Exhibit 25

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM T-1

STATEMENT OF ELIGIBILITY UNDER

THE TRUST INDENTURE ACT OF 1939 OF A

CORPORATION DESIGNATED TO ACT AS TRUSTEE

| ☐ | Check if an Application to Determine Eligibility of a Trustee Pursuant to Section 305(b)(2) |

U.S. BANK NATIONAL ASSOCIATION

(Exact name of Trustee as specified in its charter)

31-0841368

I.R.S. Employer Identification No.

| 800 Nicollet Mall Minneapolis, Minnesota |

55402 | |

| (Address of principal executive offices) | (Zip Code) |

Christopher J. Grell

U.S. Bank National Association

100 Wall Street, 6th Fl.

New York, NY 10005

(212) 951-6990

(Name, address and telephone number of agent for service)

The New York Times Company

(Issuer with respect to the Securities)

| New York | 13-1102020 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 620 Eigth Avenue New York, New York |

10018 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Debt Securities

(Title of the Indenture Securities)

FORM T-1

| Item 1. | GENERAL INFORMATION. Furnish the following information as to the Trustee. |

| a) | Name and address of each examining or supervising authority to which it is subject. |

Comptroller of the Currency

Washington, D.C.

| b) | Whether it is authorized to exercise corporate trust powers. |

Yes

| Item 2. | AFFILIATIONS WITH OBLIGOR. If the obligor is an affiliate of the Trustee, describe each such affiliation. |

None

| Items 3-15 | Items 3-15 are not applicable because to the best of the Trustee’s knowledge, the obligor is not in default under any Indenture for which the Trustee acts as Trustee. |

| Item 16. | LIST OF EXHIBITS: List below all exhibits filed as a part of this statement of eligibility and qualification. |

| 1. | A copy of the Articles of Association of the Trustee.* |

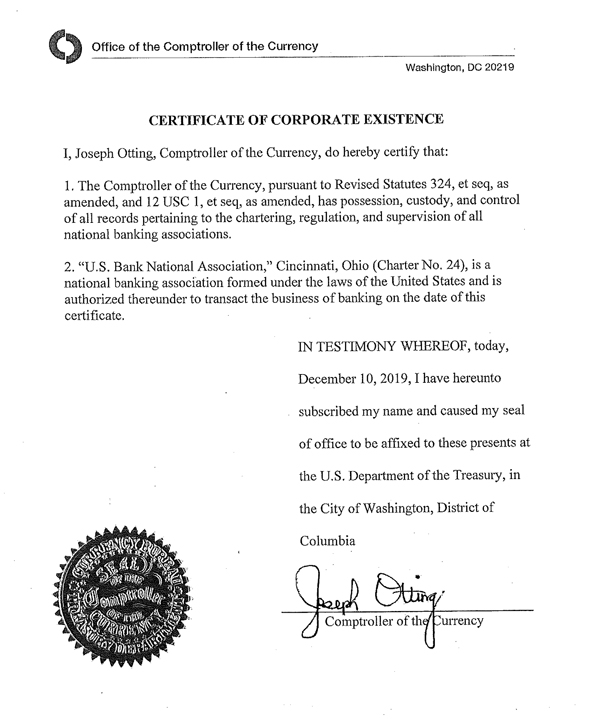

| 2. | A copy of the certificate of authority of the Trustee to commence business, attached as Exhibit 2. |

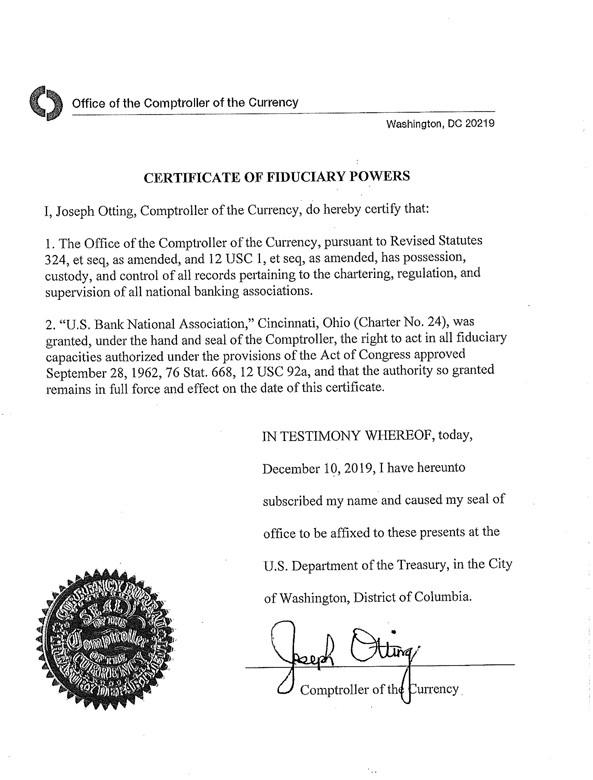

| 3. | A copy of the certificate of authority of the Trustee to exercise corporate trust powers, attached as Exhibit 3. |

| 4. | A copy of the existing bylaws of the Trustee.** |

| 5. | A copy of each Indenture referred to in Item 4. Not applicable. |

| 6. | The consent of the Trustee required by Section 321(b) of the Trust Indenture Act of 1939, attached as Exhibit 6. |

| 7. | Report of Condition of the Trustee as of December 31, 2019 published pursuant to law or the requirements of its supervising or examining authority, attached as Exhibit 7. |

| * | Incorporated by reference to Exhibit 25.1 to Amendment No. 2 to registration statement on S-4, Registration Number 333-128217 filed on November 15, 2005. |

| ** | Incorporated by reference to Exhibit 25.1 to registration statement on form S-3ASR, Registration Number 333-199863 filed on November 5, 2014. |

2

SIGNATURE

Pursuant to the requirements of the Trust Indenture Act of 1939, as amended, the Trustee, U.S. BANK NATIONAL ASSOCIATION, a national banking association organized and existing under the laws of the United States of America, has duly caused this statement of eligibility and qualification to be signed on its behalf by the undersigned, thereunto duly authorized, all in the City of New York in the State of New York on the 26th day of February, 2020.

| By: |

/s/ Christopher J. Grell | |

| Christopher J. Grell | ||

| Vice President | ||

3

Exhibit 2

4

Exhibit 3

5

Exhibit 6

CONSENT

In accordance with Section 321(b) of the Trust Indenture Act of 1939, the undersigned, U.S. BANK NATIONAL ASSOCIATION hereby consents that reports of examination of the undersigned by Federal, State, Territorial or District authorities may be furnished by such authorities to the Securities and Exchange Commission upon its request therefor.

Dated: February 26, 2020

| By: | /s/ Christopher J. Grell | |

| Christopher J. Grell | ||

| Vice President | ||

6

Exhibit 7

U.S. Bank National Association

Statement of Financial Condition

As of 12/31/2019

($000’s)

| 12/31/2019 | ||||

| Assets |

||||

| Cash and Balances Due From |

$ | 22,256,667 | ||

| Depository Institutions |

||||

| Securities |

120,982,766 | |||

| Federal Funds |

881,341 | |||

| Loans & Lease Financing Receivables |

297,660,359 | |||

| Fixed Assets |

5,895,381 | |||

| Intangible Assets |

12,915,451 | |||

| Other Assets |

25,412,255 | |||

|

|

|

|||

| Total Assets |

$ | 486,004,220 | ||

| Liabilities |

||||

| Deposits |

$ | 374,303,872 | ||

| Fed Funds |

1,094,396 | |||

| Treasury Demand Notes |

0 | |||

| Trading Liabilities |

769,407 | |||

| Other Borrowed Money |

41,653,916 | |||

| Acceptances |

0 | |||

| Subordinated Notes and Debentures |

3,850,000 | |||

| Other Liabilities |

14,940,126 | |||

|

|

|

|||

| Total Liabilities |

$ | 436,611,717 | ||

| Equity |

||||

| Common and Preferred Stock |

18,200 | |||

| Surplus |

14,266,915 | |||

| Undivided Profits |

34,306,761 | |||

| Minority Interest in Subsidiaries |

800,627 | |||

|

|

|

|||

| Total Equity Capital |

$ | 49,392,503 | ||

| Total Liabilities and Equity Capital |

$ | 486,004,220 | ||

7