0000719955DEF 14AFALSE00007199552022-01-312023-01-29iso4217:USD00007199552021-02-012022-01-3000007199552020-02-032021-01-310000719955wsm:AdjustmentEquityAwardsReportedValueMemberecd:PeoMember2022-01-312023-01-290000719955wsm:AdjustmentEquityAwardAdjustmentsMemberecd:PeoMember2022-01-312023-01-290000719955wsm:AdjustmentEquityAwardsReportedValueMemberecd:PeoMember2021-02-012022-01-300000719955wsm:AdjustmentEquityAwardAdjustmentsMemberecd:PeoMember2021-02-012022-01-300000719955wsm:AdjustmentEquityAwardsReportedValueMemberecd:PeoMember2020-02-032021-01-310000719955wsm:AdjustmentEquityAwardAdjustmentsMemberecd:PeoMember2020-02-032021-01-310000719955wsm:EquityAwardsGrantedDuringTheYearUnvestedMember2022-01-312023-01-290000719955wsm:EquityAwardsGrantedInPriorYearsUnvestedMember2022-01-312023-01-290000719955wsm:EquityAwardsGrantedDuringTheYearVestedMember2022-01-312023-01-290000719955wsm:EquityAwardsGrantedInPriorYearsVestedMember2022-01-312023-01-290000719955wsm:EquityAwardsThatFailedToMeetVestingConditionsMember2022-01-312023-01-290000719955wsm:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2022-01-312023-01-290000719955wsm:EquityAwardAdjustmentsMember2022-01-312023-01-290000719955wsm:EquityAwardsGrantedDuringTheYearUnvestedMember2021-02-012022-01-300000719955wsm:EquityAwardsGrantedInPriorYearsUnvestedMember2021-02-012022-01-300000719955wsm:EquityAwardsGrantedDuringTheYearVestedMember2021-02-012022-01-300000719955wsm:EquityAwardsGrantedInPriorYearsVestedMember2021-02-012022-01-300000719955wsm:EquityAwardsThatFailedToMeetVestingConditionsMember2021-02-012022-01-300000719955wsm:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2021-02-012022-01-300000719955wsm:EquityAwardAdjustmentsMember2021-02-012022-01-300000719955wsm:EquityAwardsGrantedDuringTheYearUnvestedMember2020-02-032021-01-310000719955wsm:EquityAwardsGrantedInPriorYearsUnvestedMember2020-02-032021-01-310000719955wsm:EquityAwardsGrantedDuringTheYearVestedMember2020-02-032021-01-310000719955wsm:EquityAwardsGrantedInPriorYearsVestedMember2020-02-032021-01-310000719955wsm:EquityAwardsThatFailedToMeetVestingConditionsMember2020-02-032021-01-310000719955wsm:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2020-02-032021-01-310000719955wsm:EquityAwardAdjustmentsMember2020-02-032021-01-310000719955ecd:NonPeoNeoMemberwsm:EquityAwardsReportedValueMember2022-01-312023-01-290000719955ecd:NonPeoNeoMemberwsm:EquityAwardAdjustmentsMember2022-01-312023-01-290000719955ecd:NonPeoNeoMemberwsm:EquityAwardsReportedValueMember2021-02-012022-01-300000719955ecd:NonPeoNeoMemberwsm:EquityAwardAdjustmentsMember2021-02-012022-01-300000719955ecd:NonPeoNeoMemberwsm:EquityAwardsReportedValueMember2020-02-032021-01-310000719955ecd:NonPeoNeoMemberwsm:EquityAwardAdjustmentsMember2020-02-032021-01-31000071995512022-01-312023-01-29000071995522022-01-312023-01-29000071995532022-01-312023-01-29000071995542022-01-312023-01-29000071995552022-01-312023-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Williams-Sonoma, Inc.

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

3250 Van Ness Avenue

San Francisco, California 94109

www.williams-sonomainc.com

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

| | | | | |

MEETING DATE: | May 31, 2023 |

| |

TIME: | 9:00 a.m. Pacific Time |

| |

PLACE: | Virtual meeting via live webcast. Registration is required online at register.proxypush.com/wsm. |

| |

ITEMS OF BUSINESS: | 1) The election of our Board of Directors; |

| |

| | 2) An advisory vote on executive compensation; |

| |

| 3) An advisory vote on the frequency of an advisory vote to approve executive compensation; |

| |

| | 4) The ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending January 28, 2024; and |

| |

| | 5) Such other business as may properly come before the meeting or any adjournment or postponement of the meeting. |

| |

RECORD DATE: | You may vote if you were a stockholder of record as of the close of business on April 5, 2023. |

Williams-Sonoma, Inc.’s 2023 Annual Meeting of Stockholders (the “Annual Meeting”) will be held as a virtual-only meeting on May 31, 2023 at 9:00 a.m. Pacific Time.

The platform for the virtual Annual Meeting includes functionality that affords validated stockholders the same meeting participation rights and opportunities they would have at an in-person meeting. Stockholders who attend the Annual Meeting by following the instructions below will have the opportunity to vote and submit questions or comments electronically during the Annual Meeting.

Access and Log-in Instructions for Virtual Annual Meeting

Only stockholders of record and beneficial owners of shares of our common stock as of the close of business on April 5, 2023, the record date, may attend and participate in the Annual Meeting, including voting and asking questions during the Annual Meeting. You will not be able to attend the Annual Meeting in person.

To virtually attend the Annual Meeting, you must register at register.proxypush.com/wsm. Upon completing your registration, you will receive further instructions via email, including a unique link that will allow you access to the Annual Meeting and to vote and submit questions during the Annual Meeting.

As part of the registration process, you must enter the control number located on your proxy card, voting instruction form, or Notice of Internet Availability. If you are a beneficial owner of shares registered in the name of a broker, bank or other nominee, you will also need to provide the registered name on your account and the name of your broker, bank or other nominee as part of the registration process.

On the day of the Annual Meeting, May 31, 2023, stockholders may begin to log in to the virtual-only Annual Meeting 15 minutes prior to the start of the Annual Meeting. The Annual Meeting will begin promptly at 9:00 a.m. Pacific Time.

How Beneficial Owners May Participate in the Virtual Annual Meeting

If you hold your shares in street name through an intermediary, such as a bank, broker or other nominee, to attend and submit questions at the virtual Annual Meeting, you must obtain a control number in advance. This is a different number than what is on your voting instruction form. To obtain a control number, follow the instructions provided by your bank, broker or other nominee. Once you have your new control number, please follow the steps set forth above to access the virtual Annual Meeting.

If you hold your shares in street name, in order to vote during the virtual Annual Meeting, you also must obtain in advance a “legal proxy” from your bank, broker or other nominee. To cast your vote during the meeting, follow the instructions on the virtual Annual Meeting website for completing an online ballot and submit the completed ballot along with a copy of your legal proxy via email.

List of Stockholders

During the virtual Annual Meeting, a list of our stockholders of record will be available for viewing by stockholders who signed into the virtual Annual Meeting website with a valid control number by following the instructions on the virtual Annual Meeting website. The names of stockholders of record entitled to vote will also be available for inspection by stockholders of record for 10 days prior to the Annual Meeting. If you are a stockholder of record and want to inspect the stockholder list, please send a written request by writing to: Williams-Sonoma, Inc., Attention: Corporate Secretary, 3250 Van Ness Avenue, San Francisco, California 94109 to arrange for electronic access to the stockholder list.

| | |

By Order of the Board of Directors |

|

David King Secretary April 14, 2023 |

YOUR VOTE IS IMPORTANT

Instructions for submitting your proxy are provided in the Notice of Internet Availability of Proxy Materials, the Proxy Statement and your proxy card. It is important that your shares be represented and voted at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, we urge you to vote and submit your proxy in advance of the meeting by one of the methods described in the proxy materials. Please submit your proxy through the Internet, by telephone, or by completing the enclosed proxy card and returning it in the enclosed envelope. You may revoke your proxy at any time prior to its exercise at the virtual Annual Meeting.

TABLE OF CONTENTS

3250 Van Ness Avenue

San Francisco, California 94109

www.williams-sonomainc.com

PROXY STATEMENT FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION

Our Board of Directors is soliciting your proxy to vote your shares at our 2023 Annual Meeting of Stockholders, or the Annual Meeting, to be held on Wednesday, May 31, 2023 at 9:00 a.m. Pacific Time, and for any adjournment or postponement of the meeting. Our Annual Meeting will be held virtually via live webcast. Registration is required online at register.proxypush.com/wsm. Details on how to participate are provided below.

Our Annual Report to Stockholders for the fiscal year ended January 29, 2023, or fiscal 2022, including our financial statements for fiscal 2022, is also included with this Proxy Statement and posted on our website at ir.williams-sonomainc.com/financial-reports-page. The Annual Report, Notice of Internet Availability of Proxy Materials, or the Notice, and the Proxy Statement were first made available to stockholders and posted on our website on or about April 14, 2023.

Why are you holding a virtual Annual Meeting?

We will be hosting the Annual Meeting virtually to allow stockholders to attend our Annual meeting without the need to travel. The platform for the virtual Annual Meeting includes functionality that affords validated stockholders the same meeting participation rights and opportunities they would have at an in-person meeting. Stockholders who attend the virtual Annual Meeting by following the instructions below will have the opportunity to vote and submit questions or comments electronically during the Annual Meeting.

How can stockholders attend the virtual Annual Meeting?

If you are a stockholder of record, to attend, vote, and submit questions at the virtual Annual Meeting, you must register at register.proxypush.com/wsm. Upon completing your registration, you will receive further instructions via email, including a unique link that will allow you access to the Annual Meeting and to vote and submit questions during the Annual Meeting.

As part of the registration process, you must enter the control number located on your proxy card, voting instruction form, or Notice of Internet Availability. If you are a beneficial owner of shares registered in the name of a broker, bank or other nominee, you will also need to provide the registered name on your account and the name of your broker, bank or other nominee as part of the registration process.

On the day of the Annual Meeting, May 31, 2023, stockholders may begin to log in to the virtual-only Annual Meeting 15 minutes prior to the start of the Annual Meeting. The Annual Meeting will begin promptly at 9:00 a.m. Pacific Time.

If you hold your shares in street name through an intermediary, such as a bank, broker or other nominee, to attend and submit questions at the virtual Annual Meeting, you must obtain a control number in advance. This is a different number than what is on your voting instruction form. To obtain a control number, follow the instructions provided by your bank, broker or other nominee. Once you have your new control number, please follow the steps set forth above to access the virtual Annual Meeting website.

If you hold your shares in street name, in order to vote during the virtual Annual Meeting, you also must obtain in advance a “legal proxy” from your bank, broker or other nominee. To cast your vote during the meeting, follow the instructions on the virtual Annual Meeting website for completing an online ballot and submit the completed ballot along with a copy of your legal proxy via email.

Will you make a list of the stockholders of record entitled to vote at the 2023 Annual Meeting available?

During the virtual Annual Meeting, a list of our stockholders will be available for viewing by stockholders who signed into the virtual Annual Meeting website with a valid control number by following the instructions on the virtual Annual Meeting website. The names of stockholders of record entitled to vote will also be available for inspection by stockholders of record for 10 days prior to the Annual Meeting. If you are a stockholder of record and want to inspect the stockholder list, please send a written request to: Williams-Sonoma, Inc., Attention: Corporate Secretary, 3250 Van Ness Avenue, San Francisco, California 94109 to arrange for electronic access to the stockholder list.

What is the purpose of the Annual Meeting?

Stockholders will be asked to vote on the following matters:

1)The election of our Board of Directors;

2)An advisory vote to approve executive compensation;

3)An advisory vote on the frequency of an advisory vote to approve executive compensation;

4)The ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending January 28, 2024; and

5)Such other business as may properly come before the meeting or any adjournment or postponement of the meeting, including stockholder proposals. At this time, we do not know of any other matters to be brought before the Annual Meeting.

What is the Notice of Internet Availability of Proxy Materials?

In accordance with rules and regulations adopted by the SEC, instead of mailing a printed copy of our proxy materials to all stockholders entitled to vote at the Annual Meeting, we are furnishing the proxy materials to certain of our stockholders over the Internet. If you received the Notice, by mail, you will not receive a printed copy of the proxy materials. Instead, the Notice will instruct you as to how you may access and review the proxy materials and submit your vote on the Internet or by telephone. If you received a Notice by mail and would like to receive a printed copy of the proxy materials, please follow the instructions for requesting such materials included in the Notice.

On the date of mailing of the Notice, all stockholders will have the ability to access all of our proxy materials on a website referred to in the Notice. These proxy materials will be available free of charge.

Can I receive future proxy materials by e-mail?

Yes. You may choose to receive future proxy materials by e-mail by following the instructions provided on the website referred to in the Notice. Choosing to receive your future proxy materials by e-mail will save us the cost of printing and mailing documents to you and will reduce the impact of our Annual Meeting on the environment.

If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by e-mail will remain in effect until you terminate it.

Who may vote?

Only stockholders of record as of the close of business on April 5, 2023, the record date, or those with a valid proxy from a bank, broker or other nominee that held our shares on the record date, are entitled to receive notice of and vote on the matters to be considered at the Annual Meeting. Each holder of our common stock will be entitled to one vote for each share of our common stock owned as of the record date. As of the record date, there were 65,662,563 shares of our common stock outstanding and entitled to vote, and there were 285 stockholders of record, which number does not include beneficial owners of shares held in the name of a bank or brokerage firm. We do not have any outstanding shares of preferred stock.

How do I vote?

You may vote at the virtual Annual Meeting held via live webcast, electronically by submitting your proxy through the Internet, by telephone or by returning a hard copy of the proxy card before the Annual Meeting. Proxies properly executed, returned to us on a timely basis and not revoked will be voted in accordance with the instructions contained in the proxy. If any matter not described in this Proxy Statement is properly presented for action at the meeting, the persons named in the enclosed proxy will have discretionary authority to vote according to their best judgment.

How do I vote electronically or by telephone?

You may vote by submitting your proxy through the Internet or by telephone. The Internet and telephone voting procedures are designed to authenticate your identity as a Williams-Sonoma, Inc. stockholder, to allow you to vote your shares and to confirm that your instructions have been properly recorded. Specific instructions to be followed for voting on the Internet or by telephone are provided below in this Proxy Statement, in the Notice and on the proxy card.

Shares Registered Directly in the Name of the Stockholder

If your shares are registered directly in your name in our stock records maintained by our transfer agent, EQ Shareowner Services, then you may vote your shares:

•on the Internet at www.proxypush.com/wsm; or

•by calling EQ Shareowner Services from within the United States at 866-883-3382.

Proxies for shares registered directly in your name that are submitted on the Internet or by telephone must be received before noon Pacific Time on May 30, 2023.

Shares Registered in the Name of a Brokerage Firm or Bank

If your shares are held in an account at a brokerage firm or bank, you should follow the voting instructions on the Notice or the voting instruction card provided by your brokerage firm or bank.

Can I vote my shares by filling out and returning the Notice?

No. The Notice identifies the items to be voted on at the Annual Meeting, but you cannot vote by marking the Notice and returning it. The Notice provides instructions on how to vote on the Internet or by telephone and how to request paper copies of the proxy materials.

What if I return my proxy card directly to the company, but do not provide voting instructions?

If a signed proxy card is returned to us without any indication of how your shares should be voted, votes will be cast “FOR” the election of the directors named in this Proxy Statement, “FOR” the approval, on an advisory basis, of the compensation of our Named Executive Officers, “FOR” “1 Year” as the frequency with which stockholders are provided an advisory vote to approve executive compensation, and “FOR” the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending January 28, 2024.

Who may attend the Annual Meeting?

Only stockholders of record as of the close of business on April 5, 2023, the record date, or those with a valid proxy from a bank, broker or other nominee that held our shares on the record date, are entitled to vote on the matters to be considered at the Annual Meeting.

How many shares must be present to transact business at the Annual Meeting?

Stockholders holding a majority of our outstanding shares as of the record date must be present virtually or by proxy at the Annual Meeting so that we may transact business. This is known as a quorum. Shares that are voted at the Annual Meeting, on the Internet, by telephone or by signed proxy card, and abstentions and broker non-votes, will be included in the calculation of the number of shares considered to be present for purposes of determining whether there is a quorum at the Annual Meeting.

What is a broker non-vote?

The term broker non-vote refers to shares that are held of record by a broker for the benefit of the broker’s clients but that are not voted at the Annual Meeting by the broker on certain “non-routine” matters set forth in New York Stock Exchange, or NYSE, Rule 402.08(B) because the broker did not receive instructions from the broker’s clients on how to vote the shares and, therefore, was prohibited from voting the shares. Brokers and other nominees may vote without instruction only on “routine” proposals. The proposal to ratify Deloitte & Touche LLP as the company’s independent registered public accounting firm is the only routine proposal on the agenda for our Annual Meeting. The other three proposals on the agenda are non-routine. If you hold your shares with a broker or other nominee, they will not be voted on non-routine proposals unless you give voting instructions.

How many votes are needed to elect directors?

Pursuant to a majority voting bylaw adopted by our Board of Directors and further described in our Amended and Restated Bylaws, the election of each of the seven director nominees requires the affirmative vote of a majority of the votes cast at the Annual Meeting with respect to each nominee. The number of shares voted “for” a director nominee must exceed the number of votes cast “against” that nominee for the nominee to be elected as a director to serve until the next annual meeting or until a successor has been duly elected and qualified. Your proxy will be voted in accordance with your instructions. If no instructions are given, the proxy holders will vote “FOR” each of the director nominees. If you hold your shares through a brokerage, bank or other nominee, or in “street name,” it is important to cast your vote if you want it to count in the election of directors. If you hold your shares in street name

and you do not instruct your bank or broker how to vote your shares in the election of directors, no votes will be cast on your behalf. Broker non-votes and abstentions will have no effect on the outcome of the election.

Pursuant to the resignation policy adopted by our Board of Directors and further described in our Corporate Governance Guidelines, any nominee for director who is not elected shall promptly tender his or her conditional resignation to our Board of Directors following certification of the stockholder vote. The Nominations, Corporate Governance and Social Responsibility Committee will consider the resignation offer and recommend to our Board of Directors the action to be taken with respect to the offered resignation. In determining its recommendation, the Nominations, Corporate Governance and Social Responsibility Committee shall consider all factors it deems relevant. Our Board of Directors will act on the Nominations, Corporate Governance and Social Responsibility Committee’s recommendation within 90 days following certification of the stockholder vote and will publicly disclose its decision with respect to the director’s resignation offer (and the reasons for rejecting the resignation offer, if applicable).

Any director who tenders his or her resignation pursuant to the resignation policy shall not participate in the Nominations, Corporate Governance and Social Responsibility Committee’s recommendation or Board of Directors action regarding whether to accept the resignation offer. If each member of the Nominations, Corporate Governance and Social Responsibility Committee is required to tender his or her resignation pursuant to the resignation policy in the same election, then the independent directors of our Board of Directors who are not required to tender a resignation pursuant to the resignation policy shall consider the resignation offers and make a recommendation to our Board of Directors.

To the extent that one or more directors’ resignations are accepted by our Board of Directors, our Board of Directors in its discretion may determine either to fill such vacancy or vacancies or to reduce the size of the Board within the authorized range.

How many votes are needed to approve Proposals 2, 3 and 4?

Proposals 2 and 4 require the affirmative vote of holders of a majority of voting power entitled to vote thereon, present virtually or represented by proxy, at the Annual Meeting. Proxy cards marked “abstain” will have the effect of a “NO” vote and broker non-votes will have no effect on the outcome of these proposals.

The outcome of Proposal 2, the advisory vote on the approval of the compensation of our Named Executive Officers, will not be binding on us or the Board. However, the Board and the Compensation Committee will review the voting results and take them into consideration when making future decisions regarding executive compensation.

For Proposal 3, the frequency of the advisory vote to approve compensation of our named executive officers – every year, every two years, or every three years – receiving the highest number of votes at the Annual Meeting will be the frequency recommended by the stockholders. Proxy cards marked “abstain” and broker non-votes will have no effect on the outcome of the vote. Because your vote is advisory, it will not be binding on us or the Board. However, the Board will review the voting results and take them into consideration when making future decisions regarding the frequency of the advisory vote on executive compensation.

Are there any stockholder proposals this year?

No stockholder proposals are included in this Proxy Statement, and we have not received notice of any stockholder proposals to be raised at this year’s Annual Meeting.

What if I want to change my vote(s)?

You may revoke your proxy prior to the close of voting at the Annual Meeting by any of the following methods:

•sending written notice of revocation to our Secretary;

•sending a signed proxy card bearing a later date;

•voting by telephone or on the Internet at a later date; or

•attending the virtual Annual Meeting, revoking your proxy and voting virtually.

What is householding?

Householding is a cost-cutting procedure used by us and approved by the SEC to limit duplicate copies of our proxy materials being printed and delivered to stockholders sharing a household. Under the householding procedure, we send only one Notice or Annual Report and Proxy Statement to stockholders of record who share the same address and last name, unless one of those stockholders notifies us that the stockholder would like a separate Notice or Annual Report and Proxy Statement. A separate proxy card is included in the materials for each stockholder of record. A stockholder may notify us that the stockholder would like a separate Notice or Annual Report and Proxy Statement by phone at 415-421-7900 or by mail at the following mailing address: Williams-Sonoma, Inc., Attention:

Secretary, 3250 Van Ness Avenue, San Francisco, California 94109. If we receive such notification that the stockholder wishes to receive a separate Notice or Annual Report and Proxy Statement, we will promptly deliver such Notice or Annual Report and Proxy Statement. If you wish to update your participation in householding, you may contact your broker or our mailing agent, Broadridge Investor Communications Solutions, at 800-542-1061.

What if I received more than one proxy card?

If you received more than one proxy card, it means that you have multiple accounts with brokers and/or our transfer agent. You must complete each proxy card in order to ensure that all shares beneficially held by you are represented at the meeting. If you are interested in consolidating your accounts, you may contact your broker or our transfer agent, EQ Shareowner Services, at 800-468-9716.

Who pays the expenses incurred in connection with the solicitation of proxies?

We will pay all of the expenses incurred in preparing, assembling and mailing the Notice or this Proxy Statement and the materials enclosed. We have retained MacKenzie Partners, Inc. to assist in the solicitation of proxies at an estimated cost to us of approximately $10,000. Some of our officers or employees may solicit proxies personally or by telephone or other means. None of those officers or employees will receive special compensation for such services.

CORPORATE GOVERNANCE

Corporate Governance Highlights

ü Active and ongoing stockholder engagement

ü Independent Board Chair

ü Regular Board and committee refreshments with a range of tenures

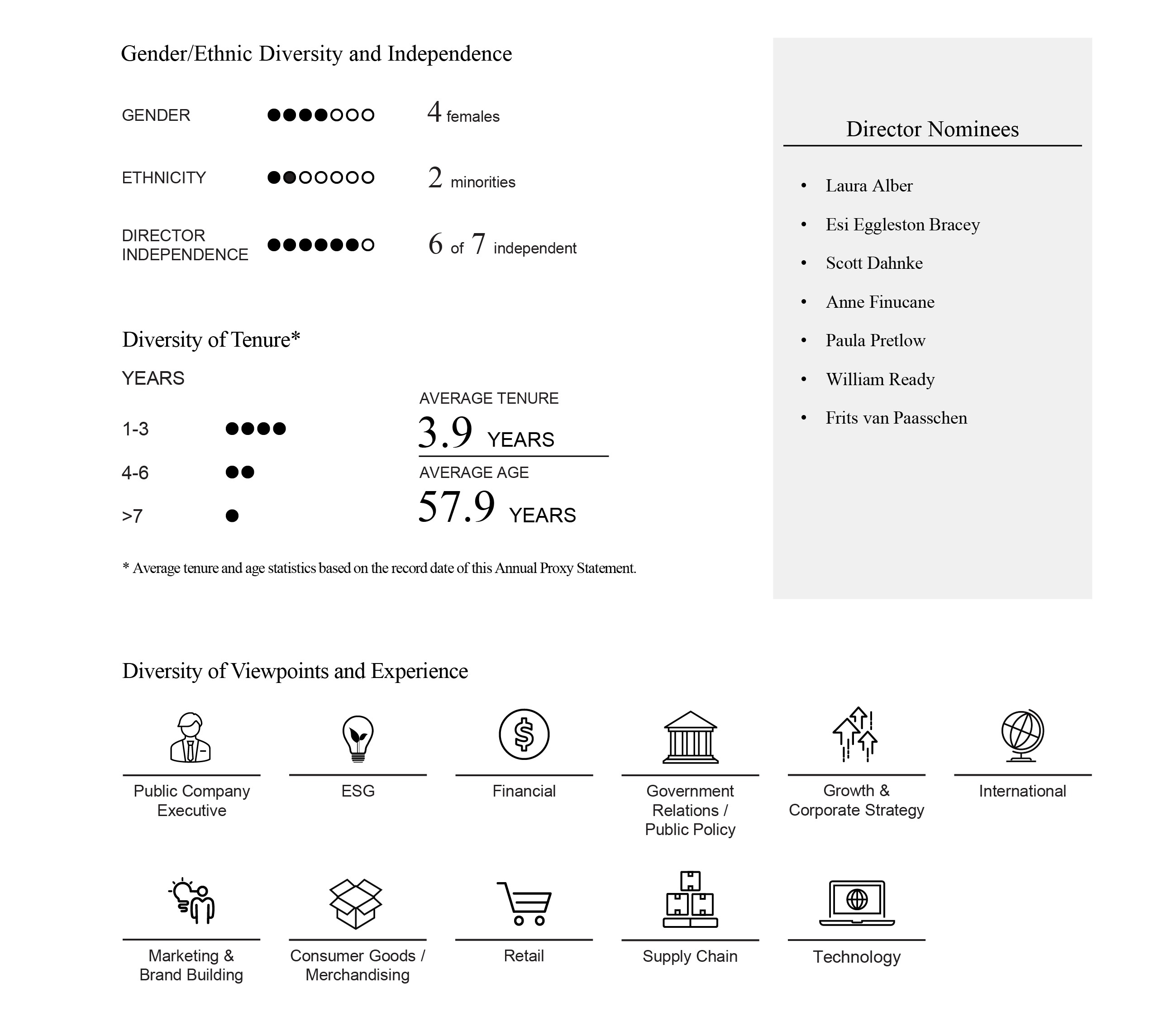

ü Diverse Board that provides a range of viewpoints

ü Annual election of all directors

ü All directors are independent except the CEO

ü Majority voting for directors (in uncontested elections)

ü 10-year director term limit

ü Proxy access rights

ü Significant share ownership requirements for senior executives and directors

ü Robust Business Code of Conduct and Ethics

ü Annual board and committee performance evaluations

ü No multi-class voting stock or non-voting stock

ü Director access to experts and advisors, both internal and external

Director Independence and Renomination Considerations

Our Board of Directors has determined that the following former, current, or prospective members of the Board satisfied the independence requirements of our “Policy Regarding Director Independence Determinations,” which is part of our Corporate Governance Guidelines: Esi Eggleston Bracey, Scott Dahnke, Anne Finucane, Anne Mulcahy, Paula Pretlow, William Ready, Sabrina Simmons, and Frits van Paasschen.

In making this determination in the case of Ms. Finucane, the Board considered her role with Bank of America, N.A., which provides banking services to the company, and determined that Ms. Finucane did not have any direct involvement in our business relationship with Bank of America and that the amounts paid to Bank of America were immaterial.

In making an independence determination in the case of Mr. Ready, the Board considered his roles with Google LLC and Pinterest, Inc., each of which provides certain advertising, marketing and related services to the company, and determined that Mr. Ready did not have any direct involvement in our business relationship with either Google or Pinterest and that the amounts paid to Google and Pinterest were immaterial. Additionally, in making its determination to renominate Mr. Ready to the Board, the Board considered Mr. Ready’s June 2022 appointment as chief executive officer and a member of the board of directors of Pinterest, Inc. In addition to Williams-Sonoma and Pinterest, Mr. Ready also serves on the board of Automatic Data Processing, Inc. Our board evaluated Mr. Ready’s many contributions, including his consistent attendance and participation in Board and committee meetings. Specifically, the Board considered his deep and distinctive operational experience and knowledge of the technology industry’s consumer, payments and money movement spaces, experience in founding, leading, and scaling innovative startups, and cybersecurity expertise. The Board further considered the number of Board objectives for which Mr. Ready provides great insight and value in all of the foregoing respects and the benefit to the Board of his continued service. The Board also believes that Mr. Ready’s new chief executive officer role, which possesses the highest degree of responsibility and leadership in a company, will contribute to and inform his work and service on the Williams-Sonoma Board. Mr. Ready also indicated to us that he will be able to balance his time commitments and devote sufficient time to our Board. Therefore, our Board concluded that Mr. Ready is an invaluable member of our Board who will be able to effectively balance his time commitments and has recommended that Mr. Ready continue to serve our Board.

Accordingly, the Board has determined that none of these individuals has a material relationship with us and that each of these individuals is independent within the meaning of the NYSE and SEC director independence standards, as currently in effect. Further, the Board has determined that each member of our Board committees satisfied the independence requirements of the NYSE, and any heightened independence standards applicable to each committee on which they serve. The Board’s independence determination was based on information provided by our directors and discussions among our officers and directors.

Board Leadership Structure

We currently separate the positions of Chief Executive Officer and Board Chair. Mr. Dahnke, an independent director, has served as our Board Chair since June 2020. Our Corporate Governance Guidelines provide that in the event that the Board Chair is not an independent director, the Board shall elect a Lead Independent Director. As Mr. Dahnke is an independent director, we have not appointed a separate Lead Independent Director.

Separating the positions of Chief Executive Officer and Board Chair maximizes the Board’s independence and aligns our leadership structure with current trends in corporate governance best practices. Our Chief Executive Officer is responsible for day-to-day leadership and for setting the strategic direction of the company, while the Board Chair provides independent oversight and advice to our management team, and presides over Board meetings.

Board Meetings and Executive Sessions

During fiscal 2022, our Board held a total of four meetings. Each incumbent director attended at least 75% of the aggregate of (i) the total number of meetings of the Board held during the period of fiscal 2022 for which such director served as a director and (ii) the total number of meetings held by all committees of the Board on which such director served during the period of fiscal 2022 that such director served. It is the Board’s policy to have a separate meeting time for independent directors, typically during the regularly scheduled Board meetings. During fiscal 2022, executive sessions were led by our Board Chair, Mr. Dahnke.

Attendance of Directors at Annual Meeting of Stockholders

It is our policy that directors who are nominated for election at our Annual Meeting should attend the Annual Meeting. All seven directors who were nominated for election at our 2022 Annual Meeting attended the meeting.

Board Committees

Our Board has three standing committees: the Audit and Finance Committee, the Compensation Committee and the Nominations, Corporate Governance and Social Responsibility Committee. Each committee operates under a written charter adopted by the Board. The committee charters are each available on the company’s website at ir.williams-sonomainc.com/governance and are also available in print to any stockholder upon request.

The following table sets forth the members of each committee as of April 5, 2023, the functions of each committee, and the number of meetings held during fiscal 2022.

| | | | | | | | | | | | | | |

Committee and Members | | Functions of Committee | | Number of Meetings in Fiscal 2022 |

| | | | |

Audit and Finance: Paula Pretlow, Chair Esi Eggleston Bracey William Ready | | •Assists our Board in its oversight of the integrity of our financial statements; the qualifications, independence, retention and compensation of our independent registered public accounting firm; the performance of our internal audit function; and our compliance with legal and regulatory requirements; •Prepares the report that the SEC rules require to be included in our annual proxy statement; •Reviews and recommends policies related to dividend, stock repurchase and foreign currency programs; and •Assists the Board with its oversight of our major financial risk exposures, and reviews with management such exposures and the steps management has taken to monitor and control such exposures. | | 11 |

| | | |

| | | | | | | | | | | | | | |

Compensation: Scott Dahnke, Chair William Ready Frits van Paasschen | | •Reviews and determines our executive officers’ compensation; •Reviews and determines our general compensation goals and guidelines for our employees; •Administers certain of our compensation plans and provides assistance and recommendations with respect to other compensation plans; •Reviews the compensation discussion and analysis report that the SEC rules require to be included in our annual proxy statement; •Assists the Board with its oversight of risk arising from our compensation policies and programs, and assesses on an annual basis potential material risk from our compensation policies and programs; and •Appoints, sets the compensation of, and determines independence of any compensation consultant or other advisor retained. | | 3 |

| | | |

Nominations, Corporate Governance and Social Responsibility: Frits van Paasschen, Chair Scott Dahnke Anne Finucane | | •Reviews and recommends corporate governance policies; •Identifies and makes recommendations for nominees for director and considers criteria for selecting director candidates; •Considers stockholders’ director nominations and proposals; •Reviews and determines our compensation policy for our non-employee directors; •Considers resignation offers of director nominees and recommends to the Board the action to be taken with respect to each such offered resignation; •Oversees the evaluation of our Board and our senior management team; and •Oversees environmental, social, and governance (“ESG”) matters, corporate social responsibility, stockholder engagement and disclosure regarding such matters. | | 4 |

Audit and Finance Committee

The Board has determined that each member of the Audit and Finance Committee is independent under the NYSE rules, as currently in effect, and Rule 10A-3 of the Securities Exchange Act of 1934, as amended. The Board has determined that Ms. Pretlow is an “audit committee financial expert” under the SEC rules. The Board has also determined that each Audit and Finance Committee member is “financially literate,” as described in the NYSE rules.

No member of the Audit and Finance Committee may serve on the audit committees of more than three public companies, including the company, unless the Board determines that such simultaneous service would not impair the ability of such member to effectively serve on our Audit and Finance Committee and discloses such determination in accordance with NYSE requirements. Currently, all members of the Audit and Finance Committee are in compliance with this requirement.

Compensation Committee

The Board has determined that each member of the Compensation Committee is independent under the NYSE rules, as currently in effect and is a “non-employee director” under Section 16(b) of the Securities Exchange Act of 1934, as amended.

Compensation Committee Interlocks and Insider Participation

Mr. Dahnke, Mr. Ready, and Mr. van Paasschen served as members of the Compensation Committee during fiscal 2022. No member of this committee was at any time during fiscal 2022 or at any other time an officer or employee of the company, or had any relationship with the company requiring disclosure under Item 404 of Regulation S-K. In addition, none of our executive officers served as a member of the board of directors or compensation committee of any entity that has or had one or more executive officers serving as a member of our Board or Compensation Committee.

Nominations, Corporate Governance and Social Responsibility Committee

The Board has determined that each member of the Nominations, Corporate Governance and Social Responsibility Committee is independent under the NYSE rules currently in effect. Each member of the Nominations, Corporate Governance and Social Responsibility Committee is a non-employee director.

During fiscal 2022, in furtherance of the Nominations, Corporate Governance and Social Responsibility Committee’s functions, the Committee took the following actions, among other things:

•Evaluated the composition of the Board, and considered desired skill sets, qualities and experience for potential future Board members, as well as potential candidates;

•Evaluated the composition of the committees of the Board;

•Oversaw key initiatives related to ESG, corporate social responsibility, and stockholder engagement;

•Considered and recommended to the Board the submission to stockholders of the director nominees described in the company’s 2023 Proxy Statement; and

•Managed the annual Board self-assessment process.

Director Nominations

The Nominations, Corporate Governance and Social Responsibility Committee’s criteria and process for evaluating and identifying the candidates that it selects, or recommends to the Board for selection, as director nominees are as follows:

•The Nominations, Corporate Governance and Social Responsibility Committee periodically reviews the current composition and size of the Board;

•The Nominations, Corporate Governance and Social Responsibility Committee manages the annual self-assessment of the Board as a whole and considers the performance and qualifications of individual members of the Board when recommending individuals for election or re-election to the Board;

•The Nominations, Corporate Governance and Social Responsibility Committee reviews the qualifications of any candidates who have been properly recommended by stockholders, as well as those candidates who have been identified by management, individual members of the Board or, if it deems appropriate, a search firm. Such review may, in the Nominations, Corporate Governance and Social Responsibility Committee’s discretion, include a review solely of information provided to it or also may include discussions with persons familiar with the candidate, an interview with the candidate or other actions that the Nominations, Corporate Governance and Social Responsibility Committee deems appropriate;

•In evaluating the qualifications of candidates for the Board, the Nominations, Corporate Governance and Social Responsibility Committee considers many factors, including issues of character, judgment, independence, financial expertise, industry experience, range of experience, and other commitments. The Nominations, Corporate Governance and Social Responsibility Committee values diversity, but does not assign any particular weight or priority to any particular factor. The Nominations, Corporate Governance and Social Responsibility Committee considers each individual candidate in the context of the current perceived needs of the Board as a whole. While the Nominations, Corporate Governance and Social Responsibility Committee has not established specific minimum qualifications for director candidates, it believes that candidates and nominees must be suitable for a Board that is composed of directors (i) a majority of whom are independent; (ii) who are of high integrity; (iii) who have qualifications that will increase the overall effectiveness of the Board; and (iv) who meet the requirements of all applicable rules, such as financial literacy or financial expertise with respect to Audit and Finance Committee members;

•In evaluating and identifying candidates, the Nominations, Corporate Governance and Social Responsibility Committee has the sole authority to retain and terminate any third-party search firm that is used to identify director candidates and the sole authority to approve the fees and retention terms of any search firm;

•After such review and consideration, the Nominations, Corporate Governance and Social Responsibility Committee recommends to the Board the slate of director nominees; and

•The Nominations, Corporate Governance and Social Responsibility Committee endeavors to notify, or cause to be notified, all director candidates of the decision as to whether to nominate individuals for election to the Board.

There are no differences in the manner in which the Nominations, Corporate Governance and Social Responsibility Committee evaluates nominees for director based on whether the nominee is recommended by a stockholder, management or a search firm.

Stockholder Recommendations

The Nominations, Corporate Governance and Social Responsibility Committee will consider recommendations from stockholders regarding possible director candidates for election at next year’s Annual Meeting. Pursuant to our Stockholder Recommendations Policy, the Nominations, Corporate Governance and Social Responsibility Committee considers recommendations for candidates to the Board from stockholders holding no fewer than 500

shares of the company’s common stock continuously for at least six months prior to the date of the submission of the recommendation.

A stockholder that desires to recommend a candidate for election to the Board shall direct the recommendation in writing to Williams-Sonoma, Inc., Attention: Corporate Secretary, 3250 Van Ness Avenue, San Francisco, California 94109. The recommendation must include: (i) the candidate’s name, home and business contact information; (ii) detailed biographical data and qualifications of the candidate; (iii) information regarding any relationships between the candidate and the company within the last three years; (iv) evidence of the recommending person’s ownership of company common stock; (v) a statement from the recommending stockholder in support of the candidate; and (vi) a written indication by the candidate of his or her willingness to serve if elected. A stockholder that desires to recommend a person directly for election to the Board at the company’s Annual Meeting must also meet the deadlines and other requirements set forth in Rule 14a-8 of the Securities Exchange Act of 1934, as amended, and the company’s Restated Bylaws, each of which are described in the “Stockholder Proposals” section on page 81.

Each director nominated in this Proxy Statement was recommended for election to the Board by the Nominations, Corporate Governance and Social Responsibility Committee. The Board did not receive any director nominee recommendation from any stockholder in connection with this Proxy Statement.

Risk Oversight

Board Oversight of Risk

The Board actively manages the company’s risk oversight process and receives regular reports from management on areas of material risk to the company, including operational, financial, legal and regulatory risks. Our Board committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. The Audit and Finance Committee assists the Board with its oversight of the company’s major financial risk exposures. Additionally, in accordance with NYSE requirements, the Audit and Finance Committee reviews with management the company’s major financial risk exposures and the steps management has taken to monitor and control such exposures, including the company’s risk assessment and risk management policies. The Compensation Committee assists the Board with its oversight of risks arising from our compensation policies and programs and assesses on an annual basis potential material risk to the company from its compensation policies and programs, including incentive and commission plans at all levels. The Nominations, Corporate Governance and Social Responsibility Committee assists the Board with its oversight of risks associated with Board organization, Board independence, succession planning, corporate governance, and ESG. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports about such risks and participates in regularly-scheduled Board discussions covering such risks.

Cybersecurity Risk Oversight

The Board, which is comprised entirely of independent directors except for our CEO, takes an active role in oversight of the company’s cybersecurity and data privacy policies. Among other things, at least annually, the Board receives an overview of the company’s cybersecurity program from the company’s management, covering topics such as information security, fraud, data security, and cybersecurity risk and developments, as well as the steps management has taken to monitor and control such exposures. Our Chief Technology Officer and Chief Information Security Officer also periodically update the Board regarding the company’s cybersecurity and data privacy risk mitigation plan, and the status of the company’s progress towards pre-determined risk-mitigation-related goals. Members of the Board are also encouraged to regularly engage in ad hoc conversations with management on cybersecurity-related news events and discuss any updates to the company’s cybersecurity programs.

The company maintains an information security risk insurance policy and also performs internal penetration testing and vulnerability assessments monthly and engages third-party penetration testers quarterly. An independent Qualified Security Assessor annually reviews security practices and compliance and we train employees on customer data handling and use requirements annually. The company closely monitors emerging data privacy laws and implements changes to our processes to comply with global data privacy regulations. We undertake an annual review of our consumer facing privacy policies and associate privacy policies to ensure compliance. We also proactively inform our customers of substantive changes related to customer data handling.

Evaluation of Risks Relating to Compensation Programs

Our Compensation Committee is responsible for monitoring our compensation policies and programs relative to all our employees, including non-executive officers, for potential risks that are reasonably likely to have a material adverse effect on our company. In performing its duties, the Compensation Committee regularly reviews and discusses potential risks that could arise from our employee compensation plans and programs with our management

and the Compensation Committee’s independent compensation consultant. The Compensation Committee is responsible for reporting to the Board any material risks associated with our compensation plans and programs, including recommended actions to mitigate such risks.

For fiscal 2022, the Compensation Committee retained an independent consultant, Pay Governance LLC, to identify and assess the risks inherent in the company’s compensation programs and policies. Accordingly, Pay Governance LLC evaluated the company’s executive and non-executive compensation programs for such risk and the mechanisms in our programs designed to mitigate these risks. Among other things, Pay Governance LLC reviewed our pay philosophy, forms of incentives, performance metrics, balance of cash and equity compensation, balance of long-term and short-term incentive periods, compensation governance practices, and equity grant administration practices. Based on the assessment, Pay Governance LLC concluded that our compensation programs and policies do not create risks that are reasonably likely to have a material adverse effect on our company.

Environmental, Social and Governance (ESG) Matters

For almost two decades, Williams-Sonoma, Inc. has prioritized sustainability and equity in our business to create a more resilient company. We carry on the legacy that began with the first Williams Sonoma store in 1956—to care for our customers and the communities where we work. Building on that solid foundation, we are positioning our company to mitigate future risks, capture opportunity, and drive impact.

Williams-Sonoma, Inc. is Good by Design—our pillars of Planet, People, and Purpose are the cornerstones of our work and represent a business-integrated ESG strategy. Within these pillars, we set ambitious goals that are woven into our business and that our family of brands plays an active role in achieving.

Our ESG strategy focuses on climate strategy; quality products; responsible materials and production; safe, healthy and inclusive work environments; equity and inclusion; and impactful corporate citizenship. We continue to evolve our ESG strategy in response to a changing environment and with products at the center of our strategy. Today, over 46% of our products are labeled with one or more environmental or social standards, and we strive to reach 75% by 2030.

We will continue to demonstrate that our strong sustainability agenda enables long-term value creation for all our stockholders and drives impact across our operations and supply chain.

We invite you to visit our website and read our annual Impact Report to learn more about our ESG initiatives and impact: www.sustainability.williams-sonomainc.com.

ESG Oversight

Given the alignment of our ESG work with our strategic direction, our Board is highly engaged on the topic of sustainability. Our Nominations, Corporate Governance and Social Responsibility Committee and our Board oversee ESG matters. The Committee oversees corporate policies and programs that speak to long-standing commitments to our associates, supply chain, environment, health and safety, human rights, cybersecurity, and ethics. These policies and programs are relevant to our business, critical to our associates, and important to our customers.

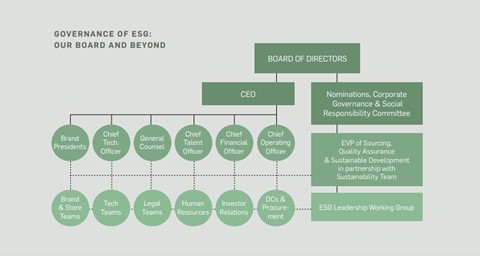

The Board of Directors oversees environmental and social matters by means of updates from our Executive Vice President of Sourcing, Quality Assurance, and Sustainable Development, and through annual updates from the company’s dedicated sustainability team. The sustainability team presents to the full Board at least once a year for the Board to monitor and review existing and proposed strategy, goals, and targets. The Executive Vice President leads both the organization’s dedicated global team of sustainability professionals as well as a working group of cross-functional leaders. An organizational chart summarizing our ESG team structure is below. Additional details about our governance structure can be found in our most recent Impact Report.

Planet

As a multinational retailer with a global supply chain, we are committed to responsible practices across our business—from designing and sourcing responsible products, to reducing waste, to working with suppliers to lower emissions and adopt sustainable business practices. Our work has earned recognition across our industry. We’ve been recognized as a Sustainable Furnishings Council Top Scoring global company for sustainable wood furniture for the past five years, and one of Barron’s 100 Most Sustainable Companies for six years running.

Climate & Energy

We amplified our climate work in the past year, making progress toward our Science-Based Target for emissions reduction across our value chain. We have reported our Scope 1 and 2 greenhouse gas emissions since 2011, and in 2021 set a goal to be carbon neutral in our operations by 2025 and set a Science-Based Target for emissions reduction across our value chain by 2030. Our goals are:

•By 2025, reach carbon neutrality in Williams-Sonoma Inc. operations (Scopes 1 and 2).

•By 2030, reduce absolute Scope 1 and 2 emissions 50% and Scope 3 emissions 14%.

To meet our climate goals, we are focusing on efficiency, renewable energy, lower impact materials, and production. Building on the progress of our cotton and wood goals, we are aligning our preferred materials work with our climate strategy, using materials as part of our efforts to reach our Science-Based Target.

We participate in CDP Climate Change and Forests disclosures annually and were recognized on CDP’s 2022 Supplier Engagement Rating for our engagement with our suppliers on climate change. Our CDP responses and additional detail on our Science-Based Target are available on our website: www.sustainability.williams-sonomainc.com.

In March 2022, we announced a new goal to plant 6 million trees by 2023 in partnership with the Arbor Day Foundation, with participation across Pottery Barn, Pottery Barn Kids and Teen, West Elm, Rejuvenation, and Williams Sonoma Home. This goal doubles an original commitment made by the Pottery Barn Brand in 2021 to plant 3 million trees, one tree for every piece of select indoor wood furniture sold, within the same timeframe.

Responsible Materials

Some of our greatest environmental impacts come from the materials we use in our products. For that reason, responsibly sourced materials and practices are a key focus across all our brands. Building on the progress of our

responsible materials goals, which we will continue to maintain, we are expanding our responsible materials work beyond wood and cotton and transitioning to lower-impact materials across our brands. We created a Preferred Materials Framework to evaluate individual materials and guide the transition to lower-impact materials. The framework supports our broader emissions reduction strategy.

We also continue to consider the chemicals and finishes used in our products. We use certifications including GREENGUARD and STANDARD 100 by OEKO-TEX to test that our company-produced products are free from harmful chemicals and volatile inorganic compounds.

Waste & Circularity

In 2022, we drove progress toward our landfill diversion goal with stores implementing waste reduction initiatives, such as backhauling of expanded polystyrene foam to distribution centers where it is recycled. We continued to divert products from landfill into donation streams and to identify opportunities to further waste reduction. We continue to repurpose our scrap waste through textile recycling and donation.

Reporting

We are committed to providing transparent sustainability-related information to our stockholders and other stakeholders. We responded to the Standard & Poor’s Corporate Sustainability Assessment and were listed in the Dow Jones Sustainability Index North America for the first time. We align our annual Impact Report with recognized sustainability frameworks, including the Sustainability Accounting Standards Board (SASB), the Task Force on Climate-Related Financial Disclosures (TCFD), and the U.N. Sustainable Development Goals, and will continue to expand and enhance our sustainability disclosures in the future.

People

From the artisans and factory workers making our products to our associates, taking care of our people is a key priority. We strive to create a workplace where the quality of our engagement with fellow associates, business partners and customers matches the quality of the products and services we bring to the marketplace. These commitments have garnered external recognition including:

•Forbes’ Best Employers for Women 2019-2022;

•Forbes’ Best Employers for Diversity 2020-2022;

•Bloomberg Gender-Equality Index 2021-2023; and

•Great Place to Work Certified.

Ethical Production

We hold our suppliers to high ethical standards, and we are committed to integrity and honesty throughout all aspects of our business. We require our suppliers to adhere to the standards outlined in our Vendor Code of Conduct and accompanying implementation standards, which are informed by the conventions of the International Labour Organization (ILO) and the UN’s Guiding Principles on Business and Human Rights. Hundreds of factories in our audit scope are audited annually by independent third-party audit firms to ensure compliance with our standards relating to labor practices, health and safety, environmental protection, ethical conduct, sub-contracting, management systems, and transparency. Using a continuous improvement model, we work alongside factories to improve working conditions.

Worker Well-being

We go beyond compliance to develop industry-leading initiatives that improve the lives of workers. We set the following goals to deepen our impact:

•By 2025, pay an additional $10 million in Fair Trade Premiums and purchase $50 million in Nest Certified Ethically Handcrafted products.

•By 2030, 75% of product purchases from suppliers who offer worker well-being programs.

Our goals reflect our commitment to increase the well-being and prosperity of the workers in our supply chain, and support craft traditions around the world. We were the first home retailer to bring Fair Trade USA’s factory certification program into the home sector. We also were the founding partner with the non-profit Nest on The Nest Ethical Handcraft Program and the first retailer to feature the Nest Seal of Ethical Handcraft on products.

Through partnership with organizations such as Fair Trade, Nest, VisionSpring and HERproject, we support programs that contribute to a resilient, sustainable supply chain and deliver concrete business value. For every Fair Trade Certified product sold, we pay a premium that goes directly back to workers, who collectively decide how to spend the funds to improve their lives and communities. Nest assesses ethical production outside of traditional factories where production standards end, and lets shoppers know that the items they purchased were ethically made by hand, supporting artisans and home-based craft production.

Diversity, Equity & Inclusion

We firmly believe that working in a culture focused on diversity, equity, and inclusion (DEI) spurs innovation, creates healthy and high-performing teams, and delivers superior customer experiences. In June 2020, we established an Equity Action Plan and formed an Equity Action Committee, including a diverse group of executives and associates, to drive positive change in the fight for racial justice. We continue to honor our commitment to equity through our partnership and donation support with national non-profit leaders. We are focused on creating diverse teams and continue to partner with numerous organizations to diversify our talent pipeline. In addition to our talent initiatives, our brands worked to consciously increase Black representation among our vendors, partners, and collaborators.

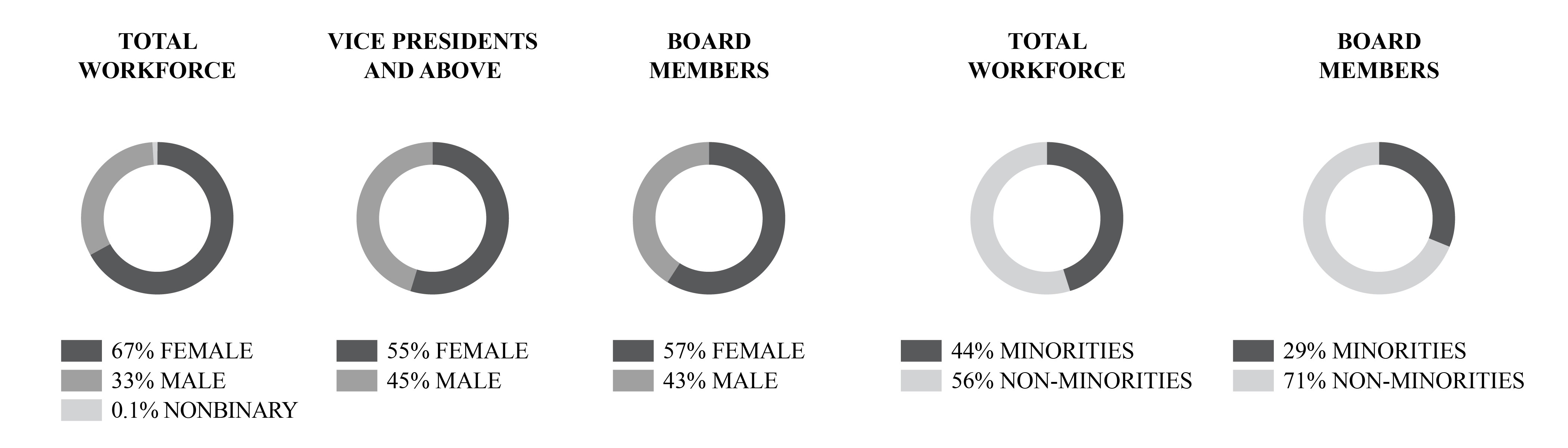

As part of our commitment to DEI, we publish gender and ethnicity representation numbers. Some of our key representation statistics for our U.S. workforce as of the end of fiscal 2022 are as follows:

We continue to ensure we bring forward a diverse slate of candidates for all of our corporate roles posted externally, and have seen improvement in both overall representation and hire rate since we launched our Equity Action Plan.

We are a member of CEO Action for Diversity & Inclusion, in which we pledge to “identify and establish associate networks for underrepresented communities to promote diversity and inclusion throughout the company.” Aligned with this goal, we maintain associate equity networks including an LGBTQIA+ Network, Black Associate Network, Veterans Appreciation Network, Hispanic/LatinX Associate Network, Asian WSI Network, and a Disability, Education & Advocacy Network. Our networks are a core part of our Equity Action Plan and they strive to create a culture of connection, belonging, inclusivity, and equity. Ambassadors of these groups are instrumental in organizing celebrations for Diwali, Lunar New Year, Pride, Veteran’s Day, and Black History Month.

Associate Engagement & Well-being

We conduct an annual Associate Opinion Survey to directly engage with and collect feedback from our associates, which we use to improve the experience of our teams. Our human resources department maintains an open-door policy for associates to report concerns, and we provide an anonymous reporting hotline, available in multiple languages and managed by an independent company not affiliated with us.

Purpose

As a values-based business, we rely on our associates to lead and make an impact every day. We cannot succeed without them—from the people working in our stores, to our corporate offices, to our factory floors.

Outside of our operations, our mission of enhancing the quality of people’s lives at home guides our giving and volunteering strategy. We raise funds for and support a range of causes that reflect the passion and dedication of our associates and that resonate with our customers. Through online and in-store donations, special product collaborations, and national and local fundraising, we give back to the communities we serve. We remain committed to our partnerships with St. Jude Children’s Research Hospital, No Kid Hungry, The Trevor Project, AIDS Walk, Canada Children’s Hospitals, and the Arbor Day Foundation. We also support organizations and partners, like Good360 and Habitat for Humanity, that assist those with damaged or lost homes, or those seeking decent, affordable housing. Our Williams-Sonoma, Inc. Foundation also provides need-based grants to our associates directly impacted by federally-declared disasters.

Volunteering deepens our presence in the community, enhances our relationships with customers, and strengthens employee engagement. We support our communities through our associates’ time and leadership, providing 8 hours of paid Community Involvement Time each year to each of our eligible associates, and encourage associates to volunteer for local causes. Associates log an average of over 4,000 volunteer hours annually, choosing where to devote their time, with efforts ranging from school renovations to habitat restoration.

Director Compensation

Fiscal 2022 Highlights

• Emphasis on equity in the overall compensation mix to support alignment with our stockholders.

• Full-value equity grants under a fixed-value annual grant policy with vesting for retention purposes.

• No performance-based equity awards.

• A robust stock ownership guideline to support stockholder alignment.

• A stockholder-approved annual limit on total director compensation.

• No retirement benefits and limited perquisites.

Director Compensation Program

Overview

Our non-employee directors receive cash compensation and equity grants for their service on our Board, with additional cash and equity compensation provided to the Board Chair, the Chair of each Board committee, and members of each Board committee. Decisions regarding our non-employee director compensation program are approved by the full Board based on recommendations by the Nominations, Corporate Governance and Social Responsibility Committee. In making such recommendations, the Nominations, Corporate Governance and Social Responsibility Committee takes into consideration the duties and responsibilities of our non-employee directors, the director compensation practices of peer companies, the recommendations of the independent compensation consultant and whether such recommendations align with the interests of our stockholders. The Nominations, Corporate Governance and Social Responsibility Committee periodically reviews the total compensation of our non-employee directors and each element of our director compensation program. At the direction of the Nominations, Corporate Governance and Social Responsibility Committee, the Compensation Committee’s independent compensation consultant analyzes the competitive position of our director compensation program against the peer group used for executive compensation purposes.

Director Stock Ownership Policy

The Board has approved a stock ownership policy. Each non-employee director must hold at least $400,000 worth of shares of company stock by the fifth anniversary of such director’s initial election to the Board. If a director holds at least $400,000 worth of shares of company stock during the required time period, but the value of such director’s shares decreases below $400,000 due to a drop in the company’s stock price, the director shall be deemed to have complied with this policy so long as the director does not sell shares of company stock. If a director has not complied with this policy during the required time period, then the director may not sell any shares until such director holds at least $400,000 worth of shares of company stock. A director’s unvested restricted stock units will not count toward satisfying the ownership requirements. As of April 5, 2023, all of our directors have satisfied the ownership requirements or have been on the Board for less than five years.

Stockholder Approved Compensation Limit

Under our stockholder-approved maximum annual limit on non-employee director compensation, stock awards granted during a single fiscal year under the plan or otherwise, taken together with any cash fees paid during such fiscal year for services on the Board, will not exceed $750,000 in total value for any non-employee director.

Fiscal 2022 Non-Employee Director Compensation

The following table sets forth non-employee director compensation amounts for fiscal 2022.

| | | | | |

| Fiscal 2022 |

| Per-Committee Meeting Attendance Fee | — |

| Annual Cash Compensation for Board Service(1)(2) | $80,000 |

| Annual Equity Grant for Board Service(2)(3)(4) | $165,000 |

| Annual Cash Compensation to Board Chair(1)(2) | $100,000 |

| Annual Equity Grant to Board Chair(2)(3) | $100,000 |

| Annual Cash Compensation to Chair of the Audit and Finance Committee(1) | $22,500 |

| Annual Equity Grant to Chair of the Audit and Finance Committee(3) | $22,500 |

| Annual Cash Compensation to Chair of the Compensation Committee(1)(2) | $15,000 |

| Annual Equity Grant to Chair of the Compensation Committee(2)(3) | $15,000 |

| Annual Cash Compensation to Chair of the Nominations, Corporate Governance and Social Responsibility Committee(1) | $12,500 |

| Annual Equity Grant to Chair of the Nominations, Corporate Governance and Social Responsibility Committee(3) | $12,500 |

| Annual Compensation to Member of the Audit and Finance Committee(5) | $17,500 |

| Annual Compensation to Member of the Compensation Committee(5)(2) | $15,000 |

| Annual Compensation to Member of the Nominations, Corporate Governance and Social Responsibility Committee(5)(2) | $10,000 |

| | | | | |

| (1) | The annual cash compensation is paid in quarterly installments so long as the non-employee director continues to serve on the Board at the time of such payments. |

| (2) | Any cash compensation or equity grant otherwise payable to Scott Dahnke will be paid directly to or transferred from Mr. Dahnke to a non-investment fund affiliate of his employer, of which he does not have any voting or dispositive control. |

| (3) | The annual equity grant is awarded on the date of the Annual Meeting. Equity grants are made in the form of restricted stock units. These restricted stock units vest on the earlier of one year from the date of grant or the day before the next regularly scheduled annual meeting, subject to continued service through the vesting date. The number of restricted stock units granted is determined by dividing the total monetary value of each award, as set forth in the table, by the closing price of our common stock on the trading day prior to the grant date, rounding down to the nearest whole share. Directors also receive dividend equivalent payments with respect to outstanding restricted stock unit awards, which are paid upon the vesting of the underlying restricted stock units. |

| (4) | Directors who are appointed to the Board after the company’s last Annual Meeting receive an equity grant on the appointment date on a prorated basis based on the number of days that the director is scheduled to serve between the appointment date to the Board and the date one year from the prior year’s Annual Meeting. |

| (5) | Compensation for membership on each Board committee is paid 50% in cash and 50% in equity. |

In addition to the compensation described above, non-employee directors received reimbursement for travel expenses related to attending our Board, committee or business meetings. Non-employee directors and their spouses received discounts on our merchandise. Non-employee directors may also participate in a deferred stock unit program, pursuant to which non-employee directors may elect, on terms prescribed by the company, to receive 100% of their annual cash compensation to be earned in respect of the applicable fiscal year either in the form of (i) fully vested stock units or (ii) fully vested deferred stock units. Such changes were made to align our director compensation program with competitive market practices and/or to compensate directors fairly for their level of services.

Director Compensation Table

The following table shows the compensation provided to non-employee directors who served during all or a portion of fiscal 2022.

| | | | | | | | | | | | | | |

| Fees Earned or Paid in Cash($)(1) | Stock Awards($)(2) | All Other Compensation($)(3)(4) | Total ($) |

Esi Eggleston Bracey................................. | $88,540 | $173,715(5) | $56 | $262,311 |

Scott Dahnke............................................ | $199,810 | $284,878(6) | $2,181 | $486,869 |

Anne Finucane.......................................... | $83,338 | $169,878(7) | $19,046 | $272,262 |

Anne Mulcahy.......................................... | $31,287 | — | $12,399 | $43,686 |

Paula Pretlow........................................... | $97,929 | $187,403(8) | $6,350 | $291,682 |

William Ready.......................................... | $93,041 | $181,135(9) | — | $274,176 |

Sabrina Simmons...................................... | $35,360 | — | $139 | $35,499 |

Frits van Paasschen.................................... | $100,000 | $184,972(10) | $3,293 | $288,265 |

(1)The following directors elected to receive 100% of his or her annual cash compensation for fiscal 2022 either in fully vested stock grants or fully vested deferred stock units: Esi Eggleston Bracey: $88,540; Scott Dahnke: $199,810; William Ready: $93,041; and Anne Mulcahy: $31,287.

(2)Represents the grant date fair value of the restricted stock unit awards granted in fiscal 2022 as calculated in accordance with FASB ASC Topic 718, by multiplying the closing price of our common stock on the trading day prior to the grant date by the number of restricted stock units granted. As of January 29, 2023, the persons who served as non-employee directors during all or a portion of fiscal 2022 held the following numbers of unvested restricted stock units: Esi Eggleston Bracey: 1,358; Scott Dahnke: 2,227; Anne Finucane: 1,328; Anne Mulcahy: 0; Paula Pretlow: 1,465; William Ready: 1,416; Sabrina Simmons: 0; and Frits van Paasschen: 1,446.

(3)Represents the taxable value of discount on merchandise.

(4)Excludes dividend equivalent payments, which were previously factored into the grant date fair value of disclosed equity awards.

(5)Represents the grant date fair value associated with a restricted stock unit award of 1,358 shares of common stock made on June 1, 2022, with a fair value as of the grant date of $127.92 per share for an aggregate grant date fair value of $173,715.

(6)Represents the grant date fair value associated with a restricted stock unit award of 2,227 shares of common stock made on June 1, 2022, with a fair value as of the grant date of $127.92 per share for an aggregate grant date fair value of $284,878. Any cash compensation or equity grant otherwise payable to Scott Dahnke will be paid directly to or transferred from Mr. Dahnke to a non-investment fund affiliate of his employer, of which he does not have any voting or dispositive control.

(7)Represents the grant date fair value associated with a restricted stock unit award of 1,328 shares of common stock made on June 1, 2022, with a fair value as of the grant date of $127.92 per share for an aggregate grant date fair value of $169,878.

(8)Represents the grant date fair value associated with a restricted stock unit award of 1,465 shares of common stock made on June 1, 2022, with a fair value as of the grant date of $127.92 per share for an aggregate grant date fair value of $187,403.

(9)Represents the grant date fair value associated with a restricted stock unit award of 1,416 shares of common stock made on June 1, 2022, with a fair value as of the grant date of $127.92 per share for an aggregate grant date fair value of $181,135.

(10)Represents the grant date fair value associated with a restricted stock unit award of 1,446 shares of common stock made on June 1,2022, with a fair value as of the grant date of $127.92 per share for an aggregate grant date fair value of $184,972.

Corporate Governance Guidelines and Code of Business Conduct and Ethics

Our Corporate Governance Guidelines and our Code of Business Conduct and Ethics, both of which apply to all of our employees, including our Chief Executive Officer, Chief Financial Officer, and Chief Accounting Officer, are available on our website at ir.williams-sonomainc.com/governance. Copies of our Corporate Governance Guidelines and our Code of Business Conduct and Ethics are also available upon written request and without charge to any stockholder by writing to: Williams-Sonoma, Inc., Attention: Corporate Secretary, 3250 Van Ness Avenue, San Francisco, California 94109. To date, there have been no waivers that apply to our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, or persons performing similar functions under our Code of Business Conduct and Ethics. We intend to disclose any amendment to, or waivers of, the provisions of our Code of Business Conduct and Ethics that affect our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, or persons performing similar functions by posting such information on our website at ir.williams-sonomainc.com/governance.

Communicating with Members of the Board

Stockholders and all other interested parties may send written communications to the Board or to any of our directors individually, including non-management directors and the of the Board, at the following address: Williams-Sonoma, Inc., Attention: Corporate Secretary, 3250 Van Ness Avenue, San Francisco, California 94109. All communications will be compiled by our Corporate Secretary and submitted to the Board or an individual director, as appropriate, on a periodic basis.

PROPOSAL 1