Table of Contents

Exhibit 99.1

connectivity environment security network service technology education Better growth workplace communities mental health content world value investments opportunities ANNUAL INFORMATION FORM FOR THE YEAR ENDED DECEMBER 31, 2022 MARCH 2, 2023

Table of Contents

In this Annual Information Form, we, us, our, BCE and the company mean, as the context may require, either BCE Inc. or, collectively, BCE Inc., Bell Canada, their subsidiaries, joint arrangements and associates. Bell means, as the context may require, either Bell Canada or, collectively, Bell Canada, its subsidiaries, joint arrangements and associates.

Each section of BCE’s 2020, 2021 and 2022 management’s discussion and analysis (BCE 2020 MD&A, BCE 2021 MD&A and BCE 2022 MD&A, respectively) and each section of BCE’s 2022 consolidated financial statements referred to in this Annual Information Form is incorporated by reference herein. No other document shall be considered to be incorporated by reference in this Annual Information Form. The BCE 2020 MD&A, BCE 2021 MD&A, BCE 2022 MD&A and BCE 2022 consolidated financial statements have been filed with the Canadian provincial securities regulatory authorities (available at sedar.com) and with the United States (U.S.) Securities and Exchange Commission (SEC) as exhibits to BCE’s annual reports on Form 40-F (available at sec.gov). They are also available on BCE’s website at BCE.ca.

Unless otherwise indicated herein, documents and other information contained in BCE’s website or in any other site referred to in BCE’s website or in this Annual Information Form are not part of this Annual Information Form and are not incorporated by reference herein. In particular, but without limitation, BCE’s integrated annual report for the year ended December 31, 2022 and BCE’s TCFD Report on Climate-Related Risks and Opportunities are not part of this Annual Information Form and are not incorporated by reference herein.

All dollar figures are in Canadian dollars, unless stated otherwise. The information in this Annual Information Form is as of March 2, 2023, unless stated otherwise, and except for information in documents incorporated by reference that have a different date.

Trademarks in this Annual Information Form which are owned or used under licence by BCE Inc., Bell Canada or their subsidiaries include, without limitation, BCE, BELL Design, BELL MOBILITY and BELL MEDIA. This Annual Information Form also includes trademarks of other parties. The trademarks referred to in this Annual Information Form may be listed without the ® and TM symbols.

© BCE Inc., 2023. All rights reserved.

Table of Contents

|

| ||||||||||

| Annual information form |

Parts of MD&A and financial statements incorporated by reference (references are to pages of the BCE 2022 Annual Financial Report, except where otherwise indicated) | |||||||||

|

| ||||||||||

| 1 | Caution regarding forward-looking statements | 2 | 32; 38; 66; 68; 91-100 | |||||||

| 2 | Corporate structure | 4 | ||||||||

| 2.1 | 4 | |||||||||

| 2.2 | 4 | |||||||||

| 3 | Description of our business | 5 | ||||||||

| 3.1 | 5 | 14-18; 46; 54; 58; 65-66; 68; 85 | ||||||||

| 3.2 | 6 | 33-36 | ||||||||

| 3.3 | 7 | 34 | ||||||||

| 3.4 | 11 | |||||||||

| 3.5 | 12 | |||||||||

| 3.6 | 12 | |||||||||

| 3.7 | 15 | |||||||||

| 3.8 | 15 | 22-32 | ||||||||

| 3.9 | 20 | 39-43; 55-56; 60-61; 63-64; 67; 69 | ||||||||

| 3.10 | 20 | 86-90 | ||||||||

| 3.11 | 20 | |||||||||

| 4 | General development of our business – three-year history | 21 | ||||||||

| 4.1 | 21 | |||||||||

| 4.2 | 22 | 18-21; 33-36; 38-42 (1); 51-54 (1); 38-41 (2); 49-53 (2) | ||||||||

| 4.3 | 22 | 86-90; 103-106 (1); 99-102 (2) | ||||||||

| 5 | Our capital structure | 23 | ||||||||

| 5.1 | 23 | 157-158 | ||||||||

| 5.2 | 24 | 147-148 | ||||||||

| 5.3 | 25 | |||||||||

| 5.4 | 28 | |||||||||

| 6 | Dividends and dividend payout policy | 30 | 19-21; 105-110 | |||||||

| 7 | Our directors and executive officers | 31 | ||||||||

| 7.1 | 31 | |||||||||

| 7.2 | 32 | |||||||||

| 7.3 | 32 | |||||||||

| 8 | Legal proceedings | 33 | ||||||||

| 9 | Interest of management and others in material transactions | 35 | ||||||||

| 10 | Interest of experts | 35 | ||||||||

| 11 | Transfer agent and registrar | 35 | ||||||||

| 12 | For more information | 35 | ||||||||

| 13 | Schedule 1 – Audit Committee information | 36 | ||||||||

| 14 | Schedule 2 – Audit Committee charter | 38 | ||||||||

| (1) | References to parts of the BCE 2021 MD&A contained in BCE’s annual report for the year ended December 31, 2021 (BCE 2021 Annual Report). |

| (2) | References to parts of the BCE 2020 MD&A contained in BCE’s annual report for the year ended December 31, 2020 (BCE 2020 Annual Report). |

| BCE INC. 2022 ANNUAL INFORMATION FORM | 1 |

Table of Contents

1 Caution regarding forward-looking statements

| 1 | Caution regarding forward-looking statements |

Certain statements made in this Annual Information Form are forward-looking statements. These statements include, without limitation, statements relating to BCE’s dividend growth objective and 2023 annualized common share dividend and dividend payout ratio level, BCE’s network deployment and capital investment plans and the benefits expected to result therefrom, our objectives concerning carbon abatement enablement and greenhouse gas (GHG) emissions reduction, including our objective for carbon neutral operations starting in 2025 and to achieve science-based targets (SBTs) by 2026 or 2030, as applicable, our business outlook, objectives, plans and strategic priorities, and other statements that do not refer to historical facts. A statement we make is forward-looking when it uses what we know and expect today to make a statement about the future. Forward-looking statements are typically identified by the words assumption, goal, guidance, objective, outlook, project, strategy, target and other similar expressions or future or conditional verbs such as aim, anticipate, believe, could, expect, intend, may, plan, seek, should, strive and will. All such forward-looking statements are made pursuant to the safe harbour provisions of applicable Canadian securities laws and of the U.S. Private Securities Litigation Reform Act of 1995.

Unless otherwise indicated by us, forward-looking statements in this Annual Information Form describe our expectations as at March 2, 2023 and, accordingly, are subject to change after that date. Except as may be required by applicable securities laws, we do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Forward-looking statements, by their very nature, are subject to inherent risks and uncertainties and are based on several assumptions, both general and specific, which give rise to the possibility that actual results or events could differ materially from our expectations expressed in, or implied by, such forward-looking statements and that our business outlook, objectives, plans and strategic priorities may not be achieved. These statements are not guarantees of future performance or events, and we caution you against relying on any of these forward-looking statements. Forward-looking statements are presented in this Annual Information Form for the purpose of assisting investors and others in understanding our objectives, strategic priorities and business outlook, as well as our anticipated operating environment. Readers are cautioned, however, that such information may not be appropriate for other purposes.

Subject to various factors including, without limitation, the future impacts of general economic conditions, of the COVID-19 pandemic and of geopolitical events, which are difficult to predict, we believe that the assumptions on which the forward-looking statements made in this Annual Information Form are based were reasonable at March 2, 2023. Refer in particular to the sub-sections of the BCE 2022 MD&A entitled Assumptions on pages 32, 38, 66 and 68 of BCE’s annual financial report for the year ended December 31, 2022 (BCE 2022 Annual Financial Report) for a discussion of certain key economic, market, operational and other assumptions we have made in preparing forward-looking statements. If our assumptions turn out to be inaccurate, actual results or events could be materially different from what we expect.

Important risk factors that could cause actual results or events to differ materially from those expressed in, or implied by, the previously mentioned forward-looking statements and other forward-looking statements contained in this Annual Information Form include, but are not limited to: the negative effect of adverse economic conditions, including a potential recession, and related inflationary cost pressures, higher interest rates and financial and capital market volatility; the negative effect of adverse conditions associated with the COVID-19 pandemic and geopolitical events; a declining level of business and consumer spending, and the resulting negative impact on the demand for, and prices of, our products and services; regulatory initiatives, proceedings and decisions, government consultations and government positions that affect us and influence our business including, without limitation, concerning mandatory access to networks, spectrum auctions, the imposition of consumer-related codes of conduct, approval of acquisitions, broadcast and spectrum licensing, foreign ownership requirements, privacy and cybersecurity obligations and control of copyright piracy; the inability to implement enhanced compliance frameworks and to comply with legal and regulatory obligations; unfavourable resolution of legal proceedings; the intensity of competitive activity and the failure to effectively respond to evolving competitive dynamics; the level of technological substitution and the presence of alternative service providers contributing to disruptions and disintermediation in each of our business segments; changing customer behaviour and the expansion of cloud-based, over-the-top (OTT) and other alternative solutions; advertising market pressures from economic conditions, fragmentation and non-traditional/global digital services; rising content costs and challenges in our ability to acquire or develop key content; higher Canadian smartphone penetration and reduced or slower immigration flow; the inability to protect our physical and non-physical assets from events such as information security attacks, unauthorized access or entry, fire and natural disasters; the failure to implement effective data governance; the failure to evolve and transform our networks, systems and operations using next-generation technologies while lowering our cost structure; the inability to drive a positive customer

| 2 |

BCE INC. 2022 ANNUAL INFORMATION FORM |

Table of Contents

1 Caution regarding forward-looking statements

experience; the failure to attract, develop and retain a diverse and talented team capable of furthering our strategic imperatives; the failure to adequately manage health and safety concerns; labour disruptions and shortages; the failure to maintain operational networks; the risk that we may need to incur significant capital expenditures to provide additional capacity and reduce network congestion; the inability to maintain service consistency due to network failures or slowdowns, the failure of other infrastructure, or disruptions in the delivery of services; service interruptions or outages due to legacy infrastructure and the possibility of instability as we transition towards converged wireline and wireless networks and newer technologies; the failure by us, or by other telecommunications carriers on which we rely to provide services, to complete planned and sufficient testing, maintenance, replacement or upgrade of our or their networks, equipment and other facilities, which could disrupt our operations including through network or other infrastructure failures; events affecting the functionality of, and our ability to protect, test, maintain, replace and upgrade, our networks, IT systems, equipment and other facilities; the complexity of our operations; the failure to implement or maintain highly effective processes and information technology (IT) systems; in-orbit and other operational risks to which the satellites used to provide our satellite television (TV) services are subject; our dependence on third-party suppliers, outsourcers, and consultants to provide an uninterrupted supply of the products and services we need; the failure of our vendor selection, governance and oversight processes, including our management of supplier risk in the areas of security, data governance and responsible procurement; the quality of our products and services and the extent to which they may be subject to defects or fail to comply with applicable government regulations and standards; reputational risks and the inability to meaningfully integrate environmental, social and governance (ESG) considerations into our business strategy and operations; the failure to take appropriate actions to adapt to current and emerging environmental impacts, including climate change; pandemics, epidemics and other health risks, including health concerns about radio frequency emissions from wireless communications devices and equipment; the inability to adequately manage social issues; the failure to develop and implement strong corporate governance practices; various internal and external factors could challenge our ability to achieve our ESG targets including, without limitation, those related to GHG emissions reduction and diversity, equity, inclusion and belonging; the inability to access adequate sources of capital and generate sufficient cash flows from operating activities to meet our cash requirements, fund capital expenditures and provide for planned growth; uncertainty as to whether dividends will be declared by BCE’s board of directors (BCE Board) or whether the dividend on common shares will be increased; the inability to manage various credit, liquidity and market risks; the failure to reduce costs, as well as unexpected increases in costs; the failure to evolve practices to effectively monitor and control fraudulent activities; new or higher taxes due to new tax laws or changes thereto or in the interpretation thereof, and the inability to predict the outcome of government audits; the impact on our financial statements and estimates from a number of factors; and pension obligation volatility and increased contributions to post-employment benefit plans.

These and other risk factors that could cause actual results or events to differ materially from our expectations expressed in, or implied by, our forward-looking statements are discussed in this Annual Information Form and the BCE 2022 MD&A and, in particular, in section 9, Business risks of the BCE 2022 MD&A, on pages 91 to 100 of the BCE 2022 Annual Financial Report.

Forward-looking statements contained in this Annual Information Form for periods beyond 2023 involve longer-term assumptions and estimates than forward-looking statements for 2023 and are consequently subject to greater uncertainty. In particular, our GHG emissions reduction and supplier engagement targets are based on a number of assumptions including, without limitation, the following principal assumptions: implementation of various corporate and business initiatives to reduce our electricity and fuel consumption, as well as reduce other direct and indirect GHG emissions enablers; no new corporate initiatives, business acquisitions, business divestitures or technologies that would materially increase our anticipated levels of GHG emissions; our ability to purchase sufficient credible carbon credits and renewable energy certificates to offset or further reduce our GHG emissions, if and when required; no negative impact on the calculation of our GHG emissions from refinements in or modifications to international standards or the methodology we use for the calculation of such GHG emissions; no required changes to our SBTs pursuant to the Science Based Targets initiative (SBTi) methodology that would make the achievement of our updated SBTs more onerous or unachievable in light of business requirements; and sufficient supplier engagement and collaboration in setting their own SBTs, no significant change in the allocation of our spend by supplier and sufficient collaboration with partners in reducing their own GHG emissions.

Forward-looking statements for periods beyond 2023 further assume, unless otherwise indicated, that the risks described above and in section 9, Business risks of the BCE 2022 MD&A will remain substantially unchanged during such periods, except for an assumed improvement in the risks related to the COVID-19 pandemic in future years.

We caution readers that the risks described above are not the only ones that could affect us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also have a material adverse effect on our business, financial condition, liquidity, financial results or reputation. We regularly consider potential acquisitions, dispositions, mergers, business combinations, investments, monetizations, joint ventures and other transactions, some of which may be significant. Except as otherwise indicated by us, forward-looking statements do not reflect the potential impact of any such transactions or of special items that may be announced or that may occur after March 2, 2023. The financial impact of these transactions and special items can be complex and depends on facts particular to each of them. We therefore cannot describe the expected impact in a meaningful way or in the same way we present known risks affecting our business.

| BCE INC. 2022 ANNUAL INFORMATION FORM | 3 |

Table of Contents

2 Corporate structure

| 2 | Corporate structure |

| 2.1 | Incorporation and registered office |

BCE Inc. was incorporated in 1970 and was continued under the Canada Business Corporations Act in 1979. It is governed by a certificate and articles of amalgamation dated August 1, 2004, as amended by: (a) a certificate and articles of arrangement dated July 10, 2006 to implement a plan of arrangement providing for the distribution by BCE Inc. to its shareholders of units in the Bell Aliant Regional Communications Income Fund and to consolidate outstanding BCE Inc. common shares; (b) a certificate and articles of amendment dated January 25, 2007 to implement a plan of arrangement providing for

the exchange of Bell Canada preferred shares for BCE Inc. preferred shares; (c) a certificate and articles of amendment dated June 29, 2011 to create two additional series of BCE Inc. Cumulative Redeemable First Preferred Shares (first preferred shares or Preferred Shares); and (d) certificates and articles of amendment dated September 22, 2014 and November 11, 2014 to create six additional series of BCE Inc. first preferred shares. BCE Inc.’s head and registered offices are located at 1, Carrefour Alexander-Graham-Bell, Building A, Verdun, Québec H3E 3B3.

| 2.2 | Subsidiaries |

The table below shows BCE Inc.’s main subsidiaries at December 31, 2022, which are all incorporated in Canada, and the percentage of voting securities that BCE Inc. directly or indirectly held in such subsidiaries on that date. BCE Inc. has other subsidiaries that have not been included in the table since each represented 10% or less of our total consolidated

assets and 10% or less of our total consolidated operating revenues at December 31, 2022. These other subsidiaries together represented 20% or less of our total consolidated assets and 20% or less of our total consolidated operating revenues at December 31, 2022.

| Subsidiary | |

Percentage of voting securities held by BCE Inc. at December 31, 2022 |

(1) | |

| Bell Canada |

100% | |||

| Bell Mobility Inc. |

100% | |||

| Bell Media Inc. |

100% | |||

| (1) | At December 31, 2022, BCE Inc. directly held 94.1% of the voting securities of Bell Canada and indirectly held the remaining 5.9% through its wholly-owned subsidiary, Bell MTS Inc. BCE Inc. indirectly held all the voting securities of: (i) Bell Mobility Inc. (Bell Mobility) through Bell Canada, which in turn indirectly held all the voting securities of Bell Mobility through its wholly-owned subsidiary, Bell Mobility Holdings Inc.; and (ii) Bell Media Inc. (Bell Media) through Bell Canada. |

| 4 |

BCE INC. 2022 ANNUAL INFORMATION FORM |

Table of Contents

3 Description of our business

| 3 | Description of our business |

This section contains forward-looking statements, including relating to our network deployment and capital investment plans, our objectives concerning carbon abatement enablement and GHG emissions reduction, our objective for carbon neutral operations starting in 2025 and to achieve SBTs by 2026 or 2030, as applicable, and our business outlook, objectives, plans and strategic priorities. Refer to section 1, Caution regarding forward-looking statements in this Annual Information Form.

General economic conditions, COVID-19 pandemic

and geopolitical events

BCE’s purpose is to advance how Canadians connect with each other and the world. Our strategy builds on our longstanding strengths in networks, service innovation and content creation, and positions the company for continued growth and innovation leadership. Through Bell for Better, we are investing to create a better today and a better tomorrow by supporting the social and economic prosperity of our communities. With our network deployments in remote communities and the largest cities, as well as investments in mental health initiatives, environmental sustainability and an engaged workplace, we look to create a thriving, prosperous and more connected world.

The COVID-19 pandemic has had significant impacts on our business. The emergency measures put in place in Canada starting in March 2020 to combat the COVID-19 pandemic significantly disrupted retail and commercial activities across most sectors of the economy and had an adverse and pervasive impact on our financial and operating performance throughout most of 2020. In 2021, our financial and operating performance saw a steady improvement despite the continued adverse impacts of the COVID-19 pandemic experienced throughout the year, due to our strong operational execution and the easing of government restrictions in the second half of the year. In 2022,

the unfavourable effects of the COVID-19 pandemic on our financial and operating performance continued to moderate due to our operational execution and the lifting of most public health restrictions during the year. While we expect the pandemic to continue to affect, although to a lesser extent, our operations, we have adapted many aspects of our business, including scaling our digital sales capabilities and evolving our self-serve tools, and continue to adapt to future modes of operating.

Macroeconomic uncertainty has also caused pressure in certain areas of our business. Global supply chain disruptions, which began to intensify during the second half of 2021 and were exacerbated by geopolitical events in 2022, have affected the availability of business data equipment and related spending on new services by our large enterprise customers. We expect an improvement in the situation during the second half of 2023. In addition, advertising demand and spending across the North American media industry in 2022 was impacted by unfavourable economic conditions and disruptions to supply chains. In particular, TV and radio advertising demand softened as a result of persistently high inflation, fears of a potential recession and supply chain issues in certain key consumer verticals, such as the automotive industry. We expect a gradual recovery in the advertising market to begin in the second half of 2023.

| 3.1 | General summary |

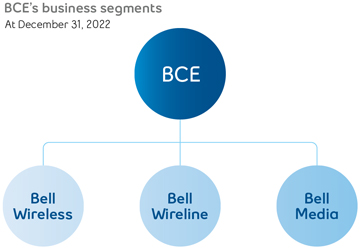

BCE is Canada’s largest communications company, providing residential, business and wholesale customers with a wide range of solutions for all their communications needs. Our results are reported in three segments: Bell Wireless, Bell Wireline and Bell Media. Effective with our Q1 2023 results, our previous Bell Wireless and Bell Wireline operating segments are being combined to form a single reporting segment called Bell Communication and Technology Services (Bell CTS). Bell Media remains a distinct operating segment and is unaffected. Refer to Segmented reporting changes in 2023 below for further details.

Bell Wireless includes wireless service revenues and product sales as well as the results of operations of our national consumer electronics retailer, The Source (Bell) Electronics Inc. (The Source). Wireless services are provided to our residential, small and medium-sized business and large enterprise customers across Canada.

Bell Wireline includes data revenues (including Internet, Internet protocol television (IPTV), cloud-based services and business solutions), voice and other communication services revenues, and wireline product sales. These services are provided to our residential, small and medium-sized business and large enterprise customers primarily in Ontario, Québec, the Atlantic provinces and Manitoba, while satellite TV service and connectivity to business customers are available nationally across Canada. In addition, this segment includes the results of our wholesale business, which buys and sells local telephone, long distance, data and other services from or to resellers and other carriers.

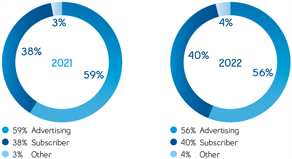

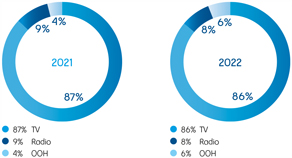

Bell Media provides conventional TV, specialty TV, pay TV, streaming services, digital media services, radio broadcasting services and out-of-home (OOH) advertising services to customers nationally across Canada. Revenues are derived primarily from advertising and subscriber fees.

Additional information regarding our business operations and the products and services we provide can be found in section 1.2, About BCE of the BCE 2022 MD&A, on pages 14 to 18 of the BCE 2022 Annual Financial Report.

In addition to our operating segments, we also hold investments in a number of other assets, including:

| • | a 37.5% indirect equity interest in Maple Leaf Sports & Entertainment Ltd. (MLSE) (1), a sports and entertainment company that owns several sports teams, including the Toronto Maple Leafs, the Toronto Raptors, Toronto FC and the Toronto Argonauts, as well as real estate and entertainment assets in Toronto |

| • | a 50% indirect equity interest in Glentel Inc. (Glentel), a Canadian-based connected services retailer |

| • | an 18.4% indirect equity interest in entities that operate the Montréal Canadiens Hockey Club, evenko (a promoter and producer of cultural and sports events) and the Bell Centre in Montréal, Québec, as well as Place Bell in Laval, Québec |

A discussion of the key transactions completed by BCE in the last three financial years can be found in section 4.1, Transactions of this Annual Information Form.

(1) In January 2023, we repurchased the BCE Master Trust Fund’s interest in MLSE for a cash consideration of $149 million, thereby increasing our indirect equity interest in MLSE from 28% to 37.5%.

| BCE INC. 2022 ANNUAL INFORMATION FORM | 5 |

Table of Contents

3 Description of our business

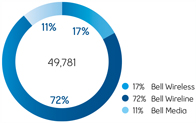

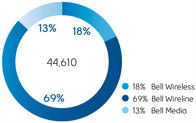

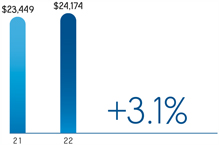

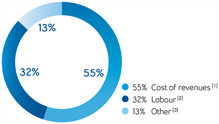

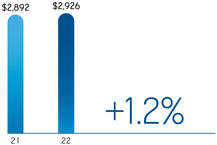

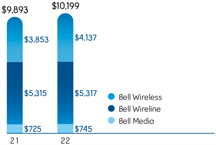

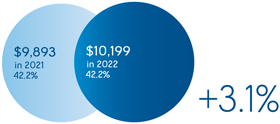

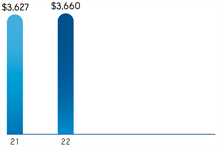

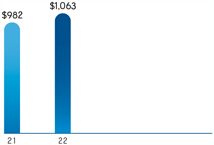

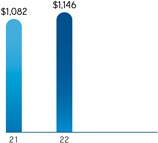

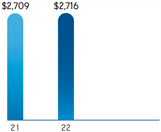

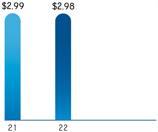

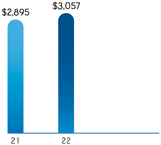

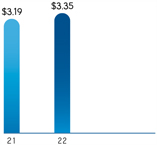

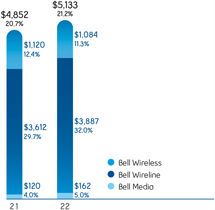

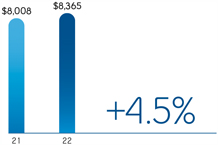

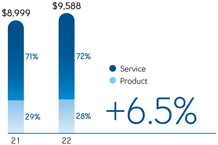

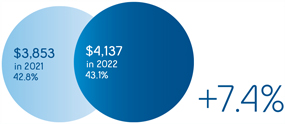

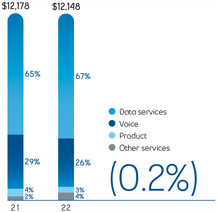

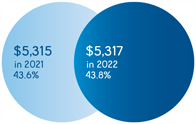

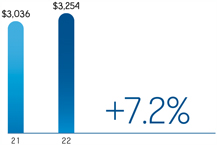

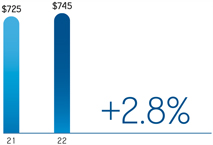

For the years ended December 31, 2022 and 2021, we generated consolidated operating revenues of $24,174 million and $23,449 million, respectively, and consolidated net earnings of $2,926 million and $2,892 million, respectively. For the year ended December 31, 2022, Bell Wireless’ operating revenues totalled $9,588 million ($9,535 million external revenues), Bell Wireline’s operating revenues totalled $12,148 million ($11,735 million external revenues) and Bell Media’s operating revenues totalled $3,254 million ($2,904 million external revenues). For the year ended December 31, 2021, Bell Wireless’ operating revenues totalled $8,999 million ($8,948 million external revenues), Bell Wireline’s operating revenues totalled $12,178 million ($11,820 million external revenues) and Bell Media’s operating revenues totalled $3,036 million ($2,681 million external revenues). A table showing the operating revenues that each segment contributed to total operating revenues for the years ended December 31, 2022 and 2021 can be found in section 4.3, Operating revenues of the BCE 2022 MD&A, on page 46 of the BCE 2022 Annual Financial Report. A table showing the operating revenues of our Bell Wireless and Bell Wireline segments by category of products and services can be found in section 5.1, Bell Wireless and section 5.2, Bell Wireline of the BCE 2022 MD&A, on pages 54 and 58, respectively, of the BCE 2022 Annual Financial Report.

Some of our segments’ revenues vary slightly by season. For more information, refer to section 7.2, Quarterly financial information – Seasonality considerations of the BCE 2022 MD&A, on page 85 of the BCE 2022 Annual Financial Report.

Segmented reporting changes in 2023

In 2022, we began modifying our internal and external reporting processes to align with organizational changes that were made to reflect an increasing strategic focus on multiproduct sales, the continually increasing technological convergence of our wireless and wireline telecommunications infrastructure and operations driven by the deployment of our Fifth Generation (5G) and fibre networks, and our digital transformation. These factors have made it increasingly

difficult to distinguish between our wireless and wireline operations and will result in changes in the first quarter of 2023 to the financial information that is regularly provided to our chief operating decision maker to measure performance and allocate resources.

Effective with our Q1 2023 results, our previous Bell Wireless and Bell Wireline operating segments are being combined to form a single reporting segment called Bell Communication and Technology Services (Bell CTS). Bell Media remains a distinct operating segment and is unaffected. As a result of our reporting changes, prior periods are being restated in 2023 for comparative purposes.

Our Bell CTS segment provides a wide range of communication products and services to consumers, businesses and government customers across Canada. Wireless products and services include mobile data and voice plans and devices and are available nationally. Wireline products and services comprise data (including Internet access, IPTV, cloud-based services and business solutions), voice, and other communication services and products, which are available to our residential, small and medium-sized business and large enterprise customers primarily in Ontario, Québec, the Atlantic provinces and Manitoba, while satellite TV service and connectivity to business customers are available nationally across Canada. In addition, this segment includes our wholesale business, which buys and sells local telephone, long distance, data and other services from or to resellers and other carriers, as well as the results of operations of our national consumer electronics retailer, The Source.

Our Bell Media segment provides conventional TV, specialty TV, pay TV, streaming services, digital media services, radio broadcasting services and OOH and advanced advertising services to customers nationally across Canada.

Additional information regarding the business outlook of our Bell CTS and Bell Media segments can be found in the sections entitled Business outlook and assumptions of the BCE 2022 MD&A, on pages 65, 66 and 68 of the BCE 2022 Annual Financial Report.

| 3.2 | Strategic imperatives |

BCE’s purpose is to advance how Canadians connect with each other and the world. Our strategy builds on our longstanding strengths in networks, service innovation and content creation, and positions the company for continued growth and innovation leadership. Our primary business objectives are to grow our subscriber base profitably and to maximize revenues, operating profit, free cash flow and return on invested capital by further enhancing our position as the foremost provider in Canada of comprehensive communications services to residential, business and wholesale customers, and as Canada’s leading content creation company. We seek to take advantage of opportunities to leverage our networks, infrastructure, sales channels, and brand and marketing resources across our various lines of business to create value for our customers and other stakeholders.

Our strategy is centred on our disciplined focus and execution of six strategic imperatives that position us to deliver continued success in a fast-changing communications marketplace. The six strategic imperatives that underlie BCE’s business plan are:

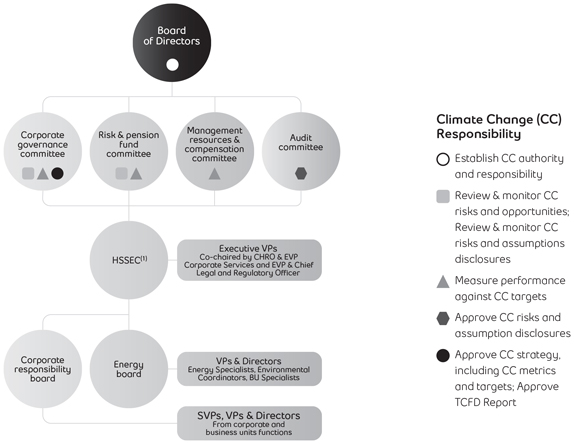

In 2022, we embedded our focus on creating a more sustainable future directly into our six strategic imperatives, reflecting our longstanding commitment to the highest ESG standards. As one of Canada’s largest companies, we are driven to continually improve our impact and our contribution to society with our network deployments, investments in mental health initiatives, environmental sustainability and an engaged workplace.

Additional information regarding our strategic imperatives can be found in section 2, Strategic imperatives of the BCE 2022 MD&A, on pages 33 to 36 of the BCE 2022 Annual Financial Report.

| 6 |

BCE INC. 2022 ANNUAL INFORMATION FORM |

Table of Contents

3 Description of our business

| 3.3 | Competitive strengths |

Canada’s largest communications company

We are Canada’s largest communications company, providing residential, business and wholesale customers with a wide range of solutions for all their communications needs, as described below:

| • | We are the largest local exchange carrier in Canada. BCE operates an extensive local access network in Ontario, Québec, the Atlantic provinces and Manitoba, as well as in Canada’s Northern Territories. We provide a complete suite of wireless communications, wireline voice and data, including Internet access and TV, product and service offerings to residential, business and wholesale customers. We also own Bell Media, Canada’s leading content creation company with premier assets in TV, radio, and OOH advertising, monetized through traditional and digital platforms. |

| • | We also offer competitive local exchange carrier (CLEC) services in Alberta and British Columbia. |

| • | At December 31, 2022, BCE was one of the largest wireless operators in Canada based on number of subscribers, providing more than 9.9 million mobile phone subscribers with nationwide mobile voice and data services. We also had approximately 2.5 million mobile connected device subscribers at December 31, 2022. |

| • | BCE is the largest Internet service provider in Canada based on number of subscribers, providing approximately 4.3 million retail customers at December 31, 2022 with high-speed Internet access through fibre-optic, wireless-to-the-premise (WTTP) and digital subscriber line (DSL) technology. |

| • | BCE is the largest TV provider in Canada based on number of subscribers, nationally broadcasting a wide range of domestic and international programming to approximately 2.8 million retail subscribers at December 31, 2022 through its IPTV services, namely Fibe TV, the Fibe TV app and Virgin Plus TV, as well as its satellite TV service. |

| • | BCE operated approximately 2.2 million retail residential network access service (NAS) voice lines at December 31, 2022. |

Our large customer base, our wireline and wireless network reach, and our ability to sell through a variety of distribution channels, as discussed in more detail in section 3.4, Marketing and distribution channels in this Annual Information Form, give us scale that supports the execution of our six strategic imperatives. With a wireless network service footprint that encompasses more than 99% of Canada’s population, a coast-to-coast national fibre transport network and a local exchange carrier footprint from Manitoba to the Atlantic provinces, BCE is well positioned to take advantage of integrated wireless and wireline solutions in the future.

On May 31, 2021, we announced that our capital expenditure acceleration program, initially announced on February 4, 2021, of $1 billion to $1.2 billion in additional network funding for 2021 and 2022, would increase to up to $1.7 billion in response to the support for infrastructure investment reflected in federal regulatory and policy decisions rendered earlier in the year. This $1.7 billion in accelerated capital expenditures advanced the rollout of our broadband fibre, 5G wireless and rural networks and helped drive Canada’s recovery from the COVID-19 pandemic, and was in addition to the approximately $4 billion in capital expenditures that Bell has typically spent each year on network expansion and enhancement prior to 2020.

Technologically advanced wireless networks

and services

Our Bell Wireless segment provides wireless services over technologically advanced wireless networks that are available to virtually all Canadians. We offer a broad range of wireless voice and data communication products and services to residential and business customers through our Bell brand, as well as our Virgin Plus and Lucky Mobile brands, which enhance our competitive market position by allowing us to compete more effectively with the Canadian industry’s other discount brands as well as regional facilities-based wireless service providers.

Wireless is a key growth segment for us, and we have established strategic priorities seeking to further enhance our offerings. We are focused on growing our market share of national operators’ postpaid mobile phone net customer activations, growing our prepaid mobile phone subscriber base, improving sales execution and customer retention, and introducing new devices and data services. We also believe our priorities for improved customer experience at all touch points, enhanced network quality and performance driven by effective spectrum deployment and carrier aggregation that support bandwidth and speeds, as well as a broad device offering, should continue to improve our ability to attract and retain wireless customers. With our national high-speed packet access plus (HSPA+) network, our fourth-generation (4G) long-term evolution (LTE) wireless network, our Dual-band, Tri-band and Quad-band LTE Advanced (LTE-A) network, and our 5G wireless network, we are able to offer one of the broadest ranges of choice in wireless smartphones in Canada, along with extensive North American and international coverage. In addition, Bell’s enhanced Gigabit LTE-A network, initially rolled out in 2018 to core locations in Toronto and Kingston, has since expanded to more areas as smartphones that support these advanced speeds have come to market, and is available in select cities across Canada. Bell also launched in 2018 a new LTE, Category M1 (LTE-M) network, which is a subset of our LTE network supporting low-power Internet of Things (IoT) applications with enhanced coverage, longer device battery life and enabling lower costs for IoT devices connecting to Bell’s national network.

In 2020, Bell launched 5G wireless service, offering enhanced mobile data speeds and the latest 5G-capable smartphones. As with previous wireless and wireline network deployments, Bell is working with multiple equipment suppliers for its 5G rollout, including Nokia Corporation (Nokia) and Telefonaktiebolaget LM Ericsson (Ericsson). In 2021, Bell acquired significant additional mid-band, flexible-use 3500 megahertz (MHz) wireless spectrum in the auction by Innovation, Science and Economic Development Canada (ISED). Essential to Canada’s ongoing transition to 5G communications, these high-capacity airwaves extend Bell’s leadership in delivering enhanced 5G digital experiences to Canadian consumers and businesses in urban, rural and remote communities. Refer to section 4.1, Transactions in this Annual Information Form for more details.

| BCE INC. 2022 ANNUAL INFORMATION FORM | 7 |

Table of Contents

3 Description of our business

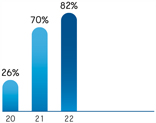

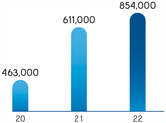

Bell’s 5G network covered 82% of Canada’s population at December 31, 2022, a significant increase from the 26% of Canada’s population covered at the end of 2020, attributable in part to our capital expenditure acceleration program described above. In 2022, Bell launched its 5G+ service, a faster and more responsive service allowing for a superior mobile experience, and which covered 38% of Canada’s population at December 31, 2022. Refer to section 3.6, Networks – Wireless in this Annual Information Form for more details concerning our wireless networks.

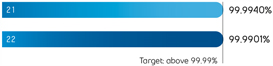

Bell’s wireless networks received several awards in 2022. In February 2022, Bell’s 5G mobile network ranked as Canada’s fastest 5G network for the second time in a row in Ookla’s 2021 Speedtest Awards based on Speedtest results independently collected and analyzed by Ookla, a web service specializing in analysis of Internet access performance metrics, for Q3-Q4 2021 and calculated using median 5G download and upload speeds. In September 2022, Bell’s wireless network was further ranked Canada’s fastest in PCMag’s Fastest Mobile Networks Canada 2022, its annual study of mobile network performance across the country. PCMag delivers labs-based, independent reviews of the latest technology products and services. Its researchers tested service speeds in more than 30 cities and rural areas across Canada. PCMag’s analysis took place in August 2022 and ranked providers based on a weighted average of download speeds, upload speeds and average latency.

Advancing 5G and IoT solutions

Bell is working with a range of global and domestic 5G partners, including Ericsson and Nokia, to accelerate Canada’s 5G innovation ecosystem. This includes continued investment in research and development at Canadian institutions, such as a partnership between Western University and Bell creating an advanced centre for research into 5G applications across health (including mental health), transportation, education and other sectors, and a partnership with Université de Sherbrooke through the Interdisciplinary Institute for Technological Innovation (3IT) to drive broadband technology research in a broad range of sectors, including IoT, Smart Campus/Smart City, innovative manufacturing and smart energy management. On the international stage, Bell is involved in the setting of global 5G standards with our participation in the Next Generation Mobile Networks (NGMN) consortium and Third Generation Partnership Program (3GPP).

The high capacity and near instant connections offered by 5G will support a virtually unlimited range of new consumer and business applications in the coming years, including augmented and virtual reality (AR/VR), artificial intelligence (AI) and machine learning, immersive entertainment services, connected vehicles, smart cities and enhanced rural access, and IoT opportunities for business and government enterprises. In 2021, our 5G network enabled the launch of TSN 5G View/Vision 5G RDS, an exclusive in-app feature that leverages Bell’s 5G network to offer fans interactive new ways to watch sports. It was initially introduced with Montréal Canadiens and Toronto Maple Leafs regional home game broadcasts, enabling fans to control the viewing angle of the game on their smartphones, getting up close to every goal, pass, hit and penalty with zoom, pause, rewind and slow motion capabilities. The feature was later expanded to Toronto Raptors home games and was expanded again in 2022 to Winnipeg Jets home games. In January 2023, we announced a partnership with Snap Inc. which introduced the first ever 5G multi-user AR basketball experience on Snapchat. Fans with a 5G device in attendance at four Toronto Raptors Welcome Toronto home games in early 2023 can join a shared AR experience where

thousands can participate by teaming up and competing against each other, leveraging Snapchat’s AR technology and the unprecedented speed, latency and bandwidth capabilities of 5G.

Bell also provides a number of solutions in the fast-growing IoT sector, which enables the interconnection of a range of devices and applications that send and receive data. Bell further offers global connectivity solutions for our IoT platforms and applications, which offer customers worldwide network access and the ability to manage all of their international devices remotely from a single web platform. Bell’s lineup of innovative IoT applications includes connected telematics services, including security, safety, diagnostics and infotainment, for vehicles; fuel tank monitoring and water management solutions; fleet management solutions connecting commercial vehicles to the Internet to provide web-based analytics to manage the fleet; connected laptop solutions, enabling LTE connectivity directly from select LTE-enabled laptops; managed IoT security services that offer businesses, smart cities and other organizations employing IoT solutions a fully managed solution to detect and protect organizations from evolving cyber threats; and new solutions made available in the context of the COVID-19 pandemic, such as real-time occupancy monitoring, digital signage and sanitizer kiosks.

In Q2 2022, Bell launched a private mobile network (PMN) at the Centre for Port Innovation, Engagement and Research (The PIER), an innovation hub in Halifax focused on developing innovative solutions for supply chain and logistics in the transportation industry. The PMN enables The PIER members and start-ups to trial innovative new solutions to help improve worker safety, increase port operations efficiency and further enhance the reputation of the Port of Halifax. Bell is a Founding Partner and the exclusive telecommunications provider of The PIER. Our PMN enables IoT solutions that help support business-critical functions with real-time data monitoring and reporting, as well as support all partners as they work to develop commercial opportunities seeking to benefit Canadian and global companies and their customers.

Next-generation high-speed internet

and TV services

Our strategic imperative to build the best networks is focused on the expansion of our all-fibre network to more homes and business locations. At December 31, 2022, our broadband fibre network, consisting of fibre-to-the-premise (FTTP) and fibre-to-the-node (FTTN) locations, covered approximately 10 million homes and businesses in Ontario, Québec, the Atlantic provinces and Manitoba. Our all-fibre network enables the delivery of Bell’s next-generation fibre-optic high-speed Internet service marketed as Fibe Internet, offering symmetrical download and upload speeds of up to 3 gigabits per second (Gbps) with FTTP through our Gigabit Fibe 3.0 service, and symmetrical download and upload speeds of up to 8 Gbps with FTTP through our Gigabit Fibe 8.0 service available in eligible areas of Toronto. Fibe Internet further offers download speeds of up to 100 megabits per second (Mbps) with FTTN. Our network also enables the delivery of our Internet service marketed as Virgin Plus Internet, offering download speeds of up to 300 Mbps. Refer to section 3.6, Networks – Wireline – High-speed fibre deployment in this Annual Information Form for more details concerning the deployment of our fibre-optic high-speed Internet services.

| 8 |

BCE INC. 2022 ANNUAL INFORMATION FORM |

Table of Contents

3 Description of our business

As Bell extends its direct fibre links in urban and suburban centres, we are also delivering broadband speeds to smaller towns and rural locations with our innovative Wireless Home Internet fixed wireless service, which is based on 5G-capable WTTP technology. With the expansion of wireless cell site coverage, deep fibre backhaul and advancements in technology, the cost to provide a fixed wireless solution has become viable in rural areas where it is uneconomical to deploy FTTP. In 2021, we completed the buildout of our Wireless Home Internet service in smaller towns and rural communities across Ontario, Québec, the Atlantic provinces and Manitoba, reaching our target of 1 million locations one year ahead of schedule. Already delivering download speeds of up to 25 Mbps, Bell increased its Wireless Home Internet service’s download speeds to up to 50 Mbps and upload speeds to 10 Mbps (50/10) in the fall of 2020, which enhanced speeds are now available to a majority of customers. In August 2021, an agreement with Casa Systems, Inc. was announced for the upgrade of Bell’s WTTP network to 5G to further boost speed and capacity for Wireless Home Internet customers.

Our FTTP and FTTN broadband fibre network also enables the delivery of Bell’s IPTV services, namely Fibe TV, the Fibe TV app and Virgin Plus TV.

Bell’s Fibe TV service, built on an IPTV platform, offers a wide range of flexible programming options and innovative features to customers in Ontario, Québec, the Atlantic provinces and Manitoba, such as: the Fibe TV wireless receiver, which enables customers to enjoy the Fibe experience on up to five additional TVs anywhere in the home without the hassle of running cable through the house; the Restart and Look Back features, enabling customers to rewind and watch TV shows already in progress from the beginning and up to 30 hours after they started; and the Trending feature, which lists the five most-watched shows in both English and French among Fibe TV customers at any given time and allows customers to switch to watch live or Restart from the beginning. Fibe TV further allows access to Crave, Prime Video and YouTube directly from customer TV receivers, providing a seamless experience. The Fibe TV app brings the rich Fibe TV viewing experience to laptops, smartphones, tablets, Bell Streamer, Apple TV, Amazon Fire TV, Google Chromecast and a variety of Android TV devices, with access to more than 500 live and on-demand channels at home or on the go, which allows customers to seamlessly transfer a channel being viewed from a mobile device to a TV, or resume what is being watched on TV on a mobile device, and allows customers to control their TVs with their mobile devices. In addition, Fibe customers can download their personal video recordings with the Fibe TV app to watch on iOS and Android mobile devices without Wi-Fi network access, and customers can pause and rewind live TV on any device with the Fibe TV app. In 2021, the availability of the Fibe TV app was extended to customers in Manitoba. In 2022, Bell introduced the new evolution of Fibe TV with thousands of apps and powerful search options to make our customers’ experience even better. With the latest Google Android TV technology, Fibe TV now provides access to over 10,000 apps from Google Play. Viewers can easily find the content they want to watch, and explore new and exciting entertainment with a voice remote powered by Google Assistant and intuitive universal search capabilities that will find content across Fibe TV and supported subscribed streaming services. With added Cloud PVR capabilities, viewers can store content for up to a year to watch at their convenience.

In addition, we offer the Fibe TV app service in Ontario and Québec as a standalone app-based live TV streaming service that offers live and on-demand programming. With no traditional TV set-top box required, the Fibe TV app offers up to 500 live and on-demand channels on laptops, smartphones, tablets, Bell Streamer, Apple TV, Amazon Fire TV, Google Chromecast and a variety of Android TV devices. The standalone Fibe

TV app offers access to two TV streams at a time and customers can add individual channels to build their own packages. Like Bell’s Fibe TV service, the standalone Fibe TV app operates as a licensed broadcast service on the privately managed Bell Fibe broadband network for in-home viewing, and on mobile or Wi-Fi networks outside the home.

In 2020, we launched Virgin TV (now Virgin Plus TV), a completely new way for Virgin Plus Internet members in Ontario and Québec to watch live and on-demand TV shows and live sports on any screen they want. Virgin Plus TV is an app-based service that does not require a traditional TV set-top box or installation, and it works on virtually all devices – iOS and Android smartphones and tablets, laptops, Amazon Fire TV, Android TV, Apple TV and Google Chromecast. The Virgin Plus TV app lets members watch two streams at once, pause and rewind live TV, resume on-demand programs where they left off, and track all the top trending shows.

In 2020, Bell launched the Bell Streamer, an all-in-one 4K High Dynamic Range (HDR) streaming device powered by Android TV that offers customers in Ontario and Québec all-in-one access to the Fibe TV app, support for all major streaming services and access to thousands of apps on Google Play.

National wireline service provider with market leadership position

Our leadership position in broadband Internet and TV and our broad suite of product offerings serve as a foundation for the other products and services we offer. This provides us with a significant number of established customer connections to drive uptake of new products and services, either through bundled offerings or on a standalone basis, and allows us to improve customer retention.

Our business markets team maintains a leadership position, having established relationships with a majority of Canada’s largest 100 corporations. Our team continues to deliver network-centric business service solutions to large business and public sector clients, including data hosting and cloud computing services, which are key to business communications today and increase the value of connectivity services.

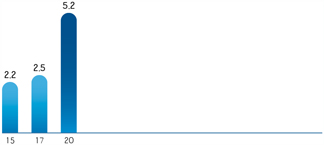

Innovation in communications technology

Technological advancement plays a significant role in the success of our business. We invest in Canadian innovation and have spent approximately $600 million in research and development (R&D) capital expenditures in 2022. Our investments in R&D enable us to continue providing our customers with innovative products and services and to adopt new technologies that better support our own operations, champion the customer experience, and drive growth with innovative services. Our deployment of new and innovative networks and services is a direct result of our investment in R&D.

Over the past decades, Bell has invested in developing data analytics capabilities and AI applications in multiple areas of its operations. Providing advanced technological solutions allows us to differentiate our product and service offerings and to seek to provide greater value to our customers. As part of Bell’s objective to remain at the forefront of technology and innovation in telecommunications services, and encourage the development of, and expertise in, new emerging technologies in Canada, we partner with a range of global and domestic organizations like Google, Amazon Web Services, Inc. (AWS), Centech and the Vector Institute.

On March 3, 2022, we announced a five-year strategic engagement with the Vector Institute, an independent, not-for-profit corporation dedicated to research in the field of AI. The collaboration is expected to help to accelerate the development and adoption of AI applications

| BCE INC. 2022 ANNUAL INFORMATION FORM | 9 |

Table of Contents

3 Description of our business

across Bell. In November 2022, we further announced a three-year strategic partnership with Montréal innovation centre Centech. As Centech’s exclusive telecommunications provider, Bell will leverage its advanced network capabilities, 5G and AI management expertise to help emerging Canadian businesses drive innovation, growth and adoption of advanced technological solutions.

In addition, on October 25, 2022, Bell introduced Bell Ventures, its corporate venture capital initiative to encourage development of early-stage and growth companies that harness the power of Bell’s networks to drive growth and adoption of advanced technological solutions. Building on Bell’s history of innovation and investments, Bell Ventures is a natural extension of Bell’s purpose to advance how Canadians connect with each other and the world. Bell Ventures invests in early-stage and growth companies that provide advanced technology solutions seeking to further differentiate Bell’s 5G and fibre networks and deliver solutions for its customers, including in the areas of network security, IoT, robotics, telematics, clean technology (cleantech), AR/VR, and the metaverse. Recent investments by Bell Ventures include Cohere Technologies, the creator of spectrum multiplier software for 4G and 5G networks, and Boreal Ventures, a venture capital fund supporting promising Québec deep tech start-ups, created in partnership with Centech.

We also announced in 2022 a number of significant milestones in our strategic cloud and technology partnerships. In February 2022, Bell announced its deployment of Google Distributed Cloud Edge in its network, enabling more efficiency, reliability and scale while also driving new business opportunities. This is the world’s first implementation of core network functions on Google Distributed Cloud Edge, a fully managed product that brings Google Cloud’s infrastructure and services closer to where data is being generated and consumed. This advancement builds on Bell and Google Cloud’s strategic partnership, announced in 2021, to combine Bell’s 5G network leadership with Google Cloud’s expertise in multi-cloud, data analytics and AI, and to enable Bell to drive operational efficiencies and deliver richer customer experiences. In addition, Bell announced the launch of the first public multi-access edge computing (MEC) with AWS Wavelength in Canada. Building on Bell’s agreement with AWS, announced last year, together the two companies are deploying AWS Wavelength Zones throughout the country at the edge of Bell’s 5G network, starting in Toronto. Bell Public MEC with AWS Wavelength embeds AWS compute and storage services at the edge of the Bell 5G network, closer to mobile and connected devices where data is generated and consumed. This enables software developers and businesses to take full advantage of the high speed and low latency of Bell’s 5G network and the cloud with AWS to build innovative, low-latency solutions that leverage real-time visual data processing, AR/VR, AI and machine learning, advanced robotics and much more.

Our significant media assets

Bell Media’s range of video and radio content enhances the execution of our strategic imperatives by leveraging our significant network investments, delivering compelling content across all screens and platforms, and enabling us to maximize strategic and operating synergies, including the efficiency of our content and advertising spend.

Bell Media’s assets in TV, radio, OOH and digital platforms are a key competitive advantage, as described below:

| • | We own and operate 35 conventional TV stations, including CTV, Canada’s #1 network for 21 consecutive years (1), #1 Canadian advertising-based video-on-demand (AVOD) platform CTV.ca (2) and leading digital news destination CTVNews.ca, and the French-language Noovo network in Québec, including its popular AVOD platform and digital news destination Noovo.info. |

| • | We own and operate 27 specialty channels, including TSN, Canada’s sports leader (3), and RDS, the top French-language sports network (1). |

| • | We own and operate four pay TV services, as well as four direct-to-consumer streaming services, including Crave, the exclusive home of HBO in Canada, TSN and RDS. |

| • | We own 109 licensed radio stations in 58 markets across Canada, all available through the iHeartRadio Canada app alongside an extensive catalogue of podcasts. |

| • | We lead Canadian TV media competitors in the digital landscape in the number of unique visitors, page views and total page minutes. |

| • | We own Astral, a leader among Canada’s OOH advertising companies with more than 45,000 advertising faces strategically located across the country. Astral offers six product lines: outdoor advertising, lifestyle networks, street furniture, airport, large digital format and transit. |

| • | We own Crave, a subscription-based video-on-demand streaming service providing premium content and a robust lineup of video programming. Crave features a broad catalogue of sought-after content and Emmy Award-winning programming. With Crave, HBO and HBO Max original programming, box-office hits and original Canadian content are available directly to all Canadians with access to the Internet. As a bilingual service, Crave offers English and French-language content through participating TV providers and streaming platforms. STARZ remains available through participating service providers and directly to consumers as a separate add-on. |

| • | Our noovo.info website offers exclusive original features dedicated entirely to news, which represents the final piece to Noovo’s multi-platform news division. |

| • | Through CTV’s all-in-one digital video platform and streaming from CTV.ca and the CTV app on smartphones, Smart TVs and other connected devices, audiences can get even more value from their TV subscriptions all in one place, with livestreams and on-demand viewing of programming from CTV Comedy Channel, CTV Drama Channel, CTV Sci-Fi Channel, CTV Life Channel, CTV2, Discovery, E! and MTV, as well as Canada’s #1 lineup from CTV (1). The platform provides access for subscribers of CTV-branded entertainment channels to stream premium content from those channels, as well as CTV Throwback and CTV Movies, all at no additional cost and with one simple login. |

| • | We continue to provide live and on-demand access to content from our specialty networks, BNN Bloomberg, TSN, RDS and other brands in news, sports and entertainment. As discussed under Advancing 5G and IoT Solutions above, TSN and RDS operate TSN 5G View/Vision 5G RDS, an exclusive in-app feature that leverages Bell’s 5G network to offer fans interactive new ways to watch sports, and which was expanded in 2022 for TSN’s regional coverage of Winnipeg Jets home games. |

| (1) | Based on data provided by Numeris, a data company providing audience data and insights capturing media behaviours for the Canadian media industry. |

| (2) | Based on data provided by Comscore, Inc., an American media measurement and analytics company. |

| (3) | Based on the depth and breadth of broadcasted sporting events, and TSN’s reach, according to data provided by Numeris, and TSN being the consumer preferred brand for live sports and sports news. |

| 10 |

BCE INC. 2022 ANNUAL INFORMATION FORM |

Table of Contents

3 Description of our business

Our competitive strengths also include our broad reach across Canada, our ability to deliver top programming for conventional, specialty and pay TV and streaming services, our constant drive to provide the most engaging and interactive experience for viewers, and our ability to serve the needs of advertisers across multiple platforms.

Refer to section 2.3, Deliver the most compelling content of the BCE 2022 MD&A, on page 34 of the BCE 2022 Annual Financial Report, for a description of certain agreements entered into and initiatives launched in 2022 by Bell Media.

| 3.4 | Marketing and distribution channels |

Bell Wireless and Bell Wireline

The guiding principle driving our marketing strategy is to offer our clients the ultimate in reliable, simple and accessible telecommunications services. In doing so, our objective is to increase customer acquisition, retention and loyalty through multiple service offerings.

Through the bundling of services, which combines wireline local voice and long distance, high-speed Internet, TV and smart home, as well as wireless services, our goal is to use a multi-product offering to achieve competitive differentiation by offering a premium, integrated set of services that provides customers with more freedom, flexibility and choice. We also make use of limited-time promotional offers featuring discounted rate plans, special rates on wireless handsets and TV receivers, as well as other incentives, to stimulate new customer acquisition and retain existing customers or to respond to competitive actions in our markets.

We focus our marketing efforts on a coordinated program of TV, print, radio, Internet, outdoor signage, direct mail and point-of-sale media promotions. We engage in mass market advertising in order to maintain our brand and support direct and indirect distribution channels. Coordinated marketing efforts throughout our service area ensure that our marketing message is presented consistently across all our markets. Promoting the Bell brand is complemented by our other brand marketing efforts, reinforcing awareness of all our services and capitalizing on the size and breadth of our customer base across all product lines.

The Bell brands play a key role in product positioning. Our branding is straightforward and directly supports our strategy of delivering a better customer experience at every level. In July 2021, Virgin Mobile Canada officially rebranded to Virgin Plus, a new name and a new identity that reflect the company’s evolving service offerings beyond mobility.

Specifically for Bell Wireless, acquiring and retaining subscribers is a key marketing objective that we seek to achieve through our networks and suite of leading-edge devices and services to drive higher usage and increased adoption of data services. We offer unlimited plans featuring unlimited data access with no overage charges. We also offer SmartPay device financing plans that let Bell Mobility customers buy their new smartphones with 24 interest-free instalments separate from their service plan, and we similarly offer Sweet Pay device financing plans for Virgin Plus customers. In addition, we offer Connect Everything plans that provide a way to link all of a customer’s Bell devices with a pool of data to share across smartphones, tablets, smartwatches and other devices, such as wireless trackers, security cameras and vehicles with Bell Connected Car. In January 2022, we introduced new mobile unlimited Ultimate plans to make the most of 5G with more data at maximum speeds, international messaging, high-definition video quality and hotspot capability. We also continue to offer discounts on the price of wireless handsets in exchange for a contractual commitment from a subscriber, a practice also used by other Canadian wireless operators. As the Canadian wireless market further matures and competition

intensifies, customer retention is increasingly important. Accordingly, we employ customer retention initiatives aimed at increasing our customers’ level of satisfaction and loyalty.

We deliver our products and services to residential wireless and wireline customers through:

| • | more than 1,000 Bell, Virgin Plus, Lucky Mobile and The Source retail locations |

| • | national retailers such as Best Buy, Walmart, Loblaws and Glentel’s WIRELESSWAVE, Tbooth wireless and WIRELESS etc., as well as a network of regional and independent retailers in all regions |

| • | call centre representatives |

| • | our websites, including bell.ca, virginplus.ca, luckymobile.ca and thesource.ca |

| • | door-to-door sales representatives. |

On January 31, 2023, Bell and Staples Canada ULC (Staples) announced a multi-year exclusive agreement to sell Bell, Virgin Plus and Lucky Mobile wireless and wireline services through Staples stores across Canada for consumers and small businesses, starting in the first half of 2023. In addition, Bell and Staples will partner to sell Bell wireless and wireline services direct to medium-sized businesses through the Staples Professional sales team, backed by Bell’s advanced communications expertise.

We also offer eligible customers the convenience of One Bill for Internet, TV, home phone, wireless and smart home services.

For small and medium-sized business customers, our small and medium business (SMB) team offers a wide range of wireline and wireless services, including Business Fibe Internet, Bell Total Connect, Business Phone and TV, and IoT solutions, along with many other communications solutions, all designed for companies. All solutions are sold through dedicated call centre representatives and our bell.ca website, as well as our retail network and door-to-door sales representatives.

Communications solutions for large enterprise customers, including since 2021 our wireless services, are delivered by our business markets team, and our products and services are sold through dedicated sales representatives, certified resellers and competitive bids. Prior to 2021, our wireless products and services were delivered to these business customers through the same channels as those previously described for services to residential customers and were also served by our nationwide sales team responsible for the sale of wireless products and services to business customers, as well as the execution of sales contracts. By combining products and services, including professional services, into fully managed, end-to-end information and technology solutions, we have been successful in providing large enterprise customers with complex communications products and services. We continue to differentiate ourselves in the marketplace by enhancing our customer service levels and offering solutions designed to provide superior service, performance, availability and security. We deliver expertise in key solution areas, including Internet, private networks and broadcasts, voice and unified communications, customer contact centre, security solutions, cloud solutions, IoT and MEC.

| BCE INC. 2022 ANNUAL INFORMATION FORM | 11 |

Table of Contents

3 Description of our business

Our wholesale business communications products and services are delivered by our wholesale team. They are sold through our dedicated sales representatives, web portals and call centres.

Restrictive measures taken by Canadian governments to combat the COVID-19 pandemic included the temporary closure of non-essential businesses, including most locations in our retail distribution channels. While the subsequent lifting of these measures allowed the reopening of our retail distribution channels and the elimination of in-store COVID-19 restrictions by the second half of 2022, traffic to our retail locations did not return to pre-pandemic levels. In response to the COVID-19 pandemic, we enhanced online and phone sales and support, equipped team members to work from home, retrained thousands of team members as service agents and introduced innovative remote installation practices. We also encouraged customers to take advantage of MyBell online and mobile self-serve options and launched enhanced online and appointment-based sales options.

Bell Media

Bell Media’s TV and OOH advertising customer base is comprised primarily of large advertising agencies, which place advertisements with Bell Media on behalf of their customers. Bell Media also has contracts with a variety of broadcasting distribution undertakings (BDUs), under

which monthly subscription fees for specialty TV and pay TV are earned. Bell Media’s radio broadcast customer base is comprised of both advertising agencies and businesses in local markets.

Bell Media’s conventional TV networks are delivered to Canadians through over-the-air broadcast transmission and through distribution by BDUs. Bell Media’s specialty TV, pay TV channels and streaming services are delivered through distribution arrangements with BDUs, and its radio programming is distributed through over-the-air transmission. In addition to these primary distribution channels, Bell Media also distributes its video and radio programming through a variety of non-traditional means, such as mobile and Internet streaming (iHeartRadio). Crave is available through participating TV providers across Canada, which provide the added opportunity to access the Crave linear channels on traditional set-top boxes, as well as via on-demand channels, through the Crave app and online at Crave.ca. Crave, TSN and RDS are also available directly via the Internet through each brand’s official website and app. Crave, TSN and RDS can be streamed on the web and through partner platforms such as iOS and Android mobile devices, Apple TV, Android TV, Amazon Fire TV, Bell Streamer, Chromecast, Roku, Smart TVs, Sony PlayStation and Xbox One. Finally, Bell Media’s OOH business delivers its services through an inventory of OOH faces and street furniture equipment in key urban cities across the country.

| 3.5 | Transformation of our networks, systems and processes |

We are transforming our networks, systems and processes with three main objectives: (a) to become more agile in our service delivery and operations, including self-serve and instant-on capabilities for our customers; (b) to ensure best quality and best customer experience; and (c) to develop a new network infrastructure that enables a competitive cost structure with rapidly growing capacity needs, and enabling new revenue opportunities. We are leveraging new technologies, such as software-defined networks, big data and AI/machine learning, and cloud technologies, focusing primarily on automating our processes. These technologies offer unprecedented levels of flexibility, automation and

elastic capacity, enabling 5G, IoT, enhanced Internet, communication and video services, as well as the next generation of enterprise cloud applications, which all depend heavily on these capabilities. In 2022, we announced significant milestones in our partnerships with AWS and Google Cloud, building towards the objective of accelerating our transformation to a hybrid cloud environment. These various transformation initiatives have produced tangible business benefits in multiple technology domains, resulting in increased agility in development and operations while reducing costs.

| 3.6 | Networks |

The telecommunications industry is evolving rapidly as it continues to move from multiple service-specific networks to Internet protocol (IP)-based integrated communications networks that can carry voice, data and video traffic. We continue to work with key vendor partners to expand our national multi-service IP-enabled networks.

Our communications networks provide wireless and wireline voice, data and video services to customers across Canada. Our infrastructure includes:

| • | national transport networks for voice, data and video traffic, including Internet traffic |

| • | urban and rural access networks and infrastructure for delivering services to customers |

| • | national wireless networks that provide voice, data and video services |

Wireless

To provide wireless connectivity, we have deployed and operate a number of nationwide wireless broadband networks compatible with global standards that deliver high-quality and reliable voice and high-speed data services. With our high-speed data network, we are able to offer Canadian consumers a broad range of choice in wireless smartphones, as well as touch screen tablets, IoT devices and other

devices designed for data services such as video and audio streaming, IoT communications, e-mail, messaging, Internet access and social networking. We also support international roaming to over 230 outbound destinations, with 209 of them supporting 4G LTE and 63 supporting 5G.

HSPA+ network

Our wireless HSPA+ network offered high-speed mobile access to 99% of Canada’s population at December 31, 2022, covering thousands of cities and towns in both urban and rural locations. The HSPA+ network supports global roaming, as well as a wide range of smartphones, data cards, universal serial bus (USB) sticks, tablets and other leading-edge mobile devices. The vast majority of the site connectivity for the HSPA+ network was built with high-speed fibre and an all-IP architecture for enhanced reliability.

4G LTE network

With Bell’s 4G LTE wireless network coverage, customers have data access speeds similar to those of broadband connections and significantly faster than our HSPA+ network, making it easier for users to download applications, stream high-definition videos and music, play online games, or videoconference and chat with virtually no delays or buffering. The HSPA+ and LTE networks work together such that most Bell LTE devices support both networks.

| 12 |

BCE INC. 2022 ANNUAL INFORMATION FORM |

Table of Contents

3 Description of our business

Our LTE wireless network reached more than 99% of Canada’s population coast-to-coast at December 31, 2022 with theoretical peak download speeds of up to 150 Mbps, with expected average download speeds of 18 to 40 Mbps. LTE currently accounts for 81% of our total wireless data traffic.

LTE-A network

With Dual-band LTE-A technology, Bell generally delivers theoretical peak download speeds of up to 260 Mbps (expected average download speeds of 18 to 74 Mbps). By assigning three radio channels or carriers to one user, we generally deliver, with Tri-band LTE-A technology, theoretical mobile data peak download speeds of up to 335 Mbps (expected average download speeds of 25 to 100 Mbps). With the addition of multiple-input and multiple-output (MIMO) technologies and quadrature amplitude modulation (QAM), we can deliver in certain areas theoretical peak download speeds of up to 800 Mbps with Dual-band LTE-A technology and 1.2 Gbps with Tri-band LTE-A technology.

Bell’s LTE network is also capable of delivering Quad-band LTE-A service. Quad-band technology leverages four bands of wireless spectrum to boost LTE-A speeds to the gigabit level. In addition to employing a combination of carrier aggregation, Bell also uses 256 QAM and 4X4 MIMO technologies to increase spectrum efficiency and multiply capacity. Bell’s enhanced Gigabit LTE-A network is available in select cities across Canada. Quad-band LTE-A now offers theoretical mobile data peak download speeds of up to 1.5 Gbps in markets across Canada (expected average download speeds of 25 to 325 Mbps).

At December 31, 2022, Bell’s LTE-A network provided service to approximately 96% of the population in Canada. In addition, our Quad-band LTE-A service had expanded to over 60% of Canadians at December 31, 2022.

LTE-M network