SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

| For the fiscal year ended | ||||||||

| OR | ||||||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

| For the transition period from to | ||||||||

Commission file number 1-8590

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |||||||

| (Zip Code) | ||||||||

| (Address of principal executive offices) | ||||||||

| (Registrant’s telephone number, including area code) | ||||||||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

Aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter (as of June 30, 2023) – $4,406,165,207 .

Number of shares of Common Stock, $1.00 Par Value, outstanding at January 31, 2024 was 152,755,027 .

Documents incorporated by reference:

Portions of the Registrant’s definitive Proxy Statement relating to the Annual Meeting of Stockholders on May 08, 2024 have been incorporated by reference in Part III herein. | ||

MURPHY OIL CORPORATION

2023 FORM 10-K

TABLE OF CONTENTS

| Page Number | ||||||||

Item 9. | ||||||||

| Item 9C. | ||||||||

i

PART I

Item 1. BUSINESS

Summary

Murphy Oil Corporation is a global oil and gas exploration and production company, with both onshore and offshore operations and properties. As used in this report, the terms Murphy, Murphy Oil, we, our, its and Company may refer to Murphy Oil Corporation or any one or more of its consolidated subsidiaries.

The Company was originally incorporated in Louisiana in 1950 as Murphy Corporation. It was reincorporated in Delaware in 1964, at which time it adopted the name Murphy Oil Corporation. In 2013, the U.S. downstream business was separated from Murphy Oil Corporation’s oil and gas exploration and production business. For reporting purposes, Murphy’s exploration and production activities are subdivided into three geographic segments, including the United States, Canada and all other countries. Additionally, the Corporate segment includes interest income, interest expense, foreign exchange effects, corporate risk management activities and administrative costs not allocated to the exploration and production segments. The Company’s corporate headquarters are located in Houston, Texas.

As part of the Company’s underlying operations, the Company is continually monitoring its greenhouse gas (GHG) emissions and impact on the environment as well as other social and environmental aspects of its business. See Sustainability on page 10.

In addition to the following information about each business activity, data about Murphy’s operations, properties and business segments, including revenues by class of products and financial information by geographic area, are provided on pages 32 through 45, 74 through 76, 77 through 78, 98 through 100, and 103 through 118 of this Form 10-K report.

Interested parties may obtain the Company’s public disclosures filed with the Securities and Exchange Commission (SEC), including Form 10-K, Form 10-Q, Form 8-K and other documents, by accessing the Investor Relations section of Murphy Oil Corporation’s Website at www.murphyoilcorp.com.

Exploration and Production

The Company produces crude oil, natural gas and natural gas liquids primarily in the U.S. and Canada and explores for crude oil, natural gas and natural gas liquids in targeted areas worldwide.

During 2023, Murphy’s principal exploration and production activities were conducted in the United States by wholly-owned Murphy Exploration & Production Company – USA (Murphy Expro USA) and its subsidiaries, in Canada by wholly-owned Murphy Oil Company Ltd. and its subsidiaries and in Australia, Brazil, Brunei, Côte d’Ivoire, Mexico and Vietnam by wholly-owned Murphy Exploration & Production Company – International (Murphy Expro International) and its subsidiaries. Murphy’s operations and production in 2023 were in the United States, Canada and Brunei.

Unless otherwise indicated, all references to the Company’s offshore U.S. and total oil, natural gas liquids and natural gas production and sales volumes and proved reserves include a noncontrolling interest in MP Gulf of Mexico, LLC (MP GOM; see further details below).

Murphy’s worldwide 2023 production on a barrel of oil equivalent basis (six thousand cubic feet of natural gas equals one barrel of oil) was 192,640 barrels of oil equivalent per day, an increase of 10.0% compared to 2022.

For further details on business execution, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” starting on page 32. For further details on 2023 production and sales volume see pages 35 to 36.

United States

In the United States, Murphy produces crude oil, natural gas liquids and natural gas primarily from fields in the Gulf of Mexico and in the Eagle Ford Shale area of South Texas. The Company produced 108,084 barrels of crude oil and natural gas liquids per day and approximately 96 MMCF of natural gas per day in the U.S. in 2023. These amounts represented 94.0% of the Company’s total worldwide oil and natural gas liquids and 20.6% of worldwide natural gas production volumes.

1

Offshore

The Company holds rights to approximately 600 thousand gross acres in the Gulf of Mexico. During 2023, approximately 73% of total U.S. hydrocarbon production was produced at fields in the Gulf of Mexico, of which approximately 90% was derived from ten fields, including St. Malo, Samurai, Khaleesi, Mormont, Cascade and Chinook, Kodiak, Lucius, Neidermeyer, Marmalard and Front Runner. Total average daily production in the Gulf of Mexico in 2023 was 79,397 barrels of crude oil and natural gas liquids and 70 MMCF of natural gas. At December 31, 2023, Murphy had total proved reserves for Gulf of Mexico fields of 132.3 million barrels of oil and natural gas liquids and 100.7 billion cubic feet of natural gas.

Onshore

The Company holds rights to approximately 133 thousand gross acres in South Texas in the Eagle Ford Shale unconventional oil and natural gas play. During 2023, approximately 27% of total U.S. hydrocarbon production was produced in the Eagle Ford Shale. Total 2023 production in the Eagle Ford Shale area was 28,641 barrels of oil and liquids per day and 25.7 MMCF per day of natural gas. At December 31, 2023, the Company’s proved reserves for the U.S. Onshore business totaled 130 million barrels of liquids and 192.4 billion cubic feet of natural gas.

Canada

In Canada, the Company holds working interests in Tupper Montney (100% owned), Kaybob Duvernay (operated) and two non-operated offshore assets – the Hibernia and Terra Nova fields, located offshore Newfoundland in the Jeanne d’Arc Basin. During 2023 the Company sold a portion of its working interest in Kaybob Duvernay and our entire 30% non-operated working interest in Placid Montney.

Onshore

Murphy has approximately 139 thousand gross acres of Tupper Montney mineral rights located in northeast British Columbia. In addition, the Company holds a 70% operated working interest in Kaybob Duvernay lands in Alberta. The Company has approximately 165 thousand gross acres of Kaybob Duvernay mineral rights. Daily production in 2023 in Onshore Canada averaged 3,618 barrels of liquids and 370 MMCF of natural gas, which included production from our divested Placid Montney of 274 barrels of liquids and 3 MMCF of natural gas. Total Onshore Canada proved liquids and natural gas reserves at December 31, 2023, were approximately 16.4 million barrels and 2.2 trillion cubic feet, respectively.

Offshore

The Company holds a non-operated interest in approximately 133 thousand gross acres offshore Canada. Murphy has a 6.5% working interest in Hibernia Main, a 4.3% working interest in Hibernia South Extension and an 18% working interest in Terra Nova.

Oil production in 2023 was 2,780 barrels of oil per day for Hibernia.

In 2023, the Terra Nova asset life extension project was completed and production restarted at the end of November. Production is expected to ramp up over the coming months. Total oil production in 2023 was 240 barrels of oil per day for Terra Nova.

Total proved reserves for offshore Canada at December 31, 2023 were approximately 22.3 million barrels of liquids and 14.8 billion cubic feet of natural gas.

Brazil

The Company holds a 20% non-operated working interest in nine blocks in the offshore regions of the Sergipe-Alagoas Basin (SEAL) in Brazil (SEAL-M-351, SEAL-M-428, SEAL-M-430, SEAL-M-501, SEAL-M-503, SEAM-M-505, SEAL-M-573, SEAL-M-575 and SEAL-M-637).

Murphy has a 100% working interest in three blocks in the Potiguar Basin (POT-M-857, POT-M-863 and POT-M-865).

Murphy’s total acreage position in Brazil as of December 31, 2023 is approximately 2.5 million gross acres, offsetting several major discoveries. There are no well commitments.

2

Brunei

The Company has a working interest of 8.051% in Block CA-1 as of December 31, 2023.

Oil production in 2023 was 250 barrels of oil per day for Brunei.

Total proved reserves for our Jagus East discovery in Block CA-1 at December 31, 2023 were approximately 0.3 million barrels of liquids and 188 million cubic feet of natural gas. Block CA-1 covers 2 thousand gross acres.

Mexico

Murphy holds a 40% working interest and is the operator of Block 5 in the deepwater Salina Basin. The block covers approximately 623 thousand gross acres, with water depths ranging from 2,300 to 3,500 feet (700 to 1,100 meters). The license contract is currently in the first additional exploration period, which expires in May 2025 and has no outstanding commitments. In 2022, an exploration well was drilled and did not find commercial hydrocarbons.

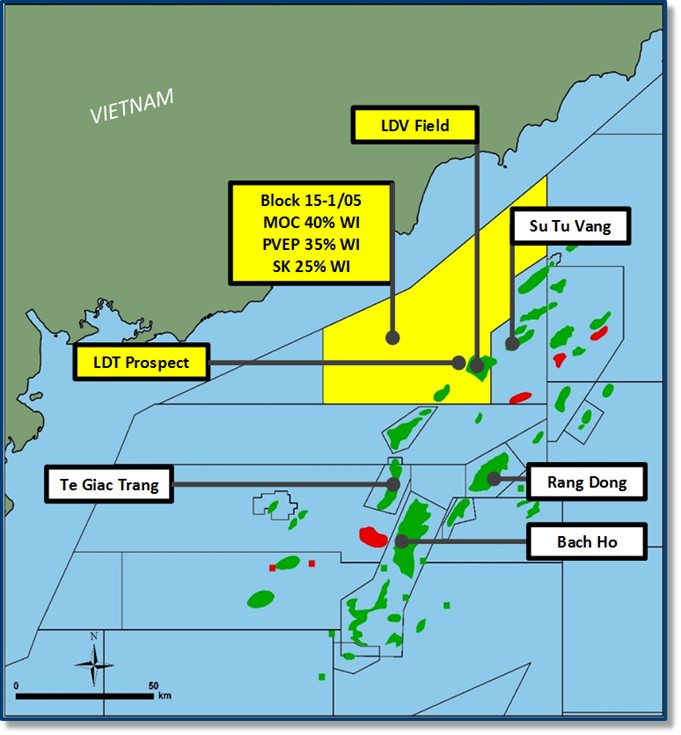

Vietnam

The Company holds an interest in 7.3 million gross acres, consisting of a 65% working interest in blocks 144 and 145; and a 40% interest in Block 15-1/05 and Block 15-2/17. The Company is operator of each of the three Production Sharing Contracts (PSCs).

Block 15-1/05 contains the Lac Da Vang (LDV) discovered field in the Cuu Long Basin where the Declaration of Commerciality was made in January 2019, and the field Outline Development Plan was approved by Petrovietnam in August 2019. The Lac Da Trang (LDT) 1X exploration well, the last remaining commitment of the PSC, was completed in April 2019. In 2023, the Company received government approval of the field development plan and the Board of Directors of the Company (the Board) sanctioned the project. The Company anticipates drilling an exploration well in 2024.

In Block 15-2/17, the Company completed its seismic study program, which included 3D seismic reprocessing. In 2024 the Company anticipates drilling an exploration commitment well.

In blocks 144 and 145, the Company acquired 2D seismic in 2013 and undertook seabed surveys in 2015 and 2016. The Company will be seeking an extension to complete the remaining seismic commitment.

Total proved reserves for Vietnam at December 31, 2023 were approximately 12.1 million barrels of liquids and 2.8 billion cubic feet of natural gas.

Côte d’Ivoire

During the second quarter of 2023, Murphy signed PSCs as operator in five deepwater blocks in the Tano Basin offshore Côte d’Ivoire in Africa. The five blocks have a total area of 1.5 million gross acres, with Murphy initially holding a 90% working interest in four blocks and 85% working interest in the fifth block. Société Nationale d’Opérations Pétrolières de la Côte d’Ivoire holds the remaining working interest for each block.

Commitments for the initial exploration periods across the five blocks consist of seismic reprocessing. Block CI-103 includes the Paon discovery, appraised with multiple wells by a previous operator. The PSC for this block also includes a commitment to submit a field development plan for this discovery by the end of 2025.

3

Proved Reserves

Total proved reserves for crude oil, natural gas liquids and natural gas as of December 31, 2023 are presented in the following table.

| Proved Reserves | |||||||||||||||||||||||

| All Products | Crude Oil | Natural Gas Liquids | Natural Gas 4 | ||||||||||||||||||||

| Proved Developed Reserves: | (MMBOE) | (MMBBL) | (BCF) | ||||||||||||||||||||

| United States | 223.2 | 163.7 | 24.1 | 212.4 | |||||||||||||||||||

| Onshore | 109.4 | 70.3 | 16.3 | 136.7 | |||||||||||||||||||

Offshore 1 | 113.8 | 93.4 | 7.8 | 75.7 | |||||||||||||||||||

| Canada | 202.0 | 22.3 | 1.8 | 1,066.7 | |||||||||||||||||||

| Onshore | 183.4 | 6.0 | 1.8 | 1,053.0 | |||||||||||||||||||

| Offshore | 18.6 | 16.3 | — | 13.7 | |||||||||||||||||||

| Other | 0.3 | 0.3 | — | 0.2 | |||||||||||||||||||

| Total proved developed reserves | 425.5 | 186.3 | 25.9 | 1,279.3 | |||||||||||||||||||

| Proved Undeveloped Reserves: | |||||||||||||||||||||||

| United States | 87.9 | 64.3 | 10.2 | 80.7 | |||||||||||||||||||

| Onshore | 52.7 | 35.8 | 7.6 | 55.7 | |||||||||||||||||||

Offshore 2 | 35.2 | 28.5 | 2.6 | 25.0 | |||||||||||||||||||

| Canada | 213.5 | 13.1 | 1.5 | 1,193.4 | |||||||||||||||||||

| Onshore | 207.3 | 7.1 | 1.5 | 1,192.3 | |||||||||||||||||||

| Offshore | 6.2 | 6.0 | — | 1.1 | |||||||||||||||||||

| Other | 12.6 | 12.1 | — | 2.8 | |||||||||||||||||||

| Total proved undeveloped reserves | 314.0 | 89.5 | 11.7 | 1,276.9 | |||||||||||||||||||

Total proved reserves 3 | 739.5 | 275.8 | 37.6 | 2,556.2 | |||||||||||||||||||

1 Includes proved developed reserves of 12.8 MMBOE, consisting of 11.7 million barrels of oil (MMBBL) oil, 0.5 MMBBL NGLs and 3.8 BCF natural gas, attributable to the noncontrolling interest in MP GOM.

2 Includes proved undeveloped reserves of 2.7 MMBOE, consisting of 2.3 MMBBL oil, 0.1 MMBBL NGLs and 1.5 BCF natural gas, attributable to the noncontrolling interest in MP GOM.

3 Includes proved reserves of 15.5 MMBOE, consisting of 14.0 MMBBL oil, 0.6 MMBBL NGLs and 5.3 BCF natural gas, attributable to the noncontrolling interest in MP GOM.

4 Includes proved natural gas reserves to be consumed in operations as fuel of 71.3 BCF, 41.9 BCF and 2.8 BCF for the U.S. Canada and Other, respectively, with 1.2 BCF attributable to the noncontrolling interest in MP GOM.

4

Murphy Oil’s 2023 total proved reserves and proved undeveloped reserves are reconciled from 2022 as presented in the table below:

(Millions of oil equivalent barrels) 1 | Total Proved Reserves | Total Proved Undeveloped Reserves | |||||||||

| Beginning of year | 715.4 | 279.4 | |||||||||

| Revisions of previous estimates | (13.3) | (3.7) | |||||||||

| Extensions and discoveries | 112.6 | 111.2 | |||||||||

| Improved recovery | 0.4 | 0.4 | |||||||||

| Conversions to proved developed reserves | – | (73.3) | |||||||||

| Sale of properties | (5.2) | – | |||||||||

| Production | (70.4) | – | |||||||||

End of year 2 | 739.5 | 314.0 | |||||||||

1 For purposes of these computations, natural gas sales volumes are converted to equivalent barrels of oil using a ratio of six thousand cubic feet (MCF) of natural gas to one barrel of oil.

2 Includes 15.5 MMBOE and 2.7 MMBOE for total proved and proved undeveloped reserves, respectively, attributable to the noncontrolling interest in MP GOM.

During 2023, Murphy’s total proved reserves increased by 24.1 million barrels of oil equivalent (MMBOE). The increase in reserves principally relates to extensions of 86.4 MMBOE in Onshore Canada, 11.7 MMBOE in the Eagle Ford Shale, 12.6 MMBOE in Vietnam, 1.1 MMBOE in the Gulf of Mexico, and 0.9 MMBOE in Offshore Canada. These revisions were offset by production of 70.4 MMBOE in 2023, performance and price related reductions of 11.4 MMBOE in the Eagle Ford Shale and 1.9 MMBOE in the Gulf of Mexico, and disposition of 5.2 MMBOE in Onshore Canada.

Murphy’s total proved undeveloped reserves at December 31, 2023 increased 34.6 MMBOE from a year earlier. The proved undeveloped reserves reported in the table as extensions and discoveries during 2023 were predominantly attributable to four areas: the U.S. Gulf of Mexico, the Eagle Ford Shale in South Texas, Tupper Montney in Onshore Canada and Offshore Vietnam. The U.S. and Canadian assets had active development work ongoing during the year, while the Tupper Montney had increased capital allocations and the Lac Da Vang development project in Vietnam was sanctioned. The majority of proved undeveloped reserves associated with revisions of previous estimates was the result of performance adjustments in Tupper Montney and the Eagle Ford Shale and negative price revisions in the U.S. Onshore and U.S. Offshore fields, and were substantially offset by positive price revisions in Tupper Montney from decreased royalty rates and decelerated royalty incentive payouts arising from lower commodity prices. The majority of the proved undeveloped reserves migration to the proved developed category are attributable to drilling in Tupper Montney, the Gulf of Mexico, and the Eagle Ford Shale and the completion of the Terra Nova field life extension project in Offshore Canada. Other proved undeveloped increases resulted from sanctioned development plans for the Longclaw field in the Gulf of Mexico and Lac Da Vang field in Vietnam.

The Company spent approximately $704 million in 2023 to convert proved undeveloped reserves to proved developed reserves. In the next three years, the Company expects to spend a range of approximately $450 million to $700 million per year to move current undeveloped proved reserves to the developed category. The anticipated level of spending in 2024 primarily includes drilling and development in the Gulf of Mexico, Eagle Ford Shale, Tupper Montney and Vietnam areas.

At December 31, 2023, proved reserves are included for several development projects, including oil developments in the Eagle Ford Shale in South Texas, deepwater Gulf of Mexico, Kaybob Duvernay in Onshore Canada and Lac Da Vang in Vietnam; as well as natural gas developments in Tupper Montney in Onshore Canada. Total proved undeveloped reserves associated with various development projects at December 31, 2023 were approximately 314.0 MMBOE, which represents 42% of the Company’s total proved reserves.

Certain development projects have proved undeveloped reserves that will take more than five years to bring to production. The Company currently operates deepwater fields in the Gulf of Mexico that have two undeveloped locations that exceed this five-year window. Total reserves associated with the two locations amount to less than 1% of the Company’s total proved reserves at year-end 2023. The development of certain reserves extends

5

beyond five years due to limited well slot availability, thus making it necessary to wait for depletion of other wells prior to initiating further development of these locations or behind-pipe completions with significant capital costs that categorize them as undeveloped.

Murphy Oil’s Reserves Processes and Policies

All estimates of reserves are made in compliance with SEC Rule 4-10 of Regulation S-X, which states that “proved oil and gas reserves are those quantities of oil and gas which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible —from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations.” Proved reserves estimates will generally be revised only as additional geologic or engineering data become available or as economic conditions change. Moreover, estimates of proved reserves may be revised as a result of future operations, effects of regulation by governmental agencies or geopolitical or economic risks. Therefore, the proved reserves included in this report are estimates only and should not be construed as being exact quantities, and if recovered, could be more or less than the estimated amounts.

Murphy has established both internal and external controls for estimating proved reserves that follow the guidelines set forth by the SEC for oil and gas reporting. Crude oil and condensate, natural gas liquids (NGL) and natural gas reserve estimates are developed or reviewed by Qualified Reserves Estimators (“QREs”). QREs are technical professionals embedded within the asset teams. QRE qualification generally requires a minimum of five years of practical experience in petroleum engineering or petroleum production geology, with at least three years of such experience being in the estimation and evaluation of reserves, and either a bachelors or advanced degree in petroleum engineering, geology or other discipline of engineering or physical science from a college or university of recognized stature, or the equivalent thereof from an appropriate government authority or professional organization. Larger business units of the Company also employ Regional Reserves Coordinators who coordinate and provide oversight of the reserve submissions to senior management and the Corporate Reserves group. Murphy provides annual training to all Company reserves estimators to ensure SEC requirements associated with reserves estimation and Form 10-K reporting are fulfilled.

Proved reserves are consolidated and reported through the Corporate Reserves group. Murphy’s General Manager Corporate Reserves (Reserves General Manager) leads the Corporate Reserves group that also includes Corporate Reserve engineers and support staff, all of which are independent of the Company’s oil and gas operational management and technical personnel. The Reserves General Manager joined Murphy in 2020 and has more than 32 years of industry experience. He has a Bachelor of Science in Mechanical Engineering and is also a licensed Professional Engineer in the State of Texas. The Reserves General Manager reports to the Executive Vice President and Chief Financial Officer and makes annual presentations to the Board about the Company’s reserves. The Reserves Manager and the Corporate Reserve engineers review and discuss reserves estimates directly with the Company’s technical staff in order to make every effort to ensure compliance with the rules and regulations of the SEC.

The Reserves General Manager coordinates and oversees the third-party audits which are performed annually. In 2023, third party audits were conducted for proved reserves covering 96.6% of total proved reserves. All audits conducted during this period were within the established +/- 10.0% tolerance.

Ryder Scott Company (“Ryder Scott”) performed audits for certain reserve estimates of Murphy’s U.S. fields as of December 31, 2023. The Ryder Scott summary report is filed as an exhibit to this Annual Report on Form 10-K. The team lead for Ryder Scott has over 21 years of industry experience, joining Ryder Scott over 18 years ago. He is a registered Professional Engineer in the State of Texas.

McDaniel & Associates (“McDaniel”) performed audits for certain reserve estimates of our Canadian fields as of December 31, 2023. The McDaniel summary report is filed as an exhibit to this Annual Report on Form 10-K. The two technical advisors for McDaniel both have over 17 years of experience in the estimation and evaluation of reserves with McDaniel. Both are registered Professional Engineers with the Association of Professional Engineers and Geoscientists of Alberta.

Gaffney, Cline & Associates Pte Ltd (“GaffneyCline”) performed audits for certain reserve estimates of our Vietnam fields as of December 31, 2023. The GaffneyCline summary report is filed as an exhibit to this Annual Report on Form 10-K. The team lead for GaffneyCline has over 40 years of industry experience, joining GaffneyCline over 19 years ago.

6

To ensure accuracy and security of reported reserves, the proved reserves estimates are coordinated in industry-standard software with access controls for approved users. In addition, Murphy complies with internal controls concerning the various business processes related to reserves.

More information regarding Murphy’s estimated quantities of proved reserves of crude oil, natural gas liquids and natural gas for the last three years are presented by geographic area on pages 105 through 112 of this Form 10-K report. Murphy currently has no oil and natural gas reserves from non-traditional sources. Murphy has not filed and is not required to file any estimates of its total proved oil or natural gas reserves on a recurring basis with any federal or foreign governmental regulatory authority or agency other than the SEC. Annually, Murphy reports gross reserves of properties operated in the United States to the U.S. Department of Energy; such reserves are derived from the same data from which estimated proved reserves of such properties are determined.

Crude oil, condensate and natural gas liquids production and sales, and natural gas sales by geographic area with weighted average sales prices for each of the three years ended December 31, 2023 are shown on page 34 of this Form 10-K report.

Production expenses for the last three years in U.S. dollars per equivalent barrel are discussed beginning on page 38 of this Form 10-K report.

Supplemental disclosures relating to oil and natural gas producing activities are reported on pages 103 through 118 of this Form 10-K report.

7

Acreage and Well Count

At December 31, 2023, Murphy held leases, concessions, contracts or permits on developed and undeveloped acreage as shown by geographic area in the following table. Gross acres are those in which all or part of the working interest is owned by Murphy. Net acres are the portions of the gross acres attributable to Murphy’s interest.

| Developed | Undeveloped | Total | ||||||||||||||||||||||||||||||||||||

Area (Thousands of acres) | Gross | Net | Gross | Net | Gross | Net | ||||||||||||||||||||||||||||||||

| United States | Onshore | 111 | 97 | 22 | 22 | 133 | 119 | |||||||||||||||||||||||||||||||

| Gulf of Mexico | 59 | 26 | 541 | 288 | 600 | 314 | ||||||||||||||||||||||||||||||||

| Total United States | 170 | 123 | 563 | 310 | 733 | 433 | ||||||||||||||||||||||||||||||||

| Canada | Onshore | 129 | 105 | 175 | 138 | 304 | 243 | |||||||||||||||||||||||||||||||

| Offshore | 105 | 12 | 28 | 1 | 133 | 13 | ||||||||||||||||||||||||||||||||

| Total Canada | 234 | 117 | 203 | 139 | 437 | 256 | ||||||||||||||||||||||||||||||||

| Mexico | – | – | 623 | 249 | 623 | 249 | ||||||||||||||||||||||||||||||||

| Brazil | – | – | 2,453 | 1,110 | 2,453 | 1,110 | ||||||||||||||||||||||||||||||||

| Brunei | 2 | – | – | – | 2 | – | ||||||||||||||||||||||||||||||||

| Vietnam | – | – | 7,324 | 4,571 | 7,324 | 4,571 | ||||||||||||||||||||||||||||||||

| Côte d’Ivoire | – | – | 1,489 | 1,332 | 1,489 | 1,332 | ||||||||||||||||||||||||||||||||

| Totals | 406 | 240 | 12,655 | 7,711 | 13,061 | 7,951 | ||||||||||||||||||||||||||||||||

Certain acreage held by the Company will expire in the next three years.

Scheduled expirations in 2024 include 4,521 thousand net acres in Vietnam, 52 thousand net acres in in the Gulf of Mexico and 6 thousand net acres in Onshore Canada. Murphy has applied for and anticipates receiving lease extensions in Vietnam.

Acreage currently scheduled to expire in 2025 include 249 thousand net acres in Mexico, 75 thousand net acres in Brazil, 6 thousand net acres in the Gulf of Mexico and 1 thousand net acres in Onshore Canada.

Scheduled expirations in 2026 include 27 thousand net acres in the Gulf of Mexico and 6 thousand net acres in Offshore Canada.

8

As used in the three tables that follow, “gross” wells are the total wells in which all or part of the working interest is owned by Murphy, and “net” wells are the total of the Company’s fractional working interests in gross wells expressed as the equivalent number of wholly-owned wells. An “exploratory” well is drilled to find and produce crude oil or natural gas in an unproved area and includes delineation wells which target a new reservoir in a field known to be productive or to extend a known reservoir beyond the proved area. A “development” well is drilled within the proved area of an oil or natural gas reservoir that is known to be productive.

The following table shows the number of oil and natural gas wells producing or capable of producing at December 31, 2023.

| Oil Wells | Natural Gas Wells | |||||||||||||||||||||||||

| Gross | Net | Gross | Net | |||||||||||||||||||||||

| Country | ||||||||||||||||||||||||||

| United States | Onshore | 1,184 | 949 | 30 | 4 | |||||||||||||||||||||

| Gulf of Mexico | 80 | 36 | 14 | 6 | ||||||||||||||||||||||

| Total United States | 1,264 | 985 | 44 | 10 | ||||||||||||||||||||||

| Canada | Onshore | 20 | 14 | 342 | 326 | |||||||||||||||||||||

| Offshore | 48 | 5 | — | — | ||||||||||||||||||||||

| Total Canada | 68 | 19 | 342 | 326 | ||||||||||||||||||||||

| Totals | 1,332 | 1,004 | 386 | 336 | ||||||||||||||||||||||

Murphy’s net wells drilled and completed in the last three years are shown in the following table.

| United States | Canada | Other | Totals | ||||||||||||||||||||||||||||||||||||||||||||

| Productive | Dry | Productive | Dry | Productive | Dry | Productive | Dry | ||||||||||||||||||||||||||||||||||||||||

| 2023 | |||||||||||||||||||||||||||||||||||||||||||||||

| Exploration | – | 1.3 | – | – | – | – | – | 1.3 | |||||||||||||||||||||||||||||||||||||||

| Development | 34.1 | – | 15.1 | – | – | – | 49.2 | — | |||||||||||||||||||||||||||||||||||||||

| 2022 | |||||||||||||||||||||||||||||||||||||||||||||||

| Exploration | – | – | – | – | – | 0.6 | – | 0.6 | |||||||||||||||||||||||||||||||||||||||

| Development | 29.1 | – | 22.1 | – | – | – | 51.2 | – | |||||||||||||||||||||||||||||||||||||||

| 2021 | |||||||||||||||||||||||||||||||||||||||||||||||

| Exploration | – | 0.1 | – | – | – | – | – | 0.1 | |||||||||||||||||||||||||||||||||||||||

| Development | 27.9 | – | 14.6 | – | – | – | 42.5 | – | |||||||||||||||||||||||||||||||||||||||

Murphy’s drilling wells in progress at December 31, 2023 are shown in the following table. The year-end well count includes wells awaiting various completion operations.

| Exploration | Development | Total | ||||||||||||||||||||||||||||||||||||

| Gross | Net | Gross | Net | Gross | Net | |||||||||||||||||||||||||||||||||

| Country | ||||||||||||||||||||||||||||||||||||||

| United States | Onshore | – | – | 6.0 | 1.3 | 6.0 | 1.3 | |||||||||||||||||||||||||||||||

| Gulf of Mexico | 1.0 | 0.1 | 3.0 | 0.8 | 4.0 | 0.9 | ||||||||||||||||||||||||||||||||

| Canada | Onshore | – | – | 11.0 | 11.0 | 11.0 | 11.0 | |||||||||||||||||||||||||||||||

| Offshore | – | – | – | – | – | – | ||||||||||||||||||||||||||||||||

| Totals | 1.0 | 0.1 | 20.0 | 13.1 | 21.0 | 13.2 | ||||||||||||||||||||||||||||||||

9

Sustainability

Environment and Climate Change

We understand that our industry, and the use of our products, create emissions – which raise climate change concerns. At the same time, access to affordable, reliable energy is essential to improving the world’s quality of life and the functioning of the global economy. We believe that as the energy economy transitions, oil and gas will continue to play a vital role in the long-term energy mix.

We are committed to reducing our GHG emissions and are focused on understanding and mitigating our climate change risks. To guide our climate change strategy, Murphy has adopted a climate change position, and we are setting meaningful emissions reduction goals. The Company has established a GHG emissions intensity reduction target of 15% to 20% by 2030 from our 2019 level, excluding our discontinued and divested Malaysia operations. In addition, we have endorsed the goal of eliminating routine flaring by 2030, under the current World Bank definition of routine flaring.

Murphy recognizes that emissions are only one element of our total environmental footprint. Protecting natural resources is also an important factor in our overall sustainability efforts. See our 2023 Sustainability Report, located on the Company’s website, for details.

Further, we are subject to various international, foreign, national, state, provincial and local environmental, health and safety laws and regulations, including related to the generation, storage, handling, use, disposal and remediation of petroleum products, wastewater and hazardous materials; the emission and discharge of such materials to the environment, including GHG emissions; wildlife, habitat and water protection; the placement, operation and decommissioning of production equipment; and the health and safety of our employees, contractors and communities where our operations are located.

U.S. Comprehensive Environmental Response, Compensation and Liability Act (CERCLA). CERCLA and similar state statutes impose joint and several liability, without regard to fault or legality of the conduct, on current and past owners or operators of a site where a release occurred and anyone who disposed or arranged for the disposal of a hazardous substance released at the site. Although CERCLA generally exempts “petroleum” from regulation, in the course of our operations, we may and could generate wastes that may fall within CERCLA’s definition of hazardous substances and may have disposed of these wastes at disposal sites owned and operated by others.

Water discharges. The U.S. Clean Water Act and analogous state laws impose restrictions and strict controls with respect to the discharge of pollutants, including spills and leaks of produced water and other oil and gas wastes, into regulated waters. The U.S. Oil Pollution Act (OPA) imposes certain duties and liabilities on the owner or operator of a facility, vessel or pipeline that is a source of or that poses the substantial threat of an oil discharge, or the lessee or permittee of the area in which a discharging offshore facility is located. OPA assigns joint and several liability, without regard to fault, to each liable party for oil removal costs and a variety of public and private damages. OPA also requires owners and operators of offshore oil production facilities to establish and maintain evidence of financial responsibility to cover costs that could be incurred in responding to an oil spill.

U.S. Bureau of Ocean Energy Management (BOEM) and the U.S. Bureau of Safety and Environmental Enforcement (BSEE) requirements. BOEM and BSEE have regulations applicable to lessees in federal waters that impose various safety, permitting and certification requirements applicable to exploration, development and production activities in the Gulf of Mexico and also require lessees to have substantial U.S. assets and net worth or post bonds or other acceptable financial assurance that the regulatory obligations will be met. These include, in the Gulf of Mexico, well design, well control, casing, cementing, real-time monitoring and subsea containment, among other items. Under applicable requirements, BOEM evaluates the financial strength and reliability of lessees and operators active on the U.S. Outer Continental Shelf, including the Gulf of Mexico. If the BOEM determines that a company does not have the financial ability to meet its decommissioning and other obligations, that company will be required to post additional financial security as assurance.

Air emissions and climate change. The U.S. Clean Air Act and comparable state laws and regulations govern emissions of various air pollutants through the issuance of permits and other authorization requirements. Since 2009, the U.S. Environmental Protection Agency (EPA) has been monitoring and regulating GHG emissions, including carbon dioxide and methane, from certain sources in the oil and gas sector due to their association with climate change. In addition, international climate efforts, including the 2015 “Paris Agreement” and the

10

recent Conferences of the Parties of the UN Framework Convention on Climate Change (COP26, COP27, and COP28, respectively), have resulted in commitments from many countries to reduce GHG emissions and have called for parties to eliminate certain fossil fuel subsidies and pursue further action on non-carbon dioxide GHGs.

Murphy is currently required to report GHG emissions from its U.S. operations in the Gulf of Mexico and onshore in south Texas and in its Canadian onshore business in British Columbia and Alberta. In Canada, Murphy is subject to GHG regulations and resultant carbon pricing programs specific to the jurisdiction of operation. Any limitations or further regulation of GHG, such as a cap and trade system, technology mandate, emissions tax, or expanded reporting requirements, could cause the Company to restrict operations, curtail demand for hydrocarbons generally, and/or cause costs to increase. Examples of cost increases include costs to operate and maintain facilities, install pollution emission controls and administer and manage emissions trading programs.

Endangered and threatened species. The U.S. Endangered Species Act was established to protect endangered and threatened species. If a species is listed as threatened or endangered, restrictions may be imposed on activities adversely affecting that species’ habitat. Similar protections are offered to migratory birds, under the Migratory Bird Treaty Act, and marine mammals under the Marine Mammal Protection Act.

As noted above, Murphy is subject to various laws and regulatory regimes governing similar matters in other jurisdictions in which it operates. More specifically, Murphy’s operations in Canada are subject to and conducted under Canadian laws and regulations that address many of the same environmental, health and safety issues as those in the U.S., including, without limitation, pollution and contamination, air quality and emissions, water discharges and other health and safety concerns.

Health and Safety

Murphy’s commitment to safety is strong, and so are our actions to protect our workforce and communities. Our employees are our most valuable asset. Murphy strives to achieve incident-free operations through continuous improvement processes managed by the Company’s Health, Safety, Environment (HSE) Management System, which engages all personnel, contractors and partners associated with Murphy operations and facilities, and provides a consistent method for integrating HSE concepts into our procedures and programs. We work hard to build a culture of safety across our organization, with regular training, exercise drills and key targeted safety initiatives.

Safety. The Company is subject to the requirements of the U.S. Occupational Safety and Health Act (OSHA) and comparable foreign and state laws that regulate the protection of the health and safety of workers. In addition, the OSHA hazard communication standard requires that certain information regarding hazardous materials used or produced in Murphy’s operations be maintained and provided to employees, state and local government authorities and citizens. In Canada, the Company is subject to Federal Occupational Health and Safety Legislation, the provincially-administered Occupational Health and Safety Act (Alberta), the Workers Compensation Act (British Columbia) and the Workplace Hazardous Materials Information System.

Environmental, Social and Governance (ESG) Disclosure

We publish an annual sustainability report according to internationally recognized ESG reporting frameworks and standards, including Sustainability Accounting Standards Board, Task Force on Climate-related Financial Disclosures (TCFD), Global Reporting Initiative, Ipieca and American Petroleum Institute.

As this is an area of continual improvement across our industry, we strive to update our disclosures in line with operating developments and with emerging best practice ESG reporting standards. In 2023, we published our fifth annual sustainability report, located on the Company’s website.

11

Human Capital Management

At Murphy, we believe in providing energy that empowers people, and that is what our 725 employees do every day. As of December 31, 2023, we had 438 office-based employees and 287 field employees, all of whom are guided by our mission, vision, values and behaviors. Together with the Executive Leadership Team, the Vice President, Human Resources and Administration, who reports directly to our Chief Executive Officer, is responsible for developing and executing our human capital management strategy. This includes the attraction, recruitment, development and engagement of talent to deliver on our strategy, the design of employee compensation, health and welfare benefits, and talent programs. We focus on the following factors in order to implement and develop our human capital strategy:

•Employee Compensation Programs

•Employee Performance and Feedback

•Talent Development and Training

•Diversity, Equity and Inclusion

•Health and Welfare Benefits

The Board receives related updates from the Vice President, Human Resources and Administration on a regular basis including the review of compensation, benefits, succession and talent development, along with diversity, equity and inclusion.

Employee Compensation Programs

Our purpose, to empower people, includes tying a portion of our employees’ pay to performance in a variety of ways, including incentive compensation and performance-based bonus programs, while maintaining the best interest of stockholders. We benchmark for market practices, and regularly review our compensation and hiring acceptance rates against the market to ensure competitiveness to attract and retain the best talent. We believe our current practices align our employees’ compensation with the interests of our stockholders, and support our focus on cash flow generation, capital return and environmental stewardship. For further detail on the Company’s compensation framework please see the Compensation Discussion and Analysis section of the forthcoming Proxy Statement relating to the Annual Meeting of Stockholders on May 8, 2024.

Employee Performance and Feedback

We are committed to efforts to enhance our employees’ professional growth and development through feedback that utilizes our internal performance management system (Murphy Performance Management - MPM). The purpose of the MPM process is to show our commitment to the development of all employees and to better align rewards with Company and individual performance. The goals of the MPM process are the following:

•Drive behavior to align with the Company’s mission, vision, values and behaviors

•Develop employee capabilities through effective feedback and coaching

•Maintain a process that is consistent throughout the organization to measure employee performance that is tied to Company and stockholder interests

All employees’ performance is evaluated at least annually through self-assessments that are reviewed in discussions with supervisors. Employees’ performance is evaluated on various key performance indicators set annually, including behaviors that support our mission, vision, values and contributions toward executing our Company’s goals/business strategy.

Talent Development and Training

Employees are able to participate in continuous training and development, with the goal of equipping them for success and providing increased opportunities for growth. Through our digital platform, My Murphy Learning, employees now have access to LinkedIn Learning with more than 15,000 courses, Continuing Education Unit (CEU) credit and certification opportunities, and access to expert instructors. We also administer mandatory compliance training for our employees through My Murphy Learning with a 100% utilization. Finally, we provide a tuition reimbursement program for those who choose to acquire additional knowledge to increase their effectiveness in their present position or to prepare for career advancement.

12

To enhance employees’ commitment to the Company’s Scorecard and understanding of annual incentive plans, three training courses were introduced covering the following topics: (1) Free Cash Flow and return metrics; (2) Lease Operating Expenses (LOE) and General and Administrative; and (3) Total Recordable Incident Rate, Spill Rate and Emissions. These training opportunities, in particular, enhanced the business acumen of our employee base, as well as brought renewed focus to how we measure success.

We strive to empower our leadership with programs that offer career advancement for experienced and emerging leaders. Over eighty managers participated in leadership programs, from a top rated business school, addressing focus areas such as strategic agility, enterprise thinking, building high-performing teams and enhancing trust.

We encourage employee engagement and solicit feedback through internal surveys and our employee-led Ambassador program to gain insights into workplace experiences. Employees are provided opportunities to raise suggestions and collaborate with leadership to improve programs and increase their alignment with Murphy’s mission, vision, values and behaviors.

To monitor the effectiveness of our human capital investment and development programs, we track voluntary turnover. This data is shared on a regular basis with our Executive Leadership Team, who use it in addition to other pertinent data to develop our human capital strategy. In 2023, our voluntary employee turnover rate was 6.0%.

Health and Welfare Benefits

We believe that doing our part to aid in maintaining the health and welfare of our employees is a critical element in Murphy’s achieving success. As such, we provide our employees and their families with a comprehensive set of subsidized benefits that are competitive and aligned to Murphy’s mission, vision, values and behaviors. We also believe that the well-being of our employees is enhanced when they can give back to their local communities or charities either through the Company Matching Gift Program, “Impact – Murphy Makes a Difference” Program or on their own and receive a Company match for donations.

Finally, we offer an Employee Assistance Program that provides confidential assistance to employees and their immediate family members for mental and physical well-being, as well as legal and financial issues. We also maintain an Ethics Hotline that is available to all our employees to report, anonymously if desired, any matter of concern. Communications to the hotline, which is facilitated by an independent third party, are routed to appropriate functions, Human Resources, Law or Compliance, for investigation and resolution.

Diversity, Equity and Inclusion

We are committed to fostering work environments that value diversity, equity and inclusion (DE&I). This commitment includes providing equal access to and participation in programs and services without regard to race, creed, religion, color, national origin, disability, sex (including pregnancy), sexual orientation, gender identity, veteran status, age or stereotypes or assumptions based thereon. We also support interest-based groups such as sports, hobbies and charity volunteering. We welcome our employees’ differences, experiences and beliefs and we are investing in a more productive, engaged, diverse and inclusive workforce. The Board receives DE&I updates on demographic data, strategic partnerships, recruiting strategies and programs from the Vice President, Human Resources and Administration on a regular cadence.

We seek input and program recommendations from our DE&I Committee and through the sponsorship of our Vice President, Human Resources and Administration. Our DE&I Committee consists of diverse employees at various levels from across the organization that share a passion for DE&I. Our Board currently includes three directors who are women, with at least one woman on each committee. Our Nominating and Governance Committee is actively focused on DE&I issues as part of its overall mandate.

Female Representation (U.S. and International) | December 31, 2023 | ||||

| Executive and Senior Level Managers | 21 | % | |||

| First- and Mid-Level Managers | 22 | % | |||

| Professionals | 33 | % | |||

| Other (Administrative Support and Field) | 7 | % | |||

| Total | 22 | % | |||

13

Minority 1 Representation (U.S.-Based Only) | December 31, 2023 | ||||

| Executive and Senior Level Managers | 32 | % | |||

| First- and Mid-Level Managers | 28 | % | |||

| Professionals | 42 | % | |||

| Other (Administrative Support and Field) | 30 | % | |||

| Total | 35 | % | |||

1 As defined by the U.S. Equal Employment Opportunity Commission.

We believe that it is important we attract employees with diverse backgrounds where we operate and are focusing on attracting and retaining women and minorities in our workforce ensuring a vibrant talent pipeline.

Website Access to SEC Reports

Murphy Oil’s internet address is http://www.murphyoilcorp.com. The information contained on the Company’s Website is not part of, or incorporated into, this report on Form 10-K.

The Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available on Murphy’s Website, free of charge, as soon as reasonably practicable after such reports are filed with, or furnished to, the SEC. You may also access these reports at the SEC’s Website at http://www.sec.gov.

14

PART I

Item 1A. RISK FACTORS

The Company faces risks in the normal course of business and through global, regional and local events that could have an adverse impact on its reputation, operations, and financial performance. The Board exercises oversight of the Company’s enterprise risk management program, which includes strategic, operational and financial matters, as well as compliance and legal risks. The Board receives updates annually on the risk management processes.

The following are some important factors that could cause the Company’s actual results to differ materially from those projected in any forward-looking statements. If any of the events or circumstances described in any of the following risk factors occurs, our business, results of operations and/or financial condition could be materially and adversely affected, and our actual results may differ materially from those contemplated in any forward-looking statements we make in any public disclosures.

Price Risk Factors

Volatility in the global prices of crude oil, natural gas liquids and natural gas can significantly affect the Company’s operating results, cash flows and financial condition.

Among the most significant variable factors impacting the Company’s results of operations are the sales prices for crude oil and natural gas that it produces. Many of the factors influencing prices of crude oil and natural gas are beyond our control. These factors include:

•worldwide and domestic supplies of, and demand for, crude oil, natural gas liquids and natural gas;

•the ability of the members of the Organization of the Petroleum Exporting Countries (OPEC) and certain non-OPEC members, for example, Russia, to agree to maintain or adjust production levels;

•the production levels of non-OPEC countries, including, amongst others, production levels in the shale plays in the United States;

•political instability or armed conflict in oil and gas producing regions, such as the Russia-Ukraine conflict and Israeli-Palestinian conflict;

•the level of drilling, completion and production activities by other exploration and production companies, and variability therein, in response to market conditions;

•changes in weather patterns and climate, including those that may result from climate change;

•natural disasters such as hurricanes and tornadoes, including those that may result from climate change;

•the price, availability and the demand for and of alternative and competing forms of energy, such as nuclear, hydroelectric, wind or solar;

•the effect of conservation efforts and focus on climate-change;

•technological advances affecting energy consumption and energy supply;

•increased activism against, or change in public sentiment for, oil and gas exploration, development, and production activities and considerations including climate change and the transition to a lower carbon economy;

•the occurrence or threat of epidemics or pandemics, such as the outbreak of COVID-19, or any government response to such occurrence or threat which may lower the demand for hydrocarbon fuels;

•domestic and foreign governmental regulations and taxes, including further legislation requiring, subsidizing or providing tax benefits for the use or generation of alternative energy sources and fuels; and

•general economic conditions worldwide, including inflationary conditions and related governmental policies and interventions.

West Texas Intermediate (WTI) crude oil prices averaged $77.62 per barrel in 2023, compared to $94.23 in 2022 and $67.91 in 2021. Certain U.S. and Canadian crude oils are priced from oil indices other than WTI, and these indices are influenced by different supply and demand forces than those that affect WTI prices. The most

15

common crude oil indices used to price the Company’s crude include Mars, WTI Houston (MEH), Heavy Louisiana Sweet (HLS) and Brent.

The average New York Mercantile Exchange (NYMEX) natural gas sales price was $2.53 per million British Thermal Units (MMBTU) in 2023, compared to $6.38 in 2022 and $3.84 in 2021. The Company also has exposure to the Canadian benchmark natural gas price, Alberta Energy Company (AECO), which averaged C$2.64 per MCF in 2023, compared to C$5.31 in 2022 and C$3.63 in 2021. The Company has entered into certain forward fixed price contracts as detailed in the Outlook section beginning on page 51 and spot contracts providing exposure to other market prices at specific sales points such as Malin (Oregon, U.S.) and Dawn (Ontario, Canada).

Lower prices, should they occur, will materially and adversely affect our results of operations, cash flows and financial condition. Lower oil and natural gas prices could reduce the amount of oil and natural gas that the Company can economically produce, resulting in a reduction in the proved oil and natural gas reserves we could recognize, which could impact the recoverability and carrying value of our assets. The Company cannot predict how changes in the sales prices of oil and natural gas will affect the results of operations in future periods.

Lower oil and natural gas prices adversely affect the Company in several ways:

•Lower sales value for the Company’s oil and natural gas production reduces cash flows and net income.

•Lower cash flows may cause the Company to reduce its capital expenditure program, thereby potentially restricting its ability to grow production and add proved reserves.

•Lower oil and natural gas prices could lead to impairment charges in future periods, therefore reducing net income.

•Reductions in oil and natural gas prices could lead to reductions in the Company’s proved reserves in future years. Low prices could make a portion of the Company’s proved reserves uneconomic, which in turn could lead to the removal of certain of the Company’s year-end reported proved oil reserves in future periods. These reserve reductions could be significant.

•Lower oil and natural gas prices could lead to an inability to access, renew, or replace credit facilities, and could also impair access to other sources of funding as these mature, potentially negatively impacting our liquidity.

•Lower prices for oil and natural gas could cause the Company to lower its dividend because of lower cash flows.

See Note K for additional information on the derivative instruments used to manage certain risks related to commodity prices.

Murphy’s commodity price risk management may limit the Company’s ability to fully benefit from potential future price increases for oil and natural gas.

The Company, from time to time, enters into various contracts to protect its cash flows against lower oil and natural gas prices. To the extent that the Company enters into these contracts and in the event that prices for oil and natural gas increase in future periods, the Company will not fully benefit from the price improvement on all production. See Note K for additional information on the derivative instruments used to manage certain risks related to commodity prices.

16

Operational Risk Factors

Murphy operates in highly competitive environments which could adversely affect it in many ways, including its profitability, cash flows and its ability to grow.

Murphy operates in the oil and gas industry and experiences competition from other oil and gas companies, which include major integrated oil companies, independent producers of oil and gas, and state-owned foreign oil companies. Many of the major integrated and state-owned oil companies and some of the independent producers that compete with the Company have substantially greater resources than Murphy.

In addition, the oil industry as a whole competes with other industries in supplying energy requirements around the world. Within the industry, Murphy competes for, among other things, valuable acreage positions, exploration licenses, drilling equipment and talent.

Exploration drilling results can significantly affect the Company’s operating results.

The Company drills exploratory wells which subjects its exploration and production operating results to exposure to dry hole expense, which has in the past, and may in the future, adversely affect our results of operations. The Company plans to continue assessing exploration activities as part of its overall strategy. In 2023, the Company participated in three exploration wells. The Longclaw #1 well (Green Canyon 433), located in the Gulf of Mexico, resulted in a commercial discovery while the Oso #1 (Atwater Valley 138) and Chinook #7 (Walker Ridge 425) wells, located in the Gulf of Mexico, failed to encounter commercial hydrocarbons. Additionally, the Company expensed previously suspended costs associated with the 2019 Cholula-1EXP well which was determined to be non-commercial. The Company has budgeted $120 million for its 2024 exploration program, which includes drilling two operated wells in Vietnam and two non-operated wells in the Gulf of Mexico.

If Murphy cannot replace its oil and natural gas reserves, it may not be able to sustain or grow its business.

Murphy continually depletes its oil and natural gas reserves as production occurs. To sustain and grow its business, the Company must successfully replace the oil and natural gas it produces with additional reserves. Therefore, it must create and maintain a portfolio of good prospects for future reserves additions and production. The Company must find, acquire or develop, and produce reserves at a competitive cost to be successful in the long-term. Murphy’s ability to operate profitably in the exploration and production business, therefore, is dependent on its ability to find (and/or acquire), develop and produce oil and natural gas reserves at costs that are less than the realized sales price for these products.

Murphy’s proved reserves are based on the professional judgment of its engineers and may be subject to revision.

Proved reserves of crude oil, natural gas liquids, and natural gas included in this report on pages 103 through 112 have been prepared according to the SEC guidelines by qualified company personnel or qualified independent engineers based on an unweighted average of crude oil, NGL and natural gas prices in effect at the beginning of each month of the respective year as well as other conditions and information available at the time the estimates were prepared. Estimation of reserves is a subjective process that involves professional judgment by engineers about volumes to be recovered in future periods from underground oil and natural gas reservoirs. Estimates of economically recoverable crude oil, NGL and natural gas reserves and future net cash flows depend upon a number of variable factors and assumptions, and consequently, different engineers could arrive at different estimates of reserves and future net cash flows based on the same available data and using industry accepted engineering practices and scientific methods. In 2023, 96.6% of the proved reserves were audited by third-party auditors.

Murphy’s actual future oil and natural gas production may vary substantially from its reported quantity of proved reserves due to a number of factors, including:

•Oil and natural gas prices which are materially different from prices used to compute proved reserves;

•Operating and/or capital costs which are materially different from those assumed to compute proved reserves;

17

•Future reservoir performance which is materially different from models used to compute proved reserves; and

•Governmental regulations or actions which materially impact operations of a field.

The Company’s proved undeveloped reserves represent significant portions of total proved reserves. As of December 31, 2023, and including noncontrolling interests, approximately 32% of the Company’s crude oil and condensate proved reserves, 31% of natural gas liquids proved reserves and 50% of natural gas proved reserves are undeveloped. The ability of the Company to reclassify these undeveloped proved reserves to the proved developed classification is generally dependent on the successful completion of one or more operations, which might include further development drilling, construction of facilities or pipelines and well workovers.

The discounted future net revenues from our proved reserves as reported on pages 116 and 117 should not be considered as the market value of the reserves attributable to our properties. As required by U.S. generally accepted accounting principles (GAAP), the estimated discounted future net revenues from our proved reserves are based on an unweighted average of the oil and natural gas prices in effect at the beginning of each month during the year. Actual future prices and costs may be materially higher or lower than those used in the reserves computations.

In addition, the 10% discount factor that is required to be used to calculate discounted future net revenues for reporting purposes under GAAP is not necessarily the most appropriate discount factor based on our cost of capital, the risks associated with our business and the risk associated with the industry in general.

Murphy is reliant on certain third party infrastructure to develop projects and operations.

The Company relies on the availability and capacity of infrastructure, such as transportation and processing facilities, and equipment that are often owned and operated by others. These third-party systems, facilities, and equipment may not always be available to the Company and, if available, may not be available at a price that is acceptable to the Company. The unavailability or high cost of such equipment or infrastructure could adversely affect our ability to establish and execute exploration and development plans within budget and on a timely basis, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our inability to access appropriate equipment and infrastructure in a timely manner and on acceptable terms may hinder our access to oil and natural gas markets or delay our oil and natural gas production.

Murphy is sometimes reliant on joint venture partners for operating assets, and/or funding development projects and operations.

Certain of the Company’s major oil and natural gas producing properties are operated by others. Therefore, Murphy does not fully control all activities at certain of its revenue generating properties. During 2023, approximately 18% of the Company’s total production was at fields operated by others, while at December 31, 2023, approximately 13% of the Company’s total proved reserves were at fields operated by others.

Some of Murphy’s development projects entail significant capital expenditures and have long development cycle times. As a result, the Company’s partners must be able to fund their share of investment costs through the development cycle, through cash flow from operations, external credit facilities, or other sources, including financing arrangements. Murphy’s partners are also susceptible to certain of the risk factors noted herein, including, but not limited to, commodity prices, fiscal regime changes, government project approval delays, regulatory changes, credit downgrades and regional conflict. If one or more of these factors negatively impacts a project operator’s or partners’ cash flows or ability to obtain adequate financing, or if an operator of our projects fails to adequately perform operations or fulfill its obligations under the applicable agreements, it could result in a delay or cancellation of a project, resulting in a reduction of the Company’s reserves and production, which negatively impacts the timing and receipt of planned cash flows and expected profitability.

18

Murphy’s business is subject to operational hazards, severe weather events, physical security risks and risks normally associated with the exploration and production of oil and natural gas, which could become more significant as a result of climate change.

The Company operates in a variety of locales, including urban, remote, and sometimes inhospitable, areas around the world. The occurrence of an event, including but not limited to acts of nature such as hurricanes, floods, earthquakes (and other forms of severe weather), mechanical equipment failures, industrial accidents, fires, explosions, acts of war, civil unrest, piracy and acts of terrorism could result in the loss of hydrocarbons and associated revenues, environmental pollution or contamination, personal injury, (including death), and property damages for which the Company could be deemed to be liable and which could subject the Company to substantial fines and/or claims for punitive damages. This risk extends to actions and operational hazards of other operators in the industry, which may also impact the Company.

The location of many of Murphy’s key assets causes the Company to be vulnerable to severe weather, including hurricanes, tropical storms and extreme temperatures. Many of the Company’s offshore fields are in the U.S. Gulf of Mexico, where hurricanes and tropical storms can lead to shutdowns and damages. The U.S. hurricane season runs from June through November. Moreover, scientists have predicted that increasing concentrations of GHG in the earth’s atmosphere may produce climate changes that increase significant weather events, such as increased frequency and severity of storms, droughts, and floods and other climatic events. If such effects were to occur, our operations could be adversely affected. Although the Company maintains insurance for such risks, due to policy deductibles and possible coverage limits, weather-related risks to our operations are not fully insured. For additional details on insurance, see Risk Factors, “General Risk Factors – Murphy’s insurance may not be adequate to offset costs associated with certain events, and there can be no assurance that insurance coverage will continue to be available in the future on terms that justify its purchase.”

In addition, certain customer and supplier assets, such as storage terminals, processing facilities, refineries and pipelines, are located in areas that may be prone to severe weather events, including hurricanes, winter storms, floods and major tropical storms, all of which may be exacerbated by climate change. Severe weather events that significantly affect facilities belonging to such customers or suppliers may reduce demand for our products and interrupt our ability to bring products to market and may therefore materially and adversely affect our results of operations, cash flows and financial condition, even if our own facilities escape significant damage.

Hydraulic fracturing operations subject the Company to operational risks inherent in the drilling and production of oil and natural gas.

The Company’s onshore North America oil and natural gas production is dependent on a technique known as hydraulic fracturing whereby water, sand and certain chemicals are injected into deep oil and natural gas bearing reservoirs in North America. This process occurs thousands of feet below the surface and creates fractures in the rock formation within the reservoir which enhances migration of oil and natural gas to the wellbore.

The risks associated with hydraulic fracturing operations include, but are not limited to, underground migration or surface spillage due to releases of oil, natural gas, formation water or well fluids, as well as any related surface or groundwater contamination, including from petroleum constituents or hydraulic fracturing chemical additives. Ineffective containment of surface spillage and surface or groundwater contamination resulting from hydraulic fracturing operations, including from petroleum constituents or hydraulic fracturing chemical additives, could result in environmental pollution, remediation expenses, and third-party claims alleging damages, which could adversely affect the Company’s financial condition and results of operations. In addition, hydraulic fracturing requires significant quantities of water; the wastewater from oil and natural gas operations is often disposed of through underground injection. Certain increased seismic activities have been linked to underground water injection. Any diminished access to water for use in the hydraulic fracturing process, any inability to properly dispose of wastewater, or any further restrictions placed on wastewater, could curtail the Company’s operations due to regulatory initiatives or natural constraints such as drought or otherwise result in operational delays or increased costs.

Murphy is subject to numerous environmental, health and safety laws and regulations, and such existing and any potential future laws and regulations may result in material liabilities and costs.

The Company’s operations are subject to various international, foreign, national, state, provincial and local environmental, health and safety laws, regulations, governmental actions and permit requirements, including

19

related to the generation, storage, handling, use, disposal and remediation of petroleum products, wastewater and hazardous materials; the emission and discharge of such materials to the environment, including methane and other GHG emissions; wildlife, habitat and water protection; water access, use and disposal; the placement, operation and decommissioning of production equipment; the health and safety of our employees, contractors and communities where our operations are located, including indigenous communities; and the causes and impacts of climate change. The laws, regulations, governmental actions and permit requirements are subject to frequent change and have tended to become stricter over time and at times may be motivated by political considerations. They can impose permitting and financial assurance obligations, as well as operational controls and/or siting constraints on our business, and can result in additional capital and operating expenditures. For example, in December 2023, the U.S. EPA announced its final rule regulating methane and volatile organic compounds emissions in the oil and gas industry which, among other things, requires periodic inspections to detect leaks (and subsequent repairs), places stringent restrictions on venting and flaring of methane, and establishes a program whereby third-parties can monitor and report large methane emissions to the EPA. In addition, it is possible in the future, that certain regulatory bodies such as the Railroad Commission of Texas may enact regulation that bans or reduces flaring for U.S. Onshore operations, and certain regulatory bodies in Canada may decide to revoke permits or pause the issuance of permits as a result of non-compliance with, or litigation related to, environmental, health and safety laws and regulations. Compliance with such regulations could result in capital investment which would reduce the Company’s net cash flows and profitability.

Murphy also could be subject to strict liability for environmental contamination in various jurisdictions where it operates, including with respect to its current or former properties, operations and waste disposal sites, or those of its predecessors. Contamination has been identified at some locations, and the Company has been required, and in the future may be required, to investigate, remove or remediate previously disposed wastes; or otherwise clean up contaminated soil, surface water or groundwater, address spills and leaks from pipelines and production equipment, and perform remedial plugging operations. In addition to significant investigation and remediation costs, such matters can result in fines and also give rise to third-party claims for personal injury and property or other environmental damage.

The Company primarily uses hydraulic fracturing in the Eagle Ford Shale in South Texas and in Kaybob Duvernay and Tupper Montney in Western Canada. Texas law imposes permitting, disclosure, disposal and well construction requirements on hydraulic fracturing operations, as well as public disclosure of certain information regarding the components used in the hydraulic fracturing process. Regulations in the provinces of British Columbia and Alberta also govern various aspects of hydraulic fracturing activities under their jurisdictions. It is possible that Texas, other states in which we may conduct fracturing in the future, the U.S., Canadian provinces and certain municipalities may adopt further laws or regulations which could render the process unlawful, less effective or drive up its costs. If any such action is taken in the future, the Company’s production levels could be adversely affected, or its costs of drilling and completion could be increased. Once new laws and/or regulations have been enacted and adopted, the costs of compliance are appraised.