|

Investment Company Act file number

|

811-03706

|

|||||

|

AMERICAN CENTURY CALIFORNIA TAX-FREE AND MUNICIPAL FUNDS

|

||||||

|

(Exact name of registrant as specified in charter)

|

||||||

|

4500 MAIN STREET, KANSAS CITY, MISSOURI

|

64111

|

|||||

|

(Address of principal executive offices)

|

(Zip Code)

|

|||||

|

CHARLES A. ETHERINGTON

4500 MAIN STREET, KANSAS CITY, MISSOURI 64111

|

||||||

|

(Name and address of agent for service)

|

||||||

|

Registrant’s telephone number, including area code:

|

816-531-5575

|

|||||

|

Date of fiscal year end:

|

8-31

|

|||||

|

Date of reporting period:

|

8-31-2011

|

|||||

|

ANNUAL REPORT

|

AUGUST 31, 2011

|

|

|

California High-Yield Municipal Fund

|

|

President’s Letter

|

2

|

|

Market Perspective

|

3

|

|

Performance

|

4

|

|

Portfolio Commentary

|

6

|

|

Fund Characteristics

|

8

|

|

Shareholder Fee Example

|

9

|

|

Schedule of Investments

|

11

|

|

Statement of Assets and Liabilities

|

19

|

|

Statement of Operations

|

20

|

|

Statement of Changes in Net Assets

|

21

|

|

Notes to Financial Statements

|

22

|

|

Financial Highlights

|

27

|

|

Report of Independent Registered Public Accounting Firm

|

29

|

|

Management

|

30

|

|

Approval of Management Agreement

|

33

|

|

Additional Information

|

38

|

|

U.S. Fixed-Income Total Returns

|

||||

|

For the 12 months ended August 31, 2011

|

||||

|

Barclays Capital Municipal Market Indices

|

Barclays Capital U.S. Taxable Market Indices

|

|||

|

7 Year Municipal Bond

|

4.06%

|

Aggregate Bond

|

4.62%

|

|

|

Municipal High Yield Bond

|

3.45%

|

Treasury Bond

|

4.17%

|

|

|

Municipal Bond

|

2.66%

|

|||

|

California Tax-Exempt Bond

|

2.62%

|

|||

|

Long-Term Municipal Bond

|

1.84%

|

|||

|

Total Returns as of August 31, 2011

|

||||||

|

Average Annual Returns

|

||||||

|

Ticker

Symbol

|

1 year

|

5 years

|

10 years

|

Since

Inception

|

Inception

Date

|

|

|

Investor Class

|

BCHYX

|

2.07%

|

3.39%

|

4.80%

|

5.87%

|

12/30/86

|

|

Barclays Capital Municipal Bond Index

|

—

|

2.66%

|

4.94%

|

4.95%

|

6.41%(1)

|

—

|

|

Institutional Class

|

BCHIX

|

2.27%

|

—

|

—

|

6.29%

|

3/1/10

|

|

A Class

No sales charge*

With sales charge*

|

CAYAX

|

1.82%

-2.80%

|

3.13%

2.19%

|

—

—

|

4.43%

3.87%

|

1/31/03

|

|

B Class

No sales charge*

With sales charge*

|

CAYBX

|

1.06%

-2.94%

|

2.37%

2.18%

|

—

—

|

3.66%

3.66%

|

1/31/03

|

|

C Class

|

CAYCX

|

1.06%

|

2.37%

|

—

|

3.69%

|

1/31/03

|

|

*

|

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 4.50% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. B Class shares redeemed within six years of purchase are subject to a CDSC that declines from 5.00% during the first year after purchase to 0.00% the sixth year after purchase. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

|

|

(1)

|

Since 12/31/86, the date nearest the Investor Class’s inception for which data are available.

|

|

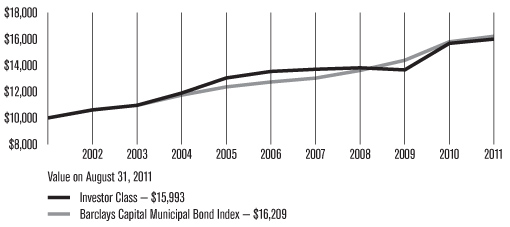

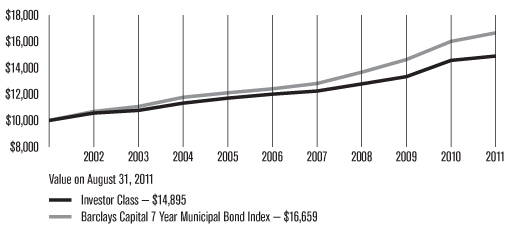

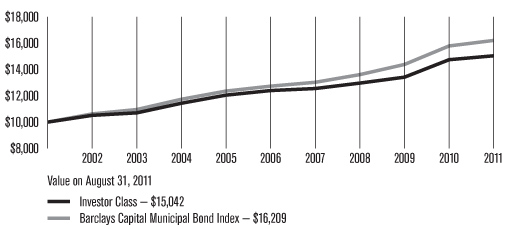

Growth of $10,000 Over 10 Years

|

|

$10,000 investment made August 31, 2001

|

|

Total Annual Fund Operating Expenses

|

||||

|

Investor Class

|

Institutional Class

|

A Class

|

B Class

|

C Class

|

|

0.51%

|

0.31%

|

0.76%

|

1.51%

|

1.51%

|

|

*

|

All fund returns referenced in this commentary are for Investor Class shares.

|

|

**

|

The Barclays Capital Municipal High Yield Bond Index’s average returns were 2.41% and 4.96% for the five- and ten-year periods ended August 31, 2011, respectively.

|

|

***

|

The average returns for Lipper California Municipal Debt Funds category were 3.09% and 3.78% for the five- and ten-year periods ended August 31, 2011, respectively. Data provided by Lipper Inc. — A Reuters Company. © 2011 Reuters. All rights reserved. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon. Lipper fund performance data is total return, and is preliminary and subject to revision. The data contained herein has been obtained from company reports, financial reporting services, periodicals and other resources believed to be reliable. Although carefully verified, data on compilations is not guaranteed by Lipper and may be incomplete. No offer or solicitations to buy or sell any of the securities herein is being made by Lipper.

|

|

AUGUST 31, 2011

|

|

|

Portfolio at a Glance

|

|

|

Weighted Average Maturity

|

19.4 years

|

|

Average Duration (Modified)

|

7.0 years

|

|

30-Day SEC Yields

|

|

|

Investor Class

|

4.53%

|

|

Institutional Class

|

4.73%

|

|

A Class

|

4.08%

|

|

B Class

|

3.52%

|

|

C Class

|

3.53%

|

|

Investor Class 30-Day Tax-Equivalent Yields(1)

|

|

|

31.98% Tax Bracket

|

6.66%

|

|

34.70% Tax Bracket

|

6.94%

|

|

39.23% Tax Bracket

|

7.45%

|

|

41.05% Tax Bracket

|

7.68%

|

|

(1)

|

The tax brackets indicated are for combined state and federal income tax. Actual tax-equivalent yields may be lower, if alternative minimum tax is applicable.

|

|

Top Five Sectors

|

% of fund investments

|

|

Land Based

|

28%

|

|

Hospital Revenue

|

10%

|

|

General Obligation (GO)

|

9%

|

|

Electric Revenue

|

9%

|

|

Tax Allocation/Tax Increment Revenue

|

6%

|

|

Types of Investments in Portfolio

|

% of net assets

|

|

Municipal Securities

|

98.5%

|

|

Other Assets and Liabilities

|

1.5%

|

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

|

Beginning

Account Value

3/1/11

|

Ending

Account Value

8/31/11

|

Expenses Paid

During Period(1)

3/1/11 - 8/31/11

|

Annualized

Expense Ratio(1)

|

|

|

Actual

|

||||

|

Investor Class (after waiver)

|

$1,000

|

$1,071.90

|

$2.56

|

0.49%

|

|

Investor Class (before waiver)

|

$1,000

|

$1,071.90(2)

|

$2.66

|

0.51%

|

|

Institutional Class (after waiver)

|

$1,000

|

$1,073.00

|

$1.52

|

0.29%

|

|

Institutional Class (before waiver)

|

$1,000

|

$1,073.00(2)

|

$1.62

|

0.31%

|

|

A Class (after waiver)

|

$1,000

|

$1,070.60

|

$3.86

|

0.74%

|

|

A Class (before waiver)

|

$1,000

|

$1,070.60(2)

|

$3.97

|

0.76%

|

|

B Class (after waiver)

|

$1,000

|

$1,066.50

|

$7.76

|

1.49%

|

|

B Class (before waiver)

|

$1,000

|

$1,066.50(2)

|

$7.87

|

1.51%

|

|

C Class (after waiver)

|

$1,000

|

$1,066.50

|

$7.76

|

1.49%

|

|

C Class (before waiver)

|

$1,000

|

$1,066.50(2)

|

$7.87

|

1.51%

|

|

Hypothetical

|

||||

|

Investor Class (after waiver)

|

$1,000

|

$1,022.74

|

$2.50

|

0.49%

|

|

Investor Class (before waiver)

|

$1,000

|

$1,022.63

|

$2.60

|

0.51%

|

|

Institutional Class (after waiver)

|

$1,000

|

$1,023.74

|

$1.48

|

0.29%

|

|

Institutional Class (before waiver)

|

$1,000

|

$1,023.64

|

$1.58

|

0.31%

|

|

A Class (after waiver)

|

$1,000

|

$1,021.48

|

$3.77

|

0.74%

|

|

A Class (before waiver)

|

$1,000

|

$1,021.37

|

$3.87

|

0.76%

|

|

B Class (after waiver)

|

$1,000

|

$1,017.69

|

$7.58

|

1.49%

|

|

B Class (before waiver)

|

$1,000

|

$1,017.59

|

$7.68

|

1.51%

|

|

C Class (after waiver)

|

$1,000

|

$1,017.69

|

$7.58

|

1.49%

|

|

C Class (before waiver)

|

$1,000

|

$1,017.59

|

$7.68

|

1.51%

|

|

(1)

|

Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 184, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period.

|

|

(2)

|

Ending account value assumes the return earned after waiver and would have been lower if a portion of the management fee had not been waived.

|

|

Principal

Amount

|

Value

|

|

|

Municipal Securities — 98.5%

|

||

|

CALIFORNIA — 94.9%

|

||

|

ABC Unified School District GO, Series 2000 B, 0.00%, 8/1/21 (NATL/FGIC)(1)(2)

|

$1,000,000

|

$605,600

|

|

Adelanto Public Utility Auth. Rev., Series 2009 A, (Utility System), 6.75%, 7/1/39

|

5,225,000

|

5,417,019

|

|

Alhambra Rev., Series 2010 A, (Atherton Baptist Homes), 7.50%, 1/1/30

|

1,640,000

|

1,695,055

|

|

Anaheim Public Financing Auth. Lease Rev., Series 1997 A, (Public Improvements), 6.00%, 9/1/24 (AGM)(1)

|

1,200,000

|

1,391,784

|

|

Beaumont Financing Auth. Local Agency Special Tax Rev., Series 2004 D, 5.80%, 9/1/35

|

2,875,000

|

2,674,871

|

|

Beaumont Financing Auth. Local Agency Special Tax Rev., Series 2005 B, 5.40%, 9/1/35

|

1,390,000

|

1,230,303

|

|

Beaumont Financing Auth. Local Agency Special Tax Rev., Series 2005 C, 5.50%, 9/1/29

|

855,000

|

797,647

|

|

Beaumont Financing Auth. Local Agency Special Tax Rev., Series 2005 C, 5.50%, 9/1/35

|

4,000,000

|

3,593,040

|

|

Beaumont Financing Auth. Local Agency Special Tax Rev., Series 2006 A, (Improvement Area No. 19C), 5.35%, 9/1/36

|

2,700,000

|

2,348,136

|

|

Beaumont Financing Auth. Local Agency Special Tax Rev., Series 2008 A, (Improvement Area No. 19C), 6.875%, 9/1/36

|

1,050,000

|

1,071,956

|

|

Berryessa Union School District GO, Series 2000 A, 0.00%, 8/1/21 (AGM)(1)(2)

|

1,190,000

|

736,170

|

|

Berryessa Union School District GO, Series 2000 A, 0.00%, 8/1/22 (AGM)(1)(2)

|

1,220,000

|

686,945

|

|

Berryessa Union School District GO, Series 2000 A, 0.00%, 8/1/23 (AGM)(1)(2)

|

1,000,000

|

522,570

|

|

California Department of Water Resources Power Supply Rev., Series 2008 H, 5.00%, 5/1/22(1)

|

4,500,000

|

5,089,905

|

|

California Department of Water Resources Power Supply Rev. Series 2010 L, 5.00%, 5/1/21(1)

|

4,725,000

|

5,588,446

|

|

California Department of Water Resources Power Supply Rev. Series 2010 L, 5.00%, 5/1/22(1)

|

4,200,000

|

4,896,654

|

|

California Department of Water Resources Water System Rev., Series 2008 AE (Central Valley), 5.00%, 12/1/23(1)

|

2,500,000

|

2,846,100

|

|

California Economic Recovery GO, Series 2004 C5, VRDN, 0.09%, 9/1/11 (LOC: Bank of America N.A.)(1)

|

8,600,000

|

8,600,000

|

|

California Economic Recovery GO, Series 2004 A, 5.25%, 7/1/14 (NATL/FGIC)(1)

|

6,000,000

|

6,778,080

|

|

California Educational Facilities Auth. Rev., (Western University Health Sciences), 6.00%, 10/1/12, Prerefunded at 100% of Par(1)(3)

|

1,505,000

|

1,584,434

|

|

California Educational Facilities Auth. Rev., Series 2009 A, (Pomona College), 5.00%, 1/1/24(1)

|

1,400,000

|

1,593,410

|

|

California GO, 5.25%, 10/1/29(1)

|

5,000,000

|

5,284,550

|

|

California GO, 6.00%, 4/1/38(1)

|

5,000,000

|

5,458,700

|

|

California Health Facilities Financing Auth. Rev., Series 1989 A, (Kaiser Permanente), 0.00%, 10/1/12 (Ambac-TCRS)(1)(2)

|

4,000,000

|

3,947,200

|

|

California Health Facilities Financing Auth. Rev., Series 2008 A, (Scripps Health), 5.50%, 10/1/20(1)

|

1,500,000

|

1,709,415

|

|

California Health Facilities Financing Auth. Rev., Series 2008 A, (Sutter Health), 5.50%, 8/15/16(1)

|

5,000,000

|

5,859,050

|

|

California Health Facilities Financing Auth. Rev., Series 2008 C, (Providence Health & Services), 6.50%, 10/1/33(1)

|

1,000,000

|

1,132,420

|

|

Principal

Amount

|

Value

|

|

California Health Facilities Financing Auth. Rev., Series 2008 G, (Catholic Healthcare West), 5.50%, 7/1/25(1)

|

$2,000,000

|

$2,107,980

|

|

California Health Facilities Financing Auth. Rev., Series 2009 A, (Catholic Healthcare West), 6.00%, 7/1/39(1)

|

4,300,000

|

4,558,387

|

|

California Health Facilities Financing Auth. Rev., Series 2009 A, (Children’s Hospital of Orange County), 6.50%, 11/1/38(1)

|

3,000,000

|

3,217,380

|

|

California Health Facilities Financing Auth. Rev., Series 2010 B, (Stanford Hospital), 5.25%, 11/15/31(1)

|

4,000,000

|

4,162,600

|

|

California Mobilehome Park Financing Auth. Rev., Series 2001 B, (Rancho Vallecitos - San Marcos), 6.75%, 11/15/36

|

1,905,000

|

1,892,198

|

|

California Mobilehome Park Financing Auth. Rev., Series 2003 B, (Palomar Estates E&W), 7.00%, 9/15/36(1)

|

6,345,000

|

6,384,085

|

|

California Mobilehome Park Financing Auth. Rev., Series 2006 B, (Union City Tropics), 5.50%, 12/15/41

|

2,000,000

|

1,676,760

|

|

California Municipal Finance Auth. Rev., (Biola University), 5.875%, 10/1/34

|

1,000,000

|

1,004,540

|

|

California Municipal Finance Auth. Rev., Series 2011 B, (Azusa Pacific University), 8.00%, 4/1/41

|

3,335,000

|

3,424,311

|

|

California Public Works Board Lease Rev., Series 1993 D, (Department of Corrections), 5.25%, 6/1/15 (AGM)(1)

|

2,000,000

|

2,167,400

|

|

California Public Works Board Lease Rev., Series 2009 G1, (Various Capital Projects), 5.75%, 10/1/30(1)

|

2,000,000

|

2,100,680

|

|

California Public Works Board Lease Rev., Series 2010 A1, (Various Capital Projects), 6.00%, 3/1/35(1)

|

1,250,000

|

1,324,600

|

|

California State University Fresno Association, Inc. Rev., (Auxiliary Organization Event Center), 7.00%, 7/1/12, Prerefunded at 101% of Par(1)(3)

|

2,455,000

|

2,608,855

|

|

California State University Systemwide Rev., Series 2005 C, (Systemwide Financing Program), 5.00%, 11/1/30 (NATL)(1)

|

$5,000,000

|

$5,171,450

|

|

California State University Systemwide Rev., Series 2009 A, (Systemwide Financing Program), 5.25%, 11/1/38(1)

|

3,000,000

|

3,086,880

|

|

California Statewide Communities Development Auth. COP, (Sonoma County Indian Health), 6.40%, 9/1/29(1)

|

2,085,000

|

2,085,104

|

|

California Statewide Communities Development Auth. Pollution Control, Rev., Series 2010 A, (Southern California Education), 4.50%, 9/1/29(1)

|

4,000,000

|

3,913,040

|

|

California Statewide Communities Development Auth. Rev., (Cottage Health Obligation Group), 5.25%, 11/1/30(1)

|

1,250,000

|

1,273,588

|

|

California Statewide Communities Development Auth. Rev., (Lancer Educational Student Housing), 5.625%, 6/1/33

|

2,500,000

|

2,145,875

|

|

California Statewide Communities Development Auth. Rev., (Southern California Presbyterian Homes), 7.25%, 11/15/41(1)

|

2,500,000

|

2,686,450

|

|

California Statewide Communities Development Auth. Rev., (Thomas Jefferson School of Law), 7.75%, 10/1/11, Prerefunded at 101% of Par(1)(3)

|

1,855,000

|

1,884,086

|

|

California Statewide Communities Development Auth. Rev., Series 2001 C, (Kaiser Permanente), 5.25%, 8/1/31(1)

|

4,000,000

|

4,051,640

|

|

California Statewide Communities Development Auth. Rev., Series 2004 D, (Sutter Health), 5.05%, 8/15/38 (AGM)(1)

|

2,000,000

|

2,006,340

|

|

California Statewide Communities Development Auth. Rev., Series 2007 A, (California Baptist University), 5.50%, 11/1/38

|

7,000,000

|

5,939,430

|

|

Principal

Amount

|

Value

|

|

California Statewide Communities Development Auth. Rev., Series 2007 A, (Front Porch Communities and Services), 5.125%, 4/1/37(1)(4)

|

$3,400,000

|

$2,798,710

|

|

California Statewide Communities Development Auth. Rev., Series 2007 A, (Valleycare Health System), 5.125%, 7/15/31

|

2,000,000

|

1,717,360

|

|

Capistrano Unified School District Special Tax Rev., (Community Facilities District No. 90-2), 6.00%, 9/1/33

|

6,250,000

|

6,268,625

|

|

Carson Redevelopment Agency Tax Allocation Rev., Series 2009 A, (Project Area No. 1), 7.00%, 10/1/36(1)

|

2,000,000

|

2,190,800

|

|

Chula Vista Community Facilities District No. 06-1 Area A Special Tax Rev., (Eastlake Woods), 6.20%, 9/1/33

|

3,600,000

|

3,600,684

|

|

Chula Vista Industrial Development Rev., Series 2004 D, (San Diego Gas), 5.875%, 1/1/34(1)

|

1,000,000

|

1,096,930

|

|

Clovis Public Financing Auth. Lease Rev., (Corporate Yard), 5.375%, 3/1/20 (Ambac)(1)

|

1,780,000

|

1,804,208

|

|

Corcoran COP 8.75%, 6/1/16(4)

|

345,000

|

411,268

|

|

Duarte Unified School District GO, Series 1999 B, 0.00%, 11/1/23 (AGM)(1)(2)

|

1,150,000

|

591,629

|

|

Eastern Municipal Water District Water and Sewer COP, Series 2008 H, 5.00%, 7/1/33(1)

|

4,000,000

|

4,112,720

|

|

El Dorado County Community Facilities District No. 2001-1 Special Tax Rev., (Promontory Specific), 6.30%, 9/1/31

|

2,500,000

|

2,441,750

|

|

Folsom Community Facilities District No. 7 Special Tax Rev., 5.75%, 9/1/14

|

1,885,000

|

1,885,000

|

|

Foothill-De Anza Community College District GO, 0.00%, 8/1/21 (NATL)(1)(2)

|

3,000,000

|

1,984,290

|

|

Foothill/Eastern Transportation Corridor Agency Toll Road Rev., 5.875%, 1/15/27(1)(2)

|

5,000,000

|

4,922,150

|

|

Fullerton Community Facilities District No. 1 Special Tax Rev., (Amerige Heights), 6.20%, 9/1/32

|

3,000,000

|

3,043,170

|

|

Fullerton Unified School District Special Tax Rev., (Community Facilities District No. 2001-1), 6.375%, 9/1/31

|

5,000,000

|

5,078,000

|

|

Golden State Tobacco Securitization Corp. Settlement Rev., Series 2007 A1, 5.125%, 6/1/47(1)

|

8,500,000

|

5,484,880

|

|

Golden State Tobacco Securitization Corp. Settlement Rev., Series 2007 A1, 5.75%, 6/1/47(1)

|

9,500,000

|

6,731,320

|

|

Hemet Unified School District Special Tax Rev., (Community Facilities District No. 2005-2), 5.25%, 9/1/30

|

2,670,000

|

2,394,616

|

|

Hemet Unified School District Special Tax Rev., (Community Facilities District No. 2005-2), 5.25%, 9/1/35

|

1,510,000

|

1,298,494

|

|

Hesperia Public Financing Auth. Tax Allocation Rev., Series 2007 A, (Redevelopment and Housing), 5.50%, 9/1/32 (XLCA)(1)

|

3,000,000

|

2,243,040

|

|

Hesperia Public Financing Auth. Tax Allocation Rev., Series 2007 A, (Redevelopment and Housing), 5.50%, 9/1/37 (XLCA)(1)

|

2,025,000

|

1,452,431

|

|

Highland Community Facilities District No. 2001-1 Special Tax Rev., 6.45%, 9/1/28

|

2,000,000

|

2,000,000

|

|

Independent Cities Finance Auth. Mobile Home Park Rev., Series 2011 A, (Castle Mobile Estates), 6.75%, 8/15/46(1)

|

2,500,000

|

2,554,375

|

|

Independent Cities Lease Finance Auth. Rev., Series 2004 A, (Morgan Hill - Hacienda Valley Mobile Estates), 5.90%, 11/15/34

|

2,235,000

|

2,129,106

|

|

Independent Cities Lease Finance Auth. Rev., Series 2006 B, (San Juan Mobile Estates), 5.55%, 5/15/31

|

500,000

|

447,590

|

|

Principal

Amount

|

Value

|

|

Independent Cities Lease Finance Auth. Rev., Series 2006 B, (San Juan Mobile Estates), 5.85%, 5/15/41

|

$1,150,000

|

$1,016,543

|

|

Independent Cities Lease Finance Auth. Rev., Series 2007 A, (Santa Rosa Leisure Mobilehome Park), 5.70%, 11/15/47

|

3,430,000

|

3,090,361

|

|

Irvine Unified School District Special Tax Rev., (Community Facilities District No. 06-1), 6.70%, 9/1/35

|

1,000,000

|

1,061,700

|

|

Jurupa Community Services District Special Tax Rev., Series 2008 A, (Community Facilities District No. 25), 8.875%, 9/1/38

|

2,000,000

|

2,223,420

|

|

Lake Elsinore Community Facilities District No. 2004-3 Special Tax Rev., Series 2005 A, (Rosetta Canyon Improvement Area No. 1), 5.25%, 9/1/35

|

1,225,000

|

1,045,440

|

|

Lake Elsinore Community Facilities District No. 2004-3 Special Tax Rev., Series 2006 A, (Rosetta Canyon Improvement Area No. 2), 5.25%, 9/1/37

|

5,000,000

|

4,198,850

|

|

Lake Elsinore Community Facilities District No. 2005-1 Special Tax Rev., Series 2006 A, 5.35%, 9/1/36

|

1,100,000

|

962,819

|

|

Lake Elsinore Community Facilities District No. 2005-2 Special Tax Rev., Series 2005 A, (Alverhill Ranch Improvement Area A), 5.45%, 9/1/36

|

4,000,000

|

3,478,200

|

|

Lake Elsinore Unified School District Special Tax Rev., (Community Facilities District No. 2005-1, Improvement Area A), 5.40%, 9/1/35

|

2,245,000

|

1,987,072

|

|

Lincoln Community Facilities District No. 2003-1 Special Tax Rev., (Lincoln Crossing), 6.00%, 9/1/13, Prerefunded at 102% of Par(3)

|

1,775,000

|

1,996,059

|

|

Los Angeles Community College District GO, Series 2008 F1, (Election of 2003), 5.00%, 8/1/27(1)

|

2,000,000

|

2,149,120

|

|

Los Angeles Community Facilities District No. 3 Special Tax Rev., (Cascades Business Park & Golf Course), 6.40%, 9/1/22

|

1,310,000

|

1,317,402

|

|

Los Angeles Department of Airports Rev., Series 2008 C, (Los Angeles International Airport), 5.25%, 5/15/25(1)

|

2,000,000

|

2,163,360

|

|

Milpitas Improvement Bond Act of 1915 Special Assessment Rev., Series 1996 A, (Local Improvement District No 18), 6.75%, 9/2/16

|

1,120,000

|

1,132,723

|

|

Modesto Irrigation District COP, Series 2009 A, (Capital Improvements), 6.00%, 10/1/39(1)

|

3,000,000

|

3,193,110

|

|

Montebello Community Redevelopment Agency Tax Allocation Rev., Series 2009 A, (Montebello Hills Redevelopment), 8.10%, 3/1/27(1)

|

2,000,000

|

2,200,040

|

|

Moorpark Mobile Home Park Rev., Series 2011 A, (Villa Delaware Arroyo), 6.50%, 5/15/41(1)

|

4,000,000

|

4,033,840

|

|

Moreno Valley Unified School District Special Tax Rev., (Community Facilities District No. 2002-1), 6.20%, 9/1/32

|

4,000,000

|

4,021,680

|

|

Murrieta Community Facilities District No. 2002-2 Special Tax Rev., Series 2004 A, (The Oaks Improvement Area), 6.00%, 9/1/34

|

1,920,000

|

1,797,542

|

|

Murrieta Improvement Bond Act of 1915 Special Tax Rev., (Community Facilities District No. 2000-1), 6.375%, 9/1/30

|

4,060,000

|

4,061,137

|

|

Oakland Unified School District Alameda County GO, Series 2009 A, (Election of 2006), 6.125%, 8/1/29(1)

|

2,500,000

|

2,683,575

|

|

Oceanside Community Development Commission Tax Allocation Rev., (Downtown Redevelopment), 5.70%, 9/1/25(1)

|

3,500,000

|

3,401,475

|

|

Principal

Amount

|

Value

|

|

Oceanside Community Facilities District No. 2001-1 Special Tax Rev., Series 2002 A, (Morrow Hills Development), 6.20%, 9/1/32

|

$2,435,000

|

$2,280,645

|

|

Orange County Community Facilities District Special Tax Rev., (No. 06-1-Delaware Rio Public Improvements), 6.00%, 10/1/40

|

1,375,000

|

1,363,698

|

|

Oxnard School District GO, Series 2001 A, 5.75%, 8/1/30 (NATL)(1)

|

3,000,000

|

3,235,920

|

|

Palomar Pomerado Health Care District COP, 6.75%, 11/1/39

|

4,000,000

|

4,080,360

|

|

Palomar Pomerado Health Care District COP, 6.00%, 11/1/41

|

1,145,000

|

1,073,884

|

|

Palomar Pomerado Health Care District COP, (Indian Health Council, Inc.), 6.25%, 10/1/29(1)

|

2,345,000

|

2,356,022

|

|

Perris Public Financing Auth. Special Tax Rev., Series 2003 A, 6.25%, 9/1/33

|

2,955,000

|

2,961,205

|

|

Perris Public Financing Auth. Special Tax Rev., Series 2004 A, 6.125%, 9/1/34

|

2,995,000

|

2,960,438

|

|

Perris Public Financing Auth. Special Tax Rev., Series 2008 A, (Community Facilities District No. 2005-4), 6.60%, 9/1/38

|

2,210,000

|

2,100,848

|

|

Pleasant Valley School District/Ventura County GO, Series 2002 A, 5.85%, 8/1/31 (NATL)(1)

|

4,835,000

|

5,224,846

|

|

Poway Unified School District Public Financing Auth. Rev., 7.875%, 9/15/39

|

4,000,000

|

4,284,480

|

|

Rancho Cordova Community Facilities District No. 2003-1 Special Tax Rev., (Sunridge Anatolia), 5.375%, 9/1/37

|

3,000,000

|

2,536,290

|

|

Rancho Cordova Community Facilities District No. 2004-1 Special Tax Rev., (Sunridge Park Area), 6.125%, 9/1/37

|

5,000,000

|

4,677,300

|

|

Riverside County COP, 5.75%, 11/1/31 (NATL)(1)

|

2,365,000

|

2,427,696

|

|

Riverside County Improvement Bond Act of 1915 Special Assessment Rev., (District No. 168-Rivercrest), 6.70%, 9/2/26

|

1,875,000

|

1,882,688

|

|

Riverside County Redevelopment Agency Tax Allocation Rev., Series 2010 E, (Interstate 215 Corridor), 6.25%, 10/1/30(1)

|

2,200,000

|

2,283,160

|

|

Riverside Unified School District Special Tax Rev., (Community Facilities District No. 13, Improvement Area 1), 5.375%, 9/1/34

|

2,000,000

|

1,697,560

|

|

Riverside Unified School District Special Tax Rev., Series 2005 A, (Community Facilities School District No. 15, Improvement Area 2), 5.25%, 9/1/30

|

1,000,000

|

917,770

|

|

Rohnert Park Finance Auth. Rev., Series 2001 A, (Las Casitas de Sonoma), 6.40%, 4/15/36

|

4,315,000

|

4,316,424

|

|

Romoland School District Special Tax Rev., (Community Facilities District No. 1, Improvement Area 1), 5.40%, 9/1/36

|

4,000,000

|

3,505,280

|

|

Roseville Community Facilities District No. 1 Special Tax Rev., (The Fountains), 6.125%, 9/1/38

|

2,600,000

|

2,544,620

|

|

Roseville Finance Auth. Electric System Rev., 5.00%, 2/1/37(1)

|

1,295,000

|

1,323,050

|

|

Sacramento Airport System Rev., Series 2009 D, (Grant Revenue Bonds), 6.00%, 7/1/35(1)

|

4,000,000

|

4,262,160

|

|

Sacramento County COP, 5.75%, 2/1/30(1)

|

3,000,000

|

3,136,110

|

|

Sacramento Municipal Utility District Electric Rev., Series 1997 K, 5.25%, 7/1/24 (Ambac)(1)

|

4,000,000

|

4,498,720

|

|

Sacramento Special Tax Rev. (North Natomas Community Facilities District No.1), 6.30%, 9/1/26

|

3,840,000

|

3,848,218

|

|

San Buenaventura Rev., (Community Memorial Health System), 7.50%, 12/1/41(1)

|

3,850,000

|

3,822,010

|

|

Principal

Amount

|

Value

|

|

San Buenaventura City COP, (Wastewater Revenue), 5.00%, 3/1/29 (NATL)(1)

|

$1,975,000

|

$2,018,944

|

|

San Diego Redevelopment Agency Tax Allocation Rev., Series 2009 A, (North Park Redevelopment), 7.00%, 11/1/39(1)

|

3,000,000

|

3,189,150

|

|

San Francisco City and County Airports Commission Rev., Series 2008 34D, (San Francisco International Airport), 5.25%, 5/1/26(1)

|

3,000,000

|

3,205,620

|

|

San Francisco City and County Airports Commission Rev., Series 2011 D, 5.00%, 5/1/31(1)

|

5,390,000

|

5,644,246

|

|

San Francisco City and County Redevelopment Agency Lease Rev., (George R. Mascone), 0.00%, 7/1/13(1)(2)

|

1,250,000

|

1,221,763

|

|

San Francisco City and County Redevelopment Financing Auth. Tax Allocation Rev., Series 2009 D, (Mission Bay South Redevelopment), 6.625%, 8/1/39(1)

|

2,000,000

|

2,037,900

|

|

San Francisco City and County Redevelopment Financing Auth. Tax Allocation Rev., Series 2011 C, (Mission Bay South Redevelopment), 6.75%, 8/1/41(1)

|

1,000,000

|

1,060,230

|

|

San Francisco City and County Redevelopment Financing Auth. Tax Allocation Rev., Series 2011 D, (Mission Bay South Redevelopment), 7.00%, 8/1/41(1)

|

1,250,000

|

1,311,350

|

|

San Jose Airport Rev., Series 2011 A2, 5.25%, 3/1/34(1)

|

2,605,000

|

2,643,945

|

|

San Marcos Public Facilities Auth. Special Tax Rev., Series 2004 A, 5.45%, 9/1/24

|

2,790,000

|

2,718,074

|

|

Santa Barbara County Water COP, 5.50%, 9/1/22 (Ambac)(1)

|

3,005,000

|

3,143,951

|

|

Santa Cruz County Redevelopment Agency Tax Allocation Rev., Series 2009 A, (Live Oak/Soquel Community Improvement), 7.00%, 9/1/36(1)

|

3,000,000

|

3,327,000

|

|

Santa Margarita Water District Special Tax Rev., Series 2011 A, (Community Facilities District No. 99-1), 5.25%, 9/1/29

|

1,000,000

|

1,008,520

|

|

Santa Margarita Water District Special Tax Rev., Series 2011 B, (Community Facilities District No. 99-1), 5.875%, 9/1/38

|

650,000

|

656,604

|

|

Shasta Lake Public Finance Auth. Rev., (Electrical Enterprise), 6.25%, 4/1/13, Prerefunded at 102% of Par(1)(3)

|

7,755,000

|

8,643,645

|

|

Soledad Improvement Bond Act of 1915 District No. 2002-01 Special Assessment Rev., (Diamond Ridge), 6.75%, 9/2/33

|

2,160,000

|

2,173,586

|

|

Southern California Public Power Auth. Rev., (Southern Transmission), 0.00%, 7/1/14 (NATL-IBC)(1)(5)

|

2,400,000

|

2,267,136

|

|

Southern California Public Power Auth. Rev., (Southern Transmission), 0.00%, 7/1/15 (NATL-IBC)(1)(5)

|

1,250,000

|

1,144,875

|

|

Southern California Public Power Auth. Rev., Series 2008 A, (Southern Transmission), 5.00%, 7/1/22(1)

|

5,750,000

|

6,485,827

|

|

Stockton Community Facilities District Special Tax Rev., (Spanos Park West No. 2001-1), 6.375%, 9/1/12, Prerefunded at 102% of Par(1)(3)

|

4,195,000

|

4,529,258

|

|

Sunnyvale Community Facilities District No. 1 Special Tax Rev., 7.75%, 8/1/32

|

6,500,000

|

6,499,610

|

|

Susanville Public Financing Auth. Rev., Series 2010 B, (Utility Enterprises), 6.00%, 6/1/45(1)

|

3,000,000

|

2,944,320

|

|

Tahoe-Truckee Unified School District GO, Series 1999 A, (Improvement District No. 2), 0.00%, 8/1/22 (NATL/FGIC)(1)(2)

|

2,690,000

|

1,514,658

|

|

Tahoe-Truckee Unified School District GO, Series 1999 A, (Improvement District No. 2), 0.00%, 8/1/23 (NATL/FGIC)(1)(2)

|

2,220,000

|

1,160,105

|

|

Principal

Amount

|

Value

|

|

Tracy Community Facilities District No. 2006-1 Special Tax Rev., (NEI Phase II), 5.75%, 9/1/36

|

$3,105,000

|

$2,702,281

|

|

Tri-Dam Power Auth. Rev., 4.00%, 5/1/16

|

2,165,000

|

2,273,683

|

|

Tri-Dam Power Auth. Rev., 4.00%, 11/1/16

|

2,165,000

|

2,275,891

|

|

Tuolumne Wind Project Auth. Rev., Series 2009 A, 5.875%, 1/1/29(1)

|

2,000,000

|

2,217,420

|

|

Turlock Health Facility COP, Series 2007 B, (Emanuel Medical Center, Inc.), 5.50%, 10/15/37(1)

|

1,000,000

|

857,200

|

|

Turlock Public Financing Auth. Tax Allocation Rev., 7.50%, 9/1/39(1)

|

2,770,000

|

2,916,533

|

|

Tustin Community Facilities District No. 06-1 Special Tax Rev., Series 2007 A, (Tustin Legacy/Columbus Villages), 6.00%, 9/1/36

|

5,000,000

|

4,861,400

|

|

Tustin Community Facilities District No. 07-1 Special Tax Rev., (Tustin Legacy/Retail Center), 6.00%, 9/1/37

|

1,300,000

|

1,261,741

|

|

Tustin Unified School District Special Tax Rev., (Community Facilities District No. 06-1), 5.75%, 9/1/30(1)

|

1,000,000

|

1,009,790

|

|

Tustin Unified School District Special Tax Rev., (Community Facilities District No. 06-1), 6.00%, 9/1/40(1)

|

1,500,000

|

1,511,400

|

|

Twin Rivers Unified School District COP, (Facility Bridge Program), VRDN, 3.50%, 5/31/13 (AGM)(1)

|

4,000,000

|

4,003,240

|

|

Val Verde Unified School District Special Tax Rev., (Community Facilities District No. 1, Improvement Area A), 5.40%, 9/1/30

|

2,500,000

|

2,193,025

|

|

Val Verde Unified School District Special Tax Rev., (Community Facilities District No. 1, Improvement Area A), 5.45%, 9/1/36

|

2,600,000

|

2,190,656

|

|

Ventura County Community College District GO, Series 2008 C, (Election of 2002), 5.50%, 8/1/33(1)

|

1,600,000

|

1,729,152

|

|

Vernon Electric System Rev., Series 2009 A, 5.125%, 8/1/21(1)

|

5,000,000

|

4,843,050

|

|

West Sacramento Community Facilities District No. 20 Special Tax Rev., 5.30%, 9/1/35

|

1,740,000

|

1,496,243

|

|

Yosemite Community College District GO, (Election of 2004), 0.00%, 8/1/16 (AGM)(1)(2)

|

3,545,000

|

3,068,304

|

|

Yuba City Redevelopment Agency Tax Allocation Rev., 5.70%, 9/1/24

|

2,270,000

|

2,103,995

|

|

Yuba City Unified School District GO, 0.00%, 3/1/25 (NATL/FGIC)(1)(2)

|

1,500,000

|

624,045

|

|

472,202,501

|

||

|

GUAM — 0.7%

|

||

|

Guam Government GO, Series 2009 A, 7.00%, 11/15/39(1)

|

3,300,000

|

3,407,250

|

|

PUERTO RICO — 2.2%

|

||

|

Puerto Rico GO, Series 2006 A, (Public Improvement), 5.25%, 7/1/30(1)

|

1,145,000

|

1,109,642

|

|

Puerto Rico GO, Series 2008 A, 6.00%, 7/1/38(1)

|

2,500,000

|

2,523,425

|

|

Puerto Rico GO, Series 2009 B, (Public Improvement), 6.00%, 7/1/39(1)

|

2,000,000

|

2,020,940

|

|

Puerto Rico Sales Tax Financing Corp. Rev., Series 2007 A, VRN, 1.10%, 11/1/11(1)

|

10,000,000

|

5,374,800

|

|

11,028,807

|

||

|

U.S. VIRGIN ISLANDS — 0.7%

|

||

|

Virgin Islands Public Finance Auth. Rev., Series 2009 A, (Diageo Matching Fund Bonds), 6.75%, 10/1/37

|

2,000,000

|

2,123,740

|

|

Virgin Islands Public Finance Auth. Rev., Series 2010 B, (Subordinated Lien), 5.25%, 10/1/29(1)

|

1,500,000

|

1,492,140

|

|

3,615,880

|

||

|

TOTAL INVESTMENT SECURITIES — 98.5%(Cost $488,953,321)

|

490,254,438

|

|

|

OTHER ASSETS AND LIABILITIES — 1.5%

|

7,421,074

|

|

|

TOTAL NET ASSETS — 100.0%

|

$497,675,512

|

|

|

Futures Contracts

|

||||

|

Contracts Purchased

|

Expiration Date

|

Underlying Face

Amount at Value

|

Unrealized Gain (Loss)

|

|

|

29

|

U.S. Long Bond

|

December 2011

|

$3,944,906

|

$(18,870)

|

|

Contracts Sold

|

Expiration Date

|

Underlying Face

Amount at Value

|

Unrealized Gain (Loss)

|

|

|

92

|

U.S. Treasury 2-Year Notes

|

December 2011

|

$20,286,000

|

$1,230

|

|

(1)

|

Security, or a portion thereof, has been segregated for futures contracts. At the period end, the aggregate value of securities pledged was $24,231,000.

|

|

(2)

|

Convertible capital appreciation bond. These securities are issued with a zero-coupon and become interest bearing at a predetermined rate and date and are issued at a substantial discount from their value at maturity. Interest reset or final maturity date is indicated, as applicable. Rate shown is effective at the period end.

|

|

(3)

|

Escrowed to maturity in U.S. government securities or state and local government securities.

|

|

(4)

|

Security was purchased under Rule 144A of the Securities Act of 1933 or is a private placement and, unless registered under the Act or exempted from registration, may only be sold to qualified institutional investors. The aggregate value of these securities at the period end was $3,209,978, which represented 0.6% of total net assets.

|

|

(5)

|

Security is a zero-coupon municipal bond. Zero-coupon securities are issued at a substantial discount from their value at maturity.

|

|

AUGUST 31, 2011

|

||||

|

Assets

|

||||

|

Investment securities, at value (cost of $488,953,321)

|

$490,254,438 | |||

|

Cash

|

504,981 | |||

|

Receivable for investments sold

|

896,550 | |||

|

Receivable for capital shares sold

|

687,907 | |||

|

Interest receivable

|

9,353,474 | |||

| 501,697,350 | ||||

|

Liabilities

|

||||

|

Payable for investments purchased

|

2,485,846 | |||

|

Payable for capital shares redeemed

|

723,702 | |||

|

Payable for variation margin on futures contracts

|

37,156 | |||

|

Accrued management fees

|

210,457 | |||

|

Distribution and service fees payable

|

39,898 | |||

|

Dividends payable

|

524,779 | |||

| 4,021,838 | ||||

|

Net Assets

|

$497,675,512 | |||

|

Net Assets Consist of:

|

||||

|

Capital paid in

|

$535,773,022 | |||

|

Accumulated net realized loss

|

(39,380,987 | ) | ||

|

Net unrealized appreciation

|

1,283,477 | |||

| $497,675,512 | ||||

|

Net assets

|

Shares outstanding

|

Net asset value per share

|

||||||

|

Investor Class

|

$374,466,726 | 39,836,377 | $9.40 | |||||

|

Institutional Class

|

$9,784,296 | 1,041,092 | $9.40 | |||||

|

A Class

|

$89,027,893 | 9,470,508 | $9.40 | * | ||||

|

B Class

|

$479,232 | 50,977 | $9.40 | |||||

|

C Class

|

$23,917,365 | 2,544,027 | $9.40 | |||||

|

*

|

Maximum offering price $9.84 (net asset value divided by 0.955) |

|

YEAR ENDED AUGUST 31, 2011

|

||||

|

Investment Income (Loss)

|

||||

|

Income:

|

||||

|

Interest

|

$28,463,245 | |||

|

Expenses:

|

||||

|

Management fees

|

2,537,831 | |||

|

Distribution and service fees:

|

||||

|

A Class

|

239,351 | |||

|

B Class

|

7,209 | |||

|

C Class

|

254,137 | |||

|

Trustees’ fees and expenses

|

27,929 | |||

|

Other expenses

|

2,162 | |||

| 3,068,619 | ||||

|

Fees waived

|

(93,432 | ) | ||

| 2,975,187 | ||||

|

Net investment income (loss)

|

25,488,058 | |||

|

Realized and Unrealized Gain (Loss)

|

||||

|

Net realized gain (loss) on:

|

||||

|

Investment transactions

|

(5,982,536 | ) | ||

|

Futures contract transactions

|

(1,952,320 | ) | ||

| (7,934,856 | ) | |||

|

Change in net unrealized appreciation (depreciation) on:

|

||||

|

Investments

|

(9,827,929 | ) | ||

|

Futures contracts

|

(148,880 | ) | ||

| (9,976,809 | ) | |||

|

Net realized and unrealized gain (loss)

|

(17,911,665 | ) | ||

|

Net Increase (Decrease) in Net Assets Resulting from Operations

|

$7,576,393 | |||

|

YEARS ENDED AUGUST 31, 2011 AND AUGUST 31, 2010

|

||||||||

|

Increase (Decrease) in Net Assets

|

2011

|

2010

|

||||||

|

Operations

|

||||||||

|

Net investment income (loss)

|

$25,488,058 | $26,407,392 | ||||||

|

Net realized gain (loss)

|

(7,934,856 | ) | (4,867,527 | ) | ||||

|

Change in net unrealized appreciation (depreciation)

|

(9,976,809 | ) | 50,932,301 | |||||

|

Net increase (decrease) in net assets resulting from operations

|

7,576,393 | 72,472,166 | ||||||

|

Distributions to Shareholders

|

||||||||

|

From net investment income:

|

||||||||

|

Investor Class

|

(19,320,213 | ) | (20,168,524 | ) | ||||

|

Institutional Class

|

(413,005 | ) | (668 | ) | ||||

|

A Class

|

(4,626,144 | ) | (4,958,395 | ) | ||||

|

B Class

|

(29,339 | ) | (40,637 | ) | ||||

|

C Class

|

(1,036,820 | ) | (1,241,451 | ) | ||||

|

Decrease in net assets from distributions

|

(25,425,521 | ) | (26,409,675 | ) | ||||

|

Capital Share Transactions

|

||||||||

|

Net increase (decrease) in net assets from capital share transactions

|

(39,890,836 | ) | 3,228,416 | |||||

|

Net increase (decrease) in net assets

|

(57,739,964 | ) | 49,290,907 | |||||

|

Net Assets

|

||||||||

|

Beginning of period

|

555,415,476 | 506,124,569 | ||||||

|

End of period

|

$497,675,512 | $555,415,476 | ||||||

|

Accumulated net investment loss

|

— | $(50,885 | ) | |||||

|

Year ended August 31, 2011

|

Year ended August 31, 2010(1)

|

|||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

|||||||||||||

|

Investor Class

|

||||||||||||||||

|

Sold

|

8,511,978 | $79,214,553 | 8,560,326 | $79,770,530 | ||||||||||||

|

Issued in reinvestment of distributions

|

1,577,617 | 14,566,298 | 1,630,497 | 15,236,776 | ||||||||||||

|

Redeemed

|

(13,359,965 | ) | (123,867,707 | ) | (9,144,211 | ) | (85,139,104 | ) | ||||||||

| (3,270,370 | ) | (30,086,856 | ) | 1,046,612 | 9,868,202 | |||||||||||

|

Institutional Class

|

||||||||||||||||

|

Sold

|

1,331,279 | 12,513,170 | 2,694 | 25,000 | ||||||||||||

|

Issued in reinvestment of distributions

|

45,139 | 412,959 | 71 | 668 | ||||||||||||

|

Redeemed

|

(338,091 | ) | (3,045,420 | ) | — | — | ||||||||||

| 1,038,327 | 9,880,709 | 2,765 | 25,668 | |||||||||||||

|

A Class

|

||||||||||||||||

|

Sold

|

2,586,970 | 24,073,713 | 2,306,535 | 21,540,276 | ||||||||||||

|

Issued in reinvestment of distributions

|

360,424 | 3,326,466 | 370,535 | 3,462,892 | ||||||||||||

|

Redeemed

|

(4,480,944 | ) | (41,206,399 | ) | (3,064,884 | ) | (28,530,752 | ) | ||||||||

| (1,533,550 | ) | (13,806,220 | ) | (387,814 | ) | (3,527,584 | ) | |||||||||

|

B Class

|

||||||||||||||||

|

Sold

|

63 | 589 | 191 | 1,776 | ||||||||||||

|

Issued in reinvestment of distributions

|

2,275 | 21,041 | 2,614 | 24,493 | ||||||||||||

|

Redeemed

|

(56,890 | ) | (523,069 | ) | (4,748 | ) | (44,265 | ) | ||||||||

| (54,552 | ) | (501,439 | ) | (1,943 | ) | (17,996 | ) | |||||||||

|

C Class

|

||||||||||||||||

|

Sold

|

316,280 | 2,938,770 | 304,086 | 2,826,002 | ||||||||||||

|

Issued in reinvestment of distributions

|

52,701 | 486,787 | 61,306 | 572,964 | ||||||||||||

|

Redeemed

|

(951,568 | ) | (8,802,587 | ) | (702,493 | ) | (6,518,840 | ) | ||||||||

| (582,587 | ) | (5,377,030 | ) | (337,101 | ) | (3,119,874 | ) | |||||||||

|

Net increase (decrease)

|

(4,402,732 | ) | $(39,890,836 | ) | 322,519 | $3,228,416 | ||||||||||

|

(1)

|

March 1, 2010 (commencement of sale) through August 31, 2010 for the Institutional Class.

|

|

•

|

Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical securities;

|

|

•

|

Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for similar securities, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.); or

|

|

•

|

Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions).

|

|

2011

|

2010

|

|||||||

|

Distributions Paid From

|

||||||||

|

Exempt income

|

$25,425,521 | $26,409,675 | ||||||

|

Taxable ordinary income

|

— | — | ||||||

|

Long-term capital gains

|

— | — | ||||||

|

Federal tax cost of investments

|

$488,941,712 | |||

|

Gross tax appreciation of investments

|

$18,630,691 | |||

|

Gross tax depreciation of investments

|

(17,317,965 | ) | ||

|

Net tax appreciation (depreciation) of investments

|

$1,312,726 | |||

|

Net tax appreciation (depreciation) on derivatives

|

— | |||

|

Other book-to-tax adjustments

|

$(215,547 | ) | ||

|

Net tax appreciation (depreciation)

|

$1,097,179 | |||

|

Accumulated capital losses

|

$(32,789,723 | ) | ||

|

Capital loss deferral

|

$(6,404,966 | ) |

|

2015

|

2016

|

2017

|

2018

|

2019

|

|

$(1,856,959)

|

$(59,454)

|

$(11,784,441)

|

$(12,885,340)

|

$(6,203,529)

|

|

For a Share Outstanding Throughout the Years Ended August 31 (except as noted)

|

|||||||||||||

|

Per-Share Data

|

Ratios and Supplemental Data

|

||||||||||||

|

Income From Investment Operations:

|

Distributions

From:

|

Ratio to Average Net Assets of:

|

|||||||||||

|

Net Asset

Value,

Beginning

of Period

|

Net

Investment

Income

(Loss)

|

Net

Realized

and

Unrealized

Gain (Loss)

|

Total From

Investment

Operations

|

Net

Investment

Income

|

Net Asset

Value,

End of Period

|

Total

Return(1)

|

Operating

Expenses

|

Operating

Expenses

(before

expense

waiver)

|

Net

Investment

Income

(Loss)

|

Net Investment

Income (Loss)

(before

expense

waiver)

|

Portfolio

Turnover

Rate

|

Net Assets,

End of Period

(in thousands)

|

|

|

Investor Class

|

|||||||||||||

|

2011

|

$9.69

|

0.47(2)

|

(0.29)

|

0.18

|

(0.47)

|

$9.40

|

2.07%

|

0.49%

|

0.51%

|

5.10%

|

5.08%

|

37%

|

$374,467

|

|

2010

|

$8.88

|

0.47(2)

|

0.81

|

1.28

|

(0.47)

|

$9.69

|

14.78%

|

0.49%

|

0.51%

|

5.08%

|

5.06%

|

17%

|

$417,503

|

|

2009

|

$9.50

|

0.48

|

(0.62)

|

(0.14)

|

(0.48)

|

$8.88

|

(1.16)%

|

0.52%

|

0.52%

|

5.56%

|

5.56%

|

26%

|

$373,313

|

|

2008

|

$9.90

|

0.48

|

(0.40)

|

0.08

|

(0.48)

|

$9.50

|

0.81%

|

0.52%

|

0.52%

|

4.91%

|

4.91%

|

31%

|

$455,741

|

|

2007

|

$10.25

|

0.48

|

(0.35)

|

0.13

|

(0.48)

|

$9.90

|

1.22%

|

0.52%

|

0.52%

|

4.70%

|

4.70%

|

17%

|

$467,477

|

|

Institutional Class

|

|||||||||||||

|

2011

|

$9.69

|

0.49(2)

|

(0.29)

|

0.20

|

(0.49)

|

$9.40

|

2.27%

|

0.29%

|

0.31%

|

5.30%

|

5.28%

|

37%

|

$9,784

|

|

2010(3)

|

$9.28

|

0.25(2)

|

0.41

|

0.66

|

(0.25)

|

$9.69

|

7.16%

|

0.29%(4)

|

0.31%(4)

|

5.24%(4)

|

5.22%(4)

|

17%(5)

|

$27

|

|

A Class

|

|||||||||||||

|

2011

|

$9.69

|

0.45(2)

|

(0.29)

|

0.16

|

(0.45)

|

$9.40

|

1.82%

|

0.74%

|

0.76%

|

4.85%

|

4.83%

|

37%

|

$89,028

|

|

2010

|

$8.88

|

0.45(2)

|

0.81

|

1.26

|

(0.45)

|

$9.69

|

14.50%

|

0.74%

|

0.76%

|

4.83%

|

4.81%

|

17%

|

$106,577

|

|

2009

|

$9.50

|

0.46

|

(0.62)

|

(0.16)

|

(0.46)

|

$8.88

|

(1.41)%

|

0.77%

|

0.77%

|

5.31%

|

5.31%

|

26%

|

$101,111

|

|

2008

|

$9.90

|

0.45

|

(0.40)

|

0.05

|

(0.45)

|

$9.50

|

0.55%

|

0.77%

|

0.77%

|

4.66%

|

4.66%

|

31%

|

$133,480

|

|

2007

|

$10.25

|

0.46

|

(0.35)

|

0.11

|

(0.46)

|

$9.90

|

0.97%

|

0.77%

|

0.77%

|

4.45%

|

4.45%

|

17%

|

$147,314

|

|

For a Share Outstanding Throughout the Years Ended August 31 (except as noted)

|

|||||||||||||

|

Per-Share Data

|

Ratios and Supplemental Data

|

||||||||||||

|

Income From Investment Operations:

|

Distributions

From:

|

Ratio to Average Net Assets of:

|

|||||||||||

|

Net Asset

Value,

Beginning

of Period

|

Net

Investment

Income

(Loss)

|

Net

Realized

and

Unrealized

Gain (Loss)

|

Total From

Investment

Operations

|

Net

Investment

Income

|

Net Asset

Value,

End of Period

|

Total

Return(1)

|

Operating

Expenses

|

Operating

Expenses

(before

expense

waiver)

|

Net

Investment

Income

(Loss)

|

Net Investment

Income (Loss)

(before

expense

waiver)

|

Portfolio

Turnover

Rate

|

Net Assets,

End of Period

(in thousands)

|

|

|

B Class

|

|||||||||||||

|

2011

|

$9.69

|

0.38(2)

|

(0.29)

|

0.09

|

(0.38)

|

$9.40

|

1.06%

|

1.49%

|

1.51%

|

4.10%

|

4.08%

|

37%

|

$479

|

|

2010

|

$8.88

|

0.38(2)

|

0.81

|

1.19

|

(0.38)

|

$9.69

|

13.65%

|

1.49%

|

1.51%

|

4.08%

|

4.06%

|

17%

|

$1,022

|

|

2009

|

$9.50

|

0.39

|

(0.62)

|

(0.23)

|

(0.39)

|

$8.88

|

(2.14)%

|

1.52%

|

1.52%

|

4.56%

|

4.56%

|

26%

|

$954

|

|

2008

|

$9.90

|

0.38

|

(0.40)

|

(0.02)

|

(0.38)

|

$9.50

|

(0.20)%

|

1.52%

|

1.52%

|

3.91%

|

3.91%

|

31%

|

$1,209

|

|

2007

|

$10.25

|

0.38

|

(0.35)

|

0.03

|

(0.38)

|

$9.90

|

0.22%

|

1.52%

|

1.52%

|

3.70%

|

3.70%

|

17%

|

$1,454

|

|

C Class

|

|||||||||||||

|

2011

|

$9.69

|

0.38(2)

|

(0.29)

|

0.09

|

(0.38)

|

$9.40

|

1.06%

|

1.49%

|

1.51%

|

4.10%

|

4.08%

|

37%

|

$23,917

|

|

2010

|

$8.88

|

0.38(2)

|

0.81

|

1.19

|

(0.38)

|

$9.69

|

13.64%

|

1.49%

|

1.51%

|

4.08%

|

4.06%

|

17%

|

$30,286

|

|

2009

|

$9.50

|

0.39

|

(0.62)

|

(0.23)

|

(0.39)

|

$8.88

|

(2.14)%

|

1.52%

|

1.52%

|

4.56%

|

4.56%

|

26%

|

$30,747

|

|

2008

|

$9.90

|

0.38

|

(0.40)

|

(0.02)

|

(0.38)

|

$9.50

|

(0.20)%

|

1.52%

|

1.52%

|

3.91%

|

3.91%

|

31%

|

$39,283

|

|

2007

|

$10.25

|

0.38

|

(0.35)

|

0.03

|

(0.38)

|

$9.90

|

0.22%

|

1.52%

|

1.52%

|

3.70%

|

3.70%

|

17%

|

$42,125

|

|

(1)

|

Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges, if any. Total returns for periods less than one year are not annualized.

|

|

(2)

|

Computed using average shares outstanding throughout the period.

|

|

(3)

|

March 1, 2010 (commencement of sale) through August 31, 2010.

|

|

(4)

|

Annualized.

|

|

(5)

|

Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended August 31, 2010.

|

|

Name

(Year of Birth)

|

Position(s)

Held with

Funds

|

Length of

Time Served

|

Principal Occupation(s)

During Past 5 Years

|

Number of

American

Century

Portfolios

Overseen by

Trustee

|

Other

Directorships

Held During

Past 5 Years

|

|

Independent Trustees

|

|||||

|

Tanya S. Beder

(1955)

|

Trustee

|

Since 2011

|

Chairman, SBCC Group Inc.

(investment advisory services)

(2006 to present); Fellow in

Practice, International Center

for Finance, Yale University

School of Management (1985

to present); Chief Executive

Officer, Tribeca Global

Management LLC (asset

management firm) (2004

to 2006)

|

40

|

None

|

|

Jeremy I. Bulow

(1954)

|

Trustee

|

Since 2011

|

Professor of Economics,

Stanford University, Graduate

School of Business (1979

to present)

|

40

|

None

|

|

John Freidenrich

(1937)

|

Trustee

|

Since 2005

|

Founder, Member and Manager,

Regis Management Company,

LLC (investment management

firm) (April 2004 to present)

|

40

|

None

|

|

Name

(Year of Birth)

|

Position(s)

Held with

Funds

|

Length of

Time Served

|

Principal Occupation(s)

During Past 5 Years

|

Number of

American

Century

Portfolios

Overseen by

Trustee

|

Other

Directorships

Held During

Past 5 Years

|

|

Independent Trustees

|

|||||

|

Ronald J. Gilson

(1946)

|

Trustee and

Chairman of

the Board

|

Since 1995

|

Charles J. Meyers Professor

of Law and Business, Stanford

Law School (1979 to present);

Marc and Eva Stern Professor

of Law and Business, Columbia

University School of Law (1992

to present)

|

40

|

None

|

|

Frederick L. A. Grauer

(1946)

|

Trustee

|

Since 2008

|

Senior Advisor, BlackRock, Inc.

(investment management firm)

(2010 to 2011); Senior Advisor,

Barclays Global Investors

(investment management firm)

(2003 to 2009)

|

40

|

None

|

|

Peter F. Pervere

(1947)

|

Trustee

|

Since 2007

|

Retired

|

40

|

Intraware, Inc.

(2003 to 2009)

|

|

Myron S. Scholes

(1941)

|

Trustee

|

Since 1980

|

Chairman, Platinum Grove

Asset Management, L.P. (asset

manager) (1999 to 2009);

Frank E. Buck Professor of

Finance-Emeritus, Stanford

Graduate School of Business

(1996 to present)

|

40

|

Dimensional

Fund Advisors

(investment

advisor); CME

Group, Inc.

(futures and

options exchange)

|

|

John B. Shoven

(1947)

|

Trustee

|

Since 2002

|

Professor of Economics,

Stanford University (1973

to present)

|

40

|

Cadence Design

Systems;

Exponent;

Financial Engines;

Watson Wyatt

Worldwide (2002

to 2006)

|

|

Interested Trustee

|

|||||

|

Jonathan S. Thomas

(1963)

|

Trustee and

President

|

Since 2007

|

President and Chief Executive

Officer, ACC (March 2007 to

present); Chief Administrative

Officer, ACC (February 2006

to February 2007); Executive

Vice President, ACC (November

2005 to February 2007). Also

serves as: Chief Executive

Officer and Manager, ACS;

Executive Vice President, ACIM;

Director, ACC, ACIM and other

ACC subsidiaries

|

104

|

None

|

|

Name (Year of Birth)

|

Offices with the Funds

|

Principal Occupation(s) During the Past Five Years

|

||

|

Jonathan S. Thomas

(1963)

|

Trustee and President

since 2007

|

President and Chief Executive Officer, ACC (March 2007 to present); Chief

Administrative Officer, ACC (February 2006 to February 2007); Executive

Vice President, ACC (November 2005 to February 2007). Also serves as:

Chief Executive Officer and Manager, ACS; Executive Vice President, ACIM;

Director, ACC, ACIM and other ACC subsidiaries

|

||

|

Barry Fink

(1955)

|

Executive Vice President

since 2007

|

Chief Operating Officer and Executive Vice President, ACC (September 2007

to present); President, ACS (October 2007 to present); Managing Director,

Morgan Stanley (2000 to 2007); Global General Counsel, Morgan Stanley

(2000 to 2006). Also serves as: Manager, ACS and Director, ACC and certain

ACC subsidiaries

|

||

|

Maryanne L. Roepke

(1956)

|

Chief Compliance Officer

since 2006 and Senior Vice

President since 2000

|

Chief Compliance Officer, American Century funds, ACIM and ACS (August

2006 to present); Assistant Treasurer, ACC (January 1995 to August 2006);

and Treasurer and Chief Financial Officer, various American Century funds

(July 2000 to August 2006). Also serves as: Senior Vice President, ACS

|

||

|

Charles A. Etherington

(1957)

|

General Counsel since 2007

and Senior Vice President

since 2006

|

Attorney, ACC (February 1994 to present); Vice President, ACC (November

2005 to present), General Counsel, ACC (March 2007 to present); Also

serves as General Counsel, ACIM, ACS, ACIS and other ACC subsidiaries; and

Senior Vice President, ACIM and ACS

|

||

|

Robert J. Leach

(1966)

|

Vice President, Treasurer

and Chief Financial Officer

since 2006

|

Vice President, ACS (February 2000 to present); and Controller, various

American Century funds (1997 to September 2006)

|

||

|

David H. Reinmiller

(1963)

|

Vice President since 2001

|

Attorney, ACC (January 1994 to present); Associate General Counsel, ACC

(January 2001 to present); Also serves as Vice President, ACIM and ACS

|

||

|

Ward D. Stauffer

(1960)

|

Secretary since 2005

|

Attorney, ACC (June 2003 to present)

|

|

Approval of Management Agreement

|

|

•

|

the nature, extent, and quality of investment management, shareholder services, and other services provided by the Advisor to the Fund;

|

|

•

|

the wide range of other programs and services the Advisor provides to the Fund and its shareholders on a routine and non-routine basis;

|

|

•

|

the investment performance of the fund, including data comparing the Fund’s performance to appropriate benchmarks and/or a peer group of other mutual funds with similar investment objectives and strategies;

|

|

•

|

data comparing the cost of owning the Fund to the cost of owning similar funds;

|

|

•

|

the Advisor’s compliance policies, procedures, and regulatory experience;

|

|

•

|

financial data showing the cost of services provided to the Fund, the profitability of the Fund to the Advisor, and the overall profitability of the Advisor;

|

|

•

|

data comparing services provided and charges to other investment management clients of the Advisor; and

|

|

•

|

consideration of collateral benefits derived by the Advisor from the management of the Fund and any potential economies of scale relating thereto.

|

|

•

|

constructing and designing the Fund

|

|

•

|

portfolio research and security selection

|

|

•

|

initial capitalization/funding

|

|

•

|

securities trading

|

|

•

|

Fund administration

|

|

•

|

custody of Fund assets

|

|

•

|

daily valuation of the Fund’s portfolio

|

|

•

|

shareholder servicing and transfer agency, including shareholder confirmations, recordkeeping, and communications

|

|

•

|

legal services

|

|

•

|

regulatory and portfolio compliance

|

|

•

|

financial reporting

|

|

•

|

marketing and distribution

|

|

Contact Us

|

americancentury.com

|

|

Automated Information Line

|

1-800-345-8765

|

|

Investor Services Representative

|

1-800-345-2021

or 816-531-5575

|

|

Investors Using Advisors

|

1-800-378-9878

|

|

Business, Not-For-Profit, Employer-Sponsored Retirement Plans

|

1-800-345-3533

|

|

Banks and Trust Companies, Broker-Dealers, Financial Professionals, Insurance Companies

|

1-800-345-6488

|

|

Telecommunications Device for the Deaf

|

1-800-634-4113

|

|

ANNUAL REPORT

|

AUGUST 31, 2011

|

|

|

California Intermediate-Term Tax-Free Bond Fund

|

|

President’s Letter

|

2

|

|

Market Perspective

|

3

|

|

Performance

|

4

|

|

Portfolio Commentary

|

6

|

|

Fund Characteristics

|

8

|

|

Shareholder Fee Example

|

9

|

|

Schedule of Investments

|

11

|

|

Statement of Assets and Liabilities

|

24

|

|

Statement of Operations

|

25

|

|

Statement of Changes in Net Assets

|

26

|

|

Notes to Financial Statements

|

27

|

|

Financial Highlights

|

32

|

|

Report of Independent Registered Public Accounting Firm

|

34

|

|

Management

|

35

|

|

Approval of Management Agreement

|

38

|

|

Additional Information

|

43

|

|

U.S. Fixed-Income Total Returns

|

||||

|

For the 12 months ended August 31, 2011

|

||||

|

Barclays Capital Municipal Market Indices

|

Barclays Capital U.S. Taxable Market Indices

|

|||

|

7 Year Municipal Bond

|

4.06%

|

Aggregate Bond

|

4.62%

|

|

|

Municipal High Yield Bond

|

3.45%

|

Treasury Bond

|

4.17%

|

|

|

Municipal Bond

|

2.66%

|

|||

|

California Tax-Exempt Bond

|

2.62%

|

|||

|

Long-Term Municipal Bond

|