Exhibit 99.1

STIFEL REPORTS FOURTH QUARTER AND FULL-YEAR 2012 FINANCIAL RESULTS

17th Consecutive Year of Record Net Revenues

Financial highlights for the three months ended December 31, 2012:

| • | Record revenues of $426.4 million. |

| • | Net revenues of $417.8 million. |

| • | Net income of $40.0 million, or $0.63 per diluted share. |

| • | Stockholders’ equity was $1.49 billion and book value per share was $27.24. |

Financial highlights for the year ended December 31, 2012:

| • | Record net revenues of $1.61 billion increased 14% from 2011. |

| • | Record net income of $138.6 million, or $2.20 per diluted share. |

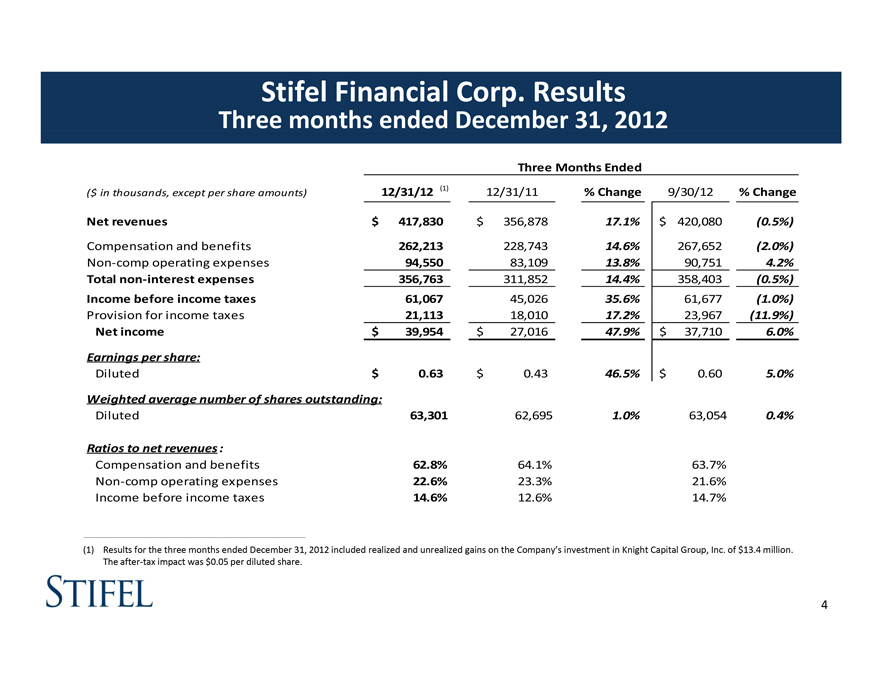

ST. LOUIS, February 25, 2013 –Stifel Financial Corp. (NYSE: SF) today reported net income of $40.0 million, or $0.63 per diluted share, on net revenues of $417.8 million for the three months ended December 31, 2012, compared with net income of $27.0 million, or $0.43 per diluted share, on net revenues of $356.9 million for the fourth quarter of 2011. The results for the three months ended December 31, 2012 were impacted by gains recognized on the Company’s investment in Knight Capital Group, Inc. offset by merger-related and other unusual expenses. The after-tax impact of these items was a gain of $0.02 per diluted share.

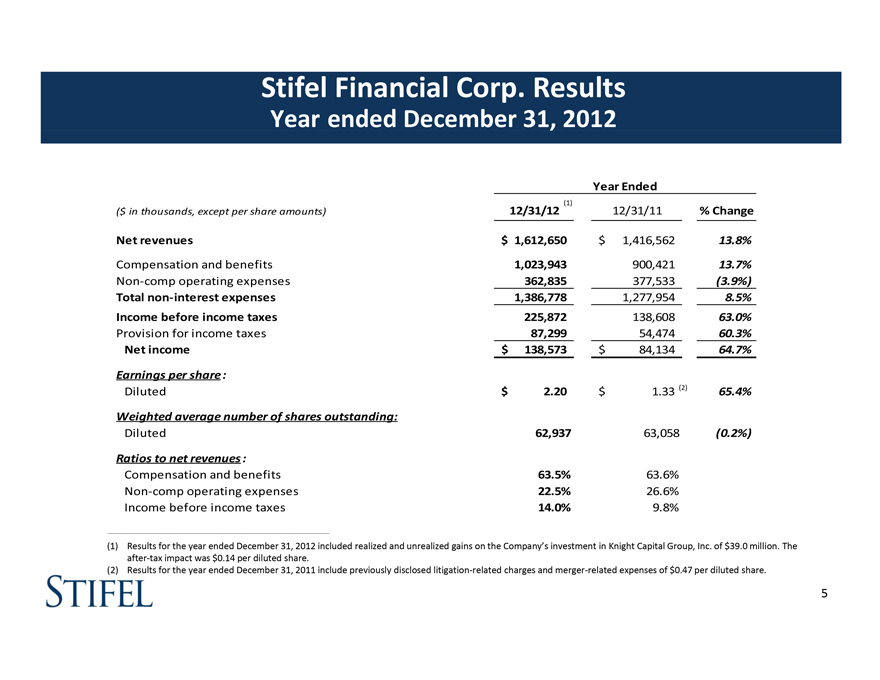

For the year ended December 31, 2012, the Company reported record net income of $138.6 million, or $2.20 per diluted share, on record net revenues of $1.61 billion, compared with net income of $84.1 million, or $1.33 per diluted share1, on net revenues of $1.4 billion during the comparable period in 2011.

“2012 represented Stifel’s 17th consecutive year of record net revenues. This is a significant accomplishment, particularly given past market cycles. We remain focused on our goal of delivering superior client services, which has benefitted all Stifel constituents: clients, shareholders, and associates,” said Ronald J. Kruszewski, Chairman, President and CEO of Stifel.

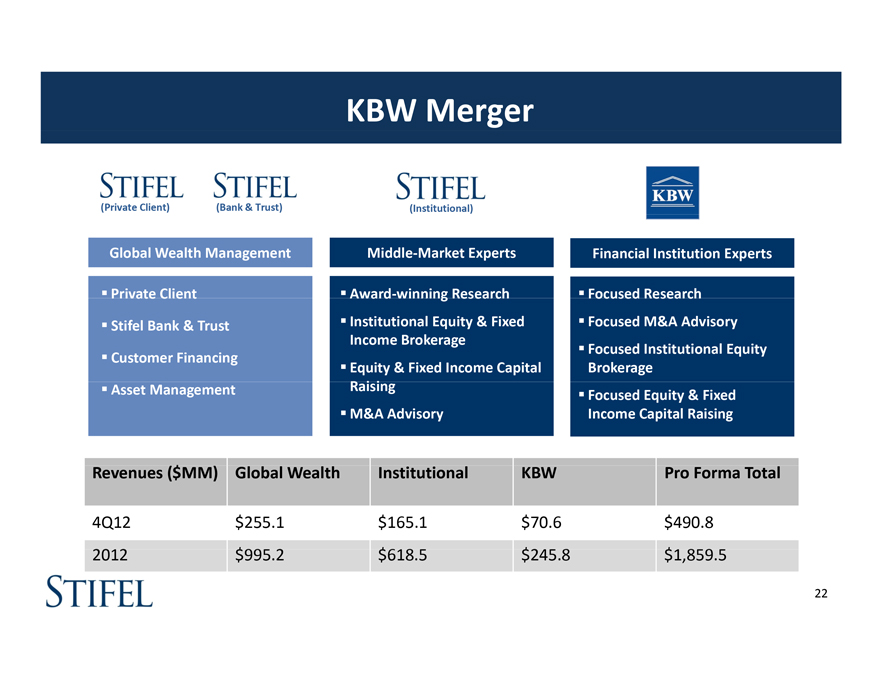

Kruszewski continued, “Our fourth quarter results finished the year with record revenues. Both segments, Global Wealth Management and Institutional Group, reflected strong underlying performance, even in light of the political and economic uncertainty in the quarter. We continue to selectively add talented professionals to expand our product offerings and gain market share. At the end of last year, we acquired Miller Buckfire, a preeminent franchise in restructuring advisory, and most recently our merger with KBW, a leading financial services investment bank. As we have done in the past, we will continue to position Stifel to take advantage of opportunities.”

| Summary Results of Operations (Unaudited)

|

| |||||||||||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||

| (in 000s) | 12/31/12 | 12/31/11 | % Change |

9/30/12 | % Change |

12/31/12 | 12/31/11 | % Change |

||||||||||||||||||||||||

| Net revenues |

$ | 417,830 | $ | 356,878 | 17.1 | $ | 420,080 | (0.5 | ) | $ | 1,612,650 | $ | 1,416,562 | 13.8 | ||||||||||||||||||

| Net income |

$ | 39,954 | $ | 27,016 | 47.9 | $ | 37,710 | 6.0 | $ | 138,573 | $ | 84,134 | 64.7 | |||||||||||||||||||

| Earnings per share: |

||||||||||||||||||||||||||||||||

| Basic |

$ | 0.74 | $ | 0.52 | 42.3 | $ | 0.70 | 5.8 | $ | 2.59 | $ | 1.61 | 60.9 | |||||||||||||||||||

| Diluted |

$ | 0.63 | $ | 0.43 | 46.5 | $ | 0.60 | 5.0 | $ | 2.20 | $ | 1.33 | 65.4 | |||||||||||||||||||

| Weighted average number of common shares outstanding: |

||||||||||||||||||||||||||||||||

| Basic |

53,835 | 51,849 | 3.9 | 53,601 | 0.5 | 53,563 | 52,418 | 2.2 | ||||||||||||||||||||||||

| Diluted |

63,301 | 62,695 | 1.0 | 63,054 | 0.4 | 62,937 | 63,058 | (0.2 | ) | |||||||||||||||||||||||

| 1 | Included in the results for the year ended December 31, 2011 were the estimated costs of settlement and litigation-related expenses of $29.4 million after tax, or $0.47 per diluted share, respectively, associated with the civil lawsuit and related regulatory investigation in connection with the previously disclosed matter involving five Southeastern Wisconsin school districts and certain merger-related expenses. |

1

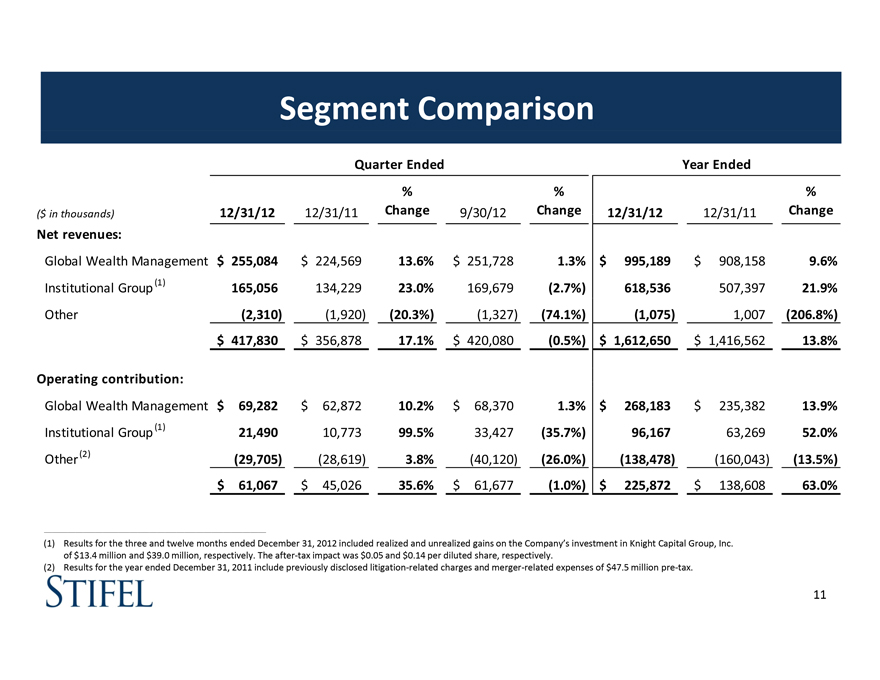

Business Segment Results

| Summary Segment Results (Unaudited)

|

| |||||||||||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||

| (in 000s) | 12/31/12 | 12/31/11 | % Change |

9/30/12 | % Change |

12/31/12 | 12/31/11 | % Change |

||||||||||||||||||||||||

| Net revenues: |

||||||||||||||||||||||||||||||||

| Global Wealth Management |

$ | 255,084 | $ | 224,569 | 13.6 | $ | 251,728 | 1.3 | $ | 995,189 | $ | 908,158 | 9.6 | |||||||||||||||||||

| Institutional Group 2 |

165,056 | 134,229 | 23.0 | 169,679 | (2.7 | ) | 618,536 | 507,397 | 21.9 | |||||||||||||||||||||||

| Other |

(2,310 | ) | (1,920 | ) | (20.3 | ) | (1,327 | ) | (74.1 | ) | (1,075 | ) | 1,007 | (206.8 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| $ | 417,830 | $ | 356,878 | 17.1 | $ | 420,080 | (0.5 | ) | $ | 1,612,650 | $ | 1,416,562 | 13.8 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Pre-tax operating income: |

||||||||||||||||||||||||||||||||

| Global Wealth Management |

$ | 69,282 | $ | 62,872 | 10.2 | $ | 68,370 | 1.3 | $ | 268,183 | $ | 235,382 | 13.9 | |||||||||||||||||||

| Institutional Group 2 |

21,490 | 10,773 | 99.5 | 33,427 | (35.7 | ) | 96,167 | 63,269 | 52.0 | |||||||||||||||||||||||

| Other 3 |

(29,705 | ) | (28,619 | ) | 3.8 | (40,120 | ) | (26.0 | ) | (138,478 | ) | (160,043 | ) | (13.5 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| $ | 61,067 | $ | 45,026 | 35.6 | $ | 61,677 | (1.0 | ) | $ | 225,872 | $ | 138,608 | 63.0 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Fourth Quarter

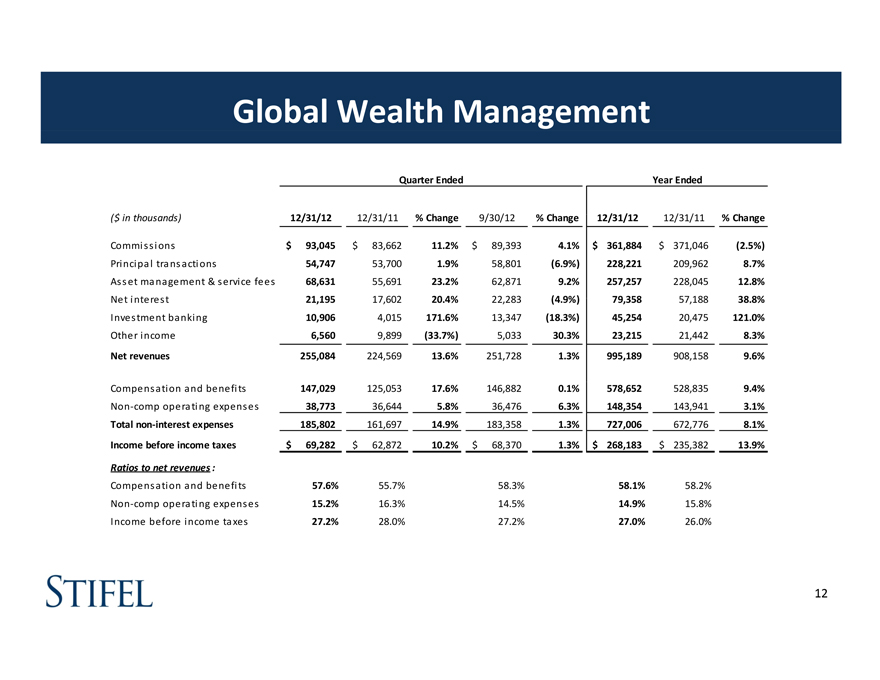

Global Wealth Management

For the quarter ended December 31, 2012, the Global Wealth Management (“GWM”) segment generated pre-tax operating income of $69.3 million, compared with $62.9 million in the fourth quarter of 2011 and $68.4 million in the third quarter of 2012. Net revenues for the quarter were $255.1 million, compared with $224.6 million in the fourth quarter of 2011, and $251.7 million in the third quarter of 2012. The increase in net revenues over the comparable period in 2011 is primarily attributable to: (1) growth in asset management and service fees as a result of an increase in client assets and positive gains in market performance; (2) growth in commissions revenues; (3) higher sales credits from investment banking underwritings; and (4) increased net interest revenues as a result of the growth of net interest-earning assets at Stifel Bank. The increase in net revenues from the third quarter of 2012 was primarily attributable to: (1) growth in asset management and service fees as a result of an increase in client assets and positive gains in market performance; and (2) growth in commissions revenue, offset by (1) a decrease in principal transactions revenues; (2) reduced sales credits from investment banking underwritings; and (3) lower net interest revenues.

| • | The Private Client Group reported net revenues of $232.5 million, a 13% increase compared with the fourth quarter of 2011 and a 1% increase compared with the third quarter of 2012. |

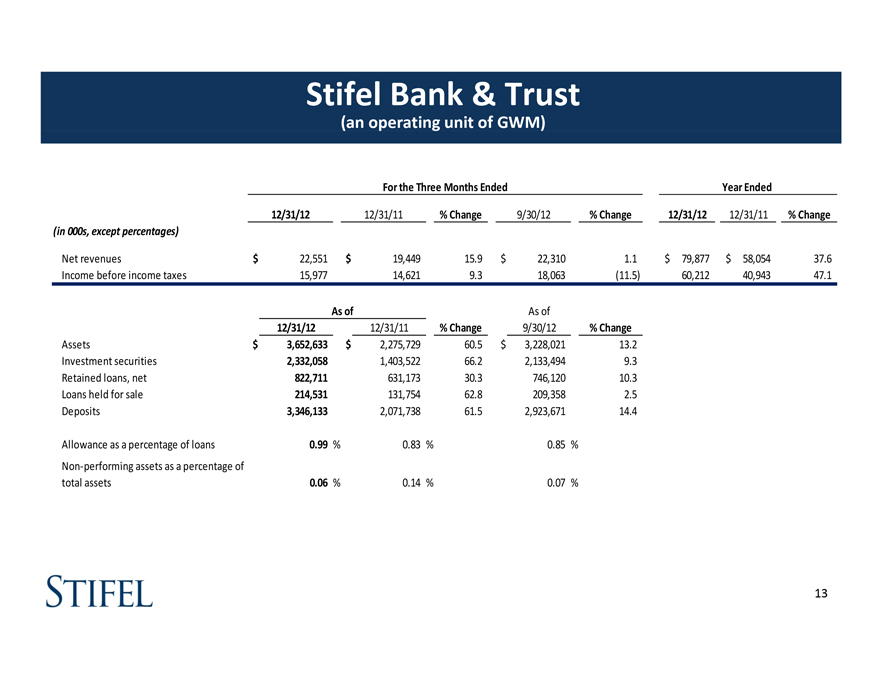

| • | Stifel Bank reported net revenues of $22.6 million, a 16% increase compared with the fourth quarter of 2011 and a 1% increase compared with the third quarter of 2012. |

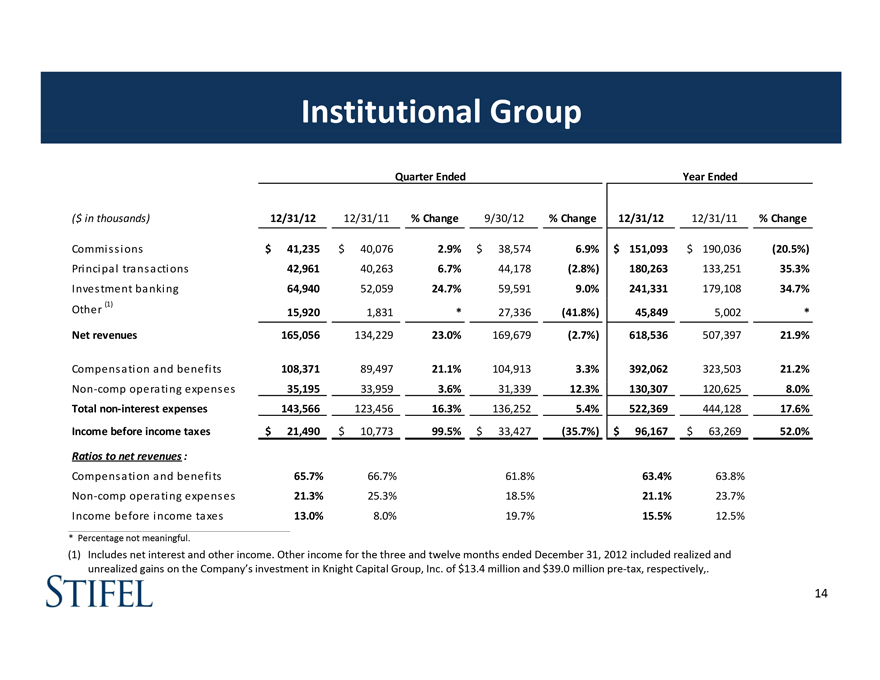

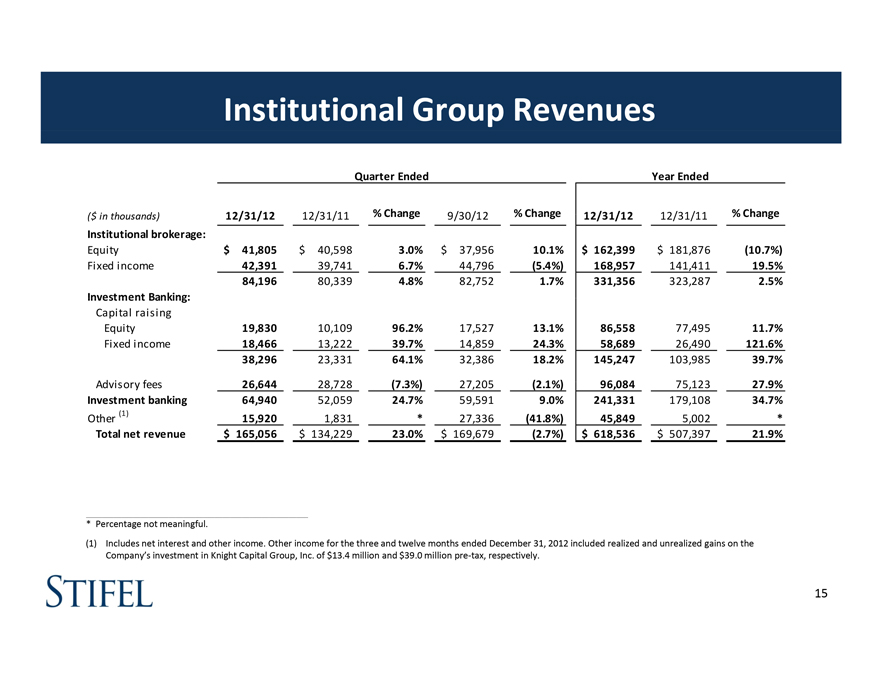

Institutional Group

For the quarter ended December 31, 2012, the Institutional Group segment generated pre-tax operating income of $21.5 million, compared with $10.8 million in the fourth quarter of 2011 and $33.4 million in the third quarter of 2012. Net revenues for the quarter were $165.1 million, compared with $134.2 million in the fourth quarter of 2011 and $169.7 million in the third quarter of 2012. The increase in net revenues from the comparable period in 2011 was driven by: (1) an increase in equity and fixed income capital raising revenues; (2) higher fixed income and equity institutional brokerage revenues; and (3) the realized and unrealized gains recognized on the Company’s investment in Knight Capital Group, Inc. Offsetting these increases was a decrease in advisory fees. The decrease in net revenues from the third quarter of 2012 was primarily attributable to: (1) a decrease in unrealized gains recognized on the Company’s investment in Knight Capital Group, Inc. The decrease was offset by: (1) an increase in fixed income and equity capital raising revenues; and (2) an increase in equity institutional brokerage revenues.

| 2 | Results for the three and twelve months ended December 31, 2012 includes $13.4 million and $39.0 million, respectively, in realized and unrealized gains recognized on the Company’s investment in Knight Capital Group, Inc. |

| 3 | Results for the year ended December 31, 2011 include litigation-related charges and merger-related expenses of $47.5 million pre-tax. |

2

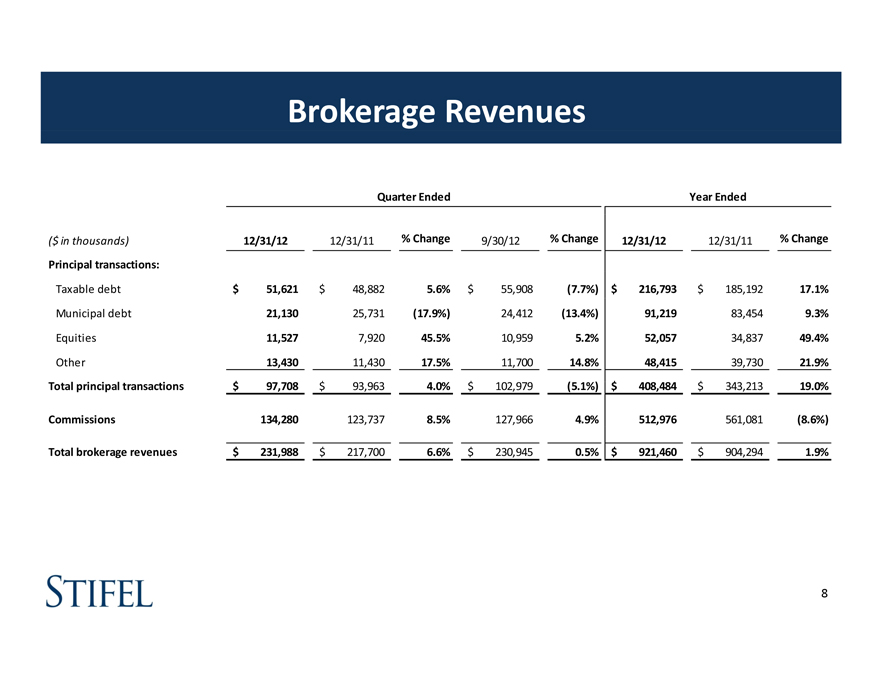

Institutional brokerage revenues were $84.2 million, a 5% increase compared with the fourth quarter of 2011 and a 2% increase compared with the third quarter of 2012.

| • | Equity brokerage revenues were $41.8 million, a 3% increase compared with the fourth quarter of 2011 and a 10% increase compared with the third quarter of 2012. |

| • | Fixed income brokerage revenues were $42.4 million, a 7% increase compared with the fourth quarter of 2011 and a 5% decrease compared with the third quarter of 2012. |

Investment banking revenues were $64.9 million, a 25% increase compared with the fourth quarter of 2011 and a 9% increase compared with the third quarter of 2012.

| • | Equity capital raising revenues were $19.8 million, a 96% increase compared with the fourth quarter of 2011 and a 13% increase compared with the third quarter of 2012. |

| • | Fixed income capital raising revenues were $18.5 million, a 40% increase compared with the fourth quarter of 2011 and a 24% increase compared with the third quarter of 2012. |

| • | Advisory fee revenues were $26.6 million, a 7% decrease compared with the fourth quarter of 2011 and a 2% decrease compared with the third quarter of 2012. |

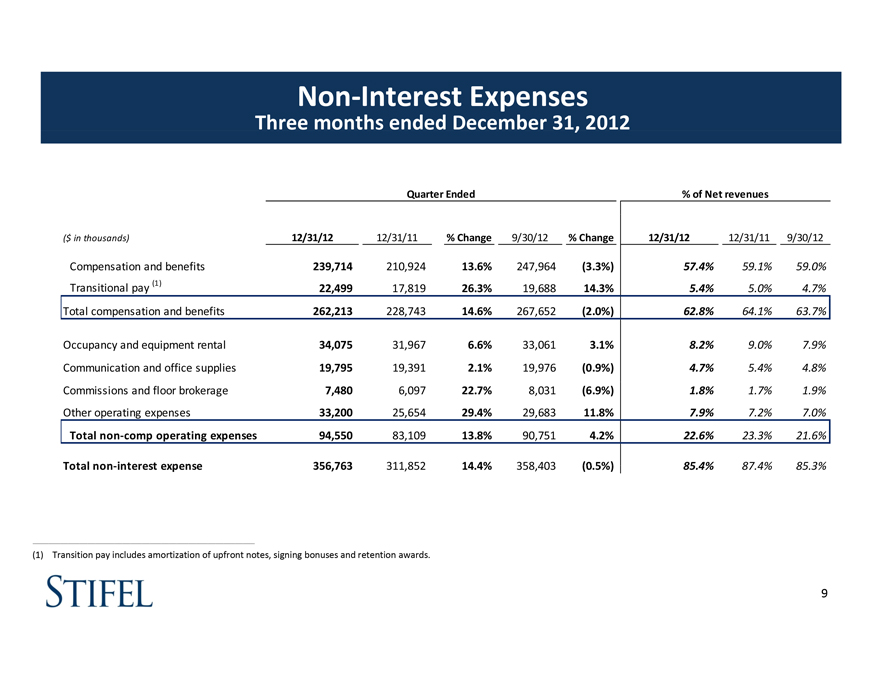

Consolidated Compensation and Benefits Expenses

For the quarter ended December 31, 2012, compensation and benefits expenses were $262.2 million, compared with $228.7 million in the fourth quarter of 2011 and $267.7 million in the third quarter of 2012.

Compensation and benefits as a percentage of net revenues was 62.8% in the fourth quarter of 2012, compared with 64.1% in the fourth quarter of 2011 and 63.7% in the third quarter of 2012. Transition pay, which primarily consists of amortization of upfront notes, signing bonuses and retention awards, as a percentage of net revenues was 5% in the fourth quarter of 2012, consistent with the fourth quarter of 2011 and the third quarter of 2012.

Consolidated Non-Compensation Operating Expenses

For the quarter ended December 31, 2012, non-compensation operating expenses were $94.6 million, compared to $83.1 million in the fourth quarter of 2011 and $90.8 million in the third quarter of 2012. The increase in non-compensation operating expenses for the fourth quarter of 2012 was due to acquisition-related professional fees and other non-recurring expenses.

Non-compensation operating expenses as a percentage of net revenues for the quarter ended December 31, 2012 was 22.6% compared with 23.3% in the fourth quarter of 2011 and 21.6% in the third quarter of 2012.

Provision for Income Taxes

The effective income tax rate for the quarter ended December 31, 2012 was 35% compared with 40% in the fourth quarter of 2011 and 39% in the third quarter of 2012. The decrease in the effective rate for the three months ended December 31, 2012 is primarily attributable to adjustments to the provision as a result of the Miller Buckfire acquisition, offset by an increase in the valuation allowance to adjust the tax benefit of certain state and foreign net operating loss carryforwards to the amount that we have determined is more likely than not to be realized.

3

Full-Year 2012

Global Wealth Management

For the year ended December 31, 2012, the GWM segment generated pre-tax operating income of $268.2 million on net revenues of $995.2 million compared with $235.4 million on net revenues of $908.2 million in 2011. The increase in net revenues over the comparable period in 2011 is primarily attributable to: (1) growth in asset management and service fees as a result of an increase in client assets and positive gains in market performance; (2) higher sales credits from investment banking underwritings; (3) increased net interest revenues as a result of the growth of net interest-earning assets at Stifel Bank; and (4) higher principal transactions revenues, offset by a decrease in commissions revenues.

| • | The Private Client Group reported net revenues of $915.3 million, an 8% increase compared to $850.1 million in 2011. |

| • | Stifel Bank reported net revenues of $79.9 million, a 38% increase compared to $58.1 million in 2011. |

Institutional Group

For the year ended December 31, 2012, the Institutional Group segment generated pre-tax operating income of $96.2 million on net revenues of $618.5 million compared with $63.3 million on net revenues of $507.4 million in 2011. The increase in net revenues from the comparable period in 2011 was driven by: (1) an increase in fixed income capital raising revenues; (2) an increase in advisory fees; (3) higher fixed income institutional brokerage revenues; and (4) the realized and unrealized gains recognized on the Company’s investment in Knight Capital Group, Inc. Offsetting these increases was a decrease in equity institutional brokerage revenues.

Institutional brokerage revenues were $331.4 million, a 3% increase compared with $323.3 million in 2011.

| • | Equity brokerage revenues were $162.4 million, an 11% decrease compared with $181.9 million in 2011. |

| • | Fixed income brokerage revenues were $169.0 million, a 20% increase compared with $141.4 million in 2011. |

Investment banking revenues were $241.3 million, a 35% increase compared with $179.1 million in 2011.

| • | Equity capital raising revenues were $86.6 million, a 12% increase compared with $77.5 million in 2011. |

| • | Fixed income capital raising revenues were $58.7 million, a 122% increase compared with $26.5 million in 2011. |

| • | Advisory fee revenues were $96.1 million, a 28% increase compared with $75.1 million in 2011. |

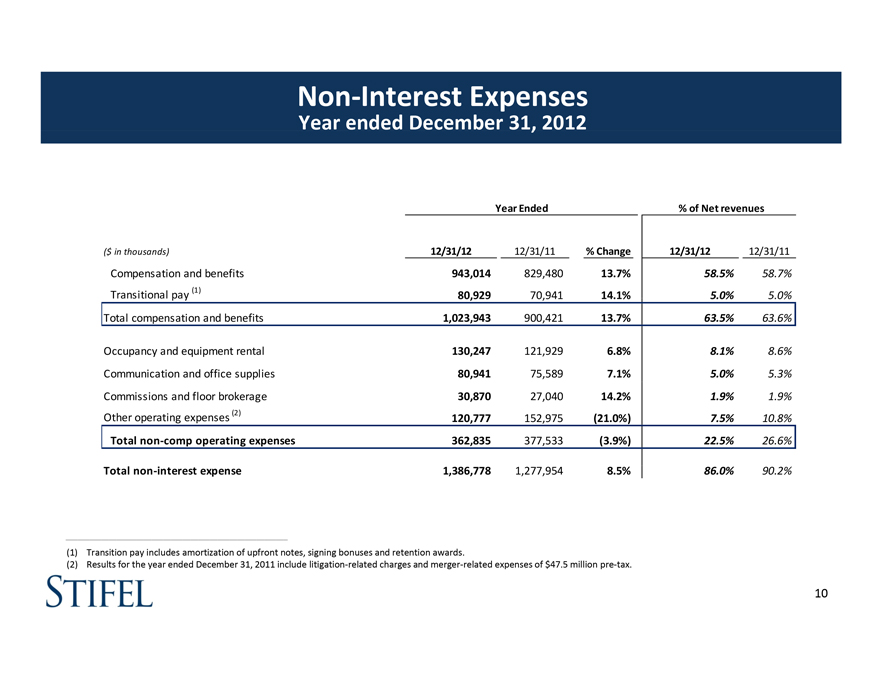

Consolidated Compensation and Benefits Expenses

For the year ended December 31, 2012, compensation and benefits expenses were $1.02 billion compared with $900.4 million in 2011.

Compensation and benefits as a percentage of net revenues for the year ended December 31, 2012 was 63.5% compared with 63.6% in 2011. Transition pay as a percentage of net revenues was 5% for the year ended December 31, 2012, the same for 2011.

Consolidated Non-Compensation Operating Expenses

For the year ended December 31, 2012, non-compensation operating expenses were $362.8 million compared to $377.5 million in 2011. Non-compensation operating expenses for the year ended December 31, 2011 included $45.8 million of litigation-related charges and merger-related expenses.

Non-compensation operating expenses as a percentage of net revenues for the year ended December 31, 2012 was 22.5% compared with 26.6% in 2011.

Provision for Income Taxes

For the year ended December 31, 2012, provision for income taxes was $87.3 million, representing an effective tax rate of 39% compared to $54.5 million in 2011, representing an effective tax rate of 39%.

4

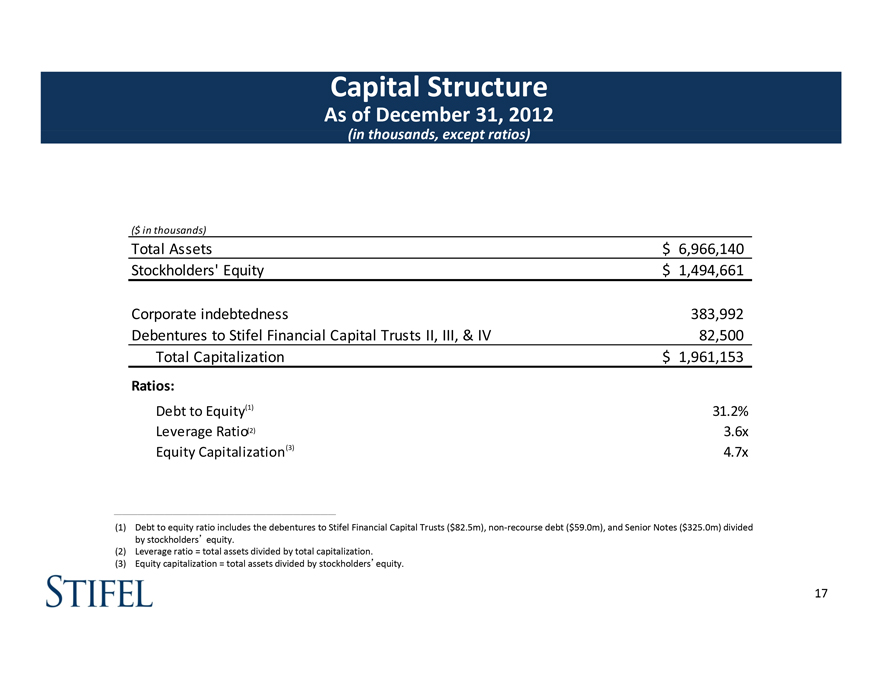

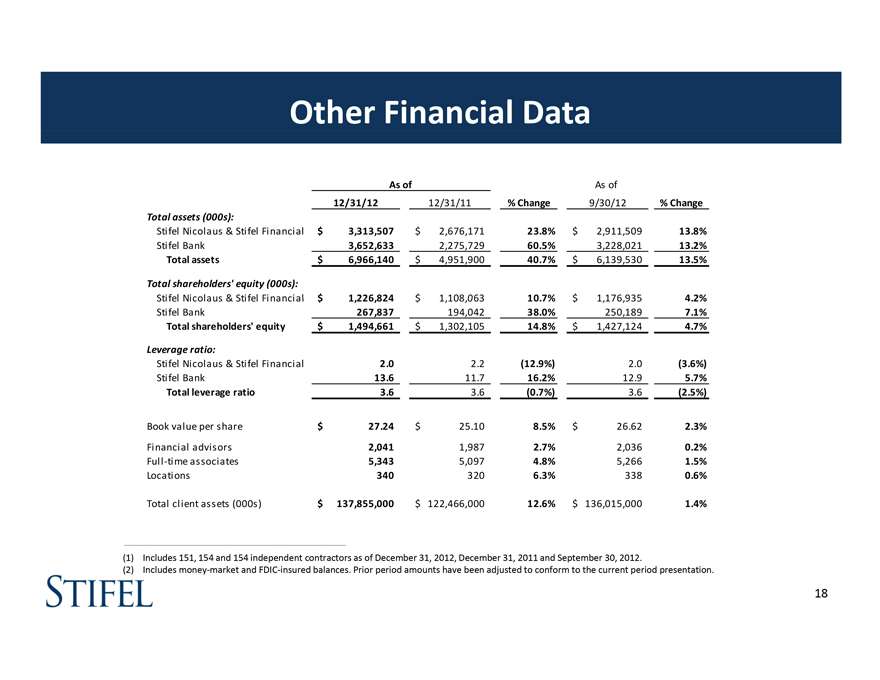

Statement of Financial Condition (Unaudited)

Total assets increased 40.7% to $7.0 billion as of December 31, 2012 from $5.0 billion as of December 31, 2011. The increase is primarily attributable to growth of Stifel Bank, the Company’s bank subsidiary, which as of December 31, 2012 has grown its assets to $3.7 billion from $2.3 billion as of December 31, 2011. As of December 31, 2012, Stifel Bank’s investment portfolio of $2.3 billion has increased 66% from December 31, 2011, with more than 99% of the investment portfolio comprised of investment grade securities, of which more than 70% were Government-Sponsored Enterprise guaranteed MBS or AAA-rated investments. The Company’s broker-dealer subsidiary’s gross assets and liabilities, including trading inventory, stock loan/borrow, receivables and payables from/to brokers, dealers and clearing organizations and clients, fluctuate with business levels and overall market conditions.

Total stockholders’ equity as of December 31, 2012 increased $192.6 million, or 14.8%, to $1.49 billion from $1.30 billion as of December 31, 2011. Book value per share was $27.24 as of December 31, 2012. The Company repurchased $11.4 million, or 0.4 million shares, of its common stock pursuant to existing Board repurchase authorizations during the year ended December 31, 2012.

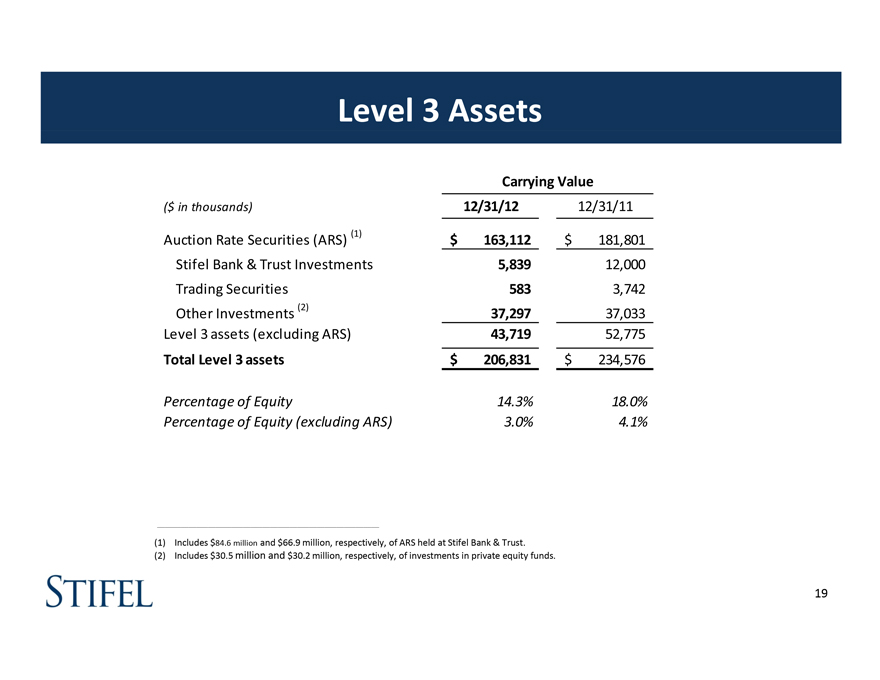

As of December 31, 2012, the Company reported total securities owned and investments at fair value of $2.7 billion, which included securities categorized as Level 3 of $206.8 million. The Company’s Level 3 assets include auction rate securities with a fair value of $163.1 million, and private equity, municipal securities and other fixed income securities with a fair value $43.7 million as of December 31, 2012.

Conference Call Information

Stifel Financial Corp. will host its fourth quarter and full-year 2012 financial results conference call on Monday, February 25, 2012, at 5:00 p.m. Eastern time. The conference call may include forward-looking statements.

All interested parties are invited to listen to the Company’s Chairman, President, and CEO, Ronald J. Kruszewski, by dialing (800) 651-2240 and referencing conference ID #12018117. A live audio webcast of the call, as well as a presentation highlighting the Company’s results, will be available through the Company’s web site, www.stifel.com. For those who cannot listen to the live broadcast, a replay of the broadcast will be available through the above-referenced web site beginning approximately one hour following the completion of the call.

Company Information

Stifel Financial Corp. (NYSE: SF) is a financial services holding company headquartered in St. Louis, Missouri that conducts its banking, securities, and financial services business through several wholly owned subsidiaries. Stifel clients are served through Stifel, Nicolaus & Company, Incorporated in the U.S., through Stifel Nicolaus Canada Inc. in Canada, through Stifel Nicolaus Europe Limited in the United Kingdom and Europe, and through Keefe, Bruyette & Woods, Inc. in the U.S. and Europe. The Company’s broker-dealer affiliates provide securities brokerage, investment banking, trading, investment advisory, and related financial services to individual investors, professional money managers, businesses, and municipalities. Stifel Bank & Trust offers a full range of consumer and commercial lending solutions. Stifel Trust Company, N.A. offers trust and related services. To learn more about Stifel, please visit the Company’s web site at www.stifel.com.

Forward-Looking Statements

This earnings release contains certain statements that may be deemed to be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements in this earnings release not dealing with historical results are forward-looking and are based on various assumptions. The forward-looking statements in this earnings release are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in or implied by the statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, among other things, the following possibilities: the ability to successfully integrate acquired companies or the branch offices and financial advisors; a material adverse change in financial condition; the risk of borrower, depositor, and other customer attrition; a change in general business and economic conditions; changes in the interest rate environment, deposit flows, loan demand, real estate values, and competition; changes in accounting principles, policies, or guidelines; changes in legislation and regulation; other economic, competitive, governmental, regulatory, geopolitical, and technological factors affecting the companies’ operations, pricing, and services; and other risk factors referred to from time to time in filings made by Stifel Financial Corp. with the Securities and Exchange Commission. Forward-looking statements speak only as to the date they are made. Stifel Financial Corp. disclaims any intent or obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made.

5

Summary Results of Operations (Unaudited)

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||

| (in thousands, except per share amounts) | 12/31/12 | 12/31/11 | % Change |

9/30/12 | % Change |

12/31/12 | 12/31/11 | % Change |

||||||||||||||||||||||||

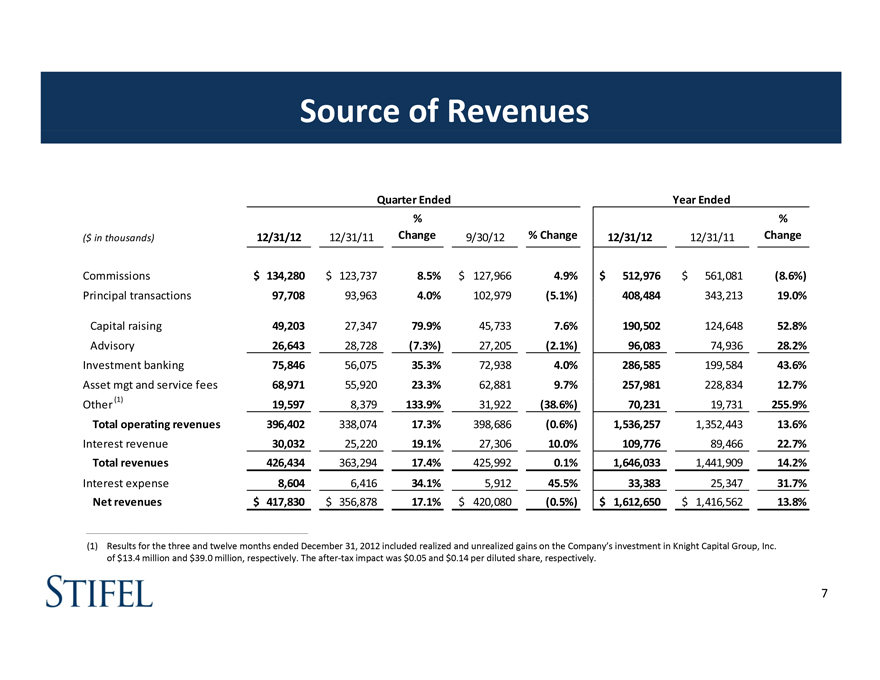

| Revenues: |

||||||||||||||||||||||||||||||||

| Commissions |

$ | 134,280 | $ | 123,737 | 8.5 | $ | 127,966 | 4.9 | $ | 512,976 | $ | 561,081 | (8.6 | ) | ||||||||||||||||||

| Principal transactions |

97,708 | 93,963 | 4.0 | 102,979 | (5.1 | ) | 408,484 | 343,213 | 19.0 | |||||||||||||||||||||||

| Investment banking |

75,846 | 56,075 | 35.3 | 72,938 | 4.0 | 286,585 | 199,584 | 43.6 | ||||||||||||||||||||||||

| Asset management and service fees |

68,971 | 55,920 | 23.3 | 62,881 | 9.7 | 257,981 | 228,834 | 12.7 | ||||||||||||||||||||||||

| Other income |

19,597 | 8,379 | 133.9 | 31,922 | (38.6 | ) | 70,231 | 19,731 | 255.9 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Operating revenues |

396,402 | 338,074 | 17.3 | 398,686 | (0.6 | ) | 1,536,257 | 1,352,443 | 13.6 | |||||||||||||||||||||||

| Interest revenue |

30,032 | 25,220 | 19.1 | 27,306 | 10.0 | 109,776 | 89,466 | 22.7 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total revenues |

426,434 | 363,294 | 17.4 | 425,992 | 0.1 | 1,646,033 | 1,441,909 | 14.2 | ||||||||||||||||||||||||

| Interest expense |

8,604 | 6,416 | 34.1 | 5,912 | 45.5 | 33,383 | 25,347 | 31.7 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net revenues |

417,830 | 356,878 | 17.1 | 420,080 | (0.5 | ) | 1,612,650 | 1,416,562 | 13.8 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Non-interest expenses: |

||||||||||||||||||||||||||||||||

| Compensation and benefits |

262,213 | 228,743 | 14.6 | 267,652 | (2.0 | ) | 1,023,943 | 900,421 | 13.7 | |||||||||||||||||||||||

| Occupancy and equipment rental |

34,075 | 31,967 | 6.6 | 33,061 | 3.1 | 130,247 | 121,929 | 6.8 | ||||||||||||||||||||||||

| Communications and office supplies |

19,795 | 19,391 | 2.1 | 19,976 | (0.9 | ) | 80,941 | 75,589 | 7.1 | |||||||||||||||||||||||

| Commission and floor brokerage |

7,480 | 6,097 | 22.7 | 8,031 | (6.9 | ) | 30,870 | 27,040 | 14.2 | |||||||||||||||||||||||

| Other operating expenses |

33,200 | 25,654 | 29.4 | 29,683 | 11.8 | 120,777 | 152,975 | (21.0 | ) | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total non-interest expenses |

356,763 | 311,852 | 14.4 | 358,403 | (0.5 | ) | 1,386,778 | 1,277,954 | 8.5 | |||||||||||||||||||||||

| Income before income taxes |

61,067 | 45,026 | 35.6 | 61,677 | (1.0 | ) | 225,872 | 138,608 | 63.0 | |||||||||||||||||||||||

| Provision for income taxes |

21,113 | 18,010 | 17.2 | 23,967 | (11.9 | ) | 87,299 | 54,474 | 60.3 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net income |

$ | 39,954 | $ | 27,016 | 47.9 | $ | 37,710 | 6.0 | $ | 138,573 | $ | 84,134 | 64.7 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Earnings per share: |

||||||||||||||||||||||||||||||||

| Basic |

$ | 0.74 | $ | 0.52 | 42.3 | $ | 0.70 | 5.8 | $ | 2.59 | $ | 1.61 | 60.9 | |||||||||||||||||||

| Diluted |

$ | 0.63 | $ | 0.43 | 46.5 | $ | 0.60 | 5.0 | $ | 2.20 | $ | 1.33 | 65.4 | |||||||||||||||||||

| Weighted average number of common shares outstanding: |

||||||||||||||||||||||||||||||||

| Basic |

53,835 | 51,849 | 3.9 | 53,601 | 0.5 | 53,563 | 52,418 | 2.2 | ||||||||||||||||||||||||

| Diluted |

63,301 | 62,695 | 1.0 | 63,054 | 0.4 | 62,937 | 63,058 | (0.2 | ) | |||||||||||||||||||||||

(in thousands, except per share, employee and location amounts)

| 12/31/12 | 12/31/11 | % Change |

9/30/12 | % Change |

||||||||||||||||

| Statistical Information: |

||||||||||||||||||||

| Book value per share |

$ | 27.24 | $ | 25.10 | 8.5 | $ | 26.62 | 2.3 | ||||||||||||

| Financial advisors 4 |

2,041 | 1,987 | 2.7 | 2,036 | 0.2 | |||||||||||||||

| Full-time associates |

5,343 | 5,097 | 4.8 | 5,266 | 1.5 | |||||||||||||||

| Locations |

340 | 320 | 6.3 | 338 | 0.6 | |||||||||||||||

| Total client assets 5 |

$ | 137,855,000 | $ | 122,466,000 | 12.6 | $ | 136,015,000 | 1.4 | ||||||||||||

| 4 | Includes 151, 154 and 154 independent contractors at December 31, 2012 and 2011 and September 30, 2012, respectively. |

| 5 | Includes money market and FDIC-insured balances. Prior period amounts have been adjusted to conform to the current period presentation. |

6

| Global Wealth Management Summary Results of Operations (Unaudited)

|

| |||||||||||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||

| (in 000s) | 12/31/12 | 12/31/11 | % Change |

9/30/12 | % Change |

12/31/12 | 12/31/11 | % Change |

||||||||||||||||||||||||

| Revenues: |

||||||||||||||||||||||||||||||||

| Commissions |

$ | 93,045 | $ | 83,662 | 11.2 | $ | 89,393 | 4.1 | $ | 361,884 | $ | 371,046 | (2.5 | ) | ||||||||||||||||||

| Principal transactions |

54,747 | 53,700 | 1.9 | 58,801 | (6.9 | ) | 228,221 | 209,962 | 8.7 | |||||||||||||||||||||||

| Asset management and service fees |

68,631 | 55,691 | 23.2 | 62,871 | 9.2 | 257,257 | 228,045 | 12.8 | ||||||||||||||||||||||||

| Net interest |

21,195 | 17,602 | 20.4 | 22,283 | (4.9 | ) | 79,358 | 57,188 | 38.8 | |||||||||||||||||||||||

| Investment banking |

10,906 | 4,015 | 171.6 | 13,347 | (18.3 | ) | 45,254 | 20,475 | 121.0 | |||||||||||||||||||||||

| Other income |

6,560 | 9,899 | (33.7 | ) | 5,033 | 30.3 | 23,215 | 21,442 | 8.3 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net revenues |

255,084 | 224,569 | 13.6 | 251,728 | 1.3 | 995,189 | 908,158 | 9.6 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Non-interest expenses: |

||||||||||||||||||||||||||||||||

| Compensation and benefits |

147,029 | 125,053 | 17.6 | 146,882 | 0.1 | 578,652 | 528,835 | 9.4 | ||||||||||||||||||||||||

| Non-compensation operating expenses |

38,773 | 36,644 | 5.8 | 36,476 | 6.3 | 148,354 | 143,941 | 3.1 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total non-interest expenses |

185,802 | 161,697 | 14.9 | 183,358 | 1.3 | 727,006 | 672,776 | 8.1 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Income before income taxes |

$ | 69,282 | $ | 62,872 | 10.2 | $ | 68,370 | 1.3 | $ | 268,183 | $ | 235,382 | 13.9 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| As a percentage of net revenues: |

||||||||||||||||||||||||||||||||

| Compensation and benefits |

57.6 | 55.7 | 58.3 | 58.1 | 58.2 | |||||||||||||||||||||||||||

| Non-compensation operating expenses |

15.2 | 16.3 | 14.5 | 14.9 | 15.8 | |||||||||||||||||||||||||||

| Income before income taxes |

27.2 | 28.0 | 27.2 | 27.0 | 26.0 | |||||||||||||||||||||||||||

| Stifel Bank & Trust (Unaudited)

|

| |||||||||||||||||||

| Key Statistical Information | ||||||||||||||||||||

| (in 000s, except percentages) | 12/31/12 | 12/31/11 | % Change |

9/30/12 | % Change |

|||||||||||||||

| Other information: |

||||||||||||||||||||

| Assets |

$ | 3,652,633 | $ | 2,275,729 | 60.5 | $ | 3,228,021 | 13.2 | ||||||||||||

| Investment securities |

2,332,058 | 1,403,522 | 66.2 | 2,133,494 | 9.3 | |||||||||||||||

| Retained loans |

822,711 | 631,173 | 30.3 | 746,120 | 10.3 | |||||||||||||||

| Loans held for sale |

214,531 | 131,754 | 62.8 | 209,358 | 2.5 | |||||||||||||||

| Deposits |

3,346,133 | 2,071,738 | 61.5 | 2,923,671 | 14.4 | |||||||||||||||

| Allowance as a percentage of loans |

0.99 | % | 0.83 | % | 0.85 | % | ||||||||||||||

| Non-performing assets as a percentage of total assets |

0.06 | % | 0.14 | % | 0.07 | % | ||||||||||||||

7

Institutional Group Summary Results of Operations (Unaudited)

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||

| (in 000s) | 12/31/12 | 12/31/11 | % Change |

9/30/12 | % Change |

12/31/12 | 12/31/11 | % Change |

||||||||||||||||||||||||

| Revenues: |

||||||||||||||||||||||||||||||||

| Commissions |

$ | 41,235 | $ | 40,076 | 2.9 | $ | 38,574 | 6.9 | $ | 151,093 | $ | 190,036 | (20.5 | ) | ||||||||||||||||||

| Principal transactions |

42,961 | 40,263 | 6.7 | 44,178 | (2.8 | ) | 180,263 | 133,251 | 35.3 | |||||||||||||||||||||||

| Capital raising |

38,296 | 23,331 | 64.1 | 32,386 | 18.2 | 145,247 | 103,985 | 39.7 | ||||||||||||||||||||||||

| Advisory fees |

26,644 | 28,728 | (7.3 | ) | 27,205 | (2.1 | ) | 96,084 | 75,123 | 27.9 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Investment banking |

64,940 | 52,059 | 24.7 | 59,591 | 9.0 | 241,331 | 179,108 | 34.7 | ||||||||||||||||||||||||

| Other 6 |

15,920 | 1,831 | * | 27,336 | (41.8 | ) | 45,849 | 5,002 | * | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net revenues |

165,056 | 134,229 | 23.0 | 169,679 | (2.7 | ) | 618,536 | 507,397 | 21.9 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Non-interest expenses: |

||||||||||||||||||||||||||||||||

| Compensation and benefits |

108,371 | 89,497 | 21.1 | 104,913 | 3.3 | 392,062 | 323,503 | 21.2 | ||||||||||||||||||||||||

| Non-compensation operating expenses |

35,195 | 33,959 | 3.6 | 31,339 | 12.3 | 130,307 | 120,625 | 8.0 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total non-interest expenses |

143,566 | 123,456 | 16.3 | 136,252 | 5.4 | 522,369 | 444,128 | 17.6 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Income before income taxes |

$ | 21,490 | $ | 10,773 | 99.5 | $ | 33,427 | (35.7 | ) | $ | 96,167 | $ | 63,269 | 52.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| As a percentage of net revenues: |

||||||||||||||||||||||||||||||||

| Compensation and benefits |

65.7 | 66.7 | 61.8 | 63.4 | 63.8 | |||||||||||||||||||||||||||

| Non-compensation operating expenses |

21.3 | 25.3 | 18.5 | 21.1 | 23.7 | |||||||||||||||||||||||||||

| Income before income taxes |

13.0 | 8.0 | 19.7 | 15.5 | 12.5 | |||||||||||||||||||||||||||

| * | Percentage not meaningful. |

Institutional Group Brokerage & Investment Banking Revenues (Unaudited)

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||

| (in 000s) | 12/31/12 | 12/31/11 | % Change |

9/30/12 | % Change |

12/31/12 | 12/31/11 | % Change |

||||||||||||||||||||||||

| Institutional brokerage: |

||||||||||||||||||||||||||||||||

| Equity |

$ | 41,805 | $ | 40,598 | 3.0 | $ | 37,956 | 10.1 | $ | 162,399 | $ | 181,876 | (10.7 | ) | ||||||||||||||||||

| Fixed income |

42,391 | 39,741 | 6.7 | 44,796 | (5.4 | ) | 168,957 | 141,411 | 19.5 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Institutional brokerage |

84,196 | 80,339 | 4.8 | 82,752 | 1.7 | 331,356 | 323,287 | 2.5 | ||||||||||||||||||||||||

| Investment banking: |

||||||||||||||||||||||||||||||||

| Capital raising: |

||||||||||||||||||||||||||||||||

| Equity |

19,830 | 10,109 | 96.2 | 17,527 | 13.1 | 86,558 | 77,495 | 11.7 | ||||||||||||||||||||||||

| Fixed income |

18,466 | 13,222 | 39.7 | 14,859 | 24.3 | 58,689 | 26,490 | 121.6 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Capital raising |

38,296 | 23,331 | 64.1 | 32,386 | 18.2 | 145,247 | 103,985 | 39.7 | ||||||||||||||||||||||||

| Advisory fees |

26,644 | 28,728 | (7.3 | ) | 27,205 | (2.1 | ) | 96,084 | 75,123 | 27.9 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Investment banking |

$ | 64,940 | $ | 52,059 | 24.7 | $ | 59,591 | 9.0 | $ | 241,331 | $ | 179,108 | 34.7 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Investor Relations Contact

Sarah Anderson, (415) 364-2500, investorrelations@stifel.com

| 6 | Includes net interest and other income. Other income for the three and twelve months ended December 31, 2012 includes $13.4 million and $39.0 million, respectively, in realized and unrealized gains recognized on the Company’s investment in Knight Capital Group, Inc. |

8