EX-15.1

Exhibit 15.1

Swedish annual report

for 2017 in English

(adjusted version)

Contents

|

|

|

|

|

| The business |

|

|

|

|

|

|

| Ericsson in brief |

|

|

1 |

|

|

|

| CEO comment |

|

|

2 |

|

|

|

| This is Ericsson |

|

|

4 |

|

|

|

| Strategy and financial targets |

|

|

6 |

|

|

|

| Segments |

|

|

12 |

|

|

|

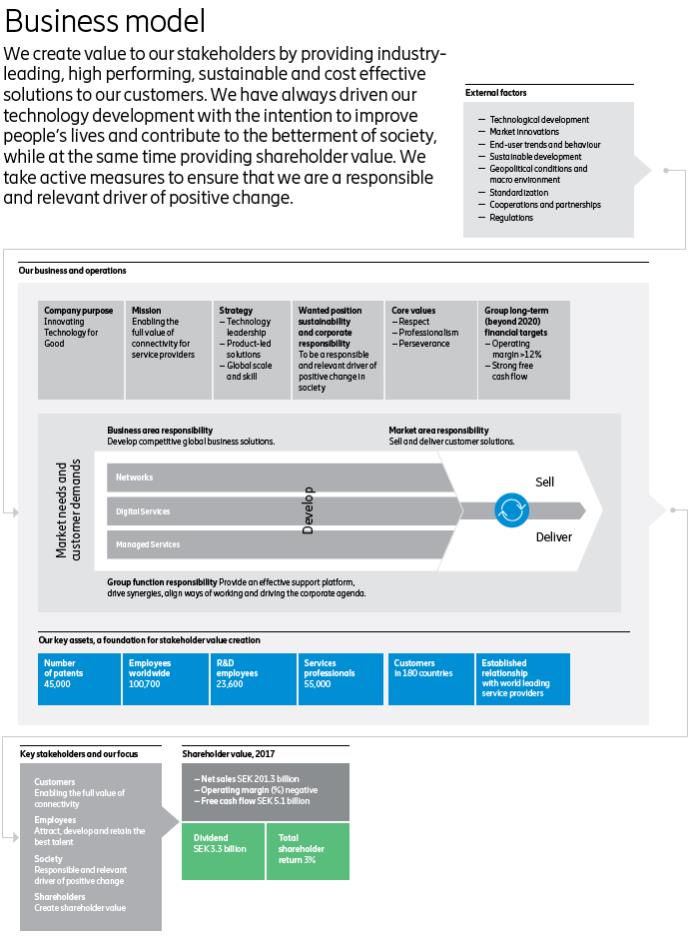

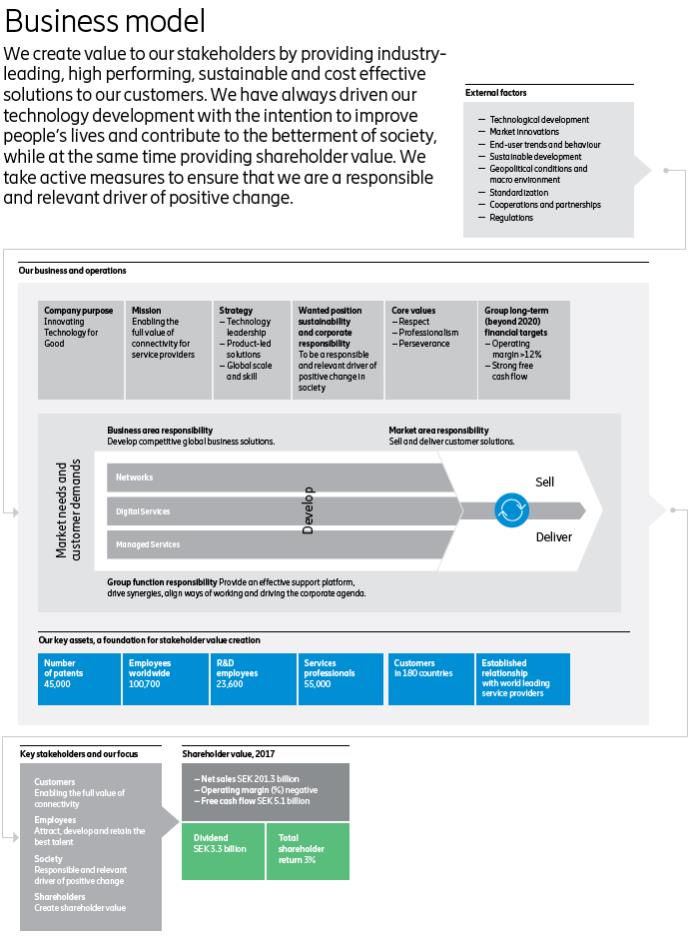

| Business model |

|

|

16 |

|

|

|

| Financials |

|

|

|

|

|

|

| Letter from the Chairman |

|

|

17 |

|

|

|

| Board of Directors’ report |

|

|

18 |

|

|

|

| Report of independent registered public accounting firm |

|

|

29 |

|

|

|

| Consolidated financial statements |

|

|

30 |

|

|

|

| Notes to the consolidated financial statements |

|

|

37 |

|

|

|

| Management’s report on internal control over financial reporting |

|

|

77 |

|

|

|

| Risk factors |

|

|

78 |

|

|

|

| Forward-looking statements |

|

|

87 |

|

|

|

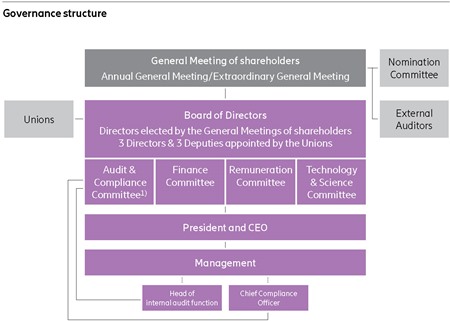

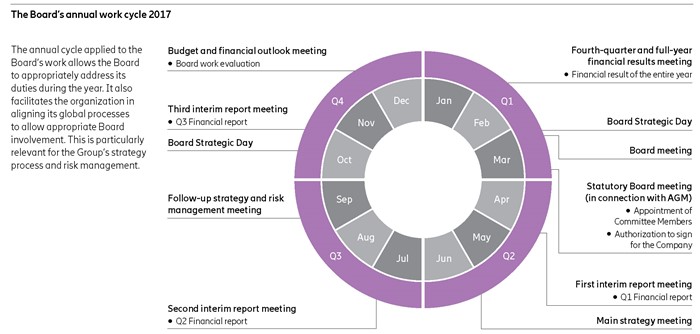

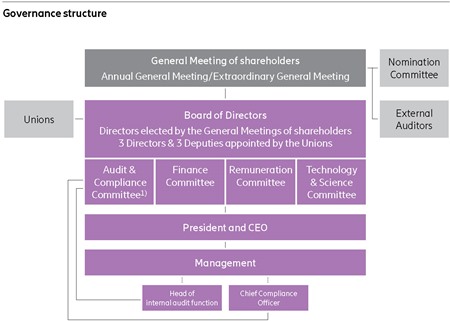

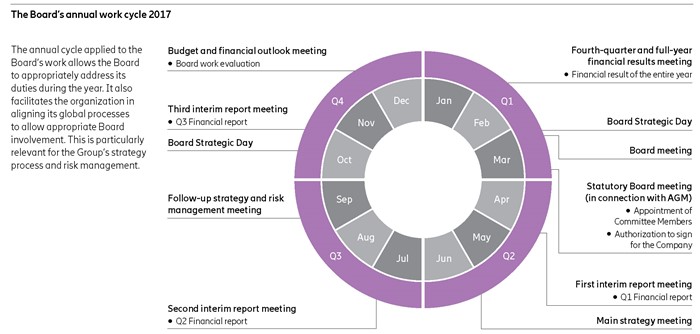

| Corporate governance |

|

|

|

|

|

|

| Corporate governance report |

|

|

88 |

|

|

|

| Remuneration report |

|

|

113 |

|

|

|

| Share information |

|

|

|

|

|

|

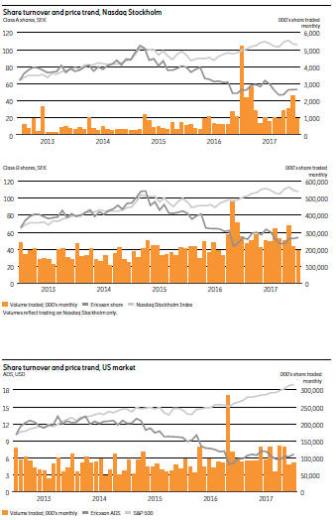

| The Ericsson share |

|

|

119 |

|

|

|

| Other information |

|

|

|

|

|

|

| Five-year summary |

|

|

123 |

|

|

|

| Alternative Performance Measures |

|

|

124 |

|

|

|

| Financial terminology and exchange rates |

|

|

128 |

|

|

|

| Glossary |

|

|

129 |

|

|

|

| Shareholder information |

|

|

130 |

|

|

|

| Signatures |

|

|

132 |

|

Ericsson Annual Report on Form 20-F 2017

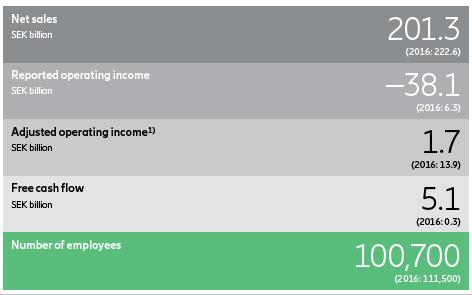

Ericsson in brief

Ericsson has been at the forefront of innovation for more than 140 years and as the market continues to transform and user demands continue to

change – so does Ericsson.

It all started in a mechanical workshop in Stockholm where Lars Magnus Ericsson designed telephones and

Hilda Ericsson produced them by winding copper wire coils.

Over the years, inclusion and diversity have remained important building

blocks of the company, and are fundamental to the culture and its core values of respect, professionalism and perseverance.

Ericsson has

revolutionized communications with new switching techniques and digital technology, and has been leading the development of mobile communications. When broadband was in its infancy Ericsson was already working on the technology that would become 3G,

and was developing 4G long before the smartphone became ubiquitous. Now 5G is around the corner and Ericsson is investing for technology leadership in 5G.

Ericsson has its headquarters in Stockholm, and the Ericsson shares trade on Nasdaq Stockholm and the Ericsson ADSs trade on NASDAQ, New York.

Highlights 2017

| |

• |

|

January 16; President and CEO Börje Ekholm took office. |

| |

• |

|

March 28; The focused business strategy was presented with the target to significantly improve the operating margin with a long-term target of more than 12%. |

| |

• |

|

April 25 Q1; Provisions and adjustments related to certain customer contracts, asset write-downs and restructuring of a total of SEK 13.4 billion. |

| |

• |

|

June 26; Vodafone UK selected Ericsson to evolve its 4G networks in London and southern England to improve capacity and end-user performance. |

| |

• |

|

July 18 Q2; Cost reduction activities to achieve an annual run rate reduction of at least SEK 10 billion by mid-2018 were presented. |

| |

• |

|

October 9; The nomination committee presented its intention to propose Ronnie Leten as new Chairman of the Board, as current Chair- man of the Board Leif Johansson steps down. |

| |

• |

|

October 20 Q3; Strong performance in Networks driven by the Ericsson Radio System portfolio. |

| |

• |

|

November 8; Capital Markets Day where targets for 2020 were presented; sales of SEK 190–200 billion, 37–39% gross margin and at least 10% operating margin, supporting the long-term target of

more than 12%. |

| |

• |

|

December 11; Verizon selected Ericsson to provide equipment for their commercial 5G launch in the United States. |

| |

• |

|

December 14; Deutsche Telekom selected Ericsson as supplier for its current and future network in Germany. |

| |

• |

|

January 31 Q4; Write-down of assets impacted the result by SEK –14.5 billion. In addition, provisions and customer project adjustments amounted to SEK –3.2 billion. |

| 1) |

Reported operating income excluding restructuring charges (SEK –8.5 billion), write-down of assets (SEK –17.8 billion), gains/losses on sales of certain investments and operations (SEK 0.3 billion), provisions

and adjustments related to certain customer projects announced March 28, 2017 (SEK –8.4 billion) and provisions and adjustments related to certain market and customer projects announced in Q2 2017 (SEK –5.5 billion).

|

Contact

investor.relations@ericsson.com

1

Ericsson Annual Report on Form 20-F 2017

2017 – a year of starting over

2017 was a tough year. We started to execute on our focused strategy and we laid the foundation for achieving our financial targets.

The telecom industry is a key driver of economic growth and innovation.

The power of change that mobile technology unleashes is extraordinary. No other technology has ever scaled as fast. By 2023, less than 35

years after the introduction of mobile technology, it’s predicted that there will be 9.1 billion mobile subscriptions and research shows a strong correlation between growth in mobile broadband adoption and GDP growth.

And the potential of mobility has only just begun. Yet with extraordinary change, comes challenges. Our customers, the service providers, need

to become more efficient, more digital and find new growth. This puts pressure on the industry and pressure on us as a company, but it also creates new opportunities.

When assuming the role as new CEO in the beginning of 2017, we initiated a strategic review. Our starting point was to listen to our customers

combined with in-depth analysis of our portfolio and performance. In March we presented our focused strategy.

Our mission is to enable our customers to capture the full value of connectivity with three core pillars – technology leadership,

product led solutions and global scale and skill.

Stabilize and simplify

To be successful and relevant to our customers, we need to be profitable. The first phase is therefore to simplify the organization and to

restore stability and profitability.

We appointed a new Executive Team and simplified organizational structure. In 2017, the structure

was built on three business areas: Networks, Digital Services and Managed Services, and five market areas which were created based on the structure of our large customers. In January 2018, a new business area called Emerging Business was created.

Ericsson’s organizational structure is efficient and responsive to customer needs, with strong accountability.

Invest in areas where we can and

must win

We are investing in Networks to strengthen our current offerings and to lead the way in 5G. We are investing in Digital

Services to secure leadership in the control and monetization layers in the networks and to increase our cloud delivery competence. We automate Managed Services and we invest in innovation including IoT, Artificial Intelligence and other new

technologies in Emerging Business.

In Networks we are investing in R&D both for technology and cost leadership. This includes

preparing for 5G and securing a leading position in that technology wave, but also making our 4G offering more competitive both for us and our customers. Increased R&D investments in Networks is therefore a key driver for increased gross

margins. Despite a declining topline during the year we were able to strengthen our adjusted gross margin1) in Q4 to 36% (32%) YoY, by increasing share of Ericsson Radio System (ERS) deliveries

and improvements in service delivery efficiency. ERS represented 71% of radio unit deliveries in Q4 2017.

In Managed Services, our

first priority is on restoring profitability. We set out to review 42 challenged contracts and to date we have either exited, renegotiated or transformed 23 of those with a positive impact on operating profit with SEK 0.5 billion. To

capture opportunities from new technologies and business models we invest in becoming a leader in data-and analytics-driven operations enabled by automation, machine learning and artificial intelligence. By doing so we will be able to further

improve our profitability and increase the value we provide to our customers.

Our profitability in Digital Services has been

unsatisfactory for quite some time. Digital Services is strategically important for our future success and for the success of our customers, as they virtualize their networks and become fully digital enterprises. In 2017 Digital Services reported

significant losses and our first priority has been to stabilize our product roadmaps and large transformation projects. We have made great progress during the year. We are now focusing on restoring profitability, by increasing software content but

also by taking costs out in service delivery.

In Emerging Business, we will develop new partnership based services and innovate new

sources of revenues for our customers. We will scale new opportunities as we are doing with our Internet of Things (IOT) platform and Unified Delivery Network (UDN).

During the year we have also explored strategic opportunities for our Media business; Media Solutions and Red Bee Media (former

| 1) |

Networks Q4 2017 reported gross margin excluding restructuring charges of SEK –1.1 billion and excluding SEK –0.4 billion related to market and customer project adjustments announced in the Q2 2017

report. Networks Q4 2016 reported gross margin excluding restructuring charges of SEK –1.1 billion. |

2

Ericsson Annual Report on Form 20-F 2017

Broadcast and Media Services). That process has now been concluded, including evaluation of various options such as partnerships, divestments and continued

in-house development, with the objective to maximize shareholder value. We have also substantially improved operational performance in both units during the year, which has given us more strategic flexibility.

Both units ended the year with only limited losses.

Given the importance of Media Solutions for our customers, we have decided to partner

with One Equity Partners and retain a 49% ownership stake. This allows us to capture the upside of the business while at the same time taking active part in the expected consolidation of the industry. We have chosen to keep Red Bee Media as the bids

received did not reflect the value of the business. We will continue to develop the business as an independent entity within Ericsson, and build on the improvements in the operations accomplished during the year.

Financial ambitions

By executing on our

focused strategy, we will improve profitability. Our long-term target is an operating margin of at least 12%. Looking more near term, we have robust plans in place which will take us to a gross margin of 37–39% and an operating margin of at

least 10%, excluding restructuring charges, in 2020. A part of delivering on the short-term target is to reduce our cost by at least SEK 10 billion in service delivery and common group functions by

mid-2018. During the second half of 2017, we reduced our internal and external workforce by almost 15,000 net and the annual run-rate effect of cost savings is

approximately SEK 6 billion. The impact on the P&L is still limited but will be increasingly visible in the first half of 2018.

Beyond 2020, reaching the long-term target will be driven by a combination of 5G ramp up, a

software-led Digital Services business, new growth opportunities in Managed Services via analytics and automation, and scaling of selected Emerging Business ventures.

Ericsson at its best

Our success is

driven by our people. We aim to work in the same way as the technology we create – think fast, cut through complexity, and knock down barriers – to best serve our customers.

We will continue to recruit for the future. By recruiting in priority areas of the business, we will both increase the pace of product

development and lead in future technologies. In 2017 we recruited 3,800 R&D engineers.

Zero-tolerance to corruption

It is important to underline that Ericsson has a zero-tolerance approach to corruption and that

the company over the years continuously and systematically has focused on strengthening its anti-corruption processes. Through Ericsson’s Code of Business Ethics, we work to secure that business activities are conducted with a strong sense of

integrity.

Currently Ericsson cooperates, on a voluntary basis, with United States Securities and Exchange Commission and United States

Department of Justice to answer inquiries related to compliance with the U.S. Foreign Corrupt Practices Act. These inquiries cover the last ten years and we will communicate and disclose information about these inquiries if materiality arises.

To sum up

2017 was a year of starting

over. We have a new strategy, a simplified company structure and strong plans in place to improve our performance. 2017 was also the year when 5G went from vision to reality and the first commercial contracts were signed. This also created traction

for our 5G-ready 4G portfolio. The success of the ERS platform shows that technology leadership and a competitive portfolio pays off, both in terms of customer feedback and margin improvements.

Going into 2018, we are fully committed to our plans and targets and we expect to see tangible results of our turnaround during the

year.

Börje Ekholm

President and CEO

3

Ericsson Annual Report on Form 20-F 2017

Ericsson in brief

We are a technology company with the mission to enable our customers to capture the full value of connectivity. Our strategy builds on

technology leadership, product-led solutions and global scale and skill.

At the forefront of technology

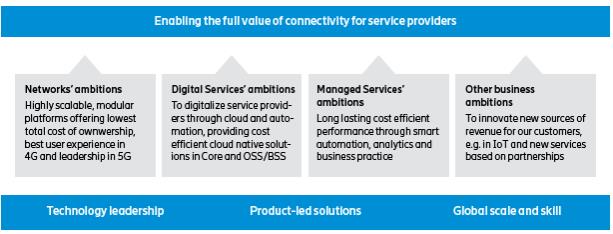

Business structure 2017

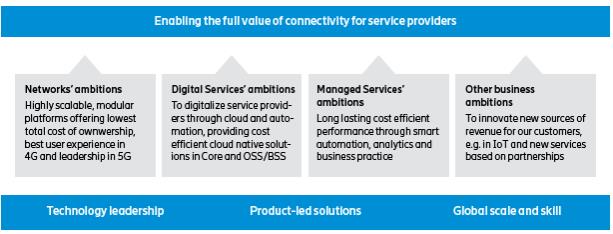

The business areas Networks, Digital Services and Managed Services are organized to reflect our ambition to serve customers with offerings that

address their key priorities:

Each business area has different strategic priorities.

In Networks, focus is to expand gross margin by investing in R&D for technology and cost leadership.

In Digital Services, focus is shifting to software-led solutions and on adjusting the cost base.

In Managed Services, contract reviews are first priority and investments in automation and artificial intelligence have started.

In addition, we have Emerging Business where a structured approach to technology and business innovations will over time drive new growth.

Emerging Business as well as Media Solutions, Red Bee Media and iconectiv are all businesses that are externally reported within segment Other.

In line with the focused business strategy presented in March 2017, we are divesting or downsizing assets that are not part of our core

businesses such as for example fiber rollout and low end field maintenance. During the year we divested Ericsson Power Modules. In January 2018 the strategic review of the Media business was concluded. 51% of Media Solutions will be divested to

an external partner, while we will continue to develop Red Bee Media as an independent and focused in-house media service business.

Our reporting structure

4

Ericsson Annual Report on Form 20-F 2017

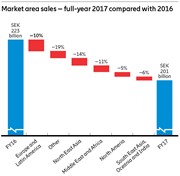

Our market areas

Our geographical structure contains five market areas, to enable clear customer interfaces and faster time to market. In addition there is one

market area Other. Our gegraphical market areas are responsible for selling and delivering the competitive solutions that our business areas develop.

|

|

|

|

|

|

|

|

|

|

|

| North America |

|

Europe and |

|

Middle East and |

|

South East Asia, |

|

North East Asia |

|

Other |

| |

|

Latin America |

|

Africa |

|

Oceania and India |

|

|

|

|

| Net sales: |

|

Net sales: |

|

Net sales: |

|

Net sales: |

|

Net sales: |

|

Net sales: |

| SEK 49.6 billion |

|

SEK 56.2 billion |

|

SEK 25.1 billion |

|

SEK 30.6 billion |

|

SEK 23.5 billion |

|

SEK 16.4 billion |

| Number of |

|

Number of |

|

Number of |

|

Number of |

|

Number of |

|

Mainly revenues |

| employees: |

|

employees: |

|

employees: |

|

employees: |

|

employees: |

|

related to IPR and the |

| 10,000 |

|

49,200 |

|

4,500 |

|

24,500 |

|

12,500 |

|

media business |

|

|

|

|

|

|

|

|

|

|

|

A global company

Our people are key to ensuring Ericsson’s future success and our continued technology leadership. We focus on attracting the best

talent, supporting competence development and enabling a work culture that supports our people to bring out the best version of Ericsson. We recruit and retain talent, regardless of age, race, gender, nationality or sexual orientation. Our

core values – respect, professionalism, and perseverance – define our company culture, and guide us in our daily work and in the way we do business.

5

Ericsson Annual Report on Form 20-F 2017

Focused business strategy

Our focused business strategy takes its starting point in our customers, the service providers. It is a large and profitable customer group

that plays a vital role in society by digitalizing the economy, to date creating more than 8 billion mobile subscriptions. So far, these subscriptions are mainly connecting consumers to voice and mobile broadband services. A key challenge for

the service providers is that while traffic in the mobile networks is growing rapidly, revenues are growing at a much slower pace than traffic, driving a need to continuously improve efficiency. Going forward, service providers will play a central

role also in the digitalization of industries, which will enable them to create new opportunities and capture revenue streams in the enterprise space.

To summarize, the service provider market is large and profitable but challenged with finding new growth within their existing consumer

market. The services they provide are, however, fundamental to society and to people around the world and will become even more important in the future when the networks will connect not only people but also things, transforming industries and

society.

Value creation in three key areas

We have identified three core areas in which we can support our service provider customers to leverage the full value of connectivity and

enable their success.

Firstly, they need to continuously drive efficiency, relentlessly lowering the cost of delivering traffic in the

networks. Also, 5G will increase spectrum efficiency which will lower cost.

Secondly, they need to go truly digital to enable

faster service provisioning, faster network configuration and to make services easier to use. This will be increasingly important in order to attract new customers, but it will also help them to lower their costs further.

Finally, they need to capture new revenue streams and new opportunities enabled by emerging technologies such as 5G and IoT.

In our business study of 5G’s market potential we have identified the opportunity for service providers to expand their

revenues by more than 30% by going beyond the mobile broadband business into enterprise and industrial applications.

We support our

customers’ priorities to drive value creation in three key areas

6

Ericsson Annual Report on Form 20-F 2017

Three core pillars

Based on our customers’ priorities, we have developed a focused business strategy. It is built on three core pillars – technology

leadership, product-led solutions and global scale and skill.

Technology leadership

Technology leadership enables us to bring the most innovative and best solutions to market and to do it ahead of competition, giving our

customers an advantage. At the same time, technology leadership is a key driver for cost leadership as we use the latest technology to bring the cost down in our products. This benefits both us and our customers.

Product-led solutions

Product-led solutions implies that we put software and hardware at the core of our customer solutions.

These are complemented by services offerings such as installation, roll-out, system integration, support and consulting. Focus is on pre-integrated solutions that create

scale and ease of use for our customers.

Global scale and skill

One important dimension is our strong relationships with our customers, the world’s leading service providers. The other dimension is

the importance of the competence and people we have within Ericsson, close to our customers all across the world – be it in R&D, production, service delivery, sales or any of the supporting functions.

Business structure

Based on our core

strategic pillars we have divided our business into three business areas: Networks, Digital Services and Managed Services. In addition, in January 2018 we added business area Emerging Business.

In Networks we provide the hardware, software and services that build the actual networks.

Digital Services is a software-led business that focuses on operating, controlling and monetizing the

network.

With our Managed Services offering we can operate our customers’ networks, allowing them to focus on the services they

provide to their customers.

In Emerging Business we explore ways to leverage connectivity to create new revenue streams for

our customers, such as IoT.

All business areas address the same customer group, the service providers, and they all build their

offerings and strategies on the three core strategic pillars described above. It is a competitive advantage for us to be able to combine the different offerings from the business areas into customer solutions that address each customer’s

unique needs, while keeping the scale advantage within each business area.

A focused business strategy

7

Ericsson Annual Report on Form 20-F 2017

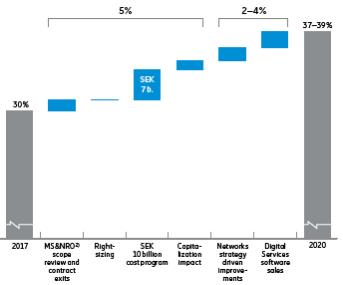

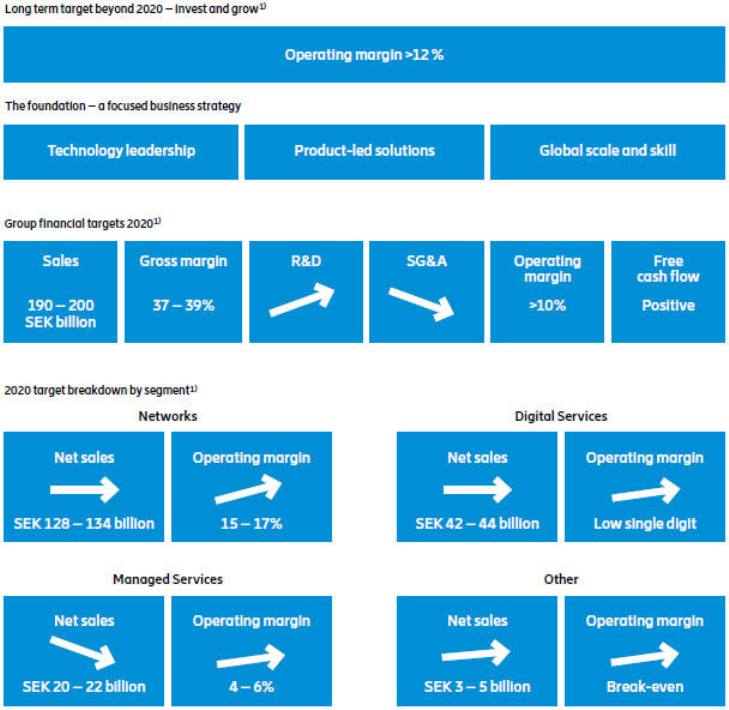

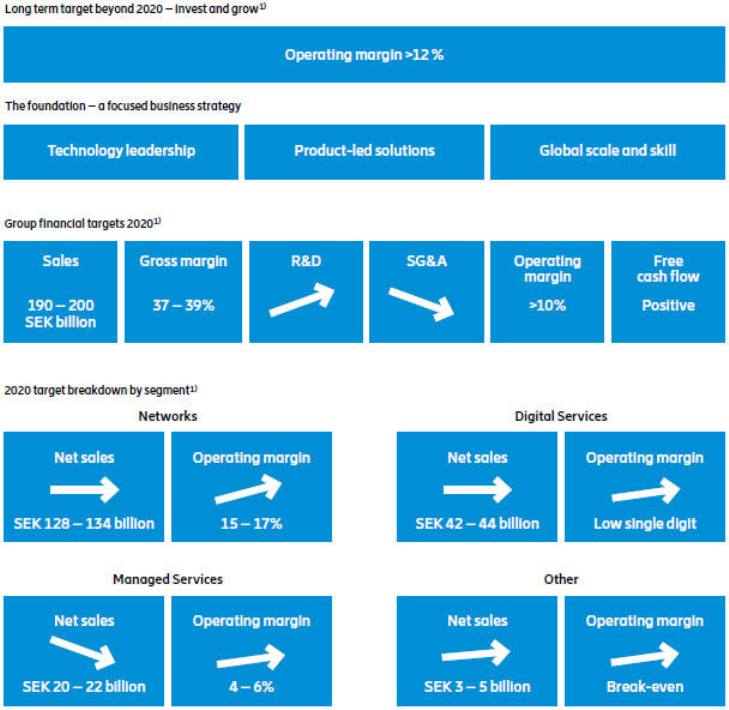

Target of more than 12% operating margin on a sustainable basis

The focused business strategy that we presented in March 2017, states our ambition to improve returns to shareholders, including the target to

reach more than 12% operating margin on a sustainable basis excluding restructuring charges.

The near-term focus is on performance

turnaround and there are robust plans in place to reach a gross margin of 37–39% and an operating margin of at least 10% in 2020, excluding restructuring charges.

Beyond 2020, our ambition is to drive continued improvements and capture upsides from innovation and emerging business, to reach our long term

target of at least 12% operating margin. Key priorities are 5G driven Networks business ramp up, a software-led Digital Services business, new growth and profitability improvements in Managed Services via

analytics and automation and finally scaling of Emerging business such as IoT and UDN.

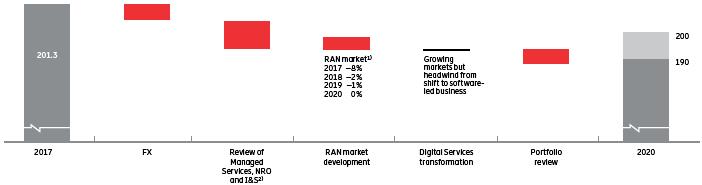

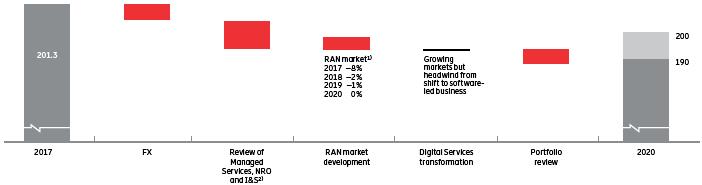

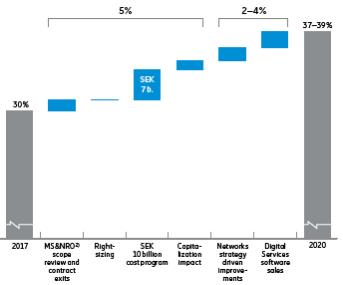

Reaching the 2020 target

The target for company net sales is SEK 190–200 billion in 2020. Net sales are expected to decline compared to the SEK

201 billion in 2017, partly due to the current declining Radio Access Network (RAN) market, but also to a large extent due to the focused business strategy. However there are growth

opportunities in specific areas; in Networks there are selective market expansion opportunities enabled by increased investments in R&D for technology and cost leadership, and there are opportunities to scale in Emerging Business.

Gross margin expansion driven by cost reduction program

A large share of the gross margin expansion is expected to be realized over the next 1–2 years, driven by the ongoing cost reduction

program of at least SEK 10 billion that is expected to be completed by mid 2018. However, to stay competitive, cost efficiency will continue to be in focus.

Approximately 70% of this cost reduction program is related to cost of sales and addresses areas such as service delivery efficiencies,

reductions in supply, IT and real estate costs. To enable additional gross margin improvements, sales will be concentrated to product-led solutions, leading to an improved sales mix with a higher share of

software sales and a lower share of services sales. Other strategy related items that are intended to drive gross margin improvements include for example increased R&D investments to strengthen cost leadership.

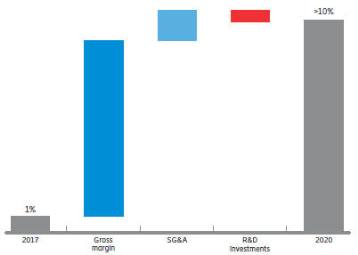

Increased R&D investments combined with structural cost reductions in SG&A

The R&D ramp-up is expected to drive profitability, secure technology and cost leadership and to

protect the long-term business. Technology leadership will also allow us to capture market share and to increase scale advantage. The company target to reduce SG&A will be achieved by a simplified organization and improved G&A efficiencies

and right-sizing efforts. The profitability target for 2020 requires that all business segments improve their operating margins compared to current levels.

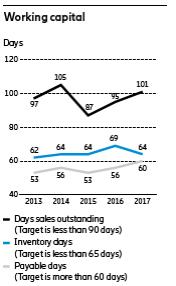

Working capital efficiency and free cash flow in focus

Our ambition is to retain a strong balance sheet and positive free cash flow. We aim to secure financial resilience, improve performance

visibility, increase accountability and drive focus on profit and cash. The target is to improve collection and credit management, as well as sourcing and supply chain management,

Robust plan for topline development

SEK billion

Illustrative reconciliation to 2020 target

| 1) |

Radio Access Network market. |

| 2) |

Industry & Society customers (not traditional service providers). |

8

Ericsson Annual Report on Form 20-F 2017

with a long term ambition to reach below 100 working capital days compared to 105 days December 31, 2017. Sharp discipline in both CAPEX and M&A activities as well as cost reductions are

other major elements to drive positive free cash flow. The target is to generate positive free cash flow each year up until 2020, and beyond 2020 to generate strong positive free cash flow.

To support this we apply financial discipline with priority on profitability and return on capital over growth. As one of several measures to

drive this change, we are introducing a value-based steering model in the 2018 short-term variable compensation program, which also takes cost of capital into account.

Key activities in 2017

During the year

there was strong progress in strategy execution. A simplified company structure and organization, with clear accountability and strong governance, was put in place. There is good progress in the contract reviews in Managed Services and during the

year 23 contracts were either exited, renegotiated or transformed. The portfolio review is well underway and during the year we divested our power module business while we explored strategic opportunities for the Media business. In January 2018 we

concluded the strategic review of the Media business.

Cost reduction progress

We have a target of reducing cost with at least SEK 10 billion by mid 2018 compared to the baseline, second quarter 2017 runrate. As per

December 31, 2017, we have executed an annual net saving runrate of SEK 6 billion.

50% of the SEK 10 billion cost

reductions relate to service delivery costs. The headcount reduction in service delivery, amounted to 7,700 in 2017.

IT, indirect spend

and supply represents some 30% of the 10 billion cost reduction target. The emphasis is on reduction of IT spend, indirect spend as well as real estate site footprint and facility management. In 2017, Ericsson identified a number of sites to be

closed down.

The balance, or 20% of the SEK 10 billion cost program, relates to support functions. In this area, we have

reduced the total G&A head count with 1,100 by year end 2017. For more details on progress, see Board of Directors’ report.

We have deliberately taken selling and R&D expenses out of the cost reduction scope to protect the business and to invest in technology

leadership. There is also a clear separation between taking out structural costs through the cost reduction program, and rightsizing the organization for lower business volumes.

Restructuring charges for 2017 were SEK 8.5 billion, and in 2018 we expect restructuring charges of SEK 5–7 billion.

Implementing the targets

In the process

to improve financial performance, all business areas are critical for success and all have clear focus areas. In Networks, focus is to expand gross margin by investing in R&D for technology and cost leadership. In Digital Services, focus is

shifting to software-led solutions and on adjusting the cost base. In Managed Services, contract reviews are ongoing and investments in automation and artificial intelligence have started. Finally, a

structured approach to technology and business innovations are expected to over time drive new growth in Emerging Business.

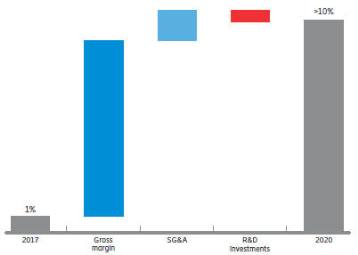

Adjusted gross margin1)

Illustrative reconciliation to 2020 target

| 1) |

Reported gross income excluding restructuring charges (SEK –5.2 billion), write-down of assets (SEK –0.7 billion), total provisions and adjustments related to certain customer projects announced March 28

2017 (SEK –6.7 billion) and total provisions and adjustments related to certain market and customer projects announced in Q2 2017 (SEK –3.7 billion). |

| 2) |

Managed Services and Network Rollout. |

Adjusted operating margin1)

Illustrative reconciliation to 2020 target

| 1) |

Reported operating income excluding restructuring charges (SEK –8.5 billion), write-down of assets (SEK –17.8 billion), total gains/losses on sales of certain investments and operations (SEK 0.3 billion),

total provisions and adjustments related to certain customer projects announced March 28 2017 (SEK –8.4 billion) and total provisions and adjustments related to certain market and customer projects announced in Q2 2017 (SEK –5.5

billion). |

9

Ericsson Annual Report on Form 20-F 2017

A main driver in 5G development

Introduction

Previous generations of

mobile networks addressed consumers predominantly for voice and SMS in 2G, web browsing in 3G, and higher-speed data and video streaming in 4G. The transition from 4G to 5G will serve both consumers and multiple industries. With global mobile data

traffic expected to grow eight times by the end of 2023, there is a need for a more efficient technology, higher data rates and improved spectrum utilization. New applications such as 4K/8K video streaming, virtual and augmented reality and

industrial use cases will also require higher bandwidth, greater capacity, security, and lower latency. Equipped with these capabilities, 5G will bring new opportunities for people, society, and businesses.

5G will create value in three main areas

Three areas of usage and applications drive 5G development:

1. Enhanced mobile broadband

Mobile

broadband is the first case for 5G, addressing traffic growth demands and higher consumer experience needs. It also enables access to multimedia content such as 4K streaming on a mobile device or on-site live

experiences. Fixed Wireless Access, as another use case example, can provide connectivity for households and Small Medium Enterprises (SMEs) using wireless technologies.

2. Massive machine-type communications

Realizing internet of things, enabling connectivity for millions of devices which typically transmit a low volume of non-delay-sensitive data (low bandwidth and not latency critical). Examples of use cases for massive machine-type communications are tracking of goods, fleet management and smart metering.

3. Critical machine-type communication

Ultra-reliable, resilient and instantaneous connectivity with stringent requirements on availability, latency and throughput. Examples of use

cases are wireless control of industrial manufacturing and production processes, remote medical surgery and transportation safety.

What will 5G mean

for Ericsson’s customers?

The introduction of 5G will enable new services, new ecosystems and new revenue streams. By addressing

industry digitalization with 5G, we estimate that service providers can benefit from a market opportunity of approximately USD 600 billion globally in 2026. We anticipate that service providers will find the greatest opportunities in the

manufacturing and energy/utilities sectors. Capturing this market potential requires investment in technology, as well as business development, go-to-market models, and

organizational adaptation.

The availability of 5G

Ericsson has, together with our partners, been working on 5G technology for several years in the labs, and in 2017 we continued to take these

technologies into advanced outdoor field trials. The 5G standardization has been accelerated and is planned to be finalized by mid-2018. The first commercial 5G networks and devices based on the 3GPP standards

are expected in 2019, with major network deployments from 2020. Ericsson estimates the number of 5G subscriptions to reach one billion by the end of 2023.

Technology at the heart of 5G

Whereas

2G, 3G and 4G were primarily radio focused, 5G will represent an entire system with radio, a telecom core, and operations support systems (OSS) – all transformed to support new requirements. This process will involve new radio technologies, a

virtualized cloud-based core, and end-to-end management and orchestration to facilitate automation and new concepts like network slicing. While the system in itself will

not be standardized, many technology areas and interfaces will be standardized in different environments.

Ericsson’s 5G position

Ericsson is well positioned for 5G. By the end of 2017 we had 38 MoUs for 5G trials and collaborations. These early trials are key to

developing leading technologies for the 5G standard as well as competitive product portfolios. In addition, we have announced three 5G deals, one in North America (Verizon) and two in Europe (Vodafone in the UK and Swisscom in Switzerland).

The ecosystem is essential to 5G. To better understand new use cases and support our customers, we are collaborating with 45 universities and

institutes as well as 22 industry partners.

Ericsson is a main driver of industry standardization for 5G. As early as 2011, we started to

lead the industry discussions around 5G, scoping out 5G services and requirements, and doing R&D in the area of the 5G technical concept. Our number of contributions to the standardization body 3GPP in 2016 was higher than any other company.

Ericsson’s 5G technical contributions have been recognized with numerous 5G awards.

Already today we have an advanced 5G portfolio,

enabling today’s networks to evolve smoothly to the next generation of networks.

10

Ericsson Annual Report on Form 20-F 2017

Financial ambition

| 1) |

Excluding restructuring charges. |

11

Ericsson Annual Report on Form 20-F 2017

Networks

Offering – main components

Networks’ solutions support all radio access technologies and we offer hardware, software and related services both for radio access and

transport with a focus on service providers This encompasses all cellular generations offering best performance, low total cost of ownership, smooth evolution and a broad range of network capabilities (from Gigabit LTE to Massive IoT).

The product-related services comprise of design, tuning, network rollout and customer support.

Business model

The contracts are

primarily based on a transactional approach, where Ericsson is developing, selling, licensing and delivering hardware, software and services that are purchased by customers for its specific functionality or capability. One example could be to build

and install a 4G network for a service provider in a specific country or region. The Networks business also includes recurring revenue streams such as customer support and software revenues.

Market

Mobile connectivity, mobility and

omnipresent connectivity are increasingly important for society, consumers and industries and mobile data traffic has grown exponentially.

However, the Networks business has been challenged in the recent years with a declining overall RAN market and market share. We expect the

overall RAN market to continue to decline by –2% in 2018, –1% in 2019 and to increase slightly by 1 % in 2020. Today, Ericsson is one of the largest global suppliers of mobile telecom equipment.

Strategic priorities

The target for

Networks in 2020 is to reach an operating margin of 15–17% (excluding restructuring charges) and net sales of SEK 128–134 billion. The expected market development for 2018 and 2019 as well as the contraction of the network rollout

business, as we focus on our own products, will have a negative impact on sales.

Selective market expansion and sales growth supported by

technology leadership are major long-term growth drivers. To drive gross margin improvements, we are investing in R&D for technology and cost leadership.

The cost leadership will support selected market share expansion in 4G, building a foundation for 5G expansion. The Ericsson Radio System

(ERS), the radio platform launched in 2016, brings added capabilities and competitiveness as well as cost reductions including service delivery efficiency.

In 2017 61% of total radio deliveries were based on the ERS platform. The target is to reach 100% ERS deliveries before the end of 2018.

The business focus is to develop solutions based on modular and flexible platforms to offer our customers the lowest sustainable total cost of

ownership, best network performance and a smooth evolution to 5G.

We also focus on reducing cost of sales in the service delivery and in

the supply chain.

| 1) |

Q3 2017, source: Dell’Oro. |

| 2) |

2017, source: Dell’Oro. |

| 3) |

Reported operating income excluding SEK –9.5 billion related to; restructuring charges, write-down of assets, gains on sales of certain investments and operations, provisions and adjustments related to certain

customer projects announced March 28 2017, and provisions and adjustments related to certain market and customer projects announced in Q2 2017. |

12

Ericsson Annual Report on Form 20-F 2017

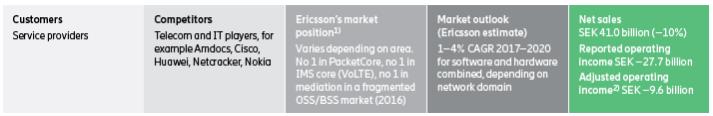

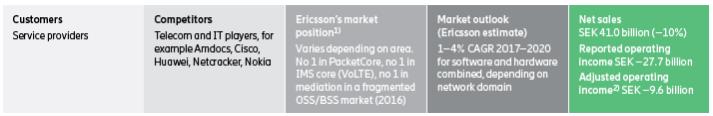

Digital Services

Offering – main components

Ericsson

provides solutions that realize our customers’ digital transformations. These solutions consist primarily of software and services in the areas of monetization and management systems (OSS/BSS), telecom core (packet core and communication

services), cloud & NFV (Network Functions Virtualization) infrastructure, and application development and modernization.

Business model

Ericsson develops, sells, licenses and delivers software and services for specific functions or capabilities in our customers’

operations. The new strategic direction of Digital Services is to shift from a service-led to a software-led sales approach, supported by industrialized services

capabilities. This is expected to change the sales mix towards a much higher portion of software content.

In addition, the segment will

move to a higher share of recurring revenues. Going forward Ericsson believes that subscription based aaS (as a Service) delivered functions and capabilities will be the dominant model, especially for tier 2 and tier 3 service providers.

Market

The ongoing digitalization drives

new opportunities for service providers. It gives possibilities to program 4G and 5G core networks for specific consumer and industry needs, to automate operations to become radically more efficient and to serve and engage with customers digitally.

Consequently, service providers increasingly invest in the areas where Digital Services provide solutions.

We estimate the addressable

market to grow between 1% and 4% CAGR 2017 to 2020 depending on network domain, software and hardware combined. The market for legacy products is declining while the market for virtualized and cloud based solutions is growing. There is also an

ongoing shift from larger systems integration contracts, into a market where service providers instead are purchasing pre-integrated software suites.

Strategic priorities

Segment Digital

Services reported significant negative results in 2017 mainly due to reduced legacy product sales, losses in large service-led transformation contracts, and asset write-downs. The latter partly as a

consequence of the focused business strategy.

Top priority is to reduce the losses and turning the segment around to profitable business.

This turnaround is executed in three steps: Stability – Profitability – Growth

The first step has been to get stability in the

business, stability in product roadmaps and stability in key customer contracts. With increased stability in 2017, focus has expanded to improve profitability while the third step will be on sales growth.

The financial target for 2020 is to achieve a low single digit positive operating margin. Key for this is the execution of the previously

mentioned strategy; to increase software sales and shift the portfolio from legacy products to new cloud-native products. Net sales in 2020 is estimated to be relatively stable compared to 2017, but gross margin is expected to benefit from a sales

mix change where increased software sale offset the reduced services sales. In addition, focus is on improved operational efficiency through an industrialized and automated service delivery, and through strict governance and management of critical

multi-year customer projects.

The long-term ambition for Digital Services is to become the telecom industry’s leading software

provider by addressing the service providers’ needs for programmable networks, automated operations and digital engagements.

| 1) |

PacketCore and IMS core (VoLTE) – Q3 2017. |

| 2) |

Reported operating income excluding SEK –18.1 billion related to; restructuring charges, write-down of assets, gains on sales of certain investments and operations, provisions and adjustments related to

certain customer projects announced March 28 2017, and provisions and adjustments related to certain market and customer projects announced in Q2 2017. |

13

Ericsson Annual Report on Form 20-F 2017

Managed Services

Offering – main components

Ericsson

provides managed services and network optimization to service providers. Through these offerings, customers entrust us to run the operations of their network/IT systems and optimize network performance. Our main differentiators are our deep

understanding of service provider processes and our tools for advanced automation.

Business model

In Managed Services, Ericsson assumes responsibility for areas within a customer’s network/IT operations for an agreed period, typically

3–7 years.

The managed services business model includes three phases – transition, transformation and optimization.

The transition phase is associated with lower profitability as it involves up-front costs when staff

and expertise are transferred from the customer to Ericsson.

During the transformation phase, we introduce our global processes, methods

and tools and implement a global delivery model.

In the final phase, optimization, we focus on optimization and industrialization by

simplifying, implementing and consolidating resources, processes, methods and tools to allow for improved profitability.

Managed services

contracts are frequently renewed. Furthermore, the nature of the manages services business gives a higher than Group average working capital turnover ratio, which gives Managed Services a higher return on investment than the other segments. We can

also optimize customers’ networks for a shorter project duration, delivering increased network performance or increased performance of specific applications according to scope agreed with the customer.

Market

The main drivers for the managed

services and network design and optimization business are the increasingly complex network and IT systems that service providers face; high demand for better customer experience, along with increased pressure to reduce costs. We expect the market to

have a growth of 2–4% CAGR 2017–2020.

Strategic priorities

The target is to achieve a 4–6% operating margin and sales of SEK 20–22 billion in 2020. Contract profitability and managing

risk is prioritized over growth. One important initiative undertaken to improve profitability is the contract review process. This involves 42 contracts (out of more than 300), which are unprofitable. These contracts will be either exited,

renegotiated or transformed. In 2017, 23 contracts out of the 42 were completed, resulting in an annualized profit improvement of SEK 0.5 billion. Sales in 2020 are expected to decline compared to 2017 as a result of the contract review

process. We expect the contract review process to be completed by 2019.

The main business focus will be to deliver high levels of

operational performance combined with further cost efficiency through advanced automation and analytics, and to pursue new contracts with a broad service delivery scope.

| 1) |

Reported operating income excluding SEK –3.2 billion related to; restructuring charges, write-down of assets, gains on sales of certain investments and operations, provisions and adjustments related to certain

customer projects announced March 28 2017, and provisions and adjustments related to certain market and customer projects announced in Q2 2017. |

14

Ericsson Annual Report on Form 20-F 2017

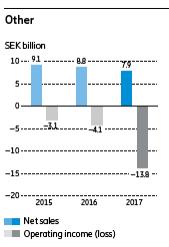

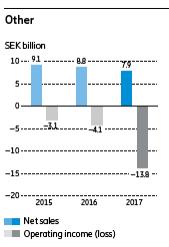

Other

Business models and offering

Segment

Other consists of four businesses; Emerging Business, iconectiv, Media solutions and Red Bee Media (former Broadcast services).

In

Emerging Business focus is to develop new partnership based services and to innovate new sources of revenues for the service providers and for the Group. Examples of innovation efforts, in which we are investing, are Internet of Things platforms

(IoT) and Unified Delivery Network(UDN). Ericsson’s UDN is a global Content Delivery Network (G-CDN) that connects content providers all over the world with the service providers. First commercial

deployments started in 2017, and customer contracts included NTT DOCOMO where UDN will enable NTT DOCOMO subscribers to access and enjoy a diverse range of high-quality content over the mobile network.

iconectiv provides interconnection solutions that include network and operations management, numbering, registry, security and identity, and

messaging solutions. The iconectiv business offers services that enable service providers and enterprises to discover, route and interact with their customers in a secure manner. Media solutions include platforms for compression, software and

hardware-based video processing and storage, content publishing via set-top box or pure OTT (Over the Top), content delivery and analytics.

Red Bee Media consists of technologyenabled services, where Ericsson handles the technical platform, operational and systems integration

related services. The service is provided for broadcasters and content owners and the contracts are multi-year.

Strategic priorities

Total operating expenses invested in Emerging Business and iconectiv in 2017 was SEK 2.8 billion, almost a doubling compared to 2016. We

see good traction with our UDN solutions with a strong pipeline of new customers and for IoT we continue to see strong customer interest in our Device Connection Platform, especially in automotive.

The targets for 2020 in segment Other include scaling the Emerging Business and iconectiv to SEK 3–5 billion in net sales and to

achieve a break-even operating income. The key strategy is to run the businesses like in-house startups, business incubators, with clear financial targets and with regular review of business performance

compared to target milestones.

The targets for 2020 exclude Media Solutions and Red Bee Media. In March 2017, Ericsson announced its

focused business strategy. Consequently, the company decided to explore strategic opportunities for Media Solutions and Red Bee Media.

In

January 2018 the strategic review of the Media business was concluded. 51% of Media Solutions will be divested to an external partner, while we will continue to develop Red Bee Media as an independent and focused

in-house media service business.

| 1) |

Reported operating income excluding SEK –9.0 billion related to; restructuring charges, write-down of assets, gains on sales of certain investments and operations, provisions and adjustments related to certain

customer projects announced March 28 2017, and provisions and adjustments related to certain market and customer projects announced in Q2 2017. |

15

Ericsson Annual Report on Form 20-F 2017

16

Ericsson Annual Report on Form 20-F 2017

Letter from the Chairman

Dear shareholders

The year of 2017 was a

year of change and execution, reflected in a determination to address financial performance and value creation. It started out with Börje Ekholm assuming the position as CEO. The Board is convinced that he will succeed in leading the Company to

improved performance and profitability. He is also passionate about innovation and we believe that he will constantly drive Ericsson to remain at the forefront of technology.

Already in the first quarter of 2017, the Company presented a new focused business strategy and a new executive team. The Board, and the major

shareholders, fully support the strategy, which creates a solid foundation for Ericsson to serve its customers, the service providers, in the best way, by supporting them in their value creation. We, as a Board, are fully committed and supportive to

the Company’s long-term target of at least 12% operating margin.

The strategy implies simplifying the organization and restoring

profitability, while at the same time investing in the business for technology and cost leadership. The Board believes that in addition to simplicity, stability and accountability, general good talent management, succession plans and performance

based remuneration, are important contributors to improved performance. At the AGM 2017, the Board presented a new compensation package for senior management to reflect a closer link between company performance and shareholder value.

The three core values of respect, professionalism and perseverance remain a solid platform in times of change, reflecting a transparent and

empowering culture. The Board invests considerable time on corporate governance, and how to conduct business responsibly. Ericsson faces the same challenges as other global companies in ensuring that it conducts its business in an ethical and

compliant way. Since 2013 the Company has been voluntarily cooperating with inquiries from the United States Securities and Exchange Commission and the United States Department of Justice regarding its compliance with the U.S. Foreign

Corrupt Practices Act in multiple regions.

Ericsson has a zero-tolerance approach

to corruption and during 2017 an external counsel, appointed by the Board, assessed the Group’s anti-corruption program, with suggestions on how to improve the program further. In 2017 the Company also established Regional Compliance

Offices and Business Partner Review Boards in every market area and introduced an Ethics and Compliance vetting process that reviews ethics and compliance-related behavior of senior leaders. In order to retain the trust of its stakeholders, the

Company and all its employees need to meet demanding financial, social and environmental standards.

For stakeholders in the capital

market, including our shareholders, the capital structure is of high relevance. The Board continuously analyses and monitors the capital structure and carefully evaluates business plans and investments in R&D and other assets. We increased our

focus on free cash flow during the year and the full-year number of SEK 5.1 billion mark a clear improvement over 2016. For the first time in five years, the full-year free cash flow exceeded the dividend payout. For the AGM, the Board proposal

is a dividend of SEK 1.00 (1.00) for 2017. The Board expresses confidence in the ongoing profitability improvement actions, and has the ambition to increase the dividend over time as the financial performance improves.

The Company has a new ownership constellation, with Cevian Capital as one of its largest shareholders beside Investor and Industrivärden.

After 2017 it is now natural for me to stand down, and to let the owners propose a new Chairman at the Annual General Meeting of shareholders 2018.

So after seven years, it is now time for me to hand over to my proposed successor Ronnie Leten, and I wish him and Ericsson all the best.

Leif Johansson

Chairman of the Board

17

Ericsson Annual Report on Form 20-F 2017

Board of Directors’ report

Reporting structure in 2017

The 2017

reporting structure is applied in this Board of Directors’ report with the following segments; Networks, Digital Services, Managed Services and Other.

Full-year highlights

| |

• |

|

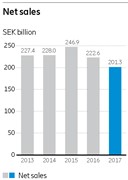

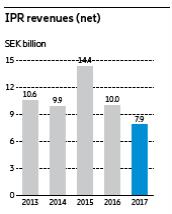

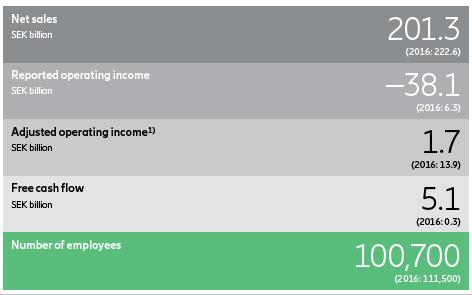

Reported sales decreased by –10% to SEK 201.3 (222.6) billion with a decline in all segments. Sales adjusted for comparable units and currency declined also by –10%. IPR licensing revenues amounted to SEK

7.9 (10.0) billion. |

| |

• |

|

Operating income declined to SEK –38.1 (6.3) billion, mainly due to write-down of assets as well as provisions and customer project adjustments. |

| |

• |

|

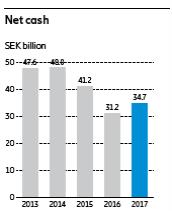

Cash flow from operating activities was SEK 9.6 (14.0) billion. Free cash flow amounted to SEK 5.1 (0.3) billion. Net cash at year-end was SEK 34.7 (31.2) billion.

|

| |

• |

|

The Board of Directors proposes a dividend for 2017 of SEK 1.00 (1.00) per share to the AGM. |

Business in 2017

In 2017, net sales decreased by –10% with a decline in all segments as described in more detail below. The sales decrease in Networks

was mainly due to lower demand for radio access network equipment. The sales decrease in Digital services and Other was mainly due to lower sales of legacy products. The sales decline in Manages Services was mainly due to a renewed contract in North

America in 2016 that was reduced in scope.

IPR licensing revenues were SEK 7.9 (10.0) billion.

In 2017 a focused business strategy was set and a new organizational structure was implemented. In addition, the company initiated a cost

saving program with the target to reduce annual cost by SEK 10 billion by mid 2018. Together, this resulted in a write-down of assets of SEK –17.8 billion and restructuring charges of SEK –8.5 (–7.6) billion. When the

focused business strategy was announced in March 2017, the company also identified risks related to certain market and customer projects. These provisions and adjustments amounted to SEK –8.4 billion in Q1 2017. In the Q2 2017 report, the

company identified a risk of further market and customer project adjustments of SEK 3 – 5 billion The review of such risks was completed in the second half of the year and resulted in total provisions and customer project adjustments of

SEK –5.5 billion

Due to technology and portfolio shifts, the company has reduced the capitalization of development expenses for

product platforms and software releases and the deferral of hardware costs. As a consequence, higher amortization than capitalization of development expenses and higher recognition than deferral of hardware costs had a negative impact on operating

income of SEK –2.9 (3.8) billion.

18

Ericsson Annual Report on Form 20-F 2017

Operating income was SEK –38.1 (6.3) billion.

Ericsson delivered a full-year cash flow from operating activities of SEK 9.6 (14.0) billion. Free cash flow amounted to SEK 5.1 (0.3)

billion. Net cash at year end was SEK 34.7 (31.2) billion.

Financial highlights

Net sales

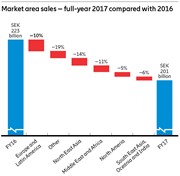

Reported sales decreased

by SEK –21.3 billion or –10%, with a SEK –13.0 billion or –9% decrease in Networks, SEK –4.3 billion or –10% decrease in Digital Services, SEK –3.0 billion or –11% in Managed Services

and SEK –1.0 billion or –11% in segment Other. The sales decrease in Networks was mainly due to lower demand for radio access network (RAN) equipment, which was estimated by an external source to decline by –8% for full-year

2017. The sales decrease in segments Digital Services and Other was mainly due to lower sales of legacy products. The sales decline in Managed Services was mainly due to a renewed contract in North America in 2016 that was reduced in scope.

IPR licensing revenues amounted to SEK 7.9 (10.0) billion. The revenues in 2016 were positively impacted by two signed contracts which

included certain one-time items. The baseline for the current IPR licensing contract portfolio is approximately SEK 7 billion on an annual basis.

Sales adjusted for comparable units and currency decreased by –10%.

The sales mix by commodity was: software 21% (22%), hardware 34% (33%) and services 45% (45%).

Gross margin

Gross margin

declined to 22.1% (29.8%) due to provisions and customer projects adjustments of SEK –10.4 billion, write-down of assets of SEK –0.7 billion and lower IPR licensing revenues at SEK 7.9 (10.0) billion. In addition,

restructuring charges included in the gross margin increased to SEK –5.2 (–3.5) billion.

Due to technology and portfolio

shifts, the company has reduced the capitalization of development expenses for software releases and the deferral of hardware costs. As a consequence, higher amortization than capitalization of development expenses and higher recognition than

deferral of hardware costs had a negative impact on gross income of SEK –2.6 (–0.5) billion.

Operating expenses

Operating expenses increased to SEK –70.6 (–60.5) billion, mainly as a result of provisions and customer project adjustments of SEK

–3.5 billion and write-down of assets of SEK –4.1 billion. In addition, operating expenses increased due to higher amortized than capitalized development expenses with a negative effect on operating expenses of SEK –0.3

(4.3) billion. Operating expenses included restructuring charges of SEK –3.3 (–4.1) billion of which the sale of the global ICT center in Montreal generated a restructuring charge of SEK –1.3 billion. Operating expenses,

excluding write-down of assets, provisions and customer project adjustments as well as restructuring charges were SEK –59.7 (–56.4) billion.

Other operating income and expenses

Other operating income was SEK 1.2 (2.0) billion. In 2017, the power modules business was divested, which resulted in a gain of SEK

0.3 billion. Other operating expenses declined to SEK –13.3 (–1.6) billion negatively impacted by write-down of goodwill of SEK –13.0 billion.

As of 2017, the funding of foreign exchange forecast hedging is managed through foreign exchange loans (USD) instead of foreign exchange

derivates. Therefore, revaluation and realization effects are included in financial expenses instead of other operating income and expenses. In 2016, the currency hedge contract effects impacted other operating income and expenses by

SEK –0.9 billion.

Restructuring charges and cost savings

Restructuring charges amounted to SEK –8.5 (–7.6) billion. This was lower than the earlier estimate of SEK 9–10 billion.

The restructuring charges mainly relate to cost savings. The target is to implement such savings with an annual run rate effect of at least SEK 10 billion by mid-2018. Approximately 30% of the cost

savings are targeted at administrative expenses and 70% at cost of sales.

Total restructuring charges for 2018 are estimated to

be SEK 5–7 billion.

Consequences of technology and portfolio shifts

Due to technology and portfolio shifts the company is reducing the capitalization of development expenses for product platforms and software

releases and the deferral of hardware costs. As a consequence, higher amortization than capitalization of development expenses and higher recognition than deferral of hardware costs had a negative impact on operating income.

19

Ericsson Annual Report on Form 20-F 2017

Impact from amortization and capitalization of development expenses and from recognition and deferral of

hardware costs

|

|

|

|

|

|

|

|

|

| SEK billion |

|

2017 |

|

|

2016 |

|

| Cost of sales |

|

|

–2.6 |

|

|

|

–0.5 |

|

| R&D expenses |

|

|

–0.3 |

|

|

|

4.3 |

|

| Total impact on operating income |

|

|

–2.9 |

|

|

|

3.8 |

|

Operating income (loss)

Operating income (loss) decreased to SEK –38.1 (6.3) billion, mainly due to write-down of assets of SEK –17.8 billion,

provisions and customer project adjustments of SEK –13.9 billion and lower sales.

In addition, higher amortization than

capitalization of development expenses and higher recognition than deferral of hardware costs had a negative impact on operating income of SEK –2.9 (3.8) billion.

Operating margin was –18.9% (2.8%).

Financial net

The financial net

improved to SEK –1.2 (–2.3) billion, mainly due to lower negative effects of foreign exchange revaluation. Lower interest rates partly offset the improvement. New borrowings have been signed on more favorable terms and risk reduction, in

both currency exchange and interest rates, has been improved in 2017.

The currency hedge effects, which derive from the hedge loan balance

in USD, impacted financial net by SEK 0.5 billion. The SEK has strengthened against the USD between December 31, 2016 (SEK/USD rate 9.06) and December 31, 2017 (SEK/USD rate 8.20).

Taxes

Taxes were SEK 4.3

(–2.1) billion following the negative net income. The effective tax rate was 11%, negatively impacted by non-deductible expenses (mainly goodwill impairment), by revaluation of deferred tax assets due to

the change in U.S. corporate income tax rate, and by an allowance related to certain Swedish tax assets.

Net income (loss) and EPS

Net income (loss) decreased to SEK –35.1 (1.9) billion, for the same reasons as for the decrease in operating income. EPS diluted was SEK

–10.74 (0.52) and EPS (non-IFRS) was SEK –4.04 (2.66).

Employees

The number of employees on December 31, 2017 was 100,735, a net reduction of more than 10,000 employees in 2017.

Cash flow

Cash flow from

operating activities was SEK 9.6 (14.0) billion. The decline was due to lower income and increased cash outlays related to restructuring charges. The cash flow was supported by a reduction of operating assets. Cash outlays related to restructuring

charges were SEK –5.3 (–2.4) billion.

Cash flow from investing activities was impacted by investments and sale of property,

plant and equipment with a net effect of SEK –2.9 (–5.6) billion. In addition, product development decreased by SEK –1.4 (–4.5) billion due to reduced capitalization of product platform development following technology shifts.

The cash flow was supported by the sale of Power Modules and the ICT center in Montreal.

Cash flow from financing activities was

positive at SEK 5.5 (–11.7) billion due to increased net borrowings of SEK 8.6 billion. Dividends of SEK 3.4 (12.3) billion were paid out.

The increased focus on free cash flow and release of working capital, in combination with low investing activities, resulted in a free cash

flow of SEK 5.1 (0.3) billion. The more even distribution of cash flow over the year and the amount of free cash flow mark a clear improvement over 2016. For the first time in five years, the full-year free cash flow exceeded dividend

payout.

Financial position

Gross cash increased to SEK 67.7 (57.9) billion and net cash increased to SEK 34.7 (31.2) billion. Post-employments benefits increased by SEK

1.3 billion due to decreased discount rates and normal service cost, offset by returns on pension assets.

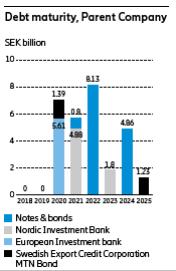

The average maturity of

long-term borrowings as of December 31, 2017, was 4.4 years, compared with 3.8 years 12 months earlier. Ericsson has an unutilized Revolving Credit Facility of USD 2.0 billion. The facility will expire in 2022. In 2017, Ericsson concluded

the following financing activities to strengthen the balance sheet and extend the average debt maturity profile:

| |

• |

|

Issue of one EUR 500 million 4-year bond |

| |

• |

|

Issue of one EUR 500 million 7-year bond |

| |

• |

|

Repayment of one EUR 500 million bond at maturity date. |

| |

• |

|

The company received a USD 200 million payment relating to Francisco Partners’ investments for a 16.7% ownership in Ericsson’s independent subsidiary iconectiv. Due to the structure of the investment,

IFRS accounting standards stipulate that the main part of the USD 200 million should be treated as borrowings, non-current. |

| |

• |

|

Ericsson raised USD 220 million from the Nordic Investment Bank (NIB) and USD 150 million from the Swedish Export Credit Corporation (SEK). The credit agreements mature in 2023 and 2025 respectively. Of these

new funds, USD 98 million replaced a credit with NIB that was set to mature in 2019. |

20

Ericsson Annual Report on Form 20-F 2017

In 2017, Standard & Poor’s downgraded Ericsson’s long-term rating from BBB

with negative outlook to BB+ with stable outlook. Moody’s downgraded Ericsson’s long-term rating from Baa3 with negative outlook to Ba2 with negative outlook.

Intangible assets

The amount of

intellectual property rights and other intangible assets amounted to SEK 32.0 (51.1) billion, including goodwill of SEK 27.8 (43.4) billion. The goodwill impairment testing was based on the new segments that became effective as per October 1,

2017 and resulted in a write-down of goodwill of SEK –13.0 billion triggered by the implementation of the focused business strategy and new organizational structure. For more information, see Note C3, “Segment reporting” and Note

C10, “Intangible assets.”

Research and development, patents and licensing

In 2017, R&D expenses amounted to SEK 37.9 (31.6) billion. The increase is mainly due to higher amortized than capitalized

development expenses with a negative effect of SEK –0.3 (4.3) billion and write-down of assets of SEK –2.5 billion. The number of R&D resources were 23,600. The number of patents continued to increase and amounted to

approximately 45,000 by end of 2017.

Research and development, patents and licensing

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2017 |

|

|

2016 |

|

|

2015 |

|

| Expenses (SEK billion) |

|

|

37.9 |

|

|

|

31.6 |

|

|

|

34.8 |

|

| As percent of Net sales |

|

|

18.8 |

% |

|

|

14.2 |

% |

|

|

14.1 |

% |

| Employees within R&D as of December 311)

|

|

|

23,600 |

|

|

|

24,100 |

|

|

|

23,700 |

|

| Patents1) |

|

|

45,000 |

|

|

|

42,000 |

|

|

|

39,000 |

|

| IPR revenues, net (SEK billion) |

|

|

7.9 |

|

|

|

10.0 |

|

|

|

14.4 |

|

| 1) |

The number of employees and patents are approximate. |

Seasonality

The Company’s sales, income and cash flow from operations vary between quarters, and are generally lowest in the first quarter of the year

and highest in the fourth quarter. This is mainly a result of the seasonal purchase patterns of network operators.

Most recent five-year average seasonality

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

First

quarter |

|

|

Second

quarter |

|

|

Third

quarter |

|

|

Fourth

quarter |

|

| Sequential change, sales |

|

|

–26 |

% |

|

|

9 |

% |

|

|

–2 |

% |

|

|

23 |

% |

| Share of annual sales |

|

|

22 |

% |

|

|

24 |

% |

|

|

24 |

% |

|

|

29 |

% |

Off-balance sheet arrangements

There are currently no material off-balance sheet arrangements that have, or would be reasonably likely

to have, a current or anticipated material effect on the Company’s financial condition, revenues, expenses, result of operations, liquidity, capital expenditures or capital resources.

Capital expenditures

For 2017,

capital expenditure was SEK 3.9 (6.1) billion, representing 1.9% of sales. Expendituares are largely related to test sites and equipment for R&D, network operation centers and manufacturing and repair operations.

Ericsson believes that the Company’s property, plant and equipment and the facilities the Company occupies are suitable for its

present needs.

Annual capital expenditures are normally around 2% of sales. This corresponds to the needs for keeping and maintaining the

current capacity level. The Board of Directors reviews the Company’s investment plans and proposals.

As of December 31, 2017,

no material land, buildings, machinery or equipment were pledged as collateral for outstanding indebtedness.

Capital expenditures 2013–2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SEK billion |

|

2017 |

|

|

2016 |

|

|

2015 |

|

|

2014 |

|

|

2013 |

|

| Capital expenditures |

|

|

3.9 |

|

|

|

6.1 |

|

|

|

8.3 |

|

|

|

5.3 |

|

|

|

4.5 |

|

| Of which in Sweden |

|

|

1.5 |

|

|

|

2.0 |

|

|

|

2.6 |

|

|

|

2.4 |

|

|

|

1.9 |

|

| Share of annual sales |

|

|

1.9 |

% |

|

|

2.8 |

% |

|

|

3.4 |

% |

|

|

2.3 |

% |

|

|

2.0 |

% |

21

Ericsson Annual Report on Form 20-F 2017

Business results – Segments

Networks

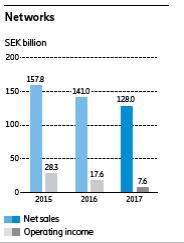

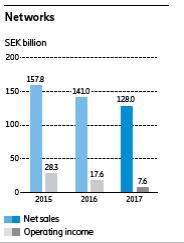

Networks represented 64%

(63%) of net sales in 2017. The segment delivers products and services that are needed for mobile and fixed communication, several generations of radio networks and transmission networks.

Net sales

Sales as reported decreased by

–9% YoY to SEK 128.0 (141.0) billion. Networks sales declined in all market areas except for North America, where sales grew slightly. The decrease was mainly due to lower operator investments in mobile broadband, both products and services. In

addition, the IPR licensing business declined to SEK 6.5 (8.2) billion.

Sales adjusted for comparable units and currency decreased by

–10%.

Gross margin

Gross

income decreased to SEK 40.6 (47.1) billion and gross margin decreased to 31.7% (33.4%). The gross margin decrease was mainly due to provisions and customer project adjustments made in the year. Higher amortization than capitalization of development

expenses and higher recognition than deferral of hardware costs, together amounting to SEK –1.5 (0.2) billion, also had a negative impact on gross margin. This is a consequence of technology and portfolio shifts. Gross margin was positively

impacted by higher hardware margins.

Operating income

Operating income decreased to SEK 7.6 (17.6) billion due to lower sales with lower IPR licensing revenues, provisions and customer project

adjustments, write-down of assets made in the year as well as increased operating expenses. The higher operating expenses are partly due to the strategic decision to increase investments in Networks’ R&D. Higher amortization than

capitalization of development expenses and higher recognition than deferral of hardware costs together amounted to SEK –1.5 (1.0) billion. Write-down of intangible assets and goodwill amounted to SEK –0.4 billion. Restructuring

charges were SEK –4.8 (–3.4) billion. Operating margin decreased to 6.0% (12.5%).

Digital Services

Digital Services represented 20% (20%) of net sales in 2017. The segment is providing solutions for operators’ digital transformation

journeys across the support systems BSS and OSS, Telecom Core, and IT Cloud domains through a combination of products, technology and expertise in networks, software, cloud, and business processes.

Net sales

Sales as reported decreased by

–10% to SEK 41.0 (45.3) billion, due to lower sales of legacy products and related services, primarily in OSS, BSS and Packet Core. IPR and licensing revenues declined to SEK 1.4 (1.8) billion.

Sales adjusted for comparable units and currency decreased by –9%.

Gross margin

Gross income declined to

SEK 4.4 (16.1) billion and gross margin decreased to 10.6% (35.5%) . The gross margin decrease was mainly due to write-down of assets as well as provisions and customer project adjustments. In addition, there was a negative impact from higher costs

in ongoing large transformation projects and from reduced sales of legacy products including related services.

Operating income (loss)

Operating income (loss) declined to –27.7 (–6.7) billion, mainly due to write-down of assets as well as provisions and customer

project adjustments. In addition, operating income was negatively impacted by lower gross margin and lower sales. Write-down of intangible assets and goodwill amounted to SEK –8.7 billion.

The full-year negative impact of higher amortized than capitalized development expenses was SEK –1.3 (2.1) billion. This was partly

offset by cost reductions, impacting both R&D and selling and administrative expenses. Restructuring charges were SEK –2.5 (–3.2) billion. Operating margin declined to –67.5% (–14.7%).

22

Ericsson Annual Report on Form 20-F 2017

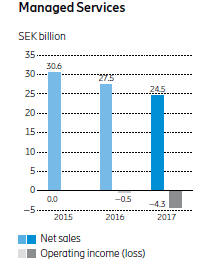

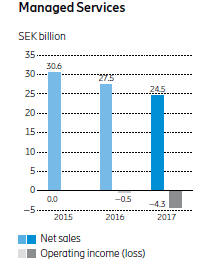

Managed Services

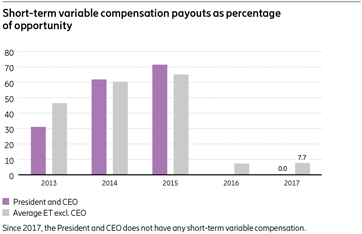

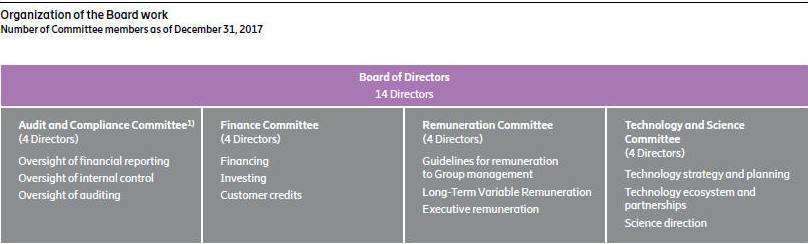

Managed Services represented 12% (12%) of net sales in 2017. The segment delivers managed services and network optimization to telecom