UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

The Securities Exchange Act of 1934

For the Fiscal Year Ended December 31 , 2022

of The Securities Exchange Act of 1934

Commission File Number: 0-12507

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

| Registrant’s telephone number, including area code: | ||||||||||||||

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☐ Yes ☒ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | ☒ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | ||||||||||

| Indicate by a check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7562(b)) by the registered public accounting firm that prepared or issued its audit report. | |||||||||||

| If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. | ☐ | ||||||||||

| Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). | ☐ | ||||||||||

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | |||||||||||

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $508,555,420

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Class | Outstanding as of June 30, 2023 | |||||||

| Common Stock, par value $1.00 per share | ||||||||

DOCUMENTS INCORPORATED BY REFERENCE

Auditor Name: KPMG LLP Auditor Location: Albany, New York Auditor Firm ID: 185

ARROW FINANCIAL CORPORATION

FORM 10-K

TABLE OF CONTENTS

| Page | |||||

| Note on Terminology | 3 | ||||

| The Company and Its Subsidiaries | 3 | ||||

| Forward-Looking Statements | 3 | ||||

| Use of Non-GAAP Financial Measures | 4 | ||||

| PART I | |||||

| PART II | |||||

| PART III | |||||

| PART IV | |||||

2

NOTE ON TERMINOLOGY

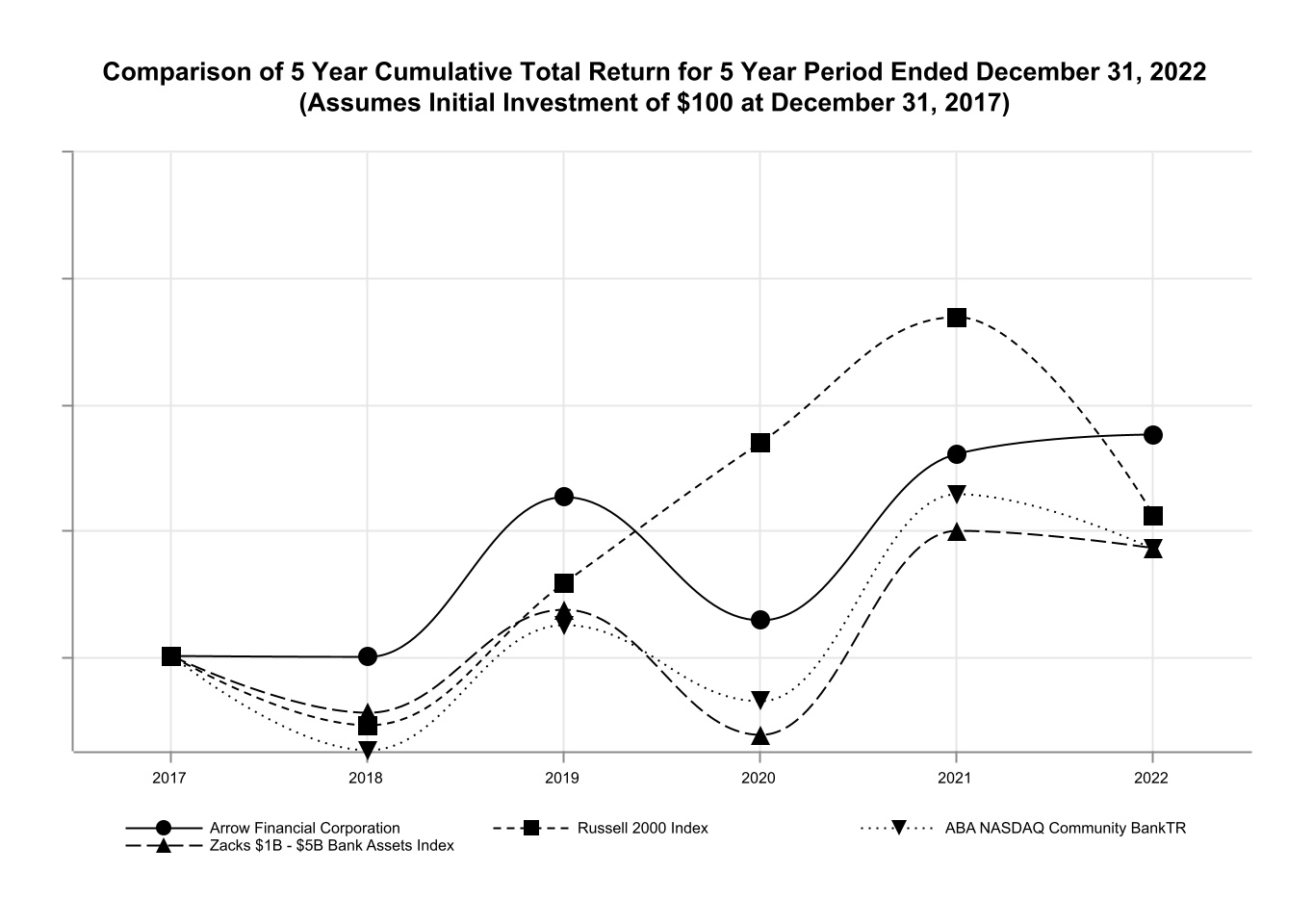

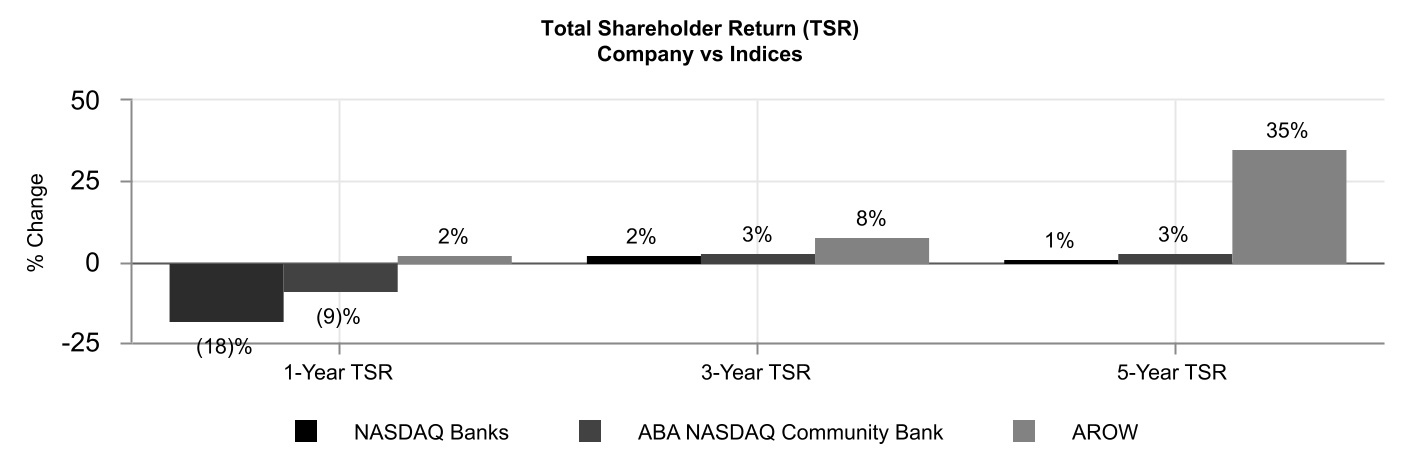

In this Annual Report on Form 10-K, the terms “Arrow,” “the registrant,” “the Company,” “we,” “us,” and “our,” generally refer to Arrow Financial Corporation and subsidiaries as a group, except where the context indicates otherwise. At certain points in this Report, our performance is compared with that of our “peer group” of financial institutions. Unless otherwise specifically stated, this peer group is comprised of the group of 165 domestic (U.S.-based) bank holding companies with $3 to $10 billion in total consolidated assets as identified in the Federal Reserve Board’s most recent “Bank Holding Company Performance Report” (which is the Performance Report for the most recently available period ending September 30, 2022), and peer group data has been derived from such Report. This peer group is not, however, identical to either of the peer groups comprising the two bank indices included in the stock performance graphs on pages 21 and 22 of this Report.

THE COMPANY AND ITS SUBSIDIARIES

Arrow is a two-bank holding company headquartered in Glens Falls, New York. The banking subsidiaries are Glens Falls National Bank and Trust Company (Glens Falls National or GFNB) whose main office is located in Glens Falls, New York, and Saratoga National Bank and Trust Company (Saratoga National or SNB) whose main office is located in Saratoga Springs, New York. Active subsidiaries of Glens Falls National include Upstate Agency, LLC (an insurance agency that sells property and casualty insurance and also specializes in selling and servicing group health care policies and life insurance), North Country Investment Advisers, Inc. (a registered investment adviser that provides investment advice to Arrow's proprietary mutual fund) and Arrow Properties, Inc. (a real estate investment trust, or REIT). Arrow also owns directly two subsidiary business trusts, organized in 2003 and 2004 to issue trust preferred securities (TRUPs), which are still outstanding.

FORWARD-LOOKING STATEMENTS

The information contained in this Annual Report on Form 10-K contains statements that are not historical in nature but rather are based on our beliefs, assumptions, expectations, estimates and projections about the future. These statements are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and involve a degree of uncertainty and attendant risk. Words such as “expects,” “believes,” “anticipates,” “estimates” and variations of such words and similar expressions often identify such forward-looking statements. Some of these statements, such as those included in the interest rate sensitivity analysis in Item 7A of this Report, entitled “Quantitative and Qualitative Disclosures About Market Risk,” are merely presentations of what future performance or changes in future performance would look like based on hypothetical assumptions and on simulation models. Other forward-looking statements are based on our general perceptions of market conditions and trends in activity, both locally and nationally, as well as current management strategies for future operations and development.

These forward-looking statements may not be exhaustive, are not guarantees of future performance and involve certain risks and uncertainties that are difficult to quantify or, in some cases, to identify. You should not place undue reliance on any such forward-looking statements. In the case of all forward-looking statements, actual outcomes and results may differ materially from what the statements predict or forecast. Factors that could cause or contribute to such differences include, but are not limited to the following:

•continued period of high inflation could adversely impact our business and our customers;

•other rapid and dramatic changes in economic and market conditions;

•sharp fluctuations in interest rates, economic activity, or consumer spending patterns;

•sudden changes in the market for products the Company provides, such as real estate or automobile loans;

•significant changes in banking or other laws and regulations, including both enactment of new legal or regulatory measures (e.g., the Economic Growth, Regulatory Relief, and Consumer Protection Act ("Economic Growth Act"), the Tax Cuts and Jobs Act of 2017 ("Tax Act") and the Dodd-Frank Wall Street Reform and Consumer Protection Act ("Dodd-Frank")) or the modification or elimination of pre-existing measures;

•significant changes in U.S. monetary or fiscal policy, including new or revised monetary programs or targets adopted or announced by the Federal Reserve ("monetary tightening or easing") or significant new federal legislation materially affecting the federal budget ("fiscal tightening or expansion");

•the COVID-19 pandemic and its impact on economic, market and social conditions, or other health emergencies, either of which may amplify certain of the other listed factors;

•competition from other sources (e.g., non-bank entities);

•similar uncertainties inherent in banking operations or business generally, including technological developments and changes;

•our ability to remediate the material weaknesses we have identified in our internal control over financial reporting and resolve litigation and other claims related to or arising out of the identified material weaknesses;

•the continuity, timing and effectiveness of the recent transition in executive management; and

•other risks detailed from time to time within our filings with the Securities and Exchange Commission ("SEC").

The Company is under no duty to update any of the forward-looking statements after the date of this Annual Report on Form 10-K to conform such statements to actual results. All forward-looking statements, express or implied, included in this Report and the documents incorporated by reference and that are attributable to the Company are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that the Company or any persons acting on our behalf may issue.

3

USE OF NON-GAAP FINANCIAL MEASURES

The SEC has adopted Regulation G, which applies to all public disclosures, including earnings releases, made by registered companies that contain “non-GAAP financial measures.” GAAP is generally accepted accounting principles in the United States of America. Under Regulation G, companies making public disclosures containing non-GAAP financial measures must also disclose, along with each non-GAAP financial measure, certain additional information, including a reconciliation of the non-GAAP financial measure to the closest comparable GAAP financial measure and a statement of the Company’s reasons for utilizing the non-GAAP financial measure as part of its financial disclosures. The SEC has exempted from the definition of “non-GAAP financial measures” certain commonly used financial measures that are not based on GAAP. When these exempted measures are included in public disclosures, supplemental information is not required. The following measures used in this Report, which are commonly utilized by financial institutions, have not been specifically exempted by the SEC and may constitute "non-GAAP financial measures" within the meaning of the SEC's rules, although the Company is unable to state with certainty that the SEC would so regard them.

Tax-Equivalent Net Interest Income and Net Interest Margin: Net interest income, as a component of the tabular presentation by financial institutions of Selected Financial Information regarding their recently completed operations, as well as disclosures based on that tabular presentation, is commonly presented on a tax-equivalent basis. That is, to the extent that some component of the institution's net interest income, which is presented on a before-tax basis, is exempt from taxation (e.g., is received by the institution as a result of its holdings of state or municipal obligations), an amount equal to the tax benefit derived from that component is added to the actual before-tax net interest income total. This adjustment is considered helpful in comparing one financial institution's net interest income to that of another institution or in analyzing any institution’s net interest income trend line over time, to correct any analytical distortion that might otherwise arise from the fact that financial institutions vary widely in the proportions of their portfolios that are invested in tax-exempt securities, and from the fact that even a single institution may significantly alter over time the proportion of its own portfolio that is invested in tax-exempt obligations. Moreover, net interest income is itself a component of a second financial measure commonly used by financial institutions, net interest margin, which is the ratio of net interest income to average earning assets. For purposes of this measure as well, tax-equivalent net interest income is generally used by financial institutions, again to provide a better basis of comparison from institution to institution and to better demonstrate a single institution’s performance over time. The Company follows these practices.

The Efficiency Ratio: Financial institutions often use an "efficiency ratio" as a measure of expense control. The efficiency ratio typically is defined as the ratio of noninterest expense to net interest income and noninterest income. Net interest income as utilized in calculating the efficiency ratio is typically the same as the net interest income presented in Selected Financial Information table discussed in the preceding paragraph, i.e., it is expressed on a tax-equivalent basis. Moreover, many financial institutions, in calculating the efficiency ratio, also adjust both noninterest expense and noninterest income to exclude from these items (as calculated under GAAP) certain recurring component elements of income and expense, such as intangible asset amortization (which is included in noninterest expense under GAAP but may not be included therein for purposes of calculating the efficiency ratio) and securities gains or losses (which are reflected in the calculation of noninterest income under GAAP but may be ignored for purposes of calculating the efficiency ratio). The Company makes these adjustments.

Tangible Book Value per Share: Tangible equity is total stockholders’ equity less intangible assets. Tangible book value per share is tangible equity divided by total shares issued and outstanding. Tangible book value per share is often regarded as a more meaningful comparative ratio than book value per share as calculated under GAAP, that is, total stockholders’ equity including intangible assets divided by total shares issued and outstanding. Intangible assets include many items, but in our case, essentially represents goodwill.

Adjustments for Certain Items of Income or Expense: In addition to our regular utilization in our public filings and disclosures of the various non-GAAP measures commonly utilized by financial institutions discussed above, we also may elect from time to time, in connection with our presentation of various financial measures prepared in accordance with GAAP, such as net income, earnings per share (i.e., EPS), return on average assets (i.e., ROA), and return on average equity (i.e., ROE), to additionally provide certain comparative disclosures that adjust these GAAP financial measures, typically by removing therefrom the impact of certain transactions or other material items of income or expense that are unusual or unlikely to be repeated. The Company does so only if it believes that inclusion of the resulting non-GAAP financial measures may improve the average investor's understanding of Arrow's results of operations by separating out items that have a disproportional positive or negative impact on the particular period in question or by otherwise permitting a better comparison from period-to-period in the results of operations with respect to the Company's fundamental lines of business, including the commercial banking business.

The Company believes that the non-GAAP financial measures disclosed from time-to-time are useful in evaluating Arrow's performance and that such information should be considered as supplemental in nature, and not as a substitute for or superior to, the related financial information prepared in accordance with GAAP. Arrow's non-GAAP financial measures may differ from similar measures presented by other companies.

4

PART I

Item 1. Business

A. GENERAL

The holding company, Arrow Financial Corporation, a New York corporation, was incorporated on March 21, 1983 and is registered as a bank holding company within the meaning of the Bank Holding Company Act of 1956. Arrow owns two nationally-chartered banks in New York (Glens Falls National and Saratoga National), and through such banks indirectly owns various non-bank subsidiaries, including an insurance agency, a registered investment adviser and a REIT. See "The Company and Its Subsidiaries," above.

Subsidiary Banks (dollars in thousands and data is as of December. 31, 2022) | |||||||||||

| Glens Falls National | Saratoga National | ||||||||||

| Total Assets at Year-End | $ | 3,125,180 | $ | 895,584 | |||||||

| Trust Assets Under Administration and Investment Management at Year-End (Not Included in Total Assets) | $ | 1,486,327 | $ | 119,805 | |||||||

| Date Organized | 1851 | 1988 | |||||||||

| Employees (full-time equivalent) | 454 | 48 | |||||||||

| Offices | 26 | 11 | |||||||||

| Counties of Operation | Warren, Washington, Saratoga, Essex & Clinton | Saratoga, Albany, Rensselaer, & Schenectady | |||||||||

| Main Office | 250 Glen Street Glens Falls, NY | 171 So. Broadway Saratoga Springs, NY | |||||||||

The holding company’s business consists primarily of the ownership, supervision and control of Arrow's two banks, including the banks' subsidiaries. The holding company provides various advisory and administrative services and coordinates the general policies and operation of the banks. There were 502 full-time equivalent employees, including 34 employees within Arrow's insurance agency subsidiary, at December 31, 2022. See the discussion of our human capital resources in Section G ("HUMAN CAPITAL") of this Item 1.

Arrow offers a broad range of commercial and consumer banking and financial products. The deposit base consists of deposits derived principally from the communities served. The Company targets lending activities to consumers and small- and mid-sized companies in Arrow's regional geographic area. In addition, through an indirect lending program Arrow acquires consumer loans from an extensive network of automobile dealers that operate in New York and Vermont. Through the banks' trust operations, the Company provides retirement planning, trust and estate administration services for individuals, and pension, profit-sharing and employee benefit plan administration for corporations.

B. LENDING ACTIVITIES

Arrow engages in a wide range of lending activities, including commercial and industrial lending primarily to small and mid-sized companies; mortgage lending for residential and commercial properties; and consumer installment and home equity financing. An active indirect lending program is maintained through Arrow's sponsorship of automobile dealer programs under which consumer auto loans, primarily from dealers that meet pre-established specifications are purchased. From time to time, a portion of the Arrow's residential real estate loan originations are sold into the secondary market, primarily to the Federal Home Loan Mortgage Corporation ("Freddie Mac") and other governmental agencies. Normally, the Company retains the servicing rights on mortgage loans originated and sold into the secondary markets, subject to periodic determinations on the continuing profitability of such activity.

Generally, Arrow continues to implement lending strategies and policies that are intended to protect the quality of the loan portfolio, including strong underwriting and collateral control procedures and credit review systems. Loans are placed on nonaccrual status either due to the delinquency status of principal and/or interest or a judgment by management that the full repayment of principal and interest is unlikely. Home equity lines of credit, secured by real property, are systematically placed on nonaccrual status when 120 days past due, and residential real estate loans are placed on nonaccrual status when 150 days past due. Commercial and commercial real estate loans are evaluated on a loan-by-loan basis and are placed on nonaccrual status when 90 days past due if the full collection of principal and interest is uncertain (See Part II, Item 7.C.II.c. "Risk Elements") Subsequent cash payments on loans classified as nonaccrual may be applied entirely to principal, although income in some cases may be recognized on a cash basis.

Arrow lends primarily to borrowers within the normal retail service area in northeastern New York State, with the exception of the indirect consumer lending line of business, where Arrow acquires retail paper from an extensive network of automobile dealers that operate in a larger area of New York and Vermont. The loan portfolio does not include any foreign loans or any other significant risk concentrations. Arrow does not generally participate in loan syndications, either as originator or as a participant. However, from time to time, Arrow buys and offers participations in individual loans, typically commercial loans, in New York and adjacent states. In recent periods, the total dollar amount of such participations has fluctuated, but generally represents less than 20% of commercial loans outstanding. The majority of the portfolio is properly collateralized, and most commercial loans are further supported by personal guarantees. Arrow also participated as a lender in the Paycheck Protection

5

Program ("PPP") administered by the Small Business Administration ("SBA") under the Coronavirus Aid, Relief, and Economic Security Act (the "CARES Act"). Arrow originated over $91.5 million in loans under the PPP in 2021 and approximately $234.2 million over the life of the PPP program. As of December 31, 2022, there were no PPP loans outstanding. See the discussion of the CARES Act in Section D ("RECENT LEGISLATIVE DEVELOPMENTS") of this Item 1.

Arrow does not engage in subprime mortgage lending as a business line and does not extend or purchase so-called "Alt A," "negative amortization," "option ARM's" or "negative equity" mortgage loans.

C. SUPERVISION AND REGULATION

The following generally describes the laws and regulations to which Arrow is subject. Bank holding companies, banks and their affiliates are extensively regulated under both federal and state law. To the extent that the following information summarizes statutory or regulatory law, it is qualified in its entirety by reference to the particular provisions of the various statutes and regulations. Any change in applicable law may have a material effect on business operations, customers, prospects and investors.

Bank Regulatory Authorities with Jurisdiction over Arrow and its Subsidiary Banks

Arrow is a registered bank holding company within the meaning of the Bank Holding Company Act of 1956 ("BHC Act") and as such is subject to regulation by the Board of Governors of the Federal Reserve System ("FRB"). As a "bank holding company" under New York State law, Arrow is also subject to regulation by the New York State Department of Financial Services. Arrow's two subsidiary banks are both national banks and are subject to supervision and examination by the Office of the Comptroller of the Currency ("OCC"). The banks are members of the Federal Reserve System and the deposits of each bank are insured by the Deposit Insurance Fund of the Federal Deposit Insurance Corporation ("FDIC"). The BHC Act generally prohibits Arrow from engaging, directly or indirectly, in activities other than banking, activities closely related to banking, and certain other financial activities. Under the BHC Act, a bank holding company generally must obtain FRB approval before acquiring, directly or indirectly, voting shares of another bank or bank holding company, if after the acquisition the acquiror would own 5 percent or more of a class of the voting shares of that other bank or bank holding company. Bank holding companies are able to acquire banks or other bank holding companies located in all 50 states, subject to certain limitations. Bank holdings companies that meet certain qualifications may choose to apply to the FRB for designation as “financial holding companies.” Upon receipt of such designation, a financial holding company may engage in a broader array of activities, such as insurance underwriting, securities underwriting and merchant banking. Arrow has not attempted to become, and has not been designated as, a financial holding company.

The FRB and the OCC have broad regulatory, examination and enforcement authority. The FRB and the OCC conduct regular examinations of the entities they regulate. In addition, banking organizations are subject to requirements for periodic reporting to the regulatory authorities. The FRB and OCC have the authority to implement various remedies if they determine that the financial condition, capital, asset quality, management, earnings, liquidity or other aspects of a banking organization's operations are unsatisfactory or if they determine the banking organization is violating or has violated any law or regulation. The authority of the federal bank regulators over banking organizations includes, but is not limited to, prohibiting unsafe or unsound practices; requiring affirmative action to correct a violation or unsafe or unsound practice; issuing administrative orders; requiring the organization to increase capital; requiring the organization to sell subsidiaries or other assets; restricting dividends, distributions and repurchases of the organization's stock; restricting the growth of the organization; assessing civil money penalties; removing officers and directors; and terminating deposit insurance. The FDIC may terminate a depository institution's deposit insurance upon a finding that the institution's financial condition is unsafe or unsound or that the institution has engaged in unsafe or unsound practices for certain other reasons.

Regulatory Supervision of Other Arrow Subsidiaries

The insurance agency subsidiary of Glens Falls National is subject to the licensing and other provisions of New York State Insurance Law and is regulated by the New York State Department of Financial Services. Arrow's investment adviser subsidiary is subject to the licensing and other provisions of the federal Investment Advisers Act of 1940 and is regulated by the SEC.

Regulation of Transactions between Banks and their Affiliates

Transactions between banks and their "affiliates" are regulated by Sections 23A and 23B of the Federal Reserve Act (FRA). Each of Arrow's non-bank subsidiaries (other than the business trusts formed to issue the TRUPs) is a subsidiary of one of the subsidiary banks, and also is an "operating subsidiary" under Sections 23A and 23B. This means each non-bank subsidiary is considered to be part of the bank that owns it and thus is not an affiliate of that bank for purposes of Section 23A and 23B. However, each of the two banks is an affiliate of the other bank, under Section 23A, and Arrow, the holding company, is also an affiliate of each bank under both Sections 23A and 23B. Extensions of credit that a bank may make to affiliates, or to third parties secured by securities or obligations of the affiliates, are substantially limited by the FRA and the Federal Deposit Insurance Act (FDIA). Such acts further restrict the range of permissible transactions between a bank and any affiliate, including a bank affiliate. Furthermore, under the FRA, a bank may engage in certain transactions, including loans and purchases of assets, with a non-bank affiliate, only if certain special conditions, including collateral requirements for loans, are met and if the other terms and conditions of the transaction, including interest rates and credit standards, are substantially the same as, or at least as favorable to the bank as, those prevailing at the time for comparable transactions by the bank with non-affiliated companies or, in the absence of comparable transactions, on terms and conditions that would be offered by the bank to non-affiliated companies.

6

Regulatory Capital Standards

An important area of banking regulation is the federal banking system's promulgation and enforcement of minimum capitalization standards for banks and bank holding companies.

Bank Capital Rules. In July 2013, federal bank regulators, including the FRB and the OCC, approved revised bank capital rules aimed at implementing capital requirements pursuant to Dodd-Frank. These rules were also intended to coordinate U.S. bank capital standards with the then-current drafts of the Basel III proposed bank capital standards for all of the developed world's banking organizations. The federal regulators' revised capital rules (the "Capital Rules"), which impose significantly higher minimum capital ratios on U.S. financial institutions than the rules they replaced, became effective for Arrow and its subsidiary banks on January 1, 2015, and were fully phased in by the end of 2019.

In 2020, federal bank regulators introduced an optional simplified measure of capital adequacy for qualifying community banking organizations (CBLR). A qualifying community banking organization that opts into the CBLR framework and meets all the requirements under the CBLR framework will be considered to have met the well-capitalized ratio requirements under the “prompt corrective action” regulations and will not be required to report or calculate risk-based capital ratios.

The CBLR final rule became effective as of January 1, 2020, and Arrow and both subsidiary banks have opted out of utilizing the CBLR framework. Therefore, the Capital Rules promulgated under Dodd-Frank remain applicable to Arrow and both subsidiary banks.

The Capital Rules which remain applicable to Arrow consist of two basic types of capital measures, a leverage ratio and a set of risk-based capital measures. Within these two broad types of rules, however, significant changes were made in the revised Capital Rules, as discussed as follows.

Leverage Ratio. The Capital Rules increased the minimum required leverage ratio from 3.0% to 4.0%. The leverage ratio continues to be defined as the ratio of the institution's "Tier 1" capital (as defined under the new leverage rule) to total tangible assets (as defined under the revised leverage rule).

Risk-Based Capital Measures. Current risk-based capital measures assign various risk weightings to all of the institution's assets, by asset type, and to certain off balance sheet items, and then establish minimum levels of capital to the aggregate dollar amount of such risk-weighted assets. Under the risk-based Capital Rules, there are eight major risk-weighted categories of assets (although there are several additional super-weighted categories for high-risk assets that are generally not held by community banking organizations like Arrow). The Capital Rules include a measure called the "common equity tier 1 capital ratio" (CET1). For this ratio, only common equity (basically, common stock plus surplus plus retained earnings) qualifies as capital (i.e., CET1). Preferred stock and trust preferred securities, which qualified as Tier 1 capital under the old Tier 1 risk-based capital measure (and continue to qualify as capital under the revised Tier 1 risk-based capital measure), are not included in CET1 capital. Under these rules, CET1 capital also includes most elements of accumulated other comprehensive income (AOCI), including unrealized securities gains and losses, as part of both total regulatory capital (numerator) and total assets (denominator). However, smaller banking organizations like Arrow's were given the opportunity to make a one-time irrevocable election to include or not to include certain elements of AOCI, most notably unrealized securities gains or losses. Arrow made such an election, and therefore does not include unrealized securities gains and losses in calculating the CET1 ratio under the Capital Rules. The minimum CET1 ratio under these rules, effective January 1, 2015, is 4.50%, which remained constant throughout the phase-in period.

Consistent with the general theme of higher capital levels, the Capital Rules also increased the minimum ratio for Tier 1 risk-based capital from 4.0% to 6.0%, effective January 1, 2015. The minimum level for total risk-based capital under the Capital Rules remained at 8.0%.

The Capital Rules also incorporated a capital concept, the so-called "capital conservation buffer" (set at 2.5%, after full phase-in), which must be added to each of the minimum required risk-based capital ratios (i.e., the minimum CET1 ratio, the minimum Tier 1 risk-based capital ratio and the minimum total risk-based capital ratio). The capital conservation buffer was phased-in over four years beginning January 1, 2016 (see the table below). When, during economic downturns, an institution's capital begins to erode, the first deductions from a regulatory perspective would be taken against the capital conservation buffer. To the extent that such deductions should erode the buffer below the required level (2.5% of total risk-based assets after full phase-in), the institution will not necessarily be required to replace the buffer deficit immediately, but will face restrictions on paying dividends and other negative consequences until the buffer is fully replenished.

Also under the Capital Rules, and as required under Dodd-Frank, TRUPs issued by small- to medium-sized banking organizations (such as Arrow) that were outstanding on the Dodd-Frank grandfathering date for TRUPS (May 19, 2010) will continue to qualify as tier 1 capital, up to a limit of 25% of tier 1 capital, until the TRUPs mature or are redeemed, subject to certain limitations. See the discussion of grandfathered TRUPs in Section E ("CAPITAL RESOURCES AND DIVIDENDS") of Item 7.

The following is a summary of the definitions of capital under the various risk-based measures in the Capital Rules:

Common Equity Tier 1 Capital (CET1): Equals the sum of common stock instruments and related surplus (net of treasury stock), retained earnings, accumulated other comprehensive income (AOCI), and qualifying minority interests, minus applicable regulatory adjustments and deductions. Such deductions will include AOCI, if the organization has exercised its irrevocable option not to include AOCI in capital (Arrow made such an election). Mortgage-servicing assets, deferred tax assets, and investments in financial institutions are limited to 15% of CET1 in the aggregate and 10% of CET1 for each such item individually.

Additional Tier 1 Capital: Equals the sum of noncumulative perpetual preferred stock, tier 1 minority interests, grandfathered TRUPs, and Troubled Asset Relief Program instruments, minus applicable regulatory adjustments and deductions.

7

Tier 2 Capital: Equals the sum of subordinated debt and preferred stock, total capital minority interests not included in Tier 1, and allowance for loan and lease losses (not exceeding 1.25% of risk-weighted assets) minus applicable regulatory adjustments and deductions.

The following table presents the Capital Rules applicable to Arrow and its subsidiary banks:

| Year, as of January 1 | 2022 | ||||

| Minimum CET1 Ratio | 4.500 | % | |||

| Capital Conservation Buffer ("Buffer") | 2.500 | % | |||

| Minimum CET1 Ratio Plus Buffer | 7.000 | % | |||

| Minimum Tier 1 Risk-Based Capital Ratio | 6.000 | % | |||

| Minimum Tier 1 Risk-Based Capital Ratio Plus Buffer | 8.500 | % | |||

| Minimum Total Risk-Based Capital Ratio | 8.000 | % | |||

| Minimum Total Risk-Based Capital Ratio Plus Buffer | 10.500 | % | |||

| Minimum Leverage Ratio | 4.000 | % | |||

At December 31, 2022, Arrow and its two subsidiary banks exceeded, by a substantial amount, each of the applicable minimum capital ratios established under the revised Capital Rules, including the minimum CET1 Ratio, the minimum Tier 1 Risk-Based Capital Ratio, the minimum Total Risk-Based Capital Ratio, and the minimum Leverage Ratio, and including in the case of each risk-based ratio, the phased-in portion of the capital buffer. See Note 20, Regulatory Matters, to the Consolidated Financial Statements for a presentation of Arrow's period-end ratios for 2022 and 2021.

Regulatory Capital Classifications. Under applicable banking law, federal banking regulators are required to take prompt corrective action with respect to depository institutions that do not meet minimum capital requirements. The regulators have established five capital classifications for banking institutions, ranging from the highest category of "well-capitalized" to the lowest category of "critically under-capitalized". Under the Capital Rules, a banking institution is considered "well-capitalized" if it meets the following capitalization standards on the date of measurement: a CET1 risk-based capital ratio of 6.50% or greater, a Tier 1 risk-based capital ratio of 8.00% or greater, and a total risk-based capital ratio of 10.00% or greater, provided the institution is not subject to any regulatory order or written directive regarding capital maintenance.

As of December 31, 2022, Arrow and its two subsidiary banks qualified as "well-capitalized" under the revised capital classification scheme.

Regulatory Reporting. Arrow's recent failure to timely file this Annual Report on Form 10-K and the Quarterly Report on Form 10-Q for the quarter ended March 31, 2023 has resulted in a failure to timely file certain other regulatory reports, which rely in whole or in part upon the information contained in such 10-K and 10-Q Reports. Any such required reports will be promptly filed upon the filing of this Annual Report on Form 10-K and the Quarterly Report on Form 10-Q.

Dividend Restrictions; Other Regulatory Sanctions

A holding company's ability to pay dividends or repurchase its outstanding stock, as well as its ability to expand its business, including for example, through acquisitions of additional banking organizations or permitted non-bank companies, may be restricted if its capital falls below minimum regulatory capital ratios or fails to meet other informal capital guidelines that the regulators may apply from time to time to specific banking organizations. In addition to these potential regulatory limitations on payment of dividends, the holding company's ability to pay dividends to shareholders, and the subsidiary banks' ability to pay dividends to the holding company are also subject to various restrictions under applicable corporate laws, including banking laws (which affect the subsidiary banks) and the New York Business Corporation Law (which affects the holding company). The ability of the holding company and banks to pay dividends or repurchase shares in the future is, and is expected to continue to be, influenced by regulatory policies, the Capital Rules and other applicable law.

In cases where banking regulators have significant concerns regarding the financial condition, assets or operations of a bank holding company and/or one of its banks, the regulators may take enforcement action or impose enforcement orders, formal or informal, against the holding company or the particular bank. If the ratio of tangible equity to total assets of a bank falls to 2% or below, the bank will likely be closed and placed in receivership, with the FDIC as receiver.

Cybersecurity

In addition to the provisions in the Gramm-Leach-Bliley Act relating to data security (discussed below), Arrow and its subsidiaries are subject to many federal and state laws, regulations and regulatory interpretations which impose standards and requirements related to cybersecurity.

In March 2015, federal regulators issued related statements regarding cybersecurity. One statement indicates that financial institutions should design multiple layers of security controls to establish lines of defense and to ensure that their risk management processes also address the risk posed by compromised customer credentials, including security measures to reliably authenticate customers accessing internet-based services of the financial institution. The other statement indicates that a financial institution’s management is expected to maintain sufficient business continuity planning processes to ensure the rapid recovery, resumption and maintenance of the institution’s operations after a cyber-attack involving destructive malware. A financial institution is also expected to develop appropriate processes to enable recovery of data and business operations and address rebuilding network capabilities and restoring data if the institution or its critical service providers fall victim to this type of

8

cyber-attack. Financial institutions that fail to observe this regulatory guidance on cybersecurity may be subject to various regulatory sanctions, including financial penalties.

In February 2018, the SEC issued the “Commission Statement and Guidance on Public Company Cybersecurity Disclosures” to assist public companies in preparing disclosures about cybersecurity risks and incidents. With the increased frequency and magnitude of cybersecurity incidents, the SEC stated that it is critical that public companies take all required actions to inform investors about material cybersecurity risks and incidents in a timely fashion. Additionally, in October 2018 the SEC issued the “Report of Investigation Pursuant to Section 21(a) of the Securities Exchange Act of 1934 Regarding Certain Cyber-Related Frauds Perpetrated Against Public Companies and Related Internal Controls Requirements” which cited business email compromises that led to the incidents and that internal accounting controls may need to be reassessed in light of these emerging risks. Certain Arrow subsidiaries are subject to certain New York State cybersecurity regulations.

Privacy and Confidentiality Laws

Arrow and its subsidiaries are subject to a variety of laws that regulate customer privacy and confidentiality. The Gramm-Leach-Bliley Act requires financial institutions to adopt privacy policies, to restrict the sharing of nonpublic customer information with nonaffiliated parties upon the request of the customer, and to implement data security measures to protect customer information. Certain state laws may impose additional privacy and confidentiality restrictions. The Fair Credit Reporting Act, as amended by the Fair and Accurate Credit Transactions Act of 2003, regulates use of credit reports, providing of information to credit reporting agencies and sharing of customer information with affiliates, and sets identity theft prevention standards.

Anti-Money Laundering, the U.S. Patriot Act and OFAC

The Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism (USA PATRIOT) Act of 2001 initially adopted in 2001 and re-adopted by the U.S. Congress in 2006 with certain changes (the “Patriot Act”), imposes substantial record-keeping and due diligence obligations on banks and other financial institutions, with a particular focus on detecting and reporting money-laundering transactions involving domestic or international customers. The U.S. Treasury Department has issued and will continue to issue regulations clarifying the Patriot Act's requirements.

Under the Patriot Act and other federal anti-money laundering laws and regulations, including, but not limited to, the Currency and Foreign Transactions Report Act (collectively, “Anti-Money Laundering Laws”), financial institutions, including banks, must maintain certain anti-money laundering compliance, customer identification and due diligence programs that include established internal policies, procedures, and controls. Financial institutions are also prohibited from entering into specified financial transactions and account relationships and must meet enhanced standards for due diligence and customer identification. Financial institutions must take reasonable steps to conduct enhanced scrutiny of account relationships to guard against money laundering and to report suspicious transactions. Law enforcement authorities have been granted increased access to financial information maintained by financial institutions. Bank regulators routinely examine institutions for compliance with these obligations and they must consider an institution's compliance in connection with the regulatory review of applications, including applications for banking mergers and acquisitions. The U.S. Treasury Department's Financial Crises Enforcement Network (“FinCEN”) issued a final rule in 2016 increasing customer due diligence requirements for banks, including adding a requirement to identify and verify the identity of beneficial owners of customers that are legal entities, subject to certain exclusions and exemptions. The Company has established procedures for compliance with these requirements. Compliance with the provisions of the Patriot Act and other Anti-Money Laundering Laws results in substantial costs on all financial institutions.

The U.S. Department of the Treasury's Office of Foreign Assets Control (“OFAC”) is responsible for helping to insure that United States persons, including banks, do not engage in transactions with certain prohibited parties, as defined by various Executive Orders and Acts of Congress. OFAC publishes lists of persons, organizations, and countries suspected of aiding, harboring or engaging in terrorist acts, including, but not limited to, Specially Designated Nationals and Blocked Persons. If Arrow finds a name on any transaction, account or wire transfer that is on an OFAC list, Arrow must freeze or block such account or transaction, file a suspicious activity report, if required, notify the appropriate authorities and maintain appropriate records.

Community Reinvestment Act

Arrow's subsidiary banks are subject to the Community Reinvestment Act ("CRA") and implementing regulations. CRA regulations establish the framework and criteria by which the bank regulatory agencies assess an institution's record of helping to meet the credit needs of its community, including low and moderate-income individuals. CRA ratings are taken into account by regulators in reviewing certain applications made by Arrow and its bank subsidiaries.

The Dodd-Frank Act

Dodd-Frank significantly changed the regulatory structure for financial institutions and their holding companies, for example, through provisions requiring the Capital Rules. Among other provisions, Dodd-Frank implemented corporate governance revisions that apply to all public companies, not just financial institutions, permanently increased the FDIC’s standard maximum deposit insurance amount to $250,000, changed the FDIC insurance assessment base to assets rather than deposits and increased the reserve ratio for the deposit insurance fund to ensure the future strength of the fund. The federal prohibition on the payment of interest on certain demand deposits was repealed, thereby permitting depository institutions to pay interest on business transaction accounts. Dodd-Frank established a new federal agency, the Consumer Financial Protection Bureau (the “CFPB”), centralizing significant aspects of consumer financial protection under this agency. Limits were imposed for debit card interchange fees for issuers that have assets greater than $10 billion, which also could affect the amount of interchange fees collected by financial institutions with less than $10 billion in assets. Dodd-Frank also imposed new requirements related to mortgage lending, including prohibitions against payment of steering incentives and provisions relating to underwriting standards,

9

disclosures, appraisals and escrows. The Volcker Rule prohibited banks and their affiliates from engaging in proprietary trading and investing in certain unregistered investment companies.

Federal banking regulators and other agencies including, among others, the FRB, the OCC and the CFPB, have been engaged in extensive rule-making efforts under Dodd-Frank, and the Community Bank Leverage Ratio has impacted certain Dodd-Frank requirements, as explained above.

Incentive Compensation

Dodd-Frank required the federal bank regulatory agencies and the SEC to establish joint regulations or guidelines prohibiting incentive-based payment arrangements at specified regulated entities, such as the Company, having at least $1 billion in total assets that encourage inappropriate risks by providing an executive officer, employee, director or principal shareholder with excessive compensation, fees, or benefits or that could lead to material financial loss to the entity. In addition, these regulators must establish regulations or guidelines requiring enhanced disclosure to regulators of incentive-based compensation arrangements.

The federal bank regulators issued proposed rules to address incentive-based compensation arrangements in June 2016. Final rules have not yet been issued by the federal bank regulatory agencies under this Dodd-Frank provision.

In 2010, the FRB, OCC and FDIC issued comprehensive final guidance on incentive compensation policies intended to ensure that the incentive compensation policies of banking organizations do not undermine the safety and soundness of such organizations by encouraging excessive risk-taking. The guidance, which covers all employees that have the ability to materially affect the risk profile of an organization, either individually or as part of a group, is based upon the key principles that a banking organization’s incentive compensation arrangements should (i) provide incentives that do not encourage risk-taking beyond the organization’s ability to effectively identify and manage risks, (ii) be compatible with effective internal controls and risk management, and (iii) be supported by strong corporate governance, including active and effective oversight by the organization’s board of directors. Management believes the current and past compensation practices of the Company do not encourage excessive risk taking or undermine the safety and soundness of the organization.

The FRB will review, as part of the regular, risk-focused examination process, the incentive compensation arrangements of banking organizations, such as the Company, that are not “large, complex banking organizations.” These reviews will be tailored to each organization based on the scope and complexity of the organization’s activities and the prevalence of incentive compensation arrangements. The findings of the supervisory initiatives will be included in reports of examination. Deficiencies will be incorporated into the organization’s supervisory ratings, which can affect the organization’s ability to make acquisitions and take other actions. Enforcement actions may be taken against a banking organization if its incentive compensation arrangements, or related risk-management control or governance processes, pose a risk to the organization’s safety and soundness and the organization is not taking prompt and effective measures to correct the deficiencies.

Deposit Insurance Laws and Regulations

In February 2011, the FDIC finalized a new assessment system that took effect in the second quarter of 2011. The final rule changed the assessment base from domestic deposits to average assets minus average tangible equity, adopted a new large-bank pricing assessment scheme, and set a target size for the Deposit Insurance Fund. The rule (as mandated by Dodd-Frank) finalized a target size for the Deposit Insurance Fund Reserve Ratio at 2.0% of insured deposits.

Due to increased growth in insured deposits during the first half of 2020, on September 15, 2020, the FDIC established a plan to restore the Deposit Insurance Fund Reserve Ratio to at least 1.35% by September 30, 2028, as required by the FDIA, utilizing the rate schedule in effect at that time. In response to updated analysis and projections for the fund balance and the Deposit Insurance Fund Reserve Ratio, the FDIC adopted a final rule in October 2022 increasing the initial base deposit insurance assessment rate schedules by two percent effective January 1, 2023 and beginning on the first quarterly assessment period of 2023. The increase is intended to ensure that the reserve ratio meets the minimum ratio of 1.35% by the September 30, 2028 statutory deadline. Arrow is unable to predict whether or to what extent the FDIC may elect to impose additional special assessments on insured institutions in upcoming years, especially in light of recent high-profile large bank failures.

Reserve Requirements

Pursuant to regulations of the FRB, all banking organizations are required to maintain average daily reserves at mandated ratios against their transaction accounts and certain other types of deposit accounts. These reserves must be maintained in the form of vault cash or in an account at a Federal Reserve Bank. In March 2020, the Federal Reserve Board reduced reserve requirement ratios to zero percent to free up liquidity in the banking industry to support lending to households and businesses.

D. RECENT LEGISLATIVE DEVELOPMENTS

The CARES Act and other COVID-19 Responses

In response to the COVID-19 pandemic, the CARES Act was signed into law on March 27, 2020. The CARES Act is a $2.2 trillion economic stimulus bill that was enacted to provide relief in the wake of the COVID-19 pandemic. Several provisions within the CARES Act directly impacted financial institutions and led to action from the bank regulatory agencies.

Section 1102 of the CARES Act created the PPP, a program administered by the SBA to provide loans to small businesses for payroll and other basic expenses during the COVID-19 pandemic. Arrow participated in the PPP as a lender, originating over $234.2 million in loans in 2020 and 2021. These loans were eligible to be forgiven if certain conditions were satisfied and were fully guaranteed by the SBA. As of December 31, 2022, there were no PPP loans outstanding in Arrow's loan portfolio.

On March 22, 2020, a statement was issued by the Board of Governors of the Federal Reserve Bank, the Federal Deposit Insurance Corporation, the National Credit Union Administration, the office of the Comptroller of the Currency and the Consumer

10

Financial Protection Bureau, titled the “Interagency Statement on Loan Modifications and Reporting for Financial Institutions Working with Customers Affected by the Coronavirus” (the “Interagency Statement”) that encourages financial institutions to work prudently with borrowers who are or may be unable to meet their contractual payment obligations due to the effects of COVID-19. Additionally, Section 4013 of the CARES Act further provides that a qualified loan modification is exempt from classification as a troubled debt restructuring ("TDR") as defined by GAAP, from the period beginning March 1, 2020 until the earlier of December 31, 2020 or the date that is 60 days after the date on which the national emergency concerning the COVID-19 outbreak declared by the President of the United States under the National Emergencies Act terminates. Section 541 of the CAA extended this relief to the earlier of January 1, 2022, or 60 days after the national emergency termination date. The Interagency Statement was subsequently revised in April 2020 to clarify the interaction of the original guidance with Section 4013 of the CARES Act, as well as setting forth the federal banking regulators’ views on consumer protection considerations. In accordance with such guidance, Arrow offered short-term modifications in response to COVID-19 to qualified borrowers. As of January 1, 2022, all COVID related deferrals had ended.

On May 11, 2023, the COVID-19 national emergency and public health emergency declarations ended.

The American Rescue Plan Act of 2021

On March 11, 2021, the American Rescue Plan Act of 2021 ("American Rescue Plan") was signed into law to speed up the recovery from the economic and health effects of the COVID-19 pandemic and the ongoing recession. The American Rescue Plan is a $1.9 trillion economic stimulus bill that builds upon both the CARES Act and the CAA.

Several provisions within the American Rescue Plan impact financial institutions. Key provisions include direct stimulus payments for the majority of Americans, extending unemployment benefits and continuing eviction and foreclosure moratoriums. In addition, over $350 billion has been allocated to state, local and tribal governments to bridge budget shortfalls.

Other Legislative Initiatives

From time to time, various legislative and regulatory initiatives are introduced in Congress and state legislatures, as well as by regulatory authorities. These initiatives may include proposals to expand or contract the powers of bank holding companies and depository institutions or proposals to change the financial institution regulatory environment. Such legislation could change banking laws and the operating environment of our Company in substantial, but unpredictable ways. Arrow cannot predict whether any such legislation will be enacted, and, if enacted, the effect that it, or any implementing regulations would have on the Company's financial condition or results of operations.

E. STATISTICAL DISCLOSURE – (Regulation S-K, Subpart 1400)

Set forth below is an index identifying the location in this Report of various items of statistical information required to be included in this Report by the SEC’s industry guide for Bank Holding Companies.

| Required Information | Location in Report | ||||

| Distribution of Assets, Liabilities and Stockholders' Equity; Interest Rates and Interest Differential | Part II, Item 7.B.I. | ||||

| Investment Portfolio | Part II, Item 7.C.I. | ||||

| Loan Portfolio | Part II, Item 7.C.II. | ||||

| Summary of Credit Loss Experience | Part II, Item 7.C.III. | ||||

| Deposits | Part II, Item 7.C.IV. | ||||

| Return on Equity and Assets | Part II, Item 6. | ||||

| Short-Term Borrowings | Part II, Item 7.C.V. | ||||

F. COMPETITION

Arrow faces intense competition in all markets served. Competitors include traditional local commercial banks, savings banks and credit unions, non-traditional internet-based lending alternatives, as well as local offices of major regional and money center banks. Like all banks, the Company encounters strong competition in the mortgage lending space from a wide variety of other mortgage originators, all of whom are principally affected in this business by the rate and terms set, and the lending practices established from time-to-time by the very large government sponsored enterprises ("GSEs") engaged in residential mortgage lending, most importantly, “Fannie Mae” and “Freddie Mac.” For many years, these GSEs have purchased and/or guaranteed a very substantial percentage of all newly-originated mortgage loans in the U.S. Additionally, non-banking financial organizations, such as consumer finance companies, insurance companies, securities firms, money market funds, mutual funds, credit card companies and wealth management enterprises offer substantive equivalents of the various other types of loan and financial products and services and transactional accounts that are offered, even though these non-banking organizations are not subject to the same regulatory restrictions and capital requirements that apply to Arrow. Under federal banking laws, such non-banking financial organizations not only may offer products and services comparable to those offered by commercial banks, but also may establish or acquire their own commercial banks.

G. HUMAN CAPITAL

Arrow believes that its employees are among its most important assets. Accordingly, Arrow has prioritized investment in the well-being, performance, engagement and development of its employees. This includes, but is not limited to, providing access to well-being resources and assistance, offering competitive compensation and benefits to attract and retain top-level talent, empowering team members to take an active role in the formation and execution of the business strategy, and fostering a diverse and inclusive work environment that reflects the many values of the communities that Arrow serves. One example is through the

11

creation of Arrow University, we are investing in our people by bringing employee learning and development to the forefront. We offer opportunities to employees at all levels for personal and professional growth, technical training, and career exploration and enhancement. At December 31, 2022, Arrow had 502 full-time equivalent employees.

H. ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG)

Arrow is firmly committed to operating in a socially conscious manner that demonstrates positive environmental, social and governance contributions.

Environmentally, Arrow is dedicated to conserving natural resources and complying with environmental regulations. Some of the steps we have taken to help promote environmentally responsible corporate citizenship include:

•Expanded our philanthropic support of environmental sustainability in our community, including organizations that impact soil and water conservation, land conservation, sustainable farming, mountain and lake protection and stewardship, and parks and recreation

•Incorporated energy-saving features into the renovation of our branches, such as interior and exterior LED lighting and energy-efficient plumbing in 40% of our branch network

•Incorporated the above environmentally friendly attributes into our Glens Falls, New York, headquarters renovation, which includes approximately 76,000 square feet of office space; motion-activated lighting; significant improvements to exterior wall and roof insulation; new HVAC systems with higher efficiency which meet modern fresh-air and ventilation requirements; energy-efficient windows and entry doors; low-VOC materials; a separate tie-in to the city stormwater and sewer system to bypass the municipal treatment of rainwater collected off the building; and green plantings on a portion of the roof

•Installed solar panels at part of our corporate headquarters, to support the main campus with approximately 3,000 square feet of green energy

•Installed electric vehicle charging stations at our SNB Main Office, with utilization offered at no charge to customers

•Reduced emissions via remote work and video conferencing for large segments of employees

•Provided and encouraged digital banking options and paperless statements

Socially, Arrow is proud of its many contributions to its employees, customers and communities, including providing professional development and holistic support of its team, giving back to its communities in dollars and volunteer hours, and meeting financial needs of the low- to moderate-income population. Arrow is also working on many ways to demonstrate the value of differences, particularly around diversity, equity, inclusion and belonging (“DEIB”).

Steps taken in this area include:

•More than $675,000 and 9,395 hours donated to our communities in 2022 in support of arts and culture, child care, economic and workforce development, emergency assistance, food security, financial literacy, mental and physical health, safe and affordable housing, transportation and more

•71 percent of donated dollars and 40 percent of hours are Community Reinvestment Act-eligible

•Prioritization of donations to organizations that make it their mission to provide affordable homeownership, environmental or sustainable activities and programming, economic empowerment, health and human services and social progress

•Lending program to facilitate first-time home ownership

•Extensive pandemic-related support to customers in need, including loan deferrals and over $234.2 million of 2,400 PPP loans through 2022

•Bank On-certified checking product for the unbanked or underbanked population with no overdraft fees

•Partnership with numerous organizations to meet the financial needs of the low- to moderate-income population

•Annual engagement with a third party to assess diversity within our employee base and support for setting and tracking goals to encourage the advancement of minorities, women, veterans and persons with disabilities

•Professional development, wellness and mental health services to our employees through the HR Department and through outside Employee Assistance Program (EAP) contracted services

•Ongoing outreach to measure employee engagement

•Three consecutive years of special bonuses for all employees in recognition of exceptional commitment and performance

•Incorporation of inclusion and belonging into our human resources policies, practices and programs

•Upcoming DEIB educational series for the Arrow Team as well as the development of a group of stakeholders to guide further initiatives

•Encouraged and facilitated employee giving including payroll deduction, dress-down days, and a fundraising campaign that totaled more than $103,000, a true reflection of our culture of giving

•Developed ESG Investment Models for our socially conscious clients

•Longstanding dedication to diversity on Arrow’s Board of Directors, exceeding Nasdaq requirements

Finally, Arrow believes that strong corporate governance is the foundation to delivering on its commitments to its stakeholders. Arrow adheres to a comprehensive governance program, which is described in further detail in its annual Proxy Statement.

12

I. EXECUTIVE OFFICERS OF THE REGISTRANT

The names and ages of the executive officers of Arrow and positions held by each are presented in the following table:

| Name | Age | Positions Held and Years from Which Held | ||||||

| David S. DeMarco | 61 | President and Chief Executive Officer of Arrow since May 13, 2023 and Chief Banking Officer since 2018. In addition to his executive leadership role at Arrow, Mr. DeMarco serves as President and Chief Executive Officer of each of GFNB (serving since May 13, 2023) and SNB (serving since 2012). Prior positions in the Company include Senior Executive Vice President from February 2022 through May 2023, Senior Vice President of Arrow between May 2009 and January 2022, Executive Vice President and Chief Banking Officer of GFNB and Executive Vice President and Head of the Branch, Corporate Development, Financial Services & Marketing Division of GFNB (2003-2012). Mr. DeMarco started with the Company as a commercial lender in 1987. | ||||||

| Penko Ivanov | 54 | Chief Financial Officer, Executive Vice President, Treasurer and Chief Accounting Officer effective February 21, 2023. Mr. Ivanov most recently served as executive vice president and chief financial officer of Bankwell Financial Group, Inc. in New Canaan, Connecticut. Prior to that, he worked in various finance positions for Doral Bank, General Electric Co. and PepsiCo Inc. Mr. Ivanov began his career with Ernst & Young in Munich, Germany. | ||||||

| David D. Kaiser | 63 | Senior Executive Vice President and Chief Credit Officer of Arrow, GFNB and SNB since February 2022. Prior positions in the Company include Senior Vice President and Chief Credit Officer of Arrow from February 2015 through January 2022, Executive Vice President of GFNB from 2012 through January 2022, Chief Credit Officer of GFNB from 2011 through January 2022 and Corporate Banking Manager for GFNB from 2005 to 2011. Mr. Kaiser started with the Company in 2000. | ||||||

| Andrew J. Wise | 56 | Senior Executive Vice President and Chief Operating Officer of Arrow, GFNB and SNB since February 2022. Prior positions in the Company include Senior Vice President and Chief Operating Officer of Arrow from February 2018 through January 2022, Executive Vice President and Chief Operating Officer of GFNB from October 2017 through January 2022, Chief Administrative Officer of GFNB. He joined GFNB in May 2016 as Senior Vice President of Administration. Prior to that, he worked at Adirondack Trust Company for 12 years where he was Executive Vice President and Chief Operating Officer of the Company’s insurance subsidiary. | ||||||

J. AVAILABLE INFORMATION

Arrow's Internet address is www.arrowfinancial.com. The Company makes available, free of charge on or through Arrow's website, the annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports as soon as practicable after they are filed or furnished with the SEC pursuant to the Exchange Act. We intend to use our website to disclose material non-public information and various other documents related to corporate operations, including Corporate Governance Guidelines, the charters of principal board committees, and codes of ethics and to comply with our disclosure obligations under Regulation FD. Accordingly, investors should monitor our website, in addition to following and reviewing our news releases, filings with the SEC and public conference calls and other presentations. The Company has adopted a financial code of ethics that applies to Arrow’s chief executive officer, chief financial officer and principal accounting officer and a business code of ethics that applies to all directors, officers and employees of the holding company and its subsidiaries. Both of these can be found at: https://www.arrowfinancial.com/Corporate/Governance.

13

Item 1A. Risk Factors

Arrow's financial results and the market price of its stock are subject to risks arising from many factors, including the risks listed below, as well as other risks and uncertainties. Any of these risks could materially and adversely affect Arrow's business, financial condition or results of operations. Please note that the discussion below regarding the potential impact on Arrow of certain of these factors that may develop in the future is not meant to provide predictions by Arrow's management that such factors will develop, but to acknowledge the possible negative consequences to the Company and business if certain conditions materialize.

MACROECONOMIC AND INDUSTRY RISKS

Market conditions could present significant challenges to the U.S. commercial banking industry and its core business of making and servicing loans and any substantial downturn in the regional markets in which Arrow operates or in the U.S. economy generally could adversely affect Arrow's ability to maintain steady growth in the loan portfolio and earnings. Arrow's business is highly dependent on the business environment in the markets in which the Company operates as well as the United States as a whole. Arrow's business is dependent upon the financial stability of the Company's borrowers, including their ability to pay interest on and repay the principal amount of, outstanding loans, the value of the collateral securing those loans, and the overall demand for loans and other products and services, all of which impact Arrow's stability and future growth. Although Arrow's market area has experienced a stabilizing of economic conditions in recent years and even periods of modest growth, if unpredictable or unfavorable economic conditions unique to the market area should occur in upcoming periods, these conditions will likely have an adverse effect on the quality of the loan portfolio and financial performance. As a community bank, Arrow is less able than larger regional competitors to spread the risk of unfavorable local economic conditions over a larger market area. Further, if the overall U.S. economy deteriorates, then Arrow's business, results of operations, financial condition and prospects could be adversely affected. In particular, financial performance may be adversely affected by short-term and long-term interest rates, the prevailing yield curve, inflation, monetary supply, fluctuations in the debt and equity capital markets, and the strength of the domestic economy and the local economies in the markets in which Arrow operates, all of which are beyond Arrow's control.

A continued period of high inflation could adversely impact our business and our customers. The Federal Reserve Board has raised certain benchmark interest rates in an effort to combat the pronounced increase in inflation. As rates continue to rise, the value of our investment securities, particularly those with longer maturities, would likely decrease (although this effect may be mitigated for floating rate instruments). Further, inflation increases the cost of operational expenses which increases our noninterest expenses. Additionally, our customers may be affected by inflation, which could have a negative impact on their ability to repay loans. Finally, the high inflationary environment may discourage our customers from pursuing new loans.

Arrow operates in a highly competitive industry and market areas that could negatively affect growth and profitability. Competition for commercial banking and other financial services is fierce in Arrow's market areas. In one or more aspects of business, Arrow's subsidiaries compete with other commercial banks, savings and loan associations, credit unions, finance companies, Internet-based financial services companies, mutual funds, insurance companies, brokerage and investment banking companies, and other financial intermediaries. Additionally, due to their size and other factors, many competitors may be able to achieve economies of scale and, as a result, may offer a broader range of products and services, as well as better pricing for those products and services, than Arrow can. Technology has lowered barriers to entry and made it possible for non-banks to offer products and services traditionally provided by banks, such as automatic transfer and automatic payment systems. In addition, many of Arrow's competitors are not subject to the same extensive federal regulations that govern bank holding companies and federally insured banks. Failure, by Arrow, to offer competitive services in Arrow's market areas could significantly weaken Arrow's market position, adversely affecting growth, which, in turn, could have a material adverse effect on Arrow's financial condition and results of operations.

Uncertainty relating to LIBOR and other reference rates and their potential discontinuance may negatively impact our access to funding and the value of our financial instruments and commercial agreements. Due to uncertainty surrounding the suitability and sustainability of the London interbank offered rate (LIBOR), central banks and global regulators have called for financial market participants to prepare for the discontinuance of LIBOR and the establishment of alternative reference rates. ICE Benchmark Administration (IBA), the administrator of LIBOR, announced that it will consult on its intention to cease publication of one-week and two-month U.S. dollar LIBOR at December 31, 2021, and stop the remaining U.S. dollar settings immediately after publication on June 30, 2023. At this time, it is not anticipated to have a significant impact to Arrow, or Arrow's financial instruments or commercial agreements that reference LIBOR.

Certain of our financial instruments and commercial agreements contain provisions to replace LIBOR as the benchmark following the occurrence of specified transition events. Such provisions may not be sufficient to trigger a change in the benchmark at all times when LIBOR is no longer representative of market interest rates, or that these events will align with similar events in the market generally or in other parts of the financial markets, such as the derivatives market.

Alternative reference rates are calculated using components different from those used in the calculation of LIBOR and may fluctuate differently than, and not be representative of, LIBOR. In order to compensate for these differences, certain of our financial instruments and commercial agreements allow for a benchmark replacement adjustment. However, there is no assurance that any benchmark replacement adjustment will be sufficient to produce the economic equivalent of LIBOR, either at the benchmark replacement date or over the life of such instruments and agreements.

Arrow established a committee in 2020 comprised of Bank Management to prepare for the discontinuance of LIBOR. Arrow has determined that the financial products tied to LIBOR will not be subject to cessation until June 30, 2023. This review also identified that only a few legacy contracts do not include appropriate fallback language. Arrow anticipates that the appropriate fallback provisions for these contracts will be implemented and allow for an orderly transition prior to the June 30, 2023 cessation of U.S. Dollar LIBOR (additional information regarding the replacement of LIBOR for "tough legacy" contracts can be found in the Reference Rate Reform section). As of December 31, 2021, Arrow no longer issues new LIBOR-based financial instruments. Furthermore, U.S. Dollar LIBOR indices utilized by Arrow's existing financial instruments shall cease on June 30, 2023.

14

Beginning January 1, 2022, Arrow is using the CME Term Secured Overnight Financing Rate (SOFR) as the primary index for financial instruments.