SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 10-Q

(Mark One)

|

☑ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended: September 30, 2016

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

Commission file number 1-8625

READING INTERNATIONAL, INC.

(Exact name of Registrant as specified in its charter)

|

NEVADA (State or other jurisdiction of incorporation or organization) |

95-3885184 (IRS Employer Identification No.) |

|

6100 Center Drive, Suite 900 Los Angeles, CA (Address of principal executive offices) |

90045 (Zip Code) |

Registrant’s telephone number, including area code: (213) 235-2240

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer ☐ Accelerated filer ☑ Non-accelerated filer ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. As of November 8, 2016, there were 21,654,302 shares of Class A Nonvoting Common Stock, $0.01 par value per share and 1,680,590 shares of Class B Voting Common Stock, $0.01 par value per share outstanding.

1

READING INTERNATIONAL, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

|

|

Page |

|

3 |

|

|

3 |

|

|

3 |

|

|

4 |

|

|

Consolidated Statements of Comprehensive Income (Unaudited) |

5 |

|

6 |

|

|

7 |

|

|

Item 2 – Management’s Discussion and Analysis of Financial Condition and Results of Operations |

24 |

|

Item 3 – Quantitative and Qualitative Disclosure about Market Risk |

40 |

|

41 |

|

|

42 |

|

|

42 |

|

|

42 |

|

|

Item 2 - Unregistered Sales of Equity Securities and Use of Proceeds |

43 |

|

43 |

|

|

43 |

|

|

43 |

|

|

44 |

|

|

Certifications |

|

2

PART 1 – FINANCIAL INFORMATION

READING INTERNATIONAL, INC.

CONSOLIDATED BALANCE SHEETS

(U.S. dollars in thousands, except share information)

|

|

||||

|

|

||||

|

|

September 30, |

December 31, |

||

|

|

2016 |

2015(1) |

||

|

ASSETS |

(Unaudited) |

|||

|

Current Assets: |

||||

|

Cash and cash equivalents |

$ |

9,980 |

$ |

19,702 |

|

Receivables |

8,183 | 10,036 | ||

|

Inventory |

1,163 | 1,122 | ||

|

Investment in marketable securities |

55 | 51 | ||

|

Restricted cash |

1,043 | 160 | ||

|

Prepaid and other current assets |

6,224 | 5,429 | ||

|

Land held for sale – current |

-- |

421 | ||

|

Total current assets |

26,648 | 36,921 | ||

|

Operating property, net |

227,919 | 210,298 | ||

|

Land held for sale – non-current |

39,951 | 37,966 | ||

|

Investment and development property, net |

37,490 | 23,002 | ||

|

Investment in unconsolidated joint ventures and entities |

5,504 | 5,370 | ||

|

Investment in Reading International Trust I |

838 | 838 | ||

|

Goodwill |

20,434 | 19,715 | ||

|

Intangible assets, net |

10,187 | 9,889 | ||

|

Deferred tax asset, net |

28,726 | 25,649 | ||

|

Other assets |

3,759 | 3,615 | ||

|

Total assets |

$ |

401,456 |

$ |

373,263 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

||||

|

Current Liabilities: |

||||

|

Accounts payable and accrued liabilities |

$ |

21,312 |

$ |

23,638 |

|

Film rent payable |

6,342 | 9,291 | ||

|

Debt – current, net |

8,338 | 14,887 | ||

|

Taxes payable – current |

7,546 | 5,275 | ||

|

Deferred current revenue |

11,938 | 14,591 | ||

|

Other current liabilities |

8,078 | 7,640 | ||

|

Total current liabilities |

63,554 | 75,322 | ||

|

Debt – long-term, net |

106,776 | 87,101 | ||

|

Subordinated debt, net |

27,286 | 27,125 | ||

|

Noncurrent tax liabilities |

16,873 | 16,457 | ||

|

Other liabilities |

30,756 | 30,062 | ||

|

Total liabilities |

245,245 | 236,067 | ||

|

Commitments and contingencies (Note 13) |

||||

|

Stockholders’ equity: |

||||

|

Class A non-voting common stock, par value $0.01, 100,000,000 shares authorized, |

||||

|

32,831,113 issued and 21,654,302 outstanding at September 30, 2016 and December 31, 2015 |

229 | 229 | ||

|

Class B voting common stock, par value $0.01, 20,000,000 shares authorized and |

||||

|

1,680,590 issued and outstanding at September 30, 2016 and December 31, 2015 |

17 | 17 | ||

|

Nonvoting preferred stock, par value $0.01, 12,000 shares authorized and no issued |

||||

|

or outstanding shares at September 30, 2016 and December 31, 2015 |

-- |

-- |

||

|

Additional paid-in capital |

144,263 | 143,815 | ||

|

Accumulated deficit |

(425) | (9,478) | ||

|

Treasury shares |

(13,524) | (13,524) | ||

|

Accumulated other comprehensive income |

21,220 | 11,806 | ||

|

Total Reading International, Inc. stockholders’ equity |

151,780 | 132,865 | ||

|

Noncontrolling interests |

4,431 | 4,331 | ||

|

Total stockholders’ equity |

156,211 | 137,196 | ||

|

Total liabilities and stockholders’ equity |

$ |

401,456 |

$ |

373,263 |

See accompanying Notes to Unaudited Consolidated Financial Statements.

(1)Certain prior period amounts have been reclassified to conform to the current period presentation (see Note 1 – The Company and Basis of Presentation – Reclassifications)

3

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited; U.S. dollars in thousands, except per share data)

|

|

|||||||||

|

|

Quarter Ended |

Nine Months Ended |

|||||||

|

|

September 30, |

September 30, |

September 30, |

September 30, |

|||||

|

|

2016 |

2015 |

2016 |

2015 |

|||||

|

|

|||||||||

|

Operating revenue |

|||||||||

|

Cinema |

$ |

67,825 |

$ |

54,368 |

$ |

192,579 |

$ |

180,223 | |

|

Real estate |

3,490 | 3,420 | 10,443 | 10,951 | |||||

|

Total operating revenue |

71,315 | 57,788 | 203,022 | 191,174 | |||||

|

Operating expense |

|||||||||

|

Cinema |

(52,103) | (44,463) | (148,864) | (140,825) | |||||

|

Real estate |

(2,296) | (2,570) | (6,628) | (7,004) | |||||

|

Depreciation and amortization |

(4,131) | (3,501) | (11,766) | (10,769) | |||||

|

General and administrative |

(6,175) | (4,134) | (18,372) | (13,736) | |||||

|

Total operating expense |

(64,705) | (54,668) | (185,630) | (172,334) | |||||

|

Operating income |

6,610 | 3,120 | 17,392 | 18,840 | |||||

|

Interest income |

18 | 485 | 74 | 1,007 | |||||

|

Interest expense |

(1,571) | (2,379) | (5,264) | (7,077) | |||||

|

Net gain on sale of assets |

-- |

-- |

393 | 11,023 | |||||

|

Other expense |

(12) | (577) | (115) | (667) | |||||

|

Income before income tax expense and equity earnings of unconsolidated joint ventures and entities |

5,045 | 649 | 12,480 | 23,126 | |||||

|

Equity earnings of unconsolidated joint ventures and entities |

200 | 195 | 808 | 915 | |||||

|

Income before income taxes |

5,245 | 844 | 13,288 | 24,041 | |||||

|

Income tax expense |

(1,328) | (517) | (4,222) | (4,605) | |||||

|

Net income |

$ |

3,917 |

$ |

327 |

$ |

9,066 |

$ |

19,436 | |

|

Net (income) loss attributable to noncontrolling interests |

(62) | 54 | (12) | 60 | |||||

|

Net income attributable to Reading International, Inc. common stockholders |

$ |

3,855 |

$ |

381 |

$ |

9,054 |

$ |

19,496 | |

|

Basic earnings per share attributable to Reading International, Inc. stockholders |

$ |

0.17 |

$ |

0.02 |

$ |

0.39 |

$ |

0.84 | |

|

Diluted earnings per share attributable to Reading International, Inc. stockholders |

$ |

0.16 |

$ |

0.02 |

$ |

0.38 |

$ |

0.83 | |

|

Weighted average number of shares outstanding – basic |

23,334,892 | 23,287,449 | 23,334,892 | 23,283,405 | |||||

|

Weighted average number of shares outstanding – diluted |

23,532,796 | 23,482,262 | 23,532,796 | 23,478,218 | |||||

See accompanying Notes to Unaudited Consolidated Financial Statements.

4

READING INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited; U.S. dollars in thousands)

|

|

|||||||||||||

|

|

Quarter Ended |

Nine Months Ended |

|||||||||||

|

|

September 30, |

September 30, |

September 30, |

September 30, |

|||||||||

|

|

2016 |

2015 |

2016 |

2015 |

|||||||||

|

Net income |

$ |

3,917 |

$ |

327 |

$ |

9,066 |

$ |

19,436 | |||||

|

Foreign currency translation gain (loss) |

5,042 | (13,741) | 9,310 | (27,769) | |||||||||

|

Unrealized gain (loss) on available for sale investments |

2 | (4) | 2 | (3) | |||||||||

|

Amortization of actuarial loss |

52 | 51 | 116 | 155 | |||||||||

|

Comprehensive income (loss) |

9,013 | (13,367) | 18,494 | (8,181) | |||||||||

|

Net (income) loss attributable to noncontrolling interests |

(62) | 54 | (12) | 60 | |||||||||

|

Comprehensive income attributable to noncontrolling interests |

(8) | (37) | (14) | (59) | |||||||||

|

Comprehensive income (loss) attributable to Reading International, Inc. |

$ |

8,943 |

$ |

(13,350) |

$ |

18,468 |

$ |

(8,180) | |||||

See accompanying Notes to Unaudited Consolidated Financial Statements.

5

READING INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited; U.S. dollars in thousands)

|

|

|||||

|

|

Nine Months Ended |

||||

|

|

September 30, |

September 30, |

|||

|

|

2016 |

2015 |

|||

|

Cash flows from Operating Activities |

|||||

|

Net income |

$ |

9,066 |

$ |

19,436 | |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|||||

|

Equity earnings of unconsolidated joint ventures and entities |

(808) | (915) | |||

|

Distributions of earnings from unconsolidated joint ventures and entities |

779 | 901 | |||

|

Gain on sale of property |

(393) | (11,023) | |||

|

Change in net deferred tax assets |

(3,782) | 1,405 | |||

|

Depreciation and amortization |

11,766 | 10,769 | |||

|

Amortization of actuarial loss |

116 | 155 | |||

|

Amortization of beneficial leases |

898 | 344 | |||

|

Amortization of deferred financing costs |

653 | 706 | |||

|

Amortization of straight-line rent |

(258) | (370) | |||

|

Stock based compensation expense |

449 | 222 | |||

|

Net change in: |

|||||

|

Receivables |

2,092 | 2,492 | |||

|

Prepaid and other assets |

(738) | (85) | |||

|

Accounts payable and accrued expenses |

(2,783) | 2,905 | |||

|

Film rent payable |

(3,089) | (3,608) | |||

|

Taxes payable |

2,142 | (314) | |||

|

Deferred revenue and other liabilities |

(1,594) | (1,653) | |||

|

Net cash provided by operating activities |

14,516 | 21,367 | |||

|

Cash flows from Investing Activities |

|||||

|

Purchases of and additions to property and equipment |

(35,682) | (14,411) | |||

|

Change in restricted cash |

(848) | 1,256 | |||

|

Distributions of investment in unconsolidated joint ventures and entities |

190 |

-- |

|||

|

Proceeds from sale of property |

831 | 21,889 | |||

|

Net cash (used in)/provided by investing activities |

(35,509) | 8,734 | |||

|

Cash flows from Financing Activities |

|||||

|

Repayment of long-term borrowings |

(40,802) | (7,347) | |||

|

Proceeds from borrowings |

52,396 |

-- |

|||

|

Capitalized borrowing costs |

(785) | (191) | |||

|

Repurchase of Class A Nonvoting Common Stock |

-- |

(3,109) | |||

|

Proceeds from the exercise of stock options |

-- |

183 | |||

|

Noncontrolling interest contributions |

268 | 17 | |||

|

Noncontrolling interest distributions |

(194) | (139) | |||

|

Net cash provided by/(used in) financing activities |

10,883 | (10,586) | |||

|

Effect of exchange rate changes on cash and cash equivalents |

388 | (7,682) | |||

|

Net (decrease)/increase in cash and cash equivalents |

(9,722) | 11,833 | |||

|

Cash and cash equivalents at the beginning of the period |

19,702 | 50,248 | |||

|

Cash and cash equivalents at the end of the period |

$ |

9,980 |

$ |

62,081 | |

|

Supplemental Disclosures |

|||||

|

Interest paid |

$ |

3,053 |

$ |

6,582 | |

|

Income taxes paid |

5,288 | 6,665 | |||

See accompanying Notes to Unaudited Consolidated Financial Statements.

6

READING INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

Note 1 – The Company and Basis of Presentation

Reading International, Inc., a Nevada corporation (“RDI” and collectively with our consolidated subsidiaries and corporate predecessors, the “Company,” “Reading” and “we,” “us,” or “our”), was incorporated in 1999, and, following the consummation of a consolidation transaction on December 31, 2001, is now the owner of the consolidated businesses and assets of Reading Entertainment, Inc. (“RDGE”), Craig Corporation (“CRG”) and Citadel Holding Corporation (“CDL”). Our businesses consist primarily of:

|

· |

the development, ownership, and operation of multiplex cinemas in the United States, Australia, and New Zealand; and, |

|

· |

the development, ownership, and operation of retail and commercial real estate in Australia, New Zealand, and the United States. |

Use of Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and footnotes thereto. Significant estimates include projections we make regarding the recoverability of our assets, valuations of our interest rate swaps and the recoverability of our deferred tax assets. Actual results may differ from those estimates.

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of the Company’s wholly-owned subsidiaries as well as majority-owned subsidiaries that the Company controls, and should be read in conjunction with the Company’s Annual Report on Form 10-K as of and for the year-ended December 31, 2015. All significant intercompany balances and transactions have been eliminated in consolidation. These were prepared in accordance with the U.S. GAAP for interim reporting with the instructions for Form 10-Q and Rule 10-01 of Regulation S-X of the Securities and Exchange Commission (“SEC”). As such, they do not include all information and footnotes required by U.S. GAAP for complete financial statements. We believe that we have included all normal recurring adjustments necessary for a fair presentation of the results for the interim period. Operating results for the quarter and nine months ended September 30, 2016 are not necessarily indicative of the results that may be expected for the year ending December 31, 2016.

Reclassifications

Certain reclassifications have been made in the 2015 comparative information in the consolidated balance sheets and notes to conform to the 2016 presentation. These changes relate to the adoption of Accounting Standards Update (“ASU”) 2015-03 as discussed more fully below. These reclassifications had no significant impact on our 2015 financial position, results of operations and cash flows as previously reported.

Recently Adopted and Issued Accounting Pronouncements

Adopted:

On January 1, 2016, the Company adopted ASU 2015-03, Interest—Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs, issued by the Financial Accounting Standards Board (“FASB”). This new standard, which became effective for fiscal years beginning after December 15, 2015, required that debt issuance costs be presented in the balance sheet as a direct deduction from the carrying amount of debt liability, consistent with debt discounts or premiums. The impact of this adoption included reclassification of the deferred financing costs (net of amortization) from “Other Assets” to a reduction in the associated Debt account.

Also, on January 1, 2016, the Company adopted ASU 2015-16, Business Combinations (Topic 805): Simplifying the Accounting for Measurement-Period Adjustments. Under this new standard, an acquirer in a business combination transaction must recognize adjustments to provisional amounts that are identified during the measurement period in the reporting period in which the adjustment amounts are determined. The effect on earnings of changes in depreciation or amortization, or other income effects, if any, because of the change to the provisional amounts, calculated as if the accounting had been completed as of the acquisition date, must be recorded in the reporting period in which the adjustment amounts are determined rather than retrospectively. The ASU also requires that the acquirer present separately on the face of the income statement, or disclose in the notes, the portion of the amount recorded in current-period earnings by line item that would have been recorded in previous reporting periods if the adjustment to the provisional amounts had been recognized as of the acquisition date. The adoption of this standard had an impact on the finalization of the purchase price allocation of Cannon Park acquired in December 2015, which was completed during this current third quarter of 2016. Please refer to Note 5 – Property & Equipment for the Cannon Park acquisition discussion.

7

Issued:

In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments. The amendments covered in this ASU are improvements to current GAAP, as it will provide guidance to eight (8) specific cash flow classification issues, thereby reducing the current and potential future diversity in practice. The new standard becomes effective for the Company on January 1, 2018. Early adoption is permissible. The Company does not anticipate the adoption of ASU 2016-15 to have a material impact on the consolidated financial statements and related disclosures.

In March 2016, the FASB issued ASU 2016-09, Compensation—Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting. This new guidance provides simplifications involving several aspects of the accounting for share-based payment transactions, including the income tax consequences (such as excess tax benefits recorded in income tax expense/benefit, rather than additional paid-in capital), classification of awards as either equity or liabilities, and classification on the statement of cash flows. The new standard is effective for the Company on January 1, 2017. Early adoption is permitted. An entity that elects early adoption must adopt all of the amendments in the same period. The Company is currently assessing the impact of this new guidance on the consolidated financial statements and related disclosures.

In addition, in March 2016, the FASB issued ASU 2016-07, Investments—Equity Method and Joint Ventures (Topic 323): Simplifying the Transition to the Equity Method of Accounting. This new guidance effectively removes the retroactive application imposed in current guidance when an investment qualifies for use of the equity method as a result of an increase in the level of ownership interest or degree of influence. The amendments require that the equity method investor add the cost of acquiring the additional interest in the investee to the current basis of the investor’s previously held interest and adopt the equity method of accounting as of the date the investment becomes qualified for equity method accounting. The new standard becomes effective for the Company on January 1, 2017. Early adoption is permissible. The Company does not anticipate the adoption of ASU 2016-07 to have a material impact on the consolidated financial statements and related disclosures.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). This new guidance establishes a right-of-use ("ROU") model that requires a lessee to record a ROU asset and a lease liability on the balance sheet for all leases with terms longer than 12 months. The new standard becomes effective for the Company on January 1, 2019. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. The Company is currently assessing the impact of this new guidance on the consolidated financial statements and related disclosures.

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606), to achieve a consistent application of revenue recognition within the U.S., resulting in a single revenue model to be applied by reporting companies under U.S. GAAP. Under the new model, recognition of revenues occurs when a customer obtains control of promised goods or services in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. In addition, the new standard requires that reporting companies disclose the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers. Subsequently, in March 2016, FASB issued ASU 2016-08 to provide guidance on principal versus agent considerations. The new standard becomes effective for the Company on January 1, 2018. Early adoption is permitted but cannot be earlier than January 1, 2017. The new standard is required to be applied retrospectively to each prior reporting period presented or retrospectively with the cumulative effect of initially applying it recognized at the date of initial application. We have not yet selected a transition method nor have we determined the impact of the new standard on our consolidated condensed financial statements. While we believe the proposed guidance will not have a material impact on our business because our revenue predominantly comes from movie ticket sales and concession purchases, we plan to complete the analysis to ensure that we are in compliance prior to the effective date.

8

Note 2 – Business Segments

Reported below are the operating segments of the Company for which separate financial information is available and for which segment results are evaluated regularly by the Chief Executive Officer, the chief operating decision-maker of the Company. As part of our real estate activities, we have acquired, and continue to hold raw land in urban and suburban centers in Australia, New Zealand, and the United States.

The tables below summarize the results of operations for each of our business segments for the quarter and nine months ended September 30, 2016 and 2015, respectively. Operating expense includes costs associated with the day-to-day operations of the cinemas and the management of rental properties, including our live theater assets.

|

|

Quarter Ended |

Nine Months Ended |

||||||||||||

|

(Dollars in thousands) |

September 30, 2016 |

September 30, 2015 |

September 30, 2016 |

September 30, 2015 |

||||||||||

|

Revenue: |

||||||||||||||

|

Cinema exhibition |

$ |

67,825 |

$ |

54,368 |

$ |

192,579 |

$ |

180,223 | ||||||

|

Real estate |

5,390 | 4,968 | 15,961 | 15,908 | ||||||||||

|

Inter-segment elimination |

(1,900) | (1,548) | (5,518) | (4,957) | ||||||||||

|

|

$ |

71,315 |

$ |

57,788 |

$ |

203,022 |

$ |

191,174 | ||||||

|

Segment operating income: |

||||||||||||||

|

Cinema exhibition |

$ |

9,726 |

$ |

4,838 |

$ |

26,536 |

$ |

23,745 | ||||||

|

Real estate |

1,755 | 1,443 | 5,844 | 5,952 | ||||||||||

|

|

$ |

11,481 |

$ |

6,281 |

$ |

32,380 |

$ |

29,697 | ||||||

A reconciliation of segment operating income to income before income taxes is as follows:

|

|

Quarter Ended |

Nine Months Ended |

|||||||||||

|

(Dollars in thousands) |

September 30, 2016 |

September 30, 2015 |

September 30, 2016 |

September 30, 2015 |

|||||||||

|

Segment operating income |

$ |

11,481 |

$ |

6,281 |

$ |

32,380 |

$ |

29,697 | |||||

|

Unallocated corporate expense |

|||||||||||||

|

Depreciation and amortization expense |

(102) | (86) | (295) | (220) | |||||||||

|

General and administrative expense |

(4,769) | (3,075) | (14,693) | (10,637) | |||||||||

|

Interest expense, net |

(1,553) | (1,894) | (5,190) | (6,070) | |||||||||

|

Equity earnings of unconsolidated joint ventures and entities |

200 | 195 | 808 | 915 | |||||||||

|

Gain on sale of assets |

-- |

-- |

393 | 11,023 | |||||||||

|

Other expense |

(12) | (577) | (115) | (667) | |||||||||

|

Income before income tax expense |

$ |

5,245 |

$ |

844 |

$ |

13,288 |

$ |

24,041 | |||||

Note 3 – Operations in Foreign Currency

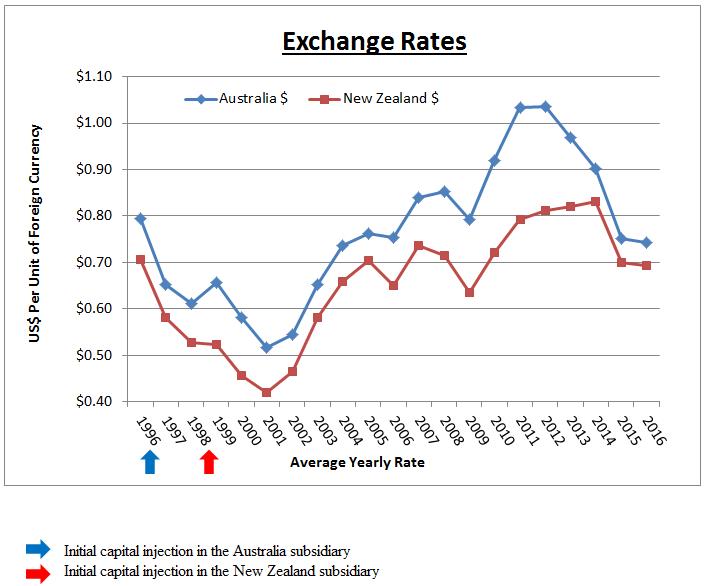

We have significant assets in Australia and New Zealand. To the extent possible, we conduct our Australian and New Zealand operations (collectively “foreign operations”) on a self-funding basis where we use cash flows generated by our foreign operations to pay for the expense of foreign operations. Our Australian and New Zealand assets and liabilities are translated from their functional currencies of Australian dollar (“AU$”) and New Zealand dollar (“NZ$”), respectively, to the U.S. dollar based on the exchange rate as of September 30, 2016. The carrying value of the assets and liabilities of our foreign operations fluctuates as a result of changes in the exchange rates between the functional currencies of the foreign operations and the U.S. dollar. The translation adjustments are accumulated in the Accumulated Other Comprehensive Income in the Consolidated Balance Sheets.

Because we intend to conduct business mostly on a self-funding basis (except for funds used to pay an appropriate share of our U.S. corporate overhead), we do not use derivative financial instruments to hedge against the risk of foreign currency exposure.

9

Presented in the table below are the currency exchange rates for Australia and New Zealand as of and for the period-ended September 30, 2016, December 31, 2015 and September 30, 2015:

|

|

Foreign Currency / USD |

||||||||

|

|

September 30, 2016 |

December 31, 2015 |

September 30, 2015 |

||||||

|

|

As of and for the quarter ended |

As of and for the nine months ended |

As of and for the twelve months ended |

As of and for the quarter ended |

As of and for the nine months ended |

||||

|

Spot Rate |

|||||||||

|

Australian Dollar |

0.7667 |

0.7286 |

0.7020 |

||||||

|

New Zealand Dollar |

0.7290 |

0.6842 |

0.6390 |

||||||

|

Average Rate |

|||||||||

|

Australian Dollar |

0.7583 |

0.7420 |

0.7524 |

0.7254 |

0.7633 |

||||

|

New Zealand Dollar |

0.7226 |

0.6926 |

0.7004 |

0.6513 |

0.7117 |

||||

Note 4 – Earnings Per Share

Basic earnings per share (“EPS”) is calculated by dividing the net income attributable to the Company’s common stockholders by the weighted average number of common shares outstanding during the period. Diluted EPS is calculated by dividing the net income attributable to the Company’s common stockholders by the weighted average number of common and common equivalent shares outstanding during the period and are calculated using the treasury stock method for equity-based compensation awards.

The following table sets forth the computation of basic and diluted EPS and a reconciliation of the weighted average number of common and common equivalent shares outstanding:

|

|

Quarter Ended |

Nine Months Ended |

||||||||||

|

(Dollars in thousands, except share data) |

September 30, |

September 30, |

September 30, |

September 30, |

||||||||

|

Numerator: |

||||||||||||

|

Net income attributable to RDI common stockholders |

$ |

3,855 |

$ |

381 |

$ |

9,054 |

$ |

19,496 | ||||

|

Denominator: |

||||||||||||

|

Weighted average number of common stock – basic |

23,334,892 | 23,287,449 | 23,334,892 | 23,283,405 | ||||||||

|

Weighted average dilutive impact of awards |

197,904 | 194,813 | 197,904 | 194,813 | ||||||||

|

Weighted average number of common stock – diluted |

23,532,796 | 23,482,262 | 23,532,796 | 23,478,218 | ||||||||

|

Basic EPS attributable to RDI common stockholders |

$ |

0.17 |

$ |

0.02 |

$ |

0.39 |

$ |

0.84 | ||||

|

Diluted EPS attributable to RDI common stockholders |

$ |

0.16 |

$ |

0.02 |

$ |

0.38 |

$ |

0.83 | ||||

|

|

||||||||||||

|

Awards excluded from diluted EPS |

108,000 | 100,000 | 108,000 | 100,000 | ||||||||

Note 5 – Property and Equipment

Operating Property, net

As of September 30, 2016 and December 31, 2015, property associated with our operating activities is summarized as follows:

|

|

September 30, |

December 31, |

||||

|

(Dollars in thousands) |

2016 |

2015 |

||||

|

Land |

$ |

76,700 |

$ |

70,063 | ||

|

Building and improvements |

132,446 | 126,622 | ||||

|

Leasehold improvements |

47,485 | 46,874 | ||||

|

Fixtures and equipment |

117,320 | 112,423 | ||||

|

Construction-in-progress |

20,014 | 7,825 | ||||

|

Total cost |

393,965 | 363,807 | ||||

|

Less: accumulated depreciation |

(166,046) | (153,509) | ||||

|

Operating property, net |

$ |

227,919 |

$ |

210,298 | ||

10

Depreciation expense for operating property was $4.0 million and $11.2 million for the quarter and nine months ended September 30, 2016, respectively, and $3.3 million and $10.1 million for the quarter and nine months ended September 30, 2015, respectively.

New Corporate Headquarters in Los Angeles

On April 11, 2016, we purchased a 24,000 square foot Class B office building with 72 parking spaces located at 5995 Sepulveda Boulevard in Culver City, California (a Los Angeles suburb) for $11.2 million. We intend to use approximately 50% of the leasable area for our headquarters offices and to lease the remainder to unaffiliated third parties. We anticipate, when the move is completed at the end of 2016 or early 2017 and the excess space is leased, that we will be able to reduce our headquarters occupancy cost by approximately $350,000 per annum.

Burwood, Australia

On May 12, 2014, we entered into a contract to sell our undeveloped 50.6 acre parcel in Burwood, Victoria, Australia, to Australand Holdings Limited (now known as Frasers Property Australia) for a purchase price of $50.8 million (AU$65.0 million). We received $5.9 million (AU$6.5 million) on May 23, 2014. The remaining purchase price of $44.9 million (AU$58.5 million) is due on December 31, 2017. Refer to Note 18 – Subsequent Events for further information.

Our book value in the property is $40.0 million (AU$52.1 million) and $38.0 (AU$52.1 million) as of September 30, 2016 and December 31, 2015, respectively (the difference being attributable solely to currency fluctuations). While the transaction was treated as a sale for tax purposes in 2014, it does not qualify as a sale under US GAAP until the receipt of the payment of the balance of the purchase price due on December 31, 2017 (or earlier depending upon whether any prepayment obligation is triggered). The asset is classified as long-term land held for sale on the consolidated balance sheets as of September 30, 2016 and December 31, 2015.

Doheny Condo, Los Angeles

On February 25, 2015, we sold our Los Angeles Condo for $3.0 million resulting in a $2.8 million gain on sale.

Taupo, New Zealand

On April 1, 2015, we entered into two definitive purchase and sale agreements to sell our properties at Taupo, New Zealand for a combined sales price of $2.4 million (NZ$3.4 million). The first agreement related to a property with a sales price of $1.6 million (NZ$2.2 million) and a book value of $1.3 million (NZ$1.8 million), which closed on April 30, 2015 when we received the sales price in full. The other agreement related to a property with a sales price of $831,000 (NZ$1.2 million) and a book value of $426,000 (NZ$615,000) which was completed and for which we received cash settlement representing the full sales price on March 31, 2016. The first transaction qualified as a sale under both U.S. GAAP and tax purposes during the year-ended December 31, 2015. The second transaction was recorded as a sale during the three months ended March 31, 2016.

Moonee Ponds, Australia

On October 15, 2013, we entered into a definitive purchase and sale agreement to sell this property for a sales price of $17.5 million (AU$23.0 million) payable in full upon closing of the transaction on April 16, 2015. In accordance with the requirements under U.S. GAAP, we recognized a gain on sale of $8.0 million (AU$10.3 million) in the prior-year second quarter upon the receipt of sale proceeds on April 16, 2015.

Cannon Park, Queensland, Australia

On December 23, 2015, we completed a 100% acquisition of two adjoining entertainment-themed centers (“ETCs”) in Townsville, Australia for a total of $24.1 million (AU$33.4 million) in cash. The properties are located approximately 6 miles from downtown Townsville, the second largest city in Queensland, Australia. The total gross leasable area of the two adjoining properties, the Cannon Park City Centre and the Cannon Park Discount Centre, is 133,000 square feet. The Cannon Park City Centre is anchored by Reading Cinemas, which is operated by Reading International’s 75% owned subsidiary, Australia Country Cinemas, and has three mini-major tenants and ten specialty family oriented restaurant tenants. The Cannon Park Discount Centre is anchored by Kingpin Bowling and supported by four other retailers. This acquisition is consistent with our business plan to own, where practical, the land underlying our entertainment assets.

The acquired assets consist primarily of the land and buildings, which, at the time of acquisition, was approximately 98% leased to existing tenants. Tenancies ranged from having 9 months to 8 years left to run on their leases at the time of purchase.

11

During the quarter ended September 30, 2016, the Company finalized the allocation of the purchase price to the identifiable assets acquired and liabilities assumed based on its estimates of their fair values on the acquisition date. The acquired value components of this real estate acquisition included both tangible and intangible assets. The determination of the fair values of the acquired assets and assumed liabilities (and the related determination of estimated lives of depreciable tangible and identifiable intangible assets) requires significant judgment. The estimates and assumptions include projected timing and amount of future cash flows and discount rates reflecting the risk inherent in the future cash flows. Typical of a real estate acquisition, there was no goodwill recorded as the purchase price did not exceed the fair value estimates of the net acquired assets.

The following table summarizes the final allocation of the purchase price to the estimated fair values of assets acquired and liabilities assumed at the date of acquisition, as well as adjustments made during the measurement period:

|

|

Measurement |

||||||||||||||

|

|

Preliminary Purchase Price |

Period |

Final Purchase Price |

||||||||||||

|

|

Allocation |

Adjustments(2) |

Allocation |

||||||||||||

|

(Dollars in thousands) |

US Dollars(1) |

AU dollars |

AU dollars |

US Dollars(1) |

AU dollars |

||||||||||

|

Tangible Assets |

|||||||||||||||

|

Operating property: |

|||||||||||||||

|

Land |

7,525 | 10,421 |

$ |

721 | 8,046 | 11,142 | |||||||||

|

Building and improvements |

16,588 | 22,971 | (6,453) | 11,928 | 16,518 | ||||||||||

|

Site improvements |

-- |

-- |

2,321 | 1,676 | 2,321 | ||||||||||

|

Tenant improvements |

-- |

-- |

957 | 691 | 957 | ||||||||||

|

Intangible Assets |

|||||||||||||||

|

Above-market leases |

-- |

-- |

61 | 44 | 61 | ||||||||||

|

In-place leases |

-- |

-- |

2,135 | 1,542 | 2,135 | ||||||||||

|

Unamortized leasing commissions |

-- |

-- |

333 | 240 | 333 | ||||||||||

|

Unamortized legal fees |

-- |

-- |

55 | 40 | 55 | ||||||||||

|

Total assets acquired |

24,113 | 33,392 | 130 | 24,207 | 33,522 | ||||||||||

|

Liabilities |

|||||||||||||||

|

Below-market leases |

-- |

-- |

(130) | (94) | (130) | ||||||||||

|

Net assets acquired |

$ |

24,113 |

$ |

33,392 |

$ |

-- |

$ |

24,113 | 33,392 | ||||||

(1) The balances were translated into U.S. Dollars based on the applicable exchange rate as of the date of acquisition, December 23, 2015.

(2) The measurement period adjustments were mainly due to the finalization of the valuations of the tangible land, building and improvements, site improvements and tenant improvements, as well as valuations of intangible assets and liabilities typically present in an acquisition of a regional mall with existing tenancies. This resulted in a reallocation of the purchase price from Building to other tangible assets (site and tenant improvements), as well as to intangible assets, including above and below market leases, in-place leases and unamortized lease origination costs.

Investment and Development Property

As of September 30, 2016 and December 31, 2015, our investment and development property is summarized below:

|

|

September 30, |

December 31, |

||||

|

(Dollars in thousands) |

2016 |

2015 |

||||

|

Land |

$ |

24,784 |

$ |

21,434 | ||

|

Building |

1,900 |

-- |

||||

|

Construction-in-progress |

10,806 | 1,568 | ||||

|

Investment and development property |

$ |

37,490 |

$ |

23,002 | ||

12

Note 6 – Investments in Unconsolidated Joint Ventures and Entities

Our investments in unconsolidated joint ventures and entities are accounted for under the equity method of accounting, except for Rialto Distribution, which is accounted for as a cost method investment. The table below summarizes our investments in unconsolidated joint ventures and entities as of September 30, 2016 and December 31, 2015:

|

|

September 30, |

December 31, |

||||||

|

(Dollars in thousands) |

Interest |

2016 |

2015 |

|||||

|

Rialto Distribution |

33.3% |

$ |

-- |

$ |

-- |

|||

|

Rialto Cinemas |

50.0% |

1,378 | 1,276 | |||||

|

Mt. Gravatt |

33.3% |

4,126 | 4,094 | |||||

|

Total investments |

$ |

5,504 |

$ |

5,370 | ||||

For the quarter and nine months ended September 30, 2016 and 2015, we recorded our share of equity earnings from our investments in unconsolidated joint ventures and entities as follows:

|

|

Quarter Ended |

Nine Months Ended |

||||||||||||

|

|

September 30, |

September 30, |

September 30, |

September 30, |

||||||||||

|

(Dollars in thousands) |

2016 |

2015 |

2016 |

2015 |

||||||||||

|

Rialto Distribution |

$ |

-- |

$ |

93 |

$ |

-- |

$ |

115 | ||||||

|

Rialto Cinemas |

47 | (100) | 208 | 35 | ||||||||||

|

Mt. Gravatt |

153 | 202 | 600 | 765 | ||||||||||

|

Total equity earnings |

$ |

200 |

$ |

195 |

$ |

808 |

$ |

915 | ||||||

Note 7 – Goodwill and Intangible Assets

The table below summarizes goodwill by business segment as of September 30, 2016 and December 31, 2015.

|

|

|||||||||

|

(Dollars in thousands) |

Cinema |

Real Estate |

Total |

||||||

|

Goodwill as of December 31, 2015 |

$ |

14,491 |

$ |

5,224 |

$ |

19,715 | |||

|

Foreign currency translation adjustment |

719 |

-- |

719 | ||||||

|

Goodwill at September 30, 2016 |

$ |

15,210 |

$ |

5,224 |

$ |

20,434 | |||

The Company is required to test goodwill and other intangible assets for impairment on an annual basis and, if current events or circumstances require, on an interim basis. Our next annual evaluation of goodwill and other intangible assets is scheduled for the fourth quarter of 2016. To test the impairment of goodwill, the Company compares the fair value of each reporting unit to its carrying amount, including the goodwill, to determine if there is potential goodwill impairment. A reporting unit is generally one level below the operating segment. As of September 30, 2016, we were not aware of any events that made us believe potential impairment of goodwill had occurred.

The tables below summarize intangible assets other than goodwill as of September 30, 2016 and December 31, 2015, respectively.

|

|

As of September 30, 2016 |

|||||||||||

|

(Dollars in thousands) |

Beneficial Leases |

Trade Name |

Other Intangible Assets |

Total |

||||||||

|

Gross intangible assets |

$ |

28,834 |

$ |

7,254 |

$ |

766 |

$ |

36,854 | ||||

|

Less: Accumulated amortization |

(21,651) | (4,551) | (465) | (26,667) | ||||||||

|

Net intangible assets |

$ |

7,183 |

$ |

2,703 |

$ |

301 |

$ |

10,187 | ||||

13

|

|

As of December 31, 2015 |

|||||||||||

|

(Dollars in thousands) |

Beneficial Leases |

Trade Name |

Other Intangible Assets |

Total |

||||||||

|

Gross intangible assets |

$ |

26,793 |

$ |

7,254 |

$ |

696 |

$ |

34,743 | ||||

|

Less: Accumulated amortization |

(20,108) | (4,300) | (446) | (24,854) | ||||||||

|

Net intangible assets |

$ |

6,685 |

$ |

2,954 |

$ |

250 |

$ |

9,889 | ||||

Beneficial leases are amortized over the life of the lease up to 30 years, trade names are amortized based on the accelerated amortization method over its estimated useful life of 45 years, and other intangible assets are amortized over their estimated useful lives of up to 30 years (except for transferrable liquor licenses, which are indefinite-lived assets). The table below summarizes the amortization expense of intangible assets for the quarter and nine months ended September 30, 2016 and September 30, 2015, respectively.

|

|

Quarter Ended |

Nine Months Ended |

||||||||||

|

|

September 30, |

September 30, |

September 30, |

September 30, |

||||||||

|

(Dollars in thousands) |

2016 |

2015 |

2016 |

2015 |

||||||||

|

Beneficial lease amortization |

$ |

578 |

$ |

191 |

$ |

968 |

$ |

574 | ||||

|

Other amortization |

296 | 207 | 845 | 649 | ||||||||

|

Total intangible assets amortization |

$ |

874 |

$ |

398 |

$ |

1,813 |

$ |

1,223 | ||||

Note 8 – Prepaid and Other Assets

Prepaid and other assets are summarized as follows:

|

|

||||||

|

|

September 30, |

December 31, |

||||

|

(Dollars in thousands) |

2016 |

2015 |

||||

|

Prepaid and other current assets |

||||||

|

Prepaid expenses |

$ |

1,792 |

$ |

879 | ||

|

Prepaid taxes |

3,107 | 3,160 | ||||

|

Prepaid rent |

946 | 1,021 | ||||

|

Deposits |

379 | 369 | ||||

|

Total prepaid and other current assets |

$ |

6,224 |

$ |

5,429 | ||

|

Other non-current assets |

||||||

|

Other non-cinema and non-rental real estate assets |

$ |

1,134 |

$ |

1,134 | ||

|

Long-term deposits |

40 | 63 | ||||

|

Straight-line rent |

2,585 | 2,417 | ||||

|

Other |

-- |

1 | ||||

|

Total other non-current assets |

$ |

3,759 |

$ |

3,615 | ||

Note 9 – Income Tax

The provision for income taxes is different from the amount determined by applying the U.S. federal statutory rate to consolidated income before taxes. The differences are attributable to earnings considered indefinitely reinvested in foreign operations, change in valuation allowance, state taxes, unrecognized tax benefits, and foreign withholding tax on interest. Our effective tax rate was 31.8% and 19.2% for the nine months ended September 30, 2016 and 2015, respectively. The rate difference was primarily caused by the Company's determination during the second quarter of 2015 that earnings of Australian subsidiaries are indefinitely invested in foreign operations.

14

Note 10 – Debt

The Company’s borrowings at September 30, 2016 and December 31, 2015, net of deferred financing costs and including the impact of interest rate swaps on effective interest rates, are summarized below:

|

|

As of September 30, 2016 |

|||||||||||||||

|

(Dollars in thousands) |

Maturity Date |

Contractual Facility |

Balance, Gross |

Balance, Net (3) |

Stated Interest Rate |

Effective Interest Rate (1) |

||||||||||

|

Denominated in USD |

||||||||||||||||

|

|

Trust Preferred Securities (USA) |

April 30, 2027 |

$ |

27,913 |

$ |

27,913 |

$ |

27,286 |

4.76% |

5.20% |

||||||

|

|

Bank of America Credit Facility (USA) |

November 28, 2019 |

55,000 | 38,950 | 38,699 |

3.27% |

3.90% |

|||||||||

|

|

Bank of America Line of Credit (USA) |

October 31, 2017 |

5,000 | 1,000 | 1,000 |

3.45% |

3.45% |

|||||||||

|

|

Cinema 1, 2, 3 Term Loan (USA)(4) |

September 1, 2019 |

20,000 | 20,000 | 19,401 |

3.25% |

3.25% |

|||||||||

|

|

Minetta & Orpheum Theatres Loan (USA)(4) |

June 1, 2018 |

7,500 | 7,500 | 7,380 |

3.31% |

3.31% |

|||||||||

|

|

Union Square Line of Credit (USA)(4) |

June 2, 2017 |

8,000 | 8,000 | 7,937 |

3.51% |

3.51% |

|||||||||

|

Denominated in foreign currency ("FC") (2) |

||||||||||||||||

|

|

National Australia Bank ("NAB") Corporate Term Loan (AU) |

June 28, 2019 |

50,986 | 30,285 | 30,126 |

2.62% |

2.62% |

|||||||||

|

|

Westpac Bank Corporate Credit Facility (NZ) |

March 31, 2018 |

36,450 | 10,571 | 10,571 |

3.95% |

3.95% |

|||||||||

|

|

$ |

210,849 |

$ |

144,219 |

$ |

142,400 | ||||||||||

(1) Effective interest rate includes the impact of interest rate derivatives hedging the interest rate risk associated with Trust Preferred Securities and Bank of America Credit Facility that were outstanding as of September 30, 2016.

(2) The contractual facilities and outstanding balances of the FC-denominated borrowings were translated into U.S. dollars based on the applicable exchange rates as of September 30, 2016.

(3) Net of deferred financing costs amounting to $1.8 million.

(4) The loan for our Minetta & Orpheum Theatres was obtained from Santander Bank. The Union Square line of credit was obtained through East West Bank. We are currently in the process of negotiating a construction loan for our Union Square property that will pay-off this loan with East West Bank. The term loan for our Cinema 1,2,3 Theatre, which was previously provided by Santander Bank, was refinanced during the third quarter of 2016 with Valley National Bank. Refer below for further discussion.

|

|

As of December 31, 2015 |

|||||||||||||||

|

(Dollars in thousands) |

Maturity Date |

Contractual Facility |

Balance, Gross |

Balance, Net (3) |

Stated Interest Rate |

Effective Interest Rate (1) |

||||||||||

|

Denominated in USD |

||||||||||||||||

|

|

Trust Preferred Securities (USA) |

April 30, 2027 |

$ |

27,913 |

$ |

27,913 | 27,125 |

4.32% |

5.20% |

|||||||

|

|

Bank of America Credit Facility (USA) |

November 28, 2019 |

55,000 | 29,750 | 29,321 |

2.92% |

3.65% |

|||||||||

|

|

Bank of America Line of Credit (USA) |

October 31, 2017 |

5,000 | 2,500 | 2,500 |

3.42% |

3.42% |

|||||||||

|

|

Cinema 1, 2, 3 Term Loan (USA)(4) |

July 1, 2016 |

15,000 | 15,000 | 14,887 |

3.75% |

3.75% |

|||||||||

|

|

Cinema 1, 2, 3 Line of Credit (USA)(4) |

July 1, 2016 |

6,000 |

-- |

-- |

3.75% |

3.75% |

|||||||||

|

|

Minetta & Orpheum Theatres Loan (USA)(4) |

June 1, 2018 |

7,500 | 7,500 | 7,326 |

3.00% |

3.00% |

|||||||||

|

|

Union Square Line of Credit (USA)(4) |

June 2, 2017 |

8,000 | 8,000 | 7,858 |

3.65% |

3.65% |

|||||||||

|

Denominated in FC (2) |

||||||||||||||||

|

|

NAB Corporate Term Loan (AU) |

June 30, 2019 |

48,452 | 26,594 | 26,412 |

3.06% |

3.06% |

|||||||||

|

|

Westpac Bank Corporate Credit Facility (NZ) |

March 31, 2018 |

34,210 | 13,684 | 13,684 |

4.45% |

4.45% |

|||||||||

|

|

$ |

207,075 |

$ |

130,941 |

$ |

129,113 | ||||||||||

(1) Effective interest rate includes the impact of interest rate derivatives hedging the interest rate risk associated with Trust Preferred Securities and Bank of America Credit Facility that were outstanding as of December 31, 2015.

(2) The contractual facilities and outstanding balances of the FC-denominated borrowings were translated into U.S. dollar based on the applicable exchange rates as of December 31, 2015.

(3) The balance as of December 31, 2015 included the reclassification adjustment relating to netting of deferred financing costs amounting to $1.8 million, as discussed in Note 1 – Recently Adopted and Issued Accounting Pronouncements.

(4) The loans for our Cinema 1,2,3 and Minetta & Orpheum Theatres were obtained from Bank of Santander. The Union Square line of credit was obtained through East West Bank.

Cinema 1,2,3 Term Loan

On August 31, 2016, Sutton Hill Properties LLC (“SHP”), a 75% subsidiary of Reading International Inc., refinanced its $15 million Santander Bank term loan with a different lender, Valley National Bank. This new $20 million loan is collateralized by our Cinema 1,2,3 property and bears an interest rate of 3.25% per annum, with principal installments and accruing interest paid monthly. The new loan matures on September 1, 2019, with a one-time option to extend maturity date for another year.

15

Prior to the above refinancing, on June 27, 2016, SHP obtained approval from Santander Bank to extend the maturity of our $15 million mortgage term loan from July 1, 2016 to October 1, 2016. This term extension was not considered substantial in accordance with US GAAP. This term loan was subsequently paid prior to its extended maturity date on August 31, 2016 as a result of the refinancing discussed in the previous paragraph. In conjunction with the extension, our line of credit with Santander Bank amounting to $6.0 million was deactivated effective July 1, 2016. The Company did not make any drawdown against this line of credit.

Bank of America Credit Facility

On March 3, 2016, we amended our $55.0 million credit facility with Bank of America to permit real property acquisition loans. This amendment was subject to the provision that the consolidated leverage ratio would be reduced by 0.25% from the established levels in the credit facility during the period of such borrowing subject further to a repayment of such borrowings on the earlier of the eighteen months from the date of such borrowing or the maturity date of the credit agreement. Such modification was not considered substantial in accordance with US GAAP.

Note 11 – Other Liabilities

Other liabilities are summarized as follows:

|

(Dollars in thousands) |

September 30, 2016 |

December 31, 2015 |

||||

|

Current liabilities |

||||||

|

Lease liability |

$ |

5,900 |

$ |

5,900 | ||

|

Security deposit payable |

126 | 180 | ||||

|

Accrued pension |

2,052 | 1,539 | ||||

|

Other |

-- |

21 | ||||

|

Other current liabilities |

$ |

8,078 |

$ |

7,640 | ||

|

Other liabilities |

||||||

|

Straight-line rent liability |

$ |

12,385 |

$ |

10,823 | ||

|

Accrued pension |

5,858 | 6,236 | ||||

|

Lease make-good provision |

5,224 | 5,228 | ||||

|

Deferred revenue - real estate |

4,662 | 4,596 | ||||

|

Environmental reserve |

1,656 | 1,656 | ||||

|

Interest rate swap |

200 | 156 | ||||

|

Acquired leases |

296 | 866 | ||||

|

Other |

475 | 501 | ||||

|

Other liabilities |

$ |

30,756 |

$ |

30,062 | ||

On August 29, 2014, the Supplemental Executive Retirement Plan (“SERP”) that was effective since March 1, 2007, was ended and replaced with a new pension annuity. As a result of the termination of the SERP program, the accrued pension liability of $7.6 million was reversed and replaced with a new pension annuity liability of $7.5 million. The valuation of the liability is based on the present value of $10.2 million discounted at a rate of 4.25% over a 15- year term, resulting in a monthly payment of $57,000 payable to the Cotter Estate or Cotter Trust (as defined herein). The discount rate of 4.25% has been applied since 2014 to determine the net periodic benefit cost and plan benefit obligation and is expected to be used in future years. The discounted value of $2.7 million (which is the difference between the estimated payout of $10.2 million and the present value of $7.5 million) as of August 29, 2014 will be amortized and expensed based on the 15-year term. In addition, the accumulated actuarial loss of $3.1 million recorded, as part of other comprehensive income will also be amortized based on the 15-year term.

As a result of the above, included in our current and non-current liabilities are accrued pension costs of $7.9 million at September 30, 2016. The benefits of our pension plans are fully vested and therefore no service costs were recognized for the quarter and nine months ended September 30, 2016 and 2015. Our pension plans are unfunded. During the quarter and nine months ended September 30, 2016, the interest cost was $45,000 and $135,000, respectively, and actuarial loss was $52,000 and $116,000, respectively. During the quarter and nine months ended September 30, 2015, the interest cost was $45,000 and $135,000, respectively, and actuarial loss was $51,000 and $155,000, respectively.

16

Note 12 – Accumulated Other Comprehensive Income

The following table summarizes the changes in each component of accumulated other comprehensive income attributable to RDI:

|

(Dollars in thousands) |

Foreign Currency Items |

Unrealized Gain (Losses) on Available-for-Sale Investments |

Accrued Pension Service Costs |

Total |

||||||||

|

Balance at January 1, 2016 |

$ |

14,642 |

$ |

12 |

$ |

(2,848) |

$ |

11,806 | ||||

|

Net current-period other comprehensive income |

9,296 | 2 | 116 | 9,414 | ||||||||

|

Balance at September 30, 2016 |

$ |

23,938 |

$ |

14 |

$ |

(2,732) |

$ |

21,220 | ||||

Note 13 – Commitments and Contingencies

Litigation

The STOMP Arbitration

In April 2016, we received a Final Award in our arbitration with The STOMP Company Limited Partnership (“Stomp”), the producer of the show STOMP, which has been playing at our Orpheum Theater in New York City for 20 years and still continues to play to this day. The Final Award awards us $2.3 million in attorney’s fees and costs. In September 2016, the parties agreed on the payment terms of the Final Award (“Payment Agreement”), on a basis that is intended to allow recovery by the Company of the entire Final Award (plus interest at 4%), while at the same time allowing the show to continue playing at our Orpheum Theater. Under the Payment Agreement, Stomp made an initial payment of $325,000 on September 28, 2016 and the remaining amount to be paid over time, with final payment due and payable in June 2019. We have filed a judgment of the arbitral award against Stomp with the New York Supreme Court to protect the Company in the event Stomp defaults on the Payment Agreement. STOMP continues to play at our Orpheum Theater under a license agreement that was amended by the Payment Agreement.

Derivative Litigation

In July 2016, all of the stockholder plaintiffs in the consolidated derivative cases other than James J. Cotter, Jr. (the “Independent Plaintiff Stockholders) entered into a settlement agreement with the Company and all of the Company’s directors (other than James J. Cotter Jr.) withdrew their claims. The settlement was approved by the District Court of the State of Nevada for Clark County and the judgment dismissing with prejudice the claims of the Independent Plaintiff Stockholders was entered on October 20, 2016. Under the judgment, each party is to bear its own legal fees. In the joint press release issued by the Company and the Independent Plaintiff Stockholders on July 13, 2016, representatives of the Independent Plaintiff Stockholders stated as follows: "We are pleased with the conclusions reached by our investigations as Plaintiff Stockholders and now firmly believe that the Reading Board of Directors has and will continue to protect stockholder interests and will continue to work to maximize shareholder value over the long term. We appreciate the Company's willingness to engage in open dialogue and are excited about the Company's prospects. Our questions about the termination of James Cotter, Jr., and various transactions between Reading and members of the Cotter family-or entities they control-have been definitively addressed and put to rest. We are impressed by measures the Reading Board has made over the past year to further strengthen corporate governance. We fully support the Reading Board and management team and their strategy to create stockholder value.”

On August 3, 2016 James J. Cotter Jr., filed a motion with the Court seeking permission to file a “Second Amended Verified Complaint” (the “SAP”), which motion has been approved.

The SAP adds as defendants Directors Judy Codding and Michael Wrotniak It adds additional purported claims including purported claims relating to the selection of Ellen Cotter to serve as our Company’s President and Chief Executive Officer, the retention of Margaret Cotter to serve as our Executive Vice President responsible for our live theater operations and the management and development of our New York properties, the ability of Ellen Cotter and Margaret Cotter to vote 100,000 share of our Class B stock, issued upon the exercise of certain stock options held of record by the Estate of James J. Cotter, Sr., and the handling by our Board of Directors of an indication of interest received at the end of May relating to the purchase of all of the stock of our Company.

Discovery is continuing. No trial date has been scheduled.

To date, except for a $500,000 deductible, the bulk of the out-of-pocket costs associated with the defense of the above described litigation has been covered by the Company’s Directors and Officers Insurance. However, the $10,000,000 limits of that policy have now been exhausted. Accordingly, the costs of such defense going forward will be a general administrative expense of the Company.

17

Debt Guarantee

The total estimated debt of unconsolidated joint ventures and entities, consisting solely of Rialto Distribution (see Note 6 – Investments in Unconsolidated Joint Ventures and Entities), was $1.1 million (NZ$1.5 million) as of September 30, 2016 and $1.0 million (NZ$1.5 million) as of December 31, 2015. Our share of the unconsolidated debt, based on our ownership percentage, was NZ$500,000 as of September 30, 2016 and December 31, 2015, respectively. This debt is guaranteed by one of our subsidiaries to the extent of our ownership percentage. Based on the financial position of Rialto Distribution and in consideration of this debt guarantee, we accrued $364,500 (NZ$500,000) and $342,000 (NZ$500,000) as of September 30, 2016 and December 31, 2015, recorded as part of Accounts payable and accrued liabilities.

Note 14 – Non-controlling Interests

These are composed of the following enterprises:

|

· |

Australia Country Cinemas Pty Ltd. -- 25% noncontrolling interest owned by Panorama Cinemas for the 21st Century Pty Ltd.; |

|

· |

Shadow View Land and Farming, LLC -- 50% noncontrolling membership interest owned by either the estate of Mr. James J. Cotter, Sr. (the “Cotter Estate”) or the James J. Cotter, Sr. Living Trust (the “Cotter Trust”); and, |

|

· |

Sutton Hill Properties, LLC -- 25% noncontrolling interest owned by Sutton Hill Capital, LLC (which in turn is 50% owned by Cotter Estate and/or the Cotter Trust). |

The components of noncontrolling interests are as follows:

|

|

September 30, |

December 31, |

||||

|

(Dollars in thousands) |

2016 |

2015 |

||||

|

Australian Country Cinemas, Pty Ltd |

$ |

275 |

$ |

318 | ||

|

Shadow View Land and Farming, LLC |

2,010 | 1,940 | ||||

|

Sutton Hill Properties, LLC |

2,146 | 2,073 | ||||

|

Noncontrolling interests in consolidated subsidiaries |

$ |

4,431 |

$ |

4,331 | ||

The components of gain/(loss) attributable to noncontrolling interests are as follows:

|

|

Quarter Ended |

Nine Months Ended |

||||||||||

|

|

September 30, |

September 30, |

September 30, |

September 30, |

||||||||

|

(Dollars in thousands) |

2016 |

2015 |

2016 |

2015 |

||||||||

|

Australian Country Cinemas, Pty Ltd |

$ |

79 |

$ |

1 |

$ |

137 |

$ |

131 | ||||

|

Shadow View Land and Farming, LLC |

(12) | (9) | (29) | (66) | ||||||||

|

Sutton Hill Properties, LLC |

(5) | (46) | (96) | (125) | ||||||||

|

Net income (loss) attributable to noncontrolling interests |

$ |

62 |

$ |

(54) |

$ |

12 |

$ |

(60) | ||||

18

Summary of Controlling and Noncontrolling Stockholders’ Equity

A summary of the changes in controlling and noncontrolling stockholders’ equity is as follows:

|

(Dollars in thousands) |

Controlling Stockholders’ Equity |

Noncontrolling Stockholders’ Equity |

Total Stockholders’ Equity |

||||||

|

Equity at January 1, 2016 |

$ |

132,865 |

$ |

4,331 |

$ |

137,196 | |||

|

Net income |

9,054 | 12 | 9,066 | ||||||

|

Increase in additional paid in capital |

447 |

-- |

447 | ||||||

|

Contributions from noncontrolling stockholders - SHP |

-- |

268 | 268 | ||||||

|

Distributions to noncontrolling stockholders |

-- |

(194) | (194) | ||||||

|

Accumulated other comprehensive income |

9,414 | 14 | 9,428 | ||||||

|

Equity at September 30, 2016 |

$ |

151,780 |

$ |

4,431 |

$ |

156,211 | |||

|

|

|||||||||

|

(Dollars in thousands) |

Controlling Stockholders’ Equity |

Noncontrolling Stockholders’ Equity |

Total Stockholders’ Equity |

||||||

|

Equity at January 1, 2015 |

$ |

127,686 |

$ |

4,612 |

$ |

132,298 | |||

|

Net income (loss) |

19,496 | (60) | 19,436 | ||||||

|

Increase in additional paid in capital |

2,242 |

-- |

2,242 | ||||||

|

Treasury stock purchased |

(4,942) |

-- |

(4,942) | ||||||

|

Contributions from noncontrolling stockholders - SHP |

-- |

17 | 17 | ||||||

|

Distributions to noncontrolling stockholders |

-- |

(139) | (139) | ||||||

|

Accumulated other comprehensive loss |

(27,675) | (59) | (27,734) | ||||||

|

Equity at September 30, 2015 |

$ |

116,807 |

$ |

4,371 |

$ |

121,178 |

Note 15 – Equity and Stock-Based Compensation

Employee and Director Stock Option Plan

The Company may grant stock options and other share-based payment awards of our Class A Stock to eligible employees, directors, and consultants under the 2010 Stock Incentive Plan (the “Plan”). The aggregate total number of shares of the Class A Nonvoting Common Stock authorized for issuance under the Plan is 1,250,000. As of September 30, 2016, we had 551,800 shares remaining for future issuances.

Since the adoption of the Plan in 2010, the Company has granted awards primarily in the form of stock options. In the 1st quarter of 2016, the Company started to award restricted stock units (“RSUs”) to directors and certain members of management. Stock options are generally granted at exercise prices equal to the grant-date market prices and typically expire no later than five years from the grant date. In contrast to a stock option where the grantee buys the Company’s share at an exercise price determined on grant date, an RSU entitles the grantee to receive one share for every RSU based on a vesting plan. At the discretion of our Compensation and Stock Options Committee, the vesting period of stock options and RSUs ranges from zero to four years. At the time the options are exercised or RSUs vest, at the discretion of management, we will issue treasury shares or make a new issuance of shares to the option or RSU holder.

Stock Options

We estimate the grant-date fair value of our stock options using the Black-Scholes option-valuation model, which takes into account assumptions such as the dividend yield, the risk-free interest rate, the expected stock price volatility, and the expected life of the options. We expense the estimated grant-date fair values of options over the vesting period on a straight-line basis. Based on our historical experience and the relative market price to strike price of the options, we have not hereto estimated any forfeitures of vested or unvested options.

19

For the nine months ended September 30, 2016 and 2015, respectively, the weighted average assumptions used in the option-valuation model were as follows:

|

|

Nine Months Ended September 30 |

||||

|

|

2016 |

2015 |

|||

|

Stock option exercise price |

$ |

11.87 |

$ |

13.30 | |

|

Risk-free interest rate |

1.20% | 2.23% | |||

|

Expected dividend yield |

-- |

-- |

|||

|

Expected option life in years |

3.75 | 4.00 | |||

|

Expected volatility |

25.01% | 31.86% | |||

|

Weighted average fair value |

$ |

2.49 |

$ |

3.82 | |

For the quarter and nine months ended September 30, 2016, we recorded compensation expense of $74,000 and $264,000, respectively. For the quarter and nine months ended September 30, 2015, we recorded compensation expense of $75,000 and $209,000, respectively. At September 30, 2016, the total unrecognized estimated compensation expense related to non-vested stock options was $661,000, which we expect to recognize over a weighted average vesting period of 1.94 years. No stock options were exercised during the quarter and nine months ended September 30, 2016. The intrinsic, unrealized value of all options outstanding, vested and expected to vest, at September 30, 2016 was $2.1 million, of which 75.8% are currently exercisable.

The following table summarizes the information of options outstanding and exercisable as of September 30, 2016 and December 31, 2015:

|

|

Options Outstanding |

Exercisable Options |

||||||||||||||||||||||

|

|

Number of Options |

Weighted Average Exercise Price |

Weighted Average Remaining Years of Contractual Life |

Number of Options |

Weighted Average Exercise Price |

Weighted Average Remaining Years of Contractual Life |

||||||||||||||||||

|

(Shares in thousands) |

Class A |

Class B |

Class A |

Class B |

Class A & B |

Class A |

Class B |

Class A |

Class B |

Class A & B |

||||||||||||||

|

Balance - December 31, 2014 |

568 | 185 |

$ |

6.88 |

$ |

9.90 | 2.40 | 348 | 185 |

$ |

6.82 |

$ |

9.90 | 3.63 | ||||||||||

|

Granted |

112 |

-- |

13.30 |

-- |

101 |

-- |

-- |

-- |

||||||||||||||||

|

Exercised |

(185) | (185) | 6.09 | 9.90 | (185) | (185) |

-- |

-- |

||||||||||||||||

|

Forfeited |

(8) |

-- |

6.23 |

-- |

(8) |

-- |

-- |

-- |

||||||||||||||||

|

Balance - December 31, 2015 |

487 |

-- |

$ |

7.64 |

$ |

-- |

2.89 | 256 |

-- |

$ |

7.64 |

$ |

-- |

2.14 | ||||||||||

|

Granted |

169 |

-- |

11.87 |

-- |

75 |

-- |

-- |

-- |

||||||||||||||||

|

Exercised |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

||||||||||||||||

|

Forfeited |

(74) |

-- |

7.02 |

-- |

(29) |

-- |

-- |

-- |

||||||||||||||||

|

Balance - September 30, 2016 |

582 |

-- |

$ |

9.82 |

-- |

2.83 | 302 |

-- |

$ |

8.18 |

$ |

-- |

1.89 | |||||||||||

|

|

||||||||||||||||||||||||

Termination of Previous President’s Unvested Stock Options