UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03752

AMG Funds III

(Exact name of registrant as specified in charter)

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Address of principal executive offices) (Zip code)

AMG Funds LLC

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: May 31

Date of reporting period: June 1, 2015 – May 31, 2016

(Annual Shareholder Report)

Item 1. Reports to Shareholders

|

|

ANNUAL REPORT

|

| AMG Funds

| ||||||

| May 31, 2016

|

||||||

| AMG Managers Cadence Capital Appreciation Fund

| ||||||

| Investor Class: MPAFX

|

| Service Class: MCFYX | | Institutional Class: MPCIX | ||||

| AMG Managers Cadence Mid Cap Fund

| ||||||

| Investor Class: MCMAX

|

| Service Class: MCMYX | | Institutional Class: MCMFX | ||||

| AMG Managers Cadence Emerging Companies Fund

| ||||||

| Service Class: MECAX | | Institutional Class:MECIX | |||||

| www.amgfunds.com | AR065-0516 |

| AMG Funds | ||||

| Annual Report—May 31, 2016

|

| TABLE OF CONTENTS | PAGE | |||||

|

|

||||||

| 2 | ||||||

| 3 | ||||||

| PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS, AND SCHEDULES OF PORTFOLIO INVESTMENTS |

||||||

| 4 | ||||||

| 9 | ||||||

| 14 | ||||||

| 19 | ||||||

| FINANCIAL STATEMENTS |

||||||

| 21 | ||||||

| Balance sheets, net asset value (NAV) per share computations and cumulative undistributed amounts |

||||||

| 23 | ||||||

| Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal year |

||||||

| 24 | ||||||

| Detail of changes in assets for the past two fiscal years |

||||||

| 25 | ||||||

| Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets |

||||||

| 30 | ||||||

| 31 | ||||||

| Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks |

||||||

| 39 | ||||||

| 40 | ||||||

| Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds family of mutual funds. Such offering is made only by prospectus, which includes details as to offering price and other material information.

|

|

Letter to Shareholders | |||

| 2 |

| About Your Fund’s Expenses | ||||

| 3 |

| AMG Managers Cadence Capital Appreciation Fund | ||||

| Portfolio Manager’s Comments (unaudited) |

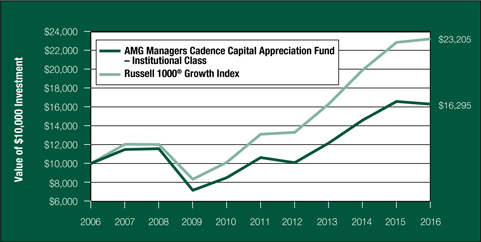

| For the fiscal year ended May 31, 2016, the AMG Managers Cadence Capital Appreciation Fund (Institutional Class) (the “Fund”) returned (1.7)%, lagging its benchmark, the Russell 1000® Growth Index, which returned 1.6%.

PERFORMANCE SUMMARY Investors experienced a volatile ride during the fiscal year ended May 31, 2016. While the S&P 500, the Russell 1000® and the Russell 1000® Growth Indices all ended the fiscal year at essentially the same price levels as they started, each index experienced drawdowns of 10% to nearly 14% on two occasions during the year. By the market’s close on May 31st, the S&P 500 had a total return of +1.7%, the Russell 1000®, +0.8%; and the Russell 1000® Growth, +1.6%, with dividends accounting for much of each index’s 12-month total return. From the perspective of investment style, the Russell 1000® Growth returned +1.6% versus the Russell 1000® Value’s (0.1)% total return. Large-cap stocks led mid- and small-cap stocks, as the Russell Midcap® index declined (2.0)%, and the Russell 2000® fell (6.0)%.

The Fund’s holdings in information technology, consumer staples and financials contributed positively both to absolute and relative performance, while consumer discretionary, health care and energy detracted. The Fund averaged 28.1% in information technology, essentially in line with technology’s 27.8% average weight in the Russell 1000® Growth Index, but achieved average gains of 11.7% that exceeded the +2.4% return for the sector. Within the sector, software and services represented nearly 21% of the portfolio, and achieved average gains of 23%. The Fund was modestly underweight consumer staples, averaging 9.4% versus the sector’s 11.2% weighting in the index. The Fund had average total returns of 15.9% in consumer staples, outperforming the sector’s 11.8% return of the benchmark. The Fund’s positions in |

consumer discretionary, health care and energy detracted from performance, with stock selection accounting for most of the fiscal year’s overall shortfall versus the Russell 1000® Growth Index. Consumer discretionary was the Fund’s second largest sector weighting at 19.7% versus the index’s 21.0%. However, the Fund’s holdings lagged the sector performance, accounting for -217 basis points of shortfall relative to the benchmark. Within health care, the Fund’s pharmaceuticals and biotechnology holdings averaged 10.2% of the portfolio — slightly under the index’s 11.0% weighting — but declined an average 23.1% versus (11.3)% for the index, detracting 150 basis points from relative performance.

THE YEAR IN REVIEW

Macroeconomic issues dominated the fiscal-year performance of stocks and, by extension, essentially all asset classes and markets. Throughout the year, debate centered on the health of China’s economy and its banking system. While it was widely recognized that China’s growth was decelerating, would the slowdown become something more pernicious — a hard landing —that might spread to its trading partners and global neighbors? The market behavior of oil prices and essentially all industrial commodities, the strengthening Dollar, widening credit spreads and similar market-based risk indicators signaled that it might. Central bankers responded with accommodative monetary policies, including negative interest rates, to preempt the threat of cascading deflation and its economic consequences. This spilled onto U.S. shores, as the U.S Federal Reserve (the “Fed”) maintained its zero-interest-rate policy throughout the summer of 2015 and into mid-December to sidestep unintended deflationary policy actions that might undermine budding global growth.

While no one can state with absolute certainty what triggered the abrupt reversal on February 12, |

2016, stock prices across the globe changed course, along with crude oil prices, industrial commodities, credit spreads and other indicators of recovering global economic health. From its highs of around $60 per barrel at the June 1, 2015, start of the fiscal year, West Texas Intermediate crude oil collapsed by nearly 57% to $26 by mid-February, 2016. Since then, oil has rallied by over 90% to around $50 a barrel1. While not to the same extent, many industrial commodities have also recovered since mid-February, suggesting that the risks of global recession have lessened considerably. Similarly, economically-sensitive value stocks began to outperform the growth stocks that had been leading the market.

OUTLOOK

Volatile markets with sector leadership that rotates almost monthly may be the most difficult for investment managers to navigate. We believe that the U.S. economy will continue to improve, absent an unexpected economic or geopolitical shock from China or the Euro Zone. Recent data suggest the Fed, as well as other central banks, are hesitant to raise interest rates any time soon, although this seems to change like the weather in New England. While we make no attempt to forecast the behavior of investors or policy makers, our investment approach seeks to identify companies with improving business fundamentals and attractive relative valuations, wherever in the market they may be found. Consistent implementation of this philosophy and approach is the key to our long-term investment success. Thank you for your continued trust.

This commentary reflects the viewpoints of the Cadence Capital Management, LLC. as of May 31, 2016 and is not intended as a forecast or guarantee of future results.

1Source: Dow Jones & Co |

| 4 |

| AMG Managers Cadence Capital Appreciation Fund | ||||

| Portfolio Manager’s Comments (continued) |

| 5 |

| AMG Managers Cadence Capital Appreciation Fund | ||||

| Fund Snapshots (unaudited) | ||||

| May 31, 2016 |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

| 6 |

| AMG Managers Cadence Capital Appreciation Fund | ||||

| Schedule of Portfolio Investments | ||||

| May 31, 2016 |

| The accompanying notes are an integral part of these financial statements. |

| 7 |

| AMG Managers Cadence Capital Appreciation Fund | ||||

| Schedule of Portfolio Investments (continued) |

| The accompanying notes are an integral part of these financial statements. |

| 8 |

| AMG Managers Cadence Mid Cap Fund | ||||

| Portfolio Manager’s Comments (unaudited) |

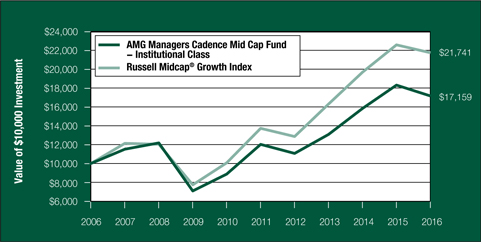

| For the fiscal year ended May 31, 2016, the AMG Managers Cadence Mid Cap Fund (Institutional Class) (the “Fund”) returned (6.3)%, lagging its benchmark, the Russell Midcap® Growth Index, which returned (3.7)%.

PERFORMANCE SUMMARY

Investors experienced a volatile ride during the fiscal year ended May 31, 2016. While the large-cap dominated S&P 500, Russell 1000® and the Russell 1000® Growth Indices all ended the fiscal year at essentially the same price levels as they started, it was not the same experience for investors in mid- and small-cap stocks. The Russell Midcap® Index returned (2.0)%, while the Russell Midcap® Growth was off 3.7% over this period. To underscore the month-to-month volatility, the Russell Midcap® Growth Index failed to achieve positive returns for more than two sequential months before reversing and erasing any gains. At one point in mid-February, the index was off nearly 20% from its June 1, 2015, level. From the perspective of investment style, growth and value mirrored investor sentiment and rotated leadership until mid-February, when stocks began their latest leg up.

The Fund’s holdings in financials and consumer staples contributed positively both to absolute and relative performance, while health care and consumer discretionary detracted. The Fund averaged 12.5% in financials, modestly above the sector’s 11.8% average weight in the Russell Midcap® Growth Index, but achieved average gains of 11.4%, exceeding the 1.4% return for the sector. The combination of positive security selection and weighting decisions added 99 basis points of positive attribution. Within financials, the Fund’s real estate holdings drove performance, gaining 26.0% and contributing 86 of the sector’s 99 basis points of relative return. Consumer staples holdings were strong performers during the fiscal year, as investors sought the safety of this defensive growth sector. Our staples holdings constituted 13.2% of the fund compared with 8.1% of the index, an overweighting of 5.1%, the |

largest in the portfolio. Food, beverage and tobacco stocks — constituting 9.3% of the Fund — were the sector leaders, gaining an average of 11.9% and adding 57 basis points to relative performance.

Health care and consumer discretionary offset the positive attribution of financials and staples. Health care stocks averaged 13.8% of the Fund and declined an average 21.1% over the period, subtracting 226 basis points of relative return. Consumer discretionary represented 22.8% of the Fund — the largest absolute position, but an underweight of 1.8% compared with the benchmark. The Fund’s holdings declined 13.3%, underperforming the sector’s (6.7)% return and detracting 154 basis points from relative return.

THE YEAR IN REVIEW

Macroeconomic issues dominated the fiscal-year performance of stocks and, by extension, essentially all asset classes and markets. Throughout the year, debate centered on the health of China’s economy and its banking system. While it was widely recognized that China’s growth was decelerating, would the slowdown become something more pernicious — a hard landing —that might spread to its trading partners and global neighbors? The market behavior of oil prices and essentially all industrial commodities, the strengthening Dollar, widening credit spreads and similar market-based risk indicators signaled that it might. Central bankers responded with accommodative monetary policies, including negative interest rates, to preempt the threat of cascading deflation and its economic consequences. This spilled onto U.S. shores, as the U.S. Federal Reserve (the “Fed”) maintained its zero-interest-rate policy throughout the summer of 2015 and into mid-December to sidestep unintended deflationary policy actions that might undermine budding global growth.

While no one can state with absolute certainty what triggered the abrupt reversal on February 12, 2016, stock prices across the globe changed |

course, along with crude oil prices, industrial commodities, credit spreads and other indicators of recovering global economic health. From its highs of around $60 per barrel at the June 1, 2015, start of the fiscal year, West Texas Intermediate crude oil collapsed by nearly 57% to $26 by mid-February, 2016. Since then, oil has rallied by over 90% to around $50 a barrel1. While not to the same extent, many industrial commodities have also recovered since mid-February, suggesting that the risks of global recession have lessened considerably. Similarly, economically-sensitive value stocks began to outperform the growth stocks that had been leading the market.

OUTLOOK

Volatile markets with sector leadership that rotates almost monthly may be the most difficult for investment managers to navigate. We believe that the U.S. economy will continue to improve, absent an unexpected economic or geopolitical shock from China or the Euro Zone. Recent data suggest the Fed, as well as other central banks, are hesitant to raise interest rates any time soon, although this seems to change like the weather in New England. While we make no attempt to forecast the behavior of investors or policy makers, our investment approach seeks to identify companies with improving business fundamentals and attractive relative valuations, wherever in the market they may be found. Consistent implementation of this philosophy and approach is the key to our long-term investment success. Thank you for your continued trust.

This commentary reflects the viewpoints of the Cadence Capital Management, LLC. as of May 31, 2016 and is not intended as a forecast or guarantee of future results.

1Source: Dow Jones & Co |

| 9 |

| AMG Managers Cadence Mid Cap Fund | ||||

| Portfolio Manager’s Comments (continued) |

| 10 |

| AMG Managers Cadence Mid Cap Fund | ||||

| Fund Snapshots (unaudited) | ||||

| May 31, 2016 |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

| 11 |

| AMG Managers Cadence Mid Cap Fund | ||||

| Schedule of Portfolio Investments | ||||

| May 31, 2016 |

| The accompanying notes are an integral part of these financial statements. |

| 12 |

| AMG Managers Cadence Mid Cap Fund | ||||

| Schedule of Portfolio Investments (continued) |

| The accompanying notes are an integral part of these financial statements. |

| 13 |

| AMG Managers Cadence Emerging Companies Fund | ||||

| Portfolio Manager’s Comments (unaudited) |

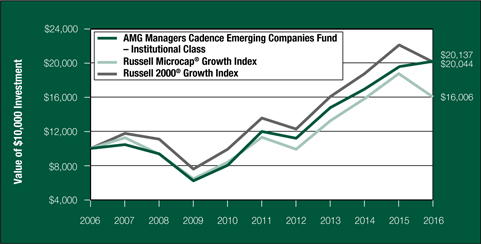

| For the fiscal year ended May 31, 2016, the AMG Managers Cadence Emerging Companies Fund (Institutional Class) (the “Fund”) returned 3.2%, outperforming its benchmark, the Russell Microcap® Growth Index, which returned (14.6)%.

PERFORMANCE SUMMARY Investors experienced a volatile ride during the fiscal year ended May 31, 2016. While the large-cap dominated S&P 500, Russell 1000® and the Russell 1000® Growth Indices all ended the fiscal year at essentially the same price levels as they started, it was not the same experience for investors in small and micro-cap growth stocks. The Russell 2000® Index returned (6.0)%, the Russell 2000® Growth was off 9.1% and the Russell Microcap® Growth Index dropped (14.6)% over this period. Month-to-month volatility was heightened, with the Microcap Growth Index off 17.3% in 3Q15 and down 19.9% between December 2015 and February 2016. From the perspective of investment style, growth and value mirrored investor sentiment and rotated leadership until mid-February, when stocks began their latest leg up.

The Fund’s positioning in the health care and information technology sectors were the primary drivers of the Fund’s outperformance for the fiscal year. In addition, every sector except energy contributed to positive relative performance. Health care, the largest sector in the Russell Microcap® Growth Index at 39.1%, contributed 10.5% of the Fund’s total outperformance. Two industry groups constitute the sector: pharmaceuticals and biotechnology, which represented 28.2% of the index, and equipment and services, with 11.0%. Biotechnology’s nearly 2.5 years of market leadership reversed during the fiscal year. While our holdings were not immune to the selloff in the pharmaceuticals and biotechnology group, the Fund’s holdings were down an average of 17.1% versus the group’s (30.2)% decline in the Index. The Fund was also underweight the group: 14% |

compared with 28%, which also contributed to outperformance. The Fund’s holdings and positioning in health care equipment and services also contributed to relative performance. The portfolio achieved average gains of 10.5% versus the (13.8)% loss in the index, and the portfolio was overweight the group by 4.7% on average during the period. Information technology also contributed to relative performance, with average gains of 12.1% compared with (5.34)% for the benchmark. The Fund’s holdings in software and services, semiconductors and semi cap equipment and tech hardware all made positive contributions to relative performance.

THE YEAR IN REVIEW Macroeconomic issues dominated the fiscal-year performance of stocks and, by extension, essentially all asset classes and markets. Throughout the year, debate centered on the health of China’s economy and its banking system. While it was widely recognized that China’s growth was decelerating, would the slowdown become something more pernicious — a hard landing —that might spread to its trading partners and global neighbors? The market behavior of oil prices and essentially all industrial commodities, the strengthening Dollar, widening credit spreads and similar market-based risk indicators signaled that it might. Central bankers responded with accommodative monetary policies, including negative interest rates, to preempt the threat of cascading deflation and its economic consequences. This spilled onto U.S. shores, as the U.S. Federal reserve (the “Fed”) maintained its zero-interest-rate policy throughout the summer of 2015 and into mid-December to sidestep unintended deflationary policy actions that might undermine budding global growth.

While no one can state with absolute certainty what triggered the abrupt reversal on February 12, 2016, stock prices across the globe changed course, along with crude oil prices, industrial |

commodities, credit spreads and other indicators of recovering global economic health. From its highs of around $60 per barrel at the June 1, 2015, start of the fiscal year, West Texas Intermediate crude oil collapsed by nearly 57% to $26 by mid-February, 2016. Since then, oil has rallied by over 90% to around $50 a barrel1. While not to the same extent, many industrial commodities have also recovered since mid-February, suggesting that the risks of global recession have lessened considerably. Similarly, economically-sensitive value stocks began to outperform the growth stocks that had been leading the market.

OUTLOOK Volatile markets with sector leadership that rotates almost monthly may be the most difficult for investment managers to navigate. We believe that the U.S. economy will continue to improve, absent an unexpected economic or geopolitical shock from China or the Euro Zone. Recent data suggest the Fed, as well as other central banks, are hesitant to raise interest rates any time soon, although this seems to change like the weather in New England. While we make no attempt to forecast the behavior of investors or policy makers, our investment approach seeks to identify companies with improving business fundamentals and attractive relative valuations, wherever in the market they may be found. Consistent implementation of this philosophy and approach is the key to our long-term investment success. Thank you for your continued trust.

This commentary reflects the viewpoints of the Cadence Capital Management, LLC as of May 31, 2016 and is not intended as a forecast or guarantee of future results.

1Source: Dow Jones & Co |

| 14 |

| AMG Managers Cadence Emerging Companies Fund | ||||

| Portfolio Manager’s Comments (continued) |

| 15 |

| AMG Managers Cadence Emerging Companies Fund | ||||

| Fund Snapshots (unaudited) | ||||

| May 31, 2016 |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

| 16 |

| AMG Managers Cadence Emerging Companies Fund | ||||

| Schedule of Portfolio Investments | ||||

| May 31, 2016 |

|

The accompanying notes are an integral part of these financial statements. |

| 17 |

| AMG Managers Cadence Emerging Companies Fund | ||||

| Schedule of Portfolio Investments (continued) |

| The accompanying notes are an integral part of these financial statements. |

| 18 |

| Notes to Schedules of Portfolio Investments |

The following footnotes should be read in conjunction with each of the Schedules of Portfolio Investments previously presented in this report.

At May 31, 2016, the approximate cost of investments and the aggregate gross unrealized appreciation and depreciation for federal income tax were as follows:

| Fund | Cost | Appreciation | Depreciation | Net | ||||||||||||

| AMG Managers Cadence Capital Appreciation Fund |

$85,775,649 | $22,446,588 | $(4,379,496 | ) | $18,067,092 | |||||||||||

| AMG Managers Cadence Mid Cap Fund |

121,014,458 | 13,674,530 | (1,652,752 | ) | 12,021,778 | |||||||||||

| AMG Managers Cadence Emerging Companies Fund |

38,156,540 | 4,622,372 | (2,394,301 | ) | 2,228,071 | |||||||||||

| * | Non-income producing security. |

| 1 | Some or all of these securities were out on loan to various brokers as of May 31, 2016, amounting to the following: |

| Fund | Market Value | % of Net Assets | ||||||

| AMG Managers Cadence Capital Appreciation Fund |

$1,464,324 | 1.4 | % | |||||

| AMG Managers Cadence Mid Cap Fund |

7,027,917 | 5.4 | % | |||||

| AMG Managers Cadence Emerging Companies Fund |

1,566,065 | 4.0 | % | |||||

| 2 | Collateral received from brokers for securities lending was invested in these joint repurchase agreements. |

| 3 | Yield shown represents the May 31, 2016, seven-day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

The following tables summarize the inputs used to value the Funds’ investments by the fair value hierarchy levels as of May 31, 2016: (See Note 1(a) in the Notes to Financial Statements.)

| Quoted Prices in Active Markets Level 1 |

Significant Other Level 2 |

Significant Unobservable Level 3 |

Total | |||||||||||||

| AMG Managers Cadence Capital Appreciation Fund | ||||||||||||||||

| Investments in Securities |

||||||||||||||||

| Common Stocks† |

$101,813,249 | — | — | $101,813,249 | ||||||||||||

| Short-Term Investments |

||||||||||||||||

| Repurchase Agreements |

— | $1,492,668 | — | 1,492,668 | ||||||||||||

| Other Investment Companies |

536,824 | — | — | 536,824 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$102,350,073 | $1,492,668 | — | $103,842,741 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Quoted Prices in Active Markets Level 1 |

Significant Other Observable Inputs Level 2 |

Significant Level 3 |

Total | |||||||||||||

| AMG Managers Cadence Mid Cap Fund | ||||||||||||||||

| Investments in Securities |

||||||||||||||||

| Common Stocks† |

$125,803,465 | — | — | $125,803,465 | ||||||||||||

| Short-Term Investments |

||||||||||||||||

| Repurchase Agreements |

— | $7,232,771 | — | 7,232,771 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$125,803,465 | $7,232,771 | — | $133,036,236 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

The accompanying notes are an integral part of these financial statements. |

| 19 |

| Notes to Schedules of Portfolio Investments (continued) |

| Quoted Prices in Active Markets Level 1 |

Significant Other Level 2 |

Significant Unobservable Level 3 |

Total | |||||||||||||

| AMG Managers Cadence Emerging Companies Fund | ||||||||||||||||

| Investments in Securities |

||||||||||||||||

| Common Stocks† |

$37,745,143 | — | — | $37,745,143 | ||||||||||||

| Short-Term Investments |

||||||||||||||||

| Repurchase Agreements |

— | $1,590,055 | — | 1,590,055 | ||||||||||||

| Other Investment Companies |

1,049,413 | — | — | 1,049,413 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$38,794,556 | $1,590,055 | — | $40,384,611 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| † | All common stocks held in the Funds are level 1 securities. For a detailed break-out of the common stocks by major industry classification, please refer to the respective Schedule of Portfolio Investments. |

As of May 31, 2016, the Funds had no transfers between levels from the beginning of the reporting period.

|

The accompanying notes are an integral part of these financial statements. |

| 20 |

| Statement of Assets and Liabilities | ||||

| May 31, 2016 |

| AMG Managers Cadence Capital Appreciation Fund |

AMG Managers Mid Cap Fund |

AMG Managers Cadence Emerging Companies Fund |

||||||||||

| Assets: |

||||||||||||

| Investments at value* (including securities on loan valued at $1,464,324, |

||||||||||||

| $7,027,917, and $1,566,065, respectively) |

$103,842,741 | $133,036,236 | $40,384,611 | |||||||||

| Receivable for investments sold |

— | 4,401,862 | 498,721 | |||||||||

| Dividends, interest and other receivables |

192,096 | 186,254 | 30,702 | |||||||||

| Receivable from affiliate |

24,255 | 13,440 | 15,002 | |||||||||

| Receivable for Fund shares sold |

3,065 | 32,998 | 26,091 | |||||||||

| Prepaid expenses |

10,560 | 7,552 | 5,577 | |||||||||

| Total assets |

104,072,717 | 137,678,342 | 40,960,704 | |||||||||

| Liabilities: |

||||||||||||

| Payable upon return of securities loaned |

1,492,668 | 7,232,771 | 1,590,055 | |||||||||

| Payable for Fund shares repurchased |

172,254 | 254,787 | 1,173 | |||||||||

| Payable for investments purchased |

— | — | 124,559 | |||||||||

| Payable to Custodian |

— | 491,828 | — | |||||||||

| Accrued expenses: |

||||||||||||

| Investment advisory and management fees |

38,683 | 48,769 | 39,791 | |||||||||

| Administrative fees |

21,491 | 27,094 | 7,958 | |||||||||

| Distribution fees - Investor Class |

13,198 | 18,639 | — | |||||||||

| Shareholder servicing fees - Investor Class |

— | 6,372 | — | |||||||||

| Shareholder servicing fees - Service Class |

— | 2,874 | 107 | |||||||||

| Trustees fees and expenses |

3,113 | 3,833 | 1,230 | |||||||||

| Other |

56,258 | 61,115 | 33,487 | |||||||||

| Total liabilities |

1,797,665 | 8,148,082 | 1,798,360 | |||||||||

| Net Assets |

$102,275,052 | $129,530,260 | $39,162,344 | |||||||||

| Net Assets Represent: |

||||||||||||

| Paid-in capital |

$141,328,463 | $115,475,032 | $56,407,853 | |||||||||

| Undistributed (accumulated) net investment income (loss) |

286,341 | 1,006,762 | (85,445 | ) | ||||||||

| Accumulated net realized gain (loss) from investments |

(58,163,352 | ) | 711,495 | (19,602,626 | ) | |||||||

| Net unrealized appreciation (depreciation) of investments |

18,823,600 | 12,336,971 | 2,442,562 | |||||||||

| Net Assets |

$102,275,052 | $129,530,260 | $39,162,344 | |||||||||

| * Investments at cost |

$85,019,141 | $120,699,265 | $37,942,049 | |||||||||

| The accompanying notes are an integral part of these financial statements. |

| 21 |

| Statement of Assets and Liabilities (continued) | ||||

| AMG Managers Cadence Capital Appreciation Fund |

AMG Managers Cadence Mid Cap Fund |

AMG Managers Cadence Emerging Companies Fund |

||||||||||

| Investor Class: |

||||||||||||

| Net Assets |

$62,759,812 | $89,178,687 | n/a | |||||||||

| Shares outstanding |

2,429,904 | 3,318,796 | n/a | |||||||||

| Net asset value, offering and redemption price per share |

$25.83 | $26.87 | n/a | |||||||||

| Service Class: |

||||||||||||

| Net Assets |

$4,841,759 | $13,715,381 | $3,098,699 | |||||||||

| Shares outstanding |

184,850 | 496,104 | 85,282 | |||||||||

| Net asset value, offering and redemption price per share |

$26.19 | $27.65 | $36.33 | |||||||||

| Institutional Class: |

||||||||||||

| Net Assets |

$34,673,481 | $26,636,192 | $36,063,645 | |||||||||

| Shares outstanding |

1,293,948 | 925,154 | 918,818 | |||||||||

| Net asset value, offering and redemption price per share |

$26.80 | $28.79 | $39.25 | |||||||||

| The accompanying notes are an integral part of these financial statements. |

| 22 |

| Statement of Operations | ||||

| For the fiscal year ended May 31, 2016 |

| AMG Managers Cadence Capital Appreciation Fund |

AMG Managers Mid Cap Fund |

AMG Managers Cadence Emerging Companies Fund |

||||||||||

| Investment Income: |

||||||||||||

| Dividend income |

$1,788,248 | 1 | $2,493,866 | 1 | $263,540 | 1 | ||||||

| Securities lending income |

918 | 20,681 | 12,778 | |||||||||

| Miscellaneous income |

19,719 | 24,658 | 7,030 | |||||||||

| Foreign withholding tax |

— | (1,381 | ) | (1,015 | ) | |||||||

| Total investment income |

1,808,885 | 2,537,824 | 282,333 | |||||||||

| Expenses: |

||||||||||||

| Investment advisory and management fees |

504,544 | 638,433 | 494,166 | |||||||||

| Administrative fees |

280,302 | 354,685 | 98,833 | |||||||||

| Distribution fees - Investor Class |

169,457 | 246,079 | — | |||||||||

| Shareholder servicing fees - Investor Class |

32,493 | 139,110 | — | |||||||||

| Shareholder servicing fees - Service Class |

17,997 | 35,292 | 7,375 | |||||||||

| Registration fees |

41,147 | 43,862 | 31,590 | |||||||||

| Professional fees |

38,664 | 42,889 | 34,329 | |||||||||

| Transfer agent fees |

27,991 | 28,401 | 1,567 | |||||||||

| Reports to shareholders |

27,639 | 35,569 | 9,906 | |||||||||

| Custodian fees |

11,898 | 10,928 | 11,862 | |||||||||

| Trustees fees and expenses |

7,922 | 8,144 | 2,742 | |||||||||

| Miscellaneous |

6,540 | 7,051 | 2,831 | |||||||||

| Total expenses before offsets/reductions |

1,166,594 | 1,590,443 | 695,201 | |||||||||

| Expense reimbursements |

(138,122 | ) | (147,630 | ) | (126,216 | ) | ||||||

| Expense reductions |

(3,680 | ) | (497 | ) | (61 | ) | ||||||

| Net expenses |

1,024,792 | 1,442,316 | 568,924 | |||||||||

| Net investment income (loss) |

784,093 | 1,095,508 | (286,591 | ) | ||||||||

| Net Realized and Unrealized Gain (Loss): |

||||||||||||

| Net realized gain on investments |

8,269,066 | 3,025,232 | 2,890,106 | |||||||||

| Net change in unrealized appreciation (depreciation) of investments |

(11,579,523 | ) | (15,089,387 | ) | (1,759,644 | ) | ||||||

| Net realized and unrealized gain (loss) |

(3,310,457 | ) | (12,064,155 | ) | 1,130,462 | |||||||

| Net increase (decrease) in net assets resulting from operations |

$(2,526,364) | $(10,968,647) | $843,871 | |||||||||

1 Includes non-recurring dividends of $67,187, $899,270 and $28,980 for AMG Managers Cadence Capital Appreciation Fund, AMG Managers Cadence Mid Cap Fund and AMG Managers Cadence Emerging Companies Fund, respectively.

| The accompanying notes are an integral part of these financial statements. |

| 23 |

| Statements of Changes in Net Assets | ||||

| For the fiscal year ended May 31, |

| AMG Managers Cadence Capital Appreciation Fund |

AMG Managers Cadence Mid Cap Fund |

AMG Managers Cadence Emerging Companies Fund |

||||||||||||||||||||||

| 2016 | 2015 | 2016 | 2015 | 2016 | 2015 | |||||||||||||||||||

| Increase (Decrease) in Net |

||||||||||||||||||||||||

| Net investment income (loss) |

$784,093 | $629,533 | $1,095,508 | $(13,887 | ) | $(286,591 | ) | $(278,397 | ) | |||||||||||||||

| Net realized gain on investments |

8,269,066 | 17,201,283 | 3,025,232 | 34,018,847 | 2,890,106 | 5,090,199 | ||||||||||||||||||

| Net change in unrealized appreciation (depreciation) of investments |

(11,579,523 | ) | (407,439 | ) | (15,089,387 | ) | (3,481,338 | ) | (1,759,644 | ) | 584,905 | |||||||||||||

| Net increase (decrease) in net assets resulting from operations |

(2,526,364 | ) | 17,423,377 | (10,968,647 | ) | 30,523,622 | 843,871 | 5,396,707 | ||||||||||||||||

| Distributions to Shareholders: |

||||||||||||||||||||||||

| From net investment income: |

||||||||||||||||||||||||

| Investor Class |

(356,449 | ) | (430,064 | ) | — | — | — | — | ||||||||||||||||

| Service Class |

(53,559 | ) | (17,436 | ) | (13,249 | ) | — | — | — | |||||||||||||||

| Institutional Class |

(325,307 | ) | (447,908 | ) | (100,817 | ) | — | — | — | |||||||||||||||

| From net realized gain on investments: |

||||||||||||||||||||||||

| Investor Class |

— | — | (10,199,415 | ) | (22,396,748 | ) | — | — | ||||||||||||||||

| Service Class |

— | — | (1,508,909 | ) | (2,704,133 | ) | — | — | ||||||||||||||||

| Institutional Class |

— | — | (3,048,088 | ) | (13,096,718 | ) | — | — | ||||||||||||||||

| Total distributions to shareholders |

(735,315 | ) | (895,408 | ) | (14,870,478 | ) | (38,197,599 | ) | — | — | ||||||||||||||

| Capital Share Transactions:1 |

||||||||||||||||||||||||

| Net increase (decrease) from capital share transactions |

(26,432,738 | ) | (54,464,464 | ) | (9,797,749 | ) | (153,790,230 | ) | 609,600 | (10,690,675 | ) | |||||||||||||

| Total increase (decrease) in net assets |

(29,694,417 | ) | (37,936,495 | ) | (35,636,874 | ) | (161,464,207 | ) | 1,453,471 | (5,293,968 | ) | |||||||||||||

| Net Assets: |

||||||||||||||||||||||||

| Beginning of year |

131,969,469 | 169,905,964 | 165,167,134 | 326,631,341 | 37,708,873 | 43,002,841 | ||||||||||||||||||

| End of year |

$102,275,052 | $131,969,469 | $129,530,260 | $165,167,134 | $39,162,344 | $37,708,873 | ||||||||||||||||||

| End of year undistributed (accumulated) net investment income (loss) |

$286,341 | $238,577 | $1,006,762 | $25,370 | $(85,445 | ) | $(111,235 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

1 See Note 1(g) of the Notes to Financial Statements.

| The accompanying notes are an integral part of these financial statements. |

| 24 |

| AMG Managers Cadence Capital Appreciation Fund Financial Highlights |

||||

| For a share outstanding throughout each fiscal year |

| For the fiscal years ended May 31, | ||||||||||||||||||||

| Investor Class | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

| Net Asset Value, Beginning of Year |

$26.49 | $23.54 | $19.78 | $16.59 | $17.57 | |||||||||||||||

| Income from Investment Operations: |

||||||||||||||||||||

| Net investment income1,2 |

0.15 | 14 | 0.08 | 0.13 | 4 | 0.15 | 6 | 0.04 | ||||||||||||

| Net realized and unrealized gain (loss) on investments |

(0.67 | ) | 3.01 | 3.73 | 3.17 | (1.01 | ) | |||||||||||||

| Total income (loss) from investment operations |

(0.52 | ) | 3.09 | 3.86 | 3.32 | (0.97 | ) | |||||||||||||

| Less Distributions to Shareholders from: |

||||||||||||||||||||

| Net investment income |

(0.14 | ) | (0.14 | ) | (0.10 | ) | (0.13 | ) | (0.01 | ) | ||||||||||

| Net Asset Value, End of Year |

$25.83 | $26.49 | $23.54 | $19.78 | $16.59 | |||||||||||||||

| Total Return2 |

(1.98 | )% | 13.16 | % | 19.53 | % | 20.12 | % | (5.50 | )% | ||||||||||

| Ratio of net expenses to average net assets (with offsets/reductions) |

1.02 | % | 1.12 | % | 1.09 | %5 | 1.12 | %7 | 1.11 | % | ||||||||||

| Ratio of expenses to average net assets (with offsets) |

1.02 | % | 1.13 | % | 1.13 | %5 | 1.14 | %7 | 1.12 | % | ||||||||||

| Ratio of total expenses to average net assets (without offsets/reductions)3 |

1.15 | % | 1.22 | % | 1.23 | %5 | 1.23 | %7 | 1.21 | % | ||||||||||

| Ratio of net investment income to average net assets2 |

0.60 | % | 0.30 | % | 0.59 | %5 | 0.81 | %7 | 0.21 | % | ||||||||||

| Portfolio turnover |

22 | % | 41 | % | 52 | % | 79 | % | 163 | % | ||||||||||

| Net assets at end of year (000’s omitted) |

$62,760 | $75,755 | $81,866 | $87,419 | $68,310 | |||||||||||||||

|

|

||||||||||||||||||||

| For the fiscal years ended May 31, | ||||||||||||||||||||

| Service Class | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

| Net Asset Value, Beginning of Year |

$26.88 | $23.74 | $19.99 | $16.71 | $17.67 | |||||||||||||||

| Income from Investment Operations: |

||||||||||||||||||||

| Net investment income1,2 |

0.17 | 14 | 0.12 | 0.16 | 4 | 0.14 | 6 | 0.06 | ||||||||||||

| Net realized and unrealized gain (loss) on investments |

(0.70 | ) | 3.06 | 3.76 | 3.24 | (1.01 | ) | |||||||||||||

| Total income (loss) from investment operations |

(0.53 | ) | 3.18 | 3.92 | 3.38 | (0.95 | ) | |||||||||||||

| Less Distributions to Shareholders from: |

||||||||||||||||||||

| Net investment income |

(0.16 | ) | (0.04 | ) | (0.17 | ) | (0.10 | ) | (0.01 | ) | ||||||||||

| Net Asset Value, End of Year |

$26.19 | $26.88 | $23.74 | $19.99 | $16.71 | |||||||||||||||

| Total Return2 |

(1.97 | )% | 13.41 | % | 19.63 | %8 | 20.31 | %8 | (5.38 | )% | ||||||||||

| Ratio of net expenses to average net assets (with offsets/reductions) |

0.96 | % | 0.97 | % | 0.94 | %5 | 0.95 | %7 | 0.96 | % | ||||||||||

| Ratio of expenses to average net assets (with offsets) |

0.96 | % | 0.98 | % | 0.98 | %5 | 0.97 | %7 | 0.97 | % | ||||||||||

| Ratio of total expenses to average net assets (without offsets/reductions)3 |

1.09 | % | 1.07 | % | 1.08 | %5 | 1.06 | %7 | 1.06 | % | ||||||||||

| Ratio of net investment income to average net assets2 |

0.66 | % | 0.45 | % | 0.74 | %5 | 0.76 | %7 | 0.34 | % | ||||||||||

| Portfolio turnover |

22 | % | 41 | % | 52 | % | 79 | % | 163 | % | ||||||||||

| Net assets at end of year (000’s omitted) |

$4,842 | $10,287 | $42,245 | $55,735 | $67,536 | |||||||||||||||

|

|

||||||||||||||||||||

| 25 |

| AMG Managers Cadence Capital Appreciation Fund Financial Highlights |

||||

| For a share outstanding throughout each fiscal year |

| For the fiscal years ended May 31, | ||||||||||||||||||||

| Institutional Class | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

| Net Asset Value, Beginning of Year |

$27.50 | $24.44 | $20.57 | $17.21 | $18.24 | |||||||||||||||

| Income from Investment Operations: |

||||||||||||||||||||

| Net investment income1,2 |

0.24 | 14 | 0.18 | 0.22 | 4 | 0.18 | 6 | 0.10 | ||||||||||||

| Net realized and unrealized gain (loss) on investments |

(0.70 | ) | 3.14 | 3.88 | 3.34 | (1.03 | ) | |||||||||||||

| Total income (loss) from investment operations |

(0.46 | ) | 3.32 | 4.10 | 3.52 | (0.93 | ) | |||||||||||||

| Less Distributions to Shareholders from: |

||||||||||||||||||||

| Net investment income |

(0.24 | ) | (0.26 | ) | (0.23 | ) | (0.16 | ) | (0.10 | ) | ||||||||||

| Net Asset Value, End of Year |

$26.80 | $27.50 | $24.44 | $20.57 | $17.21 | |||||||||||||||

| Total Return2 |

(1.67 | )% | 13.62 | % | 19.96 | % | 20.57 | % | (5.10 | )% | ||||||||||

| Ratio of net expenses to average net assets (with offsets/reductions) |

0.72 | % | 0.72 | % | 0.69 | %5 | 0.70 | %7 | 0.71 | % | ||||||||||

| Ratio of expenses to average net assets (with offsets) |

0.72 | % | 0.73 | % | 0.73 | %5 | 0.72 | %7 | 0.72 | % | ||||||||||

| Ratio of total expenses to average net assets (without offsets/reductions)3 |

0.85 | % | 0.82 | % | 0.83 | %5 | 0.81 | %7 | 0.81 | % | ||||||||||

| Ratio of net investment income to average net assets2 |

0.90 | % | 0.70 | % | 1.00 | %5 | 1.00 | %7 | 0.58 | % | ||||||||||

| Portfolio turnover |

22 | % | 41 | % | 52 | % | 79 | % | 163 | % | ||||||||||

| Net assets at end of year (000’s omitted) |

$34,673 | $45,927 | $45,795 | $37,536 | $85,338 | |||||||||||||||

|

|

||||||||||||||||||||

| 26 |

| AMG Managers Cadence Mid Cap Fund Financial Highlights |

||||

| For a share outstanding throughout each fiscal year |

| For the fiscal years ended May 31, | ||||||||||||||||||||

| Investor Class | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

| Net Asset Value, Beginning of Year |

$32.15 | $34.15 | $28.32 | $24.10 | $26.29 | |||||||||||||||

| Income from Investment Operations: |

||||||||||||||||||||

| Net investment income (loss)1,2 |

0.19 | 14 | (0.06 | ) | (0.02 | )4 | 0.03 | 6 | (0.06 | ) | ||||||||||

| Net realized and unrealized gain (loss) on investments |

(2.32 | ) | 4.88 | 5.85 | 4.23 | (2.13 | ) | |||||||||||||

| Total income (loss) from investment operations |

(2.13 | ) | 4.82 | 5.83 | 4.26 | (2.19 | ) | |||||||||||||

| Less Distributions to Shareholders from: |

||||||||||||||||||||

| Net investment income |

— | — | — | (0.04 | ) | — | ||||||||||||||

| Net realized gain on investments |

(3.15 | ) | (6.82 | ) | — | — | — | |||||||||||||

| Total distributions to shareholders |

(3.15 | ) | (6.82 | ) | — | (0.04 | ) | — | ||||||||||||

| Net Asset Value, End of Year |

$26.87 | $32.15 | $34.15 | $28.32 | $24.10 | |||||||||||||||

| Total Return2 |

(6.64 | )% | 15.14 | % | 20.59 | % | 17.70 | % | (8.33 | )% | ||||||||||

| Ratio of net expenses to average net assets (with offsets/reductions) |

1.11 | % | 1.12 | % | 1.11 | %9 | 1.13 | %10 | 1.11 | % | ||||||||||

| Ratio of expenses to average net assets (with offsets) |

1.11 | % | 1.13 | % | 1.13 | %9 | 1.14 | %10 | 1.12 | % | ||||||||||

| Ratio of total expenses to average net assets (without offsets/reductions)3 |

1.21 | % | 1.19 | % | 1.18 | %9 | 1.21 | %10 | 1.20 | % | ||||||||||

| Ratio of net investment income (loss) to average net assets2 |

0.67 | % | (0.16 | )% | (0.05 | )%9 | 0.13 | %10 | (0.25 | )% | ||||||||||

| Portfolio turnover |

149 | % | 130 | % | 203 | % | 121 | % | 127 | % | ||||||||||

| Net assets at end of year (000’s omitted) |

$89,179 | $116,666 | $122,497 | $163,088 | $138,115 | |||||||||||||||

|

|

||||||||||||||||||||

| For the fiscal years ended May 31, | ||||||||||||||||||||

| Service Class | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

| Net Asset Value, Beginning of Year |

$33.07 | $35.04 | $29.02 | $24.67 | $26.87 | |||||||||||||||

| Income from Investment Operations: |

||||||||||||||||||||

| Net investment income (loss)1,2 |

0.25 | 14 | (0.01 | ) | 0.05 | 4 | 0.08 | 6 | (0.02 | ) | ||||||||||

| Net realized and unrealized gain (loss) on investments |

(2.39 | ) | 5.02 | 5.97 | 4.32 | (2.18 | ) | |||||||||||||

| Total income (loss) from investment operations |

(2.14 | ) | 5.01 | 6.02 | 4.40 | (2.20 | ) | |||||||||||||

| Less Distributions to Shareholders from: |

||||||||||||||||||||

| Net investment income |

(0.03 | ) | — | — | (0.05 | ) | — | |||||||||||||

| Net realized gain on investments |

(3.25 | ) | (6.98 | ) | — | — | — | |||||||||||||

| Total distributions to shareholders |

(3.28 | ) | (6.98 | ) | — | (0.05 | ) | — | ||||||||||||

| Net Asset Value, End of Year |

$27.65 | $33.07 | $35.04 | $29.02 | $24.67 | |||||||||||||||

| Total Return2 |

(6.50 | )% | 15.34 | % | 20.74 | % | 17.88 | % | (8.19 | )% | ||||||||||

| Ratio of net expenses to average net assets (with offsets/reductions) |

0.97 | % | 0.97 | % | 0.96 | %9 | 0.98 | %10 | 0.96 | % | ||||||||||

| Ratio of expenses to average net assets (with offsets) |

0.97 | % | 0.98 | % | 0.98 | %9 | 0.99 | %10 | 0.97 | % | ||||||||||

| Ratio of total expenses to average net assets (without offsets/reductions)3 |

1.07 | % | 1.04 | % | 1.03 | %9 | 1.06 | %10 | 1.05 | % | ||||||||||

| Ratio of net investment income (loss) to average net assets2 |

0.86 | % | (0.01 | )% | 0.15 | %9 | 0.32 | %10 | (0.09 | )% | ||||||||||

| Portfolio turnover |

149 | % | 130 | % | 203 | % | 121 | % | 127 | % | ||||||||||

| Net assets at end of year (000’s omitted) |

$13,715 | $14,809 | $33,215 | $65,393 | $92,851 | |||||||||||||||

|

|

||||||||||||||||||||

| 27 |

| AMG Managers Cadence Mid Cap Fund Financial Highlights |

||||

| For a share outstanding throughout each fiscal year |

| For the fiscal years ended May 31, | ||||||||||||||||||||

| Institutional Class | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

| Net Asset Value, Beginning of Year |

$34.45 | $36.44 | $30.18 | $25.66 | $27.88 | |||||||||||||||

| Income from Investment Operations: |

||||||||||||||||||||

| Net investment income1,2 |

0.33 | 14 | 0.09 | 0.12 | 4 | 0.15 | 6 | 0.04 | ||||||||||||

| Net realized and unrealized gain (loss) on investments |

(2.49 | ) | 5.21 | 6.23 | 4.50 | (2.26 | ) | |||||||||||||

| Total income (loss) from investment operations |

(2.16 | ) | 5.30 | 6.35 | 4.65 | (2.22 | ) | |||||||||||||

| Less Distributions to Shareholders from: |

||||||||||||||||||||

| Net investment income |

(0.11 | ) | — | (0.09 | ) | (0.13 | ) | — | ||||||||||||

| Net realized gain on investments |

(3.39 | ) | (7.29 | ) | — | — | — | |||||||||||||

| Total distributions to shareholders |

(3.50 | ) | (7.29 | ) | (0.09 | ) | (0.13 | ) | — | |||||||||||

| Net Asset Value, End of Year |

$28.79 | $34.45 | $36.44 | $30.18 | $25.66 | |||||||||||||||

| Total Return2 |

(6.28 | )% | 15.62 | % | 21.04 | % | 18.20 | % | (7.96 | )% | ||||||||||

| Ratio of net expenses to average net assets (with offsets/reductions) |

0.72 | % | 0.72 | % | 0.71 | %9 | 0.73 | %10 | 0.71 | % | ||||||||||

| Ratio of expenses to average net assets (with offsets) |

0.72 | % | 0.73 | % | 0.73 | %9 | 0.74 | %10 | 0.72 | % | ||||||||||

| Ratio of total expenses to average net assets (without |

0.82 | % | 0.79 | % | 0.78 | %9 | 0.81 | %10 | 0.80 | % | ||||||||||

| Ratio of net investment income to average net assets2 |

1.07 | % | 0.24 | % | 0.35 | %9 | 0.56 | %10 | 0.15 | % | ||||||||||

| Portfolio turnover |

149 | % | 130 | % | 203 | % | 121 | % | 127 | % | ||||||||||

| Net assets at end of year (000’s omitted) |

$26,636 | $33,693 | $170,920 | $194,755 | $234,346 | |||||||||||||||

|

|

||||||||||||||||||||

| 28 |

| AMG Managers Cadence Emerging Companies Fund Financial Highlights |

||||

| For a share outstanding throughout each fiscal year |

| For the fiscal years ended May 31, | ||||||||||||||||||||

| Service Class | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

| Net Asset Value, Beginning of Year |

$35.29 | $30.70 | $26.84 | $20.39 | $21.88 | |||||||||||||||

| Income from Investment Operations: |

||||||||||||||||||||

| Net investment loss1,2 |

(0.33 | )14 | (0.32 | )11 | (0.29 | )4 | (0.07 | )6 | (0.24 | ) | ||||||||||

| Net realized and unrealized gain (loss) on investments |

1.37 | 4.91 | 4.15 | 6.52 | (1.25 | ) | ||||||||||||||

| Total income (loss) from investment operations |

1.04 | 4.59 | 3.86 | 6.45 | (1.49 | ) | ||||||||||||||

| Net Asset Value, End of Year |

$36.33 | $35.29 | $30.70 | $26.84 | $20.39 | |||||||||||||||

| Total Return2 |

2.95 | %8 | 14.95 | % | 14.38 | % | 31.63 | % | (6.81 | )% | ||||||||||

| Ratio of net expenses to average net assets (with offsets/reductions) |

1.65 | % | 1.66 | % | 1.61 | %12 | 1.63 | %13 | 1.60 | % | ||||||||||

| Ratio of expenses to average net assets (with offsets) |

1.65 | % | 1.67 | % | 1.66 | %12 | 1.68 | %13 | 1.66 | % | ||||||||||

| Ratio of total expenses to average net assets (without offsets/reductions)3 |

1.97 | % | 1.96 | % | 1.90 | %12 | 1.99 | %13 | 1.98 | % | ||||||||||

| Ratio of net investment loss to average net assets2 |

(0.96 | )% | (0.98 | )% | (0.94 | )%12 | (0.31 | )%13 | (1.16 | )% | ||||||||||

| Portfolio turnover |

150 | % | 146 | % | 127 | % | 101 | % | 120 | % | ||||||||||

| Net assets at end of year (000’s omitted) |

$3,099 | $3,143 | $3,540 | $3,184 | $2,505 | |||||||||||||||

|

|

||||||||||||||||||||

| For the fiscal years ended May 31, | ||||||||||||||||||||

| Institutional Class | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

| Net Asset Value, Beginning of Year |

$38.04 | $33.00 | $28.80 | $21.81 | $23.35 | |||||||||||||||

| Income from Investment Operations: |

||||||||||||||||||||

| Net investment loss1,2 |

(0.27 | )14 | (0.25 | )11 | (0.23 | )4 | (0.01 | )6 | (0.20 | ) | ||||||||||

| Net realized and unrealized gain (loss) on investments |

1.48 | 5.29 | 4.43 | 7.00 | (1.34 | ) | ||||||||||||||

| Total income (loss) from investment operations |

1.21 | 5.04 | 4.20 | 6.99 | (1.54 | ) | ||||||||||||||

| Net Asset Value, End of Year |

$39.25 | $38.04 | $33.00 | $28.80 | $21.81 | |||||||||||||||

| Total Return2 |

3.18 | % | 15.27 | % | 14.58 | %8 | 32.05 | %8 | (6.60 | )% | ||||||||||

| Ratio of net expenses to average net assets (with offsets/reductions) |

1.42 | % | 1.41 | % | 1.38 | %12 | 1.38 | %13 | 1.37 | % | ||||||||||

| Ratio of expenses to average net assets (with offsets) |

1.42 | % | 1.42 | % | 1.43 | %12 | 1.43 | %13 | 1.43 | % | ||||||||||

| Ratio of total expenses to average net assets (without offsets/reductions)3 |

1.74 | % | 1.71 | % | 1.67 | %12 | 1.74 | %13 | 1.73 | % | ||||||||||

| Ratio of net investment loss to average net assets2 |

(0.71 | )% | (0.73 | )% | (0.71 | )%12 | (0.05 | )%13 | (0.94 | )% | ||||||||||

| Portfolio turnover |

150 | % | 146 | % | 127 | % | 101 | % | 120 | % | ||||||||||

| Net assets at end of year (000’s omitted) |

$36,064 | $34,566 | $39,463 | $36,123 | $34,883 | |||||||||||||||

|

|

||||||||||||||||||||

| 29 |

| Notes to Financial Highlights |

| The | following should be read in conjunction with the Financial Highlights of the Funds previously presented in this report. |

| 1 | Per share numbers have been calculated using average shares. |

| 2 | Total returns and net investment income would have been lower had certain expenses not been offset. |

| 3 | Excludes the impact of expense reimbursements or fee waivers and expense reductions such as brokerage credits, but includes expense repayments and non-reimbursable expenses, if any, such as interest, taxes and extraordinary expenses. (See Notes 1(c) and 2, in the Notes to Financial Statements.) |

| 4 | Includes non-recurring dividends. Without these dividends, net investment income per share would have been $0.12, $0.15, and $0.21 for AMG Managers Cadence Capital Appreciation Fund’s Investor Class, Service Class, and Institutional Class, respectively, $(0.03), $0.04, and $0.11 for AMG Managers Cadence Mid Cap Fund’s Investor Class, Service Class, and Institutional Class, respectively, and $(0.32) and $(0.26) for AMG Managers Cadence Emerging Companies Fund’s Service Class and Institutional Class, respectively. |

| 5 | Includes non-routine extraordinary expenses amounting to 0.007%, 0.007%, and 0.007% of average net assets for the Investor Class, Service Class and Institutional Class, respectively. |

| 6 | Includes non-recurring dividends. Without these dividends, net investment income per share would have been $0.09, $0.08, and $0.13 for AMG Managers Cadence Capital Appreciation Fund’s Investor Class, Service Class, and Institutional Class, respectively, $(0.11), $(0.06), and $0.01 for AMG Managers Cadence Mid Cap Fund’s Investor Class, Service Class, and Institutional Class, respectively, and $(0.31) and $(0.25) for AMG Managers Cadence Emerging Companies Fund’s Service Class and Institutional Class, respectively. |

| 7 | Includes non-routine extraordinary expenses amounting to 0.022%, 0.004%, and 0.003% of average net assets for the Investor Class, Service Class and Institutional Class, respectively. |

| 8 | The Total Return is based on the Financial Statement Net Asset Values as shown above. |

| 9 | Includes non-routine extraordinary expenses amounting to 0.008%, 0.007%, and 0.008% of average net assets for the Investor Class, Service Class and Institutional Class, respectively. |

| 10 | Includes non-routine extraordinary expenses amounting to 0.018%, 0.015%, and 0.016% of average net assets for the Investor Class, Service Class and Institutional Class, respectively. |

| 11 | Includes non-recurring dividends. Without these dividends, net investment income per share would have been $(0.33) and $(0.27) for the Service Class and Institutional Class, respectively. |

| 12 | Includes non-routine extraordinary expenses amounting to 0.009% and 0.009% of average net assets for the Institutional Class and Service Class, respectively. |

| 13 | Includes non-routine extraordinary expenses amounting to 0.014% and 0.014% of average net assets for the Institutional Class and Service Class, respectively |

| 14 | Includes non-recurring dividends. Without these dividends, net investment income per share would have been $0.14, $0.16, and $0.23 for AMG Managers Cadence Capital Appreciation Fund’s Investor Class, Service Class, and Institutional Class, respectively, $0.01, $0.07, and $0.13 for AMG Managers Cadence Mid Cap Fund’s Investor Class, Service Class, and Institutional Class, respectively and $(0.36) and $(0.29) for AMG Managers Cadence Emerging Companies Fund’s Service Class, and Institutional Class, respectively. |

| 30 |

| Notes to Financial Statements | ||||||

| May 31, 2016 |

| 31 |

| Notes to Financial Statements (continued) |

| 32 |

| Notes to Financial Statements (continued) |

| 33 |

| Notes to Financial Statements (continued) |

For the fiscal year ended May 31, 2016 and May 31, 2015, the capital stock transactions by class for Capital Appreciation, Mid Cap and Emerging Companies were as follows:

| Capital Appreciation | ||||||||||||||||

|

May 31, 2016 |

May 31, 2015 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| Investor Class: |

||||||||||||||||

| Proceeds from sale of shares |

37,130 | $955,633 | 59,873 | $1,481,224 | ||||||||||||

| Reinvestment of distributions |

11,367 | 294,737 | 14,114 | 357,803 | ||||||||||||

| Cost of shares repurchased |

(477,975) | (12,266,387) | (692,331) | (17,079,885) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net decrease |

(429,478) | $(11,016,017) | (618,344) | $(15,240,858) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Service Class: |

||||||||||||||||

| Proceeds from sale of shares |

17,006 | $436,281 | 72,208 | $1,772,208 | ||||||||||||

| Reinvestment of distributions |

2,034 | 53,472 | 678 | 17,413 | ||||||||||||

| Cost of shares repurchased |

(216,927) | (5,726,406) | (1,469,452) | (35,749,664) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net decrease |

(197,887) | $(5,236,653) | (1,396,566) | $(33,960,043) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Institutional Class: |

||||||||||||||||

| Proceeds from sale of shares |

111,888 | $2,976,211 | 194,715 | $4,967,777 | ||||||||||||

| Reinvestment of distributions |

11,785 | 316,664 | 16,609 | 436,318 | ||||||||||||

| Cost of shares repurchased |

(499,525) | (13,472,943) | (415,104) | (10,667,658) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net decrease |

(375,852) | $(10,180,068) | (203,780) | $(5,263,563) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Mid Cap | ||||||||||||||||

|

May 31, 2016 |

May 31, 2015 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| Investor Class: |

||||||||||||||||

| Proceeds from sale of shares |

100,480 | $2,851,927 | 195,258 | $6,377,413 | ||||||||||||

| Reinvestment of distributions |

344,385 | 9,270,856 | 657,238 | 20,098,353 | ||||||||||||

| Cost of shares repurchased |

(754,662) | (21,649,721) | (810,820) | (26,759,793) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) |

(309,797) | $(9,526,938) | 41,676 | $(284,027) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Service Class: |

||||||||||||||||

| Proceeds from sale of shares |

64,572 | $1,951,956 | 65,637 | $2,282,045 | ||||||||||||

| Reinvestment of distributions |

54,636 | 1,512,326 | 85,370 | 2,683,174 | ||||||||||||

| Cost of shares repurchased |

(70,939) | (2,038,365) | (650,986) | (22,775,066) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) |

48,269 | $1,425,917 | (499,979) | $(17,809,847) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Institutional Class: |

||||||||||||||||

| Proceeds from sale of shares |

66,803 | $2,080,580 | 218,489 | $7,866,084 | ||||||||||||

| Reinvestment of distributions |

95,511 | 2,750,719 | 363,321 | 11,884,230 | ||||||||||||

| Cost of shares repurchased |

(215,258) | (6,528,027) | (4,293,880) | (155,446,670) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net decrease |

(52,944) | $(1,696,728) | (3,712,070) | $(135,696,356) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 34 |

| Notes to Financial Statements (continued) |

| Emerging Companies | ||||||||||||||||

|

May 31, 2016 |

May 31, 2015 | |||||||||||||||

|

Shares |

Amount | Shares | Amount | |||||||||||||

| Service Class: |

||||||||||||||||

| Proceeds from sale of shares |

26,996 | $944,985 | 20,070 | $659,133 | ||||||||||||

| Cost of shares repurchased |

(30,776) | (1,056,913) | (46,316) | (1,474,031) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net decrease |

(3,780) | $(111,928) | (26,246) | $(814,898) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Institutional Class: |

||||||||||||||||

| Proceeds from sale of shares |

407,411 | $15,710,861 | 107,635 | $3,880,982 | ||||||||||||

| Cost of shares repurchased |

(397,306) | (14,989,333) | (394,697) | (13,756,759) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) |

10,105 | $721,528 | (287,062) | $(9,875,777) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 35 |

| Notes to Financial Statements (continued) |

| 36 |

| Notes to Financial Statements (continued) |

| 37 |

| Notes to Financial Statements (continued) |

The following table is a summary of the Funds’ open repurchase agreements that are subject to a master netting agreement as of May 31, 2016:

| Gross Amount Not Offset in the Statement of Assets and Liabilities |

||||||||||||||||

| Fund | Net Amounts of Assets Presented in the Statement of Assets and Liabilities |

Financial Instruments |

Cash Collateral Received |

Net Amount | ||||||||||||

| Capital Appreciation |

||||||||||||||||

| Deutsche Bank Securities, Inc. |

$492,668 | $492,668 | — | — | ||||||||||||

| Merrill Lynch Pierce Fenner & Smith Inc. |

1,000,000 | 1,000,000 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$1,492,668 | $1,492,668 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Mid Cap |

||||||||||||||||

| Cantor Fitzgerald Securities, Inc. |

$1,717,836 | $1,717,836 | — | — | ||||||||||||

| Citigroup Global Markets, Inc. |

1,717,836 | 1,717,836 | — | — | ||||||||||||

| Deutsche Bank Securities, Inc. |

1,717,836 | 1,717,836 | — | — | ||||||||||||

| Merrill Lynch Pierce Fenner & Smith, Inc. |

361,427 | 361,427 | — | — | ||||||||||||

| Nomura Securities International, Inc. |

1,717,836 | 1,717,836 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$7,232,771 | $7,232,771 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Emerging Companies |

||||||||||||||||

| Cantor Fitzgerald Securities, Inc. |

$1,000,000 | $1,000,000 | — | — | ||||||||||||

| Nomura Securities International, Inc. |

590,055 | 590,055 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$1,590,055 | $1,590,055 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

7. SUBSEQUENT EVENTS

Each Fund has determined that no material events or transactions occurred through the issuance date of the Funds’ financial statements which require additional disclosure in or adjustment of the Funds’ financial statements.

| 38 |

| Report of Independent Registered Public Accounting Firm |

TO THE BOARD OF TRUSTEES OF AMG FUNDS III AND THE SHAREHOLDERS OF THE AMG MANAGERS CADENCE CAPITAL APPRECIATION FUND, AMG MANAGERS CADENCE MID CAP FUND AND AMG MANAGERS CADENCE EMERGING COMPANIES FUND:

In our opinion, the accompanying statements of assets and liabilities, including the schedules of portfolio investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of AMG Managers Cadence Capital Appreciation Fund, AMG Managers Cadence Mid Cap Fund and AMG Managers Cadence Emerging Companies Fund (the “Funds”) at May 31, 2016, and the results of their operations, the changes in their net assets and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at May 31, 2016 by correspondence with the custodian and brokers, and the application of alternative auditing procedures where securities purchased had not been received, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

July 21, 2016

| 39 |

| AMG Funds | ||||

| Trustees and Officers |

| The Trustees and Officers of the Trust, their business addresses, principal occupations for the past five years and dates of birth are listed below. The Trustees provide broad supervision over the affairs of the Trust and the Funds. The Trustees are experienced executives who meet periodically throughout the year to oversee the Funds’ activities, review contractual arrangements with | companies that provide services to the Funds, and review the Funds’ performance. Unless otherwise noted, the address of each Trustee or Officer is the address of the Trust: 600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830.

There is no stated term of office for Trustees. Trustees serve until their resignation, retirement or removal in accordance with the Trust’s |

organizational documents and policies adopted by the Board from time to time. The Chairman of the Trustees, President, Treasurer and Secretary of the Trust are elected by the Trustees annually. Other officers hold office at the pleasure of the Trustees. |

Independent Trustees

The following Trustees are not “interested persons” of the Trust within the meaning of the 1940 Act:

| Number of Funds Overseen in Fund |

Name, Age, Principal Occupation(s) During Past 5 Years and Other Directorships Held by Trustee | |

| • Trustee since 2012 • Oversees 72 Funds in Fund Complex |

Bruce B. Bingham, 67 Partner, Hamilton Partners (real estate development firm) (1987-Present); Director of the Yacktman Funds (2000-2012). | |

| • Independent Chairman • Trustee since 1999 • Oversees 72 Funds in Fund Complex |

William E. Chapman, II, 74 President and Owner, Longboat Retirement Planning Solutions (1998-Present); Hewitt Associates, LLC (part time) (provider of Retirement and Investment Education Seminars) (2002-2009); Trustee Emeritus of Bowdoin College (2013-Present); Trustee of Bowdoin College (2002-2013); Director of Harding, Loevner Funds, Inc. (6 portfolios); Trustee of Third Avenue Trust (5 portfolios); Trustee of Third Avenue Variable Trust (1 portfolio). | |

| • Trustee since 1999 • Oversees 72 Funds in Fund Complex |

Edward J. Kaier, 70 Attorney at Law and Partner, Teeters Harvey Marrone & Kaier LLP (2007-Present); Attorney at Law and Partner, Hepburn Willcox Hamilton & Putnam, LLP (1977-2007); Trustee of Third Avenue Trust (5 portfolios); Trustee of Third Avenue Variable Trust (1 portfolio). | |

| • Trustee since 2013 • Oversees 74 Funds in Fund Complex |

Kurt A. Keilhacker, 52 Managing Member, TechFund Capital (1997-Present); Managing Member, TechFund Europe (2000-Present); Board Member, 6wind SA, (2002-Present); Managing Member, Elementum Ventures (2013-Present); Trustee, Gordon College (2001-2016). | |

| • Trustee since 1993 • Oversees 72 Funds in Fund Complex |

Steven J. Paggioli, 66 Independent Consultant (2002-Present); Formerly Executive Vice President and Director, The Wadsworth Group (1986-2001); Executive Vice President, Secretary and Director, Investment Company Administration, LLC (1990-2001); Vice President, Secretary and Director, First Fund Distributors, Inc. (1991-2001); Trustee, Professionally Managed Portfolios (32 portfolios); Advisory Board Member, Sustainable Growth Advisors, LP; Independent Director, Chase Investment Counsel (2008 – Present). | |

| • Trustee since 2013 • Oversees 72 Funds in Fund Complex |

Richard F. Powers III, 70 Adjunct Professor, Boston College (2010-2013); President and CEO of Van Kampen Investments Inc. (1998-2003). | |

| • Trustee since 1999 • Oversees 74 Funds in Fund Complex |

Eric Rakowski, 58 Professor, University of California at Berkeley School of Law (1990-Present); Director of Harding, Loevner Funds, Inc. (6 portfolios); Trustee of Third Avenue Trust (5 portfolios); Trustee of Third Avenue Variable Trust (1 portfolio). | |

| • Trustee since 2013 • Oversees 74 Funds in Fund Complex |

Victoria L. Sassine, 50 Lecturer, Babson College (2007 – Present). | |

| • Trustee since 1987 • Oversees 72 Funds in Fund Complex |

Thomas R. Schneeweis, 68 Professor Emeritus, University of Massachusetts (2013-Present); Partner, S Capital Wealth Advisors (2015-Present); President, TRS Associates (1982-Present); Board Member, Chartered Alternative Investment Association (“CAIA”) (2002-Present); Director, CAIA Foundation (Education) (2010-Present); Director, Institute for Global Asset and Risk Management (Education) (2010-Present); Partner, S Capital Management, LLC (2007-2015); Director, CISDM at the University of Massachusetts, (1996-2013); President, Alternative Investment Analytics, LLC, (formerly Schneeweis Partners, LLC) (2001-2013); Professor of Finance, University of Massachusetts (1977-2013). | |

| 40 |

| AMG Funds | ||||

| Trustees and Officers (continued) |

Interested Trustees

Each Trustee in the following table is an “interested person” of the Trust within the meaning of the 1940 Act. Ms. Carsman is an interested person of the Trust within the meaning of the 1940 Act by virtue of her position with, and interest in securities of, AMG.

| Number of Funds Overseen in Fund Complex |

Name, Age, Principal Occupation(s) During Past 5 Years and Other Directorships Held by Trustee | |

| • Trustee since 2011 • Oversees 74 Funds in Fund Complex |

Christine C. Carsman, 64 Senior Vice President and Deputy General Counsel, Affiliated Managers Group, Inc. (2011-Present); Senior Vice President and Chief Regulatory Counsel, Affiliated Managers Group, Inc. (2007-2011); Vice President and Chief Regulatory Counsel, Affiliated Managers Group, Inc. (2004-2007); Secretary and Chief Legal Officer, AMG Funds, AMG Funds I, AMG Funds II and AMG Funds III (2004-2011); Senior Counsel, Vice President and Director of Operational Risk Management and Compliance, Wellington Management Company, LLP (1995-2004). | |

|

Officers |

||

| Position(s) Held with Fund and Length of Time Served |

Name, Age, Principal Occupation(s) During Past 5 Years | |

| • President since 2014 • Principal Executive Officer since 2014 • Chief Executive Officer since 2016 |

Jeffrey T. Cerutti, 48 Chief Executive Officer, AMG Funds LLC (2014-Present); Director, President and Principal, AMG Distributors, Inc. (2014-Present); President and Principal Executive Officer, AMG Funds, AMG Funds I, AMG Funds II, and AMG Funds III (2014-Present); Chief Executive Officer, AMG Funds, AMG Funds I, AMG Funds II, and AMG Funds III (2016-Present); Chief Executive Officer, Aston Asset Management, LLC (2016-Present); Chief Executive Officer, President and Principal Executive Officer, Aston Funds (2015-Present); President, VP Distributors, (2011-2014); Executive Vice President, Head of Distribution, Virtus Investment Partners, Inc. (2010-2014); Managing Director, Head of Sales, UBS Global Asset Management (2001-2010). | |

| • Chief Operating Officer since 2007 |

Keitha L. Kinne, 58 Chief Operating Officer, AMG Funds LLC (2007-Present); Chief Investment Officer, AMG Funds LLC (2008-Present); Chief Operating Officer, AMG Distributors, Inc. (2007-Present); Chief Operating Officer, AMG Funds, AMG Funds I, AMG Funds II, and AMG Funds III (2007-Present); Chief Operating Officer and Chief Investment Officer, Aston Asset Management, LLC (2016-Present); Chief Operating Officer, Aston Funds (2016-Present); President and Principal Executive Officer, AMG Funds, AMG Funds I, AMG Funds II and AMG Funds III (2012-2014); Managing Partner, AMG Funds LLC (2007-2014); President, AMG Funds (2012-2014); President, AMG Distributors, Inc. (2012-2014); Managing Director, Legg Mason & Co., LLC (2006-2007); Managing Director, Citigroup Asset Management (2004-2006). | |

| • Secretary since 2015 • Chief Legal Officer |

Mark J. Duggan, 51 Senior Vice President and Senior Counsel, AMG Funds LLC (2015-Present); Secretary and Chief Legal Officer, AMG Funds, AMG Funds I, AMG Funds II and AMG Funds III (2015-Present); Secretary and Chief Legal Officer, Aston Funds (2015-Present); Attorney, K&L Gates, LLP (2009-2015). | |

| • Chief Financial Officer since 2007 • Treasurer since 1995 • Principal Financial Officer since 2008 |