|

DAVIS NEW YORK VENTURE FUND, INC.

|

Table of Contents

|

|

DAVIS GLOBAL FUND

|

|

|

DAVIS INTERNATIONAL FUND

|

|

2

|

|

|

Management’s Discussion of Fund Performance:

|

|

|

3

|

|

|

5

|

|

|

Fund Overview:

|

|

|

7

|

|

|

9

|

|

|

11

|

|

|

Schedule of Investments:

|

|

|

12

|

|

|

15

|

|

|

17

|

|

|

18

|

|

|

19

|

|

|

21

|

|

|

29

|

|

|

31

|

|

|

32

|

|

|

33

|

|

|

34

|

|

|

35

|

|

DAVIS GLOBAL FUND

|

|

|

DAVIS INTERNATIONAL FUND

|

|

|

|

Christopher C. Davis

|

Danton G. Goei

|

|

President

|

Portfolio Manager

|

|

December 2, 2022

|

|

DAVIS GLOBAL FUND

|

|

1

|

The companies included in the Morgan Stanley Capital International All Country World Index are divided into eleven sectors. One or more industry groups make up a

sector. For purposes of measuring concentration, the Fund generally classifies companies at the industry group or industry level. See the SAI for additional information regarding the Fund’s concentration policy.

|

|

2

|

A company’s or sector’s contribution to or detraction from the Fund’s performance is a product both of its appreciation or depreciation and its weighting within the

Fund. For example, a 5% holding that rises 20% has twice as much impact as a 1% holding that rises 50%.

|

|

3

|

This Management Discussion of Fund Performance discusses a number of individual companies. The information provided in this report does not provide information

reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase, sell, or hold any particular security. The Schedule of Investments lists the Fund’s holdings of each company

discussed.

|

|

DAVIS GLOBAL FUND – (CONTINUED)

|

Management’s Discussion of Fund Performance

|

|

Fund & Benchmark Index

|

1-Year

|

5-Year

|

10-Year

|

Since

Inception

|

Inception

Date

|

Gross Expense

Ratio

|

Net Expense

Ratio

|

|

Class A - without sales charge

|

(31.04)%

|

(1.75)%

|

6.91%

|

5.75%

|

12/22/04

|

0.96%

|

0.96%

|

|

Class A - with sales charge*

|

(34.31)%

|

(2.70)%

|

6.40%

|

5.47%

|

12/22/04

|

0.96%

|

0.96%

|

|

Class C**

|

(32.17)%

|

(2.50)%

|

6.22%

|

5.28%

|

12/22/04

|

1.74%

|

1.74%

|

|

Class Y

|

(30.87)%

|

(1.51)%

|

7.18%

|

3.07%

|

07/25/07

|

0.72%

|

0.72%

|

|

MSCI ACWI®***

|

(19.96)%

|

5.24%

|

7.98%

|

6.30%

|

|

Class A Shares

|

1-Year

|

5-Year

|

10-Year

|

|

With sales charge*

|

(31.08)%

|

(1.98)%

|

6.49%

|

|

DAVIS INTERNATIONAL FUND

|

|

1

|

The companies included in the Morgan Stanley Capital International All Country World Index ex USA are divided into eleven sectors. One or more industry groups make up a

sector. For purposes of measuring concentration, the Fund generally classifies companies at the industry group or industry level. See the SAI for additional information regarding the Fund’s concentration policy.

|

|

2

|

A company’s or sector’s contribution to or detraction from the Fund’s performance is a product both of its appreciation or depreciation and its weighting within the

Fund. For example, a 5% holding that rises 20% has twice as much impact as a 1% holding that rises 50%.

|

|

3

|

This Management Discussion of Fund Performance discusses a number of individual companies. The information provided in this report does not provide information reasonably sufficient upon

which to base an investment decision and should not be considered a recommendation to purchase, sell, or hold any particular security. The Schedule of Investments lists the Fund’s holdings of each company discussed.

|

|

DAVIS INTERNATIONAL FUND – (CONTINUED)

|

Management’s Discussion of Fund Performance

|

|

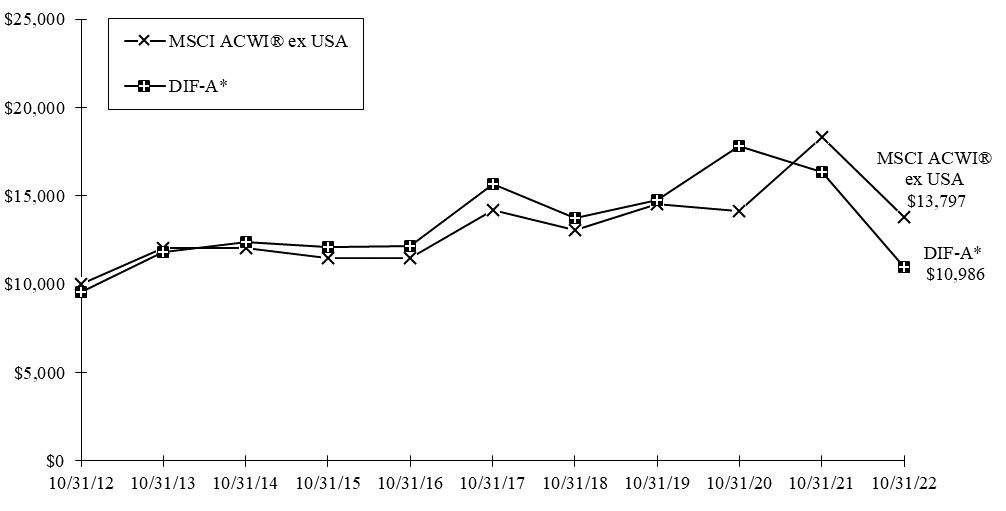

Fund & Benchmark Index

|

1-Year

|

5-Year

|

10-Year

|

Since

Inception

|

Inception

Date

|

Gross Expense

Ratio

|

Net Expense

Ratio

|

|

Class A - without sales charge

|

(32.72)%

|

(6.83)%

|

1.44%

|

0.10%

|

12/29/06

|

1.13%

|

1.05%

|

|

Class A - with sales charge*

|

(35.92)%

|

(7.74)%

|

0.94%

|

(0.21)%

|

12/29/06

|

1.13%

|

1.05%

|

|

Class C**

|

(33.86)%

|

(7.58)%

|

0.64%

|

(0.55)%

|

12/29/06

|

1.94%

|

1.80%

|

|

Class Y

|

(32.52)%

|

(6.58)%

|

1.75%

|

1.36%

|

12/31/09

|

0.80%

|

0.80%

|

|

MSCI ACWI® ex USA***

|

(24.73)%

|

(0.60)%

|

3.27%

|

1.76%

|

|

Class A Shares

|

1-Year

|

5-Year

|

10-Year

|

|

With sales charge*

|

(32.16)%

|

(7.15)%

|

1.33%

|

|

DAVIS GLOBAL FUND

|

|

|

October 31, 2022

|

|

Portfolio Composition

|

Industry Weightings

|

|||||

|

(% of Fund’s 10/31/22 Net Assets)

|

(% of 10/31/22 Stock Holdings)

|

|||||

|

MSCI

|

||||||

|

Fund

|

ACWI®

|

|||||

|

Common Stock (Foreign)

|

55.45%

|

Banks

|

23.15%

|

7.15%

|

||

|

Common Stock (U.S.)

|

43.53%

|

Retailing

|

18.19%

|

4.72%

|

||

|

Short-Term Investments

|

1.16 %

|

Diversified Financials

|

11.64%

|

4.45%

|

||

|

Other Assets & Liabilities

|

(0.14)%

|

Media & Entertainment

|

11.34%

|

4.93%

|

||

|

100.00%

|

Information Technology

|

10.76%

|

20.90%

|

|||

|

Health Care

|

7.93%

|

13.25%

|

||||

|

Insurance

|

7.84%

|

3.18%

|

||||

|

Materials

|

3.64%

|

4.63%

|

||||

|

Food, Beverage & Tobacco

|

2.19%

|

4.31%

|

||||

|

Capital Goods

|

1.72%

|

6.62%

|

||||

|

Consumer Durables & Apparel

|

0.96%

|

1.63%

|

||||

|

Transportation

|

0.62%

|

2.02%

|

||||

|

Commercial & Professional Services

|

0.02%

|

1.20%

|

||||

|

Energy

|

–

|

5.81%

|

||||

|

Utilities

|

–

|

3.03%

|

||||

|

Other

|

–

|

12.17%

|

||||

|

100.00%

|

100.00%

|

|||||

|

Country Diversification

|

Top 10 Long-Term Holdings

|

|||

|

(% of 10/31/22 Stock Holdings)

|

(% of Fund’s 10/31/22 Net Assets)

|

|||

|

United States

|

43.97%

|

DBS Group Holdings Ltd.

|

7.59%

|

|

|

China

|

16.57%

|

Wells Fargo & Co.

|

7.26%

|

|

|

Singapore

|

7.67%

|

Danske Bank A/S

|

6.17%

|

|

|

South Korea

|

6.26%

|

Julius Baer Group Ltd.

|

4.41%

|

|

|

Denmark

|

6.23%

|

Cigna Corp.

|

4.37%

|

|

|

Switzerland

|

4.46%

|

Ping An Insurance (Group) Co. of China, Ltd. - H

|

4.35%

|

|

|

Canada

|

3.64%

|

Samsung Electronics Co., Ltd.

|

3.95%

|

|

|

Hong Kong

|

3.45%

|

Alphabet Inc., Class C

|

3.88%

|

|

|

Netherlands

|

3.37%

|

JD.com, Inc., Class A*

|

3.65%

|

|

|

Bermuda

|

1.72%

|

Meta Platforms, Inc., Class A

|

3.63%

|

|

|

Germany

|

1.46%

|

|||

|

South Africa

|

1.01%

|

*Includes ADR and foreign ordinary shares.

|

||

|

United Kingdom

|

0.19%

|

|||

|

100.00%

|

||||

|

DAVIS GLOBAL FUND – (CONTINUED)

|

Fund Overview

|

|

October 31, 2022

|

|

Security

|

Industry

|

Date of 1st

Purchase

|

% of Fund’s

10/31/22

Net Assets

|

|

Alibaba Group Holding Ltd.

|

Retailing

|

12/07/21

|

0.98%

|

|

Coupang, Inc., Class A

|

Retailing

|

01/26/22

|

1.29%

|

|

Delivery Hero SE

|

Retailing

|

05/13/22

|

1.45%

|

|

Fila Holdings Corp.

|

Consumer Durables & Apparel

|

03/02/22

|

0.96%

|

|

JD.com, Inc., Class A

|

Retailing

|

12/07/21

|

0.20%

|

|

Owens Corning

|

Capital Goods

|

04/05/22

|

1.71%

|

|

Security

|

Industry

|

Date of

Final Sale

|

Realized

Gain (Loss)

|

|

|

Baidu, Inc., Class A, ADR

|

Media & Entertainment

|

05/26/22

|

$

|

(7,753,240)

|

|

Fang Holdings Ltd., Class A, ADR

|

Media & Entertainment

|

07/20/22

|

(2,540,421)

|

|

|

Grab Holdings Ltd., Series A

|

Transportation

|

12/06/21

|

28,167,558

|

|

|

Kuaishou Technology, Class B

|

Media & Entertainment

|

01/27/22

|

(68,300)

|

|

|

Missfresh Ltd., Class B, ADS

|

Food & Staples Retailing

|

05/31/22

|

(44,509,275)

|

|

|

Quotient Technology Inc.

|

Retailing

|

01/12/22

|

(2,165,037)

|

|

|

Vroom, Inc.

|

Retailing

|

05/10/22

|

(25,972,664)

|

|

|

DAVIS INTERNATIONAL FUND

|

|

|

October 31, 2022

|

|

Portfolio Composition

|

Industry Weightings

|

|||||

|

(% of Fund’s 10/31/22 Net Assets)

|

(% of 10/31/22 Stock Holdings)

|

|||||

|

MSCI

|

||||||

|

ACWI®

|

||||||

|

Fund

|

ex USA

|

|||||

|

Common Stock (Foreign)

|

98.92%

|

Banks

|

31.99%

|

12.98%

|

||

|

Short-Term Investments

|

1.09%

|

Retailing

|

22.22%

|

2.85%

|

||

|

Other Assets & Liabilities

|

(0.01)%

|

Information Technology

|

14.72%

|

10.91%

|

||

|

100.00%

|

Insurance

|

10.90%

|

4.46%

|

|||

|

Diversified Financials

|

6.42%

|

3.46%

|

||||

|

Capital Goods

|

4.60%

|

8.21%

|

||||

|

Materials

|

3.70%

|

8.11%

|

||||

|

Consumer Durables & Apparel

|

3.04%

|

3.05%

|

||||

|

Transportation

|

1.24%

|

2.78%

|

||||

|

Media & Entertainment

|

0.73%

|

2.49%

|

||||

|

Commercial & Professional Services

|

0.44%

|

1.50%

|

||||

|

Health Care

|

–

|

10.02%

|

||||

|

Energy

|

–

|

6.61%

|

||||

|

Food, Beverage & Tobacco

|

–

|

5.47%

|

||||

|

Automobiles & Components

|

–

|

3.47%

|

||||

|

Other

|

–

|

13.63%

|

||||

|

100.00%

|

100.00%

|

|||||

|

Country Diversification

|

Top 10 Long-Term Holdings

|

|||

|

(% of 10/31/22 Stock Holdings)

|

(% of Fund’s 10/31/22 Net Assets)

|

|||

|

China

|

25.75%

|

DBS Group Holdings Ltd.

|

10.44%

|

|

|

South Korea

|

11.33%

|

Danske Bank A/S

|

9.16%

|

|

|

Singapore

|

10.56%

|

Samsung Electronics Co., Ltd.

|

6.82%

|

|

|

Denmark

|

9.26%

|

DNB Bank ASA

|

6.29%

|

|

|

Norway

|

6.35%

|

AIA Group Ltd.

|

6.04%

|

|

|

Hong Kong

|

6.10%

|

JD.com, Inc., Class A, ADR

|

5.76%

|

|

|

Switzerland

|

5.73%

|

Julius Baer Group Ltd.

|

5.67%

|

|

|

Bermuda

|

5.54%

|

Bank of N.T. Butterfield & Son Ltd.

|

5.48%

|

|

|

France

|

4.60%

|

Ping An Insurance (Group) Co. of China, Ltd. - H

|

4.74%

|

|

|

Netherlands

|

3.93%

|

Hollysys Automation Technologies Ltd.

|

4.63%

|

|

|

South Africa

|

3.72%

|

|||

|

Canada

|

3.70%

|

|||

|

Japan

|

3.15%

|

|||

|

United Kingdom

|

0.28%

|

|||

|

100.00%

|

||||

|

DAVIS INTERNATIONAL FUND – (CONTINUED)

|

Fund Overview

|

|

October 31, 2022

|

|

Security

|

Industry

|

Date of 1st

Purchase

|

% of Fund’s

10/31/22

Net Assets

|

|

Coupang, Inc., Class A

|

Retailing

|

01/27/22

|

1.38%

|

|

Security

|

Industry

|

Date of

Final Sale

|

Realized

Gain (Loss)

|

|

|

Baidu, Inc., Class A, ADR

|

Media & Entertainment

|

04/22/22

|

$

|

(4,915,838)

|

|

Fang Holdings Ltd., Class A, ADR

|

Media & Entertainment

|

07/20/22

|

(1,619,166)

|

|

|

Grab Holdings Ltd., Series A

|

Transportation

|

12/06/21

|

5,561,762

|

|

|

Missfresh Ltd., Class B, ADS

|

Food & Staples Retailing

|

05/31/22

|

(13,871,820)

|

|

|

Trip.com Group Ltd., ADR

|

Retailing

|

11/18/21

|

(819,211)

|

|

|

DAVIS GLOBAL FUND

|

|

|

DAVIS INTERNATIONAL FUND

|

|

Beginning

|

Ending

|

Expenses Paid

|

|||

|

Account Value

|

Account Value

|

During Period*

|

|||

|

(05/01/22)

|

(10/31/22)

|

(05/01/22-10/31/22)

|

|||

|

Davis Global Fund

|

|||||

|

Class A (annualized expense ratio 0.99%**)

|

|||||

|

Actual

|

$1,000.00

|

$869.59

|

$4.67

|

||

|

Hypothetical

|

$1,000.00

|

$1,020.21

|

$5.04

|

||

|

Class C (annualized expense ratio 1.78%**)

|

|||||

|

Actual

|

$1,000.00

|

$866.33

|

$8.37

|

||

|

Hypothetical

|

$1,000.00

|

$1,016.23

|

$9.05

|

||

|

Class Y (annualized expense ratio 0.74%**)

|

|||||

|

Actual

|

$1,000.00

|

$870.65

|

$3.49

|

||

|

Hypothetical

|

$1,000.00

|

$1,021.48

|

$3.77

|

||

|

Davis International Fund

|

|||||

|

Class A (annualized expense ratio 1.05%**)

|

|||||

|

Actual

|

$1,000.00

|

$860.51

|

$4.92

|

||

|

Hypothetical

|

$1,000.00

|

$1,019.91

|

$5.35

|

||

|

Class C (annualized expense ratio 1.80%**)

|

|||||

|

Actual

|

$1,000.00

|

$857.30

|

$8.43

|

||

|

Hypothetical

|

$1,000.00

|

$1,016.13

|

$9.15

|

||

|

Class Y (annualized expense ratio 0.80%**)

|

|||||

|

Actual

|

$1,000.00

|

$861.00

|

$3.75

|

||

|

Hypothetical

|

$1,000.00

|

$1,021.17

|

$4.08

|

|

Hypothetical assumes 5% annual return before expenses.

|

|

*Expenses are equal to each Class’s annualized operating expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

|

|

**The expense ratios reflect the impact, if any, of certain reimbursements from the Adviser.

|

|

Shares/Units

|

Value

(Note 1) |

||||||||||

|

COMMON STOCK – (98.98%)

|

|||||||||||

|

COMMUNICATION SERVICES – (11.23%)

|

|||||||||||

|

Media & Entertainment – (11.23%)

|

|||||||||||

|

Alphabet Inc., Class C *

|

277,080

|

$

|

26,228,393

|

||||||||

|

ASAC II L.P. *(a)(b)

|

35,352

|

34,645

|

|||||||||

|

IAC Inc. *

|

99,440

|

4,840,739

|

|||||||||

|

iQIYI, Inc., Class A, ADR (China)*

|

717,460

|

1,449,269

|

|||||||||

|

Liberty Media Corp., Liberty Formula One, Series A *

|

196,180

|

10,205,284

|

|||||||||

|

Liberty Media Corp., Liberty Formula One, Series C *

|

111,525

|

6,438,338

|

|||||||||

|

Meta Platforms, Inc., Class A *

|

263,050

|

24,505,738

|

|||||||||

|

Vimeo, Inc. *

|

571,000

|

2,169,800

|

|||||||||

|

Total Communication Services

|

75,872,206

|

||||||||||

|

CONSUMER DISCRETIONARY – (18.96%)

|

|||||||||||

|

Consumer Durables & Apparel – (0.96%)

|

|||||||||||

|

Fila Holdings Corp. (South Korea)

|

281,070

|

6,452,307

|

|||||||||

|

Retailing – (18.00%)

|

|||||||||||

|

Alibaba Group Holding Ltd. (China)*

|

850,000

|

6,654,118

|

|||||||||

|

Alibaba Group Holding Ltd., ADR (China)*

|

118,620

|

7,541,860

|

|||||||||

|

Amazon.com, Inc. *

|

196,200

|

20,098,728

|

|||||||||

|

Coupang, Inc., Class A (South Korea)*

|

503,610

|

8,697,345

|

|||||||||

|

Delivery Hero SE (Germany)*

|

296,500

|

9,772,085

|

|||||||||

|

JD.com, Inc., Class A (China)

|

71,430

|

1,320,376

|

|||||||||

|

JD.com, Inc., Class A, ADR (China)

|

626,375

|

23,357,524

|

|||||||||

|

Meituan, Class B (China)*

|

940,329

|

14,950,101

|

|||||||||

|

Naspers Ltd. - N (South Africa)

|

65,261

|

6,750,727

|

|||||||||

|

Prosus N.V., Class N (Netherlands)

|

517,450

|

22,520,727

|

|||||||||

|

121,663,591

|

|||||||||||

|

Total Consumer Discretionary

|

128,115,898

|

||||||||||

|

CONSUMER STAPLES – (2.17%)

|

|||||||||||

|

Food, Beverage & Tobacco – (2.17%)

|

|||||||||||

|

Darling Ingredients Inc. *

|

186,740

|

14,655,355

|

|||||||||

|

Total Consumer Staples

|

14,655,355

|

||||||||||

|

FINANCIALS – (42.19%)

|

|||||||||||

|

Banks – (22.91%)

|

|||||||||||

|

Bank of N.T. Butterfield & Son Ltd. (Bermuda)

|

332,750

|

11,493,185

|

|||||||||

|

Danske Bank A/S (Denmark)

|

2,582,670

|

41,683,059

|

|||||||||

|

DBS Group Holdings Ltd. (Singapore)

|

2,122,394

|

51,275,696

|

|||||||||

|

Metro Bank PLC (United Kingdom)*

|

1,598,302

|

1,301,382

|

|||||||||

|

Wells Fargo & Co.

|

1,066,870

|

49,065,351

|

|||||||||

|

154,818,673

|

|||||||||||

|

DAVIS GLOBAL FUND – (CONTINUED)

|

Schedule of Investments

|

|

October 31, 2022

|

|

Shares

|

Value

(Note 1) |

||||||||||||

|

COMMON STOCK – (CONTINUED)

|

|||||||||||||

|

FINANCIALS – (CONTINUED)

|

|||||||||||||

|

Diversified Financials – (11.52%)

|

|||||||||||||

|

Capital Markets – (4.67%)

|

|||||||||||||

|

Julius Baer Group Ltd. (Switzerland)

|

622,100

|

$

|

29,801,904

|

||||||||||

|

Noah Holdings Ltd., Class A, ADS (China)*

|

132,390

|

1,736,957

|

|||||||||||

|

31,538,861

|

|||||||||||||

|

Consumer Finance – (3.49%)

|

|||||||||||||

|

Capital One Financial Corp.

|

222,290

|

23,567,186

|

|||||||||||

|

Diversified Financial Services – (3.36%)

|

|||||||||||||

|

Berkshire Hathaway Inc., Class B *

|

77,010

|

22,724,881

|

|||||||||||

|

77,830,928

|

|||||||||||||

|

Insurance – (7.76%)

|

|||||||||||||

|

Life & Health Insurance – (7.76%)

|

|||||||||||||

|

AIA Group Ltd. (Hong Kong)

|

3,049,180

|

23,093,227

|

|||||||||||

|

Ping An Insurance (Group) Co. of China, Ltd. - H (China)

|

7,343,500

|

29,375,310

|

|||||||||||

|

52,468,537

|

|||||||||||||

|

Total Financials

|

285,118,138

|

||||||||||||

|

HEALTH CARE – (7.84%)

|

|||||||||||||

|

Health Care Equipment & Services – (4.37%)

|

|||||||||||||

|

Cigna Corp.

|

91,390

|

29,524,453

|

|||||||||||

|

Pharmaceuticals, Biotechnology & Life Sciences – (3.47%)

|

|||||||||||||

|

Viatris Inc.

|

2,319,370

|

23,495,218

|

|||||||||||

|

Total Health Care

|

53,019,671

|

||||||||||||

|

INDUSTRIALS – (2.34%)

|

|||||||||||||

|

Capital Goods – (1.71%)

|

|||||||||||||

|

Owens Corning

|

134,690

|

11,530,811

|

|||||||||||

|

Commercial & Professional Services – (0.02%)

|

|||||||||||||

|

China Index Holdings Ltd., Class A, ADR (China)*

|

189,667

|

151,696

|

|||||||||||

|

Transportation – (0.61%)

|

|||||||||||||

|

DiDi Global Inc., Class A, ADS (China)*

|

2,111,298

|

4,117,031

|

|||||||||||

|

Total Industrials

|

15,799,538

|

||||||||||||

|

INFORMATION TECHNOLOGY – (10.65%)

|

|||||||||||||

|

Semiconductors & Semiconductor Equipment – (2.99%)

|

|||||||||||||

|

Applied Materials, Inc.

|

127,940

|

11,295,823

|

|||||||||||

|

Intel Corp.

|

312,770

|

8,892,051

|

|||||||||||

|

20,187,874

|

|||||||||||||

|

Software & Services – (0.72%)

|

|||||||||||||

|

Clear Secure, Inc., Class A *

|

179,950

|

4,862,249

|

|||||||||||

|

Technology Hardware & Equipment – (6.94%)

|

|||||||||||||

|

Hollysys Automation Technologies Ltd. (China)

|

1,266,941

|

20,195,039

|

|||||||||||

|

Samsung Electronics Co., Ltd. (South Korea)

|

640,890

|

26,725,309

|

|||||||||||

|

46,920,348

|

|||||||||||||

|

Total Information Technology

|

71,970,471

|

||||||||||||

|

MATERIALS – (3.60%)

|

|||||||||||||

|

Teck Resources Ltd., Class B (Canada)

|

798,940

|

24,319,733

|

|||||||||||

|

Total Materials

|

24,319,733

|

||||||||||||

|

TOTAL COMMON STOCK – (Identified cost $689,183,950)

|

668,871,010

|

||||||||||||

|

DAVIS GLOBAL FUND – (CONTINUED)

|

Schedule of Investments

|

|

October 31, 2022

|

|

Principal

|

Value

(Note 1) |

|||||||||||

|

SHORT-TERM INVESTMENTS – (1.16%)

|

||||||||||||

|

StoneX Financial Inc. Joint Repurchase Agreement, 3.05%, 11/01/22,

dated 10/31/22, repurchase value of $4,272,362 (collateralized by: U.S.

Government agency mortgages and obligations in a pooled cash

account, 0.70%-9.50%, 03/15/23-09/20/70, total market value

$4,357,440)

|

$

|

4,272,000

|

$

|

4,272,000

|

||||||||

|

Truist Securities, Inc. Joint Repurchase Agreement, 3.04%, 11/01/22,

dated 10/31/22, repurchase value of $3,557,300 (collateralized by: U.S.

Government agency mortgages in a pooled cash account, 3.50%-4.50%,

05/01/37-08/01/52, total market value $3,628,140)

|

3,557,000

|

3,557,000

|

||||||||||

|

TOTAL SHORT-TERM INVESTMENTS – (Identified cost $7,829,000)

|

7,829,000

|

|||||||||||

|

Total Investments – (100.14%) – (Identified cost $697,012,950)

|

676,700,010

|

|||||||||||

|

Liabilities Less Other Assets – (0.14%)

|

(928,523)

|

|||||||||||

|

Net Assets – (100.00%)

|

$

|

675,771,487

|

||||||||||

|

ADR: American Depositary Receipt

|

||||||||||||

|

ADS: American Depositary Share

|

||||||||||||

|

*

|

Non-income producing security.

|

|||||||||||

|

(a)

|

Restricted Security – See Note 6 of the Notes to Financial Statements.

|

|||||||||||

|

(b)

|

The value of this security was determined using significant unobservable inputs. See Note 1 of the Notes to Financial Statements.

|

|||||||||||

|

See Notes to Financial Statements

|

||||||||||||

|

DAVIS INTERNATIONAL FUND

|

|

|

October 31, 2022

|

|

Shares

|

Value

(Note 1) |

|||||||||||

|

COMMON STOCK – (98.92%)

|

||||||||||||

|

COMMUNICATION SERVICES – (0.72%)

|

||||||||||||

|

Media & Entertainment – (0.72%)

|

||||||||||||

|

iQIYI, Inc., Class A, ADR (China)*

|

496,600

|

$

|

1,003,132

|

|||||||||

|

Total Communication Services

|

1,003,132

|

|||||||||||

|

CONSUMER DISCRETIONARY – (24.99%)

|

||||||||||||

|

Consumer Durables & Apparel – (3.01%)

|

||||||||||||

|

Fila Holdings Corp. (South Korea)

|

183,090

|

4,203,056

|

||||||||||

|

Retailing – (21.98%)

|

||||||||||||

|

Alibaba Group Holding Ltd., ADR (China)*

|

68,900

|

4,380,662

|

||||||||||

|

Coupang, Inc., Class A (South Korea)*

|

111,240

|

1,921,115

|

||||||||||

|

JD.com, Inc., Class A, ADR (China)

|

215,660

|

8,041,961

|

||||||||||

|

Meituan, Class B (China)*

|

363,511

|

5,779,388

|

||||||||||

|

Naspers Ltd. - N (South Africa)

|

49,720

|

5,143,136

|

||||||||||

|

Prosus N.V., Class N (Netherlands)

|

124,882

|

5,435,179

|

||||||||||

|

30,701,441

|

||||||||||||

|

Total Consumer Discretionary

|

34,904,497

|

|||||||||||

|

FINANCIALS – (48.77%)

|

||||||||||||

|

Banks – (31.64%)

|

||||||||||||

|

Bank of N.T. Butterfield & Son Ltd. (Bermuda)

|

221,690

|

7,657,173

|

||||||||||

|

Danske Bank A/S (Denmark)

|

792,270

|

12,786,859

|

||||||||||

|

DBS Group Holdings Ltd. (Singapore)

|

603,610

|

14,582,836

|

||||||||||

|

DNB Bank ASA (Norway)

|

495,992

|

8,778,493

|

||||||||||

|

Metro Bank PLC (United Kingdom)*

|

472,490

|

384,714

|

||||||||||

|

44,190,075

|

||||||||||||

|

Diversified Financials – (6.35%)

|

||||||||||||

|

Capital Markets – (6.35%)

|

||||||||||||

|

Julius Baer Group Ltd. (Switzerland)

|

165,200

|

7,913,960

|

||||||||||

|

Noah Holdings Ltd., Class A, ADS (China)*

|

72,460

|

950,675

|

||||||||||

|

8,864,635

|

||||||||||||

|

Insurance – (10.78%)

|

||||||||||||

|

Life & Health Insurance – (10.78%)

|

||||||||||||

|

AIA Group Ltd. (Hong Kong)

|

1,113,100

|

8,430,159

|

||||||||||

|

Ping An Insurance (Group) Co. of China, Ltd. - H (China)

|

1,657,000

|

6,628,295

|

||||||||||

|

15,058,454

|

||||||||||||

|

Total Financials

|

68,113,164

|

|||||||||||

|

INDUSTRIALS – (6.22%)

|

||||||||||||

|

Capital Goods – (4.56%)

|

||||||||||||

|

Schneider Electric SE (France)

|

50,170

|

6,359,193

|

||||||||||

|

Commercial & Professional Services – (0.43%)

|

||||||||||||

|

China Index Holdings Ltd., Class A, ADR (China)*

|

753,944

|

603,005

|

||||||||||

|

Transportation – (1.23%)

|

||||||||||||

|

DiDi Global Inc., Class A, ADS (China)*

|

879,576

|

1,715,173

|

||||||||||

|

Total Industrials

|

8,677,371

|

|||||||||||

|

INFORMATION TECHNOLOGY – (14.56%)

|

||||||||||||

|

Semiconductors & Semiconductor Equipment – (3.11%)

|

||||||||||||

|

Tokyo Electron Ltd. (Japan)

|

16,370

|

4,347,499

|

||||||||||

|

Technology Hardware & Equipment – (11.45%)

|

||||||||||||

|

Hollysys Automation Technologies Ltd. (China)

|

405,246

|

6,459,621

|

||||||||||

|

DAVIS INTERNATIONAL FUND – (CONTINUED)

|

Schedule of Investments

|

|

October 31, 2022

|

|

Shares/Principal

|

Value

(Note 1) |

||||||||||||||

|

COMMON STOCK – (CONTINUED)

|

|||||||||||||||

|

INFORMATION TECHNOLOGY – (CONTINUED)

|

|||||||||||||||

|

Technology Hardware & Equipment – (Continued)

|

|||||||||||||||

|

Samsung Electronics Co., Ltd. (South Korea)

|

228,520

|

$

|

9,529,354

|

||||||||||||

|

15,988,975

|

|||||||||||||||

|

Total Information Technology

|

20,336,474

|

||||||||||||||

|

MATERIALS – (3.66%)

|

|||||||||||||||

|

Teck Resources Ltd., Class B (Canada)

|

167,710

|

5,105,092

|

|||||||||||||

|

Total Materials

|

5,105,092

|

||||||||||||||

|

TOTAL COMMON STOCK – (Identified cost $161,847,493)

|

138,139,730

|

||||||||||||||

|

SHORT-TERM INVESTMENTS – (1.09%)

|

|||||||||||||||

|

StoneX Financial Inc. Joint Repurchase Agreement, 3.05%, 11/01/22,

dated 10/31/22, repurchase value of $831,070 (collateralized by: U.S.

Government agency mortgages and obligations in a pooled cash

account, 0.70%-9.50%, 03/15/23-09/20/70, total market value $847,620)

|

$

|

831,000

|

831,000

|

||||||||||||

|

Truist Securities, Inc. Joint Repurchase Agreement, 3.04%, 11/01/22,

dated 10/31/22, repurchase value of $692,058 (collateralized by: U.S.

Government agency mortgages and obligation in a pooled cash account,

3.00%-5.00%, 01/12/26-10/01/52, total market value $705,840)

|

692,000

|

692,000

|

|||||||||||||

|

TOTAL SHORT-TERM INVESTMENTS – (Identified cost $1,523,000)

|

1,523,000

|

||||||||||||||

|

Total Investments – (100.01%) – (Identified cost $163,370,493)

|

139,662,730

|

||||||||||||||

|

Liabilities Less Other Assets – (0.01%)

|

(7,294)

|

||||||||||||||

|

Net Assets – (100.00%)

|

$

|

139,655,436

|

|||||||||||||

|

ADR: American Depositary Receipt

|

|||||||||||||||

|

ADS: American Depositary Share

|

|||||||||||||||

|

*

|

Non-income producing security.

|

||||||||||||||

|

See Notes to Financial Statements

|

|||||||||||||||

|

DAVIS GLOBAL FUND

|

|

|

DAVIS INTERNATIONAL FUND

|

At October 31, 2022

|

|

Davis Global

Fund

|

Davis International

Fund

|

|||||||||

|

ASSETS:

|

||||||||||

|

Investments in securities at value* (see accompanying Schedules of Investments)

|

$

|

676,700,010

|

$

|

139,662,730

|

||||||

|

Cash

|

548

|

856

|

||||||||

|

Receivables:

|

||||||||||

|

Capital stock sold

|

762,828

|

125,269

|

||||||||

|

Dividends and interest

|

586,676

|

445,465

|

||||||||

|

Investment securities sold

|

7,118,694

|

–

|

||||||||

|

Prepaid expenses

|

33,855

|

7,693

|

||||||||

|

Due from Adviser

|

–

|

3,229

|

||||||||

|

Total assets

|

685,202,611

|

140,245,242

|

||||||||

|

LIABILITIES:

|

||||||||||

|

Payables:

|

||||||||||

|

Capital stock redeemed

|

1,666,318

|

278,471

|

||||||||

|

Investment securities purchased

|

6,913,909

|

–

|

||||||||

|

Accrued custodian fees

|

235,422

|

137,023

|

||||||||

|

Accrued distribution and service plan fees

|

82,481

|

7,339

|

||||||||

|

Accrued investment advisory fees

|

333,554

|

69,081

|

||||||||

|

Accrued registration and filing fees

|

51,532

|

38,200

|

||||||||

|

Other accrued expenses

|

147,908

|

59,692

|

||||||||

|

Total liabilities

|

9,431,124

|

589,806

|

||||||||

|

NET ASSETS

|

$

|

675,771,487

|

$

|

139,655,436

|

||||||

|

NET ASSETS CONSIST OF:

|

||||||||||

|

Par value of shares of capital stock

|

$

|

1,815,644

|

$

|

841,895

|

||||||

|

Additional paid-in capital

|

756,252,009

|

235,542,852

|

||||||||

|

Accumulated losses

|

(82,296,166)

|

(96,729,311)

|

||||||||

|

Net Assets

|

$

|

675,771,487

|

$

|

139,655,436

|

||||||

|

*Including:

|

||||||||||

|

Cost of investments

|

$

|

697,012,950

|

$

|

163,370,493

|

||||||

|

CLASS A SHARES:

|

||||||||||

|

Net assets

|

$

|

139,361,428

|

$

|

16,632,290

|

||||||

|

Shares outstanding

|

7,464,695

|

1,981,222

|

||||||||

|

Net asset value and redemption price per share (Net assets ÷ Shares outstanding)

|

$

|

18.67

|

$

|

8.39

|

||||||

|

Maximum offering price per share (100/95.25 of net asset value)†

|

$

|

19.60

|

$

|

8.81

|

||||||

|

CLASS C SHARES:

|

||||||||||

|

Net assets

|

$

|

50,202,714

|

$

|

3,965,579

|

||||||

|

Shares outstanding

|

2,956,945

|

511,663

|

||||||||

|

Net asset value, offering, and redemption price per share (Net assets ÷ Shares

outstanding)

|

$

|

16.98

|

$

|

7.75

|

||||||

|

CLASS Y SHARES:

|

||||||||||

|

Net assets

|

$

|

486,207,345

|

$

|

119,057,567

|

||||||

|

Shares outstanding

|

25,891,237

|

14,345,023

|

||||||||

|

Net asset value, offering, and redemption price per share (Net assets ÷ Shares

outstanding)

|

$

|

18.78

|

$

|

8.30

|

||||||

|

†On purchases of $100,000 or more, the offering price is reduced.

|

|

See Notes to Financial Statements

|

|

DAVIS GLOBAL FUND

|

|

|

DAVIS INTERNATIONAL FUND

|

For the year ended October 31, 2022

|

|

Davis Global

Fund

|

Davis International

Fund

|

|||||||||

|

INVESTMENT INCOME:

|

||||||||||

|

Income:

|

||||||||||

|

Dividends*

|

$

|

16,091,499

|

$

|

4,991,810

|

||||||

|

Interest

|

94,412

|

23,008

|

||||||||

|

Net securities lending fees

|

54,502

|

39,712

|

||||||||

|

Total income

|

16,240,413

|

5,054,530

|

||||||||

|

Expenses:

|

||||||||||

|

Investment advisory fees (Note 3)

|

5,293,051

|

1,275,810

|

||||||||

|

Custodian fees

|

569,814

|

289,426

|

||||||||

|

Transfer agent fees:

|

||||||||||

|

Class A

|

165,845

|

46,930

|

||||||||

|

Class C

|

73,438

|

12,010

|

||||||||

|

Class Y

|

522,582

|

120,871

|

||||||||

|

Audit fees

|

30,240

|

25,424

|

||||||||

|

Legal fees

|

8,411

|

1,966

|

||||||||

|

Accounting fees (Note 3)

|

52,000

|

16,670

|

||||||||

|

Reports to shareholders

|

45,158

|

8,861

|

||||||||

|

Directors’ fees and expenses

|

59,983

|

17,278

|

||||||||

|

Registration and filing fees

|

65,600

|

51,825

|

||||||||

|

Miscellaneous

|

77,465

|

34,930

|

||||||||

|

Distribution and service plan fees (Note 3):

|

||||||||||

|

Class A

|

422,974

|

57,073

|

||||||||

|

Class C

|

753,088

|

59,805

|

||||||||

|

Total expenses

|

8,139,649

|

2,018,879

|

||||||||

|

Reimbursement of expenses by Adviser (Note 3):

|

||||||||||

|

Class A

|

–

|

(20,640)

|

||||||||

|

Class C

|

–

|

(8,354)

|

||||||||

|

Class Y

|

–

|

(2,156)

|

||||||||

|

Net expenses

|

8,139,649

|

1,987,729

|

||||||||

|

Net investment income

|

8,100,764

|

3,066,801

|

||||||||

|

REALIZED AND UNREALIZED LOSS ON INVESTMENTS AND FOREIGN

CURRENCY TRANSACTIONS:

|

||||||||||

|

Net realized loss from:

|

||||||||||

|

Investment transactions

|

(49,275,782)

|

(27,405,377)

|

||||||||

|

Foreign currency transactions

|

(163,541)

|

(111,580)

|

||||||||

|

Net realized loss

|

(49,439,323)

|

(27,516,957)

|

||||||||

|

Net change in unrealized appreciation (depreciation)

|

(312,082,164)

|

(66,799,745)

|

||||||||

|

Net realized and unrealized loss on investments and foreign currency

transactions

|

(361,521,487)

|

(94,316,702)

|

||||||||

|

Net decrease in net assets resulting from operations

|

$

|

(353,420,723)

|

$

|

(91,249,901)

|

||||||

|

*Net of foreign taxes withheld of

|

$

|

656,938

|

$

|

475,413

|

||||||

|

See Notes to Financial Statements

|

|

DAVIS GLOBAL FUND

|

|

|

DAVIS INTERNATIONAL FUND

|

For the year ended October 31, 2022

|

|

Davis Global

Fund

|

Davis International

Fund

|

||||||||

|

OPERATIONS:

|

|||||||||

|

Net investment income

|

$

|

8,100,764

|

$

|

3,066,801

|

|||||

|

Net realized loss from investments and foreign currency transactions

|

(49,439,323)

|

(27,516,957)

|

|||||||

|

Net change in unrealized appreciation (depreciation) on investments and foreign

currency transactions

|

(312,082,164)

|

(66,799,745)

|

|||||||

|

Net decrease in net assets resulting from operations

|

(353,420,723)

|

(91,249,901)

|

|||||||

|

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS:

|

|||||||||

|

Class A

|

(22,793,376)

|

(534,649)

|

|||||||

|

Class C

|

(9,831,053)

|

(32,683)

|

|||||||

|

Class Y

|

(91,980,192)

|

(4,874,300)

|

|||||||

|

CAPITAL SHARE TRANSACTIONS:

|

|||||||||

|

Net decrease in net assets resulting from capital share transactions (Note 4):

|

|||||||||

|

Class A

|

(3,004,203)

|

(17,197,805)

|

|||||||

|

Class C

|

(13,419,277)

|

(2,067,676)

|

|||||||

|

Class Y

|

(98,625,983)

|

(105,842,324)

|

|||||||

|

Total decrease in net assets

|

(593,074,807)

|

(221,799,338)

|

|||||||

|

NET ASSETS:

|

|||||||||

|

Beginning of year

|

1,268,846,294

|

361,454,774

|

|||||||

|

End of year

|

$

|

675,771,487

|

$

|

139,655,436

|

|||||

|

See Notes to Financial Statements

|

|

DAVIS GLOBAL FUND

|

Statements of Changes in Net Assets

|

|

DAVIS INTERNATIONAL FUND

|

For the year ended October 31, 2021

|

|

Davis Global

Fund

|

Davis International

Fund

|

|||||||

|

OPERATIONS:

|

||||||||

|

Net investment income

|

$

|

2,892,729

|

$

|

2,922,546

|

||||

|

Net realized gain (loss) from investments and foreign currency transactions

|

131,115,799

|

(32,973,439)

|

||||||

|

Net increase (decrease) in unrealized appreciation on investments and foreign currency

transactions

|

35,027,258

|

(20,648,878)

|

||||||

|

Net increase (decrease) in net assets resulting from operations

|

169,035,786

|

(50,699,771)

|

||||||

|

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: |

||||||||

|

Class A

|

(635,474)

|

–

|

||||||

|

Class C

|

(346,051)

|

–

|

||||||

|

Class Y

|

(3,119,200)

|

(258,272)

|

||||||

|

CAPITAL SHARE TRANSACTIONS:

|

||||||||

|

Net increase (decrease) in net assets resulting from capital share transactions (Note 4):

|

||||||||

|

Class A

|

958,579

|

12,939,879

|

||||||

|

Class C

|

(16,903,810)

|

(243,456)

|

||||||

|

Class Y

|

28,540,724

|

5,945,445

|

||||||

|

Total increase (decrease) in net assets

|

177,530,554

|

(32,316,175)

|

||||||

|

NET ASSETS:

|

||||||||

|

Beginning of year

|

1,091,315,740

|

393,770,949

|

||||||

|

End of year

|

$

|

1,268,846,294

|

$

|

361,454,774

|

||||

|

See Notes to Financial Statements

|

|

DAVIS GLOBAL FUND

|

|

|

DAVIS INTERNATIONAL FUND

|

October 31, 2022

|

|

DAVIS GLOBAL FUND

|

Notes to Financial Statements – (Continued)

|

|

DAVIS INTERNATIONAL FUND

|

October 31, 2022

|

|

Level 1 –

|

quoted prices in active markets for identical securities

|

|

Level 2 –

|

other significant observable inputs (including quoted prices for similar investments, interest rates,

prepayment speeds, credit risk, etc.)

|

|

Level 3 –

|

significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of

investments)

|

|

Investments in Securities at Value

|

|||||

|

Davis Global

|

Davis International

|

||||

|

Fund

|

Fund

|

||||

|

Valuation Inputs

|

|||||

|

Level 1 – Quoted Prices:

|

|||||

|

Common Stock:

|

|||||

|

Communication Services

|

$

|

75,837,561

|

$

|

1,003,132

|

|

|

Consumer Discretionary

|

128,115,898

|

34,904,497

|

|||

|

Consumer Staples

|

14,655,355

|

–

|

|||

|

Financials

|

285,118,138

|

68,113,164

|

|||

|

Health Care

|

53,019,671

|

–

|

|||

|

Industrials

|

15,799,538

|

8,677,371

|

|||

|

Information Technology

|

71,970,471

|

20,336,474

|

|||

|

Materials

|

24,319,733

|

5,105,092

|

|||

|

Total Level 1

|

668,836,365

|

138,139,730

|

|||

|

Level 2 – Other Significant Observable Inputs:

|

|||||

|

Short-Term Investments

|

7,829,000

|

1,523,000

|

|||

|

Total Level 2

|

7,829,000

|

1,523,000

|

|||

|

Level 3 – Significant Unobservable Inputs:

|

|||||

|

Common Stock:

|

|||||

|

Communication Services

|

34,645

|

–

|

|||

|

Total Level 3

|

34,645

|

–

|

|||

|

Total Investments

|

$

|

676,700,010

|

$

|

139,662,730

|

|

|

DAVIS GLOBAL FUND

|

Notes to Financial Statements – (Continued)

|

|

DAVIS INTERNATIONAL FUND

|

October 31, 2022

|

|

Beginning

Balance at

November 1, 2021

|

Cost of

Purchases

|

Net Change in

Unrealized

Appreciation

(Depreciation)**

|

Net Realized

Gain (Loss)

|

Transfers

into

Level 3

|

Transfers

out of

Level 3***

|

Ending

Balance at

October 31,

2022

|

|||||||||||||||

|

Davis Global Fund

|

|||||||||||||||||||||

|

Investments in Securities:

|

|||||||||||||||||||||

|

Common Stock

|

$

|

36,158

|

$

|

–

|

$

|

(1,513)

|

$

|

–

|

$

|

–

|

$

|

–

|

$

|

34,645

|

|||||||

|

Preferred Stock

|

44,642,079

|

–

|

7,961,100

|

–

|

–

|

(52,603,179)

|

–

|

||||||||||||||

|

Total Level 3

|

$

|

44,678,237

|

$

|

–

|

$

|

7,959,587

|

$

|

–

|

$

|

–

|

$

|

(52,603,179)

|

$

|

34,645

|

|||||||

|

Davis International Fund

|

|||||||||||||||||||||

|

Investments in Securities:

|

|||||||||||||||||||||

|

Preferred Stock

|

$

|

8,721,618

|

$

|

–

|

$

|

1,555,341

|

$

|

–

|

$

|

–

|

$

|

(10,276,959)

|

$

|

–

|

|||||||

|

Total Level 3

|

$

|

8,721,618

|

$

|

–

|

$

|

1,555,341

|

$

|

–

|

$

|

–

|

$

|

(10,276,959)

|

$

|

–

|

|||||||

|

Fair Value at

|

Valuation

|

Unobservable

|

Impact to

Valuation from an

|

||||||||

|

October 31, 2022

|

Technique

|

Input

|

Amount

|

Increase in Input

|

|||||||

|

Davis Global Fund

|

|||||||||||

|

Investments in Securities:

|

|||||||||||

|

Common Stock

|

$

|

34,645

|

Discounted Cash Flow

|

Annualized Yield

|

4.185%

|

Decrease

|

|||||

|

Total Level 3

|

$

|

34,645

|

|||||||||

|

DAVIS GLOBAL FUND

|

Notes to Financial Statements – (Continued)

|

|

DAVIS INTERNATIONAL FUND

|

October 31, 2022

|

|

Davis Global

|

Davis International

|

|||||

|

Fund

|

Fund

|

|||||

|

Cost

|

$

|

707,928,356

|

$

|

168,863,196

|

||

|

Unrealized appreciation

|

138,891,907

|

19,129,676

|

||||

|

Unrealized depreciation

|

(170,120,253)

|

(48,330,142)

|

||||

|

Net unrealized depreciation

|

$

|

(31,228,346)

|

$

|

(29,200,466)

|

||

|

DAVIS GLOBAL FUND

|

Notes to Financial Statements – (Continued)

|

|

DAVIS INTERNATIONAL FUND

|

October 31, 2022

|

|

Davis Global

Fund

|

Davis International

Fund

|

||||

|

Accumulated losses

|

$

|

(1,506,180)

|

$

|

–

|

|

|

Paid-in capital

|

(1,506,180)

|

–

|

|||

|

Ordinary

Income

|

Long-Term

Capital Gain

|

Return of

Capital

|

Total

|

||||||||

|

Davis Global Fund

|

|||||||||||

|

2022

|

$

|

12,019,848

|

$

|

112,584,773

|

$

|

–

|

$

|

124,604,621

|

|||

|

2021

|

626,853

|

3,473,872

|

–

|

4,100,725

|

|||||||

|

Davis International Fund

|

|||||||||||

|

2022

|

$

|

5,441,632

|

$

|

–

|

$

|

–

|

$

|

5,441,632

|

|||

|

2021

|

258,272

|

–

|

–

|

258,272

|

|||||||

|

Davis Global

Fund

|

Davis International Fund

|

||||

|

Undistributed ordinary income

|

$

|

–

|

$

|

105,670

|

|

|

Accumulated net realized losses from investments

|

(50,973,349)

|

(67,573,607)

|

|||

|

Net unrealized depreciation on investments and foreign currency

transactions

|

(31,272,311)

|

(29,247,138)

|

|||

|

Other temporary differences

|

(50,506)

|

(14,236)

|

|||

|

Total

|

$

|

(82,296,166)

|

$

|

(96,729,311)

|

|

|

DAVIS GLOBAL FUND

|

Notes to Financial Statements – (Continued)

|

|

DAVIS INTERNATIONAL FUND

|

October 31, 2022

|

|

Davis Global

Fund

|

Davis International

Fund

|

||||

|

Cost of purchases

|

$

|

184,444,499

|

$

|

12,466,090

|

|

|

Proceeds from sales

|

420,933,575

|

140,498,373

|

|||

|

Davis Global

Fund

|

Davis International

Fund

|

|

|

n/a

|

50%

|

|

Year ended October 31, 2022

|

|||||

|

Davis Global

Fund

|

Davis International

Fund

|

||||

|

Transfer agent fees paid to Adviser

|

$

|

62,968

|

$

|

19,115

|

|

|

Accounting fees paid to Adviser

|

52,000

|

16,670

|

|||

|

DAVIS GLOBAL FUND

|

Notes to Financial Statements – (Continued)

|

|

DAVIS INTERNATIONAL FUND

|

October 31, 2022

|

|

Year ended October 31, 2022

|

|||||

|

Davis Global

Fund

|

Davis International

Fund

|

||||

|

Distribution fees:

|

|||||

|

Class C

|

$

|

564,816

|

$

|

44,854

|

|

|

Service fees:

|

|||||

|

Class A

|

422,974

|

57,073

|

|||

|

Class C

|

188,272

|

14,951

|

|||

|

Year ended October 31, 2022

|

|||||

|

Davis Global

Fund

|

Davis International

Fund

|

||||

|

Class A commissions retained by Distributor

|

$

|

5,909

|

$

|

1,432

|

|

|

Class A commissions re-allowed to investment dealers

|

33,739

|

8,398

|

|||

|

Total commissions earned on sale of Class A

|

$

|

39,648

|

$

|

9,830

|

|

|

Class C commission advances by the Distributor

|

$

|

26,321

|

$

|

4,610

|

|

|

Class C CDSCs received by the Distributor

|

5,278

|

1,133

|

|||

|

DAVIS GLOBAL FUND

|

Notes to Financial Statements – (Continued)

|

|

DAVIS INTERNATIONAL FUND

|

October 31, 2022

|

|

Year ended October 31, 2022

|

|||||||||||

|

Sold

|

Reinvestment of

Distributions

|

Redeemed*

|

Net Decrease

|

||||||||

|

Davis Global Fund

|

|||||||||||

|

Shares: Class A

|

998,488

|

775,170

|

(2,020,200)

|

(246,542)

|

|||||||

|

Class C

|

148,144

|

402,551

|

(1,269,529)

|

(718,834)

|

|||||||

|

Class Y

|

5,322,628

|

3,174,114

|

(13,423,508)

|

(4,926,766)

|

|||||||

|

Value: Class A

|

$

|

23,620,223

|

$

|

20,224,162

|

$

|

(46,848,588)

|

$

|

(3,004,203)

|

|||

|

Class C

|

3,243,984

|

9,616,939

|

(26,280,200)

|

(13,419,277)

|

|||||||

|

Class Y

|

123,247,725

|

83,098,299

|

(304,972,007)

|

(98,625,983)

|

|||||||

|

Davis International Fund

|

|||||||||||

|

Shares: Class A

|

308,888

|

41,888

|

(1,903,786)

|

(1,553,010)

|

|||||||

|

Class C

|

72,053

|

2,922

|

(285,238)

|

(210,263)

|

|||||||

|

Class Y

|

2,165,562

|

405,636

|

(12,869,444)

|

(10,298,246)

|

|||||||

|

Value: Class A

|

$

|

3,524,443

|

$

|

503,908

|

$

|

(21,226,156)

|

$

|

(17,197,805)

|

|||

|

Class C

|

687,683

|

32,668

|

(2,788,027)

|

(2,067,676)

|

|||||||

|

Class Y

|

24,346,823

|

4,814,895

|

(135,004,042)

|

(105,842,324)

|

|||||||

|

Year ended October 31, 2021

|

|||||||||||

|

Sold

|

Reinvestment of

Distributions

|

Redeemed*

|

Net Increase

(Decrease)

|

||||||||

|

Davis Global Fund

|

|||||||||||

|

Shares: Class A

|

1,197,821

|

19,689

|

(1,207,308)

|

10,202

|

|||||||

|

Class C

|

362,688

|

12,438

|

(958,142)

|

(583,016)

|

|||||||

|

Class Y

|

5,733,393

|

94,306

|

(4,999,081)

|

828,618

|

|||||||

|

Value: Class A

|

$

|

38,536,367

|

$

|

580,422

|

$

|

(38,158,210)

|

$

|

958,579

|

|||

|

Class C

|

10,797,833

|

338,569

|

(28,040,212)

|

(16,903,810)

|

|||||||

|

Class Y

|

184,310,731

|

2,791,450

|

(158,561,457)

|

28,540,724

|

|||||||

|

Davis International Fund

|

|||||||||||

|

Shares: Class A

|

2,355,630

|

–

|

(1,602,227)

|

753,403

|

|||||||

|

Class C

|

229,649

|

–

|

(280,621)

|

(50,972)

|

|||||||

|

Class Y

|

8,354,309

|

17,200

|

(9,124,341)

|

(752,832)

|

|||||||

|

Value: Class A

|

$

|

35,615,061

|

$

|

–

|

$

|

(22,675,182)

|

$

|

12,939,879

|

|||

|

Class C

|

3,310,371

|

–

|

(3,553,827)

|

(243,456)

|

|||||||

|

Class Y

|

125,954,738

|

254,208

|

(120,263,501)

|

5,945,445

|

|||||||

|

Fund

|

Security

|

Initial

Acquisition

Date

|

Units

|

Cost per

Unit

|

Valuation per Unit as of

October 31, 2022

|

|||||||

|

Davis Global Fund

|

ASAC II L.P.

|

10/10/13

|

35,352

|

$

|

1.00

|

$

|

0.98

|

|||||

|

DAVIS INTERNATIONAL FUND

|

|

The following financial information represents selected data for each share of capital stock outstanding throughout each period:

|

|

Income (Loss) from Investment Operations

|

||||

|

Net Asset Value,

Beginning of

Period

|

Net Investment

Income (Loss)a

|

Net Realized and

Unrealized Gains

(Losses)

|

Total from

Investment

Operations

|

|

|

Davis Global Fund Class A:

|

||||

|

Year ended October 31, 2022

|

$30.16

|

$0.17

|

$(8.68)

|

$(8.51)

|

|

Year ended October 31, 2021

|

$26.13

|

$0.04

|

$4.07

|

$4.11

|

|

Year ended October 31, 2020

|

$23.09

|

$(0.02)

|

$3.52

|

$3.50

|

|

Year ended October 31, 2019

|

$22.56

|

$0.05

|

$2.24

|

$2.29

|

|

Year ended October 31, 2018

|

$25.27

|

$0.09

|

$(2.80)

|

$(2.71)

|

|

Davis Global Fund Class C:

|

||||

|

Year ended October 31, 2022

|

$27.64

|

$(0.01)

|

$(7.92)

|

$(7.93)

|

|

Year ended October 31, 2021

|

$24.16

|

$(0.19)

|

$3.75

|

$3.56

|

|

Year ended October 31, 2020

|

$21.36

|

$(0.18)

|

$3.26

|

$3.08

|

|

Year ended October 31, 2019

|

$21.10

|

$(0.11)

|

$2.08

|

$1.97

|

|

Year ended October 31, 2018

|

$23.81

|

$(0.10)

|

$(2.61)

|

$(2.71)

|

|

Davis Global Fund Class Y:

|

||||

|

Year ended October 31, 2022

|

$30.33

|

$0.23

|

$(8.73)

|

$(8.50)

|

|

Year ended October 31, 2021

|

$26.25

|

$0.11

|

$4.07

|

$4.18

|

|

Year ended October 31, 2020

|

$23.19

|

$0.04

|

$3.55

|

$3.59

|

|

Year ended October 31, 2019

|

$22.67

|

$0.10

|

$2.25

|

$2.35

|

|

Year ended October 31, 2018

|

$25.35

|

$0.16

|

$(2.81)

|

$(2.65)

|

|

Davis International Fund Class A:

|

||||

|

Year ended October 31, 2022

|

$12.64

|

$0.12

|

$(4.21)

|

$(4.09)

|

|

Year ended October 31, 2021

|

$13.78

|

$0.06

|

$(1.20)

|

$(1.14)

|

|

Year ended October 31, 2020

|

$11.82

|

$(0.03)

|

$2.40

|

$2.37

|

|

Year ended October 31, 2019

|

$11.28

|

$0.05

|

$0.75

|

$0.80

|

|

Year ended October 31, 2018

|

$12.85

|

$0.08

|

$(1.63)

|

$(1.55)

|

|

Davis International Fund Class C:

|

||||

|

Year ended October 31, 2022

|

$11.65

|

$0.04

|

$(3.89)

|

$(3.85)

|

|

Year ended October 31, 2021

|

$12.80

|

$(0.05)

|

$(1.10)

|

$(1.15)

|

|

Year ended October 31, 2020

|

$10.99

|

$(0.13)

|

$2.24

|

$2.11

|

|

Year ended October 31, 2019

|

$10.52

|

$(0.03)

|

$0.69

|

$0.66

|

|

Year ended October 31, 2018

|

$12.08

|

$(0.02)

|

$(1.54)

|

$(1.56)

|

|

Davis International Fund Class Y:

|

||||

|

Year ended October 31, 2022

|

$12.51

|

$0.15

|

$(4.16)

|

$(4.01)

|

|

Year ended October 31, 2021

|

$13.61

|

$0.10

|

$(1.19)

|

$(1.09)

|

|

Year ended October 31, 2020

|

$11.68

|

$–e

|

$2.37

|

$2.37

|

|

Year ended October 31, 2019

|

$11.16

|

$0.09

|

$0.73

|

$0.82

|

|

Year ended October 31, 2018

|

$12.72

|

$0.12

|

$(1.63)

|

$(1.51)

|

|

a

|

Per share calculations were based on average shares outstanding for the period.

|

|

b

|

Assumes hypothetical initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the

reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns.

|

|

c

|

The ratios in this column reflect the impact, if any, of certain reimbursements.

|

|

Financial Highlights

|

|

Dividends and Distributions

|

Ratios to Average Net Assets

|

|||||||||

|

Dividends

from Net

Investment

Income

|

Distributions

from

Realized

Gains

|

Return of

Capital

|

Total

Distributions

|

Net Asset

Value, End

of Period

|

Total Returnb

|

Net Assets,

End of Period

(in thousands)

|

Gross

Expense

Ratio

|

Net Expense

Ratioc

|

Net

Investment

Income (Loss)

Ratio

|

Portfolio

Turnoverd

|

|

$(0.26)

|

$(2.72)

|

$–

|

$(2.98)

|

$18.67

|

(31.04)%

|

$139,361

|

0.96%

|

0.96%

|

0.73%

|

19%

|

|

$–

|

$(0.08)

|

$–

|

$(0.08)

|

$30.16

|

15.75%

|

$232,565

|

0.92%

|

0.92%

|

0.11%

|

35%

|

|

$(0.46)

|

$–

|

$–

|

$(0.46)

|

$26.13

|

15.38%

|

$201,247

|

0.92%

|

0.92%

|

(0.06)%

|

24%

|

|

$(0.05)

|

$(1.71)

|

$–

|

$(1.76)

|

$23.09

|

11.35%

|

$194,163

|

0.98%

|

0.98%

|

0.19%

|

15%

|

|

$–

|

$–

|

$–

|

$–

|

$22.56

|

(10.72)%

|

$192,199