As filed with the Securities and Exchange Commission on January 16, 2013

Registration No. 333-184681

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-14

|

|

REGISTRATION STATEMENT |

x |

|

|

|

|

|

|

Pre-Effective Amendment No. 1 |

x |

|

|

Post-Effective Amendment No. |

o |

|

|

(Check appropriate box or boxes) |

|

Morgan Stanley Variable Investment Series

(Exact name of Registrant as Specified in its Charter)

522 Fifth Avenue

New York, New York 10036

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Stefanie V. Chang Yu, Esq.

Morgan Stanley Investment Management Inc.

522 Fifth Avenue

New York, New York 10036

(Name and Address of Agent for Service)

Copy to:

|

Carl Frischling, Esq. |

|

Stuart M. Strauss, Esq. |

Approximate Date of Proposed Public Officer: As soon as practicable after the effective date of this Registration Statement.

No filing fee is required because an indefinite number of common shares of beneficial interest of Morgan Stanley Variable Investment Series have previously been registered pursuant to Section 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

MORGAN STANLEY VARIABLE INVESTMENT SERIES

522 Fifth Avenue

New York, NY 10036

Dear Variable Life Insurance and Variable Annuity Contract Owners:

Morgan Stanley Variable Investment Series (the "Trust") will hold a special meeting of shareholders of the Aggressive Equity Portfolio (the "Acquired Fund") on February 21, 2013 at 9:00 a.m., New York time, at the offices of Morgan Stanley Investment Management Inc., Conference Room 3A, 3rd Floor, 522 Fifth Avenue, New York, NY 10036. At the meeting, shareholders of the Acquired Fund will be asked to consider and vote upon a proposal to approve the actions and transactions described in that certain Agreement and Plan of Reorganization, dated September 28, 2012 (the "Reorganization Agreement"), between the Trust, on behalf of the Acquired Fund, and the Trust, on behalf of the Multi Cap Growth Portfolio (the "Acquiring Fund"), pursuant to which substantially all of the assets and the liabilities of the Acquired Fund will be transferred to the Acquiring Fund in exchange for shares of the corresponding class of the Acquiring Fund and pursuant to which the Acquired Fund will be liquidated and terminated (the "Reorganization"). A formal Notice of Special Meeting of Shareholders appears on the next page, followed by the Proxy Statement and Prospectus, which explains in more detail the proposal to be considered.

Like the Acquired Fund, the Acquiring Fund is currently offered only to certain life insurance companies in connection with particular variable life insurance and/or variable annuity contracts they issue (each an "Insurance Company" and, collectively, the "Insurance Companies"). Please review the enclosed Proxy Statement and Prospectus for a more detailed description of the Reorganization and the specific reasons it is being proposed.

If you are an owner of a variable life insurance and/or variable annuity contract issued by the separate accounts of the Insurance Companies, you are not a shareholder of the Acquired Fund, but you have the right to instruct your Insurance Company how to vote at the Meeting. You may give voting instructions for the number of shares of the Acquired Fund attributable to your variable life insurance policy or variable annuity contract as of the close of business on December 26, 2012.

The Board of Trustees of the Acquired Fund recommends that you give voting instructions in favor of the Reorganization. In order for shares to be voted at the Meeting based on your instructions, we urge you to read the Proxy Statement and Prospectus and then complete and mail your Voting Instruction Form in the enclosed postage-paid envelope. To give voting instructions by touch-tone telephone or via the Internet, follow the instructions on the Voting Instruction Form.

Please take a few moments to review the details of the proposal. If you have any questions regarding the Reorganization, please feel free to call the contact number listed in the enclosed Proxy Statement and Prospectus. We urge you to vote at your earliest convenience.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

Very truly yours,

Arthur Lev

President and Principal Executive Officer

January 18, 2013

MORGAN STANLEY VARIABLE INVESTMENT SERIES

AGGRESSIVE EQUITY PORTFOLIO

522 Fifth Avenue

New York, NY 10036

(800) 869-6397

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD FEBRUARY 21, 2013

To the Shareholders of the Aggressive Equity Portfolio:

Notice is hereby given of a Special Meeting of Shareholders (the "Meeting") of the Aggressive Equity Portfolio (the "Acquired Fund"), a series of Morgan Stanley Variable Investment Series (the "Trust"), to be held in Conference Room 3A, 3rd Floor, 522 Fifth Avenue, New York, NY 10036, at 9:00 a.m., New York time, on February 21, 2013, and any adjournments or postponements thereof, for the following purposes:

1. To consider and vote upon a proposal to approve the actions and transactions described in that certain Agreement and Plan of Reorganization, dated September 28, 2012 (the "Reorganization Agreement"), between the Trust, on behalf of the Acquired Fund, and the Trust, on behalf of the Multi Cap Growth Portfolio (the "Acquiring Fund"), pursuant to which substantially all of the assets and the liabilities of the Acquired Fund will be transferred to the Acquiring Fund in exchange for shares of the corresponding class of the Acquiring Fund and pursuant to which the Acquired Fund will be liquidated and terminated (the "Reorganization"). As a result of this transaction, shareholders of the Acquired Fund will become shareholders of the Acquiring Fund receiving shares of the Acquiring Fund with a value equal to the aggregate net asset value of their shares of the Acquired Fund held immediately prior to the Reorganization; and

2. To act upon such other matters as may properly come before the Meeting.

The Reorganization is more fully described in the accompanying Proxy Statement and Prospectus and a form of the Reorganization Agreement is attached as Exhibit A thereto. Shareholders of record of the Acquired Fund as of the close of business on December 26, 2012 are entitled to notice of, and to vote at, the Meeting and any adjournments or postponements thereof. The Board of Trustees of the Acquired Fund recommends that you vote in favor of the Reorganization.

By Order of the Board of Trustees,

Mary E. Mullin

Secretary

January 18, 2013

MORGAN STANLEY VARIABLE INVESTMENT SERIES

MULTI CAP GROWTH PORTFOLIO

522 Fifth Avenue

New York, NY 10036

(800) 869-6397

This Proxy Statement and Prospectus is being furnished to shareholders ("Shareholders") of the Aggressive Equity Portfolio (the "Acquired Fund"), a series of Morgan Stanley Variable Investment Series (the "Trust"), in connection with a Special Meeting of Shareholders (the "Meeting") to be held in Conference Room 3A, 3rd Floor, 522 Fifth Avenue, New York, NY 10036, at 9:00 a.m., New York time, on February 21, 2013, and any adjournments or postponements thereof, for the following purposes:

1. To consider and vote upon a proposal to approve the actions and transactions described in that certain Agreement and Plan of Reorganization, dated September 28, 2012 (the "Reorganization Agreement"), between the Trust, on behalf of the Acquired Fund, and the Trust, on behalf of the Multi Cap Growth Portfolio (the "Acquiring Fund"), pursuant to which substantially all of the assets and the liabilities of the Acquired Fund will be transferred to the Acquiring Fund in exchange for shares of the corresponding class of the Acquiring Fund and pursuant to which the Acquired Fund will be liquidated and terminated (the "Reorganization"). As a result of this transaction, Shareholders of the Acquired Fund will become shareholders of the Acquiring Fund receiving shares of the Acquiring Fund with a value equal to the aggregate net asset value ("NAV") of their shares of the Acquired Fund held immediately prior to the Reorganization; and

2. To act upon such other matters as may properly come before the Meeting.

The terms and conditions of the transaction are more fully described in this Proxy Statement and Prospectus and in the form of the Reorganization Agreement attached hereto as Exhibit A. The address and telephone number of the Acquired Fund are the same as those of the Acquiring Fund set forth above. This Proxy Statement also constitutes a Prospectus of the Acquiring Fund, filed by the Trust with the Securities and Exchange Commission (the "Commission") as part of the Trust's Registration Statement on Form N-14 (the "Registration Statement"). The Acquired Fund and Acquiring Fund are referred to collectively as the "Funds."

The Funds are each series of the Trust, which is a duly registered, open-end management investment company. The Acquiring Fund's investment objective of capital growth through investments in common stock believed by Morgan Stanley Investment Management Inc. ("MSIM"), the Acquiring Fund's and Acquired Fund's adviser, to have potential for superior growth is similar to the Acquired Fund's investment objective of long-term capital growth. Shares of each Fund are offered only to certain life insurance companies in connection with particular variable life insurance and/or variable annuity contracts they issue (each an "Insurance Company" and, collectively, the "Insurance Companies"). Each Insurance Company is the legal owner of shares of the Acquired Fund and has the right to vote those shares at the Meeting. Although being an owner of a variable life insurance or variable annuity contract (a "Contract") issued by separate accounts of the Insurance Companies does not make you a shareholder of the Acquired Fund, you have the right to instruct your Insurance Company on how to vote at the Meeting.

This Proxy Statement and Prospectus sets forth concisely information about the Acquiring Fund that Shareholders of the Acquired Fund should know before voting on the Reorganization Agreement. A copy of the Prospectuses for the Acquiring Fund, each dated April 30, 2012, as may be amended and supplemented from time to time, are attached as Exhibit B, which Prospectuses form a part of Post-Effective Amendment No. 50 to the Trust's Registration Statement on Form N-1A (File Nos. 022-82510; 811-3692), and incorporated herein by reference. Also incorporated herein by reference are the Prospectuses of the Acquired Fund, each dated April 30, 2012, as may be amended and supplemented from time to time, which Prospectuses form a part of Post-Effective Amendment No. 50 to the Trust's Registration Statement on Form N-1A (File Nos. 022-82510; 811-3692).

In addition, also enclosed and incorporated herein by reference is the Annual Report of the Trust relating to the Acquiring Fund and Acquired Fund for the fiscal year ended December 31, 2011 (File No. 811-03692) and the Semi-Annual Report of the Trust relating to the Acquiring Fund for the six-month period ended June 30, 2012 (File No. 811-03692). Also incorporated herein by reference is the Semi-Annual Report of the Trust relating to the Acquired Fund for the six-month period ended June 30, 2012 (File No. 811-03692). A Statement of Additional Information relating to the Reorganization, described in this Proxy Statement and Prospectus, dated January 18, 2013, has been filed with the Commission and is also incorporated herein by reference. Such documents are available upon request and without charge by calling (800) 869-6397 with respect to the Acquiring Fund and Acquired Fund or by visiting the Commission's website at www.sec.gov.

Shareholders are advised to read and retain this Proxy Statement and Prospectus for future reference.

The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

This Proxy Statement and Prospectus is dated January 18, 2013.

TABLE OF CONTENTS

PROXY STATEMENT AND PROSPECTUS

|

Synopsis |

1 |

||||||

|

General |

1 |

||||||

|

The Reorganization |

1 |

||||||

|

Fee Tables |

2 |

||||||

|

Annual Fund Operating Expenses |

3 |

||||||

|

Portfolio Turnover |

3 |

||||||

|

Tax Consequences of the Reorganization |

3 |

||||||

|

Comparison of the Acquired Fund and Acquiring Fund |

3 |

||||||

|

Record Date |

6 |

||||||

|

Voting Information |

6 |

||||||

|

General |

6 |

||||||

|

Solicitation of Proxies and Voting Instructions |

6 |

||||||

|

Voting Procedures |

6 |

||||||

|

Quorum |

7 |

||||||

|

Adjournments; Other Business |

7 |

||||||

|

Expenses of Solicitation |

7 |

||||||

|

Vote Required |

7 |

||||||

|

Principal Risk Factors |

8 |

||||||

|

Performance Information |

10 |

||||||

|

The Reorganization |

12 |

||||||

|

The Board's Considerations |

12 |

||||||

|

The Reorganization Agreement |

13 |

||||||

|

Tax Aspects of the Reorganization |

14 |

||||||

|

Description of Shares |

15 |

||||||

|

Capitalization Tables (unaudited) |

15 |

||||||

|

Appraisal Rights |

15 |

||||||

|

Comparison of Investment Objectives, Principal Policies and Restrictions |

16 |

||||||

|

Investment Objectives and Policies |

16 |

||||||

|

Investment Restrictions |

17 |

||||||

|

Additional Information About the Acquiring Fund and the Acquired Fund |

18 |

||||||

|

General |

18 |

||||||

|

Rights of Acquired Fund Shareholders and Acquiring Fund Shareholders |

18 |

||||||

|

Financial Information |

19 |

||||||

|

Shareholder Proposals |

19 |

||||||

|

Management |

19 |

||||||

|

Description of Shares and Shareholder Inquiries |

19 |

||||||

|

Dividends, Distributions and Taxes |

19 |

||||||

|

Purchases and Redemptions |

19 |

||||||

|

Share Information |

19 |

||||||

|

Financial Statements and Experts |

20 |

||||||

|

Legal Matters |

20 |

||||||

|

Available Information |

20 |

||||||

|

Other Business |

21 |

||||||

|

Exhibit A – Agreement and Plan of Reorganization |

A-1 |

||||||

|

Exhibit B – Prospectuses of the Acquiring Fund dated April 30, 2012, as they may be amended and supplemented from time to time |

B-1 |

||||||

|

Exhibit C – Annual Report for the Trust relating to the Acquiring Fund for the fiscal year ended December 31, 2011 |

C-1 |

||||||

|

Exhibit D – Semi-Annual Report of the Trust relating to the Acquiring Fund for the six-month period ended June 30, 2012 |

D-1 |

||||||

SYNOPSIS

The following is a synopsis of certain information contained in or incorporated by reference in this Proxy Statement and Prospectus. This synopsis is only a summary and is qualified in its entirety by the more detailed information contained or incorporated by reference in this Proxy Statement and Prospectus and the Reorganization Agreement. Shareholders should carefully review this Proxy Statement and Prospectus and the Reorganization Agreement in their entirety and, in particular, the Acquiring Fund's Prospectuses, which are attached to this Proxy Statement and Prospectus as Exhibit B and incorporated herein by reference.

General

This Proxy Statement and Prospectus is being furnished to Shareholders of the Acquired Fund, a series of an open-end management investment company, in connection with the solicitation by the Board of Trustees of the Trust, on behalf of the Acquired Fund (the "Board"), of proxies ("Proxies") to be used at the Meeting to consider the Reorganization. It is expected that the first mailing of this Proxy Statement and Prospectus will be made on or about January 22, 2013.

Pursuant to the Reorganization, Class X Shareholders of the Acquired Fund will receive Class X shares of the Acquiring Fund, and Class Y Shareholders of the Acquired Fund will receive Class Y shares of the Acquiring Fund. The shares to be issued by the Acquiring Fund in connection with the Reorganization (the "Acquiring Fund Shares") will be issued at NAV without any sales charges. Further information relating to the Acquiring Fund is set forth herein and in the Acquiring Fund's current Prospectuses, each dated April 30, 2012 (the "Acquiring Fund's Prospectuses"), attached to this Proxy Statement and Prospectus as Exhibit B and incorporated herein by reference.

The Board has authorized the issuance of the Acquiring Fund Shares to Shareholders of the Acquired Fund in connection with the Reorganization. The information concerning the Acquiring Fund and Acquired Fund contained herein has been supplied by the Trust.

The Reorganization

The Reorganization is being proposed because the Board has determined that such Reorganization is in the best interests of the Acquired Fund and its Shareholders. The Reorganization will allow Shareholders of the Acquired Fund to be invested in a fund that is managed according to similar investment objectives, strategies and restrictions with lower total operating expenses. See "The Reorganization—The Board's Considerations."

The Reorganization Agreement provides for the transfer of substantially all the assets and the liabilities of the Acquired Fund to the Acquiring Fund in exchange for Acquiring Fund Shares. The aggregate NAV of the Acquiring Fund Shares issued in the exchange will equal the aggregate value of the net assets of the Acquired Fund received by the Acquiring Fund. On or after the closing date scheduled for the Reorganization (the "Closing Date"), the Acquired Fund will distribute the Acquiring Fund Shares received by the Acquired Fund to its Shareholders as of the Valuation Date (as defined below) in complete liquidation of the Acquired Fund and, without further notice, the outstanding shares of the Acquired Fund held by the Shareholders will then be redeemed and canceled as permitted by the organizational documents of the Acquired Fund and applicable law. The Acquired Fund thereafter will be terminated as a series of the Trust. As a result of the Reorganization, each shareholder will receive that number of full and fractional Acquiring Fund Shares equal in value to such shareholder's pro rata interest in the net assets of the Acquired Fund transferred to the Acquiring Fund. Pursuant to the Reorganization, Class X Shareholders of the Acquired Fund will receive Class X shares of the Acquiring Fund, and Class Y Shareholders of the Acquired Fund will receive Class Y shares of the Acquiring Fund. The Board has determined that the interests of the Shareholders will not be diluted as a result of the Reorganization. The "Valuation Date" is the third business day following the receipt of the requisite approval of this Reorganization Agreement by Shareholders of the Acquired Fund or at such time on such earlier or later date after such approval as may be mutually agreed upon in writing.

1

For the reasons set forth below under "The Reorganization—The Board's Considerations," the Board, including the Trustees who are not "interested persons" of the Acquired Fund ("Independent Board Members"), as that term is defined in the Investment Company Act of 1940, as amended (the "1940 Act"), has concluded that the Reorganization is advisable and in the best interests of the Acquired Fund and its Shareholders and recommends approval of the Reorganization.

Fee Tables

The following tables briefly describe the annual Fund operating expenses that Shareholders of the Funds may pay if they buy and hold shares of the Funds. Total Annual Fund Operating Expenses in the tables below do not reflect the impact of any charges by your insurance company. Each Fund pays expenses for management of its assets, distribution of its shares and other services, and those expenses are reflected in the NAV per share of each Fund. These expenses are deducted from each respective Fund's assets and are based on actual expenses incurred by each of the Acquiring Fund and Acquired Fund for its semi-annual period ended June 30, 2012. The tables also set forth pro forma fees for the surviving combined fund (Multi Cap Growth Portfolio) (the "Combined Fund") reflecting what the fee schedule would have been on June 30, 2012, if the Reorganization had been consummated twelve (12) months prior to that date.

Annual Fund Operating Expenses

(expenses that are deducted from Fund assets)

|

Aggressive Equity Portfolio (Acquired Fund) |

Class X |

Class Y |

|||||||||

|

Advisory Fees |

0.67 |

% |

0.67 |

% |

|||||||

|

Distribution (12b-1) Fees |

None |

0.25 |

% |

||||||||

|

Other Expenses |

0.42 |

% |

0.42 |

% |

|||||||

|

Total Annual Fund Operating Expenses |

1.09 |

% |

1.34 |

% |

|||||||

|

Multi Cap Growth Portfolio (Acquiring Fund) |

Class X |

Class Y |

|||||||||

|

Advisory Fees |

0.42 |

% |

0.42 |

% |

|||||||

|

Distribution (12b-1) Fees |

None |

0.25 |

% |

||||||||

|

Other Expenses |

0.15 |

% |

0.15 |

% |

|||||||

|

Total Annual Fund Operating Expenses |

0.57 |

% |

0.82 |

% |

|||||||

|

Pro Forma Combined Fund (Multi Cap Growth Portfolio) |

Class X |

Class Y |

|||||||||

|

Advisory Fees |

0.42 |

% |

0.42 |

% |

|||||||

|

Distribution (12b-1) Fees |

None |

0.25 |

% |

||||||||

|

Other Expenses |

0.16 |

% |

0.16 |

% |

|||||||

|

Total Annual Fund Operating Expenses* |

0.58 |

% |

0.83 |

% |

|||||||

|

Fee Waiver and/or Expense Reimbursement* |

0.01 |

% |

0.01 |

% |

|||||||

|

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement* |

0.57 |

% |

0.82 |

% |

|||||||

* MSIM has agreed to reduce its advisory fee and/or reimburse the Combined Fund so that Total Annual Fund Operating Expenses, excluding certain investment related expenses, will not exceed 0.57% for Class X and 0.82% for Class Y. The fee waivers and/or expense reimbursements will continue for at least two years from the date of the Reorganization or until such time as the Board of Trustees acts to discontinue all or a portion of such waivers and/or reimbursements when it deems such action is appropriate.

2

Example

To attempt to show the effect of these expenses on an investment over time, the hypothetical example shown below has been created. The example assumes that an investor invests $10,000 in either the Acquired Fund or Acquiring Fund for the time periods indicated and that an investor then redeems all of his or her shares at the end of those periods. The example also assumes that the investment has a 5% return each year and that the operating expenses for each Fund remains the same (as set forth in the chart above). Although a Shareholder's actual costs may be higher or lower, the table below shows a Shareholder's costs at the end of each period based on these assumptions.

|

Aggressive Equity Portfolio (Acquired Fund) |

1 Year |

3 Years |

5 Years |

10 Years |

|||||||||||||||

|

Class X |

$ |

111 |

$ |

347 |

$ |

601 |

$ |

1,329 |

|||||||||||

|

Class Y |

$ |

136 |

$ |

425 |

$ |

734 |

$ |

1,613 |

|||||||||||

|

Multi Cap Growth Portfolio (Acquiring Fund) |

|||||||||||||||||||

|

Class X |

$ |

58 |

$ |

183 |

$ |

318 |

$ |

714 |

|||||||||||

|

Class Y |

$ |

84 |

$ |

262 |

$ |

455 |

$ |

1,014 |

|||||||||||

|

Pro Forma Combined Fund (Multi Cap Growth Portfolio) |

|||||||||||||||||||

|

Class X |

$ |

58 |

$ |

183 |

$ |

318 |

$ |

714 |

|||||||||||

|

Class Y |

$ |

84 |

$ |

262 |

$ |

455 |

$ |

1,014 |

|||||||||||

Annual Fund Operating Expenses

The purpose of the foregoing fee tables is to assist Shareholders in understanding the various costs and expenses that a shareholder in each Fund may pay if they buy and hold shares of the Funds. For a more complete description of these costs and expenses, see "Comparison of Acquired Fund and Acquiring Fund—Investment Advisory Fees," "—Plan of Distribution Fees," "—Other Significant Fees" and "—Purchases and Redemptions" below.

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the Example, affect Fund performance. During the most recent fiscal year, the Acquiring Fund's portfolio turnover rate was 24% of the average value of its portfolio and the Acquired Fund's portfolio turnover rate was 28% of the average value of its portfolio.

Tax Consequences of the Reorganization

As a condition to the Reorganization, the Acquired Fund has requested an opinion of Dechert LLP to the effect that, based upon certain facts, assumptions and representations, the Reorganization will constitute a tax-free reorganization for federal income tax purposes, and no gain or loss will be recognized by the Acquired Fund, the Acquiring Fund or the Acquired Fund's shareholders for federal income tax purposes as a result of the transactions included in the Reorganization. Receipt of such opinion is a condition to the Reorganization. For further information about the tax consequences of the Reorganization, see "The Reorganization—Tax Aspects of the Reorganization" below.

Comparison of Acquired Fund and Acquiring Fund

Investment Objectives and Principal Investment Policies. The investment objective and principal investment policies of each Fund are similar and are set forth below. Each Fund is a diversified fund. The principal differences between the principal investment policies of the Acquired Fund and the Acquiring Fund are more fully described under "Comparison of Investment Objectives, Principal Policies and Restrictions" below. Each Fund's investment objective is a fundamental policy and may not be changed without shareholder approval of a majority of the Acquired Fund's outstanding voting securities, as defined in the 1940 Act.

3

| Acquired Fund |

Acquiring Fund |

||||||

|

Investment Objective |

Investment Objectives |

||||||

|

• seeks long-term capital growth |

• primary objective: seeks growth of capital through investments in common stocks of companies believed by MSIM to have potential for superior growth • secondary objective: seeks income but only when consistent with its primary objective |

||||||

|

Principal Investment Policies |

Principal Investment Policies |

||||||

|

• normally invests at least 80% of its assets in common stocks and other equity securities of companies that MSIM believes offers the potential for superior earnings growth |

• normally invests primarily in equity securities and securities convertible into equity securities |

||||||

|

• invests primarily in established and emerging companies with capitalizations within the range of companies included in the Russell 3000® Growth Index |

• invests primarily in established and emerging companies with capitalizations within the range of companies included in the Russell 3000® Growth Index |

||||||

|

• up to 25% of the Fund's assets may be invested in foreign securities, which may include securities issued by companies located in emerging market or developing countries |

• up to 25% of the Fund's net assets may be invested in foreign equity securities (including depositary receipts), which may include securities issued by companies located in emerging markets or developing countries |

||||||

|

• MSIM emphasizes a bottom-up stock selection process, seeking attractive investments on an individual company basis |

• MSIM emphasizes a bottom-up stock selection process, seeking attractive investments on an individual company basis |

||||||

|

• may invest in privately placed and restricted securities |

• may invest in privately placed and restricted securities |

||||||

|

• investments may include securities of small and medium capitalizations companies |

• investments may include securities of small and medium capitalizations companies |

||||||

|

• may utilize foreign currency forward exchange contracts, which are derivatives, in connection with its investments in foreign securities |

• may utilize foreign currency forward exchange contracts, which are derivatives, in connection with its investments in foreign securities |

||||||

Fund Management. The Acquiring Fund and Acquired Fund are both managed within MSIM's Growth team, and, if the Reorganization is approved, the Acquiring Fund is expected to continue to be managed by members of MSIM's Growth team. The team consists of portfolio managers and analysts. Current members of the team jointly and primarily responsible for the day-to-day management of the Acquiring Fund and Acquired Fund, and those members that are expected to continue to be responsible for the day-to-day management of Acquiring Fund if the Reorganization is approved, are Dennis P. Lynch, David S. Cohen, Sam G. Chainani, Alexander T. Norton, Jason C. Yeung and Armistead B. Nash.

Mr. Lynch, a Managing Director of MSIM, has been associated with MSIM in an investment management capacity since 1998, and has managed the Acquired Fund since 2004 and the Acquiring Fund since 2006. Mr. Cohen, a Managing Director of MSIM, has been associated with MSIM in an investment management capacity since 1993, and has managed the Acquired Fund since 2004 and the Acquiring Fund since 2006. Mr. Chainani, a Managing Director of MSIM, has been associated with MSIM in an investment management capacity since 1996, and has managed the Acquired Fund since 2004 and the Acquiring Fund since 2006. Mr. Norton, an Executive Director of MSIM, has been associated with MSIM in an investment management capacity since 2000, and has managed the Acquired Fund since 2006 and the Acquiring Fund since 2005. Mr. Yeung, a Managing Director of MSIM, has been

4

associated with MSIM in an investment management capacity since 2002, and has managed the Acquired Fund and the Acquiring Fund since 2007. Mr. Nash, an Executive Director of MSIM, has been associated with MSIM in an investment management capacity since 2002, and has managed the Acquired Fund and the Acquiring Fund a since 2008. Mr. Lynch is the lead portfolio manager of the Acquiring Fund and Acquired Fund. Messrs. Cohen, Chainani, Norton, Yeung and Nash are co-portfolio managers of the Funds.

Additional information about the portfolio managers' compensation structure, other accounts managed by the portfolio managers and the portfolio managers' ownership of securities in the Funds is provided in the Trust's Statement of Additional Information.

Investment Advisory Fees. The Acquiring Fund and Acquired Fund currently obtain advisory services from MSIM. MSIM is a wholly-owned subsidiary of Morgan Stanley with its principal office located at 522 Fifth Avenue, New York, NY 10036. Morgan Stanley is a preeminent global financial services firm engaged in securities trading and brokerage activities, as well as providing investment banking, research and analysis, financing and financial advisory services.

The annual advisory fee (as a percentage of daily net assets) payable by the Funds is set forth below. The Funds pay their advisory fees on a monthly basis.

|

Aggressive Equity Portfolio: |

0.67% of the portion of daily net assets not exceeding $500 million; 0.645% of the portion of daily net assets exceeding $500 million but not exceeding $2 billion; 0.62% of the portion of daily net assets exceeding $2 billion but not exceeding $3 billion; and 0.595% of the portion of daily net assets exceeding $3 billion |

||||||

|

Multi Cap Growth Portfolio: |

0.42% of the portion of the daily net assets not exceeding $1 billion; 0.395% of the portion of the daily net assets exceeding $1 billion but not exceeding $2 billion; and 0.37% of the portion of the daily net assets exceeding $2 billion |

||||||

Comparison of Other Service Providers. The Acquired Fund and Acquiring Fund have the same administrator, transfer agent, custodian, distributor and independent registered public accounting firm. For each Fund, the administrator and transfer agent are Morgan Stanley Services Company Inc., the custodian is State Street Bank and Trust Company, the distributor is Morgan Stanley Distribution, Inc., and the independent registered public accounting firm is Ernst & Young LLP.

Plan of Distribution Fees. The Trust has adopted a plan of distribution with respect to Class Y shares of each of the Acquired Fund and Acquiring Fund, pursuant to Rule 12b-1 under the 1940 Act (the "Plan"). Under the Plan, each of the Acquired Fund and Acquiring Fund pays distribution fees in connection with the sale and distribution of Class Y shares of 0.25% of the average daily net assets of such class. The Plan also allows the Funds to pay for services to Class Y shareholders. For a complete description of the Plan, see the section of the Acquired Fund's prospectuses and the Acquiring Fund's Prospectuses (attached as Exhibit B) each entitled "Plan of Distribution" and the section of the Trust's Statement of Additional Information entitled "V. Investment Advisory and Other Services—D. Rule 12b-1 Plan." Class X shares of each Fund are not subject to the Plan.

Other Significant Fees. The Acquiring Fund and Acquired Fund pay additional fees in connection with their operations, including legal, auditing, transfer agent and custodial fees. See "Synopsis—Fee Tables" above for the percentage of average net assets represented by such "Other Expenses."

Purchases and Redemptions. The Board has authorized the issuance of the Acquiring Fund Shares in connection with the Reorganization.

The Funds offer their shares only to insurance company separate accounts that insurance companies establish to fund variable life insurance and/or variable annuity contracts. An insurance company purchases or redeems shares of the Funds based on, among other things, the amount of net contract premiums or purchase payments allocated to a separate account investment division, transfers to or from a separate account investment division, contract loans and repayments, contract withdrawals and surrenders, and benefit payments. The contract prospectus describes how contract owners may allocate, transfer and withdraw amounts to and from separate accounts.

5

Class X and Class Y shares of the Funds are offered on each day that the New York Stock Exchange ("NYSE") is open for business. The insurance company separate accounts purchase and redeem shares of the Fund at the Funds' NAV per share calculated as of the close of the NYSE, provided that the insurance company places its order with the Trust before the NYSE closes. The NAV per share of each of Class X and Class Y shares of the Funds is calculated by dividing the value of the portion of each of Funds' securities and other assets attributable to each class, respectively, less the liabilities attributable to each class, respectively, by the number of shares of each class outstanding.

The Funds generally value securities based on the securities' market price when available. If market prices are unavailable or may be unreliable because of events occurring after the close of trading, fair value prices may be determined in good faith using methods approved by the Board.

For further information on the purchase and sale of shares of the Funds, see the sections of the Acquired Fund's prospectuses and the Acquiring Fund's Prospectuses (attached as Exhibit B) each entitled "Purchase and Sales of Portfolio Shares" and "Pricing Portfolio Shares," as well as the section of the Trust's Statement of Additional Information entitled "VIII. Purchase, Redemption and Pricing of Shares."

Dividends. Each Fund declares dividends separately for each of its classes. Each Fund pays dividends from net investment income and distributes net realized capital gains, if any, at least annually.

Record Date

The Board has fixed the close of business on December 26, 2012 as the record date (the "Record Date") for the determination of Shareholders of the Acquired Fund entitled to notice of, and to vote at, the Meeting. As of the Record Date, there were 853,047 shares of the Acquired Fund issued and outstanding.

VOTING INFORMATION

General

The shares of the Acquired Fund are currently sold to the Insurance Companies as the record owners for allocation to certain of their separate accounts that are registered as investment companies under the 1940 Act.

Solicitation of Proxies and Voting Instructions

The Board is soliciting proxies from the Shareholders of the Acquired Fund, including the Insurance Companies, which have the right to vote upon matters that may be voted upon at the Meeting. The Insurance Companies will furnish this Proxy Statement and Prospectus to the owners of Contracts participating in their separate accounts that are registered with the Commission under the 1940 Act ("Registered Accounts") and that hold shares of the Acquired Fund to be voted at the Meeting, and will solicit voting instructions from those Contract owners.

Each Insurance Company will vote shares of the Acquired Fund held in its Registered Accounts: (i) for which timely voting instructions are received from Contract owners, in accordance with such instructions; and (ii) for which no voting instructions are timely received, in the same proportion as the instructions received from Contract owners participating in all its Registered Accounts. The Insurance Companies will vote all other shares of the Acquired Fund held by them in the same proportion as the voting instructions timely received by all the Insurance Companies from Contract owners participating in all their Registered Accounts. The effect of proportional voting as described above is that a small number of Contract owners can determine the outcome of the voting.

Voting Procedures

Proxies from shareholders may be revoked at any time prior to the voting of the shares represented thereby by: (i) mailing written instructions addressed to the Secretary of the Trust, 19th Floor, 522 Fifth Avenue, New York, NY 10036; (ii) signing and returning a new proxy; or (iii) attending the Meeting and voting shares. Attendance at the Meeting will not in and of itself revoke a proxy. All valid proxies will be voted in accordance with specifications thereon, or in the absence of specifications, for approval of the Reorganization. Instructions from Contract owners

6

may be revoked by: (i) mailing written instructions addressed to the Secretary of the Trust, 522 Fifth Avenue, 19th Floor, New York, NY 10036; or (ii) signing and returning a new Voting Instruction Form. A Contract owner may also attend the Meeting in person to revoke previously provided voting instructions and to provide new voting instructions.

Quorum

Shareholders of record as of the close of business on the Record Date are entitled to one vote per share and a fractional vote for a fractional share on each matter submitted to a vote at the Meeting. Shareholders of each class of the Acquired Fund will vote together as a single class in connection with the Reorganization Agreement. The holders of a majority of the shares issued and outstanding and entitled to vote of the Acquired Fund, represented in person or by proxy, will constitute a quorum at the Meeting.

In the event that the necessary quorum to transact business or the vote required to approve or reject the Reorganization is not obtained at the Meeting, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of the holders of a majority of shares of the Acquired Fund present in person or by proxy at the Meeting. Where an adjournment is proposed because the necessary quorum to transact business is not obtained at the Meeting, the persons named as proxies will vote in favor of such adjournment provided that such persons named as proxies determine that such adjournment and additional solicitation is reasonable and in the interests of shareholders based on all relevant factors, including the nature of the proposal, the percentage of shareholders present, the nature of the proposed solicitation activities and the nature of the reasons for the further solicitation. Where an adjournment is proposed because the vote required to approve or reject the Reorganization is not obtained at the Meeting, the persons named as proxies will vote in favor of such adjournment those proxies which they are entitled to vote in favor of the Reorganization and will vote against any such adjournment those proxies required to be voted against the Reorganization. Abstentions will not be voted either for or against any such adjournment.

Adjournments; Other Business

The Meeting has been called to transact any business that properly comes before it. The only business that management of the Trust intends to present or knows that others will present is the Reorganization. If any other matters properly come before the Meeting, and on all matters incidental to the conduct of the Meeting, the persons named as proxies intend to vote the proxies in accordance with their judgment, unless the Secretary of the Trust has previously received written contrary instructions from the shareholder entitled to vote the shares.

Expenses of Solicitation

Voting instructions will be solicited primarily by mailing this Proxy Statement and Prospectus and its enclosures. In addition to the voting instructions by mail, employees of MSIM and its affiliates, without additional compensation, may solicit voting instructions in person or by telephone, facsimile or oral communication. The expenses of the Reorganization, including the cost of printing, filing and voting instructions solicitation, and legal and accounting expenses, are expected to be approximately $171,300, all of which will be borne by the Acquired Fund.

Vote Required

Approval of the Reorganization by shareholders requires the affirmative vote of a majority of the outstanding shares of the Acquired Fund present or represented by Proxy. Abstentions are not considered votes "FOR" the Reorganization at the Meeting. As a result, abstentions have the same effect as a vote against the Reorganization because approval of the Reorganization requires the affirmative vote of a percentage of the voting securities present or represented by proxy.

If the Reorganization is not approved by shareholders of the Acquired Fund, the Acquired Fund will continue in existence and the Board will consider alternative actions for such Fund.

7

PRINCIPAL RISK FACTORS

The principal risks of investing in the Acquiring Fund are substantially similar to those of investing in the Acquired Fund. The value of an investment in all of the Funds is based on the market prices of the securities such Fund holds. These prices change daily due to economic and other events that affect markets generally, as well as those that affect particular regions, countries, industries, companies or governments.

Common Stock and other Equity Securities. A principal risk of investing in each Fund is associated with its investments in common stock and other equity securities. In general, common stock and other equity security prices fluctuate in response to activities specific to the company as well as general market, economic and political conditions. These prices can fluctuate widely in response to these factors.

Investments in convertible securities may subject each Fund to the risks associated with both fixed income securities and common stocks. To the extent that a convertible security's investment value is greater than its conversion value, its price will be likely to increase when interest rates fall and decrease when interest rates rise, as with a fixed income security. If the conversion value exceeds the investment value, the price of the convertible security will tend to fluctuate directly with the price of the underlying equity security. The Acquiring Fund may invest up to 5% of its net assets in convertible securities that are rated below investment grade. Securities rated below investment grade are commonly known as "junk bonds" and have speculative credit risk characteristics. A portion of the Acquired Fund's investments in convertible securities also may have speculative characteristics.

Small and Medium Capitalization Companies. Each Fund may invest in stocks of small and medium capitalization companies. Investments in securities of these companies carry more risk than investments in larger, more established companies. While some of the Funds' holdings in these companies may be listed on a national securities exchange, such securities are more likely to be traded in the over-the-counter market. The low market liquidity of these securities may have an adverse impact on the Funds' ability to sell certain securities at favorable prices and may also make it difficult for the Funds to obtain market quotations based on actual trades for purposes of valuing the Funds' securities. Investing in lesser-known, small and medium capitalization companies involves greater risk of volatility of the Funds' NAV than is customarily associated with larger, more established companies. Often small and medium capitalization companies and the industries in which they are focused are still evolving and, while this may offer better growth potential than larger, more established companies, it also may make them more sensitive to changing market conditions.

Foreign and Emerging Market Securities. Each Fund may invest in foreign and emerging market securities. The Funds' investment in foreign securities involves risks that are in addition to the risks associated with domestic securities. One additional risk is currency risk. While the price of Fund shares is quoted in U.S. dollars, the Funds may convert U.S. dollars to a foreign market's local currency to purchase a security in that market. If the value of that local currency falls relative to the U.S. dollar, the U.S. dollar value of the foreign security will decrease. This is true even if the foreign security's local price remains unchanged.

Foreign securities also have risks related to economic and political developments abroad, including expropriations, confiscatory taxation, exchange control regulation, limitations on the use or transfer of Fund assets and any effects of foreign social, economic or political instability. Foreign companies, in general, are not subject to the regulatory requirements of U.S. companies and, as such, there may be less publicly available information about these companies. Moreover, foreign accounting, auditing and financial reporting standards generally are different from those applicable to U.S. companies. Finally, in the event of a default of any foreign debt obligations, it may be more difficult for the Funds to obtain or enforce a judgment against the issuers of the securities.

Securities of foreign issuers may be less liquid than comparable securities of U.S. issuers and, as such, their price changes may be more volatile. In addition, the prices of such securities may be susceptible to influence by large traders, due to the limited size of many foreign securities markets. Moreover, investments in certain foreign markets, which have historically been considered stable, may become more volatile and subject to increased risk due to ongoing developments and changing conditions in such markets. Also, the growing interconnectivity of global economies and financial markets has increased probability that adverse developments and conditions in one country or region will affect the stability of economies and financial markets in other countries or regions.

8

Furthermore, foreign exchanges and broker-dealers are generally subject to less government and exchange scrutiny and regulation than their U.S. counterparts. In addition, differences in clearance and settlement procedures in foreign markets may cause delays in settlement of the Funds' trades effected in those markets and could result in losses to the Funds due to subsequent declines in the value of the securities subject to the trades.

The foreign securities in which the Funds may invest may be issued by issuers located in emerging market or developing countries. Compared to the United States and other developed countries, emerging market or developing countries may have relatively unstable governments, economies based on only a few industries and securities markets that trade a small number of securities. Securities issued by companies located in these countries tend to be especially volatile and may be less liquid than securities traded in developed countries. In the past, securities in these countries have been characterized by greater potential loss than securities of companies located in developed countries.

Depositary receipts involve many of the same risks as those associated with direct investment in foreign securities. In addition, the underlying issuers of certain depositary receipts, particularly unsponsored or unregistered depositary receipts, are under no obligation to distribute shareholder communications to the holders of such receipts, or to pass through to them any voting rights with respect to the deposited securities.

In connection with their investments in foreign securities, the Funds also may enter into foreign currency forward exchange contracts. A foreign currency forward exchange contract is a negotiated agreement between the contracting parties to exchange a specified amount of currency at a specified future time at a specified rate. The rate can be higher or lower than the spot rate between the currencies that are the subject of the contract. Foreign currency forward exchange contracts may be used to protect against uncertainty in the level of future foreign currency exchange rates or to gain or modify exposure to a particular currency. In addition, the Funds may use cross currency hedging or proxy hedging with respect to currencies in which the Funds have or expect to have portfolio or currency exposure. Cross currency hedges involve the sale of one currency against the positive exposure to a different currency and may be used for hedging purposes or to establish an active exposure to the exchange rate between any two currencies. Hedging the Funds' currency risks involves the risk of mismatching the Funds' objectives under a foreign currency forward exchange or futures contract with the value of securities denominated in a particular currency. Furthermore, such transactions reduce or preclude the opportunity for gain if the value of the currency should move in the direction opposite to the position taken. There is an additional risk to the effect that currency contracts create exposure to currencies in which the Funds' securities are not denominated. Unanticipated changes in currency prices may result in poorer overall performance for the Funds than if they had not entered into such contracts. The use of foreign currency forward exchange contracts involves the risk of loss from the insolvency or bankruptcy of the counterparty to the contract or the failure of the counterparty to make payments or otherwise comply with the terms of the contract.

Privately Placed and Restricted Securities. Each Fund may invest in privately placed and restricted securities. The Funds' investments may also include privately placed securities, which are subject to resale restrictions. These securities will have the effect of increasing the level of Fund illiquidity to the extent the Funds may be unable to sell or transfer these securities due to restrictions on transfers or on the ability to find buyers interested in purchasing the securities. The illiquidity of the market, as well as the lack of publicly available information regarding these securities, may also adversely affect the ability to arrive at a fair value for certain securities at certain times.

The foregoing discussion is a summary of the principal risk factors. For a more complete discussion of the risks of the Acquiring Fund, see "Portfolio Details—Additional Information About the Portfolio's Investment Objectives, Strategies and Risks—Principal Risks" and "Portfolio Details—Additional Information About the Portfolio's Investment Objectives, Strategies and Risks—Additional Risk Information" in the Acquiring Fund's Prospectuses attached hereto as Exhibit B. For a more complete discussion of the risks of the Acquired Fund, see "Portfolio Details—Additional Information About the Portfolio's Investment Objective, Strategies and Risks—Principal Risks" and "Portfolio Details—Additional Information About the Portfolio's Investment Objectives, Strategies and Risks—Additional Risk Information" in the Acquired Fund's Prospectuses, each incorporated herein by reference.

9

PERFORMANCE INFORMATION

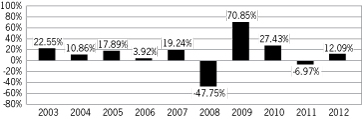

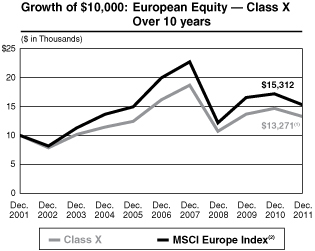

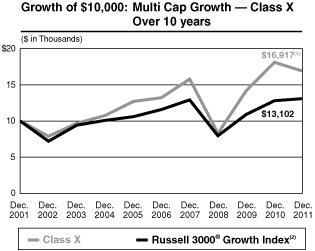

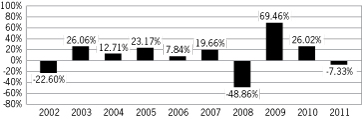

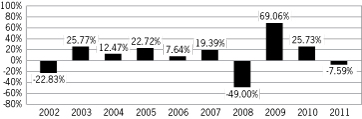

The bar charts and tables below provide some indication of the risks of investing in each Fund by showing changes in the performance of each Fund's Class X and Class Y shares from year to year and by showing how the average annual returns of each Fund's Class X and Class Y shares for the one, five and 10 year periods compare with those of broad measures of market performance over time. This performance information does not include the impact of any charges deducted by your insurance company. If it did, returns would be lower. Each Fund's past performance does not indicate how such Fund will perform in the future.

Multi Cap Growth Portfolio (Acquiring Fund)

Annual Total Returns—Calendar Years (Class X)

|

High Quarter |

6/30/09: |

22.87 |

% |

||||||||

|

Low Quarter |

12/31/08: |

-30.24 |

% |

||||||||

Average Annual Total Returns for Periods Ended December 31, 2012 (Class X)

| Past 1 Year |

Past 5 Years |

Past 10 Years |

|||||||||

| Multi Cap Growth Portfolio 12.37% |

3.74 |

% |

9.21 |

% |

|||||||

|

Russell 3000® Growth Index (reflects no deduction for fees, expenses, or taxes)1 15.21% |

3.15 |

% |

7.69 |

% |

|||||||

(1) The Russell 3000® Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000® Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000® Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. It is not possible to invest directly in an index.

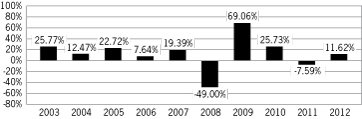

Annual Total Returns—Calendar Years (Class Y)

|

High Quarter |

6/30/09: |

22.77 |

% |

||||||||

|

Low Quarter |

12/31/08: |

-30.24 |

% |

||||||||

10

Average Annual Total Returns for Periods Ended December 31, 2012 (Class Y)

| Past 1 Year |

Past 5 Years |

Past 10 Years |

|||||||||

| Multi Cap Growth Portfolio 12.09% |

3.48 |

% |

8.94 |

% |

|||||||

|

Russell 3000® Growth Index (reflects no deduction for fees, expenses, or taxes)1 15.21% |

3.15 |

% |

7.69 |

% |

|||||||

(1) The Russell 3000® Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000® Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000® Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. It is not possible to invest directly in an index.

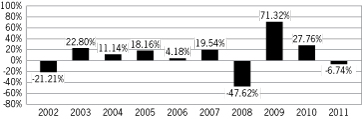

Aggressive Equity Portfolio (Acquired Fund)

Annual Total Returns—Calendar Years (Class X)

|

High Quarter |

6/30/09: |

22.22 |

% |

||||||||

|

Low Quarter |

12/31/08: |

-31.29 |

% |

||||||||

Average Annual Total Returns for Periods Ended December 31, 2012 (Class X)

| Past 1 Year |

Past 5 Years |

Past 10 Years |

|||||||||

| Aggressive Equity Portfolio 11.85% |

2.51 |

% |

9.84 |

% |

|||||||

|

Russell 3000® Growth Index (reflects no deduction for fees, expenses, or taxes)1 15.21% |

3.15 |

% |

7.69 |

% |

|||||||

(1) The Russell 3000® Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000® Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000® Index measures the performance of the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market. It is not possible to invest directly in an index.

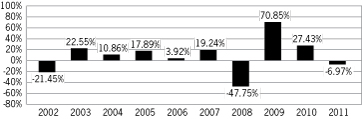

Annual Total Returns—Calendar Years (Class Y)

|

High Quarter |

6/30/09: |

22.20 |

% |

||||||||

|

Low Quarter |

12/31/08: |

-31.33 |

% |

||||||||

11

Average Annual Total Returns for Periods Ended December 31, 2012 (Class Y)

| Past 1 Year |

Past 5 Years |

Past 10 Years |

|||||||||

| Aggressive Equity Portfolio 11.62% |

2.26 |

% |

9.57 |

% |

|||||||

|

Russell 3000® Growth Index (reflects no deduction for fees, expenses, or taxes)1 15.21% |

3.15 |

% |

7.69 |

% |

|||||||

(1) The Russell 3000® Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000® Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000® Index measures the performance of the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market. It is not possible to invest directly in an index.

THE REORGANIZATION

The Board's Considerations

The Board, including the Independent Board Members, unanimously declared advisable and approved the Reorganization on behalf of the Acquired Fund and determined to recommend that shareholders of the Acquired Fund approve the Reorganization. In reaching this decision, the Board made an extensive inquiry into a number of factors, particularly the Acquiring Fund's substantially larger asset base and the comparative expenses currently incurred in the operations of the Acquiring Fund. In connection with the Board review of the Reorganization, MSIM advised the Board about a variety of matters, including, but not limited to:

1. the similarity of the investment objectives, policies and risks of the Acquiring Fund as compared to the Acquired Fund;

2. the continuity of the portfolio management team before and after the Reorganization;

3. the lower total operating expenses of the Acquiring Fund;

4. the terms and conditions of the Reorganization, which would affect the price of shares to be issued in the Reorganization;

5. there is not expected to be a significant amount of portfolio turnover as a result of the Reorganization;

6. the estimated expenses of the Reorganization, such as the expenses of this solicitation, including the cost of preparing and mailing this Proxy Statement and Prospectus, which will be borne by the Acquired Fund in connection with the Reorganization;

7. the tax-free nature of the Reorganization; and

8. while the Reorganization may delay when capital losses can be utilized, there is no expectation that any amount of losses would be written off.

The Board discussed with MSIM the foreseeable short- and long-term effects on the Acquired Fund and its shareholders. The Independent Board members conferred separately with their counsel about the Reorganization on several occasions.

In its deliberations, the Board considered all information it received, as described above, as well as advice and analysis from its counsel. The Board considered the Reorganization and the impact of the Reorganization on the Acquired Fund and its shareholders. The Board concluded, based on all of the information presented, that the Reorganization is advisable and in the best interest of the Acquired Fund's Shareholders and that shareholders will not be diluted as a result thereof, and decided to recommend that the Acquired Fund's Shareholders approve the Reorganization.

If shareholders of the Acquired Fund do not approve the Reorganization, the Board will consider other courses of action for the Acquired Fund.

12

The Reorganization Agreement

The terms and conditions under which the Reorganization would be consummated, as summarized below, are set forth in the Reorganization Agreement. This summary is qualified in its entirety by reference to the Agreement and Plan of Reorganization, a copy of which is attached as Exhibit A to this Proxy Statement and Prospectus.

The Reorganization Agreement provides that (i) the Acquired Fund will transfer substantially all of its assets, including portfolio securities, cash, cash equivalents and receivables, to the Acquiring Fund on the Closing Date in exchange for the assumption by the Acquiring Fund of all liabilities of the Acquired Fund, including all expenses, costs, charges and reserves, as reflected on an unaudited statement of assets and liabilities of Acquired Fund prepared by the Treasurer of the Acquired Fund as of the Valuation Date (as defined below) in accordance with generally accepted accounting principles consistently applied from the prior audited period, and the delivery of the Acquiring Fund Shares; (ii) such Acquiring Fund Shares would be distributed to shareholders on the Closing Date or as soon as practicable thereafter; (iii) the Acquired Fund would be liquidated and terminated; and (iv) the outstanding shares of the Acquired Fund would be canceled.

The number of Acquiring Fund Shares to be delivered to the Acquired Fund will be determined by dividing the aggregate NAV of each class of shares of the Acquired Fund acquired by the Acquiring Fund by the NAV per share of the corresponding class of shares of the Acquiring Fund. These values will be calculated as of the close of business of the NYSE on the third business day following the receipt of the requisite approval by shareholders of the Reorganization Agreement or at such other time as the Acquiring Fund and Acquired Fund may agree (the "Valuation Date"). As an illustration, assume that on the Valuation Date, Class X shares of the Acquired Fund had an aggregate NAV of $100,000. If the NAV per Class X share of the Acquiring Fund was $10 per share at the close of business on the Valuation Date, the number of Class X shares of the Acquiring Fund to be issued would be 10,000 ($100,000 ÷ $10). These 10,000 Class X shares of the Acquiring Fund would be distributed to the former Class X shareholders of the Acquired Fund. This example is given for illustration purposes only and does not bear any relationship to the dollar amounts or shares expected to be involved in the Reorganization.

On the Closing Date, or as soon as practicable thereafter, the Acquired Fund will distribute pro rata to its shareholders of record as of the close of business on the Valuation Date, the Acquiring Fund Shares it receives. Each shareholder will receive the class of shares of the Acquiring Fund that corresponds to the class of shares of the Acquired Fund currently held by that shareholder. Accordingly, the Acquiring Fund Shares will be distributed as follows: each of the Class X shares of the Acquiring Fund will be distributed to holders of the Class X shares of the Acquired Fund and each of the Class Y shares of the Acquiring Fund will be distributed to holders of Class Y shares of the Acquired Fund. The Acquiring Fund will cause its transfer agent to credit and confirm an appropriate number of the Acquiring Fund's Shares to each shareholder.

The consummation of the Reorganization is contingent upon the approval of the Reorganization by the shareholders and the receipt of the other opinions and certificates set forth in Sections 6, 7 and 8 of the Reorganization Agreement and the occurrence of the events described in those Sections, certain of which may be waived by a Fund. The Reorganization Agreement may be amended in any mutually agreeable manner.

The Reorganization Agreement may be terminated and the Reorganization abandoned at any time, before or after approval by shareholders, by mutual consent of the Trust, on behalf of the Acquiring Fund, and the Acquired Fund. In addition, either party may terminate the Reorganization Agreement upon the occurrence of a material breach of the Reorganization Agreement by the other party or if, by September 28, 2013, any condition set forth in the Reorganization Agreement has not been fulfilled or waived by the party entitled to its benefits.

Under the Reorganization Agreement, within one year after the Closing Date, the Acquired Fund shall either pay or make provision for all of its liabilities to former shareholders of the Acquired Fund that received Acquiring Fund Shares. The Acquired Fund shall be liquidated and terminated following the distribution of the Acquiring Fund Shares to shareholders of record of the Acquired Fund.

The effect of the Reorganization is that shareholders who vote their shares in favor of the Reorganization Agreement are electing to sell their shares of the Acquired Fund and reinvest the proceeds in the Acquiring Fund Shares at NAV and without recognition of taxable gain or loss for federal income tax purposes. See "Tax Aspects

13

of the Reorganization" below. As noted in "Tax Aspects of the Reorganization" below, if the Acquired Fund recognizes net gain from the sale of securities prior to the Closing Date, such gain, to the extent not offset by capital loss carry-forwards, will be distributed to shareholders prior to the Closing Date and will be taxable to shareholders as capital gain.

Shareholders will continue to be able to redeem their shares of the Acquired Fund at NAV next determined after receipt of the redemption request until the close of business on the business day next preceding the Closing Date. Redemption requests received by Acquired Fund thereafter will be treated as requests for redemption of shares of the Acquiring Fund.

Tax Aspects of the Reorganization

The following is a general summary of the material federal income tax consequences of the Reorganization and is based upon the current provisions of the Internal Revenue Code of 1986, as amended (the "Code"), the existing U.S. Treasury Regulations thereunder, current administrative rulings of the Internal Revenue Service ("IRS") and published judicial decisions, all of which are subject to change. This discussion is limited to U.S. persons who hold shares of the Acquired Fund as capital assets for federal income tax purposes. This summary does not address all of the U.S. federal income tax consequences that may be relevant to a particular shareholder or to shareholders who may be subject to special treatment under federal income tax laws.

Tax Consequences of the Reorganization to Shareholders. The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization under Section 368(a)(1) of the Code.

As a condition to the Reorganization, the Acquired Fund and the Acquiring Fund, has requested an opinion of Dechert LLP substantially to the effect that, based on certain assumptions, facts, the terms of the Reorganization Agreement and representations set forth in the Reorganization Agreement or otherwise provided by the Acquired Fund and the Acquiring Fund:

1. The transfer of substantially all of the assets of the Acquired Fund in exchange solely for the Acquiring Fund Shares and the assumption by the Acquiring Fund of the liabilities of the Acquired Fund followed by the distribution by the Acquired Fund of the Acquiring Fund Shares to shareholders in exchange for their Acquired Fund shares pursuant to and in accordance with the terms of the Reorganization Agreement will constitute a "reorganization" within the meaning of Section 368(a)(1) of the Code;

2. No gain or loss will be recognized by the Acquiring Fund upon the receipt of the assets of the Acquired Fund solely in exchange for the Acquiring Fund Shares and the assumption by the Acquiring Fund of the liabilities of the Acquired Fund;

3. No gain or loss will be recognized by the Acquired Fund upon the transfer of substantially all of the assets of the Acquired Fund to the Acquiring Fund solely in exchange for the Acquiring Fund Shares and the assumption by the Acquiring Fund of the liabilities or upon the distribution of the Acquiring Fund Shares to shareholders in exchange for their Acquired Fund Shares, except that the Acquired Fund may be required to recognize gain or loss with respect to contracts described in Section 1256(b) of the Code or stock in a passive foreign investment company, as defined in Section 1297(a) of the Code;

4. No gain or loss will be recognized by Shareholders upon the exchange of the shares of the Acquired Fund solely for the Acquiring Fund Shares;

5. The aggregate tax basis for the Acquiring Fund Shares received by each Shareholder pursuant to the Reorganization will be the same as the aggregate tax basis of the shares in the Acquired Fund surrendered by each such Shareholder in exchange therefor;

6. The holding period of the Acquiring Fund Shares to be received by each Shareholder will include the period during which the shares in the Acquired Fund surrendered in exchange therefor were held (provided such shares in the Acquired Fund were held as capital assets on the date of the Reorganization);

7. The tax basis of the assets of the Acquired Fund acquired by the Acquiring Fund will be the same as the tax basis of such assets of the Acquired Fund immediately prior to the Reorganization; and

14

8. The holding period of the assets of the Acquired Fund in the hands of the Acquiring Fund will include the period during which those assets were held by the Acquired Fund (except where the investment activities of the Acquiring Fund have the effect of reducing or eliminating such period with respect to an asset).

Prior to the closing of the Reorganization, the Acquired Fund will distribute to its shareholders any undistributed income and gains to the extent required to avoid entity level tax or as otherwise deemed desirable. The advice of counsel is not binding on the IRS or the courts and neither the Acquired Fund nor the Acquiring Fund has sought a ruling with respect to the tax treatment of the Reorganization. The opinion of counsel, if delivered, will be based on the Code, regulations issued by the Treasury Department under the Code, court decisions, and administrative pronouncements issued by the IRS with respect to all of the foregoing, all as in effect on the date of the opinion, and all of which may be repealed, revoked or modified thereafter, possibly on a retroactive basis.

After the Reorganization, you will continue to be responsible for tracking the adjusted tax basis and holding period of your shares for federal income tax purposes.

Shareholders should consult their tax advisors regarding the effect, if any, of the proposed Reorganization in light of their individual circumstances. Because the foregoing discussion only relates to the federal income tax consequences of the proposed Reorganization, shareholders should also consult their tax advisors as to state and local tax consequences, if any, of the proposed Reorganization.

Description of Shares

The Acquiring Fund Shares to be issued pursuant to the Reorganization Agreement will, when issued in exchange for the consideration therefor, be fully paid and non-assessable by the Acquiring Fund and transferable without restrictions and will have no preemptive rights. For greater details regarding the Acquiring Fund's shares, see "Shareholder Information" in the Acquiring Fund's Prospectuses attached hereto as Exhibit B.

Capitalization Tables (unaudited)

The following tables set forth the capitalization of the Acquired Fund as of December 31, 2012 and the Acquiring Fund on a pro forma combined basis as if the Reorganization had occurred on that date:

|

Aggressive Equity Portfolio (Acquired Fund) |

Class X |

Class Y |

Total |

||||||||||||

|

Net Assets |

$ |

11,151,056 |

$ |

15,352,451 |

$ |

26,503,507 |

|||||||||

|

Pro Forma Adjustments† |

$ |

(72,073 |

) |

$ |

(99,227 |

) |

$ |

(171,300 |

) |

||||||

|

Net Assets minus Pro Forma Adjustments |

$ |

11,078,983 |

$ |

15,253,224 |

$ |

26,332,207 |

|||||||||

|

Shares Outstanding |

601,328 |

852,131 |

1,453,459 |

||||||||||||

|

Net Asset Value Per Share |

$ |

18.42 |

$ |

17.90 |

— |

||||||||||

|

Multi Cap Growth Portfolio (Acquiring Fund) |

Class X |

Class Y |

Total |

||||||||||||

|

Net Assets |

$ |

165,063,932 |

$ |

45,536,692 |

$ |

210,600,624 |

|||||||||

|

Shares Outstanding |

4,024,680 |

1,122,677 |

5,147,357 |

||||||||||||

|

Net Asset Value Per Share |

$ |

41.01 |

$ |

40.56 |

— |

||||||||||

|

Pro Forma Combined Fund (Multi Cap Growth Portfolio) |

Class X |

Class Y |

Total |

||||||||||||

|

Net Assets |

$ |

176,142,915 |

$ |

60,789,916 |

$ |

236,932,831 |

|||||||||

|

Shares Outstanding |

4,294,833 |

1,498,743 |

5,793,576 |

||||||||||||

|

Net Asset Value Per Share |

$ |

41.01 |

$ |

40.56 |

— |

||||||||||

† Reflects the charge for estimated reorganization expenses of $72,073 and $99,227 by Class X shares and Class Y shares, respectively, of the Acquired Fund.

Appraisal Rights

Shareholders will have no appraisal rights in connection with the Reorganization.

15

COMPARISON OF INVESTMENT OBJECTIVES, PRINCIPAL POLICIES AND RESTRICTIONS

Investment Objectives and Policies

The investment objectives of the Acquired Fund and the Acquiring Fund are set forth in the table below:

|

Aggressive Equity Portfolio (Acquired Fund) |

Multi Cap Growth Portfolio (Acquiring Fund) |

||||||||||

|

Investment Objective(s) |

• seeks long-term capital growth |

• primary objective: seeks growth of capital through investments in common stocks of companies believed by MSIM to have potential for superior growth • secondary objective: seeks income but only when consistent with its primary objective |

|||||||||

|

• Acquired Fund's investment objective is a fundamental policy and may not be changed without shareholder approval of a majority of the Fund's outstanding voting securities, as defined in the 1940 Act |

• Acquiring Fund's investment objective is a fundamental policy and may not be changed without shareholder approval of a majority of the Fund's outstanding voting securities, as defined in the 1940 Act |

||||||||||

Aggressive Equity Portfolio (Acquired Fund)

The Acquired Fund normally invests at least 80% of its assets in common stocks and other equity securities of companies that MSIM believes offer the potential for superior earnings growth. MSIM seeks to achieve the Acquired Fund's investment objective by investing primarily in established and emerging companies with capitalizations within the range of companies included in the Russell 3000® Growth Index, which as of September 30, 2012 was between $46.3 million and $624 billion.