UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

|

| |

o | Preliminary Proxy Statement |

|

| |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

| |

x | Definitive Proxy Statement |

|

| |

o | Definitive Additional Materials |

|

| |

o | Soliciting Material Pursuant to §240.14a-12 |

|

| | | | |

THE NEW YORK TIMES COMPANY |

(Name of Registrant as Specified In Its Charter) |

|

| | | | |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

|

| |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

| | |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

|

| |

o | Fee paid previously with preliminary materials. |

|

| |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

| | |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

|

|

|

620 Eighth Avenue New York, NY 10018 tel 212-556-1234 |

Invitation to 2020 Annual Meeting of Stockholders

|

| |

DATE: | Wednesday, April 22, 2020 |

TIME: | 9:00 a.m. |

PLACE: | The New York Times Building |

| 620 Eighth Avenue, 15th Floor, New York, NY 10018 |

March 13, 2020

Dear Fellow Stockholder:

Please join me at our Annual Meeting on Wednesday, April 22, 2020, which will be held at 9:00 a.m. on the 15th floor of the Company’s headquarters building. At the meeting, you will be asked to vote on the election of the Board of Directors, the adoption of a new incentive compensation plan and the ratification of the selection of auditors. In addition, our Class B stockholders will be asked to vote on an advisory resolution on executive compensation.

You will have an opportunity at the meeting to ask questions and express your views to the senior management of the Company. Members of the Board of Directors will also be present.

We are furnishing our proxy materials to stockholders primarily electronically. On or about March 13, 2020, we will begin mailing a Notice of Internet Availability of Proxy Materials to stockholders informing you that the Proxy Statement, the 2019 Annual Report and voting instructions are available online. As more fully described in that Notice, stockholders also may request paper copies of the proxy materials.

As part of our precautions regarding the coronavirus (COVID-19), we are sensitive to the public health and travel concerns that our stockholders may have, as well as any protocols that federal, state and local governments may impose. In the event we determine it is necessary or appropriate to take additional steps regarding how we conduct our meeting, we will announce this decision in advance, and details will be posted on our website and filed with the SEC.

Whether or not you are able to attend the Annual Meeting in person, it is important that your shares be represented. Please vote your shares (i) electronically, (ii) by phone or (iii) by mail. Instructions on each of these voting methods are outlined in the enclosed Proxy Statement. Please vote as soon as possible.

I hope to see you on April 22nd.

ARTHUR SULZBERGER, JR.

Chairman of the Board

|

|

|

620 Eighth Avenue New York, NY 10018 tel 212-556-1234 |

Notice of Annual Meeting of Stockholders

To be held Wednesday, April 22, 2020

To the Holders of Class A and Class B

Common Stock of The New York Times Company: The Annual Meeting of Stockholders of The New York Times Company will be held at 9:00 a.m., local time, on Wednesday, April 22, 2020, at The New York Times Building, 620 Eighth Avenue, 15th Floor, New York, NY 10018, for the following purposes:

| |

1. | To elect a Board of 12 members; |

| |

2. | To act upon a proposal to adopt The New York Times Company 2020 Incentive Compensation Plan; |

| |

3. | To hold an advisory vote to approve executive compensation; |

| |

4. | To ratify the selection of Ernst & Young LLP, an independent registered public accounting firm, as auditors for the fiscal year ending December 27, 2020; and |

| |

5. | To transact such other business as may properly come before the meeting. |

Holders of the Class A and Class B common stock as of the close of business on February 26, 2020, are entitled to notice of, and to attend, this meeting as set forth in the Proxy Statement. Class A stockholders are entitled to vote for the election of four of the 12 directors. Class B stockholders are entitled to vote for the election of eight of the 12 directors and on the advisory resolution to approve executive compensation. Class A and Class B stockholders, voting together as a single class, are entitled to vote on the proposals to adopt The New York Times Company 2020 Incentive Compensation Plan and to ratify the selection of Ernst & Young LLP as auditors for the 2020 fiscal year. Class B stockholders are entitled to vote on any other matters presented at the meeting. Your vote is important. Whether or not you plan to attend the meeting in person, please vote as promptly as possible using the internet or the designated toll-free telephone number, or by requesting a printed copy of the proxy materials and returning by mail the proxy card you receive in response to your request. New York, NY

March 13, 2020

By Order of the Board of Directors

DIANE BRAYTON

Executive Vice President, General Counsel and Secretary

Proxy Statement Summary

This summary highlights certain information contained in this proxy statement. You should read the entire proxy statement carefully before voting.

ANNUAL MEETING OF STOCKHOLDERS

|

| |

Date: | April 22, 2020 |

Time: | 9:00 a.m. |

Location: | The New York Times Building 620 Eighth Avenue, 15th Floor New York, NY 10018 |

VOTING MATTERS |

| | | |

Proposal | Board Recommendation | More Information |

1. Election of Board of Directors of the Company | For | p. 14 |

Class A stockholders | Class B stockholders | |

Robert E. Denham

Rachel Glaser

John W. Rogers, Jr. Rebecca Van Dyck

| Amanpal S. Bhutani Hays N. Golden Brian P. McAndrews David Perpich A.G. Sulzberger Arthur Sulzberger, Jr. Mark Thompson Doreen Toben | |

2. Adoption of The New York Times Company 2020 Incentive Compensation Plan (Class A and B stockholders) | For | p.63 |

3. Advisory vote to approve executive compensation (Class B stockholders) | For | p.73 |

4. Ratification of selection of Ernst & Young LLP as auditors for fiscal year ending December 27, 2020 (Class A and B stockholders) | For | p.74 |

CORPORATE GOVERNANCE HIGHLIGHTS

The Company is committed to strong corporate governance, a critical component of our corporate culture. Below are certain highlights of our governance practices. More information can be found beginning on page 20.

|

| | | |

l | Annual election of all directors | l | Ethics policies for all directors and employees |

l | Commitment to Board refreshment, with five new non-employee directors since the beginning of 2015. | l | Director/executive stock ownership requirements |

l | Retirement policy for non-employee directors of the earlier of age 75 and 20 years of service | l | Robust director nominee selection process |

l | Annual rotation of independent directors elected by Class A stockholders | l | No hedging/pledging of Company stock |

l | Independent Audit, Compensation and Nominating & Governance Committees | l | Clawback policy that applies to performance-based cash and equity compensation |

l | Active lead independent director as Presiding Director | l | Comprehensive director orientation |

l

| Annual Board and Committee self-evaluation process | l | Regular outreach to significant Class A stockholders on various matters |

l

| Regular executive sessions of non-employee directors and independent directors | | |

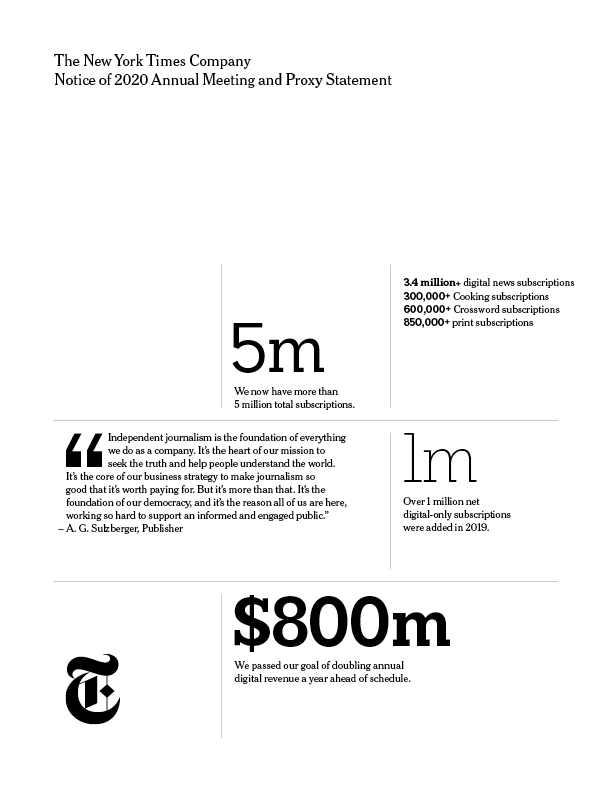

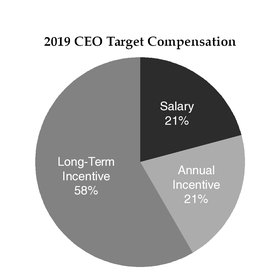

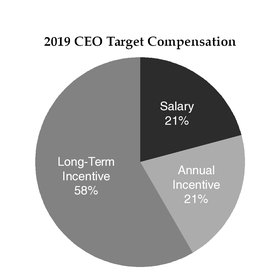

EXECUTIVE COMPENSATION HIGHLIGHTS

The Company’s executive compensation program is designed to support business performance and drive long-term stockholder value. Below are certain highlights of our 2019 executive compensation program. More information can be found beginning on page 35.

|

| | | |

Pay for Performance |

l | Significant portion of named executive officers’ target compensation is performance-based – Approximately 79% for CEO – Approximately 66% for other NEOs | l | Under financial metric of annual incentive compensation, above-target compensation paid only for above-target Company performance |

l | Significant portions of annual and long-term incentive compensation tied to performance against pre-established, measurable financial performance goals | l | Under total stockholder return metric of long-term incentive compensation, above-target compensation paid only for above-median Company performance and no payout for lower quartile performance |

|

| | | |

Executive Compensation Governance |

What We Do |

ü | Align pay and performance (see above) | ü | Set meaningful stock ownership guidelines for executive officers (2-5x annual base salary) |

ü

| Engage with significant Class A stockholders periodically on executive compensation matters | ü | Have a clawback policy that applies to performance-based cash and equity compensation paid to executive officers |

ü | Annual Compensation Committee benchmarking review of compensation of Company executives with the Committee’s independent compensation consultant | ü | Perform annual risk assessment of executive compensation program |

ü | Hold an annual “say-on-pay” advisory vote | | |

What We Do Not Do |

û | No tax “gross-ups” for executive officers | û

| No employment agreements with named executive officers |

û | No significant perks for executive officers | û | No individual change in control agreements |

û | No hedging/pledging of Company stock | | |

STOCKHOLDER OUTREACH

Management engages in regular outreach to representatives of significant holders of our Class A common stock to solicit their feedback on corporate governance and executive compensation matters. In fall 2019, we solicited feedback from investors representing approximately 75% of our outstanding Class A common stock, and engaged with institutional investors representing over 50% of our outstanding Class A common stock on a variety of topics, including the Company’s executive compensation program and corporate governance practices. Stockholder feedback was summarized and shared with the Board of Directors.

Table of Contents

|

| |

| Page |

| |

| |

| |

| |

| |

| |

| |

| |

DELINQUENT SECTION 16(a) REPORTS | |

| |

| |

| |

| |

RELATED PERSON TRANSACTIONS | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

CEO Pay Ratio | |

| 63 |

Background | |

Certain Key Provisions | |

Determination of Shares to be Available for Issuance | |

Description of the 2020 Plan | |

U.S. Federal Income Tax Implications of the 2020 Plan | |

|

| |

New Plan Benefits under the 2020 Plan | |

Equity Compensation Plan Information | |

Recommendation and Vote Required | |

PROPOSAL NUMBER 3—ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION | |

PROPOSAL NUMBER 4—SELECTION OF AUDITORS | |

| |

Stockholder Proposals for the 2021 Annual Meeting | 76 |

| 76 |

| A-1 |

APPENDIX B—THE NEW YORK TIMES COMPANY 2020 INCENTIVE COMPENSATION PLAN | B-1 |

The New York Times Company

Proxy Statement

Annual Meeting of Stockholders to be Held on April 22, 2020

VOTING ON MATTERS BEFORE THE ANNUAL MEETING | |

A: | Stockholders are asked to vote on four items at the 2020 Annual Meeting: |

| |

• | Proposal 1: Election of the Board of Directors of The New York Times Company (the “Board”). |

| |

• | Proposal 2: Adoption of The New York Times Company 2020 Incentive Compensation Plan (the “2020 Incentive Plan”). |

| |

• | Proposal 3: Advisory vote to approve executive compensation (the “say-on-pay” vote). |

| |

• | Proposal 4: Ratification of the selection of Ernst & Young LLP as auditors for the fiscal year ending December 27, 2020. |

| |

Q: | How does the Board of Directors recommend voting? |

| |

A: | The Board of Directors recommends voting: |

| |

• | FOR each nominee to the Board; |

| |

• | FOR the adoption of the 2020 Incentive Plan; |

| |

• | FOR the approval, on an advisory basis, of the executive compensation of our named executive officers; and |

The Audit Committee of the Board recommends voting:

| |

• | FOR ratification of Ernst & Young LLP as auditors for the fiscal year ending December 27, 2020. |

| |

Q: | Who is entitled to vote? |

| |

A: | The New York Times Company has two classes of outstanding voting securities: Class A common stock, $.10 par value per share (“Class A stock”) and Class B common stock, $.10 par value per share (“Class B stock”). Stockholders of record of Class A stock or Class B stock as of the close of business on February 26, 2020, may vote at the 2020 Annual Meeting. As of February 26, 2020, there were 165,852,671 shares of Class A stock and 803,404 shares of Class B stock outstanding. Each share of stock is entitled to one vote. |

| |

• | Proposal 1: Class A stockholders vote for the election of four of the 12 director nominees. Class B stockholders vote for the election of eight of the 12 director nominees. |

| |

• | Proposal 2: Class A and B stockholders, voting together as a single class, vote on this proposal. |

| |

• | Proposal 3: Class B stockholders vote on this proposal. |

| |

• | Proposal 4: Class A and B stockholders, voting together as a single class, vote on this proposal. |

| |

Q: | Why did I receive a notice in the mail regarding the Internet availability of the proxy materials instead of a paper copy of the proxy materials? |

| |

A: | The Notice of Internet Availability of Proxy Materials (the “Notice”) that we mail to our stockholders (other than those who previously requested printed copies or electronic delivery) directs you to a website where you can access our proxy materials and view instructions on how to vote. By furnishing this Proxy Statement and our 2019 Annual Report to our stockholders by providing access to these documents on the Internet rather than mailing printed copies, we save natural resources and reduce printing and distribution costs, while providing a convenient way to access the materials and vote. If you would prefer to receive a paper copy of these materials, please follow the instructions included in the Notice. |

THE NEW YORK TIMES COMPANY - P. 1

| |

Q: | How do I get electronic access to the proxy materials? |

| |

A: | The Notice provides instructions on how to view the proxy materials for our Annual Meeting on the Internet. In addition, this Proxy Statement is available at http://investors.nytco.com/investors/financials/proxy-statements, and the 2019 Annual Report is available at http://investors.nytco.com/investors/financials/annual-reports. |

You can elect to receive all future stockholder communications (i.e., notices of Internet availability of proxy materials and other correspondence) electronically by email instead of in print, by choosing this delivery method in the “Investors” section of our website at http://investors.nytco.com/investors/investor-resources/annual-meeting-information. If you choose to receive future stockholder communications electronically, and we encourage you to do so, you will receive an email next year with instructions containing links to those materials and to the proxy voting site. Your election to receive stockholder communications by email will remain in effect until you terminate it or for as long as the email address you provided is valid.

| |

A: | You can vote your shares either by proxy or in person at the Annual Meeting. If you choose to vote by proxy, you may do so by using the Internet or the designated toll-free telephone number, or if you received a printed copy of the proxy materials, by mail. Whichever method you use, for your proxy to be counted, it must be received by 11:59 p.m. Eastern Time on April 21, 2020. Each of these procedures is more fully explained below. |

You can vote your shares by Internet on the voting website, http://www.proxyvote.com. Internet voting is available 24 hours a day, seven days a week. Follow the instructions and have your Notice, proxy card or voting instruction form in hand, as you will need to reference your assigned Control Number(s).

You can also vote your shares by calling the toll-free telephone number provided on the voting website, http://www.proxyvote.com, and on the proxy card. Telephone voting is available 24 hours a day, seven days a week.

If you received a printed copy of the proxy materials, you can vote by completing and returning the proxy card or voting instruction form in the envelope provided. If you received a Notice, you can request a printed copy of the proxy materials by following the instructions in the Notice. If you voted by Internet or telephone, you do not need to return your proxy card or voting instruction form.

| |

• | Voting in Person at the Annual Meeting |

If you wish to vote in person, written ballots will be available at the Annual Meeting. If you are a beneficial or street name holder, while you are invited to attend the Annual Meeting, you may only vote your shares in person at the Annual Meeting if you bring with you a legal proxy from your broker, bank or other nominee.

Even if you plan to attend the Annual Meeting, you may still cast your vote in advance using any of the methods described above.

If you are a registered holder and submit a proxy without giving instructions, your shares will be voted as recommended by the Board.

If you are a beneficial owner of shares, voting your shares is critical due to a New York Stock Exchange (“NYSE”) rule that prohibits your broker from voting your shares on Proposals 1, 2 and 3 without your instructions. See “What is a broker non-vote?”

If you have any questions about this NYSE rule or the proxy voting process in general, the U.S. Securities and Exchange Commission (the “SEC”) has a website (http://www.sec.gov/spotlight/proxymatters.shtml) with more information about your rights as a stockholder.

THE NEW YORK TIMES COMPANY - P. 2

| |

Q: | What is the difference between holding shares as a registered holder and as a beneficial owner of shares held in street name? |

| |

A: | Registered Holder. If your shares are registered directly in your name on the books of the Company maintained with the Company’s transfer agent, Computershare, Inc., you are considered the “registered holder” of those shares, and the Notice is sent directly to you by the Company. |

Beneficial Owner of Shares Held in Street Name. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner of shares held in street name” (also called a “street name holder”), and the Notice is forwarded to you by your broker, bank or other nominee. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote the shares held in your account.

| |

Q: | What are the procedures for attending the Annual Meeting? |

| |

A: | All stockholders as of the record date and members of their immediate families are welcome to attend the Annual Meeting. If you attend, please note that you will be asked to present government-issued identification (such as a driver’s license or passport) and evidence of your share ownership on the record date. This can be the Notice, your proxy card, a brokerage statement or letter from a bank or broker indicating ownership on February 26, 2020, your voting instruction form, or a legal proxy provided by your broker, bank or other nominee. |

We will have in place customary security measures, which may include a bag search. The use of cameras, cellphones or other recording devices will not be allowed.

As part of our precautions regarding the coronavirus (COVID-19), we are sensitive to the public health and travel concerns that our stockholders may have, as well as any protocols that federal, state and local governments may impose. In the event we determine it is necessary or appropriate to take additional steps regarding how we conduct our meeting, we will announce this decision in advance, and details will be posted on our website and filed with the SEC.

You do not need to attend the Annual Meeting to vote. See “How do I cast my vote?” above.

| |

Q: | How will my stock be voted on other business brought up at the Annual Meeting? |

| |

A: | By submitting your proxy, you authorize the persons named as proxies to use their discretion in voting on any other matter brought before the Annual Meeting. The Company does not know of any other business to be considered at the Annual Meeting. |

| |

Q: | Can I change my vote or revoke my proxy? |

| |

A: | Yes. If you are a registered holder, you can change your vote or revoke your proxy at any time before it is voted at the Annual Meeting, subject to the voting deadlines that are described on the proxy card or voting instruction form, as applicable, by submitting a later-dated proxy (either by mail, telephone or Internet) or by voting by ballot at the Annual Meeting. |

If you are a beneficial owner of shares, you can submit new voting instructions by contacting your broker, bank or other nominee. You can also vote in person at the Annual Meeting if you obtain a legal proxy as described above.

| |

Q: | What is the quorum requirement for the Annual Meeting? |

| |

A: | The holders of record of a majority of the Company’s shares of stock issued and outstanding on the record date and entitled to vote, in person or by proxy, constitute a quorum for the transaction of business at the Annual Meeting. However, the Certificate of Incorporation of the Company provides that Class A stockholders, voting separately, are entitled to elect 30% of the Board of Directors (or the nearest larger whole number) and Class B stockholders, voting separately, are entitled to elect the balance of the Board of Directors. Accordingly, with respect to the election of directors, the holders of a majority of the shares of each of the Class A and Class B stock, respectively, constitute a quorum for the election of the Board of Directors. In addition, only Class B stockholders are entitled to vote on the advisory say-on-pay vote to approve executive compensation. Accordingly, the holders of a majority of the shares of Class B stock constitute a quorum for this proposal. Broker non-votes and abstentions (as described below) are counted as present for establishing a quorum. |

THE NEW YORK TIMES COMPANY - P. 3

| |

Q: | What is the voting requirement to elect the directors and to approve each of the other proposals? |

| |

A: | The voting requirements are as follows: |

| |

• | Proposal 1: Directors are elected by a plurality of the votes cast. However, please see our policy described on page 21 regarding directors who do not receive more “for” votes than “withheld” votes. |

| |

• | Proposal 2: Approval of the 2020 Incentive Plan requires the affirmative vote of a majority of the shares of Class A and Class B stock represented at the Annual Meeting, in person or by proxy, and entitled to vote on the proposal, voting together as a single class. |

| |

• | Proposal 3: The advisory say-on-pay vote to approve executive compensation requires, pursuant to the Company’s By-laws, the affirmative vote of a majority of the shares of Class B stock represented at the Annual Meeting, in person or by proxy, and entitled to vote on the proposal. |

| |

• | Proposal 4: Ratification of the selection of Ernst & Young LLP as auditors for the fiscal year ending December 27, 2020, requires, pursuant to the Company’s By-laws, the affirmative vote of a majority of the shares of Class A and Class B stock represented at the Annual Meeting, in person or by proxy, and entitled to vote on the proposal, voting together as a single class. |

| |

Q: | What is a broker non-vote? |

| |

A: | If you are a beneficial owner whose shares are held by a broker, bank or other nominee, you must instruct the broker, bank or other nominee how to vote your shares. If you do not provide voting instructions, your shares will not be voted on proposals on which brokers do not have discretionary authority, namely: Proposal 1 (election of the Board of Directors), Proposal 2 (approval of the 2020 Incentive Plan) and Proposal 3 (advisory vote to approve executive compensation). This is called a “broker non-vote.” Your shares will be counted as present at the meeting for quorum purposes but not present and entitled to vote for purposes of these specific proposals. Therefore, it is very important that beneficial owners instruct their broker, bank or other nominee how they wish to vote their shares. |

If you do not provide your broker, bank or other nominee with voting instructions with respect to Proposal 4 (ratification of the selection of Ernst & Young LLP as auditors for the fiscal year ending December 27, 2020), your broker, bank or other nominee has discretion to vote your shares on this proposal, which is considered a “routine” management proposal.

| |

Q: | How will broker non-votes, withheld votes and abstentions affect the voting results? |

| |

A: | Pursuant to the Company’s By-laws, withheld votes and broker non-votes will have no effect on the election of directors; broker non-votes will have no effect on Proposal 2 or advisory Proposal 3; and abstentions will have the same effect as votes against Proposal 2, advisory Proposal 3 and Proposal 4. |

| |

Q: | Who pays for the solicitation of proxies and how are they solicited? |

| |

A: | Proxies are solicited by our Board of Directors. The Company bears the costs of the solicitation of the proxies on behalf of the Board of Directors. Our directors, officers or employees may solicit proxies in person or by mail, telephone, facsimile or electronic transmission. The costs associated with the solicitation of proxies include the cost of preparing, printing and mailing our proxy materials, the Notice and any other information we send to stockholders. |

We also pay banks, brokers and other persons representing beneficial owners of shares held in street name certain fees associated with forwarding our proxy materials and obtaining beneficial owners’ voting instructions. We reimburse those firms for their reasonable expenses in accordance with applicable rules. In addition, we have engaged Alliance Advisors, LLC to assist in soliciting proxies for an estimated fee of $12,500, plus out-of-pocket expenses and certain administrative fees.

| |

Q: | Who will serve as inspector of election? |

| |

A: | We have engaged Broadridge Financial Solutions, Inc. as the independent inspector of election to tabulate stockholder votes at the Annual Meeting. |

THE NEW YORK TIMES COMPANY - P. 4

GLOSSARY OF CERTAIN TERMS To improve the readability of this Proxy Statement, we use certain shortened “defined terms” to refer to various terms that are used frequently. These defined terms are generally provided the first time the longer term appears in the text and, for your convenience, certain defined terms are also set forth below.

“1997 Trust” means the trust created in 1997 by the four children of Iphigene Ochs Sulzberger (Marian S. Heiskell, Ruth S. Holmberg, Judith P. Sulzberger and Arthur Ochs Sulzberger (the “Grantors”)) for the benefit of each of the Grantors and his or her family;

“2010 Incentive Plan” means The New York Times Company 2010 Incentive Compensation Plan;

“2020 Incentive Plan” means The New York Times Company 2020 Incentive Compensation Plan, which is proposed for approval under Proposal 2;

“Class A stock” means the Company’s Class A Common Stock, $.10 par value per share;

“Class B stock” means the Company’s Class B Common Stock, $.10 par value per share;

“Company” means The New York Times Company;

“Exchange Act” means the Securities Exchange Act of 1934, as amended;

“NYSE” means the New York Stock Exchange;

“say-on-pay vote” means the advisory vote to approve executive compensation under Proposal 3;

“SEC” means the U.S. Securities and Exchange Commission;

“Trustees” means the current trustees of the 1997 Trust: Theresa Dryfoos, David Golden, Gertrude A.L. Golden, Hays N. Golden, David Perpich, A.G. Sulzberger, Arthur Sulzberger, Jr. and Margot Golden Tishler; and their successors.

_________________________________________________________

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 22, 2020.

This Proxy Statement is available at http://investors.nytco.com/investors/financials/proxy-statements, and the 2019 Annual Report is available at http://investors.nytco.com/investors/financials/annual-reports.

THE NEW YORK TIMES COMPANY - P. 5

WHERE TO FIND MORE INFORMATION ON THE NEW YORK TIMES COMPANY Documents Filed with the Securities and Exchange Commission

This Proxy Statement is accompanied by our 2019 Annual Report, which includes our Annual Report on Form 10-K for the fiscal year ended December 29, 2019, which we have previously filed with the SEC and which includes audited financial statements.

You can obtain any of the documents we file with the SEC (including our Annual Report on Form 10-K for the fiscal year ended December 29, 2019). To obtain documents from us, please direct requests in writing or by telephone to:

The New York Times Company

620 Eighth Avenue

New York, NY 10018

Phone: (212) 556-1234

Attention: Corporate Secretary

We will send you the requested documents without charge, excluding exhibits.

Additional Information

There are a number of other sources for additional information on The New York Times Company:

SEC. We file reports, proxy statements and other information with the SEC, which can be accessed through the SEC’s website (http://www.sec.gov).

NYSE. The Class A stock of The New York Times Company is listed on the NYSE, and reports and other information on the Company can be reviewed at the office of the NYSE at 11 Wall Street, New York, NY 10005.

The New York Times Company website. Our website at http://www.nytco.com provides ongoing information about the Company and its performance, including documents filed with the SEC. In addition, printable versions of the following materials can be found on the Corporate Governance section of our website at http://investors.nytco.com/investors/corporate-governance:

— Corporate Governance Principles

— Board Committee Charters:

•Audit Committee

•Compensation Committee

•Finance Committee

•Nominating & Governance Committee

— Code of Ethics for the Executive Chairman, Chief Executive Officer and Senior Financial Officers

— Code of Ethics for Directors

— Business Ethics Policy

— Policy on Transactions with Related Persons

— Procedures Regarding Communications by Security Holders and Other Interested Parties to the Board of Directors

Please note that information contained on our website does not constitute part of this Proxy Statement. |

| | | | |

IMPORTANT NOTE: |

This Proxy Statement is dated March 13, 2020. You should not assume that the information contained in this Proxy Statement is accurate as of any date other than such date, and the furnishing of this Proxy Statement to stockholders shall not create any implication to the contrary. |

THE NEW YORK TIMES COMPANY - P. 6

The 1997 Trust

Since the purchase of The New York Times newspaper by Adolph S. Ochs in 1896, control of The New York Times and related properties has rested with his family. Family members have taken an active role in the stewardship and management of The New York Times Company. The position of Publisher of The New York Times has been held by various family members, from Adolph S. Ochs to the current Publisher, A.G. Sulzberger, who also serves as a member of the Company’s Board.

In February 1990, on the death of Adolph S. Ochs’s daughter, Iphigene Ochs Sulzberger (“Mrs. Sulzberger”), control passed to her four children through the automatic termination of a trust established by Mr. Ochs. That trust held 83.7% of the Class B stock of the Company, which is not publicly traded. Holders of Class B stock have the right to elect approximately 70% of the Board of Directors. Mrs. Sulzberger’s four children, all of whom are deceased, were: Marian S. Heiskell, Ruth S. Holmberg, Judith P. Sulzberger and Arthur Ochs Sulzberger (each a “Grantor,” and collectively, the “Grantors”).

In 1997, the Grantors executed an indenture creating a trust (the “1997 Trust”) for the benefit of each Grantor and his or her family, and entered into a first amendment to the indenture on December 14, 2000 (the indenture and first amendment thereto are collectively referred to as the “Trust Indenture”). The Grantors transferred to the 1997 Trust all shares of Class B stock previously held by the trust established by Adolph S. Ochs, together with a number of shares of Class A stock. The 1997 Trust currently holds 738,810 shares of Class B stock and 1,400,000 shares of Class A stock. The primary objective of the 1997 Trust is to maintain the editorial independence and the integrity of The New York Times and to perpetuate it “as an independent newspaper, entirely fearless, free of ulterior influence and unselfishly devoted to the public welfare” (the “primary objective of the 1997 Trust”) in accordance with the wishes of Adolph S. Ochs as expressed in his will.

The current trustees of the 1997 Trust are Theresa Dryfoos, David Golden, Gertrude A.L. Golden, Hays N. Golden, David Perpich, A.G. Sulzberger, Arthur Sulzberger, Jr. and Margot Golden Tishler (each a “Trustee,” and collectively, together with their successors, the “Trustees”).

The Trust Indenture is subject to the terms and provisions of a 1986 shareholders agreement (the “Shareholders Agreement”) among the Grantors, their children and the Company, which restricts the transfer of Class B stock that is held by the 1997 Trust by requiring, prior to any sale or transfer, the offering of those shares among the other family stockholders and then to the Company at the Class A stock market price then prevailing (or if the Company is the purchaser, at the option of the selling stockholder, in exchange for Class A stock on a share-for-share basis). The Shareholders Agreement provides for the conversion of such shares into Class A stock if the purchase rights are not exercised by the family stockholders or the Company and such shares of Class A stock are to be transferred to a person or persons other than family stockholders or the Company. There are certain exceptions for gifts and other transfers among the descendants of Adolph S. Ochs, provided that the recipients become parties to the Shareholders Agreement.

In addition, the Shareholders Agreement provides that, if the Company is a party to a merger (other than a merger solely to change the Company’s jurisdiction of incorporation), consolidation or plan of liquidation in which such Class B stock is exchanged for cash, stock, securities or any other property of the Company or of any other corporation or entity, each signing stockholder will convert his or her shares of such Class B stock into Class A stock prior to the effective date of such transaction so that a holder of such shares will receive the same cash, stock or other consideration that a holder of Class A stock would receive in such a transaction. Except for the foregoing, each signing stockholder has agreed not to convert any shares of such Class B stock received from a trust created under the will of Adolph S. Ochs into Class A stock. The Shareholders Agreement will terminate upon the expiration of 21 years after the death of the last remaining survivor of all descendants of Mrs. Sulzberger living on August 5, 1986.

The Trustees, subject to the limited exceptions described below, are directed to retain the Class B stock held in the 1997 Trust and not to sell, distribute or convert such shares into Class A stock and to vote such Class B stock against any merger, sale of assets or other transaction pursuant to which control of The New York Times passes from the Trustees, unless they determine that the primary objective of the 1997 Trust can be best achieved by the sale, distribution or conversion of such stock or by the implementation of such transaction. If, upon such determination, any Class B stock is distributed to the beneficiaries of the 1997 Trust, it must be distributed only to descendants of

THE NEW YORK TIMES COMPANY - P. 7

Mrs. Sulzberger, subject to the provisions of the Shareholders Agreement (if it is still in effect). Similarly, any sale by the 1997 Trust of Class B stock upon such determination can be made only in compliance with the Shareholders Agreement.

The Trustees are granted various powers and rights, including among others: (i) to vote all of the shares of Class A and Class B stock held by the 1997 Trust; (ii) to nominate the successor Trustees who may also serve on the Company’s Board of Directors; and (iii) to amend certain provisions of the Trust Indenture, but not the provisions relating to retaining the Class B stock or the manner in which such shares may be distributed, sold or converted. The Trust Indenture provides for eight Trustees. All actions of the Trustees require the affirmative vote of six of the eight Trustees. Any Trustee may be removed without cause by a vote of six Trustees. In general, the Trustees will appoint four of the Trustees and the beneficiaries of the 1997 Trust will elect the remaining four Trustees.

The 1997 Trust will continue in existence until the expiration of 21 years after the death of the last survivor of all of the descendants of Mrs. Sulzberger then living on December 14, 2000. Upon the termination of the 1997 Trust at the end of the stated term thereof, all of the trust property, including the shares of Class A and Class B stock held by the 1997 Trust, will be distributed to the descendants of Mrs. Sulzberger then living.

The Company has been informed by representatives of the Ochs-Sulzberger family that, as of February 26, 2020, the aggregate holdings of the 1997 Trust and an additional entity controlled by descendants of Mrs. Sulzberger represented approximately 92 percent of the Company’s Class B stock and 3.4 percent of the Company’s Class A stock. These amounts do not include the personal holdings of the more than 80 individual members of the Ochs-Sulzberger family, many of which are sizable.

THE NEW YORK TIMES COMPANY - P. 8

PRINCIPAL HOLDERS OF COMMON STOCK The following table sets forth the only persons who, to the knowledge of management, owned beneficially on February 26, 2020, more than 5% of the outstanding shares of either Class A stock or Class B stock:

|

| | | | | | | | |

| |

Name and Address | Shares of Class A Stock | Percent of Class A Stock | Shares of Class B Stock | Percent of Class B Stock |

1997 Trust1,2 620 Eighth Avenue

New York, NY 10018 | 2,138,810 |

| 1.3 | % | 738,810 |

| 92.0 | % |

Theresa Dryfoos1,2,3 620 Eighth Avenue

New York, NY 10018 | 2,153,234 |

| 1.3 | % | 741,780 |

| 92.3 | % |

David Golden1,2,4 620 Eighth Avenue

New York, NY 10018 | 2,145,857 |

| 1.3 | % | 738,810 |

| 92.0 | % |

Gertrude A.L. Golden1,2,5 620 Eighth Avenue

New York, NY 10018 | 2,230,812 |

| 1.3 | % | 740,521 |

| 92.2 | % |

Hays N. Golden1,2,6 620 Eighth Avenue

New York, NY 10018 | 2,221,511 |

| 1.3 | % | 738,810 |

| 92.0 | % |

David Perpich1,2,7 620 Eighth Avenue

New York, NY 10018 | 2,273,864 |

| 1.4 | % | 741,615 |

| 92.3 | % |

A.G. Sulzberger1,2,8 620 Eighth Avenue

New York, NY 10018 | 2,184,787 |

| 1.3 | % | 738,810 |

| 92.0 | % |

Arthur Sulzberger, Jr.1,2,9 620 Eighth Avenue

New York, NY 10018 | 2,949,302 |

| 1.8 | % | 740,662 |

| 92.2 | % |

Margot Golden Tishler1,2,10 620 Eighth Avenue

New York, NY 10018 | 2,196,130 |

| 1.3 | % | 738,810 |

| 92.0 | % |

Carlos Slim Helú11 Paseo de las Palmas 736

Colonia Lomas de Chapultepec

11000 México, D.F., México | 16,197,175 |

| 9.8 | % | | |

The Vanguard Group12

100 Vanguard Boulevard

Malvern, PA 19355 | 13,960,892 |

| 8.4 | % | | |

Jackson Square Partners, LLC13

101 California Street, Suite 3750

San Francisco, CA 94111 | 13,922,765 |

| 8.4 | % | | |

BlackRock, Inc.14 55 East 52nd Street New York, NY 10055 | 13,195,727 |

| 8.0 | % | | |

Darsana Capital Partners LP15 40 West 57th Street, 15th Floor New York, NY 10019 | 12,000,000 |

| 7.2 | % | | |

| Footnotes appear on following pages. |

THE NEW YORK TIMES COMPANY - P. 9

| |

1. | Includes 1,400,000 shares of Class A stock and 738,810 shares of Class A stock issuable upon the conversion of 738,810 shares of Class B stock directly owned by the 1997 Trust. Each of the Trustees of the 1997 Trust shares voting and investment power with respect to the shares owned by the 1997 Trust. Therefore, under SEC regulations, each may be deemed a beneficial owner of the shares held by the 1997 Trust. Such shares are therefore included in the amounts listed in this table for each Trustee. As a result of this presentation, there are substantial duplications in the number of shares and percentages shown in the table. By virtue of their being Trustees of the 1997 Trust, the Trustees could be deemed to comprise a “group” within the meaning of SEC regulations. Such group is the beneficial owner in the aggregate of 3,383,827 shares of Class A stock, representing approximately 2.0% of the outstanding shares of Class A stock. This amount includes those shares directly held by the 1997 Trust, as well as (i) 837,858 shares of Class A stock directly or indirectly held by individual Trustees; (ii) 9,338 shares of Class A stock issuable upon the conversion of 9,338 shares of Class B stock held directly or indirectly by individual Trustees; (iii) 24,224 shares of Class A stock underlying restricted stock units awarded under the Company’s 2010 Incentive Compensation Plan (the “2010 Incentive Plan”) that have vested or will vest within 60 days; and (iv) 373,597 shares of Class A stock that could be acquired within 60 days upon the exercise of options granted under the Company’s 2010 Incentive Plan. |

| |

2. | Class B stock is convertible into Class A stock on a share-for-share basis. Ownership of Class B stock is therefore deemed to be beneficial ownership of Class A stock under SEC regulations. For purposes of the presentation of ownership of Class A stock in this table, it has been assumed that each person listed therein as holding Class B stock has converted into Class A stock all shares of Class B stock of which that person is deemed the beneficial owner. Thus, all shares of Class B stock held by the 1997 Trust and by the Trustees have been included in the calculation of the total amount of Class A stock owned by each such person as well as in the calculation of the total amount of Class B stock owned by each such person. As a result of this presentation, there are substantial duplications in the number of shares and percentages shown in the table. |

| |

3. | In addition to the amounts of Class A stock and Class B stock described in footnotes 1 and 2, the holdings reported for Ms. Dryfoos include (i) 1,454 shares of Class A stock held by two trusts, of which she is a co-trustee, (ii) 10,000 shares of Class A stock held by a trust of which her husband is a trustee, and (iii) 2,970 shares of Class B stock held by a trust of which her husband is a co-trustee. Ms. Dryfoos disclaims beneficial ownership of these shares. |

| |

4. | In addition to the amounts of Class A stock and Class B stock described in footnotes 1 and 2, Mr. Golden is the direct beneficial owner of, and has sole voting and dispositive power with respect to, 7,047 shares of Class A stock. |

| |

5. | In addition to the amounts of Class A stock and Class B stock described in footnotes 1 and 2, the holdings of Ms. Golden include (a) 1,711 shares of Class B stock indirectly held through her husband, (b) 42,073 shares of Class A stock held by a trust of which Ms. Golden’s husband is a trustee, and (c) 48,218 shares of Class A stock held in a family trust, of which Ms. Golden is a co-trustee. The holdings reported for Ms. Golden exclude 3,269 shares of Class A stock held by three trusts, of which her husband is a co-trustee, as to which Ms. Golden disclaims beneficial ownership. |

| |

6. | In addition to the amounts of Class A stock and Class B stock described in footnotes 1 and 2, the holdings of Dr. Golden include (a) 19,563 shares of Class A stock held solely, (b) 14,921 restricted stock units for Class A stock (which will be distributed upon his cessation of service on the Board), including 3,461 unvested restricted stock units for Class A stock that will vest within 60 days, on the date of the 2020 Annual Meeting, and (c) 48,217 shares of Class A stock held by a trust, of which he is a co-trustee. The holdings of Class A stock reported for Dr. Golden exclude 3,450 shares of Class A stock held by a trust, of which his wife is the sole trustee and for which Dr. Golden disclaims beneficial ownership. |

| |

7. | In addition to the amounts of Class A stock and Class B stock described in footnotes 1 and 2, the holdings of Mr. Perpich include (a) 19,266 shares of Class A stock held solely, (b) 112,000 shares of Class A stock and 2,805 shares of Class B stock held by two family trusts for which Mr. Perpich serves as a trustee, and (c) 983 shares of Class A stock held in two custodial accounts created for the benefit of his children, for which Mr. Perpich serves as a custodian. Mr. Perpich disclaims beneficial ownership of the shares described in (b) and (c) above. The amounts reported exclude 2,114 stock-settled restricted stock units for Class A stock that are subject to vesting conditions. |

| |

8. | In addition to the amounts of Class A stock and Class B stock described in footnotes 1 and 2, the holdings of Mr. Sulzberger include (a) 44,993 shares of Class A stock held solely and (b) 984 shares of Class A stock held in a custodial account for which Mr. Sulzberger serves as a custodian. |

THE NEW YORK TIMES COMPANY - P. 10

| |

9. | In addition to the amounts of Class A stock and Class B stock described in footnotes 1 and 2, the holdings of Mr. Sulzberger, Jr. include (a) 374,756 shares of Class A stock and 1,852 shares of Class B stock held solely, (b) 9,303 restricted stock units for Class A stock (which will be distributed upon cessation of service on the Board), including 3,461 unvested restricted stock units of Class A stock that will vest within 60 days, on the date of the 2020 Annual Meeting, (c) 373,597 shares that could be acquired within 60 days upon the exercise of options granted under the Company’s 2010 Incentive Plan and (d) 50,984 shares of Class A stock held by four trusts of which Mr. Sulzberger, Jr. serves as a co-trustee. Mr. Sulzberger, Jr. disclaims beneficial ownership of the shares described in (d) above. |

| |

10. | In addition to the amounts of Class A stock and Class B stock described in footnotes 1 and 2, the holdings of Ms. Tishler include (a) 16,820 shares of Class A stock held indirectly by a trust and (b) 40,500 shares of Class A stock held by a trust of which she is the sole trustee. Ms. Tishler disclaims beneficial ownership of the shares described in (b) above. |

| |

11. | According to information contained in a filing with the SEC pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as of December 31, 2019, Inversora Carso, S.A. de C.V., formerly known as Inmobiliaria Carso, S.A. de C.V. (“Inversora Carso”), beneficially owns 8,247,175 shares of Class A stock. In addition, Grupo Financiero Inbursa, S.A.B. de C.V. (“GFI”), as the parent company of Banco Inbursa, S.A., Institución de Banca Múltiple, Grupo Financiero Inbursa (“Banco Inbursa”), owns 7,950,000 shares of Class A stock. |

According to the filing, (i) Inversora Carso pledged all 8,247,175 shares of Class A stock to the 2017 Mandatory Exchangeable Trust (the “Trust”) pursuant to certain forward agreements dated December 15, 2017, and (ii) GFI pledged all 7,950,000 shares of Class A stock to the Trust pursuant to a certain forward agreement dated December 15, 2017. Inversora Carso and Banco Inbursa retain voting rights to the pledged shares and share dispositive power with U.S. Bank National Association as collateral agent for the benefit of the Trust, which has been granted a security interest in the pledged shares pursuant to certain collateral agreements dated December 15, 2017.

According to the filing, Carlos Slim Helú, Carlos Slim Domit, Marco Antonio Slim Domit, Patrick Slim Domit, María Soumaya Slim Domit, Vanessa Paola Slim Domit and Johanna Monique Slim Domit (collectively, the “Slim Family”) are beneficiaries of a trust that in turn owns all of the outstanding voting securities of Inversora Carso and a majority of the outstanding voting equity securities of GFI. As a result, the Slim Family may be deemed to beneficially own indirectly all 16,197,175 shares of Class A stock beneficially owned by Inversora Carso and GFI. In addition, according to filings with the SEC, to the best of the holders’ knowledge, the shares were not acquired for the purpose of or with the effect of changing or influencing the control of the Company.

| |

12. | According to information contained in a filing with the SEC pursuant to the Exchange Act, as of December 31, 2019, The Vanguard Group beneficially owned 13,960,892 shares of Class A stock. The filing states that, to the best of the holder’s knowledge, the shares were not acquired for the purpose of or with the effect of changing or influencing the control of the Company. |

| |

13. | According to information contained in a filing with the SEC pursuant to the Exchange Act, as of December 31, 2019, Jackson Square Partners, LLC beneficially owned 13,922,765 shares of Class A stock. The filing states that, to the best of the holder’s knowledge, the shares were acquired in the ordinary course of such holder’s business and were not acquired for the purpose of or with the effect of changing or influencing the control of the Company. |

| |

14. | According to information contained in a filing with the SEC pursuant to the Exchange Act, as of December 31, 2019, BlackRock, Inc. beneficially owned 13,195,727 shares of Class A stock. The filing states that, to the best of the holder’s knowledge, the shares were acquired in the ordinary course of such holder’s business and were not acquired for the purpose of or with the effect of changing or influencing the control of the Company. |

| |

15. | According to information contained in a filing with the SEC pursuant to the Exchange Act, as of December 31, 2019, Darsana Capital Partners LP beneficially owned 12,000,000 shares of Class A stock. The filing states that, to the best of the holder’s knowledge, the shares were acquired in the ordinary course of such holder’s business and were not acquired for the purpose of or with the effect of changing or influencing the control of the Company. |

THE NEW YORK TIMES COMPANY - P. 11

SECURITY OWNERSHIP OF MANAGEMENT AND DIRECTORS The following table shows the beneficial ownership, reported to the Company as of February 26, 2020, of Class A stock and Class B stock, including shares as to which a right to acquire ownership exists (by the exercise of stock options, the vesting of restricted stock units or the conversion of Class B stock into Class A stock) within the meaning of Rule 13d-3(d)(1) under the Exchange Act, of each director named in this Proxy Statement, the chief executive officer, the chief financial officer, the three other most highly compensated executive officers of the Company during 2019, and all directors and executive officers of the Company as a group. A portion of the shares reported below are held by the 1997 Trust, whose Trustees share voting and, in some cases, investment power with respect thereto. See “General Information—The 1997 Trust.” The table also shows, under “Class A Stock Units,” in the case of non-employee directors, cash-settled phantom stock units credited under the Directors’ Deferral Plan. |

| | | | | | | | | | |

| Class A Stock |

| Percent of Class A Stock |

| Class A Stock Units |

| Class B Stock |

| Percent of Class B Stock |

|

Amanpal S. Bhutani1 Director | 5,653 |

| * |

| — |

| — |

| |

Diane Brayton Executive Vice President, General Counsel and Secretary | 25,194 |

| * |

| — |

| — |

| |

Roland A. Caputo2 Executive Vice President and Chief Financial Officer | 51,227 |

| * |

| — |

| — |

| |

Robert E. Denham1 Director | 53,392 |

| * |

| 37,023 |

| — |

| |

Rachel Glaser1 Director | 9,169 |

| * |

| — |

| — |

| |

Hays N. Golden1,3,4 Director | 2,221,511 |

| 1.3 | % |

|

| 738,810 |

| 92.0 | % |

Meredith Kopit Levien2 Executive Vice President and Chief Operating Officer | 38,355 |

| * |

| — |

| — |

| |

Brian P. McAndrews1 Director | 32,210 |

| * |

| 16,313 |

| — |

| |

David Perpich3,4 Head of Standalone Products and Director | 2,273,864 |

| * |

| — |

| 741,615 |

| 92.3 | % |

John W. Rogers, Jr.1 Director | 27,955 |

| * |

| — |

| — |

| |

A.G. Sulzberger3,4 Publisher of The New York Times and Director | 2,184,787 |

| 1.3 | % | — |

| 738,810 |

| 92.0 | % |

Arthur Sulzberger, Jr.1,2,3,4 Chairman of the Board | 2,949,302 |

| 1.8 | % | — |

| 740,662 |

| 92.2 | % |

Mark Thompson2 President, Chief Executive Officer and Director | 788,125 |

| * |

| — |

| — |

| |

Doreen Toben1 Director | 29,050 |

| * |

| 79,990 |

| — |

| |

Rebecca Van Dyck1 Director | 29,050 |

| * |

| — |

| — |

| |

All Directors and Executive Officers3 (15 Individuals) | 4,209,262 |

| 2.6 | % | 133,326 |

| 743,467 |

| 92.5 | % |

*Indicates beneficial ownership of less than 1%. | Footnotes continue on following page. | |

| |

1. | The amounts reported for this director include (a) 3,461 unvested restricted stock units for Class A stock that will vest within 60 days, on the date of the 2020 Annual Meeting, and (b) vested restricted stock units for Class A stock (which will be distributed upon the director’s retirement from the Board) as follows: Mr. Bhutani, 2,192; Mr. Denham, 25,589; Ms. Glaser, 5,708; Dr. Golden, 11,460; Mr. McAndrews, 25,589; Mr. Rogers, 4,494; Mr. Sulzberger, Jr., 5,842; Ms. Toben, 25,589; and Ms. Van Dyck, 25,589. |

THE NEW YORK TIMES COMPANY - P. 12

| |

2. | The amounts reported include shares of Class A stock that could be acquired within 60 days upon the exercise of stock options awarded under the 2010 Incentive Plan, as follows: Mr. Caputo, 11,640; Mr. Sulzberger, Jr., 373,597; and Mr. Thompson, 385,604. The amounts reported for Ms. Kopit Levien exclude 34,042 stock-settled restricted stock units granted under the 2010 Incentive Plan that are subject to vesting conditions. |

| |

3. | Class B stock is convertible into Class A stock on a share-for-share basis. Therefore, ownership of Class B stock is deemed to be beneficial ownership of Class A stock under SEC regulations. For purposes of the presentation of ownership of Class A stock in this table, it has been assumed that each director and executive officer has converted into Class A stock all shares of Class B stock of which that person is deemed the beneficial owner. Thus, all shares of Class B stock held by the directors and executive officers, including shares held by the 1997 Trust, have been included in the calculation of the total amount of Class A stock owned by such persons as well as in the calculation of the total amount of Class B stock owned by such persons. As a result of this presentation, there are duplications in the number of shares and percentages shown in this table. |

| |

4. | See “Principal Holders of Common Stock” and “General Information—The 1997 Trust” for a discussion of this person’s holdings. |

DELINQUENT SECTION 16(a) REPORTS

The Company’s directors and executive officers and the beneficial holders of more than 10% of the Class A stock are required to file reports with the SEC of changes in their ownership of Company stock. Based on its review of such reports, the Company believes that all such filing requirements were met during 2019.

On February 27, 2020, reports on Form 4 that were filed for Messrs. Sulzberger, Jr. and Sulzberger disclosed certain transactions in 2017 and 2018 that were inadvertently omitted from previous reports: (i) for Mr. Sulzberger, Jr., two gifts of Class A stock that he made in 2017; and (ii) for Mr. Sulzberger, the transfer of Class A stock in 2018 to an account for which he serves as custodian.

THE NEW YORK TIMES COMPANY - P. 13

PROPOSAL NUMBER 1—ELECTION OF DIRECTORS

Twelve directors will be elected to the Board of The New York Times Company at the 2020 Annual Meeting. Nominees proposed for election as directors are listed below. Each of the nominees is a current director who was elected at the 2019 Annual Meeting for which proxies were solicited. Directors will hold office until the next annual meeting and until their successors are elected and qualified.

The Certificate of Incorporation of the Company provides that Class A stockholders have the right to elect 30% of the Board of Directors (or the nearest larger whole number). Accordingly, Class A stockholders will elect four of the 12 directors; Class B stockholders will elect eight directors. Directors are elected by a plurality of the votes cast. (Please see our policy described on page 21 regarding directors who do not receive more “for” votes than “withheld” votes.) Once elected, our directors have no ongoing status as “Class A” or “Class B” directors and have the same duties and responsibilities to all stockholders. Our Board serves as one Board with fiduciary responsibilities to all stockholders of the Company.

Proxies will be used to vote for the election of the nominees named below unless you withhold the authority to do so when you vote your proxy. Each person nominated for election has consented to being named in this Proxy Statement and has agreed to serve if elected. If any of the nominees become unavailable for election, all uninstructed proxies will be voted for such other person or persons designated by the Board. The Board has no reason to anticipate that this will occur.

|

| | | |

Name | Age | Position with The New York Times Company | Director Since |

Class A Nominees (4) | | | |

Robert E. Denham | 74 | Independent Director | 2008 |

Rachel Glaser | 58 | Independent Director | 2018 |

John W. Rogers, Jr. | 61 | Independent Director | 2018 |

Rebecca Van Dyck | 50 | Independent Director | 2015 |

Class B Nominees (8) | | | |

Amanpal S. Bhutani | 43 | Independent Director | 2018 |

Hays N. Golden1 | 35 | Non-Employee Director | 2017 |

Brian P. McAndrews | 61 | Independent Director | 2012 |

David Perpich2 | 42 | Head of Standalone Products and Director | 2019 |

A.G. Sulzberger3 | 39 | Publisher of The New York Times and Director | 2018 |

Arthur Sulzberger, Jr. | 68 | Chairman of the Board | 1997 |

Mark Thompson | 62 | President, Chief Executive Officer and Director | 2012 |

Doreen Toben | 70 | Independent Director | 2004 |

| |

1. | Hays N. Golden is A.G. Sulzberger’s cousin and his father is a cousin of Arthur Sulzberger, Jr. |

| |

2. | David Perpich is A.G. Sulzberger’s cousin and Arthur Sulzberger, Jr.’s nephew. |

| |

3. | A.G. Sulzberger is Arthur Sulzberger, Jr.’s son. |

THE NEW YORK TIMES COMPANY - P. 14

Skills, Experience and Qualifications

Consistent with the Company’s Corporate Governance Principles, the Nominating & Governance Committee is responsible for reviewing with the Board, on an annual basis, the requisite skills and characteristics of director nominees, as well as the composition of the Board as a whole. This assessment includes consideration of directors’ independence, character, judgment and business experience, as well as their appreciation of the Company’s core purpose, core values and journalistic mission. The Nominating & Governance Committee also considers the diversity of Board candidates, which may include diversity of skills and experience, as well as geographic, gender, age and ethnic diversity.

We believe that the combination of backgrounds, skills and experiences represented by the 12 director nominees will enable the Board and each of its committees to continue to provide sound judgment and leadership in the context of an evolving business environment and the Company’s long-term strategy, and to function effectively as a group. The biographical information for each director nominee includes a summary of the specific experience, qualifications, attributes or skills that led the Board to conclude that the person should serve as a director of the Company. While it is not possible to detail all of the experience, qualifications, attributes or skills possessed by each director, we have set out those unique and important professional characteristics that each person would bring to the Board.

Director Tenure

Our Board is composed of directors with a mix of tenure, with longer serving directors providing important experience and institutional knowledge, and newer directors providing fresh perspective to deliberations. Of the seven currently serving independent director nominees this year, four have served five or fewer years: Amanpal S. Bhutani, Rachel Glaser and John W. Rogers, Jr. each joined the Board in 2018; and Rebecca Van Dyck joined the Board in 2015. Three non-independent directors, Hays N. Golden, David Perpich and A.G. Sulzberger, have served fewer than three years.

Director Retirement Policy

Under the Company’s director retirement policy, which is set forth in our Corporate Governance Principles, a non-employee director may not stand for re-election following the earlier of (a) his or her 75th birthday or (b) 20 years of service on the Board, unless the Board determines otherwise.

PROFILES OF NOMINEES FOR THE BOARD OF DIRECTORS Class A Nominees

Robert E. Denham has served as a member of our Board of Directors since 2008, including as presiding director from 2013 to 2019. Mr. Denham is a partner of Munger, Tolles & Olson LLP (from 1973 to 1991 and since 1998). From 1992 to 1998, he was chairman and chief executive officer of Salomon Inc, and from 1991 to 1992, he was general counsel of Salomon Inc and Salomon Brothers. Mr. Denham has served as a director of Fomento Económico Mexicano, S.A. de C.V. since 2001. Mr. Denham was a director of Oaktree Capital Group LLC from 2007 to 2019 and Chevron Corporation from 2004 to 2018.

Mr. Denham’s legal practice emphasizes advising clients on strategic and financial issues and providing disclosure and corporate law advice to public and private corporations and boards of directors. In addition, as chairman and chief executive officer of Salomon Inc, Mr. Denham successfully guided that investment banking firm as it was rebuilding. Mr. Denham also has extensive experience serving on the boards (and various board committees) of other large public companies and brings significant financial expertise to the Company and the Board. Mr. Denham has also held numerous leadership positions with associations and councils focusing on corporate governance, executive compensation, accounting, professional ethics and business, including serving as chairman of the Financial Accounting Foundation from 2004 to 2009.

Rachel Glaser has served as a member of our Board of Directors since 2018. Ms. Glaser is the chief financial officer of Etsy, Inc., a global creative commerce platform (since 2017). From 2015 to 2017, she was the chief financial officer of Leaf Group Ltd., a company that owns and operates consumer media and marketplaces. From 2012 to 2015, she was the chief financial officer of Move, Inc., the parent company of Realtor.com. From 2008 to 2011, she was the chief operating and financial officer of MyLife.com, a subscription-based search business, and from 2005 to 2008, she

THE NEW YORK TIMES COMPANY - P. 15

was the senior vice president of finance at Yahoo! Inc. From 1986 to 2005, Ms. Glaser held various finance and operations positions at The Walt Disney Company.

Ms. Glaser brings to the Company and the Board extensive financial and strategic expertise, gained from her experience in key roles at digitally focused, consumer-facing public companies. This experience provides the Board with a valuable perspective as the Company continues to expand its digital and subscription-first strategy. In addition to this experience, Ms. Glaser’s financial and accounting expertise is a valuable asset to the Company, the Board and the Audit Committee.

John W. Rogers, Jr. has served as a member of our Board of Directors since 2018. Mr. Rogers is the founder, chairman, co-chief executive officer and chief investment officer of Ariel Investments, LLC, an institutional money management and mutual fund firm, as well as a trustee of Ariel Investment Trust. He has been a director of Nike, Inc. since 2018 and McDonald’s Corporation since 2003. Mr. Rogers was a director of Exelon Corporation from 2000 to 2019.

Mr. Rogers brings to the Company and the Board extensive business, financial and risk-management experience gained as the founder and long-serving chief executive officer and chief investment officer of a firm with over $13 billion in assets under management. In addition, his experience serving on the boards (and several board committees) of large public companies provides highly valuable strategic perspective to the Board and the Company.

Rebecca Van Dyck has served as a member of our Board of Directors since 2015. Ms. Van Dyck is chief marketing officer for AR/VR at Facebook, Inc. (since 2017). Previously, she was vice president of consumer and brand marketing at Facebook, Inc. from 2012 to 2017. From 2011 to 2012, she was senior vice president and global chief marketing officer of Levi Strauss & Co. From 2007 to 2011, she was senior director, worldwide marketing and communications, of Apple Inc., and from 1994 to 2006, she held various positions at Wieden + Kennedy, Inc., including global account director for Nike International, from 2002 to 2006. From 1992 to 1994, she held various positions at TBWA Worldwide Inc.

Ms. Van Dyck brings to the Company and the Board extensive knowledge of digital consumer brand marketing and management, gained from her experience in senior executive roles at large digital and consumer-focused companies and in the advertising industry. Ms. Van Dyck’s brand expertise, as well as her international experience, provide the Board with a valuable perspective highly relevant to the Company’s digital strategy.

Class B Nominees

Amanpal S. Bhutani has served as a member of our Board of Directors since 2018. Mr. Bhutani is the chief executive officer of GoDaddy Inc. (since 2019). From 2015 to 2019, he was president of the Brand Expedia Group at Expedia Group, Inc. From 2010 to 2015, he was the senior vice president of Expedia Worldwide Engineering at Expedia Group, Inc. From 2008 to 2010, he was a technology senior director at JPMorgan Chase and Co., and from 2002 to 2008, he was the senior vice president of ecommerce technology at Washington Mutual, Inc., which was acquired by JPMorgan Chase and Co. in 2008. Prior to that, Mr. Bhutani was the founder and technical lead at a startup, and was a senior engineer at a consultancy.

Mr. Bhutani brings to the Company and the Board extensive technological and international business expertise gained from his collective experiences in senior leadership roles at digital and consumer-facing companies. This experience provides the Board with a valuable, highly relevant perspective to the Company’s innovation efforts as the Company positions itself for further global growth.

Hays N. Golden has served as a member of our Board of Directors since 2017. Dr. Golden is the senior director for science and strategy at Crime Lab New York, which is part of the University of Chicago’s Urban Labs (since 2019). From 2017 to 2018, he was vice president of commercial underwriting at American International Group, Inc. (“AIG”). Prior to that, he was senior manager in the commercial underwriting division of AIG from 2016 to 2017. From 2013 to 2016, he held various positions in AIG Science, a division of AIG with a focus on data science and analytics.

Dr. Golden is a fifth-generation member of the Ochs-Sulzberger family and brings to the Board a deep appreciation of the values and societal contributions of The New York Times and the Company throughout their history. His alignment with stockholder interests makes Dr. Golden an important part of the Board’s leadership and decision-making process.

THE NEW YORK TIMES COMPANY - P. 16

Brian P. McAndrews has served as a member of our Board of Directors since 2012 and as presiding director since 2019. Mr. McAndrews was president, chief executive officer and chairman of Pandora Media, Inc. from 2013 to 2016. From 2012 to 2013, he was venture partner, and from 2009 to 2011, he was managing director, of Madrona Venture Group, LLC. From 2007 to 2008, he was senior vice president, advertiser and publisher solutions, of Microsoft Corporation. From 2000 to 2007, he was president and chief executive officer, and from 1999 to 2000 he served as chief executive officer, of aQuantive, Inc. From 1990 to 1999, he held various positions of increasing responsibility at ABC, Inc., including executive vice president and general manager of ABC Sports. Mr. McAndrews has been a director of GrubHub, Inc. since 2011, and chairman of its board of directors since 2014. In addition, he is a director of Chewy, Inc. (since 2019), Frontdoor, Inc. (since 2018) and Teladoc Health, Inc. (since 2017). (Teladoc Health, Inc. announced that Mr. McAndrews planned to step down from its board of directors at the conclusion of his term in 2020.)

Mr. McAndrews brings to the Company and the Board extensive digital expertise gained through his experience as a chief executive officer of public companies in the technology industry. His background in both traditional and digital media has also given him an understanding of digital advertising and the integration of emerging technologies, which is highly valued by the Company and the Board as the Company continues to expand its digital businesses. In addition, his service on the boards of other public companies provides highly valuable strategic perspective to the Board and the Company.

David Perpich is head of standalone products at the Company (since 2020) and has served as a member of our Board of Directors since 2019. Prior to this, Mr. Perpich served as president and general manager of Wirecutter, a subsidiary of the Company (from 2017 to 2020). From 2015 to 2017, he served as senior vice president of product for the Company, where he was responsible for overseeing The Times’s digital product portfolio across mobile and web products. In addition, Mr. Perpich served as general manager, new digital products, at the Company from 2013 to 2015, and as vice president, product management, from 2011 to 2013. Mr. Perpich joined the Company in February 2010 as executive director, NYTimes.com paid products.

Mr. Perpich is a fifth-generation member of the Ochs-Sulzberger family and brings a deep appreciation of the values and societal contributions of The New York Times and the Company throughout their history. In addition, he has served in a variety of critical executive positions that have provided him with extensive knowledge of our Company and its operations. His alignment with stockholder interests makes Mr. Perpich an important part of the Board’s leadership and decision-making process.

A.G. Sulzberger has served as publisher of The New York Times and a member of our Board of Directors since 2018. Mr. Sulzberger was deputy publisher of The New York Times from 2016 to 2017. He joined The New York Times as a reporter in 2009 from various reporting roles at other publications. From 2010 to 2012, he served as head of the Kansas City bureau, and later served as an assistant editor (from 2012 to 2015) and associate editor (from 2015 to 2016) of The Times, before he was appointed deputy publisher.

Mr. Sulzberger is a fifth-generation member of the Ochs-Sulzberger family and brings a deep appreciation of the values and societal contributions of The New York Times and the Company to his role as publisher of The New York Times. In addition, as one of the driving forces behind the Company’s digital transformation and subscription-first focus, Mr. Sulzberger brings a deep understanding and unique perspective to the Board about the Company’s business strategy and industry opportunities and challenges.

Arthur Sulzberger, Jr. has served as Chairman of the Board since 1997. In addition, until he retired as an executive in 2017, he served as publisher of The New York Times from 1992, and as executive chairman of the Company from 1997. Mr. Sulzberger, Jr. was also chief executive officer of the Company from 2011 to 2012. From 1988 to 1992, he was deputy publisher and from 1987 to 1988, he was assistant publisher, of The New York Times.

Mr. Sulzberger, Jr. is a fourth-generation member of the Ochs-Sulzberger family and brings a deep appreciation of the values and societal contributions of The New York Times and the Company throughout their history. He served in a variety of critical positions since joining the Company in 1978. As a long-time employee of the Company, including 25 years as publisher of The New York Times and 20 years as executive chairman, Mr. Sulzberger, Jr., gained extensive knowledge of the Company and our businesses and provides a unique insight and perspective to the Board about the Company’s business strategy and industry opportunities and challenges. In addition, his life-long affiliation with the Company provides the Board with an important historical perspective and a focus on long-term interests of the Company.

THE NEW YORK TIMES COMPANY - P. 17

Mark Thompson has served as our president and chief executive officer and as a member of our Board of Directors since 2012. From 2004 to 2012, he was director-general of the British Broadcasting Corporation (the “BBC”), and from 2002 to 2004, he was chief executive of Channel 4 Television Corporation. From 1979 to 2001, he served in various positions of increasing responsibility at the BBC, including director of television and controller of BBC Two.

As the Company’s president and chief executive officer, Mr. Thompson has primary responsibility for overseeing and coordinating all of the Company’s strategy, operations and businesses. Mr. Thompson brings to the Company and the Board a global perspective and more than 30 years of experience in the media industry, including extensive international business and management experience gained serving as director-general of the BBC and chief executive of Channel 4 Television Corporation. In addition, his experience in reshaping the BBC to meet the challenges of the digital age is highly valued by the Company and the Board as the Company continues to expand its businesses digitally and globally.