UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-03712 | |

| Exact name of registrant as specified in charter: | Prudential Investment Portfolios, Inc. 14 | |

| Address of principal executive offices: | 655 Broad Street, 17th Floor | |

| Newark, New Jersey 07102 | ||

| Name and address of agent for service: | Deborah A. Docs | |

| 655 Broad Street, 17th Floor | ||

| Newark, New Jersey 07102 | ||

| Registrant’s telephone number, including area code: | 800-225-1852 | |

| Date of fiscal year end: | 2/28/2018 | |

| Date of reporting period: | 2/28/2018 | |

Item 1 – Reports to Stockholders

PRUDENTIAL GOVERNMENT INCOME FUND

ANNUAL REPORT

FEBRUARY 28, 2018

To enroll in e-delivery, go to pgiminvestments.com/edelivery

| Objective: Seek high current return |

Highlights (unaudited)

| • | The Fund benefited from its curve positioning strategy, as the Fund was positioned to benefit from a flatter yield curve. |

| • | Sector allocations added to relative performance, highlighted by an overweight (holding a larger percentage of securities than the Bloomberg Barclays US Government Bond Index) in commercial mortgage-backed securities. |

| • | The Fund was hurt by the active management of its duration positioning. The Fund was positioned for long duration, as rates rose at the beginning of 2018; this positioning detracted from performance. |

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings is for the period covered by this report and is subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies. © 2018 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| 2 | Visit our website at pgiminvestments.com |

PRUDENTIAL FUNDS — UPDATE

The Board of Directors/Trustees for the Fund has approved renaming the Fund’s Class Q shares as Class R6 shares, effective on June 11, 2018. The renaming of Class Q shares as Class R6 shares will not result in any changes to pricing, eligibility, or shareholder rights and obligations. The renamed Class R6 shares will not be exchangeable with Class R6 shares of the Prudential Day One Funds or the Prudential 60/40 Allocation Fund.

- Not part of the Annual Report -

| Prudential Government Income Fund | 3 |

PRUDENTIAL FUNDS — UPDATE

Effective on or about June 1, 2018 (the “Effective Date”), each Fund’s Class A, Class C, Class R and Class Z shares, as applicable, will be closed to investments by new group retirement plans, except as discussed below. Existing group retirement plans as of the Effective Date may keep their investments in their current share class and may continue to make additional purchases or exchanges of that class of shares. As of the Effective Date, all new group retirement plans wishing to add the Funds as new additions to the plan generally will be into one of the available Class Q shares, Class R2 shares, or Class R4 shares of the Funds.

In addition, on or about the Effective Date, the Class R shares of each Fund will be closed to all new investors, except as discussed below. Due to the closing of the Class R shares to new investors, effective on or about the Effective Date new IRA investors may only purchase Class A, Class C, Class Z or Class Q shares of the Funds, subject to share class eligibility. Following the Effective Date, no new accounts may be established in the Funds’ Class R shares and no Class R shares may be purchased or acquired by any new Class R shareholder, except as discussed below.

| Class A | Class C | Class Z | Class R | |||||

|

Existing Investors (Group Retirement Plans, IRAs, and all other investors) |

No Change | No Change | No Change | No Change | ||||

| New Group Retirement Plans | Closed to group retirement plans wishing to add the share classes as new additions to plan menus on or about June 1, 2018, subject to certain exceptions below | |||||||

| New IRAs |

No Change | No Change | No Change | Closed to all new investors on or about June 1, 2018, subject to certain exceptions below | ||||

| All Other New Investors | No Change | No Change | No Change | |||||

- Not part of the Annual Report -

| 4 | Visit our website at pgiminvestments.com |

However, the following new investors may continue to purchase Class A, Class C, Class R and Class Z shares of a Fund, as applicable:

| • | Eligible group retirement plans who are exercising their one-time 90-day repurchase privilege in a Fund will be permitted to purchase such share classes. |

| • | Plan participants in a group retirement plan that offers Class A, Class C, Class R or Class Z shares of a Fund as of the Effective Date will be permitted to purchase such share classes of the Fund, even if the plan participant did not own shares of that class of the Fund as of the Effective Date. |

| • | Certain new group retirement plans will be permitted to offer such share classes of a Fund after the Effective Date, provided that the plan has or is actively negotiating a contractual agreement with the Fund’s distributor or service provider to offer such share classes of the Fund prior to or on the Effective Date. |

| • | New group retirement plans that combine with, replace or are otherwise affiliated with a current plan that invests in such share classes prior to or on the Effective Date will be permitted to purchase such share classes. |

The Funds also reserve the right to refuse any purchase order that might disrupt management of a Fund or to otherwise modify the closure policy at any time on a case-by-case basis.

- Not part of the Annual Report -

| Prudential Government Income Fund | 5 |

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 13 | ||||

| 16 | ||||

| 19 | ||||

| 6 | Visit our website at pgiminvestments.com |

Dear Shareholder:

We hope you find the annual report for Prudential Government Income Fund informative and useful. The report covers performance for the 12-month period ended February 28, 2018.

We have important information to share with you. Effective June 11, 2018, Prudential Mutual Funds will be renamed from Prudential to PGIM Funds. Renaming our funds is part of our ongoing effort to further build our reputation and establish our global brand, which began when our firm adopted PGIM Investments as its name in April 2017. Please note that only the Fund’s name is changing. Your Fund’s management and operation, along with the Fund’s symbols, will remain the same.*

Over the reporting period, global economic growth continued its positive momentum, and central banks gradually tightened monetary policy. The US economy experienced moderate expansion and robust employment levels.

Equity returns were solid, due to healthy earnings expectations and the anticipated impact from tax reform. Global equities, including emerging markets, generally posted strong returns. US equities soared on new regulatory policy and revised corporate tax legislation. However, late in the period volatility arose on jitters over inflation and rising interest rates, tariffs, and a potential trade war.

In bond markets, US Treasury yields rose across both short and longer maturities. European bonds followed and often led during the period. In Japan, policy stance kept yields considerably lower. US corporate bonds handily outpaced Treasuries. Although most bond market sectors delivered positive returns, a great deal of gains were erased at the end of the period. Shortly afterward, the Federal Reserve hiked interest rates for the sixth time since 2015, based on confidence in the economy.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals.

Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. PGIM is a top-10 global investment manager with more than $1 trillion in assets under management. This investment expertise allows us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

Prudential Government Income Fund

April 16, 2018

*Note: The Prudential Day One Funds will not be changing their names.

| Prudential Government Income Fund | 7 |

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.pgiminvestments.com or by calling (800) 225-1852.

| Average Annual Total Returns as of 2/28/18 (with sales charges) |

||||||||||||||

| One Year (%) | Five Years (%) | Ten Years (%) | Since Inception (%) | |||||||||||

| Class A | –5.08 | –0.11 | 2.57 | — | ||||||||||

| Class B | –6.26 | –0.15 | 2.27 | — | ||||||||||

| Class C | –2.35 | 0.06 | 2.33 | — | ||||||||||

| Class R | –0.88 | 0.54 | 2.79 | — | ||||||||||

| Class Z | –0.36 | 1.07 | 3.31 | — | ||||||||||

| Class Q | –0.19 | N/A | N/A | –1.66 (8/9/16) | ||||||||||

| Bloomberg Barclays US Government Bond Index | –0.52 | 0.91 | 2.68 | — | ||||||||||

| Bloomberg Barclays US Aggregate ex-Credit Index | –0.20 | 1.25 | 3.09 | — | ||||||||||

| Lipper General US Government Funds Average | –0.74 | 0.57 | 2.47 | — | ||||||||||

| Average Annual Total Returns as of 2/28/18 (without sales charges) |

||||||||||||||

| One Year (%) | Five Years (%) | Ten Years (%) | Since Inception (%) | |||||||||||

| Class A |

–0.61 | 0.82 | 3.05 | — | ||||||||||

| Class B |

–1.40 | 0.04 | 2.27 | — | ||||||||||

| Class C |

–1.38 | 0.06 | 2.33 | — | ||||||||||

| Class R |

–0.88 | 0.54 | 2.79 | — | ||||||||||

| Class Z |

–0.36 | 1.07 | 3.31 | |

— |

| ||||||||

| Class Q |

–0.19 | N/A | N/A | –1.66 (8/9/16) | ||||||||||

| Bloomberg Barclays US Government Bond Index | –0.52 | 0.91 | 2.68 | — | ||||||||||

| Bloomberg Barclays US Aggregate ex-Credit Index | –0.20 | 1.25 | 3.09 | — | ||||||||||

| Lipper General US Government Funds Average | –0.74 | 0.57 | 2.47 | — | ||||||||||

| 8 | Visit our website at pgiminvestments.com |

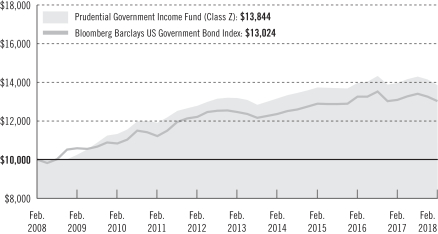

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Prudential Government Income Fund (Class Z shares) with a similar investment in the Bloomberg Barclays US Government Bond Index by portraying the initial account values at the beginning of the 10-year period for Class Z shares (February 29, 2008) and the account values at the end of the current fiscal year (February 28, 2018) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for Class A, Class B, Class C, Class R, and Class Q shares will vary due to the differing charges and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursement, if any, the Fund’s returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Source: PGIM Investments LLC and Lipper Inc.

Since Inception returns are provided for any share class with less than 10 fiscal years of returns. Since Inception returns for the Indexes and the Lipper Average are measured from the closest month-end to the class’ inception date.

| Prudential Government Income Fund | 9 |

Your Fund’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| Class A* | Class B** | Class C* | Class R* | Class Z* | Class Q*** | |||||||

| Maximum initial sales charge | 4.50% of the public offering price | None | None | None | None | None | ||||||

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase price or net asset value at redemption) | 1.00% on sales of $1 million or more made within 12 months of purchase | 5.00% (Yr. 1) 4.00% (Yr. 2) 3.00% (Yr. 3) 2.00% (Yr. 4) 1.00% (Yr. 5) 1.00% (Yr. 6) 0.00% (Yr. 7) | 1.00% on sales made within 12 months of purchase | None | None | None | ||||||

| Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | 0.25% | 1.00% up to $3 billion, 0.80% next $1 billion, and 0.50% over $4 billion | 1.00% | 0.75% (0.50% currently) |

None | None |

*Certain share classes will be generally closed to investments by new group retirement plans effective on or about June 1, 2018. Please see the ‘PRUDENTIAL FUNDS-UPDATE” on page 3 of this report for more information.

**Class B shares are closed to all purchase activity and no additional Class B shares may be purchased or acquired except by exchange from Class B shares of another Fund or through dividend or capital gains reinvestment.

***Class Q shares will be renamed as Class R6 shares effective on June 11, 2018. Please see the “PRUDENTIAL FUNDS-UPDATE” on page 3 of this report for more information.

Benchmark Definitions

Bloomberg Barclays US Government Bond Index—The Bloomberg Barclays US Government Bond Index is an unmanaged index of securities issued or backed by the US government, its agencies, and instrumentalities with between one and 30 years remaining to maturity. It gives a broad look at how US government bonds have performed. The average annual total returns for the Index through 2/28/18 measured from the month-end closest to the inception date of the Fund’s Class Q shares is –2.65%.

Bloomberg Barclays US Aggregate ex-Credit Index—The Bloomberg Barclays US Aggregate ex-Credit Index is an unmanaged index that represents securities that are SEC registered, taxable, and dollar denominated. The Index covers the US investment-grade fixed rate bond market, with index components for government and

| 10 | Visit our website at pgiminvestments.com |

corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indexes that are calculated and reported on a regular basis. The average annual total returns for the Index through 2/28/18 measured from the month-end closest to the inception date of the Fund’s Class Q shares is –1.78%.

Lipper General US Government Funds Average—The Lipper General US Government Funds Average (Lipper Average) is based on the average return of all funds in the Lipper General US Government Funds universe for the periods noted. Funds in the Lipper Average invest primarily in US government and agency issues. The average annual total returns for the Lipper Average through 2/28/18 measured from the month-end closest to the inception date of the Fund’s Class Q shares is –2.67%.

Investors cannot invest directly in an index or average. The returns for the Indexes would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| Credit Quality expressed as a percentage of total investments as of 2/28/18 (%) | ||||

| AAA | 97.9 | |||

| AA | 1.2 | |||

| A | 1.0 | |||

| Not Rated | 0.9 | |||

| Cash/Cash Equivalents | –1.0 | |||

| Total Investments | 100.0 | |||

Source: PGIM Fixed Income

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investor Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature used by both S&P and Fitch. These ratings agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by a NRSRO and may include derivative instruments that could have a negative value. Credit ratings are subject to change. Values may not sum to 100% due to rounding.

| Prudential Government Income Fund | 11 |

Your Fund’s Performance (continued)

| Distributions and Yields as of 2/28/18 | ||||||

| Total Distributions Paid for 12 Months ($) |

SEC 30-Day Subsidized Yield* (%) |

SEC 30-Day Unsubsidized Yield** (%) | ||||

| Class A | 0.21 | 1.88 | 1.88 | |||

| Class B | 0.13 | 0.91 | –2.99 | |||

| Class C | 0.13 | 1.03 | 1.03 | |||

| Class R | 0.18 | 1.59 | 1.34 | |||

| Class Z | 0.23 | 2.25 | 2.25 | |||

| Class Q | 0.25 | 2.36 | 2.36 | |||

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements).

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses.

| 12 | Visit our website at pgiminvestments.com |

Strategy and Performance Overview

How did the Fund perform?

The Prudential Government Income Fund’s Class Z shares returned –0.36% during the 12-month reporting period that ended February 28, 2018. The Fund outperformed the –0.52% return of the Bloomberg Barclays US Government Bond Index during the period, but underperformed the –0.20% return of the Bloomberg Barclays US Aggregate-ex Credit Index, neither of which include the effect of mutual fund operating expenses. In addition, the Fund outperformed the –0.74% return of the Lipper General US Government Funds Average.

What were market conditions?

| • | During the second quarter of 2017, developed markets central banks shifted towards tighter monetary policies. In the US, the front end of the Treasury yield curve rose as the Federal Reserve (Fed) hiked short-term interest rates in June and set the stage to start tapering its balance sheet by the end of the calendar year. US agency mortgage-backed securities (MBS) underperformed other high-quality spread sectors as net supply increased and outright buyers, such as banks and overseas investors, seemed willing to wait for better entry points to add exposure. Spread sectors are agency MBS, corporate bonds, emerging markets debt, and other types of debt securities that provide extra yield (spread) over similar-duration government bond sectors to compensate for the greater credit risk associated with investing in them. |

| • | Developed markets interest rates rose at the beginning of the third quarter after European Central Bank President Mario Draghi stated that “we can be more assured about the return of inflation to our objective than we were a few years ago.” In the US, prospects for further monetary policy tightening arrived as the Fed announced it would start trimming its balance sheet in October. The August US inflation report broke a multi-month streak of weaker-than-expected readings. This news, along with a hawkish Fed, lifted market expectations for a rate hike in December 2017. (Hawkish suggests higher interest rates.) Agency MBS benefited from favorable supply and demand dynamics, as investors underweighted the sector prior to the Fed’s tapering announcement and then sought to increase their positions amid strong buying by banks and in light of the Fed’s sizable reinvestment needs. |

| • | In the fourth quarter, US economic growth accelerated, increasing an estimated 2.3% in 2017 from 1.5% in 2016. A rebound in corporate profits, US dollar weakening, and broad-based, synchronized economic growth among US trading partners contributed to the economic improvement. Meanwhile, strong consumer spending was supported by a drop in the household saving rate over the past two years and a modest pick-up in borrowing. In December, the Fed raised short-term interest rates, as had been anticipated by the markets. Within agency MBS, 3.0% and 3.5% coupons performed well during the fourth quarter, largely because of strong buying by banks and due to taxable bond mutual fund inflows. Prepayment speeds remained contained, as they had through most of 2017, given that mortgage interest rates increased only slightly. |

| Prudential Government Income Fund | 13 |

Strategy and Performance Overview (continued)

| • | In January 2018, the US Treasury yield curve flattened, with short-term yields rising more than long-term yields. Stronger-than-expected economic data, increased consumer confidence, and elevated equity performance contributed to the broad increase in interest rates. |

| • | During February, the US Treasury yield curve steepened as long-term yields rose more than short-term yields. Stronger-than-expected economic data, particularly average hourly earnings and inflation, and the perceived hawkishness of new Fed Chair Jerome Powell, based on his congressional testimony, contributed to the increase in interest rates. |

| • | For the reporting period overall, corporate bonds broadly outpaced Treasuries, which slightly outperformed agency MBS. Although most bond market sectors delivered positive returns during the period, significant gains were erased due to volatility during January and February. |

What worked?

| • | The Fund benefited from its curve positioning strategy, as the Fund was positioned to benefit from a flatter yield curve. A curve positioning strategy attempts to gain from changes in the Treasury yield curve. |

| • | Sector allocations added to relative performance, highlighted by an overweight in commercial mortgage-backed securities. |

What didn’t work?

| • | The Fund was hurt by the active management of its duration positioning. (Duration measures the approximate price volatility of a bond portfolio for a given change in interest rates.) The Fund was positioned for long duration, as rates rose at the beginning of 2018; this detracted from performance. Over the reporting period the Fund was positioned between a short duration position of 0.3 years and a long duration position of 0.8 years. At period end, it held a long duration position of 0.2 years. |

| • | Positioning in municipal securities slightly detracted from performance. |

Did the Fund use derivatives, and how did they affect performance?

| • | The Fund held futures contracts on US Treasury securities and interest rate swaps to help manage the portfolio’s duration and yield curve exposure, which reduced its sensitivity to changes in the levels of interest rates. Overall, this strategy had a positive impact on performance during the reporting period. |

Current outlook

| • | Following exceptionally strong private-sector demand in the fourth quarter of 2017, first-quarter 2018 economic growth was tracking at a little less than 2%. PGIM Fixed Income thinks that some of the softness, which may prove temporary, is likely due to a |

| 14 | Visit our website at pgiminvestments.com |

| hurricane-related surge in demand during the fourth quarter and could also be similar to the pattern of first-quarter economic weakness seen in three out of the last four years. |

| • | At the end of the reporting period, PGIM Fixed Income believed the tax cuts had begun to take effect, which could boost household disposable income and create more incentives, on the margin, for companies to invest. Also, PGIM Fixed Income expects the tax law, combined with increased government spending following a two-year budget deal, to lift US economic growth from an estimated 2.3% in 2017 to 2.9% in 2018. |

| • | In PGIM Fixed Income’s opinion, inflation is expected to firm in the first half of 2018 and to remain capped near 2% by the second half of the year. This view is based on continued competitive pressures in many industries, global production capacity, ongoing disinflation pressures from technology and demographics, and already-elevated household indebtedness. |

| • | PGIM Fixed Income thinks the combination of fiscal stimulus and firming inflation is likely to keep the Fed on a trajectory of three to four rate hikes in 2018. In congressional testimony near the end of the period, Fed Chair Powell noted that previous headwinds have turned into tailwinds for the US economy. However, unforeseen negative shocks could affect the Fed’s projections, in PGIM Fixed Income’s view. |

| Prudential Government Income Fund | 15 |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended February 28, 2018. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of Prudential funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account

| 16 | Visit our website at pgiminvestments.com |

over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Prudential Government Income Fund |

Beginning Account Value September 1, 2017 |

Ending Account February 28, 2018 |

Annualized Expense Ratio Based on the Six-Month Period |

Expenses Paid During the Six-Month Period* |

||||||||||||||

| Class A | Actual | $ | 1,000.00 | $ | 972.10 | 1.00 | % | $ | 4.89 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,019.84 | 1.00 | % | $ | 5.01 | ||||||||||

| Class B | Actual | $ | 1,000.00 | $ | 968.10 | 1.83 | % | $ | 8.93 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,015.72 | 1.83 | % | $ | 9.15 | ||||||||||

| Class C | Actual | $ | 1,000.00 | $ | 968.20 | 1.81 | % | $ | 8.83 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,015.82 | 1.81 | % | $ | 9.05 | ||||||||||

| Class R | Actual | $ | 1,000.00 | $ | 970.70 | 1.30 | % | $ | 6.35 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,018.35 | 1.30 | % | $ | 6.51 | ||||||||||

| Class Z | Actual | $ | 1,000.00 | $ | 973.30 | 0.74 | % | $ | 3.62 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,021.12 | 0.74 | % | $ | 3.71 | ||||||||||

| Class Q | Actual | $ | 1,000.00 | $ | 974.00 | 0.59 | % | $ | 2.89 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,021.87 | 0.59 | % | $ | 2.96 | ||||||||||

* Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 181 days in the six-month period ended February 28, 2018, and divided by the 365 days in the Fund’s fiscal year ended February 28, 2018 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying funds in which the Fund may invest.

| Prudential Government Income Fund | 17 |

as of February 28, 2018

| Description |

Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| LONG-TERM INVESTMENTS 99.7% |

||||||||||||||||

| ASSET-BACKED SECURITIES 5.1% |

||||||||||||||||

| Collateralized Loan Obligations 5.1% |

||||||||||||||||

| Battalion CLO Ltd., Series 2014-7A, Class A1R, 144A, 3 Month LIBOR + 1.190% (original cost $1,250,000; purchased 03/22/17)(f) |

2.921 | %(c) | 10/17/26 | 1,250 | $ | 1,252,555 | ||||||||||

| BlueMountain CLO Ltd., Series 2015-1A, Class A1R, 144A, 3 Month LIBOR + 1.330% |

3.052 | (c) | 04/13/27 | 1,250 | 1,250,729 | |||||||||||

| Carlyle Global Market Strategies CLO Ltd., |

3.089 | (c) | 05/15/25 | 1,000 | 1,000,951 | |||||||||||

| Eaton Vance CLO Ltd., Series 2014-1A, Class AR, 144A, 3 Month LIBOR + 1.200% |

2.922 | (c) | 07/15/26 | 4,500 | 4,509,364 | |||||||||||

| Flagship CLO Ltd., Series 2014-8A, Class AR, 144A, 3 Month LIBOR + 1.250% |

2.972 | (c) | 01/16/26 | 4,500 | 4,504,764 | |||||||||||

| Jackson Mill CLO Ltd., Series 2015-1A, Class A, 144A, 3 Month LIBOR + 1.540% |

3.262 | (c) | 04/15/27 | 1,750 | 1,755,226 | |||||||||||

| KVK CLO Ltd., Series 2014-1A, Class A1R, 144A, |

3.139 | (c) | 05/15/26 | 5,000 | 5,017,204 | |||||||||||

| Limerock CLO LLC, Series 2014-3A, Class A1R, 144A, 3 Month LIBOR + 1.200% |

2.945 | (c) | 10/20/26 | 2,450 | 2,455,197 | |||||||||||

|

|

|

|||||||||||||||

| 21,745,990 | ||||||||||||||||

| Small Business Loan 0.0% |

||||||||||||||||

| Small Business Administration Participation Certificates, Series 1998-20I, Class 1 |

6.000 | 09/01/18 | 88 | 88,842 | ||||||||||||

|

|

|

|||||||||||||||

| TOTAL ASSET-BACKED SECURITIES |

21,834,832 | |||||||||||||||

|

|

|

|||||||||||||||

| COMMERCIAL MORTGAGE-BACKED SECURITIES 15.8% |

|

|||||||||||||||

| Bank, Series 2017-BNK5, Class A3 |

3.020 | 06/15/60 | 3,600 | 3,521,057 | ||||||||||||

| Citigroup Commercial Mortgage Trust, |

3.515 | 09/10/58 | 2,500 | 2,514,206 | ||||||||||||

| Deutsche Bank Commercial Mortgage Trust, Series 2017-C6, Class A3 |

3.269 | 06/10/50 | 3,600 | 3,578,867 | ||||||||||||

| Fannie Mae-Aces, Series 2012-M2, Class A2 |

2.717 | 02/25/22 | 270 | 268,601 | ||||||||||||

| Series 2014-M2, Class A2 |

3.513 | (cc) | 12/25/23 | 3,950 | 4,037,343 | |||||||||||

| Series 2015-M1, Class AB2 |

2.465 | 09/25/24 | 772 | 725,665 | ||||||||||||

| Series 2015-M17, Class A2 |

2.938 | (cc) | 11/25/25 | 2,900 | 2,861,498 | |||||||||||

| Series 2016-M11, Class A2 |

2.369 | (cc) | 07/25/26 | 2,600 | 2,442,907 | |||||||||||

| Series 2016-M13, Class A2 |

2.477 | (cc) | 09/25/26 | 4,400 | 4,150,745 | |||||||||||

See Notes to Financial Statements.

| Prudential Government Income Fund | 19 |

Schedule of Investments (continued)

as of February 28, 2018

| Description |

Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) |

|

|||||||||||||||

| FHLMC Multifamily Structured Pass-Through Certificates, |

||||||||||||||||

| Series K008, Class X1, IO |

1.531 | %(cc) | 06/25/20 | 23,119 | $ | 659,955 | ||||||||||

| Series K019, Class X1, IO |

1.673 | (cc) | 03/25/22 | 25,150 | 1,401,249 | |||||||||||

| Series K020, Class X1, IO |

1.424 | (cc) | 05/25/22 | 14,228 | 697,141 | |||||||||||

| Series K021, Class X1, IO |

1.463 | (cc) | 06/25/22 | 15,462 | 796,764 | |||||||||||

| Series K025, Class X1, IO |

0.867 | (cc) | 10/25/22 | 39,813 | 1,309,980 | |||||||||||

| Series K038, Class A2 |

3.389 | 03/25/24 | 6,800 | 6,930,638 | ||||||||||||

| Series K041, Class A2 |

3.171 | 10/25/24 | 6,000 | 6,034,093 | ||||||||||||

| Series K044, Class A2 |

2.811 | 01/25/25 | 5,000 | 4,911,957 | ||||||||||||

| Series K060, Class AM |

3.300 | (cc) | 10/25/26 | 3,860 | 3,857,820 | |||||||||||

| Series K064, Class AM |

3.327 | (cc) | 03/25/27 | 2,100 | 2,098,489 | |||||||||||

| Series K068, Class AM |

3.315 | 08/25/27 | 3,200 | 3,187,318 | ||||||||||||

| Series K151, Class A3 |

3.511 | 04/25/30 | 900 | 913,962 | ||||||||||||

| Series K710, Class X1, IO |

1.731 | (cc) | 05/25/19 | 12,038 | 183,587 | |||||||||||

| Series K711, Class X1, IO |

1.681 | (cc) | 07/25/19 | 12,009 | 188,062 | |||||||||||

| Series KS03, Class A4 |

3.161 | (cc) | 05/25/25 | 4,000 | 3,963,998 | |||||||||||

| JPMBB Commercial Mortgage Securities Trust, |

3.515 | 03/15/49 | 2,500 | 2,483,293 | ||||||||||||

| JPMorgan Chase Commercial Mortgage Securities Trust, Series 2013-LC11, Class A4 |

2.694 | 04/15/46 | 867 | 853,349 | ||||||||||||

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C9, Class A3 |

2.834 | 05/15/46 | 1,000 | 984,229 | ||||||||||||

| Wells Fargo Commercial Mortgage Trust, |

3.572 | 09/15/58 | 2,500 | 2,519,468 | ||||||||||||

|

|

|

|||||||||||||||

| TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES |

68,076,241 | |||||||||||||||

|

|

|

|||||||||||||||

| CORPORATE BONDS 2.0% |

||||||||||||||||

| Diversified Financial Services |

||||||||||||||||

| Private Export Funding Corp., Sr. Unsec’d. Notes, 144A |

2.650 | 02/16/21 | 3,185 | 3,179,060 | ||||||||||||

| CDP Financial, Inc. (Canada), Gtd. Notes, 144A |

3.150 | 07/24/24 | 470 | 471,318 | ||||||||||||

| Private Export Funding Corp., |

||||||||||||||||

| U.S. Gov’t. Gtd. Notes |

4.300 | 12/15/21 | 2,660 | 2,811,019 | ||||||||||||

| U.S. Gov’t. Gtd. Notes |

3.550 | 01/15/24 | 2,085 | 2,163,855 | ||||||||||||

|

|

|

|||||||||||||||

| TOTAL CORPORATE BONDS |

8,625,252 | |||||||||||||||

|

|

|

|||||||||||||||

See Notes to Financial Statements.

| 20 |

| Description |

Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| MUNICIPAL BONDS 0.3% |

||||||||||||||||

| California 0.1% |

||||||||||||||||

| California Educational Facilities Authority, Revenue Bonds, BABs |

5.000 | % | 06/01/46 | 275 | $ | 355,058 | ||||||||||

| Texas 0.2% |

||||||||||||||||

| University of Texas System (The), Revenue Bonds, BABs |

5.000 | 08/15/47 | 610 | 765,562 | ||||||||||||

|

|

|

|||||||||||||||

| TOTAL MUNICIPAL BONDS |

1,120,620 | |||||||||||||||

|

|

|

|||||||||||||||

| RESIDENTIAL MORTGAGE-BACKED SECURITIES 0.1% |

|

|||||||||||||||

| Merrill Lynch Mortgage Investors Trust, |

2.241 | (c) | 10/25/28 | 70 | 68,465 | |||||||||||

| Structured Adjustable Rate Mortgage Loan Trust, Series 2004-1, Class 4A3 |

3.680 | (cc) | 02/25/34 | 323 | 325,139 | |||||||||||

|

|

|

|||||||||||||||

| TOTAL RESIDENTIAL MORTGAGE-BACKED SECURITIES (cost $394,100) |

393,604 | |||||||||||||||

|

|

|

|||||||||||||||

| U.S. GOVERNMENT AGENCY OBLIGATIONS 42.6% |

||||||||||||||||

| Federal Home Loan Mortgage Corp. |

3.000 | 11/01/46 | 984 | 954,748 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

3.000 | 12/01/30 | 790 | 787,052 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

3.000 | 12/01/46 | 968 | 939,179 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

4.000 | 05/01/46 | 2,385 | 2,453,440 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

4.000 | 08/01/46 | 454 | 466,823 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

1.625 | 09/29/20 | 800 | 784,638 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

2.000 | 01/01/32 | 326 | 309,930 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

2.375 | 02/16/21 | 2,270 | 2,261,404 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

2.500 | 03/01/30 | 1,333 | 1,300,703 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

3.000 | 10/01/28 | 278 | 278,046 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

3.000 | 06/01/29 | 797 | 794,213 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

3.000 | 01/01/37 | 1,595 | 1,575,271 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

3.000 | 04/01/43 | 1,855 | 1,812,224 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

3.000 | 11/01/46 | 1,192 | 1,156,126 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

3.000 | 01/01/47 | 4,848 | 4,699,922 | ||||||||||||

| Federal Home Loan Mortgage Corp.MTN |

3.208 | (s) | 12/11/25 | 1,100 | 863,942 | |||||||||||

| Federal Home Loan Mortgage Corp. |

3.500 | 08/01/26 | 476 | 485,568 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

3.500 | 01/01/27 | 247 | 251,729 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

3.500 | 06/01/42 | 1,950 | 1,958,803 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

3.500 | 06/01/43 | 1,409 | 1,415,009 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

4.000 | 06/01/26 | 172 | 178,962 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

4.000 | 09/01/26 | 425 | 442,078 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

4.000 | 11/01/39 | 1,347 | 1,392,166 | ||||||||||||

See Notes to Financial Statements.

| Prudential Government Income Fund | 21 |

Schedule of Investments (continued)

as of February 28, 2018

| Description |

Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| U.S. GOVERNMENT AGENCY OBLIGATIONS (Continued) |

|

|||||||||||||||

| Federal Home Loan Mortgage Corp. |

4.000 | % | 09/01/40 | 923 | $ | 953,439 | ||||||||||

| Federal Home Loan Mortgage Corp. |

4.000 | 12/01/40 | 716 | 740,068 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

4.000 | 12/01/40 | 508 | 524,622 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

4.000 | 04/01/42 | 1,776 | 1,825,794 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

4.000 | 12/01/46 | 486 | 499,998 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

4.500 | 09/01/39 | 2,019 | 2,131,766 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

5.000 | 06/01/33 | 859 | 927,200 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

5.000 | 03/01/34 | 85 | 91,522 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

5.000 | 05/01/34 | 1,125 | 1,211,981 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

5.000 | 05/01/34 | 94 | 100,627 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

5.500 | 05/01/37 | 138 | 151,275 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

5.500 | 01/01/38 | 121 | 132,448 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

6.000 | 12/01/33 | 68 | 77,218 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

6.000 | 09/01/34 | 150 | 166,831 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

6.500 | 09/01/32 | 159 | 179,597 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

6.500 | 09/01/32 | 54 | 60,426 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

7.000 | 09/01/32 | 32 | 33,415 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

8.000 | 03/01/22 | 15 | 14,658 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

8.000 | 08/01/22 | 3 | 3,065 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

8.500 | 09/01/19 | 2 | 1,735 | ||||||||||||

| Federal Home Loan Mortgage Corp. |

9.000 | 01/01/20 | 2 | 2,019 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 01/01/31 | 447 | 445,782 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 01/01/32 | 430 | 428,395 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 08/01/43 | 699 | 682,219 | ||||||||||||

| Federal National Mortgage Assoc. |

1.000 | 10/24/19 | 5,000 | 4,898,740 | ||||||||||||

| Federal National Mortgage Assoc. |

2.000 | 08/01/31 | 691 | 657,266 | ||||||||||||

| Federal National Mortgage Assoc. |

2.375 | 01/19/23 | 1,435 | 1,412,383 | ||||||||||||

| Federal National Mortgage Assoc. |

2.500 | 08/01/28 | 874 | 858,567 | ||||||||||||

| Federal National Mortgage Assoc. |

2.500 | 11/01/31 | 483 | 471,696 | ||||||||||||

| Federal National Mortgage Assoc. |

2.500 | 02/01/43 | 350 | 328,474 | ||||||||||||

| Federal National Mortgage Assoc. |

2.500 | 12/01/46 | 1,523 | 1,423,655 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | TBA | 1,000 | 968,591 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 01/01/27 | 825 | 826,818 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 08/01/28 | 1,541 | 1,539,815 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 02/01/31 | 3,221 | 3,209,874 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 11/01/32 | 500 | 498,296 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 01/01/33 | 553 | 550,618 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 01/01/33 | 400 | 398,638 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 02/01/33 | 670 | 667,773 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 03/01/33 | 6,500 | 6,477,861 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 11/01/36 | 1,768 | 1,746,013 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 12/01/42 | 1,452 | 1,418,318 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 02/01/43 | 978 | 955,217 | ||||||||||||

See Notes to Financial Statements.

| 22 |

| Description |

Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| U.S. GOVERNMENT AGENCY OBLIGATIONS (Continued) |

|

|||||||||||||||

| Federal National Mortgage Assoc. |

3.000 | % | 03/01/43 | 514 | $ | 501,548 | ||||||||||

| Federal National Mortgage Assoc. |

3.000 | 04/01/43 | 890 | 869,016 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 05/01/43 | 1,315 | 1,284,218 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 06/01/43 | 1,031 | 1,007,107 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 06/01/43 | 467 | 455,951 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 07/01/43 | 2,865 | 2,796,781 | ||||||||||||

| Federal National Mortgage Assoc. |

3.000 | 01/01/47 | 988 | 957,768 | ||||||||||||

| Federal National Mortgage Assoc. |

3.500 | TBA | 1,500 | 1,497,170 | ||||||||||||

| Federal National Mortgage Assoc. |

3.500 | 09/01/26 | 304 | 309,357 | ||||||||||||

| Federal National Mortgage Assoc. |

3.500 | 03/01/27 | 734 | 747,070 | ||||||||||||

| Federal National Mortgage Assoc. |

3.500 | 10/01/41 | 3,012 | 3,026,048 | ||||||||||||

| Federal National Mortgage Assoc. |

3.500 | 12/01/41 | 813 | 816,814 | ||||||||||||

| Federal National Mortgage Assoc. |

3.500 | 03/01/42 | 767 | 770,147 | ||||||||||||

| Federal National Mortgage Assoc. |

3.500 | 05/01/42 | 3,693 | 3,709,350 | ||||||||||||

| Federal National Mortgage Assoc. |

3.500 | 12/01/42 | 1,862 | 1,869,955 | ||||||||||||

| Federal National Mortgage Assoc. |

3.500 | 03/01/43 | 914 | 918,028 | ||||||||||||

| Federal National Mortgage Assoc. |

3.500 | 06/01/45 | 7,849 | 7,843,661 | ||||||||||||

| Federal National Mortgage Assoc. |

3.500 | 12/01/46 | 2,370 | 2,369,056 | ||||||||||||

| Federal National Mortgage Assoc. |

4.000 | 09/01/40 | 1,557 | 1,606,655 | ||||||||||||

| Federal National Mortgage Assoc. |

4.000 | 01/01/41 | 2,034 | 2,099,370 | ||||||||||||

| Federal National Mortgage Assoc. |

4.000 | 07/01/42 | 596 | 615,230 | ||||||||||||

| Federal National Mortgage Assoc. |

4.000 | 09/01/44 | 1,679 | 1,723,958 | ||||||||||||

| Federal National Mortgage Assoc. |

4.500 | 01/01/20 | 31 | 31,566 | ||||||||||||

| Federal National Mortgage Assoc. |

4.500 | 04/01/41 | 1,733 | 1,829,663 | ||||||||||||

| Federal National Mortgage Assoc. |

4.500 | 01/01/45 | 442 | 463,717 | ||||||||||||

| Federal National Mortgage Assoc. |

5.000 | 07/01/18 | 2 | 2,213 | ||||||||||||

| Federal National Mortgage Assoc. |

5.000 | 08/01/18 | 9 | 8,658 | ||||||||||||

| Federal National Mortgage Assoc. |

5.000 | 01/01/19 | 62 | 63,170 | ||||||||||||

| Federal National Mortgage Assoc. |

5.000 | 02/01/19 | 83 | 83,945 | ||||||||||||

| Federal National Mortgage Assoc. |

5.000 | 11/01/19 | 38 | 38,453 | ||||||||||||

| Federal National Mortgage Assoc. |

5.000 | 12/01/31 | 71 | 76,311 | ||||||||||||

| Federal National Mortgage Assoc. |

5.000 | 03/01/34 | 473 | 511,262 | ||||||||||||

| Federal National Mortgage Assoc. |

5.000 | 07/01/35 | 186 | 200,468 | ||||||||||||

| Federal National Mortgage Assoc. |

5.000 | 09/01/35 | 99 | 106,799 | ||||||||||||

| Federal National Mortgage Assoc. |

5.000 | 11/01/35 | 117 | 126,126 | ||||||||||||

| Federal National Mortgage Assoc. |

5.000 | 05/01/36 | 74 | 79,874 | ||||||||||||

| Federal National Mortgage Assoc. |

5.500 | 10/01/18 | 17 | 16,821 | ||||||||||||

| Federal National Mortgage Assoc. |

5.500 | 10/01/18 | 17 | 17,150 | ||||||||||||

| Federal National Mortgage Assoc. |

5.500 | 11/01/18 | 13 | 12,765 | ||||||||||||

| Federal National Mortgage Assoc. |

5.500 | 02/01/34 | 424 | 465,602 | ||||||||||||

| Federal National Mortgage Assoc. |

5.500 | 09/01/34 | 723 | 795,349 | ||||||||||||

| Federal National Mortgage Assoc. |

5.500 | 02/01/35 | 652 | 719,150 | ||||||||||||

| Federal National Mortgage Assoc. |

5.500 | 06/01/35 | 121 | 130,856 | ||||||||||||

See Notes to Financial Statements.

| Prudential Government Income Fund | 23 |

Schedule of Investments (continued)

as of February 28, 2018

| Description |

Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| U.S. GOVERNMENT AGENCY OBLIGATIONS (Continued) |

|

|||||||||||||||

| Federal National Mortgage Assoc. |

5.500 | % | 06/01/35 | 271 | $ | 295,248 | ||||||||||

| Federal National Mortgage Assoc. |

5.500 | 09/01/35 | 404 | 439,266 | ||||||||||||

| Federal National Mortgage Assoc. |

5.500 | 09/01/35 | 115 | 124,727 | ||||||||||||

| Federal National Mortgage Assoc. |

5.500 | 10/01/35 | 429 | 468,481 | ||||||||||||

| Federal National Mortgage Assoc. |

5.500 | 11/01/35 | 857 | 940,978 | ||||||||||||

| Federal National Mortgage Assoc. |

5.500 | 11/01/35 | 1,063 | 1,166,026 | ||||||||||||

| Federal National Mortgage Assoc. |

5.500 | 11/01/36 | 13 | 14,018 | ||||||||||||

| Federal National Mortgage Assoc. |

6.000 | 08/01/21 | 46 | 46,920 | ||||||||||||

| Federal National Mortgage Assoc. |

6.000 | 09/01/21 | 18 | 19,112 | ||||||||||||

| Federal National Mortgage Assoc. |

6.000 | 07/01/22 | 2 | 1,671 | ||||||||||||

| Federal National Mortgage Assoc. |

6.000 | 09/01/33 | 1 | 669 | ||||||||||||

| Federal National Mortgage Assoc. |

6.000 | 11/01/33 | 1 | 1,185 | ||||||||||||

| Federal National Mortgage Assoc. |

6.000 | 02/01/34 | 1 | 706 | ||||||||||||

| Federal National Mortgage Assoc. |

6.000 | 06/01/34 | — | (r) | 214 | |||||||||||

| Federal National Mortgage Assoc. |

6.000 | 09/01/34 | — | (r) | 435 | |||||||||||

| Federal National Mortgage Assoc. |

6.000 | 09/01/34 | 29 | 32,513 | ||||||||||||

| Federal National Mortgage Assoc. |

6.000 | 09/01/34 | 31 | 34,507 | ||||||||||||

| Federal National Mortgage Assoc. |

6.000 | 11/01/34 | 4 | 4,725 | ||||||||||||

| Federal National Mortgage Assoc. |

6.000 | 11/01/34 | 41 | 45,659 | ||||||||||||

| Federal National Mortgage Assoc. |

6.000 | 02/01/35 | 1 | 1,450 | ||||||||||||

| Federal National Mortgage Assoc. |

6.000 | 03/01/35 | 21 | 23,215 | ||||||||||||

| Federal National Mortgage Assoc. |

6.000 | 04/01/35 | 1 | 1,109 | ||||||||||||

| Federal National Mortgage Assoc. |

6.000 | 12/01/35 | 190 | 210,594 | ||||||||||||

| Federal National Mortgage Assoc. |

6.000 | 01/01/36 | 318 | 354,779 | ||||||||||||

| Federal National Mortgage Assoc. |

6.000 | 05/01/36 | 475 | 531,152 | ||||||||||||

| Federal National Mortgage Assoc. |

6.000 | 05/01/36 | 105 | 116,709 | ||||||||||||

| Federal National Mortgage Assoc. |

6.250 | 05/15/29 | 210 | 269,363 | ||||||||||||

| Federal National Mortgage Assoc. |

6.500 | 07/01/32 | 827 | 921,554 | ||||||||||||

| Federal National Mortgage Assoc. |

6.500 | 08/01/32 | 334 | 371,932 | ||||||||||||

| Federal National Mortgage Assoc. |

6.500 | 09/01/32 | 99 | 109,784 | ||||||||||||

| Federal National Mortgage Assoc. |

6.500 | 10/01/32 | 760 | 847,000 | ||||||||||||

| Federal National Mortgage Assoc. |

6.500 | 10/01/32 | 102 | 113,928 | ||||||||||||

| Federal National Mortgage Assoc. |

6.500 | 10/01/37 | 486 | 541,929 | ||||||||||||

| Federal National Mortgage Assoc. |

6.625 | 11/15/30 | 350 | 472,689 | ||||||||||||

| Federal National Mortgage Assoc. |

7.000 | 05/01/24 | 102 | 110,871 | ||||||||||||

| Federal National Mortgage Assoc. |

7.000 | 05/01/24 | 26 | 27,081 | ||||||||||||

| Federal National Mortgage Assoc. |

7.000 | 05/01/24 | 21 | 21,564 | ||||||||||||

| Federal National Mortgage Assoc. |

7.000 | 05/01/24 | 19 | 19,424 | ||||||||||||

| Federal National Mortgage Assoc. |

7.000 | 05/01/24 | 7 | 6,919 | ||||||||||||

| Federal National Mortgage Assoc. |

7.000 | 05/01/24 | 6 | 5,564 | ||||||||||||

| Federal National Mortgage Assoc. |

7.000 | 12/01/31 | 358 | 407,401 | ||||||||||||

| Federal National Mortgage Assoc. |

7.000 | 12/01/31 | 1 | 1,321 | ||||||||||||

| Federal National Mortgage Assoc. |

7.000 | 09/01/33 | 69 | 70,884 | ||||||||||||

See Notes to Financial Statements.

| 24 |

| Description |

Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| U.S. GOVERNMENT AGENCY OBLIGATIONS (Continued) |

|

|||||||||||||||

| Federal National Mortgage Assoc. |

7.000 | % | 10/01/33 | 33 | $ | 32,936 | ||||||||||

| Federal National Mortgage Assoc. |

7.000 | 11/01/33 | 12 | 11,979 | ||||||||||||

| Federal National Mortgage Assoc. |

7.000 | 11/01/33 | 72 | 73,927 | ||||||||||||

| Federal National Mortgage Assoc. |

7.000 | 02/01/36 | 6 | 6,459 | ||||||||||||

| Federal National Mortgage Assoc. |

9.000 | 04/01/25 | 5 | 5,450 | ||||||||||||

| Federal National Mortgage Assoc. |

9.500 | 01/01/25 | 8 | 8,334 | ||||||||||||

| Federal National Mortgage Assoc. |

9.500 | 01/01/25 | 2 | 1,837 | ||||||||||||

| Federal National Mortgage Assoc. |

9.500 | 01/01/25 | 3 | 2,902 | ||||||||||||

| Federal National Mortgage Assoc. |

9.500 | 02/01/25 | 3 | 2,585 | ||||||||||||

| Government National Mortgage Assoc. |

3.000 | 10/20/46 | 457 | 447,605 | ||||||||||||

| Government National Mortgage Assoc. |

2.500 | 12/20/46 | 642 | 608,083 | ||||||||||||

| Government National Mortgage Assoc. |

3.000 | 03/15/45 | 2,887 | 2,826,218 | ||||||||||||

| Government National Mortgage Assoc. |

3.000 | 02/20/47 | 8,251 | 8,072,694 | ||||||||||||

| Government National Mortgage Assoc. |

3.500 | 04/20/42 | 474 | 479,981 | ||||||||||||

| Government National Mortgage Assoc. |

3.500 | 01/20/43 | 2,628 | 2,658,604 | ||||||||||||

| Government National Mortgage Assoc. |

3.500 | 04/20/43 | 1,228 | 1,242,486 | ||||||||||||

| Government National Mortgage Assoc. |

3.500 | 03/20/45 | 2,401 | 2,419,273 | ||||||||||||

| Government National Mortgage Assoc. |

3.500 | 04/20/45 | 1,356 | 1,365,853 | ||||||||||||

| Government National Mortgage Assoc. |

3.500 | 07/20/46 | 4,977 | 5,011,471 | ||||||||||||

| Government National Mortgage Assoc. |

3.500 | 01/20/47 | 1,033 | 1,039,728 | ||||||||||||

| Government National Mortgage Assoc. |

4.000 | TBA | 5,250 | 5,379,609 | ||||||||||||

| Government National Mortgage Assoc. |

4.000 | 02/20/41 | 633 | 660,925 | ||||||||||||

| Government National Mortgage Assoc. |

4.000 | 06/20/44 | 1,410 | 1,458,874 | ||||||||||||

| Government National Mortgage Assoc. |

4.000 | 08/20/44 | 418 | 432,802 | ||||||||||||

| Government National Mortgage Assoc. |

4.000 | 11/20/45 | 970 | 1,001,939 | ||||||||||||

| Government National Mortgage Assoc. |

4.000 | 11/20/46 | 968 | 998,361 | ||||||||||||

| Government National Mortgage Assoc. |

4.500 | 02/20/40 | 384 | 403,468 | ||||||||||||

| Government National Mortgage Assoc. |

4.500 | 01/20/41 | 221 | 232,409 | ||||||||||||

| Government National Mortgage Assoc. |

4.500 | 02/20/41 | 1,109 | 1,166,328 | ||||||||||||

| Government National Mortgage Assoc. |

4.500 | 03/20/41 | 570 | 599,365 | ||||||||||||

| Government National Mortgage Assoc. |

4.500 | 06/20/44 | 843 | 890,594 | ||||||||||||

| Government National Mortgage Assoc. |

4.500 | 02/20/46 | 85 | 89,382 | ||||||||||||

| Government National Mortgage Assoc. |

4.500 | 03/20/46 | 443 | 463,349 | ||||||||||||

| Government National Mortgage Assoc. |

4.500 | 03/20/47 | 2,984 | 3,120,453 | ||||||||||||

| Government National Mortgage Assoc. |

5.000 | 07/15/33 | 641 | 690,093 | ||||||||||||

| Government National Mortgage Assoc. |

5.000 | 09/15/33 | 779 | 839,556 | ||||||||||||

| Government National Mortgage Assoc. |

5.000 | 04/15/34 | 67 | 70,353 | ||||||||||||

| Government National Mortgage Assoc. |

5.500 | 02/15/34 | 554 | 610,230 | ||||||||||||

| Government National Mortgage Assoc. |

5.500 | 02/15/36 | 140 | 155,152 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 03/15/22 | — | (r) | 412 | |||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/22 | — | (r) | 374 | |||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/22 | 1 | 1,152 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 01/15/23 | 1 | 526 | ||||||||||||

See Notes to Financial Statements.

| Prudential Government Income Fund | 25 |

Schedule of Investments (continued)

as of February 28, 2018

| Description |

Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| U.S. GOVERNMENT AGENCY OBLIGATIONS (Continued) |

|

|||||||||||||||

| Government National Mortgage Assoc. |

7.000 | % | 01/15/23 | 2 | $ | 1,977 | ||||||||||

| Government National Mortgage Assoc. |

7.000 | 01/15/23 | 3 | 3,150 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 01/15/23 | 2 | 2,262 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 01/15/23 | 4 | 3,787 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 02/15/23 | 3 | 3,474 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 03/15/23 | 2 | 2,567 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 03/15/23 | 4 | 4,133 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 04/15/23 | 1 | 1,227 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 04/15/23 | 3 | 2,809 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 04/15/23 | 1 | 1,360 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 04/15/23 | 5 | 5,152 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 05/15/23 | — | (r) | 394 | |||||||||||

| Government National Mortgage Assoc. |

7.000 | 05/15/23 | 39 | 41,101 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 05/15/23 | 2 | 1,731 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 05/15/23 | 1 | 1,418 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 05/15/23 | 1 | 714 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 05/15/23 | — | (r) | 122 | |||||||||||

| Government National Mortgage Assoc. |

7.000 | 05/15/23 | 3 | 2,573 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 05/15/23 | 3 | 2,755 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 05/15/23 | 1 | 879 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 05/15/23 | 9 | 9,151 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 05/15/23 | 4 | 3,536 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 05/15/23 | 6 | 6,251 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 05/15/23 | 1 | 898 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 06/15/23 | — | (r) | 238 | |||||||||||

| Government National Mortgage Assoc. |

7.000 | 06/15/23 | 2 | 1,557 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 06/15/23 | — | (r) | 297 | |||||||||||

| Government National Mortgage Assoc. |

7.000 | 06/15/23 | 1 | 797 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 06/15/23 | 2 | 1,767 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 06/15/23 | 4 | 3,948 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 06/15/23 | 1 | 504 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 06/15/23 | 2 | 2,268 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 06/15/23 | 3 | 3,026 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 07/15/23 | 1 | 901 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 07/15/23 | 3 | 2,737 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 07/15/23 | 17 | 17,029 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 07/15/23 | 1 | 813 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 07/15/23 | 1 | 754 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 07/15/23 | 2 | 1,615 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 07/15/23 | — | (r) | 284 | |||||||||||

| Government National Mortgage Assoc. |

7.000 | 07/15/23 | 4 | 4,063 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 07/15/23 | 2 | 2,104 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 07/15/23 | — | (r) | 392 | |||||||||||

See Notes to Financial Statements.

| 26 |

| Description |

Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| U.S. GOVERNMENT AGENCY OBLIGATIONS (Continued) |

|

|||||||||||||||

| Government National Mortgage Assoc. |

7.000 | % | 07/15/23 | 3 | $ | 3,219 | ||||||||||

| Government National Mortgage Assoc. |

7.000 | 08/15/23 | 2 | 1,855 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 08/15/23 | 1 | 640 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 08/15/23 | 2 | 1,592 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 08/15/23 | 6 | 6,181 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 08/15/23 | 4 | 3,899 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 08/15/23 | 1 | 1,012 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 08/15/23 | 3 | 3,046 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 08/15/23 | 2 | 2,163 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 08/15/23 | 1 | 826 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 08/15/23 | — | (r) | 341 | |||||||||||

| Government National Mortgage Assoc. |

7.000 | 08/15/23 | 8 | 8,498 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 08/15/23 | 3 | 3,199 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 08/15/23 | 6 | 5,706 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 08/15/23 | 1 | 1,479 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 08/15/23 | 1 | 785 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 08/15/23 | 5 | 5,091 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 08/15/23 | 1 | 1,135 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 09/15/23 | 2 | 1,784 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 09/15/23 | 1 | 1,280 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 09/15/23 | 12 | 12,196 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 09/15/23 | 1 | 1,114 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 09/15/23 | 1 | 1,362 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 09/15/23 | 1 | 742 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 09/15/23 | 2 | 1,584 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 09/15/23 | 39 | 40,801 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 50 | 52,490 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 43 | 44,258 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 12 | 12,719 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 2 | 2,138 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 1 | 663 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | — | (r) | 242 | |||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | — | (r) | 361 | |||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 2 | 1,579 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 5 | 4,788 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 2 | 2,110 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 2 | 1,982 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 3 | 3,134 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 5 | 5,449 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 2 | 1,692 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | — | (r) | 176 | |||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 7 | 6,889 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 1 | 1,246 | ||||||||||||

See Notes to Financial Statements.

| Prudential Government Income Fund | 27 |

Schedule of Investments (continued)

as of February 28, 2018

| Description |

Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| U.S. GOVERNMENT AGENCY OBLIGATIONS (Continued) |

|

|||||||||||||||

| Government National Mortgage Assoc. |

7.000 | % | 10/15/23 | 1 | $ | 1,027 | ||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 7 | 7,271 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 2 | 2,013 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 1 | 1,292 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 15 | 15,459 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 2 | 1,550 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 2 | 1,843 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 7 | 7,444 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 5 | 4,936 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 5 | 5,461 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 6 | 5,952 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 8 | 8,766 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 1 | 1,413 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 10/15/23 | 4 | 4,122 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 1 | 1,298 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 1 | 559 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 2 | 1,876 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 4 | 4,454 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 2 | 2,545 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 15 | 15,581 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 7 | 7,895 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 2 | 1,550 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 14 | 13,711 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 1 | 738 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 2 | 1,594 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | — | (r) | 500 | |||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 3 | 2,822 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 2 | 1,607 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 4 | 3,893 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 8 | 8,419 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 5 | 5,289 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 5 | 4,986 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 7 | 7,596 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 10 | 11,014 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 2 | 1,951 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 2 | 1,814 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 1 | 1,203 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 11/15/23 | 10 | 10,319 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 4 | 4,511 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 5 | 5,082 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 18 | 19,243 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 27 | 27,964 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 1 | 1,111 | ||||||||||||

See Notes to Financial Statements.

| 28 |

| Description |

Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| U.S. GOVERNMENT AGENCY OBLIGATIONS (Continued) |

|

|||||||||||||||

| Government National Mortgage Assoc. |

7.000 | % | 12/15/23 | 4 | $ | 3,685 | ||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 4 | 4,245 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 17 | 16,871 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 2 | 1,691 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 1 | 1,284 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 2 | 1,517 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 3 | 2,603 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 6 | 5,856 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 4 | 3,805 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 11 | 11,192 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 1 | 1,458 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 1 | 707 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 1 | 910 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 5 | 5,184 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 7 | 7,289 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 6 | 5,749 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 1 | 524 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 9 | 8,782 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 2 | 1,901 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 1 | 1,011 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 1 | 1,227 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 2 | 1,872 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 3 | 2,970 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 3 | 2,921 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 5 | 5,058 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 9 | 9,091 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 12/15/23 | 6 | 6,512 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 01/15/24 | 1 | 1,092 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 01/15/24 | 2 | 1,616 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 01/15/24 | 1 | 1,319 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 01/15/24 | 5 | 4,729 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 01/15/24 | 3 | 2,939 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 01/15/24 | 5 | 5,451 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 01/15/24 | 1 | 1,524 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 01/15/24 | — | (r) | 425 | |||||||||||

| Government National Mortgage Assoc. |

7.000 | 01/15/24 | 2 | 2,107 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 01/15/24 | 3 | 2,631 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 01/15/24 | 3 | 3,120 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 01/15/24 | 8 | 8,234 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 01/15/24 | 5 | 4,821 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 02/15/24 | 13 | 13,260 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 02/15/24 | 1 | 727 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 02/15/24 | 2 | 2,206 | ||||||||||||

See Notes to Financial Statements.

| Prudential Government Income Fund | 29 |

Schedule of Investments (continued)

as of February 28, 2018

| Description |

Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| U.S. GOVERNMENT AGENCY OBLIGATIONS (Continued) |

|

|||||||||||||||

| Government National Mortgage Assoc. |

7.000 | % | 02/15/24 | 4 | $ | 4,074 | ||||||||||

| Government National Mortgage Assoc. |

7.000 | 02/15/24 | 2 | 1,905 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 02/15/24 | 1 | 854 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 02/15/24 | — | (r) | 466 | |||||||||||

| Government National Mortgage Assoc. |

7.000 | 03/15/24 | 2 | 1,619 | ||||||||||||

| Government National Mortgage Assoc. |

7.000 | 03/15/24 | 3 | 3,453 | ||||||||||||

| Government National Mortgage Assoc. |