UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number:

(Exact Name of Registrant as Specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|||

Stock, par value $0.25 per share |

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

☑ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

Emerging growth company |

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Class |

|

Shares Outstanding May 5, 2023 |

Common stock, par value $0.25 par value per share |

|

Hecla Mining Company and Subsidiaries

Form 10-Q

For the Quarter Ended March 31, 2023

INDEX*

|

|

Page |

|

|

|

PART I. |

3 |

|

|

|

|

Item 1. |

3 |

|

|

3 |

|

|

Condensed Consolidated Statements of Cash Flows - Three Months Ended March 31, 2023 and 2022 |

4 |

|

Condensed Consolidated Balance Sheets - March 31, 2023 and December 31, 2022 |

5 |

|

6 |

|

|

Notes to Condensed Consolidated Financial Statements (unaudited) |

7 |

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

18 |

Item 3. |

40 |

|

Item 4. |

41 |

|

|

|

|

PART II. |

41 |

|

|

|

|

Item 1. |

41 |

|

Item 1A. |

41 |

|

Item 4. |

41 |

|

Item 6. |

42 |

|

43 |

||

*Items 2, 3 and 5 of Part II are omitted as they are not applicable. |

|

|

2

Part I - Financial Information

Item 1. Financial Statements

Hecla Mining Company and Subsidiaries

Condensed Consolidated Statements of Operations and Comprehensive (Loss) Income (Unaudited)

(Dollars and shares in thousands, except for per-share amounts)

|

|

Three Months Ended |

|

|||||

|

|

March 31, 2023 |

|

|

March 31, 2022 |

|

||

Sales |

|

$ |

|

|

$ |

|

||

Cost of sales and other direct production costs |

|

|

|

|

|

|

||

Depreciation, depletion and amortization |

|

|

|

|

|

|

||

Total cost of sales |

|

|

|

|

|

|

||

Gross profit |

|

|

|

|

|

|

||

Other operating expenses: |

|

|

|

|

|

|

||

General and administrative |

|

|

|

|

|

|

||

Exploration and pre-development |

|

|

|

|

|

|

||

Ramp-up and suspension costs |

|

|

|

|

|

|

||

Provision for closed operations and environmental matters |

|

|

|

|

|

|

||

Other operating (income) expense |

|

|

( |

) |

|

|

|

|

Total other operating expenses |

|

|

|

|

|

|

||

Income from operations |

|

|

|

|

|

|

||

Other income (expense): |

|

|

|

|

|

|

||

Interest expense |

|

|

( |

) |

|

|

( |

) |

Fair value adjustments, net |

|

|

|

|

|

|

||

Net foreign exchange gain (loss) |

|

|

|

|

|

( |

) |

|

Other income |

|

|

|

|

|

|

||

Total other expense |

|

|

( |

) |

|

|

( |

) |

Income before income and mining taxes |

|

|

|

|

|

|

||

Income and mining tax expense |

|

|

( |

) |

|

|

( |

) |

Net (loss) income |

|

|

( |

) |

|

|

|

|

Preferred stock dividends |

|

|

( |

) |

|

|

( |

) |

Net (loss) income applicable to common stockholders |

|

$ |

( |

) |

|

$ |

|

|

Comprehensive income (loss): |

|

|

|

|

|

|

||

Net (loss) income |

|

$ |

( |

) |

|

$ |

|

|

Change in fair value of derivative contracts designated as hedge transactions |

|

|

|

|

|

( |

) |

|

Comprehensive income (loss) |

|

$ |

|

|

$ |

( |

) |

|

Basic (loss) income per common share after preferred dividends |

|

$ |

( |

) |

|

$ |

|

|

Diluted (loss) income per common share after preferred dividends |

|

$ |

( |

) |

|

$ |

|

|

Weighted average number of common shares outstanding - basic |

|

|

|

|

|

|

||

Weighted average number of common shares outstanding - diluted |

|

|

|

|

|

|

||

Cash dividends declared per common share |

|

$ |

|

|

$ |

|

||

The accompanying notes are an integral part of the interim condensed consolidated financial statements.

3

Hecla Mining Company and Subsidiaries

Condensed Consolidated Statements of Cash Flows (Unaudited)

(In thousands)

|

|

Three Months Ended |

|

|||||

|

|

March 31, 2023 |

|

|

March 31, 2022 |

|

||

Operating activities: |

|

|

|

|

|

|

||

Net (loss) income |

|

$ |

( |

) |

|

$ |

|

|

Non-cash elements included in net (loss) income: |

|

|

|

|

|

|

||

Depreciation, depletion and amortization |

|

|

|

|

|

|

||

Adjustments of inventory to net realizable value |

|

|

|

|

|

|

||

Fair value adjustments, net |

|

|

( |

) |

|

|

( |

) |

Provision for reclamation and closure costs |

|

|

|

|

|

|

||

Stock-based compensation |

|

|

|

|

|

|

||

Deferred income taxes |

|

|

|

|

|

|

||

Foreign exchange (gain) loss |

|

|

( |

) |

|

|

|

|

Other non-cash items, net |

|

|

|

|

|

|

||

Change in assets and liabilities: |

|

|

|

|

|

|

||

Accounts receivable |

|

|

|

|

|

|

||

Inventories |

|

|

( |

) |

|

|

( |

) |

Other current and non-current assets |

|

|

( |

) |

|

|

|

|

Accounts payable, accrued and other current liabilities |

|

|

( |

) |

|

|

( |

) |

Accrued payroll and related benefits |

|

|

|

|

|

|

||

Accrued taxes |

|

|

|

|

|

|

||

Accrued reclamation and closure costs and other non-current liabilities |

|

|

|

|

|

( |

) |

|

Cash provided by operating activities |

|

|

|

|

|

|

||

Investing activities: |

|

|

|

|

|

|

||

Additions to properties, plants, equipment and mineral interests |

|

|

( |

) |

|

|

( |

) |

Proceeds from sale of investments |

|

|

|

|

|

|

||

Proceeds from disposition of properties, plants and equipment |

|

|

|

|

|

|

||

Purchases of investments |

|

|

|

|

|

( |

) |

|

Net cash used in investing activities |

|

|

( |

) |

|

|

( |

) |

Financing activities: |

|

|

|

|

|

|

||

Proceeds from sale of common stock, net |

|

|

|

|

|

|

||

Acquisition of treasury stock |

|

|

( |

) |

|

|

( |

) |

Borrowing of debt |

|

|

|

|

|

|

||

Repayment of debt |

|

|

( |

) |

|

|

|

|

Dividends paid to common and preferred stockholders |

|

|

( |

) |

|

|

( |

) |

Credit facility fees paid |

|

|

|

|

|

( |

) |

|

Repayments of finance leases |

|

|

( |

) |

|

|

( |

) |

Net cash provided by (used in) financing activities |

|

|

|

|

|

( |

) |

|

Effect of exchange rates on cash |

|

|

|

|

|

|

||

Net (decrease) increase in cash, cash equivalents and restricted cash |

|

|

( |

) |

|

|

|

|

Cash, cash equivalents and restricted cash at beginning of period |

|

|

|

|

|

|

||

Cash, cash equivalents and restricted cash at end of period |

|

$ |

|

|

$ |

|

||

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

||

Cash paid for interest |

|

$ |

|

|

$ |

|

||

Cash paid for income and mining taxes, net |

|

$ |

|

|

$ |

|

||

Significant non-cash investing and financing activities: |

|

|

|

|

|

|

||

Addition of finance lease obligations and right-of-use assets |

|

$ |

|

|

$ |

|

||

The accompanying notes are an integral part of the interim condensed consolidated financial statements.

4

Hecla Mining Company and Subsidiaries

Condensed Consolidated Balance Sheets (Unaudited)

(In thousands, except shares)

|

|

March 31, 2023 |

|

|

December 31, 2022 |

|

||

ASSETS |

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

|

|

$ |

|

||

Accounts receivable: |

|

|

|

|

|

|

||

Trade |

|

|

|

|

|

|

||

Other, net |

|

|

|

|

|

|

||

Inventories: |

|

|

|

|

|

|

||

Concentrates, doré, stockpiled ore, and metals in transit and in-process |

|

|

|

|

|

|

||

Materials and supplies |

|

|

|

|

|

|

||

Other current assets |

|

|

|

|

|

|

||

Total current assets |

|

|

|

|

|

|

||

Investments |

|

|

|

|

|

|

||

Restricted cash |

|

|

|

|

|

|

||

Properties, plants, equipment and mineral interests, net |

|

|

|

|

|

|

||

Operating lease right-of-use assets |

|

|

|

|

|

|

||

Deferred tax assets |

|

|

|

|

|

|

||

Other non-current assets |

|

|

|

|

|

|

||

Total assets |

|

$ |

|

|

$ |

|

||

LIABILITIES |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Accounts payable and accrued liabilities |

|

$ |

|

|

$ |

|

||

Accrued payroll and related benefits |

|

|

|

|

|

|

||

Accrued taxes |

|

|

|

|

|

|

||

Finance leases |

|

|

|

|

|

|

||

Accrued reclamation and closure costs |

|

|

|

|

|

|

||

Accrued interest |

|

|

|

|

|

|

||

Other current liabilities |

|

|

|

|

|

|

||

Total current liabilities |

|

|

|

|

|

|

||

Accrued reclamation and closure costs |

|

|

|

|

|

|

||

Long-term debt including finance leases |

|

|

|

|

|

|

||

Deferred tax liability |

|

|

|

|

|

|

||

Other non-current liabilities |

|

|

|

|

|

|

||

Total liabilities |

|

|

|

|

|

|

||

|

|

|

|

|

|

|||

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Preferred stock, |

|

|

|

|

|

|

||

Series B preferred stock, $ |

|

|

|

|

|

|

||

Common stock, $ |

|

|

|

|

|

|

||

Capital surplus |

|

|

|

|

|

|

||

Accumulated deficit |

|

|

( |

) |

|

|

( |

) |

Accumulated other comprehensive income, net |

|

|

|

|

|

|

||

Less treasury stock, at cost; March 31, 2023 — |

|

|

( |

) |

|

|

( |

) |

Total stockholders’ equity |

|

|

|

|

|

|

||

Total liabilities and stockholders’ equity |

|

$ |

|

|

$ |

|

||

The accompanying notes are an integral part of the interim condensed consolidated financial statements.

5

Hecla Mining Company and Subsidiaries

Condensed Consolidated Statements of Changes in Stockholders’ Equity (Unaudited)

(Dollars are in thousands, except for share and per share amounts)

|

|

Three Months Ended March 31, 2023 |

||||||||||||

|

|

Series B |

|

Common |

|

Capital Surplus |

|

Accumulated |

|

Accumulated |

|

Treasury |

|

Total |

Balances, January 1, 2023 |

|

$ |

|

$ |

|

$ |

|

$( |

|

$ |

|

$( |

|

$ |

Net loss |

|

— |

|

— |

|

— |

|

( |

|

— |

|

— |

|

( |

Stock-based compensation expense |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

||

Incentive compensation units distributed ( |

|

— |

|

|

( |

|

— |

|

— |

|

( |

|

( |

|

Common stock ($ |

|

— |

|

— |

|

— |

|

( |

|

— |

|

— |

|

( |

Common stock issued under ATM program ( |

|

— |

|

|

|

— |

|

— |

|

— |

|

|||

Common stock issued for 401(k) match ( |

|

— |

|

|

|

— |

|

— |

|

— |

|

|||

Other comprehensive income |

|

— |

|

— |

|

— |

|

— |

|

|

— |

|

||

Balances, March 31, 2023 |

|

$ |

|

$ |

|

$ |

|

$( |

|

$ |

|

$( |

|

$ |

|

|

Three Months Ended March 31, 2022 |

||||||||||||

|

|

Series B |

|

Common |

|

Capital Surplus |

|

Accumulated |

|

Accumulated |

|

Treasury |

|

Total |

Balances, January 1, 2022 |

|

$ |

|

$ |

|

$ |

|

$( |

|

$( |

|

$( |

|

$ |

Net income |

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

||

Stock-based compensation expense |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

||

Incentive compensation units distributed ( |

|

— |

|

|

( |

|

— |

|

— |

|

( |

|

( |

|

Common stock ($ |

|

— |

|

— |

|

— |

|

( |

|

— |

|

— |

|

( |

Common stock issued for 401(k) match ( |

|

— |

|

|

|

— |

|

— |

|

— |

|

|||

Other comprehensive loss |

|

— |

|

— |

|

— |

|

— |

|

( |

|

— |

|

( |

Balances, March 31, 2022 |

|

$ |

|

$ |

|

$ |

|

$( |

|

$( |

|

$( |

|

$ |

The accompanying notes are an integral part of the interim condensed consolidated financial statements.

6

Note 1. Basis of Preparation of Financial Statements

The accompanying unaudited interim condensed consolidated financial statements of Hecla Mining Company and its subsidiaries (collectively, “Hecla,” “the Company,” “we,” “our,” or “us,” except where the context requires otherwise) have been prepared in accordance with the instructions to Form 10-Q and do not include all information and disclosures required annually by accounting principles generally accepted in the United States of America (“GAAP”). Therefore, this information should be read in conjunction with Hecla Mining Company’s consolidated financial statements and notes contained in our annual report on Form 10-K for the year ended December 31, 2022 (“2022 Form 10-K”). The consolidated December 31, 2022 balance sheet data was derived from our audited consolidated financial statements. The information furnished herein reflects all adjustments that are, in the opinion of management, necessary for a fair statement of the results for the interim periods reported. All such adjustments are, in the opinion of management, of a normal recurring nature. Operating results for the three-month period ended March 31, 2023 are not necessarily indicative of the results that may be expected for the year ending December 31, 2023.

Note 2. Business Segments and Sales of Products

We discover, acquire and develop mines and other mineral interests and produce and market (i) concentrates, containing silver, gold, lead and zinc, (ii) carbon material containing silver and gold, and (iii) doré containing silver and gold. We are currently organized and managed in five segments: Greens Creek, Lucky Friday, Keno Hill, Casa Berardi and Nevada Operations.

General corporate activities not associated with operating mines and their various exploration activities, as well as idle properties and environmental remediation services in the Yukon, are presented as “other.” Interest expense, interest income and income and mining taxes are considered general corporate items, and are not allocated to our segments.

The following tables present information about our reportable segments metal sales for the three months ended March 31, 2023 and 2022 (in thousands):

|

|

Three Months Ended |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Net sales to unaffiliated customers: |

|

|

|

|

|

|

||

Greens Creek |

|

$ |

|

|

$ |

|

||

Lucky Friday |

|

|

|

|

|

|

||

Keno Hill |

|

|

|

|

|

|

||

Casa Berardi |

|

|

|

|

|

|

||

Nevada Operations |

|

|

|

|

|

|

||

Other |

|

|

|

|

|

|

||

|

|

$ |

|

|

$ |

|

||

Income (loss) from operations: |

|

|

|

|

|

|

||

Greens Creek |

|

$ |

|

|

$ |

|

||

Lucky Friday |

|

|

|

|

|

|

||

Keno Hill |

|

|

( |

) |

|

|

|

|

Casa Berardi |

|

|

( |

) |

|

|

( |

) |

Nevada Operations |

|

|

( |

) |

|

|

( |

) |

Other |

|

|

( |

) |

|

|

( |

) |

|

|

$ |

|

|

$ |

|

||

The following table presents identifiable assets by reportable segment as of March 31, 2023 and December 31, 2022 (in thousands):

|

|

March 31, 2023 |

|

|

December 31, 2022 |

|

||

Identifiable assets: |

|

|

|

|

|

|

||

Greens Creek |

|

$ |

|

|

$ |

|

||

Lucky Friday |

|

|

|

|

|

|

||

Keno Hill |

|

|

|

|

|

|

||

Casa Berardi |

|

|

|

|

|

|

||

Nevada Operations |

|

|

|

|

|

|

||

Other |

|

|

|

|

|

|

||

|

|

$ |

|

|

$ |

|

||

7

Our sales for the three month period ended March 31, 2023 are comprised of metal sales as described below and $

Sales by metal for the three month periods ended March 31, 2023 and 2022 were as follows (in thousands):

|

|

Three Months Ended March 31, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Silver |

|

$ |

|

|

$ |

|

||

Gold |

|

|

|

|

|

|

||

Lead |

|

|

|

|

|

|

||

Zinc |

|

|

|

|

|

|

||

Less: Smelter and refining charges |

|

|

( |

) |

|

|

( |

) |

|

|

$ |

|

|

$ |

|

||

Sales of metals for the three month periods ended March 31, 2023 and 2022, included a net gain of $

Note 3. Income and Mining Taxes

Major components of our income and mining tax benefit (provision) for the three months ended March 31, 2023 and 2022 are as follows (in thousands):

|

|

Three Months Ended |

|

|||||

|

|

March 31, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Current: |

|

|

|

|

|

|

||

Domestic |

|

$ |

( |

) |

|

$ |

( |

) |

Foreign |

|

|

( |

) |

|

|

( |

) |

Total current income and mining tax provision |

|

|

( |

) |

|

|

( |

) |

Deferred: |

|

|

|

|

|

|

||

Domestic |

|

|

( |

) |

|

|

( |

) |

Foreign |

|

|

|

|

|

|

||

Total deferred income and mining tax provision |

|

|

( |

) |

|

|

( |

) |

Total income and mining tax provision |

|

$ |

( |

) |

|

$ |

( |

) |

The income and mining tax benefit (provision) for the three months ended March 31, 2023 and 2022 varies from the amounts that would have resulted from applying the statutory tax rates to pre-tax income due primarily to the impact of taxation in foreign jurisdictions, non-recognition of net operating losses and foreign exchange gains and losses in certain jurisdictions.

For the three month period ended March 31, 2023, we used the annual effective tax rate method to calculate the tax provision. Valuation allowances on Nevada, Mexico and certain Canadian net operating losses were treated as discrete adjustments to the tax calculation including losses incurred by the acquired Alexco Resource Corp. ("Alexco") entities, which were acquired on September 7, 2022, partially causing the increase in the income tax rate for the three months ended March 31, 2023, as compared to the three months ended March 31, 2022.

Note 4. Employee Benefit Plans

We sponsor three defined benefit pension plans covering substantially all U.S. employees. Net periodic pension cost for the plans consisted of the following for the three months ended March 31, 2023 and 2022 (in thousands):

|

|

Three Months Ended |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Service cost |

|

$ |

|

|

$ |

|

||

Interest cost |

|

|

|

|

|

|

||

Expected return on plan assets |

|

|

( |

) |

|

|

( |

) |

Amortization of prior service cost |

|

|

|

|

|

|

||

Amortization of net loss |

|

|

( |

) |

|

|

|

|

Net periodic pension (benefit) cost |

|

$ |

( |

) |

|

$ |

|

|

For the three month periods ended March 31, 2023 and 2022, the service cost component of net periodic pension cost is included in the same line items of our condensed consolidated financial statements as other employee compensation costs. The net benefit related

8

to all other components of net periodic pension cost of $

Note 5. (Loss) Income Per Common Share

We calculate basic (loss) income per common share on the basis of the weighted average number of shares of common stock outstanding during the period. Diluted income per share is calculated using the weighted average number of shares of common stock outstanding during the period plus the effect of potential dilutive common shares during the period using the treasury stock and if-converted methods.

Potential dilutive shares of common stock include outstanding unvested restricted stock awards, deferred restricted stock units, warrants and convertible preferred stock for periods in which we have reported net income. For periods in which we report net losses, potential dilutive shares of common stock are excluded, as their conversion and exercise would be anti-dilutive.

The following table represents net (loss) income per common share – basic and diluted (in thousands, except income (loss) per share):

|

|

Three Months Ended March 31, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Numerator |

|

|

|

|

|

|

||

Net (loss) income |

|

$ |

( |

) |

|

$ |

|

|

Preferred stock dividends |

|

|

( |

) |

|

|

( |

) |

Net (loss) income applicable to common shares |

|

$ |

( |

) |

|

$ |

|

|

|

|

|

|

|

|

|

||

Denominator |

|

|

|

|

|

|

||

Basic weighted average common shares |

|

|

|

|

|

|

||

Dilutive restricted stock units, warrants and deferred shares |

|

|

— |

|

|

|

|

|

Diluted weighted average common shares |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Basic (loss) income per common share |

|

$ |

( |

) |

|

$ |

|

|

Diluted (loss) income per common share |

|

$ |

( |

) |

|

$ |

|

|

For the three months ended March 31, 2023, all outstanding unvested restricted stock units, deferred restricted stock units, warrants and convertible preferred stock were excluded from the computation of diluted loss per share, as our reported net loss would cause their conversion and exercise to have an anti-dilutive effect on the calculation of diluted loss per share. For the three months ended March 31, 2022, the calculation of diluted income per common share included (i)

that were unvested during the period, (ii)

Note 6. Stockholders’ Equity

At-The-Market Equity Distribution Agreement

Pursuant to an equity distribution agreement dated February 18, 2021, we may offer and sell up to

Stock-based Compensation Plans

The Company has stock incentive plans for executives, directors and eligible employees, comprised of performance shares and restricted stock. Stock-based compensation expense for restricted stock unit and performance-based grants (collectively "incentive compensation") to employees and shares issued to non-employee directors totaled $

9

ended March 31, 2023 and 2022, respectively. At March 31, 2023, there was $

In connection with the vesting of incentive compensation, employees have in the past, at their election and when permitted by us, chosen to satisfy their minimum tax withholding obligations through net share settlement, pursuant to which the Company withholds the number of shares necessary to satisfy such withholding obligations and pays the obligations in cash. As a result, in the first three months of 2023, we withheld

Common Stock Dividends

The following table summarizes the dividends our Board of Directors have declared and we have paid during 2023 pursuant to our dividend policy:

Quarter |

|

Prior Quarter Realized Silver Price |

|

Silver-linked component |

|

Minimum component |

|

Total dividend per share |

First |

|

|

$ |

|

$ |

|

$ |

Note 7. Debt, Credit Agreement and Leases

Our debt as of March 31, 2023 and December 31, 2022 consisted of our

|

|

March 31, 2023 |

|

|||||||||

|

|

Senior Notes |

|

|

IQ Notes |

|

|

Total |

|

|||

Principal |

|

$ |

|

|

$ |

|

|

$ |

|

|||

Unamortized discount/premium and issuance costs |

|

|

( |

) |

|

|

|

|

|

( |

) |

|

Long-term debt balance |

|

$ |

|

|

$ |

|

|

$ |

|

|||

|

|

December 31, 2022 |

|

|||||||||

|

|

Senior Notes |

|

|

IQ Notes |

|

|

Total |

|

|||

Principal |

|

$ |

|

|

$ |

|

|

$ |

|

|||

Unamortized discount/premium and issuance costs |

|

|

( |

) |

|

|

|

|

|

( |

) |

|

Long-term debt balance |

|

$ |

|

|

$ |

|

|

$ |

|

|||

The following table summarizes the scheduled annual future payments, including interest, for our Senior Notes, IQ Notes, and finance and operating leases as of March 31, 2023 (in thousands). The amounts for the IQ Notes are stated in U.S. dollars (“USD”) based on the USD/Canadian dollar (“CAD”) exchange rate as of March 31, 2023.

Twelve-month period ending March 31, |

|

Senior Notes |

|

|

IQ Notes |

|

|

Finance Leases |

|

|

Operating Leases |

|

||||

2024 |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

2025 |

|

|

|

|

|

|

|

|

|

|

|

|

||||

2026 |

|

|

|

|

|

— |

|

|

|

|

|

|

|

|||

2027 |

|

|

|

|

|

— |

|

|

|

|

|

|

|

|||

2028 |

|

|

|

|

|

— |

|

|

|

|

|

|

|

|||

Thereafter |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Less: effect of discounting |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Total |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Credit Agreement

On July 21, 2022, we entered into a revolving credit facility (the "Credit Agreement") with various financial institutions (the “Lenders”), Bank of Montreal and Bank of America, N.A. as letters of credit issuers, and Bank of America, N.A., as administrative agent for the Lenders and as swingline lender, to replace our prior credit agreement. The Credit Agreement is a $

10

or (iii) Term SOFR plus

We are also required to pay a commitment fee of between

Hecla Mining Company and certain of our subsidiaries are the borrowers under the Credit Agreement, while certain of our other subsidiaries are guarantors of the borrowers’ obligations under the Credit Agreement. As further security, the Credit Agreement is collateralized by a mortgage on the Greens Creek mine, the equity interests of subsidiaries that own the Greens Creek mine or are part of the Greens Creek Joint Venture and our subsidiary Hecla Admiralty Company (the “Greens Creek Group”), and by all of the Green Creek Group’s rights and interests in the Greens Creek Joint Venture Agreement, and in all assets of the joint venture and of any member of the Greens Creek Group.

At March 31, 2023, there was $

We believe we were in compliance with all covenants under the Credit Agreement as of March 31, 2023.

Note 8. Derivative Instruments

General

Our current risk management policy provides that up to

These instruments expose us to (i) credit risk in the form of non-performance by counterparties for contracts in which the contract price exceeds the spot price of the hedged commodity or foreign currency and (ii) price risk to the extent that the spot price or currency exchange rate exceeds the contract price for quantities of our production and/or forecasted costs covered under contract positions.

Foreign Currency

Our wholly-owned subsidiaries owning the Casa Berardi operation and Keno Hill operation are USD-functional entities which routinely incur expenses denominated in CAD. Such expenses expose us to exchange rate fluctuations between the USD and CAD. We have a program to manage our exposure to fluctuations in the USD exchange rate for these subsidiaries' future operating and capital costs denominated in CAD. The program utilizes forward contracts to buy CAD, some of which are designated as cash flow hedges. As of March 31, 2023, we have

As of March 31, 2023 and December 31, 2022, we recorded the following balances for the

|

|

March 31, |

|

|

December 31, |

|

||

Balance sheet line item: |

|

2023 |

|

|

2022 |

|

||

Other current assets |

|

$ |

|

|

$ |

|

||

Other non-current assets |

|

|

|

|

|

|

||

Current derivative liabilities |

|

|

|

|

|

|

||

Non-current derivative liabilities |

|

$ |

|

|

$ |

|

||

Net unrealized losses of $

11

in fair value adjustments, net on our consolidated statements of operations and comprehensive income for the three months ended March 31, 2023

Metals Prices

We are currently using financially-settled forward contracts to manage the exposure to:

The following tables summarize the quantities of metals committed under forward sales contracts at March 31, 2023 and December 31, 2022:

March 31, 2023 |

|

Ounces/pounds under contract (in 000's) |

|

|

Average price per ounce/pound |

|

||||||||||||||||||||||||||

|

|

Silver |

|

|

Gold |

|

|

Zinc |

|

|

Lead |

|

|

Silver |

|

|

Gold |

|

|

Zinc |

|

|

Lead |

|

||||||||

|

|

(ounces) |

|

|

(ounces) |

|

|

(pounds) |

|

|

(pounds) |

|

|

(ounces) |

|

|

(ounces) |

|

|

(pounds) |

|

|

(pounds) |

|

||||||||

Contracts on provisional sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

2023 settlements |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||||||

Contracts on forecasted sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

2023 settlements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

$ |

|

|

$ |

|

||||||

2024 settlements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

$ |

|

||||||

2025 settlements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

||

December 31, 2022 |

|

Ounces/pounds under contract (in 000's) |

|

|

Average price per ounce/pound |

|

||||||||||||||||||||||||||

|

|

Silver |

|

|

Gold |

|

|

Zinc |

|

|

Lead |

|

|

Silver |

|

|

Gold |

|

|

Zinc |

|

|

Lead |

|

||||||||

|

|

(ounces) |

|

|

(ounces) |

|

|

(pounds) |

|

|

(pounds) |

|

|

(ounces) |

|

|

(ounces) |

|

|

(pounds) |

|

|

(pounds) |

|

||||||||

Contracts on provisional sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

2023 settlements |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||||||

Contracts on forecasted sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

2023 settlements |

|

|

|

|

|

|

|

|

|

|

|

|

|

N/A |

|

|

N/A |

|

|

$ |

|

|

$ |

|

||||||||

2024 settlements |

|

|

|

|

|

|

|

|

|

|

|

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

$ |

|

||||||||

We recorded the following balances for the fair value of the forward contracts as of March 31, 2023 and December 31, 2022 (in millions):

|

|

March 31, 2023 |

|

|

December 31, 2022 |

|

||||||||||||||||||

Balance sheet line item: |

|

Contracts in an asset position |

|

|

Contracts in a liability position |

|

|

Net asset (liability) |

|

|

Contracts in an asset position |

|

|

Contracts in a liability position |

|

|

Net asset (liability) |

|

||||||

Other current assets |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||||

Other non-current assets |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||||

Current derivative liabilities |

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

( |

) |

||

Non-current derivative liabilities |

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

( |

) |

||

Net realized and unrealized gains of $

Credit-risk-related Contingent Features

Certain of our derivative contracts contain cross default provisions which provide that a default under our Credit Agreement would cause a default under the derivative contract. As of March 31, 2023, we have not posted any collateral related to these contracts. The fair value of derivatives in a net liability position related to these agreements was $

12

accrued interest but excludes any adjustment for nonperformance risk. If we were in breach of any of these provisions at March 31, 2023, we could have been required to settle our obligations under the agreements at their termination value of $

Note 9. Fair Value Measurement

Fair value adjustments, net is comprised of the following:

|

|

Three Months Ended March 31, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Gain (loss) on derivative contracts |

|

$ |

|

|

$ |

( |

) |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||

Total fair value adjustments, net |

|

$ |

|

|

$ |

|

||

Accounting guidance has established a hierarchy for inputs used to measure assets and liabilities at fair value on a recurring basis. The three levels included in the hierarchy are:

Level 1: quoted prices in active markets for identical assets or liabilities;

Level 2: significant other observable inputs; and

Level 3: significant unobservable inputs.

The table below sets forth our assets and liabilities that were accounted for at fair value on a recurring basis and the fair value calculation input hierarchy level that we have determined applies to each asset and liability category (in thousands).

Description |

|

Balance at |

|

|

Balance at |

|

|

Input |

||

Assets: |

|

|

|

|

|

|

|

|

||

Cash and cash equivalents: |

|

|

|

|

|

|

|

|

||

Money market funds and other bank deposits |

|

$ |

|

|

$ |

|

|

Level 1 |

||

Current and non-current investments |

|

|

|

|

|

|

|

|

||

Equity securities - mining industry |

|

|

|

|

|

|

|

Level 1 |

||

Trade accounts receivable: |

|

|

|

|

|

|

|

|

||

Receivables from provisional concentrate sales |

|

|

|

|

|

|

|

Level 2 |

||

Restricted cash balances: |

|

|

|

|

|

|

|

|

||

Certificates of deposit and other deposits |

|

|

|

|

|

|

|

Level 1 |

||

Derivative contracts - current and non-current derivatives assets: |

|

|

|

|

|

|

|

|

||

Foreign exchange contracts |

|

|

|

|

|

|

|

Level 2 |

||

|

|

|

|

|

|

|

Level 2 |

|||

Total assets |

|

$ |

|

|

$ |

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Liabilities: |

|

|

|

|

|

|

|

|

||

Derivative contracts - current derivatives liabilities and other non-current |

|

|

|

|

|

|

|

|

||

Foreign exchange contracts |

|

$ |

|

|

$ |

|

|

Level 2 |

||

|

|

|

|

|

|

|

Level 2 |

|||

Total liabilities |

|

$ |

|

|

$ |

|

|

|

||

Cash and cash equivalents consist primarily of money market funds and are valued at cost, which approximates fair value, and a small portion consists of municipal bonds having maturities of less than 90 days, which are recorded at fair value.

Current and non-current restricted cash balances consist primarily of certificates of deposit, U.S. Treasury securities, and other deposits and are valued at cost, which approximates fair value.

Our non-current available for sale securities consist of marketable equity securities of companies in the mining industry which are valued using quoted market prices for each security.

Trade accounts receivable from provisional concentrate sales are subject to final pricing and valued using quoted prices based on forward curves for the particular metals.

13

We use financially-settled forward contracts to manage exposure to changes in the exchange rate between USD and CAD, and the impact on CAD-denominated operating and capital costs incurred at our Casa Berardi operation and the Keno Hill operation (see Note 8 for more information). The fair value of each contract represents the present value of the difference between the forward exchange rate for the contract settlement period as of the measurement date and the contract settlement exchange rate.

We use financially-settled forward contracts to manage the exposure to changes in prices of silver, gold, zinc and lead contained in our concentrate shipments that have not reached final settlement. We also use financially-settled forward contracts to manage the exposure to changes in prices of silver, gold, zinc and lead contained in our forecasted future sales (see Note 8 for more information). The fair value of each forward contract represents the present value of the difference between the forward metal price for the contract settlement period as of the measurement date and the contract settlement metal price.

At March 31, 2023, our Senior Notes and IQ Notes were recorded at their carrying value of $

Note 10. Commitments, Contingencies and Obligations

Johnny M Mine Area near San Mateo, McKinley County and San Mateo Creek Basin, New Mexico

In August 2012, Hecla Limited and the U.S. Environmental Protection Agency (the “EPA”) entered into a Settlement Agreement and Administrative Order on Consent for Removal Action (“Consent Order”) regarding the Johnny M Mine Area near San Mateo, McKinley County, New Mexico. Mining at the Johnny M Mine was conducted for a limited period of time by a predecessor of Hecla Limited, and the EPA had previously asserted that Hecla Limited may be responsible under the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”) for environmental remediation and past costs incurred by the EPA at the site. Under the Consent Order, Hecla Limited agreed to pay (i) $

The Johnny M Mine is in an area known as the San Mateo Creek Basin (“SMCB”), which is an approximately 321 square mile area in New Mexico that contains numerous legacy uranium mines and mills. In addition to Johnny M, Hecla Limited’s predecessor was involved at other mining sites within the SMCB. The EPA appears to have deferred consideration of listing the SMCB site on CERCLA’s National Priorities List (“Superfund”) by removing the site from its emphasis list, and is working with various potentially responsible parties (“PRPs”) at the site in order to study and potentially address perceived groundwater issues within the SMCB. The EE/CA discussed above relates primarily to contaminated rock and soil at the Johnny M site, not groundwater and not elsewhere within the SMCB site. It is possible that Hecla Limited’s liability at the Johnny M Site, and for any other mine site within the SMCB at which Hecla Limited’s predecessor may have operated, will be greater than our current accrual of $9.0 million due to the increased scope of required remediation.

In July 2018, the EPA informed Hecla Limited that it and several other PRPs may be liable for cleanup of the SMCB site or for costs incurred by the EPA in cleaning up the site. The EPA stated it has incurred approximately $

Carpenter Snow Creek and Barker-Hughesville Sites in Montana

In July 2010, the EPA made a formal request to Hecla for information regarding the Carpenter Snow Creek Superfund site located in Cascade County, Montana. The Carpenter Snow Creek site is located in a historical mining district, and in the early 1980s

14

Hecla Limited leased 6 mining claims and performed limited exploration activities at the site. Hecla Limited terminated the mining lease in 1988.

In June 2011, the EPA informed Hecla Limited that it believes Hecla Limited, and several other PRPs, may be liable for cleanup of the site or for costs incurred by the EPA in cleaning up the site. The EPA stated in the letter that it has incurred approximately $

In February 2017, the EPA made a formal request to Hecla for information regarding the Barker-Hughesville Mining District Superfund site located in Judith Basin and Cascade Counties, Montana. Hecla Limited submitted a response in April 2017. The Barker-Hughesville site is located in a historic mining district, and between approximately June and December 1983, Hecla Limited was party to an agreement with another mining company under which limited exploration activities occurred at or near the site.

In August 2018, the EPA informed Hecla Limited that it and several other PRPs may be liable for cleanup of the site or for costs incurred by the EPA in cleaning up the site. The EPA did not include an amount of its alleged response costs to date. Hecla Limited cannot with reasonable certainty estimate the amount or range of liability, if any, relating to this matter because of, among other reasons, the lack of information concerning past or anticipated future costs at the site and the relative contributions of contamination by various other PRPs.

Greens Creek and Lucky Friday Environmental Issues

On June 30, 2022, our Greens Creek mine received a Notice of Violation (“NOV”) from the EPA alleging that the mine treated, stored, and disposed of certain hazardous waste without a permit in violation of the Resource Conservation and Recovery Act (“RCRA”), relating to the alleged presence of lead outside the concentrate storage building and the alleged improper reuse/recycling of certain materials produced from the on-site laboratories. The NOV contained two other less significant alleged violations. We disagree with several of the EPA’s allegations on a factual and legal basis.

Currently, the EPA has not initiated any formal enforcement proceeding against our Greens Creek subsidiary. In civil judicial cases, EPA can seek statutory penalties up to $

On July 12, 2022, our Lucky Friday mine received a NOV from the EPA alleging violations of the Clean Water Act (“CWA”) between 2018 and 2021 relating primarily to concentration levels of zinc and lead in the mine’s permitted water discharges. Currently, the EPA has not initiated any formal enforcement proceeding against our Lucky Friday subsidiary. In civil judicial cases, the EPA can seek statutory penalties up to $

Litigation Related to Klondex Acquisition

On May 24, 2019, a purported Hecla stockholder filed a putative class action lawsuit in the U.S. District Court for the Southern District of New York against Hecla and certain of our executive officers, one of whom is also a director. The complaint, purportedly brought on behalf of all purchasers of Hecla common stock from March 19, 2018 through and including May 8, 2019, asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 and Rule 10b-5 promulgated thereunder and seeks, among other things, damages and costs and expenses. Specifically, the complaint alleges that Hecla, under the authority and control of the individual defendants, made certain material false and misleading statements and omitted certain material information regarding Hecla’s Nevada Operations. The complaint alleges that these misstatements and omissions artificially inflated the market price of Hecla common stock during the class period, thus purportedly harming investors. The Court granted our Motion to Dismiss the lawsuit, without prejudice, in February 2023, and the plaintiffs filed an amended complaint in March 2023 which repeats the same claims. We cannot predict the outcome of this lawsuit or estimate damages if plaintiffs were to prevail. We believe that these claims are without merit and intend to defend them vigorously.

Related to this class action lawsuit, Hecla has been named as a nominal defendant in a shareholder derivative lawsuit which also names as defendants certain current and past (i) members of Hecla’s board of directors and (ii) officers of Hecla. The case was filed

15

on May 4, 2022 in the Delaware Chancery Court. In general terms, the suit alleges breaches of fiduciary duties by the individual defendants, waste of corporate assets and unjust enrichment, and seeks damages, purportedly on behalf of Hecla.

Debt

See Note 7 for information on the commitments related to our debt arrangements as of March 31, 2023.

Other Commitments

Our contractual obligations as of March 31, 2023 included open purchase orders and commitments of approximately $

Other Contingencies

We also have certain other contingencies resulting from litigation, claims, EPA investigations, and other commitments and are subject to a variety of environmental and safety laws and regulations incident to the ordinary course of business. We currently have no basis to conclude that any or all of such contingencies will materially affect our financial position, results of operations or cash flows. However, in the future, there may be changes to these contingencies, or additional contingencies may occur, any of which might result in an accrual or a change in current accruals recorded by us, and there can be no assurance that their ultimate disposition will not have a material adverse effect on our financial position, results of operations or cash flows.

Note 11. Developments in Accounting Pronouncements

Accounting Standards Updates Adopted

In March 2020, ASU No. 2020-04 was issued which provides optional guidance for a limited period of time to ease the potential burden on accounting for contract modifications caused by reference rate reform. In January 2021, ASU No. 2021-01 was issued which broadened the scope of ASU No. 2020-04 to include certain derivative instruments. In December 2022, ASU No. 2022-06 was issued which deferred the sunset date of ASU No. 2020-04. The guidance is effective for all entities as of March 12, 2020 through December 31, 2024. The guidance may be adopted over time as reference rate reform activities occur and should be applied on a prospective basis. Certain of our derivative instruments reference London Interbank Offered Rate ("LIBOR") based rates and are in the process of being amended to eliminate the LIBOR-based rate references prior to July 1, 2023. We do not expect a significant impact to our financial results, financial position or cash flows from the transition from LIBOR to alternative reference interest rates, but we will continue to monitor the impact of this transition until it is completed.

Note 12. Subsequent Events

On April 6, 2023, we and ATAC Resources Ltd. ("ATAC") a Canadian publicly traded company, announced a definitive agreement for one of our subsidiaries to acquire ATAC and its Rackla and Connaught projects in Yukon, Canada. Under the proposed transaction, our wholly-owned subsidiary, Alexco Resource Corp., would acquire all of the issued and outstanding shares of ATAC for a consideration of CAD$

16

Forward-Looking Statements

Certain statements contained in this Form 10-Q, including in Management’s Discussion and Analysis of Financial Condition and Results of Operations and Quantitative and Qualitative Disclosures About Market Risk, are intended to be covered by the safe harbor provided for under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Our forward-looking statements include our current expectations and projections about future results, performance, results of litigation, prospects and opportunities, including reserves and other mineralization. We have tried to identify these forward-looking statements by using words such as “may,” “will,” “expect,” “anticipate,” “believe,” “intend,” “feel,” “plan,” “estimate,” “project,” “forecast” and similar expressions. These forward-looking statements are based on information currently available to us and are expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are subject to a number of risks, uncertainties and other factors that could cause our actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and other factors include, but are not limited to, those set forth under Part I, Item 1A. – Risk Factors in our 2022 Form 10-K. Given these risks and uncertainties, readers are cautioned not to place undue reliance on our forward-looking statements. All subsequent written and oral forward-looking statements attributable to Hecla Mining Company or to persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Except as required by federal securities laws, we do not intend to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

17

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

In this Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”), “Hecla,” “the Company,” “we,” “us” and “our” refer to Hecla Mining Company and its consolidated subsidiaries, except where the context requires otherwise. You should read this discussion in conjunction with our consolidated financial statements, the related MD&A and the discussion of our Business and Properties in our 2022 Form 10-K filed with the United States Securities and Exchange Commission (the “SEC”). The results of operations reported and summarized below are not necessarily indicative of future operating results (refer to “Forward-Looking Statements” above for further discussion). References to “Notes” are Notes included in our Notes to Condensed Consolidated Financial Statements (Unaudited). Throughout MD&A, all references to losses or income per share are on a diluted basis.

Overview

Established in 1891, we are the oldest operating precious metals mining company in the United States. We are the largest silver producer in the United States, producing over 45% of the U.S. silver production at our Greens Creek and Lucky Friday operations. We produce gold at our Casa Berardi operation in Quebec, Canada, and Greens Creek. In addition, we are developing the Keno Hill mine in the Yukon, Canada which we acquired on September 7, 2022, and which we expect will start producing silver in the third quarter of 2023. Based upon our operational footprint, we believe we have low political and economic risk compared to other mining companies whose mines are located in other parts of the world. Our exploration interests are located in the United States, Canada and Mexico. Our operating and strategic framework is based on expanding our production and locating and developing new resource potential in a safe and responsible manner.

First Quarter 2023 Highlights

Operational:

Financial:

Outlook

Our financial results vary as a result of fluctuations in market prices primarily for silver and gold and, to a lesser extent, zinc and lead. World market prices for these commodities have fluctuated historically and are affected by numerous factors beyond our control. Beginning in 2020, with the onset of the COVID-19 pandemic, and continuing in 2022 because of a series of macro-economic factors, there has been significant volatility in the financial and commodities markets, including the precious metals market. Market sentiment improved beginning in late 2022 and we believe the outlook for precious metals fundamentals in the medium- and long-term are favorable. Refer to “Markets” and Item 1A. “Risk Factors” contained in Part I of our annual report on Form 10-K for the year ended December 31, 2022, for further discussion. Because we cannot control the price of our products, the key measures that management focuses on in operating our business are production volumes, payable sales volumes, Cash Cost, After By-product Credits, per Ounce (“Cash Cost”) (non-GAAP) and All-In Sustaining Cost, After By-product Credits, per Ounce (“AISC”) (non-GAAP), operating cash flows, capital expenditures, free cash flow and adjusted EBITDA. The average realized prices for all metals sold by us, except gold, were lower in the three months ended March 31, 2023 than in the comparable period last year. We have also experienced significant cost inflation across our operations, principally associated with higher energy prices, increased costs for other consumables such as reagents, explosives and steel, and labor and contractor costs.

18

Consolidated Results of Operations

Sales by metal for the three month periods ended March 31, 2023 and 2022 were as follows:

|

|

Three Months Ended |

|

|||||

(in thousands) |

|

2023 |

|

|

2022 |

|

||

Silver |

|

$ |

81,532 |

|

|

$ |

66,332 |

|

Gold |

|

|

75,087 |

|

|

|

77,168 |

|

Lead |

|

|

25,402 |

|

|

|

19,564 |

|

Zinc |

|

|

32,943 |

|

|

|

35,638 |

|

Less: smelter charges |

|

|

(15,973 |

) |

|

|

(12,203 |

) |

Sales of products |

|

$ |

198,991 |

|

|

$ |

186,499 |

|

Sales by metal for the three month periods ended March 31, 2023 and 2022, and the approximate variances attributed to differences in metals prices, sales volumes and smelter terms, were as follows:

(in thousands) |

|

Silver |

|

|

Gold |

|

|

Base metals |

|

|

Less: smelter and refining charges |

|

|

Total sales of products |

|

|||||

Three months ended March 31, 2022 |

|

$ |

66,332 |

|

|

$ |

77,168 |

|

|

$ |

55,202 |

|

|

$ |

(12,203 |

) |

|

$ |

186,499 |

|

Variances - 2023 versus 2022: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Price |

|

|

(7,458 |

) |

|

|

394 |

|

|

|

(11,081 |

) |

|

|

(1,489 |

) |

|

|

(19,634 |

) |

Volume |

|

|

22,658 |

|

|

|

(2,747 |

) |

|

|

14,224 |

|

|

|

(3,140 |

) |

|

|

30,995 |

|

Smelter terms |

|

|

— |

|

|

|

272 |

|

|

|

— |

|

|

|

859 |

|

|

|

1,131 |

|

Three months ended March 31, 2023 |

|

$ |

81,532 |

|

|

$ |

75,087 |

|

|

$ |

58,345 |

|

|

$ |

(15,973 |

) |

|

$ |

198,991 |

|

The fluctuations in sales for the three months ended 2023 compared to the same period in 2022 were primarily due to the following two reasons:

|

|

|

|

Three Months Ended |

|

|||||

|

|

|

|

2023 |

|

|

2022 |

|

||

Silver – |

|

London PM Fix ($/ounce) |

|

$ |

22.56 |

|

|

$ |

23.95 |

|

|

|

Realized price per ounce |

|

$ |

22.62 |

|

|

$ |

24.68 |

|

Gold – |

|

London PM Fix ($/ounce) |

|

$ |

1,889 |

|

|

$ |

1,874 |

|

|

|

Realized price per ounce |

|

$ |

1,902 |

|

|

$ |

1,880 |

|

Lead – |

|

LME Final Cash Buyer ($/pound) |

|

$ |

0.97 |

|

|

$ |

1.06 |

|

|

|

Realized price per pound |

|

$ |

1.02 |

|

|

$ |

1.08 |

|

Zinc – |

|

LME Final Cash Buyer ($/pound) |

|

$ |

1.42 |

|

|

$ |

1.70 |

|

|

|

Realized price per pound |

|

$ |

1.39 |

|

|

$ |

1.79 |

|

Average realized prices typically differ from average market prices primarily because concentrate sales are generally recorded as revenues at the time of shipment at forward prices for the estimated month of settlement, which differ from average market prices. Due to the time elapsed between shipment of concentrates and final settlement with the customers, we must estimate the prices at which sales of our metals will be settled. Previously recorded sales are adjusted to estimated settlement metals prices each period through final settlement. We recorded net positive price adjustments to provisional settlements of $2.1 million and $1.0 million for the three months ended March 31, 2023 and 2022. The price adjustments related to silver, gold, zinc and lead contained in our concentrate shipments were partially offset by gains and losses on forward contracts for those metals. See Note 8 of Notes to Condensed Consolidated Financial Statements (Unaudited) for more information. The gains and losses on these contracts are included in revenues and impact the realized prices for silver, gold, lead and zinc. Realized prices are calculated by dividing gross revenues for each metal (which include the price adjustments and gains and losses on the forward contracts discussed above) by the payable quantities of each metal included in concentrate, doré and carbon material shipped during the period.

19

|

|

|

|

Three Months Ended |

|

|||||

|

|

|

|

2023 |

|

|

2022 |

|

||

Silver - |

|

Ounces produced |

|

|

4,041,878 |

|

|

|

3,324,708 |

|

|

|

Payable ounces sold |

|

|

3,604,494 |

|

|

|

2,687,261 |

|

Gold - |

|

Ounces produced |

|

|

39,717 |

|

|

|

41,642 |

|

|

|

Payable ounces sold |

|

|

39,473 |

|

|

|

41,053 |

|

Lead - |

|

Tons produced |

|

|

13,236 |

|

|

|

10,863 |

|

|

|

Payable tons sold |

|

|

12,513 |

|

|

|

9,054 |

|

Zinc - |

|

Tons produced |

|

|

15,795 |

|

|

|

14,946 |

|

|

|

Payable tons sold |

|

|

11,858 |

|

|

|

9,947 |

|

The difference between what we report as “ounces/tons produced” and “payable ounces/tons sold” is attributable to the difference between the quantities of metals contained in the concentrates we produce versus the portion of those metals actually paid for by our customers according to the terms of our sales contracts. Differences can also arise from inventory changes incidental to shipping schedules, or variances in ore grades which impact the amount of metals contained in concentrates produced and sold.

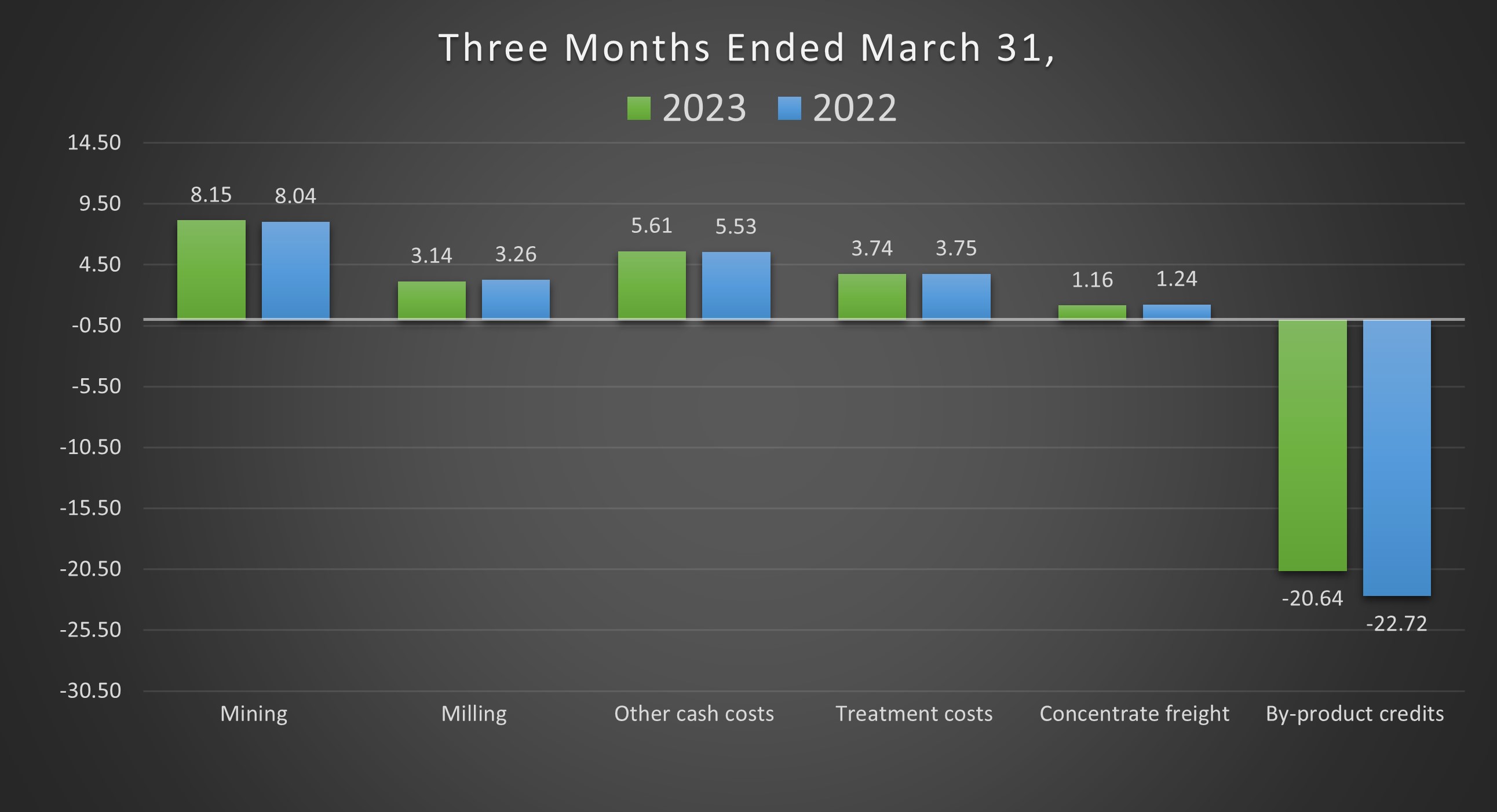

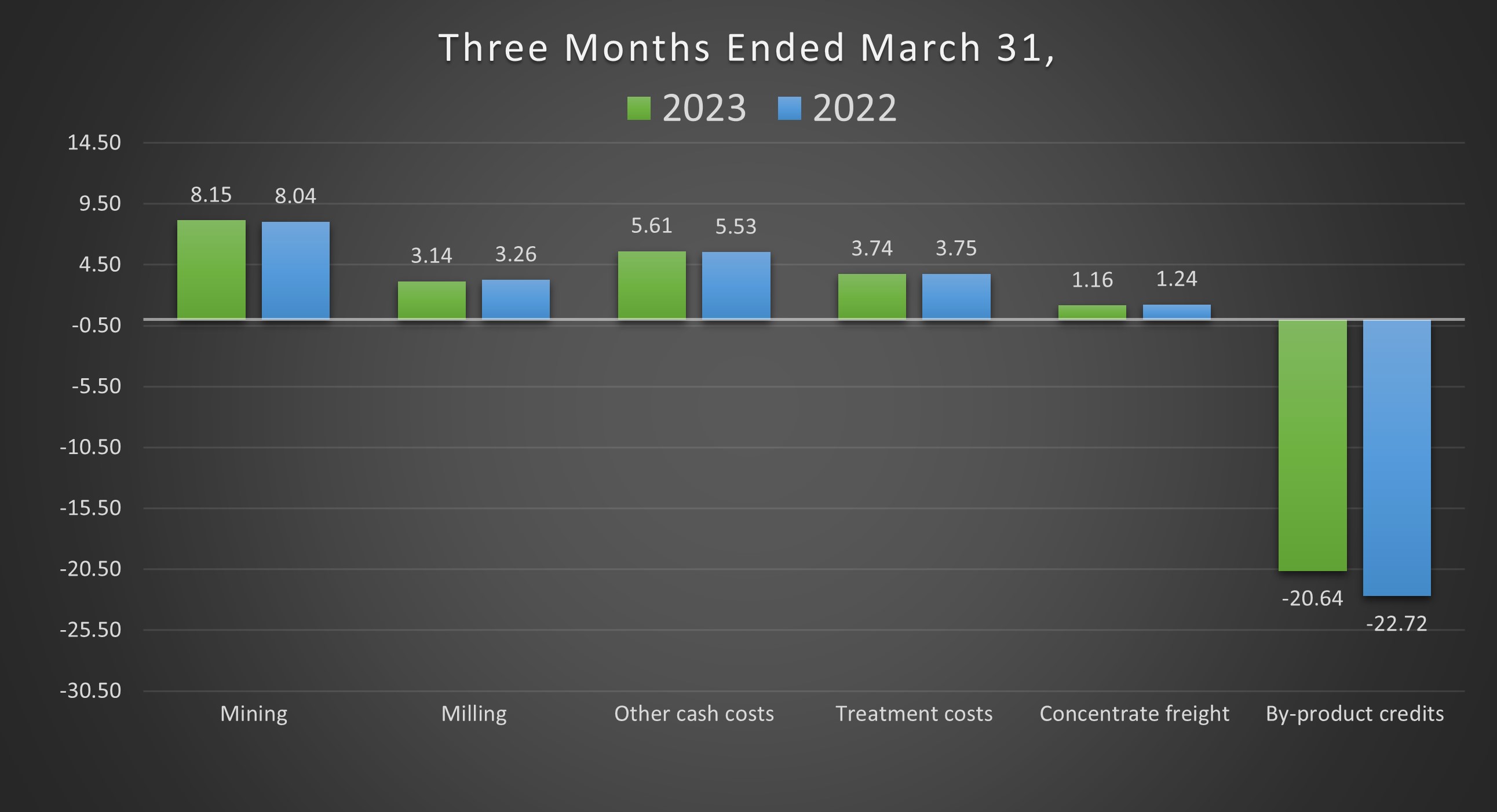

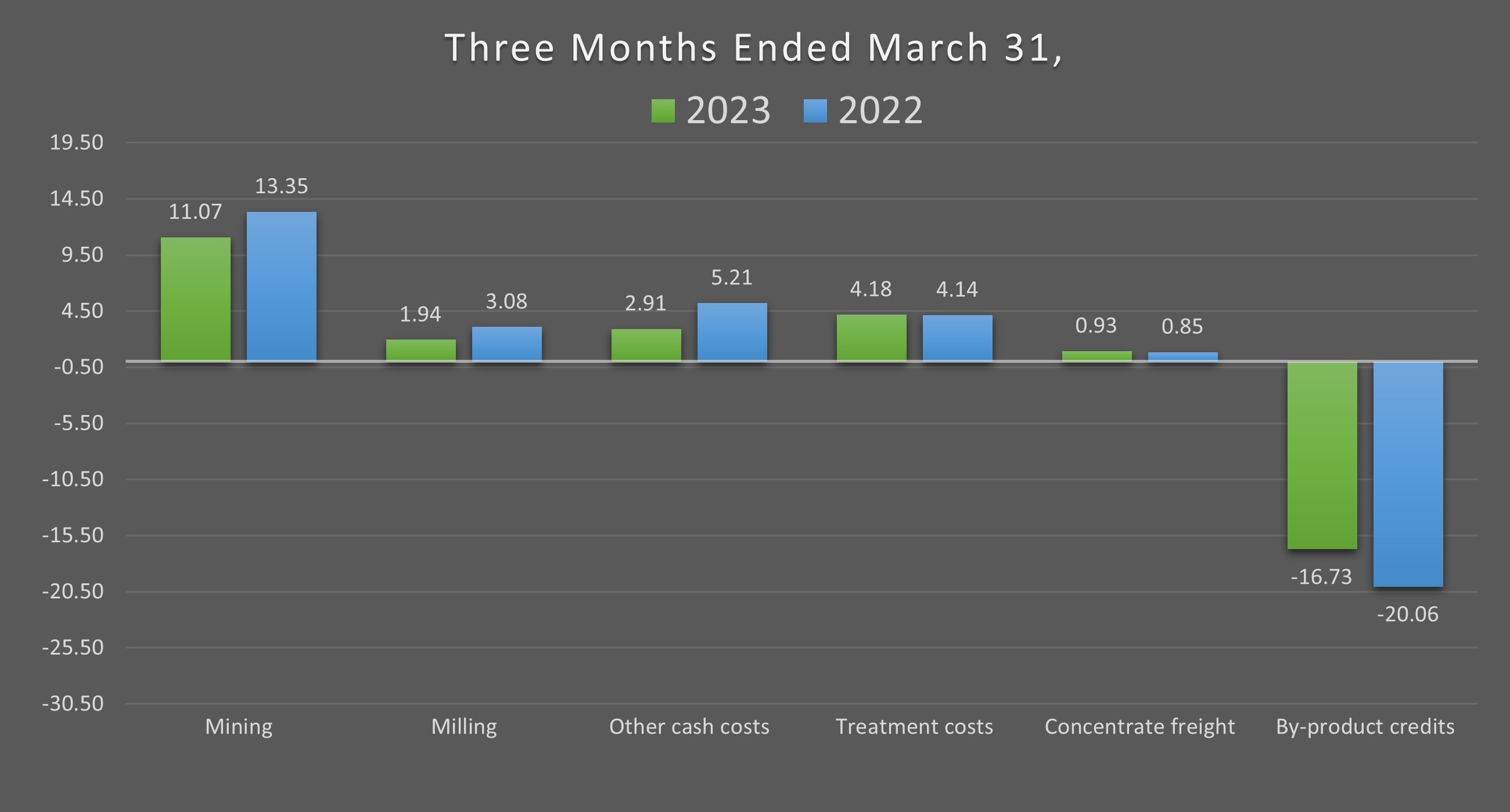

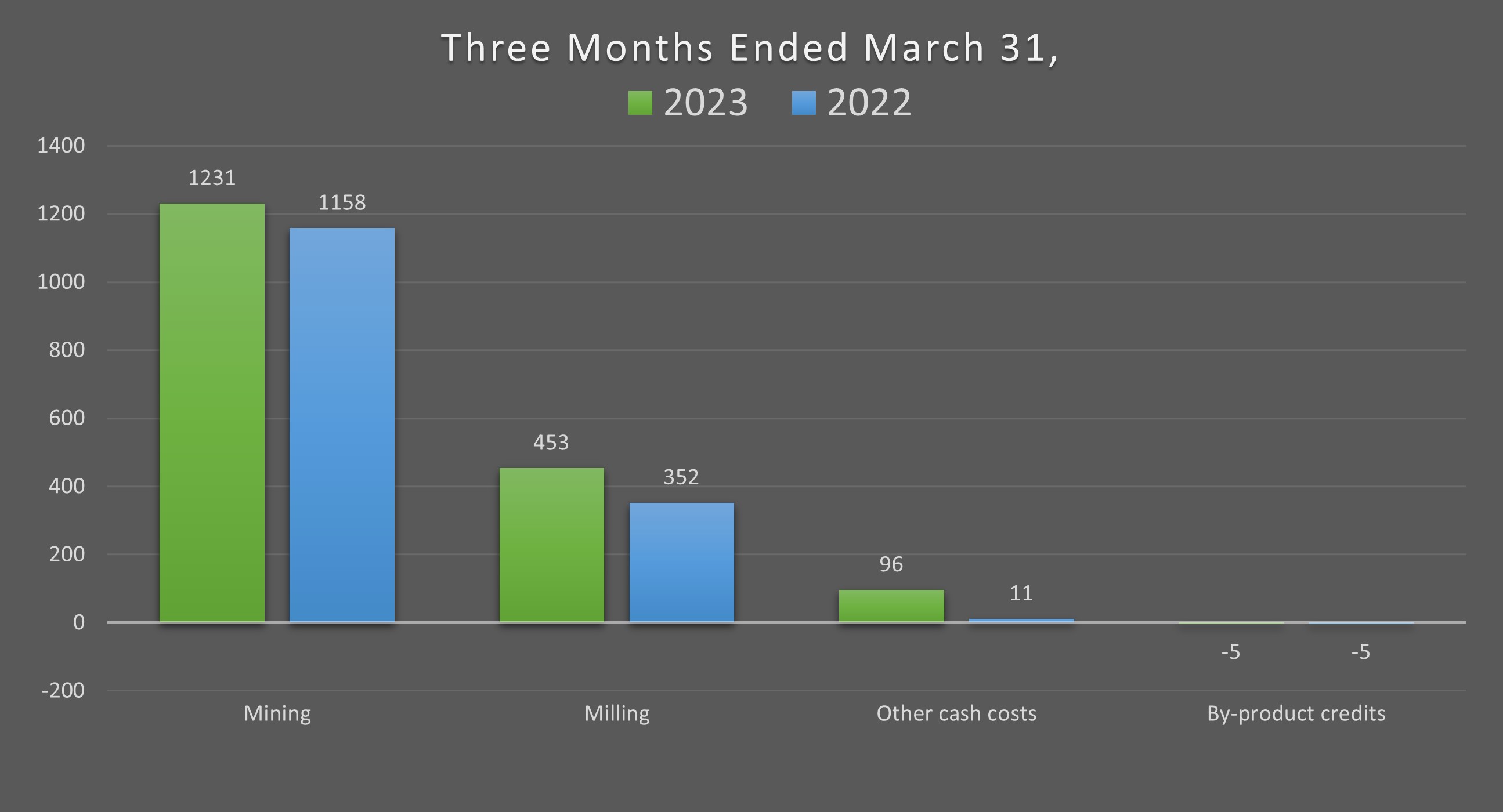

Sales, total cost of sales, gross profit (loss), Cash Cost, After By-product Credits, per Ounce (“Cash Cost”) (non-GAAP) and All-In Sustaining Cost, After By-product Credits, per Ounce (“AISC”) (non-GAAP) at our operating units for the three months ended March 31, 2023 and 2022 were as follows (in thousands, except for Cash Cost and AISC):

|

|

Silver |

|

|

Gold |

|

||||||||||||||||||||||

|

|

Greens Creek |

|

|

Lucky Friday |

|

|

Other |

|

|

Total Silver (2) |

|

|

Casa Berardi |

|

|

Nevada Operations and Other (3) |

|

|

Total Gold |

|

|||||||

Three Months Ended March 31, 2023: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Sales |

|

$ |

98,611 |

|

|

$ |

49,110 |

|

|

$ |

— |

|

|

$ |

147,721 |

|

|

$ |

50,998 |

|

|

$ |

781 |

|

|

$ |

51,779 |

|

Total cost of sales |

|

|

(66,288 |

) |

|

|

(34,534 |

) |

|

|

— |

|

|

|

(100,822 |

) |

|

|

(62,998 |

) |

|

|

(732 |

) |

|

|

(63,730 |