As filed with the Securities and Exchange Commission on September 6, 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03758

MATRIX ADVISORS VALUE FUND, INC.

(Exact name of registrant as specified in charter)

747 Third Avenue, 31st Floor, New York, NY 10017

(Address of principal executive offices) (Zip code)

David A. Katz

747 Third Avenue, 31st Floor

New York, NY 10017

(Name and address of agent for service)

1(800) 366-6223

Registrant’s telephone number, including area code

Copies to:

Carol Gehl

Godfrey & Kahn, S.C.

780 N. Water Street

Milwaukee, WI 53202

Date of fiscal year end: June 30

Date of reporting period: June 30, 2017

Item 1. Reports to Stockholders.

MATRIX ADVISORS

VALUE FUND, INC.

747 Third Avenue • New York, NY 10017 • Tel. (212) 486-2004 • Fax (212) 486-1822

July 31, 2017

Dear Fellow Shareholder:

The Matrix Advisors Value Fund posted a gain of 0.45% in the second quarter compared to the S&P 500 Index’s return of 3.09%. For the year to date through June 30th, the Fund was up 3.74% versus a gain of 9.34% for the S&P 500 Index.

Our Q2 underperformance was caused by a combination of being out of sync with the market’s preference for growth, our sector weightings and a handful of poor performing stocks. Growth outperformed Value with the Russell 1000 Growth Index more than tripling the Russell 1000 Value Index’s return in the quarter. In the last month of the quarter, this year to date trend reversed, with Value outperforming Growth, and the Fund posted its best return in the quarter (returning 2.56% for the month of June). As discussed below, we believe the Fund is well positioned to capitalize on a shift from Growth to Value.

While we had a difficult start to the year, the Fund had very healthy gains for the last 12 months and the fiscal year ended June 30th, 2017, returning 18.22%, which modestly outpaced the 17.90% increase in the S&P 500 Index.

Disclosure Note:

For your information, for the period ended June 30, 2017, the Fund’s average annual total returns for the one-year, five-years, ten-years and for the period from July 1, 1996, the inception of Matrix Asset Advisors’ involvement with the Fund, were 18.22%, 12.37%, 3.46% and 7.64%, respectively. For the same periods the returns for the S&P 500 Index were 17.90%, 14.63%, 7.18% and 8.29%.

| Gross Expense Ratio: |

1.16 | % | ||

| Net Expense Ratio: |

0.99 | %** |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800-366-6223 or by visiting www.matrixadvisorsvaluefund.com.

**The Advisor has contractually agreed to reduce fees through 10/31/17.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. Matrix Asset Advisors became the sub-advisor on July 1, 1996 and Advisor to the Fund on May 11, 1997. Prior to those dates, the Fund was managed by another advisor.

The Fund’s Net Asset Value on 6/30/17 was $66.85.

The attached commentary provides a thorough discussion on what drove our 2nd Quarter, 2017 returns and why we think the Fund is well positioned going forward.

1

MATRIX ADVISORS

VALUE FUND, INC.

As discussed below, we think the Fund should be able to capitalize on a shift in sentiment from Growth to Value and recover the first six month’s performance lag versus the S&P 500. According to Barron’s (July 3, 2017), among large-cap stocks, Value stocks are now cheaper relative to Growth stocks than at any time in the last six decades, except for the top of the dot-com bubble in the late 1990’s. As the article notes, “this wide spread provides a compelling statistical case for expecting Value to significantly outperform Growth in coming years.” As evidenced by June’s market reversal, when change comes, it can be fast and dramatic.

The earnings and dividend increases in our portfolio have met or exceeded expectations and we are optimistic about the Fund’s near-term prospects, and especially optimistic on a relative basis.

Investors generally look to buy on a dip and/or understand that down markets or flat environments can set the stage for better market returns. We think the last six months has been one of those periods where our holdings fundamentals are strong, yet the portfolio has retrenched and lagged the market on a relative basis.

We believe a combination of depressed valuations and strong outlooks, especially in a time where much of the market is richly priced, leaves us very well positioned for the second half of the year.

Matrix partners and associates are among the Fund’s largest shareholders and our interests are directly aligned with yours. We believe the current portfolio should be positioned to return to favorable investment returns in the years to come. We thank you for your continued support and confidence in the Fund.

Sincerely,

David A. Katz, CFA

Fund Manager

Past performance is not a guarantee of future results.

Diversification does not guarantee a profit or protect from loss in a declining market.

Earnings growth is not representative of the Fund’s future performance.

Please refer to the Schedule of Investments in this report for details on Fund holdings. Fund holdings are subject to change at any time and are not recommendations to buy or sell any security.

The information provided herein represents the opinion of the Matrix Advisors Value Fund management and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

The S&P 500 Index is an unmanaged index of 500 stocks, which is widely regarded as the standard for measuring large-cap U.S. stock market performance. You cannot invest directly in an index.

The Russell 1000® Growth Index measures the performance of those Russell 1000® Index companies with higher price-to-book ratios and higher forecasted growth values.

The Russell 1000® Value Index measures the performance of those Russell 1000® Index companies with lower price-to-book ratios and lower forecasted growth values.

2

MATRIX ADVISORS

VALUE FUND, INC.

Price to earnings (P/E) ratio is a common tool for comparing the prices of different common stocks and is calculated by dividing the current market price of a stock by the earnings per share.

Dividend yield refers to a stock’s annual dividend payments to shareholders, expressed as a percentage of the stock’s current price.

The term spread represents the average price-to-book ratio of Value stocks versus Growth stocks.

It is not possible to invest directly in an index.

Must be preceded or accompanied by a prospectus.

Mutual fund investing involves risk. Principal loss is possible. The stock of value companies can continue to be undervalued for long periods of time and not realize its expected value. The value of the Fund may decrease in response to the activities and financial prospects of an individual company.

The Matrix Advisors Value Fund is distributed by Quasar Distributors, LLC.

3

MATRIX ADVISORS

VALUE FUND, INC.

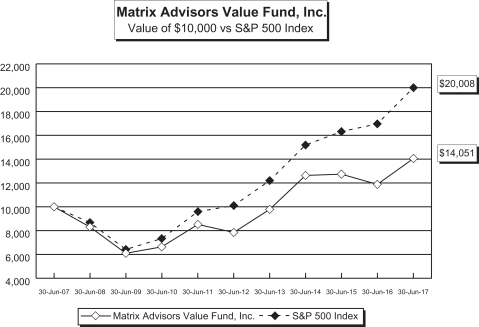

| Average Annualized Total Return Periods Ended June 30, 2017 |

||||||||||||

| One Year | Five Years | Ten Years | ||||||||||

| Matrix Advisors Value Fund, Inc. |

18.22 | % | 12.37 | % | 3.46 | % | ||||||

| S&P 500 Index* |

17.90 | % | 14.63 | % | 7.18 | % | ||||||

The graph above illustrates the performance of a hypothetical $10,000 investment made in the Fund and the S&P 500 Index ten years ago. All returns in the graph and table above reflect the reinvestment of dividends and distributions, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions. The graph and table above do not imply any future performance.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.matrixadvisorsvaluefund.com.

| * | The S&P 500 Index is an unmanaged index which is widely regarded as the standard for measuring large-cap U.S. stock market performance. The index does not incur expenses and is not available for investment. |

4

MATRIX ADVISORS

VALUE FUND, INC.

Matrix Advisors Value Fund, Inc.

Capital Markets Commentary and Quarterly Report:

2nd Quarter 2017 and Annual Review

The stock market added to its 2017 gains in the second quarter, with the S&P 500 Index rising by +3.09%. For the first six months of the year, the Index was up +9.34%. The market’s advance was propelled by continued good economic results in the U.S. and the Eurozone, while Asia maintained mid-single digit growth. Corporate earnings from S&P 500 companies this year are the best in nearly six years1. For now, the administration’s inability to pass legislation and advance their health care, tax reform and fiscal stimulus initiatives has not impeded the overall stock market’s move higher.

While the market has continued its upward move, 2017 has seen a massive rotation and reversal of several trends that were driving stock prices since the presidential election. After a strong 2016, the Fund started this year off on a weak relative note but with positive returns.

After a poor 2016, the Russell 1000 Growth Index had a sharp recovery in the first half of 2017, while the Russell 1000 Value Index slowed from its strong 2016 performance.

The change in market sentiment was caused by concerns about the strength of the economic recovery and a rethinking of the inflation and interest rate outlook. Growth stocks have thrived and Value stocks lagged as concerns about a slowing economy took hold. The outlook for faster economic growth has been negatively impacted by lower confidence in the Trump administration’s ability to deliver on tax reform, healthcare legislation and their fiscal spending agenda.

Once these market trends started to play out they took on a life of their own. Strength begot strength and weakness generated more weakness.

We think much of this market dynamic is driven by market psychology and momentum investing rather than the underlying fundamentals. We believe fundamentals would argue that these recent moves are not warranted and a look at the market in terms of Value vs. Growth suggests that Value stocks have only been this attractive relative to Growth one other time in the past 60 years. Importantly, the last time was after the Internet bubble of the late 90’s and led to a very strong period for Value (Barron’s on July 3, 2017 discussed this in some length, “Value Investing is Ready to Stage a Comeback”). As the article notes, “this wide spread provides a compelling statistical case for expecting Value to significantly outperform Growth in coming years.” As evidenced by June’s market reversal, when change comes, it can be fast and dramatic.

The backdrop for continued earnings growth remains favorable with S&P 500 companies expected to show earnings growth of 9.8% in 2017 compared to last year, according to FactSet. The U.S. economy continues to expand, the European manufacturing index in June reached its highest level since April 2011, Japan’s business confidence also hit its highest level in more than three years and China’s manufacturing data showed a return to expansion in June.

| 1 | Wall Street Journal 7/05/17 - Markets Review & Outlook |

5

MATRIX ADVISORS

VALUE FUND, INC.

The stronger economic data are moving central banks around the world towards actions that will likely lead to higher interest rates. Additionally, oil prices, which have been a depressant on inflation and economic activity, are likely to move higher as supply and demand come closer to being in balance.

Fund Annual Review

While we had a slow start to 2017, our strong second half of last year resulted in the Fund having strong absolute gains of 18.22% for the 6/30/16 – 6/30/17 period, which compares favorably to the 17.90% increase in the S&P 500. For the past fiscal year, the Fund’s results were led by gains in the Financial, Technology and Industrial sectors. Energy was a detractor from performance. Consumer Discretionary had positive returns and Consumer Staples and Healthcare returns were flat.

Standout equity contributors for the period included American Express, Apple Computer, Charles Schwab, JP Morgan, MetLife, Morgan Stanley, TE Connectivity, State Street and Symantec, each with gains in excess of 40%. Looking forward we believe that many of the stocks that didn’t fully participate in the market increases in the past year are poised to play catch up in upcoming periods.

2nd Quarter Review and Outlook

The Matrix Advisors Value Fund showed a gain in the quarter of 0.45%, lagging the S&P 500 Index’s return of 3.09%. For the year to date through June 30th, the Fund was up 3.74% versus a gain of 9.34% for the S&P 500.

For the quarter, positive performance in most portfolio sectors was offset by negative returns in Energy and Consumer Discretionary. We are overweight Energy, a poor performing sector in a period of declining oil prices. Weak share price performance from Harley-Davidson (HOG) and Viacom (VIAB) negatively impacted results in Consumer Discretionary.

HOG has a good, shareholder friendly management team who are actively managing inventory and new product introductions. This should position the company to weather the current challenging motorcycle market and thrive when business improves. Viacom brought in new senior management to revive a company that has suffered from poor leadership and we are already seeing meaningful progress in turning around their flagship brands like Nickelodeon, MTV, VH1 and Comedy Central as well as the Paramount Film Studio. We are optimistic about the prospects for both companies.

All other sectors in the portfolio showed positive returns in the quarter, led by Healthcare, Industrials and a late surge in Financials.

Healthcare was led by Thermo Fisher and AbbVie, Industrials by United Technologies and Eaton, and Financials by State Street, Chubb and American Express. As noted earlier, Financial stocks were very strong performers in June, after interest rates rose and the positive stress test results were announced.

During the quarter, we started a new position in GE. Prior to our investment, the shares had massively underperformed the market and the activist investor group Trian Partners has made a significant investment in the company. Our investment rational for purchasing GE was that the status quo was unsustainable. Either CEO Jeff Immelt would turn the company around quickly or he would be replaced. Less than one month after we

6

MATRIX ADVISORS

VALUE FUND, INC.

made our initial investment, Immelt announced his retirement as CEO, effective August 1. We think this is a very positive development and that under the right leadership the company has significantly better business and stock price potential. The new CEO John Flannery, who had been the head of GE Healthcare, has a great reputation and we are very upbeat about this change. In the meantime, the shares have a dividend yield of 3.6%.

We also started a small position in Scripps Networks Interactive (SNI), a leading lifestyle network whose channels (HGTV, Food Network, Travel Channel, DIY Network, Cooking Channel and Great American Country) enjoy very high subscriber loyalty among an upscale female demographic. The share price has been weak with the rest of the media group on concerns about declining cable subscriptions, but SNI is being included on almost all lower priced media packages and its unique programming commands above average advertising rates. At 12 times estimated earnings, we think the shares offer exceptional value (subsequent to our purchase, the company agreed to be acquired by Discovery Communications).

We added to our position in Harley Davidson, Schlumberger and Viacom. We completed the sale of the very profitable position in Symantec after it reached our target price objectives. It’s also important to point out that in addition to its healthy stock price appreciation, Symantec shareholders received an extra $4 per share of cash dividend in the spring of 2016.

Looking forward to the balance of the year, we are optimistic about how the Fund is positioned. We expect our large weighting in Financials to benefit from a gradual rise in interest rates, a less adversarial regulatory environment and improving loan demand. Energy is slogging along, with crude prices near the low end of an expected price range of $40-$60 and may be the most hated sector in the market outside of Retail. We believe it is due for a bounce on any evidence that supply and demand are moving towards balance. Our Consumer Staples holdings provide good income and stability for the portfolio and our Industrial and Consumer Discretionary holdings should benefit from the improving economic picture we foresee in the months ahead.

The earnings and dividend increases in the Fund’s holdings have met or exceeded expectations and both first and second quarter earnings and revenues versus consensus have been tracking well ahead of the S&P 500. In addition, the portfolio’s P/E ratio is below the market’s, with a median 15.0 compared to the S&P 500’s 18.4 (based on 2017 expected earnings).

The combination of favorable fundaments and attractive valuation leaves us upbeat about the portfolio’s near term prospects and particularly optimistic on a relative basis. We believe any change in sentiment toward Value and away from Growth would provide a nice portfolio tailwind and look at June as a reminder that sentiment can change rapidly.

* * *

We hope you are enjoying your summer and thank you all for confidence and trust. Please contact us if you have any questions at 800-366-6223 or 212-486-2004.

Best regards.

7

MATRIX ADVISORS

VALUE FUND, INC.

Expense Example (Unaudited)

As a shareholder of the Fund, you incur ongoing costs including advisory fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period indicated and held for the entire period from January 1, 2017 to June 30, 2017.

Actual Expenses

The information in the table under the heading “Actual Performance” provides information about actual account values and actual expenses. You may use the information in these columns together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the row entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical Performance (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the information under the heading “Hypothetical Performance (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| EXPENSE EXAMPLE | ACTUAL PERFORMANCE |

HYPOTHETICAL PERFORMANCE (5% RETURN BEFORE EXPENSES) |

||||||

| Beginning Account Value (1/1/17) |

$ | 1,000.00 | $ | 1,000.00 | ||||

| Ending Account Value (6/30/17) |

$ | 1,037.40 | $ | 1,019.89 | ||||

| Expenses Paid During Period1 |

$ | 5.00 | $ | 4.96 | ||||

| 1 | Expenses are equal to the Fund’s annualized expense ratio of 0.99% multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

8

MATRIX ADVISORS

VALUE FUND, INC.

| SECTOR BREAKDOWN | ||||

| Financials |

28.1 | % | ||

| Information Technology |

17.1 | % | ||

| Energy |

12.1 | % | ||

| Health Care |

11.6 | % | ||

| Industrials |

11.3 | % | ||

| Consumer Staples |

9.8 | % | ||

| Consumer Discretionary |

9.5 | % | ||

|

|

|

|||

| Total Investments |

99.5 | % | ||

| Short-Term Investments, net of Other Assets |

0.5 | % | ||

|

|

|

|||

| Total Net Assets |

100.0 | % | ||

|

|

|

|||

| The table above lists sector allocations as a percentage of the Fund’s total investments as of June 30, 2017. | ||||

9

MATRIX ADVISORS

VALUE FUND, INC.

| Schedule of Investments | ||||||||

| June 30, 2017 | ||||||||

| SHARES | VALUE | |||||||

| COMMON STOCKS - 99.5% |

||||||||

| BANK (MONEY CENTER): 4.8% |

||||||||

| 31,000 | JPMorgan Chase & Co. |

$ | 2,833,400 | |||||

|

|

|

|||||||

| BANK (PROCESSING): 2.4% |

||||||||

| 15,600 | State Street Corp. |

1,399,788 | ||||||

|

|

|

|||||||

| BANK (REGIONAL): 2.1% |

||||||||

| 26,500 | BB&T Corp. |

1,203,365 | ||||||

|

|

|

|||||||

| BANK (SUPER REGIONAL): 4.4% |

||||||||

| 46,000 | Wells Fargo & Co. |

2,548,860 | ||||||

|

|

|

|||||||

| BEVERAGES: 2.4% |

||||||||

| 12,200 | PepsiCo, Inc. |

1,408,978 | ||||||

|

|

|

|||||||

| BIOTECHNOLOGY: 3.0% |

||||||||

| 25,000 | Gilead Sciences, Inc. |

1,769,500 | ||||||

|

|

|

|||||||

| CONSUMER DISCRETIONARY (MULTI-MEDIA): 2.8% |

||||||||

| 3,600 | Scripps Networks Interactive, Inc. - Class A |

245,916 | ||||||

| 42,500 | Viacom, Inc. - Class B |

1,426,725 | ||||||

|

|

|

|||||||

| 1,672,641 | ||||||||

|

|

|

|||||||

| COMPUTER AND PERIPHERALS: 1.4% |

||||||||

| 5,500 | Apple, Inc. |

792,110 | ||||||

|

|

|

|||||||

| COMPUTER SOFTWARE AND SERVICES: 4.1% |

||||||||

| 35,000 | Microsoft Corp. |

2,412,550 | ||||||

|

|

|

|||||||

| DIVERSIFIED OPERATIONS: 8.5% |

||||||||

| 45,499 | Johnson Controls International Plc |

1,972,837 | ||||||

| 40,400 | General Electric Co. |

1,091,204 | ||||||

| 15,800 | United Technologies Corp. |

1,929,338 | ||||||

|

|

|

|||||||

| 4,993,379 | ||||||||

|

|

|

|||||||

| DRUG: 3.1% |

||||||||

| 25,000 | AbbVie, Inc. |

1,812,750 | ||||||

|

|

|

|||||||

The accompanying notes are an integral part of these financial statements.

10

MATRIX ADVISORS

VALUE FUND, INC.

| Schedule of Investments | ||||||||

| June 30, 2017 – Continued | ||||||||

| SHARES | VALUE | |||||||

| DRUG STORE: 3.9% |

||||||||

| 28,500 | CVS Health Corp. |

$ | 2,293,110 | |||||

|

|

|

|||||||

| ELECTRICAL COMPONENT: 3.5% |

||||||||

| 26,400 | TE Connectivity Ltd. |

2,077,152 | ||||||

|

|

|

|||||||

| FINANCIAL SERVICES: 5.3% |

||||||||

| 17,900 | American Express Co. |

1,507,896 | ||||||

| 19,300 | Capital One Financial Corp. |

1,594,566 | ||||||

|

|

|

|||||||

| 3,102,462 | ||||||||

|

|

|

|||||||

| HOUSEHOLD PRODUCTS: 3.0% |

||||||||

| 20,200 | The Procter & Gamble Co. |

1,760,430 | ||||||

|

|

|

|||||||

| INSURANCE (DIVERSIFIED): 3.9% |

||||||||

| 41,600 | MetLife, Inc. |

2,285,504 | ||||||

|

|

|

|||||||

| INSURANCE (PROPERTY CASUALTY): 3.4% |

||||||||

| 13,500 | Chubb Ltd. |

1,962,630 | ||||||

|

|

|

|||||||

| INTERNET SOFTWARE & SERVICES: 3.5% |

||||||||

| 2,250 | Alphabet, Inc. - Class C * |

2,044,642 | ||||||

|

|

|

|||||||

| MANUFACTURING - MISCELLANEOUS: 3.9% |

||||||||

| 29,700 | Eaton Corp. Plc |

2,311,551 | ||||||

|

|

|

|||||||

| MEDICAL SUPPLIES: 3.9% |

||||||||

| 17,900 | Zimmer Biomet Holdings, Inc. |

2,298,360 | ||||||

|

|

|

|||||||

| MOTORCYCLES/MOTOR SCOOTER: 2.5% |

||||||||

| 27,500 | Harley-Davidson, Inc. |

1,485,550 | ||||||

|

|

|

|||||||

| OIL & GAS SERVICES: 2.7% |

||||||||

| 24,400 | Schlumberger Ltd. |

1,606,496 | ||||||

|

|

|

|||||||

| OIL/GAS (DOMESTIC): 2.2% |

||||||||

| 39,800 | Devon Energy Corp. |

1,272,406 | ||||||

|

|

|

|||||||

| PETROLEUM (INTEGRATED): 2.6% |

||||||||

| 14,500 | Chevron Corp. |

1,512,785 | ||||||

|

|

|

|||||||

The accompanying notes are an integral part of these financial statements.

11

MATRIX ADVISORS

VALUE FUND, INC.

| Schedule of Investments | ||||||||

| June 30, 2017 – Continued | ||||||||

| SHARES | VALUE | |||||||

| PETROLEUM (PRODUCING): 4.4% |

||||||||

| 22,500 | ConocoPhillips |

$ | 989,100 | |||||

| 27,000 | Occidental Petroleum Corp. |

1,616,490 | ||||||

|

|

|

|||||||

| 2,605,590 | ||||||||

|

|

|

|||||||

| PRECISION INSTRUMENTS: 3.1% |

||||||||

| 10,300 | Thermo Fisher Scientific, Inc. |

1,797,042 | ||||||

|

|

|

|||||||

| SECURITIES BROKERAGE: 2.1% |

||||||||

| 27,000 | Morgan Stanley |

1,203,120 | ||||||

|

|

|

|||||||

| TELECOMMUNICATIONS (EQUIPMENT): 6.6% |

||||||||

| 66,000 | Cisco Systems, Inc. |

2,065,800 | ||||||

| 33,000 | QUALCOMM, Inc. |

1,822,260 | ||||||

|

|

|

|||||||

| 3,888,060 | ||||||||

|

|

|

|||||||

| TOTAL COMMON STOCKS (Cost $41,735,048) |

$ | 58,354,211 | ||||||

|

|

|

|||||||

| SHORT-TERM INVESTMENTS - 0.4% |

||||||||

| 217,430 | Fidelity Institutional Money Market Funds - Government Portfolio |

217,430 | ||||||

|

|

|

|||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $217,430) |

$ | 217,430 | ||||||

|

|

|

|||||||

| TOTAL INVESTMENTS (Cost $41,952,478): 99.9% |

58,571,641 | |||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES: 0.1% |

59,267 | |||||||

|

|

|

|||||||

| TOTAL NET ASSETS: 100.0% |

$ | 58,630,908 | ||||||

|

|

|

|||||||

| * | Non-Income Producing |

The accompanying notes are an integral part of these financial statements.

12

MATRIX ADVISORS

VALUE FUND, INC.

| Statement of Assets and Liabilities | ||||

| At June 30, 2017 | ||||

| ASSETS: |

||||

| Investments in securities, at value (cost $41,952,478) |

$ | 58,571,641 | ||

| Receivables: |

||||

| Fund shares sold |

85,537 | |||

| Investments sold |

1,179,329 | |||

| Dividends and interest |

88,897 | |||

| Prepaid expenses |

14,071 | |||

|

|

|

|||

| Total assets |

59,939,475 | |||

|

|

|

|||

| LIABILITIES: |

||||

| Payables: |

||||

| Fund shares repurchased |

1,414 | |||

| Investments purchased |

1,224,435 | |||

| Due to advisor |

19,522 | |||

| Accrued expenses: |

||||

| Professional fees |

20,805 | |||

| Fund administration fees |

12,273 | |||

| Fund accounting fees |

5,200 | |||

| Other expenses |

24,918 | |||

|

|

|

|||

| Total liabilities |

1,308,567 | |||

|

|

|

|||

| NET ASSETS |

$ | 58,630,908 | ||

|

|

|

|||

| Number of shares, $0.01 par value, issued |

877,084 | |||

|

|

|

|||

| Net Asset Value, Offering Price and Redemption Price Per Share |

$ | 66.85 | ||

|

|

|

|||

| COMPONENTS OF NET ASSETS: |

||||

| Paid in capital |

40,810,142 | |||

| Undistributed net investment income |

350,905 | |||

| Accumulated net realized gain on investments |

850,698 | |||

| Net unrealized appreciation on investments |

16,619,163 | |||

|

|

|

|||

| Net Assets |

$ | 58,630,908 | ||

|

|

|

|||

The accompanying notes are an integral part of these financial statements.

13

MATRIX ADVISORS

VALUE FUND, INC.

| Statement of Operations | ||||

| For the Year Ended June 30, 2017 | ||||

| INVESTMENT INCOME |

||||

| INCOME |

||||

| Dividend income (net of foreign taxes withheld of $3,774) |

$ | 1,504,362 | ||

| Interest income |

1,449 | |||

|

|

|

|||

| Total income |

1,505,811 | |||

|

|

|

|||

| EXPENSES |

||||

| Advisory fees |

436,515 | |||

| Fund administration fees |

73,264 | |||

| Transfer agent and accounting fees |

50,495 | |||

| Professional fees |

44,516 | |||

| Federal and state registration fees |

25,334 | |||

| Reports to shareholders |

18,903 | |||

| Custodian fees |

14,954 | |||

| Directors’ fees and expenses |

9,672 | |||

| Other expenses |

15,571 | |||

|

|

|

|||

| Total operating expenses |

689,224 | |||

| Less: Expense reimbursement by advisor |

(113,025 | ) | ||

|

|

|

|||

| Net expenses |

576,199 | |||

|

|

|

|||

| Net investment income |

929,612 | |||

|

|

|

|||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS |

||||

| Net realized gain on investments |

2,639,393 | |||

| Net change in unrealized appreciation/depreciation on investments |

6,129,618 | |||

|

|

|

|||

| Net realized and unrealized gain on investments |

8,769,011 | |||

|

|

|

|||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 9,698,623 | ||

|

|

|

|||

The accompanying notes are an integral part of these financial statements.

14

MATRIX ADVISORS

VALUE FUND, INC.

| Statement of Changes in Net Assets | YEAR ENDED JUNE 30, 2017 |

YEAR ENDED JUNE 30, 2016 |

||||||

| INCREASE (DECREASE) IN NET ASSETS |

||||||||

| OPERATIONS: |

||||||||

| Net investment income |

$ | 929,612 | $ | 1,410,249 | ||||

| Net realized gain on investments |

2,639,393 | 2,987,005 | ||||||

| Net change in net unrealized appreciation/depreciation on investments |

6,129,618 | (10,625,706 | ) | |||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets resulting from operations |

9,698,623 | (6,228,452 | ) | |||||

|

|

|

|

|

|||||

| DISTRIBUTIONS TO SHAREHOLDERS |

||||||||

| From net investment income |

(1,402,760 | ) | (1,070,965 | ) | ||||

|

|

|

|

|

|||||

| CAPITAL SHARE TRANSACTIONS: |

||||||||

| Proceeds from shares sold |

2,642,655 | 4,647,398 | ||||||

| Proceeds from reinvestment of distributions |

1,319,969 | 859,502 | ||||||

| Cost of shares redeemed |

(8,759,679 | ) | (16,890,713 | ) | ||||

| Redemption fees |

19 | 616 | ||||||

|

|

|

|

|

|||||

| Net decrease from capital share transactions |

(4,797,036 | ) | (11,383,197 | ) | ||||

|

|

|

|

|

|||||

| Total increase (decrease) in net assets |

3,498,827 | (18,682,614 | ) | |||||

| NET ASSETS |

||||||||

| Beginning of year |

55,132,081 | 73,814,695 | ||||||

|

|

|

|

|

|||||

| End of year |

$ | 58,630,908 | $ | 55,132,081 | ||||

|

|

|

|

|

|||||

| Undistributed net investment income |

$ | 350,905 | $ | 824,053 | ||||

|

|

|

|

|

|||||

| CHANGE IN SHARES |

||||||||

| Shares outstanding, beginning of year |

952,259 | 1,171,235 | ||||||

| Shares sold |

40,401 | 81,076 | ||||||

| Shares issued on reinvestment of distributions |

20,189 | 15,403 | ||||||

| Shares redeemed |

(135,765 | ) | (315,455 | ) | ||||

|

|

|

|

|

|||||

| Shares outstanding, end of year |

877,084 | 952,259 | ||||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

15

MATRIX ADVISORS

VALUE FUND, INC.

| Financial Highlights | ||||||||||||||||||||

| For a capital share outstanding through each year | ||||||||||||||||||||

| YEARS ENDED JUNE 30, | ||||||||||||||||||||

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

| Net asset value, beginning of the year |

$ | 57.90 | $ | 63.02 | $ | 63.32 | $ | 49.56 | $ | 40.44 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||

| Net investment income |

1.03 | (a) | 1.27 | (a) | 0.77 | (a) | 0.68 | (a) | 0.59 | (a) | ||||||||||

| Net realized and unrealized gain (loss) on investments |

9.47 | (5.49 | ) | (0.28 | ) | 13.71 | 9.26 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

10.50 | (4.22 | ) | 0.49 | 14.39 | 9.85 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less distributions: |

||||||||||||||||||||

| Dividends from net investment income |

(1.55 | ) | (0.90 | ) | (0.79 | ) | (0.63 | ) | (0.73 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Paid-in capital from redemption fees (Note 2) |

0.00 | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net asset value, end of year |

$ | 66.85 | $ | 57.90 | $ | 63.02 | $ | 63.32 | $ | 49.56 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total return |

18.22 | % | (6.66 | )% | 0.77 | % | 29.20 | % | 24.69 | % | ||||||||||

| Ratios/supplemental data: |

||||||||||||||||||||

| Net assets, end of year (millions) |

$ | 58.6 | $ | 55.1 | $ | 73.8 | $ | 81.0 | $ | 60.7 | ||||||||||

| Ratio of operating expenses to average net assets: |

||||||||||||||||||||

| Before expense reimbursement |

1.19 | % | 1.16 | % | 1.12 | % | 1.15 | % | 1.18 | % | ||||||||||

| After expense reimbursement |

0.99 | % | 0.99 | % | 0.99 | % | 0.99 | % | 0.99 | % | ||||||||||

| Interest Expense |

— | — | — | 0.00 | %(c) | — | ||||||||||||||

| Ratio of net investment income |

||||||||||||||||||||

| Before expense reimbursement |

1.40 | % | 2.03 | % | 1.09 | % | 1.06 | % | 1.18 | % | ||||||||||

| After expense reimbursement |

1.60 | % | 2.20 | % | 1.22 | % | 1.22 | % | 1.37 | % | ||||||||||

| Portfolio turnover rate |

22 | % | 15 | % | 12 | % | 41 | % | 15 | % | ||||||||||

| (a) | Calculated using the average shares method. |

| (b) | Less than $0.01. |

| (c) | Interest expense was less than 0.01%. |

The accompanying notes are an integral part of these financial statements.

16

MATRIX ADVISORS

VALUE FUND, INC.

Notes to Financial Statements

NOTE 1 – ORGANIZATION

Matrix Advisors Value Fund, Inc. (the “Fund”) is a Maryland corporation registered under the Investment Company Act of 1940 (the “1940 Act”) as a diversified, open-end management investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (the “FASB”) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies”. The Fund commenced operations September 16, 1983. The objective of the Fund is to achieve a total rate of return which is comprised of capital appreciation and current income.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The Fund consistently follows the accounting policies set forth below which are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

| A. | Security Valuation. |

Securities traded on a national securities exchange are valued at the last reported sales price at the close of regular trading on each day the exchanges are open for trading. Securities traded on the NASDAQ Stock Market, LLC (“NASDAQ”) are valued at the NASDAQ Official Closing Price, which may not necessarily represent the last sale price. Quotations of foreign securities, currencies and other assets denominated in foreign currencies are translated into U.S. dollars at the exchange rate of such currencies against the U.S. dollar, as provided by on independent pricing service or reporting agency. Foreign currency exchange rates generally are valued at the last sale price at the close on an exchange on which the security is primarily traded. Securities traded on an exchange for which there have been no sales are valued at the mean between the last reported bid and the asked quotes, or the last sale price when appropriate.

Securities for which quotations are not readily available are stated at their respective fair values as determined in good faith by the Fund’s valuation committee and pricing committee of Matrix Asset Advisors, Inc. (the “Advisor” or “Matrix”) in accordance with procedures approved by the Board of Directors of the Fund. In determining fair value, the Fund takes into account all relevant factors and available information. Consequently, the price of the security used by the Fund to calculate its net asset value (“NAV”) per share may differ from quoted or published prices for the same security. Fair value pricing involves subjective judgments and there is no single standard for determining a security’s fair value. As a result, different mutual funds could reasonably arrive at a different fair value for the same security. It is possible that the fair value determined for a security is materially different from the value that could be realized upon the sale of that security or from the values that other mutual funds may determine.

Investments in other funds are valued at their respective net asset values as determined by those funds, in accordance with the 1940 Act.

Foreign securities are recorded in the financial statements after translation to U.S. dollars based on the applicable exchange rate at the end of the period. The Fund does not isolate that portion of the results of operations arising as a result of changes in the currency exchange rate from the fluctuations arising as a result of changes in the market prices of investments during the period.

17

MATRIX ADVISORS

VALUE FUND, INC.

Notes to Financial Statements, Continued

| B. | Shares Valuation. |

The NAV per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash or other assets, minus all liabilities (including estimated accrued expenses), by the total number of shares outstanding of the Fund, rounded to the nearest cent. The Fund’s shares will not be priced on the days on which the New York Stock Exchange (“NYSE”) is closed for trading. The offering and redemption price per share of the Fund is equal to the Fund’s NAV per share. Prior to October 31, 2016, the Fund assessed a 1.00% fee on redemptions of Fund shares purchased and held for 60 days or less. These fees were deducted from the redemptions proceeds otherwise payable to the shareholder. The Fund retained the fee charged as paid-in capital and such fees became part of the Fund’s daily NAV calculation.

| C. | Federal Income Taxes. |

The Fund has elected to be treated as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended. The Fund intends to distribute substantially all of its taxable income and any capital gains less any applicable capital loss carryforwards. Accordingly, no provision for Federal income taxes has been made in the accompanying financial statements.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years (2014 – 2016), or expected to be taken in the Fund’s 2017 tax returns. The Fund identifies its major tax jurisdictions as U. S. Federal, New York State and New York City. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

| D. | Use of Estimates. |

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates.

| E. | Reclassification of Capital Accounts. |

U. S. GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year ended June 30, 2017, the Fund had no permanent book-to-tax differences.

| F. | Security Transactions, Investment Income, and Distributions. |

Security transactions are accounted for on the trade date. The Fund will distribute net investment income and net capital gains, if any, at least annually. Dividend income and distributions to shareholders are recorded on the ex-dividend date, and interest income is recognized on the accrual basis. Realized gains and losses are evaluated on the basis of identified costs. Premiums and discounts on the purchase of

18

MATRIX ADVISORS

VALUE FUND, INC.

Notes to Financial Statements, Continued

securities are amortized/accreted using the effective interest method. U.S. GAAP requires that permanent financial reporting and tax differences be reclassified in the capital accounts.

| G. | Indemnification Obligations. |

Under the Fund’s organizational documents, its current and former Officers and Directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred or that would be covered by other parties.

| H. | Line of Credit. |

The Fund has a Loan Agreement with U.S. Bank, N.A. Under the terms of the Loan Agreement, the Fund’s borrowings cannot exceed the lesser of $3,400,000, 5% of the gross market value of the Fund, or 33 1⁄3% of the net asset market value of the unencumbered assets of the Fund.

The interest rate on the loan equals the prime rate minus one percent per annum, payable monthly. Borrowing activity under the Loan Agreement for the year ended June 30, 2017, was as follows:

| Maximum |

Interest Expense |

Amount Outstanding June 30, 2017 |

Average Daily Amount Outstanding |

Average Interest Rate | ||||

| $35,000 | $3 | $0 | $96 | 2.75% |

| I. | Recent Accounting Prononcement. |

In October 2016, the U.S. Securities and Exchange Commission adopted new rules and amended existing rules (together, “final rules”) intended to modernize the reporting and disclosure of information by registered investment companies. The compliance date for the amendments to Regulation S-X is August 1, 2017. Management is currently evaluating the impact that the adoption of the amendments to Regulation S-X will have on the financial statements and related disclosures.

| J. | Subsequent Events. |

In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued and determined that no events have occurred that require disclosure.

NOTE 3 – INVESTMENT ADVISORY AND OTHER AGREEMENTS

The Fund has an investment advisory agreement with the Advisor to serve as investment advisor. Certain Officers of the Advisor are also Officers of the Fund. Under the terms of the agreement, the Fund has agreed to pay the Advisor as compensation for all services rendered, staff and facilities provided and expenses paid or assumed, an annual advisory fee, accrued daily, paid monthly, of 0.75% of the Fund’s average daily net assets. For the year ended June 30, 2017 the Fund accrued $436,515 in advisory fees.

19

MATRIX ADVISORS

VALUE FUND, INC.

Notes to Financial Statements, Continued

The Advisor has contractually agreed to reduce its advisory fees and/or pay expenses of the Fund through at least October 31, 2017 to ensure that the Fund’s total annual operating expenses (excluding acquired fund fees and expenses, leverage interest, taxes, brokerage commissions and extraordinary expenses) will not exceed 0.99% of the Fund’s average daily net assets. In connection with this expense limitation, the Advisor is eligible to recover expenses waived for three fiscal years following the fiscal year in which the expenses were originally waived.

The Advisor will only be able to recover previously waived expenses if the Fund’s then current expense ratio is below the 0.99% expense cap. For the year ended June 30, 2017, Matrix waived $113,025 in advisory fees. Any reduction in advisory fees or payment of expenses made by the Advisor may be reimbursed by the Fund if the Advisor requests reimbursement in subsequent fiscal years.

This reimbursement may be requested if the aggregate amount actually paid by the Fund toward operating expenses for such fiscal year (taking into account the reimbursement) does not exceed the applicable limitation on Fund expenses. The Advisor is permitted to be reimbursed for fee reductions and/or expense payments made in the prior three fiscal years. Any such reimbursement will be reviewed by the Fund’s Board of Directors. The Fund must pay its current ordinary operating expenses before the Advisor is entitled to any reimbursement of fees and/or expenses.

At June 30, 2017, the cumulative amount available for reimbursement that has been paid and/or waived is $318,700. Currently, the Advisor has agreed not to seek reimbursement of such fee reductions and/or expense payments. The Advisor may recapture a portion of this amount no later than the dates stated below:

| June 30, | ||||

| 2018 | 2019 | 2020 | ||

| $98,789 | $106,886 | $113,025 | ||

The Fund’s Chief Compliance Officer (“CCO”) receives no compensation from the Fund; however, the Administrator was paid $7,484 for the year ended June 30, 2017 for CCO support services.

NOTE 4 – INVESTMENT TRANSACTIONS

The cost of purchases and the proceeds from sales of securities, other than short-term obligations and U.S. Government securities, for the year ended June 30, 2017, are as follows:

| Purchases | Sales | |||||||

| Common Stock |

$ | 12,708,068 | $ | 17,829,502 | ||||

20

MATRIX ADVISORS

VALUE FUND, INC.

Notes to Financial Statements Continued

NOTE 5 – DISTRIBUTIONS TO SHAREHOLDERS

As of June 30, 2017, the components of distributable earnings on a tax basis were as follows:

| Cost of investments for tax purposes |

$ | 41,987,951 | ||

|

|

|

|||

| Gross tax unrealized appreciation |

18,686,419 | |||

| Gross tax unrealized depreciation |

(2,102,729 | ) | ||

| Net tax unrealized appreciation on investments |

16,583,690 | |||

|

|

|

|||

| Undistributed ordinary income |

350,905 | |||

| Undistributed long-term capital gains |

886,171 | |||

|

|

|

|||

| Total Distributable Earnings |

1,237,076 | |||

|

|

|

|||

| Other accumulated losses |

— | |||

|

|

|

|||

| Total Accumulated Earnings/Losses |

$ | 17,820,766 | ||

|

|

|

The difference between book basis and tax basis unrealized depreciation is attributable primarily to the tax deferral of losses on wash sales adjustments.

At June 30, 2017, the Fund had no capital loss carryover and post-October capital losses.

The tax character of distributions paid during the years ended June 30, 2017 and June 30, 2016 were as follows:

| June 30, 2017 | June 30, 2016 | |||||||

| Distributions Paid From: |

||||||||

| Ordinary Income* |

$ | 1,402,760 | $ | 1,070,965 | ||||

| Long-Term Capital Gain |

$ | — | $ | — | ||||

|

|

|

|

|

|||||

| $ | 1,402,760 | $ | 1,070,965 | |||||

|

|

|

|

|

|||||

| * | For tax purposes, short-term capital gains are considered ordinary income. |

The Fund may use earnings and profits distributed to shareholders on redemption of shares as part of the dividends paid deduction.

NOTE 6 – FAIR VALUE

The Fund has adopted fair valuation accounting standards which establish an authoritative definition of fair value and set forth a hierarchy for measuring fair value. These standards require additional disclosure about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These standards define fair value as the price that would be received in the sale of an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The fair value hierarchy is organized into three levels based upon the assumptions (referred to as “inputs”) used to value the asset or liability. These standards state that “observable

21

MATRIX ADVISORS

VALUE FUND, INC.

Notes to Financial Statements Continued

inputs” reflect the assumptions that market participants would use in valuing an asset or liability based on market data obtained from independent sources. “Unobservable inputs” reflect the Fund’s own assumptions about the inputs market participants would use to value the asset or liability.

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s investments and are summarized in the following fair value hierarchy:

| Level 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities that the company has the ability to access. |

| Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayments speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the company’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s net assets as of June 30, 2017. There were no transfers into or out of Level 1, Level 2 or Level 3 during the reporting period.

| Description | Quoted prices in active markets for identical assets (Level 1) |

Significant other observable inputs (Level 2) |

Significant unobservable inputs (Level 3) |

Total | ||||||||||||

| Equity |

||||||||||||||||

| Common Stock* |

$ | 58,354,211 | $ | — | $ | — | $ | 58,354,211 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Equity |

$ | 58,354,211 | $ | — | $ | — | $ | 58,354,211 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Short-Term Investments |

$ | 217,430 | $ | — | $ | — | $ | 217,430 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$ | 58,571,641 | $ | — | $ | — | $ | 58,571,641 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| * | Please refer to the Schedule of Investments for a breakout of common stocks by industry classification. |

22

MATRIX ADVISORS

VALUE FUND, INC.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

Shareholders of Matrix Advisors Value Fund, Inc.

New York, New York

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Matrix Advisors Value Fund, Inc. as of June 30, 2017 and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of June 30, 2017, by correspondence with the custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Matrix Advisors Value Fund, Inc. as of June 30, 2017, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended in conformity with accounting principles generally accepted in the United States of America.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

August 23, 2017

23

MATRIX ADVISORS

VALUE FUND, INC.

Additional Information

PROXY VOTING INFORMATION

The Advisor votes proxies relating to portfolio securities in accordance with procedures that have been approved by the Board of Directors of the Fund. You may obtain a description of these procedures and how the Fund voted proxies relating to the portfolio securities during the most recent 12-month period ended June 30, free of charge, by calling toll-free 1-800-366-6223. This information is also available through the Securities and Exchange Commission’s website at http://www.sec.gov.

FORM N-Q DISCLOSURE

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the Securities and Exchange Commission’s website at http://www.sec.gov. The Fund’s Form N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. This information is also available, without charge, by calling toll-free, 1-800-366-6223.

TAX NOTICE (UNAUDITED)

The percentage of dividend income distributed for the year ended June 30, 2017, which is designated as qualified dividend income under the Jobs and Growth Tax Relief Reconciliation Act of 2003, is 100.00%.

For the year ended June 30, 2017, the percentage of ordinary income distributions that qualify for the dividend received deduction available to corporate shareholders is 100.00%.

Additional Information Applicable to Foreign Shareholders only:

The Fund hereby designates 0.00% of its ordinary income distributions for the fiscal year as interest-related dividends under Internal Revenue Code Section 871(k)(1)(c).

24

MATRIX ADVISORS

VALUE FUND, INC.

Additional Information (Unaudited), Continued

DIRECTOR AND OFFICER INFORMATION

The Board of Directors is responsible for the overall management of the Fund’s business. The Board approves all significant agreements between the Fund and persons or companies furnishing services to it, including the agreements with the Advisor, Administrator, Custodian and Transfer Agent. The Board of Directors delegates the day-to-day operations of the Fund to its Officers, subject to the Fund’s investment objective and policies and to general supervision by the Board. The Statement of Additional Information includes additional information about the Fund’s Directors and is available, without charge, by calling 1-800-366-6223.

The Directors and Officers of the Fund, their business addresses and principal occupations during the past five years are:

| Interested Director | ||||||||||

| Name, Address, and Year of Birth |

Position(s) Held with the Fund |

Date Elected† |

Principal Occupation(s) During the Past 5 Years |

Number of Portfolios In Fund Complex Overseen by Director |

Other Directorships Held by Director | |||||

| David A. Katz, CFA 747 Third Avenue New York, NY 10017 (Born 1962) |

Director, President and Treasurer | Since 1997 | Chief Investment Officer (1986 to present) and President (1990 to present) of Matrix Asset Advisors, the Fund’s Advisor, and portfolio manager of the Fund (1996 to present). | 1 | None | |||||

| Independent Directors | ||||||||||

| T. Michael Tucker * 747 Third Avenue New York, NY 10017 (Born 1942) |

Director | Since 1997 | Owner of T. Michael Tucker, a certified public accounting firm (1977 to 2005 and 2011 to present); formerly, Consultant, Carr Riggs & Ingram, LLP, a certified public accounting firm (2005 to 2011). | 1 | None | |||||

| Larry D. Kieszek * 747 Third Avenue New York, NY 10017 (Born 1950) |

Director and Chairman | Since 1997 | Retired; formerly, Partner of Purvis, Gray & Company, a certified public accounting firm (1974 to 2015). | 1 | None | |||||

25

MATRIX ADVISORS

VALUE FUND, INC.

Additional Information (Unaudited), Continued

| Independent Directors, Continued | ||||||||||

| Name, Address, and Year of Birth |

Position(s) Held with the Fund |

Date Elected† |

Principal Occupation(s) During the Past 5 Years |

Number of Portfolios In Fund Complex Overseen by Director |

Other Directorships Held by Director | |||||

| David S. Wyler * 747 Third Avenue New York, NY 10017 1969 |

Director | Since 2016 | Vice President of Business Development, Resonate (marketing intelligence firm) (2014 to present); Vice President of Business Development, Experian (information services firm) (2013 to 2014) and 41st Parameter (fraud prevention firm) (2012 to 2013). | 1 | None | |||||

| Officers of the Fund | ||||||||||

| Lon F. Birnholz 747 Third Avenue New York, NY 10017 (Born 1960) |

Executive Vice President and Secretary | Since 2006 | Senior Managing Director of Matrix Asset Advisors, the Fund’s Advisor (1999 to present). | N/A | N/A | |||||

| Steven G. Roukis, CFA 747 Third Avenue New York, NY 10017 (Born 1967) |

Senior Vice President | Since 2000 | Managing Director of Matrix Asset Advisors, the Fund’s Advisor (2005 to present). | N/A | N/A | |||||

| Jordan F. Posner 747 Third Avenue New York, NY 10017 (Born 1957) |

Senior Vice President | Since 2006 | Managing Director of Matrix Asset Advisors, the Fund’s Advisor (2005 to present). | N/A | N/A | |||||

| Steven Pisarkiewicz 747 Third Avenue New York, NY 10017 (Born 1948) |

Senior Vice President | Since 2010 | Senior Managing Director and Senior Portfolio Manager of Matrix Asset Advisors, the Fund’s Advisor (2009 to present). | N/A | N/A | |||||

26

MATRIX ADVISORS

VALUE FUND, INC.

Additional Information (Unaudited), Continued

| Officers of Fund, Continued | ||||||||||

| Name, Address, and Year of Birth |

Position(s) Held with the Fund |

Date Elected† |

Principal Occupation(s) During the Past 5 Years |

Number of Portfolios In Fund Complex Overseen by Director |

Other Directorships Held by Director | |||||

| Stephan J. Weinberger, CFA 747 Third Avenue New York, NY 10017 (Born 1955) |

Senior Vice President | Since 2010 | Managing Director and Senior Portfolio Manager of Matrix Asset Advisors, the Fund’s Advisor (2010 to present). | N/A | N/A | |||||

| Conall Duffin 747 Third Avenue New York, NY 10017 (Born 1975) |

Chief Compliance Officer, AML Compliance Officer, Vice President and Assistant Secretary | Since 2002 | Chief Compliance Officer, Matrix Asset Advisors (2016 to present); Vice President Marketing and Mutual Fund Services, Matrix Asset Advisors, the Fund’s Advisor (2010 to present). | N/A | N/A | |||||

| Jonathan Tom 747 Third Avenue New York, NY 10017 (Born 1983) |

Vice President | Since 2016 | Chief Operating Officer of Matrix Asset Advisors, the Fund’s Advisor (2015 to present); Head Fixed Income Trader (2011 to present); Equity Research Analyst (2005 to present). | N/A | N/A | |||||

| * | Not an “interested person”, as that term is defined by the 1940 Act. |

| † | Directors and Officers of the Fund serve until their resignation, removal or retirement. |

27

MATRIX ADVISORS

VALUE FUND, INC.

PRIVACY NOTICE

The Fund collects non-public information about you from the following sources:

| • | Information we receive about you on applications or other forms; |

| • | Information you give us orally; and |

| • | Information about your transactions with us or others. |

We do not disclose any non-public personal information about our shareholders or former shareholders without the shareholder’s authorization, except as required or permitted by law or in response to inquiries from governmental authorities. We restrict access to your personal and account information to those employees who need to know that information to provide products and services to you. We may disclose that information to unaffiliated third parties (such as to brokers or custodians) only as permitted by law and only as needed for us to provide agreed services to you. We maintain physical, electronic and procedural safeguards to guard your non-public personal information.

If you hold shares of the Fund through a financial intermediary, including, but not limited to, a broker-dealer, bank, or trust company, the privacy policy of your financial intermediary would govern how your nonpublic personal information would be shared by those entities with nonaffiliated third parties.

28

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

The registrant undertakes to provide to any person without charge, upon request, a copy of its code of ethics by mail when they call the registrant at 1-800-366-6223.

Item 3. Audit Committee Financial Expert.

The registrant’s board of directors has determined that there is at least one audit committee financial expert serving on its audit committee. Messrs. Kieszek and Tucker are “audit committee financial expert(s)” and are considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. There were no “Other services” provided by the principal accountant. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| FYE 6/30/2017 | FYE 6/30/2016 | |||

| Audit Fees |

$18,000 | $18,000 | ||

| Audit-Related Fees |

$0 | $0 | ||

| Tax Fees |

$2,800 | $2,800 | ||

| All Other Fees |

$0 | $0 |

The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

The percentage of fees billed by Tait, Weller & Baker LLP applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| FYE 6/30/2017 | FYE 6/30/2016 | |||

| Audit-Related Fees |

0% | 0% | ||

| Tax Fees |

0% | 0% | ||

| All Other Fees |

0% | 0% |

All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years. The audit committee of the board of trustees/directors has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

| Non-Audit Related Fees |

FYE 6/30/2017 | FYE 6/30/2016 | ||

| Registrant |

$0 | $0 | ||

| Registrant’s Investment Adviser |

$0 | $0 |

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form. |

| (b) | Not Applicable. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of directors.

Item 11. Controls and Procedures.

| (a) | The Registrant’s President/Chief Executive Officer and Treasurer/Chief Financial Officer have reviewed the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting. |

Item 12. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Incorporated by reference to the Registrant’s Form N-CSR filed September 2, 2004. |

(2) A separate certification for each principal executive and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

| (b) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Matrix Advisors Value Fund, Inc. | ||||

| By | /s/ David A. Katz | |||

| David A. Katz, President | ||||

| Date | September 5, 2017 | |||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ David A. Katz | |||

| David A. Katz, President | ||||

| Date | September 5, 2017 | |||