Exhibit 99.1

| 3003 Tasman Drive, Santa Clara, CA 95054 | Contact: | |||||||||||||||||||||||||

| www.svb.com | Meghan O'Leary | |||||||||||||||||||||||||

| Investor Relations | ||||||||||||||||||||||||||

| For release at 1:00 P.M. (Pacific Time) | (408) 654-6364 | |||||||||||||||||||||||||

| April 22, 2021 | ||||||||||||||||||||||||||

| NASDAQ: SIVB | ||||||||||||||||||||||||||

SVB FINANCIAL GROUP ANNOUNCES 2021 FIRST QUARTER FINANCIAL RESULTS

Board of Directors declared a quarterly dividend on Series A and Series B Preferred Stock

SANTA CLARA, Calif. — April 22, 2021 — SVB Financial Group (NASDAQ: SIVB) today announced financial results for the first quarter ended March 31, 2021.

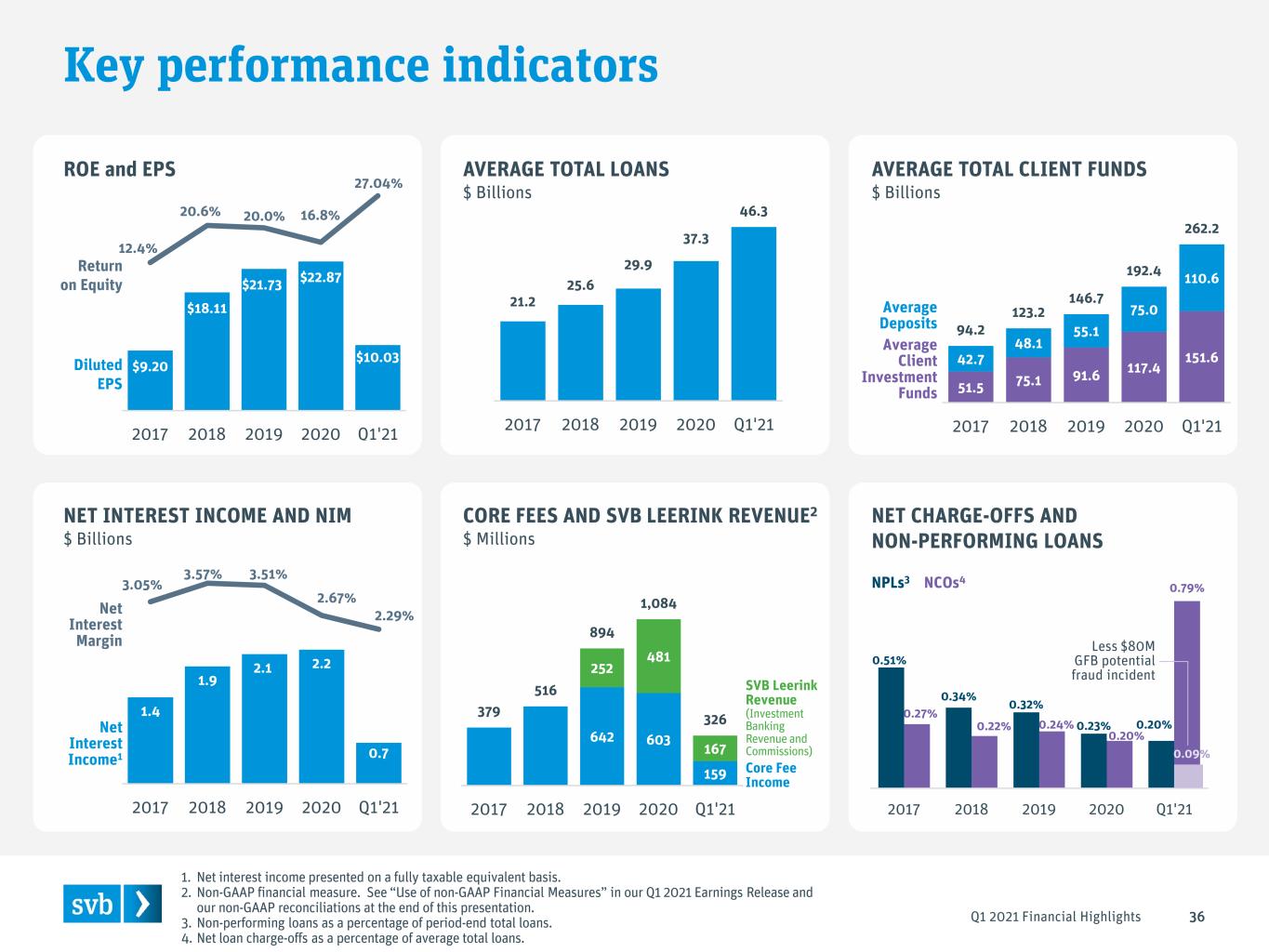

Consolidated net income available to common stockholders for the first quarter of 2021 was $532.2 million, or $10.03 per diluted common share, compared to $388.3 million, or $7.40 per diluted common share, for the fourth quarter of 2020 and $132.3 million, or $2.55 per diluted common share, for the first quarter of 2020.

"We delivered our best quarter ever with exceptional balance sheet growth, earnings and profitability against a backdrop of continued robust liquidity for our clients and an improving economic outlook," said Greg Becker, President and CEO of SVB Financial Group. "As a result of our strong performance, effective execution and remarkable momentum, we have substantially increased our growth expectations for 2021 and are leveraging the capital markets to support our momentum and continued investment in our business."

Highlights of our first quarter 2021 results (compared to fourth quarter 2020, unless otherwise noted) included:

•Average loans of $46.3 billion, an increase of $4.8 billion (or 11.5 percent).

•Period-end loans of $47.7 billion, an increase of $2.5 billion (or 5.5 percent).

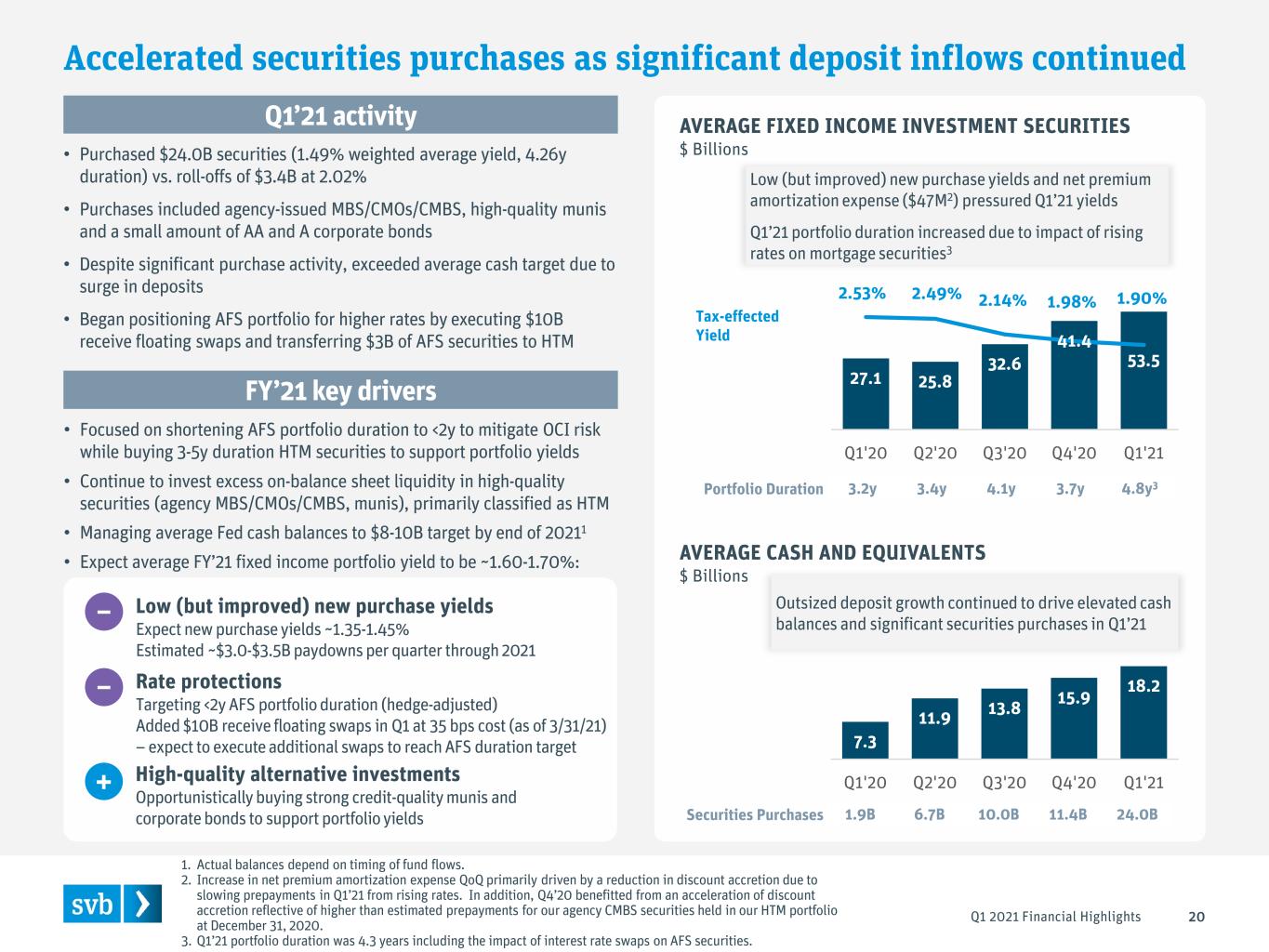

•Average fixed income investment securities of $53.5 billion, an increase of $12.1 billion (or 29.3 percent).

•Period-end fixed income investment securities of $67.2 billion, an increase of $19.6 billion (or 41.4 percent).

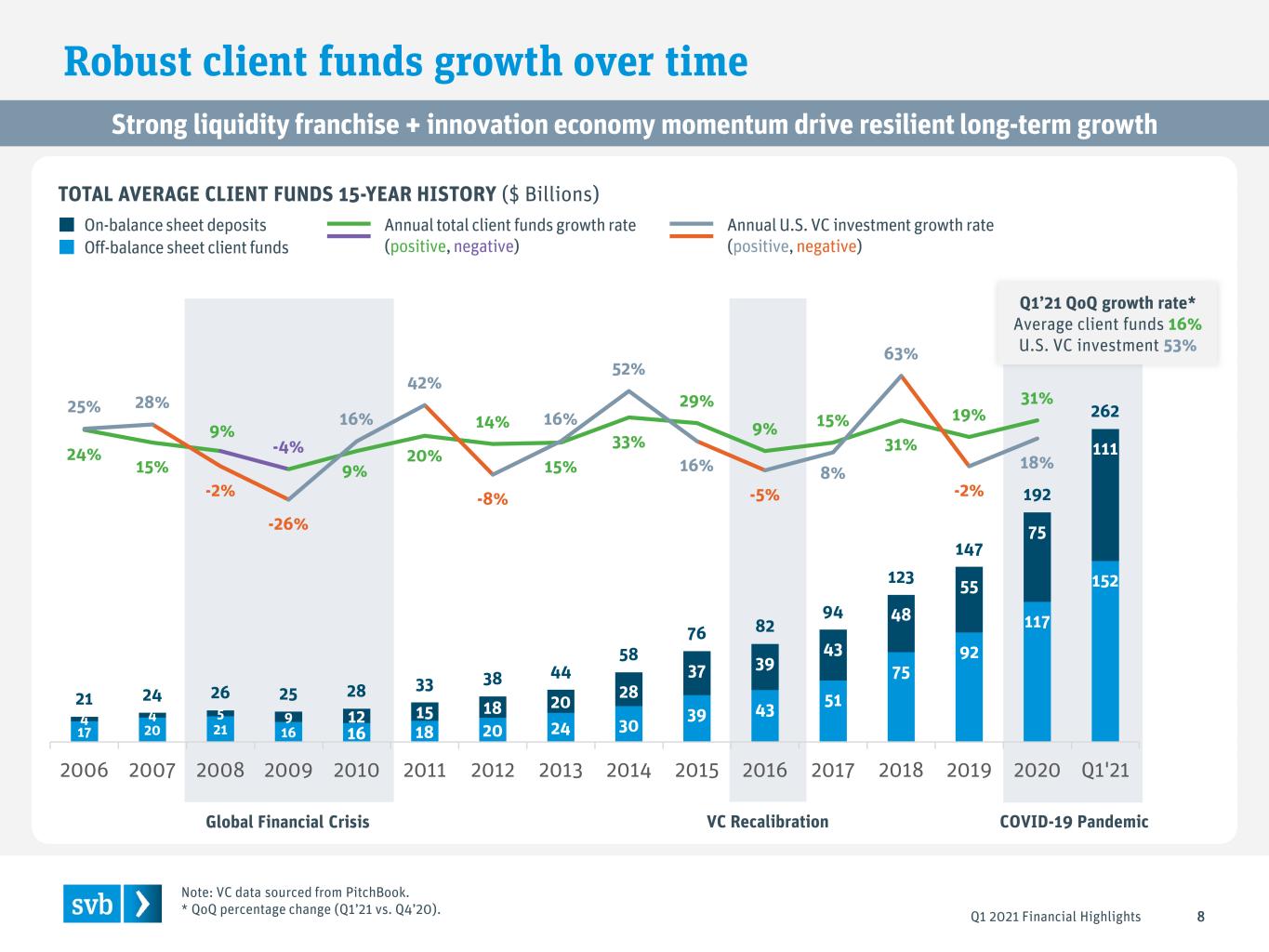

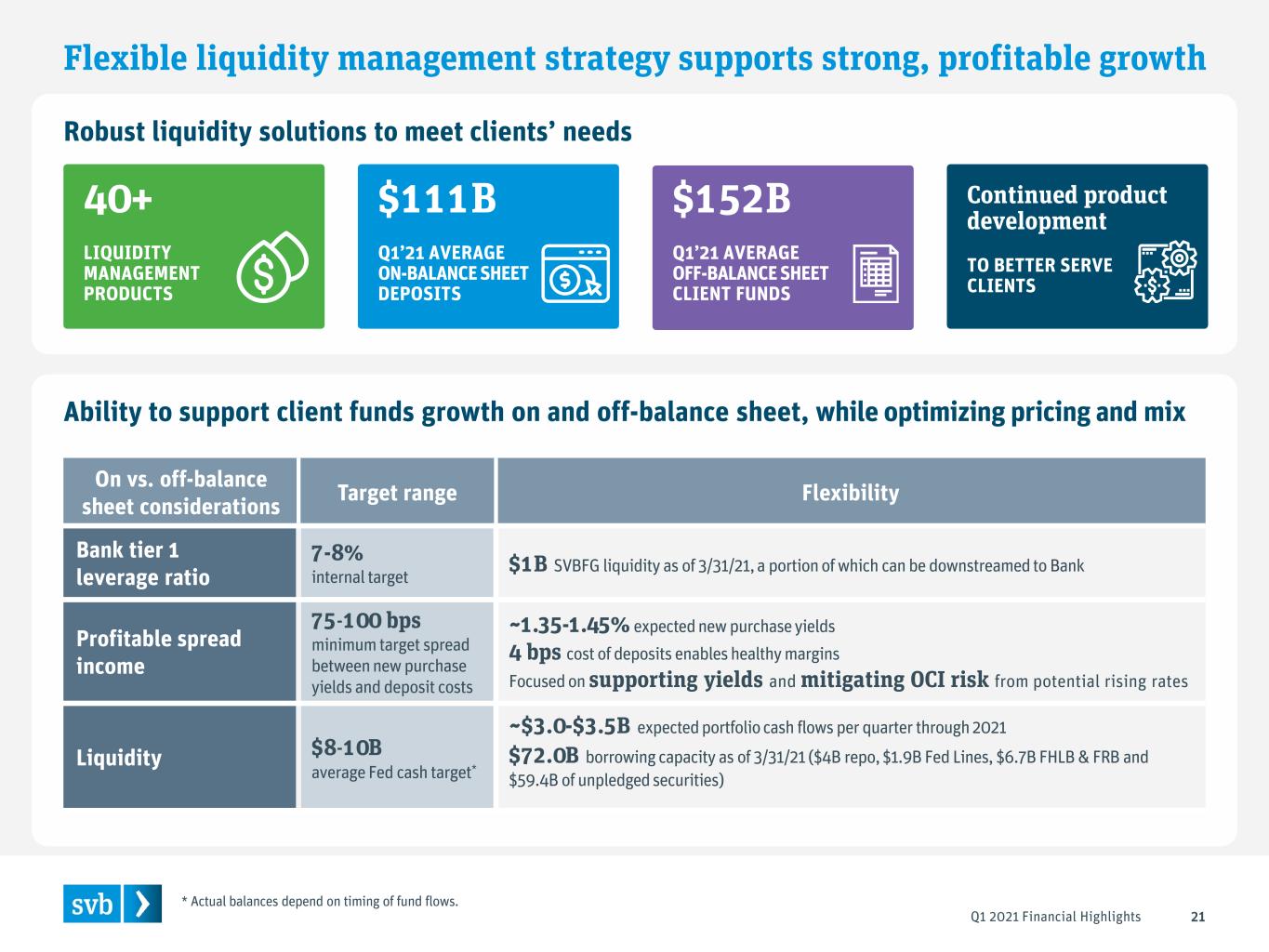

•Average total client funds (on-balance sheet deposits and off-balance sheet client investment funds) increased $36.6 billion (or 16.2 percent) to $262.2 billion, which includes an increase in average on-balance sheet deposits of $18.2 billion (or 19.7 percent).

•Period-end total client funds increased $45.0 billion (or 18.5 percent) to $288.0 billion, which includes an increase in period-end on-balance sheet deposits of $22.2 billion (or 21.7 percent).

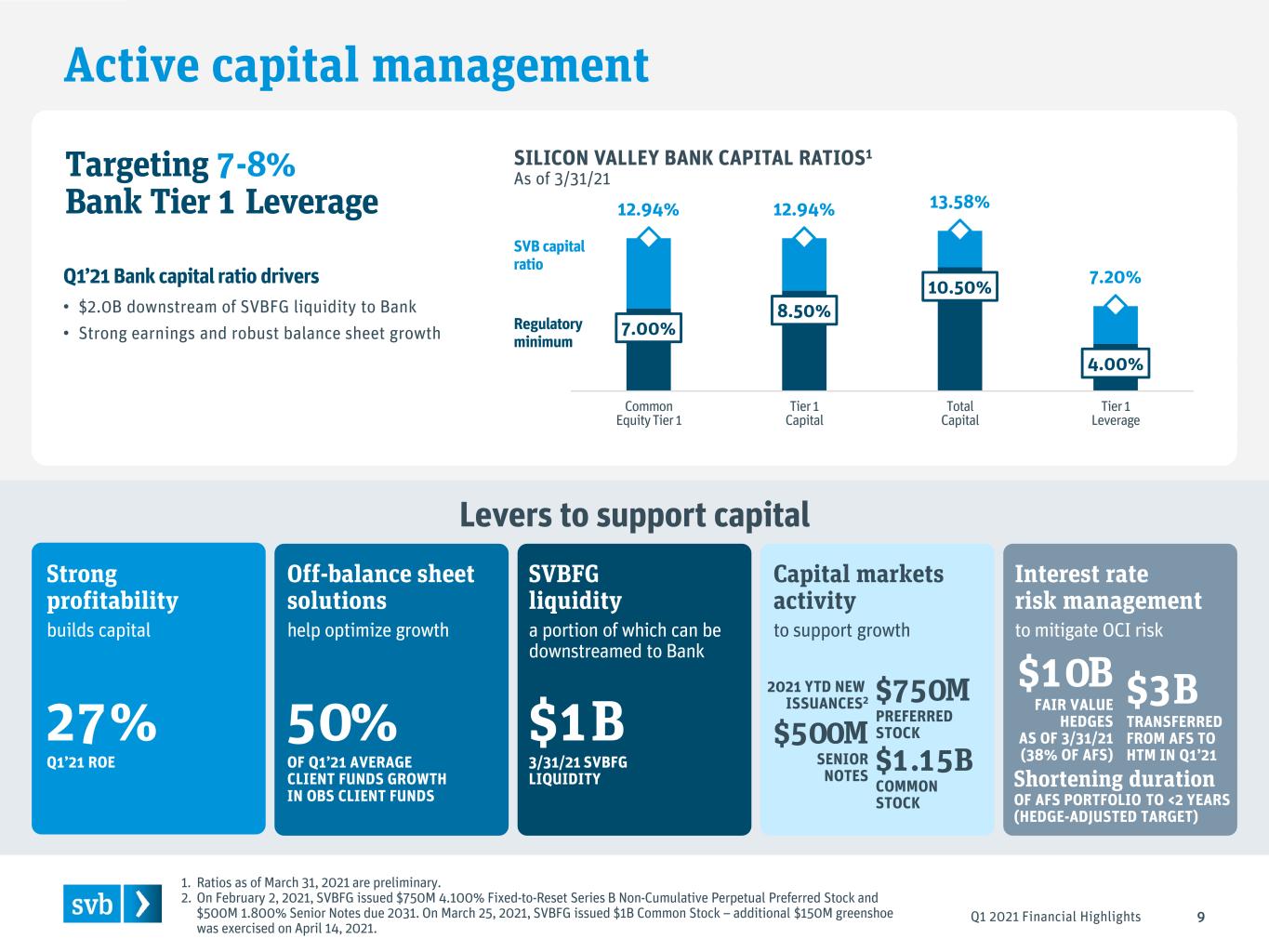

•Issuance of $500.0 million of 1.800% Senior Notes due February 2031.

•Issuance of $750.0 million in depositary shares representing an ownership interest in shares of Series B Preferred Stock.

•Issuance and sale of 2,000,000 shares of common stock at an offering price of $500.00 per share, which resulted in net proceeds of $972.0 million, with an additional issuance of 300,000 shares on April 14, 2021 resulting in net proceeds of approximately $146.0 million.

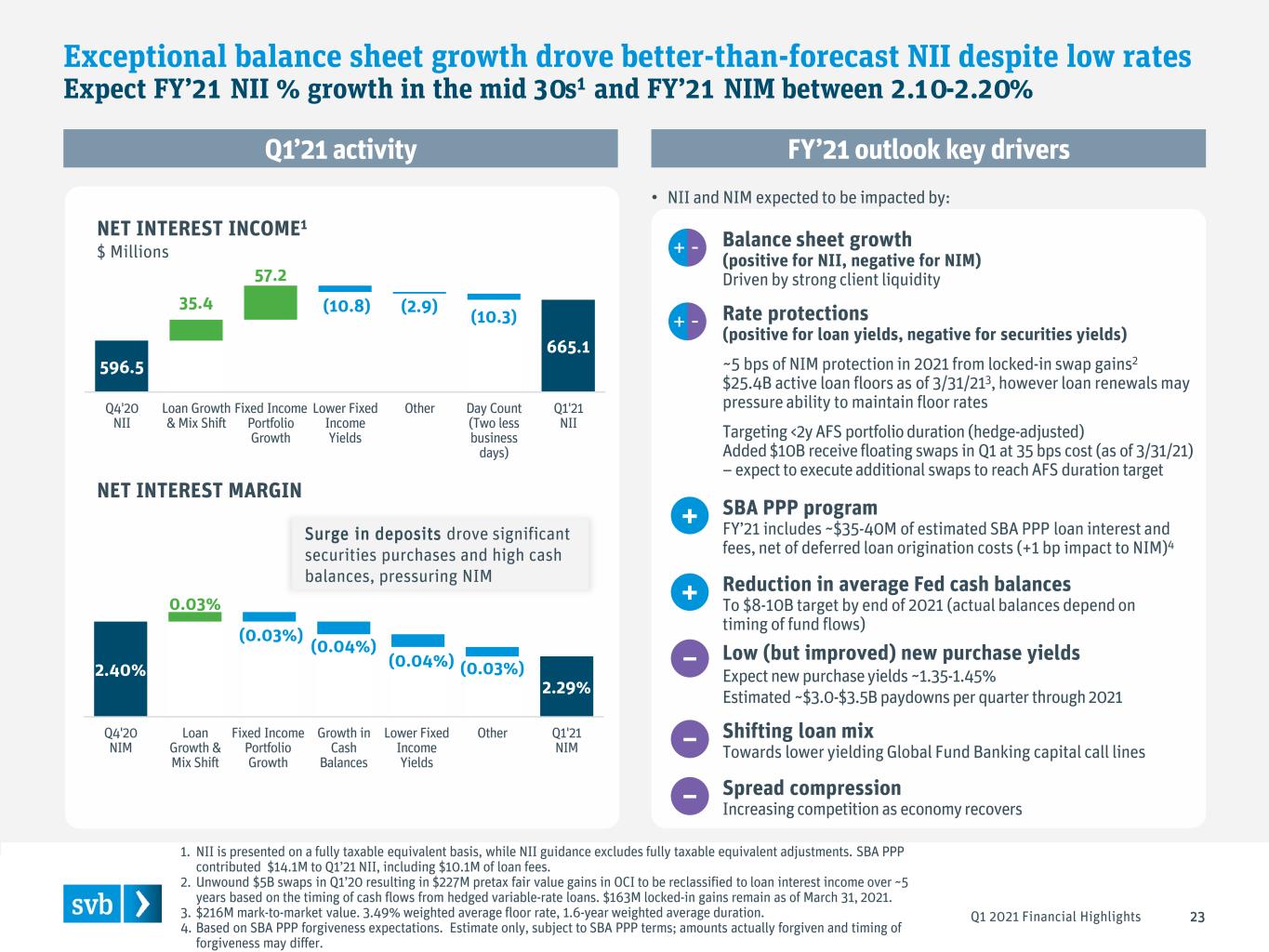

•Net interest income (fully taxable equivalent basis) of $665.1 million, an increase of $68.6 million (or 11.5 percent).

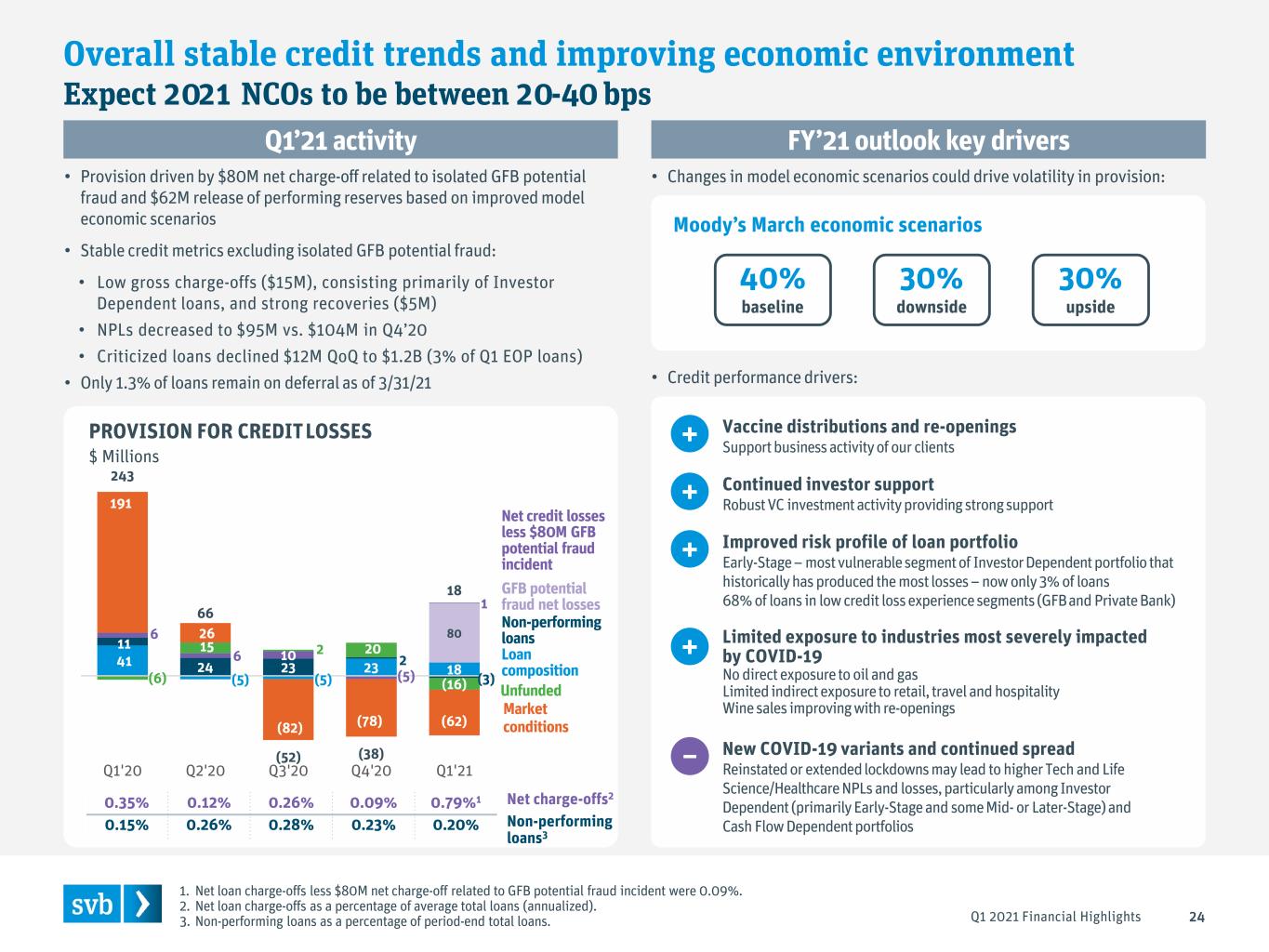

•Provision for credit losses was $18.7 million, compared to a net reduction of $38.4 million.

•Net loan charge-offs of $90.2 million, or 79 basis points of average total loans (annualized), which includes an $80.0 million pre-tax charge-off related to potentially fraudulent activity perpetrated by a Global Fund Banking client, in connection with a loan transaction funded in early February 2021, compared to $9.7 million, or 9 basis points.

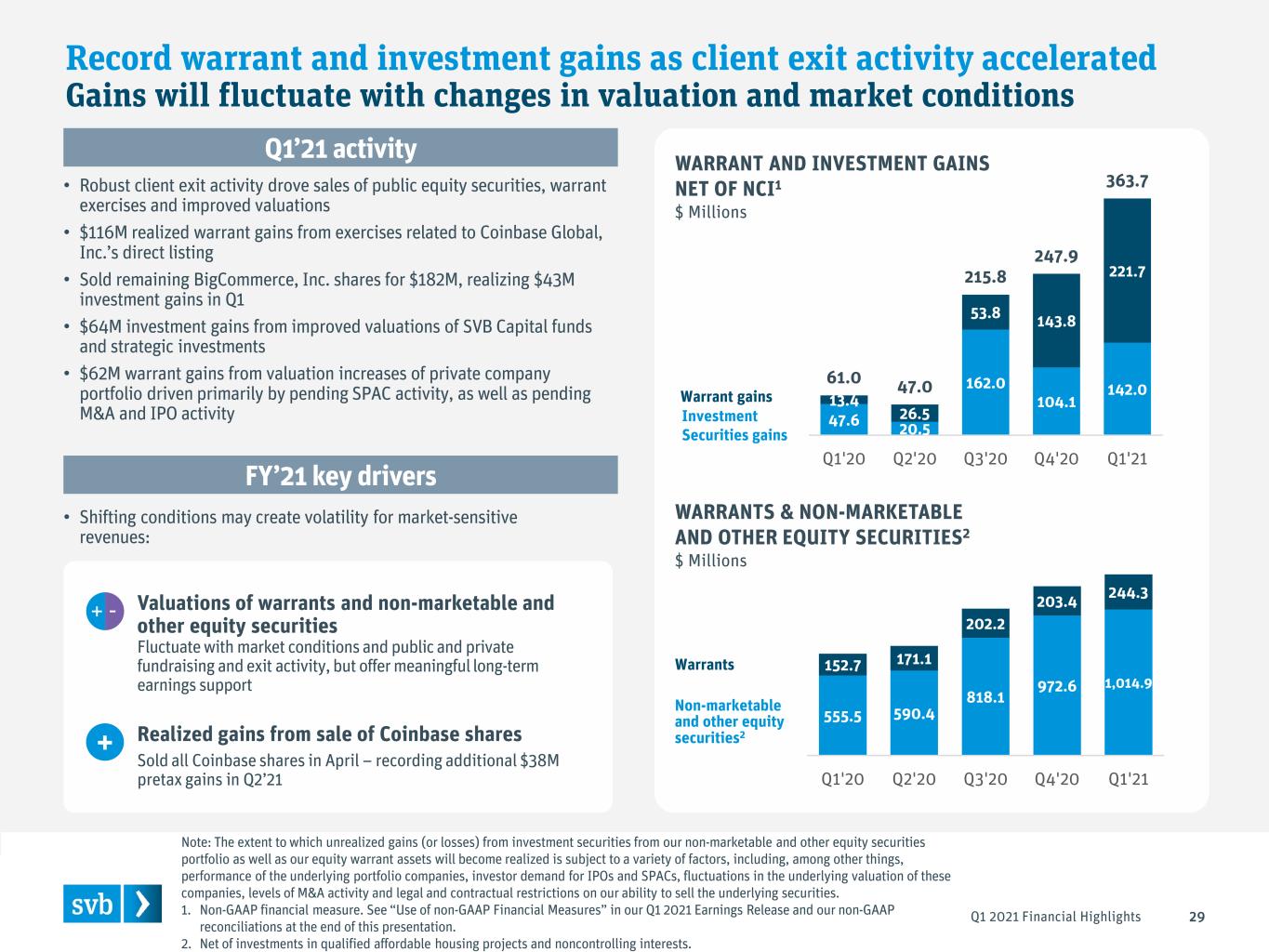

•Net gains on investment securities of $167.1 million compared to $150.0 million. Non-GAAP net gains on investment securities, net of noncontrolling interests, were $142.0 million, compared to $104.1 million. (See non-GAAP reconciliation under the section “Use of Non-GAAP Financial Measures.”)

•Net gains on equity warrant assets of $221.7 million, compared to $143.8 million.

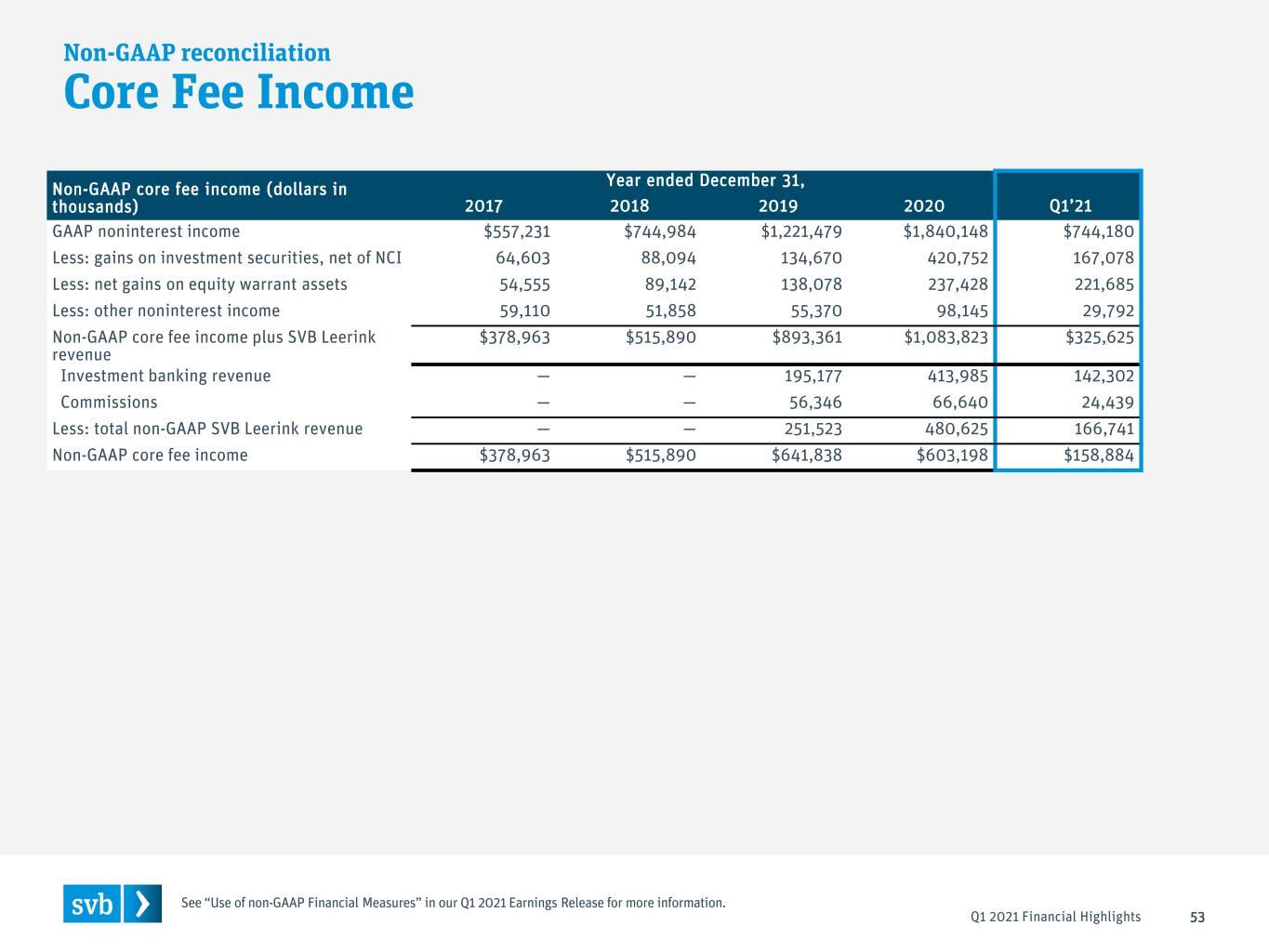

•Noninterest income of $744.2 million, an increase of $122.4 million (or 19.7 percent). Non-GAAP core fee income increased $3.0 million (or 1.9 percent) to $158.9 million. Non-GAAP SVB Leerink revenue increased $15.9 million (or 10.5 percent) to $166.7 million. (See non-GAAP reconciliation under the section “Use of Non-GAAP Financial Measures.”)

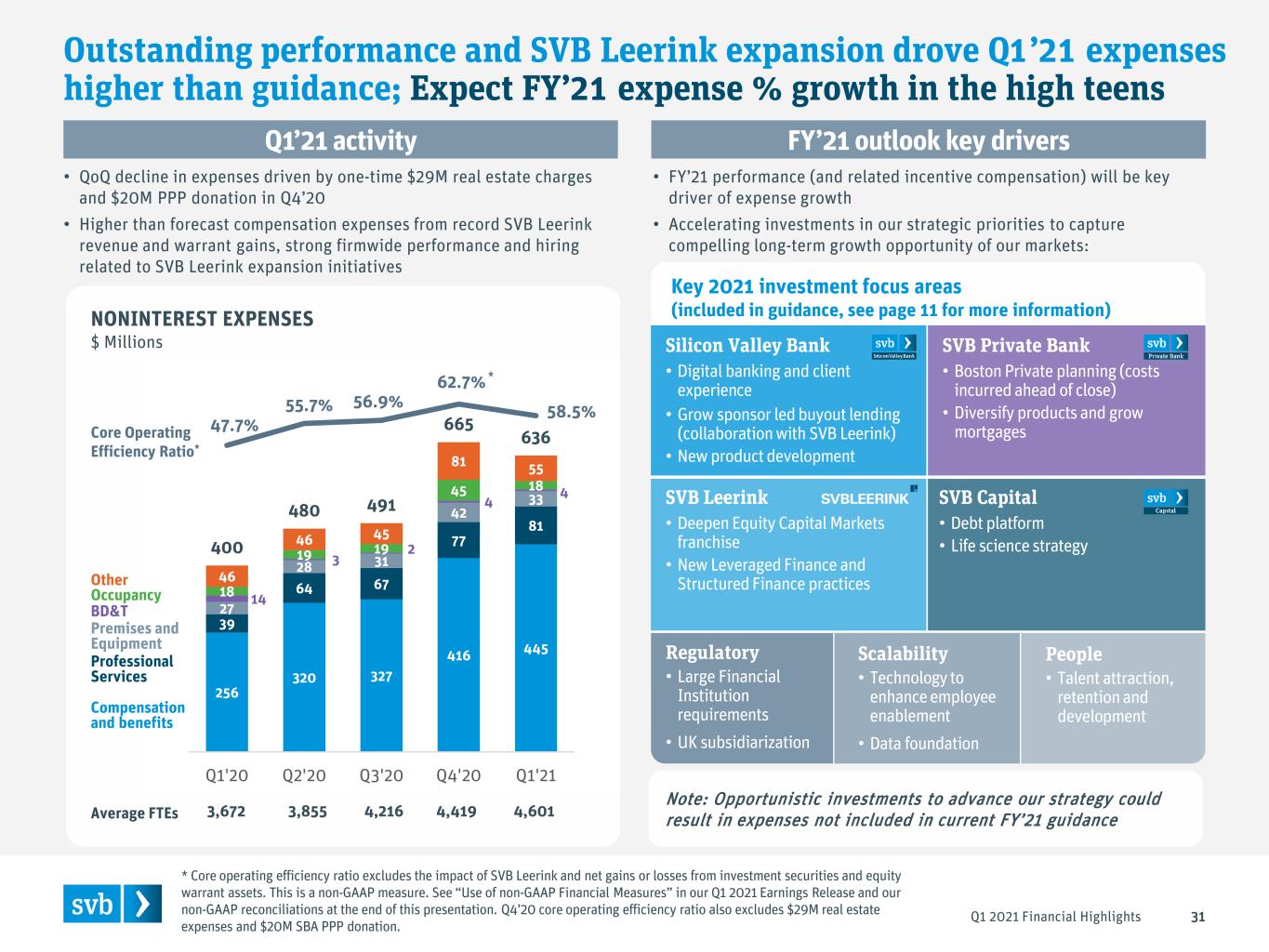

•Noninterest expense of $636.0 million, a decrease of $28.8 million (or 4.3 percent).

•GAAP operating efficiency ratio of 45.31 percent, compared to 54.79 percent. Non-GAAP core operating efficiency ratio of 58.52 percent, compared to 62.67 percent. (See non-GAAP reconciliation under the section “Use of Non-GAAP Financial Measures.”) GAAP operating efficiency ratio decreased primarily as a result of a total of $49.3 million in non-recurring expenses related to real estate and donation expenses as well as higher SVB Leerink expenses as a percentage of SVB Leerink revenue in the fourth quarter of 2020. Non-GAAP core operating efficiency ratio decreased due primarily to the overall decrease in expenses related to our core business as a percentage of revenue attributable primarily to a decrease in SVB Leerink incentive compensation expense reflective of higher expenses in the fourth quarter of 2020 as a result of SVB Leerink's strong 2020 full year financial performance.

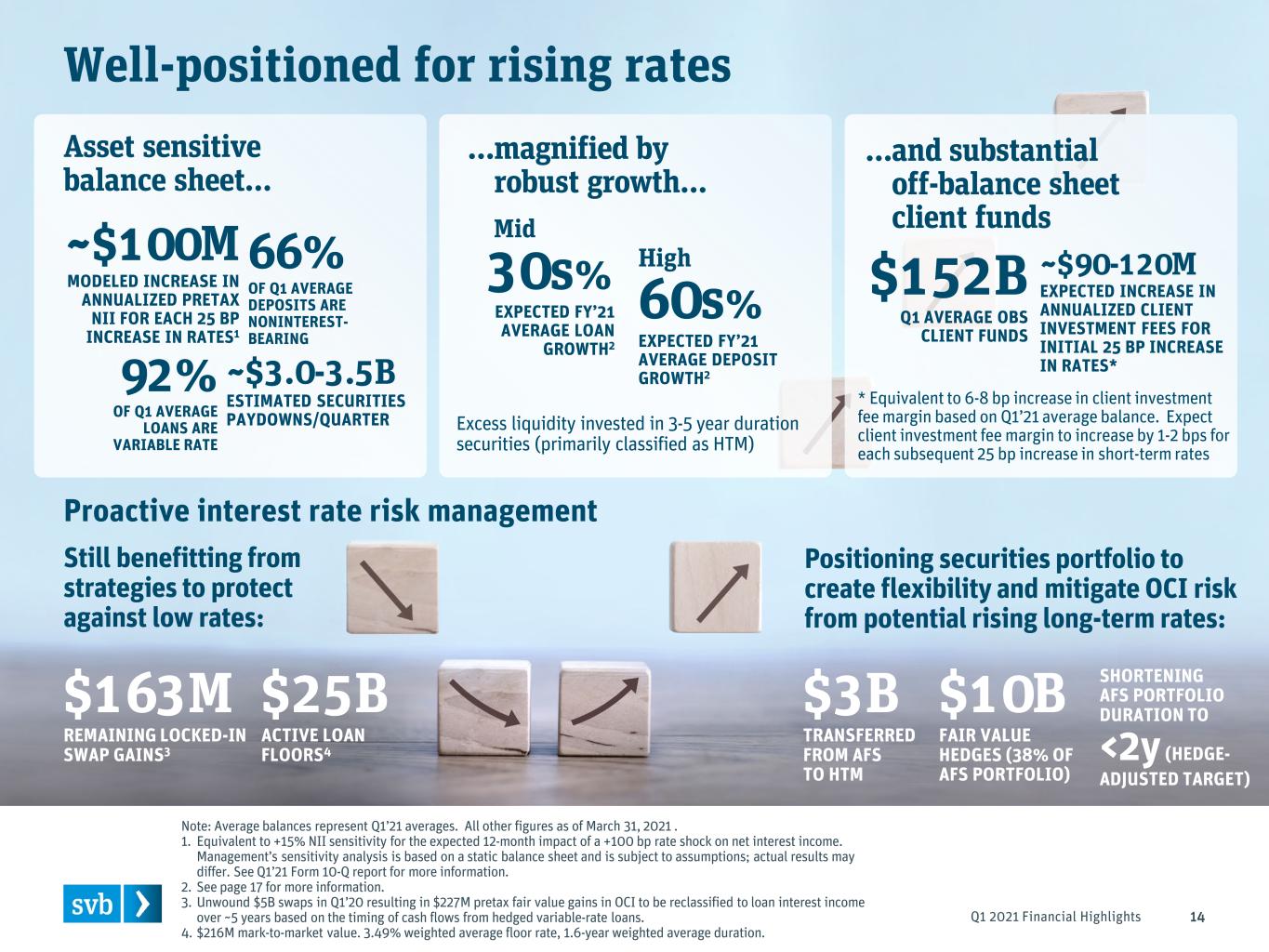

•Entered into pay-fixed, receive-floating interest rate swap fair value hedge contracts on agency-issued commercial and residential mortgage-backed securities in our available-for-sale portfolio with a notional balance of $10.0 billion and re-designated $2.9 billion of certain available-for-sale securities to held-to-maturity securities to hedge against exposure to decreases in the fair value of our available-for-sale fixed income securities resulting from increases in interest rates.

Coronavirus Disease 2019 ("COVID-19") Pandemic Update

During the first quarter of 2021, we increased our 2021 outlook as business activity and the economic environment improved with vaccine distributions and reopenings and our overall credit trends remained stable. Throughout the pandemic, our business and clients have demonstrated remarkable resilience and growth even while most of our employees and partners continue to work from home. We continue to carefully monitor the trajectory of the economic recovery, which could be impacted by the emergence of new variants and continued spread of COVID-19, delays in vaccination programs and potential government lockdowns.

We continue to support our clients, employees and communities. During the first quarter of 2021, we participated in the second round of the Paycheck Protection Program ("PPP"), originating approximately $0.4 billion PPP loans.

2

First Quarter 2021 Summary

(Dollars in millions, except share data, employees and ratios) | Three months ended | |||||||||||||||||||||||||||||||

| March 31, 2021 | December 31, 2020 | September 30, 2020 | June 30, 2020 | March 31, 2020 | ||||||||||||||||||||||||||||

| Income statement: | ||||||||||||||||||||||||||||||||

| Diluted earnings per common share | $ | 10.03 | $ | 7.40 | $ | 8.47 | $ | 4.42 | $ | 2.55 | ||||||||||||||||||||||

| Net income available to common stockholders | 532.2 | 388.3 | 441.7 | 228.9 | 132.3 | |||||||||||||||||||||||||||

| Net interest income | 659.6 | 591.5 | 527.7 | 512.9 | 524.1 | |||||||||||||||||||||||||||

| Provision (reduction) for credit losses (1) | 18.7 | (38.4) | (52.0) | 66.5 | 243.5 | |||||||||||||||||||||||||||

| Noninterest income | 744.2 | 621.8 | 547.6 | 368.8 | 301.9 | |||||||||||||||||||||||||||

| Noninterest expense | 636.0 | 664.8 | 491.0 | 479.6 | 399.6 | |||||||||||||||||||||||||||

| Non-GAAP core fee income (2) | 158.9 | 155.9 | 146.3 | 132.5 | 168.5 | |||||||||||||||||||||||||||

| Non-GAAP core fee income plus SVB Leerink revenue (2) | 325.6 | 306.8 | 254.8 | 290.9 | 231.3 | |||||||||||||||||||||||||||

| Non-GAAP SVB Leerink revenue (2) | 166.7 | 150.9 | 108.4 | 158.4 | 62.9 | |||||||||||||||||||||||||||

| Non-GAAP noninterest income, net of noncontrolling interests (2) | 719.1 | 575.8 | 519.7 | 354.5 | 303.8 | |||||||||||||||||||||||||||

| Non-GAAP noninterest expense, net of noncontrolling interests (2) | 635.9 | 664.7 | 490.9 | 479.5 | 399.4 | |||||||||||||||||||||||||||

| Fully taxable equivalent: | ||||||||||||||||||||||||||||||||

| Net interest income (2) (3) | $ | 665.1 | $ | 596.5 | $ | 531.7 | $ | 516.8 | $ | 527.5 | ||||||||||||||||||||||

| Net interest margin | 2.29 | % | 2.40 | % | 2.53 | % | 2.80 | % | 3.12 | % | ||||||||||||||||||||||

| Balance sheet: | ||||||||||||||||||||||||||||||||

| Average total assets | $ | 124,814.6 | $ | 103,753.6 | $ | 88,348.4 | $ | 78,432.0 | $ | 72,407.2 | ||||||||||||||||||||||

| Average loans, amortized cost | 46,281.5 | 41,525.0 | 37,318.6 | 36,512.2 | 33,660.7 | |||||||||||||||||||||||||||

| Average available-for-sale securities | 28,247.4 | 28,114.2 | 20,026.9 | 12,784.3 | 13,565.9 | |||||||||||||||||||||||||||

| Average held-to-maturity securities | 25,295.2 | 13,288.7 | 12,553.2 | 13,039.4 | 13,576.1 | |||||||||||||||||||||||||||

| Average noninterest-bearing demand deposits | 73,233.2 | 61,662.8 | 51,543.9 | 46,086.9 | 41,336.0 | |||||||||||||||||||||||||||

| Average interest-bearing deposits | 37,375.2 | 30,773.5 | 26,136.1 | 21,829.4 | 20,472.2 | |||||||||||||||||||||||||||

| Average total deposits | 110,608.4 | 92,436.4 | 77,680.0 | 67,916.4 | 61,808.2 | |||||||||||||||||||||||||||

| Average short-term borrowings | 12.1 | 9.8 | 15.3 | 618.1 | 969.9 | |||||||||||||||||||||||||||

| Average long-term debt | 1,162.3 | 843.5 | 843.3 | 489.6 | 348.0 | |||||||||||||||||||||||||||

| Period-end total assets | 142,346.6 | 115,511.0 | 96,916.8 | 85,731.0 | 75,009.6 | |||||||||||||||||||||||||||

| Period-end loans, amortized cost | 47,675.2 | 45,181.5 | 38,413.9 | 36,727.2 | 35,968.1 | |||||||||||||||||||||||||||

| Period-end available-for-sale securities | 25,986.5 | 30,912.4 | 25,904.3 | 18,451.9 | 12,648.1 | |||||||||||||||||||||||||||

| Period-end held-to-maturity securities | 41,164.6 | 16,592.2 | 12,982.2 | 12,858.8 | 13,574.3 | |||||||||||||||||||||||||||

| Period-end non-marketable and other equity securities | 1,857.8 | 1,802.2 | 1,547.4 | 1,270.6 | 1,200.6 | |||||||||||||||||||||||||||

| Period-end noninterest-bearing demand deposits | 84,440.0 | 66,519.2 | 57,508.2 | 49,160.9 | 42,902.2 | |||||||||||||||||||||||||||

| Period-end interest-bearing deposits | 39,710.1 | 35,462.6 | 27,264.8 | 25,344.9 | 19,009.8 | |||||||||||||||||||||||||||

| Period-end total deposits | 124,150.1 | 101,981.8 | 84,773.0 | 74,505.8 | 61,912.0 | |||||||||||||||||||||||||||

| Period-end short-term borrowings | 38.4 | 20.6 | 19.1 | 50.9 | 3,138.2 | |||||||||||||||||||||||||||

| Period-end long-term debt | 1,338.2 | 843.6 | 843.4 | 843.2 | 348.1 | |||||||||||||||||||||||||||

| Off-balance sheet: | ||||||||||||||||||||||||||||||||

| Average client investment funds | $ | 151,578.8 | $ | 133,105.4 | $ | 123,563.6 | $ | 109,259.4 | $ | 103,590.8 | ||||||||||||||||||||||

| Period-end client investment funds | 163,881.7 | 141,053.1 | 126,780.9 | 115,921.0 | 106,951.7 | |||||||||||||||||||||||||||

| Total unfunded credit commitments | 33,986.6 | 31,982.3 | 30,329.8 | 28,127.2 | 24,668.3 | |||||||||||||||||||||||||||

| Earnings ratios: | ||||||||||||||||||||||||||||||||

| Return on average assets (annualized) (4) | 1.73 | % | 1.49 | % | 1.99 | % | 1.17 | % | 0.73 | % | ||||||||||||||||||||||

| Return on average SVBFG common stockholders’ equity (annualized) (5) | 27.04 | 20.23 | 24.19 | 13.36 | 8.17 | |||||||||||||||||||||||||||

| Asset quality ratios: | ||||||||||||||||||||||||||||||||

| Allowance for credit losses for loans as a % of total loans | 0.82 | % | 0.99 | % | 1.34 | % | 1.61 | % | 1.53 | % | ||||||||||||||||||||||

| Allowance for credit losses for performing loans as a % of total performing loans | 0.74 | 0.87 | 1.17 | 1.46 | 1.43 | |||||||||||||||||||||||||||

| Gross loan charge-offs as a % of average total loans (annualized) (1) | 0.83 | 0.22 | 0.30 | 0.17 | 0.44 | |||||||||||||||||||||||||||

| Net loan charge-offs as a % of average total loans (annualized) (1) | 0.79 | 0.09 | 0.26 | 0.12 | 0.35 | |||||||||||||||||||||||||||

| Other ratios: | ||||||||||||||||||||||||||||||||

| Operating efficiency ratio (6) | 45.31 | % | 54.79 | % | 45.66 | % | 54.39 | % | 48.37 | % | ||||||||||||||||||||||

| Non-GAAP core operating efficiency ratio (2) | 58.52 | 62.67 | 56.86 | 55.70 | 47.71 | |||||||||||||||||||||||||||

| Total cost of deposits (annualized) (7) | 0.04 | 0.04 | 0.04 | 0.03 | 0.24 | |||||||||||||||||||||||||||

| SVBFG CET 1 risk-based capital ratio | 12.19 | 11.04 | 12.31 | 12.63 | 12.35 | |||||||||||||||||||||||||||

| Bank CET 1 risk-based capital ratio | 12.94 | 10.70 | 10.75 | 11.08 | 10.90 | |||||||||||||||||||||||||||

| SVBFG tier 1 risk-based capital ratio | 14.02 | 11.89 | 13.25 | 13.62 | 13.35 | |||||||||||||||||||||||||||

| Bank tier 1 risk-based capital ratio | 12.94 | 10.70 | 10.75 | 11.08 | 10.90 | |||||||||||||||||||||||||||

| SVBFG total risk-based capital ratio | 14.63 | 12.64 | 14.19 | 14.77 | 14.45 | |||||||||||||||||||||||||||

| Bank total risk-based capital ratio | 13.58 | 11.49 | 11.75 | 12.28 | 12.04 | |||||||||||||||||||||||||||

3

| SVBFG tier 1 leverage ratio | 8.01 | 7.45 | 8.26 | 8.68 | 9.00 | |||||||||||||||||||||||||||

| Bank tier 1 leverage ratio | 7.20 | 6.43 | 6.45 | 6.91 | 7.21 | |||||||||||||||||||||||||||

| Period-end loans, amortized cost, to deposits ratio | 38.40 | 44.30 | 45.31 | 49.29 | 58.10 | |||||||||||||||||||||||||||

| Average loans, amortized cost, to average deposits ratio | 41.84 | 44.92 | 48.04 | 53.76 | 54.46 | |||||||||||||||||||||||||||

| Book value per common share (8) | $ | 163.25 | $ | 151.86 | $ | 143.91 | $ | 134.89 | $ | 130.02 | ||||||||||||||||||||||

| Tangible book value per common share (2) (9) | 159.50 | 147.92 | 140.37 | 131.32 | 126.41 | |||||||||||||||||||||||||||

| Other statistics: | ||||||||||||||||||||||||||||||||

| Average full-time equivalent ("FTE") employees | 4,601 | 4,419 | 4,216 | 3,855 | 3,672 | |||||||||||||||||||||||||||

| Period-end full-time equivalent ("FTE") employees | 4,656 | 4,461 | 4,336 | 3,984 | 3,710 | |||||||||||||||||||||||||||

(1)This metric for the quarter ended March 31, 2021 includes the impact of an $80.0 million charge-off related to potentially fraudulent activity as noted above.

(2)To supplement our unaudited condensed consolidated financial statements presented in accordance with generally accepted accounting principles in the United States (“GAAP”), we use certain non-GAAP measures. A reconciliation of these non-GAAP measures to the most closely related GAAP measures is provided at the end of this release under the section “Use of Non-GAAP Financial Measures.”

(3)Interest income on non-taxable investments is presented on a fully taxable equivalent basis using the federal statutory income tax rate of 21.0 percent. The taxable equivalent adjustments were $5.6 million for the quarter ended March 31, 2021, $5.0 million for the quarter ended December 31, 2020, $4.0 million for the quarter ended September 30, 2020, $3.8 million for the quarter ended June 30, 2020 and $3.4 million for the quarter ended March 31, 2020.

(4)Ratio represents annualized consolidated net income available to common stockholders divided by average assets.

(5)Ratio represents annualized consolidated net income available to common stockholders divided by average SVB Financial Group ("SVBFG") common stockholders’ equity.

(6)Ratio is calculated by dividing noninterest expense by total net interest income plus noninterest income.

(7)Ratio represents annualized total cost of deposits and is calculated by dividing interest expense from deposits by average total deposits.

(8)Book value per common share is calculated by dividing total SVBFG common stockholders’ equity by total outstanding common shares.

(9)Tangible book value per common share is calculated by dividing tangible common equity by total outstanding common shares. Tangible common equity is a non-GAAP measure defined under the section “Use of Non-GAAP Financial Measures.”

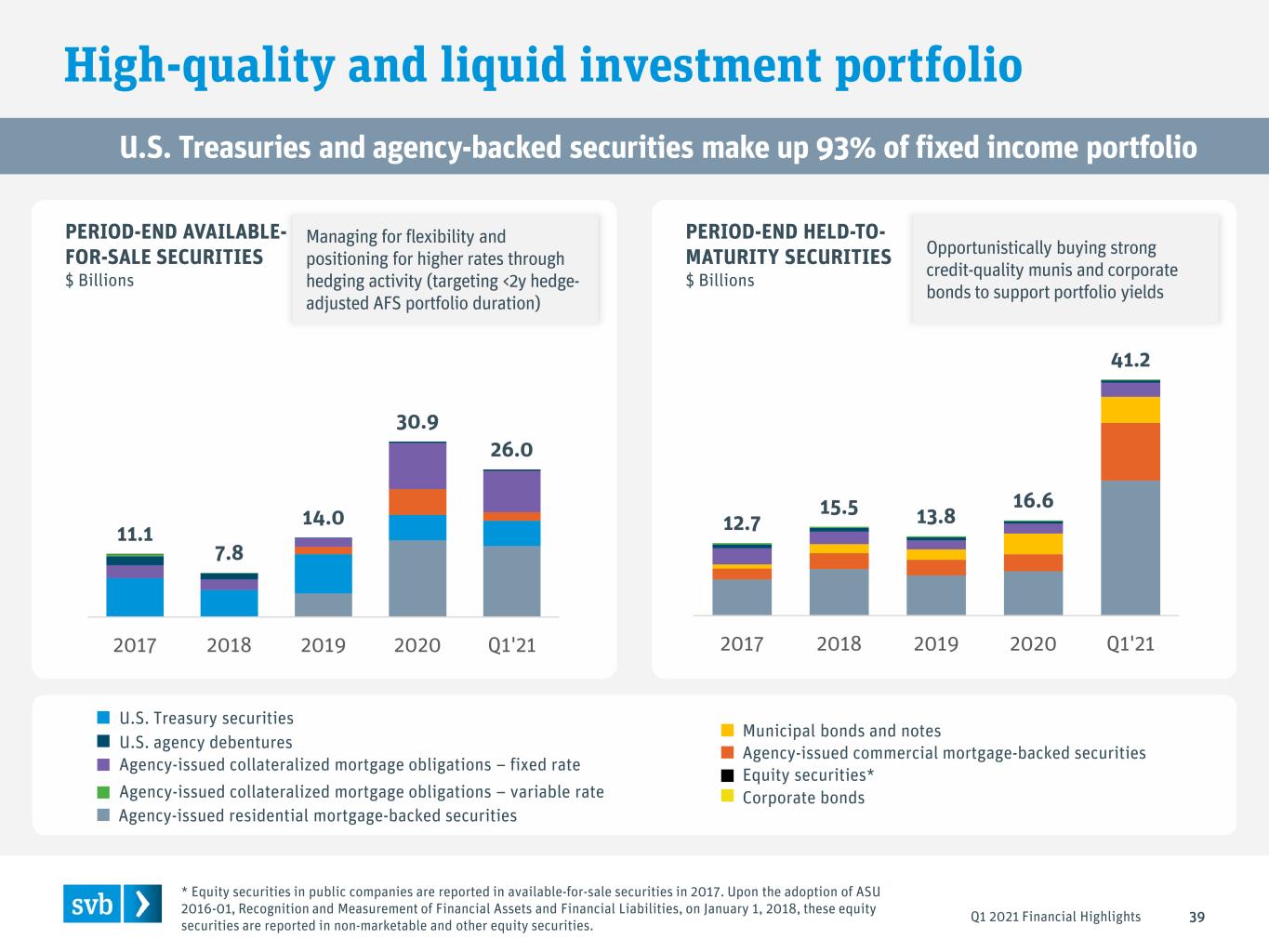

Investment Securities

Our investment securities portfolio is comprised of: (i) our available-for-sale ("AFS") and held-to-maturity ("HTM") securities portfolios, each consisting of fixed income investments which are managed to earn an appropriate portfolio yield over the long-term while maintaining sufficient liquidity and addressing our asset/liability management objectives; and (ii) our non-marketable and other equity securities portfolio, which represents investments managed as part of our funds management business as well as public equity securities held as a result of equity warrant assets exercised. Our total average fixed income investment securities portfolio increased $12.1 billion, or 29.3 percent, to $53.5 billion for the quarter ended March 31, 2021. Our total period-end fixed income investment securities portfolio increased $19.6 billion, or 41.4 percent, to $67.2 billion at March 31, 2021. Our period-end non-marketable and other equity securities portfolio increased $0.1 billion to $1.9 billion ($1.6 billion net of noncontrolling interests) at March 31, 2021.

The weighted-average duration of our total fixed income securities portfolio was 4.8 years at March 31, 2021 and 3.7 years at December 31, 2020. The extension in the weighted-average duration of our fixed income securities portfolio is reflective primarily of the slowdown in prepayment estimates, partially offset by shorter duration purchases during the first quarter of 2021. In March 2021, we entered into interest rate swap contracts to hedge against our exposure to decreases in the fair value of agency-issued commercial and residential mortgage-backed securities in our AFS securities resulting from increases in interest rates. As of March 31, 2021, the notional balance of our interest rate swap contracts was $10.0 billion. The weighted-average duration of our total fixed income securities portfolio including the impact of our fair value swaps was 4.3 years at March 31, 2021.

AFS Securities

Average AFS securities were $28.2 billion for the first quarter of 2021 compared to $28.1 billion for the fourth quarter of 2020. Period-end AFS securities were $26.0 billion at March 31, 2021 compared to $30.9 billion at December 31, 2020. The slight increase in average AFS securities from the fourth quarter of 2020 to the first quarter of 2021 was driven by purchases late in the fourth quarter of 2020, partially offset by a re-designation of AFS securities to HTM securities late in the first quarter of 2021. The decrease in period-end AFS securities was driven by a $2.9 billion re-designation of AFS securities to HTM securities, paydowns and maturities of $1.7 billion, and a decrease in fair value of $0.8 billion due to the increase in interest rates, partially offset by purchases of $0.5 billion during the quarter. The weighted-average duration of our AFS securities portfolio was 5.1 years at March 31, 2021 and 3.7 years at December 31, 2020. The weighted-average duration of our AFS securities portfolio including the impact of our fair value swaps was 3.7 years at March 31, 2021.

4

HTM Securities

Average HTM securities were $25.3 billion for the first quarter of 2021, compared to $13.3 billion for the fourth quarter of 2020. Period-end HTM securities were $41.2 billion at March 31, 2021 compared to $16.6 billion at December 31, 2020. The increases in average and period-end HTM securities from the fourth quarter of 2020 to the first quarter of 2021 were driven by purchases of $23.5 billion and the re-designation of $2.9 billion as mentioned above, partially offset by $1.8 billion in paydowns and maturities during the quarter. The weighted-average duration of our HTM securities portfolio was 4.6 years at March 31, 2021 and 3.7 years at December 31, 2020.

Non-Marketable and Other Equity Securities

Our non-marketable and other equity securities portfolio increased $0.1 billion to $1.9 billion ($1.6 billion net of noncontrolling interests) at March 31, 2021, compared to $1.8 billion ($1.6 billion net of noncontrolling interests) at December 31, 2020. Reconciliations of our non-GAAP non-marketable and other equity securities, net of noncontrolling interests, are provided under the section “Use of Non-GAAP Financial Measures."

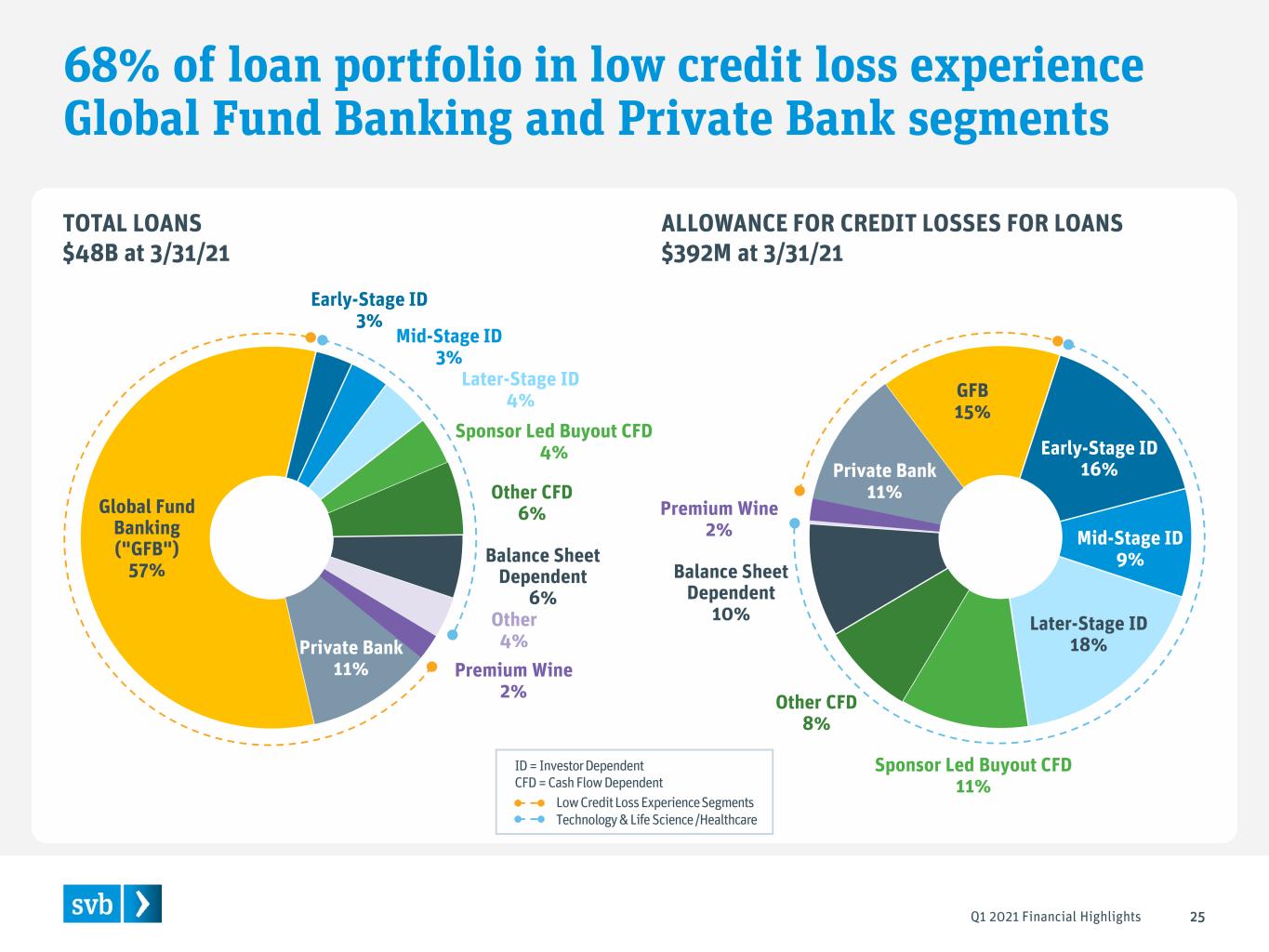

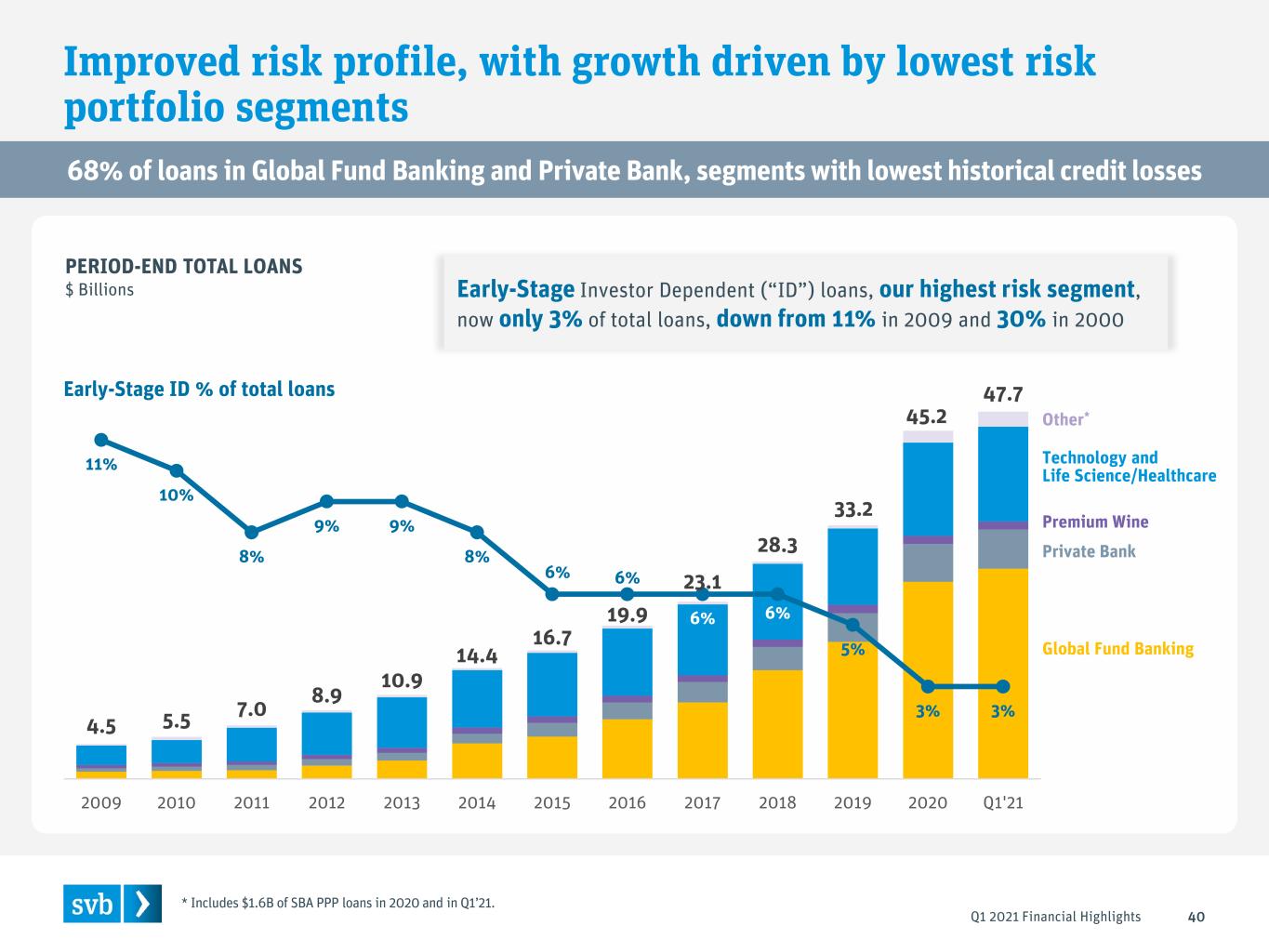

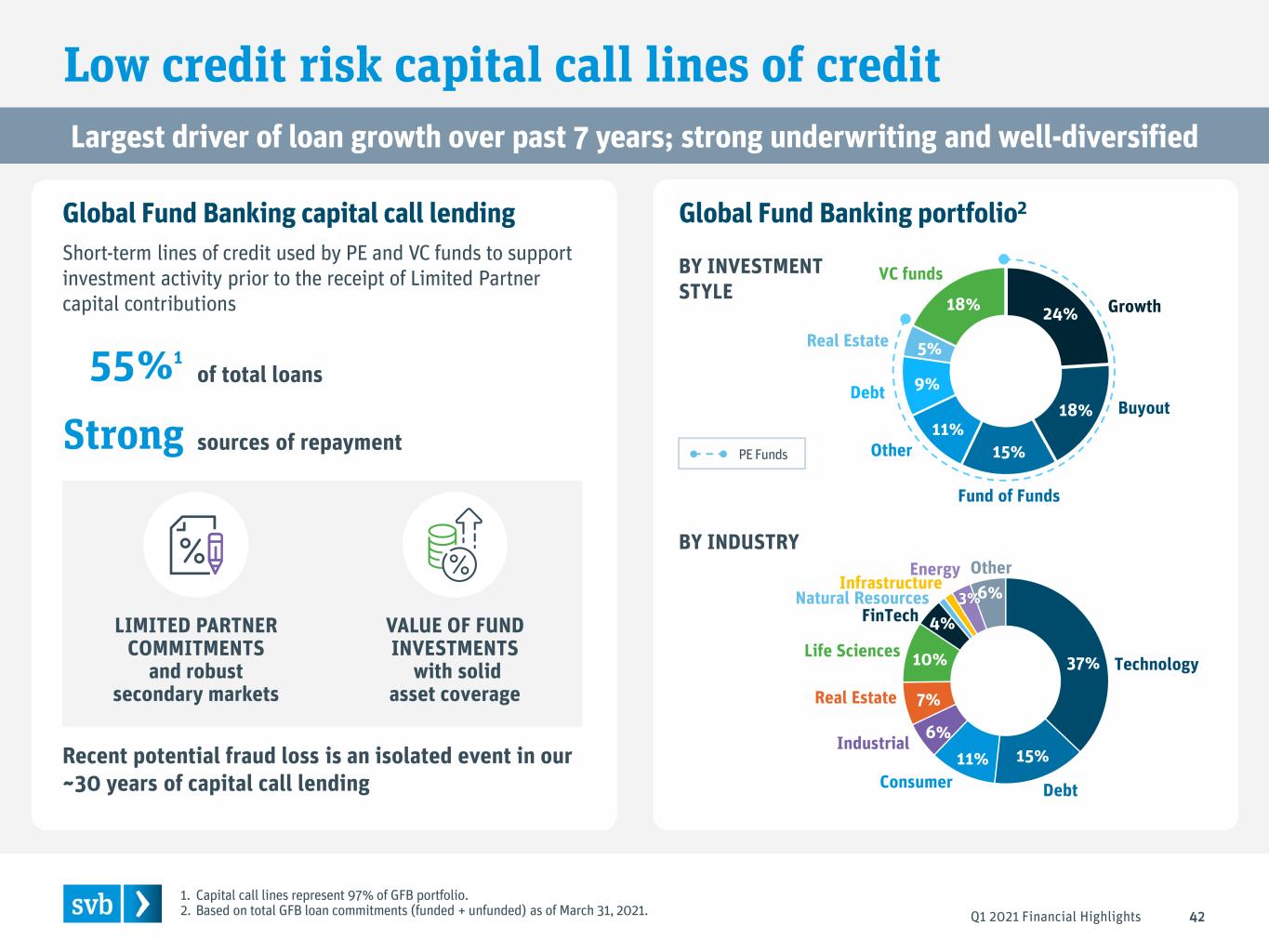

Loans

Average loans increased by $4.8 billion to $46.3 billion for the first quarter of 2021, compared to $41.5 billion for the fourth quarter of 2020. Period-end loans increased $2.5 billion to $47.7 billion at March 31, 2021, compared to $45.2 billion at December 31, 2020. Average and period-end loan growth came primarily from our Global Fund Banking and Technology and Life Science/Healthcare portfolios as well as Private Bank.

The following table provides a summary of our loans at amortized cost basis broken out by risk-based segment:

| (Dollars in thousands) | March 31, 2021 | December 31, 2020 | March 31, 2020 | |||||||||||||||||

| Global fund banking | $ | 27,306,926 | $ | 25,543,198 | $ | 18,868,875 | ||||||||||||||

| Investor dependent | ||||||||||||||||||||

| Early stage | 1,523,208 | 1,485,866 | 1,806,011 | |||||||||||||||||

| Mid stage | 1,588,185 | 1,564,870 | 1,399,209 | |||||||||||||||||

| Later stage | 2,055,676 | 1,921,082 | 2,031,490 | |||||||||||||||||

| Total investor dependent | 5,167,069 | 4,971,818 | 5,236,710 | |||||||||||||||||

| Cash flow dependent | ||||||||||||||||||||

| Sponsor led buyout | 1,984,567 | 1,989,173 | 2,121,007 | |||||||||||||||||

| Other | 2,959,609 | 2,945,360 | 2,756,295 | |||||||||||||||||

| Total cash flow dependent | 4,944,176 | 4,934,533 | 4,877,302 | |||||||||||||||||

| Private bank (1) | 5,063,827 | 4,901,056 | 3,669,295 | |||||||||||||||||

| Balance sheet dependent | 2,501,524 | 2,191,023 | 1,850,941 | |||||||||||||||||

| Premium wine (1) | 1,040,223 | 1,052,643 | 1,056,927 | |||||||||||||||||

| Other (1) | 45,688 | 27,687 | 408,035 | |||||||||||||||||

| SBA loans | 1,605,733 | 1,559,530 | — | |||||||||||||||||

| Total loans | $ | 47,675,166 | $ | 45,181,488 | $ | 35,968,085 | ||||||||||||||

(1)As of March 31, 2021 and December 31, 2020, as a result of enhanced portfolio characteristic definitions for our risk-based segments, loans in the amounts of $492.9 million and $80.1 million and $426.6 million and $52.5 million, respectively, that would have been reported in Other under historical definitions, are now being reported in our Private Bank and Premium Wine risk-based segments, respectively.

Net Interest Income and Margin

Net interest income, on a fully taxable equivalent basis, was $665.1 million for the first quarter of 2021, compared to $596.5 million for the fourth quarter of 2020. The $68.6 million increase from the fourth quarter of 2020 to the first quarter of 2021 was attributable primarily to the following:

•An increase of $44.2 million in interest income from our fixed income investment securities reflective primarily of a $12.1 billion increase in average fixed income securities, partially offset by lower yields.

◦Overall we had a decrease in fixed income investment securities yields of nine basis points due primarily to lower purchase yields reflective of the continued low market rate environment as well as a reduction in discount accretion due to slowing prepayments in the first quarter of 2021 reflective of rising interest rates. In addition, we saw higher yields in the fourth quarter of 2020 due to an

5

acceleration of discount accretion reflective of higher than estimated prepayments for our fixed-rate commercial mortgage-backed securities in our held-to-maturity portfolio for the 2020 year end.

•An increase in interest income from loans of $27.1 million to $430.4 million for the first quarter of 2021 was due primarily to a $39.0 million increase in loan interest reflective of $4.8 billion in average loan growth, partially offset by a $7.2 million decrease from lower gross loan yields and a $6.9 million decrease due to the impact of two less business days in the first quarter of 2021.

◦Overall loan yields decreased nine basis points to 3.77 percent, reflective primarily of lower gross loan yields due to growth in our higher credit quality Global Fund Banking portfolio as well as a decrease in loan fee yields due primarily to a decrease in early payoffs in the first quarter of 2021 as compared to the fourth quarter of 2020.

Net interest margin, on a fully taxable equivalent basis, was 2.29 percent for the first quarter of 2021, compared to 2.40 percent for the fourth quarter of 2020. The 11 basis point decrease in our net interest margin was due primarily to overall balance sheet growth resulting in a shift in the mix of interest earning assets from higher yielding loans to lower yielding cash and investments as a percentage of total interest earning assets.

For the first quarter of 2021, approximately 92 percent, or $42.6 billion, of our average loans were variable-rate loans that adjust at prescribed measurement dates. Of our variable-rate loans, approximately 65 percent are tied to prime-lending rates and 35 percent are tied to LIBOR. As a result of the discontinuation of LIBOR at the end of 2021, we are preparing for the transition to an alternate reference rate and expect the percent of LIBOR loans to decrease over time.

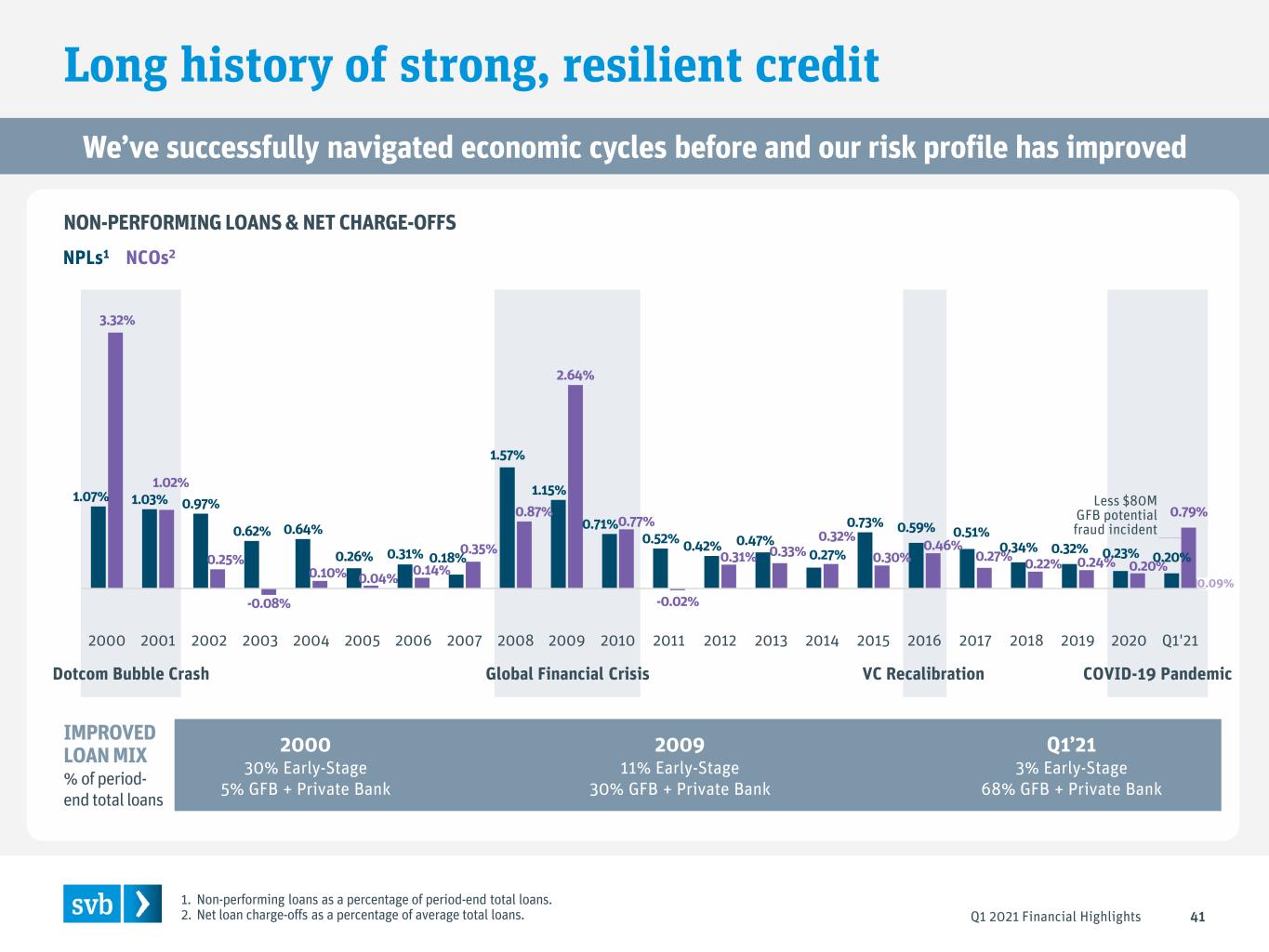

Credit Quality

Potential Fraudulent Client Activity

During the three months ended March 31, 2021, we became aware of potentially fraudulent activity conducted by JES Global Capital, Inc., a client of Silicon Valley Bank, our principal banking subsidiary, and certain of its affiliates, in connection with a loan transaction funded in early February 2021. Our investigation into this incident to determine the potential credit exposure resulted in a pre-tax charge-off of $80.0 million, or $59.2 million net of tax, relating to a Global Fund Banking capital call line of credit.

We are working with the appropriate law enforcement authorities in connection with this matter and intend to pursue all available sources of recovery and other measures to mitigate the extent of the loss.

Based on our review of the potentially fraudulent activity, as well as our risk assessment review of the Global Fund Banking loan portfolio conducted in light of the incident, we currently believe this incident to be an isolated occurrence involving a single business relationship.

6

The following table provides a summary of our allowance for credit losses for loans, unfunded credit commitments and HTM securities:

| Three months ended | ||||||||||||||||||||

| (Dollars in thousands, except ratios) | March 31, 2021 | December 31, 2020 | March 31, 2020 | |||||||||||||||||

| Allowance for credit losses for loans, beginning balance | $ | 447,765 | $ | 512,958 | $ | 304,924 | ||||||||||||||

| Day one impact of adopting CECL | — | — | 25,464 | |||||||||||||||||

| Provision (reduction) for loans | 34,026 | (57,468) | 248,901 | |||||||||||||||||

| Gross loan charge-offs (1) | (95,005) | (22,504) | (36,896) | |||||||||||||||||

| Loan recoveries | 4,853 | 12,836 | 7,755 | |||||||||||||||||

Foreign currency translation adjustments | 112 | 1,943 | (1,185) | |||||||||||||||||

Allowance for credit losses for loans, ending balance | $ | 391,751 | $ | 447,765 | $ | 548,963 | ||||||||||||||

Allowance for credit losses for unfunded credit commitments, beginning balance | 120,796 | 101,515 | 67,656 | |||||||||||||||||

| Day one impact of adopting CECL | — | — | 22,826 | |||||||||||||||||

| (Reduction) provision for unfunded credit commitments | (16,067) | 18,934 | (5,477) | |||||||||||||||||

Foreign currency translation adjustments | 21 | 347 | (315) | |||||||||||||||||

| Allowance for credit losses for unfunded credit commitments, ending balance (2) | $ | 104,750 | $ | 120,796 | $ | 84,690 | ||||||||||||||

| Allowance for credit losses for HTM securities, beginning balance | 392 | 291 | — | |||||||||||||||||

| Day one impact of adopting CECL | — | — | 174 | |||||||||||||||||

| Provision for HTM securities | 720 | 101 | 56 | |||||||||||||||||

| Allowance for credit losses for HTM securities, ending balance (3) | $ | 1,112 | $ | 392 | $ | 230 | ||||||||||||||

| Ratios and other information: | ||||||||||||||||||||

| Provision (reduction) for loans as a percentage of period-end total loans (annualized) | 0.29 | % | (0.51) | % | 2.78 | % | ||||||||||||||

| Gross loan charge-offs as a percentage of average total loans (annualized) | 0.83 | 0.22 | 0.44 | |||||||||||||||||

| Net loan charge-offs as a percentage of average total loans (annualized) | 0.79 | 0.09 | 0.35 | |||||||||||||||||

| Allowance for credit losses for loans as a percentage of period-end total loans | 0.82 | 0.99 | 1.53 | |||||||||||||||||

| Provision (reduction) for credit losses | $ | 18,679 | $ | (38,433) | $ | 243,480 | ||||||||||||||

| Period-end total loans | 47,675,166 | 45,181,488 | 35,968,085 | |||||||||||||||||

| Average total loans | 46,281,476 | 41,525,036 | 33,660,728 | |||||||||||||||||

| Allowance for credit losses for nonaccrual loans | 41,851 | 54,029 | 34,876 | |||||||||||||||||

| Nonaccrual loans | 90,247 | 104,244 | 50,607 | |||||||||||||||||

(1)Gross loan charge-offs for the quarter ended March 31, 2021 includes the impact of an $80.0 million charge-off related to potentially fraudulent activity as noted above.

(2)The “allowance for credit losses for unfunded credit commitments” is included as a component of “other liabilities.”

(3)The "allowance for credit losses for HTM securities" is included as a component of HTM securities and presented net in our consolidated financial statements.

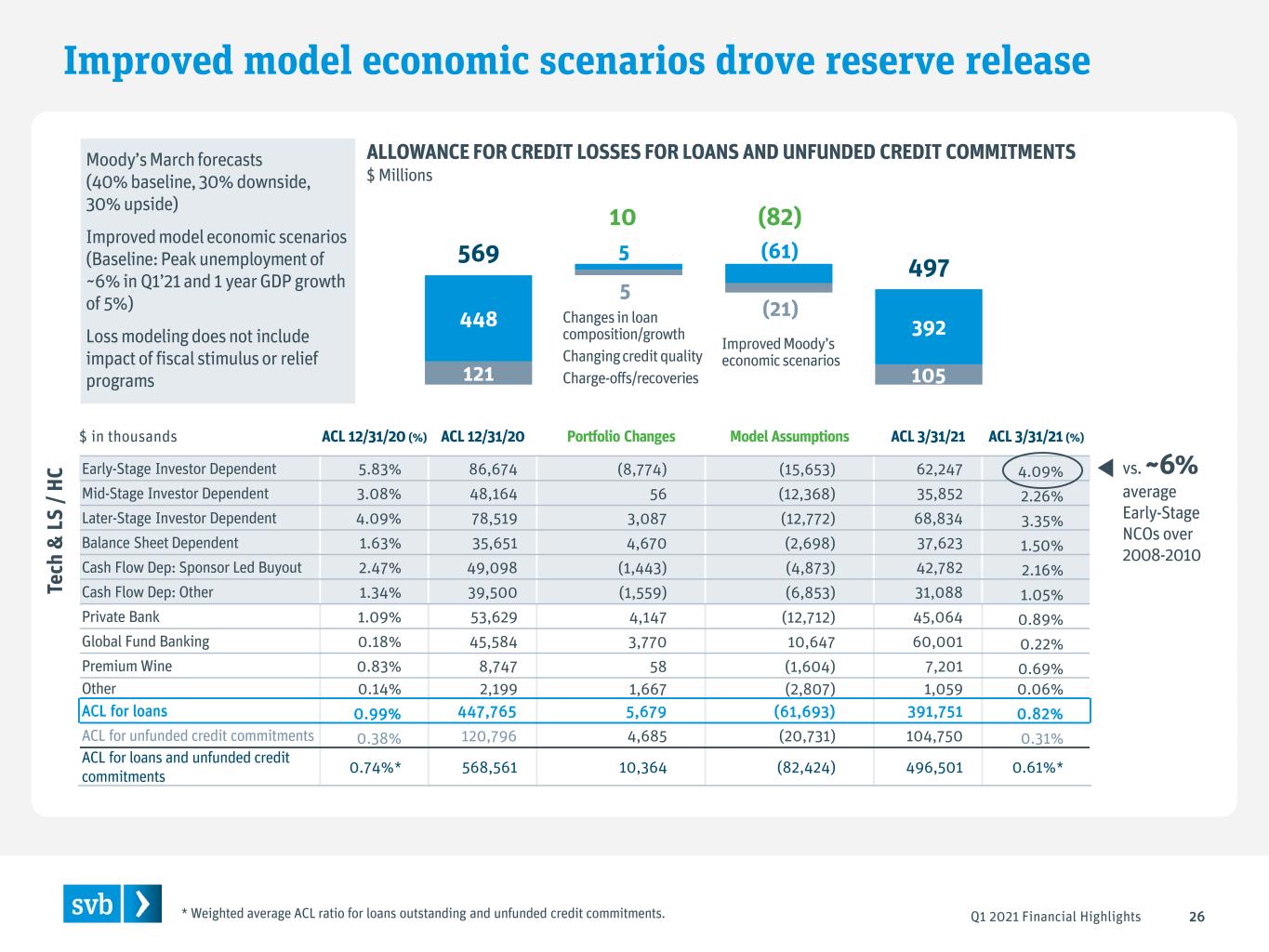

Our allowance for credit losses for loans decreased $56.0 million to $391.8 million at March 31, 2021, compared to $447.8 million at December 31, 2020. The $56.0 million decrease was driven primarily by a decrease of $61.7 million related to the reduction of expected credit losses for our performing loans reflective of improved economic scenarios in our forecast models and a $12.2 million decrease in reserves for nonaccrual loans, partially offset by a $17.9 million increase in our performing reserves for loan growth. As a percentage of total loans, our allowance for credit losses for loans decreased 17 basis points to 0.82 percent at March 31, 2021, compared to 0.99 percent at December 31, 2020. The 17 basis point decrease, due primarily to the factors described above, was driven by a 14 basis point decrease for our performing loans reserve as a percentage of total loans and a 3 basis point decrease for our nonaccrual individually assessed loans.

The provision for credit losses was $18.7 million for the first quarter of 2021, consisting primarily of the following:

•A provision for credit loss for loans of $34.0 million, driven primarily by $85.8 million in charge-offs not specifically reserved for at December 31, 2020, of which $80.0 million was related to the potentially fraudulent activity discussed above, and a $17.9 million increase for loan growth, partially offset by a $61.7 million reduction in performing reserves and $4.9 million of recoveries; and

•A reduction of our credit loss estimate for unfunded credit commitments of $16.1 million, driven primarily by improved economic scenarios in our forecast models, partially offset by changes in the unfunded credit commitments' composition within our portfolio segments.

Gross loan charge-offs were $95.0 million for the first quarter of 2021, of which $80.0 million relates to the potentially fraudulent Global Fund Banking activity discussed above, and an additional $5.8 million that was not

7

specifically reserved for at December 31, 2020. The remaining $15.0 million gross loan charge-offs were driven primarily by our Investor Dependent loan portfolio.

Nonaccrual loans were $90.2 million at March 31, 2021, compared to $104.2 million at December 31, 2020. Our nonaccrual loan balance decreased $14.0 million driven primarily by $9.5 million in repayments and $10.1 million in charge-offs, partially offset by new nonaccrual loans of $5.6 million. Repayments were driven primarily by clients in our Investor Dependent loan portfolio. New nonaccrual loans were driven primarily by $2.9 million for one Private Bank client. Nonaccrual loans as a percentage of total loans decreased to 0.20 percent for the first quarter of 2021 compared to 0.23 percent for the fourth quarter of 2020.

The allowance for credit losses for nonaccrual loans decreased $12.2 million to $41.9 million in the first quarter of 2021. The decrease was due primarily to $8.2 million in repayments and $9.1 million in charge-offs, partially offset by $5.1 million in reserves for new nonaccrual loans as noted above. Charge-offs and repayments were driven primarily by clients in our Investor Dependent loan portfolio. New nonaccrual reserves were driven primarily by reserves of $2.9 million for one Private Bank client.

We recorded an allowance for credit losses for HTM securities of $1.1 million at March 31, 2021, compared to $0.4 million at December 31, 2020. Our provision for HTM securities was driven primarily by the purchase of corporate bonds in the first quarter of 2021.

Client Funds

Our Total Client Funds consist of the sum of both our on-balance sheet deposits and off-balance sheet client investment funds. The following tables provide a summary of our average and period-end on-balance sheet deposits and off-balance sheet client investment funds:

Average On-Balance Sheet Deposits and Off-Balance Sheet Client Investment Funds (1)

| Average balances for the | ||||||||||||||||||||

| Three months ended | ||||||||||||||||||||

| (Dollars in millions) | March 31, 2021 | December 31, 2020 | March 31, 2020 | |||||||||||||||||

| Interest-bearing deposits | $ | 37,375 | $ | 30,774 | $ | 20,472 | ||||||||||||||

| Noninterest bearing demand deposits | 73,233 | 61,663 | 41,336 | |||||||||||||||||

| Total average on-balance sheet deposits | $ | 110,608 | $ | 92,437 | $ | 61,808 | ||||||||||||||

| Sweep money market funds | $ | 67,138 | $ | 58,212 | $ | 43,045 | ||||||||||||||

| Client investment assets under management (2) | 72,478 | 64,006 | 50,746 | |||||||||||||||||

| Repurchase agreements | 11,963 | 10,887 | 9,799 | |||||||||||||||||

| Total average off-balance sheet client investment funds | $ | 151,579 | $ | 133,105 | $ | 103,590 | ||||||||||||||

Period-end On-Balance Sheet Deposits and Off-Balance Sheet Client Investment Funds (1)

| Period-end balances at | ||||||||||||||||||||||||||||||||

| (Dollars in millions) | March 31, 2021 | December 31, 2020 | September 30, 2020 | June 30, 2020 | March 31, 2020 | |||||||||||||||||||||||||||

| Interest-bearing deposits | $ | 39,710 | $ | 35,463 | $ | 27,265 | $ | 25,345 | $ | 19,010 | ||||||||||||||||||||||

| Noninterest-bearing demand deposits | 84,440 | 66,519 | 57,508 | 49,161 | 42,902 | |||||||||||||||||||||||||||

| Total period-end on-balance sheet deposits | $ | 124,150 | $ | 101,982 | $ | 84,773 | $ | 74,506 | $ | 61,912 | ||||||||||||||||||||||

| Sweep money market funds | $ | 75,328 | $ | 59,844 | $ | 56,395 | $ | 49,388 | $ | 44,833 | ||||||||||||||||||||||

| Client investment assets under management (2) | 75,970 | 70,671 | 60,773 | 56,023 | 51,020 | |||||||||||||||||||||||||||

| Repurchase agreements | 12,584 | 10,538 | 9,613 | 10,510 | 11,099 | |||||||||||||||||||||||||||

| Total period-end off-balance sheet client investment funds | $ | 163,882 | $ | 141,053 | $ | 126,781 | $ | 115,921 | $ | 106,952 | ||||||||||||||||||||||

(1)Off-Balance sheet client investment funds are maintained at third-party financial institutions.

(2)These funds represent investments in third-party money market mutual funds and fixed income securities managed by SVB Asset Management.

8

The increases in our average and period-end Total Client Funds from the fourth quarter of 2020 to the first quarter of 2021 reflect growth in both on-balance sheet deposits and off-balance sheet client investments. We saw Total Client Funds growth across all portfolios with the primary contributors coming from our Technology and Life Science/Healthcare portfolios driven by strong public and private fundraising.

Long-term Debt

Long-term debt increased by $0.5 billion to $1.3 billion for the first quarter of 2021 compared to $0.8 billion for the fourth quarter of 2020. The increase in long term debt was driven by the issuance of $500.0 million of 1.800% Senior Notes on February 2, 2021 with interest payments starting August 2, 2021, and payable every February 2nd and August 2nd. We received net proceeds from this offering of approximately $494.3 million after deducting underwriting discounts, commissions and issuance costs. The balance of our 1.800% Senior Notes at March 31, 2021 was $494.4 million, which reflects a $5.6 million of discounts and issuance costs.

Noninterest Income

Noninterest income was $744.2 million for the first quarter of 2021, compared to $621.8 million for the fourth quarter of 2020. Non-GAAP noninterest income, net of noncontrolling interests, was $719.1 million for the first quarter of 2021, compared to $575.8 million for the fourth quarter of 2020. (See reconciliations of non-GAAP measures used under the section "Use of Non-GAAP Financial Measures.")

The increase was attributable primarily to increased net gains on investment securities, gains on equity warrant assets and SVB Leerink revenue. Items impacting noninterest income for the first quarter of 2021 were as follows:

Net gains on investment securities

Net gains on investment securities were $167.1 million for the first quarter of 2021, compared to $150.0 million for the fourth quarter of 2020. The following tables provide a summary of non-GAAP net gains (losses) on investment securities, net of noncontrolling interests, for the three months ended March 31, 2021 and December 31, 2020, respectively:

| Three months ended March 31, 2021 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | Managed Funds of Funds | Managed Direct Venture Funds | Managed Credit Funds | Public Equity Securities | Debt Funds | Strategic and Other Investments | SVB Leerink | Total | ||||||||||||||||||||||||||||||||||||||||||

| GAAP gains on investment securities, net | $ | 30,692 | $ | 18,487 | $ | 7,048 | $ | 76,321 | $ | 414 | $ | 30,367 | $ | 3,749 | $ | 167,078 | ||||||||||||||||||||||||||||||||||

| Less: income attributable to noncontrolling interests, including carried interest allocation | 13,165 | 8,668 | 868 | — | — | — | 2,330 | 25,031 | ||||||||||||||||||||||||||||||||||||||||||

| Non-GAAP gains on investment securities, net of noncontrolling interests | $ | 17,527 | $ | 9,819 | $ | 6,180 | $ | 76,321 | $ | 414 | $ | 30,367 | $ | 1,419 | $ | 142,047 | ||||||||||||||||||||||||||||||||||

| Three months ended December 31, 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | Managed Funds of Funds | Managed Direct Venture Funds | Managed Credit Funds | Public Equity Securities | Debt Funds | Strategic and Other Investments | SVB Leerink | Total | ||||||||||||||||||||||||||||||||||||||||||

| GAAP gains (losses) on investment securities, net | $ | 62,336 | $ | 28,949 | $ | 19,127 | $ | (17,986) | $ | (150) | $ | 56,527 | $ | 1,189 | $ | 149,992 | ||||||||||||||||||||||||||||||||||

| Less: income attributable to noncontrolling interests, including carried interest allocation | 28,493 | 13,843 | 3,150 | — | — | — | 405 | 45,891 | ||||||||||||||||||||||||||||||||||||||||||

| Non-GAAP gains (losses) on investment securities, net of noncontrolling interests | $ | 33,843 | $ | 15,106 | $ | 15,977 | $ | (17,986) | $ | (150) | $ | 56,527 | $ | 784 | $ | 104,101 | ||||||||||||||||||||||||||||||||||

Non-GAAP net gains, net of noncontrolling interests, of $142.0 million for the first quarter of 2021 were primarily attributable to realized gains on sales of public equity securities, as well as valuation increases in both public and private investments held in our strategic and other investments and managed fund of funds portfolios.

The gains in public equity securities were driven primarily by realized gains on common stock shares sold during the three months ending March 31, 2021, which includes $43.3 million from the sale of BigCommerce Holdings, Inc. common stock shares, as well as gains from other public equity securities held in our portfolio.

9

Net gains on equity warrant assets

The following table provides a summary of our net gains on equity warrant assets:

| Three months ended | ||||||||||||||||||||

| (Dollars in thousands) | March 31, 2021 | December 31, 2020 | March 31, 2020 | |||||||||||||||||

| Equity warrant assets: | ||||||||||||||||||||

Gains on exercises, net | $ | 159,637 | $ | 95,554 | $ | 19,193 | ||||||||||||||

Terminations | (249) | (419) | (326) | |||||||||||||||||

Changes in fair value, net | 62,297 | 48,626 | (5,472) | |||||||||||||||||

| Total net gains on equity warrant assets | $ | 221,685 | $ | 143,761 | $ | 13,395 | ||||||||||||||

Net gains on equity warrant assets for the first quarter of 2021 were attributable primarily to net gains from exercises of $159.6 million reflective of $115.8 million in gains related to Coinbase Global, Inc.'s ("Coinbase") announcement to enter the public markets via a direct listing with remaining gains driven primarily by IPO activity. The $62.3 million of net valuation increases were driven by our private company portfolio reflective primarily of pending special purpose acquisition company ("SPAC") activity as well as pending M&A and IPO activity.

At March 31, 2021, we held warrants in 2,670 companies with a total fair value of $244.3 million. Warrants in 42 companies each had fair values greater than $1.0 million and collectively represented $113.7 million, or 46.5 percent, of the fair value of the total warrant portfolio at March 31, 2021.

The gains (or losses) from investment securities from our non-marketable and other equity securities portfolio as well as our equity warrant assets resulting from changes in valuations (fair values) are currently unrealized, and the extent to which such gains (or losses) will become realized is subject to a variety of factors, including, among other things, performance of the underlying portfolio companies, investor demand for IPOs and SPACs, fluctuations in the underlying valuation of these companies, levels of M&A activity and legal and contractual restrictions on our ability to sell the underlying securities.

Investment in Coinbase

As of the date of this filing, we have sold all of our common stock shares of Coinbase resulting in pre-tax gains on investment securities of approximately $38.2 million to be recorded in the second quarter of 2021.

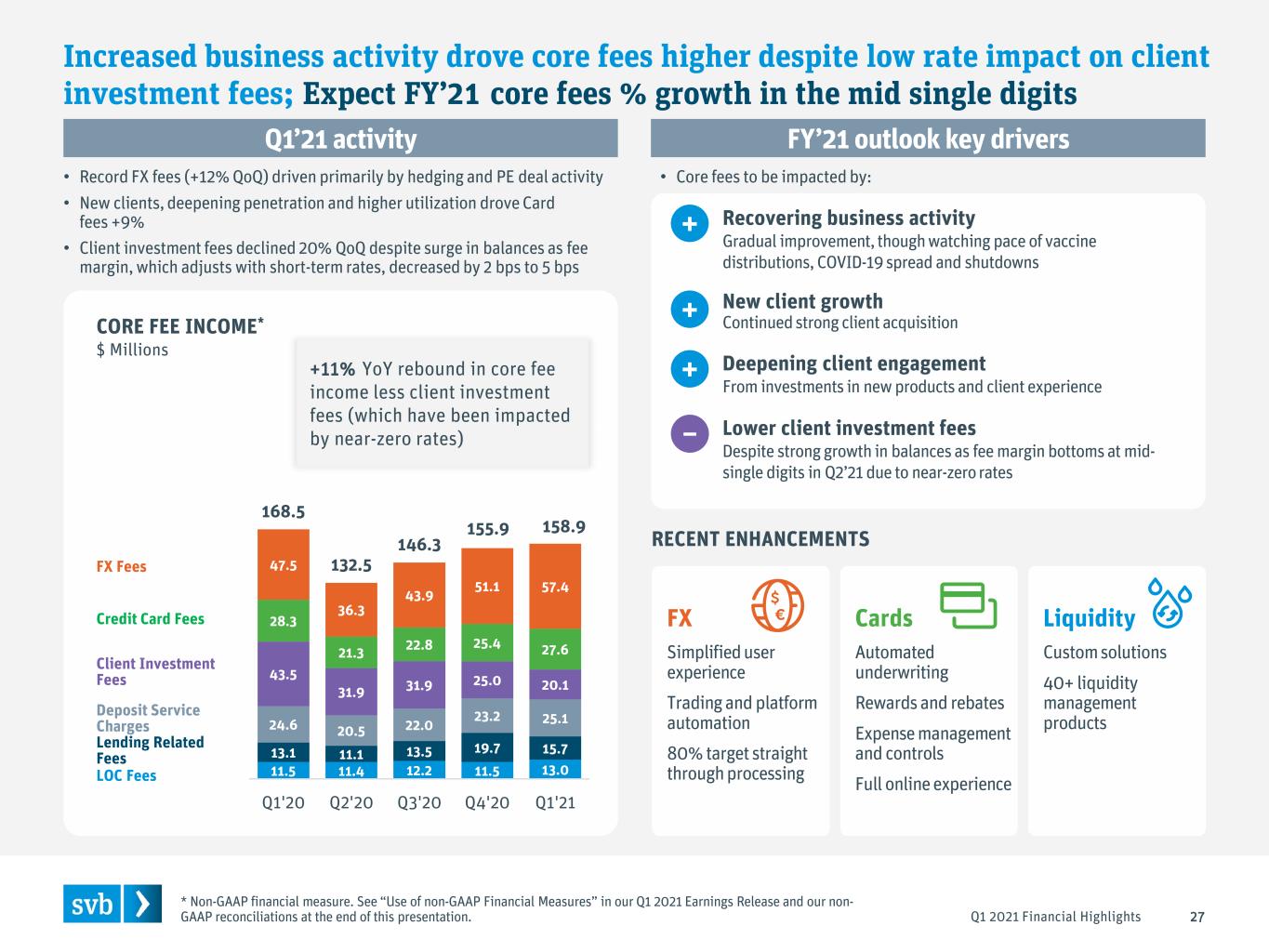

Non-GAAP core fee income plus non-GAAP SVB Leerink revenue

The following table provides a summary of our non-GAAP core fee income, non-GAAP SVB Leerink revenue and non-GAAP core fee income plus SVB Leerink revenue:

| Three months ended | ||||||||||||||||||||

| (Dollars in thousands) | March 31, 2021 | December 31, 2020 | March 31, 2020 | |||||||||||||||||

| Non-GAAP core fee income: | ||||||||||||||||||||

Client investment fees | $ | 20,065 | $ | 25,008 | $ | 43,393 | ||||||||||||||

Foreign exchange fees | 57,393 | 51,091 | 47,505 | |||||||||||||||||

Credit card fees | 27,567 | 25,389 | 28,304 | |||||||||||||||||

Deposit service charges | 25,151 | 23,221 | 24,589 | |||||||||||||||||

Lending related fees | 15,657 | 19,682 | 13,125 | |||||||||||||||||

Letters of credit and standby letters of credit fees | 13,051 | 11,504 | 11,542 | |||||||||||||||||

| Total non-GAAP core fee income | $ | 158,884 | $ | 155,895 | $ | 168,458 | ||||||||||||||

Investment banking revenue | 142,302 | 133,434 | 46,867 | |||||||||||||||||

Commissions | 24,439 | 17,443 | 16,022 | |||||||||||||||||

| Total non-GAAP SVB Leerink revenue | $ | 166,741 | $ | 150,877 | $ | 62,889 | ||||||||||||||

| Total non-GAAP core fee income plus SVB Leerink revenue | $ | 325,625 | $ | 306,772 | $ | 231,347 | ||||||||||||||

Non-GAAP core fee income increased from the fourth quarter of 2020 to the first quarter of 2021 reflective primarily by increases in foreign exchange fees and credit card fees, partially offset by a decrease in client investment fees. Foreign exchange fees increased $6.3 million driven primarily by increased foreign currency risk hedging activity as well as private equity activity. Credit card fees increased $2.2 million primarily due to new client growth, relationship

10

expansion and higher utilization. The $4.9 million decrease in client investment fees is reflective of a reduction in fee margin resulting from lower short-term market rates.

Non-GAAP SVB Leerink revenue increased from the fourth quarter of 2020 to the first quarter of 2021 as SVB Leerink continues to capitalize on strong markets. Investment banking revenue was $142.3 million, driven primarily by $132.2 million from public equity capital raising in the first quarter of 2021.

Reconciliations of our non-GAAP noninterest income, non-GAAP net gains on investment securities, non-GAAP core fee income, non-GAAP SVB Leerink revenue and non-GAAP core fee income plus SVB Leerink revenue are provided under the section “Use of Non-GAAP Financial Measures.”

Noninterest Expense

Noninterest expense was $636.0 million for the first quarter of 2021, compared to $664.8 million for the fourth quarter of 2020. The decrease of $28.8 million in noninterest expense consisted primarily of decreases in our net occupancy expense, premises and equipment and other noninterest expense, partially offset by an increase in our compensation and benefits expense in the first quarter of 2021 compared to the fourth quarter of 2020.

Net occupancy and premises and equipment expenses decreased $27.1 million and $8.9 million, respectively, due primarily to higher expenses in the fourth quarter of 2020 reflective of impairment, and accelerated depreciation, of right-of-use assets and other fixed assets related to vacating leased office space in several locations during the fourth quarter of 2020.

Other noninterest expense decreased $26.8 million, due primarily to higher expenses in the fourth quarter reflective of the $20.0 million charitable donation of net PPP fees received from the Small Business Administration ("SBA") during the fourth quarter of 2020.

The following table provides a summary of our compensation and benefits expense:

| Three months ended | ||||||||||||||||||||

| (Dollars in thousands, except employees) | March 31, 2021 | December 31, 2020 | March 31, 2020 | |||||||||||||||||

| Compensation and benefits: | ||||||||||||||||||||

Salaries and wages | $ | 163,558 | $ | 140,377 | $ | 115,614 | ||||||||||||||

Incentive compensation plans | 149,645 | 172,730 | 66,674 | |||||||||||||||||

Other employee incentives and benefits (1) | 132,222 | 102,598 | 73,298 | |||||||||||||||||

| Total compensation and benefits | $ | 445,425 | $ | 415,705 | $ | 255,586 | ||||||||||||||

| Period-end full-time equivalent employees | 4,656 | 4,461 | 3,710 | |||||||||||||||||

| Average full-time equivalent employees | 4,601 | 4,419 | 3,672 | |||||||||||||||||

(1)Other employee incentives and benefits expense includes employer payroll taxes, group health and life insurance, share-based compensation, 401(k), ESOP, warrant incentive and retention plans, agency fees and other employee-related expenses.

The $29.7 million increase in total compensation and benefits expense consists primarily of the following:

•An increase of $29.6 million in other employee incentives and benefits due primarily to an increase in warrant incentive plan expense reflective of higher gains on equity warrant assets in the first quarter of 2021 compared to the fourth quarter of 2020 and first quarter seasonal expense items relating to additional 401(k) matching contributions and employer-related payroll taxes as a result of the 2020 annual incentive compensation plan payments, and

•An increase of $23.2 million in salaries and wages expense related primarily to strategic hires for SVB Leerink as well as the increase in the number of average FTEs by 182 to 4,601, partially offset by

•A decrease of $23.1 million in incentive compensation plans expense attributable primarily to a decrease in SVB Leerink incentive compensation expense reflective of higher expenses in the fourth quarter of 2020 as a result of SVB Leerink's strong 2020 full year financial performance.

Income Tax Expense

Our effective tax rate was 25.9 percent for the first quarter of 2021, compared to 27.4 percent for the fourth quarter of 2020. Our effective tax rate is calculated by dividing income tax expense by the sum of income before income tax expense and net income attributable to noncontrolling interests. The decrease in our effective tax rate was driven

11

primarily by an increase in the recognition of excess tax benefits from share-based compensation in the first quarter of 2021 which is reflective of a higher number of stock option exercises due to the increase in our stock price and the annual vesting of our performance-based restricted stock units and SVB Leerink restricted stock units.

Noncontrolling Interests

Included in net income is income and expense related to noncontrolling interests. The relevant amounts allocated to investors in our consolidated subsidiaries, other than us, are reflected under “Net Income Attributable to Noncontrolling Interests” in our statements of income. The following table provides a summary of net income attributable to noncontrolling interests:

| Three months ended | ||||||||||||||||||||

| (Dollars in thousands) | March 31, 2021 | December 31, 2020 | March 31, 2020 | |||||||||||||||||

| Net interest income (1) | $ | — | $ | — | $ | (21) | ||||||||||||||

| Noninterest (income) loss (1) | (15,796) | (17,408) | 2,491 | |||||||||||||||||

| Noninterest expense (1) | 117 | 91 | 140 | |||||||||||||||||

| Carried interest allocation (2) | (9,271) | (28,574) | (637) | |||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | $ | (24,950) | $ | (45,891) | $ | 1,973 | ||||||||||||||

(1)Represents noncontrolling interests’ share in net interest income, noninterest income and noninterest expense.

(2)Represents the preferred allocation of income (or change in income) earned by us as the general partner of certain consolidated funds.

Net income attributable to noncontrolling interests of $25.0 million for the first quarter of 2021 was driven primarily by net gains on investment securities (including carried interest allocation) from our managed funds of funds and our managed direct venture funds portfolios.

SVBFG Stockholders’ Equity

Total SVBFG stockholders’ equity increased by $1.7 billion to $9.9 billion at March 31, 2021, compared to $8.2 billion at December 31, 2020, primarily due to $1.7 billion of capital raised related to our common stock equity offering and preferred stock issuance during the first quarter of 2021. Additionally, net income of $532 million during the first quarter of 2021 was more than offset by a decrease in the net balance of accumulated other comprehensive income to $21 million from a balance of $623 million at December 31, 2020, driven primarily by a decrease in the fair value of our AFS securities portfolio reflective of increases in market rates.

Common Stock

On March 22, 2021, to support the continued growth of our balance sheet, we issued and sold 2,000,000 shares of common stock at a price of $500.00 per share. We received net proceeds of $972.0 million after deducting underwriting discounts and commissions. On April 14, 2021, we issued and sold an additional 300,000 shares of common stock under the full exercise of the underwriter's over-allotment option resulting in additional net proceeds of approximately $146.0 million after deducting discounts and commissions.

Preferred Stock

Series A Preferred Stock

On February 16, 2021, SVB Financial Group paid a quarterly cash dividend of $13.125 per share on the Company’s 5.250% fixed-rate non-cumulative perpetual Series A Preferred Stock, liquidation amount $1,000 per share, which are represented by depositary shares (NASDAQ: SIVBP), each representing a 1/40th interest in a share of preferred stock, with a total dividend paid of $4.6 million.

On April 22, 2021, the Company's Board of Directors declared a quarterly cash dividend of $13.125 per share (representing $0.328125 per depositary share) on the Series A Preferred Stock. The dividend is payable on May 17, 2021 to holders of record at the close of business on May 3, 2021.

Series B Preferred Stock

On February 2, 2021, SVB Financial Group issued 750,000 depositary shares each representing a 1/100th ownership interest in a share of Series B Preferred Stock with a $0.001 par value and a liquidation preference of $100,000 per share, or $1,000 per depositary share. The Series B Preferred Stock is perpetual and has no stated maturity. Dividends are approved by the Board of Directors and, if declared, are payable quarterly, in arrears, at a rate per annum equal to (i) 4.10 percent from the original issue date to, but excluding, February 15, 2031 and (ii) for

12

the February 15, 2031 dividend date and during each subsequent ten year period, the ten-year treasury rate (calculated three business days prior to each reset date as the five day average of the yields on actively traded U.S. treasury securities adjusted to constant maturity, for ten-year maturities) plus 3.064 percent. As of March 31, 2021, 750,000 depositary shares were issued and outstanding, had a carrying value of $739.2 million and a liquidation preference of $750.0 million.

On April 22, 2021, the Company's Board of Directors declared a quarterly cash dividend of $1,173.056 per share (representing $11.730556 per depositary share) on the Series B Preferred Stock. The dividend is payable on May 17, 2021 to holders of record at the close of business on May 3, 2021.

SVB Financial and Bank Capital Ratios(1)

| March 31, 2021 | December 31, 2020 | March 31, 2020 | ||||||||||||||||||

| SVB Financial: | ||||||||||||||||||||

| CET 1 risk-based capital ratio (2) | 12.19 | % | 11.04 | % | 12.35 | % | ||||||||||||||

| Tier 1 risk-based capital ratio (2) | 14.02 | 11.89 | 13.35 | |||||||||||||||||

| Total risk-based capital ratio (2) | 14.63 | 12.64 | 14.45 | |||||||||||||||||

| Tier 1 leverage ratio (2) | 8.01 | 7.45 | 9.00 | |||||||||||||||||

| Tangible common equity to tangible assets ratio (3) | 6.06 | 6.66 | 8.70 | |||||||||||||||||

| Tangible common equity to risk-weighted assets ratio (3) | 12.12 | 11.87 | 13.40 | |||||||||||||||||

| Silicon Valley Bank: | ||||||||||||||||||||

| CET 1 risk-based capital ratio (2) | 12.94 | % | 10.70 | % | 10.90 | % | ||||||||||||||

| Tier 1 risk-based capital ratio (2) | 12.94 | 10.70 | 10.90 | |||||||||||||||||

| Total risk-based capital ratio (2) | 13.58 | 11.49 | 12.04 | |||||||||||||||||

| Tier 1 leverage ratio (2) | 7.20 | 6.43 | 7.21 | |||||||||||||||||

| Tangible common equity to tangible assets ratio (3) | 6.25 | 6.24 | 7.63 | |||||||||||||||||

| Tangible common equity to risk-weighted assets ratio (3) | 12.88 | 11.58 | 11.99 | |||||||||||||||||

(1)Regulatory capital ratios as of March 31, 2021 are preliminary.

(2)Capital ratios include regulatory capital phase-in of the allowance for credit losses under the 2020 CECL Interim Final Rule ("IFR") for periods beginning March 31, 2020.

(3)These are non-GAAP measures. A reconciliation of non-GAAP measures to GAAP is provided at the end of this release under the section “Use of Non-GAAP Financial Measures.”

March 31, 2021 Preliminary Results

Our risk-based capital ratios, tier 1 capital ratios and leverage ratios increased for both SVB Financial and Silicon Valley Bank as of March 31, 2021, compared to December 31, 2020. The increase in capital ratios was driven primarily by increases in our capital, partially offset by increases in our risk-weighted and average assets. The increase in capital for SVB Financial was driven by the issuance of common and preferred stock and net income. The increase in capital for Silicon Valley Bank was driven by a $2.0 billion downstream capital infusion from our bank holding company during the first quarter of 2021. The increase in average assets was driven by increases in our fixed income investments and loan portfolios.

All of our reported capital ratios remain above the levels considered to be “well capitalized” under applicable banking regulations.

13

Financial Outlook

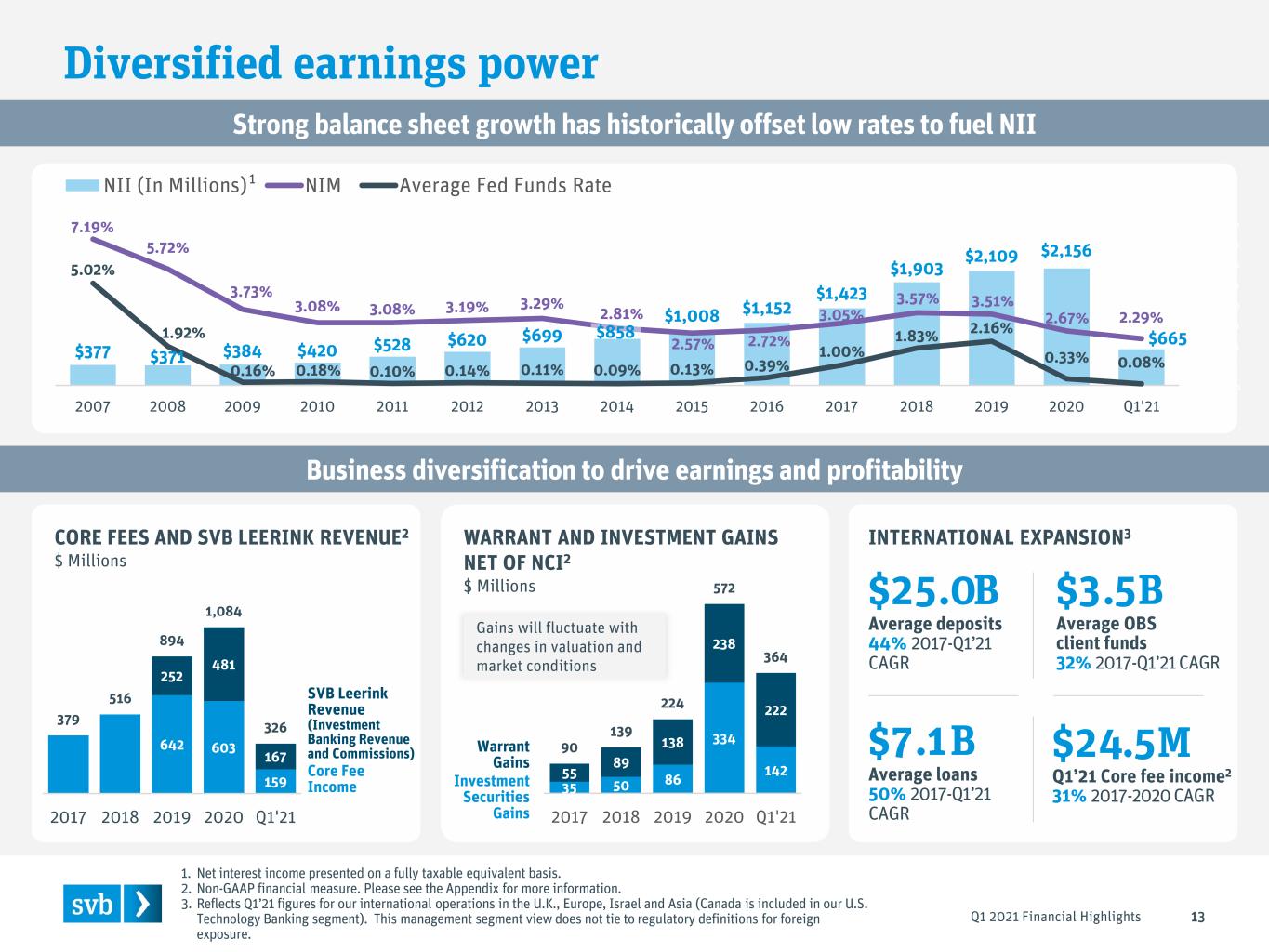

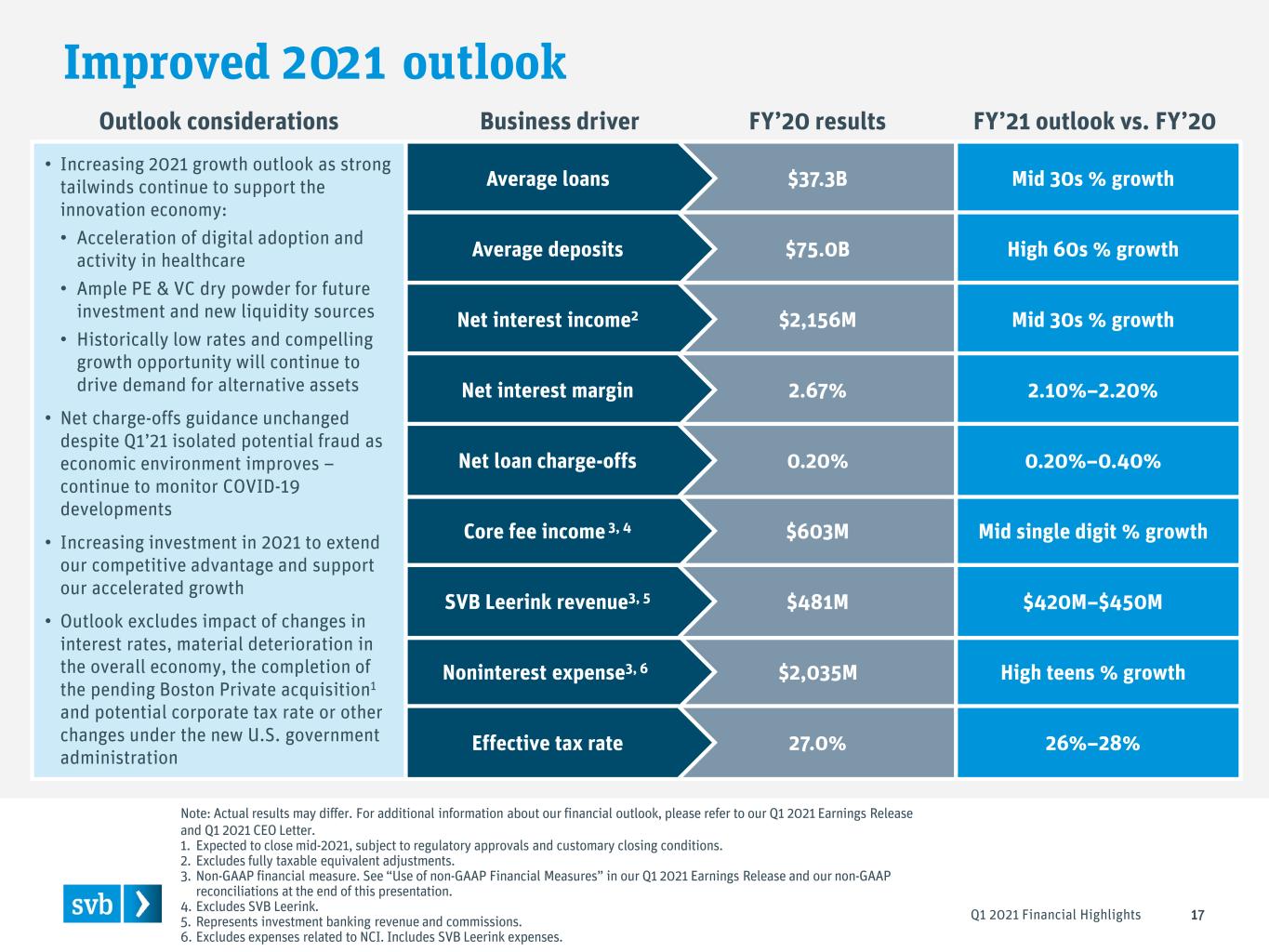

Our outlook for the year ending December 31, 2021, is provided below on a GAAP basis, unless otherwise noted. We have provided our current outlook for the expected full year results of our significant forecasted activities. Except for the items noted below, we do not provide an outlook for certain items (such as gains or losses from warrants and investment securities) where the timing or financial impact are particularly uncertain and/or subject to market or other conditions beyond our control (such as the level of IPO, M&A or general financing activity), or for potential unusual or non-recurring items. The outlook and the underlying assumptions presented are, by their nature, forward-looking statements and are subject to substantial risks and uncertainties, including risks and uncertainties related to the COVID-19 pandemic and related government orders, which are discussed below under the section “Forward-Looking Statements.” Actual results may differ. (For additional information about our financial outlook, please refer to Q1 2021 Earnings Slides. See "Additional Information" below.)

For the full year ending December 31, 2021, compared to our full year 2020 results, we currently expect the following outlook (please note that the outlook below does not include and/or take into account: (i) changes in interest rates, (ii) material deterioration in the overall economy, (iii) changes to the federal corporate tax rate and (iv) the completion of the pending acquisition of Boston Private Financial Holdings, Inc. ("Boston Private"), and includes management's updates to certain 2021 outlook metrics we previously disclosed on January 21, 2021):

| Current full year 2021 outlook compared to 2020 results (as of April 22, 2021) | |||||

| Average loan balances | Increase at a percentage rate in the mid-thirties | ||||

| Average deposit balances | Increase at a percentage rate in the high sixties | ||||

| Net interest income (1) | Increase at a percentage rate in the mid-thirties | ||||

| Net interest margin (1) | Between 2.10% and 2.20% | ||||

| Net loan charge-offs (2) | Between 0.20% and 0.40% of average total loans | ||||

| Core fee income (client investment fees, foreign exchange fees, credit card fees, deposit service charges, lending related fees and letters of credit fees) (3) | Increase at a percentage rate in the mid-single digits | ||||

| SVB Leerink revenue (3) | Between $420 million and $450 million | ||||

| Noninterest expense (4) (5) | Increase at a percentage rate in the high teens | ||||

| Effective tax rate (6) | Between 26% and 28% | ||||

(1)Our outlook for net interest income and net interest margin is based primarily on management's current forecast of average deposit and loan balances and deployment of surplus cash into investment securities. Such forecasts are subject to change, and actual results may differ, based on market conditions, the COVID-19 pandemic and its effects on the economic and business environments in which we operate, actual prepayment rates and other factors described under the section "Forward-Looking Statements" below.

(2)Our outlook for loan charge-offs includes the impact of an $80.0 million charge-off related to potentially fraudulent activity as noted above.

(3)Core fee income and SVB Leerink revenue are each non-GAAP measures, which collectively represent noninterest income, but exclude certain line items where performance is typically subject to market or other conditions beyond our control. As we are unable to quantify such line items that would be required to be included in the comparable GAAP financial measure for the future period presented without unreasonable efforts, no reconciliation for the outlook of non-GAAP core fee income and non-GAAP SVB Leerink revenue to GAAP noninterest income for fiscal year ending 2021 is included in this release, as we believe such reconciliation would imply a degree of precision that would be confusing or misleading to investors. See "Use of Non-GAAP Financial Measures" at the end of this release for further information regarding the calculation and limitations of this measure. Core fee income does not include SVB Leerink revenue. SVB Leerink revenue represents investment banking revenue and commissions.

(4)Noninterest expense is a non-GAAP measure, which represents noninterest expense, but excludes expenses attributable to noncontrolling interests. As we are unable to quantify such line items that would be required to be included in the comparable GAAP financial measure for the future period presented without unreasonable efforts, no reconciliation for the outlook of non-GAAP noninterest expense to GAAP noninterest expense for the fiscal year ending 2021 is included in this release, as we believe such reconciliation would imply a degree of precision that would be confusing or misleading to investors. See "Use of Non-GAAP Financial Measures" at the end of this release for further information regarding the calculation and limitations of this measure.

(5)Our outlook for noninterest expense is partly based on management's current forecast of performance-based incentive compensation expenses. Such forecasts are subject to change, and actual results may differ, based on our performance relative to our internal performance targets.

(6)Our outlook for our effective tax rate is based on management's current assumptions with respect to, among other things, SVB Financial Group's earnings, state income tax levels, tax deductions and estimated performance-based compensation activity and does not include assumptions for potential future tax rate changes.

14

Forward-Looking Statements

This release contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond our control. Forward-looking statements are statements that are not historical facts, such as forecasts of our future financial results and condition, expectations for our operations and business, and our underlying assumptions of such forecasts and expectations. In addition, forward-looking statements generally can be identified by the use of such words as “becoming,” “may,” “will,” “should,” “could,” “would,” “predict,” “potential,” “continue,” “anticipate,” “believe,” “estimate,” “assume,” “seek,” “expect,” “plan,” “intend,” the negative of such words or comparable terminology. In this release, including our CEO's statement and in the section “Financial Outlook,” we make forward-looking statements discussing management’s expectations for 2021 about, among other things, economic conditions; the continuing and potential effects of the COVID-19 pandemic; opportunities in the market; the outlook on our clients' performance; our financial, credit, and business performance, including loan growth, loan mix and loan yields; deposit growth; expense levels; our expected effective tax rate; accounting impact; financial results (and the components of such results) and the proposed acquisition of Boston Private.

Although we believe that the expectations reflected in our forward-looking statements are reasonable, we have based these expectations on our current beliefs as well as our assumptions, and such expectations may not prove to be correct. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside our control. Our actual results of operations and financial performance could differ significantly from those expressed in or implied by our management’s forward-looking statements. Important factors that could cause our actual results and financial condition to differ from the expectations stated in the forward-looking statements include, among others:

•market and economic conditions (including the general condition of the capital and equity markets, and IPO, secondary offering, SPAC fundraising, M&A and financing activity levels) and the associated impact on us (including effects on client demand for our commercial and investment banking and other financial services, as well as on the valuations of our investments);

•the COVID-19 pandemic and its effects on the economic and business environments in which we operate, and its effects on our operations, including, as a result of, prolonged work-from-home arrangements;

•the impact of changes from the Biden-Harris administration and the new U.S. Congress on the economic environment, capital markets and regulatory landscape, including monetary, tax and other trade policies;

•changes in the volume and credit quality of our loans as well as volatility of our levels of nonperforming assets and charge-offs;

•the impact of changes in interest rates or market levels or factors affecting or affected by them, especially on our loan and investment portfolios;

•the adequacy of our allowance for credit losses and the need to make provisions for credit losses for any period;

•the sufficiency of our capital and liquidity positions;

•changes in the levels of our loans, deposits and client investment fund balances;

•changes in the performance or equity valuations of funds or companies in which we have invested or hold derivative instruments or equity warrant assets;

•variations from our expectations as to factors impacting our cost structure;

•changes in our assessment of the creditworthiness or liquidity of our clients or unanticipated effects of credit concentration risks which create or exacerbate deterioration of such creditworthiness or liquidity;

•variations from our expectations as to factors impacting the timing and level of employee share-based transactions;

•the occurrence of fraudulent activity, including breaches of our information security or cyber security-related incidents;

•business disruptions and interruptions due to natural disasters and other external events;

•the impact on our reputation and business from our interactions with business partners, counterparties, service providers and other third parties;

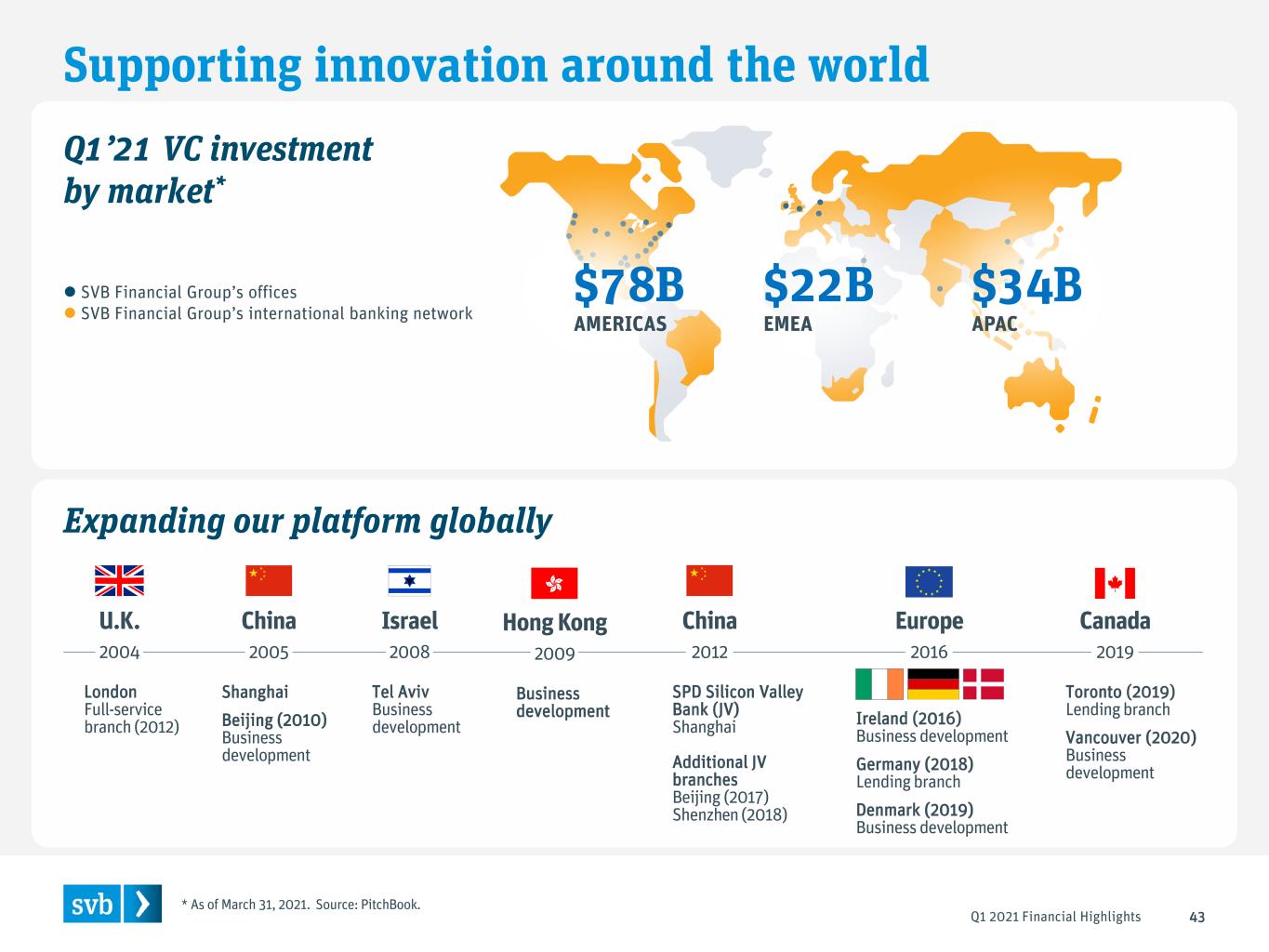

•the expansion of our business internationally, and the impact of international market and economic events on us;

•the effectiveness of our risk management framework and quantitative models;

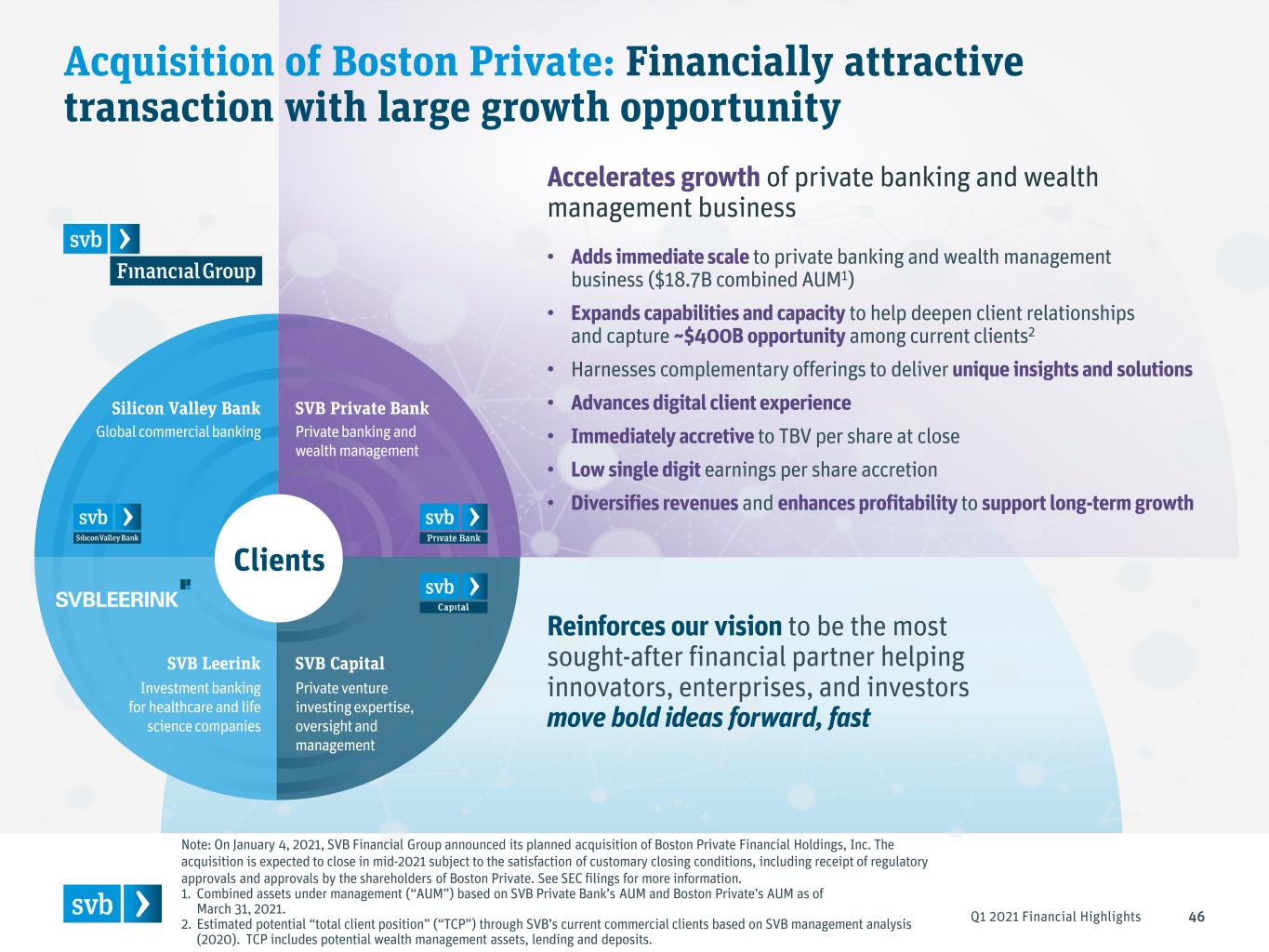

•our ability to maintain or increase our market share, including through successfully implementing our business strategy and undertaking new business initiatives, including through the integration of Boston Private;

15

•an inability to complete the acquisition of Boston Private, or changes in the currently anticipated timeframe, terms or manner of such acquisition;

•the occurrence of any event, change or other circumstance that could give rise to the right of one or both parties to terminate the merger agreement between us and Boston Private;

•greater than expected costs or other difficulties related to the integration of our business and that of Boston Private;

•variations from our expectations as to the amount and timing of business opportunities, growth prospects and cost savings associated with completing the acquisition of Boston Private;

•the inability to retain existing Boston Private clients and employees following the closing of the Boston Private acquisition;

•unfavorable resolution of legal proceedings or claims, as well as legal or regulatory proceedings or governmental actions;

•variations from our expectations as to factors impacting our estimate of our full-year effective tax rate;

•changes in applicable accounting standards and tax laws; and

•regulatory or legal changes and their impact on us.

The operating and economic environment during the first quarter continued to be impacted by the COVID-19 pandemic and related government orders. Statements about the effects of the COVID-19 pandemic on our business, operations, financial performance and prospects may constitute forward-looking statements and are subject to the risk that the actual impacts may differ, possibly materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond our control, including the scope and duration of the pandemic, potential variations of the virus, actions taken by governmental authorities in response to the pandemic, and the direct and indirect impact of the pandemic on our customers, third parties and us.

For additional information about these and other factors, please refer to our public reports filed with the U.S. Securities and Exchange Commission, including under the caption "Risk Factors" in our most recent Annual Report filed on Form 10-K. The forward-looking statements included in this release are made only as of the date of this release. We do not intend, and undertake no obligation, to update these forward-looking statements.

Earnings Conference Call

On Thursday, April 22, 2021, we will host a conference call at 3:00 p.m. (Pacific Time) to discuss the financial results for the quarter ended March 31, 2021. The conference call can be accessed by dialing (833) 494-1484 or (236) 714-2618 and entering the confirmation number "4158465". A live webcast of the audio portion of the call can be accessed on the Investor Relations section of our website at www.svb.com. A replay of the audio webcast will also be available on www.svb.com for 12 months beginning on April 22, 2021.

Additional Information

For additional information about our business, financial results for the first quarter 2021 and financial outlook, please refer to our Q1 2021 Earnings Slides and Q1 2021 CEO Letter, which are available on the Investor Relations section of our website at www.svb.com. These materials should be read together with this release, and include important supplemental information including key considerations that may impact our financial outlook.

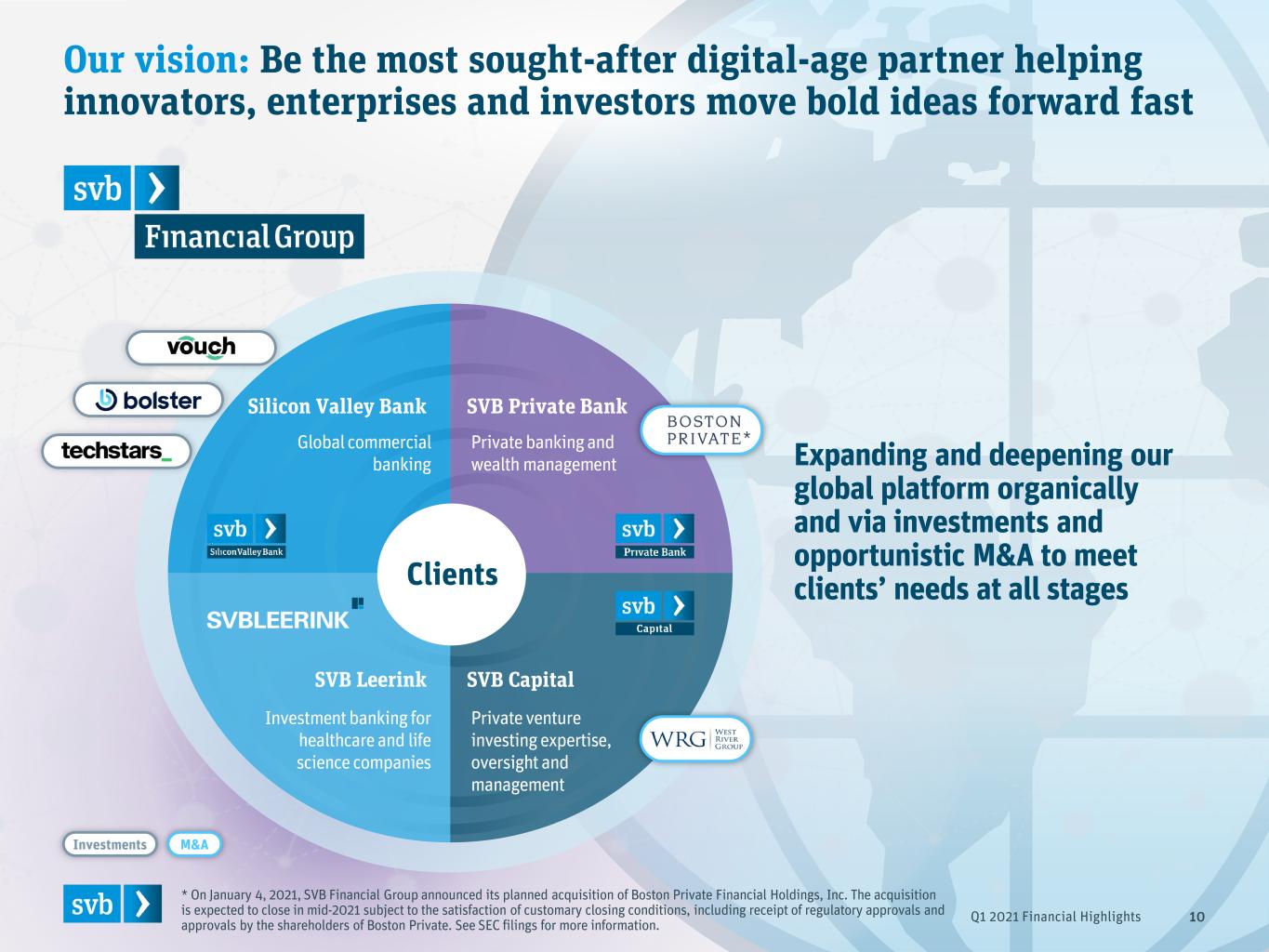

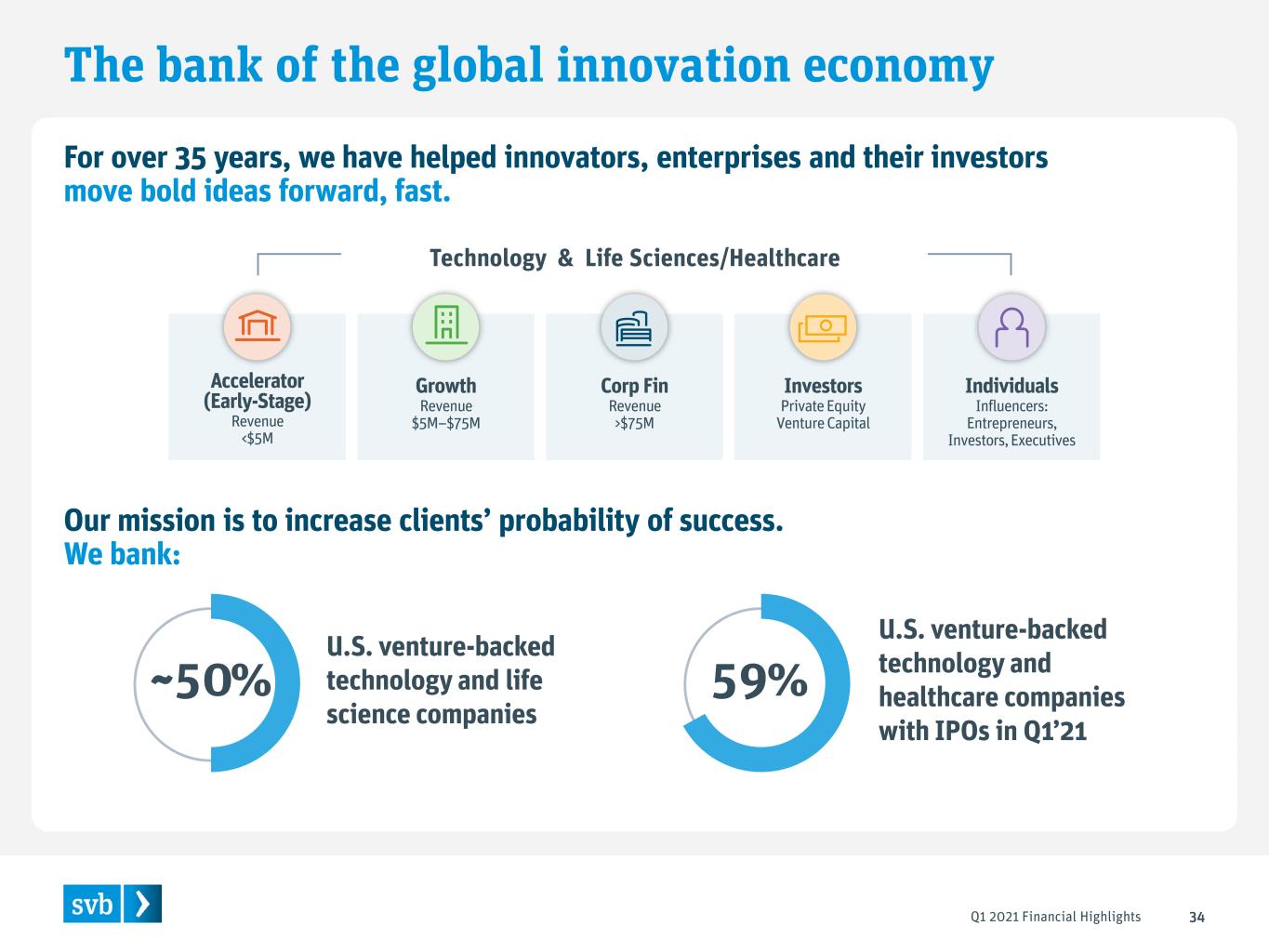

About SVB Financial Group

For more than 35 years, SVB Financial Group (NASDAQ: SIVB) and its subsidiaries have helped innovative companies and their investors move bold ideas forward, fast. SVB Financial Group’s businesses, including Silicon Valley Bank, offer commercial, investment and private banking, asset management, private wealth management, brokerage and investment services and funds management services to companies in the technology, life science and healthcare, private equity and venture capital and premium wine industries. Headquartered in Santa Clara, California, SVB Financial Group operates in centers of innovation around the world. Learn more at www.svb.com.

SVB Financial Group is the holding company for all business units and groups © 2021 SVB Financial Group. All rights reserved. SVB, SVB FINANCIAL GROUP, SILICON VALLEY BANK, SVB LEERINK, MAKE NEXT HAPPEN NOW and the chevron device are trademarks of SVB Financial Group, used under license. Silicon Valley Bank is a member of the FDIC and the Federal Reserve System. Silicon Valley Bank is the California bank subsidiary of SVB Financial Group.

16

SVB FINANCIAL GROUP AND SUBSIDIARIES

INTERIM CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

| Three months ended | ||||||||||||||||||||

| (Dollars in thousands, except share data) | March 31, 2021 | December 31, 2020 | March 31, 2020 | |||||||||||||||||

| Interest income: | ||||||||||||||||||||

| Loans | $ | 430,422 | $ | 403,361 | $ | 382,569 | ||||||||||||||

| Investment securities: | ||||||||||||||||||||

| Taxable | 224,162 | 182,543 | 154,385 | |||||||||||||||||

| Non-taxable | 20,897 | 18,855 | 12,824 | |||||||||||||||||

Federal funds sold, securities purchased under agreements to resell and other short-term investment securities | 3,265 | 2,799 | 17,624 | |||||||||||||||||

| Total interest income | 678,746 | 607,558 | 567,402 | |||||||||||||||||

| Interest expense: | ||||||||||||||||||||

| Deposits | 10,437 | 8,909 | 37,398 | |||||||||||||||||

| Borrowings | 8,730 | 7,169 | 5,867 | |||||||||||||||||

| Total interest expense | 19,167 | 16,078 | 43,265 | |||||||||||||||||

| Net interest income | 659,579 | 591,480 | 524,137 | |||||||||||||||||

| Provision (reduction) for credit losses | 18,679 | (38,433) | 243,480 | |||||||||||||||||

Net interest income after provision for credit losses | 640,900 | 629,913 | 280,657 | |||||||||||||||||

| Noninterest income: | ||||||||||||||||||||

| Gains on investment securities, net | 167,078 | 149,992 | 46,055 | |||||||||||||||||

| Gains on equity warrant assets, net | 221,685 | 143,761 | 13,395 | |||||||||||||||||

| Client investment fees | 20,065 | 25,008 | 43,393 | |||||||||||||||||

| Foreign exchange fees | 57,393 | 51,091 | 47,505 | |||||||||||||||||

| Credit card fees | 27,567 | 25,389 | 28,304 | |||||||||||||||||

| Deposit service charges | 25,151 | 23,221 | 24,589 | |||||||||||||||||

Lending related fees | 15,657 | 19,682 | 13,125 | |||||||||||||||||

Letters of credit and standby letters of credit fees | 13,051 | 11,504 | 11,542 | |||||||||||||||||

Investment banking revenue | 142,302 | 133,434 | 46,867 | |||||||||||||||||

| Commissions | 24,439 | 17,443 | 16,022 | |||||||||||||||||

| Other | 29,792 | 21,258 | 11,137 | |||||||||||||||||

| Total noninterest income | 744,180 | 621,783 | 301,934 | |||||||||||||||||

| Noninterest expense: | ||||||||||||||||||||

| Compensation and benefits | 445,425 | 415,705 | 255,586 | |||||||||||||||||

| Professional services | 81,343 | 77,336 | 38,705 | |||||||||||||||||

| Premises and equipment | 32,822 | 41,705 | 26,940 | |||||||||||||||||

| Net occupancy | 17,681 | 44,733 | 18,346 | |||||||||||||||||

| Business development and travel | 3,811 | 4,447 | 14,071 | |||||||||||||||||

| FDIC and state assessments | 9,463 | 8,601 | 5,234 | |||||||||||||||||

| Other | 45,456 | 72,272 | 40,703 | |||||||||||||||||

| Total noninterest expense | 636,001 | 664,799 | 399,585 | |||||||||||||||||

| Income before income tax expense | 749,079 | 586,897 | 183,006 | |||||||||||||||||

| Income tax expense | 187,315 | 148,096 | 49,357 | |||||||||||||||||

Net income before noncontrolling interests and dividends | 561,764 | 438,801 | 133,649 | |||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | (24,950) | (45,891) | 1,973 | |||||||||||||||||

Preferred stock dividends | (4,594) | (4,594) | (3,369) | |||||||||||||||||

Net income available to common stockholders | $ | 532,220 | $ | 388,316 | $ | 132,253 | ||||||||||||||

| Earnings per common share—basic | $ | 10.20 | $ | 7.49 | $ | 2.56 | ||||||||||||||

| Earnings per common share—diluted | 10.03 | 7.40 | 2.55 | |||||||||||||||||

Weighted average common shares outstanding—basic | 52,180,045 | 51,817,077 | 51,565,499 | |||||||||||||||||

Weighted average common shares outstanding—diluted | 53,075,690 | 52,466,389 | 51,944,091 | |||||||||||||||||

17

SVB FINANCIAL GROUP AND SUBSIDIARIES

INTERIM CONSOLIDATED BALANCE SHEETS

(Unaudited)

| (Dollars in thousands, except par value and share data) | March 31, 2021 | December 31, 2020 | March 31, 2020 | |||||||||||||||||

| Assets: | ||||||||||||||||||||

| Cash and cash equivalents | $ | 21,254,859 | $ | 17,674,763 | $ | 9,561,448 | ||||||||||||||

| Available-for-sale securities, at fair value (cost $26,159,161, $30,244,896 and $12,044,717, respectively) | 25,986,471 | 30,912,438 | 12,648,064 | |||||||||||||||||

| Held-to-maturity securities, at amortized cost and net of allowance for credit losses of $1,112, $392 and $230 (fair value of $41,186,735, $17,216,871, and $14,131,154), respectively | 41,164,620 | 16,592,153 | 13,574,289 | |||||||||||||||||

| Non-marketable and other equity securities | 1,857,761 | 1,802,235 | 1,200,595 | |||||||||||||||||

| Investment securities | 69,008,852 | 49,306,826 | 27,422,948 | |||||||||||||||||

| Loans, amortized cost | 47,675,166 | 45,181,488 | 35,968,085 | |||||||||||||||||

| Allowance for credit losses: loans | (391,751) | (447,765) | (548,963) | |||||||||||||||||

| Net loans | 47,283,415 | 44,733,723 | 35,419,122 | |||||||||||||||||

Premises and equipment, net of accumulated depreciation and amortization | 179,674 | 175,818 | 154,780 | |||||||||||||||||

| Goodwill | 142,685 | 142,685 | 137,823 | |||||||||||||||||

| Other intangible assets, net | 59,325 | 61,435 | 48,072 | |||||||||||||||||

| Lease right-of-use assets | 233,696 | 209,932 | 206,392 | |||||||||||||||||

| Accrued interest receivable and other assets | 4,184,114 | 3,205,825 | 2,059,055 | |||||||||||||||||

| Total assets | $ | 142,346,620 | $ | 115,511,007 | $ | 75,009,640 | ||||||||||||||

| Liabilities and total equity: | ||||||||||||||||||||