UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2018 or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to ______

Commission File No. 1-8625

READING INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

NEVADA (State or other jurisdiction of incorporation or organization) 5995 Sepulveda Boulevard, Suite 300 Culver City, CA (Address of principal executive offices) |

95-3885184 (I.R.S. Employer Identification Number)

90230 (Zip Code) |

Registrant’s telephone number, including Area Code: (213) 235-2240

Securities Registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Name of each exchange on which registered |

|

Class A Nonvoting Common Stock, $0.01 par value |

NASDAQ |

|

Class B Voting Common Stock, $0.01 par value |

NASDAQ |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☑

Indicate by check mark whether registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for shorter period than the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrants knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K of any amendments to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ☐ Accelerated Filer ☑ Non-Accelerated Filer ☐ Smaller Reporting Company ☐ Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. As of June 29, 2018 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the registrant's voting and non-voting common equity held by non-affiliates based on the closing price on that date as reported by the Nasdaq Stock Market was $383,954,817. As of March 15, 2019, there were 21,240,044 shares of class A non-voting common stock, par value $0.01 per share and 1,680,590 shares of class B voting common stock, par value $0.01 per share, outstanding.

Documents Incorporated by Reference

Portion of the registrant’s definitive Proxy Statement for the 2019 annual meeting of the stockholders to be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year ended December 31, 2018 are incorporated by reference into Part III of this Annual Report on Form 10-K.

- 2 -

READING INTERNATIONAL, INC.

ANNUAL REPORT ON FORM 10-K

YEAR ENDED DECEMBER 31, 2018

INDEX

|

|

Page |

|

11 |

|

|

11 |

|

|

24 |

- 3 -

|

34 |

|

|

35 |

|

|

38 |

|

|

39 |

- 4 -

|

39 |

|

|

39 |

|

|

42 |

|

|

Item 7 – Management’s Discussions and Analysis of Financial Condition and Results of Operations |

44 |

- 5 -

- 6 -

- 7 -

|

Consolidated Statements of Stockholders’ Equity for the Three Years Ended December 31, 2018 |

88 |

|

Consolidated Statements of Cash Flows for the Three Years Ended December 31, 2018 |

89 |

|

90 |

|

|

127 |

- 8 -

|

Item 9 – Change in and Disagreements with Accountants on Accounting and Financial Disclosure |

128 |

|

128 |

|

|

129 |

|

|

130 |

- 9 -

|

130 |

|

|

138 |

- 10 -

|

The information in this Annual Report on Form 10-K for the year ended December 31, 2018 ("2018 Form 10-K" or “2018 Annual Report”) contains certain forward-looking statements, including statements related to trends in the Company's business. The Company's actual results may differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include those discussed in "Item 1 – Our Business," "Item 1A – Risk Factors," and "Item 7 – Management's Discussions and Analysis of Financial Condition and Results of Operations" as well as those discussed elsewhere in this 2018 Form 10-K. |

GENERAL

Reading International, Inc. (“RDI” and collectively with our consolidated subsidiaries and corporate predecessors, the “Company,” “Reading”, “we,” “us,” or “our”) was incorporated in 1999 incident to our reincorporation in the State of Nevada. Our class A non-voting common stock (“Class A Stock”) and class B voting common stock (“Class B Stock”) are listed for trading on the NASDAQ Capital Market (Nasdaq-CM) under the symbols RDI and RDIB, respectively. Our Corporate Headquarters is located in the Silicon Beach area of Los Angeles County, at 5995 Sepulveda Blvd, Suite 300, Culver City, California, United States 90230.

Our corporate website address is www.ReadingRDI.com. We provide, free of charge on our website, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Sections 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we have electronically filed such material with or furnished it to the Securities and Exchange Commission (www.sec.gov). The contents of our Company website are not incorporated into this report. Our corporate governance charters for our Audit and Conflicts Committee and Compensation and Stock Options Committee are available on our website.

BUSINESS DESCRIPTION

Synergistic Diversification and Branding

We are a diversified company focused on the development, ownership and operation of entertainment and real property assets in three jurisdictions: (i) United States (“U.S.”), (ii) Australia, and (iii) New Zealand. We group our businesses in two (2) operating segments:

|

· |

Theatrical Motion Picture Exhibition (“Cinema Exhibition”), through our 59 cinemas as of December 31, 2018, and, |

|

· |

Real Estate, including real estate development and the rental or licensing of retail, commercial and live theater assets comprising some 22,101,800 square feet of land and approximately 879,000 square feet of net rentable area. |

- 11 -

Set forth below is a brief description of the various brands under which we organize our business operations:

|

|

|

|

|

|

|

Business Segment / Unit |

Our Commercial Brands |

Country |

Description |

Website Link |

|

Cinema Exhibition / All Countries |

|

United States, Australia, New Zealand |

Our Reading Cinemas tradename is derived from our over 180 year history as the “Reading Railroad” featured on the Monopoly game board. Under this brand, we deliver beyond-the-home entertainment (principally mainstream movies and alternative content and attendant food and beverage) across our three operating jurisdictions. All our cinemas are equipped with the latest state-of-the-art digital equipment, and 19 Reading Cinemas feature at least one TITAN LUXE, TITAN XC or IMAX premium auditorium. |

Reading Cinemas US Reading Cinemas AU Reading Cinemas NZ |

|

|

||||

|

|

United States |

Since its opening in 1989, our New York City Angelika Film Center has and consistently continues to be one of the most popular and influential arthouse cinemas in the U.S., featuring principally independent and foreign films. To date, we have expanded our Angelika Film Center Group to include 5 other Angelikas: two in the Dallas area, two in the Washington DC area and one in San Diego, CA. We are actively looking for more locations. |

Angelika Film Center |

|

|

|

United States |

In 2017, our Consolidated Theatres celebrated 100 years of providing cinematic entertainment in the state of Hawaii. We are the oldest and largest circuit in Hawaii with 9 cinemas on the islands of Oahu and Maui, including our new state-of-the-art 8-screen concept cinema: Olino by Consolidated Theatres in West Oahu.

|

Consolidated Theatres |

|

- 12 -

|

Business Segment / Unit |

Our Commercial Brands |

Country |

Description |

Description |

|

|

|

United States |

Our City Cinemas circuit, which consists of five cinemas in the Manhattan area of New York City features an eclectic mix of programming, from mainstream blockbusters to independent films. |

City Cinemas |

|

Real Estate / Leasing |

|

United States |

Our 44 Union Square property – the historic Tammany Hall, located overlooking Union Square in New York City -- is currently in the final stages of a complete re-development. We are currently in exclusive lease negotiations for long term leases with respect to approximately 90% of the net rentable area of the building and, while no assurances can be given, it is currently anticipated that our base building will be ready for tenant improvement work before the end of the second quarter of this year. |

44 Union Square |

|

|

Australia |

Located on 203,287 square feet of land in suburban Brisbane, the center is currently comprised of approximately 146,905 square feet of net rentable area and is 98% leased. At the end of 2017, we completed a major expansion that added a new 8-screen Reading Cinemas with TITAN LUXE, an additional 10,150 square feet (943m2) of restaurant tenant space and 124 parking spaces. |

Newmarket Village |

|

|

|

Australia |

Anchored by a 10-screen Reading Cinemas, Auburn/Redyard is an outdoor retail center located in a suburb of Sydney. The center is currently comprised of approximately 519,992 square feet of land and 75,492 square feet of net rentable area, serviced by a 727 space subterranean parking garage, and is 83% leased. In 2018, we added to the center approximately 20,870 square foot of land currently improved with a 16,830 square foot office building, rented to Telstra through July 2022, and over the past two years have added an additional 15,000 rentable square feet of fully leased restaurant and retail space. |

Auburn/Redyard |

|

|

|

Australia |

Anchored by a six-screen Reading Cinemas, Cannon Park is located in Townsville, Australia, and is currently comprised of 245,266 square feet of land and 104,744 square feet of net rentable area, which is currently 85% leased. We are working on plans to add approximately 13,100 square feet of net rentable area to the center. |

Cannon Park Townsville |

|

|

|

Australia |

Anchored by a 10-screen Reading Cinema and four F&B or retail tenancies, the Belmont Common is located in Perth, Australia, and is currently comprised of 103,204 square feet of land and 59,395 square feet of net rentable area, which is currently 96% leased.

|

The Belmont Common |

- 13 -

|

|

|

New Zealand |

Located in the heart of Wellington – New Zealand’s capital city – this center is comprised of 161,071 square feet of land situated proximate to the Te Papa Tongarewa Museum (attracting over 1.5 million visitors annually), across the street from the site of Wellington’s newly announced convention center (estimated to open its doors in 2022) and at a major public transit hub. Damage from the 2016 earthquake necessitated demolition of our nine-story parking garage at the site, and unrelated seismic issues have caused us to close portions of the existing cinema and retail structure while we reevaluate the center for redevelopment as an entertainment themed urban center with a major food and grocery component.

Wellington continues to be rated as one of the top cities in the world in which to live, and we continue to believe that the Courtenay Central site is located in one of the most vibrant and growing commercial and entertainment sections of Wellington.

|

Courtenay Central |

|

Real Estate / Live Theatre |

|

United States |

We continue to operate three (3) off-Broadway live theatres, one (1) in Chicago and two (2) in Manhattan, New York, under the Liberty Theatres tradename. In 2018, we entered into a license with Audible, a subsidiary of Amazon, pursuant to which our Minetta Lane Theatre serves as Audible’s live theatre home in New York City. |

Liberty Theatres |

We synergistically bring together cinema based entertainment and real estate and believe that these two business segments complement one another, as our cinemas have historically provided the steady cash flows that allow us to be opportunistic in acquiring and holding real estate assets (including non-income producing land) and support our real estate development activities. Our real estate allows us to develop an asset base that we believe will stand the test of time and one that is capable of providing financial leverage. More specifically, the combination of these two segments provides a variety of business advantages including the following:

|

· |

Cinema Anchor Tenancy. Cinemas can be used as anchors for larger retail developments (referred to as entertainment-themed centers, or “ETCs”), and our involvement in the cinema business can give us an advantage over other real estate developers or redevelopers who must identify and negotiate with third party anchor tenants. We have used cinemas to create our own anchors at our five (5) ETCs. |

|

· |

Reduced Pressure to Deliver Cinema Business Growth. Pure cinema operators can encounter financial difficulty as demands upon them to produce cinema-based earnings growth tempt them into reinvesting their cash flow into increasingly marginal cinema sites, overpaying for existing cinemas or entering into high-rent leases. While we believe that there will continue to be attractive opportunities to acquire cinema assets and/or to develop upper-end specialty type theaters in the future, we do not feel pressure to build or acquire cinemas for the sake of adding units or building gross cinema revenues. This strategy has, over the years, allowed us to acquire cinemas at multiples of trailing theater cash flow below those paid by third parties in recent acquisitions. We intend to focus our use of cash flow on our real estate development and operating activities, to the extent that attractive cinema opportunities are not available to us or that such funds are not needed for reinvestment to maintain our cinemas in a competitive position. In 2018, we invested approximately $24.0 million in the upgrading and repositioning of our historic cinema assets or adding new cinemas, and approximately $30.7 million in the acquisition or development of our non-cinema real estate assets. |

|

· |

Flexibility in Property Use. We are always open to the idea of converting an entertainment property to another use, if there is a higher and better use for the property, or to sell individual assets if an attractive opportunity presents itself. Our Union Square property, which is in the final stages of redevelopment was initially acquired as an entertainment property. |

Insofar as we are aware, we are the only publicly traded company in the world to apply this two-track, synergistic approach to the cinema and real estate development businesses on an international basis. None of the major cinema exhibition companies (other than Marcus Theatres) have any material landholdings as they operate predominantly on a leased-facility model.

Business Mix and Impact of Foreign Currency Fluctuations

We have worked to maintain a balance both between our cinema and real estate assets and between our U.S. and our Australian and New Zealand assets. In 2018, we invested approximately $40.6 million in our U.S. assets: $23.4 million for the development of our real estate assets (principally construction of our Union Square property) and $17.2 million for the improvements of our cinema assets (principally upgrading our offerings at our existing cinemas). We invested approximately $12.3 million in our Australian assets: $6.4 million for the development of our real estate assets (principally at our Auburn (Sydney) shopping centers), and $6.0 million for the development of our cinema assets (principally renovations of our cinemas at Auburn, Elizabeth, and Charlestown and the upgrade of certain other cinemas). We invested approximately $1.8 million in our New Zealand assets: $1.0 million for the development of

- 14 -

real estate assets (principally towards the redevelopment of our Courtenay Central assets), and approximately $817,000 for the development of cinema assets (principally upgrades).

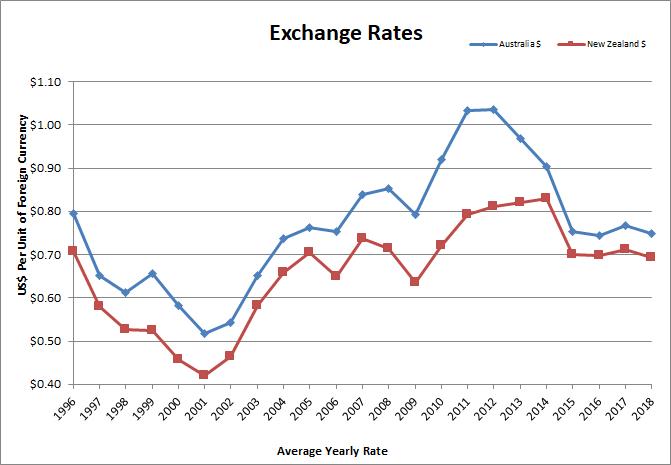

As shown in the chart set forth the International Business Risks section below, exchange rates for the currencies of these jurisdictions have varied, sometimes materially. These ratios naturally have an impact on our revenues and asset values, which are reported in USD. Notwithstanding these fluctuations, we continue to believe that, over the long term, operating in Australia and New Zealand is a prudent diversification of risk. Australia has been identified by the United Nations as among the Top 10 countries in the World in terms of natural resources per person. Deutsche Bank has twice named Wellington the best place in the world to live. In 2013, the Organization for Economic Co-operation and Development rated Australia as the best place to live and work in the world. In our view, the economies of Australian and New Zealand are stable economies and their lifestyles support our entertainment/lifestyle focus.

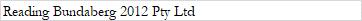

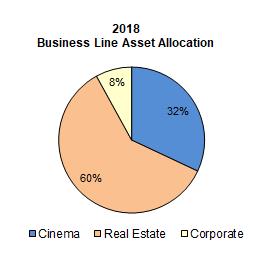

At December 31, 2018, the book value of our assets was $439.0 million, and, as of that same date, we had a consolidated stockholders’ book equity of $180.5 million. Calculated based on book value, $138.9 million, or 32% of our assets, relate to our cinema exhibition activities and $263.8 million, or 60%, of our assets, relate to our real estate activities.

For additional segment financial information, please see Note 1 – Description of Business and Segment Reporting to our 2018 consolidated financial statements.

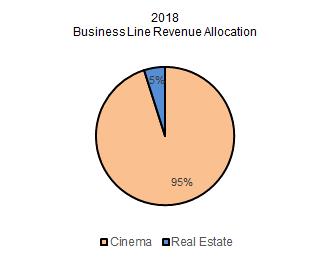

We have diversified our assets among three countries: the United States, Australia, and New Zealand. Based on book value, at December 31, 2018, we had approximately 50% of our assets in the United States, 36% in Australia and 14% in New Zealand compared to 45%, 40%, and 15% respectively, at the end of 2017. This increase in U.S. assets is principally due to our investments in the redevelopment of Union Square and the upgrades to our domestic cinema assets, as well as the continued strengthening of the U.S. dollar compared to the Australian and the New Zealand dollar.

At December 31, 2018, we had cash and cash equivalents of $13.1 million, which are treated as a corporate assets. Our cash included $7.6 million denominated in U.S. dollars, $3.5 million (AU $4.9 million) in Australian dollars, and $2.0 million (NZ$3.0 million) in New Zealand dollars. We had total worldwide non-current assets of $408.7 million, distributed as follows: $203.8 million in the United States, $147.4 million (AU$209.2 million) in Australia and $57.5 million (NZ$85.7 million) in New Zealand. We had $55.6 unused capacity of available and unrestricted corporate credit facilities at December 31, 2018.

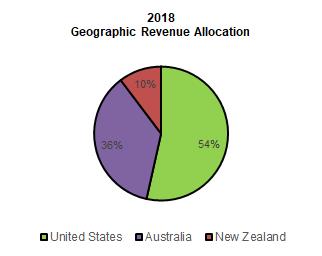

For 2018, our gross revenues in the United States, Australia, and New Zealand were $165.8 million, $111.7 million, and $31.9 million, respectively, compared to $143.8 million, $106.5 million, and $29.7 million for 2017. All three countries posted revenue increases in 2018 as a result of higher cinema attendance in all three of our circuits.

- 15 -

CINEMA EXHIBITION

Overall

We are dedicated to creating engaging cinema experiences for our guests through hospitality-styled comfort and service, cinematic presentation, uniquely designed venues, curated film and event programming, and crafted food and beverage options. As discussed previously, we manage our worldwide cinema exhibition business under various brands.

Shown in the following table are the number of locations and theatre screens in our theatre circuit in each country, by state/territory/ region and indicating our cinema brands and our interest in the underlying asset as of December 31, 2018:

|

|

||||||||||||

|

|

|

State / Territory / |

|

Location |

|

Screen |

|

Interest in Asset |

|

|

||

|

Country |

|

Region |

|

Count |

|

Count |

|

Leased |

|

Owned |

|

Operating Brands |

|

United States |

|

Hawaii |

|

9 |

|

98 |

|

9 |

|

|

|

Consolidated Theatres |

|

|

|

California |

|

7 |

|

88 |

|

7 |

|

|

|

Reading Cinemas, Angelika Film Center |

|

|

|

New York(3) |

|

6 |

|

23 |

|

5 |

|

1 |

|

Angelika Film Center, City Cinemas |

|

|

|

Texas |

|

2 |

|

13 |

|

2 |

|

|

|

Angelika Film Center |

|

|

|

New Jersey |

|

1 |

|

12 |

|

1 |

|

|

|

Reading Cinemas |

|

|

|

Virginia |

|

1 |

|

8 |

|

1 |

|

|

|

Angelika Film Center |

|

|

|

Washington DC |

|

1 |

|

3 |

|

1 |

|

|

|

Angelika Film Center |

|

|

|

U.S. Total |

|

27 |

|

245 |

|

26 |

|

1 |

|

|

|

Australia |

|

New South Wales |

|

6 |

|

44 |

|

4 |

|

2 |

|

Reading Cinemas |

|

|

|

Victoria |

|

6 |

|

43 |

|

6 |

|

|

|

Reading Cinemas |

|

|

|

Queensland |

|

5 |

|

48 |

|

2 |

|

3 |

|

Reading Cinemas, Event Cinemas(1) |

|

|

|

Western Australia |

|

2 |

|

16 |

|

1 |

|

1 |

|

Reading Cinemas |

|

|

|

South Australia |

|

2 |

|

15 |

|

2 |

|

|

|

Reading Cinemas |

|

|

|

Australia Total |

|

21 |

|

166 |

|

15 |

|

6 |

|

|

|

New Zealand |

|

Wellington |

|

2 |

|

15 |

|

1 |

|

1 |

|

Reading Cinemas |

|

|

|

Otago |

|

3 |

|

15 |

|

2 |

|

1 |

|

Reading Cinemas |

|

|

|

Auckland |

|

2 |

|

15 |

|

2 |

|

|

|

Reading Cinemas, Rialto Cinemas(2) |

|

|

|

Canterbury |

|

1 |

|

8 |

|

1 |

|

|

|

Reading Cinemas |

|

|

|

Southland |

|

1 |

|

5 |

|

|

|

1 |

|

Reading Cinemas |

|

|

|

Bay of Plenty |

|

1 |

|

5 |

|

|

|

1 |

|

Reading Cinemas |

|

|

|

Hawke's Bay |

|

1 |

|

4 |

|

|

|

1 |

|

Reading Cinemas |

|

|

|

New Zealand Total |

|

11 |

|

67 |

|

6 |

|

5 |

|

|

|

GRAND TOTAL |

|

|

|

59 |

|

478 |

|

47 |

|

12 |

|

|

|

(1) |

The Company has a 33.3% unincorporated joint venture interest in a 16-screen cinema located in Mt. Gravatt, Queensland managed by Event Cinemas. |

|

(2) |

The Company is a 50% joint venture partner in two (2) New Zealand Rialto cinemas. We are responsible for the booking of these cinemas and our joint venture partner, Event Cinemas, manages their day-to-day operations. |

|

(3) |

Our New York statistics include one (1) managed cinema. |

In January of 2019, we acquired our first cinema in Tasmania, a well-established 4 screen cinema (with liquor license) in Devonport, bringing our current cinema count up to 60. In addition, as of today, we have entered into four lease agreements, providing for the development of an additional 25 state-of-the-art screens. While no assurances can be given, the completion of these four new complexes is anticipated to increase our cinema count to 64 before the end of 2021.

We continue to focus on upgrading our existing cinemas and developing new cinema opportunities to provide our customers with premium offerings, including luxury seating, state-of-the-art presentation including sound, lounges, cafés and bar service, and other amenities. Since 2017 and continuing through 2018, we increased the number of auditoriums featuring recliner seating from 58 to 136. In addition, we added large format TITAN XC or LUXE screen offerings to 18 of our cinemas. Our circuit has been completely converted to digital projection and sound systems. In 2018, we upgraded two of our auditoriums to feature Dolby ATMOS sound which we consider to be the best in the industry at this time.

Attendance and gross box office was significantly higher for the exhibition industry in the U.S., Australia and New Zealand for 2018, compared to 2017. We believe that the cinema exhibition business will continue to generate increasing cash flows in the years ahead, even in recessionary or inflationary environments, because people will continue to spend a reasonable portion of their entertainment dollars on entertainment outside of the home. When compared to other forms of outside-the-home entertainment, movies continue to be a popular and competitively priced option. We believe that the advent of an array of streaming and mobile video services is a threat to traditional in-home forms of entertainment (such as traditional cable and satellite providers), the creation of new sources of program production will ultimately be beneficial to our industry, as cinema exhibition becomes an increasingly important point of differentiation for the marketing of such product.

Recognizing that the cinema exhibition business is considered a mature business, we continue to see growth opportunities in our cinema exhibition business principally from (i) the enhancement of our existing cinemas, (ii) the development in select markets of art and specialty cinemas, (iii) the development of new state-of-the-art cinemas on land that we already own or may in the future acquire, and (iv) the development of new mainstream cinemas in selected markets. While we continue to consider possible opportunities in

- 16 -

third party developments, we prefer, where possible, to put our capital to work in properties that we own rather than take on potentially burdensome lease obligations with their built-in rent increases and pass-throughs and their dependence on third party shopping center operators.

We continue to expand and upgrade our circuits on an opportunistic basis. Our philosophy is not one of growth at any cost and our goal is not to have more screens than anyone else. Rather, our goal is to have high quality, consistently grossing cinemas, and to grow on a steady and sustainable basis. During 2018, we continued working on the refurbishment of several of our cinema locations including Manville and Mililani in the U.S., and Charlestown, Elizabeth, and Auburn in the Australia and New Zealand circuits. At the end of 2017, we opened a new cinema at our Newmarket Village Shopping Center in Brisbane, Australia, and re-opened our Cal Oaks cinema, located in Murrieta, California which now features our new “Spotlight” level of service in 6 out of the 17 auditoriums. “Spotlight” puts focus directly on our customers by providing an in-auditorium, waitered, enhanced F&B experience for their enjoyment. We also upgraded 54 of our screens to luxury seating and extended our enhanced food offerings to 25 of our cinemas in 2017. In 2016, we opened an eight-screen, state-of-the-art cinema, branded Olino by Consolidated Theatres, our ninth theatre and first to break ground since 2001 in the state of Hawaii. In 2015, we opened a new state-of-the-art cinema (eight screens) in Auckland, New Zealand, completed the renovation and rebranding as an “Angelika” luxury art cinema of our conventional cinema at the Carmel Mountain Plaza in San Diego, California, completely renovated our fourteen-screen Harbourtown cinema in Queensland, Australia, and added the first IMAX screen to our circuit.

Since 2015, we have consistently executed our strategic priority of upgrading the food and beverage menu at a number of our U.S. cinemas. We are focused on the renovation and upgrading of our existing U.S. cinemas, along the lines of our Carmel Mountain cinema. Working with Bruce Seidel (veteran Food Network executive) of Hot Lemon Productions and chef Santos Loo, we are continuing to upgrade our food and beverage offerings. During 2017, we created our “Spotlight” service concept, which we implemented at our Cal Oaks cinema during 2018. At year-end 2018, we currently have beer and wine, and in some cases liquor, licenses for 14 of our venues in the U.S. and are in the application process for an additional 5 venues. As a result we are currently offering alcoholic beverages at 12 of our U.S. cinemas and two of our live theatres. In our international cinema operations, we offer alcoholic beverages for 11 of our cinemas in Australia and five of our cinemas in New Zealand (which includes the joint ventures).

Operating Information

At December 31, 2018, our principal tangible assets included:

|

· |

interests in 59 cinemas comprising some 478 screens; |

|

· |

fee interests in three live theaters (the Orpheum and Minetta Lane in Manhattan and the Royal George in Chicago); |

|

· |

fee interest in one cinema (the Cinemas 1,2,3), in New York City; |

|

· |

fee interests in two cinemas in Australia (Bundaberg and Maitland) and four cinemas in New Zealand (Dunedin, Invercargill, Napier and Rotorua); |

|

· |

fee interest in our Union Square property, previously used by us as a live theater venue and for rental to third parties and now in the final stages of redevelopment for retail and office uses; |

|

· |

our ETCs in Sydney (Redyard Center), Brisbane (Newmarket Village Center), Townsville (Cannon Park), Perth (Belmont) and Wellington (Courtenay Central), each of which includes a Reading Cinema; |

|

· |

fee interest in 70.4 acres of developable land located between Auckland and the airport, zoned for light industrial and heavy industrial purposes; |

|

· |

a 50% interest in a special purpose entity holding the fee interest in 202 acres of developable land located in Coachella, California zoned for residential and mixed use purposes; |

|

· |

fee interest in 2 office buildings, our corporate office in Culver City, Los Angeles as well as an office in Melbourne, Australia. Both buildings are mixed use assets, housing our corporate staff with any surplus space rented, or available to rent to third parties; |

|

· |

in addition to the fee interests described immediately above, fee ownership of approximately 20.7million square feet of developed and undeveloped real estate in the United States, Australia and New Zealand; and |

|

· |

cash and cash equivalents, aggregating $13.1 million. |

Although we operate cinemas in three jurisdictions, the general nature of our operations and operating strategies does not vary materially from jurisdiction-to-jurisdiction. In each jurisdiction, our gross receipts are primarily from box office receipts, food and beverage sales, and screen advertising. Our ancillary revenue is created principally from theater rentals (for example, for film festivals and special events), and ancillary programming (such as concerts and sporting events).

Our cinemas generated approximately 64% of their 2018 revenue from box office receipts. Ticket prices vary by location, and in selected locations we offer reduced rates for senior citizens, children and, in certain markets, military and students.

- 17 -

Show times and features are placed in advertisements on our various websites, on internet sites and, in some markets, in local newspapers. We are increasing our presence in social media, thereby, reducing our dependency on print advertising. Film distributors may also advertise certain feature films in various print, radio and television media, as well as on the internet, and distributors generally pay those costs.

F&B sales accounted for approximately 29% of our total 2018 cinema revenue. Although certain cinemas have licenses for the sale and on-premises consumption of alcoholic beverages, historically F&B products have been primarily popcorn, candy, and soda. This is changing, as more of our theaters are offering expanded food and beverage offerings. One of our strategic focuses is to upgrade our existing cinemas with expanded F&B offerings.

Screen advertising and other revenue contribute approximately 7% of our total 2018 cinema revenue. With the exception of certain rights that we have retained to sell to local advertisers, generally speaking, we are not in the screen advertising business and nationally recognized screen-advertising companies’ contract with us for the right to show such advertising on our screens.

Management of Cinemas

With the exception of our three unconsolidated cinemas, we manage our cinemas with executives located in Los Angeles and Manhattan in the U.S.; Melbourne, Australia; and Wellington, New Zealand. Our two New Zealand Rialto cinemas are owned by a joint venture in which Reading New Zealand is a 50% joint venture partner. While we assist in the booking of these two cinemas, our joint venture partner, Event Cinemas, manages their day-to-day operations. In addition, we have a passive one-third interest in a 16-screen Brisbane cinema managed by Event Cinemas.

Licensing and Pricing

Film product is available from a variety of sources, ranging from the major film distributors, such as Paramount Pictures, Twentieth Century Fox, Warner Bros, Buena Vista Pictures (Disney), Sony Pictures Releasing, Universal Pictures and Lionsgate, to a variety of smaller independent film distributors. In Australia and New Zealand, some of those major distributors distribute through local unaffiliated distributors. Worldwide, the major film distributors dominate the market for mainstream conventional films. In the U.S., art and specialty film is distributed through the art and specialty divisions of these major distributors, such as Fox Searchlight and Sony Pictures Classics, and through independent distributors such as A24. Film payment terms are generally based upon an agreed-upon percentage of box office receipts that will vary from film-to-film.

Competition

Film is allocated by the applicable distributor among competitive cinemas. Accordingly, from time-to-time, we may be unable to license every film that we desire to play. In the Australian and New Zealand markets, we generally have access to all film product in the market.

Competition for films may be intense, depending upon the number of cinemas in a particular competitive market. Our ability to obtain top grossing first run feature films may be adversely impacted by our comparatively small size, and the limited number of screens and markets that we can supply to distributors. Moreover, because of the dramatic consolidation of screens into the hands of a few very large and powerful exhibitors such as Cineworld (the new owners of Regal), AMC (including the newly acquired Carmike), Cinemark, and Galaxy Cinemas, who control 64% of the North American market, these mega-exhibition companies are in a position to offer distributors access to many more screens in major markets than we can. Also, the majors have a significant number of markets where they operate without material competition, meaning that the distributors have no alternative exhibitor for their films in these markets. Accordingly, distributors may decide to give preference to these mega-exhibitors when it comes to licensing top-grossing films, rather than deal with independents such as ourselves. The situation is different in Australia and New Zealand, where typically every major multiplex cinema has access to all of the film currently in distribution, regardless of the ownership of that multiplex cinema. However, on the reverse side, we have suffered somewhat in these markets from competition from boutique operators, who are able to book top grossing commercial films for limited runs, thus increasing competition for customers wishing to view such top grossing films.

The availability of state-of-the-art technology and/or luxury seating can also be a factor in the preference of one cinema over another. In recent periods, a number of cinemas have opened or re-opened featuring luxury seating and/or expanded food and beverage service, including the sale of alcoholic beverages and food served to the seat. We have, for a number of years, offered alcoholic beverages in certain of our Australia and New Zealand cinemas and at certain of our Angelika Film Centers in the U.S. We are currently working to upgrade the seating and food and beverage offerings (including the offering of alcoholic beverages) at a number of our existing cinemas. We now offer alcoholic beverages at 28 of our worldwide cinemas.

The film exhibition markets in the United States, Australia, and New Zealand are to a certain extent dominated by a limited number of major exhibition companies. The principal exhibitors in the United States are AMC (with 11,247 screens in 1,027 cinemas, which includes the information of newly acquired Carmike), Regal (with 7,315 screens in 561 cinemas), recently acquired by Cineworld

- 18 -

Group, the U.K.’s largest cinema operator, and Cinemark (with 4,561 screens in 339 cinemas). As of December 31, 2018, we were the 11th largest exhibitor with 1% of the box office in the United States with 245 screens in 27 cinemas under management.

The principal exhibitors in Australia are Greater Union, which does business under the Event Cinemas name (a subsidiary of Amalgamated Holdings Limited) (“Event”), Hoyts Cinemas (“Hoyts”), and Village Cinemas (“Village”). The major exhibitors control approximately 78% of the total cinema box office: Event 43%, Hoyts 22%, and Village 13%. Event has 566 screens nationally, Hoyts 354 screens, and Village 210 screens. By comparison, our 149 screens (excluding any partnership theaters) represent approximately 7% of the total box office.

The principal exhibitors in New Zealand are Event Cinemas with 116 screens nationally and Hoyts with 70 screens. Reading has 54 screens (excluding its interest in unconsolidated joint ventures). The major exhibitors in New Zealand control approximately 52% of the total box office: Event 31% and Hoyts 21%. Reading has 16% of the market (Event and Reading market share figures exclude any partnership theaters) and we were the third largest exhibitor in New Zealand.

In Australia and New Zealand, the industry is somewhat vertically integrated in that Roadshow Film Distributors, a subsidiary of Village, serves as a distributor of film in Australia and New Zealand for Warner Brothers.

Many of our competitors have substantial financial resources which could allow them to operate in a more competitive manner than us.

In-Home, Streaming and Mobile Device Competition

The “in-home,” streaming and mobile device entertainment industry has experienced significant leaps in recent periods in both the quality and affordability of in-home and mobile device entertainment systems and in the accessibility to, and quality of, entertainment programming through cable, satellite, internet distribution channels, and Blu-ray/DVD. The success of these alternative distribution channels and the entrance of new sources of product (like Netflix and Amazon) who are producing product competitive with films produced for theatrical release puts additional pressure on film distributors to reduce and/or eliminate the time period between theatrical and secondary release dates. With the acquisition of Fox, Disney is now poised to enter this market.

To a certain extent, it appears that consumers are willing to choose convenience over presentation quality. We are responding to this challenge generally by increasing the comfort and service levels available at our cinemas, by offering convenient on-line ticket reservations services with guaranteed seating, by investing in larger screens and enhanced audio, by offering more specialized and alternative product to our audiences and by providing value for the movie goer’s dollar. We are focusing on the fact that going to the movies is a social experience, and we are working to make that experience the best that it can be. Also, that we must differentiate ourselves from other forms of video entertainment by emphasizing the special nature of seeing video presentations in a cinema environment and by developing ways to position ourselves to take advantage in the increased output of film and feature product. These are issues common to both our U.S. and international cinema operations.

Competitive issues are discussed in detail under the caption, Item 1A – Risk Factors.

Seasonality

Major films are generally released to coincide with holidays. With the exception of Christmas and New Year’s Days, this fact provides some balancing of our revenue because there is no material overlap between holidays in the United States and those in Australia and New Zealand. Distributors will delay, in certain cases, releases in Australia and New Zealand to take advantage of Australian and New Zealand holidays that are not celebrated in the United States. However, the deferral of releases is becoming increasingly less common, given the need to address internet and other channels of distribution that operate on a worldwide basis.

REAL ESTATE

Overall

We engage in real estate development and the ownership and rental or licensing to third parties of retail, commercial and live theater assets. We own the fee interests in all of our live theaters, and in 12 of our cinemas (as presented in the preceding table within the “Cinema Exhibition” section). Our real estate business creates long-term value for our stockholders through the continuous improvement and development of our investment and operating properties, including our ETCs.

Our real estate activities have historically consisted principally of:

|

· |

the ownership of fee or long-term leasehold interests in properties used in our cinema exhibition activities or which were acquired for the development of cinemas or cinema-based real estate development projects; |

|

· |

the acquisition of fee interests in land for general real estate development; |

|

· |

the licensing to production companies of our live theaters; and |

- 19 -

|

· |

the redevelopment of our existing fee-owned cinema or live theater sites to their highest and best use. |

Over 2016 and 2017, we added 25,635 square feet of newly constructed net rentable space to our existing ETCs (calculated exclusive of cinema space), of which 24,924 square feet has been rented.

In light of the geographic reach of our business, and the highly localized nature of the real estate business, we have historically made use of third party contractors to provide on-site management of our real estate development and management activities. We have begun, however, in recent periods to selectively build our internal resources in this regard, concentrating on Australia and New Zealand where we have increased our overall real estate team from 3 to 7 full time employees over the last 3 years.

In 2016, we began the construction phase of the redevelopment of our Union Square property into approximately 73,322 square feet of net leasable area (inclusive of anticipated BOMA adjustments), comprised of retail and office space. While no assurances can be given, we currently anticipate that the building will be ready for the commencement of the construction of tenant improvements during the second quarter of 2019. We are currently negotiating, on an exclusive basis, leases representing approximately 90% of the net leasable area of the building. A short video on this project can be seen at www.44unionsquare.com.

Regarding our Cinemas 1,2,3 property in Manhattan, we have received the consent of the 25% minority member of the ownership entity for the redevelopment of the property. We are evaluating the potential to redevelop the property as a mixed use property. While we are still talking with the owner of the adjacent property about a possible joint venture development, we have not been able to come to an agreement as to the terms of that joint venture. Accordingly, we have shifted our strategic plan with respect to that property and have commenced the master-planning for a go-it-alone development. The Cinemas 1,2,3, is a cash flowing contributor to our domestic cinema operations. On August 31, 2016, we secured a new three-year mortgage loan ($20.0 million) with Valley National Bank, with a one year option to extend through August 31, 2020, the proceeds of which were used to repay the then existing mortgage on the property, and to repay certain inter-company indebtedness, and for working capital purposes.

On April 11, 2016, we purchased for $11.2 million a 24,000 square foot office building with 72 parking spaces located at 5995 Sepulveda Boulevard in Culver City, California. We currently use approximately 50% of the leasable area for our headquarters offices and endeavor to lease the remainder to unaffiliated third parties. Culver City has in recent years developed as a center of entertainment and high-tech activity in Los Angeles County. We moved into the building in February, 2017, and have obtained $8.4 million in financing on the property pursuant to a 10-year, fixed rate mortgage loan at an interest rate of 4.64% per annum and in June 2017 we obtained an additional $1.5 million in financing due to a reappraisal of the property, at an interest rate of 4.44%. Currently, we own essentially all of the office space from which we conduct our executive and administrative operations. All of our leasehold interests are cinema operating properties.

All of our leasehold interests are cinema operating properties.

Overseas, on December 23, 2015, we acquired two adjoining properties in Townsville, Queensland, Australia for a total of $24.1 million (AU$33.4 million) comprising approximately 5.6 acres. The total gross leasable area of the two properties, the Cannon Park City Centre and the Cannon Park Discount Centre, is 133,000 square feet. Our multiplex cinema at the Cannon Park City Centre is the anchor tenant of that center. This acquisition is consistent with our business plan to own, where practical, the land underlying our entertainment assets. We operate these two (2) properties as a single ETC. This acquisition was funded internally. For additional information, see Note 4 – Real Estate Transactions.

We continue to work on the expansion and upgrading of our Auburn/Redyard in Sydney, Australia and Newmarket Village in Brisbane, Australia and to master-plan the expansion and enhancement of our Cannon Park ETC in Townsville, Australia through the expansion or improvement of our Reading Cinemas at each of these centres and additional food and beverage focused space.

At Auburn/RedYard, since the beginning of 2016, we have constructed and entered into leases representing approximately 15,000 square feet of additional retail space, which increased the square footage of that center from approximately 117,000 to approximately 132,000 square feet. Of this 15,000 square feet, 9,600 square feet was completed in 2016, and the remaining 5,900 square feet was completed in Q4 2017. In 2018, we acquired a 20,870 square foot in-fill property, currently improved with a 16,830 square foot office building, leased to Telstra through July 2022. This increased our frontage on Parramatta Road to 1,620 of uninterrupted square feet. The center is now comprised of 519,992 square feet of land, 75,492 square feet of retail improvements, surface parking for 367 vehicles and subterranean parking for 727 vehicles and is 83% leased. The center also has approximately 10,586 square foot of additional land available for development. This expansion was funded internally.

At Newmarket Village, we added a state-of-the art eight-screen Reading Cinema, 10,150 square feet of additional retail space and 124 additional parking spaces. On November 30, 2015, we acquired an approximately 23,000 square foot parcel adjacent to our tenant Coles supermarket. This property is currently improved with an office building, which is now fully leased. These leases have early development provisions allowing us to terminate these arrangements in connection with a redevelopment of the property. We intend to ultimately demolish this office building and to integrate this parcel into Newmarket Village. This will increase our Newmarket

- 20 -

Village footprint from approximately 204,000 square feet to approximately 227,000 square feet. Our Newmarket Village project was funded internally and is currently approximately 98% leased.

Located in the heart of Wellington – New Zealand’s capital city – this center is comprised of 161,071 square feet of land situated proximate to the Te Papa Tongarewa Museum (attracting over 1.5 million visitors annually), across the street from the site of Wellington’s newly announced convention center (estimated to open its doors in 2022) and at a major public transit hub. Damage from the 2016 earthquake necessitated demolition of our nine-story parking garage at the site, and unrelated seismic issues have caused us to close portions of the existing cinema and retail structure while we reevaluate the center for redevelopment as an entertainment themed urban center with a major food and grocery component.

Wellington continues to be rated as one of the top cities in the world in which to live, and we continue to believe that the Courtenay Central site is located in one of the most vibrant and growing commercial and entertainment sections of Wellington.

In addition to certain historic railroad properties (such as our 6.8 acre Viaduct Property in downtown Philadelphia and certain adjacent commercial properties) and certain expansion space associated with our existing ETCs, we have two unimproved properties that we acquired for, and are currently being held for, development: (i) our 50% interest in a 202-acre parcel in Coachella, California (near the grounds where the Coachella Music Festival is held), currently zoned for residential and mixed-use uses, and (ii) our 70.4–acre parcel in Manukau, a suburb of Auckland, New Zealand (located adjacent to the Auckland Airport) currently zoned for a mixture of light and heavy industrial uses.

Our Coachella property was acquired as a long term land hold in a foreclosure auction by the Resolution Trust Corporation as the liquidator of the lender with the first mortgage on the property. The zoning has been established and the property freed of a burdensome development agreement. We are monitoring developments in the area, and believe that this property is likely a candidate for sale. Development activity in the vicinity appears to be strengthening.

In 2016, the Auckland City Council revised the zoning of the agricultural portion of our property in Manukau (approximately 64.0 acres) to light industrial uses. The remaining 6.4 acres of our Manukau property were already zoned for heavy industrial use. Light industrial uses include certain manufacturing, production, logistic, transportation, warehouse and wholesale distribution activities and, on an ancillary basis, certain office, retail and educational uses. Now that our zoning enhancement goal has been achieved, we are working with other major landowners in the area on the development of a master plan for the construction of needed infrastructure works, while we continue to develop our long range plans for the property.

While we report our real estate as a separate segment, it has historically operated as an integral portion of our overall business and, historically, has principally been in support of that business. We have, however, acquired or developed certain properties that do not currently have any cinema or other entertainment component.

Our real estate activities, holdings and developments are described in greater detail in Item 2 – Properties.

EMPLOYEES

As of December 31, 2018, we had 104 full-time executive and administrative employees, 113 live theatre employees, 8 Real Estate employees and 2,719 cinema employees. A small number of our cinema employees in New Zealand are union members, as are our projectionists in Hawaii. None of our Australian-based employees or other employees are subject to union contracts. Overall, we are of the view that the existence of these collective-bargaining agreements does not materially increase our costs of labor or our ability to compete.

FORWARD LOOKING STATEMENTS

Our statements in this annual report, including the documents incorporated herein by reference, contain a variety of forward-looking statements as defined by the Securities Litigation Reform Act of 1995. Forward-looking statements reflect only our expectations regarding future events and operating performance and necessarily speak only as of the date the information was prepared. No guarantees can be given that our expectation will in fact be realized, in whole or in part. You can recognize these statements by our use of words such as, by way of example, “may,” “will,” “expect,” “believe,” and “anticipate” or other similar terminology.

These forward-looking statements reflect our expectation after having considered a variety of risks and uncertainties. However, they are necessarily the product of internal discussion and do not necessarily completely reflect the views of individual members of our Board of Directors or of our management team. Individual Board members and individual members of our management team may have a different view as to the risks and uncertainties involved, and may have different views as to future events or our operating performance.

- 21 -

Among the factors that could cause actual results and our financial condition to differ materially from those expressed in or underlying our forward-looking statements are the following:

|

· |

with respect to our cinema operations: |

|

· |

the number and attractiveness to movie goers of the films released in future periods; |

|

· |

the amount of money spent by film distributors to promote their motion pictures; |

|

· |

the licensing fees and terms required by film distributors from motion picture exhibitors in order to exhibit their films; |

|

· |

the comparative attractiveness of motion pictures as a source of entertainment and willingness and/or ability of consumers (i) to spend their dollars on entertainment and (ii) to spend their entertainment dollars on movies in an outside-the-home environment; |

|

· |

the extent to which we encounter competition from other cinema exhibitors, from other sources of outside-the-home entertainment, and from inside-the-home entertainment options, such as “home theaters” and competitive film product distribution technology, such as, by way of example, cable, satellite broadcast and Blu-ray/DVD rentals and sales, and so called “movies on demand;” |

|

· |

the cost and impact of improvements to our cinemas, such as improved seating, enhanced food and beverage offerings and other improvements; |

|

· |

disruption from theater improvements; and |

|

· |

the extent to, and the efficiency with, which we are able to integrate acquisitions of cinema circuits with our existing operations. |

|

· |

with respect to our real estate development and operation activities: |

|

· |

the rental rates and capitalization rates applicable to the markets in which we operate and the quality of properties that we own; |

|

· |

the extent to which we can obtain on a timely basis the various land use approvals and entitlements needed to develop our properties; |

|

· |

the risks and uncertainties associated with real estate development; |

|

· |

the availability and cost of labor and materials; |

|

· |

the ability to obtain all permits to construct improvements; |

|

· |

the ability to finance improvements; |

|

· |

the disruptions from construction; |

|

· |

the possibility of construction delays, work stoppage and material shortage; |

|

· |

competition for development sites and tenants; |

|

· |

environmental remediation issues; |

|

· |

the extent to which our cinemas can continue to serve as an anchor tenant that will, in turn, be influenced by the same factors as will influence generally the results of our cinema operations; |

|

· |

the ability to negotiate and execute joint venture opportunities and relationships; and |

|

· |

certain of our activities are in geologically active areas, creating a risk of damage and/or disruption of real estate and/or cinema businesses from earthquakes and related seismic conditions. |

|

· |

with respect to our operations generally as an international company involved in both the development and operation of cinemas and the development and operation of real estate and previously engaged for many years in the railroad business in the United States: |

|

· |

our ability to renew, extend or renegotiate our loans that mature in 2019; |

|

· |

our ability to grow our Company and provide value to our stockholders; |

|

· |

our ongoing access to borrowed funds and capital and the interest that must be paid on that debt and the returns that must be paid on such capital; |

|

· |

expenses, management and Board distraction and other effects of the litigation efforts mounted by James Cotter, Jr. against the Company, including his efforts to cause a sale of voting control of the Company; |

|

· |

the relative values of the currency used in the countries in which we operate; |

|

· |

changes in government regulation, including by way of example, the costs resulting from the implementation of the requirements of Sarbanes-Oxley; |

|

· |

our labor relations and costs of labor (including future government requirements with respect to pension liabilities, disability insurance and health coverage, and vacations and leave); |

|

· |

our exposure from time-to-time to legal claims and to uninsurable risks, such as those related to our historic railroad operations, including potential environmental claims and health-related claims relating to alleged exposure to asbestos or other substances now or in the future recognized as being possible causes of cancer or other health related problems; |

|

· |

our exposure to cyber-security risks, including misappropriation of customer information or other breaches of information security; |

|

· |

changes in future effective tax rates and the results of currently ongoing and future potential audits by taxing authorities having jurisdiction over our various companies; and |

|

· |

changes in applicable accounting policies and practices. |

The above list is not necessarily exhaustive, as business is by definition unpredictable and risky, and it is subject to influence by numerous factors outside of our control, such as changes in government regulation or policy, competition, interest rates, supply,

- 22 -

technological innovation, changes in consumer taste, the weather, and the extent to which consumers in our markets have the economic wherewithal to spend money on beyond-the-home entertainment. Refer to Item 1A Risk factors for more information.

Given the variety and unpredictability of the factors that will ultimately influence our businesses and our results of operation, it naturally follows that no guarantees can be given that any of our forward-looking statements will ultimately prove to be correct. Actual results will undoubtedly vary and there is no guarantee as to how our securities will perform either when considered in isolation or when compared to other securities or investment opportunities.

Finally, we undertake no obligation to update publicly or to revise any of our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable law. Accordingly, you should always note the date to which our forward-looking statements speak.

Additionally, certain of the presentations included in this annual report may contain “non-US GAAP financial measures.” In such case, a reconciliation of this information to our US GAAP financial statements will be made available in connection with such statements.

- 23 -

Investing in our securities involves risk. Set forth below is a summary of various risk factors that you should consider in connection with your investment in our Company. This summary should be considered in the context of our overall Annual Report on Form 10-K, as many of the topics addressed below, and our plans to address or mitigate the risks involved, are discussed in significantly greater detail in the context of specific discussions of our business plan, our operating results, and the various competitive forces that we face.

BUSINESS RISK FACTORS

We are currently engaged principally in the cinema exhibition and real estate businesses. Because we operate in two business segments (cinema exhibition and real estate), we discuss separately below the risks we believe to be material to our involvement in each of these segments. We have discussed separately certain risks relating to the international nature of our business activities, our use of leverage, and our status as a controlled corporation. Please note that, while we report the results of our live theater operations as real estate operations – because we are principally in the business of renting space to producers rather than in producing plays ourselves – the cinema exhibition and live theater businesses share certain risk factors and are, accordingly, discussed together below.

Cinema Exhibition and Live Theater Business Risk Factors

We operate in a highly competitive environment with many competitors who are significantly larger and may have significantly better access to funds than we do. We are a comparatively small cinema operator and face competition from much larger cinema exhibitors. These larger exhibitors are able to offer distributors more screens in more markets – including markets where they may be the exclusive exhibitor – than can we. Faced with such competition, we may not be able to get access to all of the films we want, which may adversely affect our revenue and profitability. While we are concerned about the use of larger competitors of national and international booking power to limit our access to film, there is little we can do to mitigate this risk as antitrust litigation is very expensive and typically long lived. While several private lawsuits are currently pending challenging the practice of certain competitors to prevent or limit their access to film product, these are private lawsuits. We have no control over the prosecution of such lawsuits or the terms on which they may be privately resolved or settled. While several distributors have announced that they will generally provide access of film to all who desire it, this practice is not universal. Also, for major films, the terms of exhibition as a practical matter limited the competitors who could exhibit the film. This competitive disadvantage has been, in our view, exacerbated in recent periods with the further concentration of the cinema exhibition industry, for example, Cineworld Group Plc’s acquisition of Regal Entertainment Group and Dalian Wanda’s acquisition of AMC Entertainment, which has now acquired Carmike Cinemas, Odeon & UCI Cinemas Group and Nordic Cinema Group.

These larger competitors may also enjoy (i) greater cash flow, which can be used to develop additional cinemas, including cinemas that may be competitive with our existing cinemas, (ii) better access to equity capital and debt, (iii) better visibility to landlords and real estate developers, and (iv) better economies of scale than us.

In the case of our live theaters, we compete for shows not only with other “for profit” Off-Broadway theaters, but also with “not-for-profit” operators and, increasingly, with Broadway theaters. We believe our live theaters are generally competitive with other Off-Broadway venues. However, due to the increased cost of staging live theater productions, we are seeing an increasing tendency for plays that would historically have been staged in an Off-Broadway theater moving directly to larger Broadway venues. In 2016, we closed our principal live theater in New York, the Union Square incident to our redevelopment of that property.

We face competition from other sources of entertainment and other entertainment delivery systems. Both our cinema and live theater operations face competition from “in-home” and mobile device sources of entertainment. These include competition from network, cable and satellite television, internet streaming video services, Video on Demand, Blu-ray/DVD, the internet, video games and other sources of entertainment. The quality of “in-home” and mobile entertainment systems, as well as programming available on an in-home and mobile basis, has increased, while the cost to consumers of such systems (and such programming) has decreased in recent periods, and some consumers may prefer the security and/or convenience of an “in-home” or mobile entertainment experience to the more public and presentation oriented experience offered by our cinemas and live theaters. Film distributors have been responding to these developments by, in some cases, decreasing or eliminating the period of time between cinema release and the date such product is made available to “in-home” or mobile forms of distribution. The competitive pressure from streaming video may increase as a result of the acquisition of Fox by Disney.

In order to compete with these in-home and mobile forms of distribution, it is likely that we will make material capital improvements to our cinemas to increase the amenities and quality of presentation delivered. It may also be necessary to reduce admission prices.

There is the risk that, over time, distributors may move towards simultaneous release of motion picture product in multiple channels of distribution. Also, some traditional in-home and mobile distributors have begun the production of full-length movies, specifically for the purpose of direct or simultaneous release to the in-home and mobile markets. These factors may adversely affect the competitive advantage enjoyed by cinemas over “in-home” and mobile forms of entertainment, as it may be that the cinema market and the “in-home” and mobile markets will have simultaneous access to the same motion picture product. In recent times, a number of movies

- 24 -

were released on a simultaneous basis to movie exhibitors and to in-home and mobile markets. It is likely that this trend will continue, making it, in our view, increasingly important for exhibitors to enhance the convenience and quality of the theater-going experience. This can require substantial capital outlays and increased labor expense, which exhibitors may not be able to fully pass on to their customers. Also, the amount of programming (including without limitation, the live streaming of sporting, theatrical and political events) available on an “in-home” and mobile basis continues to increase.

The narrowing and/or elimination of this so-called “window” for cinema exhibition may be problematic for the cinema exhibition industry. However, to date, attempts by the major film distributors to continue to narrow or eliminate the window have been strenuously resisted by the cinema exhibition industry, and we view the total elimination of the cinema exhibition window by major film distributors, while theoretically possible, to be unlikely.

We also face competition from various other forms of “beyond-the-home” entertainment, including sporting events, concerts, restaurants, casinos, video game arcades, and nightclubs. Our cinemas also face competition from live theaters and vice versa. Also, social media offerings – such as Facebook, Instagram and Snapchat – appear to be commanding increasing portions of the recreational time of our potential audience.

Our cinema and live theater businesses may be vulnerable to fears of terrorism and random shooter incidents which could cause customers to avoid public assembly seating, and natural disasters. Political events, such as terrorist attacks, random shooter incidents and health-related epidemics, such as flu outbreaks, could cause patrons to avoid our cinemas or other public places where large crowds are in attendance. In addition, a natural disaster, such as a typhoon or an earthquake, could impact our ability to operate certain of our cinemas, which could adversely affect our results of operations.

Our cinema operations depend upon access to film and alternative entertainment product that is attractive to our patrons, and our live theater operations depend upon the continued attractiveness of our theaters to producers. Our ability to generate revenue and profits is largely dependent on factors outside of our control, specifically, the continued ability of motion picture, alternative entertainment and live theater producers to produce films, alternative entertainment and plays that are attractive to audiences, the amount of money spent by film and alternative entertainment distributors and theatrical producers to promote their motion pictures, alternative entertainment and plays, and the willingness of these distributors and producers to license their films and alternative entertainment on terms that are financially viable to our cinemas and to rent our theaters for the presentation of their plays. To the extent that popular movies, alternative entertainment and plays are produced, our cinema and live theater activities are ultimately dependent upon our ability, in the face of competition from other cinema and live theater operators to book such movies, alternative entertainment and plays into our facilities, and to provide a superior customer offering.

Distribution of film is in the discretion of the film distribution companies. Accordingly, we are at risk that the distributors may not give us all of the film we request.

Adverse economic conditions could materially affect our business by reducing discretionary income and by limiting or reducing sources of film and live theater funding. Cinema and live theater attendance is a luxury, not a necessity. Furthermore, consumer demand for better and better amenities and food offerings have resulted in an increase of the cost of a night at the movies. Accordingly, a decline in the economy resulting in a decrease in discretionary income, or a perception of such a decline, may result in decreased discretionary spending, which could adversely affect our cinema and live theater businesses. Adverse economic conditions can also affect the supply side of our business, as reduced liquidity can adversely affect the availability of funding for movies and plays. This is particularly true in the case of Off-Broadway plays, which are often times financed by high net worth individuals (or groups of such individuals) and that are very risky due to the absence of any ability to recoup investment in secondary markets like Blu-ray/DVD, cable, satellite or internet distribution.

Our screen advertising or auditorium leasing revenue may decline. Over the past several years, cinema exhibitors have been looking increasingly to screen advertising and auditorium leasing as a way to improve income. No assurances can be given that this source of income will be continuing, or that the use of screen advertising will not ultimately prove to be counterproductive, by giving consumers a disincentive to choose going to the movies over “in-home” or mobile entertainment alternatives.

We face uncertainty as to the timing and direction of technological innovations in the cinema exhibition business and as to our access to those technologies. We have converted all of our cinema auditoriums to digital projection. However, no assurances can be given that other technological advances will not require us to make further material investments in our cinemas or face loss of business. Also, equipment is currently being developed for holographic or laser projection. The future of these technologies in the cinema exhibition industry is uncertain.

We face competition from competitors offering food and beverage and luxury seating as an integral part of their cinema offerings. A number of our competitors offering an expanded food and beverage menu (including the sale of alcoholic beverages) and luxury seating, have emerged in recent periods. In addition, some competitors such as AMC are converting existing cinemas to provide such expanded menu offerings and in-theater dining options. The existence of such cinemas may alter traditional cinema selection practices of moviegoers, as they seek out cinemas with such expanded offerings as a preferred alternative to traditional cinemas. In order to

- 25 -

compete with these new cinemas, the Company has begun to materially increase its capital expenditures to add such features to many of our cinemas and to take on additional and more highly trained (and, consequently, compensated) staff. Also, the conversion to luxury seating typically requires a material reduction in the number of seats that an auditorium can accommodate which may translate into fewer movie tickets being sold.

Our failure to obtain and maintain liquor licenses at any of our cinemas could adversely affect our business, results of operations or financial condition. Each of our cinemas offering beer and wine, and in some cases liquor, is subject to licensing and regulation by the alcoholic beverage control agency in the state, county and municipality in which the cinema is located. Each cinema is required to obtain a license to sell alcoholic beverages on the premises from a state authority and, in certain locations, county and municipal authorities. Typically, licenses must be renewed annually and may be revoked or suspended for cause at any time. Alcoholic beverage control regulations relate to numerous aspects of the daily operations of each store, including minimum age of patrons and employees, hours of operation, advertising, wholesale purchasing, inventory control and handling and storage and dispensing of alcoholic beverages. The failure to receive or retain a liquor license, or any other required permit or license, in a particular location, or to continue to qualify for, or renew licenses, could have a material adverse effect on our profitability, our ability to attract patrons, and our ability to obtain such a liquor license in other locations.