10-K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| | | | |

For the fiscal year ended December 27, 2015 | | Commission file number 1-5837 |

THE NEW YORK TIMES COMPANY

(Exact name of registrant as specified in its charter)

|

| | |

New York | | 13-1102020 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

620 Eighth Avenue, New York, N.Y. | | 10018 |

(Address of principal executive offices) | | (Zip code) |

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Class A Common Stock of $.10 par value | | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | |

| Large accelerated filer | þ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate worldwide market value of Class A Common Stock held by non-affiliates, based on the closing price on June 26, 2015, the last business day of the registrant’s most recently completed second quarter, as reported on the New York Stock Exchange, was approximately $2.3 billion. As of such date, non-affiliates held 66,865 shares of Class B Common Stock. There is no active market for such stock.

The number of outstanding shares of each class of the registrant’s common stock as of February 17, 2016 (exclusive of treasury shares), was as follows: 159,393,875 shares of Class A Common Stock and 816,635 shares of Class B Common Stock.

Documents incorporated by reference

Portions of the Proxy Statement relating to the registrant’s 2016 Annual Meeting of Stockholders, to be held on May 4, 2016, are incorporated by reference into Part III of this report.

|

|

INDEX TO THE NEW YORK TIMES COMPANY 2015 ANNUAL REPORT ON FORM 10-K |

|

|

FORWARD-LOOKING STATEMENTS |

This Annual Report on Form 10-K, including the sections titled “Item 1A — Risk Factors” and “Item 7 —Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements that relate to future events or our future financial performance. We may also make written and oral forward-looking statements in our Securities and Exchange Commission (“SEC”) filings and otherwise. We have tried, where possible, to identify such statements by using words such as “believe,” “expect,” “intend,” “estimate,” “anticipate,” “will,” “could,” “project,” “plan” and similar expressions in connection with any discussion of future operating or financial performance. Any forward-looking statements are and will be based upon our then-current expectations, estimates and assumptions regarding future events and are applicable only as of the dates of such statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those anticipated in any such statements. You should bear this in mind as you consider forward-looking statements. Factors that we think could, individually or in the aggregate, cause our actual results to differ materially from expected and historical results include those described in “Item 1A — Risk Factors” below, as well as other risks and factors identified from time to time in our SEC filings.

OVERVIEW

The New York Times Company (the “Company”) was incorporated on August 26, 1896, under the laws of the State of New York. The Company and its consolidated subsidiaries are referred to collectively in this Annual Report on Form 10-K as “we,” “our” and “us.”

We are a global media organization focused on creating, collecting and distributing high-quality news and information. Our continued commitment to premium content and journalistic excellence makes The New York Times brand a trusted source of news and information for readers and viewers across various platforms. Recognized widely for the quality of our reporting and content, our publications have been awarded many industry and peer accolades, including 117 Pulitzer Prizes and citations, more than any other news organization.

The Company includes newspapers, print and digital products and investments. We have one reportable segment with businesses that include:

| |

• | our newspapers, The New York Times (“The Times”) and the International New York Times (“INYT”); |

| |

• | our websites, including NYTimes.com and international.nytimes.com; |

| |

• | our mobile applications, including The Times’s core news applications, as well as interest-specific applications such as NYT Cooking, Crossword and others; |

| |

• | related businesses, such as The Times news services division, digital archive distribution, NYT Live (our live events business) and other products and services under The Times brand. |

We generate revenues principally from circulation and advertising. Circulation revenue is derived from the sale of subscriptions to our print, web and mobile products and single-copy sales of our print newspaper. Advertising revenue is derived from the sale of our advertising products and services on our print, web and mobile platforms. Revenue information for the Company appears under “Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Revenues, operating profit and identifiable assets of our foreign operations are not significant.

During 2015, the Company continued to focus on our digital offerings, while also making targeted investments in our print products. On July 30, 2015, we reached a milestone of one million paid digital-only subscribers, less than four-and-a-half years after launching our digital pay model. In the fall, we launched a virtual reality mobile application through which we have released a number of virtual reality films on wide-ranging topics. We also created innovative digital advertising solutions for our mobile and other platforms and continued to expand our branded

THE NEW YORK TIMES COMPANY – P. 1

content studio. In print, we re-launched The New York Times Magazine at the beginning of the year, and launched Men’s Style, the first new print section in The Times in a decade.

The Company sold the New England Media Group in 2013 and the Regional Media Group and the About Group in 2012. The results of operations for these businesses have been presented as discontinued operations for all periods presented. See Note 13 of the Notes to the Consolidated Financial Statements for additional information regarding these discontinued operations.

PRODUCTS

The Company’s principal business consists of distributing content generated by our newsroom through our print, web and mobile platforms. In addition, we distribute selected content on third-party platforms. The Times’s print edition, a daily (Mon. - Sat.) and Sunday newspaper in the United States, commenced publication in 1851. The NYTimes.com website was launched in 1996. INYT, the international edition of The Times, is tailored and edited for global audiences. First published in 2013, INYT succeeded the International Herald Tribune, a leading daily newspaper that commenced publishing in Paris in 1887.

Our print newspapers are sold in the United States and around the world through individual home-delivery subscriptions, bulk subscriptions (by business, schools and other entities) and single-copy sales. All print home-delivery subscribers receive unlimited digital access.

Since 2011, we have charged consumers for content provided on our core news websites and mobile applications. Digital subscriptions can be purchased individually or through group corporate or group education subscriptions. Our metered model offers users free access to a set number of articles per month and then charges users for access to content beyond that limit. In addition, existing print and digital subscribers can, for an additional charge, access Times Insider, a suite of exclusive online content and features.

In addition to our core news websites and mobile applications, we have developed desktop and mobile applications that are tailored to a variety of interests, including cooking and our Crossword puzzle.

AUDIENCE AND CIRCULATION

Our content reaches a broad audience through our print, web and mobile platforms. As of December 27, 2015, we had over two million subscriptions in 195 countries to our print and digital products.

In the United States, The Times had the largest daily and Sunday circulation of all seven-day newspapers for the three-month period ended September 30, 2015, according to data collected by the Alliance for Audited Media (“AAM”), an independent agency that audits circulation of most U.S. newspapers and magazines.

For the fiscal year ended December 27, 2015, The Times’s average print circulation (which includes paid and qualified circulation of the newspaper in print) was approximately 603,700 for weekday (Monday to Friday) and 1,127,200 for Sunday. (Under AAM’s reporting guidance, qualified circulation represents copies available for individual consumers that are either non-paid or paid by someone other than the individual, such as copies delivered to schools and colleges and copies purchased by businesses for free distribution.)

Internationally, average circulation for INYT (which includes paid circulation of the newspaper in print and electronic replica editions) for the fiscal years ended December 27, 2015, and December 28, 2014, was approximately 214,700 (estimated) and 219,500, respectively. These figures follow the guidance of Office de Justification de la Diffusion, an agency based in Paris and a member of the International Federation of Audit Bureaux of Circulations that audits the circulation of most newspapers and magazines in France. The final 2015 figure will not be available until April 2016.

Paid subscribers to digital-only subscription packages, e-readers and replica editions totaled approximately 1,094,000 as of December 27, 2015, an increase of approximately 20% compared with December 28, 2014. This amount includes estimated paid subscribers through our group corporate and group education subscriptions (which collectively represent approximately 7% of total paid digital subscribers) and home-delivery subscribers who also subscribe to Times Insider (which represent approximately 2% of total paid digital subscribers). The number of paid subscribers through group subscriptions is derived using the value of the relevant contract and a discounted basic subscription rate. The actual number of users who have access to our products through group subscriptions is substantially higher.

P. 2 – THE NEW YORK TIMES COMPANY

According to comScore Media Metrix, an online audience measurement service, in 2015, NYTimes.com had a monthly average of approximately 62 million unique visitors in the United States on either desktop/laptop computers or mobile devices. In addition, NYTimes.com had a monthly average of approximately 13 million unique visitors on desktop/laptop computers outside the United States.

ADVERTISING

We have a comprehensive portfolio of advertising products and services that we provide across print, web and mobile platforms.

Our advertising revenue is divided into three main categories:

Display Advertising

Display advertising is principally from advertisers promoting products, services or brands, such as financial institutions, movie studios, department stores, American and international fashion and technology. In print, column-inch ads are priced according to established rates, with premiums for color and positioning. The Times had the largest market share in 2015 in print advertising revenue among a national newspaper set that consists of USA Today, The Wall Street Journal and The Times, according to MediaRadar, an independent agency that measures advertising sales volume and estimates advertising revenue.

On our web and mobile platforms, display advertising comprises banners, video, rich media and other interactive ads. Display advertising also includes branded content on The Times’s platforms. Branded content is longer form marketing content that is distinct from the Times’s editorial content. In 2015, display advertising (print and digital) represented approximately 91% of advertising revenues.

Classified Advertising

Classified advertising includes line ads sold in the major categories of real estate, help wanted, automotive and other. In print, classified advertisers pay on a per-line basis. On our web and mobile platforms, classified advertisers pay on either a per-listing basis for bundled listing packages, or as an add-on to their print ad. In 2015, classified advertising (print and digital) represented approximately 5% of advertising revenues.

Other Advertising

Other advertising primarily includes creative services fees associated with our branded content studio; revenues from preprinted advertising, also known as free-standing inserts; revenues generated from branded bags in which our newspapers are delivered; and advertising revenues from our News Services business. In 2015, other advertising (print and digital) represented approximately 4% of our advertising revenues.

Our business is affected in part by seasonal patterns in advertising, with generally higher advertising volume in the fourth quarter due to holiday advertising.

COMPETITION

Our print, web and mobile products compete for advertising and consumers with other media in their respective markets, including paid and free newspapers, broadcast, satellite and cable television, broadcast and satellite radio, magazines, other forms of media and direct marketing. Competition for advertising is generally based upon audience levels and demographics, advertising rates, service, targeting capabilities and advertising results, while competition for consumer revenue and readership is generally based upon platform, format, content, quality, service, timeliness and price.

The Times competes for advertising and circulation primarily with national newspapers such as The Wall Street Journal and USA Today; newspapers of general circulation in New York City and its suburbs; other daily and weekly newspapers and television stations and networks in markets in which The Times is circulated; and some national news and lifestyle magazines. The international print edition competes with international sources of English-language news, including The Wall Street Journal’s European and Asian Editions, the Financial Times, Time, Bloomberg Business Week and The Economist.

As our industry continues to experience a shift from print to digital media, our products face competition for audience and advertising from a wide variety of digital alternatives, such as news and other information websites and mobile applications, news aggregation sites, sites that cover niche content, social media platforms, digital advertising networks and exchanges, real-time bidding and other programmatic buying channels and other new forms of media.

THE NEW YORK TIMES COMPANY – P. 3

In addition, developments in methods of distribution, such as applications for mobile phones, tablets and other devices, also increase competition for users and digital advertising revenues.

Our websites and mobile applications most directly compete for traffic and readership with other news and information websites and mobile applications. NYTimes.com faces competition from sources such as WSJ.com, washingtonpost.com, Google News, Yahoo! News, huffingtonpost.com, MSNBC and CNN.com. Internationally, international.nytimes.com competes against international online sources of English-language news, including bbc.co.uk, guardian.co.uk, ft.com, huffingtonpost.com and reuters.com.

OTHER BUSINESSES

We derive revenue from other businesses, which primarily include:

| |

• | The Times news services division, which transmits articles, graphics and photographs from The Times and other publications to approximately 1,800 newspapers, magazines and websites in over 100 countries and territories worldwide. It also comprises a number of other businesses that primarily include our online retail store, product licensing, book development and rights and permissions; |

| |

• | The Company’s NYT Live business, which is a platform for our live journalism and convenes thought leaders from business, academia and government at conferences and events to discuss topics ranging from education to sustainability to the luxury business; and |

| |

• | Digital archive distribution, which licenses electronic archive databases to resellers of that information in the business, professional and library markets. |

JOINT VENTURE INVESTMENTS

We have noncontrolling ownership interests in three entities:

| |

• | 49% interest in Donahue Malbaie Inc., a Canadian newsprint company (“Malbaie”); |

| |

• | 40% interest in Madison Paper Industries, a partnership operating a mill that produces supercalendered paper, a polished paper that is higher-value grade than newsprint (“Madison”); and |

| |

• | 30% interest in Women in the World, LLC, a live-event conference business. |

Ownership of Malbaie is shared with the Resolute FP Canada Inc. (“Resolute Canada”), which owns the other 51%. Resolute Canada is a subsidiary of Resolute Forest Products Inc., a Delaware corporation (“Resolute”), which is a large global manufacturer of paper, market pulp and wood products. Malbaie manufactures newsprint on the paper machine it owns within Resolute’s paper mill in Clermont, Quebec, and is wholly dependent upon Resolute for its pulp, which it purchases from this paper mill. In 2015, Malbaie produced approximately 218,000 metric tons of newsprint, of which approximately 10% was sold to us.

Our Company and UPM-Kymmene Corporation, a Finnish paper manufacturing company, are partners through subsidiary companies in Madison. The Company’s percentage ownership is through an 80%-owned consolidated subsidiary. UPM-Kymmene owns 60% of Madison, including a 10% interest through a 20% noncontrolling interest in the consolidated subsidiary of the Company. Madison purchases the majority of its wood from local suppliers, mostly under long-term contracts. We purchased supercalendered paper from Madison for The New York Times Magazine until February 2015, when we changed to a different type of paper. In 2015, Madison produced approximately 184,000 short tons (167,000 metric tons) of supercalendered paper, of which less than 1% was sold to us.

Malbaie and Madison are subject to comprehensive environmental protection laws, regulations and orders of provincial, federal, state and local authorities of Canada and the United States (the “Environmental Laws”). The Environmental Laws impose effluent and emission limitations and require Malbaie and Madison to obtain, and operate in compliance with the conditions of, permits and other governmental authorizations (“Governmental Authorizations”). Malbaie and Madison follow policies and operate monitoring programs designed to ensure compliance with applicable Environmental Laws and Governmental Authorizations and to minimize exposure to environmental liabilities. Various regulatory authorities periodically review the status of the operations of Malbaie and Madison. Based on the foregoing, we believe that Malbaie and Madison are in substantial compliance with such Environmental Laws and Governmental Authorizations.

P. 4 – THE NEW YORK TIMES COMPANY

These investments are accounted for under the equity method and reported in “Investments in joint ventures” in our Consolidated Balance Sheets as of December 27, 2015. For additional information on these investments, see “Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 5 of the Notes to the Consolidated Financial Statements.

PRINT PRODUCTION AND DISTRIBUTION

The Times is currently printed at our production and distribution facility in College Point, N.Y., as well as under contract at 27 remote print sites across the United States. The Times is delivered to newsstands and retail outlets in the New York metropolitan area through a combination of third-party wholesalers and our own drivers. In other markets in the United States and Canada, The Times is delivered through agreements with other newspapers and third-party delivery agents.

INYT is printed under contract at 38 sites throughout the world and is sold in 131 countries and territories. INYT is distributed through agreements with other newspapers and third-party delivery agents.

RAW MATERIALS

The primary raw materials we use are newsprint and coated paper, which we purchase from a number of North American and European producers. A significant portion of our newsprint is purchased from Resolute.

In 2015 and 2014, we used the following types and quantities of paper:

|

| | | | | |

(In metric tons) | 2015 |

| | 2014 |

|

Newsprint | 104,000 |

| | 114,000 |

|

Coated Paper | 19,000 |

| | 10,000 |

|

Supercalendered Paper(1) | 1,000 |

| | 7,000 |

|

| |

(1) | The Times used supercalendered paper for The New York Times Magazine but discontinued such use in February 2015. |

EMPLOYEES AND LABOR RELATIONS

We had 3,560 full-time equivalent employees as of December 27, 2015.

As of December 27, 2015, approximately half of our full-time equivalent employees were represented by unions. The following is a list of collective bargaining agreements covering various categories of the Company’s employees and their corresponding expiration dates.

|

| |

Employee Category | Expiration Date |

Mailers | March 30, 2016 |

NewsGuild of New York | March 30, 2016 |

Typographers | March 30, 2016 |

Machinists | March 30, 2018 |

Drivers | March 30, 2020 |

Paperhandlers | March 30, 2021 |

Pressmen | March 30, 2021 |

Stereotypers | March 30, 2021 |

Approximately 120 of our full-time equivalent employees are located in France, and the terms and conditions of employment of those employees are established by a combination of French national labor law, industry-wide collective agreements and Company-specific agreements.

AVAILABLE INFORMATION

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports, and the Proxy Statement for our Annual Meeting of Stockholders are made available, free of charge, on our website at http://www.nytco.com, as soon as reasonably practicable after such reports have been filed with or furnished to the SEC.

THE NEW YORK TIMES COMPANY – P. 5

You should carefully consider the risk factors described below, as well as the other information included in this Annual Report on Form 10-K. Our business, financial condition or results of operations could be materially adversely affected by any or all of these risks, or by other risks or uncertainties not presently known or currently deemed immaterial, that may adversely affect us in the future.

We face significant competition in all aspects of our business.

We operate in a highly competitive environment. We compete for advertising and circulation revenue with both traditional and new content providers. This competition has intensified as a result of the continued development of new digital media technologies and new media providers offering online news and other content, and new competitors could quickly emerge. Some of our current and potential competitors may have greater resources or better competitive positions in certain areas than we do, which may allow them to respond more effectively than us to new technologies and changes in market conditions.

Our ability to compete effectively depends on many factors both within and beyond our control, including among others:

| |

• | our ability to continue to deliver high-quality journalism and content that is interesting and relevant to our audience; |

| |

• | our ability to develop, maintain and monetize new and existing print and digital products; |

| |

• | the pricing of our products; |

| |

• | the popularity, usefulness, ease of use, performance, and reliability of our digital products; |

| |

• | the engagement of our readers with our print and digital products; |

| |

• | our ability to attract, retain, and motivate talented journalists and other employees and executives; |

| |

• | our ability to manage and grow our operations in a cost-effective manner; and |

| |

• | our reputation and brand strength relative to those of our competitors. |

Our success depends on our ability to respond and adapt to changes in technology and consumer behavior.

Technology in the media industry continues to evolve rapidly. Advances in technology have led to an increasing number of methods for the delivery and consumption of news and other content. These developments are driving changes in consumer behavior as consumers seek more control over how they consume content.

Changes in technology and consumer behavior pose a number of challenges that could adversely affect our revenues and competitive position. For example, among others:

| |

• | we may be unable to develop products for mobile devices or other digital platforms that consumers find engaging, that work with a variety of operating systems and networks and that achieve a high level of market acceptance; |

| |

• | there may be changes in user sentiment about the quality or usefulness of our existing products or concerns related to privacy, security or other factors; |

| |

• | news aggregation websites and customized news feeds may reduce our traffic levels by creating a disincentive for users to visit our websites or use our digital products; |

| |

• | failure to successfully manage changes in search engine optimization and social media traffic to increase our digital presence and visibility may reduce our traffic levels; |

| |

• | we may be unable to maintain or update our technology infrastructure in a way that meets market and consumer demands; |

| |

• | the distribution of our content on delivery platforms of third parties may lead to limitations on monetization of our products, the loss of control over distribution of our content and loss of a direct relationship with our audience; and |

P. 6 – THE NEW YORK TIMES COMPANY

| |

• | we may experience challenges in creating display advertising on mobile devices that does not disrupt the user experience. |

Responding to these changes may require significant investment. We may be limited in our ability to invest funds and resources in digital products, services or opportunities, and we may incur expense in building, maintaining and evolving our technology infrastructure.

Unless we are able to use new and existing technologies to distinguish our products and services from those of our competitors and develop in a timely manner compelling new products and services that engage users across platforms, our business, financial condition and prospects may be adversely affected.

Our advertising revenues are affected by numerous factors, including economic conditions, market dynamics, audience fragmentation and evolving digital advertising technologies.

We derive substantial revenues from the sale of advertising in our products. Advertising spending is sensitive to overall economic conditions, and our advertising revenues could be adversely affected if advertisers respond to weak and uneven economic conditions by reducing their budgets or shifting spending patterns or priorities, or if they are forced to consolidate or cease operations.

In determining whether to buy advertising, our advertisers will consider the demand for our products, demographics of our reader base, advertising rates, results observed by advertisers, and alternative advertising options. The increasing number of digital media options available, including through social networking tools and news aggregation websites, has expanded consumer choice significantly, resulting in audience fragmentation and increased competition for advertising.

Print advertising revenue represented approximately 69% of our total 2015 advertising revenues. However, the advertising industry continues to experience a shift toward digital advertising, which is less expensive and can offer more directly measurable returns than traditional print media. Because rates for digital advertising are generally lower than for traditional print advertising, our digital advertising revenue may not replace in full print advertising revenue lost as a result of the shift. In addition, margins on certain of our digital advertising revenues tend to be lower than on our print advertising revenues. Growing consumer reliance on mobile devices adds additional pressure, as advertising rates are generally lower on mobile devices than on personal computers.

The digital advertising market continues to undergo significant changes. Digital advertising networks and exchanges, real-time bidding and other programmatic buying channels that allow advertisers to buy audiences at scale have led to audience fragmentation and caused downward pricing pressure. The wide range of advertising choices across digital products and platforms and the large inventory of available digital advertising space have exacerbated this pressure.

The character of our digital advertising business is also changing, as demand for newer advertising formats like branded content, mobile and video advertising increases. Some of these newer formats may generate lower margins than traditional desktop display advertising. If we are unable to effectively grow advertising revenues from these newer formats through the development of advertising products that are compelling to both marketers and consumers, our results of operations could be adversely affected.

In addition, technologies have been developed, and will likely continue to be developed, that enable consumers to circumvent digital advertising on websites and mobile devices. Advertisements blocked by these technologies are treated as not delivered and any revenue we would otherwise receive from the advertiser for that advertisement is lost. Increased adoption of these technologies could adversely affect our advertising revenues, particularly if we are unable to develop effective solutions to mitigate their impact.

Competition from a variety of digital media and services, many of which charge lower rates than us, and the significant increase in inventory of digital advertising space have affected and will likely continue to affect our ability to attract and retain advertisers and to maintain or increase our advertising rates. In addition, evolving standards for the delivery of digital advertising, such as the industry-wide standard on viewability, could also negatively affect our digital advertising revenues.

THE NEW YORK TIMES COMPANY – P. 7

The inability of the Company to retain and grow our subscriber base could adversely affect our results of operations and business.

Revenue from subscriptions to our print and digital products makes up a majority of our total revenue. Subscription revenue is sensitive to discretionary spending available to subscribers in the markets we serve, as well as economic conditions. To the extent poor economic conditions lead consumers to reduce spending on discretionary activities, our ability to retain current and obtain new subscribers could be hindered, thereby reducing our subscription revenue.

In recent years, we have experienced declining print subscriptions. This is primarily due to increased competition from digital media formats (which are often free to users), higher subscription rates and a growing preference among certain consumers to receive all or a portion of their news from sources other than a print newspaper. If we are unable to offset continued revenue declines resulting from falling print subscriptions with revenue from home-delivery price increases, our print circulation revenue will be adversely affected.

Digital-only subscriptions for content provided on our websites and other digital platforms generate substantial revenue for us. Our future growth depends upon our ability to retain and grow our digital subscription base and audience. To do so will require us to evolve our digital subscription model, address changing consumer demands and develop and improve our digital products while continuing to deliver high-quality journalism and content that is interesting and relevant to our audience. There is no assurance that we will be able to successfully maintain and increase our digital audience or that we will be able to do so without taking steps such as reducing pricing or incurring subscription acquisition costs that would affect our margin or profitability.

Failure to execute cost-control measures successfully could adversely affect our profitability.

Over the last several years, we have taken steps to reduce operating costs across the Company, and we plan to continue our cost management efforts. However, if we do not achieve expected savings or our operating costs increase as a result of investments in strategic initiatives, our total operating costs would be greater than anticipated. In addition, if we do not manage cost-reduction efforts properly, such efforts may affect the quality of our products and therefore our ability to generate future revenues. And to the extent our cost-reduction efforts result in reductions in staff and employee compensation and benefits, this could adversely affect our ability to attract and retain key employees.

Significant portions of our expenses are fixed costs that neither increase nor decrease proportionately with revenues. In addition, our ability to make short-term adjustments to manage our costs or to make changes to our business strategy may be limited by certain of our collective bargaining agreements. If we are not able to implement further cost-control efforts or reduce our fixed costs sufficiently in response to a decline in our revenues, our results of operations will be adversely affected.

The underfunded status of our pension plans may adversely affect our operations, financial condition and liquidity.

We sponsor several single-employer defined benefit pension plans. Although we have frozen participation and benefits under all but two of these qualified pension plans, our results of operations will be affected by the amount of income or expense we record for, and the contributions we are required to make to, these plans.

We are required to make contributions to our plans to comply with minimum funding requirements imposed by laws governing those plans. As of December 27, 2015, our qualified defined benefit pension plans were underfunded by approximately $273 million. Our obligation to make additional contributions to our plans, and the timing of any such contributions, depends on a number of factors, many of which are beyond our control. These include: legislative changes; assumptions about mortality; and economic conditions, including a low interest rate environment or sustained volatility and disruption in the stock and bond markets, which impact discount rates and returns on plan assets.

As a result of these required contributions, we may have less cash available for working capital and other corporate uses, which may have an adverse impact on our results of operations, financial condition and liquidity.

Our participation in multiemployer pension plans may subject us to liabilities that could materially adversely affect our results of operations, financial condition and cash flows.

We participate in, and make periodic contributions to, various multiemployer pension plans that cover many of our current and former union employees. Our required contributions to these plans could increase because of a

P. 8 – THE NEW YORK TIMES COMPANY

shrinking contribution base as a result of the insolvency or withdrawal of other companies that currently contribute to these plans, the inability or failure of withdrawing companies to pay their withdrawal liability, low interest rates, lower than expected returns on pension fund assets or other funding deficiencies. Our withdrawal liability for any multiemployer pension plan will depend on the nature and timing of any triggering event and the extent of that plan’s funding of vested benefits.

If a multiemployer pension plan in which we participate has significant underfunded liabilities, such underfunding will increase the size of our potential withdrawal liability. In addition, under the Pension Protection Act of 2006, special funding rules apply to multiemployer pension plans that are classified as “endangered,” “seriously endangered,” or “critical” status. If plans in which we participate are in critical status, benefit reductions may apply and/or we could be required to make additional contributions.

We have recorded significant withdrawal liabilities with respect to multiemployer pension plans in which we formerly participated, primarily in connection with the sales of the New England and the Regional Media Groups. In addition, we have recorded withdrawal liabilities for actual and estimated partial withdrawals from several plans in which we continue to participate. Until demand letters from some of the multiemployer plans’ trustees are received, the exact amount of the withdrawal liability will not be fully known and, as such, a difference from the recorded estimate could have an adverse effect on our results of operations, financial condition and cash flows. In addition, in the event a mass withdrawal is deemed to have occurred at any of these plans, we may be required to make additional withdrawal liability payments under applicable law.

If, in the future, we elect to withdraw from these plans or if we trigger a partial withdrawal due to declines in contribution base units or a partial cessation of our obligation to contribute, additional liabilities would need to be recorded that could have an adverse effect on our business, results of operations, financial condition or cash flows.

Security breaches and other network and information systems disruptions could affect our ability to conduct our business effectively.

Our online systems store and process confidential subscriber, employee and other sensitive personal data, and therefore maintaining our network security is of critical importance. We use third-party technology and systems for a variety of operations, including encryption and authentication technology, employee email, domain name registration, content delivery to customers, back-office support and other functions. Our systems, and those of third parties upon which our business relies, may be vulnerable to interruption or damage that can result from natural disasters, fires, power outages, acts of terrorism or other similar events, or from deliberate attacks such as computer hacking, computer viruses, worms or other destructive or disruptive software, process breakdowns, denial of service attacks, malicious social engineering or other malicious activities, or any combination of the foregoing.

We have implemented controls and taken other preventative measures designed to strengthen our systems against attacks, including measures designed to reduce the impact of a security breach at our third-party vendors. Although the costs of the controls and other measures we have taken to date have not had a material effect on our financial condition, results of operations or liquidity, there can be no assurance as to the costs of additional controls and measures that we may conclude are necessary in the future.

There can also be no assurance that the actions, measures and controls we have implemented will be effective against future attacks or be sufficient to prevent a future security breach or other disruption to our network or information systems, or those of our third-party providers. Such an event could result in a disruption of our services or improper disclosure of personal data or confidential information, which could harm our reputation, require us to expend resources to remedy such a security breach or defend against further attacks, divert management’s attention and resources or subject us to liability under laws that protect personal data, resulting in increased operating costs or loss of revenue.

Our international operations expose us to economic and other risks inherent in foreign operations.

We are focused on expanding the international scope of our business, and face the inherent risks associated with doing business abroad, including:

| |

• | effectively managing and staffing foreign operations, including complying with local laws and regulations in each different jurisdiction; |

| |

• | navigating local customs and practices; |

THE NEW YORK TIMES COMPANY – P. 9

| |

• | government policies and regulations that restrict the digital flow of information; |

| |

• | protecting and enforcing our intellectual property rights under varying legal regimes; |

| |

• | complying with international laws and regulations, including those governing consumer privacy and the collection, use, retention, sharing and security of consumer data; |

| |

• | economic uncertainty, volatility in local markets and political or social instability; |

| |

• | restrictions on foreign ownership, foreign investment or repatriation of funds; |

| |

• | higher-than-anticipated costs of entry; and |

| |

• | currency exchange rate fluctuations. |

Adverse developments in any of these areas could have an adverse impact on our business, financial condition and results of operations. We may, for example, incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure to comply. In addition, we have limited experience in developing and marketing our digital products in international regions and could be at a disadvantage compared with local and multinational competitors.

A significant number of our employees are unionized, and our business and results of operations could be adversely affected if labor agreements were to further restrict our ability to maximize the efficiency of our operations.

Approximately half of our full-time equivalent work force is unionized. As a result, we are required to negotiate the wages, salaries, benefits, staffing levels and other terms with many of our employees collectively. Our results could be adversely affected if future labor negotiations or contracts were to further restrict our ability to maximize the efficiency of our operations. If we are unable to negotiate labor contracts on reasonable terms, or if we were to experience labor unrest or other business interruptions in connection with labor negotiations or otherwise, our ability to produce and deliver our products could be impaired. In addition, our ability to make adjustments to control compensation and benefits costs, change our strategy or otherwise adapt to changing business needs may be limited by the terms and duration of our collective bargaining agreements.

Our brand and reputation are key assets of the Company, and negative perceptions or publicity could adversely affect our business, financial condition and results of operations.

The New York Times brand is a key asset of the Company, and our continued success depends on our ability to preserve, grow and leverage the value of our brand. We believe that we have a powerful and trusted brand with an excellent reputation for high-quality journalism and content. This reputation could be damaged by incidents that erode consumer trust. Our reputation could also be damaged by failures of third-party vendors we rely on in many contexts. To the extent consumers perceive the quality of our products to be less reliable or our reputation is damaged, our revenues and profitability could be adversely affected.

Our business may suffer if we cannot protect our intellectual property.

Our business depends on our intellectual property, including our valuable brands, content, services and internally developed technology. We believe our proprietary trademarks and other intellectual property rights are important to our continued success and our competitive position. Unauthorized parties may attempt to copy or otherwise unlawfully obtain and use our content, services, technology and other intellectual property, and we cannot be certain that the steps we have taken to protect our proprietary rights will prevent any misappropriation or confusion among consumers and merchants, or unauthorized use of these rights.

Advancements in technology have made the unauthorized duplication and wide dissemination of content easier, making the enforcement of intellectual property rights more challenging. In addition, as our business and the risk of misappropriation of our intellectual property rights have become more global in scope, we may not be able to protect our proprietary rights in a cost-effective manner in a multitude of jurisdictions with varying laws.

If we are unable to procure, protect and enforce our intellectual property rights, including maintaining and monetizing our intellectual property rights to our content, we may not realize the full value of these assets, and our business and profitability may suffer. In addition, if we must litigate in the United States or elsewhere to enforce our intellectual property rights or determine the validity and scope of the proprietary rights of others, such litigation may be costly and divert the attention of our management. In addition, if we must take actions, including litigation, in the

P. 10 – THE NEW YORK TIMES COMPANY

United States or elsewhere to enforce our intellectual property rights or determine the validity and scope of the proprietary rights of others, such actions may be costly and divert the attention of our management.

Legislative and regulatory developments, including with respect to privacy, could adversely affect our business.

Our business is are subject to government regulation in the jurisdictions in which we operate, and our websites, which are available worldwide, may be subject to laws regulating the Internet even in jurisdictions where we do not do business. We may incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure to comply.

Revenues from our digital products could be adversely affected, directly or indirectly, in particular by existing or future laws and regulations relating to online privacy and the collection and use of consumer data in digital media. In addition, any failure, or perceived failure, by us to comply with our posted privacy policies or with any data-related requirements could result in claims against us by governmental entities or others, or could require us to change our practices, which could adversely affect our business.

We have been, and may be in the future, subject to claims of intellectual property infringement that could adversely affect our business.

We periodically receive claims from third parties alleging infringement, misappropriation or other violations of their intellectual property rights. These third parties often include patent holding companies seeking to monetize patents they have purchased or otherwise obtained through asserting claims of infringement or misuse. Even if we believe that these claims of intellectual property infringement are without merit, defending against the claims can be time-consuming, be expensive to litigate or settle, and cause diversion of management attention.

These intellectual property infringement claims, if successful, may require us to enter into royalty or licensing agreements on unfavorable terms, use more costly alternative technology or otherwise incur substantial monetary liability. Additionally, these claims may require us to significantly alter certain of our operations. The occurrence of any of these events as a result of these claims could result in substantially increased costs or otherwise adversely affect our business.

Acquisitions, divestitures, investments and other transactions could adversely affect our costs, revenues, profitability and financial position.

In order to position our business to take advantage of growth opportunities, we engage in discussions, evaluate opportunities and enter into agreements for possible acquisitions, divestitures, investments and other transactions. We may also consider the acquisition of, or investment in, specific properties, businesses or technologies that fall outside our traditional lines of business and diversify our portfolio, including those that may operate in new and developing industries, if we deem such properties sufficiently attractive.

Acquisitions involve significant risks, including difficulties in integrating acquired operations, diversion of management resources, debt incurred in financing these acquisitions (including the related possible reduction in our credit ratings and increase in our cost of borrowing), differing levels of management and internal control effectiveness at the acquired entities and other unanticipated problems and liabilities. Competition for certain types of acquisitions, particularly digital properties, is significant. Even if successfully negotiated, closed and integrated, certain acquisitions or investments may prove not to advance our business strategy and may fall short of expected return on investment targets, which would adversely affect our business, results of operations and financial condition.

We have made investments in companies, and we may make similar investments in the future. Investments in these businesses subject us to the operating and financial risks of these businesses and to the risk that we do not have sole control over the operations of these businesses. For example, our investments in Malbaie and Madison subject us to risks related to paper mill operations, including existing pricing pressure caused by the declining demand for paper, and competitive pressures caused by currency volatility. The significant decline in the value of the Canadian dollar relative to the U.S. dollar has placed Madison, which is based in Maine, at a competitive disadvantage to supercalendered paper mills that operate in Canada and sell to the United States.

Our investments are generally illiquid and the absence of a market may inhibit our ability to dispose of them. In addition, if the book value of an investment were to exceed its fair value, we would be required to recognize an impairment charge related to the investment.

THE NEW YORK TIMES COMPANY – P. 11

A significant increase in the price of newsprint, or significant disruptions in our newsprint supply chain, would have an adverse effect on our operating results.

The cost of raw materials, of which newsprint is the major component, represented approximately 6% of our total operating costs in 2015. The price of newsprint has historically been volatile and, while it has decreased over the last several years, may increase as a result of various factors, including a reduction in the number of suppliers due to restructurings, bankruptcies and consolidations; declining newsprint supply as a result of paper mill closures and conversions to other grades of paper; and other factors that adversely impact supplier profitability, including increases in operating expenses caused by raw material and energy costs, and currency volatility.

In addition, we rely on our suppliers for deliveries of newsprint. The availability of our newsprint supply may be affected by various factors, including labor unrest, transportation issues and other disruptions that may affect deliveries of newsprint.

If newsprint prices increase significantly or we experience significant disruptions in the availability of our newsprint supply in the future, our operating results will be adversely affected.

Our debt agreements contain restrictions that limit our flexibility in operating our business.

Our debt agreements contain various covenants that limit our flexibility in operating our businesses, including our ability to engage in specified types of transactions. Subject to certain exceptions, these covenants restrict our ability and the ability of our subsidiaries to, among other things:

| |

• | incur or guarantee additional debt or issue certain preferred equity; |

| |

• | pay dividends on or make distributions to holders of our common stock or make other restricted payments; |

| |

• | create or incur liens on certain assets to secure debt; |

| |

• | make certain investments, acquisitions or dispositions; |

| |

• | consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; and |

| |

• | enter into certain transactions with affiliates. |

Our credit ratings, as well as general macroeconomic conditions, may affect our liquidity by increasing borrowing costs and limiting our financing options.

Our long-term debt is currently rated below investment grade by Standard & Poor’s and Moody’s Investors Service. If our credit ratings remain below investment grade or are lowered further, borrowing costs for future long-term debt or short-term borrowing facilities may increase and our financing options, including our access to the unsecured borrowing market, would be limited. We may also be subject to additional restrictive covenants that would reduce our flexibility.

In addition, macroeconomic conditions, such as continued or increased volatility or disruption in the credit markets, could adversely affect our ability to refinance existing debt or obtain additional financing to support operations or to fund new acquisitions or other capital-intensive initiatives.

Our Class B Common Stock is principally held by descendants of Adolph S. Ochs, through a family trust, and this control could create conflicts of interest or inhibit potential changes of control.

We have two classes of stock: Class A Common Stock and Class B Common Stock. Holders of Class A Common Stock are entitled to elect 30% of the Board of Directors and to vote, with holders of Class B Common Stock, on the reservation of shares for equity grants, certain material acquisitions and the ratification of the selection of our auditors. Holders of Class B Common Stock are entitled to elect the remainder of the Board of Directors and to vote on all other matters. Our Class B Common Stock is principally held by descendants of Adolph S. Ochs, who purchased The Times in 1896. A family trust holds approximately 90% of the Class B Common Stock. As a result, the trust has the ability to elect 70% of the Board of Directors and to direct the outcome of any matter that does not require a vote of the Class A Common Stock. Under the terms of the trust agreement, the trustees are directed to retain the Class B Common Stock held in trust and to vote such stock against any merger, sale of assets or other transaction pursuant to which control of The Times passes from the trustees, unless they determine that the primary objective of the trust can be achieved better by the implementation of such transaction. Because this concentrated control could

P. 12 – THE NEW YORK TIMES COMPANY

discourage others from initiating any potential merger, takeover or other change of control transaction that may otherwise be beneficial to our businesses, the market price of our Class A Common Stock could be adversely affected.

Adverse results from litigation or governmental investigations can impact our business practices and operating results.

From time to time, we are party to litigation and regulatory, environmental and other proceedings with governmental authorities and administrative agencies. See Note 18 of the Notes to the Consolidated Financial Statements regarding certain matters. Adverse outcomes in lawsuits or investigations could result in significant monetary damages or injunctive relief that could adversely affect our results of operations or financial condition as well as our ability to conduct our business as it is presently being conducted. In addition, regardless of merit or outcome, such proceedings can have an adverse impact on the Company as a result of legal costs, diversion of management and other personnel, and other factors.

|

|

ITEM 1B. UNRESOLVED STAFF COMMENTS |

None.

Our principal executive offices are located in our New York headquarters building in the Times Square area. The building was completed in 2007 and consists of approximately 1.54 million gross square feet, of which approximately 828,000 gross square feet of space have been allocated to us. We owned a leasehold condominium interest representing approximately 58% of the New York headquarters building until March 2009, when we entered into an agreement to sell and simultaneously lease back 21 floors, or approximately 750,000 rentable square feet, currently occupied by us (the “Condo Interest”). The sale price for the Condo Interest was $225.0 million. We have an option exercisable in 2019 to repurchase the Condo Interest for $250.0 million. The lease term is 15 years, and we have three renewal options that could extend the term for an additional 20 years. We continue to own a leasehold condominium interest in seven floors in our New York headquarters building, totaling approximately 216,000 rentable square feet that were not included in the sale-leaseback transaction, all of which are currently leased to third parties.

In addition, we have a printing and distribution facility with 570,000 gross square feet located in College Point, N.Y., on a 31-acre site owned by the City of New York for which we have a ground lease. We have an option to purchase the property at any time before the lease ends in 2019 for $6.9 million. We also currently own other properties with an aggregate of approximately 2,200 gross square feet and lease other properties with an aggregate of approximately 247,900 rentable square feet in various locations.

|

|

ITEM 3. LEGAL PROCEEDINGS |

We are involved in various legal actions incidental to our business that are now pending against us. These actions are generally for amounts greatly in excess of the payments, if any, that may be required to be made. See Note 18 of the Notes to the Consolidated Financial Statements for a description of certain matters, which is incorporated herein by reference. Although the Company cannot predict the outcome of these matters, it is possible that an unfavorable outcome in one or more matters could be material to the Company’s consolidated results of operations or cash flows for an individual reporting period. However, based on currently available information, management does not believe that the ultimate resolution of these matters, individually or in the aggregate, is likely to have a material effect on the Company’s financial position.

|

|

ITEM 4. MINE SAFETY DISCLOSURES |

Not applicable.

THE NEW YORK TIMES COMPANY – P. 13

EXECUTIVE OFFICERS OF THE REGISTRANT

|

| | | | | | | |

Name | | Age | | Employed By Registrant Since | |

Recent Position(s) Held as of February 24, 2016 |

Arthur Sulzberger, Jr. | | 64 | | 1978 | | Chairman (since 1997) and Publisher of The Times (since 1992); Chief Executive Officer (2011 to 2012) |

Mark Thompson | | 58 | | 2012 | | President and Chief Executive Officer (since 2012); Director-General, British Broadcasting Corporation (“BBC”) (2004 to 2012); Chief Executive, Channel 4 Television Corporation (2002 to 2004); and various positions of increasing responsibility at the BBC (1979 to 2001) |

Michael Golden | | 66 | | 1984 | | Vice Chairman (since 1997); President and Chief Operating Officer, Regional Media Group (2009 to 2012); Publisher of the International Herald Tribune (2003 to 2008); Senior Vice President (1997 to 2004) |

James M. Follo | | 56 | | 2007 | | Executive Vice President (since 2013) and Chief Financial Officer (since 2007); Senior Vice President (2007 to 2013); Chief Financial and Administrative Officer, Martha Stewart Living Omnimedia, Inc. (2001 to 2006) |

R. Anthony Benten | | 52 | | 1989 | | Senior Vice President, Finance (since 2008) and Corporate Controller (since 2007); Vice President (2003 to 2008); Treasurer (2001 to 2007) |

Meredith Kopit Levien | | 44 | | 2013 | | Executive Vice President and Chief Revenue Officer (since 2015); Executive Vice President, Advertising (2013 to 2015); Chief Revenue Officer, Forbes Media LLC (2011 to 2013); Senior Vice President and Group Publisher, Forbes Magazine Group (2010 to 2011); Vice President and Publisher, ForbesLife and ForbesWoman.com (2008 to 2010); and various positions of increasing responsibility at Atlantic Media Company (2001 to 2008) |

Kenneth A. Richieri | | 64 | | 1983 | | Executive Vice President (since 2013) and General Counsel (since 2006); Senior Vice President (2007 to 2013); Secretary (2008 to 2011); Vice President (2002 to 2007); Deputy General Counsel (2001 to 2005); Vice President and General Counsel, New York Times Digital (1999 to 2003) |

P. 14 – THE NEW YORK TIMES COMPANY

|

|

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

MARKET INFORMATION

The Class A Common Stock is listed on the New York Stock Exchange. The Class B Common Stock is unlisted and is not actively traded.

The number of security holders of record as of February 17, 2016, was as follows: Class A Common Stock: 6,348; Class B Common Stock: 26.

We have paid quarterly dividends of $0.04 per share on the Class A and Class B Common Stock since late 2013. We currently expect to continue to pay comparable cash dividends in the future, although changes in our dividend program may be considered by our Board of Directors in light of our earnings, capital requirements, financial condition and other factors considered relevant. In addition, our Board of Directors will consider restrictions in any existing indebtedness, such as the terms of our 6.625% senior unsecured notes due 2016, which restrict our ability to pay dividends. See also “Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Third-Party Financing.”

The following table sets forth, for the periods indicated, the high and low closing sales prices for the Class A Common Stock as reported on the New York Stock Exchange.

|

| | | | | | | | | | | | | | | | |

| | 2015 | | 2014 |

Quarters | | High |

| | Low |

| | High |

| | Low |

|

First Quarter | | $ | 14.45 |

| | $ | 12.02 |

| | $ | 16.81 |

| | $ | 13.75 |

|

Second Quarter | | 14.46 |

| | 12.81 |

| | 17.26 |

| | 14.64 |

|

Third Quarter | | 13.75 |

| | 11.62 |

| | 15.61 |

| | 11.46 |

|

Fourth Quarter | | 14.25 |

| | 11.56 |

| | 13.61 |

| | 11.22 |

|

ISSUER PURCHASES OF EQUITY SECURITIES(1)

|

| | | | | | | | | | | | | | | |

Period | | Total number of shares of Class A Common Stock purchased (a) | | Average price paid per share of Class A Common Stock (b) | | Total number of shares of Class A Common Stock purchased as part of publicly announced plans or programs (c) | | Maximum number (or approximate dollar value) of shares of Class A Common Stock that may yet be purchased under the plans or programs (d) |

September 28, 2015 - November 1, 2015 | | 1,337,353 |

| | $ | 12.48 |

| | 1,337,353 |

| | $ | 38,510,000 |

|

November 2, 2015 - November 29, 2015 | | 157,231 |

| | $ | 13.57 |

| | 157,231 |

| | $ | 36,376,000 |

|

November 30, 2015 - December 27, 2015 | | 379,010 |

| | $ | 13.48 |

| | 379,010 |

| | $ | 31,268,000 |

|

Total for the fourth quarter of 2015 | | 1,873,594 |

| | $ | 12.77 |

| | 1,873,594 |

| | $ | 31,268,000 |

|

| |

(1) | On January 13, 2015, the Board of Directors terminated an existing authorization to repurchase shares of the Company’s Class A common Stock and approved a new repurchase authorization of $101.1 million, equal to the cash proceeds received by the Company from an exercise of warrants. As of February 17, 2016, repurchases under this authorization totaled $84.9 million (excluding commissions) and $16.2 million remained under this authorization. All purchases were made pursuant to our publicly announced share repurchase program. Our Board of Directors has authorized us to purchase shares from time to time, subject to market conditions and other factors. There is no expiration date with respect to this authorization. |

THE NEW YORK TIMES COMPANY – P. 15

PERFORMANCE PRESENTATION

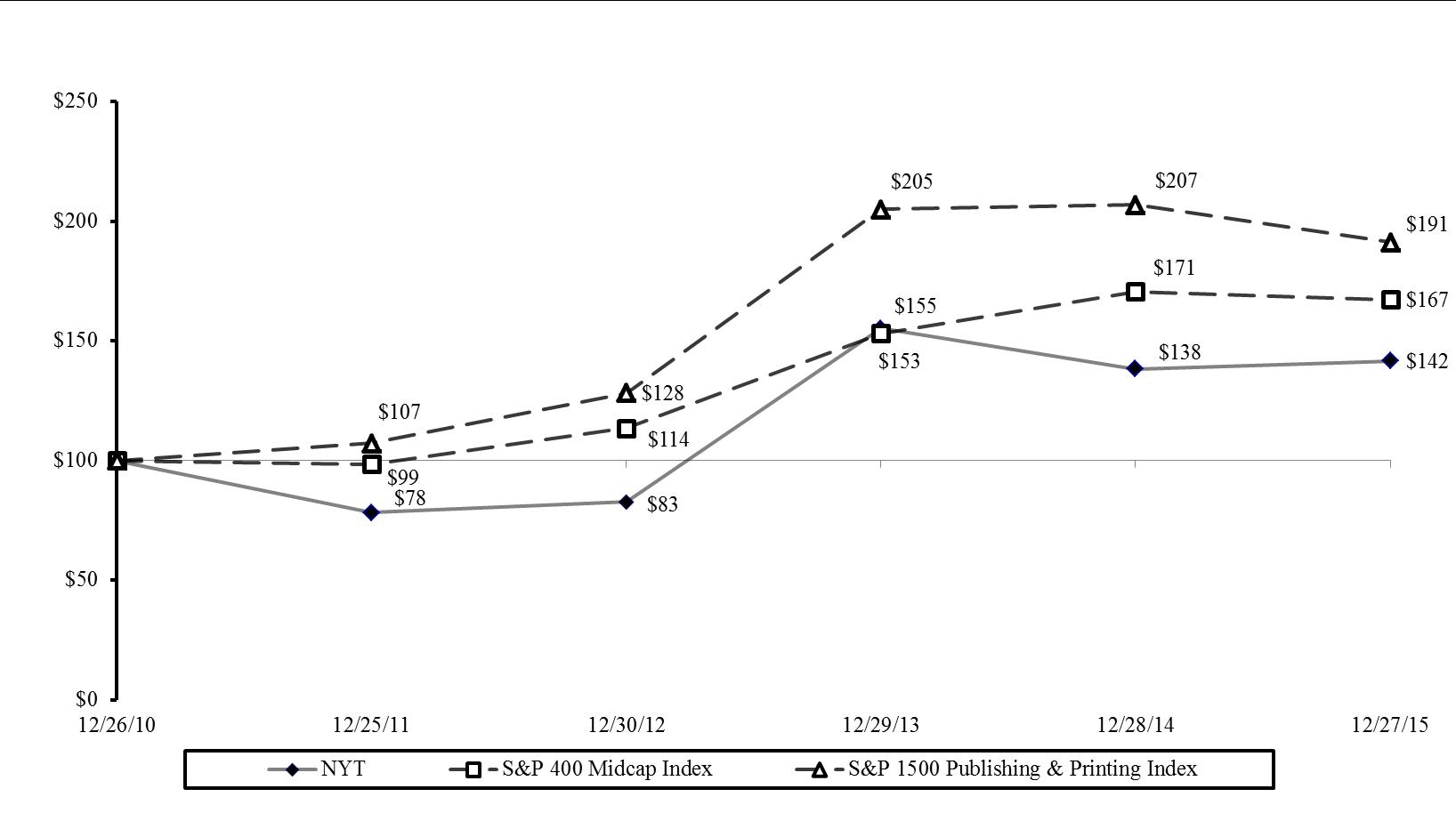

The following graph shows the annual cumulative total stockholder return for the five fiscal years ended December 27, 2015, on an assumed investment of $100 on December 26, 2010, in the Company, the Standard & Poor’s S&P 400 MidCap Stock Index and the Standard & Poor’s S&P 1500 Publishing and Printing Index. Stockholder return is measured by dividing (a) the sum of (i) the cumulative amount of dividends declared for the measurement period, assuming reinvestment of dividends, and (ii) the difference between the issuer’s share price at the end and the beginning of the measurement period, by (b) the share price at the beginning of the measurement period. As a result, stockholder return includes both dividends and stock appreciation.

Stock Performance Comparison Between the S&P 400 Midcap Index, S&P 1500 Publishing & Printing Index and The New York Times Company’s Class A Common Stock

P. 16 – THE NEW YORK TIMES COMPANY

|

| |

| ITEM 6. SELECTED FINANCIAL DATA |

The Selected Financial Data should be read in conjunction with “Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements and the related Notes in Item 8. The results of operations for the New England Media Group, which was sold in 2013, as well as for the Regional Media Group and the About Group, which were sold in 2012, have been presented as discontinued operations for all periods presented (see Note 13 of the Notes to the Consolidated Financial Statements). The pages following the table show certain items included in Selected Financial Data. All per share amounts on those pages are on a diluted basis. Fiscal year 2012 comprised 53 weeks and all other fiscal years presented in the table below comprised 52 weeks.

|

| | | | | | | | | | | | | | | | | | | | |

| | As of and for the Years Ended |

(In thousands) | | December 27,

2015 |

| | December 28,

2014 |

| | December 29,

2013 |

| | December 30,

2012 |

| | December 25,

2011 |

|

| | (52 Weeks) |

| | (52 Weeks) |

| | (52 Weeks) |

| | (53 Weeks) |

| | (52 Weeks) |

|

Statement of Operations Data | | | | | | |

Revenues | | $ | 1,579,215 |

| | $ | 1,588,528 |

| | $ | 1,577,230 |

| | $ | 1,595,341 |

| | $ | 1,554,574 |

|

Operating costs | | 1,393,246 |

| | 1,484,505 |

| | 1,411,744 |

| | 1,441,410 |

| | 1,411,652 |

|

Early termination charge | | — |

| | 2,550 |

| | — |

| | — |

| | — |

|

Pension settlement expense | | 40,329 |

| | 9,525 |

| | 3,228 |

| | 47,657 |

| | — |

|

Multiemployer pension plan withdrawal expense | | 9,055 |

| | — |

| | 6,171 |

| | — |

| | 4,228 |

|

Other expenses | | — |

| | — |

| | — |

| | 2,620 |

| | 4,500 |

|

Impairment of assets | | — |

| | — |

| | — |

| | — |

| | 7,458 |

|

Operating profit | | 136,585 |

| | 91,948 |

| | 156,087 |

| | 103,654 |

| | 126,736 |

|

Gain on sale of investments | | — |

| | — |

| | — |

| | 220,275 |

| | 71,171 |

|

Impairment of investments | | — |

| | — |

| | — |

| | 5,500 |

| | — |

|

Loss from joint ventures | | (783 | ) | | (8,368 | ) | | (3,215 | ) | | 2,936 |

| | (270 | ) |

Premium on debt redemption | | — |

| | — |

| | — |

| | — |

| | 46,381 |

|

Interest expense, net | | 39,050 |

| | 53,730 |

| | 58,073 |

| | 62,808 |

| | 85,243 |

|

Income from continuing operations before income taxes | | 96,752 |

| | 29,850 |

| | 94,799 |

| | 258,557 |

| | 66,013 |

|

Income from continuing operations, net of income taxes | | 62,842 |

| | 33,391 |

| | 56,907 |

| | 163,940 |

| | 44,596 |

|

(Loss)/income from discontinued operations, net of income taxes | | — |

| | (1,086 | ) | | 7,949 |

| | (27,927 | ) | | (82,799 | ) |

Net income/(loss) attributable to The New York Times Company common stockholders | | 63,246 |

| | 33,307 |

| | 65,105 |

| | 135,847 |

| | (37,648 | ) |

Balance Sheet Data | | | | | | | | |

Cash, cash equivalents and marketable securities | | $ | 904,551 |

| | $ | 981,170 |

| | $ | 1,023,780 |

| | $ | 959,754 |

| | $ | 279,997 |

|

Property, plant and equipment, net | | 632,439 |

| | 665,758 |

| | 713,356 |

| | 773,469 |

| | 837,595 |

|

Total assets | | 2,417,690 |

| | 2,566,474 |

| | 2,572,552 |

| | 2,807,470 |

| | 2,887,367 |

|

Total debt and capital lease obligations | | 431,228 |

| | 650,120 |

| | 684,163 |

| | 696,875 |

| | 773,120 |

|

Total New York Times Company stockholders’ equity | | 826,751 |

| | 726,328 |

| | 842,910 |

| | 662,325 |

| | 533,678 |

|

THE NEW YORK TIMES COMPANY – P. 17

|

| | | | | | | | | | | | | | | | | | | | | |

| | As of and for the Years Ended |

(In thousands, except ratios, per share and employee data) | | December 27,

2015 |

| | December 28,

2014 |

| | December 29,

2013 |

| | December 30,

2012 |

| | December 25,

2011 |

|

| (52 Weeks) |

| | (52 Weeks) |

| | (52 Weeks) |

| | (53 Weeks) |

| | (52 Weeks) |

|

Per Share of Common Stock | | | | | | | | | |

Basic earnings/(loss) per share attributable to The New York Times Company common stockholders: |

Income from continuing operations | | $ | 0.38 |

| | $ | 0.23 |

| | $ | 0.38 |

| | $ | 1.11 |

| | $ | 0.31 |

|

(Loss)/income from discontinued operations, net of income taxes | | — |

| | (0.01 | ) | | 0.05 |

| | (0.19 | ) | | (0.57 | ) |

Net income/(loss) | | $ | 0.38 |

| | $ | 0.22 |

| | $ | 0.43 |

| | $ | 0.92 |

| | $ | (0.26 | ) |

Diluted earnings/(loss) per share attributable to The New York Times Company common stockholders: |

Income from continuing operations | | $ | 0.38 |

| | $ | 0.21 |

| | $ | 0.36 |

| | $ | 1.07 |

| | $ | 0.30 |

|

(Loss)/income from discontinued operations, net of income taxes | | — |

| | (0.01 | ) | | 0.05 |

| | (0.18 | ) | | (0.55 | ) |

Net income/(loss) | | $ | 0.38 |

| | $ | 0.20 |

| | $ | 0.41 |

| | $ | 0.89 |

| | $ | (0.25 | ) |

Dividends declared per share | | $ | 0.16 |

| | $ | 0.16 |

| | $ | 0.08 |

| | $ | — |

| | $ | — |

|

New York Times Company stockholders’ equity per share | | $ | 4.97 |

| | $ | 4.50 |

| | $ | 5.34 |

| | $ | 4.34 |

| | $ | 3.51 |

|

Average basic shares outstanding | | 164,390 |

| | 150,673 |

| | 149,755 |

| | 148,147 |

| | 147,190 |

|

Average diluted shares outstanding | | 166,423 |

| | 161,323 |

| | 157,774 |

| | 152,693 |

| | 152,007 |

|

Key Ratios | | | | | | | | | | |

Operating profit to revenues | | 9 | % | | 6 | % | | 10 | % | | 6 | % | | 8 | % |

Return on average common stockholders’ equity | | 8 | % | | 4 | % | | 9 | % | | 23 | % | | (6 | )% |

Return on average total assets | | 3 | % | | 1 | % | | 2 | % | | 5 | % | | (1 | )% |

Total debt and capital lease obligations to total capitalization | | 34 | % | | 47 | % | | 45 | % | | 51 | % | | 59 | % |

Current assets to current liabilities | | 1.53 |

| | 1.91 |

| | 3.36 |

| | 3.30 |

| | 2.67 |

|

Ratio of earnings to fixed charges | | 2.90 |

| | 1.67 |

| | 2.58 |

| | 4.94 |

| | 1.76 |

|

Full-Time Equivalent Employees | | 3,560 |

| | 3,588 |

| | 3,529 |

| | 5,363 |

| | 7,273 |

|

The items below are included in the Selected Financial Data.

2015

The items below had a net unfavorable effect on our results from continuing operations of $54.1 million, or $.32 per share:

| |

• | a $40.3 million pre-tax pension settlement charge ($24.0 million after tax, or $.14 per share) in connection with lump-sum payments made under an immediate pension benefits offer to certain former employees. |

| |

• | $34.4 million of pre-tax expenses ($20.5 million after tax, or $.12 per share) for non-operating retirement costs. |

| |

• | $9.1 million of pre-tax charges ($5.4 million after tax, or $.03 per share) for partial withdrawal obligations under multiemployer pension plans. |

| |

• | a $7.0 million pre-tax charge ($4.2 million after tax, or $.03 per share) for severance costs. |

2014

The items below had a net unfavorable effect on our results from continuing operations of $35.1 million, or $.22 per share:

| |

• | $36.7 million of pre-tax expenses ($21.7 million after tax, or $.13 per share) for non-operating retirement costs. |

| |

• | a $36.1 million pre-tax charge ($21.4 million after tax, or $.13 per share) for severance costs. |

P. 18 – THE NEW YORK TIMES COMPANY

| |

• | a $21.1 million income tax benefit ($.13 per share) primarily due to reductions in the Company’s reserve for uncertain tax positions. |

| |

• | a $9.5 million pre-tax pension settlement charge ($5.7 million after tax, or $.04 per share) in connection with lump-sum payments made under an immediate pension benefits offer to certain former employees. |

| |

• | a $9.2 million pre-tax charge ($5.9 million after tax or $.04 per share) for an impairment related to the Company’s investment in a joint venture. |

| |

• | a $2.6 million pre-tax charge ($1.5 million after tax, or $.01 per share) for the early termination of a distribution agreement. |

2013

The items below had a net unfavorable effect on our results from continuing operations of $25.2 million, or $.16 per share:

| |

• | $20.8 million of pre-tax expenses ($12.3 million after tax, or $.08 per share) for non-operating retirement costs. |

| |

• | a $12.4 million pre-tax charge ($7.3 million after tax, or $.05 per share) for severance costs. |

| |

• | a $6.2 million pre-tax charge ($3.7 million after tax, or $.02 per share) for a partial withdrawal obligation under multiemployer pension plans. |

| |

• | a $3.2 million pre-tax pension settlement charge ($1.9 million after tax, or $.01 per share) in connection with lump-sum payments under an immediate pension benefit offer to certain former employees. |

2012 (53-week fiscal year)

The items below had a net favorable effect on our results from continuing operations of $69.2 million, or $.45 per share:

| |

• | a $220.3 million pre-tax gain ($134.7 million after tax, or $.87 per share) on the sales of our remaining ownership interest in Indeed.com and our remaining units in Fenway Sports Group. |

| |