Holocaust Memorial Museum u Prior experience as non-executive chairman of two public companies |

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

18

|

OUR CORPORATE GOVERNANCE PRINCIPLES

The Board has adopted Corporate Governance Guidelines (‘‘Principles’’), which are available in the corporate governance section of the Company’s web site at www.stifel.com. The Principles set forth the practices the Board follows with respect to, among other matters, the role and duties of the Board, size and composition of the Board, director responsibilities, Board committees, director access to officers, employees and independent advisors, director compensation and performance evaluation of the Board.

As described in the Principles, the role of the Board is to oversee management of the Company in its efforts to enhance shareholder value and conduct the Company’s business in accordance with its mission statement. In that connection, the Board helps management assess long-range strategies for the Company, and evaluates management performance.

It is a responsibility of the Board to assess each director’s independence regularly and to take appropriate actions in any instance in which the requisite independence has been compromised. The Board has determined that Directors Berlew, Maryam Brown, Michael Brown, Carnoy, Grady, Kavanaugh, Ludeman, Markus, Peacock, and Zimmerman are independent directors under the rules of the NYSE and the SEC, including NYSE rules regarding the independence of the Compensation Committee, and reviewed information provided by the directors in questionnaires concerning the relationships that we may have with each director.

Board of Directors – Leadership, Risk Oversight and Meetings

Leadership: The continuing membership of our Board is composed of 9 independent directors and 2 employee directors.

The Board strategically considers the combination or separation of the Chairman and Chief Executive Officer roles as an integral part of its planning process and corporate governance philosophy. Ronald J. Kruszewski concurrently serves as both the Chairman of the Board and Chief Executive Officer. The Board believes that this structure serves the Company well because it provides consistent leadership and accountability for managing Company operations. However, our Board also holds regularly scheduled executive sessions without management, at which the lead independent director presides in compliance with the NYSE Corporate Governance Standards. These sessions occurred quarterly in 2023.

Lead Director: Mr. David Peacock is currently the Independent Lead Director of Stifel Financial Corp. The Board has determined that the Lead Director will: have authority to call meetings of the independent directors; chair meetings of the independent directors; liaise between management and independent directors; serve ex officio on all committees of which the lead director is not otherwise a member and, with the chair of the Compensation Committee, lead CEO performance evaluation and succession planning. The Board believes that the Lead Director role should be filled by an independent director selected by the independent directors in order to promote independence of oversight and development of the independent directors’ overall contribution to the Board.

Risk Oversight: Our Board has responsibility for the oversight of risk management. Our Board, either as a whole or through its Committees, regularly discusses with Company management our major risk exposures, their potential impact, and the steps we take to monitor and control such exposures.

While our Board is ultimately responsible for risk oversight, each of our Committees assists the full Board in fulfilling its oversight responsibilities in certain areas of risk. In particular, the Audit Committee focuses on the management of financial and accounting risk exposures. The Compensation Committee assists our Board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs. Finally, the Risk Management Committee focuses on the management of risks associated with Board organization, membership, and structure, and the organizational and governance structure of our company, including cybersecurity matters.

We have an Enterprise Risk Management program under the direction of our Chief Risk Officer, who coordinates with management committees, including the Asset Liability Management Committee, the Products & Services Committee, the Conflicts of Interest Committee, the Operational Risk Committee, and the Disclosure Committee.

Meetings: During 2023, our Board met 7 times, including both regularly scheduled and special meetings. During the year, attendance by incumbent continuing directors of all meetings held by the Board and all Committees on which they serve exceeded 80%. We encourage our directors to attend the Annual Meeting of Shareholders. Last year, 58% of directors attended the Annual Meeting.

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

19

|

COMMITTEES OF THE BOARD OF DIRECTORS

The standing committees of our Board are the Audit Committee, Compensation Committee, Nominations & Corporate Governance Committee and Risk Management Committee. Each operates pursuant to a written charter approved by the Board. The full text of each such charter and our corporate governance guidelines are available in the “Corporate Governance” section of our web site located at www.stifel.com, or may be obtained by any shareholder, without charge, upon request by contacting Mark P. Fisher, our Corporate Secretary, at (415) 364-2500 or by e-mail at investorrelations@stifel.com.

|

Audit Committee

| ||

|

The Audit Committee met 8 times during 2023.

| ||

|

Committee Chair:*

u Michael Brown

u Zimmerman

Members:

u Carnoy

u Ludeman

u Markus

Committee members are independent directors as defined by the NYSE, the SEC, and as determined by our Board. |

Committee Role, Responsibilities and Qualifications:

| |

|

u Recommending to the Board a public accounting firm to be nominated for shareholder ratification as our independent auditors and compensating and terminating auditors as deemed necessary;

u Meeting periodically with our auditors and financial management to review the scope of the proposed audit for the then-current year, the proposed audit fees, and the audit procedures to be utilized, reviewing the audit and eliciting the judgment of the independent auditors regarding the quality of the accounting principles applied to our financial statements; and

u Evaluating on an annual basis the qualification, performance, and independence of the independent auditors, based on the Audit Committee’s review of the independent auditors’ report and the performance of the independent auditors throughout the year.

u Each member of the Audit Committee is financially literate, knowledgeable, and qualified to review financial statements. Our Board has designated each Audit Committee member an “audit committee financial expert.”

* Mr. Michael Brown is currently Chair and Mr. Zimmerman is currently Deputy Chair of the Committee. As part of a transition plan, as of the date of the Annual Meeting, Mr. Zimmerman will become Chair and Mr. Michael Brown will become a member. | ||

|

Compensation Committee

| ||

|

The Compensation Committee met 4 times during 2023.

| ||

|

Committee Chair:

u Peacock

Members:

u Berlew

u Kavanaugh

Committee members are independent directors as defined by the NYSE, the SEC, and as determined by our Board. |

Committee Role, Responsibilities and Qualifications:

| |

|

u Reviewing executive performance and recommending to our Board the compensation of each of our executive officers;

u Reviewing market data to assess the components of our executive compensation;

u Reviewing and approving executive compensation elements and plans;

u Making recommendations to our Board regarding the adoption, amendment, and rescission of certain employee benefit plans; and

u Reviewing the Company’s compensation policies and practices with respect to the Company’s employees to ensure that they are not reasonably likely to have a material adverse effect on the Company.

u During 2023, there were no interlocks or insider participation on the part of the members of the Compensation Committee.

u See page 56 for further description of the lack of interlocks and insider participation on the Compensation Committee. | ||

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

20

|

|

Nominations & Corporate Governance Committee

| ||

The Nominations & Corporate Governance Committee met 5 times during 2023.

|

Committee Chair:

u Markus

Members:

u Grady

u Peacock

Committee members are independent directors as defined by the NYSE, the SEC, and as determined by our Board. |

Committee Role & Responsibilities:

| |

|

u Overseeing Board and Board Committee organization, membership, and structure;

u Leading Board and Board Committee self-evaluation;

u Overseeing the Corporation’s executive and corporate structure and recommending improvements to its effectiveness;

u Searching for individuals qualified to become members of our Board and selecting director nominees to be presented for election at the Annual Meeting of Shareholders and considering nominees for directors recommended by our shareholders;

u Reviewing the Company’s charitable strategy, Company political contributions and lobbying policies, Company conservation and environmental policies, and Company efforts to sustain the economic development of the communities in which it operates; and

u Fostering the Company’s efforts to encourage diversity and respect for diversity among the Corporation’s associates, including its leadership, considering gender diversity, racial diversity, ethnic diversity and other diversity of background and identification.

|

|

Risk Management Committee

| ||

| The Risk Management Committee met 5 times during 2023. | ||

|

Committee Chair:

u Grady

Members:

u Berlew

u Maryam Brown

u Carnoy

u Ludeman

Committee members are independent directors as defined by the NYSE, the SEC, and as determined by our Board. |

Committee Role & Responsibilities:

| |

|

u Regularly reviewing our aggregate risk exposures and risk management processes with management, including our Chief Executive Officer, Chief Financial Officer, Chief Risk Officer and Chief Compliance Officer;

u Considering cybersecurity matters, with a special meeting devoted each year to cybersecurity;

u Overseeing the Company’s Enterprise Risk Management program and the Company’s responsiveness to and discussions and compliance with the Federal Reserve Bank of St. Louis and other regulators’ input, reviews and rules;

u Considering the wide range of risks the Company confronts, including market risk, credit risk, technological and operational risk, liquidity and funding risk, compliance and legal risk, reputational risk, risks arising from actual or potential conflicts of interest, and strategic risk; and

u Reviewing newly developing Company risks and the Company’s efforts to address these developments.

|

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

21

|

OTHER GOVERNANCE MATTERS

Director Nominations by Shareholders

In accordance with the Nominations & Corporate Governance Committee’s charter and our corporate governance guidelines, the Nominations & Corporate Governance Committee considers nominees recommended by shareholders and reviews the qualifications and contributions of the directors standing for election each year. Shareholders may recommend individuals to the Nominations & Corporate Governance Committee for consideration as potential director nominees by giving written notice to Mark Fisher, our Corporate Secretary, at least 90 days, but not more than 120 days, prior to the anniversary of our preceding year’s annual meeting, along with the specific information required by our By-Laws, including, but not limited to, the name and address of the nominee; the number of shares of our common stock beneficially owned by the shareholder (including associated persons) nominating such nominee; and a consent by the nominee to serve as a director, if elected, that would be required for a nominee under the SEC rules. If you would like to receive a copy of the provisions of our By-Laws setting forth all of these requirements, please send a written request to Stifel Financial Corp., Attention: Mark P. Fisher, Corporate Secretary, One Financial Plaza, 501 North Broadway, St. Louis, Missouri 63102-2102. The Nominations & Corporate Governance Committee has not adopted any specific policy for considering the recommendation of director nominees by shareholders, but will consider shareholder nominees on the same basis as other nominees. Please also see the procedures described in the section entitled “How can I make a Shareholder Proposal for the 2025 Annual Meeting?” on page 67 of this Proxy Statement.

Code of Ethics and Corporate Governance

In accordance with the requirements of the NYSE and the Sarbanes-Oxley Act of 2002, we have adopted Corporate Governance Guidelines as well as charters for each Board committee. These guidelines and charters are available for review under the “Corporate Governance” section of our web site at www.stifel.com. We have also adopted a Code of Ethics for Directors, Officers, and Associates. The Code of Ethics is also posted in the “Corporate Governance” section of our web site, located at www.stifel.com, or may be obtained by any shareholder, without charge, upon request by contacting Mark P. Fisher, our Corporate Secretary, at (415) 364-2500 or by e-mail at investorrelations@stifel.com.

We have established procedures for shareholders or other interested parties to communicate directly with our Board, including the presiding director at the executive sessions of the non-management directors or the non-management directors as a group. Such parties may contact our Board by mail at: Stifel Financial Corp., Attention: Ronald J. Kruszewski Chairman of the Board, 501 North Broadway, St. Louis, Missouri 63102-2102. All communications made by this means will be received by the Chairmen of the Board and relayed promptly to the Board or the individual directors, as appropriate

Relationship of Risk Management to Compensation

The Board and the Compensation Committee, with the assistance of management, periodically reviews our compensation policies and practices for all employees and has concluded that such policies and practices do not create risks that are reasonably likely to have a material adverse effect on the Company. In reaching this conclusion, the Board and Compensation Committee, with the assistance of management, undertook the following process: We conducted an analysis of our incentive compensation programs by an interdisciplinary team led by our CRO and our outside independent compensation consultant. Other members of the team consisted of employees in risk management, accounting/payroll, legal, internal audit and human resources. This team conducted an initial evaluation of our compensation programs and policies across six elements: first, performance measures; second, funding; third, performance period and pay mix; fourth, goal setting; fifth, leverage; and sixth, controls and processes, focusing on significant risk areas.

The team found that formula-based funding of bonus pools is utilized appropriately across the Company. These formulas varied, with most being either commission-based or total-compensation based, with respect to net revenues, taking into consideration operating profits. The team found that the allocation of bonus pools is generally aligned with the employee’s span of control and level of potential contribution. The team also determined that most bonus pools are not distributed on a purely formula basis, but instead based on subjective factors, including longer term performance and ongoing consideration by the employee of the risks involved in the business. The team also noted the risk mitigation effect of our stock bonus plan allocation formula, which imposes the requirement that any employee with annual compensation of greater than $200,000 receives at least 15% of their total compensation in deferred equity and debentures. The percentage of deferrals increases to up to 40% for those employees receiving over $1 million in annual compensation. The deferred compensation vests ratably over a period of five to ten years. As the vast majority of our revenue producers and senior managers receive deferred compensation, we believe that this effectively mitigates the outsized risk taking as it enables the company to potentially claw back a significant portion of unvested compensation.

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

22

|

In light of the above, our Board and Compensation Committee continue to conclude that our compensation policies in general, and our incentive programs in particular, remain well aligned with the interests of our shareholders and do not create risks that are reasonably likely to result in a material adverse impact on the Company.

Director Share Ownership Guideline

A policy of the Board is that non-employee directors generally reach holdings of Stifel common shares of at least $400,000 by market value. The full policy is part of Stifel’s Corporate Governance Guidelines, available at the investor relations section of Stifel’s website.

Age

A policy of the Board is that non-employee Directors may stand for reelection in any year upon having reached the age of 75 as of the first day of that year and must transition responsibilities and resign no later than the date of the next Annual Meeting. The Board makes exceptions to this policy if it determines such exception would be in the Company’s best interest. The Board has made such a determination with respect to Mr. Michael Brown, in connection with its transition plan for Audit Committee leadership.

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

23

|

COMPENSATION DISCUSSION & ANALYSIS

COMMITTEE PROCESS AND DETERMINATIONS

|

The Committee’s Process for Decision Making

|

|

Our Roadmap for Compensation

|

||||||||

| 1. |

2. | 3. | 4. | 5. | ||||

| Identify Key Metrics (Quantitative & Qualitative)

|

Establish Peer Group, Gather Market Pay and Shareholder Input |

Review of Performance and Market |

Make Year-End Pay and Performance Decisions |

Determine Form and Allocate Awards | ||||

| Financial Objectives: growth in earnings; net income and revenue; risk management

Long-Term Objectives: increase ROCE and book value; enhance return to shareholders

Strategic Objectives: integration of acquisitions; organic growth |

Ongoing solicitation of shareholder input and incorporation of shareholder compensation priorities Independent consultant assisted the Committee with: identifying peer companies; gathering peer and supplemental market pay data for Committee reference. | Periodic updates during the year from the CEO Company performance; segment performance; individual executive officer performance.

Periodic updates from independent consultant: relative performance; competitive pay levels; alignment of pay and performance; market trends.

|

Committee decisions based on results of the incentive framework (see below) that include an in depth review of Company, CEO and other executive officer performance across multiple factors.

Pay for executive officers other than the CEO recommended by CEO, subject to Committee approval.

|

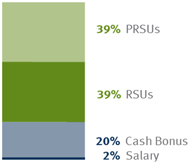

Committee awarded 2023 incentive compensation in the form of cash salary and bonuses composed of cash, debenture, restricted cash, RSU and PRSU components. | ||||

|

Committee Views of Proportion and Form of Compensation

|

The Committee continued to emphasize “At-Risk” compensation in determining the annual incentive compensation of the CEO and the other named executive officers. The Committee divides the various elements of compensation described above in “Key Executive Compensation Program Elements” into two categories: compensation that is “Realized” because it is not subject to forfeiture and compensation that is “At-Risk” because it is subject to forfeiture. The Committee determined that the allocation of variable compensation between Realized and At-Risk compensation for the CEO and other named executive officers for 2023 is as follows:

2023 Allocation of Realized and At-Risk Annual Incentive Compensation:

| Named Executive Officer | Realized Compensation | At-Risk Compensation | ||

| CEO: Mr. Kruszewski |

21% of Annual Incentive Compensation |

79% of Annual Incentive Compensation | ||

| Office of the President: Co-Presidents Zemlyak and Nesi |

35% of Annual Incentive Compensation |

65% of Annual Incentive Compensation | ||

| Committee Assessment: |

Realized and Not Retentive | At-Risk and Retentive | ||

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

24

|

| Incentive Assessment Framework |

The committee evaluates named executive officer incentive compensation based on various factors, and summarizes its judgment on groups of these factors as being below, meeting or exceeding its expectations. The following is an assessment based upon primary performance goals, additional considerations, strategic goals and overall Company performance. See “Use of Non-GAAP Measures” on page 47 for a description of how and why the Non-GAAP measures differ from GAAP measures.

| Incentive Assessment Framework Results |

| Primary Performance Goals |

2023 Result | Year-Over-Year Change | ||||||

| ▶ Non-GAAP Pre-Tax Net Income |

$770mm | 19%

| ||||||

| ▶ Non-GAAP Net Revenue |

$4.35bn | 1%

| ||||||

| ▶ Non-GAAP Diluted Earnings per Share (EPS) |

$4.68 | 19%

| ||||||

| Company Performance on Primary Goals, Committee Assessment |

☐ Below | ☑ Meets | ☐ Exceeds | |||

| Additional Considerations | 2023 Result | Year-Over-Year Change | ||||||

| ▶ Non-GAAP Return on Common Equity |

12% | 4%

| ||||||

| ▶ Total Shareholder Return (price increase + dividend) |

$12.22 | $23.07

| ||||||

| ▶ Non-GAAP Pre-Tax Margin on Net Revenues |

18% | 4%

| ||||||

| ▶ Book Value Per Share |

$45.61 | 4%

| ||||||

| ▶ Non-GAAP Comp to Revenue Ratio |

58% | even | ||||||

|

▶ Total Capitalization of Stifel Financial Corp. |

$7.0bn | 14%

| ||||||

| Company Performance on Additional Considerations, Committee Assessment |

☐ Below | ☑ Meets | ☐ Exceeds | |||

| Performance Categories | Achievements | |

|

▶ Financial Results |

See pages 31 to 35 for a detailed description of achievements in these four categories in relation to each named executive officer. | |

|

▶ Strategic Achievement | ||

|

▶ Leadership | ||

|

▶ Risk Management | ||

| Company Performance on Strategic Goals, Committee Assessment |

☐ Below | ☑ Meets | ☐ Exceeds | |||

| Overall Assessment | ||

| Overall Company Performance, Committee Assessment |

☐ Below | ☑ Meets | ☐ Exceeds | |||

Year-over-year changes to percentages are expressed as the absolute difference between the percentages. Year-over-year changes to values are expressed as relative percentages except when values change between negative and positive, in which case changes are expressed as absolute amounts.

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

25

|

COMPANY PERFORMANCE

|

We Continue To Grow and Invest in our Future

| ||||||

| Delivering Value to Shareholders |

New Business Operating Capabilities |

Expense Control | Solidifying our Position as a Premier Firm | |||

|

u Record revenue for Global Wealth Management

u 3rd highest revenue for Institutional Group

u Board of Directors authorized a 20% increase in common stock dividend starting in the first quarter of 2023. |

During 2023, we:

u Completed the Torreya Partners acquisition.

u Commenced syndicated lending through an innovative joint venture with Korea Investment & Securities.

|

u We successfully controlled our compensation and non-compensation expenses in 2023.

u This expense discipline contributed to our 17% return on tangible common equity. |

u Over $444 billion in Global Wealth client assets.

u Successful recruiting and acquisitions.

u Stifel Bank expanded client deposits and leveraged the firm’s relationships for loan growth.

| |||

| $38 billion |

Assets grew to $38 billion, up 1% over 2022. | |||

| $5.3 billion |

Equity of $5.294 billion, down 1% from 2022. | |||

| $46 per share |

Book Value per Common Share of $45.61, up 4% over 2022. | |||

We explain why we use certain non-GAAP measures on page 47.

|

2023 Segment Performance, Balance Sheet, Infrastructure and Additional Performance Indicators

| ||||||

| Global Wealth Management |

Institutional Group | Balance Sheet | Infrastructure | |||

| u Record net revenue of $3.0bn

u Pre-tax operating income of $1.2 billion

u Record recruiting pipeline; we recruited 171 new financial advisors in a challenging environment |

u Net revenue of $1.2bn

u Pre-tax operating income of $2 million

u Improved integration and alignment across all divisions and geographies in the Institutional Group

|

u Maintained a Tier 1 leverage capital ratio of 10.5%

u Repurchased over 7 million common shares at an average price of $61.16 |

u Improved client-facing infrastructure

u Extended algorithmic institutional trading capabilities in both equities and fixed income

u Maintained robust cybersecurity protections

| |||

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

26

|

| 2023 Segment Performance, Balance Sheet, Infrastructure and Additional Performance Indicators |

| (1) | We explain why we use certain non-GAAP measures on page 47. |

| Additional Performance Indicators |

2023 | 2022 | 2021 | |||||||||||||

| Non-GAAP Return on Common Equity |

12% | 15% | 21% | |||||||||||||

| Non-GAAP Tangible Return on Common Equity |

17% | 22% | 31% | |||||||||||||

| Total Shareholder Return |

21% | –15% | 41% | |||||||||||||

| Non-GAAP Pre-Tax Margin on Net Revenues |

18% | 22% | 24% | |||||||||||||

| Book Value Per Share |

$45.61 | $44.08 | $41.63 | |||||||||||||

| Non-GAAP Compensation to Revenue Ratio |

58% | 58% | 59% | |||||||||||||

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

27

|

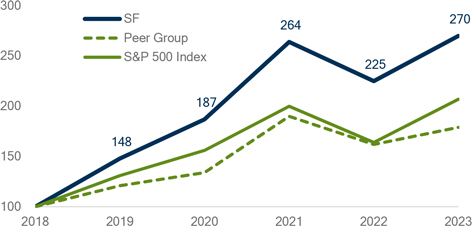

| Relative Performance of Common Stock |

5-year relative performance of Common Stock, Peer Group, and S&P 500 Index:

| Relative Performance |

5-Year

| |||||

| Growth

|

CAGR

| |||||

| Company Common Stock | 170% | 22% | ||||

| Peer Group | 79% | 12% | ||||

| S&P 500 Index | 107% | 16% | ||||

Figures for Common Stock, Peer Group and the S&P 500 Index each include reinvested dividends, consistent with Item 402(v) of Regulation S-K as reflected on page 57. The peer group reflected in the charts above is as described on page 39.

| Strategic Execution |

Stifel continued in 2023 to execute on its strategy of building a premier wealth management and investment banking firm by means of organic growth and the integration of recent acquisitions. Each recent acquisition has fit Stifel’s differentiated value proposition of growth, scale and stability that blends many of the advantages, but avoids most of the weaknesses, of larger bulge bracket and smaller boutique firms. Historically, we have executed strategic opportunities and hired teams with new business capabilities only when accretive.

Strategic Opportunity Evaluation

| Accretive to our Shareholders |

Accretive to our Associates |

Accretive to our Clients |

Accretive to our Partners | |||

| To our shareholders, through expected revenue and EPS growth in a reasonable timeframe. |

To our associates, through additional capabilities and new geographies. |

To our clients, through greater relevance and expanded product offerings. | To our new partners, through the stability of Stifel’s size and scale, coupled with a significant retention of their own ability to direct their own businesses.

| |||

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

28

|

Our Board and the Committee understand that Stifel executes on strategic opportunities to maximize retention and tax benefits. The result is non-GAAP charges to earnings, as opposed to an increase of goodwill on our balance sheet. All of those elements of our acquisition strategy result in tangible benefits to Stifel. Conversely, we do not structure our acquisitions to improve GAAP treatment in the absence of other, compelling tangible benefits. This strategy for executing acquisitions is the most important reason we describe both GAAP and non-GAAP results: the non-GAAP results illuminate how we structure and view our strategic acquisitions.

Stifel’s acquisitions are a catalyst for organic growth. Consistent with our approach to a balanced business model, acquisitions and organic expansion of our existing businesses are roughly equal sources of our growth since 2005.

| Strengthening Controls and our Culture |

We are a Company that has grown tremendously over the past decade and anticipate continued growth through the next decade. We believe that a strong and sustainable control environment is integral to achieve this end. We have also committed the effort and resources to build a platform for growth by continually enhancing our risk and control practices.

| u | Ongoing Risk Management. In 2023, Stifel continued to manage its balance sheet, capital, liquidity and overall risk conservatively. The Board’s Risk Management Committee oversees major risk exposures, including market, credit, capital and liquidity, operational, regulatory, strategic and reputational risks. Our Enterprise Risk Management program, under the direction of our Chief Risk Officer, and other members of the Company’s management have prepared a series of risk appetite statements that articulate our overall risk culture. The Board’s Risk Committee reviews and approves risk appetite statements at least annually and receives at least quarterly updates on the Company’s adherence to them. The Board’s Risk Committee also receives quarterly risk assessments that identify, measure, and monitor existing and emerging risks, in addition to any changes to internal controls. In addition, the Board’s Risk Committee reviews the potential effect of significant matters and decisions on the Company’s reputation. |

| u | Cybersecurity. The Company, including its Board and senior management, devote significant time and resources to dynamic and growing cybersecurity defense. The Risk Management Committee of the board devotes one full meeting each year to cybersecurity, and considers cybersecurity in its other meetings as appropriate. The Company’s cybersecurity architecture and layered technologies are carefully considered. Security personnel provide ongoing threat monitoring and work across technology disciplines to monitor cyber threats. The Company’s team of security architects guides and coordinates internal and external protections. Other teams focus on assurance and continually monitor and test effectiveness. Management and the Board oversee these and other measures both directly and through the Risk Management Committee. |

| u | Investing in our infrastructure. We have continued to build out the infrastructure that enables us to continue to execute on our growth strategies, by bolstering our risk management, compliance, and internal audit functions, and ensuring that we fully comply with new and existing regulatory requirements. For example, we have made significant additions to our staff who stress test risk exposures and monitor compliance with rules and regulations. We have also significantly augmented the tools available to this staff. Likewise, we developed a number of new oversight capabilities to carefully manage risk in select Private Client Group business areas. Additionally, in the Technology and Operations areas we developed a number of new cross team communication capabilities as well as enhanced system monitoring tools and procedures. And in the Technology and Operations areas we continue to invest in personnel and technology systems that enhance firm-wide communication by providing project transparency and ongoing system monitoring. In addition, our internal audit team performed scores of internal audits in 2023. |

| u | Investing in Process Improvements and Controls. We continued to enhance our overall control environment by implementing new capabilities, policies and procedures that ensure effective management of our systems. A new set of internal committees and task forces have been formed to evaluate areas for improvement across the operational platform on an ongoing basis. Similarly, a number of procedures have been implemented to periodically review existing business controls in addition to the implementation of new controls. Management supports the necessary investments required to continuously improve the Company’s systems and controls. |

| u | Building on our strong relationships with regulators. Stifel recognizes the critical importance to the safety and soundness of our company, and the value to our growth strategy, of building on the strong relationships we maintain with our regulators. Our history of growth in the heavily-regulated financial services industry, both organically and through acquisitions, is evidence of this commitment. |

|

|

Proxy Statement for the 2024 Annual Meeting of Shareholders

|

29

|

| Enhancing the Customer Experience to Deliver Sustained Performance |

Stifel has invested significantly to enhance its wealth management platform through improved client reporting and digital access capabilities, as well as enhanced client reporting and financial and estate planning. These investments help our financial advisors provide transparency and deliver solutions to clients that are tailored to their particular needs. Likewise, through prudence, training and relationship building, we are bringing lending solutions to clients seeking liquidity.

In 2023 the Company extended its work on improved client access systems and mobile access tool-sets. These investments are being made to enhance the client experience, further strengthen security, and deliver new functionality to clients. The Company also completed implementation of a new performance reporting system that will cover all client accounts across the Company. The Company also transitioned clients from a legacy online platform to a more modern and comprehensive system.

| Investment in our People |

The value of our franchise and brand depends on the quality and effectiveness of our team, and on our ability to continue to attract and develop the best people. Our Board regularly reviews our human capital practices to ensure that compensation, benefits, working conditions and culture are aligned to foster every associate’s success and growth at Stifel.

Fostering an ownership mindset in our people has been an essential part of our more than two decades of growth and success. Extending opportunities and ownership is one way the Company fosters a One Firm culture. We strive to enable each associate to think long-term, care about the Company like an owner, and grow individually.

| u | Progressive Compensation |

| u | In early 2022, the Company granted approximately half of its employees a one-time restricted stock unit grant of $5,000 per individual. Approximately 4,200 current employees benefitted. Qualifying new employees were also eligible for a similar award. As a result, in combination with existing employee ownership, substantially all Stifel employees have Company-furnished opportunities for equity ownership in the Company. |

| u | In determining full-year 2023 compensation, the Committee and Company senior management focused compensation reductions on senior management and other more highly compensated individuals. The result was a progressive compensation adjustment. |

| u | Development and Growth |

| u | By listening to our associates, including those who have joined us through acquisitions, Stifel integrates best practices and strengthens the Company. Many parts of our business have formal cross-training and continued education programs. |