UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03723

Fidelity New York Municipal Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

|

Date of fiscal year end: |

January 31 |

|

|

|

|

Date of reporting period: |

July 31, 2022 |

Item 1.

Reports to Stockholders

Contents

|

Revenue Sources (% of Fund's net assets)

|

||

|

Transportation

|

29.8%

|

|

|

Special Tax

|

24.3%

|

|

|

Education

|

16.6%

|

|

|

General Obligations

|

10.7%

|

|

|

Health Care

|

7.3%

|

|

|

Others* (Individually Less Than 5%)

|

11.3%

|

|

|

100.0%

|

||

|

*Includes net other assets

|

||

|

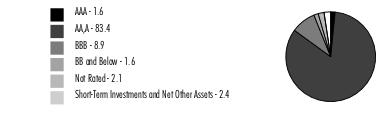

Quality Diversification (% of Fund's net assets)

|

|

|

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

|

|

Municipal Bonds - 97.6%

|

|||

|

Principal

Amount (a)

(000s)

|

Value ($)

(000s)

|

||

|

New York - 91.4%

|

|||

|

Brookhaven Loc Dev. Corp. Series 2020, 4% 11/1/45

|

1,000

|

981

|

|

|

Buffalo and Erie County Indl. Land Rev. (Catholic Health Sys., Inc. Proj.) Series 2015:

|

|||

|

5% 7/1/24

|

600

|

617

|

|

|

5% 7/1/25

|

590

|

614

|

|

|

5% 7/1/26

|

450

|

467

|

|

|

5% 7/1/27

|

600

|

621

|

|

|

5% 7/1/28

|

360

|

371

|

|

|

5% 7/1/29

|

300

|

309

|

|

|

5% 7/1/30

|

575

|

590

|

|

|

5% 7/1/40

|

1,000

|

1,010

|

|

|

5.25% 7/1/35

|

1,000

|

1,027

|

|

|

Buffalo Muni. Wtr. Fin. Auth. Series 2015 A, 5% 7/1/29

|

500

|

541

|

|

|

Dorm. Auth. New York Univ. Rev.:

|

|||

|

(Fordham Univ. Proj.) Series 2017:

|

|||

|

5% 7/1/30

|

625

|

689

|

|

|

5% 7/1/32

|

1,500

|

1,644

|

|

|

(Orange Reg'l. Med. Ctr. Proj.) Series 2017, 5% 12/1/28 (b)

|

4,000

|

4,327

|

|

|

(St Johns Univ., NY. Proj.) Series 2017 A:

|

|||

|

5% 7/1/28

|

750

|

831

|

|

|

5% 7/1/30

|

1,250

|

1,376

|

|

|

(State Univ. of New York Proj.) Series 2017 A:

|

|||

|

5% 7/1/32

|

1,500

|

1,665

|

|

|

5% 7/1/34

|

3,000

|

3,310

|

|

|

Series 2016 A:

|

|||

|

5% 7/1/41

|

2,500

|

2,615

|

|

|

5% 7/1/46

|

8,000

|

8,304

|

|

|

5% 7/1/50

|

6,280

|

6,497

|

|

|

Series 2017, 5% 12/1/32 (b)

|

4,000

|

4,247

|

|

|

Dutchess County Local Dev. Corp. Rev.:

|

|||

|

(Health Quest Systems, Inc. Proj.) Series 2016 B, 5% 7/1/46

|

9,025

|

9,305

|

|

|

(Marist College Proj.) Series 2015 A:

|

|||

|

5% 7/1/26

|

550

|

591

|

|

|

5% 7/1/27

|

350

|

376

|

|

|

5% 7/1/28

|

500

|

534

|

|

|

5% 7/1/29

|

725

|

773

|

|

|

5% 7/1/31

|

2,610

|

2,772

|

|

|

5% 7/1/32

|

2,660

|

2,821

|

|

|

5% 7/1/33

|

2,770

|

2,931

|

|

|

5% 7/1/34

|

2,935

|

3,099

|

|

|

5% 7/1/35

|

3,000

|

3,164

|

|

|

5% 7/1/36

|

1,000

|

1,052

|

|

|

5% 7/1/40

|

8,500

|

8,867

|

|

|

(The Culinary Institute of America Proj.) Series 2018:

|

|||

|

5% 7/1/26

|

850

|

920

|

|

|

5% 7/1/30

|

1,100

|

1,199

|

|

|

5% 7/1/35

|

855

|

913

|

|

|

(Vassar College Proj.) Series 2017:

|

|||

|

5% 7/1/35

|

1,100

|

1,195

|

|

|

5% 7/1/36

|

1,430

|

1,552

|

|

|

5% 7/1/37

|

1,705

|

1,843

|

|

|

Erie County Fiscal Stability Auth. Series 2017 D:

|

|||

|

5% 9/1/33

|

525

|

590

|

|

|

5% 9/1/34

|

850

|

953

|

|

|

5% 9/1/35

|

1,300

|

1,455

|

|

|

Hempstead Local Dev. Corp. Rev.:

|

|||

|

(Adelphi Univ. Proj.) Series 2021:

|

|||

|

5% 6/1/25

|

400

|

428

|

|

|

5% 6/1/26

|

550

|

600

|

|

|

5% 6/1/28

|

155

|

174

|

|

|

5% 6/1/30

|

200

|

229

|

|

|

5% 6/1/32

|

200

|

230

|

|

|

(Molloy College Proj.) Series 2017:

|

|||

|

5% 7/1/32

|

740

|

791

|

|

|

5% 7/1/33

|

475

|

506

|

|

|

Hudson Yards Infrastructure Corp. New York Rev. Series 2017 A:

|

|||

|

4% 2/15/44

|

2,100

|

2,124

|

|

|

5% 2/15/34

|

6,130

|

6,762

|

|

|

5% 2/15/36

|

4,750

|

5,215

|

|

|

5% 2/15/37

|

2,505

|

2,744

|

|

|

5% 2/15/42

|

14,890

|

16,045

|

|

|

Islip Gen. Oblig. Series 2021 A, 2% 5/1/37

|

1,575

|

1,249

|

|

|

Liberty Dev. Corp. Rev. Series 2005, 5.25% 10/1/35

|

11,440

|

13,362

|

|

|

Long Island Pwr. Auth. Elec. Sys. Rev.:

|

|||

|

Series 2016 B, 5% 9/1/36

|

3,500

|

3,850

|

|

|

Series 2020 A:

|

|||

|

5% 9/1/34

|

1,700

|

1,974

|

|

|

5% 9/1/35

|

1,200

|

1,385

|

|

|

5% 9/1/37

|

500

|

572

|

|

|

5% 9/1/38

|

1,450

|

1,651

|

|

|

Madison County Cap. Resource Corp. Rev. (Colgate Univ. Rfdg. Proj.) Series 2015 A:

|

|||

|

5% 7/1/33

|

1,000

|

1,067

|

|

|

5% 7/1/35

|

1,000

|

1,065

|

|

|

Monroe County Indl. Dev. Agcy. Rev. (Rochester Schools Modernization Proj.):

|

|||

|

Series 2015, 5% 5/1/31

|

1,205

|

1,302

|

|

|

Series 2018:

|

|||

|

5% 5/1/32

|

5,000

|

5,698

|

|

|

5% 5/1/34

|

3,000

|

3,396

|

|

|

Monroe County Indl. Dev. Corp.:

|

|||

|

(Rochester Reg'l. Health Proj.) Series 2020 A, 4% 12/1/46

|

2,500

|

2,292

|

|

|

(St. Anns Cmnty. Proj.) Series 2019, 5% 1/1/50

|

4,430

|

3,941

|

|

|

(The Rochester Gen. Hosp. Proj.) Series 2017:

|

|||

|

5% 12/1/31

|

1,595

|

1,691

|

|

|

5% 12/1/34

|

760

|

800

|

|

|

5% 12/1/35

|

700

|

736

|

|

|

5% 12/1/36

|

700

|

735

|

|

|

(Univ. of Rochester Proj.):

|

|||

|

Series 2015, 5% 7/1/32

|

1,250

|

1,341

|

|

|

Series 2017 A:

|

|||

|

5% 7/1/32

|

1,215

|

1,357

|

|

|

5% 7/1/34

|

1,310

|

1,454

|

|

|

Series 2017 C:

|

|||

|

4% 7/1/32

|

1,680

|

1,765

|

|

|

5% 7/1/31

|

800

|

896

|

|

|

Series 2017 D, 5% 7/1/31

|

825

|

924

|

|

|

MTA Hudson Rail Yards Trust Oblig. Series 2016 A:

|

|||

|

5% 11/15/51

|

3,000

|

3,005

|

|

|

5% 11/15/56

|

9,000

|

9,262

|

|

|

Nassau County Local Econ. Assistance Corp. Series 2014 B, 5% 7/1/27

|

1,000

|

1,046

|

|

|

New Rochelle Series 2020, 2% 2/15/34

|

590

|

502

|

|

|

New York Bridge Auth. Gen. Rev. Series 2021 A, 4% 1/1/51

|

1,085

|

1,092

|

|

|

New York City Edl. Construction Fund Series 2021 B, 5% 4/1/52

|

5,610

|

6,208

|

|

|

New York City Gen. Oblig.:

|

|||

|

Series 2018 F, 5% 4/1/45

|

15,485

|

16,883

|

|

|

Series 2019 D:

|

|||

|

5% 12/1/41

|

4,305

|

4,778

|

|

|

5% 12/1/44

|

9,810

|

10,809

|

|

|

Series 2020 D1, 4% 3/1/44

|

1,475

|

1,484

|

|

|

Series 2021 A1, 4% 8/1/34

|

3,250

|

3,426

|

|

|

Series 2021 F1:

|

|||

|

5% 3/1/43

|

1,500

|

1,681

|

|

|

5% 3/1/50

|

6,475

|

7,213

|

|

|

Series 2022 A1, 5% 8/1/47

|

25,000

|

28,029

|

|

|

Series 2022 D1, 5.25% 5/1/38

|

5,000

|

5,865

|

|

|

Series B:

|

|||

|

5% 10/1/42

|

2,000

|

2,211

|

|

|

5% 10/1/43

|

3,000

|

3,307

|

|

|

New York City Muni. Wtr. Fin. Auth. Wtr. & Swr. Sys. Rev.:

|

|||

|

Series 2017 EE, 5% 6/15/37

|

10,000

|

11,014

|

|

|

Series 2018 CC, 5% 6/15/48

|

7,070

|

7,674

|

|

|

Series 2019 DD 1, 5% 6/15/49

|

6,925

|

7,568

|

|

|

Series 2019 DD, 5.25% 6/15/49

|

4,410

|

4,888

|

|

|

New York City Transitional Fin. Auth. Bldg. Aid Rev.:

|

|||

|

(New York State Gen. Oblig. Proj.) Series 2015 S-1, 5% 7/15/35

|

4,000

|

4,242

|

|

|

Series 2016 S1, 5% 7/15/33

|

2,165

|

2,343

|

|

|

Series 2018 S4, 5.25% 7/15/36

|

8,095

|

9,253

|

|

|

Series 2019 S1, 5% 7/15/43

|

1,715

|

1,896

|

|

|

Series 2022 1A, 3% 7/15/39

|

1,465

|

1,338

|

|

|

New York City Transitional Fin. Auth. Rev.:

|

|||

|

Series 2017 A1, 5% 5/1/34

|

1,065

|

1,163

|

|

|

Series 2017 B, 5% 8/1/34

|

2,640

|

2,896

|

|

|

Series 2017 E-1, 5% 2/1/34

|

4,500

|

4,975

|

|

|

Series 2017 F:

|

|||

|

5% 5/1/34

|

7,000

|

7,770

|

|

|

5% 5/1/35

|

11,795

|

13,063

|

|

|

5% 5/1/38

|

5,000

|

5,504

|

|

|

Series 2018 A2, 5% 8/1/39

|

5,000

|

5,513

|

|

|

Series 2018 B-1, 5% 8/1/34

|

3,000

|

3,344

|

|

|

Series 2018 C2, 5% 5/1/37

|

4,690

|

5,213

|

|

|

Series 2021 B1, 4% 8/1/38

|

1,340

|

1,385

|

|

|

Series 2021 F1, 4% 11/1/38

|

1,500

|

1,549

|

|

|

Series C1:

|

|||

|

4% 5/1/42

|

5,000

|

5,091

|

|

|

4% 5/1/47

|

1,000

|

1,009

|

|

|

New York Convention Ctr. Dev. Corp. Rev.:

|

|||

|

Series 2015:

|

|||

|

5% 11/15/29

|

5,000

|

5,401

|

|

|

5% 11/15/30

|

2,000

|

2,157

|

|

|

5% 11/15/33

|

9,115

|

9,742

|

|

|

5% 11/15/34

|

3,000

|

3,201

|

|

|

5% 11/15/40

|

9,990

|

10,564

|

|

|

Series 2016 A, 5% 11/15/46

|

13,450

|

14,233

|

|

|

Series 2016, 0% 11/15/38

|

1,275

|

657

|

|

|

New York Dorm. Auth. Rev.:

|

|||

|

Series 2015 A:

|

|||

|

5% 7/1/28

|

5,000

|

5,343

|

|

|

5% 7/1/29

|

5,000

|

5,330

|

|

|

5% 5/1/30

|

3,450

|

3,681

|

|

|

5% 7/1/30

|

5,000

|

5,311

|

|

|

5% 5/1/31

|

11,000

|

11,705

|

|

|

5% 7/1/31

|

15,000

|

15,899

|

|

|

5% 10/1/31

|

1,595

|

1,745

|

|

|

5% 10/1/32

|

1,550

|

1,695

|

|

|

Series 2015 B:

|

|||

|

5% 10/1/33

|

1,010

|

1,101

|

|

|

5% 10/1/34

|

1,070

|

1,166

|

|

|

Series 2015:

|

|||

|

5% 12/1/23 (b)

|

700

|

726

|

|

|

5% 12/1/24 (b)

|

600

|

635

|

|

|

5% 12/1/27 (b)

|

1,200

|

1,271

|

|

|

Series 2016 A:

|

|||

|

5% 7/1/31

|

1,200

|

1,298

|

|

|

5% 7/1/31

|

600

|

669

|

|

|

5% 7/1/32

|

800

|

891

|

|

|

5% 7/1/33

|

800

|

861

|

|

|

5% 7/1/34

|

650

|

698

|

|

|

5% 7/1/35

|

500

|

536

|

|

|

5% 7/1/41

|

1,000

|

1,066

|

|

|

Series 2016 E, 5% 10/1/31

|

1,945

|

2,155

|

|

|

Series 2019 A:

|

|||

|

4% 7/1/40

|

1,000

|

898

|

|

|

4% 7/1/45

|

3,750

|

3,238

|

|

|

5% 7/1/26

|

545

|

572

|

|

|

5% 7/1/27

|

390

|

412

|

|

|

5% 7/1/28

|

465

|

491

|

|

|

5% 7/1/29

|

750

|

793

|

|

|

5% 7/1/30

|

1,475

|

1,554

|

|

|

5% 7/1/32

|

1,540

|

1,598

|

|

|

5% 7/1/33

|

5,800

|

6,271

|

|

|

5% 7/1/34

|

1,300

|

1,339

|

|

|

5% 7/1/35

|

600

|

616

|

|

|

5% 7/1/36

|

500

|

513

|

|

|

5% 7/1/38

|

3,440

|

3,850

|

|

|

5% 7/1/41

|

1,345

|

1,364

|

|

|

5% 7/1/42

|

8,500

|

9,414

|

|

|

Series 2019 B, 5% 7/1/50

|

3,000

|

3,318

|

|

|

Series 2020 A:

|

|||

|

4% 9/1/50

|

6,420

|

5,729

|

|

|

4% 7/1/53

|

5,805

|

5,696

|

|

|

5% 7/1/40

|

1,265

|

1,418

|

|

|

Series 2021 A:

|

|||

|

3% 7/1/41

|

1,000

|

880

|

|

|

4% 7/1/48

|

4,000

|

3,926

|

|

|

5% 7/1/46

|

1,025

|

1,086

|

|

|

5% 7/1/51

|

10,000

|

11,209

|

|

|

5% 7/1/51

|

3,040

|

3,204

|

|

|

Series 2022 A:

|

|||

|

4% 7/1/49

|

2,500

|

2,424

|

|

|

5% 7/1/35

|

1,425

|

1,570

|

|

|

5% 7/1/36

|

1,495

|

1,639

|

|

|

5% 7/1/37

|

785

|

858

|

|

|

5% 7/15/37

|

6,500

|

6,975

|

|

|

5% 7/1/38

|

500

|

545

|

|

|

5% 7/1/39

|

865

|

940

|

|

|

5% 7/1/40

|

915

|

991

|

|

|

5% 7/1/41

|

830

|

897

|

|

|

5% 7/1/42

|

1,005

|

1,085

|

|

|

Series 2022:

|

|||

|

4% 7/1/46

|

4,625

|

4,651

|

|

|

5% 7/1/35

|

1,095

|

1,169

|

|

|

5% 7/1/47

|

5,625

|

5,828

|

|

|

5% 7/1/52

|

4,675

|

5,190

|

|

|

New York Dorm. Auth. Revs. (New York Univ. Proj.) Series 2001 1, 5.5% 7/1/40 (AMBAC Insured)

|

3,000

|

3,785

|

|

|

New York Dorm. Auth. Sales Tax Rev.:

|

|||

|

Series 2018 A:

|

|||

|

5% 3/15/42

|

9,940

|

10,944

|

|

|

5% 3/15/43

|

9,940

|

10,924

|

|

|

Series 2018 C:

|

|||

|

5% 3/15/35

|

18,870

|

21,052

|

|

|

5% 3/15/38

|

7,025

|

7,788

|

|

|

5% 3/15/43

|

6,185

|

6,797

|

|

|

Series 2018 E, 5% 3/15/44

|

5,000

|

5,526

|

|

|

Series 2018, 5% 3/15/48

|

19,700

|

21,683

|

|

|

New York Envir. Facilities Corp. Clean Wtr. & Drinking Wtr.:

|

|||

|

(New York City Muni. Wtr. Fin. Auth. Proj.) Series 2018 B, 5% 6/15/43

|

1,000

|

1,114

|

|

|

Series 2017 E, 5% 6/15/42

|

5,000

|

5,471

|

|

|

New York Liberty Dev. Corp. (Bank of America Tower at One Bryant Park Proj.) Series 2019 1, 2.45% 9/15/69

|

8,000

|

7,607

|

|

|

New York Metropolitan Trans. Auth. Dedicated Tax Fund Rev.:

|

|||

|

Series 2016 B1, 5% 11/15/36

|

5,000

|

5,398

|

|

|

Series 2016 B2, 5% 11/15/37

|

12,700

|

13,685

|

|

|

New York Metropolitan Trans. Auth. Rev.:

|

|||

|

Series 2013 A, 5% 11/15/43

|

2,535

|

2,564

|

|

|

Series 2013 E, 5% 11/15/43

|

15,375

|

15,630

|

|

|

Series 2014 A1, 5% 11/15/44

|

8,000

|

8,131

|

|

|

Series 2014 B, 5.25% 11/15/44

|

6,300

|

6,484

|

|

|

Series 2014 D, 5.25% 11/15/44

|

5,000

|

5,175

|

|

|

Series 2015 A1:

|

|||

|

5% 11/15/40

|

5,000

|

5,166

|

|

|

5% 11/15/45

|

1,200

|

1,232

|

|

|

Series 2015 B, 5% 11/15/29

|

2,125

|

2,238

|

|

|

Series 2015 C, 5% 11/15/35

|

600

|

627

|

|

|

Series 2016 A1, 5% 11/15/46

|

32,890

|

34,036

|

|

|

Series 2016 B:

|

|||

|

4% 11/15/36

|

1,825

|

1,832

|

|

|

5% 11/15/34

|

1,490

|

1,574

|

|

|

5% 11/15/35

|

8,375

|

8,831

|

|

|

Series 2016 C1:

|

|||

|

5% 11/15/31

|

1,175

|

1,252

|

|

|

5% 11/15/32

|

730

|

774

|

|

|

Series 2016 D:

|

|||

|

5% 11/15/30

|

1,805

|

1,931

|

|

|

5% 11/15/31

|

665

|

709

|

|

|

5.25% 11/15/31

|

500

|

540

|

|

|

Series 2017 A1, 5% 11/15/51

|

1,500

|

1,579

|

|

|

Series 2017 C-2:

|

|||

|

0% 11/15/29

|

15,820

|

12,656

|

|

|

0% 11/15/32

|

18,000

|

12,606

|

|

|

Series 2017 C1:

|

|||

|

5% 11/15/27

|

620

|

683

|

|

|

5% 11/15/30

|

1,015

|

1,104

|

|

|

Series 2017 D:

|

|||

|

5% 11/15/28

|

2,125

|

2,334

|

|

|

5% 11/15/30

|

5,000

|

5,439

|

|

|

5% 11/15/32

|

925

|

997

|

|

|

Series 2020 C1, 5% 11/15/50

|

1,310

|

1,375

|

|

|

New York State Dorm. Auth.:

|

|||

|

Series 2017 A:

|

|||

|

5% 2/15/37

|

5,395

|

5,919

|

|

|

5% 2/15/37 (Pre-Refunded to 2/15/27 @ 100)

|

5

|

6

|

|

|

Series 2019 A, 5% 3/15/46

|

7,500

|

8,210

|

|

|

Series 2020 A, 3% 3/15/38

|

985

|

901

|

|

|

Series 2021 A, 5% 3/15/49

|

6,500

|

7,200

|

|

|

Series 2022 A:

|

|||

|

4% 3/15/39

|

1,000

|

1,024

|

|

|

5% 3/15/41

|

5,000

|

5,667

|

|

|

New York State Envir. Facilities Corp. Rev. Series 2019 A, 5% 2/15/49

|

12,690

|

14,239

|

|

|

New York State Mtg. Agcy. Homeowner Mtg.:

|

|||

|

Series 2021 232, 5% 10/1/28 (c)

|

1,680

|

1,881

|

|

|

Series 221, 3.5% 10/1/32 (c)

|

5,275

|

5,328

|

|

|

Series 223, 3.5% 4/1/49

|

2,270

|

2,297

|

|

|

Series 226, 3.5% 10/1/50 (c)

|

12,035

|

12,159

|

|

|

New York State Urban Dev. Corp.:

|

|||

|

Series 2020 A, 5% 3/15/42

|

2,175

|

2,428

|

|

|

Series 2020 C:

|

|||

|

4% 3/15/39

|

1,000

|

1,015

|

|

|

4% 3/15/49

|

3,165

|

3,180

|

|

|

5% 3/15/47

|

7,820

|

8,675

|

|

|

New York Thruway Auth. Gen. Rev.:

|

|||

|

Series 2016 A:

|

|||

|

5% 1/1/34

|

3,000

|

3,239

|

|

|

5% 1/1/35

|

6,455

|

6,962

|

|

|

5% 1/1/41

|

9,320

|

9,985

|

|

|

5% 1/1/46

|

7,285

|

7,744

|

|

|

5% 1/1/51

|

23,625

|

24,987

|

|

|

Series 2019 B, 4% 1/1/45

|

5,000

|

5,017

|

|

|

New York Trans. Dev. Corp.:

|

|||

|

(Delta Air Lines, Inc. Laguardia Arpt. Terminals C&D Redev. Proj.) Series 2018, 5% 1/1/33 (c)

|

5,000

|

5,207

|

|

|

(Laguardia Arpt. Term. B Redev. Proj.) Series 2016 A, 5% 7/1/34 (c)

|

4,000

|

4,149

|

|

|

(Term. 4 JFK Int'l. Arpt. Proj.):

|

|||

|

Series 2020 A:

|

|||

|

4% 12/1/38 (c)

|

600

|

577

|

|

|

4% 12/1/41 (c)

|

1,700

|

1,601

|

|

|

5% 12/1/31 (c)

|

1,200

|

1,317

|

|

|

5% 12/1/33 (c)

|

1,950

|

2,105

|

|

|

5% 12/1/35 (c)

|

1,540

|

1,648

|

|

|

Series 2020 C:

|

|||

|

5% 12/1/29

|

1,300

|

1,453

|

|

|

5% 12/1/30

|

500

|

567

|

|

|

(Term. 4 John F. Kennedy Int'l. Arpt. Proj.) Series 2022:

|

|||

|

5% 12/1/35 (c)

|

8,465

|

9,192

|

|

|

5% 12/1/36 (c)

|

7,500

|

8,121

|

|

|

Series 2016 A, 5.25% 1/1/50 (c)

|

9,095

|

9,398

|

|

|

New York Urban Dev. Corp. Rev.:

|

|||

|

(New York State Gen. Oblig. Proj.) Series 2017 A, 5% 3/15/34

|

5,000

|

5,524

|

|

|

Series 2015 A, 5% 3/15/45

|

11,970

|

12,625

|

|

|

Series 2019 A, 5% 3/15/43

|

10,830

|

11,983

|

|

|

Niagara Area Dev. Corp. Rev. (Catholic Health Sys., Inc. Proj.) Series 2022, 5% 7/1/52

|

3,000

|

2,941

|

|

|

Niagara Frontier Trans. Auth. Arpt. Rev. Series 2019 A:

|

|||

|

5% 4/1/29 (c)

|

350

|

389

|

|

|

5% 4/1/30 (c)

|

750

|

828

|

|

|

5% 4/1/32 (c)

|

900

|

982

|

|

|

5% 4/1/33 (c)

|

650

|

707

|

|

|

5% 4/1/34 (c)

|

1,765

|

1,912

|

|

|

5% 4/1/36 (c)

|

1,150

|

1,240

|

|

|

5% 4/1/38 (c)

|

750

|

802

|

|

|

Oneida County Local Dev. Corp. Rev.:

|

|||

|

(Mohawk Valley Health Sys. Proj.) Series 2019 A:

|

|||

|

4% 12/1/37 (Assured Guaranty Muni. Corp. Insured)

|

1,000

|

1,034

|

|

|

4% 12/1/38 (Assured Guaranty Muni. Corp. Insured)

|

1,000

|

1,033

|

|

|

4% 12/1/49 (Assured Guaranty Muni. Corp. Insured)

|

11,305

|

11,398

|

|

|

5% 12/1/30 (Assured Guaranty Muni. Corp. Insured)

|

755

|

868

|

|

|

5% 12/1/31 (Assured Guaranty Muni. Corp. Insured)

|

545

|

624

|

|

|

(Utica College Proj.) Series 2019:

|

|||

|

4% 7/1/39

|

2,625

|

2,442

|

|

|

5% 7/1/49

|

3,250

|

3,317

|

|

|

Onondaga Civic Dev. Corp.:

|

|||

|

(Le Moyne College Proj.) Series 2020 B:

|

|||

|

4% 7/1/36

|

425

|

426

|

|

|

4% 7/1/37

|

275

|

274

|

|

|

4% 7/1/38

|

255

|

253

|

|

|

4% 7/1/39

|

325

|

321

|

|

|

4% 7/1/40

|

300

|

295

|

|

|

5% 7/1/23

|

210

|

215

|

|

|

5% 7/1/24

|

215

|

225

|

|

|

5% 7/1/25

|

235

|

251

|

|

|

5% 7/1/27

|

815

|

897

|

|

|

5% 7/1/28

|

855

|

949

|

|

|

5% 7/1/31

|

340

|

378

|

|

|

5% 7/1/32

|

265

|

292

|

|

|

5% 7/1/33

|

300

|

329

|

|

|

5% 7/1/34

|

300

|

327

|

|

|

5% 7/1/35

|

400

|

436

|

|

|

(Syracuse Univ. Proj.) Series 2020 A, 5% 12/1/35

|

1,110

|

1,285

|

|

|

Onondaga County Trust for Cultural Resources Rev. Series 2019, 4% 12/1/47

|

10,000

|

9,991

|

|

|

Port Auth. of New York & New Jersey:

|

|||

|

Series 2019 218, 5% 11/1/36 (c)

|

4,820

|

5,312

|

|

|

Series 2021 227, 2% 10/1/34 (c)

|

4,380

|

3,612

|

|

|

Series 218, 5% 11/1/30 (c)

|

1,130

|

1,287

|

|

|

Series 221:

|

|||

|

4% 7/15/38 (c)

|

1,000

|

1,014

|

|

|

4% 7/15/40 (c)

|

2,000

|

2,020

|

|

|

5% 7/15/32 (c)

|

1,500

|

1,701

|

|

|

Saratoga County Cap. Resources Rev. (Skidmore College Proj.) Series 2020 A:

|

|||

|

4% 7/1/50

|

1,500

|

1,484

|

|

|

5% 7/1/45

|

1,625

|

1,794

|

|

|

Schenectady County Cap. Resources Corp. Rev. (Union College Proj.) Series 2017, 5% 1/1/40

|

2,600

|

2,740

|

|

|

Suffolk County Econ. Dev. Corp. Rev. Series 2021, 5.375% 11/1/54 (b)

|

3,500

|

3,148

|

|

|

Suffolk Tobacco Asset Securitization Corp. Series 2021 A2, 4% 6/1/50

|

3,000

|

2,836

|

|

|

Syracuse Reg'l. Arpt. Auth. Series 2021:

|

|||

|

4% 7/1/35 (c)

|

500

|

501

|

|

|

4% 7/1/36 (c)

|

500

|

500

|

|

|

5% 7/1/28 (c)

|

1,640

|

1,818

|

|

|

5% 7/1/29 (c)

|

1,500

|

1,673

|

|

|

5% 7/1/30 (c)

|

1,500

|

1,680

|

|

|

5% 7/1/31 (c)

|

1,060

|

1,189

|

|

|

5% 7/1/32 (c)

|

1,145

|

1,274

|

|

|

5% 7/1/33 (c)

|

755

|

833

|

|

|

5% 7/1/34 (c)

|

815

|

892

|

|

|

Tobacco Settlement Asset Securitization Corp. Series 2017 A, 5% 6/1/30

|

2,525

|

2,709

|

|

|

Triborough Bridge & Tunnel Auth. Series 2021 A1, 5% 5/15/51

|

5,435

|

6,084

|

|

|

Triborough Bridge & Tunnel Auth. Revs.:

|

|||

|

Series 2015 A, 5.25% 11/15/45

|

10,820

|

11,640

|

|

|

Series 2017 B, 5% 11/15/36

|

5,000

|

5,534

|

|

|

Series 2018 D, 4% 11/15/37

|

3,000

|

3,092

|

|

|

Series 2019 A, 5% 11/15/49

|

10,000

|

11,001

|

|

|

Series 2020 A, 5% 11/15/54

|

1,015

|

1,109

|

|

|

Series 2021 A:

|

|||

|

5% 11/15/51

|

1,990

|

2,182

|

|

|

5% 11/15/56

|

6,000

|

6,553

|

|

|

Troy Cap. Resource Corp. Rev. (Rensselaer Polytechnic Institute Proj.):

|

|||

|

Series 2015:

|

|||

|

5% 8/1/27

|

1,600

|

1,727

|

|

|

5% 8/1/28

|

1,565

|

1,681

|

|

|

5% 8/1/32

|

1,000

|

1,063

|

|

|

Series 2020 A, 5% 9/1/36

|

1,500

|

1,655

|

|

|

Western Nassau County Wtr. Auth. Series 2015 A, 5% 4/1/30

|

350

|

377

|

|

|

Yonkers Gen. Oblig.:

|

|||

|

Series 2019 A:

|

|||

|

4% 5/1/34 (Build America Mutual Assurance Insured)

|

1,500

|

1,599

|

|

|

5% 5/1/31 (Build America Mutual Assurance Insured)

|

1,000

|

1,161

|

|

|

5% 5/1/33 (Build America Mutual Assurance Insured)

|

1,000

|

1,148

|

|

|

Series 2021 B, 4% 2/15/37

|

1,200

|

1,241

|

|

|

TOTAL NEW YORK

|

1,228,617

|

||

|

New York And New Jersey - 5.6%

|

|||

|

Port Auth. of New York & New Jersey:

|

|||

|

85th Series, 5.375% 3/1/28

|

5,155

|

5,678

|

|

|

Series 193, 5% 10/15/28 (c)

|

2,015

|

2,155

|

|

|

Series 202, 5% 10/15/36 (c)

|

5,455

|

5,800

|

|

|

Series 2021 224, 5% 7/15/56

|

6,795

|

7,448

|

|

|

Series 206, 5% 11/15/47 (c)

|

2,000

|

2,090

|

|

|

Series 214:

|

|||

|

4% 9/1/37 (c)

|

4,000

|

4,064

|

|

|

4% 9/1/39 (c)

|

1,920

|

1,939

|

|

|

4% 9/1/43 (c)

|

6,500

|

6,525

|

|

|

5% 9/1/33 (c)

|

2,005

|

2,239

|

|

|

Series 218:

|

|||

|

4% 11/1/47 (c)

|

11,280

|

11,165

|

|

|

5% 11/1/44 (c)

|

5,080

|

5,483

|

|

|

Series 221:

|

|||

|

4% 7/15/36 (c)

|

3,000

|

3,066

|

|

|

4% 7/15/45 (c)

|

8,000

|

8,001

|

|

|

Series 223, 5% 7/15/56 (c)

|

8,850

|

9,470

|

|

|

TOTAL NEW YORK AND NEW JERSEY

|

75,123

|

||

|

Non-State Specific - 0.1%

|

|||

|

Port Auth. of New York & New Jersey Series 217, 5% 11/1/44

|

1,000

|

1,103

|

|

|

Puerto Rico - 0.5%

|

|||

|

Puerto Rico Commonwealth Pub. Impt. Gen. Oblig. Series 2021 A1:

|

|||

|

0% 7/1/33

|

3,720

|

2,211

|

|

|

5.625% 7/1/27

|

455

|

493

|

|

|

5.625% 7/1/29

|

1,350

|

1,492

|

|

|

5.75% 7/1/31

|

3,120

|

3,501

|

|

|

TOTAL PUERTO RICO

|

7,697

|

||

|

TOTAL MUNICIPAL BONDS

(Cost $1,356,665)

|

1,312,540

|

||

|

Municipal Notes - 0.8%

|

|||

|

Principal

Amount (a)

(000s)

|

Value ($)

(000s)

|

||

|

New York - 0.8%

|

|||

|

New York City Muni. Wtr. Fin. Auth. Wtr. & Swr. Sys. Rev. Series 2014 AA, 1.91% 8/1/22 (Liquidity Facility TD Banknorth, NA), VRDN (d)

|

3,475

|

3,475

|

|

|

New York Metropolitan Trans. Auth. Rev. Series 2005 D2, 1.86% 8/1/22, LOC Landesbank Hessen-Thuringen, VRDN (d)

|

6,500

|

6,500

|

|

|

TOTAL MUNICIPAL NOTES

(Cost $9,975)

|

9,975

|

||

|

TOTAL INVESTMENT IN SECURITIES - 98.4%

(Cost $1,366,640)

|

1,322,515

|

|

NET OTHER ASSETS (LIABILITIES) - 1.6%

|

21,914

|

|

NET ASSETS - 100.0%

|

1,344,429

|

|

VRDN

|

-

|

VARIABLE RATE DEMAND NOTE (A debt instrument that is payable upon demand, either daily, weekly or monthly)

|

|

(a)

|

Amount is stated in United States dollars unless otherwise noted.

|

|

(b)

|

Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $14,354,000 or 1.1% of net assets.

|

|

(c)

|

Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals.

|

|

(d)

|

Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

|

|

Valuation Inputs at Reporting Date:

|

||||

|

Description

(Amounts in thousands)

|

Total ($)

|

Level 1 ($)

|

Level 2 ($)

|

Level 3 ($)

|

|

Investments in Securities:

|

||||

|

Municipal Securities

|

1,322,515

|

-

|

1,322,515

|

-

|

|

Total Investments in Securities:

|

1,322,515

|

-

|

1,322,515

|

-

|

|

Statement of Assets and Liabilities

|

||||

|

Amounts in thousands (except per-share amounts)

|

July 31, 2022

(Unaudited)

|

|||

|

Assets

|

||||

|

Investment in securities, at value - See accompanying schedule

Unaffiliated issuers (cost $1,366,640):

|

$

|

1,322,515

|

||

|

Cash

|

18,129

|

|||

|

Receivable for fund shares sold

|

290

|

|||

|

Interest receivable

|

13,077

|

|||

|

Other receivables

|

2

|

|||

|

Total assets

|

1,354,013

|

|||

|

Liabilities

|

||||

|

Payable for investments purchased

|

$7,365

|

|||

|

Payable for fund shares redeemed

|

790

|

|||

|

Distributions payable

|

878

|

|||

|

Accrued management fee

|

385

|

|||

|

Distribution and service plan fees payable

|

15

|

|||

|

Other affiliated payables

|

118

|

|||

|

Other payables and accrued expenses

|

33

|

|||

|

Total Liabilities

|

9,584

|

|||

|

Net Assets

|

$

|

1,344,429

|

||

|

Net Assets consist of:

|

||||

|

Paid in capital

|

$

|

1,399,726

|

||

|

Total accumulated earnings (loss)

|

(55,297)

|

|||

|

Net Assets

|

$

|

1,344,429

|

||

|

Net Asset Value and Maximum Offering Price

|

||||

|

Class A :

|

||||

|

Net Asset Value

and redemption price per share ($37,903 ÷ 3,067 shares)

(a)

|

$

|

12.36

|

||

|

Maximum offering price per share (100/96.00 of $12.36)

|

$

|

12.88

|

||

|

Class M :

|

||||

|

Net Asset Value

and redemption price per share ($5,757 ÷ 465 shares)

(a)(b)

|

$

|

12.37

|

||

|

Maximum offering price per share (100/96.00 of $12.37)

|

$

|

12.89

|

||

|

Class C :

|

||||

|

Net Asset Value

and offering price per share ($7,223 ÷ 584 shares)

(a)(b)

|

$

|

12.36

|

||

|

New York Municipal Income :

|

||||

|

Net Asset Value

, offering price and redemption price per share ($1,239,653 ÷ 100,266 shares)

|

$

|

12.36

|

||

|

Class I :

|

||||

|

Net Asset Value

, offering price and redemption price per share ($37,704 ÷ 3,053 shares)

|

$

|

12.35

|

||

|

Class Z :

|

||||

|

Net Asset Value

, offering price and redemption price per share ($16,189 ÷ 1,311 shares)

|

$

|

12.35

|

||

|

(a)Redemption price per

share

is equal to net asset value less any applicable contingent deferred sales charge.

|

||||

|

(b)Corresponding Net Asset Value does not calculate due to rounding of fractional net assets and/or units

|

||||

|

Statement of Operations

|

||||

|

Amounts in thousands

|

Six months ended

July 31, 2022

(Unaudited)

|

|||

|

Investment Income

|

||||

|

Interest

|

$

|

19,696

|

||

|

Expenses

|

||||

|

Management fee

|

$

|

2,490

|

||

|

Transfer agent fees

|

620

|

|||

|

Distribution and service plan fees

|

97

|

|||

|

Accounting fees and expenses

|

137

|

|||

|

Custodian fees and expenses

|

8

|

|||

|

Independent trustees' fees and expenses

|

2

|

|||

|

Registration fees

|

75

|

|||

|

Audit

|

27

|

|||

|

Legal

|

7

|

|||

|

Miscellaneous

|

4

|

|||

|

Total expenses before reductions

|

3,467

|

|||

|

Expense reductions

|

(21)

|

|||

|

Total expenses after reductions

|

3,446

|

|||

|

Net Investment income (loss)

|

16,250

|

|||

|

Realized and Unrealized Gain (Loss)

|

||||

|

Net realized gain (loss) on:

|

||||

|

Investment Securities:

|

||||

|

Unaffiliated issuers

|

(11,242)

|

|||

|

Total net realized gain (loss)

|

(11,242)

|

|||

|

Change in net unrealized appreciation (depreciation) on investment securities

|

(89,305)

|

|||

|

Net gain (loss)

|

(100,547)

|

|||

|

Net increase (decrease) in net assets resulting from operations

|

$

|

(84,297)

|

||

|

Statement of Changes in Net Assets

|

||||

|

Amount in thousands

|

Six months ended

July 31, 2022

(Unaudited)

|

Year ended

January 31, 2022

|

||

|

Increase (Decrease) in Net Assets

|

||||

|

Operations

|

||||

|

Net investment income (loss)

|

$

|

16,250

|

$

|

36,948

|

|

Net realized gain (loss)

|

(11,242)

|

14,375

|

||

|

Change in net unrealized appreciation (depreciation)

|

(89,305)

|

(73,483)

|

||

|

Net increase (decrease) in net assets resulting from operations

|

(84,297)

|

(22,160)

|

||

|

Distributions to shareholders

|

(18,352)

|

(49,564)

|

||

|

Share transactions - net increase (decrease)

|

(257,848)

|

50,433

|

||

|

Total increase (decrease) in net assets

|

(360,497)

|

(21,291)

|

||

|

Net Assets

|

||||

|

Beginning of period

|

1,704,926

|

1,726,217

|

||

|

End of period

|

$

|

1,344,429

|

$

|

1,704,926

|

|

Fidelity Advisor® New York Municipal Income Fund Class A

|

|

Six months ended

(Unaudited) July 31, 2022

|

Years ended January 31, 2022

|

2021

|

2020

|

2019

|

2018

|

|||||||

|

Selected Per-Share Data

|

||||||||||||

|

Net asset value, beginning of period

|

$

|

13.19

|

$

|

13.75

|

$

|

13.71

|

$

|

12.96

|

$

|

13.02

|

$

|

13.07

|

|

Income from Investment Operations

|

||||||||||||

|

Net investment income (loss)

A,B

|

.123

|

.248

|

.270

|

.287

|

.302

|

.321

|

||||||

|

Net realized and unrealized gain (loss)

|

(.813)

|

(.462)

|

.105

|

.804

|

(.017)

|

.063

|

||||||

|

Total from investment operations

|

(.690)

|

(.214)

|

.375

|

1.091

|

.285

|

.384

|

||||||

|

Distributions from net investment income

|

(.123)

|

(.248)

|

(.270)

|

(.287)

|

(.302)

|

(.321)

|

||||||

|

Distributions from net realized gain

|

(.017)

|

(.098)

|

(.065)

|

(.054)

|

(.043)

|

(.113)

|

||||||

|

Total distributions

|

(.140)

|

(.346)

|

(.335)

|

(.341)

|

(.345)

|

(.434)

|

||||||

|

Net asset value, end of period

|

$

|

12.36

|

$

|

13.19

|

$

|

13.75

|

$

|

13.71

|

$

|

12.96

|

$

|

13.02

|

|

Total Return

C,D,E

|

(5.23)%

|

(1.61)%

|

2.81%

|

8.51%

|

2.24%

|

2.95%

|

||||||

|

Ratios to Average Net Assets

B,F,G

|

||||||||||||

|

Expenses before reductions

|

.79%

H

|

.77%

|

.78%

|

.79%

|

.79%

|

.79%

|

||||||

|

Expenses net of fee waivers, if any

|

.79%

H

|

.77%

|

.78%

|

.79%

|

.79%

|

.79%

|

||||||

|

Expenses net of all reductions

|

.79%

H

|

.77%

|

.78%

|

.79%

|

.79%

|

.79%

|

||||||

|

Net investment income (loss)

|

1.99%

H

|

1.81%

|

2.01%

|

2.14%

|

2.35%

|

2.42%

|

||||||

|

Supplemental Data

|

||||||||||||

|

Net assets, end of period (in millions)

|

$

|

38

|

$

|

41

|

$

|

43

|

$

|

42

|

$

|

35

|

$

|

41

|

|

Portfolio turnover rate

I

|

12%

H

|

16%

|

16%

|

15%

|

13%

|

14%

|

|

Fidelity Advisor® New York Municipal Income Fund Class M

|

|

Six months ended

(Unaudited) July 31, 2022

|

Years ended January 31, 2022

|

2021

|

2020

|

2019

|

2018

|

|||||||

|

Selected Per-Share Data

|

||||||||||||

|

Net asset value, beginning of period

|

$

|

13.21

|

$

|

13.76

|

$

|

13.73

|

$

|

12.97

|

$

|

13.03

|

$

|

13.08

|

|

Income from Investment Operations

|

||||||||||||

|

Net investment income (loss)

A,B

|

.127

|

.254

|

.275

|

.293

|

.308

|

.329

|

||||||

|

Net realized and unrealized gain (loss)

|

(.823)

|

(.452)

|

.095

|

.814

|

(.017)

|

.063

|

||||||

|

Total from investment operations

|

(.696)

|

(.198)

|

.370

|

1.107

|

.291

|

.392

|

||||||

|

Distributions from net investment income

|

(.127)

|

(.254)

|

(.275)

|

(.293)

|

(.308)

|

(.329)

|

||||||

|

Distributions from net realized gain

|

(.017)

|

(.098)

|

(.065)

|

(.054)

|

(.043)

|

(.113)

|

||||||

|

Total distributions

|

(.144)

|

(.352)

|

(.340)

|

(.347)

|

(.351)

|

(.442)

|

||||||

|

Net asset value, end of period

|

$

|

12.37

|

$

|

13.21

|

$

|

13.76

|

$

|

13.73

|

$

|

12.97

|

$

|

13.03

|

|

Total Return

C,D,E

|

(5.27)%

|

(1.50)%

|

2.77%

|

8.63%

|

2.29%

|

3.01%

|

||||||

|

Ratios to Average Net Assets

B,F,G

|

||||||||||||

|

Expenses before reductions

|

.73%

H

|

.74%

|

.75%

|

.74%

|

.75%

|

.73%

|

||||||

|

Expenses net of fee waivers, if any

|

.73%

H

|

.73%

|

.75%

|

.74%

|

.74%

|

.73%

|

||||||

|

Expenses net of all reductions

|

.73%

H

|

.73%

|

.75%

|

.74%

|

.74%

|

.73%

|

||||||

|

Net investment income (loss)

|

2.05%

H

|

1.85%

|

2.05%

|

2.18%

|

2.39%

|

2.48%

|

||||||

|

Supplemental Data

|

||||||||||||

|

Net assets, end of period (in millions)

|

$

|

6

|

$

|

6

|

$

|

7

|

$

|

8

|

$

|

7

|

$

|

8

|

|

Portfolio turnover rate

I

|

12%

H

|

16%

|

16%

|

15%

|

13%

|

14%

|

|

Fidelity Advisor® New York Municipal Income Fund Class C

|

|

Six months ended

(Unaudited) July 31, 2022

|

Years ended January 31, 2022

|

2021

|

2020

|

2019

|

2018

|

|||||||

|

Selected Per-Share Data

|

||||||||||||

|

Net asset value, beginning of period

|

$

|

13.19

|

$

|

13.75

|

$

|

13.71

|

$

|

12.96

|

$

|

13.02

|

$

|

13.07

|

|

Income from Investment Operations

|

||||||||||||

|

Net investment income (loss)

A,B

|

.079

|

.148

|

.173

|

.188

|

.207

|

.222

|

||||||

|

Net realized and unrealized gain (loss)

|

(.812)

|

(.461)

|

.105

|

.804

|

(.017)

|

.063

|

||||||

|

Total from investment operations

|

(.733)

|

(.313)

|

.278

|

.992

|

.190

|

.285

|

||||||

|

Distributions from net investment income

|

(.080)

|

(.149)

|

(.173)

|

(.188)

|

(.207)

|

(.222)

|

||||||

|

Distributions from net realized gain

|

(.017)

|

(.098)

|

(.065)

|

(.054)

|

(.043)

|

(.113)

|

||||||

|

Total distributions

|

(.097)

|

(.247)

|

(.238)

|

(.242)

|

(.250)

|

(.335)

|

||||||

|

Net asset value, end of period

|

$

|

12.36

|

$

|

13.19

|

$

|

13.75

|

$

|

13.71

|

$

|

12.96

|

$

|

13.02

|

|

Total Return

C,D,E

|

(5.56)%

|

(2.33)%

|

2.07%

|

7.71%

|

1.49%

|

2.18%

|

||||||

|

Ratios to Average Net Assets

B,F,G

|

||||||||||||

|

Expenses before reductions

|

1.50%

H

|

1.50%

|

1.51%

|

1.53%

|

1.53%

|

1.54%

|

||||||

|

Expenses net of fee waivers, if any

|

1.50%

H

|

1.50%

|

1.51%

|

1.52%

|

1.53%

|

1.54%

|

||||||

|

Expenses net of all reductions

|

1.49%

H

|

1.50%

|

1.51%

|

1.52%

|

1.53%

|

1.54%

|

||||||

|

Net investment income (loss)

|

1.28%

H

|

1.08%

|

1.28%

|

1.40%

|

1.61%

|

1.68%

|

||||||

|

Supplemental Data

|

||||||||||||

|

Net assets, end of period (in millions)

|

$

|

7

|

$

|

9

|

$

|

13

|

$

|

17

|

$

|

23

|

$

|

30

|

|

Portfolio turnover rate

I

|

12%

H

|

16%

|

16%

|

15%

|

13%

|

14%

|

|

Fidelity® New York Municipal Income Fund

|

|

Six months ended

(Unaudited) July 31, 2022

|

Years ended January 31, 2022

|

2021

|

2020

|

2019

|

2018

|

|||||||

|

Selected Per-Share Data

|

||||||||||||

|

Net asset value, beginning of period

|

$

|

13.20

|

$

|

13.75

|

$

|

13.72

|

$

|

12.96

|

$

|

13.03

|

$

|

13.07

|

|

Income from Investment Operations

|

||||||||||||

|

Net investment income (loss)

A,B

|

.143

|

.292

|

.314

|

.331

|

.345

|

.365

|

||||||

|

Net realized and unrealized gain (loss)

|

(.823)

|

(.452)

|

.095

|

.814

|

(.028)

|

.073

|

||||||

|

Total from investment operations

|

(.680)

|

(.160)

|

.409

|

1.145

|

.317

|

.438

|

||||||

|

Distributions from net investment income

|

(.143)

|

(.292)

|

(.314)

|

(.331)

|

(.344)

|

(.365)

|

||||||

|

Distributions from net realized gain

|

(.017)

|

(.098)

|

(.065)

|

(.054)

|

(.043)

|

(.113)

|

||||||

|

Total distributions

|

(.160)

|

(.390)

|

(.379)

|

(.385)

|

(.387)

|

(.478)

|

||||||

|

Net asset value, end of period

|

$

|

12.36

|

$

|

13.20

|

$

|

13.75

|

$

|

13.72

|

$

|

12.96

|

$

|

13.03

|

|

Total Return

C,D

|

(5.16)%

|

(1.22)%

|

3.07%

|

8.94%

|

2.50%

|

3.37%

|

||||||

|

Ratios to Average Net Assets

B,E,F

|

||||||||||||

|

Expenses before reductions

|

.47%

G

|

.46%

|

.46%

|

.46%

|

.46%

|

.46%

|

||||||

|

Expenses net of fee waivers, if any

|

.47%

G

|

.46%

|

.46%

|

.46%

|

.46%

|

.46%

|

||||||

|

Expenses net of all reductions

|

.47%

G

|

.45%

|

.46%

|

.46%

|

.46%

|

.46%

|

||||||

|

Net investment income (loss)

|

2.31%

G

|

2.13%

|

2.34%

|

2.47%

|

2.68%

|

2.76%

|

||||||

|

Supplemental Data

|

||||||||||||

|

Net assets, end of period (in millions)

|

$

|

1,240

|

$

|

1,576

|

$

|

1,600

|

$

|

1,734

|

$

|

1,509

|

$

|

1,606

|

|

Portfolio turnover rate

H

|

12%

G

|

16%

|

16%

|

15%

|

13%

|

14%

|

|

Fidelity Advisor® New York Municipal Income Fund Class I

|

|

Six months ended

(Unaudited) July 31, 2022

|

Years ended January 31, 2022

|

2021

|

2020

|

2019

|

2018

|

|||||||

|

Selected Per-Share Data

|

||||||||||||

|

Net asset value, beginning of period

|

$

|

13.18

|

$

|

13.74

|

$

|

13.70

|

$

|

12.95

|

$

|

13.01

|

$

|

13.06

|

|

Income from Investment Operations

|

||||||||||||

|

Net investment income (loss)

A,B

|

.138

|

.281

|

.303

|

.320

|

.335

|

.353

|

||||||

|

Net realized and unrealized gain (loss)

|

(.813)

|

(.462)

|

.105

|

.805

|

(.017)

|

.063

|

||||||

|

Total from investment operations

|

(.675)

|

(.181)

|

.408

|

1.125

|

.318

|

.416

|

||||||

|

Distributions from net investment income

|

(.138)

|

(.281)

|

(.303)

|

(.321)

|

(.335)

|

(.353)

|

||||||

|

Distributions from net realized gain

|

(.017)

|

(.098)

|

(.065)

|

(.054)

|

(.043)

|

(.113)

|

||||||

|

Total distributions

|

(.155)

|

(.379)

|

(.368)

|

(.375)

|

(.378)

|

(.466)

|

||||||

|

Net asset value, end of period

|

$

|

12.35

|

$

|

13.18

|

$

|

13.74

|

$

|

13.70

|

$

|

12.95

|

$

|

13.01

|

|

Total Return

C,D

|

(5.13)%

|

(1.38)%

|

3.07%

|

8.79%

|

2.51%

|

3.21%

|

||||||

|

Ratios to Average Net Assets

B,E,F

|

||||||||||||

|

Expenses before reductions

|

.55%

G

|

.54%

|

.53%

|

.53%

|

.53%

|

.54%

|

||||||

|

Expenses net of fee waivers, if any

|

.55%

G

|

.53%

|

.53%

|

.53%

|

.53%

|

.54%

|

||||||

|

Expenses net of all reductions

|

.55%

G

|

.53%

|

.53%

|

.53%

|

.53%

|

.54%

|

||||||

|

Net investment income (loss)

|

2.23%

G

|

2.05%

|

2.26%

|

2.39%

|

2.61%

|

2.67%

|

||||||

|

Supplemental Data

|

||||||||||||

|

Net assets, end of period (in millions)

|

$

|

38

|

$

|

52

|

$

|

55

|

$

|

54

|

$

|

39

|

$

|

57

|

|

Portfolio turnover rate

H

|

12%

G

|

16%

|

16%

|

15%

|

13%

|

14%

|

|

Fidelity Advisor® New York Municipal Income Fund Class Z

|

|

Six months ended

(Unaudited) July 31, 2022

|

Years ended January 31, 2022

|

2021

|

2020

|

2019

A

|

||||||

|

Selected Per-Share Data

|

||||||||||

|

Net asset value, beginning of period

|

$

|

13.18

|

$

|

13.74

|

$

|

13.70

|

$

|

12.95

|

$

|

12.76

|

|

Income from Investment Operations

|

||||||||||

|

Net investment income (loss)

B,C

|

.145

|

.295

|

.317

|

.334

|

.117

|

|||||

|

Net realized and unrealized gain (loss)

|

(.813)

|

(.461)

|

.105

|

.804

|

.212

|

|||||

|

Total from investment operations

|

(.668)

|

(.166)

|

.422

|

1.138

|

.329

|

|||||

|

Distributions from net investment income

|

(.145)

|

(.296)

|

(.317)

|

(.334)

|

(.114)

|

|||||

|

Distributions from net realized gain

|

(.017)

|

(.098)

|

(.065)

|

(.054)

|

(.025)

|

|||||

|

Total distributions

|

(.162)

|

(.394)

|

(.382)

|

(.388)

|

(.139)

|

|||||

|

Net asset value, end of period

|

$

|

12.35

|

$

|

13.18

|

$

|

13.74

|

$

|

13.70

|

$

|

12.95

|

|

Total Return

D,E

|

(5.07)%

|

(1.27)%

|

3.17%

|

8.89%

|

2.60%

|

|||||

|

Ratios to Average Net Assets

C,F,G

|

||||||||||

|

Expenses before reductions

|

.44%

H

|

.43%

|

.43%

|

.43%

|

.44%

H

|

|||||

|

Expenses net of fee waivers, if any

|

.44%

H

|

.42%

|

.43%

|

.43%

|

.43%

H

|

|||||

|

Expenses net of all reductions

|

.44%

H

|

.42%

|

.43%

|

.43%

|

.43%

H

|

|||||

|

Net investment income (loss)

|

2.34%

H

|

2.16%

|

2.36%

|

2.49%

|

2.69%

H

|

|||||

|

Supplemental Data

|

||||||||||

|

Net assets, end of period (in millions)

|

$

|

16

|

$

|

20

|

$

|

9

|

$

|

6

|

$

|

2

|

|

Portfolio turnover rate

I

|

12%

H

|

16%

|

16%

|

15%

|

13%

H

|

|

Gross unrealized appreciation

|

$

8,131

|

|

Gross unrealized depreciation

|

(52,250)

|

|

Net unrealized appreciation (depreciation)

|

$

(44,119)

|

|

Tax cost

|

$

1,366,634

|

|

|

Purchases ($)

|

Sales ($)

|

|

Fidelity New York Municipal Income Fund

|

84,288

|

335,259

|

|

|

Distribution Fee

|

Service Fee

|

Total Fees

|

Retained by FDC

|

|

Class A

|

- %

|

.25%

|

$

50

|

$

2

|

|

Class M

|

- %

|

.25%

|

7

|

-

A

|

|

Class C

|

.75%

|

.25%

|

40

|

3

|

|

|

|

|

$

97

|

$

5

|

|

|

Retained by FDC

|

|

Class A

|

$

2

|

|

Class M

|

-

A

|

|

|

$

2

|

|

|

|

|

|

Amount

|

% of Class-Level Average Net Assets

A

|

|

Class A

|

$

29

|

.15

|

|

Class M

|

3

|

.09

|

|

Class C

|

4

|

.10

|

|

New York Municipal Income

|

547

|

.08

|

|

Class I

|

33

|

.16

|

|

Class Z

|

4

|

.05

|

|

|

$

620

|

|

|

|

% of Average Net Assets

|

|

Fidelity New York Municipal Income Fund

|

.02

|

|

|

Purchases ($)

|

Sales ($)

|

Realized Gain (Loss) ($)

|

|

Fidelity New York Municipal Income Fund

|

-

|

2,500

|

-

|

|

|

Amount

|

|

Fidelity New York Municipal Income Fund

|

$

1

|

|

|

Six months ended

July 31, 2022

|

Year ended

January 31, 2022

|

|

Fidelity New York Municipal Income Fund

|

|

|

|

Distributions to shareholders

|

|

|

|

Class A

|

$

441

|

$1,086

|

|

Class M

|

68

|

167

|

|

Class C

|

63

|

193

|

|

New York Municipal Income

|

17,036

|

46,100

|

|

Class I

|

527

|

1,509

|

|

Class Z

|

217

|

509

|

|

Total

|

$

18,352

|

$

49,564

|

|

|

Shares

|

Shares

|

Dollars

|

Dollars

|

|

|

Six months ended July 31, 2022

|

Year ended January 31, 2022

|

Six months ended July 31, 2022

|

Year ended January 31, 2022

|

|

Fidelity New York Municipal Income Fund

|

|

|

|

|

|

Class A

|

|

|

|

|

|

Shares sold

|

159

|

371

|

$

2,004

|

$

5,074

|

|

Reinvestment of distributions

|

31

|

69

|

388

|

945

|

|

Shares redeemed

|

(257)

|

(422)

|

(3,174)

|

(5,769)

|

|

Net increase (decrease)

|

(67)

|

18

|

$

(782)

|

$

250

|

|

Class M

|

|

|

|

|

|

Shares sold

|

8

|

20

|

$

118

|

$

272