☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material under Rule 14a-12 |

☒ |

No fee required. |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

To my fellow shareholders:

From record financial performance, to award-winning employee engagement and customer service, to excellent progress on many important initiatives, we have many things to celebrate as we look back on 2023. Our people-forward purpose has been at the core of our success for more than 120 years. We built upon our purpose by introducing Our Shared Future – a strategic framework to define our values and drivers for profitable growth and create a roadmap that guides our proactive steps to deliver long-term, sustainable financial performance. That strategic framework supported a second consecutive year of record financial results, even during a time of historically challenging conditions for the banking industry. |

|

Performance Drivers

Our unwavering focus on our four performance drivers – deposit franchise, core profitability, asset quality, and talent and engagement – continues to help us successfully navigate the ever-changing economic environment and achieve our goals. In 2023, we made substantial progress to improve asset quality and core profitability. Additionally, we initiated infrastructure changes to grow our deposit franchise by expanding our capabilities and teams to ensure more frequent customer interaction and a more consistent experience. We are pursuing strategies to deepen relationships with existing customers while attracting new ones with a suite of services that provides convenience, simplicity and flexibility. None of this would have happened without a great team of highly engaged employees focused on delivering for our customers, shareholders and communities.

Strategic Growth Investments

We are making meaningful investments in both our people and technologies, which positions us well for future growth. We added to our already strong capital position that will support organic or inorganic growth. We also augmented our legacy S&T leadership with team members who have experience at larger banks. Approximately half of our senior leadership team has experience at banks with more than $25 billion in assets. We have the people, products, infrastructure and capital to grow.

Awards & Recognition

These strategic investments, along with a focus on our financial performance drivers, are already delivering significant achievements that will further fuel our growth. For example, we are recognized as an industry leader in both employee engagement and customer experience. For two consecutive years, we have been named by Forbes as a Best-In-State Bank, which is based on the results of a consumer survey. We have also been named to the Forbes list of America’s Best Midsize Employers, which includes companies from a wide range of industries, for two consecutive years. The Forbes Best Employers list is based on surveys of our current and former employees, as well as their families and friends. In 2023, we were also honored by Energage, a leader in employee engagement surveys, as a top workplace in the United States and as a top workplace for work-life flexibility.

Community Partnerships & Brand Awareness

As a result of our marketing investments, as well as the outstanding contributions our employees make to build our people-forward brand, our brand awareness has grown significantly in our Pennsylvania and Ohio markets during the past two years. Thanks to our more than 1,200 dedicated employees who have a passion for serving their communities, we assisted approximately 800 organizations by contributing more than 20,000 volunteer hours and donating more than $400,000.

Financial Achievements

The culmination of these efforts resulted in industry-leading financial results* for 2023, including:

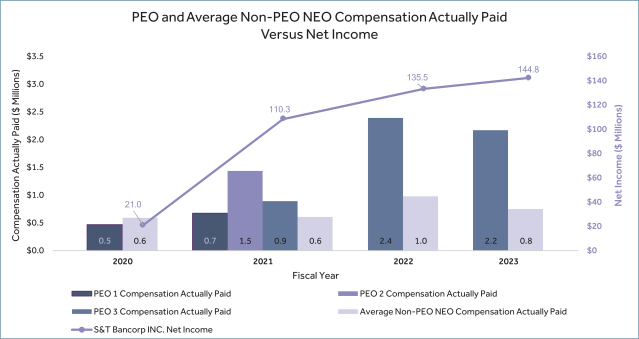

| • | Record earnings per share (EPS) and net income for the second consecutive full year. |

| • | Net income increased 6.83% to $144.8 million and EPS increased 8.09% to $3.74 per share. |

| • | Strong return metrics with return on assets (ROA) of 1.56%, return on equity (ROE) of 11.80% and return on tangible equity (ROTE) (non-GAAP) of 17.15%. |

| • | Pre-provision net revenue (PPNR) (non-GAAP) was 2.12%. |

| • | Strong net interest margin (NIM) (FTE) (non-GAAP) of 4.13%. |

| • | Net interest income increased $33.6 million, or 10.65%. |

| • | Total portfolio loans increased $469.4 million, or 6.53%. |

| • | Nonperforming assets remained low at $23.0 million, or 0.30% of total loans plus other real estate owned (OREO). |

| • | Net charge-offs of $13.2 million, or 0.18% of average loans. |

Governance Updates

I want to thank our board of directors for guiding us to successful performance as we navigate the challenging and ever-changing banking environment. In particular, we want to thank Steven J. Weingarten for his many contributions to S&T during his nine years on the board. We also welcome Bhaskar Ramachandran, global vice president and chief information officer of PPG, a Pittsburgh-based, global supplier of paints, coatings and specialty materials, to our board.

An Incredible Year Heralds an Even More Exciting Future

In closing, on behalf of the S&T board of directors, senior management team and employees, I want to thank our customers and shareholders for their confidence in S&T and belief in our people-forward purpose as we grow and adapt to a constantly shifting industry. We are proud of what we have accomplished and are even more energized about what we plan to do in the future to deliver outstanding results. As the financial services industry continues to evolve, we are committed to pursuing disciplined growth strategies that will ensure our long-term success.

Kindly,

Chris McComish CEO

| * | These highlights present certain non-GAAP financial measures. For a reconciliation to the most directly comparable GAAP measures, see Reconciliation of GAAP to Non-GAAP Financial Measures in Appendix A. |

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS May 14, 2024 |

S&T Bancorp, Inc. 800 Philadelphia Street Indiana, Pennsylvania 15701 |

|

DATE AND TIME

May 14, 2024, 10:00 a.m. Eastern Time via virtual online meeting only (www.virtualshareholdermeeting.com/STBA24)

| ||

| HOW TO VOTE

| ||

|

|

By Telephone Call (1-800-690-6903)

| |

|

|

By Internet Visit www.proxyvote.com

| |

|

|

By Mail Sign, date and return proxy card

| |

To the Shareholders of

S&T Bancorp, Inc.:

Notice is hereby given that the Annual Meeting of Shareholders of S&T Bancorp, Inc. (“S&T”) will be held on May 14, 2024, at 10:00 a.m. Eastern Time, via virtual online meeting only (www.virtualshareholdermeeting.com/STBA24) for considering and voting on the following matters:

| 1. | To elect 11 directors to serve a one-year term until the next annual meeting of shareholders and until their respective successors are elected and qualified; |

| 2. | To ratify the selection of Ernst & Young LLP as S&T’s independent registered public accounting firm for the fiscal year 2024; |

| 3. | To approve, on a non-binding advisory basis, the compensation of S&T’s named executive officers; |

| 4. | To approve, on a non-binding advisory basis, the frequency of future votes on the compensation of S&T’s named executive officers; and |

| 5. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Only shareholders of record at the close of business on February 28, 2024 are entitled to notice of and to vote at such meeting or any adjournment thereof.

To participate in the virtual Annual Meeting at www.virtualshareholdermeeting.com/STBA24, you need to use the 16-digit control number included on your Notice of Internet Availability of Proxy Materials (“Notice”), on your proxy card or on the instructions that accompanied your proxy materials. We encourage you to allow ample time for online check-in, which will begin at 9:30 a.m. Eastern Time. Please note that there is no in-person annual meeting for you to attend.

By Order of the Board of Directors,

Rachel L. Smydo

Secretary

Indiana, Pennsylvania

April 1, 2024

IMPORTANT

YOUR VOTE IS IMPORTANT, AND WE APPRECIATE YOUR TAKING THE TIME TO VOTE PROMPTLY USING ONE OF THE VOTING METHODS DESCRIBED IN THE PROXY STATEMENT.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR THE ELECTION AS DIRECTORS OF ALL OF THE NOMINEES NAMED IN THIS PROXY STATEMENT, FOR THE RATIFICATION OF THE SELECTION OF ERNST & YOUNG LLP AS S&T’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR 2024, FOR THE APPROVAL OF THE COMPENSATION OF S&T’S NAMED EXECUTIVE OFFICERS, AND FOR A FREQUENCY OF “ONE YEAR” FOR FUTURE ADVISORY VOTES ON THE COMPENSATION OF S&T’S NAMED EXECUTIVE OFFICERS.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE 2024 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 14, 2024: OUR PROXY STATEMENT, 2023 ANNUAL REPORT AND NOTICE OF

ANNUAL MEETING OF SHAREHOLDERS ARE AVAILABLE AT WWW.PROXYVOTE.COM

We are taking advantage of a rule of the Securities and Exchange Commission (the “SEC”) which allows companies to make proxy materials available on a public website rather than in paper form. This rule allows a company to send some or all of its shareholders a Notice of Internet Availability of Proxy Materials in place of the complete proxy package. For our 2024 Annual Meeting, to save significant printing and mailing expenses, S&T mailed a Notice to certain shareholders who had not previously elected to receive their proxy materials through the mail on or about April 1, 2024, to inform them of the electronic availability of the proxy materials 40 days in advance of the Annual Meeting.

TABLE OF CONTENTS

|

|

Page | |||

| 1 | ||||

| 1 | ||||

| 5 | ||||

| BENEFICIAL OWNERSHIP OF S&T COMMON STOCK BY DIRECTORS AND OFFICERS |

6 | |||

| 7 | ||||

| 15 | ||||

| 25 | ||||

| 27 | ||||

| PROPOSAL 3: ADVISORY VOTE TO APPROVE COMPENSATION OF S&T’S NAMED EXECUTIVE OFFICERS |

29 | |||

| PROPOSAL 4: ADVISORY VOTE ON FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION |

30 | |||

| 31 | ||||

| 32 | ||||

| 44 | ||||

| 45 | ||||

| 56 | ||||

| 63 | ||||

| 66 | ||||

| 67 | ||||

| 67 | ||||

| 66 | ||||

| A-1 | ||||

S&T BANCORP, INC.

PROXY STATEMENT FOR

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 14, 2024

INTRODUCTION

This Proxy Statement is being furnished to shareholders of S&T Bancorp, Inc. in connection with the solicitation of proxies by the Board of Directors of S&T (the “S&T Board” or “Board”) for use at the Annual Meeting of Shareholders, and any adjournments thereof, to be held at the time and place set forth in the accompanying notice (“Annual Meeting”). We are first sending the Notice of Internet Availability of Proxy Materials, or this Proxy Statement, S&T’s 2023 Annual Report and proxy card to shareholders on or about April 1, 2024.

At the Annual Meeting, shareholders of S&T will be asked to (i) elect 11 directors of S&T to serve a one-year term, (ii) approve the ratification of the selection of Ernst & Young LLP as S&T’s independent registered public accounting firm for the fiscal year 2024, (iii) approve, on a non-binding advisory basis, the compensation of S&T’s named executive officers (“NEOs”), and (iv) approve, on a non-binding advisory basis, the frequency of future votes on the compensation of S&T’s named executive officers.

All shareholders are urged to read this Proxy Statement carefully and in its entirety.

MEETING INFORMATION

Date, Time and Place

The Annual Meeting will be held on May 14, 2024, at 10:00 a.m. Eastern Time solely online via the Internet by going to www.virtualshareholdermeeting.com/STBA24. To participate in the Annual Meeting, you will need the 16-digit control number included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials. See “Attending the Meeting; Virtual Meeting” below.

As permitted by S&T’s By-laws and applicable law, S&T will hold a virtual-only Annual Meeting. S&T will continue holding annual meetings in virtual-only format so long as shareholders are served well through this medium, which we believe enhances accessibility to our Annual Meeting for all of our shareholders and reduces the carbon footprint of our activities.

Record Date, Voting Rights and Required Vote

The securities that can be voted at the Annual Meeting consist of shares of common stock of S&T, par value $2.50 per share (“Common Stock”), with each share entitling its owner to one vote on each matter to be voted on at the Annual Meeting. There are no cumulative voting rights with respect to the Common Stock. Only holders of the Common Stock at the close of business on February 28, 2024 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. There were 38,273,189 shares of Common Stock outstanding as of the Record Date.

A quorum is required for the transaction of business at the Annual Meeting. A “quorum” is the presence at the meeting, virtually (i.e., online via www.virtualshareholdermeeting.com/STBA24) or represented by proxy, of the holders of the majority of the outstanding shares of Common Stock entitled to vote at the meeting. Abstentions are counted for purposes of determining the presence or the absence of a quorum but are not considered a vote cast under Pennsylvania law. Under our governing documents and applicable state law, abstentions will not affect the outcome of a vote on a particular matter. Broker non-votes are counted to determine if a quorum is present but are not considered a vote cast under Pennsylvania law. Under our governing documents and applicable state law, broker non-votes will not affect the outcome of a vote on a

S&T Bancorp, Inc. | 2024 Proxy Statement | 1

Meeting Information

particular matter. Generally, broker non-votes occur on a matter when a bank, broker or other nominee is not permitted to vote on that matter without instructions from the beneficial owner and such instructions are not given. Banks, brokers and other nominees have discretionary authority to vote shares in the absence of instructions on matters considered “routine,” such as the ratification of the appointment of the independent registered public accounting firm. They do not have discretionary authority to vote shares in the absence of instructions on “non-routine” matters, such as the election of directors, the advisory vote on compensation of S&T’s NEOs and the advisory vote on the frequency of future votes on the compensation of S&T’s NEOs.

The director nominees will be elected by a plurality of the votes cast at the Annual Meeting, which means that the 11 nominees receiving the most votes will be elected. A withheld vote on any nominee will not affect the voting results. Under S&T’s voting standard policy adopted by the S&T Board, which is included in S&T’s Corporate Governance Guidelines (“Guidelines”), if a director nominee in an uncontested election at the Annual Meeting receives a greater number of “withheld” votes from his or her election than votes “for” such election, such director must submit his or her resignation to the Board promptly following the certification of election results. The resignation will first be considered by the members of the Nominating and Corporate Governance Committee (the “Nominating Committee”) within 60 days following certification of the shareholder vote. The Nominating Committee will recommend to the S&T Board whether to accept or reject the resignation after considering all factors deemed relevant by the Nominating Committee. The S&T Board shall act on the Nominating Committee’s recommendation within 90 days following certification of the shareholder vote. If a director’s resignation is accepted by the Board, the Board either may fill the resulting vacancy or may decrease the size of the Board pursuant to S&T’s By-laws.

The ratification of the selection of Ernst & Young LLP as S&T’s independent registered public accounting firm for fiscal year 2024, the approval, on a non-binding advisory basis, of the compensation of S&T’s NEOs and the approval, on a non-binding advisory basis, of the frequency of future votes on the compensation of S&T’s NEOs require the affirmative vote of a majority of the votes cast at the Annual Meeting to be approved.

Voting and Revocation of Proxies

Shareholder of Record. If you are a shareholder of record and you received the Notice, you may vote before the Annual Meeting by accessing the secure Internet website registration page identified on the Notice and following the instructions. You may also vote electronically during the virtual Annual Meeting if you participate.

If you are a shareholder of record and you received a printed copy of the proxy materials, you may vote by proxy by telephone, using the Internet or by mailing your proxy card, as further described below. You may also vote electronically during the virtual Annual Meeting if you participate.

|

|

| ||

| By Telephone: | By Internet: | By Mail: | ||

| Call the toll-free telephone number on the enclosed proxy card (1-800-690-6903) and follow the recorded instructions. | Access the secure Internet website registration page on the enclosed proxy card and follow the instructions. | Sign, date and return your proxy card in the postage-paid envelope provided. | ||

If you vote by proxy via telephone or the Internet, you do not need to mail your proxy card. The individuals named as proxies on your proxy card will vote your shares of Common Stock during the Annual Meeting as instructed by the latest dated proxy received from you, whether submitted via the Internet, telephone or mail. If you sign your proxy card but do not specify how you want your shares voted on any matter, you will be deemed to have directed the proxies to vote your shares as recommended by the S&T Board.

2 | S&T Bancorp, Inc. | 2024 Proxy Statement

Meeting Information

Beneficial Owners. If your shares of Common Stock are held in a stock brokerage account by a bank, broker or other nominee, you are considered the beneficial owner of shares held in street name and these proxy materials are being forwarded to you by your bank, broker or other nominee that is considered the shareholder of record of those shares.

As the beneficial owner, you have the right to direct your bank, broker or other nominee on how to vote your shares of Common Stock via the Internet or by telephone, if the bank, broker or other nominee offers these options, or by completing, signing, dating and returning a voting instruction form. Your bank, broker, or other nominee will send you instructions on how to submit your voting instructions for your shares of Common Stock.

If you properly complete, sign, date and return the voting instruction form, your shares of Common Stock will be voted as you specify. If you are a beneficial owner and you do not provide voting instructions to your bank, broker or other nominee holding shares of Common Stock for you, your shares of Common Stock will not be voted with respect to any proposal for which the shareholder of record does not have discretionary authority to vote.

Except for procedural matters incident to the conduct of the Annual Meeting, S&T does not know of any matters other than those described in the Notice of Annual Meeting of Shareholders that are to come before the Annual Meeting. If any other matters are properly brought before the Annual Meeting, the persons named in the proxy will vote the shares represented by the proxies in their discretion on such matters as recommended by a majority of the S&T Board.

Revocation of Proxies. The presence of a shareholder at the virtual Annual Meeting will not automatically revoke such shareholder’s proxy. However, a shareholder may revoke a proxy at any time prior to its exercise by filing with the Secretary of S&T a written notice of revocation, by delivering to S&T a duly executed proxy bearing a later date or by voting electronically during the virtual Annual Meeting.

Attending the Meeting; Virtual Meeting

You may attend the webcast of the meeting via the Internet at www.virtualshareholdermeeting.com/STBA24 when you enter the 16-digit control number included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials. Instructions on how to attend and participate in the Annual Meeting via the webcast are posted at www.virtualshareholdermeeting.com/STBA24. You will be able to vote your shares while attending the Annual Meeting by following the instructions on the website. Our management will address questions from shareholders who have submitted their questions electronically prior to and during the Annual Meeting. You may visit www.proxyvote.com at any time prior to the Annual Meeting to ask questions of our executive management that may be addressed in the Annual Meeting and access information about S&T. Even if you plan to participate in the Annual Meeting, we urge all shareholders to vote on the matters listed above and described in the Proxy Statement as soon as possible, so that your vote will be counted if you later decide not to participate in the Annual Meeting.

Solicitation of Proxies

The cost of soliciting proxies will be borne by S&T. S&T has engaged D.F. King & Co., Inc. to help solicit proxies for the Annual Meeting, and will pay D.F. King & Co., Inc. $9,000, plus its out-of-pocket expenses, for the solicitation of proxies. In addition to the solicitation of proxies by mail, S&T may also solicit proxies personally, by telephone or by electronic means, through its directors, officers and regular employees. None of these directors, officers or employees will receive any additional or special compensation for soliciting proxies. S&T also will request persons, firms and corporations holding shares of Common Stock in their names or in the name of their nominees, which are beneficially owned by others, to send proxy materials to and obtain proxies from the beneficial owners and will reimburse the holders for their reasonable expenses in so doing.

S&T Bancorp, Inc. | 2024 Proxy Statement | 3

Meeting Information

Internet Availability of Proxy Materials

S&T’s Proxy Statement for the Annual Meeting and S&T’s 2023 Annual Report are available at www.proxyvote.com. You will enter your 16-digit control number included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials to access these materials.

Householding

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for Notices or proxy statements and annual reports with respect to two or more shareholders sharing the same address by delivering a single Notice or proxy statement and annual report addressed to those shareholders. This process is commonly referred to as “householding.”

S&T has implemented “householding” to reduce the number of duplicate mailings to the same address. This process benefits both shareholders and S&T because it eliminates unnecessary mailings delivered to your home and helps to reduce S&T’s expenses. “Householding” is not being used, however, if S&T has received contrary instructions from one or more of the shareholders sharing an address. If your household has received only one Notice or one annual report and proxy statement, S&T will deliver promptly a separate copy of the Notice or annual report and proxy statement to any shareholder who contacts S&T by calling the toll-free number, 1-800-325-2265, or by mail to the attention of the Secretary of S&T at 800 Philadelphia Street, Indiana, Pennsylvania 15701. You can also notify S&T that you would like to receive separate copies of the Notice or S&T’s annual report and proxy statement in the future by calling or mailing S&T, as instructed above. If your household has received multiple copies of the Notice or S&T’s annual report and proxy statement, you can request the delivery of single copies in the future by calling or mailing S&T, as instructed above, or your broker, if you hold the shares in “street name.”

If you received more than one Notice or proxy card, it means that your shares are registered in more than one name (e.g., trust, custodial accounts, joint tenancy) or in multiple accounts. Please make sure that you vote all of your shares by following the directions on each Notice or on each proxy card that you received.

For our 2025 annual meeting, you can help us save significant printing and mailing expenses by consenting to access our proxy materials electronically via the Internet. If you hold your shares in your own name (instead of “street name” through a bank, broker or other nominee), you can choose this option by following the prompts for consenting to electronic access, if voting by telephone, or by following the instructions at the Internet voting website at www.proxyvote.com, which has been established for you to vote your shares for the 2024 Annual Meeting. If you choose to receive your proxy materials electronically, then prior to next year’s annual meeting, you will receive notification when the proxy materials are available for online review via the Internet, as well as the instructions for voting electronically via the Internet. Your choice for electronic distribution will remain in effect until you revoke it by sending a written request to S&T by mail to the attention of the Secretary of S&T at 800 Philadelphia Street, Indiana, Pennsylvania 15701. If you hold your shares in “street name” through a bank, broker or other nominee, you should follow the instructions provided by that entity if you wish to access our proxy materials electronically via the Internet.

4 | S&T Bancorp, Inc. | 2024 Proxy Statement

BENEFICIAL OWNERS OF S&T COMMON STOCK

Under Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), a beneficial owner of a security is any person who directly or indirectly has or shares voting power or investment power over such security. Such beneficial owner under this definition need not enjoy the economic benefit of such securities. The following are the only shareholders known to S&T to be deemed to be a beneficial owner of 5% or more of Common Stock as of February 28, 2024, when 38,273,189 shares of Common Stock were outstanding. S&T has relied solely on information provided in the public filings made by the holders below:

| Title of Class | Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership |

Percent of Class | |||

| Common Stock |

BlackRock, Inc. 50 Hudson Yards New York, NY 10001 |

5,588,300(1) | 14.60% | |||

| Common Stock |

The Vanguard Group, Inc. 100 Vanguard Blvd. Malvern, PA 19355 |

4,616,732(2) | 12.06% | |||

| Common Stock |

Dimensional Fund Advisors LP 6300 Bee Cave Road, Building One Austin, TX 78746 |

2,384,380(3) | 6.23% |

| (1) | According to its Schedule 13G/A filed with the SEC on January 23, 2024, BlackRock, Inc. has sole dispositive power over 5,588,300 shares, shared dispositive power over 0 shares, sole voting power over 5,515,925 shares and shared voting power over 0 shares. The interest of iShares Core S&P Small-Cap ETF represents more than 5% of the outstanding shares of Common Stock. In addition, BlackRock Fund Advisors beneficially owns at least 5% of the outstanding Common Stock. The percentage of ownership is calculated based on the information provided on the Schedule 13G/A, as updated for shares outstanding as of February 28, 2024. |

| (2) | According to its Schedule 13G/A filed with the SEC on February 13, 2024, The Vanguard Group has sole dispositive power over 4,545,470 shares, shared dispositive power over 71,262 shares, sole voting power over 0 shares and shared voting power over 32,117 shares. The percentage of ownership is calculated based on the information provided on the Schedule 13G/A, as updated for shares outstanding as of February 28, 2024. |

| (3) | According to its Schedule 13G/A filed with the SEC on February 9, 2024, Dimensional Fund Advisors LP has sole dispositive power over 2,384,380 shares, shared dispositive power over 0 shares, sole voting power over 2,347,095 shares, and shared voting power over 0 shares. The percentage of ownership is calculated based on the information provided on the Schedule 13G/A, as updated for shares outstanding as of February 28, 2024. |

S&T Bancorp, Inc. | 2024 Proxy Statement | 5

BENEFICIAL OWNERSHIP OF S&T COMMON STOCK BY DIRECTORS AND OFFICERS

The following table sets forth, as of February 28, 2024, the amount and percentage of Common Stock beneficially owned by each director, each nominee for director and each of the “NEOs” (as defined below) of S&T, as well as the directors and executive officers of S&T as a group. Unless otherwise indicated, all persons listed below have sole voting and investment power over all shares of Common Stock. The business address of each of S&T’s directors and officers is 800 Philadelphia Street, Indiana, Pennsylvania 15701.

| Name | Shares of Common Stock Beneficially Owned (1) |

Percent Owned | ||

| Lewis W. Adkins Jr. |

7,227 | * | ||

| David G. Antolik |

69,865 | * | ||

| Peter R. Barsz |

8,880 | * | ||

| Christina A. Cassotis |

11,780 | * | ||

| Michael J. Donnelly |

36,171 | * | ||

| Stephen A. Drahnak |

21,832 | * | ||

| Jeffrey D. Grube |

39,007 | * | ||

| William J. Hieb |

40,864 | * | ||

| Mark Kochvar |

87,487 | * | ||

| Melanie A. Lazzari |

18,471 | * | ||

| Christopher J. McComish |

4,675 | * | ||

| James A. Michie |

2,179 | * | ||

| Susan A. Nicholson |

4,350 | * | ||

| Frank J. Palermo, Jr. |

26,181 | * | ||

| Baskhar Ramachandran |

0 | * | ||

| Rachel L. Smydo |

2,933 | * | ||

| Christine J. Toretti |

35,478 | * | ||

| Steven J. Weingarten |

86,769 | * | ||

| LaDawn D. Yesho |

23,480 | * | ||

| All current directors and executive officers as a group (19 persons) |

527,629 | 1.38% |

| (1) | Includes shares of unvested restricted stock, as to which the holder has voting power but no investment power, as follows: Mr. Antolik, 3,796 shares; Mr. Drahnak, 3,503 shares; Mr. Kochvar, 2,820 shares; Ms. Lazzari, 1,585 shares; Ms. Nicholson, 1,331 shares; and Ms. Yesho, 1,762 shares. As of February 28, 2024, there were 38,273,189 shares of S&T Bancorp common stock issued and outstanding. The number of shares of common stock beneficially owned by each individual is less than 1% of the outstanding shares of common stock; the total number of shares of common stock beneficially owned by the group is approximately 1.38% of the class. If units payable in common stock vest or pay out within 60 days of February 28, 2024, those shares were added to the total number of shares issued and outstanding for purposes of determining these ownership percentages. |

| * | Less than 1% of the outstanding Common Stock. |

6 | S&T Bancorp, Inc. | 2024 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS

General

The S&T Board determines the number of directors to nominate for election. The By-laws of S&T provide that the number of directors constituting the Board will consist of not less than nine nor more than 17, with the exact number to be fixed and determined from time to time by resolution of a majority of the Board. For this annual meeting, the Board fixed the number of directors to be elected at 11.

There are currently 12 directors comprising the Board, however, Steven J. Weingarten intends to retire from the Board effective upon the expiration of his term immediately following the Annual Meeting. The Board has nominated the 11 persons named below for election at the Annual Meeting, all of whom are incumbent directors standing for re-election. Proxies cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement.

The Nominating Committee recommended each of the nominees to the Board. Directors are elected annually, and each director nominee elected at the Annual Meeting will serve for a term expiring at the 2025 S&T annual meeting of shareholders, until his or her successor has been elected and qualified, or until his or her earlier death, resignation, removal or disqualification. All nominees have indicated their willingness to serve, if elected, but if any should be unable to serve or unwilling to serve for good cause, proxies may be voted for a substitute nominee designated by the Board. There are no family relationships between or among any of our directors, executive officers or persons nominated or chosen to become a director or executive officer. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the nominees named below.

Set forth below is a brief description of the principal occupation and business experience of each of our nominees for director, as well as a summary of the qualifications of each nominee and continuing director to serve on the Board. The Board has had significant experience with each of the incumbent directors and has had the opportunity to assess the contributions that each director has made to the Board as well as each director’s industry knowledge, judgment and leadership capabilities. The Nominating Committee continually assesses the tenure and diversity of the Board and seeks opportunities, within the constraint of the size of the Board, to include a mix of directors with Board experience and with fresh perspectives. The average tenure of the current Board is 11.7 years and S&T’s Guidelines include a mandatory director retirement age of 72. In the last seven years, the Nominating Committee has had the opportunity to add seven (64% of the 11 director nominees) new directors to the Board to further diversify the Board’s industry knowledge, experience, judgment, gender, minority status and leadership capabilities. The Board has two female directors, one African American director and one Asian director. The following directors were appointed to the Board in the last seven years: Christina A. Cassotis, David G. Antolik, Lewis W. Adkins, Jr., Peter R. Barsz, William J. Hieb, Christopher J. McComish, and Bhaskar Ramachandran.

S&T seeks director candidates who will uphold the highest standards, are committed to S&T’s values, and who will be strong independent stewards of the long-term interests of shareholders. In selecting nominees, our Board looks for individuals with demonstrated experience and success in fields that are relevant to our business, strategy and operations, and who will contribute diverse viewpoints and perspectives.

In evaluating and selecting nominees to the Board, our Nominating Committee considers all factors and criteria it deems appropriate, including, but not limited to, the factors set forth in our Guidelines. See the section “Director Qualifications and Nominations; Board Diversity” below for further information on our director selection process and criteria. In furtherance of the foregoing, the Board considers a wide range of attributes when selecting and recruiting candidates. All nominees possess integrity, judgment, strong work ethic,

S&T Bancorp, Inc. | 2024 Proxy Statement | 7

Proposal 1: Election of Directors

collaborative approach to engagement and oversight, inquisitive and objective perspective, and a willingness to challenge management appropriately. In addition, our nominees have executive experience and skills that are aligned with our business and strategy, including the following:

| Board Skills

| ||

| Core Skills and Qualifications | ||

| Banking and Financial Services Industry |

Corporate Governance | |

| Leadership (Strategy & Execution) |

Compensation & Succession | |

| Financial Expertise Regulatory/Risk Management |

Technological (Cyber, Information Technology & Innovation) | |

| Other Board Experience | ||

| Additional Relevant Experiences | ||

| Business Development |

Investor Relations & Engagement | |

| Mergers & Acquisitions |

Local Market | |

| Capital Markets |

Diversity | |

Director Nominees for Election at the 2024 Annual Meeting:

| Lewis W. Adkins, Jr., Age 60 | ||||

|

Director since 2019 |

Committees: • Credit Risk • Nominating & Corporate Governance |

Biographical Information

Mr. Adkins is a Shareholder and Shareholder-in-Charge of Development & Practice Integration for Roetzel & Andress, LPA, a full-service law firm with offices located throughout Ohio, Florida and Chicago. Additionally, since May 2017, he has served as President of their wholly-owned consulting subsidiary, Roetzel Consulting Solutions, a bipartisan consulting company representing clients where the private and public sectors intersect. Mr. Adkins previously served as General Counsel to Summit County, Ohio. He is affiliated with numerous professional and charitable organizations including Board Chair for the University of Akron Board of Trustees, Ideastream Public Media Board of Trustees, the American Bar Association, the Greater Akron Chamber of Commerce, Alpha Phi Alpha Fraternity, Inc. and the Cleveland Metropolitan Bar Association.

Experience and Qualifications

Mr. Adkins also has acted as lead counsel for several multi-million-dollar development projects. His clients include public and private entities, as well as construction companies, engineering firms, financial institutions, diversified energy companies, governmental entities, housing authorities, urban school districts and nonprofit organizations. Prior to assuming his current leadership role, Mr. Adkins led for over a decade Roetzel & Andress, LPA’s Public Law and Finance team as Practice Group Manager. Additionally, he is currently General Counsel to Alpha Phi Alpha Homes, Inc.. He also serves as lead counsel for a number of public and private entities including Ohio’s largest banking institution, a regional public hospital and two of Ohio’s largest school districts. Mr. Adkins’ expansive business and legal knowledge and his community leadership provide the S&T Board with public finance, business development, and strategic management experience which qualifies him to serve on the S&T Board.

8 | S&T Bancorp, Inc. | 2024 Proxy Statement

Proposal 1: Election of Directors

| David G. Antolik, Age 57 | ||||

|

Director since 2019 President |

Biographical Information

Mr. Antolik has been President of S&T and S&T Bank since January 2019. He was Interim Chief Executive Officer and President from April 1, 2021 to August 23, 2021. Mr. Antolik was Chief Lending Officer of S&T and S&T Bank from 2008 to October 2020. He previously served as Senior Executive Vice President of S&T and S&T Bank from 2008 until January 2019. Mr. Antolik also serves as the chairman of the IUP Research Institute and is a member of the Indiana County Development Corporation Board.

Experience and Qualifications

With 35 years of banking experience, including 16 years of senior management experience at S&T, Mr. Antolik’s strong leadership capabilities and in-depth industry experience in commercial banking and implementing strategic initiatives provide the S&T Board with expertise that will contribute to the strategic growth of S&T. As our past Interim Chief Executive Officer and current President, Mr. Antolik provides unique insight to the S&T Board regarding our day-to-day operations, customer information, competitive intelligence, general trends in national and local banking and issues regarding our financial results.

| Peter R. Barsz, Age 67 | ||||

|

Director since 2019 |

Committees: • Audit • Compensation & Benefits • Nominating & Corporate Governance |

Biographical Information

Mr. Barsz is a Certified Public Accountant and has been a Partner at Barsz Gowie Amon & Fultz, LLC, an accounting firm, since July 2017 when Steger Gowie & Company merged with Merves Amon & Barsz LLC where Mr. Barsz became a partner in 1990. Mr. Barsz previously served on the board of DNB, the holding company for DNB First, N.A., from January 2018 until it was acquired by S&T in November 2019. Mr. Barsz serves as the appointed Treasurer and has served as the Finance Director of several municipalities in Chester and Delaware counties and is currently serving as Chairman of the Pennsylvania State Tax Equalization Board, an independent agency of the Commonwealth tasked with obtaining information on real estate sales throughout the state. Mr. Barsz also received an appointment by the Pennsylvania Legislature and is currently serving as a public member on the Legislative Audit Advisory Committee for the current and past three Legislative Sessions of the General Assembly. Mr. Barsz previously served as a director of two real estate holding companies located in Media, Pennsylvania as well as the Treasurer of the Foundation of the Delaware County Chamber of Commerce.

Experience and Qualifications

Mr. Barsz’s extensive experience in accounting and providing management and financial consulting services to governmental and nonprofit entities, his deep community engagement, as well as his broad financial perspective qualify him to serve on the Audit Committee as an “audit committee financial expert” and on the S&T Board.

S&T Bancorp, Inc. | 2024 Proxy Statement | 9

Proposal 1: Election of Directors

| Christina A. Cassotis, Age 59 | ||||

|

Director since 2017 |

Committees: • Audit • Compensation & Benefits (Chairperson) • Executive • Risk |

Biographical Information

Ms. Cassotis has been the chief executive officer of the Allegheny County Airport Authority, which operates Pittsburgh International Airport and Allegheny County Airport since January 2015. Prior to that, Ms. Cassotis joined SH&E, Inc. in 1999, a global commercial aviation consulting firm, where she advised airports worldwide on strategy, business, and system planning. She went on to serve as managing officer for Airport Services for ICF-SH&E from 2007 to 2014, leading a global team of airport consultants. She also serves as a member of the board for the U.S. Travel Association, a member of the Board at the Federal Reserve Bank of Cleveland (Pittsburgh Branch) and a member of the International Aviation Women’s Association. Ms. Cassotis served as a director of EQT Corporation from October 2018 until July 2019.

Experience and Qualifications

Ms. Cassotis has demonstrated that she is a strong, decisive, and strategic leader. Her ability to identify the complex relationship between organizations and the competitive environments in which they operate has allowed her to position her business interests for the future while paying attention to immediate demands. Her substantial leadership roles within a highly-regulated, high-stakes industry provide valuable risk oversight experience, including with respect to cyber and technology, to the S&T Board. She is an innovative leader who has successfully directed necessary change through organizations to drive growth and deliver value which qualifies her to serve on the S&T Board.

| Michael J. Donnelly, Age 66 | ||||

|

Director since 2001 |

Committees: • Compensation & Benefits • Credit Risk

|

Biographical Information

Mr. Donnelly has been president of Indiana Printing and Publishing Company, Inc. since 1993. Mr. Donnelly has spent over 30 years working with the Indiana County Chamber of Commerce and the Indiana County Development Corporation in retaining and attracting many businesses in the Indiana, Pennsylvania area.

Experience and Qualifications

Mr. Donnelly’s deep experience in managing and operating a local business provides the S&T Board with valuable insight into the issues addressing our local corporate and consumer borrowers. Mr. Donnelly’s experience in developing appropriate compensation for the executives and senior management of his company qualifies him to serve on the S&T Board.

10 | S&T Bancorp, Inc. | 2024 Proxy Statement

Proposal 1: Election of Directors

| Jeffrey D. Grube, Age 70 | ||||

|

Director since 1997 |

Committees: • Audit • Compensation & Benefits • Credit Risk (Chairperson) • Executive • Risk

|

Biographical Information

Mr. Grube served as president of B.F.G. Manufacturing Service, Inc., which provides large volume plating, painting and powder coating services with facilities in Pennsylvania and New York from 1990 until his retirement in 2020. Mr. Grube’s career as an executive in the manufacturing industry includes financial and engineering experience. Mr. Grube also served as a director on the board of a privately held company that supplies compliance products for lending solutions.

Experience and Qualifications

Mr. Grube’s extensive experience working with small and medium-sized businesses provides the S&T Board with valuable experience regarding potential borrowers and customers, customer relations, lending issues and credit risk. Mr. Grube’s executive and board experience in the manufacturing sector and experience with financial institutions allow him to bring relevant insight regarding regulatory and financial compliance issues to the S&T Board.

| William J. Hieb, Age 67 | ||||

|

Director since 2019 |

Committees: • Credit Risk • Executive • Risk (Chairperson)

|

Biographical Information

Mr. Hieb served as the president and chief executive officer of DNB, the holding company for DNB First, N.A. since April 2016 until it was acquired by S&T in November 2019. He was a director of DNB since 2005 and a director of DNB First, N.A. since 2004. Mr. Hieb served as president and chief risk & credit officer of DNB from April 2011 to January 2016. Prior to that, Mr. Hieb served as president and chief operating officer of DNB from January 2005 to April 2011. Mr. Hieb has previously served on the board of directors for the Chester County Chamber of Business and Industry, the Chester County Historical Society, the Chester County Economic Development Council, the Chester County Chamber of Business and Industry and its Foundation, the Pennsylvania Bankers Association, the Housing Partnership of Chester County and Business Leadership Organized for Catholic Schools, and the West Chester University’s President Corporate Advisory Council.

Experience and Qualifications

Mr. Hieb has acquired considerable knowledge and experience during his 41 years in commercial banking including lending, credit administration, and wealth management. In addition, his background supervising DNB’s risk management function and operations during his career strengthens the Board’s collective qualifications, skills, and experience, and qualifies him to serve on the S&T Board.

S&T Bancorp, Inc. | 2024 Proxy Statement | 11

Proposal 1: Election of Directors

| Christopher J. McComish, Age 59 | ||||

|

Director since 2021 Chief Executive Officer |

Committees: • Executive

|

Biographical Information

Mr. McComish has been Chief Executive Officer of S&T and S&T Bank since August 24, 2021. Previously, he was senior executive vice president of consumer banking of TCF Bank, leading all consumer banking lines of business as well as business banking and wealth management from July 2018 to June 2021. Prior to TCF Bank, he served as president and chief executive officer of Scottrade Bank, the banking subsidiary of Scottrade Financial Services, Inc. from August 2015 to December 2017. In addition, he served as head of personal banking and then as chief operating officer for personal and commercial banking at BMO Harris Bank from December 2008 to July 2015. He began his career at Wachovia Bank, where he spent over 20 years in various regional and line of business leadership roles.

Experience and Qualifications

With more than 36 years of banking experience, including 21 years of senior management experience in his banking career, Mr. McComish’s strong leadership capabilities as a former chief executive officer, president and chief operating officer at other banking institutions and as senior executive vice president with a larger bank in the Midwest, provide the S&T Board with expertise that contributes to the strategic growth of S&T. As our Chief Executive Officer, Mr. McComish provides in-depth industry experience and insight in commercial banking, consumer banking, business banking and wealth management from a larger bank perspective. He is familiar with the impact of technology on banking, having served as the chief executive officer of a digital online bank, and brings to the S&T Board technology risk management experience. He also provides unique insight to the S&T Board regarding our day-to-day operations, risk and strategic initiatives, general trends in national and local banking, and issues regarding our financial results.

| Frank J. Palermo, Jr., Age 71 | ||||

|

Director since 2013 |

Committees: • Audit (Chairperson) • Executive • Nominating & Corporate Governance • Risk

|

Biographical Information

Mr. Palermo is a Certified Public Accountant and has been the managing shareholder of Palermo/Kissinger & Associates, P.C., an accounting firm, since 1983. Mr. Palermo played an integral role in forming Gateway Bank of Pennsylvania (“Gateway”), where he served as chairman of the audit committee from its inception in 2004 through the date S&T acquired Gateway in 2012. Previously, Mr. Palermo served as a Certified Valuation Analyst as well. Mr. Palermo’s career also includes 43 years in public accounting and five years as a vice president and controller at a community bank.

Experience and Qualifications

Mr. Palermo’s background in accounting and finance, as well as his prior bank audit committee experience, bring a valuable perspective to the S&T Board both with respect to accounting, financial, and strategic aspects of S&T’s business and to the Audit Committee on which he serves as an “audit committee financial expert.” Mr. Palermo’s extensive board experience qualifies him to serve on the S&T Board.

12 | S&T Bancorp, Inc. | 2024 Proxy Statement

Proposal 1: Election of Directors

| Bhaskar Ramachandran, Age 50 | ||||

|

Director since 2024 |

Biographical Information

Mr. Ramachandran has served as Global Vice President and Chief Information Officer of PPG Industries, Inc., a 140-year old Pittsburgh-based leading paints and coatings company, since 2021. From 2015 until joining PPG, Mr. Ramachandran served as Vice President, Information Technology, and Chief Information Officer of the largest division, of Jabil Inc., an American worldwide manufacturing services company. At Jabil, Inc., he led the creation of a fully cloud-based connected eco-system to make production more efficient and cost-effective. Prior to joining Jabil, Inc., Mr. Ramachandran progressed through information technology roles of increasing responsibility at Textron, Inc., a multi-industry company, where he was accountable for strategy development and operational elements of Textron, Inc.’s SAP center of excellence.

Experience and Qualifications

Mr. Ramachandran’s deep knowledge of cybersecurity and information technology provide the Board with valuable cyber and technology risk expertise, as well as a strong understanding of digital business strategies and emerging technology. Mr. Ramachandran’s extensive leadership experience at large, regulated companies, including his proven track record in scaling and transforming businesses, brings a diverse range of skills and knowledge that further contribute to an engaged and well-balanced Board. His work developing and leading diverse, high-performing teams across different industries and global companies also provides the Board with a unique perspective on people, process, adaptability and emotional intelligence.

S&T Bancorp, Inc. | 2024 Proxy Statement | 13

Proposal 1: Election of Directors

| Christine J. Toretti, Age 67 | ||||

|

Director since 1984 |

Committees: • Executive (Chairperson) • Risk |

Biographical Information

Ms. Toretti was named Chairperson of the S&T Board and S&T Bank Board in 2018 and was formerly Vice Chairperson of the S&T Board and S&T Bank Board from 2013 to 2018. Ms. Toretti has been the president of Palladio, LLC, an investment holding company headquartered in Indiana, Pennsylvania, since 2011, was the chairman and chief executive officer of S.W. Jack Drilling Company from 1990 through 2010 and was the president of The Jack Company from 1988 through 2015. Ms. Toretti has been the president of Plum Production, Inc. since 1991, and president of CJT, LLC since 2002, each of which is a natural gas investment company. Ms. Toretti served as a director of EQT Corporation from October 2015 until July 2019.

Experience and Qualifications

Ms. Toretti’s deep industrial and energy experience provides the S&T Board with a strategic outlook regarding lending and other commercial opportunities in these sectors. Her experience of leading a family business allows her to offer the S&T Board valuable management perspective and credit risk assessment with respect to our industrial and oil and gas borrowers, and her board experience, including in the role of chairperson of another company, qualifies her to serve as Chairperson of the S&T Board.

Board Recommendation

|

|

The S&T Board Recommends a Vote “FOR ALL” of the Nominees. |

14 | S&T Bancorp, Inc. | 2024 Proxy Statement

CORPORATE GOVERNANCE

Corporate Governance Guidelines

The Board has developed and adopted the Guidelines which reflect S&T’s commitment to following corporate governance best practices. The Guidelines are intended to promote the functioning of the Board and its committees and provide a common set of expectations as to how the Board should perform its functions. These Guidelines are not intended to modify or amend S&T’s Articles of Incorporation, as amended (the “Articles of Incorporation”) or By-laws. In the event of a discrepancy between these Guidelines and the Articles of Incorporation or the By-laws, the Articles of Incorporation and By-laws will always govern. The Guidelines are available on S&T’s website, www.stbancorp.com, under Governance.

Director Independence

The Board annually reviews and makes a determination as to the independence of its directors under the NASDAQ listing rules. In 2023, the Board also considered all direct and indirect transactions described under “Transactions with Related Parties” in determining whether a director is independent. Finally, the Board considered whether a director has any other material relationships with S&T and concluded that none of S&T’s directors, other than Mr. Antolik and Mr. McComish, has any such relationship that impairs the director’s independence. There were no other related party transactions other than those described under “Transactions with Related Parties” in this Proxy Statement. The Nominating Committee has the delegated responsibility to evaluate each director’s qualifications for independence for the Board and for the committees of the S&T Board. In accordance with the NASDAQ listing rules and interpretations, following review of the objective measures, the Nominating Committee and Board also evaluate on a subjective basis each director’s personal, familial and/or business relationship, regardless of dollar amount.

At a meeting held on January 24, 2024, the Board affirmatively determined the following nine directors and director nominees are independent under the NASDAQ listing rules: Mr. Adkins, Mr. Barsz, Ms. Cassotis, Mr. Donnelly, Mr. Grube, Mr. Hieb, Mr. Palermo, Mr. Ramachandran, and Ms. Toretti. Mr. Weingarten, who intends to retire from the S&T Board effective upon the expiration of his term immediately following S&T’s annual shareholder meeting, was also determined to be independent by the Board under the NASDAQ listing rules. As discussed below, all members of the Compensation and Benefits Committee (the “Compensation Committee”) and the Nominating Committee are independent under the NASDAQ rules. In addition, the Board determined that each of the members of the Audit Committee is independent under applicable SEC and NASDAQ rules. The Board affirmatively determined that Mr. Antolik and Mr. McComish are the only non-independent directors as each is an executive officer of S&T. In making these determinations, the Board relied on the evaluation and recommendations made by the Nominating Committee.

Board Structure; Board and Committee Meetings

There are currently 12 directors comprising the Board, however, Steven J. Weingarten intends to retire from the Board effective upon the expiration of his term immediately following the Annual Meeting. The Board currently has established six standing committees: Audit, Compensation and Benefits, Credit Risk, Executive, Nominating and Corporate Governance, and Risk. Each Board Committee serves as a board committee of S&T Bank in addition to being a Board committee of S&T.

During 2023, the Board held seven board meetings, with the following number of meetings held by the Board committees: Audit, eight; Compensation and Benefits, five; Credit Risk, four; Nominating and Corporate Governance, four; and Risk, four. The Executive Committee, which meets as often as it determines is necessary and appropriate, did not meet during 2023.

Each director of the Board attended at least 75% of the aggregate number of meetings of the Board and the committees on which he or she served during 2023. Independent members of the Board meet at least twice per year in regularly scheduled executive sessions without management present. The independent Chairperson of the Board presides over all executive sessions. The Board has implemented a formal policy that strongly encourages director attendance at the annual meeting of shareholders. In 2023, all of S&T’s directors attended the annual meeting of shareholders.

S&T Bancorp, Inc. | 2024 Proxy Statement | 15

Corporate Governance

Separate Roles of Chairperson and Chief Executive Officer

The Board believes that, as part of our efforts to embrace and adopt good corporate governance practices, different individuals should hold the positions of Chairperson of the Board and Chief Executive Officer (“CEO”) to aid in the Board’s oversight of management. The Board believes that separation of the roles of Chairperson and CEO is the best governance model for S&T and its shareholders at this time. Under this model, our Chairperson, a non-executive position, can devote his or her attention to assuring that S&T has the proper governance controls in place; that the Board is properly structured from the standpoints of membership, size and diversity; and that management has the support it needs from the Board to carry out our strategic priorities. The CEO, relieved of the duties normally performed by the Chairperson, is free to focus his or her entire attention on growing and strengthening the business.

The duties of the non-executive Chairperson of the Board include:

| • | presiding over all meetings of the Board; |

| • | preparing the agenda for Board meetings with the Secretary and in consultation with the CEO and other members of the Board; |

| • | ensuring the Board fulfills its role in overseeing and monitoring management and operations of S&T and protecting the interests of S&T and its shareholders; |

| • | ensuring the Board receives timely, accurate and complete information and the decision time necessary to make informed judgments; |

| • | assigning tasks to the appropriate committees of the Board; |

| • | establishing a relationship of trust with the CEO, and providing advice and counsel while respecting the executive responsibilities of the CEO; |

| • | promoting effective relationships and open communication, both inside and outside the boardroom, between senior management and the Board; |

| • | communicating the Board’s evaluation of the CEO’s annual performance together with the Compensation Committee Chairperson; and |

| • | presiding over all meetings of shareholders. |

We believe that the current composition of the Board, the Board committees as presently constituted and the leadership structure of the Board enable the Board to fulfill its role in overseeing and monitoring the management and operations of S&T and to protect the interests of S&T and its shareholders.

The S&T Board’s Role in Risk Oversight

Role of the S&T Board

The S&T Board with the assistance of the Risk Committee, whose members constitute the Board Chairperson and the chairpersons from each of the Board Committees discussed below, oversees an enterprise-wide approach to risk management (“ERM”), designed to support the achievement of strategic goals, to improve long-term organizational performance and to enhance shareholder value. The Board’s oversight primarily focuses on material risks and any notable emerging themes to ensure S&T’s risk management is adequate. The chair of the Risk Committee, in collaboration with the Board Chairperson, helps ensure that the Board has appropriate discussions on risk topics. The Risk Committee is responsible for reviewing and recommending to the Board for approval certain risk appetites taking into account S&T’s structure, risk profile, complexity, activities, size, and other appropriate risk-related factors. The Risk Committee considers current risks, which include the respective timeframes reflected by those risks, emerging risks, and future threats.

16 | S&T Bancorp, Inc. | 2024 Proxy Statement

Corporate Governance

The Risk Committee is responsible for overseeing S&T’s risk management activities and the effectiveness of its ERM framework. The Risk Committee is also responsible for monitoring our compliance risk with respect to regulatory and legal matters. Per the Risk Committee charter, the chairperson of the Risk Committee must satisfy the independence requirements established by the SEC, NASDAQ and any other governmental or regulatory body with authority over S&T. Mr. Hieb, Risk Committee Chairperson, meets such independence standards. The Risk Committee recommends to the Board the risk appetite or broad level of risk that is appropriate for S&T to accept. S&T’s risk appetite is an important piece of an effective ERM framework that reinforces risk culture and is a core instrument for better aligning overall corporate strategy, capital allocation, and risk.

Our Risk Committee’s primary purpose is to assist the Board in fulfilling its fiduciary responsibilities with respect to its oversight and assessment of S&T’s ERM framework, including among other things, the identification, assessment, measurement, monitoring, and management of the following major risk categories: Credit, Market, Liquidity, Operational, Information Technology Operational and Security, Compliance, Legal, Reputational, and Strategic. The Risk Committee meets quarterly or as often as it determines is necessary and appropriate. As with the other committees of the Board, the Risk Committee has the authority to consult with outside advisors as it deems necessary or appropriate to discharge its duties and responsibilities.

The Board, with the assistance of the Risk Committee, delegates the authority and responsibility for ensuring alignment of the risk appetite with the strategic objectives to the management-level Enterprise Risk Management Committee (the “ERM Committee”). The ERM Committee serves as the primary risk management forum for monitoring S&T’s risk exposures by reviewing key risk indicators or guidelines to proactively monitor both the level and direction of risk as well as key performance indicators to monitor progress toward achievement of strategic goals. By utilizing a comprehensive and standardized view of the nature and level of risk to which S&T is exposed and the interaction of the various risk components identified in its ERM program, S&T is better able to assess and manage its risk and react to uncertainties.

The ERM Program utilizes a three lines of defense model to delegate responsibility for critical risk management processes across the business functions and operational areas, as well as risk management, compliance, and internal audit teams. S&T’s first line of defense consists of business areas and operational teams across S&T Bank. These areas and teams are responsible for identifying, assessing, mitigating, monitoring, and managing risk within their respective areas. The Bank’s risk management functions represent the second line of defense. These functions are led by the Chief Risk Officer (“CRO”) and include a team consisting of a Director of Risk Management, Chief Appraisal Officer, Chief Compliance Officer, Chief Security Officer, Director of Credit Risk Review and Director of Operational Risk Management. S&T’s Audit and Advisory Department represents the third line of defense, which provides independent and objective assurance to senior management and the Board regarding first and second line risk management functions, internal controls, and governance processes.

The ERM Committee is comprised of members of S&T executive leadership, including the CRO, CEO, President, Chief Financial Officer, Chief Credit Officer, Chief Commercial Banking Officer, Chief Human Resources Officer, Chief Operating Officer, Chief Audit Executive (“CAE”), Director of Consumer and Business Banking, Chief Information and Technology Officer, and General Counsel. The ERM Committee meets at least quarterly to take the following actions prior to presentation to the Risk Committee: discuss the risk exposures of the enterprise, review changes to those exposures based on internal and external events, manage and mitigate such risks, and discuss significant policy changes, new products and services, model risk management reviews and ERM reports. The ERM Committee promotes proper risk management practices throughout S&T. A corporate policy approved by the Risk Committee governs the ERM Committee. The ERM Committee also operates pursuant to a written charter that is formally approved by the Risk Committee.

Pursuant to our Risk Committee charter, the CRO reports directly to the CEO, but has direct access to the Risk Committee, without impediment, and provides regular communication to the Risk Committee regarding risk management and regulatory compliance activities and other matters as the CRO determines necessary. The Risk Committee reviews and approves the appointment, replacement or dismissal of the CRO and oversees CRO succession planning.

S&T Bancorp, Inc. | 2024 Proxy Statement | 17

Corporate Governance

The CRO, as the administrator of the ERM program, regularly meets with management, including the CEO, to discuss the primary areas of risk identified above as part of the ERM program. As necessary, the Risk Committee meets with the CRO to discuss and analyze risks to S&T without management present.

The Audit Committee is responsible for oversight of financial risk, including internal controls which encompasses disclosure controls and procedures, and for the oversight of all trust activities consistent with the Federal Deposit Insurance Corporation’s Statement of Principles of Trust Department Management. The Audit Committee annually reviews and evaluates our internal audit function, and at least quarterly or as needed meets with our CAE to review and assess internal audit risks including during executive sessions without management present. The Audit Committee reviews and approves the appointment, replacement, or dismissal of the CAE, and reviews with the CAE the plans, activities, staffing, and organizational structure of the Audit and Advisory Services Department. The Audit Committee meets twice quarterly or as often as it determines is necessary and appropriate.

The Compensation and Benefits Committee is responsible for assessing and mitigating risks associated with S&T’s human capital and compensation practices, both with respect to S&T’s NEOs (as further described in the Compensation Discussion and Analysis (“CD&A”) section of this Proxy Statement) and its employees generally. The Compensation Committee reviews the incentive compensation arrangements for S&T’s NEOs with the CRO at least annually to discuss and evaluate the risk posed to S&T by its employee compensation plans and to ensure that the compensation arrangements do not encourage the NEOs to take unnecessary and excessive risks that threaten the value of S&T. The Compensation Committee meets quarterly or as often as it determines is necessary and appropriate.

Our Credit Risk Committee is responsible for reviewing the credit administration risk management practices and reporting; the performance of the independent credit risk review function and its assessment of the management of credit risk arising from the lending and lending-related functions of S&T; the review of commercial lending activity, including portfolio reviews; the credit policy approval; and providing guidance on pertinent credit risk matters including loan-related strategies. The Credit Risk Committee meets quarterly or as often as it determines is necessary and appropriate. The Credit Risk Committee reviews and approves the appointment, replacement, or dismissal of the Director of Credit Risk Review and at least annually reviews with the Director of Credit Risk Review the plans, activities, staffing and organizational structure of the credit risk review function. At least quarterly or as needed, the Credit Risk Committee meets with the Director of Credit Risk Review to discuss and analyze credit risks to S&T without management present.

The Executive Committee is responsible for exercising the authority to act on behalf of the Board between meetings of the Board to the fullest extent permitted by law. The Executive Committee meets as often as it determines is necessary and appropriate. Christina A. Cassotis, Jeffrey D. Grube, William J. Hieb, Christopher J. McComish, Frank J. Palermo, Jr., Christine J. Toretti (Chairperson) and Steven J. Weingarten serve as members of the Executive Committee.

Employee Compensation Policies and Managing Risk

We believe our approach to goal setting, setting of targets with payouts at multiple levels of performance, and evaluation of performance results assists in mitigating excessive risk taking that could harm our value or reward poor judgment by our executives. We believe that several features of our compensation policies and programs reflect sound risk management practices, such as basing incentive awards on the achievement of predetermined earnings per share (“EPS”), pre-provision net revenue and non-performing asset goals, all audited numbers, and granting restricted awards subject to a three year tiered time or three year cliff performance vesting that serves the additional purposes of encouraging senior management to make current decisions that promote long-term growth, promoting retention of senior management and requiring senior management to meet stock ownership guidelines. All awards granted under S&T Bancorp, Inc.’s 2021 Incentive Plan (the “2021 Incentive Plan”) were subject to Compensation Committee review and approval based upon corporate and/or individual performance.

18 | S&T Bancorp, Inc. | 2024 Proxy Statement

Corporate Governance

The incentive plan for senior management, as described in the CD&A section below, contains a “Minimum Gateway Requirement” (other than for time-based awards) and a “Shareholder Protection Feature,” which provide that awards will not be made unless S&T achieves a Return on Average Equity of at least 5% and maintains well capitalized capital ratio requirements, as established by applicable regulatory authorities, respectively. We believe we have allocated our compensation among base salary and short and long-term compensation target opportunities in such a way as to not encourage excessive risk-taking. The Compensation Committee also reviews compensation and benefits plans affecting employees in addition to those applicable to executive officers. Based on the review by the Compensation Committee, the S&T Board determined that it is not reasonably likely that S&T’s compensation and benefit plans would have a material adverse effect on S&T.

Audit Committee

The members of the Audit Committee are Peter R. Barsz, Christina A. Cassotis, Jeffrey D. Grube, and Frank J. Palermo, Jr. (Chairperson). All members meet the independence standards for audit committees established by the SEC and NASDAQ. A written charter approved by the Board governs the Audit Committee and complies with current NASDAQ Rules relating to charters and corporate governance. The Audit Committee reviews the adequacy of this charter annually and recommends any proposed changes to the Board. A copy of the charter is included on S&T’s website www.stbancorp.com, under Governance. The Audit Committee has provided information regarding the functions performed by the Audit Committee and its membership in the “Report of the Audit Committee,” included in this Proxy Statement on page 66.

The Board has determined that Frank J. Palermo, Jr., CPA, Chair of the Audit Committee and Peter R. Barsz, CPA each qualify as an “audit committee financial expert” as defined in regulations issued pursuant to the Sarbanes-Oxley Act of 2002. The Audit Committee annually reviews the independent registered public accounting firm’s performance and independence in deciding whether to retain the firm or engage a different independent registered public accounting firm. As part of this review, the Audit Committee considers, among other things, the following:

| • | The independent registered public accounting firm’s continued independence and objectivity; |

| • | The capacity, depth, financial services knowledge and public company experience of the independent registered public accounting firm; |

| • | The quality and candor of the independent registered public accounting firm’s communications with the Audit Committee and Management; |

| • | The desired balance of the independent registered public accounting firm’s experience and fresh perspective as a result of mandatory audit partner rotation; |

| • | External data on audit quality and performance, including recent Public Company Accounting Oversight Board (PCAOB) reports on the independent registered public accounting firm and its peer reviews; |

| • | The quality and efficiency of the audit firm’s audit plans and performance conducting S&T’s audit; |

| • | The appropriateness of the independent registered public accounting firm’s fees for audit and non-audit services; |

| • | The independent registered public accounting firm’s effectiveness of communications and working relationships with the Audit Committee, Internal Audit, and management; and |

| • | The independent registered public accounting firm’s tenure as S&T’s independent registered public accounting firm, including the benefits of having a long-tenured auditor and controls and processes that help safeguard the firm’s independence. |

The Audit Committee has the authority to consult with outside advisors as it deems necessary or appropriate to discharge its duties and responsibilities.

S&T Bancorp, Inc. | 2024 Proxy Statement | 19

Corporate Governance

Compensation and Benefits Committee

The members of the Compensation Committee are Peter R. Barsz, Christina A. Cassotis (Chairperson), Michael J. Donnelly, Jeffrey D. Grube, and Steven J. Weingarten. The Compensation Committee’s primary function is to recommend to the Board action on executive compensation and compensation and benefit changes brought to it by management. A written charter approved by the Board governs the Compensation Committee and complies with current NASDAQ Rules relating to charters and corporate governance. The Compensation Committee reviews the adequacy of this charter annually and recommends any proposed changes to the S&T Board. A copy of the charter is included on S&T’s website www.stbancorp.com, under Governance. The Compensation Committee is comprised entirely of independent board members, as defined by NASDAQ listing standards.