Table of Contents

Item 1. |

Business | |

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 8. |

Financial Statements and Supplementary Data | |

Item 15. |

Exhibits and Financial Statement Schedules | |

Table of Contents

TABLE OF CONTENTS

| PART I |

||||

| 3 | ||||

| 3 | ||||

| 5 | ||||

| 5 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

10 | |||

| 10 | ||||

| 12 | ||||

| 16 | ||||

| 18 | ||||

| 20 | ||||

| 21 | ||||

| 23 | ||||

| 24 | ||||

| 31 | ||||

| Contractual Obligations and Contingent Liabilities and Commitments |

34 | |||

| 35 | ||||

| 37 | ||||

| 38 | ||||

| 40 | ||||

| 40 | ||||

| F-1 | ||||

2

Table of Contents

ITEM 1. BUSINESS

For information regarding the organization of our business segments and our significant customers, see Note 4 of Notes to Consolidated Financial Statements.

Information set forth in Items 1A and 2 below are incorporated by reference into this Item 1.

Introduction

Hecla Mining Company and its subsidiaries have provided precious and base metals to the U.S. and the world since 1891 (in this report, “we” or “our” or “us” refers to Hecla Mining Company and our affiliates and subsidiaries, unless the context requires otherwise). We discover, acquire and develop mines and other mineral interests and produce and market (i) concentrates containing silver, gold and other metals, (ii) carbon material containing silver and gold, and (iii) unrefined doré containing silver and gold. In doing so, we intend to manage our business activities in a safe, environmentally responsible and cost-effective manner.

The silver, zinc and precious metals concentrates and carbon material we produce are sold to custom smelters, metal traders and third-party processors, and the unrefined doré we produce is sold to refiners or further refined before sale of the metals to traders. We are organized and managed in four segments that encompass our operating mines and significant assets being Greens Creek, Lucky Friday, Keno Hill and Casa Berardi.

Our current business strategy is to focus our financial and human capital in the following areas:

| • | Developing the Keno Hill properties located in the Yukon Territory, Canada |

| • | Operating our properties safely, and in an environmentally responsible and cost-effective manner. |

| • | Maintaining and investing in exploration and pre-development projects in the vicinities of mining districts and projects we believe to be under-explored and under-invested: Greens Creek on Alaska’s Admiralty Island located near Juneau; North Idaho’s Silver Valley in the historic Coeur d’Alene Mining District; the silver-producing district near Durango, Mexico; in the vicinity of our Casa Berardi mine and the Heva-Hosco project in the Abitibi region of northwestern Quebec, Canada; our projects in the Keno Hill mining district in the Yukon Territory, Canada; our projects located in three districts in Nevada; northwestern Montana; the Creede district of southwestern Colorado; the Kinskuch project in British Columbia, Canada; and the Republic mining district in Washington state. |

| • | Improving operations at each of our mines, which includes incurring costs for new technologies and equipment. |

| • | Expanding our proven and probable reserves, minerals resources and production capacity at our properties. |

| • | Conducting our business with financial stewardship to preserve our financial position in varying metals price and operational environments. |

| • | Advancing permitting at our Montana exploration project. |

| • | Continuing to seek opportunities to acquire and invest in mining and exploration properties and companies. |

3

Table of Contents

Metals Prices

Our operating results are substantially dependent upon the prices of silver, gold, lead and zinc, which can fluctuate widely. The volatility of such prices is illustrated in the following table, which sets forth our average realized prices and the high, low and average daily closing market prices for silver, gold, lead and zinc over the last three years. The sources for the market prices are the London Market Fixing prices from the London Bullion Market Association for silver and gold and the Cash Official prices from the London Metals Exchange for lead and zinc.

| 2023 | 2022 | 2021 | ||||||||||

| Silver (per oz.): |

||||||||||||

| Realized average |

$ | 23.33 | $ | 21.53 | $ | 25.24 | ||||||

| Market average |

$ | 23.39 | $ | 21.75 | $ | 25.17 | ||||||

| Market high |

$ | 26.03 | $ | 26.36 | $ | 28.48 | ||||||

| Market low |

$ | 20.09 | $ | 17.81 | $ | 21.53 | ||||||

| Gold (per oz.): |

||||||||||||

| Realized average |

$ | 1,939 | $ | 1,803 | $ | 1,796 | ||||||

| Market average |

$ | 1,943 | $ | 1,801 | $ | 1,800 | ||||||

| Market high |

$ | 2,049 | $ | 2,053 | $ | 1,940 | ||||||

| Market low |

$ | 1,811 | $ | 1,622 | $ | 1,684 | ||||||

| Lead (per lb.): |

||||||||||||

| Realized average |

$ | 1.03 | $ | 1.01 | $ | 1.03 | ||||||

| Market average |

$ | 0.97 | $ | 0.98 | $ | 1.00 | ||||||

| Market high |

$ | 1.06 | $ | 1.15 | $ | 1.14 | ||||||

| Market low |

$ | 0.90 | $ | 0.80 | $ | 0.86 | ||||||

| Zinc (per lb.): |

||||||||||||

| Realized average |

$ | 1.35 | $ | 1.41 | $ | 1.44 | ||||||

| Market average |

$ | 1.20 | $ | 1.58 | $ | 1.36 | ||||||

| Market high |

$ | 1.59 | $ | 2.05 | $ | 1.73 | ||||||

| Market low |

$ | 1.01 | $ | 1.23 | $ | 1.15 | ||||||

The prices of silver, gold, lead and zinc are affected by numerous factors beyond our control. See Item 1A. Risk Factors – A substantial or extended decline in metals prices would have a material adverse effect on us for information on a number of the factors that can impact prices of the metals we produce. Our 2023 realized average prices for all metals we sold, except zinc, were higher compared to 2022. In 2022, realized average prices for all metals we sold, except gold, were lower compared to 2021. We are unable to predict fluctuations in prices for metals and have limited control over the timing of our concentrate shipments which impacts our realized prices. However, we utilize financially-settled forward contracts for the metals we produce with the objective of managing the exposure to changes in prices of those metals contained in our concentrate shipments between the time of sale and final settlement. In addition, at times we utilize a similar program to manage the exposure to changes in prices of zinc and lead contained in our forecasted future concentrate shipments. See Note 10 of Notes to Consolidated Financial Statements for more information on our base and precious metal forward contract programs.

A comprehensive discussion of our financial results for the years ended December 31, 2023, 2022 and 2021, individual operation performance and other significant items can be found in Item 7. Management’s Discussion and Analysis of Consolidated Financial Condition and Results of Operations, as well as the Consolidated Financial Statements and Notes thereto.

4

Table of Contents

Products and Segments

Our segments are differentiated by geographic region. We produce zinc, silver and precious metals flotation concentrates at Greens Creek and silver and zinc flotation concentrates at Lucky Friday, each of which we sell to custom smelters and metal traders. The flotation concentrates produced at Greens Creek and Lucky Friday contain payable silver, zinc and lead, and at Greens Creek they also contain payable gold. At Greens Creek, we also produce gravity concentrate containing payable silver, gold and lead. Unrefined bullion (doré) is produced from the gravity concentrate by a third-party processor, and shipped to a refiner before sale of the metals to precious metal traders. While Keno Hill has not yet reached commercial productions levels, it is currently in ramp-up and producing silver and zinc flotation concentrates. We also produce unrefined gold and silver bullion bars (doré) and loaded carbon and precipitates at Casa Berardi, which are shipped to refiners before sale of the metals to precious metal traders. At times, we sell loaded carbon and precipitates directly to refiners. Payable metals are those included in our products which we are paid for by smelters, metal traders and refiners. Our segments as of December 31, 2023 included:

| • | Greens Creek located on Admiralty Island, near Juneau, Alaska. Greens Creek is 100% owned and has been in production since 1989. |

| • | Lucky Friday located in northern Idaho. Lucky Friday is 100% owned and has been a producing mine for us since 1958. |

| • | Keno Hill located in the Keno Hill Silver District in Canada’s Yukon Territory. Keno Hill is 100% owned and was acquired as part of our acquisition of Alexco in September 2022. Production ramp-up commenced in June 2023. |

| • | Casa Berardi located in the Abitibi region of northwestern Quebec, Canada. Casa Berardi is 100% owned and has been in production since late 2006. |

The Nevada Operations located in northern Nevada were also considered a segment prior to January 2024. Nevada Operations is 100% owned and consists of four land packages in northern Nevada totaling approximately 110 square miles and containing four previously-operating mines with a history of high-grade gold production: Fire Creek, Hollister, Midas and Aurora. Production was suspended in the second half of 2021. During 2022, we mined and sold remnant refractory underground ore from our stockpile. Nevada Operations activity for all periods presented in this Annual Report on Form 10-K is included in “other”.

San Sebastian in Mexico was also considered a segment prior to 2021. Production ceased in the fourth quarter of 2020, and exploration activities are currently ongoing. San Sebastian’s activity for all periods presented in this Annual Report on Form 10-K is included in “other”.

The contributions to our total metals sales by our significant operations in 2023 were 53.7% from Greens Creek, 24.9% from Casa Berardi, 16.3% from Lucky Friday and 5.0% from Keno Hill. Lucky Friday’s production for 2023 was impacted by an underground fire in the secondary egress in August, which suspended production for the remainder of 2023.

Governmental Regulation

The following is a summary of governmental regulation compliance areas which we believe are significant to our business and may have a material effect on our consolidated financial statements, earnings and/or competitive position.

Health and Safety

We are subject to the regulations of the Mine Safety and Health Administration (“MSHA”) in the United States, the Commission of Labor Standards, Pay Equity and Occupational Health and Safety in Quebec, Workers’ Safety and Compensation Board in the Yukon and the Mexico Ministry of Economy and Mining, and work with these agencies to address issues outlined in any investigations and inspections and continue to evaluate our safety practices. We strive to achieve excellent mine safety and health performance, and attempt to implement reasonable best practices with respect to mine safety and emergency preparedness. Achieving and maintaining compliance with regulations will be challenging and may increase our operating costs. See Human Capital - Health and Safety below and Item 1A. Risk Factors – We face substantial governmental regulation, including the Mine Safety and Health Act, various environmental laws and regulations and the 1872 Mining Law.

5

Table of Contents

Environmental

Our operations are subject to various environmental laws and regulations at the federal and state/provincial level. Compliance with environmental regulations, and litigation based on environmental laws and regulations, involves significant costs and can threaten existing operations or constrain expansion opportunities. For example, since acquiring the Keno Hill mine in September 2022, the site has experienced permit exceedances involving the quality of water discharged into the environment. We are working to assess the existing infrastructure and implement improvements to the environmental management system that was put in place by the previous owners. As part of this process, we have submitted plans to the Yukon Department of Energy, Mines and Resources to upgrade the water treatment plan at the Bermingham mine within our Keno Hill operations. We are committed to making changes to ensure compliance with our authorizations and all environmental regulations. See Note 16 of Notes to Consolidated Financial Statements for more information on permit issues at Keno Hill.

Keno Hill is located at a site in the Yukon Territory where extensive historical mining activity occurred. The mining claims and rights that comprise our Keno Hill mine are owned by two of our indirect, wholly-owned subsidiaries, Alexco Keno Hill Mining Company and Elsa Reclamation & Development Company Ltd. (“ERDC”). ERDC and Alexco are parties to the Amended and Restated Subsidiary Agreement (“ARSA”) dated July 18, 2013, among them and Her Majesty the Queen in right of Canada (“Canada”) which addresses the pre-existing environmental condition and the environmental care and maintenance and reclamation of the historical Keno Hill site. Under the ARSA and related documents, ERDC, as a paid contractor for the Yukon Government, is responsible for the development and eventual implementation of the district wide reclamation and closure plan (“Reclamation Plan”) which addresses the historic environmental liabilities of the district from past mining activities pre-dating Alexco’s and Hecla’s acquisition of the Keno Hill project, as well as for carrying out care and maintenance at various locations within the historical Keno Hill site until the Reclamation Plan is implemented (Hecla’s predecessor, Alexco, previously deposited CDN$10 million in a trust which funds ERDC’s maximum contribution toward implementing the Reclamation Plan, and agreed to a 1.5% net smelter royalty capped at CAD$4 million, of which approximately CAD$1.2 million paid or accrued for as of December 31, 2023). ERDC receives agreed-to commercial contractor rates when retained by Canada to provide environmental services in the historical Keno Hill site outside the scope of care and maintenance and closure and reclamation planning under the ARSA (in the latter case, for which ERDC receives an annual fee of $900,000 from Canada, adjustable for material changes in scope). The potential liabilities associated with the pre-existing environmental conditions at Keno Hill are indemnified by Canada under the terms and conditions of the ARSA, subject to the requirement for ERDC to develop, permit, and implement the Reclamation Plan, or if Hecla and the Government agree to transfer portions of the historic area to active mining operations within the Keno Hill unit, then such indemnification ceases to the extent of such transferred area. Completing the Reclamation Plan is expected to take approximately 5 more years and is estimated to cost approximately $140 million over that time, for which we expect ERDC to be reimbursed for all material costs incurred. However, we are at risk for any variance in timing between expending funds by ERDC and reimbursement by Canada, as well as for any disputed or otherwise non-reimbursed costs (for example if ERDC were to act outside of the scope of the ARSA). In addition, ERDC is responsible for sharing with Canada (i) under certain circumstances, care and maintenance costs pending implementation of the Reclamation Plan, (ii) detailed design and engineering costs to support the Reclamation Plan and (iii) under certain circumstances, post active reclamation costs (i.e. in the event Hecla has brought a historical area with pre-existing environmental conditions into active operations at the Keno Hill unit), which, in each case and in the aggregate, we do not anticipate will have a material impact on our financial results as a whole.

Mine closure and reclamation regulations impose substantial costs on our operations and include requirements that we provide financial assurance supporting those obligations. We currently have $195.4 million of financial assurances, primarily in the form of surety bonds, for reclamation company-wide. We anticipate approximately $13.5 million in expenditures in 2024 for environmental permit compliance and idle property management. We also plan to invest approximately $5.5 million for on-going reclamation works at the former Troy Mine in Montana. The projected remaining cost for reclamation at the site is included in our accrued reclamation and closure costs liability. See Item 1A. Risk Factors – We face substantial governmental regulation, including the Mine Safety and Health Act, various environmental laws and regulations and the 1872 Mining Law; Our operations are subject to complex, evolving and increasingly stringent environmental laws and regulations; Compliance with environmental regulations, and litigation based on such regulations, involves significant costs and can threaten existing operations or constrain expansion opportunities; Our environmental and asset retirement obligations may exceed the provisions we have made; and New federal and state laws, regulations and initiatives could impact our operations.

Licenses, Permits and Claims/Concessions

We are required to obtain various licenses and permits to operate our mines and conduct exploration and reclamation activities. See Item 1A. Risk Factors – We are required to obtain governmental permits and other approvals in order to conduct mining operations. We can only engage in exploration at our San Sebastian (Mexico), Hatter Graben (Nevada) and Libby Exploration (Montana) projects if we are successful in obtaining necessary permits. Similarly, mining at our planned open pits at Casa Berardi requires permits we don’t yet have. And in February 2022, we submitted letters to the United States Forest Service (“USFS”) withdrawing from its consideration the former Plan of Operations for each of the Rock Creek and Libby Exploration (formerly known as Montanore) projects in Montana.

6

Table of Contents

A new Plan of Operations for the Libby Exploration project limited to underground exploration and evaluation activities was submitted to the USFS is currently under an Environmental Assessment review (“EA”) under the National Environmental Policy Act (“NEPA”). These actions reflect our consolidated ownership of the two projects and new ideas that we bring, rather than the separate ownership and ineffective strategies of the projects’ prior owners. Upon successful completion of the EA process under the NEPA, and if subsequent data collection and analysis activities suggest development of a mine is feasible, then it is anticipated that a new Plan of Operations for the construction and development of a mine at the Libby Exploration site would be submitted for approval. While no activities beyond care and maintenance are currently proposed for Rock Creek, mineral and other property rights there should not be impacted by our current focus on evaluation of the Libby Exploration site.

We are party to a Comprehensive Cooperation and Benefits Agreement (“CCBA”) with the First Nation of Na-Cho Nyäk Dun (“FNNND”) that recognizes the rights, obligations, and opportunities of the two parties. Individual chapters in the CCBA include Hecla’s ongoing obligations to consult with FNNND and annual financial contributions, including for FNNND expense reimbursement, education and training, and wealth sharing. The wealth sharing component has not yet been agreed to, but we expect to resume negotiations in the near future and/or upon Keno Hill reaching commercial production, and such arrangement could have a material impact on Keno Hill’s profitability.

See Item 1A. Risk Factors –We are required to obtain governmental permits and other approvals in order to conduct mining operations and Legal challenges could prevent our projects in Montana from ever being developed. In addition, our operations and exploration activities at Keno Hill and the Yukon, Casa Berardi and San Sebastian are conducted pursuant to claims or concessions granted by the host government, and otherwise are subject to claims renewal and minimum work commitment requirements, which are subject to certain political risks associated with foreign operations. See Item 1A. Risk Factors – Our foreign activities are subject to additional inherent risks. , Our operations and properties in Canada expose us to additional political risks and Certain of our mines and exploration properties are located on land that is or may become subject to traditional territory, title claims and/or claims of cultural significance, and such claims and the attendant obligations of the federal government to those tribal communities and stakeholders may affect our current and future operations.

Taxes and Royalties

We are subject to various taxes and government royalties in the jurisdictions where we operate, including those specific to mining activities. These include: federal income taxes; state/provincial income taxes; county/city and bureau property taxes and sales and use tax in the U.S.; goods and services tax in Canada; value added tax in Mexico; mining-specific taxes in Alaska, Idaho, Nevada, Quebec and the Yukon; and mining royalties in Alaska, Nevada and Canada. Accrual and payment of taxes and accounting for deferred taxes can involve significant estimates and assumptions and can have a material impact on our consolidated financial statements. Tax rates and the calculations of taxes can change significantly and are influenced by changes in political administrations and other factors. See Item 1A. Risk Factors – Our accounting and other estimates may be imprecise; Our ability to recognize the benefits of deferred tax assets related to net operating loss carryforwards and other items is dependent on future cash flows generating taxable income; Our foreign activities are subject to additional inherent risks; and We face substantial governmental regulation, including the Mine Safety and Health Act, various environmental laws and regulations and the 1872 Mining Law. Also, see Note 7 of Notes to Consolidated Financial Statements for more information on income and mining taxes.

Physical Assets

Our business is capital intensive and requires ongoing capital investment for the replacement, modernization and expansion of equipment and facilities and to develop new mineral reserves. At December 31, 2023, the book value of our properties, plants, equipment and mineral interests, net of accumulated depreciation, was approximately $2.7 billion. For more information see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations. We maintain insurance policies against property loss and business interruption. However, such insurance contains exclusions and limitations on coverage, and there can be no assurance that claims would be paid under such insurance policies in connection with a particular event. And when we do experience insurable losses – such as with the fire at the Lucky Friday in August and September of 2023 – it can take a long period of time before we receive any or all insurance proceeds. See Item 1A. Risk Factors – Our operations may be adversely affected by risks and hazards associated with the mining industry that may not be fully covered by insurance.

Human Capital

As of December 31, 2023, we had approximately 1,775 employees, of which approximately 990 were employed in the United States, 765 in Canada, and 20 in Mexico. The vast majority of our employees are full-time. Approximately 260 of our employees at the Lucky Friday were covered by a collective bargaining agreement.

7

Table of Contents

The attraction, development and retention of people is critical to delivering our business strategy. Key areas of focus for us include:

Health and Safety

The safety and health of our employees is of paramount importance. Our goal is to achieve world-class safety and health performance by promoting a deeply rooted value-based culture of safety and utilizing technology and innovation to continually improve the safety at our operations. We know that employees’ and contractors’ safety awareness is fundamental to making our workplace as safe as possible. Therefore, we invest in training and workforce development programs that focus on safety first. All employees and contractors receive training that complies with or exceeds the applicable safety and health regulations as set by the governing body in the jurisdiction in which each operation is located. As part of our commitment to safety, we track a variety of safety performance indicators, including injuries, near misses, observations, and equipment damages. Our goal is to reduce safety incidents. Our All Injury Frequency Rate (“AIFR”) is calculated as the number of incidents in the period multiplied by 200,000 hours and divided by the number of hours worked in the period. Company-wide, our AIFR was 1.45 for 2023.

Compensation and Benefits

We are among the largest private-sector employers in the communities in which we operate providing a compensation and benefits package that attracts, motivates, and retains employees. In addition to competitive base wages and incentive compensation, we offer retirement benefits, health insurance plans and paid time off.

Retention and Employee Development

We are committed to hiring talented people, developing effective leaders, providing an inclusive workplace and retaining a large portion of the workforce for long periods of time. The mining workforce of the future, like all industries, will see a continual change in the jobs and skill sets required as we adopt new technologies and make our workplace safer and more efficient. We are also committed to helping employees update their skills. For example, in conjunction with a trade school in Val-d’Or, Quebec, the leadership at our Casa Berardi mine has developed a customized training program for new and existing supervisors to develop their skills in the areas of leadership, communications, roles and responsibilities, and health and safety. In addition, we have long supported the Pathways to Mining Careers program, a career training partnership with the University of Alaska Southeast in Juneau. We also offer a reimbursement program to assist with educational expenses for employees who are interested in furthering their education. Advanced education can improve job performance and increase advancement opportunities for the employee, while providing flexibility to our company by increasing the employee’s knowledge base and skill set.

Annual employee surveys are conducted to gauge employee concerns and morale. The results of the surveys, and any responsive measures, are shared with our board of directors. Strategic talent reviews and succession planning reviews are conducted periodically across all business areas, and our training programs are adapted accordingly. The Chief Executive Officer (“CEO”), senior level company leadership and board of directors periodically review Hecla’s top talent. Creating more opportunities for women and indigenous people are among our priorities for employee development. We also strive to maintain an inclusive workplace and provide periodic training to employees to help meet that goal. Our employees are required to abide by our Code of Conduct, which is provided to employees upon being hired and thereafter annually, and is available on our website, to promote the conduct of our business in a consistently legal and ethical manner. Among other provisions, the Code of Conduct reflects our policy and practice not to discriminate against any employee because of race, color, religion, national origin, sex, sexual orientation, gender identity or expression, age, or physical or other disability. We expect our leaders to set the example by being positive role models and good mentors for our employees.

We employ our Senior Vice President—Chief Administrative Officer who is responsible for developing and executing our human capital strategy. The position is an executive-level position to reflect the priority we place on utilizing our human capital resources to meet our business strategy.

Available Information

Hecla Mining Company is a Delaware corporation. Our current holding company structure dates from the incorporation of Hecla Mining Company in 2006 and the renaming of our subsidiary (previously Hecla Mining Company) as Hecla Limited. Our principal executive offices are located at 6500 N. Mineral Drive, Suite 200, Coeur d’Alene, Idaho 83815-9408. Our telephone number is (208) 769-4100. Our web site address is www.hecla.com. Information on our web site is not incorporated into this Annual Report on Form 10-K. We file our annual, quarterly and current reports and any amendments to these reports with the SEC, copies of which are available on our website or from the SEC free of charge (www.sec.gov or 800-SEC-0330). Our restated certificate of incorporation, bylaws, charters of our audit, compensation, and governance and social responsibility committees, as well as our Code of Ethics for the Chief Executive Officer and Senior Financial Officers and our Code of Conduct, are also available on our website. In addition, any amendments

8

Table of Contents

to our Code of Ethics or waivers granted to our directors and executive officers will be posted on our website. Each of these documents may be periodically revised, so you are encouraged to visit our website for any updated terms. We will provide copies of these materials to stockholders upon request using the above-listed contact information, directed to the attention of Investor Relations, or via e-mail request sent to hmc-info@hecla.com.

We routinely post important information for investors on our web site, www.hecla.com, in the “Investors” section. We also may use our web site as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investors section of our web site, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our web site is not incorporated by reference into, and is not a part of, this document.

9

Table of Contents

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following Management’s Discussion and Analysis (“MD&A”) provides information that management believes is relevant to an assessment and understanding of the consolidated financial condition and results of operations of Hecla Mining Company and its subsidiaries (collectively the “Company,” “our,” or “we”). We use certain non-GAAP financial performance measures in our MD&A. For a detailed description of these measures, please see “Non-GAAP Financial Performance Measures” at the end of this item. This item should be read in conjunction with our Consolidated Financial Statements and the Notes thereto included in this annual report.

Overview

Established in 1891, we are the oldest operating precious metals mining company in the United States. We are the largest silver producer in the United States, producing over 45% of 2022 U.S. silver production at our Greens Creek and Lucky Friday operations. We also produce gold at our Casa Berardi and Greens Creek operations. In addition, we are developing the Keno Hill mine in the Yukon Territory, Canada which we acquired in September 2022. We began ramp-up of the Keno Hill mill during the second quarter of 2023, with production commencing in June 2023. Based upon the jurisdictions in which we operate, we believe we have lower political and economic risk compared to other mining companies whose mines are located in other parts of the world. Our current exploration interests are located in the United States, Canada and Mexico. Our operating and strategic framework is based on expanding our production and locating and developing new resource potential in a safe and responsible manner.

Acquisition of ATAC Resources Ltd.

On July 7, 2023, we completed the acquisition of ATAC Resources Ltd. (“ATAC”), a Canadian publicly traded company, for total consideration of approximately $19.4 million through the issuance of 3,676,904 shares of Hecla common stock to ATAC shareholders based on the share exchange ratio of 0.0166 Hecla share for each ATAC common share, and $0.6 million of acquisition costs. The acquisition was deemed to be an asset acquisition under GAAP as substantially all of the fair value of the gross assets acquired was concentrated in a single asset group being mineral interests. The total consideration was assigned to the estimated fair values of the assets acquired and liabilities assumed, with $18.1 million assigned to mineral interests. As part of the acquisition, we also acquired 5,502,956 units consisting of (i) shares of Cascadia Minerals Ltd. (“Cascadia”) representing a 19.9% stake, and (ii) full warrants with a five-year term for a CAD$2 million cash investment in Cascadia. Cascadia will be managed by the former management of ATAC, who will explore specific properties in the Yukon and British Columbia. We have the right to appoint two directors to Cascadia’s board.

2023 Highlights

Operational:

| • | Produced 14.3 million ounces of silver and 151,259 ounces of gold. See Consolidated Results of Operations below for information on total cost of sales and cash costs and AISC, after by-product credits, per silver and gold ounce for 2023, 2022 and 2021. |

| • | Keno Hill produced 1.5 million ounces of silver, with the Bermingham deposit achieving the highest mined tonnage in December; initiated a safety action plan to build a strong operational foundation at the mine. |

| • | Continued our trend of strong safety performance, as our All Injury Frequency Rate (“AIFR”) for 2023 was 1.45. |

Financial:

| • | Reported sales of $720.2 million. |

| • | Generated $75.5 million in net cash provided by operating activities. See the Financial Liquidity and Capital Resources section below for further discussion. |

| • | Made capital expenditures (excluding lease additions and other non-cash items) of approximately $223.9 million, including $70.1 million at Casa Berardi, $43.5 million at Greens Creek, $65.3 million at Lucky Friday, and $44.7 million at Keno Hill. |

| • | Returned $15.7 million to our stockholders through dividend payments. |

Our average realized prices for silver, gold and lead increased in 2023 compared to 2022 while zinc decreased. Our average realized gold price increased while our realized price for silver, lead and zinc prices decreased in 2022 compared to 2021. See the Consolidated Results of Operations section below for information on our average realized metals prices for 2023, 2022 and 2021. Lead and zinc represent important by-products at our Greens Creek and Lucky Friday segments, and gold is also a significant by-product at Greens Creek.

10

Table of Contents

See the Consolidated Results of Operations section below for a discussion of the factors impacting income applicable to common stockholders for the three years ended December 31, 2023, 2022 and 2021.

Key Issues Impacting our Business

Our current business strategy is to focus our financial and human resources in the following areas:

| • | executing value enhancing transactions, such as with the recently completed ATAC acquisition; |

| • | advancing the development and ramp up of the Keno Hill mine with the anticipation of commencement of commercial production before the end of 2024; |

| • | operating our properties safely, in an environmentally responsible and cost-effective manner; |

| • | maintaining and investing in exploration and pre-development projects in the vicinities of mining districts and projects we believe to be under-explored and under-invested: Greens Creek on Alaska’s Admiralty Island located near Juneau; North Idaho’s Silver Valley in the historic Coeur d’Alene Mining District; the silver-producing district near Durango, Mexico; in the vicinity of our Casa Berardi mine and the Heva-Hosco project in the Abitibi region of northwestern Quebec, Canada; our projects located in two districts in Nevada; our projects in the Keno Hill mining district in the Yukon Territory, Canada; northwestern Montana; the Creede district of southwestern Colorado; the Kinskuch project in British Columbia, Canada; and the Republic Mining District in Washington state; |

| • | improving operations at each of our mines, which includes incurring costs for new technologies and equipment; |

| • | expanding our proven and probable reserves, mineral resources and production capacity at our properties; |

| • | conducting our business with financial stewardship to preserve our financial position in varying metals price and operational environments; |

| • | advancing permitting of the Libby Exploration project in Montana; and |

| • | seeking opportunities to acquire and invest in mining and exploration properties and companies. |

We strive to achieve excellent mine safety and health performance. We seek to implement this goal by: training employees in safe work practices; establishing, following and improving safety standards; investigating accidents, incidents and losses to avoid recurrence; involving employees in the establishment of safety standards; and participating in the National Mining Association’s CORESafety program. We seek to implement reasonable best practices with respect to mine safety and emergency preparedness. We respond to issues outlined in investigations and inspections by MSHA, the Commission of Labor Standards, Pay Equity and Occupational Health and Safety in Quebec, the Workers’ Safety and Compensation Board in the Yukon and the Mexico Ministry of Economy and Mining and continue to evaluate our safety practices. There can be no assurance that our practices will mitigate or eliminate all safety risks. Achieving and maintaining compliance with regulations will be challenging and may increase our operating costs. See Item 1A. Risk Factors - We face substantial governmental regulation, including the Mine Safety and Health Act, various environmental laws and regulations and the 1872 Mining Law.

A number of key factors may impact the execution of our strategy, including regulatory issues, metals prices and inflationary pressures on input costs. Metals prices can be very volatile and are influenced by a number of factors beyond our control (except on a limited basis through the use of derivative contracts). See Item 7. Critical Accounting Estimates and Note 10 of Notes to Consolidated Financial Statements. While we believe longer-term global economic and industrial trends could result in continued demand for the metals we produce, prices have been volatile and there can be no assurance that current prices will continue.

Volatility in global financial markets and other factors can pose a significant challenge to our ability to access credit and equity markets, should we need to do so. We utilize forward contracts to manage exposure to declines in the prices of (i) silver, gold, zinc and lead contained in our concentrates that have been shipped but have not yet settled, and (ii) from time to time zinc and lead that we forecast for future concentrate shipments. In addition, we have in place a $150 million revolving credit agreement, with an option to be increased in an aggregate amount not to exceed $75 million. As of December 31, 2023, $6.9 million was used for letters of credit, and $128.0 million was drawn on the facility leaving approximately $15.1 million available for borrowing.

Another challenge for us is the risk associated with environmental litigation and ongoing reclamation activities. As described in Item 1A. Risk Factors and in Note 16 of Notes to Consolidated Financial Statements, it is possible that our estimate of these liabilities (and our ability to estimate liabilities in general) may change in the future, affecting our strategic plans. We are involved in various environmental legal matters and the estimate of our environmental liabilities and liquidity needs, as well as our strategic plans, may be significantly impacted as a result of these matters or new matters that may arise. We strive to ensure that our activities are conducted in compliance with applicable laws and regulations and attempt to resolve environmental litigation on terms as favorable to us as possible.

11

Table of Contents

Reserve and resource estimation is a major risk inherent in mining. Our reserve and resource estimates, which underlie (i) our mining and investment plans, (ii) the valuation of a significant portion of our long-term assets and (iii) depreciation, depletion and amortization expense, may change based on economic factors and actual production experience. Until ore is mined and processed, the volumes and grades of our reserves and resources must be considered as estimates. Our reserves are depleted as we mine. Reserves and resources can also change as a result of changes in economic and operating assumptions. See Item 1A. Risk Factors - Our mineral reserve and resource estimates may be imprecise.

Consolidated Results of Operations

Total metal sales for the years ended December 31, 2023, 2022 and 2021, and the approximate variances attributed to differences in metals prices, sales volumes and smelter terms, were as follows:

| (in thousands) | Silver | Gold | Base metals | Less: smelter and refining charges |

Total sales of products |

|||||||||||||||

| 2021 |

$ | 293,646 | $ | 362,037 | $ | 200,723 | $ | (48,933 | ) | $ | 807,473 | |||||||||

| Variances - 2022 versus 2021: |

||||||||||||||||||||

| Price |

(45,590 | ) | 676 | (3,710 | ) | (1,270 | ) | (49,894 | ) | |||||||||||

| Volume |

17,089 | (63,719 | ) | 9,428 | (2,172 | ) | (39,374 | ) | ||||||||||||

| Smelter terms |

(91 | ) | (84 | ) | — | 402 | 227 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 2022 |

265,054 | 298,910 | 206,441 | (51,973 | ) | 718,432 | ||||||||||||||

| Variances - 2023 versus 2022: |

||||||||||||||||||||

| Price |

19,682 | 18,044 | (2,897 | ) | (624 | ) | 34,205 | |||||||||||||

| Volume |

17,548 | (42,343 | ) | (14,586 | ) | 148 | (39,233 | ) | ||||||||||||

| Smelter terms |

— | — | — | 1,540 | 1,540 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 2023 |

$ | 302,284 | $ | 274,611 | $ | 188,958 | $ | (50,909 | ) | $ | 714,944 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Average market and realized metals prices for 2023, 2022 and 2021 were as follows:

| Average price for the year ended December 31, | ||||||||||||||

| 2023 | 2022 | 2021 | ||||||||||||

| Silver |

Realized price per ounce | $ | 23.33 | $ | 21.53 | $ | 25.24 | |||||||

| London PM Fix ($/ounce) | 23.39 | 21.75 | 25.17 | |||||||||||

| Gold |

Realized price per ounce | 1,939 | 1,803 | 1,796 | ||||||||||

| London PM Fix ($/ounce) | 1,943 | 1,801 | 1,800 | |||||||||||

| Lead |

Realized price per pound | 1.03 | 1.01 | 1.03 | ||||||||||

| LME Final Cash Buyer ($/pound) | 0.97 | 0.98 | 1.00 | |||||||||||

| Zinc |

Realized price per pound | 1.35 | 1.41 | 1.44 | ||||||||||

| LME Final Cash Buyer ($/pound) | $ | 1.20 | $ | 1.58 | $ | 1.36 | ||||||||

Average realized prices differ from average market prices primarily because concentrate sales are generally recorded as revenues at the time of shipment at forward prices for the estimated month of settlement, which differ from average market prices. Due to the time elapsed between shipment of concentrates and final settlement with customers, we must estimate the prices at which sales of our metals will be settled. Previously recorded sales are adjusted to estimated settlement metals prices each period through final settlement. For 2023 and 2021 we recorded positive price adjustments to provisional settlements of $18.2 million and $9.3 million, respectively, and $20.8 million in net negative price adjustments to provisional settlements in 2022. The price adjustments related to silver, gold, zinc and lead contained in our concentrate sales were partially offset by gains and losses on forward contracts for those metals for each year (see Note 10 of Notes to Consolidated Financial Statements for more information). The gains and losses on these contracts are included in revenues and impact the realized prices for silver, gold, lead and zinc. Realized prices are calculated by dividing gross revenues for each metal (which include the price adjustments and gains and losses on the forward contracts discussed above) by the payable quantities of each metal included in products sold during the period.

12

Table of Contents

Total metals production and sales volumes for each period are shown in the following table:

| Year Ended December 31, | ||||||||||||||

| 2023 | 2022 | 2021 | ||||||||||||

| Silver - |

Ounces produced | 14,342,863 | 14,182,987 | 12,887,240 | ||||||||||

| Payable ounces sold |

12,955,006 | 12,311,595 | 11,633,802 | |||||||||||

| Gold - |

Ounces produced | 151,259 | 175,807 | 201,327 | ||||||||||

| Payable ounces sold |

141,602 | 165,818 | 201,610 | |||||||||||

| Lead - |

Tons produced | 40,347 | 48,713 | 43,010 | ||||||||||

| Payable tons sold |

35,429 | 41,423 | 36,707 | |||||||||||

| Zinc - |

Tons produced | 60,579 | 64,748 | 63,617 | ||||||||||

| Payable tons sold |

43,050 | 43,658 | 43,626 | |||||||||||

The difference between what we report as “ounces/tons produced” and “payable ounces/tons sold” is attributable to the difference between the quantities of metals contained in our products versus the portion of those metals actually paid for by our customers pursuant to of our sales contract terms. Differences can also arise from inventory changes incidental to shipping schedules, or variances in ore grades which impact the amount of metals contained in concentrates produced and sold.

Sales, total cost of sales, gross profit (loss), Cash Cost, After By-product Credits, per Ounce (“Cash Cost”) (non-GAAP) and AISC (non-GAAP) at our operating units for 2023, 2022 and 2021 were as follows (in thousands, except for Cash Cost and AISC):

| Silver | Gold and Other | |||||||||||||||||||||||||||||||

| Greens Creek |

Lucky Friday |

Keno Hill |

Other (3) |

Total Silver (2) |

Casa Berardi |

Other Operations (4) |

Total Gold and Other |

|||||||||||||||||||||||||

| 2023: |

||||||||||||||||||||||||||||||||

| Sales |

$ | 384,504 | $ | 116,284 | $ | 35,518 | — | $ | 536,306 | $ | 177,678 | $ | 6,243 | $ | 183,921 | |||||||||||||||||

| Total cost of sales |

(259,895 | ) | (84,185 | ) | (35,518 | ) | — | (379,598 | ) | (221,341 | ) | (6,339 | ) | (227,680 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Gross profit (loss) |

$ | 124,609 | $ | 32,099 | $ | — | — | $ | 156,708 | $ | (43,663 | ) | $ | (96 | ) | $ | (43,759 | ) | ||||||||||||||

| Cash Cost, After By-product Credits, per Silver or Gold Ounce (1) |

$ | 2.53 | $ | 5.51 | $ | 3.23 | $ | 1,652 | $ | 1,652 | ||||||||||||||||||||||

| AISC, After By-product Credits, per Silver or Gold Ounce (1) |

$ | 7.14 | $ | 12.21 | $ | 11.76 | $ | 2,048 | $ | 2,048 | ||||||||||||||||||||||

| 2022: |

||||||||||||||||||||||||||||||||

| Sales |

$ | 335,062 | $ | 147,814 | $ | — | $ | — | $ | 482,876 | $ | 235,136 | $ | 893 | $ | 236,029 | ||||||||||||||||

| Total cost of sales |

(232,718 | ) | (116,598 | ) | — | — | (349,316 | ) | (248,898 | ) | (4,535 | ) | (253,433 | ) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Gross profit (loss) |

$ | 102,344 | $ | 31,216 | $ | — | $ | — | $ | 133,560 | $ | (13,762 | ) | $ | (3,642 | ) | $ | (17,404 | ) | |||||||||||||

| Cash Cost, After By-product Credits, per Silver or Gold Ounce (1) |

$ | 0.70 | $ | 5.06 | $ | 2.06 | $ | 1,478 | $ | 1,478 | ||||||||||||||||||||||

| AISC, After By-product Credits, per Silver or Gold Ounce (1) |

$ | 5.17 | $ | 12.86 | 10.66 | $ | 1,773 | $ | 1,773 | |||||||||||||||||||||||

| 2021: |

||||||||||||||||||||||||||||||||

| Sales |

$ | 384,843 | $ | 131,488 | $ | — | $ | 176 | $ | 516,507 | $ | 245,152 | $ | 45,814 | $ | 290,966 | ||||||||||||||||

| Total cost of sales |

(213,113 | ) | (97,538 | ) | — | (247 | ) | (310,898 | ) | (229,829 | ) | (48,945 | ) | (278,774 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Gross profit (loss) |

$ | 171,730 | $ | 33,950 | $ | — | $ | (71 | ) | $ | 205,609 | $ | 15,323 | $ | (3,131 | ) | $ | 12,192 | ||||||||||||||

| Cash Cost, After By-product Credits, per Silver or Gold Ounce (1) |

$ | (0.65 | ) | $ | 6.60 | $ | 1.37 | $ | 1,125 | $ | 1,137 | $ | 1,127 | |||||||||||||||||||

| AISC, After By-product Credits, per Silver or Gold Ounce (1) |

$ | 2.70 | $ | 14.34 | $ | 8.65 | $ | 1,359 | $ | 1,211 | $ | 1,341 | ||||||||||||||||||||

| (1) | A reconciliation of these non-GAAP measures to total cost of sales, the most comparable GAAP measure, can be found below in Reconciliation of Total Cost of Sales (GAAP) to Cash Cost, Before By-product Credits and Cash Cost, After By-product Credits (non-GAAP) and All-In Sustaining Cost, Before By-product Credits and All-In Sustaining Cost, After By-product Credits (non-GAAP). |

| (2) | The calculation of AISC for our consolidated silver properties includes corporate costs for general and administrative expense and sustaining capital and production and related costs and sustaining capital expenditures for Lucky Friday until the suspension of production during August 2023 following an underground fire for the remainder of 2023 |

13

Table of Contents

| (3) | Includes results for San Sebastian, which was an operating segment prior to 2021. |

| (4) | Other includes $5.3 million of sales and total cost of sales for the year ended December 31, 2023 and $0.5 million of sales and total cost of sales for the year ended December 31, 2022, related to the environmental services business acquired as part of the Alexco acquisition. |

While revenue from zinc, lead and gold by-products is significant, we believe that identification of silver as the primary product of Greens Creek, Lucky Friday, and Keno Hill is appropriate because:

| • | silver has historically accounted for a higher proportion of revenue than any other metal and is expected to do so in the future; |

| • | we have historically presented the Greens Creek and Lucky Friday units as primary silver producers, based on the original analysis that justified putting the project into production, and the same analysis applies to the Keno Hill unit, and further we believe that consistency in disclosure is important to our investors regardless of the relationships of metals prices and production from year to year; |

| • | metallurgical treatment maximizes silver recovery; |

| • | the Greens Creek, Lucky Friday and Keno Hill deposits are massive sulfide deposits containing an unusually high proportion of silver; and |

| • | in most of their working areas, Greens Creek, Lucky Friday and Keno Hill utilize selective mining methods in which silver is the metal targeted for highest recovery. |

Accordingly, we believe the identification of gold, lead and zinc as by-product credits at Greens Creek, Lucky Friday and Keno Hill is appropriate because of their lower economic value compared to silver and due to the fact that silver is the primary product we intend to produce at those locations. In addition, we have not consistently received sufficient revenue from any single by-product metal to warrant classification of such as a co-product.

We periodically review our revenues to ensure that reporting of primary products and by-products is appropriate. Because for Greens Creek, Lucky Friday and Keno Hill we consider zinc, lead and gold to be by-products of our silver production, the values of these metals offset operating costs within our calculations of Cash Cost, After By-product Credits, per Silver Ounce and AISC, After By-product Credits, per Silver Ounce.

We believe the identification of silver as a by-product credit is appropriate at Casa Berardi because of its lower economic value compared to gold and due to the fact that gold is the primary product we intend to produce. In addition, we do not receive sufficient revenue from silver at Casa Berardi to warrant classification of such as a co-product. Because we consider silver to be a by-product of our gold production at Casa Berardi the value of silver offsets operating costs within our calculations of Cash Cost, After By-product Credits, per Gold Ounce and AISC, After By-product Credits, per Gold Ounce.

For the year ended December 31, 2023, we reported loss applicable to common stockholders of $84.8 million compared to a loss of $37.9 million and income of $34.5 million in 2022 and 2021, respectively. The following factors contributed to those differences:

| • | Variances in gross profit (loss) at our operations as illustrated in the table above. See the Greens Creek, Lucky Friday, Keno Hill, and Casa Berardi sections below. |

| • | General and administrative costs were $42.7 million, $43.4 million and $34.6 million in 2023, 2022 and 2021 respectively. The decrease in 2023 of $0.7 million reflects lower incentive compensation accruals compared to 2022 partially offset by annual compensation adjustments effective July 1. The increase in 2022 of $8.8 million compared to 2021 reflects the acquisition of Alexco, higher incentive compensation accruals and annual incentive compensation adjustments. |

| • | Exploration and pre-development expense was $32.5 million, $46.0 million and $47.9 million in 2023, 2022 and 2021, respectively. In 2023 exploration and pre-development expense decreased by $13.5 million as exploration activities were focused primarily at Keno Hill, Casa Berardi, and Greens Creek, with pre-development activities incurred at the Hatter Graben in Nevada and the Libby Exploration project in Montana. |

| • | Provision for closed operations and environmental matters of $7.6 million in 2023 compared to $8.8 million in 2022 and $14.6 million in 2021. The decrease in 2023 compared to 2022 of $1.2 million is primarily due to less reclamation activities at Johnny M in 2023 compared to 2022. The decrease in 2022 compared to 2021 of $5.8 million is primarily due to the settlement in 2021 of a lawsuit for $6.5 million related to a 1989 agreement entered into by our subsidiary, CoCa Mines, Inc. and its subsidiary, Creede Resources, Inc. |

14

Table of Contents

| • | Ramp-up and suspension costs were $76.3 million, $24.1 million and $23.0 million in 2023, 2022 and 2021, respectively. Ramp-up and suspension costs in 2023 include $29.8 million (2022: $2.3 million) related to the ramp up of Keno Hill, $25.5 million related to the suspension of production at Lucky Friday due to the underground fire that occurred in the #2 shaft and $2.2 million at Casa Berardi due its operations being suspended for 20 days in June, due to Quebec wildfires. During 2020, San Sebastian and Nevada were placed on care and maintenance and each of 2021, 2022 and 2023 include care and maintenance costs for these sites. |

| Year Ended December 31, | ||||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Keno Hill |

$ | 29,793 | $ | 2,254 | $ | — | ||||||

| Lucky Friday |

25,548 | — | — | |||||||||

| Nevada |

16,549 | 19,743 | 20,403 | |||||||||

| Casa Berardi |

2,228 | — | — | |||||||||

| San Sebastian |

2,134 | 2,117 | 2,609 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total ramp-up and suspension costs |

$ | 76,252 | $ | 24,114 | $ | 23,012 | ||||||

|

|

|

|

|

|

|

|||||||

| • | Other operating income of $1.4 million and expense of $6.3 million and $14.3 million in 2023, 2022 and 2021, respectively. The income in 2023 compared to the expense in 2022 was primarily due to the receipt of $5.9 million in insurance proceeds in May related to an insurance coverage lawsuit. |

| • | Fair value adjustments, net resulted in gains of $2.9 million and losses of $4.7 million and $35.8 million in 2023, 2022 and 2021, respectively. The components for each period are summarized in the following table (in thousands): |

| Year Ended December 31, | ||||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Gain (loss) on derivative contracts |

$ | 3,168 | $ | 844 | $ | (32,655 | ) | |||||

| Unrealized (loss) gain on investments in equity securities |

(243 | ) | (5,632 | ) | (4,295 | ) | ||||||

| Gain on disposition or exchange of investments |

— | 65 | 1,158 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total fair value adjustments, net |

$ | 2,925 | $ | (4,723 | ) | $ | (35,792 | ) | ||||

|

|

|

|

|

|

|

|||||||

Prior to November 1, 2021, we did not designate and account for any of our base metal derivative contracts as cash flow hedges for accounting purposes and accordingly any changes in fair value of our base metals derivative contracts were recognized in gain (loss) on derivative contracts. Subsequent to November 1, 2021, any gains or losses on base metals derivative contracts designated as cash flow hedges are deferred in other comprehensive income until the transaction occurs.

| • | Net foreign exchange loss of $3.8 million in 2023, compared to a gain of $7.2 million and $0.4 million in 2022 and 2021, respectively, on translation of our monetary assets and liabilities at Casa Berardi, Keno Hill and San Sebastian. |

| • | Interest expense of $43.3 million, $42.8 million and $41.9 million in 2023, 2022 and 2021, respectively. The interest in 2023, 2022 and 2021 was primarily related to our Senior Notes with 2023 also including interest expense of $2.8 million on amounts drawn on our revolving credit facility. |

| • | Income and mining tax provision of $1.2 million compared to a benefit of $7.6 million and $29.6 million in 2022 and 2021, respectively, with the benefit in 2021 including $58.4 million for a reduction in the valuation allowance for U.S. deferred tax assets. See Corporate Matters and Note 7 of Notes to Consolidated Financial Statements for more information. |

15

Table of Contents

Greens Creek

| Dollars are in thousands (except per ounce and per ton amounts) | Years Ended December 31, | |||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Sales |

$ | 384,504 | $ | 335,062 | $ | 384,843 | ||||||

|

|

|

|

|

|

|

|||||||

| Cost of sales and other direct production costs |

(205,900 | ) | (183,807 | ) | (164,403 | ) | ||||||

| Depreciation, depletion and amortization |

(53,995 | ) | (48,911 | ) | (48,710 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total cost of sales |

(259,895 | ) | (232,718 | ) | (213,113 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Gross Profit |

$ | 124,609 | $ | 102,344 | $ | 171,730 | ||||||

|

|

|

|

|

|

|

|||||||

| Tons of ore milled |

914,796 | 881,445 | 841,967 | |||||||||

| Production: |

||||||||||||

| Silver (ounces) |

9,731,752 | 9,741,935 | 9,243,222 | |||||||||

| Gold (ounces) |

60,896 | 48,216 | 46,088 | |||||||||

| Zinc (tons) |

51,496 | 52,312 | 53,648 | |||||||||

| Lead (tons) |

19,578 | 19,480 | 19,873 | |||||||||

| Payable metal quantities sold: |

||||||||||||

| Silver (ounces) |

8,493,040 | 8,234,010 | 8,284,551 | |||||||||

| Gold (ounces) |

49,790 | 35,508 | 40,149 | |||||||||

| Zinc (tons) |

36,042 | 34,856 | 36,581 | |||||||||

| Lead (tons) |

15,247 | 14,762 | 15,489 | |||||||||

| Ore grades: |

||||||||||||

| Silver ounces per ton |

13.31 | 13.64 | 13.51 | |||||||||

| Gold ounces per ton |

0.09 | 0.08 | 0.08 | |||||||||

| Zinc percent |

6.35 | 6.69 | 7.11 | |||||||||

| Lead percent |

2.60 | 2.68 | 2.87 | |||||||||

| Total production cost per ton |

$ | 204.20 | $ | 196.73 | $ | 177.30 | ||||||

| Cash Cost, After By-product Credits, per Silver Ounce (1) |

$ | 2.53 | $ | 0.70 | $ | (0.65 | ) | |||||

| AISC, After By-Product Credits, per Silver Ounce (1) |

$ | 7.14 | $ | 5.17 | $ | 2.70 | ||||||

| Capital additions |

$ | 43,542 | $ | 36,898 | $ | 23,883 | ||||||

| (1) | A reconciliation of these non-GAAP measures to total cost of sales, the most comparable GAAP measure, can be found below in Reconciliation of Total Cost of Sales (GAAP) to Cash Cost, Before By-product Credits and Cash Cost, After By-product Credits (non-GAAP) and All-In Sustaining Cost, Before By-product Credits and All-In Sustaining Cost, After By-product Credits (non-GAAP). At Greens Creek, gold, zinc and lead are considered to be by-products of our silver production, and the values of those metals therefore offset operating costs within our calculations of Cash Cost and AISC, After By-product Credits, per Silver Ounce. |

Gross profit increased by $22.3 million to $124.6 million in 2023 from $102.3 million in 2022, as higher realized prices for all metals sold other than zinc and higher payable metal quantities for all metals sold compared to 2022, was offset by higher production costs reflecting more tons milled, and related higher labor, maintenance and consumables costs. See Item 1A. Risk Factors - Our profitability could be affected by inflation, including the prices of other commodities for a discussion of certain risks related to our operations profitability.

Gross profit decreased by $69.4 million to $102.3 million in 2022 from $171.7 million in 2021, as lower realized prices for all metals sold other than gold, and lower payable metal quantities sold compared to 2021, was further compounded by higher production costs reflecting inflationary pressures and more tons milled, and unfavorable changes in concentrate smelter terms.

16

Table of Contents

Capital additions increased by $6.6 million in 2023 to $43.5 million compared to 2022. Significant components of the 2023 capital additions were development of $19.4 million, $9.8 million in mobile equipment, and $1.6 million in claims purchases.

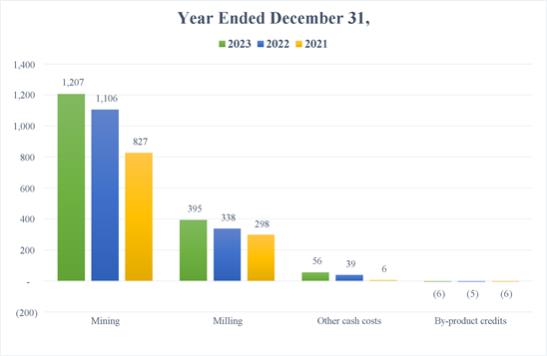

The chart below illustrates the factors contributing to the variances in Cash Cost, After By-product Credits, Per Silver Ounce for 2023 compared to 2022 and 2021:

The following table summarizes the components of Cash Cost, After By-product Credits, per Silver Ounce:

| Years Ended December 31, | ||||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Cash Cost, Before By-product Credits, per Silver Ounce |

$ | 24.85 | $ | 23.20 | $ | 21.33 | ||||||

| By-product credits per silver ounce |

(22.32 | ) | (22.50 | ) | (21.98 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Cash Cost, After By-product Credits, per Silver Ounce |

$ | 2.53 | $ | 0.70 | $ | (0.65 | ) | |||||

|

|

|

|

|

|

|

|||||||

The following table summarizes the components of AISC, After By-product Credits, per Silver Ounce:

| Years Ended December 31, | ||||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| AISC, Before By-product Credits, per Silver Ounce |

$ | 29.46 | $ | 27.67 | $ | 24.68 | ||||||

| By-product credits per silver ounce |

(22.32 | ) | (22.50 | ) | (21.98 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| AISC, After By-product Credits, per Silver Ounce |

$ | 7.14 | $ | 5.17 | $ | 2.70 | ||||||

|

|

|

|

|

|

|

|||||||

The increase in Cash Cost and AISC, each After By-product Credits, per Silver Ounce in 2023 compared to 2022 was primarily due to higher production costs related to labor, maintenance and consumables and lower by-product credits. The increase in Cash Cost and AISC, each After By-product Credits, per Silver Ounce in 2022 compared to 2021 was primarily due to higher production costs and sustaining capital expenditures, partially offset by higher by-product credits and production.

17

Table of Contents

Lucky Friday

| Dollars are in thousands (except per ounce and per ton amounts) | Years Ended December 31, | |||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Sales |

$ | 116,284 | $ | 147,814 | $ | 131,488 | ||||||

|

|

|

|

|

|

|

|||||||

| Cost of sales and other direct production costs |

(59,860 | ) | (82,894 | ) | (70,692 | ) | ||||||

| Depreciation, depletion and amortization |

(24,325 | ) | (33,704 | ) | (26,846 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total cost of sales |

(84,185 | ) | (116,598 | ) | (97,538 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Gross profit |

$ | 32,099 | $ | 31,216 | $ | 33,950 | ||||||

|

|

|

|

|

|

|

|||||||

| Tons of ore milled |

231,129 | 356,907 | 321,837 | |||||||||

| Production: |

||||||||||||

| Silver (ounces) |

3,086,119 | 4,412,764 | 3,564,128 | |||||||||

| Lead (tons) |

19,543 | 29,233 | 23,137 | |||||||||

| Zinc (tons) |

7,944 | 12,436 | 9,969 | |||||||||

| Payable metal quantities sold: |

||||||||||||

| Silver (ounces) |

3,020,116 | 4,039,435 | 3,288,261 | |||||||||

| Lead (tons) |

19,079 | 26,660 | 21,218 | |||||||||

| Zinc (tons) |

6,160 | 8,802 | 7,046 | |||||||||

| Ore grades: |

||||||||||||

| Silver ounces per ton |

14.00 | 13.00 | 11.64 | |||||||||

| Lead percent |

8.90 | 8.70 | 7.60 | |||||||||

| Zinc percent |

4.10 | 3.90 | 3.44 | |||||||||

| Total production cost per ton |

$ | 218.45 | $ | 223.55 | $ | 191.50 | ||||||

| Cash Cost, After By-product Credits, per Silver Ounce (1) |

$ | 5.51 | $ | 5.06 | $ | 6.60 | ||||||

| AISC, After By-product Credits, per Silver Ounce (1) |

$ | 12.21 | $ | 12.86 | $ | 14.34 | ||||||

| Capital additions |

$ | 65,337 | $ | 50,992 | $ | 29,885 | ||||||

| (1) | A reconciliation of these non-GAAP measures to total cost of sales, the most comparable GAAP measure, can be found below in Reconciliation of Total Cost of Sales (GAAP) to Cash Cost, Before By-product Credits and Cash Cost, After By-product Credits (non-GAAP) and All-In Sustaining Cost, Before By-product Credits and All-In Sustaining Cost, After By-product Credits (non-GAAP). At Lucky Friday, lead and zinc are considered to be by-products of our silver production, and the values of those metals therefore offset operating costs within our calculations of Cash Cost and AISC, each After By-product Credits, per Silver Ounce. |

During August 2023, the production at the mine was suspended due to a fire that occurred while repairing an unused station in the #2 ventilation shaft, which is also the secondary egress (required by MSHA regulations). By early September, the fire had been extinguished, normal ventilation was reestablished and the workforce recalled. Following evaluation of alternatives, it was determined that in order to safely bring the mine back into production in the most rapid and cost effective way, a new secondary egress needed to be developed to bypass the damaged portion of the #2 shaft. The new egress includes extension of an existing ramp 1,600 feet, installation of a 290-foot-long manway raise, and development of an 850 foot ventilation raise. Production was suspended for the remainder of 2023. Following an MSHA inspection on January 9, 2024, production was resumed.

The Company has property and business interruption insurance coverage with an underground sub-limit of $50.0 million. On January 3, 2024, the Company received a coverage letter from the insurance carrier establishing coverage up to the underground sub-limit of $50.0 million, less any applicable deductions. There can be no assurance as to the total amount or timing of when we will start receiving such proceeds.

Gross profit in 2023 of $32.1 million, was $0.9 million higher than 2022, due to higher grades, higher realized silver and lead prices and higher tons milled per day prior to the shutdown in August compared to 2022. For the year ended December 31, 2023, $25.5 million of site specific suspension costs were included within Ramp-up and suspension costs on our consolidated statements of operations and comprehensive (loss) income.

Gross profit in 2022 of $31.2 million, was $2.7 million lower than 2021, due to lower realized prices and higher production costs in 2022 reflecting inflationary cost pressures and more tons milled. See Item 1A. Risk Factors - Our profitability could be affected by inflation, including the prices of other commodities for a discussion of certain risks related to our operations profitability.

18

Table of Contents

Total capital additions increased by $14.3 million in 2023 to $65.3 million compared to 2022 as investments were made to support sustained higher throughput and costs were incurred to build the secondary egress following the August 2023 fire. Significant components related to development ($21.7 million), the service hoist ($8.3 million), coarse ore bunker ($6.6 million), shaft and related infrastructure ($4.4 million), drilling ($4.9 million) and underground mobile equipment ($4.6 million).

The chart below illustrates the factors contributing to the variances in Cash Cost, After By-product Credits, Per Silver Ounce for 2023, 2022 and 2021.

The following table summarizes the components of Cash Cost, After By-product Credits, per Silver Ounce:

| Year Ended December 31, |

Year Ended December 31, |

Three Months Ended December 31, |

||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Cash Cost, Before By-product Credits, per Silver Ounce |

$ | 21.45 | $ | 23.23 | 24.12 | |||||||

| By-product credits per silver ounce |

(15.94 | ) | (18.17 | ) | (17.52 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Cash Cost, After By-product Credits, per Silver Ounce |

$ | 5.51 | $ | 5.06 | $ | 6.60 | ||||||

|

|

|

|

|

|

|

|||||||

The following table summarizes the components of AISC, After By-product Credits, per Silver Ounce:

| Year Ended December 31, |

Year Ended December 31, |

Three Months Ended December 31, |

||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| AISC, Before By-product Credits, per Silver Ounce |

$ | 28.15 | $ | 31.03 | $ | 31.86 | ||||||

| By-product credits per silver ounce |

(15.94 | ) | (18.17 | ) | (17.52 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| AISC, After By-product Credits, per Silver Ounce |

$ | 12.21 | $ | 12.86 | $ | 14.34 | ||||||

|

|

|

|

|

|

|

|||||||

The increase in Cash Cost and AISC, each After By-product Credits, per Silver Ounce in 2023 compared to 2022 was due to lower by-product credits in 2023. The decrease in Cash Cost and AISC, each After By-product Credits, per Silver Ounce in 2022 compared to 2021 was due to increased silver production and higher by-product credits, partially offset by higher production costs and sustaining capital expenditures.

19

Table of Contents

Keno Hill

We acquired our Keno Hill operations as part of the Alexco acquisition in September 2022, and have focused on development activities and began ramp-up of the mill during the second quarter. A number of safety related matters have slowed the ramp up as Hecla’s injury-free standard drives the pace of production and development at Keno Hill. A safety action plan focusing on training, supervision, mining practices, and implementation of the safety processes has been initiated and should be executed during 2024. The average throughput during the ramp-up of the mill has been 230 tons per day, with silver grades milled of 27.7 ounces per ton. Tonnage mined was constrained by delays in infrastructure construction which has impacted development rates. Key underground infrastructure projects completed include the shotcrete plant and the cemented rockfill plant. Modifications to the secondary crushing circuit were also completed which are expected to increase crusher availability and efficiency.

| Dollars are in thousands (except per ounce and per ton amounts) | Year Ended December 31, |

|||

| 2023 | ||||

| Sales |

$ | 35,518 | ||

|

|

|

|||

| Cost of sales and other direct production costs |

(31,241 | ) | ||

| Depreciation, depletion and amortization |

(4,277 | ) | ||

|

|

|

|||

| Total cost of sales |

(35,518 | ) | ||

|

|

|

|||

| Gross profit |

$ | — | ||

|

|

|

|||

| Tons of ore milled |

56,331 | |||

| Production: |

||||

| Silver (ounces) |

1,502,577 | |||

| Zinc (tons) |

1,139 | |||

| Lead (tons) |

1,225 | |||

| Payable metal quantities sold: |

||||

| Silver (ounces) |

1,419,173 | |||

| Zinc (tons) |

1,102 | |||

| Lead (tons) |

848 | |||

| Ore grades: |

||||

| Silver ounces per ton |

27.7 | |||

| Zinc percent |

2.5 | % | ||

| Lead percent |

2.3 | % | ||

| Capital additions |

$ | 44,672 | ||

During the year ended December 31, 2023, Keno Hill recorded sales and total cost of sales of $35.5 million, related to the concentrate produced and sold during the ramp up. During the year ended December 31, 2023, $29.8 million of site specific ramp up costs were included within Ramp-up and suspension costs and $4.7 million of site specific exploration costs were included within Exploration and pre-development as reported on our consolidated statements of operations and comprehensive (loss) income. During the year ended December 31, 2023, Keno Hill recorded capital additions of $44.7 million, of which $29.6 million related to mine development and $11.3 million to mobile equipment purchases, crusher modifications and camp upgrades.

20

Table of Contents

Casa Berardi

| Dollars are in thousands (except per ounce and per ton amounts) | Years Ended December 31, | |||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Sales |

$ | 177,678 | $ | 235,136 | $ | 245,152 | ||||||

|

|

|

|

|

|

|

|||||||

| Cost of sales and other direct production costs |

(155,304 | ) | (187,936 | ) | (149,085 | ) | ||||||

| Depreciation, depletion and amortization |

(66,037 | ) | (60,962 | ) | (80,744 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total cost of sales |

(221,341 | ) | (248,898 | ) | (229,829 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Gross (loss) profit |

$ | (43,663 | ) | $ | (13,762 | ) | $ | 15,323 | ||||

|

|

|

|

|

|

|

|||||||

| Tons of ore milled |

1,446,488 | 1,588,739 | 1,528,246 | |||||||||

| Production: |

||||||||||||

| Gold (ounces) |

90,363 | 127,590 | 134,511 | |||||||||

| Silver (ounces) |

22,415 | 28,289 | 33,571 | |||||||||

| Payable metal quantities sold: |

||||||||||||

| Gold (ounces) |

91,268 | 130,245 | 135,987 | |||||||||

| Silver (ounces) |

22,566 | 31,788 | 30,022 | |||||||||

| Ore grades: |

||||||||||||

| Gold ounces per ton |

0.07 | 0.09 | 0.10 | |||||||||

| Silver ounces per ton |

0.02 | 0.02 | 0.03 | |||||||||

| Total production cost per ton |

$ | 104.75 | $ | 117.89 | $ | 98.60 | ||||||

| Cash Cost, After By-product Credits, per Gold Ounce (1) |

$ | 1,652 | $ | 1,478 | $ | 1,125 | ||||||

| AISC, After By-product Credits, per Gold Ounce (1) |

$ | 2,048 | $ | 1,773 | $ | 1,359 | ||||||

| Capital additions |

$ | 70,056 | $ | 39,667 | $ | 49,617 | ||||||