| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Notice of Annual Meeting of Stockholders

| Date: Wednesday, May 8, 2024

Time: 10:00 a.m. Central Daylight Time / 11:00 a.m. Eastern Daylight Time

Virtual Location: http://www.virtualshareholdermeeting.com/MUR2024 | ||||

The 2024 Annual Meeting of Stockholders of Murphy Oil Corporation, a Delaware corporation, will be held on Wednesday, May 8, 2024, at 10:00 a.m. CDT, in a virtual-only format via live webcast at http://www.virtualshareholdermeeting.com/MUR2024. The Proxy Statement is first sent to stockholders on or about March 21, 2024.

Matters to be voted on:

| 1 | Election of Directors; |

| 2 | Advisory vote to approve executive compensation; |

| 3 | Approval of the action of the Audit Committee of the Board of Directors in appointing KPMG LLP as the Company’s independent registered public accounting firm for 2024; and |

| 4 | Such other business as may properly come before the meeting. |

Record date:

Only stockholders of record at the close of business on March 11, 2024, the record date fixed by the Board of Directors of the Company, will be entitled to notice of and to vote at the meeting or any postponement or adjournment thereof. A list of all stockholders entitled to vote will be on file at the office of the Company, 9805 Katy Freeway, G-200, Houston, Texas 77024, at least ten days before the meeting.

Your vote is very important to us and to our business:

Prior to the meeting, you may submit your vote and proxy by telephone, mobile device, the internet, or, if you received your materials by mail, you can sign and return your proxy card. Instructions on how to vote can be found on page 50.

E. Ted Botner

Executive Vice President, General Counsel and Corporate Secretary

Murphy Oil Corporation

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD MAY 8, 2024:

We have elected to take advantage of the U.S. Securities and Exchange Commission (the “SEC”) rules that allow us to furnish proxy materials to the Company’s stockholders via the internet. These rules allow us to provide information that the Company’s stockholders need while lowering the costs and accelerating the speed of delivery and reducing the environmental impact of the Annual Meeting. This Proxy Statement, along with the Company’s Annual Report to Stockholders, which includes the Company’s Form 10-K report for the year ended December 31, 2023, are available via the internet at www.proxydocs.com/MUR.

2024 PROXY STATEMENT i

Murphy Oil at a Glance

Our Social and Environmental Sustainability

|

Our People |

Competitive compensation and benefits along with an inclusive work environment help us to attract and retain talented people, the real strength of our Company.

A summary of employee benefits, which may vary by country, is listed below:

| · | Medical, dental, and vision care coverage |

| · | Birth/Adoption leave for mothers and fathers |

| · | Expanded mental health network of providers and coverage for behavioral health |

| · | Health Savings/Flexible Spending Accounts |

| · | 401(k) Savings Plan with Company match |

| · | Defined-Benefit Pension Plan for all eligible employees |

| · | Life and AD&D Insurance Benefits |

| · | Employee Assistance Program |

| · | Employee Educational Assistance |

| · | Employee Gift Matching (as outlined in the Compensation Discussion and Analysis) |

Each year we review our benefits package and enhance it, when appropriate. For example, in 2023, we added more fund choices to the 401(k) Savings Plan, along with providing numerous financial wellness education sessions. We have been recognized by the Greater Houston Partnership as a “Best Place for Working Parents” from 2022 to 2024, and named one of “America’s Most Responsible Companies 2024” by Newsweek.

We continue to build upon our diversity, equity and inclusion efforts focusing on (i) building strategic recruiting relationships, (ii) training and development opportunities, (iii) exploring partnerships with minority and women-owned businesses, (iv) employee engagement, and (v) participation in events hosted by external organizations. We have expanded our diversity disclosures in our Sustainability Report and have published our annual Equal Employment Opportunity (EEO-1) filings on our website.

|

Climate Change |

We understand that our industry, and the use of our products, create emissions – which raise climate change concerns. At the same time, access to affordable, reliable, secure energy is essential to improving the world’s quality of life and the functioning of the global economy. We believe that as the energy economy transitions under the Paris Agreement, oil and natural gas will continue to play a vital role in the long-term energy mix.

We are committed to reducing our greenhouse gas (GHG) emissions and focused on understanding and mitigating climate change risks. The Board of Directors actively oversees climate-related risks and opportunities, as well as the executive team in its assessment, agenda-setting and strategic initiatives. Established processes for performance and risk assessments are in place and are informed by experts from within and outside the organization, as well as by the executive team.

We are committed to communicating with transparency and reporting annually in our Sustainability Report in line with the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD) guidelines.

In 2023, the Company continued to make significant strides in our sustainability efforts:

| · | We achieved our lowest GHG emissions intensity since becoming an independent exploration and production company in 2013, and are on track to achieve 15-20% reduction by 2030 (from 2019 baseline) |

| · | We are on track to achieve zero routine flaring by 2030 |

| · | We achieved our lowest methane emissions intensity |

| · | We continued to secure third-party assurance of our Scope 1 and 2 GHG emissions, and to report our estimated Scope 3, Category 11 – Use of Sold Products emissions |

| · | We continued to publish our TCFD climate-related scenario analysis, including a net zero emissions by 2050 scenario |

| · | We achieved our second highest water recycling ratio in Company history |

Note: Unless otherwise specified, the information provided is at the total enterprise level, for assets under our operational control and for calendar year 2023

ii MURPHY OIL CORPORATION

|

Health, Safety & Environment |

Charles H. Murphy, Jr. was a forerunner in the environmental awareness movement. His efforts helped lead to new standards and practices for the oil and natural gas industry and we strive to do the same today.

| · | We established a Health, Safety and Environmental Committee of the Board of Directors in 1993 |

| · | Our worldwide Health, Safety and Environment Management System applies to every Murphy employee, contractor and partner |

| · | Safety metrics, including both employees and contractors, have been included in annual incentive plan performance metrics since 2008 |

| · | Environmental metrics have been included in annual incentive plan performance metrics since 2016 |

| · | We are a founding member of the API Environmental Partnership, launched in 2017, which is focused on reducing methane emissions |

| · | We strive to achieve top-quartile safety performance as measured against our peers. In 2023, we had zero work-related fatalities |

We monitor environmental performance and strive for continual improvement:

| · | Continuing to de-risk our assets through implementation of our detailed Asset Integrity Management Programs |

| · | Continuing to eliminate natural gas pneumatic instruments |

| · | Upgrading central processing facilities to add electric motor driven tank Vapor Recovery Units (VRUs) to eliminate continuous tank flaring |

| · | Adding natural gas pipeline infrastructure to legacy and future Murphy onshore developments to eliminate flaring and venting |

| · | Continuing to internally report GHG and methane emissions performance metrics monthly to increase visibility to operations and management |

|

Our Communities |

Working with Communities

| · | We communicate with community stakeholders to understand issues applicable to our operations and to mitigate potential risks |

| · | Opportunities to support local communities through: |

| - | Prioritization of local suppliers |

| - | Threshold investment targets for local content |

| - | Specifications for local companies or workers |

| - | Commitments to social investment programs |

| · | We actively seek to understand and respond to community feedback, concerns or grievances |

Committed to the Dignity and Rights of All People

| · | We have enacted a Human Rights Policy, Indigenous Rights Policy and Supplier Code of Conduct |

Investing in Our Communities

| · | Long time commitment with the El Dorado Promise Scholarship Program – through a $50 million commitment from the Company, more than 3,500 El Dorado, Arkansas students have received scholarships to 181 colleges and universities in 40 states |

| · | Numerous corporate citizenship programs, with Murphy employees enthusiastically volunteering their time and generously donating to their communities. In 2023, our employees’ exceptional voluntary contributions were honored with the United States President’s Volunteer Service Award by the Houston Food Bank for the second consecutive year. Additionally, the Spring Branch Independent School District in Houston recognized our commitment with their esteemed Good Neighbor Award |

| · | Also, in 2023, Murphy donated approximately $200,000 through its gift matching program for employees and non-employee directors. Over the last 20 years, Murphy and its employees contributed more than $15 million to benefit the United Way organization |

2024 PROXY STATEMENT iii

Murphy Oil at a Glance

Our 2023 Financial and Operational Highlights

Murphy closed another year of strong production and excellent execution in 2023 with the priorities of Delever, Execute, Explore, Return remaining at the forefront. By achieving our $500 million debt reduction goal for the year, we have fortified our balance sheet by reducing total debt by $1.7 billion since 2020. This has provided further strength to our longstanding quarterly dividend, which was increased in early 2024 to the 2016 level of $1.20 per share annualized, as well as initiating share repurchases in 2023 with $150 million, or 3.4 million, shares repurchased.

This debt reduction was accomplished through the successful execution of Murphy’s onshore well delivery program during the year, as well as steady operational achievements of above-forecast production offshore. Also in 2023, we extended our portfolio longevity with the sanctioning of the Lac Da Vang field development project in Vietnam. As a result of the team’s efforts, Murphy achieved total reserve replacement of 139% for the year.

Reviewing our exploration portfolio, Murphy was awarded five exploration blocks in the March 2023 Gulf of Mexico federal lease sale and named apparent high bidder on eight exploration blocks in the December 2023 federal lease sale. The Company also acquired working interests in the non-operated Zephyrus discovery in the Gulf of Mexico, as well as signed production sharing contracts on five exploration blocks in Côte d’Ivoire, including one block that holds a previous operator’s discovery. Murphy’s plans in 2024 include drilling exploration wells in the Gulf of Mexico and Vietnam, as well as advancing seismic reprocessing projects in the Gulf of Mexico and Côte d’Ivoire.

With our 2024 debt reduction goal of $300 million, we are on track to reach Murphy 3.0 of the capital allocation framework by year-end, with up to 50% of adjusted free cash flow1 allocated to the balance sheet and the remaining 50% of adjusted free cash flow1 allocated to shareholder returns. Shareholder returns remain at the forefront, and ongoing debt reduction has substantially improved the Company’s resiliency in this cyclical commodity business. Pairing balance sheet strength and operational excellence with a strong safety culture and an ongoing focus on protecting the environment, Murphy is positioned for long-term stability and success.

Highlights for 2023:

Delever

| · | Utilized proceeds from non-core divestiture to progress capital allocation framework |

| · | Achieved $500 MM debt reduction goal through senior notes redemption and partial tender |

| · | Advanced Murphy 2.0 of capital allocation framework with $1.7 BN of total debt reduction since year-end 2020 |

Execute

| · | Produced 186 MBOEPD with 98 MBOPD, or 52 percent, oil volumes |

| · | Initiated procurement for Lac Da Vang field development project in Vietnam with first oil forecast in 2026 |

| · | Acquired 8 percent working interest in the non-operated Zephyrus discovery in the Gulf of Mexico for $13 MM after closing adjustments |

| · | Achieved 139% total reserve replacement with 724 MMBOE proved reserves and ~11-year reserve life |

Explore

| · | Initiated new exploration focus area in Côte d’Ivoire |

| · | Drilled a discovery at operated Longclaw #1 exploration well in Gulf of Mexico |

| · | Awarded five exploration blocks in Gulf of Mexico Federal Lease Sale 259 and named apparent high bidder on eight exploration blocks in Gulf of Mexico Federal Lease Sale 261 |

Return

| · | Progressed Murphy 2.0 of capital allocation framework, with 75% of adjusted FCF1 allocated to debt reduction and 25% allocated to shareholder returns |

| · | Repurchased $150 MM, or 3.4 MM shares, at an average price of $43.96 / share in FY 2023 |

| 1 | Adjusted free cash flow is calculated as net cash provided by continuing operations activities before noncash working capital changes, less property additions and dry hole costs, acquisition of oil and natural gas properties, cash dividends paid, distributions to noncontrolling interest and other contractual payments |

iv MURPHY OIL CORPORATION

Financial

| $1.7 BN Approximate net cash provided by continuing operations activities (including noncontrolling interest)

$782 MM of free cash flow2,3, with the majority used to repay long-term debt, fund accretive acquisitions, increase longstanding dividend and repurchase shares

|

Operations

| 186,000 barrels of oil equivalent per day produced with ~98 thousand barrels of oil per day

724 MM barrels of oil equivalent of proved reserves, with 139% total reserve replacement and a reserve life index of approximately 11 years

|

Onshore

Eagle Ford Shale

Eagle Ford Shale

| · | Continued realizing strong performance with wells producing at or above forecast |

Tupper Montney

Tupper Montney

| · | Continued realizing strong well performance with modifications to flowback, facility and wellhead equipment, and procedures |

| · | Achieved some of highest 30-day initial production (IP30) rates in Company history |

Exploration

Côte d’Ivoire

Côte d’Ivoire

| · | Signed production sharing contracts for five exploration blocks |

| · | Includes undeveloped Paon discovery |

Offshore

U.S. Gulf of Mexico

U.S. Gulf of Mexico

| · | Maintained high uptime across operated assets with safe operations and strong environmental performance |

Offshore Canada

Offshore Canada

| · | Completed the non-operated Terra Nova floating production storage and offloading vessel (FPSO) asset life extension project, with wells returning to production in late 2023 |

Vietnam

Vietnam

| · | Sanctioned the Lac Da Vang field development project, with first oil forecast in 2026 |

| 2 | Free cash flow is calculated as net cash provided by continuing operations activities (including noncontrolling interest) and before noncash working capital changes, less property additions and dry hole costs |

| 3 | See Annex for reconciliations of non-GAAP financial measures to their most closely comparable GAAP metric |

2024 PROXY STATEMENT v

Murphy Oil at a Glance

Note: Unless otherwise noted, the financial and operating highlights and metrics discussed above exclude noncontrolling interest, thereby representing only the amounts attributable to Murphy

Forward-Looking Statements and Risks

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identified through the inclusion of words such as “aim,” “anticipate,” “believe,” “drive,” “estimate,” “expect,” “expressed confidence,” “forecast,” “future,” “goal,” “guidance,” “intend,” “may,” “objective,” “outlook,” “plan,” “position,” “potential,” “project,” “seek,” “should,” “strategy,” “target,” “will” or variations of such words and other similar expressions. These statements, which express management’s current views concerning future events, results and plans, are subject to inherent risks, uncertainties and assumptions (many of which are beyond our control) and are not guarantees of performance. In particular, statements, express or implied, concerning the Company’s future operating results or activities and returns or the Company’s ability and decisions to replace or increase reserves, increase production, generate returns and rates of return, replace or increase drilling locations, reduce or otherwise control operating costs and expenditures, generate cash flows, pay down or refinance indebtedness, achieve, reach or otherwise meet initiatives, plans, goals, ambitions or targets with respect to emissions, safety matters or other ESG (environmental/social/governance) matters, make capital expenditures or pay and/or increase dividends or make share repurchases and other capital allocation decisions are forward-looking statements. Factors that could cause one or more of these future events, results or plans not to occur as implied by any forward-looking statement, which consequently could cause actual results or activities to differ materially from the expectations expressed or implied by such forward-looking statements, include, but are not limited to: macro conditions in the oil and gas industry, including supply/demand levels, actions taken by major oil exporters and the resulting impacts on commodity prices; geopolitical concerns; increased volatility or deterioration in the success rate of our exploration programs or in our ability to maintain production rates and replace reserves; reduced customer demand for our products due to environmental, regulatory, technological or other reasons; adverse foreign exchange movements; political and regulatory instability in the markets where we do business; the impact on our operations or market of health pandemics such as COVID-19 and related government responses; other natural hazards impacting our operations or markets; any other deterioration in our business, markets or prospects; any failure to obtain necessary regulatory approvals; any inability to service or refinance our outstanding debt or to access debt markets at acceptable prices; or adverse developments in the U.S. or global capital markets, credit markets, banking system or economies in general, including inflation. For further discussion of factors that could cause one or more of these future events or results not to occur as implied by any forward-looking statement, see Item 1A. Risk Factors in our most recent Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (“SEC”) and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K that we file, available from the SEC’s website and from Murphy Oil Corporation’s website at http://ir.murphyoilcorp.com. Investors and others should note that we may announce material information using SEC filings, press releases, public conference calls, webcasts and the investors page of our website. We may use these channels to distribute material information about the Company; therefore, we encourage investors, the media, business partners and others interested in the Company to review the information we post on our website. The information on our website is not part of, and is not incorporated into, this report. Murphy Oil Corporation undertakes no duty to publicly update or revise any forward-looking statements.

vi MURPHY OIL CORPORATION

Table of Contents

| 1 | ||||

| 2 | ||||

| 7 | ||||

| 10 | ||||

| 13 | ||||

| 15 | ||||

| 16 | ||||

| 18 | ||||

| 19 | ||||

| 22 | ||||

| 29 | ||||

| 30 | ||||

| Compensation Committee Report | 31 | |||

| Executive Compensation | 32 | |||

| Our Stockholders | 41 | |||

| 44 | ||||

| Approval of Appointment of Independent Registered Public Accounting Firm |

45 | |||

| 47 | ||||

| 48 | ||||

| 51 | ||||

The solicitation of the enclosed proxy is made on behalf of the Board of Directors of Murphy Oil Corporation (the “Board”) for use at the Annual Meeting of Stockholders to be held on May 8, 2024. It is expected that this Proxy Statement and related materials will first be provided to stockholders on or about March 21, 2024. The complete mailing address of the Company’s principal executive office is 9805 Katy Freeway, G-200, Houston, Texas 77024. References in this Proxy Statement to “we,” “us,” “our,” “the Company”, “Murphy Oil” and “Murphy” refer to Murphy Oil Corporation and its consolidated subsidiaries.

2024 PROXY STATEMENT vii

2024 PROXY STATEMENT 1

Who We Are

|

CLAIBORNE P. DEMING El Dorado, Arkansas Age: 69 Director Since: 1993

|

Board Committees

· Chair of the Board

Other Public Company Directorships

· Murphy USA Inc., El Dorado, Arkansas

Principal occupation or employment

· President and Chief Executive Officer of the Company from October 1994 through December 2008, retired from the Company June 2009 |

Mr. Deming brings to the Board over four decades of experience in the oil and gas industry. He previously served as President and CEO of Murphy and has served on the Boards of two other public companies and one private company in the energy sector. In addition, Mr. Deming has been an advisor to both private firms and government entities in the energy field including serving as Chairman of the National Petroleum Council which provides policy recommendations to the Secretary of Energy. His deep understanding of the energy sector enhances the Board’s collective knowledge of this industry. |

||||||||||||||

|

LAWRENCE R. DICKERSON Houston, TX Age: 71 Director Since: 2014

|

Board Committees

· Audit (Chair)

· Nominating and Governance

Other Public Company Directorships

· Oil States International, Inc., Houston, Texas

· Great Lakes Dredge & Dock Corporation, Chair, Oak Brook, Illinois

Principal occupation or employment

· President and Chief Executive Officer, Diamond Offshore Drilling, Inc., an offshore drilling company, from May 2008 through March 2014, retired March 2014 |

Mr. Dickerson’s experience at Diamond Offshore Drilling, Inc. as President and director from March 1998; as Chief Executive Officer from May 2008 until his retirement in March 2014; and as Chief Financial Officer from 1989 to 1998, brings to the Board broad experience in leadership and financial matters. Among other qualifications, he brings to the Board expertise in international drilling operations. |

||||||||||||||

2 MURPHY OIL CORPORATION

|

MICHELLE A. EARLEY Austin, Texas Age: 52 Director Since: 2021

|

Board Committees

· Finance

· Health, Safety, Environment and Corporate Responsibility

Other Public Company Directorships

· Adams Resources & Energy, Inc., Houston, Texas

Principal occupation or employment

· Partner, O’Melveny & Meyers LLP, an international law firm, since April 2022

· Partner, Locke Lord LLP, from 2008 to April 2022 |

Ms. Earley is currently a Partner at the law firm of O’Melveny & Meyers LLP, having joined the firm in April 2022. Ms. Earley was previously with the law firm of Locke Lord LLP, where she joined in 1998 and served as a Partner from 2008 until 2022. Ms. Earley has extensive experience in mergers and acquisitions, as well as securities regulation and offering matters and routinely advises boards of directors on corporate governance topics. She brings to the Board expertise in legal matters and corporate governance. She holds a bachelor’s degree from Texas A&M University and a law degree from Yale University. |

||||||||||||||

|

ROGER W. JENKINS Houston, Texas Age: 62 Director Since: 2013

|

Board Committees

· None

Other Public Company Directorships

· Noble Corporation plc, London, United Kingdom, until February 2021

Principal occupation or employment

· Chief Executive Officer of the Company from August 2013; President of the Company from August 2013 through January 2024; President of Murphy Exploration & Production Company since June 2012 |

Mr. Jenkins’ leadership as Chief Executive Officer of Murphy Oil Corporation allows him to provide the Board with his detailed perspective of the Company’s global operations. With a bachelor’s degree in Petroleum Engineering, a master’s degree in Business Administration and approximately 41 years of industry experience, he has played a critical leadership role in Murphy’s worldwide exploration and production operations, including the development of the Kikeh field in Malaysia and the Eagle Ford Shale in Texas. |

||||||||||||||

2024 PROXY STATEMENT 3

Who We Are

|

ELISABETH W. KELLER Cambridge, Massachusetts Age: 66 Director Since: 2016

|

Board Committees

· Audit

· Health, Safety, Environment and Corporate Responsibility (Chair)

· Nominating and Governance

Other Public Company Directorships

· None

Principal occupation or employment

· President, Inglewood Plantation, LLC, from 2014 to 2022, retired December 2022 |

Ms. Keller served as the President of Inglewood Plantation, LLC and was responsible for the development of strategic vision and oversight of operations for the largest organic farm in Louisiana. She brings to the Board extensive knowledge in health and environmental issues, both domestically and internationally. |

||||||||||||||

|

JAMES V. KELLEY Little Rock, Arkansas Age: 74 Director Since: 2006

|

Board Committees

· Audit

· Nominating and Governance (Chair)

Other Public Company Directorships

· None

Principal occupation or employment

· Retired, President and Chief Operating Officer, BancorpSouth, Inc., a NYSE bank holding company, since August 2014 |

Mr. Kelley has extensive knowledge of capital markets and accounting issues. As former President and Chief Operating Officer of BancorpSouth, Inc., he understands the fundamentals and responsibilities of operating a large company. Among other qualifications, Mr. Kelley brings to the Board experience in banking, finance and accounting, as well as executive management. |

||||||||||||||

4 MURPHY OIL CORPORATION

|

R. MADISON MURPHY El Dorado, Arkansas Age: 66 Director Since: 1993 (Chair, 1994-2002)

|

Board Committees

· Finance (Chair)

· Health, Safety, Environment and Corporate Responsibility

Other Public Company Directorships

· Murphy USA Inc. (Chair), El Dorado, Arkansas

Principal occupation or employment

· President, The Murphy Foundation

· Owner, The Sumac Company, LLC

· Owner, Arc Vineyards

· Owner, Presqu’ile Winery |

Mr. Murphy served at Murphy Oil Corporation in several capacities from 1980 including as Vice President of Planning and Treasurer from 1988-1990; Chief Financial and Administrative Officer from 1990-1994; and Chair of the Board from 1994 to 2002. This background, along with his current membership on the Board of Directors of Murphy Oil and Chairmanship of Murphy USA, together with his past membership on the Board of Directors of BancorpSouth, Inc. (a NYSE bank holding company), and Deltic Timber Corporation, brings to the Board invaluable corporate leadership and financial expertise. |

||||||||||||||

|

JEFFREY W. NOLAN Little Rock, Arkansas Age: 55 Director Since: 2012

|

Board Committees

· Compensation

· Finance

· Nominating and Governance

Other Public Company Directorships

· None

Principal occupation or employment

· President and Chief Executive Officer, Loutre Land and Timber Company, a natural resources company with a focus on the acquisition, ownership and management of timberland and mineral properties, from 1998 until 2021, retired December 2021

· Chair of the Board of Directors, First Financial Bank, headquartered in EI Dorado, Arkansas, since 2015 |

Mr. Nolan’s experience as President and Chief Executive Officer of a natural resources company, in addition to his former legal practice focused on business and corporate transactions, allows him to bring to the Board expertise in legal matters, corporate governance, corporate finance, acquisitions and divestitures and the management of mineral properties. |

||||||||||||||

2024 PROXY STATEMENT 5

Who We Are

|

Robert N. Ryan, Jr. Houston, Texas Age: 67 Director Since: 2019

|

Board Committees

· Audit

· Compensation

· Health, Safety, Environment and Corporate Responsibility

Other Public Company Directorships

· None

Principal occupation or employment

· Retired, Vice President, Chevron Corporation, an integrated energy company, since 2018 |

Mr. Ryan has 43 years of experience in the energy industry including 15 years as Vice President - Global Exploration for Chevron from 2003 until his retirement in 2018. He brings to the Board extensive experience in worldwide exploration and portfolio management, and a broad knowledge of oil and natural gas operations and energy policy. His experience includes a position in the Office of Energy Efficiency and Renewable Energy at the U.S. Department of Energy. He holds degrees in geology. |

||||||||||||||

|

LAURA A. SUGG Montgomery, Texas Age: 63 Director Since: 2015

|

Board Committees

· Compensation (Chair)

· Finance

Other Public Company Directorships

· Kinetik Holdings Inc., Houston, Texas

· Public Service Enterprise Group Inc., Newark, New Jersey

· Denbury Resources, Plano, Texas, until 2019

Principal occupation or employment

· Retired, Senior Executive, ConocoPhillips, then an international, integrated energy company, since 2010 |

Ms. Sugg’s broad background in capital allocation and accomplishments in the energy industry allow her to bring to the Board expertise in industry, operational and technical matters. Among other qualifications, she brings to the Board specific experience in executive leadership, human resources, compensation and financial matters. As a former leader at ConocoPhillips, Ms. Sugg has a proficient understanding of an oil and natural gas company’s challenges and opportunities. |

||||||||||||||

6 MURPHY OIL CORPORATION

How We Are Selected, Comprised and Evaluated

Diversity

The Board believes it is important for directors to possess a diverse array of attributes, backgrounds, perspectives, skills, and achievements. When considering new candidates, the Nominating and Governance Committee, with input from the Board, adopts criteria for Board membership which encourages a diversity of race, ethnicity, gender and national origin and takes into account other important characteristics, such as sound judgment, professional ethics, practical wisdom and integrity. The Nominating and Governance Committee, when searching for nominees for directors, includes diverse candidates in the pool of nominees and any search firm engaged by the Committee is affirmatively instructed to seek diverse candidates. In addition, as stated in the Company’s Corporate Governance Guidelines, “the Company endeavors to have a board representing diverse experience at the policy-making levels in business areas that are relevant to the Company’s global activities”. The goal is to assemble and maintain a Board comprised of individuals that not only bring to bear a wealth of business and/or technical expertise, but that also demonstrate a commitment to ethics in carrying out the Board’s responsibilities with respect to oversight of the Company’s operations.

The matrix below outlines the diverse set of skills and expertise represented on the Company’s Board:

| SKILLS AND EXPERTISE | ||||||||||||||||||||||

| EXPERIENCE |

|

|

|

|

|

|

|

|

|

| ||||||||||||

|

|

Former CEO |

● | ● | ● | ● | ● | ||||||||||||||||

|

|

Senior Management/Corporate Culture |

● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||

|

|

Accounting/Audit |

● | ● | ● | ● | ● | ● | ● | ||||||||||||||

|

|

Finance/Banking |

● | ● | ● | ● | ● | ||||||||||||||||

|

|

Corporate Governance |

● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||

|

|

Law |

● | ● | ● | ||||||||||||||||||

|

|

Government Relations/Public Policy |

● | ● | ● | ● | ● | ● | ● | ||||||||||||||

|

|

Industry |

● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||

|

|

Operations |

● | ● | ● | ● | ● | ||||||||||||||||

|

|

Environment, Health & Safety |

● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||

|

|

Business Development & Corporate Strategy |

● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||

|

|

Human Capital/Compensation |

● | ● | ● | ● | ● | ● | ● | ||||||||||||||

|

|

Board of Directors |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||

|

|

Risk Management |

● | ● | ● | ● | ● | ||||||||||||||||

|

|

International Business |

● | ● | ● | ● | ● | ● | |||||||||||||||

|

|

Climate |

● | ● | ● | ||||||||||||||||||

|

|

Cybersecurity |

● | ● | |||||||||||||||||||

2024 PROXY STATEMENT 7

| DEMOGRAPHICS | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||

| RACE/ETHNICITY |

||||||||||||||||||||||

| African American |

● | |||||||||||||||||||||

| Asian/Pacific Islander |

||||||||||||||||||||||

| White/Caucasian |

● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||

| Hispanic/Latino |

||||||||||||||||||||||

| Native American |

||||||||||||||||||||||

| GENDER |

||||||||||||||||||||||

| Male |

● | ● | ● | ● | ● | ● | ● | |||||||||||||||

| Female |

● | ● | ● | |||||||||||||||||||

| BOARD TENURE |

||||||||||||||||||||||

| Years |

30 | 9 | 3 | 7 | 17 | 30 | 11 | 4 | 8 | 10 | ||||||||||||

| Age |

69 | 71 | 52 | 66 | 74 | 66 | 55 | 67 | 63 | 62 | ||||||||||||

|

|

|

8 MURPHY OIL CORPORATION

Majority Voting

The Company’s belief in directors’ accountability is evident in the provision in our Corporate Governance Guidelines providing that an incumbent director who fails to receive a majority of votes cast for re-election shall tender a resignation to the Board. To the extent authorized by the proxies, the shares represented by the proxies will be voted in favor of the election of the ten nominees for director whose names are set forth herein. If for any reason any of these nominees is not a candidate when the election occurs, the shares represented by such proxies will be voted for the election of the other nominees named and may be voted for any substituted nominees or the Board may reduce its size. However, the Company does not expect this to occur. All nominees were elected at the last Annual Meeting of Stockholders.

Director and Nominee Independence

The Company’s belief in the importance of directors’ independence is reflected by the fact that all directors, other than Mr. Roger Jenkins, have been deemed independent by the Board based on the rules of the New York Stock Exchange (“NYSE”) and the standards of independence included in the Company’s Corporate Governance Guidelines. As part of its independence recommendation to the Board, the Nominating and Governance Committee at its February meeting considered familial relationships (Mr. Deming, Mr. Murphy and Ms. Keller are first cousins).

Mr. Deming, the independent Chair of the Board, serves as presiding director at regularly scheduled board meetings as well as at no less than three meetings solely for non-employee directors. The meetings for non-employee directors are held in conjunction with the regularly scheduled February, August and December board meetings. If the Company had a non-employee director that was not independent, at least one of these meetings would include only independent non-employee directors.

COMPOSITION OF THE BOARD

2024 PROXY STATEMENT 9

How We Are Organized and Operate

Board Leadership Structure/Separate Chair and CEO Positions

The positions of Chair of the Board and the Chief Executive Officer of the Company are held by two individuals. Mr. Deming serves as the Chair of the Board as an independent director. Mr. Jenkins is the Company’s Chief Executive Officer. Along with the Chair of the Board of Directors and the Chief Executive Officer, other directors bring different perspectives and roles to the Company’s management, oversight, and strategic development. The Company’s directors bring experience and expertise from both inside and outside the Company and industry, while the Chief Executive Officer is most familiar with the Company’s business and most capable of leading the execution of the Company’s strategy. The Board believes that separating the roles of Chair and Chief Executive Officer is currently in the best interest of stockholders because it provides the appropriate balance between strategy development and independent oversight of management. The Board does not believe that its role in risk oversight has been affected by the Board’s leadership structure.

Risk Management

The Board exercises risk management oversight and control both directly and indirectly, the latter through various Board Committees. The Board regularly reviews information regarding the Company’s credit, liquidity, and operations, including the related risks. Further, the Company provides continuing education to our Board on topics that assist in the execution of their duties, including ESG matters. The Compensation Committee is responsible for overseeing the management of risks relating to the Company’s executive compensation plans and arrangements and the Company’s key human capital management strategies. The Audit Committee is responsible for oversight of certain risks, including financial, cybersecurity, information security, and the ethical conduct of the Company’s business, including the steps the Company has taken to monitor and mitigate these risks. In addition, the Company maintains property and casualty insurance coverage that may cover damages caused as a result of a cybersecurity event. The Finance Committee works in concert with the Audit Committee on certain aspects of risk management, including hedging and foreign exchange exposure. The Nominating and Governance Committee, in its role of assessing the overall corporate governance structure of the Company and reviewing and maintaining the Company’s corporate governance guidelines, manages risks associated with the independence of the Board and potential conflicts of

interest. The Health, Safety, Environment and Corporate Responsibility Committee oversees management of risks associated with environmental, health and safety issues. While each Committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports and by management about the known risks to the strategy and the business of the Company.

For more information on Board and Managerial oversight of ESG-focused responsibilities, see section titled “Board and Managerial Oversight of ESG Topics” in our 2023 Sustainability Report at www.murphyoilcorp.com/sustainability-report.

Committees

The standing Committees of the Board are the Audit Committee, the Compensation Committee, the Finance Committee, the Health, Safety, Environment and Corporate Responsibility Committee, and the Nominating and Governance Committee.

The Audit Committee has the sole authority to appoint or replace the Company’s independent registered public accounting firm, which reports directly to the Audit Committee. The Audit Committee also assists the Board with its oversight of the integrity of the Company’s financial statements, the independent registered public accounting firm’s qualifications, independence and performance, the Company’s internal audit function, the compliance by the Company with legal and regulatory requirements, and the review of programs related to risk oversight, including cybersecurity, and compliance with the Company’s Code of Business Conduct and Ethics.

The Audit Committee meets with representatives of the independent registered public accounting firm and with members of the internal audit function for these purposes. In February 2023, the Board designated Mr. Dickerson as its “Audit Committee Financial Expert” as defined in Item 407 of Regulation S-K.

All of the members of the Audit Committee are independent under the rules of the NYSE and the Company’s independence standards.

The Compensation Committee oversees the compensation of the Company’s executives and directors, administers the Company’s annual incentive compensation plan, the long-term incentive plan and the stock plan for non-employee directors, administers the Company’s Compensation

10 MURPHY OIL CORPORATION

Recoupment Policy, and reviews the Company’s key human capital management strategies. The Compensation Discussion and Analysis section contains additional information about the Compensation Committee. In carrying out its duties, the Compensation Committee will have direct access independent compensation consultants to assist them.

All of the members of the Compensation Committee are independent under the rules of the NYSE and the Company’s independence standards.

The Finance Committee assists the Board of Directors on matters relating to the financial strategy, liquidity position and financial policies and activities of the Company. In addition, the Finance Committee reviews and makes recommendations with respect to the Company’s capital structure, major capital projects and any dividend or share repurchase programs. The Finance Committee also works in consultation with the Audit Committee on the Company’s risk management strategy, including hedging and foreign exchange exposure.

The Health, Safety, Environment and Corporate Responsibility Committee assists the Board and management in monitoring compliance with applicable environmental, health and safety laws, rules and regulations as well as the Company’s response to laws and regulations as part of the Company’s business strategy and operations. The Committee assists the Board on matters relating to the Company’s response to evolving public issues affecting the Company in the realm of health, safety, and the environment. Consideration of evolving matters regarding the climate, responsible business conduct, the community, and review of the Company’s sustainability reports and other ESG issues that could affect the Company’s business activities is also within the purview of this Committee. To supplement the expertise of the Committee (as well as the full Board) and assist the Committee in the discharge of its duties, the Company regularly brings in outside subject matter experts and also continuously briefs the Committee on current and developing issues relevant to the Company’s business. The Committee has benefited from the Company’s involvement with groups such as the International Petroleum Industry Environmental Conservation Association (Ipieca) and sponsorship of initiatives like the Massachusetts Institute of Technology’s Joint Program on the Science and Policy of Global Change, which keeps abreast of emerging issues with respect to climate change.

The Nominating and Governance Committee identifies and recommends potential Board members, recommends to the Board the slate of directors nominated for selection at the annual meeting, recommends appointments to Board Committees, oversees evaluation of the Board’s performance, and assesses and makes recommendations concerning the overall corporate governance structure of the Company, including proposed changes to the Corporate Governance Guidelines of the Company. The Committee also oversees the Company’s lobbying activities

and political spending, and reviews current and emerging governance trends, issues and concerns that may affect the Company’s business, operations, performance, or reputation. All of the members of the Nominating and Governance Committee are independent under the rules of the NYSE and the Company’s independence standards.

Information regarding the process for evaluating and selecting potential director candidates, including those recommended by stockholders, is set out in the Committee’s Charter and in the Company’s Corporate Governance Guidelines. Stockholders desiring to recommend Board candidates for consideration by the Nominating and Governance Committee should address their recommendations to: Nominating and Governance Committee of the Board of Directors, c/o Corporate Secretary, Murphy Oil Corporation, 9805 Katy Freeway, G-200, Houston, Texas 77024. As a matter of policy, candidates recommended by stockholders are evaluated on the same basis as candidates recommended by Board members, executive search firms or other sources.

Committee Charters

All Committee Charters, along with the Corporate Governance Guidelines, Code of Business Conduct and Ethics and the Ethical Conduct for Executive Management, are available on the Company’s website: https://ir.murphyoilcorp.com/corporate-governance/governance-documents. The information on the website is not deemed part of this proxy statement and is not incorporated by reference.

Board and Committee Evaluations

Our Board of Directors recognizes that a thorough evaluation process is an important element of corporate governance and enhances our Board’s effectiveness. Therefore, each year, the Chair of the Board and the Chair of each Board Committee request that the directors provide their assessment of the effectiveness of the full Board and each of the committees on which they serve. The Corporate Secretary is instructed by each Chair to manage the distribution and collection of the individual assessment forms which is conducted electronically through a third-party vendor portal. Once each director submits the completed assessment(s) through the portal, the responses are organized and summarized by the Corporate Secretary and provided to each Chair for review and discussion at the next scheduled meeting during executive session.

It should be noted that the Board and each Board Committee reviews the adequacy of its own performance through self-evaluation, but the Nominating and Governance Committee is charged with evaluating the adequacy of the entire process. Thus, each year, the Nominating and Governance Committee reviews and determines if the assessment forms stimulate a thoughtful evaluation about the Board and each Committee’s function and provides a forum for feedback on areas of improvement.

2024 PROXY STATEMENT 11

Meetings and Attendance

During 2023, there were six meetings of the Board, five meetings of the Audit Committee, five meetings of the Compensation Committee, four meetings of the Finance Committee, two meetings of the Nominating and Governance Committee and three meetings of the Health, Safety, Environment and Corporate Responsibility Committee. All nominees’ attendance substantially exceeded 75% of the total number of meetings of the Board and committees on which they served. All the Board members attended the 2023 Annual Meeting of Stockholders. As set forth in the Company’s Corporate Governance Guidelines, all Board members are expected to attend each Annual Meeting of Stockholders.

| The Board and Committees | ||||||||||

| Audit | Compensation | Finance | Health, Safety, Environment and Corporate Responsibility |

Nominating and Governance | ||||||

| Claiborne P. Deming |

||||||||||

| Lawrence R. Dickerson

|

C | M | ||||||||

| Michelle A. Earley |

M | M | ||||||||

| Roger W. Jenkins |

||||||||||

| Elisabeth W. Keller |

M | C | M | |||||||

| James V. Kelley |

M | C | ||||||||

| R. Madison Murphy |

C | M | ||||||||

| Jeffrey W. Nolan |

M | M | M | |||||||

| Robert N. Ryan, Jr. |

M | M | M | |||||||

| Laura A. Sugg |

C | M | ||||||||

C = Chair M = Member

= Audit Committee Financial Expert

= Audit Committee Financial Expert

12 MURPHY OIL CORPORATION

How We Are Compensated

The Company’s standard arrangement for the compensation of non-employee directors divides remuneration into cash and equity components. This approach aligns the interests of directors and the stockholders they represent. The Company further targets total director compensation at a level near the 50th percentile of the competitive market (as determined by our Compensation Committee (the “Committee”) together with its independent compensation consultant, Meridian Compensation Partners LLC (“Meridian”), enhancing the Company’s ability to retain and recruit qualified individuals.

Directors can elect to defer their cash compensation into the Company’s Non-Qualified Deferred Compensation Plan for Non-Employee Directors (“NED DCP Plan”). Deferred amounts are deemed to be notionally invested through a fund in the Company’s stock. The “Fees Earned or Paid in Cash” column in the 2023 Director Compensation Table on the next page includes any amounts that were voluntarily deferred into the NED DCP Plan. In addition, beginning with cash compensation to be paid in 2024, Directors can elect to receive their cash compensation in the form of deferred restricted stock units, which settle either on (1) termination of service from the Board or (2) a future date selected by the director at the time of their deferral election.

For 2023, the cash component consisted of an annual retainer of $85,000. Supplemental retainers were paid to the Chair of the Board ($140,000), Audit Committee Chair ($20,000), the Audit Committee Financial Expert ($7,000), other members of the Audit Committee ($5,000), Finance Committee Chair ($20,000), other members of the Finance Committee ($5,000), and the Chair of each other committee ($15,000). Further, in early 2023, the Board established an ad hoc committee to assist the Board in its review of key

strategic topics, including the Company’s capital structure, competitor analysis, and energy strategy. The committee met three times in 2023. The Chair of the committee, Mr. Ryan, was awarded a supplemental retainer of $15,000 for his service during this period. The Company also reimburses directors for reasonable travel, lodging and related expenses they incur in attending Board and committee meetings. Also, in 2023, the total equity compensation for non-employee directors was maintained at a grant date fair value of $200,000 to keep the total director compensation near the 50th percentile of the Company’s peer group, enhancing the Company’s ability to retain and recruit qualified individuals. Each non-employee director received 4,740 time-based restricted stock units on February 2, 2023, which cliff vest after one year.

Pursuant to the 2021 Stock Plan for Non-Employee Directors and the applicable award agreements thereunder, directors can elect to defer settlement of their restricted stock units. In 2023, Mr. Dickerson, Ms. Earley, Mr. Nolan and Ms. Sugg elected to defer settlement of their restricted stock units to either (1) termination of service from the Board or (2) on a future date selected by the director at the time of their deferral election.

The non-employee directors are eligible to participate in the matching charitable gift program on the same terms as U.S.-based Murphy employees. Under this program, an eligible person’s total charitable gifts of up to $7,500 per calendar year will qualify. The Company will contribute to qualified educational institutions and hospitals an amount equal to twice the amount (2 to 1) contributed by the eligible person. The Company will match contributions to qualified welfare and cultural organizations an amount equal to (1 to 1) the contribution made by the eligible person. Those amounts are in the column below showing “All Other Compensation”.

2024 PROXY STATEMENT 13

| 2023 Director Compensation Table | ||||||||||||||||||||||||||||

| Fees Earned or Paid in Cash ($) |

Stock Awards1,2 ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings3 ($) |

All Other Compensation4 ($) |

Total ($) |

||||||||||||||||||||||

| Claiborne P. Deming |

225,011 | 5 | 200,028 | — | — | — | — | 425,039 | ||||||||||||||||||||

| Lawrence R. Dickerson |

117,000 | 200,028 | — | — | — | — | 317,028 | |||||||||||||||||||||

| Michelle A. Earley |

90,000 | 200,028 | — | — | — | 515 | 290,543 | |||||||||||||||||||||

| Elisabeth W. Keller |

105,011 | 200,028 | — | — | — | 1,000 | 306,039 | |||||||||||||||||||||

| James V. Kelley |

105,011 | 200,028 | — | — | — | — | 305,039 | |||||||||||||||||||||

| R. Madison Murphy |

110,011 | 200,028 | — | — | 15,353 | 15,000 | 340,392 | |||||||||||||||||||||

| Jeffrey W. Nolan |

90,000 | 200,028 | — | — | — | — | 290,028 | |||||||||||||||||||||

| Robert N. Ryan, Jr. |

105,011 | 200,028 | — | — | — | 15,000 | 320,039 | |||||||||||||||||||||

| Laura A. Sugg |

105,000 | 200,028 | — | — | — | 10,000 | 315,028 | |||||||||||||||||||||

| 1 | Represents grant date fair value of time-based restricted stock units awarded in 2023 as computed in accordance with FASB ASC Topic 718, excluding forfeiture estimates, as more fully described in Note J to the consolidated financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. |

| 2 | Each non-employee director receives the same number of time-based restricted stock units as part of their annual compensation. Outstanding amounts listed below vary due to whether a director has elected to defer settlement of a restricted stock unit award. For further details regarding the number of shares of the Company’s common stock owned by all directors, please refer to the beneficial ownership table on page 42. At December 31, 2023, total time-based restricted stock units outstanding were: |

| Restricted Stock Units | ||||

| Claiborne P. Deming |

4,740 | |||

| Lawrence R. Dickerson |

26,052 | |||

| Michelle A. Earley |

16,486 | |||

| Elisabeth W. Keller |

4,740 | |||

| James V. Kelley |

4,740 | |||

| R. Madison Murphy |

4,740 | |||

| Jeffrey W. Nolan |

42,062 | |||

| Robert N. Ryan, Jr. |

4,740 | |||

| Laura A. Sugg |

42,062 | |||

| 3 | The 1994 Retirement Plan for Non-Employee Directors was frozen on May 14, 2003. At that time, then current directors were vested based on their years of service, with no further benefits accruing and benefits being paid out according to the terms of the plan. Only Mr. Murphy continues to be eligible for benefits under the plan. |

| 4 | Total reflects matching charitable contributions the Company made on behalf of the directors for fiscal year 2023 pursuant to the Company’s Gift Matching Program. |

| 5 | The director elected to defer payment of such amounts under the NED DCP Plan. |

14 MURPHY OIL CORPORATION

How You Can Communicate With Us

The Board values input from stockholders and other stakeholders and therefore provides a number of means for communication with the Board. Stockholders are encouraged to communicate by voting on the items in this proxy statement, by attending the annual meeting, by participating in the Company’s quarterly calls or webcast investor updates and by reaching out at any time via mail or email. The Corporate Governance Guidelines provide that stockholders and other interested parties may send communications to the Board, specified individual directors and the independent directors as a group c/o the Corporate Secretary, Murphy Oil Corporation, 9805 Katy Freeway, G-200, Houston, Texas 77024 or via email at corporatesecretary@murphyoilcorp.com. Items that are unrelated to a director’s duties and responsibilities as a Board member, such as junk mail, may be excluded by the Corporate Secretary.

2024 PROXY STATEMENT 15

16 MURPHY OIL CORPORATION

PROPOSAL 2

The Dodd-Frank Wall Street Reform and Consumer Protection Act (“the Dodd-Frank Act”) enables the Company’s stockholders to vote to approve, on an advisory (non-binding) basis, the compensation of the Named Executive Officers as disclosed in this Proxy Statement in accordance with the SEC’s rules. At the 2023 Annual Meeting, stockholders endorsed the compensation of the Company’s Named Executive Officers with over 97% of the votes cast supporting the proposal.

As described in detail under the heading “Compensation Discussion and Analysis,” the Company’s executive compensation programs are designed to attract, motivate, and retain the Named Executive Officers who are critical to the Company’s success. Under these programs, the Named Executive Officers are rewarded for the achievement of specific annual, long-term and strategic goals, corporate goals, and the realization of increased stockholder value. Please read the “Compensation Discussion and Analysis” along with the information in the compensation tables for additional details about the executive compensation programs, including information about the fiscal year 2023 compensation of the Named Executive Officers.

Stockholders are asked to indicate their support for the Named Executive Officer compensation as described in this proxy statement. This proposal, commonly known as a “Say-on-Pay” proposal, gives stockholders the opportunity to express their views on the Named Executive Officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of the Named Executive Officers and the philosophy, policies and practices described in this proxy statement. Accordingly, stockholders are requested to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the Named Executive Officers, as disclosed in the Company’s Proxy Statement for the 2024 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the 2023 Summary Compensation Table and the other related tables and disclosures.”

The Say-on-Pay vote is advisory, and therefore not binding on the Company, the Compensation Committee (the “Committee”) or the Board of Directors. The Board of Directors and the Committee value the opinions of stockholders and to the extent there is a significant vote against the Named Executive Officer compensation as disclosed in this proxy statement, the Committee will consider stockholders’ concerns and will evaluate whether any actions are necessary to address those concerns.

The Company has determined to submit Named Executive Officer compensation to an advisory (non-binding) vote annually. At the 2023 Annual Meeting, stockholders voted on an advisory basis regarding the frequency of Say-on-Pay votes and approved holding Say on Pay votes on an annual basis. The next advisory vote on our Named Executive Officer compensation will be held at our 2025 Annual Meeting of Stockholders.

2024 PROXY STATEMENT 17

Compensation

Discussion and Analysis

Dear fellow Murphy shareholders, employees and stakeholders,

Pay does more than attract, retain, and motivate. Pay decisions affect—and can reveal a lot about—a company’s fairness, honesty, and values; its time horizons and resilience; its creativity and willingness to be a leader; and ultimately how it goes about growing long-term value per share for owners.

We hope you will agree that the Company’s executive compensation program, as described in this Compensation Discussion and Analysis (“CD&A”), reflects this leadership and these values. Thank you to each of our major investors who provided thoughtful comments on this updated layout and content. We welcome feedback from all investors both on this, the CD&A, and other general matters, throughout the year.

As Murphy’s Compensation Committee Chair, I want to share, on behalf of our committee and my fellow board colleagues that we value your investment and your support.

Laura A. Sugg

18 MURPHY OIL CORPORATION

Pay at Murphy: The Key Facts Right Up Front

Who did we pay?

Murphy Oil Corporation provides employment to 725 people and we support many more jobs via our supply chains and community involvement. While all of our employees’ compensation is important to us, we are required by regulation to report on the compensation of the Company’s Named Executive Officers (“NEOs”) for 2023:

| Officer(s) |

Age | Years with Murphy |

Shares owned outright1 |

|||||||||

| Roger W. Jenkins Chief Executive Officer2 |

62 | 22 | 1,148,086 | |||||||||

| Thomas J. Mireles Executive Vice President and Chief Financial Officer |

51 | 18 | 141,842 | |||||||||

| Eric M. Hambly President and Chief Operating Officer2 |

49 | 17 | 311,138 | |||||||||

| E. Ted Botner Executive Vice President, General Counsel and Corporate Secretary2 |

59 | 22 | 184,184 | |||||||||

| Daniel R. Hanchera Senior Vice President, Business Development |

66 | 16 | 80,464 | |||||||||

| 1 | Shares of common stock of the Company beneficially owned as of February 20, 2024. For more information, see section titled “Our Stockholders”. |

| 2 | During 2023, Mr. Jenkins served as our President and Chief Executive Officer, Mr. Hambly served as our Executive Vice President, Operations and Mr. Botner served as Senior Vice President, General Counsel and Corporate Secretary. Mr. Hambly and Mr. Botner were promoted to the roles listed in this table effective February 1, 2024. In connection with Mr. Hambly assuming the role of President, Mr. Jenkins’ title was changed to Chief Executive Officer, effective February 1, 2024. |

During 2023, NEOs bought -0- shares in the open market and sold 14,500 shares.

What did we pay in 2023?

The target total direct compensation (“TTDC”)1 for each of our NEOs in 2023 was:

| · | $9,314,500 for Roger W. Jenkins |

| · | $3,392,500 for Thomas J. Mireles |

| · | $3,474,200 for Eric M. Hambly |

| · | $2,183,620 for E. Ted Botner |

| · | $1,553,550 for Daniel R. Hanchera |

Each NEO’s TTDC was comprised of a base salary (cash), [target] cash-based Annual Incentive Plan (“AIP” or bonus) opportunity, [target] stock-based long-term incentive compensation (LTI) opportunity, each reflecting what is consistent with our goals and values stated above and each described in more detail in the pages that follow.

Murphy will celebrate its 74th anniversary in 2024, and it retains its founding family’s values, and its belief in the alignment of pay and sustainable performance:

CEO Compensation

Modest adjustments to 2023 target compensation: to better align pay to be competitive with the peer group used for benchmarking compensation:

| · | Mr. Jenkins’ received a 2.9% adjustment to his base salary, increasing his salary to $1,070,000. |

| · | His target annual incentive opportunity as a percent of salary (135%) remained unchanged. |

| · | His intended 2023 target LTI compensation opportunity did not materially change from 2022. The Committee granted Mr. Jenkins LTI compensation for 2023 with an intended targeted grant date value of $6,800,000, which was a 3% increase from his intended targeted grant date value of his annual LTI awards approved by the Committee for each of 2022, 2021 and 2020. |

| 1 | Includes base salary (cash), target cash-based annual incentive plan (AIP or Bonus) opportunity and target stock-based long-term incentive compensation (LTI) opportunity. |

Note: For more information on the “Committee’s Oversight and Processes” and “Factors Influencing Our Pay Designs and Decision Making”, see pages 29 and 30.

2024 PROXY STATEMENT 19

Actual bonus paid at 105.4% of target: Based on the Company’s results for 2023 and the AIP performance metrics, Mr. Jenkins’ actual cash bonus (payable in first quarter 2024) totaled $1,522,503, which represents 105.4% of his target award opportunity, a level commensurate with other AIP participants including non-executive employees.

Reported value of 2023 equity grants differs from the intended target value: Despite the Committee’s approval of a $6,800,000 grant date value for Mr. Jenkins’ 2023 LTI award, representing a 3% increase over the previous three years, the reported value in the 2023 Summary Compensation Table (page 32) and Grants of Plan-Based Awards Table (page 33) is $8,826,424. This discrepancy primarily arises from changes in share price and valuation methods mandated for SEC reporting under FASB ASC Topic 718. This variance stems from two main factors:

| · | Determining number of shares: The Committee-approved targeted grant date value was converted into restricted stock units and performance stock units by dividing it by the average high/low Murphy stock price on the grant date. |

| · | Accounting for performance units with total shareholder return (“TSR”) condition: SEC rules necessitate reporting the grant date fair value of Mr. Jenkins’ LTI awards using a Monte Carlo simulation method under FASB ASC Topic 718. This method differs from the Committee’s approach in setting intended targeted grant date values. As a result, reported values may deviate from approved grant date values. |

In aggregate, Mr. Jenkins’ TTDC for 2023 was $9,314,500, which is an approximate 2.9% increase in total compensation from his 2022 level of $9,044,000.

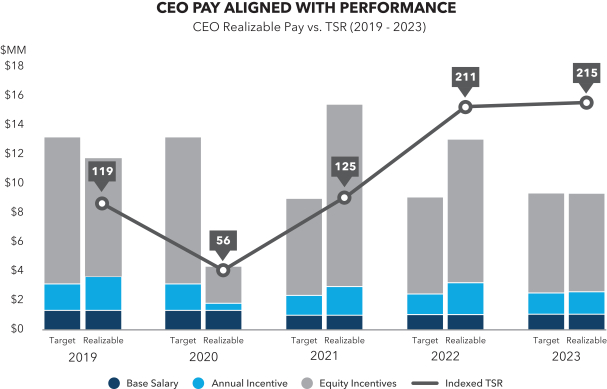

| ||||||

| Base Salary | Annual Incentive | Equity Incentives | ||||

| Target Compensation |

✓ | Target opportunity | Approved LTI target value of awards granted during each year | |||

| Realizable Compensation1 |

✓ | Actual bonus paid | Value of awards granted during each year based on year-end stock price | |||

| 1 | Realizable compensation for 2019, 2020 and 2021 includes the year-end value of performance units adjusted for actual performance over the full three-year performance period. |

Note: The amounts reflected above may differ from the amounts required to be reported by SEC rules and direct investors to see the Summary Compensation Table for additional information on the compensation amounts required to be reported for the NEOs for 2023 pursuant to SEC rules.

20 MURPHY OIL CORPORATION

What major pay changes did we make in 2023?

None. Our focus was on stability—no sudden, too frequent or troubling changes:

| · | No big new grants or sudden pay increases [unaligned with performance] |

| · | No novel new metrics or pay categories |

| · | No lowering of performance targets or use of discretion to increase realized amounts |

| · | No change to our pay or engagement calendars or practices |

2024 PROXY STATEMENT 21

Pay Elements: What We Designed, Targeted and Paid

2023 Compensation Structure

| · | NEO compensation is targeted in the middle range of our competitive market |

| · | Annual bonus is tied to pre-determined financial and operational performance goals |

| · | LTIs are comprised of performance-based restricted stock units (“PSUs”) and time-based restricted stock units (“RSUs”) delivered via awards that are performance-based in both absolute and relative terms |

| · | In combination with base salary, our incentive compensation programs provide a majority of NEO compensation in a form that is at-risk and performance-based: |

| CEO | Other NEOs (Average) |

|||||||

| Portion of cash compensation (salary + target bonus) that is based on annual performance goals |

57 | % | 46 | % | ||||

| Portion of TTDC that is tied to specific performance criteria |

70 | % | 59 | % | ||||

| Portion of TTDC that is based directly on long-term growth in value per share |

73 | % | 61 | % | ||||

| Portion of TTDC at risk for financial performance, stock price performance, and continued employment |

89 | % | 79 | % | ||||

2023 Peer Group

As recommended by Meridian, we use the same group of comparator peer companies for 2023 compensation and TSR assessments, except for adjustments due to mergers, acquisitions and bankruptcies, as follows:

| Valuation | Total Shareholder Return | Returns | ||||||||||||||||||||||

| Company |

Market Cap ($BN) |

EV ($BN) |

1 Yr. | 3 Yr. | 10 Yr. | Dividend Yield |

||||||||||||||||||

| APA Corporation (APA) |

$ | 11.0 | $ | 17.7 | (21.2 | %) | 165.3 | % | (49.4 | %) | 2.8 | % | ||||||||||||

| Callon Petroleum Company (CPE) |

$ | 2.2 | $ | 4.1 | (12.6 | %) | 146.2 | % | (50.4 | %) | 0.0 | % | ||||||||||||

| Coterra Energy, Inc. (CTRA) |

$ | 19.2 | $ | 20.9 | 8.9 | % | 90.0 | % | (14.8 | %) | 4.6 | % | ||||||||||||

| Devon Energy Corporation (DVN) |

$ | 29.0 | $ | 34.9 | (21.9 | %) | 249.5 | % | 2.7 | % | 6.3 | % | ||||||||||||

| Hess Corporation (HES) |

$ | 44.3 | $ | 52.2 | 2.9 | % | 183.8 | % | 104.9 | % | 1.2 | % | ||||||||||||

| Kosmos Energy Ltd. (KOS) |

$ | 3.1 | $ | 5.3 | 5.5 | % | 185.5 | % | (37.1 | %) | 0.0 | % | ||||||||||||

| Marathon Oil Corporation (MRO) |

$ | 14.1 | $ | 19.4 | (9.3 | %) | 278.2 | % | (19.4 | %) | 1.8 | % | ||||||||||||

| Matador Resources Company (MTDR) |

$ | 6.8 | $ | 9.2 | 0.6 | % | 381.7 | % | 211.7 | % | 1.4 | % | ||||||||||||

| Ovintiv Inc. (OVV) |

$ | 12.0 | $ | 19.1 | (10.9 | %) | 225.5 | % | (40.1 | %) | 2.7 | % | ||||||||||||

| Range Resources Corporation (RRC) |

$ | 7.3 | $ | 9.0 | 23.0 | % | 361.9 | % | (62.1 | %) | 1.1 | % | ||||||||||||

| SM Energy Company (SM) |

$ | 4.5 | $ | 5.7 | 13.2 | % | 547.0 | % | (50.6 | %) | 1.9 | % | ||||||||||||

| Southwestern Energy Company (SWN) |

$ | 7.2 | $ | 11.5 | 12.0 | % | 119.8 | % | (83.3 | %) | 0.0 | % | ||||||||||||

| Talos Energy, Inc. (TALO) |

$ | 1.8 | $ | 3.0 | (24.6 | %) | 72.7 | % | N/A | 0.0 | % | |||||||||||||

| Median |

$ | 7.3 | $ | 11.5 | 0.6 | % | 185.5 | % | (38.6 | %) | 1.4 | % | ||||||||||||

| Murphy Oil Corporation (MUR) |

$ | 6.6 | $ | 8.8 | 1.9 | % | 279.6 | % | (7.5 | %) | 2.6 | % | ||||||||||||

| Percentile |

33%ile | 33%ile | 55%ile | 75%ile | 77%ile | 74%ile | ||||||||||||||||||

22 MURPHY OIL CORPORATION

For reasons listed above in setting our 2023 peer group, we removed: PDC Energy, Inc. and CNX Resources Corporation. For purposes of calculating TSR metric performance for PSU awards, for merged or acquired companies, the TSR will continue to be tracked by the value of successor company shares into which they were converted.

In addition to these peers, the Committee uses Meridian and Mercer U.S. Energy 27 Compensation Survey information to determine competitive market pay levels for the NEOs. The Committee also reviews a special analysis of the competitive pay levels of the Company’s peer group in establishing pay levels for the CEO and NEOs.

Base Salary

| · | Our starting point is the median, or 50th percentile of the competitive market pay |

| · | We adjust this target both higher and lower based on each NEO’s duties and responsibilities, prior experience, job performance, company performance, job and company tenure, and marketplace trends |

In February 2023, the Committee approved these adjustments in each NEO’s base salary from the 2022 base. These adjustments, as well as information regarding each NEO’s base salary over the last five fiscal years, are set forth in the table below. Our CEO’s base salary continues to remain below pre-pandemic levels:

| 2023 | 2022 | 2021 | April 2020 |

February 2020 |

2019 | |||||||||||||||||||

| Roger W. Jenkins |

$ | 1,070,000 | $ | 1,040,000 | $ | 1,000,000 | $ | 866,125 | $ | 1,332,500 | $ | 1,332,500 | ||||||||||||

| Thomas J. Mireles |

$ | 575,000 | $ | 500,000 | $ | 400,000 | $ | 323,825 | $ | 431,766 | $ | 423,300 | ||||||||||||

| Eric M. Hambly |

$ | 618,000 | $ | 600,000 | $ | 575,000 | $ | 490,000 | $ | 550,515 | $ | 514,500 | ||||||||||||

| E. Ted Botner |

$ | 490,900 | $ | 467,500 | $ | 425,000 | $ | 375,000 | $ | 418,620 | $ | 410,410 | ||||||||||||

| Daniel R. Hanchera |

$ | 430,600 | $ | 418,000 | $ | 400,000 | $ | 314,085 | $ | 418,779 | $ | 410,568 | ||||||||||||

Annual Incentive Plan or Bonus

| · | AIPs are designed to attract, retain, and reward NEOs with competitive incentive opportunities that reward sustainable, safe and profitable performance, that benefits our stakeholders, and contributes to long-term value growth for our shareholders |

| · | Our starting point for each NEO’s AIP is the 50th percentile of market pay levels |

The Committee maintained the 2023 annual incentive target for each NEO at the same percentage as 2022:

| Roger W. Jenkins |

135 | % | ||

| Thomas J. Mireles |

90 | % | ||

| Eric M. Hambly |

90 | % | ||

| E. Ted Botner |

80 | % | ||

| Daniel R. Hanchera |

75 | % | ||

2024 PROXY STATEMENT 23

For 2023, the AIP’s performance metrics and weightings were:

| Metric |

Weighting | Rationale | ||||

| FINANCIAL |

|

|

|

| ||

| Return on Average Capital Employed (ROACE)1

AIP Free Cash Flow (FCF)2

Lease Operating Expense (LOE)/BOE3

General and Administrative (G&A) Expense4 |

|

25

25

15

15 |

%

%

%

% |

These financial goals focus on cost management, financial discipline and encourage employees to manage costs relative to gross margins and the commodity price environment. | ||

| SUSTAINABILITY Safety |

20 | %5 |

| |||

| Total Recordable Incident Rate (TRIR)6 |

|

|

|

The health and safety of the Company’s employees and contractors is important to the Company. Inclusion of a safety metric reflects the Company’s emphasis on safe operations by both employees and contractors. | ||

| Environmental |

|

|

|

| ||

| Spill Rate7 |

|

|

|

Inclusion of a spill metric reflects the Company’s commitment to environmentally sound operations, including asset integrity. | ||

| Greenhouse Gas (GHG) Emissions Intensity |

|

|

|

Inclusion of a GHG metric reflects the Company’s commitment to environmental stewardship and sustainability. | ||

| 1 | ROACE is calculated by dividing the Company’s EBITDA for fiscal year 2023 by the sum of the opening plus closing Capital Employed (total equity + total long-term debt + total short-term debt) divided by two (EBITDA/ACE). EBITDA and ACE may be adjusted for items which affect the representation of EBITDA to underlying performance, e.g. unrealized mark to market movements on commodity hedging. |

| 2 | AIP Free Cash Flow, for the purpose of compensation, is an internal management metric and is calculated as “accrual basis” operating cash flow less “value of work done” capital expenditures and may be adjusted for certain items to ensure fair comparability to target. |

| 3 | A barrel of oil equivalent (BOE) is a term used to summarize the amount of energy that is equivalent to the amount of energy found in one barrel of crude oil. One barrel of oil is generally deemed to have the same amount of energy content as 6,000 cubic feet of natural gas. |

| 4 | General and Administrative Expense is a management metric for the purpose of compensation to incentivize overhead cost management. It includes certain cash controllable overhead costs and excludes certain short-term and long-term incentive costs. |

| 5 | Individual metrics are evenly weighted. |

| 6 | Defined as the combined number of incidents for both contractors and employees worldwide per 200,000 work hours. The lower the result, the better the performance. |