UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period From to

Commission File Number 001-2960

Newpark Resources, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 72-1123385 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

9320 Lakeside Blvd., Suite 100 | |

The Woodlands, Texas | 77381 |

(Address of principal executive office) | (Zip Code) |

Registrant’s telephone number, including area code (281) 362-6800

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

Common Stock, $0.01 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ___ No √

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ___ No √

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes √ No ___

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes √ No ___

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ___

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “small reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ___ | Accelerated filer √ |

Non-accelerated filer ___ (Do not check if a smaller reporting company) | Smaller Reporting Company ___ |

Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ___ No √

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, computed by reference to the price at which the common equity was last sold as of June 30, 2017, was $613.1 million. The aggregate market value has been computed by reference to the closing sales price on such date, as reported by The New York Stock Exchange.

As of February 16, 2018, a total of 89,218,581 shares of Common Stock, $0.01 par value per share, were outstanding.

Documents Incorporated by Reference

Pursuant to General Instruction G(3) to this Form 10-K, the information required by Items 10, 11, 12, 13 and 14 of Part III hereof is incorporated by reference from the registrant’s definitive Proxy Statement for its 2018 Annual Meeting of Stockholders.

NEWPARK RESOURCES, INC.

INDEX TO ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2017

1

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, as amended. We also may provide oral or written forward-looking information in other materials we release to the public. Words such as “will”, “may”, “could”, “would”, “anticipates”, “believes”, “estimates”, “expects”, “plans”, “intends”, and similar expressions are intended to identify these forward-looking statements but are not the exclusive means of identifying them. These forward-looking statements reflect the current views of our management; however, various risks, uncertainties, contingencies and other factors, some of which are beyond our control, are difficult to predict and could cause our actual results, performance or achievements to differ materially from those expressed in, or implied by, these statements, including the success or failure of our efforts to implement our business strategy.

We assume no obligation to update, amend or clarify publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by securities laws. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this Annual Report might not occur.

For further information regarding these and other factors, risks and uncertainties affecting us, we refer you to the risk factors set forth in Item 1A of this Annual Report on Form 10-K.

2

PART I

ITEM 1. Business

General

Newpark Resources, Inc. was organized in 1932 as a Nevada corporation. In 1991, we changed our state of incorporation to Delaware. We are a geographically diversified supplier providing products, rentals and services primarily to the oil and gas exploration and production (“E&P”) industry. We operate our business through two reportable segments: Fluids Systems and Mats and Integrated Services. Our Fluids Systems segment provides drilling fluids products and technical services to customers in the North America, Europe, the Middle East and Africa (“EMEA”), Latin America and Asia Pacific regions. Our Mats and Integrated Services segment provides composite mat rentals, site construction and related site services to customers in various markets including oil and gas exploration and production, electrical transmission & distribution, pipeline, solar, petrochemical and construction across the U.S., Canada and Europe. We also sell composite mats to customers outside of the U.S. and to domestic customers outside of the E&P market.

Our principal executive offices are located at 9320 Lakeside Blvd., Suite 100, The Woodlands, Texas 77381. Our telephone number is (281) 362-6800. You can find more information about us at our website located at www.newpark.com. Our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q, our Current Reports on Form 8-K and any amendments to those reports are available free of charge through our website. These reports are available as soon as reasonably practicable after we electronically file these materials with, or furnish them to, the Securities and Exchange Commission (“SEC”). Our Code of Ethics, our Corporate Governance Guidelines, our Audit Committee Charter, our Compensation Committee Charter and our Nominating and Corporate Governance Committee Charter are also posted to the corporate governance section of our website. We make our website content available for informational purposes only. It should not be relied upon for investment purposes, nor is it incorporated by reference in this Form 10-K. Information filed with the SEC may be read or copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C., 20549. Information on operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

When referring to “Newpark” and using phrases such as the “Company”, “we”, “us” and “our”, our intent is to refer to Newpark Resources, Inc. and its subsidiaries as a whole or on a segment basis, depending on the context in which the statements are made.

Industry Fundamentals

Historically, several factors have driven demand for our products and services, including the supply, demand and pricing of oil and gas commodities, which drive E&P drilling and development activity. Demand for most of our Fluids Systems’ products and services is also driven, in part, by the level, type, depth and complexity of oil and gas drilling. Historically, drilling activity levels in North America have been volatile, primarily driven by the price of oil and natural gas. Beginning in the fourth quarter of 2014 and continuing through early 2016, the price of oil declined dramatically from the price levels in previous years. As a result, E&P drilling activity significantly declined in North America and many global markets over this period. While oil prices and drilling activity have improved from the lows reached in early 2016, both oil price and activity levels remain significantly lower than pre-downturn levels. The most widely accepted measure of activity for our North American operations is the Baker Hughes Rotary Rig Count. The average North America rig count was 1,083 in 2017, compared to 639 in 2016, 1,170 in 2015, and 2,241 in 2014.

The declining E&P drilling activity levels in 2015 and 2016 reduced the demand for our services, negatively impacted customer pricing and resulted in elevated costs associated with workforce reductions, all of which negatively impacted our profitability. Further, due to the fact that our business contains substantial levels of fixed costs, including significant facility and personnel expenses, North American operating margins in both operating segments were negatively impacted by the lower customer demand during this period.

Outside of North America, drilling activity is generally more stable, as drilling activity in many countries is based upon longer term economic projections and multiple year drilling programs, which tend to reduce the impact of short-term changes in commodity prices on overall drilling activity. While drilling activity in certain of our international markets (including Brazil and Australia) has declined in recent years, as a whole, our international activities have remained relatively stable. This stability is primarily driven by new contract awards, which include geographical expansion into new markets as well as market share gains in existing markets.

In addition to our ongoing activity in the E&P industry, our Mats and Integrated Services segment is continuing to expand into other industries in North America, including electrical transmission & distribution and pipeline construction and maintenance. The demand for our composite matting systems from customers in these industries, is driven in part, by the level of construction and maintenance activity associated with the electrical transmission & distribution grid, as well as the oil and natural gas pipeline infrastructure within the U.S.

3

Reportable Segments

Fluids Systems

Our Fluids Systems business provides drilling fluids products and technical services to customers in the North America, EMEA, Latin America, and Asia Pacific regions. We offer customized solutions for highly technical drilling projects involving complex subsurface conditions such as horizontal, directional, geologically deep or drilling in deep water. These projects require increased monitoring and critical engineering support of the fluids system during the drilling process. In addition, our Fluids Systems offering is expanding into adjacent areas to drilling fluids, including completion and stimulation chemistry, which are typically utilized by customers following the drilling process.

We also have industrial mineral grinding operations for barite, a critical raw material in drilling fluids products, which serve to support our activity in the North American drilling fluids market. We grind barite and other industrial minerals at four facilities, including locations in Texas, Louisiana and Tennessee. We use the resulting products in our drilling fluids business, and also sell them to third party users, including other drilling fluids companies. We also sell a variety of other minerals, principally to third-party industrial (non-oil and gas) markets.

Raw Materials — We believe that our sources of supply for materials and equipment used in our drilling fluids business are adequate for our needs, however, we have experienced periods of short-term scarcity of barite ore, which have resulted in significant cost increases. Our specialty milling operation is our primary supplier of barite used in our North American drilling fluids business. Our mills obtain raw barite ore under supply agreements from foreign sources, primarily China and India. We obtain other materials used in the drilling fluids business from various third party suppliers. We have encountered no serious shortages or delays in obtaining these raw materials.

Technology — Proprietary technology and systems are an important aspect of our business strategy. We seek patents and licenses on new developments whenever we believe it creates a competitive advantage in the marketplace. We own patent rights in a family of high-performance water-based fluids systems, which we market as Evolution® and DeepDrill® systems, which are designed to enhance drilling performance and provide environmental benefits. We also rely on a variety of unpatented proprietary technologies and know-how in many of our applications. We believe that our reputation in the industry, the range of services we offer, ongoing technical development and know-how, responsiveness to customers and understanding of regulatory requirements are of equal or greater competitive significance than our existing proprietary rights.

Competition — We face competition from larger companies, including Halliburton and Schlumberger, which compete vigorously on fluids performance and/or price. In addition, these companies have broad product and service offerings in addition to their drilling fluids. We also have smaller regional competitors competing with us mainly on price and local relationships. We believe that the principal competitive factors in our businesses include a combination of technical proficiency, reputation, price, reliability, quality, breadth of services offered and experience. We believe that our competitive position is enhanced by our proprietary products and services.

Customers — Our customers are principally major integrated and independent oil and gas E&P companies operating in the markets that we serve. During 2017, approximately 51% of segment revenues were derived from the 20 largest segment customers, of which the largest customer represented 10% of our segment revenues. The segment also generated 55% of revenues domestically during 2017. Typically, in North America, we perform services either under short-term standard contracts or under “master” service agreements. Internationally, some customers issue multi-year contracts, but many are on a well-by-well, or project basis. As most agreements with our customers can be terminated upon short notice, our backlog is not significant. We do not derive a significant portion of our revenues from government contracts. See “Note 12 – Segment and Related Information” in our Consolidated Financial Statements for additional information on financial and geographic data.

Mats and Integrated Services

Our Mats and Integrated Services segment provides composite mat rentals, site construction and related site services to customers in various markets including oil and gas exploration and production (“E&P”), electrical transmission & distribution, pipeline, solar, petrochemical and construction across North America and Europe. We also sell composite mats to customers outside of the U.S. and to domestic customers outside of the E&P market. Following our efforts in recent years to diversify our customer base, Mats and Integrated Services segment revenues from non-E&P markets represented approximately two-thirds of our segment revenues in 2017.

We manufacture our DURA-BASE® Advanced Composite Mats for use in our rental operations as well as for third-party sales. Our mats provide environmental protection and ensure all-weather access to sites with unstable soil conditions. In order to support our efforts to expand our markets globally, we completed an expansion of our mats manufacturing facility in 2015 which nearly doubled our manufacturing capacity and significantly expanded our research and development capabilities. We continue to expand our product offerings, which now include the EPZ Grounding System™ for enhanced safety and efficiency for contractors working on power line maintenance and construction projects and the T-REX™ automated mat cleaning system to provide customers with a cost effective system to clean composite mats on site.

4

In November 2017, we acquired certain assets and assumed certain liabilities of Well Service Group, Inc. and Utility Access Solutions, Inc. (together, “WSG”). Since 2012, WSG has been a strategic logistics and installation service provider for our Mats and Integrated Service segment, offering a variety of complementary services to our composite matting systems, including access road construction, site planning and preparation, environmental protection, fluids and spill storage/containment, erosion control, and site restoration services. The completion of the WSG acquisition expanded our service offering as well as our U.S. geographic footprint across the Northeast, Midwest, Rockies, and West Texas regions of the U.S.

Raw Materials — We believe that our sources of supply for materials used in our business are adequate for our needs. We are not dependent upon any one supplier and we have encountered no serious shortages or delays in obtaining any raw materials. The resins, chemicals and other materials used to manufacture composite mats are widely available. Resin is the largest material component in the manufacturing of our composite mat products.

Technology — We have obtained patents related to the design and manufacturing of our DURA-BASE mats and several of the components, as well as other products and systems related to these mats (including the connecting pins and the EPZ Grounding System™). Using proprietary technology and systems is an important aspect of our business strategy. We believe that these products provide us with a distinct advantage over our competition. While we continue to add to our patent portfolio, two patents related to our DURA-BASE matting system will expire in May of 2020, and competitors may begin offering mats that include features described in those patents. We also believe that our reputation in the industry, the range of services we offer, ongoing technical development and know-how, responsiveness to customers and understanding of regulatory requirements also have competitive significance in the markets we serve.

Competition — Our market is fragmented and competitive, with many competitors providing various forms of site preparation products and services. The mat sales component of our business is not as fragmented as the rental and services segment with only a few competitors providing various alternatives to our DURA-BASE mat products, such as Signature Systems Group and Checkers Group. This is due to many factors, including large capital start-up costs and proprietary technology associated with this product. We believe that the principal competitive factors in our businesses include product capabilities, price, reputation, and reliability. We also believe that our competitive position is enhanced by our proprietary products, services and experience.

Customers — Our customers are principally infrastructure construction and oil and gas E&P companies operating in the markets that we serve. Approximately 63% of our segment revenues in 2017 were derived from the 20 largest segment customers, of which, the largest customer represented 15% of our segment revenues. The segment generated 91% of its revenues domestically during 2017. As a result of our efforts to expand beyond our traditional oilfield customer base, revenues from non E&P customers represented approximately 67% of segment revenues in 2017. Typically, we perform services either under short-term contracts or rental service agreements. As most agreements with our customers are cancelable upon short notice, our backlog is not significant. We do not derive a significant portion of our revenues from government contracts. See “Note 12 - Segment and Related Information” in our Consolidated Financial Statements for additional information on financial and geographic data.

Employees

At January 31, 2018, we employed approximately 2,400 full and part-time personnel none of which are represented by unions. We consider our relations with our employees to be satisfactory.

Environmental Regulation

We seek to comply with all applicable legal requirements concerning environmental matters. Our business is affected by governmental regulations relating to the oil and gas industry in general, as well as environmental, health and safety regulations that have specific application to our business. Our activities are impacted by various federal and state regulatory agencies, and provincial pollution control, health and safety programs that are administered and enforced by regulatory agencies.

Additionally, our business exposes us to environmental risks. We have implemented various procedures designed to ensure compliance with applicable regulations and reduce the risk of damage or loss. These include specified handling procedures and guidelines for waste, ongoing employee training, and monitoring and maintaining insurance coverage.

We also employ a corporate-wide web-based health, safety and environmental management system (“HSEMS”), which is ISO 14001:2004 compliant. The HSEMS is designed to capture information related to the planning, decision-making, and general operations of environmental regulatory activities within our operations. We also use the HSEMS to capture the information generated by regularly scheduled independent audits that are done to validate the findings of our internal monitoring and auditing procedures.

5

ITEM 1A. Risk Factors

The following summarizes the most significant risk factors to our business. Our success will depend, in part, on our ability to anticipate and effectively manage these and other risks. Any of these risk factors, either individually or in combination, could have significant adverse impacts to our results of operations and financial condition, or prevent us from meeting our profitability or growth objectives.

Risks Related to the Worldwide Oil and Natural Gas Industry

We derive a significant portion of our revenues from customers in the worldwide oil and natural gas industry; therefore, our risk factors include those factors that impact the demand for oil and natural gas. Spending by our customers for exploration, development and production of oil and natural gas is based on a number of factors, including expectations of future hydrocarbon demand, energy prices, the risks associated with developing reserves, our customers' ability to finance exploration and development of reserves, regulatory developments and the future value of the reserves. Reductions in customer spending levels adversely affect the demand for our services and consequently, our revenue and operating results; and the presence of these market conditions negatively affects our revenue and operating results. The key risk factors that we believe influence the worldwide oil and natural gas markets are discussed below.

Demand for oil and natural gas is subject to factors beyond our control

Demand for oil and natural gas, as well as the demand for our services, is highly correlated with global economic growth and in particular by the economic growth of countries such as the U.S., India, China, and developing countries in Asia and the Middle East. Weakness in global economic activity could reduce demand for oil and natural gas and result in lower oil and natural gas prices. In addition, demand for oil and natural gas could be impacted by environmental regulation, including cap and trade legislation, regulation of hydraulic fracturing, and carbon taxes. Weakness or deterioration of the global economy could reduce our customers’ spending levels and reduce our revenue and operating results.

Supply of oil and natural gas is subject to factors beyond our control

The ability to produce oil and natural gas can be affected by the number and productivity of new wells drilled and completed, as well as the rate of production and resulting depletion of existing wells. Productive capacity in excess of demand is also an important factor influencing energy prices and spending by oil and natural gas exploration companies. Oil and natural gas storage inventory levels are indicators of the relative balance between supply and demand. Supply can also be impacted by the degree to which individual Organization of Petroleum Exporting Countries (“OPEC”) nations and other large oil and natural gas producing countries are willing and able to control production and exports of hydrocarbons, to decrease or increase supply and to support their targeted oil price or meet market share objectives. Any of these factors could affect the supply of oil and natural gas and could have a material effect on our results of operations.

Volatility of oil and natural gas prices can adversely affect demand for our products and services

Volatility in oil and natural gas prices can also impact our customers’ activity levels and spending for our products and services. The level of energy prices is important to the cash flow for our customers and their ability to fund exploration and development activities. Compared to 2011 to 2014 levels, oil prices have declined significantly due in large part to increasing supplies, weakening demand growth and the decision by OPEC countries to maintain production levels throughout 2015 and most of 2016. While OPEC production limits were put in place in late 2016 and maintained throughout 2017, expectations about future commodity prices and price volatility are important for determining future spending levels. Our customers also take into account the volatility of energy prices and other risk factors by requiring higher returns for individual projects if there is higher perceived risk.

Our customers’ activity levels, spending for our products and services and ability to pay amounts owed us could be impacted by the ability of our customers to access equity or credit markets

Our customers’ access to capital is dependent on their ability to access the funds necessary to develop oil and gas prospects. Limited access to external sources of funding has and may continue to cause customers to reduce their capital spending plans. In addition, a reduction of cash flow to our customers resulting from declines in commodity prices or the lack of available debt or equity financing may impact the ability of our customers to pay amounts owed to us.

Risks Related to our Customer Concentration and Reliance on the U.S. Exploration and Production Market

In 2017, approximately 45% of our consolidated revenues were derived from our 20 largest customers, although no customer accounted for more than 10% of our consolidated revenues. In addition, approximately 62% of our consolidated revenues were derived from our U.S. operations.

6

Beginning in the fourth quarter of 2014 and continuing through early 2016, the price of oil declined dramatically from the price levels in previous years. Following this decline, North American drilling activity decreased significantly, which reduced the demand for our services and negatively impacted customer pricing in our North American operations, relative to pre-downturn levels. While oil prices and drilling activity have since improved from the lows reached in early 2016, there are no assurances that the price for oil or activity levels will not decline again in the future. Due to these changes, our quarterly and annual operating results have fluctuated significantly and may continue to fluctuate in future periods. Because our business has substantial fixed costs, including significant facility and personnel expenses, downtime or low productivity due to reduced demand can have a significant adverse impact on our profitability.

Risks Related to International Operations

We have significant operations outside of the United States, including certain areas of Canada, EMEA, Latin America, and Asia Pacific. In 2017, these international operations generated approximately 38% of our consolidated revenues. Algeria represents our largest international market with our total Algerian operations representing 12% of our consolidated revenues in 2017 and 8% of our total assets at December 31, 2017, including 28% of our total cash balance at December 31, 2017.

In addition, we may seek to expand to other areas outside the United States in the future. International operations are subject to a number of risks and uncertainties, including:

▪ | difficulties and cost associated with complying with a wide variety of complex foreign laws, treaties and regulations; |

▪ | uncertainties in or unexpected changes in regulatory environments or tax laws; |

▪ | legal uncertainties, timing delays and expenses associated with tariffs, export licenses and other trade barriers; |

▪ | difficulties enforcing agreements and collecting receivables through foreign legal systems; |

▪ | risks associated with failing to comply with the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act, export laws, and other similar laws applicable to our operations in international markets; |

▪ | exchange controls or other limitations on international currency movements, including restrictions on the repatriation of funds to the U.S. from certain countries, such as Algeria; |

▪ | sanctions imposed by the U.S. government that prevent us from engaging in business in certain countries or with certain counter-parties; |

▪ | inability to obtain or preserve certain intellectual property rights in the foreign countries in which we operate; |

▪ | our inexperience in certain international markets; |

▪ | fluctuations in foreign currency exchange rates; |

▪ | political and economic instability; and |

▪ | acts of terrorism. |

In addition, several North African markets in which we operate, including Tunisia, Egypt, Libya, and Algeria have experienced social and political unrest in past years, which, when they occur, negatively impact our operating results, and can include the temporary suspension of our operations. More recently in Brazil, the ongoing widely-publicized corruption investigation has continued to disrupt Petrobras’ operations, which could negatively impact our operating results in Brazil.

Risks Related to the Cost and Continued Availability of Borrowed Funds, including Risks of Noncompliance with Debt Covenants

We employ borrowed funds as an integral part of our long-term capital structure and our future success is dependent upon continued access to borrowed funds to support our operations. The availability of borrowed funds on reasonable terms is dependent on the condition of credit markets and financial institutions from which these funds are obtained. Adverse events in the financial markets may significantly reduce the availability of funds, which may have an adverse effect on our cost of borrowings and our ability to fund our business strategy. Our ability to meet our debt service requirements and the continued availability of funds under our existing or future loan agreements is dependent upon our ability to generate operating income and remain in compliance with the covenants in our debt agreements. This, in turn, is subject to the volatile nature of the oil and natural gas industry, and to competitive, economic, financial and other factors that are beyond our control.

We fund our ongoing operational needs through a $150 million asset-based revolving credit facility (the “Amended ABL Facility”). Borrowing availability under the Amended ABL Facility is calculated based on eligible accounts receivable, inventory, and, subject to satisfaction of certain financial covenants as described below, composite mats included in the rental fleet, net of reserves and limits on such assets included in the borrowing base calculation. To the extent pledged by us, the borrowing base calculation shall also include the amount of eligible pledged cash. The lender may establish reserves, in part based on appraisals of the asset base, and other limits at its discretion which could reduce the amounts otherwise available under the Amended ABL Facility. Availability associated with eligible rental mats will also be subject to maintaining a minimum consolidated fixed charge coverage ratio and a minimum level of operating income for the Mats and Integrated Services segment. The availability under the

7

Amended ABL Facility is expected to fluctuate directionally with changes in our domestic accounts receivable, inventory, and composite mat rental fleet.

The Amended ABL Facility terminates on October 17, 2022; however, the Amended ABL Facility has a springing maturity date that will accelerate the maturity of the Amended ABL Facility to September 1, 2021 if, prior to such date, the convertible notes due 2021 (“2021 Convertible Notes”) have not either been repurchased, redeemed, converted or we have not provided sufficient funds to repay the 2021 Convertible Notes in full on their maturity date. For this purpose, funds may be provided in cash to an escrow agent or a combination of cash to an escrow agent and the assignment of a portion of availability under the Amended ABL Facility. The Amended ABL Facility requires compliance with a minimum fixed charge coverage ratio and minimum unused availability of $25.0 million to utilize borrowings or assignment of availability under the Amended ABL Facility towards funding the repayment of the 2021 Convertible Notes.

We are subject to compliance with a fixed charge coverage ratio covenant if our borrowing availability falls below $22.5 million. If we are unable to make required payments under the Amended ABL Facility or other indebtedness of more than $25.0 million, or if we fail to comply with the various covenants and other requirements of the Amended ABL Facility, we would be in default thereunder, which would permit the holders of the indebtedness to accelerate the maturity thereof, unless we are able to obtain, on a timely basis, a necessary waiver or amendment. Any waiver or amendment may require us to revise the terms of our agreements which could increase the cost of our borrowings, require the payment of additional fees, and adversely impact the results of our operations. Upon the occurrence of any event of default that is not waived, the lenders could elect to exercise any of their available remedies, which include the right to not lend any additional amounts or, in the event we have outstanding indebtedness under the Amended ABL Facility, to declare any outstanding indebtedness, together with any accrued interest and other fees, to be immediately due and payable. If we are unable to repay the outstanding indebtedness, if any, under the Amended ABL Facility when due, the lenders would be permitted to proceed against their collateral. In the event any outstanding indebtedness in excess of $25.0 million is accelerated, this could also cause an event of default under our 2021 Convertible Notes. The acceleration of any of our indebtedness and the election to exercise any such remedies could have a material adverse effect on our business and financial condition.

Risks Related to Operating Hazards Present in the Oil and Natural Gas Industry

Our operations are subject to hazards present in the oil and natural gas industry, such as fire, explosion, blowouts, oil spills and leaks or spills of hazardous materials (both onshore and offshore). These incidents as well as accidents or problems in normal operations can cause personal injury or death and damage to property or the environment. Our customers’ operations can also be interrupted and it is possible that such incidents can interrupt our ongoing operations and the ability to provide our services. From time to time, customers seek recovery for damage to their equipment or property that occurred during the course of our service obligations. Damage to our customers’ property and any related spills of hazardous materials could be extensive if a major problem occurred. We purchase insurance which may provide coverage for incidents such as those described above, however, the policies may not provide coverage or a sufficient amount of coverage for all types of damage claims that could be asserted against us. See the section entitled “Risks Related to the Inherent Limitations of Insurance Coverage” for additional information.

Risks Related to Business Acquisitions and Capital Investments

Our ability to successfully execute our business strategy will depend, among other things, on our ability to make capital investments and acquisitions which provide us with financial benefits. In November 2017, we acquired certain assets and assumed certain liabilities of WSG for approximately $78 million. WSG has been a strategic logistics and installation service provider for our Mats and Integrated Service segment, offering a variety of complementary services to the composite matting systems, including access road construction, site planning and preparation, environmental protection, fluids and spill storage/containment, erosion control, and site restoration services. In addition, our 2018 capital expenditures are expected to range between $20 million to $25 million (exclusive of any acquisitions). These acquisitions and investments are subject to a number of risks and uncertainties, including:

▪ | incorrect assumptions regarding business activity levels or results from our capital investments, acquired operations or assets; |

▪ | failure to complete a planned acquisition transaction or to successfully integrate the operations or management of any acquired businesses or assets in a timely manner, including the WSG acquisition mentioned above; |

▪ | diversion of management’s attention from existing operations or other priorities; |

▪ | unanticipated disruptions to our business associated with the implementation of our enterprise-wide operational and financial system; and |

▪ | delays in completion and cost overruns associated with large capital investments. |

Any of the factors above could have an adverse effect on our business, financial condition or results of operations.

8

Risks Related to the Availability of Raw Materials and Skilled Personnel

Our ability to provide products and services to our customers is dependent upon our ability to obtain the raw materials and qualified personnel necessary to operate our business.

Barite is a naturally occurring mineral that constitutes a significant portion of our drilling fluids systems. We currently secure the majority of our barite ore from foreign sources, primarily China and India. The availability and cost of barite ore is dependent on factors beyond our control including transportation, political priorities and government imposed export fees in the exporting countries, as well as the impact of weather and natural disasters. The future supply of barite ore from existing sources could be inadequate to meet the market demand, particularly during periods of increasing world-wide demand, which could ultimately restrict industry activity or our ability to meet customer’s needs.

Our mats business is highly dependent on the availability of high-density polyethylene (“HDPE”), which is the primary raw material used in the manufacture of our DURA-BASE mats. The cost of HDPE can vary significantly based on the energy costs of the producers of HDPE, demand for this material, and the capacity/operations of the plants used to make HDPE. Should our cost of HDPE increase, we may not be able to increase our customer pricing to cover our costs, which may result in a reduction in future profitability.

All of our businesses are also highly dependent on our ability to attract and retain highly-skilled engineers, technical sales and service personnel. The market for these employees is competitive, and if we cannot attract and retain quality personnel, our ability to compete effectively and to grow our business will be severely limited. Also, a significant increase in the wages paid by competing employers could result in a reduction in our skilled labor force or an increase in our operating costs.

Risk Related to our Market Competition

We face competition in the Fluids Systems business from larger companies, including Halliburton and Schlumberger, which compete vigorously on fluids performance and/or price. In addition, these companies have broad product and service offerings in addition to their drilling fluids. At times, these larger companies attempt to compete by offering discounts to customers to use multiple products and services from our competitors, some of which we do not offer. We also have smaller regional competitors competing with us mainly on price and local relationships. Our competition in the Mats and Integrated Services business is fragmented, with many competitors providing various forms of mat products and services. More recently, several competitors have begun marketing composite products to compete with our DURA-BASE mat system. While we believe the design and manufacture of our mat products provide a differentiated value to our customers, many of our competitors seek to compete on pricing. Some of the early patents we received related to our DURA-BASE mat system will expire in 2020 and competitors may begin offering mats that include features described in those patents. We have filed legal actions against competitors in the U.S. to enforce our patents, and have filed for additional patents, but there is no assurance that these actions will be successful or that competitors will not be able to offer matting products that are substantially similar to the DURA-BASE mat system.

Risk Related to Offering New Products and Offering Existing Products in New Markets

As a key component of our long-term strategy in both operating segments, we seek to continue to expand our product and service offerings and enter new customer markets with our existing products. As with any market expansion effort, new customer and product markets include inherent uncertainties regarding customer expectations, industry-specific regulatory requirements, product performance and customer-specific risk profiles. As such, new market entry is subject to a number of risks and uncertainties, which could have an adverse effect on our business, financial condition or results of operations.

Risks Related to Legal and Regulatory Matters, Including Environmental Regulations

We are responsible for complying with numerous federal, state, local and foreign laws, regulations and policies that govern environmental protection, zoning and other matters applicable to our current and past business activities, including the activities of our former subsidiaries. Failure to remain compliant with these laws, regulations and policies may result in, among other things, fines, penalties, costs of cleanup of contaminated sites and site closure obligations, or other expenditures. Further, any changes in the current legal and regulatory environment could impact industry activity and the demands for our products and services, the scope of products and services that we provide, or our cost structure required to provide our products and services, or the costs incurred by our customers.

Many of the markets for our products and services are dependent on the continued exploration for and production of fossil fuels (predominantly oil and natural gas). Climate change is receiving increased attention worldwide. Many scientists, legislators and others attribute climate change to increased levels of greenhouse gases, including carbon dioxide attributed to the use of fossil fuels, which has led to significant legislative and regulatory efforts to limit greenhouse gas emissions. The Environmental Protection Agency (the “EPA”) and other domestic and foreign regulatory agencies have adopted regulations that potentially limit greenhouse gas emissions and impose reporting obligations on large greenhouse gas emission sources. In addition, the EPA has adopted rules that could require the reduction of certain air emissions during exploration and production of oil and gas. To the extent that laws and regulations enacted as part of climate change legislation increase the costs of drilling for or

9

producing such fossil fuels, limit or restrict oil and natural gas exploration and production, or reduce the demand for fossil fuels, such legislation could have a material adverse impact on our operations and profitability.

Hydraulic fracturing is a common practice used by E&P operators to stimulate production of hydrocarbons, particularly from shale oil and gas formations in the United States. The process of hydraulic fracturing, which involves the injection of sand (or other forms of proppants) laden fluids into oil and gas bearing zones, has come under increasing scrutiny from a variety of regulatory agencies, including the EPA and various state authorities. Several states have adopted regulations requiring operators to identify the chemicals used in fracturing operations, others have adopted moratoriums on the use of fracturing, and the State of New York has banned the practice altogether. In addition, concerns have been raised about whether injection of waste associated with hydraulic fracturing operations or from the fracturing operations themselves, may cause or increase the impact of earthquakes. Studies are in process regarding the correlation between hydraulic fracturing and earthquakes. Although we do not provide hydraulic fracturing services, we have begun to offer stimulation fluids used in the hydraulic fracturing process. Regulations which have the effect of limiting the use or significantly increasing the costs of hydraulic fracturing, could have a significant negative impact on both the drilling and stimulation activity levels of our customers, and, therefore, the demand for our products and services.

Risks Related to the Inherent Limitations of Insurance Coverage

While we maintain liability insurance, this insurance is subject to coverage limitations. Specific risks and limitations of our insurance coverage include the following:

▪ | self-insured retention limits on each claim, which are our responsibility; |

▪ | exclusions for certain types of liabilities and limitations on coverage for damages resulting from pollution; |

▪ | coverage limits of the policies, and the risk that claims will exceed policy limits; and |

▪ | the financial strength and ability of our insurance carriers to meet their obligations under the policies. |

In addition, our ability to continue to obtain insurance coverage on commercially reasonable terms is dependent upon a variety of factors impacting the insurance industry in general, which are outside our control. Any of the issues noted above, including insurance cost increases, uninsured or underinsured claims, or the inability of an insurance carrier to meet their financial obligations could have a material adverse effect on our profitability.

Risks Related to the Ongoing Effects of the U.S. Tax Cuts and Jobs Act and the Refinement of Provisional Estimates

The U.S. Tax Cuts and Jobs Act (“Tax Act”) was enacted on December 22, 2017, resulting in broad and complex changes to U.S. income tax law. Our effective tax rate may fluctuate in the future as a result of the Tax Act, which introduces significant changes to U.S. income tax law that will have a meaningful impact on our provision for income taxes. Accounting for the income tax effects of the Tax Act requires significant judgments and estimates in the interpretation and calculations of the provisions of the Tax Act. Due to the timing of the enactment and the complexity involved in applying the provisions of the Tax Act, we made reasonable estimates of the effects and recorded provisional amounts in our financial statements for the year ended December 31, 2017. The U.S. Treasury Department, the U.S. Internal Revenue Service (“IRS”), and other standard-setting bodies may issue guidance on how the provisions of the Tax Act will be applied or otherwise administered that is different from our interpretation. As we finalize the necessary data, and interpret the Tax Act and any additional guidance issued by the U.S. Treasury Department, the IRS or other standard-setting bodies, we may make adjustments to the provisional amounts that could materially affect our financial position and results of operations as well as our effective tax rate in the period in which the adjustments are made.

Risks Related to Potential Impairments of Long-lived Intangible Assets

As of December 31, 2017, our consolidated balance sheet includes $43.6 million in goodwill and $30.0 million of intangible assets, net, substantially all of which relates to the Mats and Integrated Services segment. Goodwill and indefinite-lived intangible assets are tested for impairment annually, or more frequently as the circumstances require, if any qualitative factors exist. In completing this annual evaluation during the fourth quarter of 2017, we determined that no reporting unit has a fair value below its net carrying value, and therefore, no impairment is required.

However, if the financial performance or future projections for our operating segments deteriorate from current levels, a future impairment of goodwill or indefinite-lived intangible assets may be required, which would negatively impact our financial results in the period of impairment.

Risks Related to Technological Developments and Intellectual Property in our Industry

The market for our products and services is characterized by continual technological developments that generate substantial improvements in product functions and performance. If we are not successful in continuing to develop product enhancements or new products that are accepted in the marketplace or that comply with industry standards, we could lose market share to competitors, which would negatively impact our results of operations and financial condition.

10

Our success can be affected by our development and implementation of new product designs and improvements and by our ability to protect and maintain critical intellectual property assets related to these developments. Although in many cases our products are not protected by any registered intellectual property rights, in other cases we rely on a combination of patents and trade secret laws to establish and protect this proprietary technology. While patent rights give the owner of a patent the right to exclude third parties from making, using, selling, and offering for sale the inventions claimed in the patents, they do not necessarily grant the owner of a patent the right to practice the invention claimed in a patent. It may also be possible for a third party to design around our patents. We do not have patents in every country in which we conduct business and our patent portfolio will not protect all aspects of our business. When patent rights expire, competitors are generally free to offer the technology and products that were covered by the patents.

We also protect our trade secrets by customarily entering into confidentiality and/or license agreements with our employees, customers and potential customers and suppliers. Our rights in our confidential information, trade secrets, and confidential know-how will not prevent third parties from independently developing similar information. Publicly available information (such as information in expired patents, published patent applications, and scientific literature) can also be used by third parties to independently develop technology. We cannot provide assurance that this independently developed technology will not be equivalent or superior to our proprietary technology.

We may from time to time engage in litigation to determine the enforceability, scope and validity of our patent rights. In addition, we can seek to enforce our rights in trade secrets, or “know-how,” and other proprietary information and technology in the conduct of our business. However, it is possible that our competitors may infringe upon, misappropriate, violate or challenge the validity or enforceability of our intellectual property, and we may not able to adequately protect or enforce our intellectual property rights in the future.

Risks Related to Severe Weather, Particularly in the U.S. Gulf Coast

We have significant operations located in market areas in the U.S. Gulf of Mexico and related near-shore areas which are susceptible to hurricanes and other adverse weather events. In these market areas, we generated approximately 16% of our consolidated revenue in 2017 and had approximately $215 million of inventory and property, plant and equipment as of December 31, 2017. Such adverse weather events can disrupt our operations and result in damage to our properties, as well as negatively impact the activity and financial condition of our customers. Our business may be adversely affected by these and other negative effects of future hurricanes or other adverse weather events in regions in which we operate.

Risks Related to Cybersecurity Breaches or Business System Disruptions

We utilize various management information systems and information technology infrastructure to manage or support a variety of our business operations, and to maintain various records, which may include confidential business or proprietary information as well as information regarding our customers, business partners, employees or other third parties. Failures of or interference with access to these systems, such as communication disruptions, could have an adverse effect on our ability to conduct operations or directly impact consolidated financial reporting. Security breaches pose a risk to confidential data and intellectual property which could result in damages to our competitiveness and reputation. We have policies and procedures in place, including system monitoring and data back-up processes, to prevent or mitigate the effects of these potential disruptions or breaches, however there can be no assurance that existing or emerging threats will not have an adverse impact on our systems or communications networks. These risks could harm our reputation and our relationships with our customers, business partners, employees or other third parties, and may result in claims against us. In addition, these risks could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

Risks Related to Fluctuations in the Market Value of our Common Stock

The market price of our common stock may fluctuate due to a number of factors, including the general economy, stock market conditions, general trends in the E&P industry, announcements made by us or our competitors, and variations in our operating results. Investors may not be able to predict the timing or extent of these fluctuations.

ITEM 1B. Unresolved Staff Comments

None.

11

ITEM 2. Properties

We lease office space to support our operating segments as well as our corporate offices. All material domestic owned properties are subject to liens and security interests under our Amended ABL Facility.

Fluids Systems. We own a facility containing approximately 103,000 square feet of office space on approximately 11 acres of land in Katy, Texas, which houses the divisional headquarters and technology center for this segment. We own a distribution warehouse and fluids blending facility containing approximately 65,000 square feet of office and industrial space on approximately 21 acres of land in Conroe, Texas. We lease approximately 9 acres of industrial space in Fourchon, Louisiana which houses a drilling fluids blending, storage, and transfer station to serve the Gulf of Mexico deepwater market. Additionally, we own six warehouse facilities and have 12 leased warehouses and 13 contract warehouses to support our customers and operations in the U.S. We own two warehouse facilities and have 22 contract warehouses in Canada to support our Canadian operations. For our international operations in the EMEA, Latin America and Asia Pacific regions, we lease 35 warehouses and own two warehouses to support these operations. Some of the warehouses also include blending facilities.

We operate four specialty product grinding facilities in the U.S. These facilities are located in Houston, Texas on approximately 18 acres of owned land, in New Iberia, Louisiana on 15.7 acres of leased land, in Corpus Christi, Texas on 6 acres of leased land, and in Dyersburg, Tennessee on 13.2 acres of owned land.

Mats and Integrated Services. We own a facility containing approximately 93,000 square feet of office and industrial space on approximately 34 acres of land in Carencro, Louisiana, which houses our manufacturing facilities and technology center for this segment. We also own three facilities and lease 18 sites throughout the U.S. which serve as bases for our well site service activities. Additionally, we lease two facilities in the United Kingdom to support field operations.

ITEM 3. Legal Proceedings

Escrow Claims Related to the Sale of the Environmental Services Business

Newpark Resources, Inc. v. Ecoserv, LLC. On July 13, 2015, we filed a declaratory action in the District Court in Harris County, Texas (80th Judicial District) seeking release of $8.0 million of funds placed in escrow by Ecoserv in connection with its purchase of our Environmental Services business. Ecoserv filed a counterclaim asserting that we breached certain representations and covenants contained in the purchase/sale agreement including, among other things, the condition of certain assets. In addition, Ecoserv has alleged that Newpark committed fraud in connection with the March 2014 transaction.

Under the terms of the March 2014 sale of the Environmental Services business to Ecoserv, $8.0 million of the sales price was withheld and placed in an escrow account to satisfy claims for possible breaches of representations and warranties contained in the purchase/sale agreement. For the amount withheld in escrow, $4.0 million was scheduled for release to Newpark at each of the nine-month and 18-month anniversary of the closing. In December 2014, we received a letter from Ecoserv asserting that we had breached certain representations and warranties contained in the purchase/sale agreement, including failing to disclose operational problems and service work performed on injection/disposal wells and increased barge rental costs. The letter indicated that Ecoserv expected the damages associated with these claims to exceed the escrow amount. Following a further exchange of letters, in July 2015, we filed the action against Ecoserv referenced above. Thereafter, Ecoserv filed a counterclaim seeking recovery in excess of the escrow funds based on the alleged breach of representations and covenants in the purchase/sale agreement. Ecoserv also alleged that we committed fraud in connection with the March 2014 transaction. Discovery in the case provided more information about Ecoserv’s claims, which included, among other things, alleged inadequate disclosures regarding the condition of a disposal cavern (at the time of the execution of the purchase/sale agreement and as it relates to the time period between execution of the purchase/sale agreement and at closing) and the lack of appropriate reserves/accruals/provisions in the financial statements of the business relating to certain regulatory obligations (such as plug and abandonment costs for injection wells and costs associated with a solids drying facility). Ecoserv sought to use a damage model for most of its damages based on its calculation of the difference between (a) the value of the business at closing, and (b) the sales price ($100.0 million), and had claimed damages of approximately $20.0 million. Following commencement of the trial in December 2017, we reached a settlement agreement with Ecoserv, under which Ecoserv will receive $22.0 million in cash effectively reducing the net sales price of the Environmental Services business by such amount in exchange for dismissal of the pending claims in the lawsuit, and release of any future claims related to the March 2014 transaction. The impact of this settlement results in a $17.4 million loss from disposal of discontinued operations, net of tax in 2017 to reduce the previously recognized gain from the sale of the Environmental Services business. The reduction in sales price will be funded, in part, through the release of the $8.0 million that has been held in escrow since the March 2014 transaction. The remaining $14 million will be funded in the first quarter of 2018 through available cash on hand and borrowings under our Amended ABL Facility. Litigation expenses related to this matter are included in corporate office expenses in operating income.

12

ITEM 4. Mine Safety Disclosures

The information concerning mine safety violations and other regulatory matters required by Section 1503 (a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 104 of Regulation S-K is included in Exhibit 95.1 of this Annual Report on Form 10-K, which is incorporated by reference.

PART II

ITEM 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the New York Stock Exchange under the symbol “NR.”

The following table sets forth the range of the high and low sales prices for our common stock for the periods indicated:

Period | High | Low | ||||||

2017 | ||||||||

Fourth Quarter | $ | 10.05 | $ | 8.20 | ||||

Third Quarter | $ | 10.15 | $ | 7.00 | ||||

Second Quarter | $ | 8.25 | $ | 6.65 | ||||

First Quarter | $ | 8.45 | $ | 6.75 | ||||

2016 | ||||||||

Fourth Quarter | $ | 8.20 | $ | 5.80 | ||||

Third Quarter | $ | 7.72 | $ | 5.48 | ||||

Second Quarter | $ | 5.89 | $ | 3.74 | ||||

First Quarter | $ | 5.47 | $ | 3.35 | ||||

As of February 1, 2018, we had 1,305 stockholders of record as determined by our transfer agent.

The following table details our repurchases of shares of our common stock for the three months ended December 31, 2017:

Period | Total Number of Shares Purchased (1) | Average Price per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Approximate Dollar Value of Shares that May Yet be Purchased Under Plans or Programs ($ in millions) | ||||||||||

October 2017 | 8,195 | $ | 8.54 | — | $ | 33.5 | ||||||||

November 2017 | 41,950 | $ | 9.45 | — | $ | 33.5 | ||||||||

December 2017 | — | — | — | $ | 33.5 | |||||||||

Total | 50,145 | $ | 9.30 | — | ||||||||||

(1) | During the three months ended December 31, 2017, we purchased an aggregate of 50,145 shares surrendered in lieu of taxes under vesting of restricted stock awards. |

Our Board of Directors has approved a repurchase program that authorizes us to purchase up to $100.0 million of our outstanding shares of common stock and prior to their maturity, our outstanding 2017 Convertible Notes in the open market or as otherwise determined by management, subject to certain limitations under the Amended ABL Facility and other factors. The repurchase program has no specific term. Repurchases are expected to be funded from operating cash flows and available cash on-hand. As part of the share repurchase program, our management has been authorized to establish trading plans under Rule 10b5-1 of the Securities Exchange Act of 1934.

There were no share or 2017 Convertible Notes repurchases under the program during 2017. At December 31, 2017, there was $33.5 million of authorization remaining under the program. During 2017, we repurchased 415,418 of shares surrendered in lieu of taxes under vesting of restricted stock awards. All of the shares repurchased are held as treasury stock.

We have not paid any dividends during the three most recent fiscal years or any subsequent interim period, and we do not intend to pay any cash dividends in the foreseeable future. In addition, our Amended ABL Facility contains covenants which limit the payment of dividends on our common stock. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources - Asset-Based Loan Facility.”

13

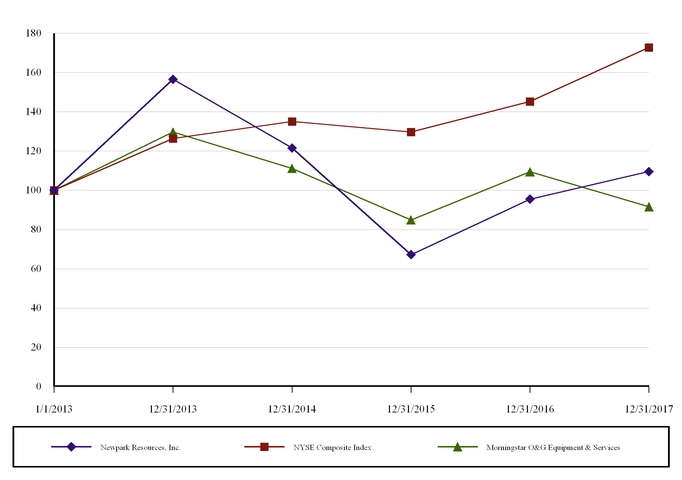

Performance Graph

The following graph reflects a comparison of the cumulative total stockholder return of our common stock from January 1, 2013 through December 31, 2017, with the New York Stock Exchange Market Value Index, a broad equity market index, and the Morningstar Oil & Gas Equipment & Services Index, an industry group index. The graph assumes the investment of $100 on January 1, 2013 in our common stock and each index and the reinvestment of all dividends, if any. This information shall be deemed furnished not filed, in this Form 10-K, and shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, or the Securities Exchange Act of 1934, except to the extent we specifically incorporate it by reference.

14

ITEM 6. Selected Financial Data

The selected consolidated historical financial data presented below for the five years ended December 31, 2017 is derived from our consolidated financial statements. The following data should be read in conjunction with the consolidated financial statements and notes thereto and with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Items 7 and 8 below.

As of and for the Year Ended December 31, | |||||||||||||||||||

(In thousands, except share data) | 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||

Consolidated Statements of Operations Data: | |||||||||||||||||||

Revenues | $ | 747,763 | $ | 471,496 | $ | 676,865 | $ | 1,118,416 | $ | 1,042,356 | |||||||||

Operating income (loss) | 31,436 | (57,213 | ) | (99,099 | ) | 130,596 | 94,445 | ||||||||||||

Interest expense, net | 13,273 | 9,866 | 9,111 | 10,431 | 11,279 | ||||||||||||||

Income (loss) from continuing operations | 11,219 | (40,712 | ) | (90,828 | ) | 79,009 | 52,622 | ||||||||||||

Income from discontinued operations, net of tax | — | — | — | 1,152 | 12,701 | ||||||||||||||

Gain (loss) from disposal of discontinued operations, net of tax | (17,367 | ) | — | — | 22,117 | — | |||||||||||||

Net income (loss) | (6,148 | ) | (40,712 | ) | (90,828 | ) | 102,278 | 65,323 | |||||||||||

Basic income (loss) per share from continuing operations | $ | 0.13 | $ | (0.49 | ) | $ | (1.10 | ) | $ | 0.95 | $ | 0.62 | |||||||

Basic net income (loss) per share | $ | (0.07 | ) | $ | (0.49 | ) | $ | (1.10 | ) | $ | 1.23 | $ | 0.77 | ||||||

Diluted income (loss) per share from continuing operations | $ | 0.13 | $ | (0.49 | ) | $ | (1.10 | ) | $ | 0.84 | $ | 0.56 | |||||||

Diluted net income (loss) per share | $ | (0.07 | ) | $ | (0.49 | ) | $ | (1.10 | ) | $ | 1.07 | $ | 0.69 | ||||||

Consolidated Balance Sheet Data: | |||||||||||||||||||

Working capital | $ | 346,623 | $ | 283,139 | $ | 380,950 | $ | 440,098 | $ | 395,159 | |||||||||

Total assets | 902,716 | 798,183 | 848,893 | 1,007,672 | 954,918 | ||||||||||||||

Foreign bank lines of credit | 1,000 | — | 7,371 | 11,395 | 12,809 | ||||||||||||||

Other current debt | 518 | 83,368 | 11 | 253 | 58 | ||||||||||||||

Long-term debt, less current portion | 158,957 | 72,900 | 171,211 | 170,462 | 170,009 | ||||||||||||||

Stockholders' equity | 547,480 | 500,543 | 520,259 | 625,458 | 581,054 | ||||||||||||||

Consolidated Cash Flow Data: | |||||||||||||||||||

Net cash provided by operations | $ | 38,381 | $ | 11,095 | $ | 121,517 | $ | 89,173 | $ | 151,903 | |||||||||

Net cash used in investing activities | (68,374 | ) | (28,260 | ) | (84,366 | ) | (14,002 | ) | (60,063 | ) | |||||||||

Net cash used in financing activities | (2,290 | ) | (650 | ) | (6,730 | ) | (49,158 | ) | (72,528 | ) | |||||||||

During 2016 and 2015, operating loss includes charges totaling $14.8 million and $80.5 million, respectively, resulting from the reduction in value of certain assets, the wind-down of our operations in Uruguay and the resolution of certain wage and hour litigation claims. Charges in 2016 include $6.9 million of non-cash impairments in the Asia Pacific region, $4.1 million of charges for the reduction in carrying values of certain inventory, $4.5 million of charges in the Latin America region associated with the wind-down of our operations in Uruguay, partially offset by a $0.7 million gain in 2016 associated with the change in final settlement amount of certain wage and hour litigation claims. Charges in 2015 include a $70.7 million non-cash impairment of goodwill, a $2.6 million non-cash impairment of assets, a $2.2 million charge to reduce the carrying value of inventory and a $5.0 million charge for the resolution of certain wage and hour litigation claims and related costs.

15

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition, results of operations, liquidity and capital resources should be read together with our Consolidated Financial Statements and Notes to Consolidated Financial Statements included in Item 8 of this Annual Report.

Overview

We are a geographically diversified supplier providing products, rentals and services primarily to the oil and gas exploration and production (“E&P”) industry. We operate our business through two reportable segments: Fluids Systems and Mats and Integrated Services. In recent years, our Mats and Integrated Services segment has expanded beyond the E&P industry, and now serves a variety of industries, including the electrical transmission & distribution, pipeline, solar, petrochemical and construction industries.

Our operating results depend, to a large extent, on oil and gas drilling activity levels in the markets we serve, and particularly for the Fluids Systems segment, the nature of the drilling operations (including the depth and whether the wells are drilled vertically or horizontally), which governs the revenue potential of each well. Drilling activity, in turn, depends on oil and gas commodity pricing, inventory levels, product demand and regulatory restrictions. Oil and gas prices and activity are cyclical and volatile. This market volatility has a significant impact on our operating results.

Beginning in the fourth quarter of 2014 and continuing through early 2016, the price of oil declined dramatically from the price levels in previous years. As a result, E&P drilling activity declined sharply in North America and many global markets over this period. Since reaching a low point in early 2016, oil prices and North American drilling activity have steadily improved, although both remain significantly lower than pre-downturn levels. While our revenue potential is driven by a number of factors including those described above, rig count data remains the most widely accepted indicator of drilling activity. Average North America rig count data for the last three years is as follows:

Year Ended December 31, | 2017 vs 2016 | 2016 vs 2015 | |||||||||||||||||||

2017 | 2016 | 2015 | Count | % | Count | % | |||||||||||||||

U.S. Rig Count | 877 | 509 | 978 | 368 | 72 | % | (469 | ) | (48 | %) | |||||||||||

Canadian Rig Count | 206 | 130 | 192 | 76 | 58 | % | (62 | ) | (32 | %) | |||||||||||

Total | 1,083 | 639 | 1,170 | 444 | 69 | % | (531 | ) | (45 | %) | |||||||||||

________________

Source: Baker Hughes, a GE Company

As of February 16, 2018, the U.S. and Canadian rig counts were 975 and 318, respectively. The Canadian rig count reflects the normal seasonality for this market, with the highest rig count levels generally observed in the first quarter of each year, prior to Spring break-up.

Outside of North America, drilling activity has remained generally more stable during this period as drilling activity in many countries is based upon longer term economic projections and multiple year drilling programs, which tends to reduce the impact of short term changes in commodity prices on overall drilling activity. While drilling activity in certain of our international markets (including Brazil and Australia) has declined in recent years, as a whole, our international activities have remained relatively stable. This stability is primarily driven by new contract awards, including those described below, which include geographical expansion into new markets as well as market share gains in existing markets. While our international contracts vary in revenue potential and duration, certain international contracts are scheduled to conclude in 2018, including those with Sonatrach and Petrobras. Our future revenue levels in international markets are largely dependent on our ability to maintain existing market share upon contract renewals which may be subject to a competitive bid process and can be impacted by our customers’ procurement strategies and allocation of contract awards.

Segment Overview

Our Fluids Systems segment, which generated 82% of consolidated revenues in 2017, provides customized fluids solutions to E&P customers globally, operating through four geographic regions: North America, Europe, the Middle East and Africa (“EMEA”), Latin America, and Asia Pacific.

16

International expansion is a key element of our Fluids Systems strategy, which in recent years, has helped to stabilize revenues as North American oil and gas exploration activities have fluctuated significantly. Significant international contract awards in recent years include:

• | A five year contract with Kuwait Oil Company to provide drilling fluids and related services for land operations. Work under this contract began in the second half of 2014. |

• | Lot 1 and Lot 3 of a restricted tender by Sonatrach to provide drilling fluids and related services, which expanded our market share with Sonatrach in Algeria. Work under this three-year contract began in the second quarter of 2015, with activity levels ramping up during the second half of 2015 and early 2016. While revenues from this contract represented less than 10% of consolidated revenues in 2017, the contract contributed approximately 14% of our consolidated revenues in 2016. |

• | A contract with Total S.A. to provide drilling fluids and related services for an exploratory ultra-deepwater well in Block 14 of offshore Uruguay. This project was completed in 2016, contributing approximately $12 million of revenue for the year in 2016. |

• | A two-year contract with Shell Oil in Albania to provide drilling fluids and related services for onshore drilling activity. Work under this contract began in 2016. |

• | A three-year contract with Cairn Oil & Gas to provide drilling and completion fluids, along with associated services, in support of Cairn’s onshore drilling in India. Work under this contract began in the third quarter of 2017. |

• | A contract with Baker Hughes, a GE Company, to provide drilling fluids and related services as part of Baker Hughes’ integrated service offering in support of the Greater Enfield project in offshore Western Australia. Work under this contract began in January 2018. |

Within the U.S. operations of our Fluids Systems segment we invested approximately $40 million in recent years to significantly expand existing capacity and upgrade the drilling fluids blending, storage, and transfer capabilities in our Fourchon, Louisiana facility which serves customers in the Gulf of Mexico deepwater market. This project is part of our Fluids Systems strategy to penetrate the Gulf of Mexico deepwater market and was substantially completed in the second quarter of 2017. Capital expenditures related to the Fourchon expansion totaled $6.9 million, $22.2 million and $10.1 million in 2017, 2016 and 2015, respectively.

Our Mats and Integrated Services segment, which generated 18% of consolidated revenues in 2017, provides composite mat rentals, site construction and related site services to customers in various markets including oil and gas exploration and production, electrical transmission & distribution, pipeline, solar, petrochemical and construction across North America and Europe. We also sell composite mats to customers outside of the U.S. and to domestic customers outside of the E&P market. Following our efforts in recent years to diversify our customer base, Mats and Integrated Services segment revenues from non-E&P markets represented approximately two-thirds of our segment revenues in 2017.