|

DAVIS NEW YORK VENTURE FUND, INC.

|

Table of Contents

|

|

DAVIS GLOBAL FUND

|

|

|

DAVIS INTERNATIONAL FUND

|

|

2

|

|

|

Management’s Discussion of Fund Performance:

|

|

|

3

|

|

|

5

|

|

|

Fund Overview:

|

|

|

7

|

|

|

9

|

|

|

11

|

|

|

Schedule of Investments:

|

|

|

12

|

|

|

15

|

|

|

18

|

|

|

19

|

|

|

20

|

|

|

22

|

|

|

31

|

|

|

33

|

|

|

34

|

|

|

35

|

|

|

36

|

|

|

37

|

|

DAVIS GLOBAL FUND

|

|

|

DAVIS INTERNATIONAL FUND

|

|

|

|

Christopher C. Davis

|

Danton G. Goei

|

|

President

|

Portfolio Manager

|

|

December 3, 2021

|

|

1

|

The companies included in the Morgan Stanley Capital International All Country World Index are divided into eleven sectors. One or more industry groups make up a

sector. For purposes of measuring concentration, the Fund generally classifies companies at the industry group or industry level. See the SAI for additional information regarding the Fund’s concentration policy.

|

|

2

|

A company’s or sector’s contribution to or detraction from the Fund’s performance is a product both of its appreciation or depreciation and its weighting within the

Fund. For example, a 5% holding that rises 20% has twice as much impact as a 1% holding that rises 50%.

|

|

3

|

This Management Discussion of Fund Performance discusses a number of individual companies. The information provided in this report does not provide information reasonably sufficient upon

which to base an investment decision and should not be considered a recommendation to purchase, sell, or hold any particular security. The Schedule of Investments lists the Fund’s holdings of each company discussed.

|

|

DAVIS GLOBAL FUND – (CONTINUED)

|

Management’s Discussion of Fund Performance

|

|

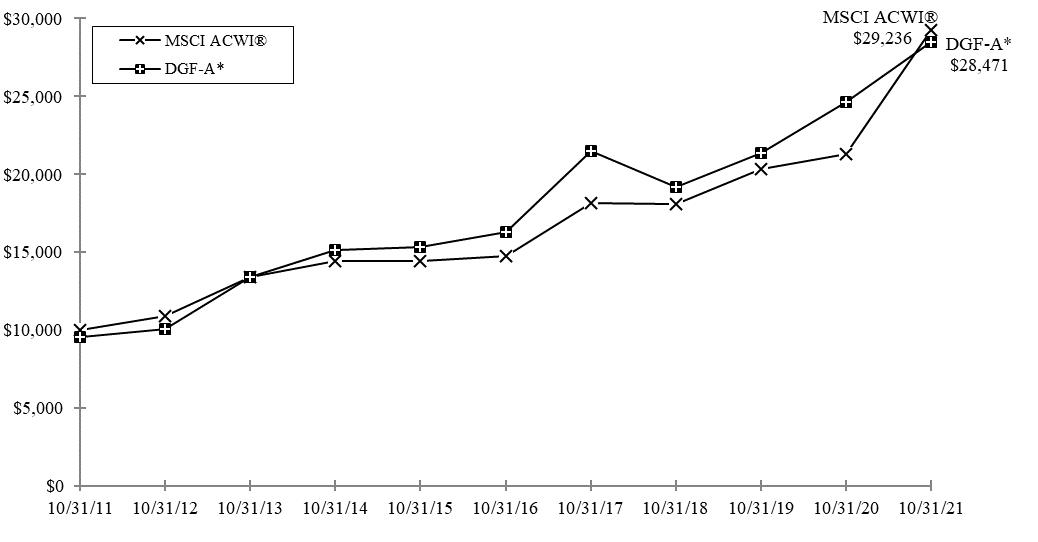

Fund & Benchmark Index

|

1-Year

|

5-Year

|

10-Year

|

Since

Inception

|

Inception

Date

|

Gross Expense

Ratio

|

Net Expense

Ratio

|

|

Class A - without sales charge

|

15.75%

|

11.82%

|

11.56%

|

8.46%

|

12/22/04

|

0.92%

|

0.92%

|

|

Class A - with sales charge*

|

10.25%

|

10.75%

|

11.03%

|

8.16%

|

12/22/04

|

0.92%

|

0.92%

|

|

Class C**

|

13.75%

|

10.96%

|

10.81%

|

7.95%

|

12/22/04

|

1.70%

|

1.70%

|

|

Class Y

|

15.95%

|

12.09%

|

11.85%

|

5.99%

|

07/25/07

|

0.69%

|

0.69%

|

|

MSCI ACWI®***

|

37.28%

|

14.71%

|

11.31%

|

8.10%

|

|

Class A Shares

|

1-Year

|

5-Year

|

10-Year

|

|

With sales charge*

|

8.37%

|

9.07%

|

11.67%

|

|

DAVIS INTERNATIONAL FUND

|

|

1

|

The companies included in the Morgan Stanley Capital International All Country World Index ex USA are divided into eleven sectors. One or more industry groups make up a

sector. For purposes of measuring concentration, the Fund generally classifies companies at the industry group or industry level. See the SAI for additional information regarding the Fund’s concentration policy.

|

|

2

|

A company’s or sector’s contribution to or detraction from the Fund’s performance is a product both of its appreciation or depreciation and its weighting within the

Fund. For example, a 5% holding that rises 20% has twice as much impact as a 1% holding that rises 50%.

|

|

3

|

This Management Discussion of Fund Performance discusses a number of individual companies. The information provided in this report does not provide information reasonably sufficient upon

which to base an investment decision and should not be considered a recommendation to purchase, sell, or hold any particular security. The Schedule of Investments lists the Fund’s holdings of each company discussed.

|

|

DAVIS INTERNATIONAL FUND – (CONTINUED)

|

Management’s Discussion of Fund Performance

|

|

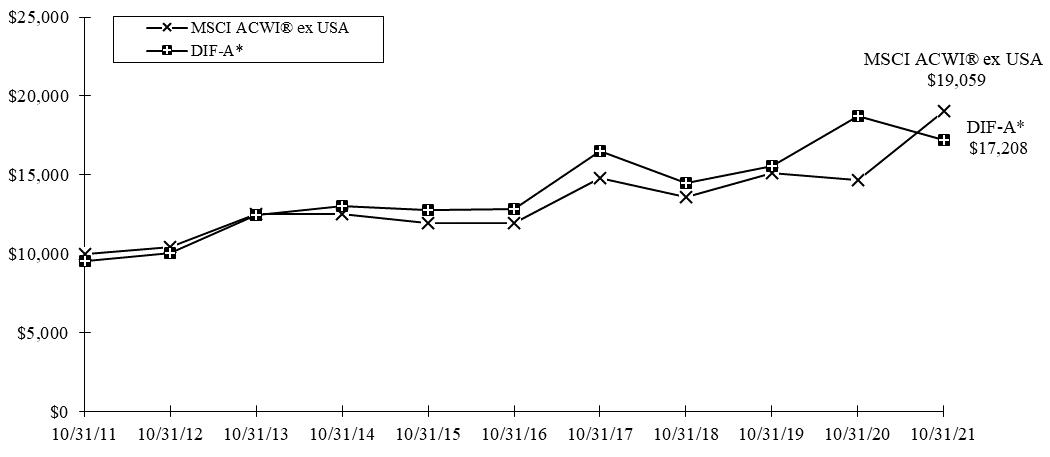

Fund & Benchmark Index

|

1-Year

|

5-Year

|

10-Year

|

Since

Inception

|

Inception

Date

|

Gross Expense

Ratio

|

Net Expense

Ratio

|

|

Class A - without sales charge

|

(8.27)%

|

6.09%

|

6.09%

|

2.82%

|

12/29/06

|

1.00%

|

1.00%

|

|

Class A - with sales charge*

|

(12.63)%

|

5.07%

|

5.58%

|

2.48%

|

12/29/06

|

1.00%

|

1.00%

|

|

Class C**

|

(9.89)%

|

5.18%

|

5.24%

|

2.10%

|

12/29/06

|

1.79%

|

1.79%

|

|

Class Y

|

(8.02)%

|

6.38%

|

6.42%

|

4.90%

|

12/31/09

|

0.72%

|

0.72%

|

|

MSCI ACWI® ex USA***

|

29.66%

|

9.77%

|

6.66%

|

3.84%

|

|

Class A Shares

|

1-Year

|

5-Year

|

10-Year

|

|

With sales charge*

|

(12.88)%

|

3.62%

|

6.37%

|

|

DAVIS GLOBAL FUND

|

|

|

October 31, 2021

|

|

Portfolio Composition

|

Industry Weightings

|

|||||

|

(% of Fund’s 10/31/21 Net Assets)

|

(% of 10/31/21 Stock Holdings)

|

|||||

|

MSCI

|

||||||

|

Fund

|

ACWI®

|

|||||

|

Common Stock (Foreign)

|

52.54%

|

Retailing

|

24.53%

|

5.79%

|

||

|

Common Stock (U.S.)

|

43.77%

|

Banks

|

19.92%

|

7.10%

|

||

|

Preferred Stock (Foreign)

|

3.52%

|

Media & Entertainment

|

15.77%

|

7.13%

|

||

|

Short-Term Investments

|

0.29%

|

Information Technology

|

10.49%

|

22.68%

|

||

|

Other Assets & Liabilities

|

(0.12)%

|

Diversified Financials

|

9.45%

|

4.39%

|

||

|

100.00%

|

Insurance

|

6.48%

|

2.96%

|

|||

|

Health Care

|

5.64%

|

11.54%

|

||||

|

Transportation

|

4.99%

|

2.04%

|

||||

|

Food, Beverage & Tobacco

|

1.25%

|

3.63%

|

||||

|

Food & Staples Retailing

|

1.04%

|

1.41%

|

||||

|

Materials

|

0.41%

|

4.60%

|

||||

|

Commercial & Professional Services

|

0.03%

|

1.25%

|

||||

|

Capital Goods

|

–

|

6.32%

|

||||

|

Energy

|

–

|

3.56%

|

||||

|

Automobiles & Components

|

–

|

3.14%

|

||||

|

Other

|

–

|

12.46%

|

||||

|

100.00%

|

100.00%

|

|||||

|

Country Diversification

|

Top 10 Long-Term Holdings

|

|||

|

(% of 10/31/21 Stock Holdings)

|

(% of Fund’s 10/31/21 Net Assets)

|

|||

|

United States

|

43.85%

|

Wells Fargo & Co.

|

8.25%

|

|

|

China

|

25.48%

|

JD.com, Inc., Class A, ADR

|

5.82%

|

|

|

Singapore

|

9.32%

|

DBS Group Holdings Ltd.

|

5.78%

|

|

|

Netherlands

|

5.14%

|

Prosus N.V., Class N

|

5.13%

|

|

|

Denmark

|

4.26%

|

Alphabet Inc., Class C

|

4.55%

|

|

|

Hong Kong

|

3.88%

|

Danske Bank A/S

|

4.26%

|

|

|

Switzerland

|

2.56%

|

Alibaba Group Holding Ltd., ADR

|

4.16%

|

|

|

South Korea

|

2.26%

|

AIA Group Ltd.

|

3.87%

|

|

|

Bermuda

|

1.34%

|

Capital One Financial Corp.

|

3.78%

|

|

|

South Africa

|

1.25%

|

Meituan, Class B

|

3.67%

|

|

|

Canada

|

0.41%

|

|||

|

United Kingdom

|

0.25%

|

|||

|

100.00%

|

||||

|

DAVIS GLOBAL FUND – (CONTINUED)

|

Fund Overview

|

|

October 31, 2021

|

|

Security

|

Industry

|

Date of 1st

Purchase

|

% of Fund’s

10/31/21

Net Assets

|

|

Baidu, Inc., Class A, ADR

|

Media & Entertainment

|

05/11/21

|

2.52%

|

|

Cigna Corp.

|

Health Care Equipment & Services

|

12/18/20

|

3.02%

|

|

Clear Secure, Inc., Class A

|

Software & Services

|

06/30/21

|

0.82%

|

|

Darling Ingredients Inc.

|

Food, Beverage & Tobacco

|

06/25/21

|

1.25%

|

|

iQIYI, Inc., Class A, ADR

|

Media & Entertainment

|

04/21/21

|

0.67%

|

|

Kuaishou Technology, Class B

|

Media & Entertainment

|

01/29/21

|

0.02%

|

|

Liberty Media Corp., Liberty

|

|||

|

Formula One, Series A

|

Media & Entertainment

|

01/29/21

|

1.15%

|

|

Liberty Media Corp., Liberty

|

|||

|

Formula One, Series C

|

Media & Entertainment

|

01/29/21

|

1.63%

|

|

Ping An Insurance (Group) Co.

|

|||

|

of China, Ltd. - H

|

Life & Health Insurance

|

07/14/21

|

2.60%

|

|

Samsung Electronics Co., Ltd.

|

Technology Hardware & Equipment

|

03/24/21

|

2.25%

|

|

TAL Education Group, Class A, ADR

|

Consumer Services

|

05/27/21

|

–

|

|

Teck Resources Ltd., Class B

|

Materials

|

09/24/21

|

0.41%

|

|

Viatris Inc.

|

Pharmaceuticals, Biotechnology

|

||

|

& Life Sciences

|

12/02/20

|

2.61%

|

|

|

Vroom, Inc.

|

Retailing

|

03/10/21

|

1.13%

|

|

Security

|

Industry

|

Date of

Final Sale

|

Realized

Gain (Loss)

|

|

|

Alphabet Inc., Class A

|

Media & Entertainment

|

06/23/21

|

$

|

2,476,213

|

|

Carrier Global Corp.

|

Capital Goods

|

05/06/21

|

16,110,982

|

|

|

DNB Bank ASA

|

Banks

|

07/28/21

|

27,207,213

|

|

|

Ferguson PLC

|

Capital Goods

|

02/10/21

|

14,587,929

|

|

|

New Oriental Education &

|

||||

|

Technology Group, Inc., ADR

|

Consumer Services

|

07/29/21

|

(42,287,085)

|

|

|

Raytheon Technologies Corp.

|

Capital Goods

|

03/24/21

|

9,566,315

|

|

|

TAL Education Group, Class A, ADR

|

Consumer Services

|

07/26/21

|

(24,620,214)

|

|

|

Yiren Digital Ltd., ADR

|

Consumer Finance

|

02/23/21

|

(12,429,821)

|

|

|

DAVIS INTERNATIONAL FUND

|

|

|

October 31, 2021

|

|

Portfolio Composition

|

Industry Weightings

|

|||||

|

(% of Fund’s 10/31/21 Net Assets)

|

(% of 10/31/21 Stock Holdings)

|

|||||

|

MSCI

|

||||||

|

ACWI®

|

||||||

|

Fund

|

ex USA

|

|||||

|

Common Stock (Foreign)

|

97.28%

|

Retailing

|

27.17%

|

4.01%

|

||

|

Preferred Stock (Foreign)

|

2.41%

|

Banks

|

23.22%

|

11.73%

|

||

|

Short-Term Investments

|

0.12%

|

Information Technology

|

14.08%

|

13.09%

|

||

|

Other Assets & Liabilities

|

0.19%

|

Insurance

|

8.55%

|

4.38%

|

||

|

100.00%

|

Diversified Financials

|

6.27%

|

3.42%

|

|||

|

Capital Goods

|

5.84%

|

8.11%

|

||||

|

Media & Entertainment

|

4.79%

|

3.41%

|

||||

|

Transportation

|

4.63%

|

2.48%

|

||||

|

Consumer Durables & Apparel

|

2.56%

|

3.72%

|

||||

|

Food & Staples Retailing

|

1.14%

|

1.56%

|

||||

|

Consumer Services

|

0.90%

|

1.30%

|

||||

|

Commercial & Professional Services

|

0.44%

|

1.52%

|

||||

|

Materials

|

0.41%

|

7.92%

|

||||

|

Health Care

|

–

|

9.40%

|

||||

|

Food, Beverage & Tobacco

|

–

|

4.99%

|

||||

|

Energy

|

–

|

4.98%

|

||||

|

Automobiles & Components

|

–

|

3.83%

|

||||

|

Other

|

–

|

10.15%

|

||||

|

100.00%

|

100.00%

|

|||||

|

Country Diversification

|

Top 10 Long-Term Holdings

|

|||

|

(% of 10/31/21 Stock Holdings)

|

(% of Fund’s 10/31/21 Net Assets)

|

|||

|

China

|

36.20%

|

JD.com, Inc., Class A, ADR

|

8.45%

|

|

|

Singapore

|

9.68%

|

DBS Group Holdings Ltd.

|

7.24%

|

|

|

South Korea

|

8.14%

|

Alibaba Group Holding Ltd., ADR

|

6.76%

|

|

|

Denmark

|

6.28%

|

Danske Bank A/S

|

6.27%

|

|

|

Norway

|

6.04%

|

DNB Bank ASA

|

6.02%

|

|

|

France

|

5.84%

|

Schneider Electric SE

|

5.82%

|

|

|

Switzerland

|

5.14%

|

Samsung Electronics Co., Ltd.

|

5.56%

|

|

|

Hong Kong

|

4.90%

|

Julius Baer Group Ltd.

|

5.12%

|

|

|

South Africa

|

4.77%

|

AIA Group Ltd.

|

4.88%

|

|

|

Japan

|

4.66%

|

Naspers Ltd. - N

|

4.76%

|

|

|

Netherlands

|

4.31%

|

|||

|

Bermuda

|

3.38%

|

|||

|

Canada

|

0.41%

|

|||

|

United Kingdom

|

0.25%

|

|||

|

100.00%

|

||||

|

DAVIS INTERNATIONAL FUND – (CONTINUED)

|

Fund Overview

|

|

October 31, 2021

|

|

Security

|

Industry

|

Date of 1st

Purchase

|

% of Fund’s

10/31/21

Net Assets

|

|

Kuaishou Technology, Class B

|

Media & Entertainment

|

01/29/21

|

–

|

|

Ping An Insurance (Group) Co.

|

|||

|

of China, Ltd. - H

|

Life & Health Insurance

|

07/14/21

|

3.63%

|

|

Samsung Electronics Co., Ltd.

|

Technology Hardware & Equipment

|

02/18/21

|

5.56%

|

|

TAL Education Group, Class A, ADR

|

Consumer Services

|

03/26/21

|

–

|

|

Teck Resources Ltd., Class B

|

Materials

|

09/24/21

|

0.41%

|

|

Security

|

Industry

|

Date of

Final Sale

|

Realized

Gain (Loss)

|

|

|

Ferguson PLC

|

Capital Goods

|

08/05/21

|

$

|

10,239,878

|

|

Hunter Douglas N.V.

|

Consumer Durables & Apparel

|

12/14/20

|

118,837

|

|

|

Kuaishou Technology, Class B

|

Media & Entertainment

|

08/19/21

|

(36,616)

|

|

|

New Oriental Education &

|

|

|

||

|

Technology Group, Inc., ADR

|

Consumer Services

|

07/29/21

|

(21,107,614)

|

|

|

TAL Education Group, Class A, ADR

|

Consumer Services

|

07/26/21

|

(20,833,522)

|

|

|

Yiren Digital Ltd., ADR

|

Consumer Finance

|

02/23/21

|

(5,212,449)

|

|

|

Beginning

|

Ending

|

Expenses Paid

|

|||

|

Account Value

|

Account Value

|

During Period*

|

|||

|

(05/01/21)

|

(10/31/21)

|

(05/01/21-10/31/21)

|

|||

|

Davis Global Fund

|

|||||

|

Class A (annualized expense ratio 0.94%**)

|

|||||

|

Actual

|

$1,000.00

|

$856.57

|

$4.40

|

||

|

Hypothetical

|

$1,000.00

|

$1,020.47

|

$4.79

|

||

|

Class C (annualized expense ratio 1.72%**)

|

|||||

|

Actual

|

$1,000.00

|

$853.09

|

$8.03

|

||

|

Hypothetical

|

$1,000.00

|

$1,016.53

|

$8.74

|

||

|

Class Y (annualized expense ratio 0.71%**)

|

|||||

|

Actual

|

$1,000.00

|

$857.75

|

$3.32

|

||

|

Hypothetical

|

$1,000.00

|

$1,021.63

|

$3.62

|

||

|

Davis International Fund

|

|||||

|

Class A (annualized expense ratio 1.04%**)

|

|||||

|

Actual

|

$1,000.00

|

$790.49

|

$4.69

|

||

|

Hypothetical

|

$1,000.00

|

$1,019.96

|

$5.30

|

||

|

Class C (annualized expense ratio 1.82%**)

|

|||||

|

Actual

|

$1,000.00

|

$787.69

|

$8.20

|

||

|

Hypothetical

|

$1,000.00

|

$1,016.03

|

$9.25

|

||

|

Class Y (annualized expense ratio 0.75%**)

|

|||||

|

Actual

|

$1,000.00

|

$791.77

|

$3.39

|

||

|

Hypothetical

|

$1,000.00

|

$1,021.42

|

$3.82

|

|

Hypothetical assumes 5% annual return before expenses.

|

|

*Expenses are equal to each Class’s annualized operating expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

|

|

**The expense ratios reflect the impact, if any, of certain reimbursements from the Adviser.

|

|

Shares/Units

|

Value

(Note 1) |

|||||||||||

|

COMMON STOCK – (96.31%)

|

||||||||||||

|

COMMUNICATION SERVICES – (15.74%)

|

||||||||||||

|

Media & Entertainment – (15.74%)

|

||||||||||||

|

Alphabet Inc., Class C *

|

19,488

|

$

|

57,789,910

|

|||||||||

|

ASAC II L.P. *(a)(b)

|

35,352

|

36,158

|

||||||||||

|

Baidu, Inc., Class A, ADR (China)*

|

197,110

|

31,979,126

|

||||||||||

|

Fang Holdings Ltd., Class A, ADR (China)*

|

22,864

|

133,069

|

||||||||||

|

IAC/InterActiveCorp *

|

141,910

|

21,622,827

|

||||||||||

|

iQIYI, Inc., Class A, ADR (China)*

|

1,024,160

|

8,480,045

|

||||||||||

|

Kuaishou Technology, Class B (China)*

|

15,390

|

204,725

|

||||||||||

|

Liberty Media Corp., Liberty Formula One, Series A *

|

280,020

|

14,603,043

|

||||||||||

|

Liberty Media Corp., Liberty Formula One, Series C *

|

370,485

|

20,673,063

|

||||||||||

|

Meta Platforms, Inc., Class A *

|

112,580

|

36,427,511

|

||||||||||

|

Vimeo, Inc. *

|

230,380

|

7,770,717

|

||||||||||

|

Total Communication Services

|

199,720,194

|

|||||||||||

|

CONSUMER DISCRETIONARY – (24.49%)

|

||||||||||||

|

Retailing – (24.49%)

|

||||||||||||

|

Alibaba Group Holding Ltd., ADR (China)*

|

319,820

|

52,751,111

|

||||||||||

|

Amazon.com, Inc. *

|

10,950

|

36,928,109

|

||||||||||

|

JD.com, Inc., Class A, ADR (China)*

|

943,165

|

73,830,956

|

||||||||||

|

Meituan, Class B (China)*

|

1,342,429

|

46,516,144

|

||||||||||

|

Naspers Ltd. - N (South Africa)

|

93,191

|

15,802,143

|

||||||||||

|

Prosus N.V., Class N (Netherlands)

|

738,660

|

65,075,023

|

||||||||||

|

Quotient Technology Inc. *

|

867,010

|

5,583,544

|

||||||||||

|

Vroom, Inc. *

|

747,530

|

14,300,249

|

||||||||||

|

Total Consumer Discretionary

|

310,787,279

|

|||||||||||

|

CONSUMER STAPLES – (2.29%)

|

||||||||||||

|

Food & Staples Retailing – (1.04%)

|

||||||||||||

|

Missfresh Ltd., Class B, ADS (China)*(a)

|

3,519,779

|

13,207,972

|

||||||||||

|

Food, Beverage & Tobacco – (1.25%)

|

||||||||||||

|

Darling Ingredients Inc. *

|

186,740

|

15,783,265

|

||||||||||

|

Total Consumer Staples

|

28,991,237

|

|||||||||||

|

FINANCIALS – (35.79%)

|

||||||||||||

|

Banks – (19.88%)

|

||||||||||||

|

Bank of N.T. Butterfield & Son Ltd. (Bermuda)

|

475,000

|

17,052,500

|

||||||||||

|

Danske Bank A/S (Denmark)

|

3,190,350

|

53,990,538

|

||||||||||

|

DBS Group Holdings Ltd. (Singapore)

|

3,137,994

|

73,371,117

|

||||||||||

|

Metro Bank PLC (United Kingdom)*

|

2,187,612

|

3,170,496

|

||||||||||

|

Wells Fargo & Co.

|

2,046,500

|

104,698,940

|

||||||||||

|

252,283,591

|

||||||||||||

|

Diversified Financials – (9.44%)

|

||||||||||||

|

Capital Markets – (3.19%)

|

||||||||||||

|

Julius Baer Group Ltd. (Switzerland)

|

448,550

|

32,421,405

|

||||||||||

|

Noah Holdings Ltd., Class A, ADS (China)*

|

188,970

|

8,033,115

|

||||||||||

|

40,454,520

|

||||||||||||

|

Consumer Finance – (3.78%)

|

||||||||||||

|

Capital One Financial Corp.

|

317,330

|

47,926,350

|

||||||||||

|

Diversified Financial Services – (2.47%)

|

||||||||||||

|

Berkshire Hathaway Inc., Class B *

|

109,210

|

31,344,362

|

||||||||||

|

119,725,232

|

||||||||||||

|

DAVIS GLOBAL FUND – (CONTINUED)

|

Schedule of Investments

|

|

October 31, 2021

|

|

Shares

|

Value

(Note 1) |

||||||||||||

|

COMMON STOCK – (CONTINUED)

|

|||||||||||||

|

FINANCIALS – (CONTINUED)

|

|||||||||||||

|

Insurance – (6.47%)

|

|||||||||||||

|

Life & Health Insurance – (6.47%)

|

|||||||||||||

|

AIA Group Ltd. (Hong Kong)

|

4,353,580

|

$

|

49,156,481

|

||||||||||

|

Ping An Insurance (Group) Co. of China, Ltd. - H (China)

|

4,579,000

|

32,898,413

|

|||||||||||

|

82,054,894

|

|||||||||||||

|

Total Financials

|

454,063,717

|

||||||||||||

|

HEALTH CARE – (5.63%)

|

|||||||||||||

|

Health Care Equipment & Services – (3.02%)

|

|||||||||||||

|

Cigna Corp.

|

179,640

|

38,372,900

|

|||||||||||

|

Pharmaceuticals, Biotechnology & Life Sciences – (2.61%)

|

|||||||||||||

|

Viatris Inc.

|

2,477,960

|

33,080,766

|

|||||||||||

|

Total Health Care

|

71,453,666

|

||||||||||||

|

INDUSTRIALS – (1.49%)

|

|||||||||||||

|

Commercial & Professional Services – (0.03%)

|

|||||||||||||

|

China Index Holdings Ltd., Class A, ADR (China)*

|

248,139

|

379,653

|

|||||||||||

|

Transportation – (1.46%)

|

|||||||||||||

|

DiDi Global Inc., Class A, ADS (China)*

|

234,620

|

1,893,383

|

|||||||||||

|

DiDi Global Inc., Class A, ADS (China)*(a)

|

2,171,148

|

16,645,106

|

|||||||||||

|

18,538,489

|

|||||||||||||

|

Total Industrials

|

18,918,142

|

||||||||||||

|

INFORMATION TECHNOLOGY – (10.47%)

|

|||||||||||||

|

Semiconductors & Semiconductor Equipment – (4.57%)

|

|||||||||||||

|

Applied Materials, Inc.

|

269,250

|

36,793,012

|

|||||||||||

|

Intel Corp.

|

432,470

|

21,191,030

|

|||||||||||

|

57,984,042

|

|||||||||||||

|

Software & Services – (0.82%)

|

|||||||||||||

|

Clear Secure, Inc., Class A *

|

234,720

|

10,489,637

|

|||||||||||

|

Technology Hardware & Equipment – (5.08%)

|

|||||||||||||

|

Hollysys Automation Technologies Ltd. (China)

|

1,796,296

|

35,836,105

|

|||||||||||

|

Samsung Electronics Co., Ltd. (South Korea)

|

478,640

|

28,590,195

|

|||||||||||

|

64,426,300

|

|||||||||||||

|

Total Information Technology

|

132,899,979

|

||||||||||||

|

MATERIALS – (0.41%)

|

|||||||||||||

|

Teck Resources Ltd., Class B (Canada)

|

186,210

|

5,195,259

|

|||||||||||

|

Total Materials

|

5,195,259

|

||||||||||||

|

TOTAL COMMON STOCK – (Identified cost $952,962,659)

|

1,222,029,473

|

||||||||||||

|

PREFERRED STOCK – (3.52%)

|

|||||||||||||

|

INDUSTRIALS – (3.52%)

|

|||||||||||||

|

Transportation – (3.52%)

|

|||||||||||||

|

Grab Holdings Inc., Series F (Singapore)*(a)(b)

|

2,398,770

|

25,019,171

|

|||||||||||

|

Grab Holdings Inc., Series G (Singapore)*(a)(b)

|

1,881,391

|

19,622,908

|

|||||||||||

|

Total Industrials

|

44,642,079

|

||||||||||||

|

TOTAL PREFERRED STOCK – (Identified cost $21,986,292)

|

44,642,079

|

||||||||||||

|

DAVIS GLOBAL FUND – (CONTINUED)

|

Schedule of Investments

|

|

October 31, 2021

|

|

Principal

|

Value

(Note 1) |

|||||||||||

|

SHORT-TERM INVESTMENTS – (0.29%)

|

||||||||||||

|

Nomura Securities International, Inc. Joint Repurchase Agreement,

0.02%, 11/01/21, dated 10/29/21, repurchase value of $1,633,003

(collateralized by: U.S. Government agency mortgage and obligation in

a pooled cash account, 0.00%-2.625%, 02/10/22-01/31/26, total market

value $1,665,660)

|

$

|

1,633,000

|

$

|

1,633,000

|

||||||||

|

StoneX Financial Inc. Joint Repurchase Agreement, 0.04%, 11/01/21,

dated 10/29/21, repurchase value of $1,192,004 (collateralized by: U.S.

Government agency mortgages and obligations in a pooled cash

account, 0.00%-8.50%, 10/31/21-10/15/56, total market value

$1,215,840)

|

1,192,000

|

1,192,000

|

||||||||||

|

Truist Securities, Inc. Joint Repurchase Agreement, 0.04%, 11/01/21,

dated 10/29/21, repurchase value of $817,003 (collateralized by: U.S.

Government agency mortgages in a pooled cash account, 1.50%-3.00%,

10/01/31-07/01/51, total market value $833,340)

|

817,000

|

817,000

|

||||||||||

|

TOTAL SHORT-TERM INVESTMENTS – (Identified cost $3,642,000)

|

3,642,000

|

|||||||||||

|

Total Investments – (100.12%) – (Identified cost $978,590,951)

|

1,270,313,552

|

|||||||||||

|

Liabilities Less Other Assets – (0.12%)

|

(1,467,258)

|

|||||||||||

|

Net Assets – (100.00%)

|

$

|

1,268,846,294

|

||||||||||

|

ADR: American Depositary Receipt

|

||||||||||||

|

ADS: American Depositary Share

|

||||||||||||

|

*

|

Non-income producing security.

|

|||||||||||

|

(a)

|

Restricted Security – See Note 6 of the Notes to Financial Statements.

|

|||||||||||

|

(b)

|

The value of this security was determined using significant unobservable inputs. See Note 1 of the Notes to Financial Statements.

|

|||||||||||

|

See Notes to Financial Statements

|

||||||||||||

|

DAVIS INTERNATIONAL FUND

|

|

|

October 31, 2021

|

|

Shares

|

Value

(Note 1) |

|||||||||||

|

COMMON STOCK – (97.28%)

|

||||||||||||

|

COMMUNICATION SERVICES – (4.78%)

|

||||||||||||

|

Media & Entertainment – (4.78%)

|

||||||||||||

|

Baidu, Inc., Class A, ADR (China)*

|

63,185

|

$

|

10,251,134

|

|||||||||

|

Fang Holdings Ltd., Class A, ADR (China)*

|

12,430

|

72,343

|

||||||||||

|

iQIYI, Inc., Class A, ADR (China)*

|

839,890

|

6,954,289

|

||||||||||

|

Total Communication Services

|

17,277,766

|

|||||||||||

|

CONSUMER DISCRETIONARY – (30.54%)

|

||||||||||||

|

Consumer Durables & Apparel – (2.55%)

|

||||||||||||

|

Fila Holdings Corp. (South Korea)

|

290,770

|

9,231,584

|

||||||||||

|

Consumer Services – (0.90%)

|

||||||||||||

|

Trip.com Group Ltd., ADR (China)*

|

113,680

|

3,246,701

|

||||||||||

|

Retailing – (27.09%)

|

||||||||||||

|

Alibaba Group Holding Ltd., ADR (China)*

|

148,090

|

24,425,965

|

||||||||||

|

JD.com, Inc., Class A, ADR (China)*

|

390,380

|

30,558,946

|

||||||||||

|

Meituan, Class B (China)*

|

294,411

|

10,201,556

|

||||||||||

|

Naspers Ltd. - N (South Africa)

|

101,420

|

17,197,512

|

||||||||||

|

Prosus N.V., Class N (Netherlands)

|

176,162

|

15,519,652

|

||||||||||

|

97,903,631

|

||||||||||||

|

Total Consumer Discretionary

|

110,381,916

|

|||||||||||

|

CONSUMER STAPLES – (1.14%)

|

||||||||||||

|

Food & Staples Retailing – (1.14%)

|

||||||||||||

|

Missfresh Ltd., Class B, ADS (China)*(a)

|

1,097,439

|

4,118,141

|

||||||||||

|

Total Consumer Staples

|

4,118,141

|

|||||||||||

|

FINANCIALS – (37.92%)

|

||||||||||||

|

Banks – (23.14%)

|

||||||||||||

|

Bank of N.T. Butterfield & Son Ltd. (Bermuda)

|

338,980

|

12,169,382

|

||||||||||

|

Danske Bank A/S (Denmark)

|

1,338,430

|

22,650,354

|

||||||||||

|

DBS Group Holdings Ltd. (Singapore)

|

1,119,310

|

26,171,186

|

||||||||||

|

DNB Bank ASA (Norway)

|

915,382

|

21,757,917

|

||||||||||

|

Metro Bank PLC (United Kingdom)*

|

625,030

|

905,853

|

||||||||||

|

83,654,692

|

||||||||||||

|

Diversified Financials – (6.25%)

|

||||||||||||

|

Capital Markets – (6.25%)

|

||||||||||||

|

Julius Baer Group Ltd. (Switzerland)

|

256,080

|

18,509,583

|

||||||||||

|

Noah Holdings Ltd., Class A, ADS (China)*

|

95,860

|

4,075,009

|

||||||||||

|

22,584,592

|

||||||||||||

|

Insurance – (8.53%)

|

||||||||||||

|

Life & Health Insurance – (8.53%)

|

||||||||||||

|

AIA Group Ltd. (Hong Kong)

|

1,563,500

|

17,653,554

|

||||||||||

|

Ping An Insurance (Group) Co. of China, Ltd. - H (China)

|

1,831,500

|

13,158,646

|

||||||||||

|

30,812,200

|

||||||||||||

|

Total Financials

|

137,051,484

|

|||||||||||

|

INDUSTRIALS – (8.46%)

|

||||||||||||

|

Capital Goods – (5.82%)

|

||||||||||||

|

Schneider Electric SE (France)

|

122,240

|

21,040,973

|

||||||||||

|

Commercial & Professional Services – (0.43%)

|

||||||||||||

|

China Index Holdings Ltd., Class A, ADR (China)*

|

1,027,188

|

1,571,598

|

||||||||||

|

Transportation – (2.21%)

|

||||||||||||

|

DiDi Global Inc., Class A, ADS (China)*

|

145,740

|

1,176,122

|

||||||||||

|

DAVIS INTERNATIONAL FUND – (CONTINUED)

|

Schedule of Investments

|

|

October 31, 2021

|

|

Shares

|

Value

(Note 1) |

|||||||||||

|

COMMON STOCK – (CONTINUED)

|

||||||||||||

|

INDUSTRIALS – (CONTINUED)

|

||||||||||||

|

Transportation – (Continued)

|

||||||||||||

|

DiDi Global Inc., Class A, ADS (China)* (a)

|

886,296

|

$

|

6,794,788

|

|||||||||

|

7,970,910

|

||||||||||||

|

Total Industrials

|

30,583,481

|

|||||||||||

|

INFORMATION TECHNOLOGY – (14.03%)

|

||||||||||||

|

Semiconductors & Semiconductor Equipment – (4.64%)

|

||||||||||||

|

Tokyo Electron Ltd. (Japan)

|

36,200

|

16,785,874

|

||||||||||

|

Technology Hardware & Equipment – (9.39%)

|

||||||||||||

|

Hollysys Automation Technologies Ltd. (China)

|

693,546

|

13,836,243

|

||||||||||

|

Samsung Electronics Co., Ltd. (South Korea)

|

336,650

|

20,108,827

|

||||||||||

|

33,945,070

|

||||||||||||

|

Total Information Technology

|

50,730,944

|

|||||||||||

|

MATERIALS – (0.41%)

|

||||||||||||

|

Teck Resources Ltd., Class B (Canada)

|

53,050

|

1,480,095

|

||||||||||

|

Total Materials

|

1,480,095

|

|||||||||||

|

TOTAL COMMON STOCK – (Identified cost $313,048,473)

|

351,623,827

|

|||||||||||

|

PREFERRED STOCK – (2.41%)

|

||||||||||||

|

INDUSTRIALS – (2.41%)

|

||||||||||||

|

Transportation – (2.41%)

|

||||||||||||

|

Grab Holdings Inc., Series F (Singapore)*(a)(b)

|

549,889

|

5,735,342

|

||||||||||

|

Grab Holdings Inc., Series G (Singapore)*(a)(b)

|

286,316

|

2,986,276

|

||||||||||

|

Total Industrials

|

8,721,618

|

|||||||||||

|

TOTAL PREFERRED STOCK – (Identified cost $4,236,680)

|

8,721,618

|

|||||||||||

|

DAVIS INTERNATIONAL FUND – (CONTINUED)

|

Schedule of Investments

|

|

October 31, 2021

|

|

Principal

|

Value

(Note 1) |

|||||||||||

|

SHORT-TERM INVESTMENTS – (0.12%)

|

||||||||||||

|

Nomura Securities International, Inc. Joint Repurchase Agreement,

0.02%, 11/01/21, dated 10/29/21, repurchase value of $194,000

(collateralized by: U.S. Government agency obligation in a pooled cash

account, 2.25%, 08/15/49, total market value $197,880)

|

$

|

194,000

|

$

|

194,000

|

||||||||

|

StoneX Financial Inc. Joint Repurchase Agreement, 0.04%, 11/01/21,

dated 10/29/21, repurchase value of $142,000 (collateralized by: U.S.

Government agency mortgages and obligations in a pooled cash

account, 0.00%-8.50%, 10/31/21-10/15/56, total market value $144,840)

|

142,000

|

142,000

|

||||||||||

|

Truist Securities, Inc. Joint Repurchase Agreement, 0.04%, 11/01/21,

dated 10/29/21, repurchase value of $97,000 (collateralized by: U.S.

Government agency mortgage in a pooled cash account, 3.00%,

12/01/49, total market value $98,940)

|

97,000

|

97,000

|

||||||||||

|

TOTAL SHORT-TERM INVESTMENTS – (Identified cost $433,000)

|

433,000

|

|||||||||||

|

Total Investments – (99.81%) – (Identified cost $317,718,153)

|

360,778,445

|

|||||||||||

|

Other Assets Less Liabilities – (0.19%)

|

676,329

|

|||||||||||

|

Net Assets – (100.00%)

|

$

|

361,454,774

|

||||||||||

|

ADR: American Depositary Receipt

|

||||||||||||

|

ADS: American Depositary Share

|

||||||||||||

|

*

|

Non-income producing security.

|

|||||||||||

|

(a)

|

Restricted Security – See Note 6 of the Notes to Financial Statements.

|

|||||||||||

|

(b)

|

The value of this security was determined using significant unobservable inputs. See Note 1 of the Notes to Financial Statements.

|

|||||||||||

|

See Notes to Financial Statements

|

||||||||||||

|

DAVIS GLOBAL FUND

|

|

|

DAVIS INTERNATIONAL FUND

|

At October 31, 2021

|

|

Davis Global

Fund

|

Davis International

Fund

|

|||||||

|

ASSETS:

|

||||||||

|

Investments in securities at value* (see accompanying Schedules of Investments)

|

$

|

1,270,313,552

|

$

|

360,778,445

|

||||

|

Cash

|

219

|

926

|

||||||

|

Receivables:

|

||||||||

|

Capital stock sold

|

594,996

|

139,143

|

||||||

|

Dividends and interest

|

635,116

|

1,297,502

|

||||||

|

Prepaid expenses

|

40,223

|

12,907

|

||||||

|

Total assets

|

1,271,584,106

|

362,228,923

|

||||||

|

LIABILITIES:

|

||||||||

|

Payables:

|

||||||||

|

Capital stock redeemed

|

1,353,220

|

265,792

|

||||||

|

Accrued custodian fees

|

399,983

|

204,750

|

||||||

|

Accrued distribution and service plan fees

|

133,549

|

16,149

|

||||||

|

Accrued investment advisory fees

|

610,131

|

175,006

|

||||||

|

Other accrued expenses

|

240,929

|

112,452

|

||||||

|

Total liabilities

|

2,737,812

|

774,149

|

||||||

|

NET ASSETS

|

$

|

1,268,846,294

|

$

|

361,454,774

|

||||

|

NET ASSETS CONSIST OF:

|

||||||||

|

Par value of shares of capital stock

|

$

|

2,110,251

|

$

|

1,444,971

|

||||

|

Additional paid-in capital |

872,513,045

|

360,047,581

|

||||||

|

Distributable earnings (losses)

|

394,222,998

|

(37,778)

|

||||||

|

Net Assets

|

$

|

1,268,846,294

|

$

|

361,454,774

|

||||

|

*Including:

|

||||||||

|

Cost of investments

|

$

|

978,590,951

|

$

|

317,718,153

|

||||

|

CLASS A SHARES:

|

||||||||

|

Net assets

|

$

|

232,565,359

|

$

|

44,686,877

|

||||

|

Shares outstanding

|

7,711,237

|

3,534,232

|

||||||

|

Net asset value and redemption price per share (Net assets ÷ Shares outstanding)

|

$

|

30.16

|

$

|

12.64

|

||||

|

Maximum offering price per share (100/95.25 of net asset value)†

|

$

|

31.66

|

$

|

13.27

|

||||

|

CLASS C SHARES:

|

||||||||

|

Net assets

|

$

|

101,611,306

|

$

|

8,411,746

|

||||

|

Shares outstanding

|

3,675,779

|

721,926

|

||||||

|

Net asset value, offering, and redemption price per share (Net assets ÷ Shares

outstanding)

|

$

|

27.64

|

$

|

11.65

|

||||

|

CLASS Y SHARES:

|

||||||||

|

Net assets

|

$

|

934,669,629

|

$

|

308,356,151

|

||||

|

Shares outstanding

|

30,818,003

|

24,643,269

|

||||||

|

Net asset value, offering, and redemption price per share (Net assets ÷ Shares

outstanding)

|

$

|

30.33

|

$

|

12.51

|

||||

|

†On purchases of $100,000 or more, the offering price is reduced.

|

|

See Notes to Financial Statements

|

|

DAVIS GLOBAL FUND

|

|

|

DAVIS INTERNATIONAL FUND

|

For the year ended October 31, 2021

|

|

Davis Global

Fund

|

Davis International

Fund

|

|||||||||

|

INVESTMENT INCOME:

|

||||||||||

|

Income:

|

||||||||||

|

Dividends*

|

$

|

13,797,354

|

$

|

6,452,480

|

||||||

|

Interest

|

14,726

|

24,506

|

||||||||

|

Net securities lending fees

|

110,112

|

89,459

|

||||||||

|

Total income

|

13,922,192

|

6,566,445

|

||||||||

|

Expenses:

|

||||||||||

|

Investment advisory fees (Note 3)

|

7,404,800

|

2,575,074

|

||||||||

|

Custodian fees

|

536,199

|

295,330

|

||||||||

|

Transfer agent fees:

|

||||||||||

|

Class A

|

200,302

|

71,714

|

||||||||

|

Class C

|

99,151

|

16,255

|

||||||||

|

Class Y

|

718,691

|

257,532

|

||||||||

|

Audit fees

|

28,560

|

23,968

|

||||||||

|

Legal fees

|

5,082

|

1,842

|

||||||||

|

Accounting fees (Note 3)

|

49,336

|

17,328

|

||||||||

|

Reports to shareholders

|

52,501

|

19,001

|

||||||||

|

Directors’ fees and expenses

|

57,145

|

22,308

|

||||||||

|

Registration and filing fees

|

75,000

|

62,000

|

||||||||

|

Miscellaneous

|

75,345

|

37,678

|

||||||||

|

Distribution and service plan fees (Note 3):

|

||||||||||

|

Class A

|

560,634

|

128,024

|

||||||||

|

Class C

|

1,166,717

|

115,845

|

||||||||

|

Total expenses

|

11,029,463

|

3,643,899

|

||||||||

|

Net investment income

|

2,892,729

|

2,922,546

|

||||||||

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND

FOREIGN CURRENCY TRANSACTIONS:

|

||||||||||

|

Net realized gain (loss) from:

|

||||||||||

|

Investment transactions

|

131,263,945

|

(32,845,493)

|

||||||||

|

Foreign currency transactions

|

(148,146)

|

(127,946)

|

||||||||

|

Net realized gain (loss)

|

131,115,799

|

(32,973,439)

|

||||||||

|

Net increase (decrease) in unrealized appreciation

|

35,027,258

|

(20,648,878)

|

||||||||

|

Net realized and unrealized gain (loss) on investments and foreign currency

transactions

|

166,143,057

|

(53,622,317)

|

||||||||

|

Net increase (decrease) in net assets resulting from operations

|

$

|

169,035,786

|

$

|

(50,699,771)

|

||||||

|

*Net of foreign taxes withheld of

|

$

|

1,085,526

|

$

|

841,717

|

||||||

|

See Notes to Financial Statements

|

|

DAVIS GLOBAL FUND

|

|

|

DAVIS INTERNATIONAL FUND

|

For the year ended October 31, 2021

|

|

Davis Global

Fund

|

Davis International

Fund

|

|||||||

|

OPERATIONS:

|

||||||||

|

Net investment income

|

$

|

2,892,729

|

$

|

2,922,546

|

||||

|

Net realized gain (loss) from investments and foreign currency transactions

|

131,115,799

|

(32,973,439)

|

||||||

|

Net increase (decrease) in unrealized appreciation on investments and foreign currency

transactions

|

35,027,258

|

(20,648,878)

|

||||||

|

Net increase (decrease) in net assets resulting from operations

|

169,035,786

|

(50,699,771)

|

||||||

|

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS:

|

||||||||

|

Class A

|

(635,474)

|

–

|

||||||

|

Class C

|

(346,051)

|

–

|

||||||

|

Class Y

|

(3,119,200)

|

(258,272)

|

||||||

|

CAPITAL SHARE TRANSACTIONS:

|

||||||||

|

Net increase (decrease) in net assets resulting from capital share transactions (Note 4):

|

||||||||

|

Class A

|

958,579

|

12,939,879

|

||||||

|

Class C

|

(16,903,810)

|

(243,456)

|

||||||

|

Class Y

|

28,540,724

|

5,945,445

|

||||||

|

Total increase (decrease) in net assets

|

177,530,554

|

(32,316,175)

|

||||||

|

NET ASSETS:

|

||||||||

|

Beginning of year

|

1,091,315,740

|

393,770,949

|

||||||

|

End of year

|

$

|

1,268,846,294

|

$

|

361,454,774

|

||||

|

See Notes to Financial Statements

|

|

DAVIS GLOBAL FUND

|

Statements of Changes in Net Assets

|

|

DAVIS INTERNATIONAL FUND

|

For the year ended October 31, 2020

|

|

Davis Global

Fund

|

Davis International

Fund

|

||||||||

|

OPERATIONS:

|

|||||||||

|

Net investment income (loss)

|

$

|

234,256

|

$

|

(109,329)

|

|||||

|

Net realized gain (loss) from investments and foreign currency transactions

|

19,847,021

|

(4,229,086)

|

|||||||

|

Net change in unrealized appreciation (depreciation) on investments and foreign

currency transactions

|

127,303,361

|

72,685,469

|

|||||||

|

Net increase in net assets resulting from operations

|

147,384,638

|

68,347,054

|

|||||||

|

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS:

|

|||||||||

|

Class A

|

(3,945,040)

|

(1,094,053)

|

|||||||

|

Class C

|

(1,564,309)

|

(268,938)

|

|||||||

|

Class Y

|

(15,842,121)

|

(10,369,755)

|

|||||||

|

TAX RETURN OF CAPITAL TO SHAREHOLDERS:

|

|||||||||

|

Class A

|

–

|

(13,515)

|

|||||||

|

Class C

|

–

|

(3,687)

|

|||||||

|

Class Y

|

–

|

(125,795)

|

|||||||

|

CAPITAL SHARE TRANSACTIONS:

|

|||||||||

|

Net increase (decrease) in net assets resulting from capital share transactions (Note 4):

|

|||||||||

|

Class A

|

(14,637,677)

|

1,022,260

|

|||||||

|

Class C

|

(30,145,062)

|

(1,579,805)

|

|||||||

|

Class Y

|

2,210,690

|

18,202,156

|

|||||||

|

Total increase in net assets

|

83,461,119

|

74,115,922

|

|||||||

|

NET ASSETS:

|

|||||||||

|

Beginning of year

|

1,007,854,621

|

319,655,027

|

|||||||

|

End of year

|

$

|

1,091,315,740

|

$

|

393,770,949

|

|||||

|

See Notes to Financial Statements

|

|

DAVIS GLOBAL FUND

|

|

|

DAVIS INTERNATIONAL FUND

|

October 31, 2021

|

|

DAVIS GLOBAL FUND

|

Notes to Financial Statements – (Continued)

|

|

DAVIS INTERNATIONAL FUND

|

October 31, 2021

|

|

Level 1 –

|

quoted prices in active markets for identical securities

|

|

Level 2 –

|

other significant observable inputs (including quoted prices for similar investments, interest rates,

prepayment speeds, credit risk, etc.)

|

|

Level 3 –

|

significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of

investments)

|

|

Investments in Securities at Value

|

|||||

|

Davis Global

|

Davis International

|

||||

|

Fund

|

Fund

|

||||

|

Valuation Inputs

|

|||||

|

Level 1 – Quoted Prices:

|

|||||

|

Common Stock:

|

|||||

|

Communication Services

|

$

|

199,684,036

|

$

|

17,277,766

|

|

|

Consumer Discretionary

|

310,787,279

|

110,381,916

|

|||

|

Consumer Staples

|

15,783,265

|

–

|

|||

|

Financials

|

454,063,717

|

137,051,484

|

|||

|

Health Care

|

71,453,666

|

–

|

|||

|

Industrials

|

2,273,036

|

23,788,693

|

|||

|

Information Technology

|

132,899,979

|

50,730,944

|

|||

|

Materials

|

5,195,259

|

1,480,095

|

|||

|

Total Level 1

|

1,192,140,237

|

340,710,898

|

|||

|

Level 2 – Other Significant Observable Inputs:

|

|||||

|

Common Stock:

|

|||||

|

Consumer Staples

|

13,207,972

|

4,118,141

|

|||

|

Industrials

|

16,645,106

|

6,794,788

|

|||

|

Short-Term Investments

|

3,642,000

|

433,000

|

|||

|

Total Level 2

|

33,495,078

|

11,345,929

|

|||

|

Level 3 – Significant Unobservable Inputs:

|

|||||

|

Common Stock:

|

|||||

|

Communication Services

|

36,158

|

–

|

|||

|

Preferred Stock:

|

|||||

|

Industrials

|

44,642,079

|

8,721,618

|

|||

|

Total Level 3

|

44,678,237

|

8,721,618

|

|||

|

Total Investments

|

$

|

1,270,313,552

|

$

|

360,778,445

|

|

|

DAVIS GLOBAL FUND

|

Notes to Financial Statements – (Continued)

|

|

DAVIS INTERNATIONAL FUND

|

October 31, 2021

|

|

Beginning

Balance at

November 1, 2020

|

Cost of

Purchases

|

Net Change in

Unrealized

Appreciation

(Depreciation)*

|

Net Realized

Gain (Loss)

|

Transfers

into

Level 3

|

Transfers

out of

Level 3**

|

Ending

Balance at

October 31,

2021

|

|||||||||||||||

|

Davis Global Fund

|

|||||||||||||||||||||

|

Investments in Securities:

|

|||||||||||||||||||||

|

Common Stock

|

$

|

36,183

|

$

|

–

|

$

|

(25)

|

$

|

–

|

$

|

–

|

$

|

–

|

$

|

36,158

|

|||||||

|

Preferred Stock

|

97,166,481

|

–

|

26,615,279

|

–

|

–

|

(79,139,681)

|

44,642,079

|

||||||||||||||

|

Total Level 3

|

$

|

97,202,664

|

$

|

–

|

$

|

26,615,254

|

$

|

–

|

$

|

–

|

$

|

(79,139,681)

|

$

|

44,678,237

|

|||||||

|

Davis International Fund

|

|||||||||||||||||||||

|

Investments in Securities:

|

|||||||||||||||||||||

|

Preferred Stock

|

$

|

26,297,091

|

$

|

3,800,007

|

$

|

6,012,812

|

$

|

–

|

$

|

–

|

$

|

(27,388,292)

|

$

|

8,721,618

|

|||||||

|

Total Level 3

|

$

|

26,297,091

|

$

|

3,800,007

|

$

|

6,012,812

|

$

|

–

|

$

|

–

|

$

|

(27,388,292)

|

$

|

8,721,618

|

|||||||

|

Fair Value at

|

Valuation

|

Unobservable

|

Impact to

Valuation from

|

||||||||

|

October 31, 2021

|

Technique

|

Input(s)

|

Amount

|

an Increase in Input

|

|||||||

|

Davis Global Fund

|

|||||||||||

|

Investments in Securities:

|

|||||||||||

|

Common Stock

|

$

|

36,158

|

Discounted Cash Flow

|

Annualized Yield

|

1.408%

|

Decrease

|

|||||

|

Preferred Stock

|

44,642,079

|

Market Approach

|

Transaction Price

Discount for Uncertainty

|

$13.03

20%

|

Increase

Decrease

|

||||||

|

Total Level 3

|

$

|

44,678,237

|

|||||||||

|

Davis International Fund

|

|||||||||||

|

Investments in Securities:

|

|||||||||||

|

Preferred Stock

|

$

|

8,721,618

|

Market Approach

|

Transaction Price

Discount for Uncertainty

|

$13.03

20%

|

Increase

Decrease

|

|||||

|

Total Level 3

|

$

|

8,721,618

|

|||||||||

|

DAVIS GLOBAL FUND

|

Notes to Financial Statements – (Continued)

|

|

DAVIS INTERNATIONAL FUND

|

October 31, 2021

|

|

Davis Global

|

Davis International

|

|||||

|

Fund

|

Fund

|

|||||

|

Cost

|

$

|

1,000,626,921

|

$

|

329,150,857

|

||

|

Unrealized appreciation

|

378,846,934

|

75,599,448

|

||||

|

Unrealized depreciation

|

(109,160,303)

|

(43,971,860)

|

||||

|

Net unrealized appreciation

|

$

|

269,686,631

|

$

|

31,627,588

|

||

|

DAVIS GLOBAL FUND

|

Notes to Financial Statements – (Continued)

|

|

DAVIS INTERNATIONAL FUND

|

October 31, 2021

|

|

Davis Global

Fund

|

Davis International

Fund

|

||||

|

Distributable earnings

|

$

|

(10,488,640)

|

$

|

–

|

|

|

Paid-in capital

|

10,488,640

|

–

|

|||

|

Ordinary

Income

|

Long-Term

Capital Gain

|

Return of

Capital

|

Total

|

||||||||

|

Davis Global Fund

|

|||||||||||

|

2021

|

$

|

626,853

|

$

|

3,473,872

|

$

|

–

|

$

|

4,100,725

|

|||

|

2020

|

21,255,788

|

95,682

|

–

|

21,351,470

|

|||||||

|

Davis International Fund

|

|||||||||||

|

2021

|

$

|

258,272

|

$

|

–

|

$

|

–

|

$

|

258,272

|

|||

|

2020

|

11,426,671

|

306,075

|

142,997

|

11,875,743

|

|||||||

|

Davis Global

Fund

|

Davis International

Fund

|

||||

|

Undistributed ordinary income

|

$

|

12,017,562

|

$

|

5,436,998

|

|

|

Undistributed long-term capital gain

|

112,555,459

|

–

|

|||

|

Accumulated net realized losses from investments

|

–

|

(37,075,782)

|

|||

|

Net unrealized appreciation on investments and foreign currency

transactions

|

269,689,287

|

31,612,607

|

|||

|

Other temporary differences

|

(39,310)

|

(11,601)

|

|||

|

Total

|

$

|

394,222,998

|

$

|

(37,778)

|

|

|

DAVIS GLOBAL FUND

|

Notes to Financial Statements – (Continued)

|

|

DAVIS INTERNATIONAL FUND

|

October 31, 2021

|

|

Davis Global

Fund

|

Davis International

Fund

|

||||

|

Cost of purchases

|

$

|

467,658,378

|

$

|

131,972,359

|

|

|

Proceeds from sales

|

451,669,083

|

68,230,971

|

|||

|

Davis Global

Fund

|

Davis International

Fund

|

|

|

n/a

|

29%

|

|

Year ended October 31, 2021

|

|||||

|

Davis Global

Fund

|

Davis International

Fund

|

||||

|

Transfer agent fees paid to Adviser

|

$

|

68,079

|

$

|

28,882

|

|

|

Accounting fees paid to Adviser

|

49,336

|

17,328

|

|||

|

DAVIS GLOBAL FUND

|

Notes to Financial Statements – (Continued)

|

|

DAVIS INTERNATIONAL FUND

|

October 31, 2021

|

|

Year ended October 31, 2021

|

|||||

|

Davis Global

Fund

|

Davis International

Fund

|

||||

|

Distribution fees:

|

|||||

|

Class C

|

$

|

875,038

|

$

|

86,884

|

|

|

Service fees:

|

|||||

|

Class A

|

560,634

|

128,024

|

|||

|

Class C

|

291,679

|

28,961

|

|||

|

Year ended October 31, 2021

|

|||||

|

Davis Global

Fund

|

Davis International

Fund

|

||||

|

Class A commissions retained by Distributor

|

$

|

31,681

|

$

|

10,415

|

|

|

Class A commissions re-allowed to investment dealers

|

169,495

|

58,570

|

|||

|

Total commissions earned on sale of Class A

|

$

|

201,176

|

$

|

68,985

|

|

|

Class C commission advances by the Distributor

|

$

|

102,457

|

$

|

33,142

|

|

|

Class C CDSCs received by the Distributor

|

7,707

|

3,531

|

|||

|

DAVIS GLOBAL FUND

|

Notes to Financial Statements – (Continued)

|

|

DAVIS INTERNATIONAL FUND

|

October 31, 2021

|

| Year ended October 31, 2021 | |||||||||||

|

Sold

|

Reinvestment of

Distributions

|

Redeemed*

|

Net Increase

(Decrease)

|

||||||||

|

Davis Global Fund

|

|||||||||||

|

Shares: Class A

|

1,197,821

|

19,689

|

(1,207,308)

|

10,202

|

|||||||

|

Class C

|

362,688

|

12,438

|

(958,142)

|

(583,016)

|

|||||||

|

Class Y

|

5,733,393

|

94,306

|

(4,999,081)

|

828,618

|

|||||||

|

Value: Class A

|

$

|

38,536,367

|

$

|

580,422

|

$

|

(38,158,210)

|

$

|

958,579

|

|||

|

Class C

|

10,797,833

|

338,569

|

(28,040,212)

|

(16,903,810)

|

|||||||

|

Class Y

|

184,310,731

|

2,791,450

|

(158,561,457)

|

28,540,724

|

|||||||

|

Davis International Fund

|

|||||||||||

|

Shares: Class A

|

2,355,630

|

–

|

(1,602,227)

|

753,403

|

|||||||

|

Class C

|

229,649

|

–

|

(280,621)

|

(50,972)

|

|||||||

|

Class Y

|

8,354,309

|

17,200

|

(9,124,341)

|

(752,832)

|

|||||||

|

Value: Class A

|

$

|

35,615,061

|

$

|

–

|

$

|

(22,675,182)

|

$

|

12,939,879

|

|||

|

Class C

|

3,310,371

|

–

|

(3,553,827)

|

(243,456)

|

|||||||

|

Class Y

|

125,954,738

|

254,208

|

(120,263,501)

|

5,945,445

|

|||||||

| Year ended October 31, 2020 | |||||||||||

|

Sold

|

Reinvestment of

Distributions

|

Redeemed*

|

Net Increase

(Decrease)

|

||||||||

|

Davis Global Fund

|

|||||||||||

|

Shares: Class A

|

1,782,976

|

152,928

|

(2,645,033)

|

(709,129)

|

|||||||

|

Class C

|

573,812

|

68,321

|

(2,012,907)

|

(1,370,774)

|

|||||||

|

Class Y

|

8,136,809

|

581,809

|

(8,629,282)

|

89,336

|

|||||||

|

Value: Class A

|

$

|

42,771,720

|

$

|

3,627,438

|

$

|

(61,036,835)

|

$

|

(14,637,677)

|

|||

|

Class C

|

12,608,043

|

1,508,523

|

(44,261,628)

|

(30,145,062)

|

|||||||

|

Class Y

|

186,978,880

|

13,835,435

|

(198,603,625)

|

2,210,690

|

|||||||

|

Davis International Fund

|

|||||||||||

|

Shares: Class A

|

552,136

|

87,842

|

(593,066)

|

46,912

|

|||||||

|

Class C

|

139,345

|

23,981

|

(320,078)

|

(156,752)

|

|||||||

|

Class Y

|

7,348,900

|

881,982

|

(6,564,394)

|

1,666,488

|

|||||||

|

Value: Class A

|

$

|

7,052,055

|

$

|

1,044,438

|

$

|

(7,074,233)

|

$

|

1,022,260

|

|||

|

Class C

|

1,672,498

|

266,906

|

(3,519,209)

|

(1,579,805)

|

|||||||

|

Class Y

|

84,716,207

|

10,336,831

|

(76,850,882)

|

18,202,156

|

|||||||

|

DAVIS GLOBAL FUND

|

Notes to Financial Statements – (Continued)

|

|

DAVIS INTERNATIONAL FUND

|

October 31, 2021

|

|

Fund

|

Security

|

Initial

Acquisition

Date

|

Units/

Shares

|

Cost per

Unit/

Share

|

Valuation per Unit/ Share

as of

October 31, 2021

|

||||||||

|

Davis Global Fund

|

ASAC II L.P.

|

10/10/13

|

35,352

|

$

|

1.00

|

$

|

1.0228

|

||||||

|

Davis Global Fund

|

DiDi Global Inc., Class A, ADS

|

06/30/21

|

2,171,148

|

$

|

7.8392

|

$

|

7.6665

|

||||||

|

Davis Global Fund

|

Grab Holdings Inc., Series F, Pfd.

|

08/24/16

|

2,398,770

|

$

|

4.8191

|

$

|

10.43

|

||||||

|

Davis Global Fund

|

Grab Holdings Inc., Series G, Pfd.

|

08/02/17

|

1,881,391

|

$

|

5.5419

|

$

|

10.43

|

||||||

|

Davis Global Fund

|

Missfresh Ltd., Class B, ADS

|

06/25/21

|

3,519,779

|

$