false--12-31Q220240000716634http://fasb.org/us-gaap/2024#SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberhttp://fasb.org/us-gaap/2024#SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberhttp://fasb.org/us-gaap/2024#InterestExpensehttp://fasb.org/us-gaap/2024#InterestExpenseP10YP1Y0000716634us-gaap:TreasuryStockCommonMember2024-06-300000716634us-gaap:TreasuryStockCommonMember2024-03-310000716634us-gaap:TreasuryStockCommonMember2023-12-310000716634us-gaap:TreasuryStockCommonMember2023-06-300000716634us-gaap:TreasuryStockCommonMember2023-03-310000716634us-gaap:TreasuryStockCommonMember2022-12-310000716634us-gaap:CommonClassAMember2023-01-012023-06-300000716634us-gaap:CommonClassAMemberrdi:CommonStockSharesOutstandingMember2024-04-012024-06-300000716634us-gaap:CommonClassAMemberrdi:CommonStockSharesOutstandingMember2024-01-012024-03-310000716634us-gaap:CommonClassAMemberrdi:CommonStockSharesOutstandingMember2023-04-012023-06-300000716634us-gaap:CommonClassAMemberrdi:CommonStockSharesOutstandingMember2023-01-012023-03-310000716634us-gaap:RetainedEarningsMember2024-06-300000716634us-gaap:ParentMember2024-06-300000716634us-gaap:NoncontrollingInterestMember2024-06-300000716634us-gaap:AdditionalPaidInCapitalMember2024-06-300000716634us-gaap:RetainedEarningsMember2024-03-310000716634us-gaap:ParentMember2024-03-310000716634us-gaap:NoncontrollingInterestMember2024-03-310000716634us-gaap:AdditionalPaidInCapitalMember2024-03-310000716634us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-3100007166342024-03-310000716634us-gaap:RetainedEarningsMember2023-12-310000716634us-gaap:ParentMember2023-12-310000716634us-gaap:NoncontrollingInterestMember2023-12-310000716634us-gaap:AdditionalPaidInCapitalMember2023-12-310000716634us-gaap:RetainedEarningsMember2023-06-300000716634us-gaap:ParentMember2023-06-300000716634us-gaap:NoncontrollingInterestMember2023-06-300000716634us-gaap:AdditionalPaidInCapitalMember2023-06-300000716634us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000716634us-gaap:RetainedEarningsMember2023-03-310000716634us-gaap:ParentMember2023-03-310000716634us-gaap:NoncontrollingInterestMember2023-03-310000716634us-gaap:AdditionalPaidInCapitalMember2023-03-310000716634us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-3100007166342023-03-310000716634us-gaap:RetainedEarningsMember2022-12-310000716634us-gaap:ParentMember2022-12-310000716634us-gaap:NoncontrollingInterestMember2022-12-310000716634us-gaap:AdditionalPaidInCapitalMember2022-12-310000716634us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000716634us-gaap:AccumulatedTranslationAdjustmentMember2024-06-300000716634us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300000716634us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-06-300000716634us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-06-300000716634us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-06-300000716634us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310000716634us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000716634us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-12-310000716634us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310000716634us-gaap:CommonClassAMember2022-01-012022-12-310000716634us-gaap:CommonClassAMember2022-12-310000716634rdi:SeniorExecutivesMemberus-gaap:CommonClassAMember2024-06-062024-06-060000716634srt:DirectorMemberus-gaap:CommonClassAMember2024-01-012024-06-300000716634us-gaap:CommonClassAMember2023-01-012023-12-310000716634rdi:TwoThousandTwentyStockIncentivePlanMemberus-gaap:CommonClassAMember2024-06-300000716634rdi:TwoThousandTwentyStockIncentivePlanMemberus-gaap:CommonClassAMember2024-01-012024-06-300000716634rdi:TwoThousandTwentyStockIncentivePlanMemberus-gaap:CommonClassAMember2023-12-072023-12-070000716634rdi:AwardDate8Memberus-gaap:RestrictedStockUnitsRSUMember2024-06-300000716634rdi:AwardDate12Memberus-gaap:RestrictedStockUnitsRSUMember2024-06-300000716634rdi:AwardDate11Memberus-gaap:RestrictedStockUnitsRSUMember2024-06-300000716634rdi:AwardDate10Memberus-gaap:RestrictedStockUnitsRSUMember2024-06-300000716634us-gaap:RestrictedStockUnitsRSUMember2023-12-310000716634srt:ManagementMemberrdi:AwardDate8Memberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300000716634srt:ManagementMemberrdi:AwardDate12Memberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300000716634srt:ManagementMemberrdi:AwardDate11Memberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300000716634srt:ManagementMemberrdi:AwardDate10Memberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300000716634srt:DirectorMemberrdi:AwardDate9Memberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300000716634us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-01-012024-06-300000716634us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-01-012024-06-300000716634us-gaap:RestrictedStockUnitsRSUMemberrdi:TwoThousandTwentyStockIncentivePlanMember2024-01-012024-06-300000716634srt:DirectorMemberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300000716634rdi:AwardDate9Memberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300000716634rdi:AwardDate12Memberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300000716634srt:ManagementMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310000716634srt:DirectorMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310000716634rdi:AwardDate8Memberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300000716634rdi:AwardDate11Memberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300000716634rdi:AwardDate10Memberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300000716634us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310000716634srt:ExecutiveOfficerMemberus-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2021-04-302021-04-300000716634srt:ExecutiveOfficerMemberus-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-04-302021-04-300000716634srt:ChiefExecutiveOfficerMemberus-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2021-04-302021-04-300000716634srt:ChiefExecutiveOfficerMemberus-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-04-302021-04-300000716634srt:MinimumMemberrdi:TwoThousandTwentyStockIncentivePlanMember2024-01-012024-06-300000716634srt:MaximumMemberrdi:TwoThousandTwentyStockIncentivePlanMember2024-01-012024-06-300000716634srt:ExecutiveOfficerMemberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300000716634srt:ChiefExecutiveOfficerMemberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300000716634srt:DirectorMember2024-01-012024-06-300000716634rdi:SeniorExecutivesMember2024-01-012024-06-300000716634us-gaap:IntersegmentEliminationMember2024-04-012024-06-300000716634us-gaap:IntersegmentEliminationMember2024-01-012024-06-300000716634us-gaap:IntersegmentEliminationMember2023-04-012023-06-300000716634us-gaap:IntersegmentEliminationMember2023-01-012023-06-300000716634rdi:RotoruaCinemaBuildingMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2024-06-300000716634rdi:CourtenayCentralEtcMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2024-06-300000716634rdi:TrentonAvenueWilliamsportPennsylvaniaMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-06-300000716634rdi:CulverCityLosAngelesMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2023-05-310000716634us-gaap:LeaseholdImprovementsMember2024-06-300000716634us-gaap:LandMember2024-06-300000716634us-gaap:FurnitureAndFixturesMember2024-06-300000716634us-gaap:ConstructionInProgressMember2024-06-300000716634us-gaap:BuildingAndBuildingImprovementsMember2024-06-300000716634us-gaap:LeaseholdImprovementsMember2023-12-310000716634us-gaap:FurnitureAndFixturesMember2023-12-310000716634us-gaap:ConstructionInProgressMember2023-12-310000716634us-gaap:BuildingAndBuildingImprovementsMember2023-12-310000716634us-gaap:RetainedEarningsMember2024-04-012024-06-300000716634us-gaap:RetainedEarningsMember2024-01-012024-03-310000716634us-gaap:RetainedEarningsMember2023-04-012023-06-300000716634us-gaap:RetainedEarningsMember2023-01-012023-03-310000716634us-gaap:NoncontrollingInterestMember2024-04-012024-06-300000716634us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300000716634us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-06-300000716634us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-01-012024-06-300000716634us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-06-300000716634us-gaap:NoncontrollingInterestMember2024-01-012024-03-310000716634us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000716634us-gaap:NoncontrollingInterestMember2023-04-012023-06-300000716634us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300000716634us-gaap:NoncontrollingInterestMember2023-01-012023-03-310000716634us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000716634us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-04-012024-06-300000716634us-gaap:DesignatedAsHedgingInstrumentMember2024-04-012024-06-300000716634us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-06-300000716634us-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-06-300000716634us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-04-012023-06-300000716634us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-06-300000716634us-gaap:OperatingSegmentsMemberrdi:RealEstateSegmentMember2024-04-012024-06-300000716634us-gaap:OperatingSegmentsMemberrdi:CinemaExhibitionSegmentMember2024-04-012024-06-300000716634us-gaap:OperatingSegmentsMember2024-04-012024-06-300000716634us-gaap:OperatingSegmentsMemberrdi:RealEstateSegmentMember2024-01-012024-06-300000716634us-gaap:OperatingSegmentsMemberrdi:CinemaExhibitionSegmentMember2024-01-012024-06-300000716634us-gaap:OperatingSegmentsMember2024-01-012024-06-300000716634us-gaap:OperatingSegmentsMemberrdi:RealEstateSegmentMember2023-04-012023-06-300000716634us-gaap:OperatingSegmentsMemberrdi:CinemaExhibitionSegmentMember2023-04-012023-06-300000716634us-gaap:OperatingSegmentsMember2023-04-012023-06-300000716634us-gaap:OperatingSegmentsMemberrdi:RealEstateSegmentMember2023-01-012023-06-300000716634us-gaap:OperatingSegmentsMemberrdi:CinemaExhibitionSegmentMember2023-01-012023-06-300000716634us-gaap:OperatingSegmentsMember2023-01-012023-06-300000716634rdi:SuttonHillPropertiesMember2024-04-012024-06-300000716634rdi:AustraliaCountryCinemasMember2024-04-012024-06-300000716634rdi:SuttonHillPropertiesMember2023-04-012023-06-300000716634rdi:AustraliaCountryCinemasMember2023-04-012023-06-300000716634rdi:SuttonHillPropertiesMember2023-01-012023-06-300000716634rdi:AustraliaCountryCinemasMember2023-01-012023-06-300000716634rdi:SuttonHillPropertiesMember2024-06-300000716634rdi:SuttonHillCapitalLlcMember2024-06-300000716634rdi:ShadowViewLandAndFarmingLlcMember2024-06-300000716634rdi:AustraliaCountryCinemasMember2024-06-300000716634us-gaap:RevolvingCreditFacilityMemberrdi:NationalAustraliaBankAustralianCorporateTermLoanAndRevolverTierThreeMember2024-06-300000716634rdi:NationalAustraliaBankAustralianCorporateTermLoanAndRevolverTierThreeMemberrdi:CoreFacilityMember2024-06-300000716634rdi:NationalAustraliaBankAustralianCorporateTermLoanAndRevolverTierThreeMember2024-06-300000716634rdi:CorporateLoanFacilityMember2024-06-300000716634rdi:NationalAustraliaBankGuaranteeFacilityMember2024-04-040000716634rdi:BankGuaranteeFacilityMember2024-06-300000716634rdi:RealEstateRevenueMembersrt:MinimumMember2024-06-300000716634rdi:RealEstateRevenueMembersrt:MaximumMember2024-06-300000716634srt:MinimumMember2024-06-300000716634srt:MaximumMember2024-06-300000716634rdi:RialtoCinemasMember2024-04-012024-06-300000716634rdi:MtGravattCinemaMember2024-04-012024-06-300000716634rdi:RialtoCinemasMember2024-01-012024-06-300000716634rdi:MtGravattCinemaMember2024-01-012024-06-300000716634rdi:RialtoCinemasMember2023-04-012023-06-300000716634rdi:MtGravattCinemaMember2023-04-012023-06-300000716634rdi:RialtoCinemasMember2023-01-012023-06-300000716634rdi:MtGravattCinemaMember2023-01-012023-06-300000716634rdi:BusinessSegmentCinemaMember2024-01-012024-06-300000716634rdi:BusinessSegmentRealEstateMember2024-06-300000716634rdi:BusinessSegmentCinemaMember2024-06-300000716634rdi:BusinessSegmentRealEstateMember2023-12-310000716634rdi:BusinessSegmentCinemaMember2023-12-310000716634us-gaap:TradeNamesMember2024-06-300000716634us-gaap:OtherIntangibleAssetsMember2024-06-300000716634rdi:BeneficialLeasesMember2024-06-300000716634us-gaap:TradeNamesMember2023-12-310000716634rdi:BeneficialLeasesMember2023-12-310000716634us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2024-06-300000716634us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsNonrecurringMember2024-06-300000716634us-gaap:FairValueMeasurementsNonrecurringMember2024-06-300000716634us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310000716634us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310000716634us-gaap:FairValueMeasurementsNonrecurringMember2023-12-310000716634rdi:RialtoCinemasMember2023-12-310000716634rdi:MtGravattCinemaMember2023-12-310000716634rdi:RialtoCinemasMember2024-06-300000716634rdi:MtGravattCinemaMember2024-06-300000716634us-gaap:StockOptionMember2024-06-300000716634us-gaap:RestrictedStockUnitsRSUMember2024-06-300000716634us-gaap:DesignatedAsHedgingInstrumentMember2024-06-300000716634us-gaap:DesignatedAsHedgingInstrumentMember2023-12-310000716634us-gaap:DesignatedAsHedgingInstrumentMember2023-04-012023-06-300000716634us-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-06-300000716634us-gaap:InterestRateContractMember2023-04-012023-06-300000716634us-gaap:InterestRateContractMember2023-01-012023-06-300000716634us-gaap:CorporateNonSegmentMember2024-04-012024-06-300000716634us-gaap:CorporateNonSegmentMember2024-01-012024-06-300000716634us-gaap:CorporateNonSegmentMember2023-04-012023-06-300000716634us-gaap:CorporateNonSegmentMember2023-01-012023-06-300000716634rdi:UnitedStatesBankOfAmericaCreditFacilityMember2024-03-272024-03-270000716634rdi:CorporateLoanFacilityMember2024-01-012024-06-300000716634rdi:NationalAustraliaBankGuaranteeFacilityMember2024-01-012024-06-300000716634rdi:NationalAustraliaBankBridgeFacilityMember2024-01-012024-06-300000716634rdi:NewZealandCorporateCreditFacilityMemberrdi:BankBillSwapBidRateMember2024-06-300000716634rdi:PurchaseMoneyPromissoryNoteMember2019-09-180000716634srt:MinimumMemberrdi:UnitedStateCorporateOfficeTermLoanMember2023-12-310000716634srt:MaximumMemberrdi:UnitedStateCorporateOfficeTermLoanMember2023-12-310000716634srt:MinimumMemberrdi:UnitedStateCorporateOfficeTermLoanMember2023-01-012023-12-310000716634srt:MaximumMemberrdi:UnitedStateCorporateOfficeTermLoanMember2023-01-012023-12-310000716634rdi:EmeraldCreekCapitalMember2024-06-300000716634rdi:UnitedStatesBankOfAmericaCreditFacilityMemberus-gaap:PrimeRateMember2024-01-012024-06-300000716634rdi:UnitedStatesBankOfAmericaCreditFacilityMemberrdi:FloorRateMember2024-01-012024-06-300000716634rdi:NationalAustraliaBankAustralianCorporateTermLoanAndRevolverTierThreeMember2024-01-012024-06-300000716634rdi:AustralianNabBankGuaranteeFacilityTier3Member2024-01-012024-06-300000716634rdi:SantanderBankMember2024-06-300000716634rdi:RealEstateRevenueMember2024-04-012024-06-300000716634rdi:CinemaMember2024-04-012024-06-300000716634rdi:RealEstateRevenueMember2024-01-012024-06-300000716634rdi:CinemaMember2024-01-012024-06-300000716634rdi:RealEstateRevenueMember2023-04-012023-06-300000716634rdi:CinemaMember2023-04-012023-06-300000716634rdi:RealEstateRevenueMember2023-01-012023-06-300000716634rdi:CinemaMember2023-01-012023-06-300000716634rdi:OtherRealEstateProjectsMemberrdi:OperatingAndInvestingPropertiesMember2024-06-300000716634rdi:CinemaDevelopmentsAndImprovementsMemberrdi:OperatingAndInvestingPropertiesMember2024-06-300000716634rdi:OperatingAndInvestingPropertiesMember2024-06-300000716634rdi:OtherRealEstateProjectsMemberrdi:OperatingAndInvestingPropertiesMember2023-12-310000716634rdi:CourtenayCentralDevelopmentMemberrdi:OperatingAndInvestingPropertiesMember2023-12-310000716634rdi:CinemaDevelopmentsAndImprovementsMemberrdi:OperatingAndInvestingPropertiesMember2023-12-310000716634rdi:OperatingAndInvestingPropertiesMember2023-12-310000716634us-gaap:CommonClassBMemberrdi:CommonStockSharesOutstandingMember2024-06-300000716634us-gaap:CommonClassAMemberrdi:CommonStockSharesOutstandingMember2024-06-300000716634us-gaap:CommonClassBMemberrdi:CommonStockSharesOutstandingMember2024-03-310000716634us-gaap:CommonClassAMemberrdi:CommonStockSharesOutstandingMember2024-03-310000716634us-gaap:CommonClassBMemberrdi:CommonStockSharesOutstandingMember2023-12-310000716634us-gaap:CommonClassAMemberrdi:CommonStockSharesOutstandingMember2023-12-310000716634us-gaap:CommonClassBMemberrdi:CommonStockSharesOutstandingMember2023-06-300000716634us-gaap:CommonClassAMemberrdi:CommonStockSharesOutstandingMember2023-06-300000716634us-gaap:CommonClassBMemberrdi:CommonStockSharesOutstandingMember2023-03-310000716634us-gaap:CommonClassAMemberrdi:CommonStockSharesOutstandingMember2023-03-310000716634us-gaap:CommonClassBMemberrdi:CommonStockSharesOutstandingMember2022-12-310000716634us-gaap:CommonClassAMemberrdi:CommonStockSharesOutstandingMember2022-12-310000716634us-gaap:CommonClassBMember2024-06-300000716634us-gaap:CommonClassAMember2024-06-300000716634us-gaap:CommonClassBMember2023-12-310000716634us-gaap:CommonClassAMember2023-12-3100007166342022-12-3100007166342023-06-300000716634rdi:CannonParkEtcMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2024-05-310000716634rdi:TrentonAvenueWilliamsportPennsylvaniaMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberus-gaap:LandMember2023-06-300000716634us-gaap:OtherIntangibleAssetsMember2024-04-012024-06-300000716634rdi:BeneficialLeaseMember2024-04-012024-06-300000716634us-gaap:OtherIntangibleAssetsMember2024-01-012024-06-300000716634rdi:BeneficialLeaseMember2024-01-012024-06-300000716634us-gaap:OtherIntangibleAssetsMember2023-04-012023-06-300000716634rdi:BeneficialLeaseMember2023-04-012023-06-300000716634us-gaap:OtherIntangibleAssetsMember2023-01-012023-06-300000716634rdi:BeneficialLeaseMember2023-01-012023-06-300000716634us-gaap:StockOptionMember2024-04-012024-06-300000716634us-gaap:RestrictedStockUnitsRSUMember2024-04-012024-06-300000716634us-gaap:StockOptionMember2024-01-012024-06-300000716634us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300000716634us-gaap:StockOptionMember2023-04-012023-06-300000716634us-gaap:RestrictedStockUnitsRSUMember2023-04-012023-06-300000716634us-gaap:StockOptionMember2023-01-012023-06-300000716634us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300000716634us-gaap:ParentMember2024-04-012024-06-300000716634us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300000716634us-gaap:ParentMember2024-01-012024-03-310000716634us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-3100007166342024-01-012024-03-310000716634us-gaap:ParentMember2023-04-012023-06-300000716634us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300000716634us-gaap:ParentMember2023-01-012023-03-310000716634us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-3100007166342023-01-012023-03-310000716634us-gaap:BuildingAndBuildingImprovementsMember2024-06-300000716634us-gaap:BuildingAndBuildingImprovementsMember2023-12-310000716634rdi:PurchaseMoneyPromissoryNoteMemberus-gaap:CommonClassAMember2019-09-182019-09-180000716634rdi:PurchaseMoneyPromissoryNoteMember2019-09-182019-09-180000716634rdi:CulverCityLosAngelesMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2023-05-012023-05-310000716634rdi:CulverCityLosAngelesMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2024-02-230000716634rdi:CulverCityLosAngelesMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-05-310000716634us-gaap:LandMember2023-12-310000716634rdi:ConstructionInProgressIncludingCapitalizedInterestMember2023-12-310000716634rdi:RotoruaCinemaBuildingMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2024-06-012024-06-300000716634rdi:CourtenayCentralEtcMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2024-06-012024-06-300000716634rdi:CannonParkEtcMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2024-05-012024-05-310000716634rdi:TrentonAvenueWilliamsportPennsylvaniaMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberus-gaap:LandMember2023-06-012023-06-300000716634srt:ManagementMemberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300000716634us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-06-300000716634us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-01-012024-06-300000716634rdi:EmeraldCreekCapitalMember2024-01-012024-06-300000716634rdi:SuttonHillPropertiesMember2024-01-012024-06-300000716634rdi:ShadowViewLandAndFarmingLlcMember2024-01-012024-06-300000716634rdi:AustraliaCountryCinemasMember2024-01-012024-06-300000716634rdi:SuttonHillPropertiesMember2023-01-012023-12-310000716634rdi:ShadowViewLandAndFarmingLlcMember2023-01-012023-12-310000716634rdi:AustraliaCountryCinemasMember2023-01-012023-12-310000716634rdi:UnitedStatesUnionSquareLineOfCreditMember2024-06-300000716634rdi:UnitedStatesBankOfAmericaCreditFacilityMember2024-06-300000716634rdi:TrustPreferredSecuritiesMember2024-06-300000716634rdi:PurchaseMoneyPromissoryNoteMember2024-06-300000716634rdi:NewZealandCorporateCreditFacilityMember2024-06-300000716634rdi:NationalAustraliaBankAustralianCorporateTermLoanMember2024-06-300000716634rdi:NationalAustraliaBankAustralianCorporateLoanFacilityMember2024-06-300000716634rdi:NabBridgeFacilityMember2024-06-300000716634rdi:MinettaAndOrpheumTheatresLoanMember2024-06-300000716634rdi:UnitedStatesUnionSquareLineOfCreditMember2023-12-310000716634rdi:UnitedStatesBankOfAmericaCreditFacilityMember2023-12-310000716634rdi:UnitedStateCorporateOfficeTermLoanMember2023-12-310000716634rdi:UnitedStateCinemasOneTwoThreeTermLoanMember2023-12-310000716634rdi:TrustPreferredSecuritiesMember2023-12-310000716634rdi:PurchaseMoneyPromissoryNoteMember2023-12-310000716634rdi:NewZealandCorporateCreditFacilityMember2023-12-310000716634rdi:NationalAustraliaBankAustralianCorporateTermLoanMember2023-12-310000716634rdi:MinettaAndOrpheumTheatresLoanMember2023-12-310000716634rdi:AustralianNabBankGuaranteeFacilityTier3Member2024-06-300000716634rdi:CourtenayCentralDevelopmentMemberrdi:OperatingAndInvestingPropertiesMember2024-01-012024-06-300000716634currency:NZDrdi:SpotRateMember2024-04-012024-06-300000716634currency:NZDrdi:AverageRateMember2024-04-012024-06-300000716634currency:AUDrdi:SpotRateMember2024-04-012024-06-300000716634currency:AUDrdi:AverageRateMember2024-04-012024-06-300000716634currency:NZDrdi:SpotRateMember2024-01-012024-06-300000716634currency:NZDrdi:AverageRateMember2024-01-012024-06-300000716634currency:AUDrdi:SpotRateMember2024-01-012024-06-300000716634currency:AUDrdi:AverageRateMember2024-01-012024-06-300000716634currency:NZDrdi:SpotRateMember2023-04-012023-06-300000716634currency:NZDrdi:AverageRateMember2023-04-012023-06-300000716634currency:AUDrdi:SpotRateMember2023-04-012023-06-300000716634currency:AUDrdi:AverageRateMember2023-04-012023-06-300000716634currency:NZDrdi:SpotRateMember2023-01-012023-12-310000716634currency:NZDrdi:AverageRateMember2023-01-012023-12-310000716634currency:AUDrdi:SpotRateMember2023-01-012023-12-310000716634currency:AUDrdi:AverageRateMember2023-01-012023-12-310000716634currency:NZDrdi:SpotRateMember2023-01-012023-06-300000716634currency:NZDrdi:AverageRateMember2023-01-012023-06-300000716634currency:AUDrdi:SpotRateMember2023-01-012023-06-300000716634currency:AUDrdi:AverageRateMember2023-01-012023-06-300000716634us-gaap:OtherIntangibleAssetsMember2023-12-3100007166342023-04-012023-06-300000716634rdi:LosAngelesMember2024-06-3000007166342024-06-300000716634srt:ScenarioForecastMemberrdi:UnitedStatesBankOfAmericaCreditFacilityMember2025-01-012025-01-010000716634rdi:UnitedStateCinemasOneTwoThreeTermLoanMember2024-06-300000716634rdi:NewZealandCorporateCreditFacilityMemberus-gaap:SubsequentEventMember2024-08-132024-08-130000716634rdi:UnitedStatesUnionSquareLineOfCreditMember2024-01-012024-06-300000716634rdi:UnitedStatesBankOfAmericaCreditFacilityMember2024-01-012024-06-300000716634rdi:UnitedStateCorporateOfficeTermLoanMember2024-01-012024-06-300000716634rdi:UnitedStateCinemasOneTwoThreeTermLoanMember2024-01-012024-06-300000716634rdi:TrustPreferredSecuritiesMember2024-01-012024-06-300000716634rdi:PurchaseMoneyPromissoryNoteMember2024-01-012024-06-300000716634rdi:NewZealandCorporateCreditFacilityMember2024-01-012024-06-300000716634rdi:NationalAustraliaBankAustralianCorporateTermLoanMember2024-01-012024-06-300000716634rdi:NabBridgeFacilityMember2024-01-012024-06-300000716634rdi:MinettaAndOrpheumTheatresLoanMember2024-01-012024-06-300000716634rdi:UnitedStatesUnionSquareLineOfCreditMember2023-01-012023-12-310000716634rdi:UnitedStatesBankOfAmericaCreditFacilityMember2023-01-012023-12-310000716634rdi:UnitedStateCorporateOfficeTermLoanMember2023-01-012023-12-310000716634rdi:UnitedStateCinemasOneTwoThreeTermLoanMember2023-01-012023-12-310000716634rdi:TrustPreferredSecuritiesMember2023-01-012023-12-310000716634rdi:PurchaseMoneyPromissoryNoteMember2023-01-012023-12-310000716634rdi:NewZealandCorporateCreditFacilityMember2023-01-012023-12-310000716634rdi:NationalAustraliaBankAustralianCorporateTermLoanMember2023-01-012023-12-310000716634rdi:MinettaAndOrpheumTheatresLoanMember2023-01-012023-12-3100007166342023-01-012023-12-310000716634rdi:AustralianNabBankGuaranteeFacilityTier3Member2024-06-2800007166342023-01-012023-06-300000716634rdi:OtherRealEstateProjectsMemberrdi:OperatingAndInvestingPropertiesMember2024-01-012024-06-300000716634rdi:CinemaDevelopmentsAndImprovementsMemberrdi:OperatingAndInvestingPropertiesMember2024-01-012024-06-300000716634rdi:OperatingAndInvestingPropertiesMember2024-01-012024-06-3000007166342023-12-3100007166342024-04-012024-06-300000716634us-gaap:CommonClassBMember2024-01-012024-06-300000716634us-gaap:CommonClassAMember2024-01-012024-06-300000716634us-gaap:CommonClassBMember2024-08-130000716634us-gaap:CommonClassAMember2024-08-1300007166342024-01-012024-06-30iso4217:USDxbrli:sharesutr:acreutr:sqftrdi:propertyrdi:itemxbrli:pureiso4217:NZDiso4217:AUDiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________

FORM 10-Q

(Mark One)

| |

þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended: June 30, 2024

OR

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

Commission file number 1-8625

READING INTERNATIONAL, INC.

(Exact name of Registrant as specified in its charter)

| |

Nevada State or other jurisdiction of incorporation or organization) | 95-3885184 (IRS Employer Identification Number) |

189 Second Avenue, Suite 2S New York, New York (Address of principal executive offices) | 10003 (Zip Code) |

Registrant’s telephone number, including area code: (213) 235-2240

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Class A Nonvoting Common Stock, $0.01 par value | | RDI | | The Nasdaq Stock Market LLC |

Class B Voting Common Stock, $0.01 par value | | RDIB | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ¨ Accelerated Filer ¨ Non-Accelerated Filer þ Smaller Reporting Company þ Emerging Growth Company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. As of August 13, 2024, there were 20,745,594 shares of Class A Nonvoting Common Stock, $0.01 par value per share, and 1,680,590 shares of Class B Voting Common Stock, $0.01 par value per share, outstanding.

READING INTERNATIONAL, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

PART 1 – FINANCIAL INFORMATION

Item 1 - Financial Statements

READING INTERNATIONAL, INC.

CONSOLIDATED BALANCE SHEETS

(U.S. dollars in thousands, except share information)

| | | | | | |

| | | | | | |

| | June 30, | | December 31, |

| | 2024 | | 2023 |

ASSETS | | (unaudited) | | | |

Current Assets: | | | | | | |

Cash and cash equivalents | | $ | 9,242 | | $ | 12,906 |

Restricted cash | | | 1,485 | | | 2,535 |

Receivables | | | 7,647 | | | 7,561 |

Inventories | | | 1,347 | | | 1,648 |

Prepaid and other current assets | | | 2,485 | | | 2,881 |

Land and property held for sale | | | 36,446 | | | 11,179 |

Total current assets | | | 58,652 | | | 38,710 |

Operating property, net | | | 225,473 | | | 262,417 |

Operating lease right-of-use assets | | | 168,546 | | | 181,542 |

Investment and development property, net | | | — | | | 8,789 |

Investment in unconsolidated joint ventures | | | 4,428 | | | 4,756 |

Goodwill | | | 25,023 | | | 25,535 |

Intangible assets, net | | | 1,899 | | | 2,038 |

Deferred tax asset, net | | | 2,109 | | | 299 |

Other assets | | | 8,725 | | | 8,965 |

Total assets | | $ | 494,855 | | $ | 533,051 |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | |

Current Liabilities: | | | | | | |

Accounts payable and accrued liabilities | | $ | 44,392 | | $ | 43,828 |

Film rent payable | | | 4,911 | | | 6,038 |

Debt - current portion | | | 58,401 | | | 34,484 |

Subordinated debt - current portion | | | 198 | | | 586 |

Taxes payable - current | | | 2,088 | | | 1,376 |

Deferred revenue | | | 10,027 | | | 10,993 |

Operating lease liabilities - current portion | | | 21,797 | | | 23,047 |

Other current liabilities | | | 6,625 | | | 6,731 |

Total current liabilities | | | 148,439 | | | 127,083 |

Debt - long-term portion | | | 123,347 | | | 146,605 |

Derivative financial instruments - non-current portion | | | 98 | | | — |

Subordinated debt, net | | | 27,283 | | | 27,172 |

Noncurrent tax liabilities | | | 6,418 | | | 6,586 |

Operating lease liabilities - non-current portion | | | 168,246 | | | 180,898 |

Other liabilities | | | 11,493 | | | 11,711 |

Total liabilities | | $ | 485,324 | | $ | 500,055 |

Commitments and contingencies (Note 15) | | | | | | |

Stockholders’ equity: | | | | | | |

Class A non-voting common shares, par value $0.01, 100,000,000 shares authorized, | | | | | | |

33,681,705 issued and 20,745,594 outstanding at June 30, 2024 and | | | | | | |

33,602,627 issued and 20,666,516 outstanding at December 31, 2023 | | | 238 | | | 237 |

Class B voting common shares, par value $0.01, 20,000,000 shares authorized and | | | | | | |

1,680,590 issued and outstanding at June 30, 2024 and December 31, 2023 | | | 17 | | | 17 |

Nonvoting preferred shares, par value $0.01, 12,000 shares authorized and no issued | | | | | | |

or outstanding shares at June 30, 2024 and December 31, 2023 | | | — | | | — |

Additional paid-in capital | | | 156,529 | | | 155,402 |

Retained earnings/(deficits) | | | (102,058) | | | (79,489) |

Treasury shares | | | (40,407) | | | (40,407) |

Accumulated other comprehensive income | | | (4,325) | | | (2,673) |

Total Reading International, Inc. stockholders’ equity | | | 9,994 | | | 33,087 |

Noncontrolling interests | | | (463) | | | (91) |

Total stockholders’ equity | | | 9,531 | | | 32,996 |

Total liabilities and stockholders’ equity | | $ | 494,855 | | $ | 533,051 |

See accompanying Notes to the Unaudited Consolidated Financial Statements.

READING INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited; U.S. dollars in thousands, except per share data)

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Quarter Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

Revenue | | | | | | | | | | | | |

Cinema | | $ | 42,942 | | $ | 61,056 | | $ | 84,213 | | $ | 103,042 |

Real estate | | | 3,867 | | | 3,999 | | | 7,648 | | | 7,819 |

Total revenue | | | 46,809 | | | 65,055 | | | 91,861 | | | 110,861 |

Costs and expenses | | | | | | | | | | | | |

Cinema | | | (39,418) | | | (51,364) | | | (80,138) | | | (93,019) |

Real estate | | | (2,461) | | | (2,104) | | | (4,696) | | | (4,319) |

Depreciation and amortization | | | (4,011) | | | (4,689) | | | (8,216) | | | (9,329) |

General and administrative | | | (5,271) | | | (5,109) | | | (10,693) | | | (10,288) |

Total costs and expenses | | | (51,161) | | | (63,266) | | | (103,743) | | | (116,955) |

Operating income (loss) | | | (4,352) | | | 1,789 | | | (11,882) | | | (6,094) |

Interest expense, net | | | (5,252) | | | (4,874) | | | (10,537) | | | (8,991) |

Gain (loss) on sale of assets | | | 9 | | | — | | | (1,116) | | | — |

Other income (expense) | | | (216) | | | (86) | | | 123 | | | 91 |

Income (loss) before income tax expense and equity earnings of unconsolidated joint ventures | | | (9,811) | | | (3,171) | | | (23,412) | | | (14,994) |

Equity earnings of unconsolidated joint ventures | | | 119 | | | 207 | | | 94 | | | 226 |

Income (loss) before income taxes | | | (9,692) | | | (2,964) | | | (23,318) | | | (14,768) |

Income tax benefit (expense) | | | 156 | | | 103 | | | 379 | | | 583 |

Net income (loss) | | $ | (9,536) | | $ | (2,861) | | $ | (22,939) | | $ | (14,185) |

Less: net income (loss) attributable to noncontrolling interests | | | (195) | | | (83) | | | (370) | | | (296) |

Net income (loss) attributable to Reading International, Inc. | | $ | (9,341) | | $ | (2,778) | | $ | (22,569) | | $ | (13,889) |

Basic earnings (loss) per share | | $ | (0.42) | | $ | (0.12) | | $ | (1.01) | | $ | (0.63) |

Diluted earnings (loss) per share | | $ | (0.42) | | $ | (0.12) | | $ | (1.01) | | $ | (0.63) |

Weighted average number of shares outstanding–basic | | | 22,413,617 | | | 22,262,214 | | | 22,379,881 | | | 22,183,618 |

Weighted average number of shares outstanding–diluted | | | 23,246,591 | | | 23,502,506 | | | 23,294,887 | | | 23,423,910 |

See accompanying Notes to the Unaudited Consolidated Financial Statements.

READING INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited; U.S. dollars in thousands)

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Quarter Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

Net income (loss) | | $ | (9,536) | | $ | (2,861) | | $ | (22,939) | | $ | (14,185) |

Foreign currency translation gain (loss) | | | 932 | | | (589) | | | (1,659) | | | (1,352) |

Gain (loss) on cash flow hedges | | | (98) | | | (205) | | | (98) | | | (788) |

Other | | | 52 | | | 53 | | | 102 | | | 107 |

Comprehensive income (loss) | | | (8,650) | | | (3,602) | | | (24,594) | | | (16,218) |

Less: net income (loss) attributable to noncontrolling interests | | | (195) | | | (83) | | | (370) | | | (296) |

Less: comprehensive income (loss) attributable to noncontrolling interests | | | — | | | (1) | | | (1) | | | (2) |

Comprehensive income (loss) | | $ | (8,455) | | | (3,518) | | $ | (24,223) | | $ | (15,920) |

See accompanying Notes to the Unaudited Consolidated Financial Statements.

READING INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited; U.S. dollars in thousands)

| | | | | | |

| | | | | | |

| | Six Months Ended |

| | June 30, |

| | 2024 | | 2023 |

Operating Activities | | | | | | |

Net income (loss) | | $ | (22,939) | | $ | (14,185) |

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | | | |

Equity earnings of unconsolidated joint ventures | | | (94) | | | (226) |

Distributions of earnings from unconsolidated joint ventures | | | 329 | | | 338 |

(Gain) loss recognized on foreign currency transactions | | | (66) | | | — |

(Gain) loss on sale of assets | | | 1,116 | | | — |

Amortization of operating leases | | | 9,089 | | | 9,290 |

Amortization of finance leases | | | 21 | | | 15 |

Change in operating lease liabilities | | | (9,903) | | | (10,059) |

Purchase of derivative instruments | | | — | | | — |

Change in net deferred tax assets | | | (1,824) | | | (31) |

Depreciation and amortization | | | 8,216 | | | 9,329 |

Other amortization | | | 829 | | | 753 |

Stock based compensation expense | | | 1,134 | | | 751 |

Net changes in operating assets and liabilities: | | | | | | |

Receivables | | | (151) | | | 719 |

Prepaid and other assets | | | 414 | | | (1,341) |

Payments for accrued pension | | | (342) | | | (171) |

Accounts payable and accrued expenses | | | 1,918 | | | (2,540) |

Film rent payable | | | (1,069) | | | (25) |

Taxes payable | | | 758 | | | 1,512 |

Deferred revenue and other liabilities | | | (593) | | | (2,937) |

Net cash provided by (used in) operating activities | | | (13,157) | | | (8,808) |

Investing Activities | | | | | | |

Purchases of and additions to operating and investment properties | | | (2,175) | | | (3,430) |

Contributions to unconsolidated joint ventures | | | (30) | | | — |

Proceeds from sale of assets | | | 9,603 | | | — |

Net cash provided by (used in) investing activities | | | 7,398 | | | (3,430) |

Financing Activities | | | | | | |

Repayment of borrowings | | | (11,391) | | | (3,258) |

Repayment of finance lease principal | | | (20) | | | (16) |

Proceeds from borrowings | | | 12,980 | | | 3,154 |

Capitalized borrowing costs | | | (438) | | | (349) |

(Cash paid) proceeds from the settlement of employee share transactions | | | (6) | | | (243) |

Net cash provided by (used in) financing activities | | | 1,125 | | | (712) |

Effect of exchange rate on cash and restricted cash | | | (80) | | | (188) |

Net increase (decrease) in cash and cash equivalents and restricted cash | | | (4,714) | | | (13,138) |

Cash and cash equivalents and restricted cash at the beginning of the period | | | 15,441 | | | 34,979 |

Cash and cash equivalents and restricted cash at the end of the period | | $ | 10,727 | | $ | 21,841 |

| | | | | | |

Cash and cash equivalents and restricted cash consists of: | | | | | | |

Cash and cash equivalents | | $ | 9,242 | | $ | 15,511 |

Restricted cash | | | 1,485 | | | 6,330 |

| | $ | 10,727 | | $ | 21,841 |

| | | | | | |

| | | | | | |

| | | | | | |

Supplemental Disclosures | | | | | | |

Interest paid | | $ | 9,608 | | $ | 7,724 |

Income taxes (refunded) paid | | | 1,029 | | | (728) |

Non-Cash Transactions | | | | | | |

Additions to operating and investing properties through accrued expenses | | | 2,736 | | | 3,255 |

See accompanying Notes to the Unaudited Consolidated Financial Statements.

READING INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

Note 1 – Description of Business and Segment Reporting

Our Company

Reading International, Inc., a Nevada corporation (“RDI” and collectively with our consolidated subsidiaries and corporate predecessors, the “Company,” “Reading,” and “we,” “us,” or “our”) was incorporated in 1999. Our businesses, owned and operated through our various subsidiaries, consist primarily of:

the development, ownership, and operation of cinemas in the United States, Australia, and New Zealand; and

the development, ownership, operation and/or rental of retail, commercial and live venue real estate assets in Australia, New Zealand, and the United States.

Business Segments

Reported below are the operating segments of our Company for which separate financial information is available and evaluated regularly by the Chief Executive Officer, the chief operating decision-maker of our Company. As part of our real estate activities, we hold undeveloped land in urban and suburban centers in the United States and New Zealand.

The table below summarizes the results of operations for each of our business segments for the quarter and six months ended June 30, 2024, and 2023, respectively. Operating expense includes costs associated with the day-to-day operations of the cinemas and the management of rental properties, including our live theatre assets.

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Quarter Ended | | Six Months Ended |

| | June 30, | | June 30, |

(Dollars in thousands) | | 2024 | | 2023 | | 2024 | | 2023 |

Revenue: | | | | | | | | | | | | |

Cinema exhibition | | $ | 42,941 | | $ | 61,055 | | $ | 84,213 | | $ | 103,042 |

Real estate | | | 5,013 | | | 5,217 | | | 9,946 | | | 10,282 |

Inter-segment elimination | | | (1,146) | | | (1,218) | | | (2,298) | | | (2,463) |

| | $ | 46,808 | | $ | 65,054 | | $ | 91,861 | | $ | 110,861 |

Segment operating income (loss): | | | | | | | | | | | | |

Cinema exhibition | | $ | (1,270) | | $ | 4,474 | | $ | (5,435) | | $ | (141) |

Real estate | | | 946 | | | 1,286 | | | 1,837 | | | 2,291 |

| | $ | (324) | | $ | 5,760 | | $ | (3,598) | | $ | 2,150 |

A reconciliation of segment operating income to income before income taxes is as follows:

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Quarter Ended | | Six Months Ended |

| | June 30, | | June 30, |

(Dollars in thousands) | | 2024 | | 2023 | | 2024 | | 2023 |

Segment operating income (loss) | | $ | (324) | | $ | 5,760 | | $ | (3,598) | | $ | 2,150 |

Unallocated corporate expense | | | | | | | | | | | | |

Depreciation and amortization expense | | | (99) | | | (176) | | | (201) | | | (355) |

General and administrative expense | | | (3,929) | | | (3,794) | | | (8,083) | | | (7,889) |

Interest expense, net | | | (5,252) | | | (4,875) | | | (10,537) | | | (8,991) |

Equity earnings of unconsolidated joint ventures | | | 119 | | | 207 | | | 94 | | | 226 |

Gain (loss) on sale of assets | | | 9 | | | — | | | (1,116) | | | — |

Other income (expense) | | | (216) | | | (86) | | | 123 | | | 91 |

Income (loss) before income tax expense | | $ | (9,692) | | $ | (2,964) | | $ | (23,318) | | $ | (14,768) |

Note 2 – Summary of Significant Accounting Policies

Basis of Consolidation

The accompanying consolidated financial statements include the accounts of our Company’s wholly-owned subsidiaries as well as majority-owned subsidiaries that our Company controls and should be read in conjunction with our Company’s Annual Report on Form 10-K as of and for the year ended December 31, 2023 (“2023 Form 10-K”). All significant intercompany balances and transactions have been eliminated on consolidation. These consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim reporting with the instructions for Form 10-Q and Rule 10-01 of Regulation S-X of the Securities and Exchange Commission (“SEC”). As such, they do not include all information and footnotes required by U.S. GAAP for complete financial statements. We believe that we have included all normal and recurring adjustments necessary for a fair presentation of the results for the interim period.

Operating results for the quarter and six months ended June 30, 2024, are not necessarily indicative of the results that may be expected for the year ending December 31, 2024.

Use of Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and footnotes thereto. Significant estimates include (i) projections we make regarding the recoverability and impairment of our assets (including goodwill and intangibles), (ii) valuations of our derivative instruments, (iii) recoverability of our deferred tax assets, (iv) estimation of breakage and redemption experience rates, which drive how we recognize breakage on our gift card and gift certificates, and revenue from our customer loyalty program, and (v) estimation of our Incremental Borrowing Rate (“IBR”) as relates to the valuation of our right-of-use assets and lease liabilities. Actual results may differ from those estimates.

Note 3 – Liquidity and Impairment Assessment

Going Concern

We continue to evaluate the going concern assertion required by ASC 205-40 Going Concern as it relates to our Company. The evaluation of the going concern assertion involves firstly considering whether it is probable that our Company has sufficient resources, as at the issue date of the financial statements, to meet its obligations as they fall due for twelve months following the issue date. Should it be probable that there are not sufficient resources, we must determine whether it is probable that our plans will mitigate the consequential going concern substantial doubt. Our evaluation is informed by current liquidity positions, debt obligations, our beliefs about the recovery of the global cinema industry, cash flow estimates, known capital and other expenditure requirements and commitments and our current business plan and strategies. Our Company’s business plan - two businesses (real estate and cinema) in three countries (Australia, New Zealand and the U.S.) - has served us well since the onset of COVID-19 and is key to management’s overall evaluation of ASC 205-40 Going Concern.

As of the end of the second quarter, 2024, we have $58.6 million of debt due in twelve months. We have cash of $9.2 million and negative working capital of $89.8 million, inclusive of land and property held for sale of $36.4 million (based on book as opposed to fair market value). In order to alleviate doubt that our Company will be able to generate sufficient cash flows for the coming twelve-months, these loans need to be refinanced and our revenues and net income need to increase through improved operations and asset monetization.

In April 2024, we exercised our first option to extend our Union Square financing facility, extending the maturity date of that loan ($47.1 million at June 30, 2024) to May 6, 2025. We also obtained an extension of our NAB facility ($66.8 million at June 30, 2024), extending the maturity date of that loan to July 31, 2026. This extension also included a bridge loan in the amount of $13.4 million, maturing on March 31, 2025, subject to prepayment obligations from the net sales proceeds of certain assets. We are in discussions with Santander to extend the maturity date of that loan ($8.0 million) and believe that we will be able to reach mutually acceptable terms with respect to our Cinemas 123 ($21.0 million, due third quarter of 2024) and our Westpac ($8.4 million, due first quarter of 2025) credit facilities.

We believe that the global cinema industry will continue to improve in the last half of 2024 and 2025. This belief underpins our forecasts and cash flow projections. Our forecasts rely upon, among other things, the market reception to current films such as Inside Out 2, Twisters, Deadpool and Wolverine, and Despicable Me 4, the current industry movie release schedule, which demonstrates an increased number of movies to be released from the major studios and other distributors and an improvement in the quality of the movie titles, and the public’s demonstrable desire to attend movies in a theatrical environment. These named factors are both out of Management’s control and are material, individually and in the aggregate, to the realization of Management’s forecasts and expectations. In the event that our forecasts and cash flow estimates, and our reasonable refinancing expectations, do not come to fruition to the extent needed to provide sufficient funding, we are willing and able to pursue additional asset monetizations. Since 2021, we have demonstrated our ability to complete such real estate asset monetizations.

In conclusion, as of the date of issuance of these financial statements, based on our evaluation of ASC 205-40 Going Concern and the current conditions and events, considered in the aggregate, and our various plans for enhancing liquidity and the extent to which those plans are progressing, we conclude that our plans are probable of being implemented and that they alleviate the substantial doubt about our Company’s ability to continue as a going concern.

Impairment Considerations

Our Company considers that the events and factors described above constitute impairment indicators under ASC 360 Property, Plant and Equipment. At December 31, 2023, our Company performed a quantitative recoverability test of the carrying values of all its asset groups. Our Company estimated the undiscounted future cash flows expected to result from the use of these asset groups and found that no impairment charge was necessary. The financial performance of our cinemas has been improving, despite the challenges described above, and particularly the ongoing impacts of the WGA and SAG strikes on the first six months of 2024. This improved performance at an asset group level, and the impact of this performance on our impairment modelling, resulted in no impairment charges being recognized for the first six months of 2024. Actual performance against our forecasts is dependent on several variables and conditions, many of which are subject to the uncertainties associated with among other things, the factors presented above, and as a result, actual results may materially differ from management’s estimates.

Our Company also considers that the events and factors described above continue to constitute impairment indicators under ASC 350 Intangibles – Goodwill and Other. Our Company performed a quantitative goodwill impairment test and determined that our goodwill was not impaired as of December 31, 2023. The test was performed at a reporting unit level by comparing each reporting unit’s carrying value, including goodwill, to its fair value. The fair value of each reporting unit was assessed using a discounted cash flow model based on the budgetary revisions performed by management in response to COVID-19 and the developing market conditions. Given the continuing improvements in trading conditions, taking into account the actual and expecting impacts of the WGA and SAG strikes, no impairment charges were recorded in the first six months of 2024. Actual performance against our forecasts is dependent on several variables and conditions, including among other things, the factors presented above, and as a result, actual results may materially differ from management’s estimates.

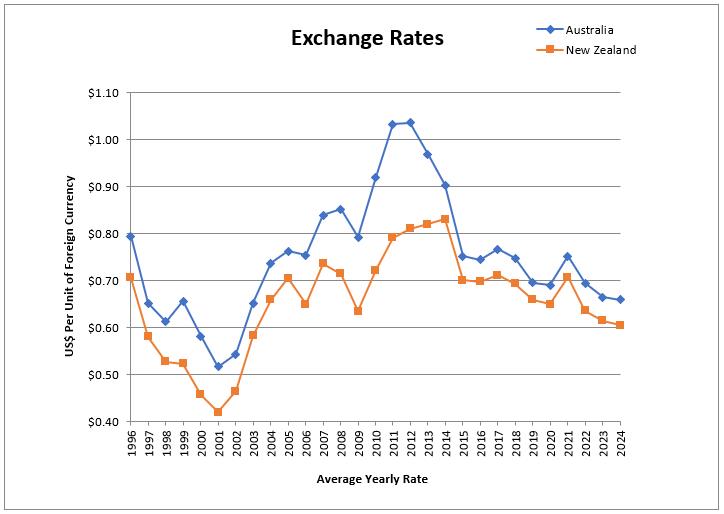

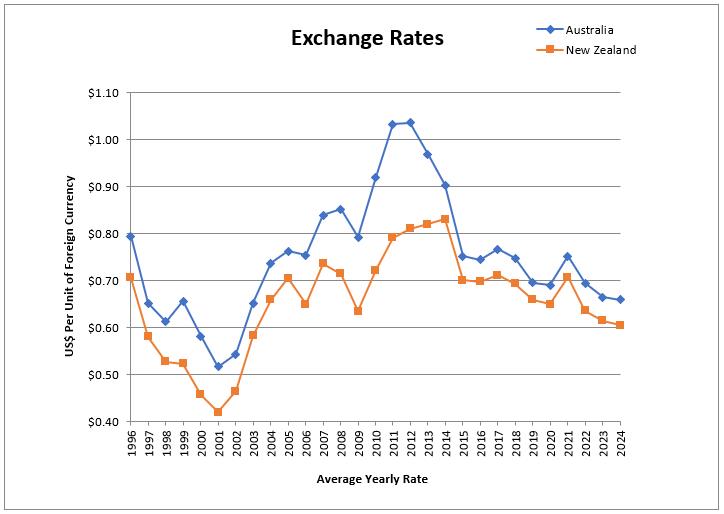

Note 4 – Operations in Foreign Currency

We have significant assets in Australia and New Zealand. Historically, we have conducted our Australian and New Zealand operations (collectively “foreign operations”) on a self-funding basis, where we use cash flows generated by our foreign operations to pay for the expenses of those foreign operations. However, in recent periods, cash flows from our overseas operations have been used to cover our domestic general and administrative costs, interest expense, and loss from our domestic cinema operations. Our Australian and New Zealand assets and liabilities are translated from their functional currencies of Australian dollar (“AU$”) and New Zealand dollar (“NZ$”), respectively, to the U.S. dollar based on the exchange rate as of June 30, 2024. The carrying value of the assets and liabilities of our foreign operations fluctuates as a result of changes in the exchange rates between the functional currencies of the foreign operations and the U.S. dollar. The translation adjustments are accumulated in the Accumulated Other Comprehensive Income in the Consolidated Balance Sheets.

We take a global view of our financial resources and are flexible in making use of resources from one jurisdiction in other jurisdictions.

Presented in the table below are the currency exchange rates for Australia and New Zealand:

| | | | | | | | | |

| | | | | | | | | |

| Foreign Currency / USD |

| As of and

for the

quarter

ended | | As of and

for the

six months ended | | As of and

for the

twelve months

ended | | As of and

for the

quarter

ended | | As of and

for the

six months ended |

| June 30, 2024 | | December 31, 2023 | | June 30, 2023 |

Spot Rate | | | | | | | | | |

Australian Dollar | 0.6677 | | 0.6828 | | 0.6663 |

New Zealand Dollar | 0.6096 | | 0.6340 | | 0.6133 |

Average Rate | | | | | | | | | |

Australian Dollar | 0.6591 | | 0.6582 | | 0.6647 | | 0.6681 | | 0.6761 |

New Zealand Dollar | 0.6054 | | 0.6089 | | 0.6145 | | 0.6186 | | 0.6243 |

Note 5 – Earnings Per Share

Basic earnings per share (“EPS”) is calculated by dividing the net income attributable to our Company by the weighted average number of common shares outstanding during the period. Diluted EPS is calculated by dividing the net income attributable to our Company by the weighted average number of common and common equivalent shares outstanding during the period and is calculated using the treasury stock method for equity-based compensation awards.

The following table sets forth the computation of basic and diluted EPS and a reconciliation of the weighted average number of common and common equivalent shares outstanding:

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Quarter Ended | | Six Months Ended |

| | June 30, | | June 30, |

(Dollars in thousands, except share data) | | 2024 | | 2023 | | 2024 | | 2023 |

Numerator: | | | | | | | | | | | | |

Net income (loss) attributable to Reading International, Inc. | | $ | (9,341) | | $ | (2,778) | | $ | (22,569) | | $ | (13,889) |

Denominator: | | | | | | | | | | | | |

Weighted average number of common stock – basic | | | 22,413,617 | | | 22,262,214 | | | 22,379,881 | | | 22,183,618 |

Weighted average dilutive impact of awards | | | 832,974 | | | 1,240,292 | | | 915,006 | | | 1,240,292 |

Weighted average number of common stock – diluted | | | 23,246,591 | | | 23,502,506 | | | 23,294,887 | | | 23,423,910 |

Basic earnings (loss) per share | | $ | (0.42) | | $ | (0.12) | | $ | (1.01) | | $ | (0.63) |

Diluted earnings (loss) per share | | $ | (0.42) | | $ | (0.12) | | $ | (1.01) | | $ | (0.63) |

Awards excluded from diluted earnings (loss) per share | | | 207,657 | | | 205,122 | | | 207,657 | | | 205,122 |

Our weighted average number of common stock - basic increased, primarily as a result of the vesting of restricted stock units. We did not repurchase any shares of Class A Common Stock during the first six months of 2024 or 2023.

207,657 shares issuable under stock options and restricted stock units were excluded from the computation of diluted net income (loss) per share in periods when their effect was anti-dilutive; either because our Company incurred a net loss for the period, or the exercise price of the options was greater than the average market price of the common stock during the period, or the effect was anti-dilutive as a result of applying the treasury stock method.

Note 6 – Property and Equipment

Operating Property, net

Property associated with our operating activities as at June 30, 2024 and December 31, 2023, is summarized as follows:

| | | | | | |

| | | | | | |

| | June 30, | | December 31, |

(Dollars in thousands) | | 2024 | | 2023 |

Land | | $ | 47,745 | | $ | 61,095 |

Building and improvements | | | 169,838 | | | 205,821 |

Leasehold improvements | | | 50,508 | | | 53,984 |

Fixtures and equipment | | | 148,602 | | | 155,156 |

Construction-in-progress | | | 2,418 | | | 4,290 |

Total cost | | | 419,111 | | | 480,346 |

Less: accumulated depreciation | | | (193,638) | | | (217,929) |

Operating property, net | | $ | 225,473 | | $ | 262,417 |

Depreciation expense for operating property was $4.0 million and $8.1 million for the quarter and six months ended June 30, 2024, respectively, as compare to $4.7 million and $9.3 million for the quarter and six months ended June 30, 2023.

Investment and Development Property, net

Our investment and development property as of June 30, 2024 and December 31, 2023, is summarized below:

| | | | | | |

| | | | | | |

| | June 30, | | December 31, |

(Dollars in thousands) | | 2024 | | 2023 |

Land | | $ | — | | $ | 3,856 |

Construction-in-progress (including capitalized interest) | | | — | | | 4,933 |

Investment and development property | | $ | — | | $ | 8,789 |

Construction-in-Progress – Operating and Investment Properties

Construction-in-Progress balances are included in both our operating and development properties. The balances of our major projects along with the movements for the six months ended June 30, 2024, are shown below:

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

(Dollars in thousands) | | Balance,

December 31,

2023 | | Additions during the period | | Completed

during the

period | | Transferred to Held for Sale | | Foreign

currency

translation | | Balance,

June 30,

2024 |

Courtenay Central development | | | 6,412 | | | — | | | — | | | (6,089) | | | (323) | | | — |

Cinema developments and improvements | | | 1,658 | | | 172 | | | (132) | | | (60) | | | (7) | | | 1,631 |

Other real estate projects | | | 1,153 | | | 403 | | | (371) | | | (387) | | | (11) | | | 787 |

Total | | $ | 9,223 | | $ | 575 | | $ | (503) | | $ | (6,536) | | $ | (341) | | $ | 2,418 |

2024 Real Estate Monetizations

Between the fourth quarter of 2020 and the fourth quarter of 2023, we classified as assets held for sale disposal groups and thereafter monetized the following real estate assets: The Auburn/Redyard Entertainment Themed Center (“ETC”), Manukau (land), Coachella (land), the Royal George Theatre, our property in Maitland, New South Wales, our Invercargill, New Zealand cinema and associated ancillary land, and our office building in Culver City (sold in February 2024).

In the second quarter of 2023, we classified our 2483 Trenton Avenue, Williamsport, Pennsylvania, as held for sale. In the second quarter of 2024, we further classified as held for sale our Cannon Park ETC, our Courtenay Central ETC and associated land and improvements, and our Rotorua land and improvements.

A ‘disposal group’ represents assets to be disposed of in a single transaction. A disposal group may represent a single asset, or multiple assets. Discussed below are those real estate transactions affecting the presentation in our consolidated balance sheet as of June 30, 2024 and 2023, and the profitability determination in our consolidated statements of income for the six months ended June 30, 2024, and 2023.

Culver City, Los Angeles

In May 2023, we classified our Culver City administrative building, commonly known as 5995 Sepulveda Blvd., as held for sale. Our book value (as opposed to fair value) of the property was $10.8 million, being the lower of cost and fair value less costs to sell. No adjustments to the book value of the assets contained within this disposal group were required. The disposal group consisted of land, a building and various leasehold improvements. The sale was completed on February 23, 2024, at a gross sales price of $10.0 million. The proceeds were used to discharge the $8.3 million first mortgage on the property.

The loss on sale of this property is calculated as follows:

| | | |

| | March 31 |

(Dollars in thousands) | | 2024 |

Sales price | | $ | 10,000 |

Net book value | | | (10,800) |

Loss on sale, gross of direct costs | | | (800) |

Direct sale costs incurred | | | (325) |

Loss on sale, net of direct costs | | $ | (1,125) |

Disposal Groups Held for Sale

Cannon Park ETC

In May 2024, we classified our Cannon Park ETC in Townsville, Queensland, Australia, as held for sale at the lower of cost and fair value less costs to sell. The disposal group consists of our Cannon Park City Center and Cannon Park Discount Center properties, comprising approximately 9.4-acres. The current book value (as opposed to fair value) of the property is $18.8 million. No adjustments to the book value of the assets contained within this disposal group were required. We expect to complete the sale within 12 months.

Wellington, New Zealand

In June 2024, we classified our Courtenay Central ETC in Wellington, New Zealand, as held for sale at the lower of cost and fair value less costs to sell. The disposal group consists of our Courtenay Central cinema and retail property, along with our Tory and

Wakefield Street car parks. The current book value (as opposed to fair value) of the property is $15.8 million. No adjustments to the book value of the assets contained within this disposal group were required. We expect to complete the sale within 12 months.

Reading Cinema in Rotorua, New Zealand

In June 2024, we classified the land and improvements constituting our Rotorua cinema in Rotorua, New Zealand, as held for sale at the lower of cost and fair value less costs to sell. The disposal group consists of our land, cinema building and the associated improvements. The current book value (as opposed to fair value) of the property is $1.4 million. No adjustments to the book value of the assets contained within this disposal group were required. We expect to complete the sale within 12 months.

2483 Trenton Avenue, Williamsport, Pennsylvania

In June 2023, we classified our industrial property at 2483 Trenton Avenue, Williamsport, Pennsylvania, as held for sale at the lower of cost and fair value less costs to sell. The current book value (as opposed to fair value) of the property is $460,000. The property is part of our historic railroad operations, consisting of land and an 18,000 square foot industrial building, and certain rail bed improvements. No adjustments to the book value of the assets contained within this disposal group were required. We continue to hold this property as held for sale, and sales efforts continue as we work to resolve certain easement issues. The property continues to meet the ASC 360 held for sale criteria.

Note 7 – Leases

In all leases, whether we are the lessor or lessee, we define lease term as the non-cancellable term of the lease plus any renewals covered by renewal options that are reasonably certain of exercise based on our assessment of economic factors relevant to the lessee. The non-cancellable term of the lease commences on the date the lessor makes the underlying property in the lease available to the lessee, irrespective of when lease payments begin under the contract.

As Lessee

We have operating leases for certain cinemas, and finance leases for certain equipment assets. Our leases have remaining lease terms of 1 to 25 years, with certain leases having options to extend up to a further 20 years. Lease payments for our cinema operating leases consist of fixed base rent, and for certain leases, variable lease payments consisting of contracted percentages of revenue, changes in the relevant CPI, and/or other contracted financial metrics.

The components of lease expense were as follows:

| | | | | | | | | | | | |

| | Quarter Ended | | Six Months Ended |

| | June 30, | | June 30, |

(Dollars in thousands) | | 2024 | | 2023 | | 2024 | | 2023 |

Lease cost | | | | | | | | | | | | |

Finance lease cost: | | | | | | | | | | | | |

Amortization of right-of-use assets | | $ | 10 | | $ | 8 | | $ | 21 | | $ | 15 |

Interest on lease liabilities | | | 1 | | | — | | | 3 | | | 1 |

Operating lease cost | | | 7,732 | | | 8,226 | | | 15,606 | | | 16,408 |

Variable lease cost | | | 678 | | | 399 | | | 1,200 | | | 669 |

Total lease cost | | $ | 8,421 | | $ | 8,633 | | $ | 16,830 | | $ | 17,093 |

Supplemental cash flow information related to leases is as follows:

| | | | | | |

| | Six Months Ended |

| | June 30, |

(Dollars in thousands) | | 2024 | | 2023 |

Cash flows relating to lease cost | | | | | | |

Cash paid for amounts included in the measurement of lease liabilities: | | | | | | |

Operating cash flows for finance leases | | $ | 22 | | $ | 17 |

Operating cash flows for operating leases | | | 12,924 | | | 16,849 |

Right-of-use assets obtained in exchange for new operating lease liabilities | | | — | | | 1,633 |

Supplemental balance sheet information related to leases is as follows:

| | | | | | |

| | June 30, | | December 31, |

(Dollars in thousands) | | 2024 | | 2023 |

Operating leases | | | | | | |

Operating lease right-of-use assets | | $ | 168,546 | | $ | 181,542 |

Operating lease liabilities - current portion | | | 21,797 | | | 23,047 |

Operating lease liabilities - non-current portion | | | 168,246 | | | 180,898 |

Total operating lease liabilities | | $ | 190,043 | | $ | 203,945 |

Finance leases | | | | | | |

Property plant and equipment, gross | | | 228 | | | 232 |

Accumulated depreciation | | | (166) | | | (177) |

Property plant and equipment, net | | $ | 62 | | $ | 55 |

Other current liabilities | | | 41 | | | 40 |

Other long-term liabilities | | | 22 | | | 43 |

Total finance lease liabilities | | $ | 63 | | $ | 83 |

| | | | | | |

Other information | | | | | | |

Weighted-average remaining lease term - finance leases | | | 2 | | | 2 |

Weighted-average remaining lease term - operating leases | | | 11 | | | 11 |

Weighted-average discount rate - finance leases | | | 7.07% | | | 7.07% |

Weighted-average discount rate - operating leases | | | 4.63% | | | 4.62% |

The maturities of our leases were as follows:

| | | | | | |

(Dollars in thousands) | | Operating

leases | | Finance

leases |

2024 | | $ | 30,207 | | $ | 44 |

2025 | | | 29,007 | | | 22 |

2026 | | | 26,751 | | | — |

2027 | | | 23,446 | | | — |

2028 | | | 21,288 | | | — |

Thereafter | | | 112,162 | | | — |

Total lease payments | | $ | 242,861 | | $ | 66 |

Less imputed interest | | | (52,818) | | | (3) |

Total | | $ | 190,043 | | $ | 63 |

As Lessor

We have entered into various leases as a lessor for our owned real estate properties. These leases vary in length between 1 and 20 years, with certain leases containing options to extend at the behest of the applicable tenants. Lease components consist of fixed base rent, and for certain leases, variable lease payments consisting of contracted percentages of revenue, changes in the relevant CPI, and/or other contracted financial metrics. None of our leases grant any right to the tenant to purchase the underlying asset.

Lease income relating to operating lease payments was as follows:

| | | | | | | | | | | | |

| | Quarter Ended | | Six Months Ended |

| | June 30, | | June 30, |

(Dollars in thousands) | | 2024 | | 2023 | | 2024 | | 2023 |

Components of lease income | | | | | | | | | | | | |

Lease payments | | $ | 2,701 | | | 2,765 | | $ | 5,425 | | $ | 5,392 |

Variable lease payments | | | 279 | | | 176 | | | 423 | | | 393 |

Total lease income | | $ | 2,980 | | $ | 2,941 | | $ | 5,848 | | $ | 5,786 |

The book value of underlying assets under operating leases from owned assets was as follows:

| | | | | | | | | | | | |

| | | | | | | | June 30, | | December 31, |

(Dollars in thousands) | | | | | | | | 2024 | | 2023 |

Building and improvements | | | | | | | | | | | | |

Gross balance | | | | | | | | $ | 115,569 | | $ | 127,222 |

Accumulated depreciation | | | | | | | | | (20,961) | | | (23,270) |

Net Book Value | | | | | | | | $ | 94,608 | | $ | 103,952 |

The minimum contractual rent payments due on our leases were as follows:

| | | | | | | | | | | | |

(Dollars in thousands) | | | | | | | | | | | Operating

leases |

2024 | | | | | | | | | | | $ | 4,311 |

2025 | | | | | | | | | | | | 8,751 |

2026 | | | | | | | | | | | | 7,303 |

2027 | | | | | | | | | | | | 6,520 |

2028 | | | | | | | | | | | | 6,568 |

Thereafter | | | | | | | | | | | | 21,323 |

Total | | | | | | | | | | | $ | 54,776 |

Note 8 – Goodwill and Intangible Assets

The table below summarizes goodwill by business segment as of June 30, 2024, and December 31, 2023.

| | | | | | | | | |

| | | | | | | | | |

(Dollars in thousands) | | Cinema | | Real Estate | | Total |

Balance at December 31, 2023 | | $ | 20,311 | | $ | 5,224 | | $ | 25,535 |

Foreign currency translation adjustment | | | (512) | | | — | | | (512) |

Balance at June 30, 2024 | | $ | 19,799 | | $ | 5,224 | | $ | 25,023 |

Our Company is required to test goodwill and other intangible assets for impairment on an annual basis and, if current events or circumstances require them, on an interim basis. Our next annual evaluation of goodwill and other intangible assets is scheduled during the fourth quarter of 2024. To test the impairment of goodwill, our Company compares the fair value of each reporting unit to its carrying amount, including the goodwill, to determine if there is potential goodwill impairment. A reporting unit is generally one level below the operating segment. As of June 30, 2024, we were not aware that any events indicating potential impairment of goodwill had occurred outside of those described at Note 3 – Liquidity and Impairment Assessment.

The tables below summarize intangible assets other than goodwill, as of June 30, 2024, and December 31, 2023, respectively.

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | As of June 30, 2024 |

(Dollars in thousands) | | Beneficial

Leases | | Trade

Name | | Other

Intangible

Assets | | Total |

Gross carrying amount | | $ | 10,459 | | $ | 9,024 | | $ | 4,380 | | $ | 23,863 |

Less: Accumulated amortization | | | (10,285) | | | (8,032) | | | (3,647) | | | (21,964) |

Net intangible assets other than goodwill | | $ | 174 | | $ | 992 | | $ | 733 | | $ | 1,899 |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | As of December 31, 2023 |

(Dollars in thousands) | | Beneficial

Leases | | Trade

Name | | Other

Intangible

Assets | | Total |

Gross carrying amount | | $ | 11,283 | | $ | 9,024 | | $ | 4,400 | | $ | 24,707 |

Less: Accumulated amortization | | | (11,089) | | | (7,961) | | | (3,611) | | | (22,661) |

Less: Impairments | | | — | | | — | | | (8) | | | (8) |

Net intangible assets other than goodwill | | $ | 194 | | $ | 1,063 | | $ | 781 | | $ | 2,038 |

Beneficial leases obtained in business combinations where we are the landlord are amortized over the life of the relevant leases. Trade names are amortized based on the accelerated amortization method over their estimated useful life of 30 years, and other intangible assets are amortized over their estimated useful lives of up to 30 years (except for transferrable liquor licenses, which are indefinite-lived assets). The table below summarizes the amortization expense of intangible assets for the quarter and six months ended June 30, 2024

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Quarter Ended | | Six Months Ended |

| | June 30, | | June 30, |

(Dollars in thousands) | | 2024 | | 2023 | | 2024 | | 2023 |

Beneficial lease amortization | | $ | 21 | | $ | 21 | | $ | 43 | | $ | 43 |

Other amortization | | | 60 | | | 54 | | | 97 | | | 101 |

Total intangible assets amortization | | $ | 81 | | $ | 75 | | $ | 140 | | $ | 144 |

Note 9 – Investments in Unconsolidated Joint Ventures

Our investments in unconsolidated joint ventures are accounted for under the equity method of accounting.

The table below summarizes our active investment holdings in two (2) unconsolidated joint ventures as of June 30, 2024, and December 31, 2023:

| | | | | | | | |

| | | | | | | | |

| | | | June 30, | | December 31, |

(Dollars in thousands) | | Interest | | 2024 | | 2023 |

Rialto Cinemas | | 50.0% | | $ | 768 | | $ | 848 |

Mt. Gravatt | | 33.3% | | | 3,660 | | | 3,908 |

Total investments | | | | $ | 4,428 | | $ | 4,756 |

For the quarter and six months ended June 30, 2024 and 2023, the recognized share of equity earnings from our investments in unconsolidated joint ventures are as follows:

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Quarter Ended | | Six Months Ended |

| | June 30, | | June 30, |

(Dollars in thousands) | | 2024 | | 2023 | | 2024 | | 2023 |

Rialto Cinemas | | $ | (9) | | $ | 1 | | $ | (77) | | $ | (39) |

Mt. Gravatt | | | 128 | | | 206 | | | 171 | | | 265 |

Total equity earnings | | $ | 119 | | $ | 207 | | $ | 94 | | $ | 226 |

Note 10 – Prepaid and Other Assets

Prepaid and other assets are summarized as follows:

| | | | | | |

| | | | | | |

| | June 30, | | December 31, |

(Dollars in thousands) | | 2024 | | 2023 |

Prepaid and other current assets | | | | | | |

Prepaid expenses | | $ | 1,436 | | $ | 1,813 |

Prepaid taxes | | | 295 | | | 802 |

Income taxes receivable | | | 435 | | | — |

Deposits | | | 301 | | | 249 |

Investments in marketable securities | | | 18 | | | 17 |

Total prepaid and other current assets | | $ | 2,485 | | $ | 2,881 |

Other non-current assets | | | | | | |

Other non-cinema and non-rental real estate assets | | | 674 | | | 674 |

Investment in Reading International Trust I | | | 838 | | | 838 |

Straight-line rent asset | | | 7,202 | | | 7,445 |

Long-term deposits | | | 11 | | | 8 |

Total other non-current assets | | $ | 8,725 | | $ | 8,965 |

Note 11 – Income Taxes

The interim provision for income taxes is different from the amount determined by applying the U.S. federal statutory rate to consolidated income or loss before taxes. The differences are attributable to foreign tax rate differential, unrecognized tax benefits, and change in valuation allowance. Our effective tax rate was 1.6% and 3.9% for the six months ended June 30, 2024 and 2023, respectively.

The difference is primarily due to an increase in unrecognized tax benefits in 2024. The forecasted effective tax rate is updated each quarter as new information becomes available.

Note 12 – Borrowings

Our Company’s borrowings at June 30, 2024 and December 31, 2023, net of deferred financing costs and including the impact of interest rate derivatives on effective interest rates, are summarized below:

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | As of June 30, 2024 |

(Dollars in thousands) | | Maturity Date | | Contractual

Facility | | Balance,

Gross | | Balance,

Net(1) | | Stated

Interest Rate | | Effective

Interest

Rate |

Denominated in USD | | | | | | | | | | | | | | | |

Trust Preferred Securities (US) | | April 30, 2027 | | $ | 27,913 | | $ | 27,913 | | $ | 27,283 | | 9.59% | | 9.59% |

Bank of America Credit Facility (US) | | August 18, 2025 | | | 17,750 | | | 17,750 | | | 17,680 | | 11.50% | | 11.50% |

Cinemas 1, 2, 3 Term Loan (US) | | October 1, 2024 | | | 20,855 | | | 20,855 | | | 20,770 | | 8.83% | | 8.83% |

Minetta & Orpheum Theatres Loan (US) | | June 1, 2024 | | | 8,000 | | | 8,000 | | | 7,984 | | 7.00% | | 7.00% |

Union Square Financing (US) | | May 6, 2025 | | | 55,000 | | | 47,141 | | | 46,938 | | 12.54% | | 12.54% |

Purchase Money Promissory Note (US) | | September 18, 2024 | | | 198 | | | 198 | | | 198 | | 5.00% | | 5.00% |

Denominated in foreign currency ("FC") (2) | | | | | | | | | | | | | | | |

NAB Corporate Term Loan (AU) | | July 31, 2026 | | | 66,770 | | | 66,770 | | | 66,610 | | 6.09% | | 6.09% |

NAB Bridge Facility (AU) | | March 31, 2025 | | | 13,354 | | | 13,354 | | | 13,329 | | 6.12% | | 6.12% |

Westpac Bank Corporate (NZ) | | January 1, 2025 | | | 8,437 | | | 8,437 | | | 8,437 | | 8.20% | | 8.20% |

| | | | $ | 218,277 | | $ | 210,418 | | $ | 209,229 | | | | |

(1)Net of deferred financing costs amounting to $1.2 million.