Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Murphy Oil Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

Table of Contents

NOTICE OF ANNUAL MEETING

| Date: | May 10, 2017 | |

| Time: | 10:00 a.m. CDT | |

| Place: | South Arkansas Arts Center | |

| 110 East 5th Street | ||

| El Dorado, Arkansas 71730 |

AGENDA:

| 1. | Election of Directors; |

| 2. | Advisory vote on executive compensation; |

| 3. | Advisory vote on the frequency of an advisory vote on executive compensation; |

| 4. | Approval or disapproval of the proposed 2012 Long-Term Incentive Plan Performance Metrics; |

| 5. | Approval or disapproval of the action of the Audit Committee of the Board of Directors in appointing KPMG LLP as the Company’s independent registered public accounting firm for 2017; and |

| 6. | Such other business as may properly come before the meeting. |

Only stockholders of record at the close of business on March 13, 2017, the record date fixed by the Board of Directors of the Company, will be entitled to notice of and to vote at the meeting or any adjournment thereof. A list of all stockholders entitled to vote is on file at the office of the Company, 300 Peach Street, El Dorado, Arkansas 71730.

Your vote is very important to us and to our business. Prior to the meeting, you may submit your vote and proxy by telephone, mobile device, the internet, or, if you received your materials by mail, you can sign and return your proxy card. Instructions on how to vote begin on page 1.

E. Ted Botner

Vice President, Law and Corporate Secretary

El Dorado, Arkansas

March 24, 2017

Table of Contents

| Proxy Statement |

|

| The solicitation of the enclosed proxy is made on behalf of the Board of Directors of Murphy Oil Corporation (the “Board”) for use at the Annual Meeting of Stockholders to be held on May 10, 2017. It is expected that this Proxy Statement and related materials will first be provided to stockholders on or about March 24, 2017. The complete mailing address of the Company’s principal executive office is 300 Peach Street, P.O. Box 7000, El Dorado, Arkansas 71731-7000. References in this Proxy Statement to “we,” “us,” “our,” “the Company”, “Murphy Oil” and “Murphy” refer to Murphy Oil Corporation and its consolidated subsidiaries. |

Table of Contents

|

|

|

Proposals to be Voted On

The following proposals will be voted on at the Annual Meeting of Stockholders.

| For More Information |

Board Recommendation |

|||||||

| Proposal 1—Election of Directors | Page 5 |

|

FOR | |||||

| Claiborne P. Deming | James V. Kelley | |||||||

| T. Jay Collins | Walentin Mirosh | |||||||

| Steven A. Cossé | R. Madison Murphy | |||||||

| Lawrence R. Dickerson | Jeffrey W. Nolan | |||||||

| Roger W. Jenkins | Neal E. Schmale | |||||||

| Elisabeth W. Keller | Laura A. Sugg |

|||||||

| Proposal 2

Advisory Vote to Approve Executive Compensation |

Page 17 |

|

FOR | |||||

| Proposal 3 | Page 18 |

|

ONE YEAR | |||||

| Advisory Vote to Approve the Frequency of an Advisory Vote on Executive Compensation

|

||||||||

| Proposal 4 | Page 19 |

|

FOR | |||||

| Approval of the proposed 2012 Long-Term Incentive Plan Performance Metrics

|

||||||||

| Proposal 5

Approval of Appointment of Independent Registered Public Accounting Firm |

Page 44 |

|

FOR | |||||

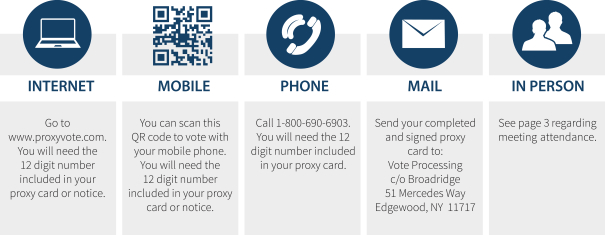

You may cast your vote in the following ways:

The 2017 Murphy Oil Corporation Annual Meeting will begin at 10:00 a.m. CDT on May 10, 2017,

at the South Arkansas Arts Center located at 110 East 5th Street in El Dorado, Arkansas 71730.

INTERNET

Go to www.proxyvote.com. You will need the 12 digit number included in your proxy card or notice.

MOBILE

You can scan this QR code to vote with your mobile phone. You will need the 12 digit number included in your proxy card or notice.

PHONE

Call 1-800-690-6903. You will need the 12 digit number included in your proxy card.

MAIL

Send your completed and signed proxy card to: Vote Processing c/o Broadridge 51 Mercedes Way Edgewood, NY

11717

IN PERSON

See page 2 regarding meeting attendance.

| Murphy Oil Corporation | 1 | |||

Table of Contents

|

|

Proxy Summary (continued)

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS:

We have elected to take advantage of the U.S. Securities and Exchange Commission (the “SEC”) rules that allow us to furnish proxy materials to the Company’s stockholders via the internet. These rules allow us to provide information that the Company’s stockholders need while lowering the costs and accelerating the speed of delivery and reducing the environmental impact of the Annual Meeting. This Proxy Statement, along with the Company’s Annual Report to Stockholders, which includes the Company’s Form 10-K report for the year ended December 31, 2016, are available via the internet at http://ir.murphyoilcorp.com/phoenix.zhtml?c=61237&p=proxy.

| 2 | Murphy Oil Corporation | |

Table of Contents

| Q&A—Questions and Answers about the Annual Meeting

|

|

When and where is the Annual Meeting?

The Company’s 60th Annual Meeting will be held at 10:00 a.m. CDT on Wednesday, May 10, 2017, at the South Arkansas Arts Center, located at 110 East 5th Street, in El Dorado, Arkansas 71730.

May I attend the meeting?

Attendance at the meeting is open to stockholders of record as of March 13, 2017, Company employees and certain guests. If you are a stockholder, regardless of the number of shares you hold, you may attend the meeting.

Who may vote?

You may vote if you were a holder of record of Murphy Oil Corporation common stock as of the close of business on March 13, 2017. Each share of common stock is entitled to one vote at the Annual Meeting. You may vote in person at the meeting, or by proxy via the methods explained on page 1 of this document.

Why should I vote?

Your vote is very important regardless of the amount of stock you hold. The Board strongly encourages you to exercise your right to vote as a stockholder of the Company.

Why did I receive a Notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

We are providing access to our proxy materials via the internet. As a result, we have sent a Notice of availability instead of a paper copy of the proxy materials to most of our stockholders. The Notice contains instructions on how to access the proxy materials via the internet and how to request a paper copy. In addition, the website provided in the Notice allows stockholders to request future proxy materials in printed form by mail or electronically by email. A stockholder’s election to receive proxy materials by mail or email will remain in effect until the stockholder terminates it.

Why didn’t I receive a Notice in the mail regarding the internet availability of proxy materials?

We are providing certain stockholders, including those who have previously requested paper copies of the proxy materials, with paper copies of the proxy materials instead of a Notice. If you would like to reduce the costs incurred by Murphy in mailing proxy materials and conserve natural resources, you can consent to receive all future proxy statements, proxy cards and annual reports electronically via email. To sign up for electronic delivery, please follow the instructions provided with your proxy materials and on your proxy card or voting instruction card. When prompted, indicate that you agree to receive or access stockholder communications electronically in the future.

May I vote my stock by filling out and returning the Notice?

No. Instructions are in the email sent to you and on the Notice.

How can I access the proxy materials through the internet?

Your Notice or proxy card will contain instructions on how to view our proxy materials for the Annual Meeting via the internet. The Proxy Statement and Annual Report are also available at http://ir.murphyoilcorp.com/phoenix.zhtml?c=61237&p=proxy.

| Murphy Oil Corporation | 3 | |||

Table of Contents

|

|

Proxy Statement

|

| VOTING PROCEDURES |

The affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting is required for approval of matters presented at the meeting. Your proxy will be voted at the meeting unless you (i) revoke it at any time before the vote by filing a revocation with the Corporate Secretary of the Company, (ii) duly execute a proxy card bearing a later date or (iii) appear at the meeting and vote in person. If you voted via the Internet, mobile device or telephone, you can change your vote with a timely and valid later vote or by voting by ballot at the meeting. Proxies returned to the Company, votes cast other than in person and written revocations will be disqualified if received after commencement of the meeting. If you elect to vote your proxy card or as directed on the Notice or vote by telephone, mobile device or internet as described in the telephone/mobile device/internet voting instructions on your proxy card or Notice, the Company will vote your shares as you direct. Your telephone/mobile device/internet vote authorizes the named proxies to vote your shares in the same manner as if you had marked, signed and returned your proxy card.

Votes cast by proxy or in person at the meeting will be counted by the persons appointed by the Company to act as Judges of Election for the meeting. The Judges of Election will treat shares represented by proxies that reflect abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum and for purposes of determining the outcome of any other business submitted at the meeting to the stockholders for a vote. Abstentions, however, do not constitute a vote “against” any matter.

The Judges of Election will treat shares referred to as “broker non-votes” (i.e., shares held by brokers or nominees as to which instructions have not been received from the beneficial owners or persons entitled to vote and that the broker or nominee does not have discretionary power to vote on a non-routine matter) as shares that are present and entitled to vote on routine matters and for purposes of determining the presence of a quorum. The proposal to approve or disapprove the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the current fiscal year should be considered a routine matter. However, for purposes of determining the outcome of any non-routine matter as to which the broker does not have discretionary authority to vote, those shares will be treated as not present and not entitled to vote with respect to that matter (even though those shares are considered entitled to vote for quorum purposes and may be entitled to vote on other matters). Accordingly, broker non-votes will be disregarded in the calculation of “votes cast” and will have no effect on the vote. Notably, the election of directors, the advisory vote to approve executive compensation, the advisory vote on the frequency of an advisory vote on executive compensation and the proposal to approve or disapprove the proposed 2012 Long-Term Incentive Plan Performance Metrics should be considered non-routine matters.

Unless specification to the contrary is made, the shares represented by the enclosed proxy will be voted FOR all the nominees for director, FOR the approval of the advisory vote for the compensation of the Company’s Named Executive Officers, for the option of ONE YEAR as the frequency with which stockholders are provided an advisory vote on executive compensation, FOR approval of the proposed 2012 Long-Term Incentive Plan Performance Metrics and FOR approval of the action of the Audit Committee of the Board of Directors in appointing KPMG LLP as the Company’s independent registered public accounting firm for 2017.

The expenses of printing and distributing proxy material, including expenses involved in forwarding materials to beneficial owners of stock, will be paid by the Company. The Company’s officers or employees, without additional compensation, may solicit the return of proxies from certain stockholders by telephone or other means.

| VOTING SECURITIES |

On March 13, 2017, the record date for the meeting, the Company had 172,544,891 shares of Common Stock outstanding, all of one class and each share having one vote with respect to all matters to be voted on at the meeting. This amount does not include 22,510,833 shares of treasury stock. Information as to Common Stock ownership of certain beneficial owners and management is set forth in the tables on pages 14 and 15 (“Security Ownership of Certain Beneficial Owners” and “Security Ownership of Management”).

| 4 | Murphy Oil Corporation | |

Table of Contents

| Proposal 1—Election of Directors

|

|

| Murphy Oil Corporation | 5 | |||

Table of Contents

|

|

Proposal 1—Election of Directors (continued)

|

The Corporate Governance Guidelines provide that stockholders and other interested parties may send communications to the Board, specified individual directors and the independent directors as a group c/o the Corporate Secretary, Murphy Oil Corporation, P.O. Box 7000, El Dorado, Arkansas 71731-7000. All such communications will be kept confidential unless otherwise required by law and relayed to the specified director(s). The names of the Director nominees and certain information as to them, are as follows:

|

T. JAY COLLINS Houston, Texas

Age: 70

Director Since: 2013 |

Board Committees

• Executive

• Nominating &

|

Certain other directorships

• Oceaneering

|

|||||

| Principal occupation or employment

• President and Chief Executive Officer, Retired, Oceaneering International, Inc., since May 2011; President and Chief Executive Officer, Oceaneering International, Inc., from May 2006 to May 2011

|

||||||||

Mr. Collins has extensive knowledge of international management and corporate development. As a prior President and Chief Executive Officer of Oceaneering International, Inc., he has substantial knowledge and experience in the oil and gas industry. Among other qualifications, Mr. Collins brings to the Board experience in field operations, executive management and finance.

|

STEVEN A. COSSÉ El Dorado, Arkansas

Age: 69

Director Since: 2011 |

Board Committees

• Executive

• Health, Safety &

|

Certain other directorships

• Simmons First National |

|||||

| Principal occupation or employment

• President and Chief Executive Officer of the Company from June 2012 to August 2013, retired from the Company December 2013; previously Executive Vice President and General Counsel of the Company from February 2005 through February 2011, retired from the Company February 2011 to May 2012

|

||||||||

Mr. Cossé’s long service in several capacities with the Company has helped him gain a proficient understanding of many areas, including environmental laws and regulations. Among other qualifications, Mr. Cossé brings to the Board expertise in corporate governance, banking and securities laws and executive leadership.

|

CLAIBORNE P. DEMING El Dorado, Arkansas

Age: 62

Director Since: 1993 |

Board Committees

• Chairman of the Board

• Chair, Executive

• Health, Safety &

|

Certain other directorships

• Murphy USA Inc.

|

|||||

| Principal occupation or employment

• President and Chief Executive Officer of the Company from October 1994 through December 2008, retired from the Company June 2009

|

||||||||

Mr. Deming’s experience as former President and Chief Executive Officer of Murphy Oil Corporation gives him insight into the Company’s challenges, opportunities and operations. Among other qualifications, Mr. Deming brings to the Board executive leadership skills and over 30 years’ experience in the oil and gas industry.

| 6 | Murphy Oil Corporation | |

Table of Contents

| Proposal 1—Election of Directors (continued)

|

|

|

LAWRENCE R. DICKERSON Houston, Texas

Age: 64

Director Since: 2014 |

Board Committees

• Audit • Nominating &

|

Certain other directorships

• Oil States International, • Great Lakes Dredge & • Hercules Offshore, Inc. |

|||||

|

Principal occupation or employment

• President and Chief Executive Officer, Retired, Diamond Offshore Drilling, Inc., an offshore drilling company, since March 2014; President and Chief Executive Officer, Diamond Offshore Drilling, Inc., from May 2008 through March 2014

|

||||||||

Mr. Dickerson’s experience as the President and a director of Diamond Offshore Drilling, Inc. from March 1998 and as Chief Executive Officer from May 2008 until his retirement in March 2014 brings to the Board broad experience in leadership and financial matters. Among other qualifications, he brings to the Board expertise as a Certified Public Accountant and in international drilling operations.

|

ROGER W. JENKINS El Dorado, Arkansas

Age: 55

Director Since: 2013 |

Board Committees

• Executive

|

Certain other directorships

• None

|

|||||

| Principal occupation or employment

• President and Chief Executive Officer of the Company since August 2013 and President of Murphy Exploration & Production Company since June 2012; previously Chief Operating Officer & Executive Vice President, Exploration & Production of the Company from June 2012 to August 2013; Executive Vice President, Exploration & Production of the Company and President of Murphy Exploration & Production Company from August 2009 to June 2012

|

||||||||

Mr. Jenkins’ leadership as President and Chief Executive Officer of Murphy Oil Corporation allows him to provide the Board with his detailed perspective of the Company’s global operations. With a Bachelor’s degree in Petroleum Engineering, a Master’s degree in Business Administration and over 30 years of industry experience, he has played a critical leadership role in Murphy’s worldwide exploration and production operations, including the development of the Kikeh field in Malaysia and the Eagle Ford Shale in South Texas.

|

ELISABETH W. KELLER Cambridge, Massachusetts

Age: 59

Director Since: 2016 |

Board Committees

• None

|

Certain other directorships

• None

|

|||||

| Principal occupation or employment

• President, Inglewood Plantation, LLC, since 2014; CEO, Keller Enterprises, LLC, from 2008 to 2014

|

||||||||

Ms. Keller is the President of Inglewood Plantation, LLC and is responsible for the development of strategic vision and oversight of operations of the largest organic farm in Louisiana. She brings to the Board extensive knowledge in health and environmental issues, both domestically and internationally.

| Murphy Oil Corporation | 7 | |||

Table of Contents

|

|

Proposal 1—Election of Directors (continued)

|

|

JAMES V. KELLEY Little Rock, Arkansas

Age: 67

Director Since: 2006 |

Board Committees

• Executive • Chair, Nominating &

|

Certain other directorships

• BancorpSouth, Inc. Tupelo,

|

|||||

| Principal occupation or employment

• President and Chief Operating Officer, Retired, BancorpSouth, Inc. (a NYSE bank holding company) since August 2014; President and Chief Operating Officer, BancorpSouth, Inc. from 2001 to August 2014

|

||||||||

Mr. Kelley has extensive knowledge of capital markets and accounting issues. As former President and Chief Operating Officer of BancorpSouth, Inc., he understands the fundamentals and responsibilities of operating a large company. Among other qualifications, Mr. Kelley brings to the Board experience in banking, finance and accounting, as well as executive management.

|

WALENTIN MIROSH Calgary, Alberta

Age: 71

Director Since: 2011 |

Board Committees

• Executive Compensation • Health, Safety &

|

Certain other directorships

• TC PipeLines GP, Inc.

|

|||||

| Principal occupation or employment

• President, Mircan Resources Ltd., a private consulting company since January 2010

|

||||||||

Mr. Mirosh, with his accomplishments in the chemical, natural gas, and investment industries, is able to provide the Board with dependable input in many areas. He brings to the Board experience in energy, regulatory and international law as well as skills in business development and corporate strategy.

|

R. MADISON MURPHY El Dorado, Arkansas

Age: 59

Director Since: 1993 |

Board Committees

• Chair, Audit • Executive

|

Certain other directorships

• Deltic Timber Corporation • Murphy USA Inc.

|

|||||

| Principal occupation or employment

• Managing Member, Murphy Family Management, LLC, which manages investments, farm, timber and real estate, since 1998; • President, The Murphy Foundation; • Owner, The Sumac Company, LLC, which manages investments, timber and vineyard operations; and • Owner, Presqu’ile Winery

|

||||||||

Mr. Murphy served as Chairman of the Board of Murphy Oil Corporation from 1994 to 2002. This background, along with his current membership on the Board of Directors of Deltic Timber Corporation and Murphy USA Inc., brings to the Board and to the Audit Committee a unique business and financial perspective.

| 8 | Murphy Oil Corporation | |

Table of Contents

| Proposal 1—Election of Directors (continued)

|

|

|

JEFFREY W. NOLAN Little Rock, Arkansas

Age: 48

Director Since: 2012 |

Board Committees

• Executive Compensation • Nominating &

|

Certain other directorships

None

|

|||||

| Principal occupation or employment

• President & Chief Executive Officer, Loutre Land and Timber Company, a natural resources company with a focus on the acquisition, ownership and management of timberland and mineral properties, since 1998

|

||||||||

Mr. Nolan’s experience as President and Chief Executive Officer of a natural resources company, in addition to his former legal practice focused on business and corporate transactions, allows him to bring to the Board expertise in legal matters, corporate governance, corporate finance, acquisitions and divestitures and the management of mineral properties.

|

NEAL E. SCHMALE La Jolla, California

Age: 70

Director Since: 2004 |

Board Committees

• Audit • Chair, Executive

|

Certain other directorships

• WD-40

Company

|

|||||

| Principal occupation or employment

• President and Chief Operating Officer, Retired, Sempra Energy, an energy services holding company, since October 2011; President and Chief Operating Officer, Sempra Energy, from February 2006 to October 2011

|

||||||||

Mr. Schmale, as former Chief Operating Officer of Sempra Energy, brings to the Board the perspective of a corporate leader having faced external economic, social and governance issues. He also brings specific experience in financial matters from his prior service as Chief Financial Officer of Sempra Energy. He holds degrees in petroleum engineering and law, and has a vast knowledge in different fields concerning the oil industry.

|

LAURA A. SUGG Montgomery, Texas

Age: 56

Director Since: 2015 |

Board Committees

• Audit • Health, Safety &

|

Certain other directorships

• Denbury Resources • Williams Companies Inc.

|

|||||

| Principal occupation or employment

• Senior Executive, Retired, ConocoPhillips, then an international, integrated oil company, since 2010

|

||||||||

Ms. Sugg’s broad background in capital allocation and accomplishments in the energy industry allow her to bring to the Board expertise in industry, operational and technical matters. Among other qualifications, she brings to the Board specific experience in executive leadership, human resources, compensation and financial matters. As a former leader at ConocoPhillips, Ms. Sugg has a proficient understanding of an oil company’s challenges and opportunities.

The Board recommends a vote “FOR” each of the persons nominated by the Board.

| Murphy Oil Corporation | 9 | |||

Table of Contents

|

|

Proposal 1—Election of Directors (continued)

|

| 10 | Murphy Oil Corporation | |

Table of Contents

| Proposal 1—Election of Directors (continued)

|

|

Corporation, P.O. Box 7000, El Dorado, Arkansas 71731-7000. As a matter of policy, candidates recommended by stockholders are evaluated on the same basis as candidates recommended by Board members, executive search firms or other sources.

The Health, Safety & Environmental Committee assists the Board and management in monitoring compliance with applicable environmental, health and safety laws, rules and regulations as well as the Company’s Worldwide Health, Safety & Environmental Policy. Review of policies, procedures and practices regarding security of the Company’s people and property is also within the purview of this committee. The Committee assists the Board on matters relating to the Company’s response to evolving public issues affecting the Company in the realm of health, safety and the environment. The Committee has benefitted from the Company’s involvement with groups such as the American Petroleum Institute (API) and sponsorship of initiatives like the Massachusetts Institute of Technology’s Joint Program on the Science and Policy of Global Change, which keeps abreast of emerging issues with respect to climate change.

Charters for the Audit, Executive Compensation, Nominating & Governance and Health, Safety & Environmental Committees, along with the Corporate Governance Guidelines, Code of Business Conduct and Ethics and the Code of Ethical Conduct for Executive Management, are available on the Company’s website, http://ir.murphyoilcorp.com/phoenix.zhtml?c=61237&p=irol-govHighlights.

BOARD AND COMMITTEE EVALUATIONS

The Board and the Audit, Executive Compensation, Nominating & Governance, and Health, Safety and Environmental Committees perform an annual self-evaluation. Each November, the directors are requested to provide their assessments of the effectiveness of the Board and the committees on which they serve. The individual assessments are organized and summarized for discussion with the Board and the committees.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During 2016, none of the members of the Executive Compensation Committee (i) was an officer or employee of the Company, (ii) was a former officer of the Company or (iii) had any relationship requiring disclosure by the Company under any paragraph of Item 404 of Regulation S-K.

MEETINGS AND ATTENDANCE

During 2016, there were seven meetings of the Board, eleven meetings of the Executive Committee, six meetings of the Audit Committee, four meetings of the Executive Compensation Committee, four meetings of the Nominating & Governance Committee and two meetings of the Health, Safety & Environmental Committee. All nominees’ attendance exceeded 75% of the total number of meetings of the Board and committees on which they served. Attendance for Board and committee meetings averaged 99% for the full year. All the Board members attended the 2016 Annual Meeting of Stockholders. As set forth in the Company’s Corporate Governance Guidelines, all Board members are expected to attend each Annual Meeting of Stockholders.

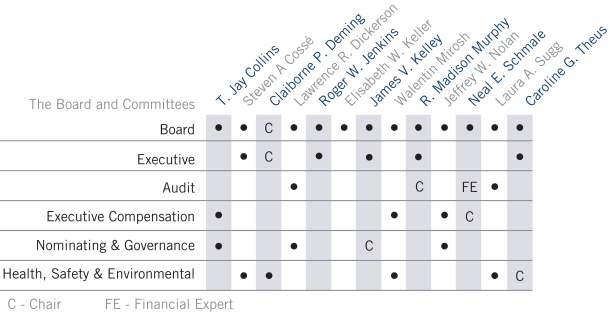

The Board and Committees

T. Jay Collins Steven A Cossé Claiborne P. Deming Lawrence R. Dickerson Roger W. Jenkins Elisabeth W. Keller James V. Kelley Walentin Mirosh R. Madison Murphy Jeffrey W. Nolan Neal E.

Schmale Laura A. Sugg Caroline G. Theus

Board Executive Audit Executive Compensation Nominating & Governance Health, Safety & Environmental

C-Chair FE-Financial Expert

| Murphy Oil Corporation | 11 | |||

Table of Contents

|

|

|

2016 DIRECTOR COMPENSATION TABLE

| Name |

Fees Earned or ($) |

Stock Awards ($)(1)(2) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Change in Nonqualified |

All Other Compensation ($) |

Total ($) |

|||||||||||||||||||||

| Claiborne P. Deming | 167,502 | 150,016 | — | — | — | — | 317,518 | |||||||||||||||||||||

| T. Jay Collins | 90,006 | 150,016 | — | — | — | — | 240,022 | |||||||||||||||||||||

| Steven A. Cossé | 100,000 | 150,016 | — | — | — | 25,000 | 275,016 | |||||||||||||||||||||

| Lawrence R. Dickerson | 99,500 | 150,016 | — | — | — | 10,000 | 259,516 | |||||||||||||||||||||

| Elisabeth W. Keller | 17,000 | 12,517 | — | — | — | — | 29,517 | |||||||||||||||||||||

| James V. Kelley | 122,815 | 150,016 | — | — | — | — | 272,831 | |||||||||||||||||||||

| Walentin Mirosh | 86,002 | 150,016 | — | — | — | — | 236,018 | |||||||||||||||||||||

| R. Madison Murphy | 128,502 | 150,016 | — | — | 15,778 | 37,315 | (4) | 331,611 | ||||||||||||||||||||

| Jeffrey W. Nolan | 90,002 | 150,016 | — | — | — | 25,000 | 265,018 | |||||||||||||||||||||

| Neal E. Schmale | 126,502 | 150,016 | — | — | — | 25,000 | 301,518 | |||||||||||||||||||||

| Laura A. Sugg | 86,687 | 150,016 | — | — | — | — | 236,703 | |||||||||||||||||||||

| Caroline G. Theus | 108,002 | 150,016 | — | — | (1,869 | ) | — | 256,149 | ||||||||||||||||||||

| (1) | Represents grant date fair value of time-based restricted stock units awarded in 2016 as computed in accordance with FASB ASC Topic 718, excluding forfeiture estimates, as more fully described in Note J to the consolidated financial statements included in the Company’s 2016 Form 10-K Annual Report. |

| 12 | Murphy Oil Corporation | |

Table of Contents

| Compensation of Directors (continued)

|

|

| (2) | At December 31, 2016, total time-based restricted stock units outstanding were: |

| Restricted Stock Units |

||||

| Claiborne P. Deming | 15,511 | |||

| T. Jay Collins | 15,511 | |||

| Steven A. Cossé | 15,511 | |||

| Lawrence R. Dickerson | 13,501 | |||

| Elisabeth W. Keller | 376 | |||

| James V. Kelley | 15,511 | |||

| Walentin Mirosh | 15,511 | |||

| R. Madison Murphy | 15,511 | |||

| Jeffrey W. Nolan | 15,511 | |||

| Neal E. Schmale | 15,511 | |||

| Laura A. Sugg | 11,706 | |||

| Caroline G. Theus | 15,511 | |||

| (3) | The 1994 Retirement Plan for Non-Employee Directors was frozen on May 14, 2003. At that time, then current directors were vested based on their years of service, with no further benefits accruing and benefits being paid out according to the terms of the plan. |

| (4) | Includes a one-time payment of $12,315 resulting from an administrative error by the Company related to Mr. Murphy’s SERP benefits. The Company learned in late 2016 that he did not begin receiving his SERP benefits in a timely manner as required by the terms of the SERP. The Company discovered the error during an internal audit of its benefits files and in 2016 provided Mr. Murphy with the missed SERP payments. This error by the Company caused Mr. Murphy to be subject to penalties and interest under Section 409A of the Internal Revenue Code of 1986. The Company reimbursed Mr. Murphy for the resulting costs to him of the Company’s mistake. |

| Murphy Oil Corporation | 13 | |||

Table of Contents

|

|

Security Ownership of Certain Beneficial Owners

|

As of December 31, 2016, the following are known to the Company to be the beneficial owners of more than five percent of the Company’s Common Stock (as of the date of such stockholder’s Schedule 13G filing with the SEC):

| Name and address of beneficial owner | Amount and nature of beneficial ownership(1) |

Percentage | ||||||

| Capital World Investors | 17,899,680 | (2) | 10.300 | % | ||||

| 333 South Hope Street | ||||||||

| Los Angeles, CA 90071 | ||||||||

| The Vanguard Group | 17,446,659 | (3) | 10.130 | % | ||||

| 100 Vanguard Blvd. | ||||||||

| Malvern, PA 19355 | ||||||||

| BlackRock Inc. | 11,768,273 | (4) | 6.800 | % | ||||

| 55 East 52nd Street | ||||||||

| New York, NY 10055 | ||||||||

| FMR LLC | 11,183,512 | (5) | 6.494 | % | ||||

| 245 Summer Street | ||||||||

| Boston, Massachusetts 02210 | ||||||||

| Hotchkis and Wiley Capital Management, LLC | 10,973,020 | (6) | 6.370 | % | ||||

| 725 S. Figueroa Street 39th Fl | ||||||||

| Los Angeles, CA 90017 | ||||||||

| T. Rowe Price Associates, Inc. | 10,734,128 | (7) | 6.200 | % | ||||

| 100 E. Pratt Street | ||||||||

| Baltimore, MD 21202 | ||||||||

| State Street Corporation | 10,553,184 | (8) | 6.130 | % | ||||

| State Street Financial Center | ||||||||

| One Lincoln Street | ||||||||

| Boston, MA 02111 | ||||||||

| Pzena Investment Management, LLC | 8,610,715 | (9) | 5.000 | % | ||||

| 320 Park Avenue, 8th floor | ||||||||

| New York, NY 10022 | ||||||||

| (1) | Includes Common Stock for which the indicated owner has sole or shared voting or investment power and is based on the indicated owner’s Schedule 13G filing for the period ended December 31, 2016. |

| (2) | An investment adviser in accordance with Rule 13d-1(b)(1)(ii)(E). Total includes 17,899,680 sole voting power shares, -0- shared voting power shares, 17,899,680 sole dispositive power shares and -0- shared dispositive power shares. Beneficial ownership disclaimed pursuant to Rule 13d-4. |

| (3) | An investment adviser in accordance with Rule 13d-1(b)(1)(ii)(E). Total includes 259,353 sole voting power shares, 29,940 shared voting power shares, 17,170,458 sole dispositive power shares and 276,201 shared dispositive power shares. |

| (4) | A parent holding company or control person in accordance with Rule 13d-1(b)(1)(ii)(G). Total includes 10,257,296 sole voting power shares, -0- shared voting power shares, 11,768,273 sole dispositive power shares and -0- shared dispositive power shares. |

| (5) | A parent holding company or control person in accordance with Rule 13d-1(b)(1)(ii)(G). Total includes 2,212,312 sole voting power shares, -0- shared voting power shares, 11,183,512 sole dispositive power shares and -0- shared dispositive power shares. |

| (6) | An investment adviser in accordance with Rule 13d-1(b)(1)(ii)(E). Total includes 6,723,523 sole voting power shares, -0- shared voting power shares, 10,973,020 sole dispositive power shares and -0- shared dispositive power shares. |

| (7) | These securities are owned by various individual and institutional investors which T. Rowe Price Associates, Inc. (“Price Associates”) serves as investment adviser with power to direct investments and/or sole power to vote the securities. For purposes of the reporting requirements of the Securities Exchange Act of 1934, Price Associates is deemed to be a beneficial owner of such securities; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such securities. Total includes 2,132,461 sole voting power shares, -0- shared voting power shares, 10,734,128 sole dispositive power shares and -0- shared dispositive power shares. |

| (8) | A parent holding company or control person in accordance with Rule 13d-1(b)(ii)(G). Total includes -0- sole voting power shares, 10,553,184 shared voting power shares, -0- sole dispositive power shares and 10,553,184 shared dispositive power shares. |

| (9) | An investment adviser in accordance with Rule 13d-1(b)(1)(ii)(E). Total includes 3,758,253 sole voting power shares, -0- shared voting power shares, 8,610,715 sole dispositive power shares and -0- shared dispositive power shares. |

| 14 | Murphy Oil Corporation | |

Table of Contents

| Security Ownership of Management

|

|

The following table sets forth information, as of February 13, 2017, concerning the number of shares of Common Stock of the Company beneficially owned by all directors and nominees, each of the Named Executive Officers (as hereinafter defined), and directors and executive officers as a group.

| Name | Personal with Full Voting and Investment Power(1)(2) |

Personal as Beneficiary of Trusts |

Voting and Investment Power Only |

Options Exercisable Within 60 Days |

Total | Percent of Outstanding (if greater than one percent) |

||||||||||||||||||

| Claiborne P. Deming | 844,370 | 1,639,538 | 209,720 | — | 2,693,628 | 1.56 | % | |||||||||||||||||

| T. Jay Collins | 5,985 | — | — | — | 5,985 | — | ||||||||||||||||||

| Steven A. Cossé | 123,212 | — | — | — | 123,212 | — | ||||||||||||||||||

| Lawrence R. Dickerson | 1,837 | — | — | — | 1,837 | — | ||||||||||||||||||

| Elisabeth W. Keller | 246,639 | 845,546 | 200,000 | (3) | — | 1,292,185 | — | |||||||||||||||||

| James V. Kelley | 39,874 | — | — | — | 39,874 | — | ||||||||||||||||||

| Walentin Mirosh | 14,327 | — | — | — | 14,327 | — | ||||||||||||||||||

| R. Madison Murphy | 313,599 | 2,082,264 | 1,616,553 | (4) | — | 4,012,416 | (5) | 2.33 | % | |||||||||||||||

| Jeffrey W. Nolan | 280,645 | 140,528 | — | — | 421,173 | — | ||||||||||||||||||

| Neal E. Schmale | 55,636 | — | — | — | 55,636 | — | ||||||||||||||||||

| Laura A. Sugg | — | — | — | — | — | — | ||||||||||||||||||

| Caroline G. Theus | 418,169 | 537,252 | 6,684 | (6) | — | 962,105 | — | |||||||||||||||||

| Roger W. Jenkins | 167,328 | — | — | 655,564 | 822,892 | — | ||||||||||||||||||

| John W. Eckart | 65,408 | — | — | 148,082 | 213,490 | — | ||||||||||||||||||

| Eugene T. Coleman | 30,359 | — | — | 199,071 | 229,430 | — | ||||||||||||||||||

| Walter K. Compton | 54,003 | — | — | 152,433 | 206,436 | — | ||||||||||||||||||

| Michael K. McFadyen | 56,275 | — | — | 182,501 | 238,776 | — | ||||||||||||||||||

| Directors and executive officers as a group(7) | 2,843,218 | 5,245,128 | 2,032,957 | 1,744,321 | 11,865,624 | 6.89 | % | |||||||||||||||||

| (1) | Includes Company Thrift (401(k)) Plan shares in the following amounts: Mr. Cossé—24,707 shares; Mr. Jenkins—3,929 shares; Mr. Eckart—12,200 shares; Mr. Coleman—4,179 shares; Mr. Compton—6,932 shares; Mr. McFadyen—814 shares. |

| (2) | Includes shares held by spouse and other household members as follows: Mr. Deming—48,006 shares which are held solely by spouse; Mr. Murphy—232,859 shares; Mr. Nolan—49,392 shares. |

| (3) | Ms. Keller has no investment power for these shares. |

| (4) | Includes 631,650 shares held by a private foundation of which Mr. Murphy is President for which beneficial ownership is expressly disclaimed and 984,903 shares held by a limited partnership that is controlled by a limited liability company of which Mr. Murphy is a member. Mr. Murphy and his wife have beneficial interest in 15,533 of these shares. |

| (5) | Total includes 184,785 shares that are pledged as security. |

| (6) | Held as trustee in trust for Ms. Theus’ son. |

| (7) | Includes eleven directors, thirteen executive officers and one director/officer. |

| Murphy Oil Corporation | 15 | |||

Table of Contents

|

|

Security Ownership of Management (continued)

|

| 16 | Murphy Oil Corporation | |

Table of Contents

|

Proposal 2—Advisory Vote to Approve Executive

|

|

The Board recommends a vote “FOR” the approval of the advisory vote for the compensation of the Company’s Named Executive Officers

| Murphy Oil Corporation | 17 | |||

Table of Contents

|

|

Proposal 3—Approval of an Advisory Vote

on the

|

The Board recommends that stockholders vote for the option of “ONE YEAR” as the frequency with which stockholders are provided an advisory vote on executive compensation.

| 18 | Murphy Oil Corporation | |

Table of Contents

|

Proposal 4—Approval of the Proposed 2012 Long-Term

|

|

| Murphy Oil Corporation | 19 | |||

Table of Contents

|

|

Proposal 4—Approval of the Proposed 2012 Long-Term

|

The Board recommends that stockholders vote “FOR” the performance measures of the 2012 Long-Term Incentive Plan.

| 20 | Murphy Oil Corporation | |

Table of Contents

| Compensation Discussion and Analysis

|

|

Murphy Oil Corporation is an independent exploration and production (“E&P”) company with a portfolio of global offshore and onshore assets delivering oil-weighted production. Murphy produces oil and natural gas in the United States, Canada and Malaysia. The Company’s long-term strategy as an independent E&P company is focused on the following key priorities that management believes will drive value for its stockholders: (1) develop differentiated perspectives in underexplored basins and plays; (2) continue to be a preferred partner to national oil companies and regional independents; (3) provide balance to the global offshore business by developing unconventional onshore plays in North America; (4) develop and produce fields in a safe, responsible, timely and cost effective manner; and (5) achieve and maintain a sustainable, profitable, oil weighted portfolio.

This Compensation Discussion and Analysis (“CD&A”) provides stockholders with an understanding of the Company’s compensation philosophy, objectives, policies and practices in place during 2016, as well as factors considered by the Executive Compensation Committee of the Board of Directors (the “Committee”) in making compensation decisions for 2016. For your reference, the Company’s CD&A is outlined in the following sections:

| Executive Summary | Page | |

| • The Company’s 2016 Operational and Financial Highlights |

22 | |

| • Impact of 2016 Company Performance on Executive Compensation |

22 | |

| • Actions Related to 2016 Performance |

23 | |

| • CEO Compensation |

24 | |

| • Other NEO Compensation |

24 | |

| • Stockholder Engagement |

24 | |

| • Compensation and Corporate Governance Policies – “What We Do” and “What We Don’t Do” |

25 | |

| Introduction | 26 | |

| Guiding Principles | 27 | |

| • Risk Evaluation |

28 | |

| Elements of Compensation | 28 | |

| A. Base Salary | 28 | |

| B. Annual Incentive Plan | 28 | |

| C. Long-Term Incentive Compensation | 30 | |

| D. Employee Benefits and Perquisites | 32 | |

| Actions Related to 2017 Executive Compensation | 33 | |

| Executive Compensation Committee Report | 34 | |

This CD&A focuses on the compensation of the Company’s Named Executive Officers (“NEOs”) listed below, whose compensation is set forth in the Summary Compensation table and other compensation tables contained in the proxy statement.

| Name | Title | |

| Roger W. Jenkins | President & Chief Executive Officer | |

| John W. Eckart | Executive Vice President & Chief Financial Officer | |

| Eugene T. Coleman | Executive Vice President, Offshore | |

| Walter K. Compton | Executive Vice President & General Counsel | |

| Michael K. McFadyen | Executive Vice President, Onshore |

On December 7, 2016, the Company announced the elections of Eugene T. Coleman as Executive Vice President, Offshore and Michael K. McFadyen as Executive Vice President, Onshore.

The Company’s compensation plans and practices are designed to align the financial interests of the above NEOs with the financial interests of its stockholders. To that end, NEOs are provided with a competitive base salary, an annual cash bonus opportunity based on the achievement of specific goals aligned with stockholder value creation and long-term incentives.

| Murphy Oil Corporation | 21 | |||

Table of Contents

|

|

Compensation Discussion and Analysis (continued)

|

OUR 2016 OPERATIONAL AND FINANCIAL HIGHLIGHTS

During fiscal year 2016, the energy industry was faced with numerous challenges. The commodity price collapse, which began in 2014, continued with a severity and duration greater than anticipated. In response, the Company took decisive actions to manage the challenges head-on and is emerging a stronger company. In 2016, Murphy delivered stabilized production following non-core asset divestitures, high-graded its portfolio, strengthened its financial health, and streamlined its organization. All of this was accomplished while achieving a record year in safety performance. Over the long-term, attaining the Company’s key business objectives is fundamental to delivering shareholder returns. Murphy’s specific achievements in 2016 include:

HIGHGRADING THE PORTFOLIO

| • | Murphy increased its long-term growth opportunities by high-grading its onshore portfolio by acquiring lands in the Kaybob Duvernay and Placid Montney at the trough in the commodity price cycle. |

| • | Murphy divested non-core synthetic and heavy oil assets as well as natural gas processing plants in Canada generating $1.2 billion cash. |

| • | The Company expanded its offshore exploration portfolio by farming into a successful exploration prospect in the Gulf of Mexico as well as capturing a highly competitive block in Mexico’s deepwater bid round. |

STABILIZING PRODUCTION AT LOWER CAPEX

| • | Murphy produced over 175 Mboepd in 2016, at the top end of the annual guidance of 174 to 175 Mboepd. |

| • | Capital expenditures, excluding acquisitions, were $604.8 million, over a 72% reduction from 2015 levels. |

REDUCING COSTS

| • | In 2016, Murphy lowered lease operating expenses, excluding Syncrude, to $7.87 per boe, a 15% reduction from 2015. |

| • | Murphy decreased selling and general expenses by 14% year-over-year, as a result of focusing on Company-wide cost reductions and streamlining the organization. |

MAINTAINING SHAREHOLDER FOCUS

| • | Murphy adjusted its dividend due to lower oil and natural gas prices, while maintaining a top quartile yield during 2016. |

| • | Murphy did not issue equity at the bottom of the cycle and stabilized the Company through lower capital spending and cost reductions. |

MAINTAINING BALANCE SHEET STRENGTH

| • | Murphy issued $550.0 million of eight year notes, holding the proceeds as cash on the balance sheet. |

| • | The Company entered into a new $1.1 billion unsecured guaranteed revolving credit facility, which remained undrawn at year end. |

| • | Finished the year with $1.0 billion of cash and invested cash on the balance sheet. |

OUTSTANDING SAFETY AND ENVIRONMENTAL PERFORMANCE

| • | Murphy achieved record safety performance in 2016 by reporting a total recordable incident rate (number of accidents per 200,000 work hours; “TRIR”) of 0.19 including all employees and contractors, a 32% improvement year-over-year, and exceeded the Company’s TRIR goal of 0.38 for 2016. |

| • | The spill rate (number of reportable spills greater than one barrel per million barrels of oil equivalent of operated production) for 2016 was an exceptional 0.09 as compared to 0.21 in 2015. |

IMPACT OF 2016 COMPANY PERFORMANCE ON EXECUTIVE COMPENSATION

Murphy has structured its cash and equity-based compensation program to position approximately 90% of the CEO’s and 75%-80% of the other NEO’s target total direct compensation opportunity in at-risk compensation components tied to the

| 22 | Murphy Oil Corporation | |

Table of Contents

| Compensation Discussion and Analysis (continued)

|

|

achievement of short- and long-term performance criteria aligned with the Company’s business objectives. Actual at-risk compensation was lower than targeted opportunity in 2016 due to reductions in long-term incentives received. Short-term incentives are paid in the form of annual cash bonus opportunities tied to the achievement of specific performance goals aligned with stockholder value creation. Long-term incentives combine performance-based and time-based restricted stock units and stock options to provide a compensation opportunity aligned with the Company’s long-term stock performance, delivered through awards that are performance based in absolute and relative terms, while also encouraging retention.

ACTIONS RELATED TO 2016 PERFORMANCE

| Base Salary | Annual Incentives | Long-Term Equity Incentives | ||||||||

| • No Adjustments to NEO Base Salaries

The Company provides base salaries to its NEOs which are structured to reward executives for the performance of their regular duties and responsibilities associated with their management of the organization.

Murphy targets the 50th percentile (median) level of base salaries paid by a select group of 10 peer companies in the exploration and production sector.

During 2016, the Company made no adjustments to the base salaries of its CEO and NEOs. This was the second consecutive year in which the Company elected to keep executive base salaries fixed at current levels in recognition of the difficult economic environment for oil and gas exploration and production companies. |

• Exercised Negative Discretion on Annual Incentive Plan (“AIP”) Awards

The Murphy AIP is a performance-driven plan intended to comply with the requirements of a performance plan pursuant to Section 162(m) of the Internal Revenue Code. The Plan, which establishes threshold, target, and maximum levels of financial, strategic, and operational goals within the first 90 days of the fiscal year, is formulaic in its application and the Committee is permitted to adjust calculated awards by means of negative discretion.

For the fiscal year 2016, the AIP measured performance in the following areas:

• EBITDA/BOE;

• Lease Operating Expense/BOE;

• Safety (Total Recordable Incident Rate);

• Environmental (Spill Rate);

• Production (BOEPD); and

• Produced Proved Reserve Replacement

Based upon the Company’s performance during fiscal year 2016, Murphy met or exceeded the performance goals in four of the six areas measured. The Company failed to achieve its threshold performance level of produced reserves replacement, and the AIP formula for the NEO positions resulted in an earned performance score of 138.76% of target.

Because the Company failed to reach a level of profitability during 2016 despite meeting or exceeding most of its key operating and strategic goals, the Executive Compensation Committee elected to exercise negative discretion bringing NEO payouts to a level commensurate with those of other plan participants. |

• Reduced Value of Long-Term Incentive Grants for 2016

In February 2016, the Executive Compensation Committee approved long-term incentive grants to the NEOs and all other long-term incentive plan participants for 2016. The Committee awarded grants in the form of: 50% of value in the form of performance-based restricted stock units; 25% of value in the form of fixed-price stock options; and 25% of value in the form of time-based restricted stock units. Due to the oil prices collapse’s impact on the Company, the Committee elected to award the same absolute number of shares for the 2016 grants for each NEO and all other participants as to the number of shares granted in 2015. This decision resulted in an approximate 63% decrease in the grant date fair value of the 2016 grants. In the judgment of the Committee, this grant strategy fairly addressed the significant oil price collapse’s impact on the Company and still provided management with an opportunity to earn competitive long-term award values.

| ||||||||

| Murphy Oil Corporation | 23 | |||

Table of Contents

|

|

Compensation Discussion and Analysis (continued)

|

ACTIONS RELATED TO 2016 PERFORMANCE (CONTINUED)

| Base Salary | Annual Incentives | Long-Term Equity Incentives | ||||||||||||||

|

The following provides a summary of the results for fiscal year 2016 based on relative TSR performance and the impact of such performance upon grants occurring in 2014, 2015, and 2016. The 2016 grants of awards were compared to a different peer group than the 2014 and 2015 awards.

|

| |||||||||||||||

| 2014 RSUs |

2015 RSUs |

2016 RSUs |

||||||||||||||

| Year 1 | 74.00% | 50.60% | 122.00% | |||||||||||||

| Year 2 | 50.60% | 131.40% | TBD | |||||||||||||

| Year 3 | 131.40% | TBD | TBD | |||||||||||||

| Cumulative Years 1-3 | 59.00% | TBD | TBD | |||||||||||||

| Total | 78.75% | TBD | TBD | |||||||||||||

| 24 | Murphy Oil Corporation | |

Table of Contents

| Compensation Discussion and Analysis (continued)

|

|

COMPENSATION AND CORPORATE GOVERNANCE POLICIES – “What We Do” and “What We Don’t Do”

Murphy is committed to developing and implementing executive compensation and corporate governance policies which are directly aligned with the best interests of our stockholders. In this regard, we have adopted executive compensation practices which are considered to be “best practices” and which will ensure that we have put stockholder interests in the forefront. The following table lists the practices that Murphy has implemented which describe the best practices we have adopted as “What We Do” as well as a listing of practices identified as “What We Don’t Do” that we consider not to be aligned with our stockholders’ interests.

| “What We Do” | “What We Don’t Do” | |

| ✓Stock Ownership Guidelines—The Company has adopted director and officer stock ownership guidelines which state that directors are to own and hold Company shares equal in value to five times the director’s annual cash retainer within five years of commencing Board service, whereas officers of the Company or any of its operating subsidiaries are expected to own and hold a number of shares at least equal in value to a multiple of base salary, depending upon the officer’s position (5.0 times for the CEO, 2.5 times for EVPs, 2.0 times for SVPs, and 1.0 times for VPs).

✓Pay for Performance—Murphy’s executive compensation program is driven by its pay for performance strategy and which is directly aligned with the achievement of Company business objectives, business strategies, and financial results. The Company has structured its executive compensation program such that more than 75% of a NEO’s direct compensation is in the form of variable compensation tied to Company performance through the annual incentive and long-term incentive compensation plans.

✓Restrictive Pledging Policy—The Company has adopted corporate governance guidelines which apply to directors and officers. A director or officer may not pledge Company securities, including the purchasing of Company securities on margin or holding Company securities in a margin account, until he or she has achieved the applicable stock ownership target specified in the guidelines above. Once such stock ownership target has been achieved, such director or officer is permitted to pledge Company securities in compliance with applicable law (including disclosure of such pledging in the Company’s Proxy Statement as required by SEC regulations), as long as all stock owned to satisfy the applicable stock ownership target remains unpledged. Any pledging of shares should be disclosed to the Company in advance.

✓Anti-Hedging Policy—The Company has implemented corporate governance guidelines that state: “Directors, officers, and employees are prohibited from engaging in any hedging transactions (including transactions involving options, puts, calls, prepaid variable forward contracts, equity swaps, collars and exchange funds, or other derivatives) that are designed to hedge or speculate on any change in the market value of the Company’s securities.”

✓Limited Perquisites—The Company’s executive officers, including the NEOs, receive no perquisites or special executive benefits, unless such benefits serve a reasonable purpose, such as limited use of Company aircraft by the CEO.

✓Clawback Provision—In connection with the Dodd-Frank Act, the Company has adopted a policy allowing for the recovering of incentive-based compensation under certain circumstances including a potential restatement of Company financial statements.

✓Independent Compensation Advisor—The Executive Compensation Committee of the Board of Directors has retained the services of Pay Governance LLC as its independent advisor regarding executive compensation issues facing the Committee. The Committee retains the right to engage, retain, and/or terminate the services of its advisory consultant in its full discretion. Pay Governance LLC provides no other services to Murphy or the Committee beyond its executive compensation advisory services.

✓Annual Stockholder Say-on-Pay Vote—Since the inception of the stockholder advisory vote regarding Say-on-Pay, Murphy has allowed for such a vote annually and has received a highly favorable (95% or higher) voting result each year. |

X No Employment Agreements—The Company does not have written employment agreements specifying compensation levels and practices for its NEOs or any Company employee. The only written agreement in effect is the Company’s change in control protection for its CEO in the CEO’s Severance Protection Agreement which is only operative in the event that the CEO is involuntarily terminated without cause or terminates for specified good reason following a change in control transaction.

X No Tax Gross-Up Payments—The Company does not provide its CEO or other NEOs with tax gross-up payments for any form of executive compensation, including the change in control severance compensation for the CEO.

X No Backdating of Stock Options—Murphy has never engaged in the practice of backdating stock options or other forms of equity compensation.

X No Payment of Dividends on Unearned Performance Awards—With respect of unearned long-term performance awards measured or paid in Company stock, the grantee will not receive dividends pursuant to such granted awards until such stock is earned and/or paid. | |

| Murphy Oil Corporation | 25 | |||

Table of Contents

|

|

Compensation Discussion and Analysis (continued)

|

| 26 | Murphy Oil Corporation | |

Table of Contents

| Compensation Discussion and Analysis (continued)

|

|

| Murphy Oil Corporation | 27 | |||

Table of Contents

|

|

Compensation Discussion and Analysis (continued)

|

| 28 | Murphy Oil Corporation | |

Table of Contents

| Compensation Discussion and Analysis (continued)

|

|

The Company’s current cash-based annual incentive plans, the 2012 Plan, was approved by stockholders at the 2012 annual meeting. Amounts earned under the 2012 Plan are intended to qualify as tax-deductible “performance-based” compensation under Section 162(m) of the Internal Revenue Code (the “Code”). The 2012 Plan provides the Committee with a list of performance criteria to be used for determination of performance-based awards. The Company submitted to shareholders in its 2016 proxy a request for approval of the 2017 Annual Incentive plan so that the Company’s annual plan will continue to be considered a performance plan pursuant to Section 162(m). Shareholders approved the 2017 plan as submitted at the 2016 Annual Meeting of Stockholders.

For 2016, the performance criteria utilized by the Committee included a mixture of a safety performance metric, an environmental performance metric, financial metrics, and operating metrics designed to work across the Company.

| 2016 Performance Criteria | ||

| Safety: Total Recordable Incident Rate (TRIR) | The Company’s TRIR is calculated as the number of incidents for both contractors and employees worldwide per 200,000 work hours. The health and safety of the Company’s employees and contractors is important to the Company. Inclusion of a safety metric reflects the Company’s emphasis on safe operations by both employees and contractors. | |

| Environmental: Spill Rate | The Company’s global spill rate is calculated as number of spills equal to or greater than one barrel per million BOEs(1) produced. Inclusion of a spill metric reflects the Company’s commitment to environmentally sound operations. | |

| Financial: EBITDA/BOE(1) Lease Operating Expense (“LOE”/BOE(1)) |

These financial goals focus on financial discipline and encourage employees to manage costs relative to gross margins and the commodity price environment. | |

| Operational: Reserves Replacement Production (BOEPD)(2) |

The primary business objectives for an exploration and production company are to find oil and gas reserves at a competitive cost while generating economic value for its stockholders and assuring that reserves are prudently converted into production and ultimately cash flow. Including specific operational goals on reserves additions (excluding acquisitions and divestitures) and production volumes provides a direct line of sight for the Company’s employees of their impact in the Company’s operational success. | |

| (1) | A barrel of oil equivalent (BOE) is a term used to summarize the amount of energy that is equivalent to the amount of energy found in a barrel of crude oil. One barrel of oil is generally deemed to have the same amount of energy content as 6,000 cubic feet of natural gas. |

| (2) | Barrels of oil equivalent per day (BOEPD) is a term that is used in conjunction with the production or distribution of oil and natural gas. |

With respect to the NEOs, the following table summarizes the performance metrics, respective weighting of performance metrics and weighted performance scores based on actual performance, used in determining their respective annual incentive awards for 2016. The targets for performance metrics were primarily based on historical data, budgets and forecasts. Under the terms of the 2012 Plan, achievement of 100% of the target rate results in the payment of 100% of individual target awards. For NEOs, achievement of the minimum of the performance range results in the payment of 62.5% of individual target awards and achievement of the maximum results in the payment of 250% of individual target awards, in each case subject to a discretionary downward adjustment by the Committee of up to 100%. Upward adjustments are not permitted for NEOs and no awards are payable if performance falls below the minimum.

| 2016 AIP Metrics and Results | ||||||||||||||||||||||||||||

| Metric | Threshold | Target | Maximum | Actual Results |

Payout Achieved (%) |

Weighting | Result | |||||||||||||||||||||

| Total Recordable Incident Rate | 0.50 | 0.38 | 0.00 | 0.19 | 187.50 | % | 7.50 | % | 14.06% | |||||||||||||||||||

| Spill Rate | 0.26 | 0.19 | 0.00 | 0.09 | 190.79 | % | 7.50 | % | 14.31% | |||||||||||||||||||

| EBITDA/BOE | $ | 9.12 | $ | 9.60 | $ | 10.56 | $ | 12.59 | 250.00 | % | 15.00 | % | 37.50% | |||||||||||||||

| LOE/BOE | $ | 10.05 | $ | 9.57 | $ | 8.61 | $ | 7.87 | 250.00 | % | 15.00 | % | 37.50% | |||||||||||||||

| Reserves Replacement | 90.00 | % | 100.00 | % | 140.00 | % | 68.00 | % | 0 | % | 25.00 | % | 0.00% | |||||||||||||||

| Production (BOEPD) | 165,034 | 183,371 | 220,045 | 181,312 | 117.98 | % | 30.00 | % | 35.39% | |||||||||||||||||||

| Total | 138.76% | |||||||||||||||||||||||||||

| Murphy Oil Corporation | 29 | |||

Table of Contents

|

|

Compensation Discussion and Analysis (continued)

|

Negative discretion in the amount of 16% to 20% was applied to each NEOs’ earned award, resulting in the actual payouts set forth below:

| Named Executive Officer | 2016 Base Salary Earnings |

Target Bonus as a Percentage of Base Salary Earnings* |

Earned Award (at % of Target) |

Negative Discretion Applied |

Actual Amount Awarded |

|||||||||||||||

| Roger W. Jenkins | $ | 1,300,013 | 135 | % | $ | 2,435,262 | 19.93 | % | $ | 1,950,000 | ||||||||||

| John W. Eckart | $ | 515,011 | 85 | % | $ | 607,434 | 19.99 | % | $ | 486,000 | ||||||||||

| Eugene T. Coleman | $ | 562,011 | 75 | % | $ | 584,885 | 15.88 | % | $ | 492,000 | ||||||||||

| Walter K. Compton | $ | 541,006 | 65 | % | $ | 487,955 | 19.87 | % | $ | 391,000 | ||||||||||

| Michael K. McFadyen* | $ | 422,289 | 75 | % | $ | 439,476 | 15.93 | % | $ | 369,451 | ||||||||||

| * | Mr. McFadyen is paid in Canadian dollars. His base salary earnings for 2016 were C$566,938. His earned award was C$590,012. Negative discretion in the amount of 15.93% was applied. The actual amount awarded to Mr. McFadyen was C$496,000. |

| 30 | Murphy Oil Corporation | |

Table of Contents

| Compensation Discussion and Analysis (continued)

|

|

| Named Executive Officer | Number of Stock Options |

Number of Time-Based Restricted Stock Units |

Number of Performance- Based Restricted Stock Units |

|||||||||

| Roger W. Jenkins | 220,000 | 51,000 | 101,000 | |||||||||

| John W. Eckart | 41,000 | 9,000 | 19,000 | |||||||||

| Eugene T. Coleman | 57,000 | 38,000 | 26,000 | |||||||||

| Walter K. Compton | 43,000 | 10,000 | 20,000 | |||||||||

| Michael K. McFadyen | 57,000 | 38,000 | 26,000 | |||||||||

| Murphy Oil Corporation | 31 | |||

Table of Contents

|

|

Compensation Discussion and Analysis (continued)

|

| 32 | Murphy Oil Corporation | |

Table of Contents

| Compensation Discussion and Analysis (continued)

|

|

ACTIONS RELATED TO 2017 COMPENSATION

At its meeting on January 31, 2017, the Committee met to discuss executive compensation issues reflecting the Company’s 2016 performance results and executive pay matters for fiscal year 2017. The Committee reviewed and analyzed the Murphy executive compensation program as well as considered the past year’s performance and proper positioning of compensation opportunities for fiscal year 2017. Key decisions and actions related to 2017 executive compensation reached by the Committee include:

Modest Adjustments to Base Salaries

For fiscal year 2017, the Committee approved minimal adjustments to base salary for four of the five NEOs effective as of February 1, 2017. Messrs. Coleman and McFayden each received 2.5% base salary increases for 2017; Mr. Compton received a 3.0% increase for 2017; and Mr. Eckart received a 10.0% increase for 2017. Mr. Eckart’s salary increase included a market-based adjustment to bring his salary rate closer to the 50th percentile market benchmark for the CFO position. The base salary for Mr. Jenkins was not increased.

Exercise Negative Discretion with Respect to 2016 Annual Incentives

The Committee exercised its negative discretion in adjusting annual cash payments under the AIP for NEOs for 2016 bonuses, which were payable in the first quarter of 2017. These downward adjustments included an across-the-board cut by 16% to 20% for all earned awards to the NEOs bringing NEO payouts to a level commensurate with those of other plan participants, even though the Company met or exceeded four of the six 2016 operational, safety, and strategic performance goals. In aggregate, the Company paid total bonus awards for 2016 performance for all employees, including the NEOs and other AIP participants, equal to approximately $27,700,000.

Granted 2017 Long-Term Incentives at 50th Percentile Target Levels

The Committee deliberated regarding the subject of long-term incentive compensation to be granted to the Company NEOs in 2017. Based upon an analysis of competitive market data, the recent grant practices of Murphy’s peer companies in the most recent market environment, and the performance of the Company’s top management during 2016, the Committee awarded long-term incentive grants equal to approximately 84% of the target award opportunities for each NEO based upon the 50th percentile (median) competitive market practice and the reduction of the number of stock options calculated to remain compliant under the 2012 Plan. Long-term incentive grants for each NEO were awarded 50% in the value of performance-based restricted stock units, 25% in the value of 7-year fixed-price stock options, and 25% in the value of time-lapse restricted stock units. It is the judgment of the Committee that these long-term grants are fully competitive with current market competitive practices while serving as the proper alignment of management’s long-term interests with Murphy shareholder interests.

Target versus Realizable Compensation Chart—CEO Compensation

The “Target” bars represent Mr. Jenkins’ base salary, target AIP opportunity and the grant-date fair value of his LTIP awards for 2014, 2015 and 2016. The “Realizable” bars represent each year’s base salary paid, AIP earned and paid, and the value of those LTIP awards as of December 31, 2016.

| Murphy Oil Corporation | 33 | |||

Table of Contents

|

|

Compensation Discussion and Analysis (continued)

|

EXECUTIVE COMPENSATION COMMITTEE REPORT

The Executive Compensation Committee has reviewed and discussed with management the foregoing Compensation Discussion and Analysis. Based on the review and discussions, the Executive Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in the Company’s Proxy Statement.

EXECUTIVE COMPENSATION COMMITTEE

Neal E. Schmale (Chair)

T. Jay Collins

Walentin Mirosh

Jeffrey W. Nolan

| 34 | Murphy Oil Corporation | |

Table of Contents

|

|

|

Tabular Information for Named Executive Officers

Further information with respect to the individuals who served as the Company’s Principal Executive Officer, Principal Financial Officer and the three other most highly compensated executive officers serving at the end of the last completed fiscal year is set forth in the following tables:

2016 SUMMARY COMPENSATION TABLE

| Name and Principal Position | Year | Salary ($) |

Bonus ($) |

Stock Awards ($)(1) |

Option Awards ($)(2) |

Non-Equity Incentive Plan Compensation ($)(3) |

Change in Pension Value and Nonqualified Compensation Earnings ($) |

All Other Compensation ($)(4) |

Total ($) |

|||||||||||||||||||||||||||

| Roger W. Jenkins |

2016 | 1,300,013 | — | 2,410,310 | 1,106,600 | 1,950,000 | 1,501,179 | 233,645 | 8,501,747 | |||||||||||||||||||||||||||

| President and Chief |

2015 | 1,300,000 | — | 7,192,723 | 2,413,400 | 1,237,714 | 1,742,060 | 197,720 | 14,083,617 | |||||||||||||||||||||||||||

| 2014 | 1,295,833 | — | 5,284,440 | 1,540,800 | 2,200,000 | 2,204,998 | 252,497 | 12,778,568 | ||||||||||||||||||||||||||||

| John W. Eckart(5) |

2016 | 515,011 | — | 442,990 | 206,230 | 486,000 | 547,018 | 31,800 | 2,229,049 | |||||||||||||||||||||||||||

| Executive Vice |

2015 | 506,333 | — | 1,323,437 | 449,770 | 289,922 | 52,062 | 31,280 | 2,652,804 | |||||||||||||||||||||||||||

| Eugene T. Coleman(6) |

2016 | 562,011 | — | 1,220,090 | 286,710 | 492,000 | 381,326 | 34,620 | 2,976,757 | |||||||||||||||||||||||||||

| Executive Vice |

||||||||||||||||||||||||||||||||||||

| Walter K. Compton |

2016 | 541,006 | — | 475,550 | 216,290 | 391,000 | 508,648 | 33,360 | 2,165,854 | |||||||||||||||||||||||||||

| Executive Vice General Counsel |

2015 | 541,000 | — | 1,419,360 | 471,710 | 248,001 | (25,556 | ) | 33,360 | 2,687,875 | ||||||||||||||||||||||||||

|

|

2014

|

|

538,108 | — | 1,027,530 | 295,320 | 405,199 | 1,401,045 | 33,421 | 3,700,623 | ||||||||||||||||||||||||||

| Michael K. McFadyen(6)(7) |

2016 | 422,289 | 100,000 | 1,220,090 | 286,710 | 369,451 | 318,445 | 26,354 | 2,743,339 | |||||||||||||||||||||||||||

| Executive Vice |

||||||||||||||||||||||||||||||||||||

| (1) | The restricted stock unit awards are shown at grant date fair value as computed in accordance with FASB ASC Topic 718, excluding forfeiture estimates, as more fully described in Note J to the consolidated financial statements included in the 2016 Form 10-K report. Performance-based restricted stock unit awards are subject to performance-based conditions and are forfeited if the grantee’s employment terminates for any reason other than retirement, death or full disability. The performance-based restricted stock unit awards vest three years from the date of grant if performance conditions are met. Time-based restricted stock unit awards vest three years from the date of grant and are forfeited if the grantee’s employment terminates for any reason other than retirement, death or full disability. There is no assurance that the value realized by the executive will be at or near the value included herein. |

| (2) | The stock option awards are shown at grant date fair value as computed in accordance with FASB ASC Topic 718, excluding forfeiture estimates, as more fully described in Note J to the consolidated financial statements included in the 2016 Form 10-K report. Options granted generally vest in two equal installments on the second and third anniversaries of the grant date. The options are exercisable for a period of seven years from the date of grant. The actual value, if any, an executive may realize will depend on the excess of the stock price over the exercise price on the date the option is exercised. There is no assurance that the value realized by the executive will be at or near the value included herein. |

| (3) | Non-Equity Incentives were awarded and paid after the end of the year in which they are reported. Because these payments related to services rendered in the year prior to payment, the Company reported these incentives as a component of compensation expense in the year for which the award was earned. |

| (4) | The total amounts shown in this column for 2016 consist of the following: |

| Mr. Jenkins $78,000—Company contributions to defined contribution plans; $900—benefit attributable to Company-provided term life insurance policy; |

| $154,745—Company airplane usage based on aggregate incremental cost to the Company. The aggregate incremental cost to the Company for airplane usage is calculated by multiplying, for each trip, the statutory miles for each trip times the 12-month average direct cost per statutory mile for the airplane used. The direct costs utilized in the calculation include: travel expenses for the aviation crew, communications expenses, landing fees, fuel and lubrication, contract maintenance and repairs, and the provision allocated for the overhaul of the engines. |

| Mr. Eckart: $30,900—Company contributions to defined contribution plans; $900—Benefit attributable to Company-provided term life insurance policy. |

| Mr. Coleman: $33,720—Company contributions to defined contribution plans; $900—Benefit attributable to Company-provided term life insurance policy. |

| Mr. Compton: $32,460—Company contributions to defined contribution plans; $900—Benefit attributable to Company-provided term life insurance policy. |

| Mr. McFadyen: $25,337—Company contributions to defined contribution plans; $1,017—Benefit attributable to Company-provided term life insurance policy (Mr. McFadyen’s benefits are a Canadian Dollar benefit converted to US Dollar). |

| (5) | Mr. Eckart was not a Named Executive officer in 2014. |

| (6) | Mr. Coleman and Mr. McFadyen were not Named Executive Officers in 2014 and 2015. |

| (7) | The currency conversation factor for the Canadian dollar utilized in this table for Mr. McFadyen’s salary, non-equity incentive plan compensation is 0.74486 Canadian dollars to one U.S. dollar. |