Financial report |

||||||

This is Ericsson |

1 |

|||||

CEO comment |

2 |

|||||

Business strategy |

5 |

|||||

Letter from the Chair of the Board |

14 |

|||||

Board of Directors’ report |

16 |

|||||

Report of independent registered public accounting firm |

32 |

|||||

Report of independent registered public accounting firm |

33 |

|||||

Consolidated financial statements with notes |

35 |

|||||

Management’s report on internal control over financial reporting |

89 |

|||||

Risk factors |

90 |

|||||

Alternative performance measures |

107 |

|||||

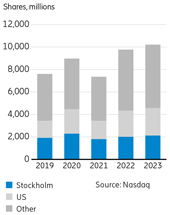

The Ericsson share |

112 |

|||||

Corporate Governance report |

||||||

Introduction and Key 2023 Governance Updates |

2 |

|||||

Regulation |

3 |

|||||

Governance Structure and Core Values |

3 |

|||||

Ethics & Compliance |

5 |

|||||

Risk Management |

6 |

|||||

General Meetings of shareholders |

8 |

|||||

Nomination Committee |

8 |

|||||

Board of Directors |

9 |

|||||

Committees of the Board of Directors |

11 |

|||||

Remuneration to Board members |

13 |

|||||

Members of the Board of Directors |

14 |

|||||

Management |

18 |

|||||

Cybersecurity |

19 |

|||||

Members of the Executive Team |

20 |

|||||

Auditor |

25 |

|||||

Internal control over financial reporting |

25 |

|||||

Remuneration report |

||||||

Statement from the Chair of the Remuneration Committee |

1 |

|||||

Introduction |

2 |

|||||

Remuneration 2023 at a glance |

3 |

|||||

Total remuneration to the President and CEO and Executive Vice President |

5 |

|||||

Variable remuneration |

6 |

|||||

Comparative information on changes in remuneration and the Company’s performance |

11 |

|||||

● |

The Financial report, including Board of Directors’ report and the financial statements and notes |

● |

The Corporate Governance report |

● |

The Remuneration report |

Contents |

||||||||

Financial report 2023 |

||||||||

This is Ericsson |

1 |

|||||||

CEO comment |

2 |

|||||||

Business strategy – Creating long-term value |

5 |

|||||||

Letter from the Chair of the Board |

14 |

|||||||

Board of Directors’ report |

16 |

|||||||

Board Assurance |

31 |

|||||||

Report of independent registered public accounting firm |

32 |

|||||||

Report of independent registered public accounting firm |

33 |

|||||||

Consolidated financial statements |

35 |

|||||||

Notes to the consolidated financial statements |

42 |

|||||||

Management’s report on internal control over financial reporting |

89 |

|||||||

Risk factors |

90 |

|||||||

Forward-looking statements |

105 |

|||||||

Alternative performance measures |

107 |

|||||||

The Ericsson share |

112 |

|||||||

Shareholder information |

116 |

|||||||

Financial terminology |

117 |

|||||||

Glossary |

118 |

|||||||

|

| |||

| 1 | Financial Report 2023 | | Ericsson Annual Report on Form 20-F 2023 | ||

| ||||

| 2 | Financial Report 2023 | CEO comment | Ericsson Annual Report on Form 20-F 2023 | ||

| ||||

| 3 | Financial Report 2023 | CEO comment | Ericsson Annual Report on Form 20-F 2023 | ||

1) |

Excluding restructuring charges. |

| ||||

| 4 | Financial Report 2023 | CEO comment | Ericsson Annual Report on Form 20-F 2023 | ||

1) |

Net sales adjusted for comparable units and currency. |

2) |

Excluding restructuring charges. |

| ||||

| 5 | Financial Report 2023 | Business strategy | Ericsson Annual Report on Form 20-F 2023 | ||

Digitalization and society Over the past three decades, mobile connectivity has fundamentally transformed our world – driving advanced digitalization in industries and society. Today, we have near-ubiquitous connectivity globally, with 8.5 billion mobile phone subscriptions. And over the last 30 years, data speeds have increased at a rate faster than Moore’s Law. During this time, 4G networks gave rise to the app economy and digitalized consumer life. Today digitalization is a key tool for solving some of society’s biggest challenges, including the climate crisis and social inclusion. But to take the next step in digitalization, “best effort” connectivity for consumers will not be enough. What is needed are faster speeds, reduced latency and improved quality of service to achieve complete digitalization in both enterprises and the public sector. Satisfying those demands will require higher-performance networks that are significantly more powerful than previous generations. |

|

| • | Quality of Service and time-bound latency |

| • | Improved outdoor and indoor coverage |

| • | Advanced location and positioning 3D-mapping |

| • | Improved security authentication |

| ||||

| 6 | Financial Report 2023 | Business strategy | Ericsson Annual Report on Form 20-F 2023 | ||

| ||||

| 7 | Financial Report 2023 | Business strategy | Ericsson Annual Report on Form 20-F 2023 | ||

Best performance for differentiated networks, relentless efficiency and growth in an open world |

Leadership in mobile networks |

Focused expansion into enterprise | |||||

• Technology leadership for performance, security, and sustainability at lowest TCO across RAN, Core & OSS/BSS • Lead industry shift to programmable, automated cloud-native networks and operations, and advanced network services |

Wireless networks • Pre-packaged solutions• Leading reliability, security, and operations |

Communication platform • Accelerate the world’s ability to connect • Global network platform | ||||

Be first in critical innovations, and capture strategic business opportunities | ||||||

Technology leadership |

Cost efficiency |

Data-driven operations |

Global skill & scale | |||

Delivering on end-user requirementsCreating value through our strategy is closely linked with our commitment to fulfill the diverse needs of consumers, enterprises and developers. For consumers, this means delivering on their demand for an unparalleled experience with seamless connectivity and high-quality communications services. Enterprises require reliable and easy-to-use |

Customer success Through our products and solutions, we drive relentless efficiency in order to minimize our customer’s total cost of ownership (TCO) while accelerating their revenue growth in an increasingly open world. This includes addressing the need for spectrum, greater energy efficiency and superior performance. We are also ensuring that our customers are well prepared for future opportunities by embracing open and programmable networks. |

| ||||

| 8 | Financial Report 2023 | Business strategy | Ericsson Annual Report on Form 20-F 2023 | ||

Focused expansion into enterprise With 5G, we are in the early stages of widespread enterprise digitalization – creating significant additional value for industrial applications such as mining, airports, and manufacturing. We continue to build an enterprise business with a strategy that is organized around two pillars. The first, Enterprise Wireless Solutions, is where we are driving business transformation through seamless and secure network solutions. The second, Global Communications Platform, is where we will help customers monetize 5G in new ways by transforming how network capabilities – such as high speed and low latency – are globally exposed, consumed and paid for. |

Enterprise Wireless Solutions We are developing wireless solutions for businesses with leading reliability, security and easy-to-manage Through business area Enterprise Wireless Solutions Wireless-WAN (WWAN) and Cloud Security (Security Services Edge – or SSE) solutions. These solutions are primarily delivered via a unified management, policy, and security framework to enterprises, Managed Service Providers (MSPs) and CSPs.The business area continues to expand its portfolio. In April 2023, Cradlepoint acquired Ericom Software including their advanced enterprise cloud security platform to solidify its Secure Access Service Edge (SASE) and zero-trust offerings for hybrid 5G and wireline environments. |

Global Communications Platform The second pillar of our enterprise strategy is powered by our acquisition of Vonage and the formation of business area Global Communications Platform Our ambition is to accelerate the world’s ability to connect and we do this by maintaining a strong position in the market for Communications Platform as a Service (CPaaS) with deep enterprise and developer engagements. In addition, 5G offers programmable and differentiated network performance and capabilities which in turn enables CSPs to provide new revenue-driving uses cases on top of their current subscription offerings. The key to this lies in making network capabilities broadly available – through network APIs – to developers and enterprises. By combining the Vonage platform and developer ecosystem with open and programmable networks, we now have the building blocks to launch a Global Network Platform – making it easy to expose, consume and pay for network APIs. In September 2023, we reached an important milestone together with Deutsche Telecom, announcing a world-first in the commercialization of network APIs. | ||||||||||

1) Excluding restructuring charges. |

| ||||

| 9 | Financial Report 2023 | Business strategy | Ericsson Annual Report on Form 20-F 2023 | ||

| ||||

| 10 | Financial Report 2023 | Business strategy | Ericsson Annual Report on Form 20-F 2023 | ||

| ||||

| 11 | Financial Report 2023 | Business strategy | Ericsson Annual Report on Form 20-F 2023 | ||

1) |

Excluding restructuring charges. |

2) |

Validated by the Science Based Targets initiative (SBTi). |

3) |

Defined as changes in operating net assets. |

4) |

Restructuring charges as reported in the income statement for each year. |

| ||||

| 12 | Financial Report 2023 | Business strategy | Ericsson Annual Report on Form 20-F 2023 | ||

Mobile Networks – Networks |

Offering |

Business model |

||||||

Networks offers multi-technology-capable Radio Access Network (RAN) solutions for all network spectrum bands, including purpose-built and Open RAN-prepared high-performance hardware and software. The offerings also include a Cloud RAN portfolio, a transport portfolio, passive and active antenna solutions and a complete service portfolio, covering network deployment and support. |

Networks is primarily based on a business model where Ericsson develops, sells, licenses and delivers hardware, software and services. Networks business also includes recurring revenue streams such as customer support and software revenues. |

|||||||

Mobile Networks – Cloud Software and Services |

Offering |

Business model |

||||||

Cloud Software and Services provides solutions for core networks, business and operational support systems, network design and optimization, and managed network services. Focus is to enable communications service providers (CSPs) to succeed in their transition to cloud operations, intelligent and automated networks. |

Cloud Software and Services develops, sells, and delivers solutions, and operate customer networks. The software solutions typically include services for deployment projects as well as recurring revenues from software, support and lifecycle management. The Managed Network Services contracts are typically multi-year outsourcing agreements. |

|||||||

Enterprise |

Offering |

Business model |

||||||

The segment comprises three business areas offering solutions primarily to enterprises: • Enterprise Wireless Solutions, including private wireless networks and wireless WAN (Cradlepoint) pre-packaged solutions.• Global Communications Platform (Vonage), including cloud-based Unified Communications as a Service (UCaaS), Contact Center as a Service (CCaaS) and Communications Platform as a Service (CPaaS).• Technologies and New Businesses, including mobile financial services, security solutions and advertising services. |

The Enterprise Wireless Solutions portfolio (including Cradlepoint) is sold through a term-based subscription contract, typically a three-year contract with subsequent yearly renewal periods. These subscriptions have up-front payments at the beginning of the contract and at each renewal period.The business model for API services in the Global Communications Platform is transaction based. In this model, Application Service Providers (ASPs) pay a transaction fee to Ericsson each time an API is used, while the CSPs get paid from Ericsson for providing network capability/capacity. CSPs also benefit from increased revenues from additional traffic going over their network. As the market for Network APIs is still being developed, multiple commercial models may emerge. Other contracts in segment Enterprise such as UCaaS, CCaaS, Private Network etc. are typically as a Service (aaS) or license based, with recurring revenue from software licenses, services, subscriptions and support. |

|||||||

Other |

Offering |

Business model |

||||||

Segment Other comprises media businesses as well as other non-allocated business, including Redbee Media, which prepares and distributes live and on-demand video services for broadcasters, sports leagues and CSPs. The segment also includes other non-allocated business. |

Outsourced broadcast service contracts are generally multi-year agreements while other media contracts are typically aaS or license based with recurring revenue from services, subscriptions and support. |

|||||||

| ||||

| 13 | Financial Report 2023 | Business strategy | Ericsson Annual Report on Form 20-F 2023 | ||

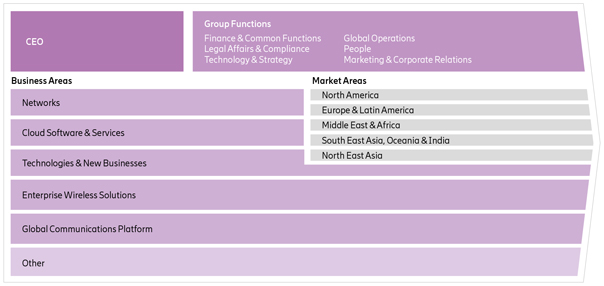

Geographical market areas |

||||

• North America • Europe and Latin America • Middle East and Africa • North East Asia • South East Asia, Oceania and India |

Sales in segments Networks and Cloud Software and Services are divided into five geographical market areas. Market areas are responsible for selling and delivering products and solutions that are developed in these business segments, mainly to CSP customers. In line with our strategy, the market areas have the responsibility to ensure that we stay close to our customers while maintaining Group guidelines and governance structures. | |||

Market area Other |

||||

The majority of sales in segment Enterprise is reported in market area Other. To reach the enterprise market with businesses of all sizes, Ericsson has a multi-channel approach, which builds on the enterprise channel from Cradlepoint. This is a global program with access to tens of thousands of reseller partners in Enterprise Wireless Solutions. In order to provide communication APIs and build a Global Network Platform, the go-to-market go-to-market |

IPR licensing revenues from Ericsson’s patents are also reported in Market Area Other. Patents are licensed globally on fair, reasonable, and nondiscriminatory terms (FRAND) to companies that use our technology. The key cellular market segments for our patents are smartphones, Internet of Things (IoT) devices, consumer electronics and automotive. Beyond cellular, other licensed technologies include media technologies and other connectivity standards. Ericsson licenses its patents bilaterally as well as by participating in patent pools covering certain market segments. | |||

| ||||

| 14 | Financial Report 2023 | Letter from the Chair of the Board | Ericsson Annual Report on Form 20-F 2023 | ||

| ||||

| 15 | Financial Report 2023 | Letter from the Chair of the Board | Ericsson Annual Report on Form 20-F 2023 | ||

| ||||

| 16 | Financial Report 2023 | Board of Directors’ report | Ericsson Annual Report on Form 20-F 2023 | ||

| 16 | Business in 2023 | |

| 17 | Financial highlights | |

| 20 | Business results – Segments | |

| 22 | Business results – Market areas | |

| 23 | Corporate governance | |

| 24 | Material contracts | |

| 24 | Risk management | |

| 24 | Sourcing and supply | |

| 25 | Sustainability and Corporate Responsibility | |

| 25 | Legal proceedings | |

| 26 | Group structure | |

| 26 | Parent Company | |

| 26 | Share information | |

| 26 | Proposed disposition of earnings | |

| 27 | Guidelines for Remuneration to Group Management | |

| 30 | Events after the reporting period | |

| 31 | Board assurance | |

| – | Net sales decreased by -3% to SEK 263.4 (271.5) billion. Sales adjusted for comparable units and currency declined by -10%. |

| – | Gross income decreased to SEK 101.6 (113.3) billion due to sales and margin decline in Networks. |

| – | EBIT (loss) amounted to SEK -20.3 (27.0) billion, impacted by a non-cash goodwill impairment charge of SEK -31.9 billion attributed to Vonage. EBIT margin was -7.7% (10.0%). EBIT margin excluding restructuring charges was -5.2% (10.1%). |

| – | Net income (loss) was SEK -26.1 (19.1) billion. Earnings per share (EPS) diluted was SEK -7.94 (5.62). |

| – | EBITA amounted to SEK 14.9 (29.1) billion with an EBITA margin of 5.7% (10.7%). EBITA margin excluding restructuring charges was 8.1% (10.9%). |

| – | Cash flow from operating activities was SEK 7.2 (30.9) billion. Free cash flow before M&A amounted to SEK -1.1 (22.2) billion. Cash and cash equivalents was SEK 35.2 (38.3) billion on December 31, 2023. Net cash was SEK 7.8 (23.3) billion on December 31, 2023. |

| – | The Board of Directors proposes a dividend for 2023 of SEK 2.70 (2.70) per share to the AGM. |

| ||||

| 17 | Financial Report 2023 | Board of Directors’ report | Ericsson Annual Report on Form 20-F 2023 | ||

| ||||

| 18 | Financial Report 2023 | Board of Directors’ report | Ericsson Annual Report on Form 20-F 2023 | ||

| ||||

| 19 | Financial Report 2023 | Board of Directors’ report | Ericsson Annual Report on Form 20-F 2023 | ||

| Most recent three-year average seasonality | ||||||||||||||||

| First quarter |

Second quarter |

Third quarter |

Fourth quarter |

|||||||||||||

| Share of annual Group sales | 22% | 24% | 25% | 30% | ||||||||||||

| Sequential change, Networks sales | -25% | 8% | 1% | 19% | ||||||||||||

| Sequential change, Cloud Software and Service sales | -34% | 13% | 3% | 33% | ||||||||||||

| Capital expenditures 2021–2023 | ||||||||||||

| SEK billion | 2023 | 2022 | 2021 | |||||||||

| Capital expenditures | 3.3 | 4.5 | 3.7 | |||||||||

Of which in Sweden |

1.2 |

1.7 |

1.5 |

|||||||||

| Share of annual sales | 1.3% | 1.6% | 1.6% | |||||||||

| ||||

| 20 | Financial Report 2023 | Board of Directors’ report | Ericsson Annual Report on Form 20-F 2023 | ||

| ||||

| 21 | Financial Report 2023 | Board of Directors’ report | Ericsson Annual Report on Form 20-F 2023 | ||

| ||||

| 22 | Financial Report 2023 | Board of Directors’ report | Ericsson Annual Report on Form 20-F 2023 | ||

| ||||

| 23 | Financial Report 2023 | Board of Directors’ report | Ericsson Annual Report on Form 20-F 2023 | ||

| – | Empowers the business, enabling strategic execution and operational excellence; |

| – | Promotes and facilitates effective oversight across the organization by the Board of Directors (Board), the President and CEO, the Executive Team and at all levels of the organization; |

| – | Ensures high-quality decision-making with clear accountabilities at all levels; and |

| – | Instills a robust approach to risk management to effectively identify, manage and mitigate risks and capture opportunities. |

| – | Fully embedded the Material Group Risk Protocol and Business Risk Committee (BRC) into the Group’s governance and risk management frameworks, as described further below. |

| – | Introduced clarified Group governance and operating principles, to be rolled out in early 2024. |

| – | Refreshed and clarified the Company’s Code of Business Ethics (CoBE), which is being re-launched in early 2024. |

| – | Updated, streamlined and clarified the Group’s key policies and other guidance documents, including those on contracting, compliance, allegation assessment, investigations and remediation, and human rights. This work will continue into 2024. |

| – | Continued to embed various aspects of its compliance program into business operations, through a close partnership with the compliance function and stakeholders across the entire organization (as described further below in the Ethics & Compliance section). |

| – | Continued to strengthen performance-management at all levels of the organization while also implementing strong remediation measures where misconduct has occurred. |

| ||||

| 24 | Financial Report 2023 | Board of Directors’ report | Ericsson Annual Report on Form 20-F 2023 | ||

| – | significant improvements made to Ericsson’s governance framework which has included enhanced Board and management oversight and strong, proactive risk management; |

| – | the effective integration of enhanced controls into Ericsson’s operations and decision-making; |

| – | emphasis on driving continuous cultural change with a focus on embedding integrity into Ericsson’s ways of working, fostering a culture of transparency, collaboration and open dialogue, sound and ethical business decisions, strong risk management; |

| – | implementation of employee training programs and providing Speak-Up resources to drive an integrity-led culture; and |

| – | significant testing of the E&C program’s effectiveness, simplification of policies, procedures and tools, an improved understanding of managing risks in business interactions, and digitalization. |

| ||||

| 25 | Financial Report 2023 | Board of Directors’ report | Ericsson Annual Report on Form 20-F 2023 | ||

| ||||

| 26 | Financial Report 2023 | Board of Directors’ report | Ericsson Annual Report on Form 20-F 2023 | ||

| – | Current and non-current liabilities to subsidiaries decreased by SEK 46.8 billion to SEK 47.6 billion. |

| – | Current and non-current receivables from subsidiaries decreased by SEK 6.3 billion to SEK 17.8 billion. |

| – | Shareholder contributions to subsidiaries of SEK 11.9 billion. |

| – | Impairment of investments in subsidiaries and associates of SEK 32.8 billion. |

| – | Dividends from subsidiaries and associated companies of SEK 32.5 billion. |

| – | Gross cash decreased by SEK 6.5 billion to SEK 34.9 billion. |

| Amount to be paid to the shareholders | SEK 9,029,209,684 | |

| Amount to be retained by the Parent Company | SEK 18,555,216,849 | |

| Total non-restricted equity of the Parent Company |

SEK 27,584,426,533 |

| ||||

| 27 | Financial Report 2023 | Board of Directors’ report | Ericsson Annual Report on Form 20-F 2023 | ||

| – | attract and retain highly competent, performing, and motivated people that have the ability, experience, and skill to deliver on the Ericsson strategy; |

| – | encourage behavior consistent with Ericsson’s culture and core values; |

| – | ensure fairness in reward by delivering total remuneration that is appropriate but not excessive, and clearly explained; |

| – | have a total compensation mix of fixed pay, variable pay and benefits that is competitive where Ericsson competes for talent; and |

| – | encourage variable remuneration which aligns employees with clear and relevant targets, reinforces their performance and enables flexible remuneration costs for Ericsson. |

| ||||

| 28 | Financial Report 2023 | Board of Directors’ report | Ericsson Annual Report on Form 20-F 2023 | ||

| Element and purpose | Description | |

Fixed salary Fixed compensation paid at set times. Purpose: – attract and retain the executive talent required to implement Ericsson’s strategy – deliver part of the annual compensation in a predictable format |

Salaries shall be set taking into account: – Ericsson’s overall business performance – business performance of the Unit that the individual leads – year-on-year – external economic environment – size and complexity of the position – external market data – pay and conditions for other employees based in locations considered to be relevant to the role. When setting fixed salaries, the impact on total remuneration, including pensions and associated costs, shall be taken into consideration. | |

Short-term variable compensation (STV) STV is a variable compensation plan that shall be measured against targets derived from the business plan and paid over a single year. Purpose: – align members of Group Management with clear and relevant targets to Ericsson’s strategy and sustainable long-term interests, – provide individuals an earning opportunity for performance at flexible cost to the Company. |

The STV shall be paid in cash every year after the Committee and, as applicable, the Board have reviewed and approved performance against targets which are normally determined at the start of each year for each member of Group Management. Target pay-out opportunity for any financial year may be up to 150% of annual fixed salary of the individual. This shall normally be determined in line with the external market practices of the country of employment. Maximum pay-out shall be up to two times the target pay-out opportunity (i.e., no more than 300% of annual fixed salary). Any existing long-term variable pay-opportunity should be taken into account when determining target opportunity for STV (and vice versa).The STV shall be based on measures linked to the annual business plan and to Ericsson’s long-term strategy and sustainability. Measures will include financial targets at Group, Business Area and/or Market Area level (for relevant members of Group Management). Other potential measures may include strategic targets, operational targets, employee engagement targets, customer satisfaction targets, sustainability and corporate responsibility targets or other lead indicator targets. At the end of the performance period for each STV cycle, the Board and the Committee shall assess performance versus the measures and determine the formula-based outcome using the financial information made public by the Company for the financial targets when applicable. The Board and the Committee reserve the right to: – revise any or all of the STV targets at any time, – adjust the STV targets retroactively under extraordinary circumstances, – reduce or cancel STV if Ericsson faces severe economic difficulties, for instance in circumstances as serious as no dividend being paid, – adjust STV in the event that the results of the STV targets are not a true reflection of business performance, – reduce or cancel STV for individuals either whose performance evaluation or whose documented performance feedback is below an acceptable level or who are on performance counselling. The Board and the Committee shall have the right in their discretion to: – deny, in whole or in part, the entitlement of an individual to the STV payout in case an individual has acted in breach of Ericsson’s Code of Business Ethics, – claim repayment in whole or in part the STV paid in case an individual has acted in breach of Ericsson’s Code of Business Ethics, – reclaim STV paid to an individual on incorrect grounds such as restatement of financial results due to incorrect financial reporting, non-compliance with a financial reporting requirement etc. | |

Pension Contributions paid towards retirement fund. Purpose: – attract and retain the executive talent required to implement Ericsson’s strategy, – facilitate planning for retirement by way of providing competitive retirement arrangements in line with local market practices. |

The operation of the pension plan shall follow competitive practice in the individual’s home country and may contain various supplementary plans in addition to any national system for social security. Pension plans should be defined contribution plans unless the individual concerned is subject to defined benefit pension plan under mandatory collective bargaining agreement provisions or mandatory local regulations. For Group Management members in Sweden: – pension benefits shall be granted based on a defined contribution plan except where law or collective bargaining agreement require a defined benefit pension. The pensionable salary shall include fixed salary and, where required by law or collective bargaining agreement, any variable salary. – a supplementary pension contribution can be paid amounting to a maximum of 35% of the fixed annual salary that exceeds any cap in collective pension plans, unless a higher percentage is obliged by law or collective bargaining agreement. – the supplementary pension contribution can, as an alternative to a pension contribution, be exchanged for a cash payment provided that it is done in a way that is cost-neutral for the Company. Members of Group Management employed outside of Sweden may participate in the local market competitive pension arrangements that apply in their home countries in line with what is offered to other employees in the same country. In some special circumstances where individuals cannot participate in the local pension plans of their home countries of employment: – cash equivalent to pension may be provided as a taxable benefit, or – contributions may be made to an international pension fund on behalf of the individual on a costneutral basis In all cases the annual pension contributions shall be capped at 70% of annual fixed salary. | |

Other benefits Additional tangible or intangible compensation paid annually which do not fall under fixed salary, short-term and long-term variable compensation, or pension. Purpose: – attract and retain the executive talent required to implement Ericsson’s strategy, – deliver part of the annual compensation in a predictable format. |

Benefits offered shall consider the competitive practices in the individual’s country of employment and should be in line with what is offered to other senior employees in the same country and may evolve year on year. Benefits may for example include Company phones, Company cars, wellbeing assistance, medical and other insurance benefits, tax support, travel, Company gifts and any international relocation and/or commuting benefits if the individual is required to relocate and/or commute internationally to execute the requirements of the role. Benefit opportunities shall be set in line with competitive market practices and shall reflect what is offered to other senior employees in the individual’s country of employment. The levels of benefits provided may vary year on year depending on the cost of the provision of benefits to the Company. Other benefits shall be capped at 10% of annual fixed salary for members of Group Management located in Sweden. Additional benefits and allowances for members of Group Management who are commuters into Sweden or who are on long-term assignment (“ LTA | |

| ||||

| 29 | Financial Report 2023 | Board of Directors’ report | Ericsson Annual Report on Form 20-F 2023 | ||

| – | the role being taken on, |

| – | the skills, experience and caliber of the candidate, |

| – | the level and type of remuneration opportunity received at a previous employer, |

| – | the geography in which the candidate is being recruited from and whether any relocation allowance is required, |

| – | the circumstances of the candidate, |

| – | the current external market and salary practice, |

| – | internal relativities. |

| – | upon change of the President and CEO, |

| – | upon material changes in the Company structure, organization, ownership, and business (for example takeover, acquisition, merger, demerger etc.) which may require adjustments in STV and LTV or other elements to ensure continuity of Group Management, and |

| – | in any other circumstances, provided that the deviation is required to serve the long-term interests and sustainability of the Company or to assure its financial viability. |

| ||||

| 30 | Financial Report 2023 | Board of Directors’ report | Ericsson Annual Report on Form 20-F 2023 | ||

| ||||

| 31 | Financial Report 2023 | Board of Directors’ report | Ericsson Annual Report on Form 20-F 2023 | ||

| ||||

| 32 | Financial Report 2023 | Report of independent registered public accounting firm | Ericsson Annual Report on Form 20-F 2023 | ||

| ||||

| 33 | Financial Report 2023 | Report of independent registered public accounting firm | Ericsson Annual Report on Form 20-F 2023 | ||

| – | We tested the effectiveness of the Company’s controls over revenue recognition with particular focus on the controls related to the identification of performance obligations within large contracts with customers and determination of the timing of revenue recognition for each performance obligation. |

| ||||

| 34 | Financial Report 2023 | Report of independent registered public accounting firm | Ericsson Annual Report on Form 20-F 2023 | ||

| – | We tested a sample of large contracts with customers to assess management’s judgments and estimates related to the identification of performance obligations and determination of the timing of recognition for each revenue obligation based on the contract. |

| – | We tested a sample of revenue transactions related to large contracts with customers recorded during the year by tracing them to supporting evidence of delivery and acceptance and assessed the judgments and estimates for revenue recorded in the period by comparing it to contract terms such as, delivery terms, transaction prices including variable considerations, discounts and incentive agreements. |

| – | We tested a sample of ongoing negotiations with existing customers and analysed reversals of revenue subsequent to year end for indicators of unrecorded discounts and concessions during the period. |

| – | We tested the effectiveness of the Company’s controls over goodwill impairment evaluation and determination of the recoverable amount with particular focus on the controls over management’s preparation and review of assumptions for future sales growth, operating income, working capital, capital expenditure requirements and method for determining the discount and terminal growth rate used. |

| – | We evaluated management’s ability to accurately forecast future sales growth, operating income, working capital and capital expenditure requirements by comparing actual results to management’s historical forecasts, the Company’s historical results, external analyst reports and internal communications to management and the Board of Directors. |

| – | With the assistance of our valuation specialists, we evaluated the discount and terminal growth rates, including testing the underlying source information and the mathematical accuracy of the calculations, and developing a range of independent estimates and comparing those to the discount rates selected by management. |

| – | With the assistance of our valuation specialists, we further evaluated the company’s sensitivity analysis by comparing to our own sensitivity analysis to corroborate the disclosures around assumptions that are most sensitive to a reasonably possible change that could cause the carrying amount to exceed its recoverable amount for a cash generating unit. |

| ||||

| 35 Consolidated financial statements with notes | Financial report 2023 | |||

Consolidated financial statements | ||||

36 |

Consolidated income statement | |||

36 |

Consolidated statement of comprehensive income (loss) | |||

37 |

Consolidated balance sheet | |||

38 |

Consolidated statement of cash flows | |||

39 |

Consolidated statement of changes in equity | |||

Notes to the consolidated financial statements | ||||

42 |

A |

Basis of presentation | ||

42 |

A1 | Material accounting policies | ||

48 |

A2 | Critical accounting estimates and judgments | ||

50 |

B |

Business and operations | ||

50 |

B1 | Segment information | ||

53 |

B2 | Net sales | ||

53 |

B3 | Expenses by nature | ||

53 |

B4 | Other operating income and expenses | ||

53 |

B5 | Inventories | ||

54 |

B6 | Customer contract related balances | ||

54 |

B7 | Other current receivables | ||

54 |

B8 | Trade payables | ||

54 |

B9 | Other current liabilities | ||

55 |

C |

Long-term assets | ||

55 |

C1 | Intangible assets | ||

57 |

C2 | Property, plant and equipment | ||

58 |

C3 | Leases | ||

59 |

D |

Obligations | ||

59 |

D1 | Provisions | ||

61 |

D2 | Contingent liabilities | ||

61 |

D3 | Assets pledged as collateral | ||

61 |

D4 | Contractual obligations | ||

62 |

E |

Group structure | ||

62 |

E1 | Equity | ||

63 |

E2 | Business combinations | ||

64 |

E3 | Associated companies | ||

65 |

F |

Financial instruments | ||

65 |

F1 | Financial risk management | ||

70 |

F2 | Financial income and expenses | ||

70 |

F3 | Financial assets, non-current | ||

71 |

F4 | Interest-bearing liabilities | ||

72 |

G |

Employee related | ||

72 |

G1 | Post-employment benefits | ||

76 |

G2 | Information regarding members of the Board of Directors and Group management | ||

78 |

G3 | Share-based compensation | ||

84 |

G4 | Employee information | ||

85 |

H |

Other | ||

85 |

H1 | Taxes | ||

86 |

H2 | Earnings per share | ||

87 |

H3 | Statement of cash flows | ||

87 |

H4 | Related party transactions | ||

88 |

H5 | Fees to auditors | ||

88 |

H6 | Events after the reporting period | ||

|

||||

Financial report 2023 |

Consolidated financial statements 36 | |||

| January–December, SEK million | Notes | 2023 | 2022 | 2021 | ||||||||||||||||||||||||

Net sales |

B1, B2 |

|||||||||||||||||||||||||||

Cost of sales |

– |

– |

– |

|||||||||||||||||||||||||

Gross income |

||||||||||||||||||||||||||||

Research and development expenses |

– |

– |

– |

|||||||||||||||||||||||||

Selling and administrative expenses |

– |

– |

– |

|||||||||||||||||||||||||

Impairment losses on trade receivables |

F1 |

– |

– |

– |

||||||||||||||||||||||||

Operating expenses |

– |

– |

– |

|||||||||||||||||||||||||

Other operating income |

B4 |

|||||||||||||||||||||||||||

Other operating expenses |

B4 |

– |

– |

– |

||||||||||||||||||||||||

Share in earnings of joint ventures and associated companies |

B1, E3 |

– |

||||||||||||||||||||||||||

Earnings (loss) before financial items and income tax (EBIT) |

B1 |

– |

||||||||||||||||||||||||||

Financial income |

F2 |

|||||||||||||||||||||||||||

Financial expenses |

F2 |

– |

– |

– |

||||||||||||||||||||||||

Net foreign exchange gains/losses |

F2 |

– |

– |

– |

||||||||||||||||||||||||

Income (loss) after financial items |

– |

|||||||||||||||||||||||||||

Income tax |

H1 |

– |

– |

– |

||||||||||||||||||||||||

Net income (loss) |

– |

|||||||||||||||||||||||||||

Net income (loss) attributable to: |

||||||||||||||||||||||||||||

Owners of the Parent Company |

– |

|||||||||||||||||||||||||||

Non-controlling interests |

||||||||||||||||||||||||||||

Other information |

||||||||||||||||||||||||||||

Average number of shares, basic (million) |

H2 |

|||||||||||||||||||||||||||

Earnings (loss) per share attributable to owners of the Parent Company, basic (SEK) |

H2 |

– |

||||||||||||||||||||||||||

Earnings (loss) per share attributable to owners of the Parent Company, diluted (SEK) |

H2 |

– |

||||||||||||||||||||||||||

| January–December, SEK million | 2023 | 2022 | 2021 | |||||||||||||||||||||||||||||

Net income (loss) |

– |

|||||||||||||||||||||||||||||||

Other comprehensive income (loss) |

||||||||||||||||||||||||||||||||

Items that will not be reclassified to profit or loss |

||||||||||||||||||||||||||||||||

Remeasurements of defined benefit pension plans including asset ceiling |

||||||||||||||||||||||||||||||||

Revaluation of borrowings due to change in credit risk |

– |

|||||||||||||||||||||||||||||||

Cash flow hedge reserve |

||||||||||||||||||||||||||||||||

Gains/losses arising during the period |

– | – | ||||||||||||||||||||||||||||||

Transfer to goodwill |

– | – |

– | |||||||||||||||||||||||||||||

Tax on items that will not be reclassified to profit or loss |

– |

– |

– |

|||||||||||||||||||||||||||||

Items that have been or may be reclassified to profit or loss |

||||||||||||||||||||||||||||||||

Cash flow hedge reserve |

||||||||||||||||||||||||||||||||

Gains/losses arising during the period |

– |

– |

||||||||||||||||||||||||||||||

Reclassification adjustments on gains/losses included in profit or loss |

– |

|||||||||||||||||||||||||||||||

Translation reserves |

||||||||||||||||||||||||||||||||

Changes in translation reserves |

– |

|||||||||||||||||||||||||||||||

Reclassification to profit and loss |

– |

|||||||||||||||||||||||||||||||

Share of other comprehensive income of JV and associated companies |

– |

|||||||||||||||||||||||||||||||

Tax on items that have been or may be reclassified to profit or loss |

– |

|||||||||||||||||||||||||||||||

Other comprehensive income (loss), net of tax |

– |

|||||||||||||||||||||||||||||||

Total comprehensive income (loss) |

– |

|||||||||||||||||||||||||||||||

Total comprehensive income (loss) attributable to: |

||||||||||||||||||||||||||||||||

Owners of the Parent Company |

– |

|||||||||||||||||||||||||||||||

Non-controlling interests |

||||||||||||||||||||||||||||||||

| ||||

| 3 7 Consolidated financial statements |

Financial report 2023 | |||

| SEK million | Notes | Dec 31 2023 |

Dec 31 2022 |

|||||||||||||||||||||

Assets |

||||||||||||||||||||||||

Non-current assets |

||||||||||||||||||||||||

Intangible assets |

C1 |

|||||||||||||||||||||||

Capitalized development expenses |

||||||||||||||||||||||||

Goodwill |

||||||||||||||||||||||||

Customer relationships, IPRs and other intangible assets |

||||||||||||||||||||||||

Property, plant and equipment |

C2 |

|||||||||||||||||||||||

Right-of-use |

C3 |

|||||||||||||||||||||||

Financial assets |

||||||||||||||||||||||||

Equity in joint ventures and associated companies |

E3 |

|||||||||||||||||||||||

Other investments in shares and participations |

F3 |

|||||||||||||||||||||||

Customer finance, non-current |

B6, F1 |

|||||||||||||||||||||||

Interest-bearing securities, non-current |

F1, F3 |

|||||||||||||||||||||||

Other financial assets, non-current |

F3 |

|||||||||||||||||||||||

Deferred tax assets |

H1 |

|||||||||||||||||||||||

Current assets |

||||||||||||||||||||||||

Inventories |

B5 |

|||||||||||||||||||||||

Contract assets |

B6, F1 |

|||||||||||||||||||||||

Trade receivables |

B6, F1 |

|||||||||||||||||||||||

Customer finance, current |

B6, F1 |

|||||||||||||||||||||||

Current tax assets |

||||||||||||||||||||||||

Other current receivables |

B7 |

|||||||||||||||||||||||

Interest-bearing securities, current |

F1 |

|||||||||||||||||||||||

Cash and cash equivalents |

H3 |

|||||||||||||||||||||||

Total assets |

||||||||||||||||||||||||

Equity and liabilities |

||||||||||||||||||||||||

Equity |

||||||||||||||||||||||||

Capital stock |

E1 |

|||||||||||||||||||||||

Additional paid in capital |

E1 |

|||||||||||||||||||||||

Other reserves |

E1 |

|||||||||||||||||||||||

Retained earnings |

E1 |

|||||||||||||||||||||||

Equity attributable to owners of the Parent Company |

E1 |

|||||||||||||||||||||||

Non-controlling interests |

E1 |

– |

– |

|||||||||||||||||||||

Non-current liabilities |

||||||||||||||||||||||||

Post-employment benefits |

G1 |

|||||||||||||||||||||||

Provisions, non-current |

D1 |

|||||||||||||||||||||||

Deferred tax liabilities |

H1 |

|||||||||||||||||||||||

Borrowings, non-current |

F4 |

|||||||||||||||||||||||

Lease liabilities, non-current |

C3 |

|||||||||||||||||||||||

Other non-current liabilities |

||||||||||||||||||||||||

Current liabilities |

||||||||||||||||||||||||

Provisions, current |

D1 |

|||||||||||||||||||||||

Borrowings, current |

F4 |

|||||||||||||||||||||||

Lease liabilities, current |

C3 |

|||||||||||||||||||||||

Contract liabilities |

B6 |

|||||||||||||||||||||||

Trade payables |

B8 |

|||||||||||||||||||||||

Current tax liabilities |

||||||||||||||||||||||||

Other current liabilities |

B9 |

|||||||||||||||||||||||

Total equity and liabilities |

||||||||||||||||||||||||

|

||||

| Financial report 2023 | Consolidated financial statements 3 8 | |||

| January–December, SEK million | Notes | 2023 | 2022 | 2021 | ||||||||||||||||||||||||||||

Operating activities |

||||||||||||||||||||||||||||||||

Net income (loss) |

– |

|||||||||||||||||||||||||||||||

Adjustments to reconcile net income to cash |

H3 |

|||||||||||||||||||||||||||||||

Changes in operating net assets |

||||||||||||||||||||||||||||||||

Inventories |

– |

– |

||||||||||||||||||||||||||||||

Customer finance, current and non-current |

– |

– |

||||||||||||||||||||||||||||||

Trade receivables and contract assets |

||||||||||||||||||||||||||||||||

Trade payables |

– |

– |

||||||||||||||||||||||||||||||

Provisions and post-employment benefits |

– |

|||||||||||||||||||||||||||||||

Contract liabilities |

– |

|||||||||||||||||||||||||||||||

Other operating assets and liabilities, net |

– |

– |

||||||||||||||||||||||||||||||

– |

||||||||||||||||||||||||||||||||

Interest received |

||||||||||||||||||||||||||||||||

Interest paid |

– |

– |

– |

|||||||||||||||||||||||||||||

Taxes paid |

– |

– |

– |

|||||||||||||||||||||||||||||

Cash flow from operating activities |

||||||||||||||||||||||||||||||||

Investing activities |

||||||||||||||||||||||||||||||||

Investments in property, plant and equipment |

C2 |

– |

– |

– |

||||||||||||||||||||||||||||

Sales of property, plant and equipment |

||||||||||||||||||||||||||||||||

Acquisitions of subsidiaries and other operations |

H3, E2 |

– |

– |

– |

||||||||||||||||||||||||||||

Divestments of subsidiaries and other operations |

H3, E2 |

– |

||||||||||||||||||||||||||||||

Product development |

C1 |

– |

– |

– |

||||||||||||||||||||||||||||

Purchase of interest-bearing securities |

– |

– |

– |

|||||||||||||||||||||||||||||

Sale of interest-bearing securities |

||||||||||||||||||||||||||||||||

Other investing activities |

– |

– |

||||||||||||||||||||||||||||||

Cash flow from investing activities |

– |

– |

– |

|||||||||||||||||||||||||||||

Financing activities |

||||||||||||||||||||||||||||||||

Proceeds from issuance of borrowings |

F4 |

|||||||||||||||||||||||||||||||

Repayment of borrowings |

F4 |

– |

– |

– |

||||||||||||||||||||||||||||

Sale of own shares |

– | |||||||||||||||||||||||||||||||

Dividends paid |

– |

– |

– |

|||||||||||||||||||||||||||||

Repayment of lease liabilities |

F4 |

– |

– |

– |

||||||||||||||||||||||||||||

Other financing activities |

– |

|||||||||||||||||||||||||||||||

Cash flow from financing activities |

– |

– |

||||||||||||||||||||||||||||||

Effect of exchange rate changes on cash |

– |

|||||||||||||||||||||||||||||||

Net change in cash and cash equivalents |

– |

– |

||||||||||||||||||||||||||||||

Cash and cash equivalents, beginning of period |

||||||||||||||||||||||||||||||||

Cash and cash equivalents, end of period |

H3 |

|||||||||||||||||||||||||||||||

| ||||

| 3 9 Consolidated financial statements |

Financial report 2023 | |||

| SEK million | Capital stock |

Additional paid in capital |

Other reserves |

Retained earnings |

Stockholders’ equity |

Non-controlling interests |

Total equity | |||||||||||||||||||||

| January 1, 2023 |

– |

|||||||||||||||||||||||||||

| Net income (loss) |

– |

– |

– |

|||||||||||||||||||||||||

| Other comprehensive income (loss) |

||||||||||||||||||||||||||||

| Items that will not be reclassified to profit or loss |

||||||||||||||||||||||||||||

| Remeasurements of defined benefit pension plans including asset ceiling | – |

|||||||||||||||||||||||||||

| Revaluation of borrowings due to change in credit risk | – |

– |

– |

|||||||||||||||||||||||||

| Tax on items that will not be reclassified to profit or loss | – |

– |

– |

|||||||||||||||||||||||||

Items that have been or may be reclassified to profit or loss |

||||||||||||||||||||||||||||

| Cash flow hedge reserve |

||||||||||||||||||||||||||||

| Gains/losses arising during the period |

||||||||||||||||||||||||||||

| Reclassification to profit and loss |

||||||||||||||||||||||||||||

| Translation reserves 1) |

||||||||||||||||||||||||||||

| Changes in translation reserves |

– |

– |

– |

|||||||||||||||||||||||||

| Reclassification to profit and loss |

||||||||||||||||||||||||||||

| Share of other comprehensive income of JV and associated companies | – |

– |

– |

|||||||||||||||||||||||||

| Tax on items that have been or may be reclassified to profit or loss | – |

– |

– |

|||||||||||||||||||||||||

| Other comprehensive income (loss), net of tax |

– |

– |

– |

|||||||||||||||||||||||||

| Total comprehensive income (loss) |

– |

– |

– |

– |

||||||||||||||||||||||||

| Transactions with owners |

||||||||||||||||||||||||||||

| Share issue, net |

||||||||||||||||||||||||||||

| Repurchase of own shares |

– |

– |

– |

|||||||||||||||||||||||||

| Long-term variable compensation plans |

||||||||||||||||||||||||||||

| Dividends paid 2) |

– |

– |

– |

– |

||||||||||||||||||||||||

| Transactions with non-controlling interest |

– |

– |

||||||||||||||||||||||||||

| December 31, 2023 |

– |

|||||||||||||||||||||||||||

1) |

Changes in translation reserves include changes regarding translation of goodwill in local currency of SEK – |

2) |

Dividends paid per share amounted to SEK |

|

||||

| Financial report 2023 | Consolidated financial statements 40 | |||

| SEK million | Capital stock |

Additional paid in capital |

Other reserves |

Retained earnings |

Stockholders’ equity |

Non-controlling interests |

Total equity | |||||||||||||||||||||

| January 1, 2022 |

– |

|||||||||||||||||||||||||||

| Net income |

||||||||||||||||||||||||||||

| Other comprehensive income (loss) |

||||||||||||||||||||||||||||

| Items that will not be reclassified to profit or loss |

||||||||||||||||||||||||||||

| Remeasurements of defined benefit pension plans including asset ceiling | ||||||||||||||||||||||||||||

| Revaluation of borrowings due to change in credit risk | ||||||||||||||||||||||||||||

| Cash flow hedge reserve | ||||||||||||||||||||||||||||

| Gains/losses arising during the period |

||||||||||||||||||||||||||||

| Transfer to goodwill |

– | – | – |

– | – |

– | – |

|||||||||||||||||||||

| Tax on items that will not be reclassified to profit or loss |

– |

– |

– |

– |

– |

|||||||||||||||||||||||

| Items that have been or may be reclassified to profit or loss |

||||||||||||||||||||||||||||

| Cash flow hedge reserve | ||||||||||||||||||||||||||||

| Gains/losses arising during the period |

– |

– |

– |

|||||||||||||||||||||||||

| Reclassification to profit and loss |

||||||||||||||||||||||||||||

| Translation reserves | ||||||||||||||||||||||||||||

| Changes in translation reserves |

– |

|||||||||||||||||||||||||||

| Reclassification to profit and loss |

– |

– |

– |

|||||||||||||||||||||||||

| Share of other comprehensive income of JV and associated companies | ||||||||||||||||||||||||||||

| Tax on items that have been or may be reclassified to profit or loss | ||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of tax |

– |

|||||||||||||||||||||||||||

| Total comprehensive income |

||||||||||||||||||||||||||||

| Transfer to retained earnings |

– |

|||||||||||||||||||||||||||

| Transactions with owners |

||||||||||||||||||||||||||||

| Long-term variable compensation plans |

||||||||||||||||||||||||||||

| Dividends paid |

– |

– |

– |

– |

||||||||||||||||||||||||

| Transactions with non-controlling interest |

||||||||||||||||||||||||||||

| December 31, 2022 |

– |

|||||||||||||||||||||||||||

| ||||

41 Consolidated financial statements |

Financial report 2023 | |||

| SEK million | Capital stock |

Additional paid in capital |

Other reserves |

Retained earnings |

Stockholders’ equity |

Non-controlling interests |

Total equity | |||||||||||||||||||||

January 1, 2021 |

– |

– |

||||||||||||||||||||||||||

Net income |

– |

– |

– |

|||||||||||||||||||||||||

Other comprehensive income (loss) |

||||||||||||||||||||||||||||

Items that will not be reclassified to profit or loss |

||||||||||||||||||||||||||||

| Remeasurements of defined benefit pension plans including asset ceiling | – | – | – | |||||||||||||||||||||||||

| Revaluation of borrowings due to change in credit risk | – | – | – | – | ||||||||||||||||||||||||

| Tax on items that will not be reclassified to profit or loss | – | – | – |

– |

– |

– |

– |

|||||||||||||||||||||

Items that have been or may be reclassified to profit or loss |

||||||||||||||||||||||||||||

| Cash flow hedge reserve | ||||||||||||||||||||||||||||

Gains/losses arising during the period |

– | – | – |

– | – |

– | – |

|||||||||||||||||||||

Reclassification to profit and loss |

– | – | – |

– | – |

– | – |

|||||||||||||||||||||

| Translation reserves | ||||||||||||||||||||||||||||

Changes in translation reserves |

– | – | – | – |

||||||||||||||||||||||||

Reclassification to profit and loss |

– | – | – | – | ||||||||||||||||||||||||

| Share of other comprehensive income of JV and associated companies | – | – | – | – | ||||||||||||||||||||||||

| Tax on items that have been or may be reclassified to profit or loss | – | – | – | – | ||||||||||||||||||||||||

Other comprehensive income (loss), net of tax |

– |

– |

– |

|||||||||||||||||||||||||

Total comprehensive income |

– |

– |

||||||||||||||||||||||||||

Transactions with owners |

||||||||||||||||||||||||||||

| Sale of own shares | – | – | – | – | ||||||||||||||||||||||||

| Long-term variable compensation plans | – | – | – | – | ||||||||||||||||||||||||

Dividends paid |

– | – | – | – |

– |

– |

– |

|||||||||||||||||||||

Transactions with non-controlling interest |

– | – | – | – |

– |

– |

– |

|||||||||||||||||||||

December 31, 2021 |

– |

|||||||||||||||||||||||||||

|

||||

| Financial report 2023 | Notes to the consolidated financial statements 42 | |||

|

Material accounting policies |

| ||||

43 Notes to the consolidated financial statements |

Financial report 2023 | |||

|

||||

| Financial report 2023 | Notes to the consolidated financial statements 44 | |||

| ||||

| 4 5 Notes to the consolidated financial statements |

Financial report 2023 | |||

|

||||

| Financial report 2023 | Notes to the consolidated financial statements 4 6 | |||

| a) | Certain customer contracts where a fluctuation in the USD/SEK foreign exchange (FX) rate would significantly impact net sales. These contracts are multi-year contracts denominated in USD with highly probable payments at fixed points in time. |

| b) | Highly probable forecasted sales denominated in USD in Ericsson AB ( EAB) for the next |

| ||||

| 4 7 Notes to the consolidated financial statements |

Financial report 2023 | |||

| – | IFRS 17 Insurance contracts (including the June 2020 and December 2021 amendments to IFRS 17, which establishes principles for the recognition, measurements, presentation and disclosure of insurance contracts ) |

| – | Amendments to IAS 1 Presentation of Financial Statements and IFRS Practice Statement 2 – Disclosure of Accounting policies |

| – | Amendments to IAS 8 Accounting policies, Changes in Accounting Estimates and Errors – Definition of Accounting Estimates |

| – | Amendments to IAS 12 Income Taxes – Deferred Tax related to Assets and Liabilities arising from a Single Transaction. |

| – | Amendments to IAS 12 Income taxes: International Tax Reform – Pillar Two Model Rules |

| – | Amendments to IAS 1 Presentation of financial statements – Classification of liabilities as current or non-current |

| – | Amendments to IAS 1 Presentation of financial statements – Non-current liabilities with covenants |

| – | Amendments to IFRS 16 Leases – Lease liability in a sale and leaseback |

| – | Amendments to IAS 7 Statement of Cash Flows and IFRS 7 Financial Instruments – Disclosures: Supplier Finance Arrangements |

| – These amendments will increase the disclosures for Supplier Finance Arrangements. |

| – | Amendments to IAS 21 The Effects of Changes in Foreign Exchange Rates: Lack of Exchangeability (issued on 15 August 2023) |

|

||||

| Financial report 2023 | Notes to the consolidated financial statements 4 8 | |||

|

Critical accounting estimates and judgments |

| – | Key sources of estimation uncertainty |

| – | Judgments management has made in the process of applying the Company’s accounting policies. |

| ||||

| 4 9 Notes to the consolidated financial statements |

Financial report 2023 | |||

|

||||

| Financial report 2023 | Notes to the consolidated financial statements 50 | |||

|

Segment information |

| – | Networks |

| – | Cloud Software and Services |

| – | Enterprise |

| – | Europe and Latin America |

| – | Middle East and Africa |

| – | North America |

| – | North East Asia |

| – | South East Asia, Oceania and India. |

Segment information 2023 |

| |||||||||||||||||||||||

Networks |

Cloud Software and Services |

Enterprise |

Other |

Total Segments |

Group |

|||||||||||||||||||

| Segment sales |

||||||||||||||||||||||||

| Net sales |

||||||||||||||||||||||||

| Gross income |

– |

|||||||||||||||||||||||

| Gross margin (%) |

– |

|||||||||||||||||||||||

| Earnings (loss) before financial items and income tax (EBIT) 1) |

– |

– |

– |

– |

– |

|||||||||||||||||||

| EBIT margin (%) |

– |

– |

– |

– |

– |

|||||||||||||||||||

| Financial income and expenses, net |

– |

|||||||||||||||||||||||

| Income (loss) after financial items |

– |

|||||||||||||||||||||||

| Income tax |

– |

|||||||||||||||||||||||

| Net income (loss) |

– |

|||||||||||||||||||||||

| Other segment items |

||||||||||||||||||||||||

| Share in earnings of JV and associated companies |

||||||||||||||||||||||||

| Amortizations |

– |

– |

– |

– |

– |

– |

||||||||||||||||||

| Depreciations |

– |

– |

– |

– |

– |

– |

||||||||||||||||||

| Impairment losses 1 ) |

– |

– |

– |

– |

– |

– |

||||||||||||||||||

| Restructuring charges |

– |

– |

– |

– |

– |

|||||||||||||||||||

| Gains/losses on investments and sale of operations |

– |

– |

– |

– |

– |

– |

||||||||||||||||||

| ||||

51 Notes to the consolidated financial statements |

Financial report 2023 | |||

Segment information 2022 |

||||||||||||||||||||||||||||

Networks |

Cloud Software and Services |

Enterprise 2) |

Other 2) |

Total Segments |

Group |

|||||||||||||||||||||||

| Segment sales |

||||||||||||||||||||||||||||

| Net sales |

||||||||||||||||||||||||||||

| Gross income |

– |

|||||||||||||||||||||||||||

| Gross margin (%) |

– |

|||||||||||||||||||||||||||

| Earnings (loss) before financial items and income tax (EBIT) 1) |

– |

– |

– |

|||||||||||||||||||||||||

| EBIT margin (%) |

– |

– |

– |

|||||||||||||||||||||||||

| Financial income and expenses, net |

– |

|||||||||||||||||||||||||||

| Income after financial items |

||||||||||||||||||||||||||||

| Income tax |

– |

|||||||||||||||||||||||||||

| Net income |

||||||||||||||||||||||||||||

| Other segment items |

||||||||||||||||||||||||||||

| Share in earnings of JV and associated companies |

– |

|||||||||||||||||||||||||||

| Amortizations |

– |

– |

– |

– |

– |

– |

||||||||||||||||||||||

| Depreciations |

– |

– |

– |

– |

– |

– |

||||||||||||||||||||||

| Impairment losses |

– |

– |

– |

– |

– |

– |

||||||||||||||||||||||

| Restructuring charges |

– |

– |

– |

– |

– |

– |

||||||||||||||||||||||

| Gains/losses on investments and sale of operations |

– |

|||||||||||||||||||||||||||

| 1) Segment Other includes a provision of SEK –2) The segments have been restated to reflect the change where the divested IoT business in the first quarter 2023 was transferred from segment Enterprise to segment Other. |

| |||||||||||||||||||||||||||

Segment information 2021 |

||||||||||||||||||||||||||||

Networks |

Cloud Software and Services |

Enterprise 1) |

Other 1) |

Total Segments |

Group |

|||||||||||||||||||||||

| Segment sales |

||||||||||||||||||||||||||||

| Net sales |

||||||||||||||||||||||||||||

| Gross income |

||||||||||||||||||||||||||||

| Gross margin (%) |

||||||||||||||||||||||||||||

| Earnings (loss) before financial items and income tax (EBIT) |

– |

– |

– |

|||||||||||||||||||||||||

| EBIT margin (%) |

– |

– |

– |

|||||||||||||||||||||||||

| Financial income and expenses, net |

– |

|||||||||||||||||||||||||||

| Income after financial items |

||||||||||||||||||||||||||||

| Income tax |

– |

|||||||||||||||||||||||||||

| Net income |

||||||||||||||||||||||||||||

| Other segment items |

||||||||||||||||||||||||||||

| Share in earnings of JV and associated companies |

– |

– |

– |

|||||||||||||||||||||||||

| Amortizations |

– |

– |

– |

– |

– |

|||||||||||||||||||||||

| Depreciations |

– |

– |

– |

– |

– |

– |

||||||||||||||||||||||

| Impairment losses |

– |

– |

– |

– |

– |

– |

||||||||||||||||||||||

| Restructuring charges |

– |

– |

– |

– |

– |

|||||||||||||||||||||||

| Gains/losses on investments and sale of operations |

– |

|||||||||||||||||||||||||||

| 1) The segments have been restated to reflect the change where the divested IoT business in the first quarter 2023 was transferred from segment Enterprise to segment Other. |

| |||||||||||||||||||||||||||

Products and Services by Segments |

||||||||||||||||||||

Networks |

Cloud Software and Services |

Enterprise 1) |

Other 1) |

Total Segments |

||||||||||||||||

| 2023 |

||||||||||||||||||||

| Products |

– |

|||||||||||||||||||

| Services |

||||||||||||||||||||

| Total |

||||||||||||||||||||

| 2022 |

||||||||||||||||||||

| Products |

– |

|||||||||||||||||||

| Services |

||||||||||||||||||||

| Total |

||||||||||||||||||||

| 2021 |

||||||||||||||||||||

| Products |

||||||||||||||||||||

| Services |

||||||||||||||||||||

| Total |

||||||||||||||||||||

1) |

The segments have been restated to reflect the change where the divested IoT business in the first quarter 2023 was transferred from segment Enterprise to segment Other. |

|

||||

| Financial report 2023 | Notes to the consolidated financial statements 52 | |||

| Market area 2023 | ||||||||||||||||||||||||

| Net sales |

Non-current assets 5) |

|||||||||||||||||||||||

| Networks | Cloud Software and Services |

Enterprise | Other | Total | Total | |||||||||||||||||||

| South East Asia, Oceania and India 3) |

||||||||||||||||||||||||

| North East Asia 4) |

||||||||||||||||||||||||

| North America 2) |

||||||||||||||||||||||||

| Europe and Latin America 1) |

||||||||||||||||||||||||

| Middle East and Africa |

||||||||||||||||||||||||

| Other 1) 2) 3) 4) 6) |

||||||||||||||||||||||||

| Total |

||||||||||||||||||||||||

| 1) Of which in EU 6) |

||||||||||||||||||||||||

| Of which in Sweden 6) |

||||||||||||||||||||||||

| 2) Of which in the United States 6) |

||||||||||||||||||||||||

| 3) Of which in India 6) |

||||||||||||||||||||||||

| 4) Of which in Japan 6) |

||||||||||||||||||||||||

| 4) Of which in China 6) |

||||||||||||||||||||||||

| 5) Total non-current assets excluding financial instruments, deferred tax assets, and post-employment benefit assets.6) Including IPR licensing revenue reported under Market area Other which is allocated based on the country location of the customer. Other sales are attributed to countries based on the destination of products or services delivered. |

| |||||||||||||||||||||||

| Market area 2022 | ||||||||||||||||||||||||

| Net sales | Non-current assets 5) |

|||||||||||||||||||||||

| Networks | Cloud Software and Services |

Enterprise 7) |

Other 7) |

Total | Total | |||||||||||||||||||

| South East Asia, Oceania and India 3) |

||||||||||||||||||||||||

| North East Asia 4) |

||||||||||||||||||||||||

| North America 2) |

||||||||||||||||||||||||

| Europe and Latin America 1) |

||||||||||||||||||||||||

| Middle East and Africa |

– |

|||||||||||||||||||||||

| Other 1) 2) 3) 4) 6) |

||||||||||||||||||||||||

| Total |

||||||||||||||||||||||||

| 1) Of which in EU 6) |

||||||||||||||||||||||||

| Of which in Sweden 6) |

||||||||||||||||||||||||

| 2) Of which in the United States 6) |

||||||||||||||||||||||||

| 3) Of which in India 6) |

||||||||||||||||||||||||

| 4) Of which in Japan 6) |

||||||||||||||||||||||||

| 4) Of which in China 6) |

||||||||||||||||||||||||

| 5) Total non-current assets excluding financial instruments, deferred tax assets, and post-employment benefit assets.6) Including IPR licensing revenue reported under Market area Other which is allocated based on the country location of the customer. Other sales are attributed to countries based on the destination of products or services delivered.7) The segments have been restated to reflect the change where the divested IoT business in the first quarter 2023 was transferred from segment Enterprise to segment Other. |

| |||||||||||||||||||||||

Market area 2021 |

||||||||||||||||||||||||

| Net sales | Non-current assets 5) |

|||||||||||||||||||||||

| Networks | Cloud Software and Services |

Enterprise 7) |

Other 7) |

Total | Total | |||||||||||||||||||

| South East Asia, Oceania and India 3) |

||||||||||||||||||||||||

| North East Asia 4) |

||||||||||||||||||||||||

| North America 2) |

||||||||||||||||||||||||

| Europe and Latin America 1) |

||||||||||||||||||||||||

| Middle East and Africa |

||||||||||||||||||||||||

| Other 1) 2) 3) 4) 6) |

||||||||||||||||||||||||

| Total |

||||||||||||||||||||||||

| 1) Of which in EU 6) |

||||||||||||||||||||||||

| Of which in Sweden 6) |

||||||||||||||||||||||||

| 2) Of which in the United States 6) |

||||||||||||||||||||||||

| 3) Of which in India 6) |

||||||||||||||||||||||||

| 4) Of which in Japan 6) |

||||||||||||||||||||||||

| 4) Of which in China 6) |

||||||||||||||||||||||||

5) |

Total non-current assets excluding financial instruments, deferred tax assets, and post-employment benefit assets. |

6) |

Including IPR licensing revenue reported under Market area Other which is allocated based on the country location of the customer. Other sales are attributed to countries based on the destination of products or services delivered. |

7) |

The segments have been restated to reflect the change where the divested IoT business in the first quarter 2023 was transferred from segment Enterprise to segment Other. |

| ||||

53 Notes to the consolidated financial statements |

Financial report 2023 | |||

|

Net sales |

Net sales |

||||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Hardware |

||||||||||||

| Software |

||||||||||||

| Services |

||||||||||||

| Net sales |

||||||||||||

| Of which IPR licensing revenues |

||||||||||||

| Of which export sales from Sweden |

||||||||||||

|

Expenses by nature |

Expenses by nature |

||||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Goods and services |

||||||||||||

| Employee remuneration |

||||||||||||

| Amortizations and depreciations |

||||||||||||

| Impairments, obsolescence allowances and revaluation | ||||||||||||

| Inventory increase, net |

– |

– |

||||||||||

| Additions to capitalized development |

– |

– |

– |

|||||||||

Expenses charged to cost of sales and operating expenses |

||||||||||||

Restructuring charges by function |

||||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Cost of sales |

||||||||||||

| R&D expenses |

||||||||||||

| Selling and administrative expenses |

||||||||||||

| Total restructuring charges |

||||||||||||

|

Other operating income and expenses |

Other operating income and expenses |

||||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Other operating income |

||||||||||||

| Gains on sales of intangible assets and PP&E |

||||||||||||

| Gains on investments and sale of operations 1) |

||||||||||||

| Other operating income |

||||||||||||

| Total other operating income |

||||||||||||

| Other operating expenses |

||||||||||||

| Losses on sales of intangible assets and PP&E |

– | – |

– |

|||||||||

| Losses on investments and sale of operations 1) |

– |

– |

– |

|||||||||

| Impairment of goodwill 2) |

– |

– | – |

|||||||||

| Other operating expenses 3) |

– |

– |

– |

|||||||||

| Total other operating expenses |

– |

– |

– |

|||||||||

1) |

Information about divestments is presented in note E2 “Business combinations.” The loss of the divestment of the IoT business is reduced by the release of the provision reported in 2022 as Other operating expenses. |

2) |

2023 includes an impairment of SEK – |

3) |

2022 includes a provision of SEK – |

|

Inventories |

Inventories |

||||||||

| 2023 | 2022 | |||||||

| Finished products and components | ||||||||

| Contract work in progress |

||||||||

| Inventories, net |

||||||||

|

||||

| Financial report 2023 | Notes to the consolidated financial statements 54 | |||

|

Customer contract related balances |

Trade receivables, customer finance, contract assets, contract liabilities and deferred sales commissions |

||||||||

| 2023 | 2022 | |||||||

| Customer finance credits 1) |

||||||||

| Trade receivables 2) |

||||||||

| Contract assets |

||||||||

| Contract liabilities 3) |

||||||||

| Deferred sales commissions 4) |

||||||||

1) |

Of the total Customer finance credits balance, SEK . |

2) |

Total trade receivables include SEK |

3) |

The decrease in contract liabilities is mainly due to decreased incentive earnings based on lower sales as well as utilization of incentives in the period . |

4) |

Of the total Deferred sales commissions balance SEK non-current balance is presented within Other financial assets, non-current (see note F3 “Financial assets, non-current”) and the current balance is presented within Other current receivables (see note B7 “Other current receivables”). |

Revenue recognized in the period |

||||||||

| 2023 | 2022 | |||||||