ck0000717316-20230831485BPOS8/31/20230000717316false3.1713.765.080.338.480.639.613.924.0412.031.316.212.680.294.620.716.413.681.266.840.010.010.010.130.420.960.920.290.010.7700007173162024-01-012024-01-010000717316ck0000717316:S000005667Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:S000005667Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:C000015521Member2024-01-012024-01-010000717316ck0000717316:S000005667Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:C000087984Member2024-01-012024-01-010000717316ck0000717316:C000189669Memberck0000717316:S000005667Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:S000005667Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:C000015522Member2024-01-012024-01-010000717316ck0000717316:C000015524Memberck0000717316:S000005667Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-01iso4217:USDxbrli:pure0000717316ck0000717316:S000005667Memberck0000717316:CreditRiskMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:S000005667Memberck0000717316:BelowInvestmentGradeSecuritiesRiskMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:S000005667Memberck0000717316:InterestRateRiskMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:S000005667Memberck0000717316:CaliforniaEconomicRiskMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:S000005667Memberck0000717316:MunicipalSecuritiesRiskMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:S000005667Memberck0000717316:LiquidityRiskMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:S000005667Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:TaxRiskMember2024-01-012024-01-010000717316ck0000717316:S000005667Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:MarketRiskMember2024-01-012024-01-010000717316ck0000717316:S000005667Memberrr:RiskLoseMoneyMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:S000005667Memberrr:RiskNotInsuredDepositoryInstitutionMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:S000005667Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:C000015521Memberrr:AfterTaxesOnDistributionsMember2024-01-012024-01-010000717316ck0000717316:S000005667Memberrr:AfterTaxesOnDistributionsAndSalesMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:C000015521Member2024-01-012024-01-010000717316ck0000717316:S000005667Memberck0000717316:SPMunicipalBondCaliforniaIndexMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:S000005668Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:C000015525Memberck0000717316:S000005668Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:C000087985Memberck0000717316:S000005668Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:C000189670Memberck0000717316:S000005668Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:C000087986Memberck0000717316:S000005668Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:C000087987Memberck0000717316:S000005668Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:CreditRiskMemberck0000717316:S000005668Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:BelowInvestmentGradeSecuritiesRiskMemberck0000717316:S000005668Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:S000005668Memberck0000717316:InterestRateRiskMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:CaliforniaEconomicRiskMemberck0000717316:S000005668Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:S000005668Memberck0000717316:MunicipalSecuritiesRiskMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:S000005668Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:LossOfTaxExemptionsRiskMember2024-01-012024-01-010000717316ck0000717316:LiquidityRiskMemberck0000717316:S000005668Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:S000005668Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:MarketRiskMember2024-01-012024-01-010000717316rr:RiskLoseMoneyMemberck0000717316:S000005668Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316rr:RiskNotInsuredDepositoryInstitutionMemberck0000717316:S000005668Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:C000015525Memberck0000717316:S000005668Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberrr:AfterTaxesOnDistributionsMember2024-01-012024-01-010000717316ck0000717316:C000015525Memberck0000717316:S000005668Memberrr:AfterTaxesOnDistributionsAndSalesMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:SPIntermediateTermCaliforniaAMT-FreeMunicipalBondIndexMemberck0000717316:S000005668Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMember2024-01-012024-01-010000717316ck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:S000005671Member2024-01-012024-01-010000717316ck0000717316:C000015528Memberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:S000005671Member2024-01-012024-01-010000717316ck0000717316:LowYieldRiskMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:S000005671Member2024-01-012024-01-010000717316ck0000717316:CaliforniaEconomicRiskMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:S000005671Member2024-01-012024-01-010000717316ck0000717316:MunicipalSecuritiesRiskMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:S000005671Member2024-01-012024-01-010000717316ck0000717316:InterestRateRiskMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:S000005671Member2024-01-012024-01-010000717316ck0000717316:CreditRiskMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:S000005671Member2024-01-012024-01-010000717316ck0000717316:LiquidityRiskMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:S000005671Member2024-01-012024-01-010000717316ck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:S000005671Memberck0000717316:LossOfTaxExemptionsRiskMember2024-01-012024-01-010000717316rr:RiskLoseMoneyMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:S000005671Member2024-01-012024-01-010000717316rr:RiskNotInsuredDepositoryInstitutionMemberck0000717316:AmericanCenturyCaliforniaTax-FreeandMunicipalFundsMemberck0000717316:S000005671Member2024-01-012024-01-01

As Filed with the U.S. Securities and Exchange Commission on December 29, 2023

1933 Act File No. 002-82734

1940 Act File No. 811-03706

| | | | | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549 |

| __________________ |

FORM N-1A __________________ |

| |

| | |

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | ☒ |

| | |

| Pre-Effective Amendment No. | ☐ |

| | |

| Post-Effective Amendment No. 72 | ☒ |

| | |

| and/or |

| | |

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 | ☒ |

| | |

| Amendment No. 76 | ☒ |

| (Check appropriate box or boxes.) |

__________________ |

| American Century California Tax-Free and Municipal Funds |

__________________ |

4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 (Address of Principal Executive Offices)(Zip Code) |

REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE: (816) 531-5575 |

JOHN PAK 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 (Name and Address of Agent for Service) |

| Approximate Date of Proposed Public Offering: January 1, 2024 | |

| | |

| It is proposed that this filing will become effective (check appropriate box) |

| | | | | |

| ☐ | immediately upon filing pursuant to paragraph (b) |

| ☒ | on January 1, 2024, at 8:30 a.m. (Central) pursuant to paragraph (b) |

| ☐ | 60 days after filing pursuant to paragraph (a)(1) |

| ☐ | on (date) pursuant to paragraph (a)(1) |

| ☐ | 75 days after filing pursuant to paragraph (a)(2) |

| ☐ | on (date) pursuant to paragraph (a)(2) of rule 485. |

| | |

| If appropriate, check the following box: |

| ☐ | this post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

January 1, 2024

American Century Investments

Prospectus

California High-Yield Municipal Fund

Investor Class (BCHYX)

I Class (BCHIX)

Y Class (ACYHX)

A Class (CAYAX)

C Class (CAYCX)

| | | | | |

The Securities and Exchange Commission

has not approved or disapproved these securities or

passed upon the adequacy of this prospectus. Any

representation to the contrary is a criminal offense. | |

Table of Contents

| | | | | |

| Fund Summary | 2 | |

| Investment Objective | 2 | |

| Fees and Expenses | 2 | |

| Principal Investment Strategies | 3 | |

| Principal Risks | 3 | |

| Fund Performance | 4 | |

| Portfolio Management | 5 | |

| Purchase and Sale of Fund Shares | 5 | |

| Tax Information | 5 | |

| Payments to Broker-Dealers and Other Financial Intermediaries | 5 | |

| Objectives, Strategies and Risks | 6 | |

| Management | 8 | |

| Investing Directly with American Century Investments | 10 | |

| Investing Through a Financial Intermediary | 12 | |

| Additional Policies Affecting Your Investment | 17 | |

| Share Price and Distributions | 21 | |

| Taxes | 23 | |

| Multiple Class Information | 25 | |

| Financial Highlights | 26 | |

| |

| Appendix A | A-1 |

©2024 American Century Proprietary Holdings, Inc. All rights reserved.

Fund Summary

Investment Objective

The fund seeks high current income that is exempt from federal and California income taxes.

Fees and Expenses

The following table describes the fees and expenses you may pay if you buy, hold and sell shares of the fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. You may qualify for A Class sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in American Century Investments funds. More information about these and other discounts is available from your financial professional and in Calculation of Sales Charges on page 12 of the fund’s prospectus, Appendix A of the fund’s prospectus and Sales Charges in Appendix B of the statement of additional information.

| | | | | | | | | | | | | | | | | |

Shareholder Fees (fees paid directly from your investment) |

| | Investor | I | Y | A | C |

Maximum Sales Charge (Load) Imposed on

Purchases (as a percentage of offering price) | None | None | None | 4.50% | None |

Maximum Deferred Sales Charge (Load) (as a

percentage of the lower of the original offering

price or redemption proceeds when redeemed

within one year of purchase) | None | None | None | None¹ | 1.00% |

Maximum Annual Account Maintenance Fee

(waived if eligible investments total at least $10,000) | $25 | None | None | None | None |

| | | | | | | | | | | | | | | | | |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| | Investor | I | Y | A | C |

| Management Fee | 0.49% | 0.29% | 0.26% | 0.49% | 0.49% |

| Distribution and Service (12b-1) Fees | None | None | None | 0.25% | 1.00% |

| Other Expenses | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% |

| Total Annual Fund Operating Expenses | 0.50% | 0.30% | 0.27% | 0.75% | 1.50% |

1 Purchases of $1 million or more may be subject to a contingent deferred sales charge of 1.00% if the shares are redeemed within one year of the date of the purchase.

Example

The example below is intended to help you compare the costs of investing in the fund with the costs of investing in other mutual funds. The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods, that you earn a 5% return each year, and that the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | | | | | | | |

| 1 year | 3 years | 5 years | 10 years |

| Investor Class | $51 | $161 | $280 | $629 |

| I Class | $31 | $97 | $169 | $381 |

| Y Class | $28 | $87 | $152 | $344 |

| A Class | $523 | $679 | $849 | $1,339 |

| C Class | $153 | $475 | $819 | $1,587 |

Portfolio Turnover

The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s performance. During the most recent fiscal year, the fund’s portfolio turnover rate was 73% of the average value of its portfolio.

Principal Investment Strategies

The fund invests in California municipal and other debt securities with an emphasis on high-yield securities. A high-yield security is one that has been rated below investment-grade, or determined by the investment advisor to be of similar quality. Under normal market conditions, the portfolio managers invest at least 80% of the fund’s net assets in municipal securities with income payments exempt from federal and California income taxes. Cities, counties and other municipalities in California and U.S. territories usually issue these securities for public projects, such as schools, roads, and water and sewer systems. Some of these investments are not necessarily exempt from the federal alternative minimum tax.

The portfolio managers seek to invest in securities that will result in a high yield for the fund. To accomplish this, the portfolio managers buy securities that are rated below investment-grade, including so-called junk bonds and bonds that are in technical or monetary default. Issuers of these securities often have short financial histories or have questionable credit or have had and may continue to have problems making interest and principal payments.

The portfolio managers also may buy unrated securities if they determine such securities meet the investment objectives of the fund.

Although the fund invests primarily for income, it also employs techniques designed to realize capital appreciation. For example, the portfolio managers may select bonds with maturities and coupon rates that position the fund for potential capital appreciation for a variety of reasons, including their view on the direction of future interest-rate movements and the potential for a credit upgrade.

When determining whether to sell a security, the portfolio managers consider, among other things, current and anticipated changes in interest rates, the credit quality of a particular issuer, comparable alternatives, general market conditions and any other factor deemed relevant by the portfolio managers.

Principal Risks

•Credit Risk – Debt securities, even investment-grade debt securities, are subject to credit risk. Credit risk is the risk that the inability or perceived inability of the issuer to make interest and principal payments will cause the value of the securities to decrease. As a result, the fund’s share price could also decrease. Changes in the credit rating of a debt security held by the fund could have a similar effect. The fund’s investments often have high credit risk, which helps the fund pursue a higher yield than more conservatively managed bond funds.

•Below Investment-Grade Securities Risk – Issuers of lower rated, high-yield securities are more vulnerable to real or perceived economic changes (such as an economic downturn or a prolonged period of rising interest rates), political changes, or adverse developments specific to the issuer. Adverse economic, political and other developments may be more likely to cause an issuer of low-quality bonds to default on its obligation to pay interest and principal due under its securities. The fund invests a significant part of its assets in securities rated below investment-grade or that are unrated, including bonds that are in technical or monetary default. By definition, the issuers of many of these securities have had and may continue to have problems making interest and principal payments.

•Interest Rate Risk – When interest rates change, the fund’s share value will be affected. Generally, the value of debt securities and the funds that hold them decline as interest rates rise. Because the fund typically invests in intermediate-term and long-term bonds, the fund’s interest rate risk is generally higher than for funds with shorter-weighted average maturities, such as money market and short-term bond funds. A period of rising interest rates may negatively affect the fund’s performance.

•California Economic Risk – The fund will be sensitive to events that affect California’s economy. Significant political or economic developments in California will likely impact virtually all municipal securities issued in the state. Because the fund invests principally in California municipal securities, it may have a higher level of risk than funds that invest in a larger universe of securities.

•Municipal Securities Risk – Because the fund invests principally in municipal securities, it will be sensitive to events that affect municipal markets, including legislative or political changes and the financial condition of the issuers of municipal securities. The fund may have a higher level of risk than funds that invest in a larger universe of securities.

•Liquidity Risk – The fund may also be subject to liquidity risk. During periods of market turbulence or unusually low trading activity, in order to meet redemptions, it may be necessary for the fund to sell securities at prices that could have an adverse effect on the fund’s share price. Changing regulatory and market conditions, including increases in interest rates and credit spreads may adversely affect the liquidity of the fund’s investments.

•Tax Risk – Some or all of the fund’s income may be subject to the federal alternative minimum tax. There is no guarantee that all of the fund’s income will remain exempt from federal or state income taxes. Income from municipal bonds held by a fund could be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the Internal Revenue Service or state tax authorities, or non-compliant conduct of a bond issuer. The fund may sell securities that lose their tax-exempt statuses at inopportune times, which may cause tax consequences or a decrease in the fund’s value.

•Market Risk – The value of securities owned by the fund may go up and down, sometimes rapidly or unpredictably. Market risks, including political, regulatory, economic and social developments, can affect the value of the fund’s investments. Natural disasters, public health emergencies, war, terrorism and other unforeseeable events may lead to increased market volatility and may have adverse long-term effects on world economies and markets generally.

•Principal Loss Risk – At any given time your shares may be worth less than the price you paid for them. In other words, it is possible to lose money by investing in the fund.

An investment in the fund is not a bank deposit, and it is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

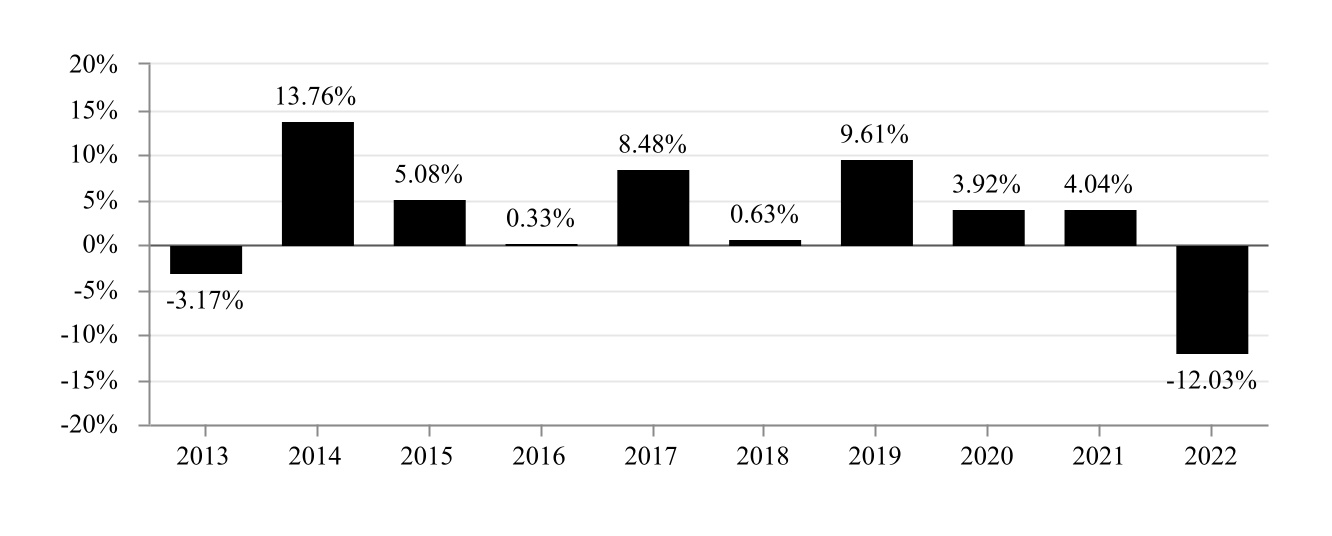

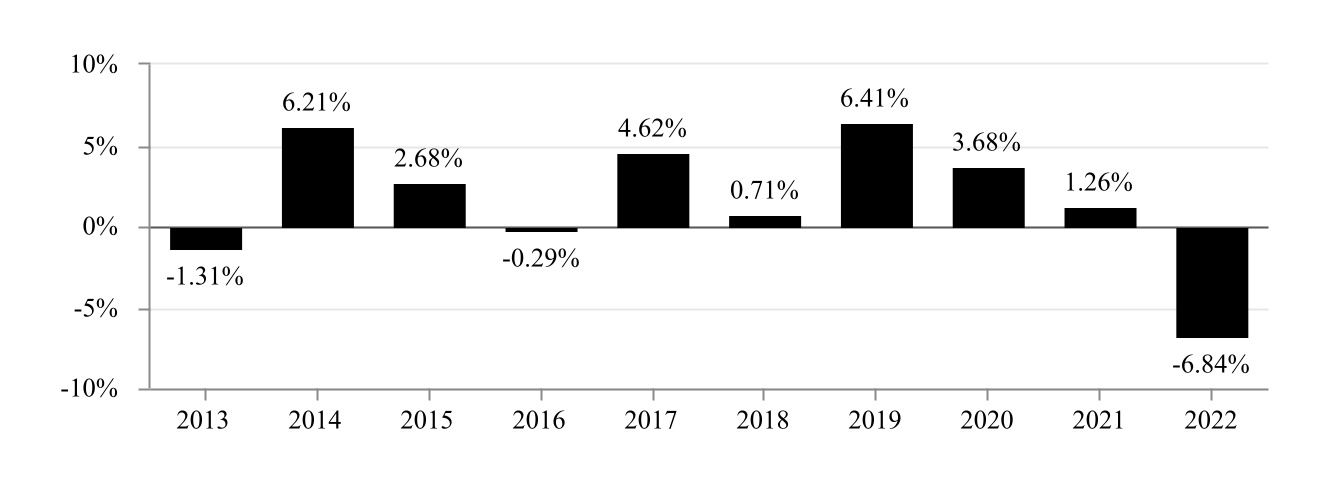

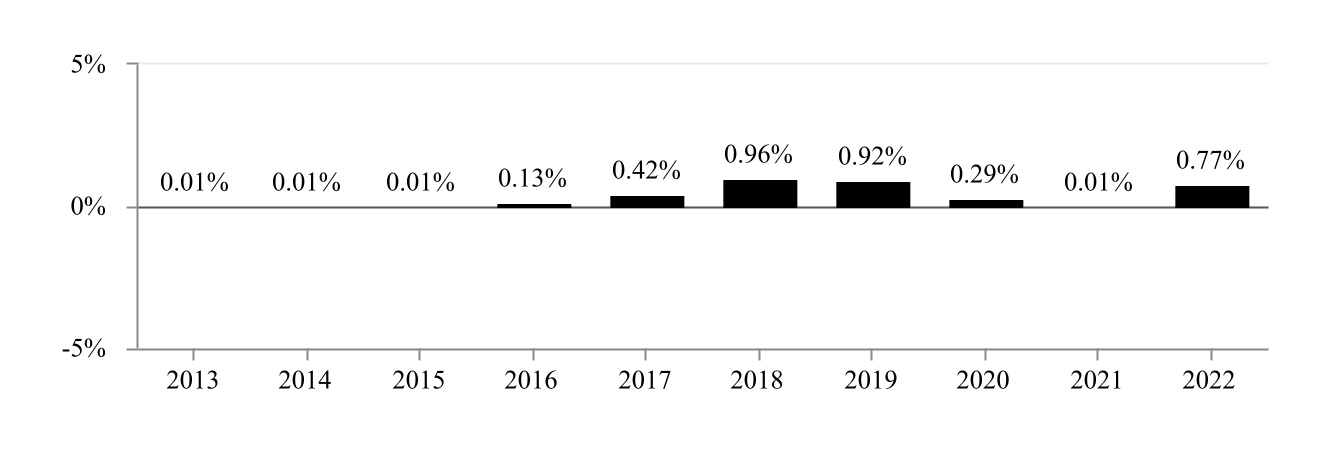

Fund Performance

The following bar chart and table provide some indication of the risks of investing in the fund. The bar chart shows changes in the fund’s performance from year to year for Investor Class shares. The table shows how the fund’s average annual returns for the periods shown compared with those of a broad measure of market performance. The fund’s past performance (before and after taxes) is not necessarily an indication of how the fund will perform in the future. For current performance information, including yields, please visit americancentury.com.

Sales charges and account fees, if applicable, are not reflected in the bar chart. If those charges were included, returns would be less than those shown.

Calendar Year Total Returns

Highest Performance Quarter (1Q 2014): 5.44% Lowest Performance Quarter (1Q 2022): -6.46%

As of September 30, 2023, the most recent calendar quarter end, the fund’s Investor Class year-to-date return was -1.91%.

| | | | | | | | | | | | | | | | | |

Average Annual Total Returns For the calendar year ended December 31, 2022 | 1 year | 5 years | 10 years | Since Inception | Inception Date |

Investor Class Return Before Taxes | -12.03% | 0.96% | 2.83% | — | 12/30/1986 |

| Return After Taxes on Distributions | -12.02% | 0.96% | 2.83% | — | 12/30/1986 |

| Return After Taxes on Distributions and Sale of Fund Shares | -5.91% | 1.53% | 3.02% | — | 12/30/1986 |

I Class Return Before Taxes | -11.77% | 1.18% | 3.03% | — | 03/01/2010 |

Y Class Return Before Taxes | -11.74% | 1.20% | — | 2.01% | 04/10/2017 |

A Class Return Before Taxes | -16.19% | -0.21% | 2.10% | — | 01/31/2003 |

C Class1 Return Before Taxes | -12.90% | -0.04% | 1.96% | — | 01/31/2003 |

S&P Municipal Bond California 50% Investment Grade/50% High Yield Index

(reflects no deduction for fees, expenses and taxes) | -10.93% | 1.19% | 3.39% | — | — |

1 C Class shares automatically convert to A Class shares after approximately eight years. All returns for periods greater than eight years reflect this conversion.

After-tax returns are shown only for Investor Class shares. After-tax returns for other share classes will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or IRAs.

Portfolio Management

Investment Advisor

American Century Investment Management, Inc.

Portfolio Managers

Joseph Gotelli, Vice President and Senior Portfolio Manager, has served on teams managing fixed-income investments for American Century Investments since joining the advisor in 2008.

Alan Kruss, Vice President and Portfolio Manager, has served on teams managing fixed-income investments for American Century Investments since joining the advisor in 1997.

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the fund on any business day through our website at americancentury.com, in person (at one of our Investor Centers), by mail (American Century Investments, P.O. Box 419200, Kansas City, MO 64141-6200), by telephone at 1-800-345-2021 (Investor Services Representative) or 1-800-345-3533 (Business, Not-For-Profit and Employer Sponsored Retirement Plans), or through a financial intermediary. Shares may be purchased and redemption proceeds received by electronic bank transfer, by check or by wire.

Unless otherwise specified below, the minimum initial investment amount to open an account is $2,500 ($1,000 for Coverdell Education Savings Accounts and IRAs). However, American Century Investments will waive the fund minimum if you make an initial investment of at least $500 and continue to make automatic investments of at least $100 a month until reaching the fund minimum.

Investors opening accounts through financial intermediaries may open an account with $250 for Investor, A and C Classes, but the financial intermediaries may require their clients to meet different investment minimums. The minimum may be waived for broker-dealer sponsored wrap program accounts, fee based accounts, and accounts through bank/trust and wealth management advisory organizations.

The minimum initial investment amount for the I Class is generally $5 million ($3 million for endowments and foundations), but the minimum may be waived if you have an aggregate investment in the American Century family of funds of $10 million or more ($5 million for endowments and foundations). This includes accounts held directly with American Century and those held through a financial intermediary.

There is no minimum initial investment amount for Y Class shares.

For the Investor, A and C Classes, there is no minimum initial investment amount for certain employer-sponsored retirement plans, however, financial intermediaries or plan recordkeepers may require plans to meet different minimums. Employer-sponsored retirement plans are not eligible to invest in the I or Y Class.

There is a $50 minimum for subsequent purchases, except that there is no subsequent purchase minimum for financial intermediaries or employer-sponsored retirement plans.

Tax Information

The fund intends to distribute income that is exempt from regular federal and California income tax, however, fund distributions may be subject to capital gains tax. A portion of the fund’s distributions may be subject to federal and/or California income taxes or to the federal alternative minimum tax.

If you hold your fund shares through a tax-deferred investment plan, such as a 401(k) plan or an IRA, any distributions received from the fund may be taxable as ordinary income upon withdrawal from the tax-deferred plan, regardless of whether the distributions were tax-exempt when earned.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the fund through a broker-dealer or other financial intermediary (such as a bank, insurance company, plan sponsor or financial professional), the fund and its related companies may pay the intermediary for the sale of fund shares and related services for investments in all classes except the Y Class. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Objectives, Strategies and Risks

What is the fund’s investment objective?

The fund seeks high current income that is exempt from federal and California income taxes.

What are the fund’s principal investment strategies?

Under normal market conditions, the portfolio managers must invest at least 80% of the fund’s net assets in municipal securities with income payments exempt from federal and California income taxes. The fund may change this 80% policy only upon 60 days’ prior written notice to shareholders. Cities, counties and other municipalities in California and U.S. territories usually issue these securities for public projects, such as schools, roads, and water and sewer systems.

| | |

Municipal securities are a debt obligation issued by or on behalf of a state, its political subdivisions, agencies or instrumentalities, the District of Columbia or a U.S. territory or possession. |

The portfolio managers also may buy long- and intermediate-term debt securities with income payments exempt from regular federal income tax, but not exempt from the federal alternative minimum tax. Cities, counties and other municipalities usually issue these securities (called private activity bonds) to fund for-profit private projects, such as athletic stadiums, airports and apartment buildings.

| | |

Debt securities include fixed-income investments such as notes, bonds, commercial paper and U.S. Treasury securities. Long-term debt securities are those with maturities longer than 10 years. Intermediate-term debt securities are those with maturities between three and 10 years. |

The portfolio managers seek to invest in securities that will result in a high yield for the fund. To accomplish this, the portfolio managers buy investment-grade securities, securities rated below investment grade, including so-called junk bonds and bonds that are in technical or monetary default, or unrated securities if the portfolio managers determine such securities meet the investment objectives of the fund. The issuers of these securities often have short financial histories or questionable credit or have had and may continue to have problems making interest and principal payments.

Although the fund invests primarily for income, it also employs techniques designed to realize capital appreciation. For example, the portfolio managers may select bonds with maturities and coupon rates that position the fund for potential capital appreciation for a variety of reasons, including their view on the direction of future interest-rate movements and the potential for a credit upgrade.

In the event of adverse market, economic, political, or other conditions, the fund may take temporary defensive positions that are inconsistent with the fund’s principal investment strategies. To the extent the fund assumes a defensive position, it may not achieve its investment objective.

When determining whether to buy or sell a security, the portfolio managers consider, among other things, current and anticipated changes in interest rates, the credit quality of a particular issuer, comparable alternatives, general market conditions and any other factor deemed relevant by the portfolio managers.

In addition to the principal investment strategies described above, the fund also may invest in derivative instruments such as options, futures contracts, options on futures contracts, and swap agreements (including, but not limited to, credit default swap agreements), provided that such investments are in keeping with the fund’s investment objective.

A description of the policies and procedures with respect to the disclosure of the fund’s portfolio securities is available in the statement of additional information.

What are the principal risks of investing in the fund?

The fund’s investments often have high credit risk, which helps the fund pursue a higher yield than more conservatively managed bond funds. Credit risk is the risk that the inability or perceived inability of the issuer to make interest and principal payments will cause the value of the securities to decrease. As a result, the fund’s share price could also decrease. Changes in the credit rating of a debt security held by the fund could have a similar effect. A high credit rating indicates a high degree of confidence by the rating organization that the issuer will be able to withstand adverse business, financial or economic conditions and make interest and principal payments on time. A lower credit rating indicates a greater risk of nonpayment. Issuers of high-yield securities are more vulnerable to real or perceived economic changes (such as an economic downturn or a prolonged period of rising interest rates), political changes or adverse developments specific to the issuer. In addition, lower-rated securities may be unsecured or subordinated to other obligations of the issuer. These factors may be more likely to cause an issuer of low-quality bonds to default on its obligation to pay the interest and principal due under its securities. The fund’s credit quality restrictions apply at the time of purchase; the fund will not necessarily sell securities if they are downgraded by a rating agency.

The fund invests a significant part of its assets in securities rated below investment grade or that are unrated, including bonds that are in technical or monetary default. By definition, the issuers of many of these securities have had and may continue to have problems making interest and principal payments.

Investments in debt securities are also sensitive to interest rate changes. Generally, the value of debt securities and the funds that hold them decline as interest rates rise. The degree to which interest rate changes affect the fund’s performance varies and is related to the weighted average maturity of the fund. For example, when interest rates rise, you can expect the share value of a long-term bond fund to fall more than that of a short-term bond fund. When rates fall, the opposite is true. Because the fund typically invests in intermediate-term and long-term bonds, the fund’s interest rate risk is generally higher than for funds with shorter-weighted average maturities, such as money market and short-term bond funds. A period of rising interest rates may negatively affect the fund’s performance.

Because the fund invests principally in California municipal securities, it will be sensitive to events that affect California’s economy. Significant political or economic developments in California will likely impact virtually all municipal securities issued in the state. The fund may have a higher level of risk than funds that invest in a larger universe of securities. For more information about the risks affecting California securities, see the statement of additional information.

Because the fund invests principally in municipal securities, it will be sensitive to events that affect municipal markets, including legislative or political changes and the financial condition of the issuers of municipal securities. By investing primarily in municipal securities, the fund may have a higher level of risk than funds that invest in a larger universe of securities.

The fund may also be subject to liquidity risk. The chance that a fund will have difficulty selling its debt securities is called liquidity risk. During periods of market turbulence or unusually low trading activity, to meet redemptions it may be necessary for the fund to sell securities at prices that could have an adverse effect on the fund’s share price. The market for lower-quality debt securities is generally less liquid than the market for higher-quality securities. Adverse publicity and investor perceptions, as well as new and proposed laws, also may have a greater negative impact on the market for lower-quality securities. Changing regulatory and market conditions, including increases in interest rates and credit spreads may adversely affect the liquidity of the fund’s investments.

There is no guarantee that all of the fund’s income will remain exempt from federal or state income taxes. Income from municipal bonds held by the fund could be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the Internal Revenue Service or state tax authorities, or non-compliant conduct of a bond issuer. Some or all of the fund’s income may be subject to the federal alternative minimum tax.

The value of securities owned by the fund may go up and down, sometimes rapidly or unpredictably, due to factors affecting securities markets generally, particular industries, real or perceived adverse economic conditions or investor sentiment generally. Market risks, including political, regulatory, economic and social developments, can affect the value of the fund’s investments. Natural disasters, public health emergencies, war, terrorism and other unforeseeable events may lead to increased market volatility and may have adverse long-term effects on world economies and markets generally.

The fund may need to sell securities at times it would not otherwise do so in order to meet shareholder redemption requests. The fund could experience a loss when selling securities, particularly if the redemption requests are unusually large or frequent, occur in times of overall market turmoil or declining prices for the securities sold or when the securities the fund wishes to sell are illiquid. Selling securities to meet such redemption requests also may increase transaction costs or have tax consequences. To the extent that a large shareholder (including a fund of funds or 529 college savings plan) invests in the fund, the fund may experience relatively large redemptions as such shareholder reallocates its assets. Although the advisor seeks to minimize the impact of such transactions where possible, the fund’s performance may be adversely affected.

Although the fund’s use of derivative instruments is limited, be aware that the use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional instruments. Derivatives are subject to a number of risks including, liquidity, interest rate, market, and credit risk. They also involve the risk of mispricing or improper valuation, the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index, and the risk of default or bankruptcy of the other party to the swap agreement. Gains or losses involving some futures, options, and other derivatives may be substantial, in part because a relatively small price movement in these securities may result in an immediate and substantial gain or loss for the fund. Further, the use of derivative instruments may give rise to taxable income.

At any given time your shares may be worth less than the price you paid for them. In other words, it is possible to lose money by investing in the fund.

Management

Who manages the fund?

The Board of Trustees, investment advisor and fund management team play key roles in the management of the fund.

The Board of Trustees

The Board of Trustees is responsible for overseeing the advisor’s management and operations of the fund pursuant to the management agreement. In performing their duties, Board members receive detailed information about the fund and its advisor regularly throughout the year, and meet at least quarterly with management of the advisor to review reports about fund operations. The trustees’ role is to provide oversight and not to provide day-to-day management. More than three-fourths of the trustees are independent of the fund’s advisor. They are not employees, directors or officers of, and have no financial interest in, the advisor or any of its affiliated companies (other than as shareholders of American Century Investments funds), and they do not have any other affiliations, positions, or relationships that would cause them to be considered “interested persons” under the Investment Company Act of 1940.

The Investment Advisor

The fund’s investment advisor is American Century Investment Management, Inc. (the advisor). The advisor has been managing mutual funds since 1958 and is headquartered at 4500 Main Street, Kansas City, Missouri 64111.

The advisor is responsible for managing the investment portfolio of the fund and directing the purchase and sale of its investment securities. The advisor also arranges for transfer agency, custody and all other services necessary for the fund to operate.

For the services it provides to the fund, the advisor receives a unified management fee based on a percentage of the daily net assets of each class of shares of the fund. The management fee is calculated daily and paid monthly in arrears. Out of the fund’s fee, the advisor pays all expenses of managing and operating the fund except brokerage expenses, taxes, interest, fees and expenses of the independent trustees (including legal counsel fees), extraordinary expenses, and expenses incurred in connection with the provision of shareholder services and distribution services under a plan adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940. The difference in unified management fees among the classes is a result of their separate arrangements for non-Rule 12b-1 shareholder services. It is not the result of any difference in advisory or custodial fees or other expenses related to the management of the fund’s assets, which do not vary by class. For all classes other than the Y Class, the advisor may pay unaffiliated third parties who provide recordkeeping and administrative services that would otherwise be performed by an affiliate of the advisor.

The percentage rate used to calculate the management fee for each class of shares of a fund is determined daily using a two-component formula that takes into account (i) the daily net assets of certain accounts managed by the advisor that are in the same broad investment category as the fund (the “Category Fee”) and (ii) the assets of all funds in the American Century Investments family of funds that have the same investment advisor and distributor as the fund (the “Complex Fee”). For purposes of determining the Category Fee and Complex Fee, the assets of funds managed by the advisor that invest exclusively in the shares of other funds (funds of funds) are not included. The statement of additional information contains detailed information about the calculation of the management fee.

| | | | | | | | | | | | | | | | | |

Management Fees Paid by the Fund to the

Advisor as a Percentage of Average Net Assets

for the Fiscal Year Ended August 31, 2023 | Investor

Class | I

Class | Y

Class | A

Class | C

Class |

| California High-Yield Municipal | 0.49% | 0.29% | 0.26% | 0.49% | 0.49% |

A discussion regarding the basis for the Board of Trustees’ approval of the fund’s investment advisory agreement with the advisor is available in the fund’s annual report to shareholders dated August 31, 2023.

The Fund Management Team

The advisor uses teams of portfolio managers and analysts, organized by broad investment categories such as money markets, corporate bonds, government bonds and municipal bonds, in its management of fixed-income funds. Designated portfolio managers serve on the firm’s Global Fixed Income Investment Committee, which is responsible for periodically adjusting each fund’s dynamic investment parameters based on economic and market conditions. All portfolio managers listed below are responsible for security selection and portfolio construction for the fund within these parameters, as well as compliance with stated investment objectives and cash flow monitoring. Other members of the investment team provide research and analytical support but generally do not make day-to-day investment decisions for the fund.

The individuals listed below are jointly and primarily responsible for the day-to-day management of the fund.

Joseph Gotelli (Global Fixed Income Investment Committee Representative)

Mr. Gotelli, Vice President and Senior Portfolio Manager, has served on teams managing fixed-income investments since joining the advisor in 2008. He has a bachelor’s degree in business economics from the University of California, Santa Barbara and an MBA from Santa Clara University.

Alan Kruss

Mr. Kruss, Vice President and Portfolio Manager, has served on teams managing fixed-income investments since joining the advisor in 1997. He has a bachelor’s degree in finance from San Francisco State University.

The statement of additional information provides additional information about the accounts managed by the portfolio managers, the structure of their compensation, and their ownership of fund securities.

Fundamental Investment Policies

Shareholders must approve any change to the fundamental investment policies contained in the statement of additional information, as well as any change to the investment objective of the fund. The Board of Trustees and/or the advisor may change any other policies or investment strategies described in this prospectus or otherwise used in the operation of the fund at any time, subject to applicable notice provisions.

Investing Directly with American Century Investments

Services Automatically Available to You

Most accounts automatically have access to the services listed under Ways to Manage Your Account when the account is opened. If you have questions about the services that apply to your account type, please call us.

Generally, once your account is established, any registered owner (including those on jointly owned accounts) or any trustee (including those on trust accounts with multiple trustees), or any authorized signer on business accounts with multiple authorized signers, may transact business by any of the methods described below. American Century reserves the right to require all owners or trustees or authorized signers to act together, at our discretion.

Account Maintenance Fee

If you hold Investor Class shares of any American Century Investments mutual fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not through a financial intermediary or employer-sponsored retirement plan account), we may charge you a $25 annual account maintenance fee if the value of those shares is less than $10,000. We will determine the amount of your total eligible investments once per year, generally the last Friday in October. If the value of those investments is less than $10,000 at that time, we will automatically redeem shares in one of your accounts to pay the $25 fee as soon as administratively possible. Please note that you may incur tax liability as a result of the redemption. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments brokerage accounts) registered under your Social Security number.

| | |

Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts, IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments brokerage accounts, you are currently not subject to this fee, but you may be subject to other fees. |

Wire Purchases

Current Investors: If you would like to make a wire purchase into an existing account, your bank will need the following information (To invest in a new fund, please call us first to set up the new account.):

•American Century Investments bank information: Commerce Bank N.A., Routing No. 101000019, Account No. 2804918;

•Your American Century Investments account number and fund name;

•Your name;

•Contribution year (for IRAs only); and

•Dollar amount.

New Investors: To make a wire purchase into a new account, please complete an application or call us prior to wiring money.

Ways to Manage Your Account

ONLINE

americancentury.com

Open an account: If you are a current or new investor, you can open an account by completing and submitting our online application. Current investors also can open an account by exchanging shares from another American Century Investments account with an identical registration.

Exchange shares: Exchange shares from another American Century Investments account with an identical registration.

Make additional investments: Make an additional investment into an established American Century Investments account. If we do not have your bank information, you can add it.

Sell shares*: Redeem shares and choose whether the proceeds are electronically transferred to your authorized bank account or sent by check to your address of record.

* Online redemptions up to $25,000 per day per account.

IN PERSON

If you prefer to handle your transactions in person, visit one of our Investor Centers and a representative can help you open an account, make additional investments, and sell or exchange shares.

•4400 Main Street, Kansas City, MO — 8 a.m. to 5 p.m., Monday – Friday

•4917 Town Center Drive, Leawood, KS — 8 a.m. to 5 p.m., Monday – Friday

BY TELEPHONE

Investor Services Representative: 1-800-345-2021

Business and Not-For-Profit: 1-800-345-3533

Automated Information Line: 1-800-345-8765

Open an account: If you are a current investor, you can open an account by exchanging shares from another American Century Investments account with an identical registration.

Exchange shares: Call or use our Automated Information Line (available only to Investor Class shareholders).

Make additional investments: Call or use our Automated Information Line if you have authorized us to invest from your bank account. The Automated Information Line is available only to Investor Class shareholders.

Sell shares: Call or use our Automated Information Line. The Automated Information Line redemptions are up to $25,000 per day per account and are available for Investor Class shareholders only.

BY MAIL OR FAX

Mail Address: P.O. Box 419200, Kansas City, MO 64141-6200 — Fax: 1-888-327-1998

Open an account: Send a signed, completed application and check or money order payable to American Century Investments.

Exchange shares: Send written instructions to exchange your shares from one American Century Investments account to another with an identical registration.

Make additional investments: Send your check or money order for at least $50 with an investment slip. If you don’t have an investment slip, include your name, address and account number on your check or money order.

Sell shares: Send written instructions or a redemption form to sell shares. Call a Service Representative to request a form.

AUTOMATICALLY

Open an account: Not available.

Exchange shares: Send written instructions to set up an automatic exchange of your shares from one American Century Investments account to another with an identical registration.

Make additional investments: With the automatic investment service, you can purchase shares on a regular basis. You must invest at least $50 per month per account.

Sell shares: You may sell shares automatically by establishing a systematic redemption plan.

See Additional Policies Affecting Your Investment for more information about investing with us.

Investing Through a Financial Intermediary

The fund may be purchased through financial intermediaries that provide various administrative and distribution services.

| | |

Financial intermediaries include banks, broker-dealers, insurance companies and financial professionals. |

Although each class of the fund’s shares represents an interest in the same fund, each has a different cost structure, as described below. Which class is right for you depends on many factors, including how long you plan to hold the shares, how much you plan to invest, the fee structure of each class, and how you wish to compensate your financial professional for the services provided to you. Your financial professional can help you choose the option that is most appropriate.

Investor Class

Investor Class shares are available for purchase without sales charges or commissions but may be subject to account or transaction fees if purchased through financial intermediaries. These shares are available to investors in retail brokerage accounts, broker-dealer-sponsored fee-based advisory accounts, other advisory accounts where fees are charged, and employer-sponsored retirement plans.

I Class

I Class shares are available for purchase without sales charges or commissions by endowments, foundations, large institutional investors and financial intermediaries. Employer-sponsored retirement plans may not invest in I Class shares, except that plans invested in the I Class prior to April 10, 2017 may make additional purchases.

Y Class

Y Class shares are available for purchase without sales charges or commissions through financial intermediaries that offer fee based advisory programs. Y Class shares may be purchased only through financial intermediaries that trade in omnibus accounts with American Century Investments.

A Class

A Class shares are available for purchase through broker-dealers and other financial intermediaries. These shares carry an initial sales charge and an ongoing distribution and service (12b-1) fee that is used to compensate your financial professional. See Calculation of Sales Charges below for commission amounts received by financial professionals on the purchase of A Class shares. The sales charge decreases with the size of the purchase, and may be reduced or eliminated in certain situations. See Reductions and Waivers of Sales Charges for A Class and CDSC Waivers below for a full description of the breakpoints, reductions and waivers that may be available through financial intermediaries in certain types of accounts or products.

C Class

C Class shares are available for purchase through broker-dealers and other financial intermediaries. These shares do not have an initial sales charge but carry an ongoing distribution and service (12b-1) fee. Except as noted below, the commission paid to your financial professional for purchases of C Class shares is 1.00% of the amount invested, and the shares have a contingent deferred sales charge (CDSC) when redeemed within one year of purchase. Your financial professional does not receive the distribution and service (12b-1) fee until the CDSC period has expired (it is retained by the distributor). See CDSC Waivers below for a full description of the waivers that may be available. C Class shares automatically convert to A Class shares 8 years after purchase.

Calculation of Sales Charges

The information regarding sales charges provided herein is included free of charge and in a clear and prominent format at americancentury.com in the Investors Using Advisors and Investment Professionals portions of the website. From the description of A or C Class shares, a hyperlink will take you directly to this disclosure.

The availability of the sales charge reductions and waivers discussed below will depend upon whether you purchase your shares directly from the fund or through a financial intermediary. Intermediaries may have different policies and procedures regarding the availability of these reductions or waivers. Please refer to Appendix A for information provided by certain financial intermediaries regarding their sales charge waiver or discount policies that are applicable to investors transacting in fund shares through such financial intermediary.

A Class

A Class shares are sold at their offering price, which is net asset value plus an initial sales charge. This sales charge varies depending on the amount of your investment, and is deducted from your purchase before it is invested. The sales charges and the amounts paid to your financial professional are:

| | | | | | | | | | | |

| Purchase Amount | Sales Charge

as a % of

Offering Price | Sales Charge

as a % of Net

Amount Invested | Dealer Commission

as a % of Offering Price |

| Less than $100,000 | 4.50% | 4.71% | 4.00% |

| $100,000 - $249,999 | 3.50% | 3.63% | 3.00% |

| $250,000 - $499,999 | 2.50% | 2.56% | 2.00% |

| $500,000 - $999,999 | 2.00% | 2.04% | 1.75% |

| $1,000,000 - $3,999,999 | 0.00% | 0.00% | 0.75% |

| $4,000,000 - $9,999,999 | 0.00% | 0.00% | 0.50% |

| $10,000,000 or more | 0.00% | 0.00% | 0.25% |

There is no front-end sales charge for purchases of $1,000,000 or more, but if you redeem your shares within one year of purchase you will pay a deferred sales charge of 1.00% of the lower of the original purchase price or the current market value at redemption, subject to the exceptions listed below. No sales charge applies to reinvested dividends. No dealer commission will be paid to your financial professional for purchases by certain employer-sponsored retirement plans. For this purpose, employer-sponsored retirement plans do not include SEP IRAs, SIMPLE IRAs or SARSEPs.

Reductions and Waivers of Sales Charges for A Class

You may qualify for a reduction or waiver of certain sales charges, but you or your financial professional must provide certain information, including the account numbers of any accounts to be aggregated, to American Century Investments at the time of purchase in order to take advantage of such reduction or waiver. If you hold assets among multiple intermediaries, it is your responsibility to inform your intermediary and/or American Century Investments at the time of purchase of any accounts to be aggregated.

You and your immediate family (which includes your spouse or domestic partner and children, step-children, parents or step-parents of you, your spouse or domestic partner) may combine investments in any share class of any American Century Investments mutual fund (excluding certain assets in money market accounts, but including account assets invested in Qualified Tuition Programs under Section 529) to reduce your A Class sales charge in the following ways:

Account Aggregation. Investments made by you and your immediate family may be aggregated at each account’s current market value if made for your own account(s) and/or certain other accounts, such as:

•Certain trust accounts

•Solely controlled business accounts

•Single-participant retirement plans

•Endowments or foundations established and controlled by you or an immediate family member

For purposes of aggregation, only investments made through individual-level accounts may be combined. Assets held in multiple participant employer-sponsored retirement plans may be aggregated at a plan level.

Concurrent Purchases. You may combine simultaneous purchases in any share class of any American Century Investments mutual fund to qualify for a reduced A Class sales charge.

Rights of Accumulation. You may take into account the current value of your existing holdings, less any commissionable shares in the money market funds, in any share class of any American Century Investments mutual fund to qualify for a reduced A Class sales charge. An investor who purchases fund shares through a financial intermediary may be subject to different rights of accumulation policies of such financial intermediary. Please consult with your financial professional for further details.

Letter of Intent. A Letter of Intent allows you to combine all purchases of any share class of any American Century Investments mutual fund you intend to make over a 13-month period to determine the applicable sales charge, except for purchases in the A or C Class of money market funds. At your request, existing holdings may be combined with new purchases and sales charge amounts may be adjusted for purchases made within 90 days prior to our receipt of the Letter of Intent. Capital appreciation, capital gains and reinvested dividends earned during the Letter of Intent period do not apply toward its completion. A portion of your account will be held in escrow to cover additional A Class sales charges that will be due if your total investments over the 13-month period do not qualify for the applicable sales charge reduction.

Waivers for Certain Investors. The sales charge on A Class shares may be waived for:

•Purchases by registered representatives and other employees of certain financial intermediaries (and their immediate family members, which includes their spouse or domestic partner and children, step-children, parents or step-parents of them, their spouse or domestic partner) having selling agreements with the advisor or distributor

•Broker-dealer sponsored wrap program accounts and/or fee-based accounts maintained for clients of certain financial intermediaries who have entered into selling agreements with American Century Investments

•Purchases in accounts of financial intermediaries that have entered into a selling agreement with American Century Investments that allows for the waiver of the sales charge in brokerage accounts that may or may not charge a transaction fee

•Current officers, directors and employees of American Century Investments

•Certain group employer-sponsored retirement plans, where plan level or omnibus accounts are held with the fund, or shares are purchased by certain retirement plans that are part of a retirement plan or platform offered by banks, broker-dealers, financial advisors or insurance companies, or serviced by retirement recordkeepers. For purposes of this waiver, employer-sponsored retirement plans do not include SEP IRAs, SIMPLE IRAs or SARSEPs. However, SEP IRA, SIMPLE IRA or SARSEP retirement plans that (i) held shares of an A Class fund prior to March 1, 2009 that received sales charge waivers or (ii) held shares of an Advisor Class fund that was renamed A Class on March 1, 2010, may permit additional purchases by new and existing participants in A Class shares without an initial sales charge. Refer to Buying and Selling Fund Shares in the statement of additional information.

•Purchases of additional shares in accounts that held shares of an Advisor Class fund that was renamed A Class on either September 4, 2007, December 3, 2007 or March 1, 2010. However, if you close your account or if you transfer your account to another financial intermediary, future purchases of A Class shares of a fund may not receive a sales charge waiver.

An investor who receives a sales charge waiver for purchases of fund shares through a financial intermediary may become ineligible to receive such waiver if the nature of the investor’s relationship with and/or the services it receives from the financial intermediary changes. Please consult with your financial professional for further details.

C Class

C Class shares are sold at their net asset value without an initial sales charge. If you purchase shares through a financial intermediary who receives a commission from the fund’s distributor on the purchase and redeem your shares within 12 months of purchase, you will pay a CDSC of 1.00% of the original purchase price or the current market value at redemption, whichever is less. The purpose of the CDSC is to permit the fund’s distributor to recoup all or a portion of the up-front payment made to your financial professional. There is no CDSC on shares acquired through reinvestment of dividends or capital gains.

American Century Investments generally limits purchases of C Class shares to investors whose aggregate investments in American Century Investments mutual funds are less than $1,000,000. However, it is your responsibility to inform your financial intermediary and/or American Century Investments at the time of purchase of any accounts to be aggregated, including investments in any share class of any American Century Investments mutual fund (excluding certain assets in money market accounts, but including account assets invested in Qualified Tuition Programs under Section 529) in accounts held by you and your immediate family members (which includes your spouse or domestic partner and children, step-children, parents or step-parents of you, your spouse or domestic partner). Once you reach this limit, you should work with your financial intermediary to determine what share class is most appropriate for additional purchases.

C Class shares automatically convert to A Class shares after being held for 8 years. The automatic conversion will be executed in the month following the 8-year anniversary of the purchase date for such C Class shares without any sales charge, fee or other charges. The conversion from C Class shares is not considered a taxable event for Federal income tax purposes. After the conversion, shares will be subject to all features and expenses of A Class shares.

Calculation of Contingent Deferred Sales Charge (CDSC)

To minimize the amount of the CDSC you may pay when you redeem shares, the fund will first redeem shares acquired through reinvested dividends and capital gain distributions, which are not subject to a CDSC. Shares that have been in your account long enough that they are not subject to a CDSC are redeemed next. For any remaining redemption amount, shares will be sold in the order they were purchased (earliest to latest).

CDSC Waivers

Any applicable CDSC for A or C Classes may be waived in the following cases:

•redemptions through systematic withdrawal plans not exceeding annually 12% of the lesser of the original purchase cost or current market value for A and C Class shares

•redemptions through employer-sponsored retirement plan accounts. For this purpose, employer-sponsored retirement plans do not include SIMPLE IRAs, SEP IRAs or SARSEPs

•distributions from IRAs due to attainment of age 59½ for A and C Class share

•required minimum distributions from retirement accounts due to the shareholder reaching the qualified age based on applicable IRS regulations

•tax-free returns of excess contributions to IRAs

•redemptions due to death or post-purchase disability

•exchanges, unless the shares acquired by exchange are redeemed within the original CDSC period

•IRA Rollovers from any American Century Investments mutual fund held in an employer-sponsored retirement plan, for A Class shares only

•if no dealer commission was paid to the financial intermediary on the purchase for any other reason

Reinstatement Privilege

Within 90 days of a redemption, dividend payment or capital gains distribution of any A or B Class shares, you may reinvest all or a portion of the proceeds in A Class shares of any American Century Investments mutual fund at the then-current net asset value without paying an initial sales charge. At your request, any CDSC you paid on an A Class redemption that you are reinvesting will be credited to your account. You may use the privilege only once per account. This privilege may only be invoked by the original account owner to reinvest shares in an account with the same registration as the account from which the redemption or distribution originated. This privilege does not apply to systematic or automatic transactions, including, for example, automatic purchases, withdrawals and payroll deductions. If you wish to use this reinvestment privilege, you or your financial professional must provide written notice to American Century Investments.

Employer-Sponsored Retirement Plans

Certain group employer-sponsored retirement plans that hold a single account for all plan participants with the fund, or that are part of a retirement plan or platform offered by banks, broker-dealers, financial advisors or insurance companies, or serviced by retirement recordkeepers are eligible to purchase Investor, A and C Class shares. Employer-sponsored retirement plans are not eligible to purchase I or Y Class shares. However, employer-sponsored retirement plans that were invested in the I Class prior to April 10, 2017 may make additional purchases. For more information regarding employer-sponsored retirement plan types, please refer to Buying and Selling Fund Shares in the statement of additional information. A and C Class purchases are available at net asset value with no dealer commission paid to the financial professional, and do not incur a CDSC. A and C Class shares purchased in employer-sponsored retirement plans are subject to applicable distribution and service (12b-1) fees, which the financial intermediary begins receiving immediately at the time of purchase. American Century does not impose minimum initial investment amount, plan size or participant number requirements by class for employer-sponsored retirement plans; however, financial intermediaries or plan recordkeepers may require plans to meet different requirements.

If you hold your fund shares through a tax-deferred investment plan, such as a 401(k) plan or an IRA, any distributions received from the fund may be taxable as ordinary income upon withdrawal from the tax-deferred plan, regardless of whether the distributions were tax-exempt when earned.

Exchanging Shares

You may exchange shares of the fund for shares of the same class of another American Century Investments mutual fund without a sales charge if you meet the following criteria:

•The exchange is for a minimum of $100

•For an exchange that opens a new account, the amount of the exchange must meet or exceed the minimum account size requirement for the fund receiving the exchange

For purposes of computing any applicable CDSC on shares that have been exchanged, the holding period will begin as of the date of purchase of the original fund owned. Exchanges from a money market fund are subject to a sales charge on the fund being purchased, unless the money market fund shares were acquired by exchange from a fund with a sales charge or by reinvestment of dividends or capital gains distributions.

Moving Between Share Classes and Accounts

You may move your investment between share classes (within the same fund or between different funds) in certain circumstances deemed appropriate by American Century Investments. You also may move investments held in certain accounts to a different type of account if you meet certain criteria. Please contact your financial professional for more information about moving between share classes or account types.

Buying and Selling Shares Through a Financial Intermediary

Your ability to purchase, exchange, redeem and transfer shares will be affected by the policies of the financial intermediary through which you do business. Some policy differences may include:

•minimum investment requirements

•exchange policies

•fund choices

•cutoff time for investments

•trading restrictions

In addition, your financial intermediary may charge a transaction fee for the purchase or sale of fund shares. Those charges are retained by the financial intermediary and are not shared with American Century Investments or the fund. Please contact your financial intermediary for a complete description of its policies. Copies of the fund’s annual reports, semiannual reports and statement of additional information are available from your financial intermediary.

The fund has authorized certain financial intermediaries to accept orders on the fund’s behalf. American Century Investments has selling agreements with these financial intermediaries requiring them to track the time investment orders are received and to comply with procedures relating to the transmission of orders. Orders must be received by the financial intermediary on the fund’s behalf before the time the net asset value is determined in order to receive that day’s share price. If those orders are transmitted to American Century Investments and paid for in accordance with the selling agreement, they will be priced at the net asset value next determined after your request is received in the form required by the financial intermediary.

If you submit a transaction request through a financial intermediary that does not have a selling agreement with us, or if the financial intermediary’s selling agreement does not cover the type of account or share class requested, we may reject or cancel the transaction without prior notice to you or the intermediary.

Investor, I and Y Class shares may also be available on brokerage platforms of financial intermediaries that have agreements with American Century Investments to offer such shares solely when acting as an agent for the shareholder. A shareholder transacting in Investor, I or Y Class shares in these programs may be required to pay a commission and/or other forms of compensation to the broker. Shares of the fund are available in other share classes that have different fees and expenses.

See Additional Policies Affecting Your Investment for more information about investing with us.

Additional Policies Affecting Your Investment

Eligibility for Investor Class Shares

The fund’s Investor Class shares are available for purchase directly from American Century Investments and through the following types of products, programs or accounts offered by financial intermediaries:

•self-directed accounts on transaction-based platforms that may or may not charge a transaction fee

•employer-sponsored retirement plans

•broker-dealer sponsored fee-based wrap programs or other fee-based advisory accounts

•insurance products and bank/trust products where fees are being charged

The fund reserves the right, when in the judgment of American Century Investments it is not adverse to the fund’s interest, to permit all or only certain types of investors to open new accounts in the fund, to impose further restrictions, or to close the fund to any additional investments, all without notice.

Minimum Initial Investment Amounts for Investor, A and C Classes

Unless otherwise specified below, the minimum initial investment amount to open an account is $2,500. However, American Century Investments will waive the fund minimum if you make an initial investment of at least $500 and continue to make automatic investments of at least $100 a month until reaching the fund minimum.

Investors opening accounts through financial intermediaries may open an account with $250, but the financial intermediaries may require their clients to meet different investment minimums. See Investing Through a Financial Intermediary for more information.

| | | | | |

| Broker-dealer sponsored wrap program accounts and/or fee-based advisory accounts | No minimum |

| Coverdell Education Savings Account (CESA) and IRAs | $1,0001, 2 |

1 American Century Investments will waive the minimum if you make an initial investment of at least $500 and continue to make automatic investments of at least $100 a month until reaching the minimum.

2 The minimum initial investment for shareholders investing through financial intermediaries is $250. Financial intermediaries may have different minimums for their clients.

Subsequent Purchases

There is a $50 minimum for subsequent purchases. See Ways to Manage Your Account for more information about making additional investments directly with American Century Investments. However, there is no subsequent purchase minimum for financial intermediaries, but financial intermediaries may require their clients to meet different subsequent purchase requirements.

Eligibility for I Class Shares

I Class shares are made available for purchase by individuals and large institutional shareholders such as bank trust departments, corporations, endowments, foundations and financial advisors that meet the fund’s minimum investment requirements. Employer-sponsored retirement plans may not invest in I Class shares, except that plans invested in the I Class prior to April 10, 2017 may make additional purchases.

Minimum Initial Investment Amounts for I Class

The minimum initial investment amount is generally $5 million ($3 million for endowments and foundations) per fund. If you invest with us through a financial intermediary, this requirement may be met if your financial intermediary aggregates your investments with those of other clients into a single group, or omnibus, account that meets the minimum. The minimum investment requirement may be waived if you have an aggregate investment in the American Century family of funds of $10 million or more ($5 million for endowments and foundations). This includes accounts held directly with American Century and those held through a financial intermediary. American Century Investments also may waive the minimum initial investment in other situations it deems appropriate.

American Century Investments may permit an intermediary to waive the initial minimum per shareholder as provided in Buying and Selling Fund Shares in the statement of additional information.

Eligibility for Y Class Shares

Y Class shares are available for purchase without sales charges or commissions through financial intermediaries that offer fee based advisory programs. Y Class shares may be purchased only through financial intermediaries that trade in omnibus accounts with American Century Investments. Y Class shares may not be purchased by shareholders investing through employer-sponsored retirement plans or individuals investing directly with American Century Investments.

Minimum Initial Investment Amounts for Y Class

There is no minimum initial investment amount or subsequent investment amount for Y Class shares, but financial intermediaries may require different investment minimums.

Limitations on Sale

As of the date of this prospectus, the fund is registered for sale only in the following states and territories: Arizona, California, Colorado, Florida, Hawaii, Idaho, Montana, New Mexico, Nevada, New York, Oregon, Texas, Utah, Washington, the Virgin Islands and Guam.

Redemptions

Your redemption proceeds will be calculated using the net asset value (NAV) next determined after we receive your transaction request in good order. If you sell C or, in certain cases, A Class shares, you may pay a sales charge, depending on how long you have held your shares, as described above.