| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| (Address of principal executive offices) | (Zip Code) | |

| Title of each class: |

Trading Symbol(s): |

Name of each exchange on which registered: | ||

PAGE |

||||||

PART I |

||||||

| Item 1. | 3 | |||||

| Item 1A. | 8 | |||||

| Item 1B. | 29 | |||||

| Item 2. | 29 | |||||

| Item 3. | 30 | |||||

| Item 4. | 30 | |||||

PART II |

||||||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 31 | ||||

| Item 6. | 33 | |||||

| Item 7. | 34 | |||||

| Item 7A. | 45 | |||||

| Item 8. | 46 | |||||

| Item 9. | 72 | |||||

| Item 9A. | 72 | |||||

| Item 9B. | 73 | |||||

PART III |

||||||

| Item 10. | 74 | |||||

| Item 11. | 74 | |||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 74 | ||||

| Item 13. | 74 | |||||

| Item 14. | 74 | |||||

PART IV |

||||||

| Item 15. | 75 | |||||

| Item 16. | 81 | |||||

ITEM 1. |

BUSINESS |

| • | Incident and hazard reporting; |

| • | Standard operating procedures aimed at reducing risk of injury; |

| • | Associate and management training; |

| • | Promotion of best practices; and |

| • | Measurement of key safety metrics. |

| • | Temporarily closing our stores and corporate offices, and implementing temporary work-from-home-policies; |

| • | Establishing strict safety protocols and procedures company-wide, including social distancing measures, enhanced sanitization, daily wellness checks and supplying personal protective gear such as masks and gloves; |

| • | Developing and distributing a playbook to guide the safe return to offices, stores, and work sites; and |

| • | Creating and refining protocols to address actual and suspected COVID-19 cases and potential exposure of our team members, customers, and trade partners. |

| • | Increased company minimum wage to $14 per hour; |

| • | Provided special bonuses to all frontline workers; |

| • | Approved special bonuses to high-performing non-executive associates to reward extraordinary efforts in COVID-19 environment; |

| • | Created a dedicated associate hotline to provide real time support for any COVID-19-related issues; |

| • | Reinforced social distancing through signage, floor markers, taped grid patterns on floors, and directional arrows; |

| • | Continued telehealth support and employee assistance programs; and |

| • | Provided special wellness resources and tools. |

ITEM 1A. |

RISK FACTORS |

| • | Our business has been and may continue to be materially impacted by the COVID-19 pandemic, and the duration and extent to which this will impact our future financial performance remains uncertain. |

| • | Declines in general economic conditions, and the resulting impact on consumer confidence and consumer spending, could adversely impact our results of operations. |

| • | We are unable to control many of the factors affecting consumer spending, and declines in consumer spending on home furnishings and kitchen products in general could reduce demand for our products. |

| • | If we are unable to identify and analyze factors affecting our business, anticipate changing consumer preferences and buying trends, and manage our inventory commensurate with customer demand, our sales levels and operating results may decline. |

| • | Our business and operating results may be harmed if we are unable to timely and effectively deliver merchandise to our stores and customers. |

| • | Our failure to successfully manage our order-taking and fulfillment operations could have a negative impact on our business and operating results |

| • | We must protect and maintain our brand image and reputation. |

| • | Our sales may be negatively impacted by increasing competition from companies with brands or products similar to ours. |

| • | Our facilities and systems, as well as those of our vendors, are vulnerable to natural disasters, adverse weather conditions, technology issues and other unexpected events, any of which could result in an interruption in our business and harm our operating results. |

| • | If we are unable to effectively manage our e-commerce business and digital marketing efforts, our reputation and operating results may be harmed. |

| • | Declines in our comparable brand revenues may harm our operating results and cause a decline in the market price of our common stock. |

| • | Our failure to successfully anticipate merchandise returns might have a negative impact on our business. |

| • | Our failure to successfully manage the costs and performance of our catalog mailings might have a negative impact on our business. |

| • | If we are unable to successfully manage the complexities associated with an omni-channel and multi-brand business, we may suffer declines in our existing business and our ability to attract new business. |

| • | A number of factors that affect our ability to successfully open new stores or close existing stores are beyond our control, and these factors may harm our ability to expand or contract our retail operations and harm our ability to increase our sales and profits. |

| • | Our inability or failure to protect our intellectual property would have a negative impact on our brands, reputation and operating results. |

| • | We outsource certain aspects of our business to third-party vendors and are in the process of insourcing certain business functions from third-party vendors, both of which subject us to risks. |

| • | If we fail to attract and retain key personnel, our business and operating results may be harmed. |

| • | If we are unable to introduce new brands and brand extensions successfully, or to reposition or close existing brands, our business and operating results may be negatively impacted. |

| • | We may be subject to legal proceedings that could result in costly litigation, require significant amounts of management time and result in the diversion of significant operational resources. |

| • | We may be exposed to cybersecurity risks and costs associated with credit card fraud, identity theft and business interruption that could cause us to incur unexpected expenses and loss of revenue. |

| • | We receive, process, store, use and share data, some of which contains personal information, which subjects us to complex and evolving governmental regulation and other legal obligations related to data privacy, data protection and other matters. |

| • | We are undertaking certain systems changes that might disrupt our business operations. |

| • | Our dependence on foreign vendors and our increased global operations subject us to a variety of risks and uncertainties that could impact our operations and financial results. |

| • | We depend on foreign vendors and third-party agents for timely and effective sourcing of our merchandise, and we may not be able to acquire products in sufficient quantities and at acceptable prices to meet our needs. |

| • | If our vendors fail to adhere to our quality control standards and test protocols, we may delay a product launch or recall a product, which could damage our reputation and negatively affect our operations and financial results. |

| • | Our efforts to expand globally may not be successful and could negatively impact the value of our brands. |

| • | We have limited experience operating on a global basis and our failure to effectively manage the risks and challenges inherent in a global business could adversely affect our business, operating results and financial condition and growth prospects. |

| • | Any significant changes in tax, trade or other policies in the U.S. or other countries, including policies that restrict imports or increase import tariffs, could have a material adverse effect on our results of operations. |

| • | Tariffs could result in increased prices and/or costs of goods or delays in product received from our vendors and could adversely affect our results of operations. |

| • | Fluctuations in our tax obligations and effective tax rate may result in volatility of our operating results. |

| • | We may require funding from external sources, which may not be available at the levels we require, or may cost more than we expect. |

| • | Our operating results may be harmed by unsuccessful management of our employment, occupancy and other operating costs, and the operation and growth of our business may be harmed if we are unable to attract qualified personnel. |

| • | Our inability to obtain commercial insurance at acceptable rates or our failure to adequately reserve for self-insured exposures might increase our expenses and have a negative impact on our business. |

| • | If our operating and financial performance in any given period does not meet the guidance that we have provided to the public or the expectations of our investors and analysts, our stock price may decline. |

| • | A variety of factors, including seasonality and the economic environment, may cause our quarterly operating results to fluctuate, leading to volatility in our stock price. |

| • | Disruptions in the financial markets may adversely affect our liquidity and capital resources and our business. |

| • | Changes in the method of determining the London Interbank Offered Rate, or LIBOR, or the replacement of LIBOR with an alternative reference rate, may adversely affect our financial condition and results of operations. |

| • | If we are unable to pay quarterly dividends or repurchase our stock at intended levels, our reputation and stock price may be harmed. |

| • | If we fail to maintain proper and effective internal controls, our ability to produce accurate and timely financial statements could be impaired and our investors’ views of us could be harmed. |

| • | Changes to accounting rules or regulations may adversely affect our operating results. |

| • | In preparing our financial statements we make certain assumptions, judgments and estimates that affect the amounts reported, which, if not accurate, may impact our financial results. |

| • | Changes to estimates related to our cash flow projections may cause us to incur impairment charges related to our long-lived assets for our retail store locations and other property and equipment, including information technology systems, as well as goodwill. |

| • | anticipating and quickly responding to changing consumer demands or preferences better than our competitors; |

| • | maintaining favorable brand recognition and achieving customer perception of value; |

| • | effectively marketing and competitively pricing our products to consumers in several diverse market segments; |

| • | effectively managing and controlling our costs; |

| • | effectively managing increasingly competitive promotional activity; |

| • | effectively attracting new customers; |

| • | developing new innovative shopping experiences, like mobile and tablet applications that effectively engage today’s digital customers; |

| • | developing innovative, high-quality products in colors and styles that appeal to consumers of varying age groups, tastes and regions, and in ways that favorably distinguish us from our competitors; and |

| • | effectively managing our supply chain and distribution strategies in order to provide our products to our consumers on a timely basis and minimize returns, replacements and damaged products. |

| • | general economic conditions; |

| • | our identification of, and the availability of, suitable store locations; |

| • | our success in negotiating new leases and amending, subleasing or terminating existing leases on acceptable terms; |

| • | the success of other retail stores in and around our retail locations; |

| • | our ability to secure required governmental permits and approvals; |

| • | our hiring and training of skilled store operating personnel, especially management; |

| • | the availability of financing on acceptable terms, if at all; and |

| • | the financial stability of our landlords and potential landlords. |

| • | increased management, infrastructure and legal compliance costs, including the cost of real estate and labor in those markets; |

| • | increased financial accounting and reporting requirements and complexities; |

| • | increased operational and tax complexities, including managing our inventory globally; |

| • | the diversion of management attention away from our core business; |

| • | general economic conditions, changes in diplomatic and trade relationships, including the imposition of new or increased tariffs, political and social instability, war and acts of terrorism, outbreaks of diseases (such as the COVID-19 pandemic) and natural disasters in each country or region; |

| • | economic uncertainty around the world; |

| • | compliance with foreign laws and regulations and the risks and costs of non-compliance with such laws and regulations; |

| • | compliance with U.S. laws and regulations for foreign operations; |

| • | dependence on certain third parties, including vendors and other service providers, with whom we do not have extensive experience; |

| • | fluctuations in foreign currency exchange rates and the related effect on our financial results, and the use of foreign exchange hedging programs to mitigate such risks; |

| • | growing cash balances in foreign jurisdictions which may be subject to repatriation restrictions; |

| • | reduced or varied protection for intellectual property rights in some countries and practical difficulties of enforcing such rights abroad; and |

| • | compliance with the laws of foreign taxing jurisdictions and the overlapping of different tax regimes. |

ITEM 1B. |

UNRESOLVED STAFF COMMENTS |

| Location | Occupied Square Footage (Approximate) | |||

| Distribution and Manufacturing Facilities |

||||

| Mississippi |

2,258,000 | |||

| New Jersey |

2,103,000 | |||

| California |

2,030,000 | |||

| Texas |

1,298,000 | |||

| Georgia |

1,075,000 | |||

| Tennessee |

603,000 | |||

| North Carolina |

442,000 | |||

| Ohio |

153,000 | |||

| Massachusetts |

140,000 | |||

| Florida |

135,000 | |||

| Oregon |

91,000 | |||

| Colorado |

80,000 | |||

| Corporate Facilities |

||||

| California |

269,000 | |||

| New York |

238,000 | |||

| Oregon |

49,000 | |||

| Customer Care Centers |

||||

| Nevada |

36,000 | |||

| Other |

32,000 | |||

ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

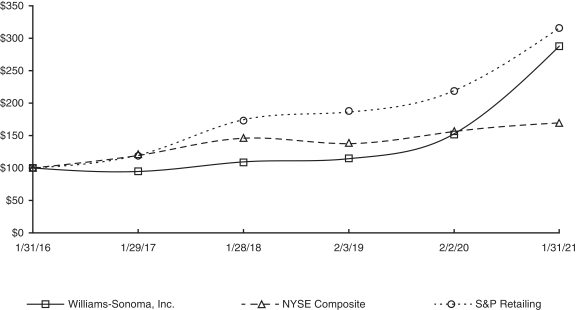

| * | $100 invested on 1/31/16 in stock or index, including reinvestment of dividends. Fiscal year ending January 31, 2021. |

1/31/16 |

1/29/17 |

1/28/18 |

2/3/19 |

2/2/20 |

1/31/21 | |||||||

| Williams-Sonoma, Inc. |

$100.00 | $94.58 | $109.64 | $114.38 | $152.80 | $287.90 | ||||||

| NYSE Composite Index |

$100.00 | $119.63 | $146.03 | $137.82 | $156.52 | $169.59 | ||||||

| S&P Retailing |

$100.00 | $120.09 | $174.49 | $186.29 | $219.46 | $316.05 |

| A. | The lines represent monthly index levels derived from compounded daily returns that include all dividends. |

| B. | The indices are re-weighted daily, using the market capitalization on the previous trading day. |

| C. | If the monthly interval, based on the fiscal year-end, is not a trading day, the preceding trading day is used. |

| Fiscal period | |

Total Number of Shares Purchased 1 |

|

Average Price Paid Per Share |

|

Total Number of Shares Purchased as Part of a Publicly Announced Program 1 |

|

Maximum Dollar Value of Shares That May Yet Be Purchased Under the Program |

||||||||||

| November 2, 2020 – November 29, 2020 |

125,310 | $ 98.91 | 125,310 | $ 453,539,000 | ||||||||||||||

| November 30, 2020 – December 27, 2020 |

116,800 | $ 108.75 | 116,800 | $ 440,837,000 | ||||||||||||||

| December 28, 2020 – January 31, 2021 |

134,655 | $ 117.75 | 134,655 | $ 424,982,000 | ||||||||||||||

| Total |

376,765 | $ 108.69 | 376,765 | $ 424,982,000 | ||||||||||||||

1 |

Excludes shares withheld for employee taxes upon vesting of stock-based awards. |

ITEM 6. |

SELECTED FINANCIAL DATA |

In thousands, except percentages, per share amounts and retail stores data |

Fiscal 2020 (52 Weeks) |

Fiscal 2019 (52 Weeks) |

Fiscal 2018 1 (53 Weeks) |

Fiscal 2017 (52 Weeks) |

Fiscal 2016 (52 Weeks) |

|||||||||||||||

| Results of Operations |

||||||||||||||||||||

| Net revenues |

$ | 6,783,189 | $ | 5,898,008 | $ | 5,671,593 | $ | 5,292,359 | $ | 5,083,812 | ||||||||||

| Net revenue growth |

15.0% | 4.0% | 7.2% | 4.1% | 2.2% | |||||||||||||||

| Comparable brand revenue growth 2 |

17.0% | 6.0% | 3.7% | 3.2% | 0.7% | |||||||||||||||

| Gross profit |

$ | 2,636,269 | $ | 2,139,092 | $ | 2,101,013 | $ | 1,931,711 | $ | 1,883,310 | ||||||||||

| Gross margin |

38.9% | 36.3% | 37.0% | 36.5% | 37.0% | |||||||||||||||

| Operating income |

$ | 910,697 | $ | 465,874 | $ | 435,953 | $ | 453,811 | $ | 472,599 | ||||||||||

| Operating margin 3 |

13.4% | 7.9% | 7.7% | 8.6% | 9.3% | |||||||||||||||

| Net earnings |

$ | 680,714 | $ | 356,062 | $ | 333,684 | $ | 259,545 | $ | 305,387 | ||||||||||

| Basic earnings per share |

$ | 8.81 | $ | 4.56 | $ | 4.10 | $ | 3.03 | $ | 3.45 | ||||||||||

| Diluted earnings per share |

$ | 8.61 | $ | 4.49 | $ | 4.05 | $ | 3.02 | $ | 3.41 | ||||||||||

| Shares used in calculation of earnings per share: Basic |

77,260 | 78,108 | 81,420 | 85,592 | 88,594 | |||||||||||||||

| Diluted |

79,055 | 79,225 | 82,340 | 86,080 | 89,462 | |||||||||||||||

| Financial Position |

||||||||||||||||||||

| Working capital 4 |

$ | 619,080 | $ | 146,080 | $ | 619,531 | $ | 628,622 | $ | 405,924 | ||||||||||

| Total assets 4 |

$ | 4,661,424 | $ | 4,054,042 | $ | 2,812,844 | $ | 2,785,749 | $ | 2,476,879 | ||||||||||

| Return on assets 4 |

15.6% | 10.4% | 11.9% | 9.9% | 12.5% | |||||||||||||||

| Net cash provided by operating activities |

$ | 1,274,848 | $ | 607,294 | $ | 585,986 | $ | 499,704 | $ | 524,709 | ||||||||||

| Capital expenditures |

$ | 169,513 | $ | 186,276 | $ | 190,102 | $ | 189,712 | $ | 197,414 | ||||||||||

| Long-term debt and other long-term liabilities 4 |

$ | 1,141,627 | $ | 1,180,968 | $ | 380,944 | $ | 372,226 | $ | 71,215 | ||||||||||

| Stockholders’ equity |

$ | 1,651,185 | $ | 1,235,860 | $ | 1,155,714 | $ | 1,203,566 | $ | 1,248,220 | ||||||||||

| Stockholders’ equity per share (book value) |

$ | 21.63 | $ | 16.02 | $ | 14.66 | $ | 14.37 | $ | 14.29 | ||||||||||

| Return on equity |

47.2% | 29.8% | 28.3% | 21.2% | 25.0% | |||||||||||||||

| Annual dividends declared per share |

$ | 2.02 | $ | 1.92 | $ | 1.72 | $ | 1.56 | $ | 1.48 | ||||||||||

| Number of stores at year-end |

581 | 614 | 625 | 631 | 629 | |||||||||||||||

| Store selling square footage at year-end |

3,975,000 | 4,129,000 | 4,105,000 | 4,019,000 | 3,951,000 | |||||||||||||||

| Store leased square footage at year-end |

6,301,000 | 6,558,000 | 6,557,000 | 6,451,000 | 6,359,000 | |||||||||||||||

1 |

In fiscal 2018, we adopted Accounting Standards Update (“ASU”) 2014-09, Revenue from Contracts with Customers, using the modified retrospective method. Amounts reported for fiscal 2017 and fiscal 2016 have not been adjusted, and continue to be reported in accordance with previous revenue recognition guidance. |

2 |

Comparable brand revenue is calculated on a 52-week to 52-week basis, with the exception of fiscal 2018 which is calculated on a 53-week to 53-week basis. See definition of comparable brand revenue within “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” |

3 |

Operating margin is defined as operating income as a percent of net revenues. |

4 |

In fiscal 2019, we adopted ASU 2016-02, Leases, as of the adoption date. Amounts reported for fiscal 2018 and prior years have not been adjusted, and continue to be reported in accordance with previous lease accounting guidance. See Note A to the Consolidated Financial Statements. |

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

In thousands |

Fiscal 2020 | Fiscal 2019 | ||||||

| Pottery Barn |

$ | 2,526,241 | $ | 2,214,397 | ||||

| West Elm |

1,682,254 | 1,466,537 | ||||||

| Williams Sonoma |

1,242,271 | 1,032,368 | ||||||

| Pottery Barn Kids and Teen |

1,042,531 | 908,561 | ||||||

| Other 1 |

289,892 | 276,145 | ||||||

| Total |

$ | 6,783,189 | $ | 5,898,008 | ||||

1 |

Primarily consists of net revenues from our international franchise operations, Rejuvenation and Mark and Graham. |

Comparable brand revenue growth |

Fiscal 2020 | Fiscal 2019 | ||||||

| Pottery Barn |

15.2 | % | 4.1 | % | ||||

| West Elm |

15.2 | 14.4 | ||||||

| Williams Sonoma |

23.8 | 0.4 | ||||||

| Pottery Barn Kids and Teen |

16.6 | 4.5 | ||||||

| Total 1 |

17.0 | % | 6.0 | % | ||||

1 |

Total comparable brand revenue growth includes the results of Rejuvenation and Mark and Graham. |

| Fiscal 2020 | 1 |

Fiscal 2019 | ||||||

| Store count – beginning of year |

614 | 625 | ||||||

| Store openings |

10 | 14 | ||||||

| Store closings |

(43 | ) | (25 | ) | ||||

| Store count – end of year |

581 | 614 | ||||||

| Store selling square footage at year-end |

3,975,000 | 4,129,000 | ||||||

| Store leased square footage (“LSF”) at year-end |

6,301,000 | 6,558,000 |

1 |

Store count at the end of the year for fiscal 2020 includes stores temporarily closed due to COVID-19. Store count data excludes temporary closures and re-openings of our stores due to COVID-19. |

| Fiscal 2020 | Fiscal 2019 | |||||||||||||||

| Store Count |

Avg. LSF Per Store |

Store Count |

Avg. LSF Per Store |

|||||||||||||

| Williams Sonoma |

198 | 6,800 | 211 | 6,900 | ||||||||||||

| Pottery Barn |

195 | 14,600 | 201 | 14,400 | ||||||||||||

| West Elm |

121 | 13,100 | 118 | 13,100 | ||||||||||||

| Pottery Barn Kids |

57 | 7,800 | 74 | 7,700 | ||||||||||||

| Rejuvenation |

10 | 8,500 | 10 | 8,500 | ||||||||||||

| Total |

581 | 10,800 | 614 | 10,700 | ||||||||||||

In thousands |

Fiscal 2020 | % Net Revenues |

Fiscal 2019 | % Net Revenues |

||||||||||||

| Cost of goods sold 1 |

$ | 4,146,920 | 61.1% | $ | 3,758,916 | 63.7% | ||||||||||

1 |

Includes occupancy expenses of $696.3 million and $710.5 million fiscal 2020 and fiscal 2019, respectively. |

In thousands |

Fiscal 2020 | % Net Revenues |

Fiscal 2019 | % Net Revenues |

||||||||||||

| Selling, general and administrative expenses |

$ | 1,725,572 | 25.4% | $ | 1,673,218 | 28.4% | ||||||||||

| Payments Due by Period 1 |

||||||||||||||||||||

In thousands |

Fiscal 2021 | Fiscal 2022 to Fiscal 2024 |

Fiscal 2025 to Fiscal 2026 |

Thereafter | Total | |||||||||||||||

| Current debt 2 |

$ | 300,000 | $ | — | $ | — | $ | — | $ | 300,000 | ||||||||||

| Interest |

542 | — | — | — | 542 | |||||||||||||||

| Operating leases 3 |

267,760 | 605,121 | 263,192 | 291,356 | 1,427,429 | |||||||||||||||

| Purchase obligations 4 |

1,350,121 | 22,456 | — | — | 1,372,577 | |||||||||||||||

| Total |

$ | 1,918,423 | $ | 627,577 | $ | 263,192 | $ | 291,356 | $ | 3,100,548 | ||||||||||

1 |

This table excludes $46.9 million of liabilities for unrecognized tax benefits associated with uncertain tax positions as we are not able to reasonably estimate when and if cash payments for these liabilities will occur. This amount, however, has been recorded as a liability in our accompanying Consolidated Balance Sheet as of January 31, 2021. |

2 |

Current debt consists of term loan borrowings under our credit facility, all of which was repaid in full, prior to maturity, in February 2021. See Note C to our Consolidated Financial Statements for discussion of our borrowing arrangements. |

3 |

Projected undiscounted payments include only those amounts that are fixed and determinable as of the reporting date. See Note E to our Consolidated Financial Statements for discussion of our operating leases. |

4 |

Represents estimated commitments at year-end to purchase inventory and other goods and services in the normal course of business to meet operational requirements. |

| Amount of Outstanding Commitment Expiration by Period 1 |

||||||||||||||||||||

In thousands |

Fiscal 2021 | Fiscal 2022 to Fiscal 2024 |

Fiscal 2025 to Fiscal 2026 |

Thereafter | Total | |||||||||||||||

| Standby letters of credit |

$ | 12,609 | $ | — | $ | — | $ | — | $ | 12,609 | ||||||||||

| Letter of credit facilities |

3,843 | — | — | — | 3,843 | |||||||||||||||

| Total |

$ | 16,452 | $ | — | $ | — | $ | — | $ | 16,452 | ||||||||||

1 |

See Note C to our Consolidated Financial Statements for discussion of our borrowing arrangements. |

ITEM 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

ITEM 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

In thousands, except per share amounts |

Fiscal 2020 (52 weeks) |

|

Fiscal 2019 (52 weeks) |

|

Fiscal 2018 (53 weeks) |

| ||||||

| Net revenues |

$ |

$ |

$ |

|||||||||

| Cost of goods sold |

||||||||||||

| Gross profit |

||||||||||||

| Selling, general and administrative expenses |

||||||||||||

| Operating income |

||||||||||||

| Interest expense, net |

||||||||||||

| Earnings before income taxes |

||||||||||||

| Income taxes |

||||||||||||

| Net earnings |

$ |

$ |

$ |

|||||||||

| Basic earnings per share |

$ |

$ |

$ |

|||||||||

| Diluted earnings per share |

$ |

$ |

$ |

|||||||||

| Shares used in calculation of earnings per share: |

||||||||||||

| Basic |

||||||||||||

| Diluted |

||||||||||||

In thousands |

Fiscal 2020 (52 weeks) |

|

Fiscal 2019 (52 weeks) |

|

Fiscal 2018 (53 weeks) |

| ||||||

| Net earnings |

$ |

$ |

$ |

|||||||||

| Other comprehensive income (loss): |

||||||||||||

| Foreign currency translation adjustments |

( |

) | ( |

) | ||||||||

| Change in fair value of derivative financial instruments, net of tax (tax benefit) of $( |

( |

) | ||||||||||

| Reclassification adjustment for realized (gain) loss on derivative financial instruments, net of tax (tax benefit) of $ and $ |

( |

) | ( |

) | ( |

) | ||||||

| Comprehensive income |

$ |

$ |

$ |

|||||||||

In thousands, except per share amounts |

Jan. 31, 2021 | Feb. 2, 2020 | ||||||

ASSETS |

||||||||

Current assets |

||||||||

Cash and cash equivalents |

$ | |

$ | |||||

Accounts receivable, net |

||||||||

Merchandise inventories, net |

||||||||

Prepaid expenses |

||||||||

Other current assets |

||||||||

Total current assets |

||||||||

Property and equipment, net |

||||||||

Operating lease right-of-use |

||||||||

Deferred income taxes, net |

||||||||

Goodwill |

||||||||

Other long-term assets, net |

||||||||

Total assets |

$ | $ | ||||||

LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||

Current liabilities |

||||||||

Accounts payable |

$ | $ | ||||||

Accrued expenses |

||||||||

Gift card and other deferred revenue |

||||||||

Income taxes payable |

||||||||

Current debt |

||||||||

Operating lease liabilities |

||||||||

Other current liabilities |

||||||||

Total current liabilities |

||||||||

Deferred lease incentives |

||||||||

Long-term operating lease liabilities |

||||||||

Other long-term liabilities |

||||||||

Total liabilities |

||||||||

Commitments and contingencies – See Note I |

||||||||

Stockholders’ equity |

||||||||

Preferred stock: $ par value; |

— | |||||||

Common stock: $ par value; |

||||||||

Additional paid-in capital |

||||||||

Retained earnings |

||||||||

Accumulated other comprehensive loss |

( |

) | ( |

) | ||||

Treasury stock, at cost: |

( |

) | ( |

) | ||||

Total stockholders’ equity |

||||||||

| Total liabilities and stockholders’ equity | $ | $ | ||||||

| Common Stock |

Additional Paid-in Capital |

Retained Earnings |

Accumulated Other Comprehensive Income (Loss) |

Treasury Stock |

Total Stockholders’ Equity |

|||||||||||||||||||||||

In thousands |

Shares |

Amount |

||||||||||||||||||||||||||

| Balance at January 28, 2018 |

$ |

$ |

$ |

$ |

( |

$ |

( |

) |

$ |

|||||||||||||||||||

| Net earnings |

— |

— |

— |

— |

— |

|||||||||||||||||||||||

| Foreign currency translation adjustments |

— |

— |

— |

— |

( |

) |

— |

( |

) | |||||||||||||||||||

| Change in fair value of derivative financial instruments, net of tax |

— |

— |

— |

— |

— |

|||||||||||||||||||||||

| Reclassification adjustment for realized (gain) loss on derivative financial instruments, net of tax |

— |

— |

— |

— |

( |

) |

— |

( |

) | |||||||||||||||||||

| Conversion/release of stock-based awards 1 |

( |

) |

— |

— |

( |

) |

( |

) | ||||||||||||||||||||

| Repurchases of common stock |

( |

) |

( |

) |

( |

) |

( |

) |

— |

— |

( |

) | ||||||||||||||||

| Reissuance of treasury stock under stock-based compensation plans 1 |

— |

— |

( |

) |

( |

) |

— |

— |

||||||||||||||||||||

| Stock-based compensation expense |

— |

— |

— |

— |

— |

|||||||||||||||||||||||

| Dividends declared |

— |

— |

— |

( |

) |

— |

— |

( |

) | |||||||||||||||||||

| Adoption of accounting pronouncements 2 |

— |

— |

— |

— |

— |

|||||||||||||||||||||||

| Balance at February 3, 2019 |

( |

) |

( |

) |

||||||||||||||||||||||||

| Net earnings |

— |

— |

— |

— |

— |

|||||||||||||||||||||||

| Foreign currency translation adjustments |

— |

— |

— |

— |

( |

) |

— |

( |

) | |||||||||||||||||||

| Change in fair value of derivative financial instruments, net of tax |

— |

— |

— |

— |

— |

|||||||||||||||||||||||

| Reclassification adjustment for realized (gain) loss on derivative financial instruments, net of tax |

— |

— |

— |

— |

( |

) |

— |

( |

) | |||||||||||||||||||

| Conversion/release of stock-based awards 1 |

( |

) |

— |

— |

( |

) |

( |

) | ||||||||||||||||||||

| Repurchases of common stock |

( |

) |

( |

) |

( |

) |

( |

) |

— |

( |

) |

( |

) | |||||||||||||||

| Reissuance of treasury stock under stock-based compensation plans 1 |

— |

— |

( |

) |

— |

— |

— |

|||||||||||||||||||||

| Stock-based compensation expense |

— |

— |

— |

— |

— |

|||||||||||||||||||||||

| Dividends declared |

— |

— |

— |

( |

) |

— |

— |

( |

) | |||||||||||||||||||

| Adoption of accounting pronouncements 3 |

— |

— |

— |

( |

) |

— |

— |

( |

) | |||||||||||||||||||

| Balance at February 2, 2020 |

( |

) |

( |

) |

||||||||||||||||||||||||

| Net earnings |

— |

— |

— |

— |

— |

|||||||||||||||||||||||

| Foreign currency translation adjustments |

— |

— |

— |

— |

— |

|||||||||||||||||||||||

| Change in fair value of derivative financial instruments, net of tax |

— |

— |

— |

— |

( |

) |

— |

( |

) | |||||||||||||||||||

| Reclassification adjustment for realized (gain) loss on derivative financial instruments, net of tax |

— |

— |

— |

— |

( |

) |

— |

( |

) | |||||||||||||||||||

| Conversion/release of stock-based awards 1 |

( |

) |

— |

— |

( |

) |

( |

) | ||||||||||||||||||||

| Repurchases of common stock |

( |

) |

( |

) |

( |

) |

( |

) |

— |

— |

( |

) | ||||||||||||||||

| Reissuance of treasury stock under stock-based compensation plans 1 |

— |

— |

( |

) |

( |

) |

— |

— |

||||||||||||||||||||

| Stock-based compensation expense |

— |

— |

— |

— |

— |

|||||||||||||||||||||||

| Dividends declared |

— |

— |

— |

( |

) |

— |

— |

( |

) | |||||||||||||||||||

| Balance at January 31, 2021 |

$ |

$ |

$ |

$ |

( |

) |

$ |

( |

) |

$ |

||||||||||||||||||

1 |

Amounts are shown net of shares withheld for employee taxes. |

2 |

Primarily relates to our adoption of ASU 2014-09, Revenue from Contracts with Customers, in fiscal 2018. |

3 |

Relates to our adoption of ASU 2016-02, Leases, in fiscal 2019. |

In thousands |

Fiscal 2020 (52 Weeks) |

Fiscal 2019 (52 Weeks) |

Fiscal 2018 (53 Weeks) |

|||||||||

| Cash flows from operating activities: |

||||||||||||

| Net earnings |

$ | $ | $ | |||||||||

| Adjustments to reconcile net earnings to net cash provided by (used in) operating activities: |

||||||||||||

| Depreciation and amortization |

||||||||||||

| Loss on disposal/impairment of assets |

||||||||||||

| Amortization of deferred lease incentives |

( |

) | ( |

) | ( |

) | ||||||

| Non-cash lease expense |

— | |||||||||||

| Deferred income taxes |

( |

) | ( |

) | ||||||||

| Stock-based compensation expense |

||||||||||||

| Other |

( |

) | ( |

) | ( |

) | ||||||

| Changes in: |

||||||||||||

| Accounts receivable |

( |

) | ( |

) | ( |

) | ||||||

| Merchandise inventories |

( |

) | ||||||||||

| Prepaid expenses and other assets |

( |

) | ( |

) | ( |

) | ||||||

| Accounts payable |

( |

) | ||||||||||

| Accrued expenses and other liabilities |

||||||||||||

| Gift card and other deferred revenue |

( |

) | ||||||||||

| Deferred rent and lease incentives |

||||||||||||

| Operating lease liabilities |

( |

) | ( |

) | — | |||||||

| Income taxes payable |

( |

) | ||||||||||

| Net cash provided by operating activities |

||||||||||||

| Cash flows from investing activities: |

||||||||||||

| Purchases of property and equipment |

( |

) | ( |

) | ( |

) | ||||||

| Other |

||||||||||||

| Net cash used in investing activities |

( |

) | ( |

) | ( |

) | ||||||

| Cash flows from financing activities: |

||||||||||||

| Borrowings under revolving line of credit |

||||||||||||

| Repayments of borrowings under revolving line of credit |

( |

) | ( |

) | ( |

) | ||||||

| Payment of dividends |

( |

) | ( |

) | ( |

) | ||||||

| Repurchases of common stock |

( |

) | ( |

) | ( |

) | ||||||

| Tax withholdings related to stock-based awards |

( |

) | ( |

) | ( |

) | ||||||

| Debt issuance costs |

( |

) | — | |||||||||

| Net cash used in financing activities |

( |

) | ( |

) | ( |

) | ||||||

| Effect of exchange rates on cash and cash equivalents |

( |

) | ||||||||||

| Net increase (decrease) in cash and cash equivalents |

( |

) | ||||||||||

| Cash and cash equivalents at beginning of year |

||||||||||||

| Cash and cash equivalents at end of year |

$ | $ | $ | |||||||||

| Supplemental disclosure of cash flow information: |

||||||||||||

| Cash paid during the year for interest |

$ | $ | $ | |||||||||

| Cash paid during the year for income taxes, net of refunds |

$ | $ | $ | |||||||||

| Non-cash investing activities: |

||||||||||||

| Purchases of property and equipment not yet paid for at end of year |

$ | $ | $ | |||||||||

| Leasehold improvements |

Shorter of estimated useful life or lease term (generally | |

| Fixtures and equipment |

||

| Buildings and building improvements |

||

| Capitalized software |

In thousands |

Jan. 31, 2021 | Feb. 2, 2020 | ||||||

Leasehold improvements |

$ | $ | ||||||

Capitalized software |

||||||||

Fixtures and equipment |

||||||||

Land and buildings |

||||||||

Corporate systems projects in progress |

||||||||

Construction in progress 1 |

||||||||

Total |

||||||||

Accumulated depreciation |

( |

) | ( |

) | ||||

Property and equipment, net |

$ | $ | ||||||

1 |

Construction in progress primarily consists of leasehold improvements and furniture and fixtures related to new, expanded or remodeled retail stores where construction had not been completed as of year-end. |

In thousands |

Fiscal 2020 (52 weeks) |

Fiscal 2019 (52 weeks) |

Fiscal 2018 (53 weeks) |

||||||||||

| United States |

$ | |

$ | |

$ | |

|||||||

| Foreign |

|||||||||||||

| Total |

$ | $ | $ | ||||||||||

| In thousands |

Fiscal 2020 (52 weeks) |

Fiscal 2019 (52 weeks) |

Fiscal (53 |

|||||||||

| Current |

||||||||||||

| Federal |

$ | |

$ | |

$ | |

||||||

| State |

||||||||||||

| Foreign |

||||||||||||

| Total Current |

$ | |

$ | $ | |

|||||||

| Deferred |

||||||||||||

| Federal |

$ | ( |

) | $ | ( |

) | $ | |||||

| State |

( |

) | ( |

) | ||||||||

| Foreign |

( |

) | ( |

) | ||||||||

| Total Deferred |

$ | ( |

) | $ | ( |

) | $ | |||||

| Total provision |

$ | $ | $ | |||||||||

| Fiscal 2020 (52 weeks) |

Fiscal 2019 (52 weeks) |

Fiscal 2018 (53 weeks) |

||||||||||||

| Federal income taxes at the statutory rate |

|

|

|

|||||||||||

| Re-measurement of deferred tax assets and liabilities |

— | — | ( |

) | ||||||||||

| Transition tax |

— | — | ( |

) | ||||||||||

| State income tax rate |

||||||||||||||

| Officer’s compensation under Sec.162(m) |

— | |||||||||||||

| Change in uncertain tax positions |

||||||||||||||

| Deferred true u p |

|

|

( |

) |

|

|

|

( |

) |

|

|

— |

|

|

| Rate differential |

( |

) |

( |

) | ( |

) | ||||||||

| Research and development credits |

( |

) |

( |

) | ( |

) | ||||||||

| Other |

( |

) |

||||||||||||

| Total |

||||||||||||||

In thousands |

Jan. 31, |

Feb. 2, |

||||||

| Deferred tax asset (liabilities ) |

|

|

|

|

|

|

|

|

| Operating lease liabilities |

$ | $ | ||||||

| Compensatio n |

|

|

|

|

|

|

|

|

| Merchandise inventories |

||||||||

| Gift cards |

||||||||

| Accrued liabilities |

||||||||

| Stock-based compensation |

||||||||

| Loyalty rewards |

||||||||

| Executive deferred compensation |

||||||||

| State taxe s |

|

|

|

|

|

|

|

|

| Federal and state net operating loss |

||||||||

| Operating lease right-of-use |

( |

) | ( |

) | ||||

| Deferred lease incentives |

( |

) | ( |

) | ||||

| Property and equipment |

( |

) | ( |

) | ||||

| Other |

( |

) | ( |

) | ||||

| Valuation allowance |

( |

) | ( |

) | ||||

| Total deferred tax assets, net |

$ | $ | |

|||||

In thousands |

Fiscal 2020 | Fiscal 2019 | Fiscal 2018 | |||||||||

Beginning Balance |

$ | $ | $ | |||||||||

Increases related to current year tax positions |

||||||||||||

Increases for tax positions for prior years |

||||||||||||

Decrease for tax positions for prior years |

( |

) | ( |

) | ( |

) | ||||||

Settlements |

— | — | ( |

) | ||||||||

Lapse in statute of limitations |

( |

) | ( |

) | ( |

) | ||||||

Ending Balance |

$ | $ | $ | |||||||||

In thousands |

Fiscal 2020 | Fiscal 2019 | ||||||

Operating lease costs |

$ | $ | ||||||

Variable lease costs |

||||||||

Total lease costs |

$ | |

$ | |

||||

In thousands |

Fiscal 2020 | Fiscal 2019 | ||||||

Cash paid for amounts included in the measurement of operating lease liabilities |

$ | |

$ | |

||||

Net additions to right-of-use |

$ | $ | ||||||

| Fiscal 2020 | Fiscal 2019 | |||||||

Weighted average remaining lease term (years) |

||||||||

Weighted average incremental borrowing rate |

||||||||

In thousands |

||||

Fiscal 2021 |

$ | |||

Fiscal 2022 |

||||

Fiscal 2023 |

||||

Fiscal 2024 |

||||

Fiscal 2025 |

||||

Fiscal 2026 and thereafter |

||||

Total lease payments |

|

|||

Less: interest |

( |

) | ||

Total operating lease liabilities |

||||

Less: current operating lease liabilities |

( |

) | ||

Total non-current operating lease liabilities |

$ | |

||

In thousands, except per share amounts |

Net Earnings | Weighted Average Shares |

Earnings Per Share |

|||||||||

Fiscal 2020 (52 Weeks) |

||||||||||||

Basic |

$ | |

|

$ | |

|||||||

Effect of dilutive stock-based awards |

||||||||||||

Diluted |

$ | $ | ||||||||||

Fiscal 2019 (52 Weeks) |

||||||||||||

Basic |

$ | $ | ||||||||||

Effect of dilutive stock-based awards |

||||||||||||

Diluted |

$ | $ | ||||||||||

Fiscal 2018 (53 Weeks) |

||||||||||||

Basic |

$ | $ | ||||||||||

Effect of dilutive stock-based awards |

||||||||||||

Diluted |

$ | $ | ||||||||||

| Shares | Weighted Average Grant Date Fair Value |

Weighted Average Contractual Term Remaining (Years) |

Intrinsic Value 1 |

|||||||||||||

| Balance at February 2, 2020 |

$ | |

||||||||||||||

| Granted |

||||||||||||||||

| Granted, with vesting subject to performance conditions |

||||||||||||||||

| Released 2 |

( |

) | ||||||||||||||

| Cancelled |

( |

) | ||||||||||||||

| Balance at January 31, 2021 |

$ | $ | |

|||||||||||||

| Vested plus expected to vest at January 31, 2021 |

$ | $ | ||||||||||||||

1 |

Intrinsic value for outstanding and unvested restricted stock units is based on the market value of our common stock on the last business day of the fiscal year (or $ |

2 |

Excludes |

| Fiscal 2020 (52 weeks) |

Fiscal 2019 (52 weeks) |

Fiscal 2018 (53 weeks) |

||||||||||

| Weighted average grant date fair value per share of awards granted |

$ | $ | $ | |||||||||

| Intrinsic value of awards released 1 |

$ | |

$ | |

$ | |

||||||

1 |

Intrinsic value for releases is based on the market value on the date of release. |

In thousands |

Fiscal 2020 (52 weeks) |

Fiscal 2019 (52 weeks) |

Fiscal 2018 (53 weeks) |

|||||||||

| Pottery Barn |

$ | $ | $ | |||||||||

| West Elm |

||||||||||||

| Williams Sonoma |

||||||||||||

| Pottery Barn Kids and Teen |

||||||||||||

| Other1 |

||||||||||||

| Total2 |

$ | |

$ | |

$ | |

||||||

1 |

Primarily consists of net revenues from our international franchise operations, Rejuvenation and Mark and Graham. |

2 |

Includes net revenues related to our international operations (including our operations in Canada, Australia, the United Kingdom and our franchise businesses) of approximately $ |

In thousands |

Jan. 31, 2021 | Feb. 2, 2020 | ||||||

| U.S. |

$ | $ | ||||||

| International |

||||||||

| Total |

$ | |

$ | |

||||

In thousands |

Jan. 31, 2021 | Feb. 2, 2020 | ||||||

| Contracts designated as cash flow hedges |

$ | $ | ||||||

Fiscal 2020 |

Fiscal 2019 |

Fiscal 2018 |

||||||||||||||||||||||

In thousands |

Cost of goods sold |

Selling, general and administrative expenses |

Cost of goods sold |

Selling, general and administrative expenses |

Cost of goods sold |

Selling, general and administrative expenses |

||||||||||||||||||

| Line items presented in the Consolidated Statement s of Earnings in which the effects of derivatives are recorded |

$ | |

$ | |

$ | |

$ | |

$ | |

$ | |

||||||||||||

| Gain (loss) recognized in income |

||||||||||||||||||||||||

| Derivatives designated as cash flow hedges |

$ | $ |

— | $ | $ |

— | $ | $ | ||||||||||||||||

| Derivatives not designated as hedging instruments |

$ |

$ | $ |

— | $ | $ |

— | $ | ||||||||||||||||

In thousands |

Fiscal 2020 | Fiscal 2019 | ||||||

| Derivatives designated as cash flow hedges: |

||||||||

| Other current assets |

$ | |

$ | |

||||

| Other current liabilities |

$ | ( |

) | $ | — | |||

| • | Level 1: inputs which include quoted prices in active markets for identical assets or liabilities; |

| • | Level 2: inputs which include observable inputs other than Level 1 inputs, such as quoted prices in active markets for similar assets or liabilities; quoted prices for identical or similar assets or liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the asset or liability; and |

• |

Level 3: inputs which include unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the underlying asset or liability. |

In thousands |

Foreign Currency Translation |

Cash Flow Hedges |

Accumulated Other Comprehensive Income (Loss) |

|||||||||

| Balance at January 28, 2018 |

$ | ( |

) | $ | ( |

) | $ | ( |

) | |||

| Foreign currency translation adjustments |

( |

) | — | ( |

) | |||||||

| Change in fair value of derivative financial instruments |

— | |||||||||||

| Reclassification adjustment for realized (gain) loss on derivative financial instruments 1 |

— | ( |

) | ( |

) | |||||||

| Other comprehensive income (loss) |

( |

) | ( |

) | ||||||||

| Balance at February 3, 2019 |

( |

) | ( |

) | ||||||||

| Foreign currency translation adjustments |

( |

) | — | ( |

) | |||||||

| Change in fair value of derivative financial instruments |

— | |||||||||||

| Reclassification adjustment for realized (gain) loss on derivative financial instruments 1 |

— | ( |

) | ( |

) | |||||||

| Other comprehensive income (loss) |

( |

) | ( |

) | ( |

) | ||||||

| Balance at February 2, 2020 |

( |

) | |

( |

) | |||||||

| Foreign currency translation adjustments |

||||||||||||

| Change in fair value of derivative financial instruments |

( |

) | ( |

) | ||||||||

| Reclassification adjustment for realized (gain) loss on derivative financial instruments 1 |

( |

) | ( |

) | ||||||||

| Other comprehensive income (loss) |

( |

) | ||||||||||

| Balance at January 31, 2021 |

$ | ( |

) | $ | ( |

) | $ | ( |

) | |||

1 |

Refer to Note L for additional disclosures about reclassifications out of accumulated other comprehensive income and their corresponding effects on the respective line items in the Consolidated Statements of Earnings . |

| • | We tested the effectiveness of controls over property and equipment, including those over management’s forecasts of future revenue growth, gross margin, employment costs, and market rental rates. |

| • | We evaluated management’s ability to accurately forecast revenue growth rates, gross margin, and employment costs by comparing actual results to management’s historical forecasts, as well as evaluating actual results after store re-openings to perform a retrospective lookback. |

| • | We evaluated the reasonableness of management’s revenue, gross margin, and employment costs by comparing the forecasts to (1) historical revenues, gross margins, and employment costs, (2) revenue, gross margin, and employment cost assumptions utilized by management in its modeling of likely scenarios of future COVID-19 impacts, (3) internal communications to management and the Board of Directors, (4) external communications made by management to analysts and investors, and (5) trends in the industry and geographical region. |

| • | We evaluated the methods and inputs used by management to determine the fair value of the lease right-of-use asset, including assessing comparable market rents, survey data, and broker quotes, as well as evaluating management’s sensitivity analysis regarding the change in market rents. |

In thousands, except per share amounts |

||||||||||||||||||||

| Fiscal 2020 | First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

Full Year |

|||||||||||||||

| Net revenues |

$ | 1,235,203 | $ | 1,490,777 | $ | 1,764,536 | $ | 2,292,673 | $ | 6,783,189 | ||||||||||

| Gross profit |

414,260 | 551,202 | 705,583 | 965,224 | 2,636,269 | |||||||||||||||

| Operating income 1,2,3 |

48,645 | 185,361 | 274,604 | 402,087 | 910,697 | |||||||||||||||

| Net earnings 5 |

35,423 | 134,564 | 201,772 | 308,955 | 680,714 | |||||||||||||||

| Basic earnings per share 6 |

$ | 0.46 | $ | 1.73 | $ | 2.60 | $ | 4.04 | $ | 8.81 | ||||||||||

| Diluted earnings per share 6 |

$ | 0.45 | $ | 1.70 | $ | 2.54 | $ | 3.92 | $ | 8.61 | ||||||||||

| Fiscal 2019 | First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

Full Year |

|||||||||||||||

| Net revenues |

$ | 1,241,132 | $ | 1,370,814 | $ | 1,442,472 | $ | 1,843,590 | $ | 5,898,008 | ||||||||||

| Gross profit |

444,331 | 483,861 | 518,172 | 692,728 | 2,139,092 | |||||||||||||||

| Operating income 1,4 |

74,132 | 86,165 | 101,891 | 203,686 | 465,874 | |||||||||||||||

| Net earnings 5 |

52,656 | 62,648 | 74,713 | 166,045 | 356,062 | |||||||||||||||

| Basic earnings per share 6 |

$ | 0.67 | $ | 0.80 | $ | 0.96 | $ | 2.15 | $ | 4.56 | ||||||||||

| Diluted earnings per share 6 |

$ | 0.66 | $ | 0.79 | $ | 0.94 | $ | 2.10 | $ | 4.49 | ||||||||||

1 |

Fiscal 2020 includes approximately $3.4 million in the first quarter, $3.3 million in the second quarter, $2.2 million in the third quarter and $3.2 million in the fourth quarter of expenses related to the acquisition of Outward, Inc. Fiscal 2019 includes approximately $6.4 million in the first quarter, $7.2 million in the second quarter, $7.4 million in the third quarter and $9.1 million in the fourth quarter of expenses related to the acquisition of Outward and its ongoing operations. |

2 |

Fiscal 2020 includes approximately $11.4 million in the first quarter of inventory write-offs for inventory with minor damage that we could not liquidate through our outlets due to store closures resulting from COVID-19. |

3 |

Fiscal 2020 includes approximately $15.6 million in the first quarter, $6.4 million in the second quarter and $5.1 million in the fourth quarter of expenses associated with store asset impairments due in part to the impact that COVID-19 had on our retail stores. |

4 |

Fiscal 2019 includes approximately $6.5 million in the first quarter, $0.6 million in the second quarter, $0.6 million in the third quarter and $0.6 million in the fourth quarter for employment-related expenses. |

5 |

Fiscal 2020 includes a tax benefit of $0.6 million in the third quarter and $4.4 million in the fourth quarter resulting from an adjustment to certain deferred tax assets and liabilities. Fiscal 2019 includes tax expense of $0.1 million in the third quarter resulting from tax legislation changes, and a tax benefit of $6.0 million in the fourth quarter resulting from a deferred tax liability adjustment. |

6 |

Due to differences between quarterly and full year weighted average share count calculations, and the effect of quarterly rounding to the nearest cent per share, full year earnings per share may not equal the sum of the quarters. |

ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

ITEM 9A. |

CONTROLS AND PROCEDURES |

ITEM 9B. |

OTHER INFORMATION |

ITEM 10. |

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

ITEM 11. |

EXECUTIVE COMPENSATION |

ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

ITEM 14. |

PRINCIPAL ACCOUNTANT FEES AND SERVICES |

ITEM 15. |

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES |

| (a | )(1) | Financial Statements: | | |||||

| The following Consolidated Financial Statements of Williams-Sonoma, Inc. and subsidiaries and the related notes are filed as part of this report pursuant to Item 8: |

| |||||||

PAGE |

||||||||

| Consolidated Statements of Earnings | 46 | |||||||

| Consolidated Statements of Comprehensive Income | 46 | |||||||

| Consolidated Balance Sheets | 47 | |||||||

| Consolidated Statements of Stockholders’ Equity | 48 | |||||||

| Consolidated Statements of Cash Flows | 49 | |||||||

| Notes to Consolidated Financial Statements | 50 | |||||||

| Report of Independent Registered Public Accounting Firm | 69 | |||||||

| Quarterly Financial Information | 72 | |||||||

| (a | )(2) | Financial Statement Schedules: Schedules have been omitted because they are not required, are not applicable, or because the required information, where material, is included in the financial statements, notes, or supplementary financial information. | | |||||

| (a | )(3) | Exhibits: The exhibits listed in the below Exhibit Index are filed or incorporated by reference as part of this Form 10-K |

| |||||

| (b | ) | Exhibits: The exhibits listed in the below Exhibit Index are filed or incorporated by reference as part of this Form 10-K |

| |||||

| (c | ) | Financial Statement Schedules: Schedules have been omitted because they are not required or are not applicable. | | |||||

| XBRL | ||||

| 101 | * | The following financial statements from the Company’s Annual Report on Form 10-K for the fiscal year ended January 31, 2021, formatted in Inline XBRL: (i) Consolidated Statements of Earnings, (ii) Consolidated Statements of Comprehensive Income, (iii) Consolidated Balance Sheets, (iv) Consolidated Statements of Stockholders’ Equity, (v) Consolidated Statements of Cash Flows and (vi) Notes to Consolidated Financial Statements, tagged as blocks of text and including detailed tags | ||

| 104 | * | Cover Page Interactive Data File (formatted as Inline XBRL and contained in the Interactive Data Files submitted under Exhibit 101). | ||

| * | Filed herewith. |

| + | Indicates a management contract or compensatory plan or arrangement. |

ITEM 16. |

FORM 10-K SUMMARY |

| WILLIAMS-SONOMA, INC. | ||||||

| Date: March 30, 2021 |

By |

/S/ LAURA ALBER | ||||

| Chief Executive Officer | ||||||

| Date: March 30, 2021 |

/s/ SCOTT DAHNKE | |

| Scott Dahnke | ||

| Chairman of the Board of Directors | ||

| Date: March 30, 2021 |

/s/ LAURA ALBER | |

| Laura Alber | ||

| Chief Executive Officer and Director | ||

| (principal executive officer) | ||

| Date: March 30, 2021 |

/s/ JULIE WHALEN | |

| Julie Whalen | ||

| Chief Financial Officer | ||

| (principal financial officer and principal accounting officer) | ||

| Date: March 30, 2021 |

/s/ ANNE MULCAHY | |

| Anne Mulcahy | ||

| Director | ||

| Date: March 30, 2021 |

/s/ WILLIAM READY | |

| William Ready | ||

| Director | ||

| Date: March 30, 2021 |

/s/ SABRINA SIMMONS | |

| Sabrina Simmons | ||

| Director | ||

| Date: March 30, 2021 |

/s/ FRITS VAN PAASSCHEN | |

| Frits van Paasschen | ||

| Director | ||