nr-202303310000071829December 312023Q1false00000718292023-01-012023-03-3100000718292023-05-01xbrli:shares00000718292023-03-31iso4217:USD00000718292022-12-31iso4217:USDxbrli:shares00000718292022-01-012022-03-310000071829us-gaap:CommonStockMember2021-12-310000071829us-gaap:AdditionalPaidInCapitalMember2021-12-310000071829us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000071829us-gaap:RetainedEarningsMember2021-12-310000071829us-gaap:TreasuryStockCommonMember2021-12-3100000718292021-12-310000071829us-gaap:RetainedEarningsMember2022-01-012022-03-310000071829us-gaap:TreasuryStockCommonMember2022-01-012022-03-310000071829us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310000071829us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310000071829us-gaap:CommonStockMember2022-03-310000071829us-gaap:AdditionalPaidInCapitalMember2022-03-310000071829us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310000071829us-gaap:RetainedEarningsMember2022-03-310000071829us-gaap:TreasuryStockCommonMember2022-03-3100000718292022-03-310000071829us-gaap:CommonStockMember2022-12-310000071829us-gaap:AdditionalPaidInCapitalMember2022-12-310000071829us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000071829us-gaap:RetainedEarningsMember2022-12-310000071829us-gaap:TreasuryStockCommonMember2022-12-310000071829us-gaap:RetainedEarningsMember2023-01-012023-03-310000071829us-gaap:TreasuryStockCommonMember2023-01-012023-03-310000071829us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000071829us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000071829us-gaap:CommonStockMember2023-03-310000071829us-gaap:AdditionalPaidInCapitalMember2023-03-310000071829us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000071829us-gaap:RetainedEarningsMember2023-03-310000071829us-gaap:TreasuryStockCommonMember2023-03-31nr:segment00000718292022-01-012022-12-310000071829nr:FluidsSystemsMember2022-10-012022-12-31nr:business_unit0000071829nr:ShareRepurchaseProgramMember2023-02-280000071829nr:ShareRepurchaseProgramMember2023-03-310000071829nr:ShareRepurchaseProgramMember2023-01-012023-03-310000071829nr:ShareRepurchaseProgramMember2022-01-012022-03-310000071829nr:ShareRepurchaseProgramMemberus-gaap:SubsequentEventMember2023-04-012023-04-300000071829nr:ShareRepurchaseProgramMemberus-gaap:SubsequentEventMember2023-05-020000071829nr:OtherReceivablesMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-03-310000071829nr:OtherReceivablesMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-12-310000071829nr:FluidsSystemsMember2023-03-310000071829nr:FluidsSystemsMember2022-12-310000071829nr:IndustrialSolutionMember2023-03-310000071829nr:IndustrialSolutionMember2022-12-310000071829nr:BlendedDrillingFluidsComponentsMember2023-03-310000071829nr:BlendedDrillingFluidsComponentsMember2022-12-310000071829nr:MatsMember2023-03-310000071829nr:MatsMember2022-12-310000071829us-gaap:RevolvingCreditFacilityMembernr:ABLFacilityMember2023-03-310000071829us-gaap:RevolvingCreditFacilityMembernr:ABLFacilityMember2022-12-310000071829us-gaap:RevolvingCreditFacilityMembernr:TermLoanMember2023-03-310000071829us-gaap:RevolvingCreditFacilityMembernr:TermLoanMember2022-12-310000071829nr:FinancingObligationMember2023-03-310000071829nr:FinancingObligationMember2022-12-310000071829nr:OtherDebtMember2023-03-310000071829nr:OtherDebtMember2022-12-310000071829us-gaap:RevolvingCreditFacilityMembernr:ABLFacilityMember2022-05-310000071829us-gaap:RevolvingCreditFacilityMembernr:ABLFacilityMember2022-05-012022-05-310000071829us-gaap:RevolvingCreditFacilityMembernr:ABLFacilityMember2023-01-012023-03-310000071829us-gaap:RevolvingCreditFacilityMemberus-gaap:FederalFundsEffectiveSwapRateMembernr:ABLFacilityMember2022-05-012022-05-31xbrli:pure0000071829us-gaap:RevolvingCreditFacilityMembernr:ABLFacilityMembernr:BSBYMember2022-05-012022-05-310000071829srt:MinimumMemberus-gaap:RevolvingCreditFacilityMembernr:ABLFacilityMembernr:BSBYMember2022-05-012022-05-310000071829srt:MaximumMemberus-gaap:RevolvingCreditFacilityMembernr:ABLFacilityMembernr:BSBYMember2022-05-012022-05-310000071829us-gaap:BaseRateMembersrt:MinimumMemberus-gaap:RevolvingCreditFacilityMembernr:ABLFacilityMember2022-05-012022-05-310000071829us-gaap:BaseRateMembersrt:MaximumMemberus-gaap:RevolvingCreditFacilityMembernr:ABLFacilityMember2022-05-012022-05-310000071829us-gaap:RevolvingCreditFacilityMembernr:ABLFacilityMembernr:BSBYMember2023-01-012023-03-310000071829us-gaap:BaseRateMemberus-gaap:RevolvingCreditFacilityMembernr:ABLFacilityMember2023-01-012023-03-310000071829us-gaap:SecuredDebtMembernr:TermLoanMembernr:UKSubsidiaryMember2022-04-30iso4217:GBP0000071829us-gaap:RevolvingCreditFacilityMembernr:UKSubsidiaryMember2022-04-300000071829us-gaap:RevolvingCreditFacilityMembernr:UKSubsidiaryMembernr:SONIAMember2022-04-012022-04-300000071829us-gaap:RevolvingCreditFacilityMembernr:UKSubsidiaryMember2023-03-310000071829us-gaap:SecuredDebtMembernr:TermLoanMembernr:UKSubsidiaryMember2022-04-012022-04-3000000718292021-08-012021-08-310000071829nr:FinancingObligationMember2021-08-310000071829us-gaap:ForeignLineOfCreditMember2023-03-310000071829us-gaap:ForeignLineOfCreditMember2022-12-310000071829us-gaap:OperatingSegmentsMembernr:FluidsSystemsMember2023-01-012023-03-310000071829us-gaap:OperatingSegmentsMembernr:FluidsSystemsMember2022-01-012022-03-310000071829nr:IndustrialSolutionMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000071829nr:IndustrialSolutionMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310000071829us-gaap:OperatingSegmentsMembernr:IndustrialBlendingMember2023-01-012023-03-310000071829us-gaap:OperatingSegmentsMembernr:IndustrialBlendingMember2022-01-012022-03-310000071829us-gaap:CorporateNonSegmentMember2023-01-012023-03-310000071829us-gaap:CorporateNonSegmentMember2022-01-012022-03-310000071829nr:ExcalibarMembernr:FluidsSystemsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-01-012023-03-310000071829nr:ExcalibarMembernr:FluidsSystemsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-01-012022-03-310000071829nr:GulfOfMexicoMembernr:FluidsSystemsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-01-012023-03-310000071829nr:GulfOfMexicoMembernr:FluidsSystemsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-01-012022-03-310000071829nr:FluidsSystemsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-01-012023-03-310000071829nr:FluidsSystemsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-01-012022-03-310000071829us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-03-310000071829us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-12-310000071829country:CLus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-03-310000071829nr:FluidsSystemsMember2023-01-012023-03-310000071829nr:FluidsSystemsMember2022-01-012022-03-310000071829country:USnr:FluidsSystemsMember2023-01-012023-03-310000071829country:USnr:FluidsSystemsMember2022-01-012022-03-310000071829country:CAnr:FluidsSystemsMember2023-01-012023-03-310000071829country:CAnr:FluidsSystemsMember2022-01-012022-03-310000071829srt:NorthAmericaMembernr:FluidsSystemsMember2023-01-012023-03-310000071829srt:NorthAmericaMembernr:FluidsSystemsMember2022-01-012022-03-310000071829us-gaap:EMEAMembernr:FluidsSystemsMember2023-01-012023-03-310000071829us-gaap:EMEAMembernr:FluidsSystemsMember2022-01-012022-03-310000071829nr:OtherMembernr:FluidsSystemsMember2023-01-012023-03-310000071829nr:OtherMembernr:FluidsSystemsMember2022-01-012022-03-310000071829nr:FluidsSystemsMembernr:InternationalMember2023-01-012023-03-310000071829nr:FluidsSystemsMembernr:InternationalMember2022-01-012022-03-310000071829nr:IndustrialSolutionMemberus-gaap:ProductMember2023-01-012023-03-310000071829nr:IndustrialSolutionMemberus-gaap:ProductMember2022-01-012022-03-310000071829nr:IndustrialSolutionMembernr:RentalMember2023-01-012023-03-310000071829nr:IndustrialSolutionMembernr:RentalMember2022-01-012022-03-310000071829nr:IndustrialSolutionMemberus-gaap:ServiceMember2023-01-012023-03-310000071829nr:IndustrialSolutionMemberus-gaap:ServiceMember2022-01-012022-03-310000071829nr:IndustrialSolutionMember2023-01-012023-03-310000071829nr:IndustrialSolutionMember2022-01-012022-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number: 001-02960

Newpark Resources, Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | |

| Delaware | 72-1123385 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| 9320 Lakeside Boulevard, | Suite 100 | |

| The Woodlands, | Texas | 77381 |

| (Address of principal executive offices) | (Zip Code) |

(281) 362-6800

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | NR | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☑ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☑

As of May 1, 2023, a total of 85,083,920 shares of common stock, $0.01 par value per share, were outstanding.

NEWPARK RESOURCES, INC.

INDEX TO QUARTERLY REPORT ON FORM 10-Q

FOR THE THREE MONTHS ENDED

MARCH 31, 2023

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, as amended. We also may provide oral or written forward-looking statements in other materials we release to the public. Words such as “will,” “may,” “could,” “would,” “should,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” and similar expressions are intended to identify these forward-looking statements but are not the exclusive means of identifying them. These forward-looking statements reflect the current views of our management as of the filing date of this Quarterly Report on Form 10-Q; however, various risks, uncertainties, contingencies, and other factors, some of which are beyond our control, are difficult to predict and could cause our actual results, performance, or achievements to differ materially from those expressed in, or implied by, these statements.

We assume no obligation to update, amend, or clarify publicly any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by securities laws. In light of these risks, uncertainties, and assumptions, the forward-looking events discussed in this Quarterly Report on Form 10-Q might not occur.

For further information regarding these and other factors, risks, and uncertainties that could cause actual results to differ, we refer you to the risk factors set forth in Item 1A “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022.

PART I FINANCIAL INFORMATION

ITEM 1. Financial Statements

Newpark Resources, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

| (In thousands, except share data) | March 31, 2023 | | December 31, 2022 |

| ASSETS | | | |

| Cash and cash equivalents | $ | 23,618 | | | $ | 23,182 | |

Receivables, net of allowance of $5,000 and $4,817, respectively | 212,694 | | | 242,247 | |

| Inventories | 149,989 | | | 149,571 | |

| Prepaid expenses and other current assets | 9,962 | | | 10,966 | |

| Total current assets | 396,263 | | | 425,966 | |

| | | |

| Property, plant and equipment, net | 194,626 | | | 193,099 | |

| Operating lease assets | 22,605 | | | 23,769 | |

| Goodwill | 47,174 | | | 47,110 | |

| Other intangible assets, net | 19,471 | | | 20,215 | |

| Deferred tax assets | 2,402 | | | 2,275 | |

| Other assets | 2,330 | | | 2,441 | |

| Total assets | $ | 684,871 | | | $ | 714,875 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current debt | $ | 23,158 | | | $ | 22,438 | |

| Accounts payable | 92,600 | | | 93,633 | |

| Accrued liabilities | 37,763 | | | 46,871 | |

| Total current liabilities | 153,521 | | | 162,942 | |

| | | |

| Long-term debt, less current portion | 78,041 | | | 91,677 | |

| Noncurrent operating lease liabilities | 18,859 | | | 19,816 | |

| Deferred tax liabilities | 7,692 | | | 8,121 | |

| Other noncurrent liabilities | 9,529 | | | 9,291 | |

| Total liabilities | 267,642 | | | 291,847 | |

| | | |

| Commitments and contingencies (Note 8) | | | |

| | | |

Common stock, $0.01 par value (200,000,000 shares authorized and 111,456,999 and 111,451,999 shares issued, respectively) | 1,115 | | | 1,115 | |

| Paid-in capital | 643,004 | | | 641,266 | |

| Accumulated other comprehensive loss | (65,187) | | | (67,186) | |

| Retained earnings | 8,109 | | | 2,489 | |

Treasury stock, at cost (25,129,909 and 21,751,232 shares, respectively) | (169,812) | | | (154,656) | |

| Total stockholders’ equity | 417,229 | | | 423,028 | |

| Total liabilities and stockholders’ equity | $ | 684,871 | | | $ | 714,875 | |

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements

Newpark Resources, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

| | | | | | | | | | | | | | | |

| | | | Three Months Ended

March 31, |

| (In thousands, except per share data) | | | | | 2023 | | 2022 |

| Revenues | | | | | $ | 200,030 | | | $ | 176,438 | |

| Cost of revenues | | | | | 164,738 | | | 150,988 | |

| Selling, general and administrative expenses | | | | | 25,410 | | | 24,433 | |

| Other operating (income) loss, net | | | | | (261) | | | 50 | |

| Operating income | | | | | 10,143 | | | 967 | |

| | | | | | | |

| Foreign currency exchange loss | | | | | 319 | | | 64 | |

| Interest expense, net | | | | | 2,089 | | | 1,206 | |

| Income (loss) before income taxes | | | | | 7,735 | | | (303) | |

| | | | | | | |

| Provision (benefit) for income taxes | | | | | 2,115 | | | (2,824) | |

| Net income | | | | | $ | 5,620 | | | $ | 2,521 | |

| | | | | | | |

| Net income per common share - basic: | | | | | $ | 0.06 | | | $ | 0.03 | |

| Net income per common share - diluted: | | | | | $ | 0.06 | | | $ | 0.03 | |

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements

Newpark Resources, Inc.

Condensed Consolidated Statements of Comprehensive Income (Loss)

(Unaudited)

| | | | | | | | | | | | | | | |

| | | | Three Months Ended

March 31, |

| (In thousands) | | | | | 2023 | | 2022 |

| | | | | | | |

| Net income | | | | | $ | 5,620 | | | $ | 2,521 | |

Foreign currency translation adjustments (net of tax benefit of $10 and $99) | | | | | 1,999 | | | (1,228) | |

| Comprehensive income | | | | | $ | 7,619 | | | $ | 1,293 | |

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements

Newpark Resources, Inc.

Condensed Consolidated Statements of Stockholders’ Equity

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands) | Common Stock | | Paid-In Capital | | Accumulated Other Comprehensive Loss | | Retained Earnings | | Treasury Stock | | Total |

| Balance at December 31, 2021 | $ | 1,093 | | | $ | 634,929 | | | $ | (61,480) | | | $ | 24,345 | | | $ | (136,501) | | | $ | 462,386 | |

| Net income | — | | | — | | | — | | | 2,521 | | | — | | | 2,521 | |

| Employee stock options, restricted stock and employee stock purchase plan | — | | | — | | | — | | | — | | | (4) | | | (4) | |

| Stock-based compensation expense | — | | | 1,468 | | | — | | | — | | | — | | | 1,468 | |

| Foreign currency translation, net of tax | — | | | — | | | (1,228) | | | — | | | — | | | (1,228) | |

| Balance at March 31, 2022 | $ | 1,093 | | | $ | 636,397 | | | $ | (62,708) | | | $ | 26,866 | | | $ | (136,505) | | | $ | 465,143 | |

| | | | | | | | | | | |

| Balance at December 31, 2022 | $ | 1,115 | | | $ | 641,266 | | | $ | (67,186) | | | $ | 2,489 | | | $ | (154,656) | | | $ | 423,028 | |

| Net income | — | | | — | | | — | | | 5,620 | | | — | | | 5,620 | |

| Employee stock options, restricted stock and employee stock purchase plan | — | | | — | | | — | | | — | | | (7) | | | (7) | |

| Stock-based compensation expense | — | | | 1,738 | | | — | | | — | | | — | | | 1,738 | |

| Treasury shares purchased at cost | — | | | — | | | — | | | — | | | (15,149) | | | (15,149) | |

| Foreign currency translation, net of tax | — | | | — | | | 1,999 | | | — | | | — | | | 1,999 | |

| Balance at March 31, 2023 | $ | 1,115 | | | $ | 643,004 | | | $ | (65,187) | | | $ | 8,109 | | | $ | (169,812) | | | $ | 417,229 | |

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements

Newpark Resources, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | |

| | Three Months Ended March 31, |

| (In thousands) | 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net income | $ | 5,620 | | | $ | 2,521 | |

| Adjustments to reconcile net income to net cash provided by operations: | | | |

| Depreciation and amortization | 7,895 | | | 10,452 | |

| Stock-based compensation expense | 1,738 | | | 1,468 | |

| Provision for deferred income taxes | (726) | | | (5,202) | |

| Credit loss expense | 272 | | | 185 | |

| Gain on sale of assets | (554) | | | (1,606) | |

| Amortization of original issue discount and debt issuance costs | 138 | | | 178 | |

| Change in assets and liabilities: | | | |

| Decrease in receivables | 27,287 | | | 5,795 | |

| Increase in inventories | (3,870) | | | (14,812) | |

| Decrease in other assets | 1,098 | | | 17 | |

| Increase (decrease) in accounts payable | (1,233) | | | 11,246 | |

| Decrease in accrued liabilities and other | (8,221) | | | (7,452) | |

| Net cash provided by operating activities | 29,444 | | | 2,790 | |

| | | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (6,972) | | | (7,621) | |

| Proceeds from divestitures | 7,153 | | | — | |

| Proceeds from sale of property, plant and equipment | 740 | | | 575 | |

| Net cash provided by (used in) investing activities | 921 | | | (7,046) | |

| | | |

| Cash flows from financing activities: | | | |

| Borrowings on lines of credit | 76,447 | | | 69,188 | |

| Payments on lines of credit | (90,212) | | | (65,202) | |

| Purchases of treasury stock | (15,006) | | | (4) | |

| Other financing activities | (1,499) | | | (2,711) | |

| Net cash provided by (used in) financing activities | (30,270) | | | 1,271 | |

| | | |

| Effect of exchange rate changes on cash | 375 | | | (376) | |

| | | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | 470 | | | (3,361) | |

| Cash, cash equivalents, and restricted cash at beginning of period | 25,061 | | | 29,489 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 25,531 | | | $ | 26,128 | |

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements

NEWPARK RESOURCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1 – Basis of Presentation and Significant Accounting Policies

Newpark Resources, Inc. is a geographically diversified supplier providing environmentally-sensitive products, as well as rentals and services to customers across multiple industries. The accompanying unaudited condensed consolidated financial statements of Newpark Resources, Inc. and our wholly-owned subsidiaries, which we collectively refer to as the “Company,” “we,” “our,” or “us,” have been prepared in accordance with Rule 10-01 of Regulation S-X for interim financial statements required to be filed with the Securities and Exchange Commission, and do not include all information and footnotes required by the accounting principles generally accepted in the United States (“U.S. GAAP”) for complete financial statements. These unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2022. Our fiscal year end is December 31 and our first quarter represents the three-month period ended March 31. The results of operations for the first quarter of 2023 are not necessarily indicative of the results to be expected for the entire year. Unless otherwise noted, all currency amounts are stated in U.S. dollars.

In the opinion of management, the accompanying unaudited condensed consolidated financial statements reflect all adjustments necessary to present fairly our financial position as of March 31, 2023 and our results of operations and cash flows for the first quarter of 2023 and 2022. All adjustments are of a normal recurring nature. Our balance sheet at December 31, 2022 is derived from the audited consolidated financial statements at that date.

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. For further information, see Note 1 in our Annual Report on Form 10-K for the year ended December 31, 2022.

We currently operate our business through two reportable segments: Fluids Systems and Industrial Solutions. In addition, we had a third reportable segment, Industrial Blending, which was exited in 2022. We have reflected these three reportable segments for all periods presented in this Quarterly Report on Form 10-Q.

•Our Fluids Systems segment provides customized drilling and completion fluids products and related technical services to oil and natural gas exploration and production (“E&P”) customers primarily in North America and Europe, the Middle East and Africa (“EMEA”), as well as certain countries in Asia Pacific and Latin America.

In the fourth quarter of 2022, we exited two of our Fluids Systems business units, including our U.S.-based mineral grinding business as well as our Gulf of Mexico fluids operations (see Note 10 for additional information).

•Our Industrial Solutions segment provides temporary worksite access solutions, including the rental of our recyclable composite matting systems, along with related site construction and services to customers in various markets including power transmission, E&P, pipeline, renewable energy, petrochemical, construction and other industries, primarily in the United States and Europe. We also manufacture and sell our recyclable composite mats to customers around the world, with power transmission being the primary end-market.

•Our Industrial Blending segment began operations in 2020 and supported industrial end-markets, including the production of disinfectants and industrial cleaning products. We completed the wind down of the Industrial Blending business in the first quarter of 2022, and we completed the sale of the industrial blending assets in the fourth quarter of 2022.

Note 2 – Earnings Per Share

The following table presents the reconciliation of the numerator and denominator for calculating net income per share:

| | | | | | | | | | | | | | | |

| | | | First Quarter |

| (In thousands, except per share data) | | | | | 2023 | | 2022 |

| Numerator | | | | | | | |

| Net income - basic and diluted | | | | | $ | 5,620 | | | $ | 2,521 | |

| | | | | | | |

| Denominator | | | | | | | |

| Weighted average common shares outstanding - basic | | | | | 88,573 | | | 92,118 | |

| Dilutive effect of stock options and restricted stock awards | | | | | 1,997 | | | 1,821 | |

| Weighted average common shares outstanding - diluted | | | | | 90,570 | | | 93,939 | |

| | | | | | | |

| Net income per common share | | | | | | | |

| Basic | | | | | $ | 0.06 | | | $ | 0.03 | |

| Diluted | | | | | $ | 0.06 | | | $ | 0.03 | |

We excluded the following weighted average potential shares from the calculations of diluted net income per share during the applicable periods because their inclusion would have been anti-dilutive:

| | | | | | | | | | | | | | | |

| | | | First Quarter |

| (In thousands) | | | | | 2023 | | 2022 |

| Stock options and restricted stock awards | | | | | 737 | | | 1,867 | |

Note 3 – Repurchase Program

In February 2023, our Board of Directors approved certain changes to our repurchase program and increased the total authorization available to $50.0 million. Our repurchase program authorizes us to purchase outstanding shares of our common stock in the open market or as otherwise determined by management, subject to certain limitations under the Amended ABL Facility (as defined in Note 6) and other factors. The repurchase program has no specific term. Repurchases are expected to be funded from borrowings under our Amended ABL Facility, operating cash flows, and available cash on hand. As part of the share repurchase program, our management has been authorized to establish trading plans under Rule 10b5-1 of the Securities Exchange Act of 1934. As of March 31, 2023, we had $35.1 million remaining under the program.

During the first quarter of 2023, we repurchased an aggregate of 3.4 million shares of our common stock under the repurchase program for a total cost of $15.1 million, inclusive of commissions and excise taxes. There were no shares of common stock repurchased under the repurchase program during the first quarter of 2022.

In April 2023, we repurchased an additional 1.2 million shares of our common stock under the repurchase program for a total cost of $5.0 million. As of May 2, 2023, we had $30.1 million remaining under the program.

Note 4 – Receivables

Receivables consisted of the following:

| | | | | | | | | | | |

| (In thousands) | March 31, 2023 | | December 31, 2022 |

| Trade receivables: | | | |

| Gross trade receivables | $ | 202,107 | | | $ | 227,762 | |

| Allowance for credit losses | (5,000) | | | (4,817) | |

| Net trade receivables | 197,107 | | | 222,945 | |

| Income tax receivables | 2,231 | | | 2,697 | |

| Other receivables | 13,356 | | | 16,605 | |

| Total receivables, net | $ | 212,694 | | | $ | 242,247 | |

Other receivables included $8.0 million and $10.8 million related to our divestitures (as described in Note 10) as of March 31, 2023 and December 31, 2022, respectively. Other receivables also included $3.9 million and $3.5 million for value added, goods and service taxes related to foreign jurisdictions as of March 31, 2023 and December 31, 2022, respectively.

Changes in our allowance for credit losses were as follows:

| | | | | | | | | | | |

| First Quarter |

| (In thousands) | 2023 | | 2022 |

| Balance at beginning of period | $ | 4,817 | | | $ | 4,587 | |

| Credit loss expense | 272 | | | 185 | |

| Write-offs, net of recoveries | (89) | | | (316) | |

| Balance at end of period | $ | 5,000 | | | $ | 4,456 | |

Note 5 – Inventories

Inventories consisted of the following:

| | | | | | | | | | | |

| (In thousands) | March 31, 2023 | | December 31, 2022 |

| Raw materials: | | | |

| Fluids Systems | $ | 114,122 | | | $ | 110,623 | |

| Industrial Solutions | 4,678 | | | 3,966 | |

| Total raw materials | 118,800 | | | 114,589 | |

| Blended fluids systems components | 24,962 | | | 29,244 | |

| Finished goods - mats | 6,227 | | | 5,738 | |

| Total inventories | $ | 149,989 | | | $ | 149,571 | |

Raw materials for the Fluids Systems segment consist primarily of chemicals and other additives that are consumed in the production of our fluids systems. Raw materials for the Industrial Solutions segment consist primarily of resins, chemicals, and other materials used to manufacture composite mats, as well as materials that are consumed in providing ground protection and other services to our customers. Our blended fluids systems components consist of base fluids systems that have been either mixed internally at our blending facilities or purchased from third-party vendors. These base fluids systems require raw materials to be added, as needed to meet specified customer requirements.

Note 6 – Financing Arrangements and Fair Value of Financial Instruments

Financing arrangements consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2023 | | December 31, 2022 |

| (In thousands) | Principal Amount | | Unamortized Discount and Debt Issuance Costs | | Total Debt | | Principal Amount | | Unamortized Discount and Debt Issuance Costs | | Total Debt |

| Amended ABL Facility | $ | 65,400 | | | $ | — | | | $ | 65,400 | | | $ | 80,300 | | | $ | — | | | $ | 80,300 | |

| U.K. term loan | 6,908 | | | (86) | | | 6,822 | | | 7,201 | | | (99) | | | 7,102 | |

| Financing obligation | 2,764 | | | (27) | | | 2,737 | | | 3,437 | | | (35) | | | 3,402 | |

| Other debt | 26,240 | | | — | | | 26,240 | | | 23,311 | | | — | | | 23,311 | |

| Total debt | 101,312 | | | (113) | | | 101,199 | | | 114,249 | | | (134) | | | 114,115 | |

| Less: current portion | (23,158) | | | — | | | (23,158) | | | (22,438) | | | — | | | (22,438) | |

| Long-term debt | $ | 78,154 | | | $ | (113) | | | $ | 78,041 | | | $ | 91,811 | | | $ | (134) | | | $ | 91,677 | |

Asset-Based Loan Facility. In October 2017, we entered into a U.S. asset-based revolving credit agreement, which was amended in March 2019 and amended and restated in May 2022 (the “Amended ABL Facility”). The Amended ABL Facility provides financing of up to $175.0 million available for borrowings (inclusive of letters of credit), which can be increased up to $250.0 million, subject to certain conditions. The Amended ABL Facility has a five-year term expiring May 2027, is based on a Bloomberg Short-Term Bank Yield Index (“BSBY”) pricing grid, and includes a mechanism to incorporate a sustainability-linked pricing framework with the consent of the required lenders (as defined in the Amended ABL Facility).

As of March 31, 2023, our total borrowing availability under the Amended ABL Facility was $154.3 million, of which $65.4 million was drawn and $3.3 million was used for outstanding letters of credit, resulting in remaining availability of $85.6 million.

Borrowing availability under the Amended ABL Facility is calculated based on eligible U.S. accounts receivable, inventory and composite mats included in the rental fleet, net of reserves and subject to limits on certain of the assets included in the borrowing base calculation. To the extent pledged by the borrowers, the borrowing base calculation also includes the amount of eligible pledged cash. The administrative agent may establish reserves in accordance with the Amended ABL Facility, in part based on appraisals of the asset base, and other limits in its discretion, which could reduce the amounts otherwise available under the Amended ABL Facility.

Under the terms of the Amended ABL Facility, we may elect to borrow at a variable interest rate based on either, (1) the BSBY rate (subject to a floor of zero) or (2) the base rate (subject to a floor of zero), equal to the highest of (a) the federal funds rate plus 0.50%, (b) the prime rate of Bank of America, N.A., and (c) BSBY for a one-month interest period plus 1.00%, plus, in each case, an applicable margin per annum. The applicable margin ranges from 1.50% to 2.00% per annum for BSBY borrowings, and 0.50% to 1.00% per annum for base rate borrowings, based on the consolidated leverage ratio (as defined in the Amended ABL Facility) as of the last day of the most recent fiscal quarter. We are also required to pay a commitment fee equal to (i) 0.375% per annum at any time the average daily unused portion of the commitments is greater than 50% and (ii) 0.25% per annum at any time the average daily unused portion of the commitments is less than 50%.

As of March 31, 2023, the applicable margin for borrowings under the Amended ABL Facility was 1.50% with respect to BSBY borrowings and 0.50% with respect to base rate borrowings. As of March 31, 2023, the weighted average interest rate for the Amended ABL Facility was 6.2% and the applicable commitment fee on the unused portion of the Amended ABL Facility was 0.375% per annum.

The Amended ABL Facility is a senior secured obligation of the Company and certain of our U.S. subsidiaries constituting borrowers thereunder, secured by a first priority lien on substantially all of the personal property and certain real property of the borrowers, including a first priority lien on certain equity interests of direct or indirect domestic subsidiaries of the borrowers and certain equity interests issued by certain foreign subsidiaries of the borrowers.

The Amended ABL Facility contains customary representations, warranties and covenants that, among other things, and subject to certain specified circumstances and exceptions, restrict or limit the ability of the borrowers and certain of their subsidiaries to incur indebtedness (including guarantees), grant liens, make investments, pay dividends or distributions with respect to capital stock and make other restricted payments, make prepayments on certain indebtedness, engage in mergers or other fundamental changes, dispose of property, and change the nature of their business.

The Amended ABL Facility requires compliance with the following financial covenants: (i) a minimum fixed charge coverage ratio of 1.00 to 1.00 for the most recently completed four fiscal quarters and (ii) while a leverage covenant trigger

period (as defined in the Amended ABL Facility) is in effect, a maximum consolidated leverage ratio of 4.00 to 1.00 as of the last day of the most recently completed fiscal quarter.

The Amended ABL Facility includes customary events of default including non-payment of principal, interest or fees, violation of covenants, inaccuracy of representations or warranties, cross-default to other material indebtedness, bankruptcy and insolvency events, invalidity or impairment of security interests or invalidity of loan documents, certain ERISA events, unsatisfied or unstayed judgments and change of control.

Other Debt. In April 2022, a U.K. subsidiary entered a £7.0 million term loan and a £2.0 million revolving credit facility. Both the term loan and revolving credit facility mature in April 2025 and bear interest at a rate of Sterling Overnight Index Average plus a margin of 3.25% per year. As of March 31, 2023, the interest rate for the U.K. facilities was 7.4%. The term loan is payable in quarterly installments of £350,000 plus interest beginning June 2022 and a £2.8 million payment due at maturity. We had $8.9 million outstanding under these arrangements at March 31, 2023.

In August 2021, we completed sale-leaseback transactions related to certain vehicles and other equipment for net proceeds of approximately $7.9 million. The transactions have been accounted for as financing arrangements as they did not qualify for sale accounting. As a result, the vehicles and other equipment continue to be reflected on our balance sheet in property, plant and equipment, net. The financing arrangements have a weighted average annual interest rate of 5.4% and are payable in monthly installments with varying maturities through October 2025. We had $2.8 million in financing obligations outstanding under these arrangements at March 31, 2023.

Certain of our foreign subsidiaries maintain local credit arrangements consisting primarily of lines of credit or overdraft facilities which are generally renewed on an annual basis. We utilize local financing arrangements in our foreign operations in order to provide short-term local liquidity needs. We had $16.7 million and $14.3 million outstanding under these arrangements at March 31, 2023 and December 31, 2022, respectively.

In addition, at March 31, 2023, we had $41.3 million in outstanding letters of credit, performance bonds, and other guarantees for which certain of the letters of credit are collateralized by $1.9 million in restricted cash.

Our financial instruments include cash and cash equivalents, receivables, payables, and debt. We believe the carrying values of these instruments approximated their fair values at March 31, 2023 and December 31, 2022.

Note 7 – Income Taxes

The provision for income taxes was $2.1 million for the first quarter of 2023, reflecting an effective tax rate of 27%. The 2023 provision for income taxes was favorably impacted by the benefit associated with a partial valuation allowance release to recognize a portion of previously unbenefited net operating losses. The benefit for income taxes was $2.8 million for the first quarter of 2022, which includes an income tax benefit of $3.1 million related to the restructuring of certain subsidiary legal entities within Europe, as the undistributed earnings for an international subsidiary are no longer subject to certain taxes upon future distribution.

Note 8 – Commitments and Contingencies

In the ordinary course of conducting our business, we become involved in litigation and other claims from private party actions, as well as judicial and administrative proceedings involving governmental authorities at the federal, state, and local levels. While the outcome of litigation or other proceedings against us cannot be predicted with certainty, management does not expect that any loss resulting from such litigation or other proceedings, in excess of any amounts accrued or covered by insurance, will have a material adverse impact on our consolidated financial statements.

Note 9 – Supplemental Disclosures to the Statements of Cash Flows

Supplemental disclosures to the consolidated statements of cash flows are presented below:

| | | | | | | | | | | |

| First Quarter |

| (In thousands) | 2023 | | 2022 |

| Cash paid for: | | | |

| Income taxes (net of refunds) | $ | 2,261 | | | $ | 3,268 | |

| Interest | $ | 1,998 | | | $ | 998 | |

Cash, cash equivalents, and restricted cash in the consolidated statements of cash flows consisted of the following:

| | | | | | | | | | | |

| (In thousands) | March 31, 2023 | | December 31, 2022 |

| Cash and cash equivalents | $ | 23,618 | | | $ | 23,182 | |

| Restricted cash (included in prepaid expenses and other current assets) | 1,913 | | | 1,879 | |

| Cash, cash equivalents, and restricted cash | $ | 25,531 | | | $ | 25,061 | |

Note 10 – Segment Data

Summarized operating results for our reportable segments are shown in the following table (net of inter-segment transfers):

| | | | | | | | | | | |

| | First Quarter |

| (In thousands) | 2023 | | 2022 |

| Revenues | | | |

| Fluids Systems | $ | 144,174 | | | $ | 141,014 | |

| Industrial Solutions | 55,856 | | | 35,424 | |

| Industrial Blending | — | | | — | |

| Total revenues | $ | 200,030 | | | $ | 176,438 | |

| | | |

| Operating income (loss) | | | |

| Fluids Systems | $ | 3,466 | | | $ | 3,374 | |

| Industrial Solutions | 14,483 | | | 6,358 | |

| Industrial Blending | — | | | (886) | |

| Corporate office | (7,806) | | | (7,879) | |

| Total operating income | $ | 10,143 | | | $ | 967 | |

We regularly review our global portfolio of business activities. These reviews focus on evaluating changes in the outlook for our served markets and customer priorities, while identifying opportunities for value-creating options in our portfolio, and placing investment emphasis in markets where we generate strong returns and where we see greater long-term viability and stability. As part of this review, we completed certain actions in 2022, including the sale of our Excalibar U.S. mineral grinding business (“Excalibar”), the exit of our Industrial Blending operations, and the exit of our Gulf of Mexico fluids operations.

Summarized operating results of our now exited Excalibar business and Gulf of Mexico operations, both included in the Fluids Systems segment historical results, are shown in the following table:

| | | | | | | | | | | |

| | First Quarter |

| (In thousands) | 2023 | | 2022 |

| Revenues | | | |

| Excalibar | $ | — | | | $ | 14,346 | |

| Gulf of Mexico | — | | | 2,694 | |

| Total revenues | $ | — | | | $ | 17,040 | |

| | | |

| Operating income (loss) | | | |

| Excalibar | $ | (77) | | | $ | 833 | |

| Gulf of Mexico | (2,311) | | | (2,617) | |

| Total operating income (loss) | $ | (2,388) | | | $ | (1,784) | |

Summarized net assets remaining from the business units exited in 2022 are shown in the following table:

| | | | | | | | | | | |

| (In thousands) | March 31, 2023 | | December 31, 2022 |

| Receivables, net | $ | 9,391 | | | $ | 27,798 | |

| Inventories | 1,409 | | | 5,805 | |

| Accounts payable | (575) | | | (2,060) | |

| Accrued liabilities | — | | | (311) | |

| Total net assets | $ | 10,225 | | | $ | 31,232 | |

The net assets remaining as of March 31, 2023 primarily reflect remaining Gulf of Mexico working capital, the majority of which we expect to realize in the second quarter of 2023.

In the first quarter of 2023, we completed our customer contract in Chile and are currently in the process of winding down our in-country operations. At March 31, 2023, we had $3 million of net assets and $0.5 million of accumulated translation losses related to our subsidiary in Chile. As we monetize these assets in 2023, we will reclassify the translation losses and recognize a charge to income at such time when we have substantially liquidated our subsidiary in Chile. In addition, we made the decision in the first quarter of 2023 to exit the stimulation chemicals product line reported in our Fluids Systems segment. We anticipate liquidating the related inventory of approximately $3 million during 2023.

In addition, the operating results for the Fluids Systems segment includes $1.0 million and $0.1 million in severance costs for the first quarter of 2023 and 2022, respectively.

The following table presents further disaggregated revenues for the Fluids Systems segment:

| | | | | | | | | | | |

| First Quarter |

| (In thousands) | 2023 | | 2022 |

| United States | $ | 68,898 | | | $ | 70,843 | |

| Canada | 19,365 | | | 22,235 | |

| Total North America | 88,263 | | | 93,078 | |

| | | |

| EMEA | 52,577 | | | 44,175 | |

| Other | 3,334 | | | 3,761 | |

| Total International | 55,911 | | | 47,936 | |

| | | |

| Total Fluids Systems revenues | $ | 144,174 | | | $ | 141,014 | |

The following table presents further disaggregated revenues for the Industrial Solutions segment:

| | | | | | | | | | | |

| First Quarter |

| (In thousands) | 2023 | | 2022 |

| Product sales revenues | $ | 19,496 | | | $ | 4,423 | |

| Rental revenues | 21,131 | | | 17,615 | |

| Service revenues | 15,229 | | | 13,386 | |

| Total Industrial Solutions revenues | $ | 55,856 | | | $ | 35,424 | |

ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition, results of operations, liquidity, and capital resources should be read in conjunction with the unaudited condensed consolidated financial statements and notes thereto included in this report as well as our Annual Report on Form 10-K for the year ended December 31, 2022. Our first quarter represents the three-month period ended March 31. Unless otherwise noted, all currency amounts are stated in U.S. dollars. The reference to a “Note” herein refers to the accompanying Notes to Unaudited Condensed Consolidated Financial Statements contained in Item 1 “Financial Statements.”

Business Overview

Newpark Resources, Inc. (the “Company,” “we,” “our,” or “us”) is a geographically diversified supplier providing environmentally-sensitive products, as well as rentals and services to customers across multiple industries. We currently operate our business through two reportable segments: Industrial Solutions and Fluids Systems, as described further below. In addition, we had a third reportable segment, Industrial Blending, which was exited in 2022.

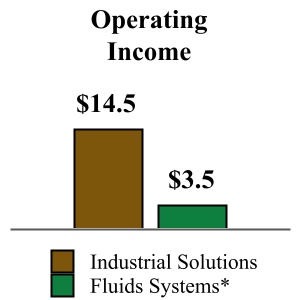

While the Fluids Systems segment has historically been the primary driver of revenues, the Industrial Solutions segment has for several years been the primary driver of operating income, cash flows, and financial returns. Industrial Solutions also represents our primary focus for capital investments. The relative revenues, operating income, and capital expenditures for the Industrial Solutions and Fluids Systems segments for the first quarter of 2023 are as follows (amounts in millions):

* Fluids Systems segment operating income for the first quarter of 2023 includes $3.2 million in charges primarily related to facility exit and severance costs.

2023 Priorities

Following the completion of several divestiture transactions in the fourth quarter of 2022 (as described further below), the following priorities have been established for 2023:

•Accelerate Industrial Solutions Growth – We plan to continue to prioritize investment capital in the growth of our Industrial Solutions business, where, over the past three years, we have seen the strong market adoption of our specialty rental products and differentiated service offering. For the first quarter of 2023, Industrial Solutions revenues were $55.9 million, reflecting a 58% increase from the first quarter of 2022. Substantially all of the increase in revenues is attributable to our continued expansion in the power transmission sector.

•Drive Operational Efficiency – We plan to increase our focus on efficiency improvements and operating cost optimization across every aspect of our global footprint. With our simplified business model and enhanced focus on balance sheet optimization, we seek to improve returns and consistency in cash flow generation. During the first quarter of 2023, we generated $29.4 million of operating cash flow, which was partially driven by the effects of the 2022 divestitures in Fluids Systems as described further below. In the first quarter of 2023, we made the decision to exit our stimulation fluids product line and are in the process of winding down our Fluids operations in Chile. We also recently announced several organizational changes, which are expected to provide annualized recurring cost savings of approximately $6 million, with the benefits beginning to be realized over the next few quarters. We will continue to evaluate other under-performing areas within our business and anticipate additional actions may be necessary to optimize our operational footprint and invested capital within the Fluids Systems segment to transform this business for the evolving market conditions and outlook. As a result, we may incur future charges related to these efforts or potential asset impairments, which may negatively impact our future results.

•Prioritize Return of Capital – We are committed to maintaining a strong balance sheet, using excess cash generation to reduce our debt and return value to our shareholders. During the first quarter of 2023, we utilized $15 million of cash generation for debt repayments and another $15 million to repurchase 3.4 million (4%) of our outstanding shares under

our repurchase program. In April 2023, we repurchased an additional 1.2 million shares of our common stock (1%) for a total cost of $5.0 million.

Segment Overview

Industrial Solutions – Our Industrial Solutions segment provides temporary worksite access solutions, including the rental of our manufactured recyclable composite matting systems, along with related site construction and services to customers in various markets including power transmission, E&P, pipeline, renewable energy, petrochemical, construction and other industries, primarily in the United States and Europe. We also sell our manufactured recyclable composite mats to customers around the world, with power transmission being the primary end-market.

Our Industrial Solutions segment has been the primary source of operating income and cash generation for us in recent years, as illustrated above, and has also been the primary focus for growth investments. The growth of the business in the power transmission and other industrial markets remains a strategic priority for us due to such markets’ relative stability compared to E&P, as well as the magnitude of growth opportunity in these markets, including the potential positive impact from the energy transition and future legislation and regulations related to greenhouse gas emissions and climate change. We expect customer activity, particularly in the power transmission sector, will remain robust in the coming years, driven in part by the impacts of the energy transition and the increasing investment in grid reliance initiatives.

Fluids Systems – Our Fluids Systems segment provides drilling and completion fluids products and related technical services to customers for oil, natural gas, and geothermal projects primarily in North America and Europe, the Middle East and Africa (“EMEA”), as well as certain countries in Asia Pacific and Latin America. Over the past few years, our primary focus within Fluids Systems has been the transformation into a more agile and simplified business focused on key markets, while monetizing assets in underperforming or sub-scale markets and reducing our invested capital.

Our Fluids Systems operating results remain dependent on oil and natural gas drilling activity levels in the markets we serve and the nature of the drilling operations, which governs the revenue potential of each well. Drilling activity levels depend on a variety of factors, including oil and natural gas commodity pricing, inventory levels, product demand, and regulatory restrictions. Rig count data remains the most widely accepted indicator of drilling activity. Average North American rig count data for the first quarter of 2023 and 2022 is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| | First Quarter | | 2023 vs 2022 |

| | 2023 | | 2022 | | Count | | % |

| U.S. Rig Count | 760 | | | 633 | | | 127 | | | 20 | % |

| Canada Rig Count | 221 | | | 198 | | | 23 | | | 12 | % |

| North America Rig Count | 981 | | | 831 | | | 150 | | | 18 | % |

_______________________________________________________

Source: Baker Hughes Company

Oil and natural gas prices and activity are cyclical and volatile, and this market volatility has a significant impact on our operating results. We anticipate that market activity in the U.S. will remain fairly stable in the near-term, as many of our customers maintain strong capital discipline and prioritize cash flow generation over growth. The Canada rig count reflects normal seasonality for this market, with the highest rig count levels generally observed in the first quarter of each year, prior to Spring break-up. Outside of North America, drilling activity is generally more stable as this drilling activity is based on longer-term economic projections and multi-year drilling programs, which typically reduces the impact of short-term changes in commodity prices on overall drilling activity.

Further, the combination of geopolitical events and elevated oil prices are causing several markets to increase drilling activity levels, to help ensure reliable energy supply in the coming years, while reducing their dependency on Russia-sourced oil and natural gas. Consequently, the outlook for several markets within the EMEA region continues to strengthen, with growth in activity expected over the next few years.

Industrial Blending – Our Industrial Blending segment began operations in 2020 and supported industrial end-markets, including the production of disinfectants and industrial cleaning products. In the first quarter of 2022, we completed the wind down of the Industrial Blending business, and in November 2022 we completed the sale of the industrial blending assets.

2022 Strategic Actions

The following strategic actions were taken in 2022.

Exit of Industrial Blending Segment and Sale of Conroe, Texas Blending Facility

In the first quarter of 2022, we exited our Industrial Blending operations. In November 2022, we completed the sale of the industrial blending assets and received cash proceeds of approximately $14 million.

Sale of Excalibar U.S. Mineral Grinding Business

In the second quarter of 2022, we initiated a formal sale process for our Excalibar U.S. mineral grinding business (“Excalibar”), which was reported within our Fluids Systems segment. In November 2022, we completed the sale of substantially all the long-lived assets, inventory, and operations of Excalibar to Cimbar Resources, INC. (“Cimbar”), and received cash proceeds (after purchase price adjustments) of approximately $51 million. The Company retained certain assets and liabilities, including accounts receivable and accounts payable, the wind down of which was substantially completed in the first quarter of 2023. Such working capital provided approximately $10 million of cash generation in the fourth quarter of 2022 and approximately $6 million of additional cash generation in the first quarter of 2023. In connection with the sale, the Company and Cimbar have entered into a long-term barite supply agreement for certain regions of our U.S. drilling fluids business, with an initial term of four years following the closing of the transaction.

Exit of Gulf of Mexico Operations

In the third quarter of 2022, our Board of Directors approved management’s plan to exit our Fluids Systems Gulf of Mexico operations, including the potential sale of related assets. In December 2022, we completed the sale of substantially all assets associated with our Gulf of Mexico completion fluids operations. Separately, we entered into a seven-year arrangement to sublease our Fourchon, LA drilling fluids shorebase and blending facility to a leading global energy services provider. As part of this arrangement, substantially all of our Gulf of Mexico drilling fluids inventory will be sold as consumed by the lessee or no later than nine months from the closing of the transaction. These transactions provided cash generation of approximately $6 million in the fourth quarter of 2022, approximately $15 million in the first quarter of 2023, and is expected to provide additional cash generation of approximately $10 million, primarily in the second quarter of 2023. In addition, we expect to receive approximately $4 million in the second quarter of 2023 from the sale of certain long-lived assets previously used to support these operations. Fluids Systems segment operating income for the first quarter of 2023 includes $2.3 million in charges related to the exit of Gulf of Mexico operations, which is expected to be substantially completed during the second quarter of 2023.

Summarized operating results of the business units exited in 2022 are shown in the following table:

| | | | | | | | | | | |

| | First Quarter |

| (In thousands) | 2023 | | 2022 |

| Revenues | | | |

| Industrial Blending | $ | — | | | $ | — | |

| Excalibar | — | | | 14,346 | |

| Gulf of Mexico | — | | | 2,694 | |

| Total revenues | $ | — | | | $ | 17,040 | |

| | | |

| Operating income (loss) | | | |

| Industrial Blending | $ | — | | | $ | (886) | |

| Excalibar | (77) | | | 833 | |

| Gulf of Mexico | (2,311) | | | (2,617) | |

| Total operating income (loss) | $ | (2,388) | | | $ | (2,670) | |

Summarized net assets remaining from the business units exited in 2022 are shown in the following table:

| | | | | | | | | | | |

| (In thousands) | March 31, 2023 | | December 31, 2022 |

| Receivables, net | $ | 9,391 | | | $ | 27,798 | |

| Inventories | 1,409 | | | 5,805 | |

| Accounts payable | (575) | | | (2,060) | |

| Accrued liabilities | — | | | (311) | |

| Total net assets | $ | 10,225 | | | $ | 31,232 | |

The net assets remaining as of March 31, 2023 primarily reflect remaining Gulf of Mexico working capital, the majority of which we expect to realize in the second quarter of 2023.

We also continue to evaluate strategic alternatives for our portfolio, which may result in additional divestitures. As a result, we may incur future charges related to these efforts or potential asset impairments, which may negatively impact our future results.

First Quarter of 2023 Compared to First Quarter of 2022

Consolidated Results of Operations

Summarized results of operations for the first quarter of 2023 compared to the first quarter of 2022 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| | First Quarter | | 2023 vs 2022 |

| (In thousands) | 2023 | | 2022 | | $ | | % |

| Revenues | $ | 200,030 | | | $ | 176,438 | | | $ | 23,592 | | | 13 | % |

| Cost of revenues | 164,738 | | | 150,988 | | | 13,750 | | | 9 | % |

| Selling, general and administrative expenses | 25,410 | | | 24,433 | | | 977 | | | 4 | % |

| Other operating (income) loss, net | (261) | | | 50 | | | (311) | | | NM |

| Operating income | 10,143 | | | 967 | | | 9,176 | | | NM |

| | | | | | | |

| Foreign currency exchange loss | 319 | | | 64 | | | 255 | | | NM |

| Interest expense, net | 2,089 | | | 1,206 | | | 883 | | | 73 | % |

| Income (loss) before income taxes | 7,735 | | | (303) | | | 8,038 | | | NM |

| | | | | | | |

| Provision (benefit) for income taxes | 2,115 | | | (2,824) | | | 4,939 | | | NM |

| Net income | $ | 5,620 | | | $ | 2,521 | | | $ | 3,099 | | | NM |

Revenues

Revenues increased 13% to $200.0 million for the first quarter of 2023, compared to $176.4 million for the first quarter of 2022 which included $17.0 million of revenues from divested Fluids Systems business units. The $23.6 million increase in revenues includes a $15.5 million (12%) increase in North America, comprised of a $20.3 million increase in the Industrial Solutions segment partially offset by a $4.8 million decrease in the Fluids Systems segment. In our Industrial Solutions segment, revenues from our North America operations increased primarily due an increase in product sales to support power transmission projects. In our Fluids Systems segment, revenues from our North America operations decreased primarily due to the impact of the divested business units, as well as lower market share, partially offset by the benefit of an improvement in North America rig count. Revenues from our international operations increased by $8.1 million (16%), driven by higher activity in Europe and Africa. Additional information regarding the change in revenues is provided within the operating segment results below.

Cost of revenues

Cost of revenues increased 9% to $164.7 million for the first quarter of 2023, compared to $151.0 million for the first quarter of 2022 which included $18.3 million of cost of revenues from divested business units. The $13.8 million increase in cost of revenues was primarily driven by the 13% increase in revenues described above, partially offset by the impact of segment mix, with Industrial Solutions representing a higher proportion of revenues for the first quarter of 2023, as compared to the prior year.

Selling, general and administrative expenses

Selling, general and administrative expenses increased $1.0 million to $25.4 million for the first quarter of 2023, compared to $24.4 million for the first quarter of 2022. This increase was primarily driven by first quarter 2023 project spending related to strategic planning activities and an organizational design project. Selling, general and administrative expenses as a percentage of revenues was 12.7% for the first quarter of 2023 compared to 13.8% for the first quarter of 2022. Consolidated selling, general and administrative expenses included $0.5 million of costs related to divested business units for the first quarter of 2022.

Foreign currency exchange

Foreign currency exchange was a $0.3 million loss for the first quarter of 2023 compared to a $0.1 million loss for the first quarter of 2022, and reflects the impact of currency translation on assets and liabilities (including intercompany balances) that are denominated in currencies other than functional currencies.

Interest expense, net

Interest expense was $2.1 million for the first quarter of 2023 compared to $1.2 million for the first quarter of 2022. The increase in interest expense is primarily due to an increase in benchmark borrowing rates partially offset by a decrease in average debt outstanding.

Provision (benefit) for income taxes

The provision for income taxes was $2.1 million for the first quarter of 2023, reflecting an effective tax rate of 27%. The 2023 provision for income taxes was favorably impacted by the benefit associated with a partial valuation allowance release to recognize a portion of previously unbenefited net operating losses. The benefit for income taxes was $2.8 million for the first quarter of 2022, which includes an income tax benefit of $3.1 million related to the restructuring of certain subsidiary legal entities within Europe, as the undistributed earnings for an international subsidiary are no longer subject to certain taxes upon future distribution.

Operating Segment Results

Summarized financial information for our reportable segments is shown in the following table (net of inter-segment transfers):

| | | | | | | | | | | | | | | | | | | | | | | |

| First Quarter | | 2023 vs 2022 |

| (In thousands) | 2023 | | 2022 | | $ | | % |

| Revenues | | | | | | | |

| Fluids Systems | $ | 144,174 | | | $ | 141,014 | | | $ | 3,160 | | | 2 | % |

| Industrial Solutions | 55,856 | | | 35,424 | | | 20,432 | | | 58 | % |

| Industrial Blending | — | | | — | | | — | | | NM |

| Total revenues | $ | 200,030 | | | $ | 176,438 | | | $ | 23,592 | | | 13 | % |

| | | | | | | |

| Operating income (loss) | | | | | | | |

| Fluids Systems | $ | 3,466 | | | $ | 3,374 | | | $ | 92 | | | |

| Industrial Solutions | 14,483 | | | 6,358 | | | 8,125 | | | |

| Industrial Blending | — | | | (886) | | | 886 | | | |

| Corporate office | (7,806) | | | (7,879) | | | 73 | | | |

| Total operating income | $ | 10,143 | | | $ | 967 | | | $ | 9,176 | | | |

| | | | | | | |

| Segment operating margin | | | | | | | |

| Fluids Systems | 2.4 | % | | 2.4 | % | | | | |

| Industrial Solutions | 25.9 | % | | 17.9 | % | | | | |

| Industrial Blending | NM | | NM | | | | |

Fluids Systems

Revenues

Total revenues for this segment consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| | First Quarter | | 2023 vs 2022 |

| (In thousands) | 2023 | | 2022 | | $ | | % |

| United States | $ | 68,898 | | | $ | 70,843 | | | $ | (1,945) | | | (3) | % |

| Canada | 19,365 | | | 22,235 | | | (2,870) | | | (13) | % |

| Total North America | 88,263 | | | 93,078 | | | (4,815) | | | (5) | % |

| | | | | | | |

| EMEA | 52,577 | | | 44,175 | | | 8,402 | | | 19 | % |

| Other | 3,334 | | | 3,761 | | | (427) | | | (11) | % |

| Total International | 55,911 | | | 47,936 | | | 7,975 | | | 17 | % |

| | | | | | | |

| Total Fluids Systems revenues | $ | 144,174 | | | $ | 141,014 | | | $ | 3,160 | | | 2 | % |

North America revenues decreased 5% to $88.3 million for the first quarter of 2023, compared to $93.1 million for the first quarter of 2022, primarily related to the divested business units. For the first quarter of 2022, U.S. revenues included $14.3 million from the U.S. mineral grinding business and $2.7 million from offshore Gulf of Mexico. Revenues from U.S. land markets increased $0.7 million as the benefit of the 20% increase in U.S. rig count was substantially offset by the $14.3 million of revenue in the prior year from the divested U.S. mineral grinding business and lower market share. In addition, Canada decreased $2.9 million driven primarily by a decline in market share, which typically fluctuates based on customer mix and timing of projects.

Internationally, revenues increased 17% to $55.9 million for the first quarter of 2023, compared to $47.9 million for the first quarter of 2022. The increase was primarily driven by higher activity in Europe and Africa.

Operating income (loss)

The Fluids Systems segment generated operating income of $3.5 million for the first quarter of 2023 compared to $3.4 million for the first quarter of 2022. The improvement in operating income primarily reflects the impact of the revenue changes described above. The first quarter of 2023 includes $3.2 million in charges primarily related to facility exit costs in the Gulf of Mexico and severance costs while the first quarter of 2022 included operating losses of $1.8 million related to the divested business units.

Industrial Solutions

Revenues

Total revenues for this segment consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| | First Quarter | | 2023 vs 2022 |

| (In thousands) | 2023 | | 2022 | | $ | | % |

| Product sales revenues | $ | 19,496 | | | $ | 4,423 | | | $ | 15,073 | | | 341 | % |

| Rental and service revenues | 36,360 | | | 31,001 | | | 5,359 | | | 17 | % |

| Total Industrial Solutions revenues | $ | 55,856 | | | $ | 35,424 | | | $ | 20,432 | | | 58 | % |

Revenues from product sales, which typically fluctuate based on the timing of customer projects and orders, increased by $15.1 million from the first quarter of 2022, reflective of robust demand from the utilities sector. Rental and service revenues increased by 17% from the first quarter of 2022, driven by the continued market penetration of the power transmission sector in the U.S., along with improved pricing.

Operating income

The Industrial Solutions segment generated operating income of $14.5 million for the first quarter of 2023 compared to $6.4 million for the first quarter of 2022, the increase being primarily attributable to the change in revenues as described above.

Corporate Office

Corporate office expenses decreased $0.1 million to $7.8 million for the first quarter of 2023, compared to $7.9 million for the first quarter of 2022. The first quarter of 2023 includes approximately $1.0 million of project spending related to strategic planning activities and an organizational design project. The first quarter of 2022 included $0.7 million associated with shareholder matters and acquisition and divestiture efforts.

Liquidity and Capital Resources

Net cash provided by operating activities was $29.4 million for the first quarter of 2023 compared to $2.8 million for the first quarter of 2022. During the first quarter of 2023, net income adjusted for non-cash items provided cash of $14.4 million and changes in working capital provided cash of $15.1 million, which is primarily related to the wind down of working capital associated with the fourth quarter 2022 divestiture transactions.

Net cash provided by investing activities was $0.9 million for the first quarter of 2023, including $7.2 million in proceeds received related to our fourth quarter of 2022 divestitures, as well as $0.7 million in proceeds from the sale of assets, which includes the sale of used mats from our Industrial Solutions rental fleet. These proceeds were partially offset by capital expenditures of $7.0 million in the first quarter of 2023, nearly all of which was directed to supporting our Industrial Solutions segment growth in the power transmission sector.

Net cash used in financing activities was $30.3 million for the first quarter of 2023, which includes $15.3 million in net repayments on our Amended ABL Facility and other financing arrangements, as well as $15.0 million in share purchases under our repurchase program.

Substantially all our $23.6 million of cash on hand at March 31, 2023 resides in our international subsidiaries. We primarily manage our liquidity utilizing availability under our Amended ABL Facility and other existing financing arrangements. Under our Amended ABL Facility, we manage daily cash requirements by utilizing borrowings or repayments under this revolving credit facility, while maintaining minimal cash on hand in the U.S.

We expect total availability under the Amended ABL Facility to fluctuate directionally based on the level of eligible U.S. accounts receivable, inventory, and composite mats included in the rental fleet. We expect the projected availability under our Amended ABL Facility and other existing financing arrangements, cash generated by operations, and available cash on-hand in our international subsidiaries to be adequate to fund our current operations during the next 12 months.

We anticipate that future working capital requirements for our operations will generally fluctuate directionally with revenues, though the second quarter of 2023 is expected to benefit approximately $14 million from the wind down of remaining working capital and sale of assets associated with the fourth quarter 2022 divestiture transactions. We expect capital expenditures in 2023 will remain fairly in line with 2022 levels, with spending heavily focused on the expansion of our mat rental fleet to further support the utilities market penetration. In April 2023, we used $5 million in cash for additional share purchases under our repurchase program. As of May 2, 2023, our total borrowing availability under the Amended ABL Facility was $152.9 million, of which $63.7 million was drawn and $3.3 million was used for outstanding letters of credit, resulting in remaining availability of $85.8 million.

Our capitalization is as follows:

| | | | | | | | | | | |

| (In thousands) | March 31, 2023 | | December 31, 2022 |

| Amended ABL Facility | 65,400 | | | 80,300 | |

| Other debt | 35,912 | | | 33,949 | |

| Unamortized discount and debt issuance costs | (113) | | | (134) | |

| Total debt | $ | 101,199 | | | $ | 114,115 | |

| | | |

| Stockholders’ equity | 417,229 | | | 423,028 | |

| Total capitalization | $ | 518,428 | | | $ | 537,143 | |

| | | |

| Total debt to capitalization | 19.5 | % | | 21.2 | % |

Asset-Based Loan Facility. In October 2017, we entered into a U.S. asset-based revolving credit agreement, which was amended in March 2019 and amended and restated in May 2022 (the “Amended ABL Facility”). The Amended ABL Facility provides financing of up to $175.0 million available for borrowings (inclusive of letters of credit), which can be increased up to $250.0 million, subject to certain conditions. The Amended ABL Facility has a five-year term expiring May 2027, is based on a Bloomberg Short-Term Bank Yield Index (“BSBY”) pricing grid, and includes a mechanism to incorporate a sustainability-linked pricing framework with the consent of the required lenders (as defined in the Amended ABL Facility).

As of March 31, 2023, our total borrowing availability under the Amended ABL Facility was $154.3 million, of which $65.4 million was drawn and $3.3 million was used for outstanding letters of credit, resulting in remaining availability of $85.6 million.

Borrowing availability under the Amended ABL Facility is calculated based on eligible U.S. accounts receivable, inventory and composite mats included in the rental fleet, net of reserves and subject to limits on certain of the assets included

in the borrowing base calculation. To the extent pledged by the borrowers, the borrowing base calculation also includes the amount of eligible pledged cash. The administrative agent may establish reserves in accordance with the Amended ABL Facility, in part based on appraisals of the asset base, and other limits in its discretion, which could reduce the amounts otherwise available under the Amended ABL Facility.

Under the terms of the Amended ABL Facility, we may elect to borrow at a variable interest rate based on either, (1) the BSBY rate (subject to a floor of zero) or (2) the base rate (subject to a floor of zero), equal to the highest of (a) the federal funds rate plus 0.50%, (b) the prime rate of Bank of America, N.A., and (c) BSBY for a one-month interest period plus 1.00%, plus, in each case, an applicable margin per annum. The applicable margin ranges from 1.50% to 2.00% per annum for BSBY borrowings, and 0.50% to 1.00% per annum for base rate borrowings, based on the consolidated leverage ratio (as defined in the Amended ABL Facility) as of the last day of the most recent fiscal quarter. We are also required to pay a commitment fee equal to (i) 0.375% per annum at any time the average daily unused portion of the commitments is greater than 50% and (ii) 0.25% per annum at any time the average daily unused portion of the commitments is less than 50%.

As of March 31, 2023, the applicable margin for borrowings under the Amended ABL Facility was 1.50% with respect to BSBY borrowings and 0.50% with respect to base rate borrowings. As of March 31, 2023, the weighted average interest rate for the Amended ABL Facility was 6.2% and the applicable commitment fee on the unused portion of the Amended ABL Facility was 0.375% per annum.

The Amended ABL Facility is a senior secured obligation of the Company and certain of our U.S. subsidiaries constituting borrowers thereunder, secured by a first priority lien on substantially all of the personal property and certain real property of the borrowers, including a first priority lien on certain equity interests of direct or indirect domestic subsidiaries of the borrowers and certain equity interests issued by certain foreign subsidiaries of the borrowers.

The Amended ABL Facility contains customary representations, warranties and covenants that, among other things, and subject to certain specified circumstances and exceptions, restrict or limit the ability of the borrowers and certain of their subsidiaries to incur indebtedness (including guarantees), grant liens, make investments, pay dividends or distributions with respect to capital stock and make other restricted payments, make prepayments on certain indebtedness, engage in mergers or other fundamental changes, dispose of property, and change the nature of their business.

The Amended ABL Facility requires compliance with the following financial covenants: (i) a minimum fixed charge coverage ratio of 1.00 to 1.00 for the most recently completed four fiscal quarters and (ii) while a leverage covenant trigger period (as defined in the Amended ABL Facility) is in effect, a maximum consolidated leverage ratio of 4.00 to 1.00 as of the last day of the most recently completed fiscal quarter.

The Amended ABL Facility includes customary events of default including non-payment of principal, interest or fees, violation of covenants, inaccuracy of representations or warranties, cross-default to other material indebtedness, bankruptcy and insolvency events, invalidity or impairment of security interests or invalidity of loan documents, certain ERISA events, unsatisfied or unstayed judgments and change of control.