| PRUDENTIAL GOVERNMENT INCOME FUND | |||||||||||||||||||||||||||||||||||||||||||||||||||

| FUND SUMMARY | |||||||||||||||||||||||||||||||||||||||||||||||||||

| INVESTMENT OBJECTIVE | |||||||||||||||||||||||||||||||||||||||||||||||||||

| The investment objective of the Fund is to seek high current return. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| FUND FEES AND EXPENSES | |||||||||||||||||||||||||||||||||||||||||||||||||||

| The tables below describe the sales charges, fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and an eligible group of related investors purchase, or agree to purchase in the future, $50,000 or more in shares of the Fund or other funds in the Prudential Investments family of funds. More information about these discounts is available from your financial professional and is explained in Reducing or Waiving Class A's and Class C’s Sales Charges on page 25 of the Fund's Prospectus and in Rights of Accumulation on page 48 of the Fund's Statement of Additional Information (SAI). | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| Example. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| The following hypothetical example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. It assumes that you invest $10,000 in the Fund for the time periods indicated and then, except as indicated, redeem all your shares at the end of those periods. It assumes a 5% return on your investment each year, that the Fund's operating expenses remain the same (except that fee waivers or reimbursements, if any, are only reflected in the 1-Year figures) and that all dividends and distributions are reinvested. Your actual costs may be higher or lower. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| If Shares Are Redeemed | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| If Shares Are Not Redeemed | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio Turnover. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the Fund's most recent fiscal year, the Fund's portfolio turnover rate was 778% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| INVESTMENTS, RISKS AND PERFORMANCE Principal Investment Strategies. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Consistent with its objective, the Fund seeks investments that provide investors with a current return in excess of the Fund's benchmark. The Fund invests, under normal circumstances, at least 80% of its investable assets in US Government securities, including US Treasury bills, notes, bonds, strips and other debt securities issued by the US Treasury, and obligations, including mortgage-related securities, issued or guaranteed by US Government agencies or instrumentalities. The term “investable assets” refers to the Fund's net assets plus any borrowings for investment purposes. The Fund's investable assets will be less than its total assets to the extent that it has borrowed money for non-investment purposes, such as to meet anticipated redemptions. The investment subadviser has a team of fixed-income professionals, including credit analysts and traders, with experience in many sectors of the US and foreign fixed-income securities markets. In deciding which portfolio securities to buy and sell, the investment subadviser will consider economic conditions and interest rate fundamentals. The investment subadviser will also evaluate individual issues within each bond sector based upon their relative investment merit and will consider factors such as yield and potential for price appreciation, as well as credit quality, maturity and risk. The Fund may actively and frequently trade its portfolio securities. Some (but not all) of the US Government securities and mortgage-related securities in which the Fund will invest are backed by the full faith and credit of the US Government, which means that payment of interest and principal is guaranteed, but yield and market value are not. These securities include, but are not limited to, direct obligations issued by the US Treasury, and obligations of certain entities that may be chartered or sponsored by Acts of Congress, such as the Government National Mortgage Association (GNMA or “Ginnie Mae”), the Farmers Home Administration and the Export-Import Bank. Securities issued by other government entities that may be chartered or sponsored by Acts of Congress, in which the Fund may invest, are not backed by the full faith and credit of the United States and must rely on their own resources to repay the debt. These securities include, but are not limited to, obligations of the Federal National Mortgage Association (FNMA or “Fannie Mae”), the Federal Home Loan Mortgage Corporation (FHLMC or “Freddie Mac”), the Federal Home Loan Bank, the Tennessee Valley Authority and the United States Postal Service, each of which has the right to borrow from the United States Treasury to meet its obligations, and obligations of the Farm Credit System, which depends entirely upon its own resources to repay its debt obligations. Although the US Government has recently provided financial support to Fannie Mae and Freddie Mac, no assurance can be given that the US Government will always do so. Most, if not all, of the Fund's debt securities are “investment-grade.” This means major rating services, like Standard & Poor's Ratings Services (S&P) or Moody's Investors Service, Inc. (Moody's), have rated the securities within one of their four highest quality grades. Debt obligations in the fourth highest grade are regarded as investment-grade, but have speculative characteristics and are riskier than higher rated securities. A rating is an assessment of the likelihood of timely repayment of interest and principal and can be useful when comparing different debt obligations. These ratings are not a guarantee of quality. The opinions of the rating agencies do not reflect market risk and they may at times lag behind the current financial conditions of a company. In the event that a security receives different ratings from different rating services, the Fund will treat the security as being rated in the highest rating category received from a rating service. We also may invest in obligations that are not rated, but that the investment subadviser believes are of comparable quality to the obligations described above. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Risks. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| All investments have risks to some degree. An investment in the Fund is not guaranteed to achieve its investment objective; is not a deposit with a bank; is not insured, endorsed or guaranteed by the Federal Deposit Insurance Corporation or any other government agency; and is subject to investment risks, including possible loss of your original investment. Credit Risk. This is the risk that the issuer, the guarantor or the insurer of a fixed-income security, or the counterparty to a contract may be unable or unwilling to make timely principal and interest payments or to otherwise honor its obligations. Additionally, the securities could lose value due to a loss of confidence in the ability of the issuer, guarantor, insurer or counterparty to pay back debt. The longer the maturity and the lower the credit quality of a bond, the more sensitive it is to credit risk. Market Risk. Securities markets may be volatile and the market prices of the Fund's securities may decline. Securities fluctuate in price based on changes in an issuer's financial condition and overall market and economic conditions. If the market prices of the securities owned by the Fund fall, the value of your investment in the Fund will decline. Interest Rate Risk. The value of your investment may go down when interest rates rise. A rise in rates tends to have a greater impact on the prices of longer term or duration securities. When interest rates fall, the issuers of debt obligations may prepay principal more quickly than expected, and the Fund may be required to reinvest the proceeds at a lower interest rate. This is referred to as "prepayment risk." When interest rates rise, debt obligations may be repaid more slowly than expected, and the value of the Fund's holdings may fall sharply. This is referred to as "extension risk." The Fund may face a heightened level of interest rate risk since the US Federal Reserve Board has ended its quantitative easing program and may continue to raise rates. The Fund may lose money if short-term or long-term interest rates rise sharply or in a manner not anticipated by the subadviser. Bond Obligations Risk. As with credit risk, market risk and interest rate risk, the Fund's holdings, share price, yield and total return may fluctuate in response to bond market movements. The value of bonds may decline for issuer-related reasons, including management performance, financial leverage and reduced demand for the issuer's goods and services. Certain types of fixed-income obligations also may be subject to "call and redemption risk," which is the risk that the issuer may call a bond held by the Fund for redemption before it matures and the Fund may lose income. Prepayment Risk. The Fund may invest in mortgage-related securities and asset-backed securities, which are subject to prepayment risk. If these securities are prepaid, the Fund may have to replace them with lower-yielding securities. Stripped mortgage-backed securities are generally more sensitive to changes in prepayment and interest rates than other mortgage-related securities. Unlike mortgage-related securities, asset-backed securities are usually not collateralized. If the issuer of a non-collateralized debt security defaults on the obligation, there is no collateral that the security holder may sell to satisfy the debt. Extension Risk. When interest rates rise, repayments of fixed income securities, particularly asset- and mortgage-backed securities, may occur more slowly than anticipated, extending the effective duration of these securities at below market interest rates and causing their market prices to decline more than they would have declined due to the rise in interest rates alone. This may cause the Fund’s share price to be more volatile. US Government and Agency Securities Risk. US Government and agency securities are subject to market risk, interest rate risk and credit risk. Not all US Government securities are insured or guaranteed by the full faith and credit of the US Government; some are only insured or guaranteed by the issuing agency, which must rely on its own resources to repay the debt. In addition, Connecticut Avenue Securities issued by Fannie Mae and Structured Agency Credit Risk issued by Freddie Mac carry no guarantee whatsoever and the risk of default associated with these securities would be borne by the Fund. The maximum potential liability of the issuers of some US Government securities held by the Fund may greatly exceed their current resources, including their legal right to support from the US Treasury. It is possible that these issuers will not have the funds to meet their payment obligations in the future. In 2008, Fannie Mae and Freddie Mac were placed into a conservatorship under the Federal Housing Finance Agency. However, there can be no assurance that the US Government will support these or other government-sponsored enterprises in the future. Portfolio Turnover Risk. The length of time the Fund has held a particular security is not generally a consideration in investment decisions. Under certain market conditions, the Fund’s turnover rate may be higher than that of other mutual funds. Portfolio turnover generally involves some expense to the Fund, including brokerage commissions or dealer mark-ups and other transaction costs on the sale of securities and reinvestment in other securities. These transactions may result in realization of taxable capital gains. The trading costs and tax effects associated with portfolio turnover may adversely affect the Fund’s investment performance. Market Events Risk. Events in the financial markets have resulted in, and may continue to result in, an unusually high degree of volatility, both in non-US and US markets. This market volatility, in addition to reduced liquidity in credit and fixed-income markets, may adversely affect issuers worldwide. Furthermore, the impact of policy and legislative changes in the US and other countries may not be fully known for some time. This environment could make identifying investment risks and opportunities especially difficult for the subadviser. Risk of Increase in Expenses. Your actual cost of investing in the Fund may be higher than the expenses shown in the expense table for a variety of reasons. For example, expense ratios may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile. Active and frequent trading of Fund securities can increase expenses. More information about the risks of investing in the Fund appears in the section of the Prospectus entitled "More Information About the Fund's Principal and Non-Principal Investment Strategies, Investments and Risks." | |||||||||||||||||||||||||||||||||||||||||||||||||||

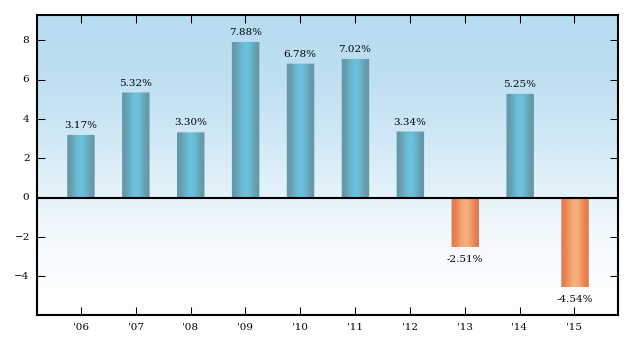

| Performance. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| The following bar chart shows the Fund's performance for Class A shares for each full calendar year of operations or for the last 10 calendar years, whichever is shorter. The following table shows the average annual returns of each of the Fund’s share classes and also compares the Fund’s performance with the average annual total returns of an index or other benchmark and a group of similar mutual funds. The bar chart and table demonstrate the risk of investing in the Fund by showing how returns can change from year to year. Past performance (before and after taxes) does not mean that the Fund will achieve similar results in the future. Updated Fund performance information is available online at www.prudentialfunds.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Total Returns (Class A Shares)1 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Annual Total Returns % (including sales charges) (as of 12-31-15) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| ° After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown only for the indicated share class. After-tax returns for other classes will vary due to differing sales charges and expenses. | |||||||||||||||||||||||||||||||||||||||||||||||||||