form10q.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 10-Q

(Mark One)

|

þ

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended: September 30, 2012

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________ to ___________

Commission file number 1-8625

READING INTERNATIONAL, INC.

(Exact name of Registrant as specified in its charter)

| |

|

|

NEVADA

(State or other jurisdiction of incorporation or organization)

|

95-3885184

(IRS Employer Identification No.)

|

|

6100 Center Drive, Suite 900

Los Angeles, CA

(Address of principal executive offices)

|

90045

(Zip Code)

|

Registrant’s telephone number, including area code: (213) 235-2240

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer ¨ Accelerated filer þ Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. As of November 8, 2012, there were 21,587,775 shares of Class A Nonvoting Common Stock, $0.01 par value per share and 1,495,490 shares of Class B Voting Common Stock, $0.01 par value per share outstanding.

READING INTERNATIONAL, INC. AND SUBSIDIARIES

PART 1 - Financial Information

Item 1 - Financial Statements

Reading International, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets (Unaudited)

(U.S. dollars in thousands)

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

September 30, 2012

|

|

|

December 31, 2011

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current Assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

22,535 |

|

|

$ |

31,597 |

|

|

Time deposits

|

|

|

8,000 |

|

|

|

-- |

|

|

Receivables

|

|

|

6,785 |

|

|

|

6,973 |

|

|

Inventory

|

|

|

796 |

|

|

|

1,035 |

|

|

Investment in marketable securities

|

|

|

53 |

|

|

|

2,874 |

|

|

Restricted cash

|

|

|

2,402 |

|

|

|

2,379 |

|

|

Deferred tax asset

|

|

|

3,605 |

|

|

|

1,985 |

|

|

Prepaid and other current assets

|

|

|

4,353 |

|

|

|

3,781 |

|

|

Assets held for sale

|

|

|

12,258 |

|

|

|

14,495 |

|

|

Total current assets

|

|

|

60,787 |

|

|

|

65,119 |

|

| |

|

|

|

|

|

|

|

|

|

Property held for and under development

|

|

|

98,788 |

|

|

|

90,699 |

|

|

Property and equipment, net

|

|

|

200,943 |

|

|

|

203,780 |

|

|

Investment in unconsolidated joint ventures and entities

|

|

|

7,632 |

|

|

|

7,839 |

|

|

Investment in Reading International Trust I

|

|

|

838 |

|

|

|

838 |

|

|

Goodwill

|

|

|

22,927 |

|

|

|

22,277 |

|

|

Intangible assets, net

|

|

|

16,221 |

|

|

|

17,999 |

|

|

Deferred tax asset, net

|

|

|

11,301 |

|

|

|

12,399 |

|

|

Other assets

|

|

|

10,720 |

|

|

|

9,814 |

|

|

Total assets

|

|

$ |

430,157 |

|

|

$ |

430,764 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Current Liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

$ |

17,933 |

|

|

$ |

16,905 |

|

|

Film rent payable

|

|

|

4,958 |

|

|

|

6,162 |

|

|

Notes payable – current portion

|

|

|

22,136 |

|

|

|

29,630 |

|

|

Taxes payable

|

|

|

14,883 |

|

|

|

14,858 |

|

|

Deferred current revenue

|

|

|

8,698 |

|

|

|

10,271 |

|

|

Other current liabilities

|

|

|

174 |

|

|

|

137 |

|

|

Total current liabilities

|

|

|

68,782 |

|

|

|

77,963 |

|

| |

|

|

|

|

|

|

|

|

|

Notes payable – long-term portion

|

|

|

143,263 |

|

|

|

143,071 |

|

|

Notes payable to related party – long-term portion

|

|

|

9,000 |

|

|

|

9,000 |

|

|

Subordinated debt

|

|

|

27,913 |

|

|

|

27,913 |

|

|

Noncurrent tax liabilities

|

|

|

9,697 |

|

|

|

12,191 |

|

|

Other liabilities

|

|

|

37,407 |

|

|

|

35,639 |

|

|

Total liabilities

|

|

|

296,062 |

|

|

|

305,777 |

|

|

Commitments and contingencies (Note 13)

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Class A non-voting common stock, par value $0.01, 100,000,000 shares authorized,

|

|

|

|

|

|

|

|

|

|

31,951,945 issued and 21,587,775 outstanding at September 30, 2012 and 31,675,518

|

|

|

|

|

|

|

|

|

|

issued and 21,311,348 outstanding at December 31, 2011

|

|

|

221 |

|

|

|

220 |

|

|

Class B voting common stock, par value $0.01, 20,000,000 shares authorized and

|

|

|

|

|

|

|

|

|

|

1,495,490 issued and outstanding at September 30, 2012 and at December 31, 2011

|

|

|

15 |

|

|

|

15 |

|

|

Nonvoting preferred stock, par value $0.01, 12,000 shares authorized and no issued

|

|

|

|

|

|

|

|

|

|

or outstanding shares at September 30, 2012 and December 31, 2011

|

|

|

-- |

|

|

|

-- |

|

|

Additional paid-in capital

|

|

|

135,718 |

|

|

|

135,171 |

|

|

Accumulated deficit

|

|

|

(65,718 |

) |

|

|

(66,079 |

) |

|

Treasury shares

|

|

|

(4,512 |

) |

|

|

(4,512 |

) |

|

Accumulated other comprehensive income

|

|

|

63,632 |

|

|

|

58,937 |

|

|

Total Reading International, Inc. stockholders’ equity

|

|

|

129,356 |

|

|

|

123,752 |

|

|

Noncontrolling interests

|

|

|

4,739 |

|

|

|

1,235 |

|

|

Total stockholders’ equity

|

|

|

134,095 |

|

|

|

124,987 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

430,157 |

|

|

$ |

430,764 |

|

See accompanying notes to consolidated financial statements.

Reading International, Inc. and Subsidiaries

Condensed Consolidated Statements of Income (Unaudited)

(U.S. dollars in thousands, except per share amounts)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

September 30,

|

|

|

Nine Months Ended

September 30,

|

|

| |

|

2012

|

|

|

2011

|

|

|

2012

|

|

|

2011

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cinema

|

|

$ |

59,246 |

|

|

$ |

61,867 |

|

|

$ |

174,636 |

|

|

$ |

173,577 |

|

|

Real estate

|

|

|

4,688 |

|

|

|

4,687 |

|

|

|

14,677 |

|

|

|

13,981 |

|

|

Total operating revenue

|

|

|

63,934 |

|

|

|

66,554 |

|

|

|

189,313 |

|

|

|

187,558 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cinema

|

|

|

48,672 |

|

|

|

48,643 |

|

|

|

141,470 |

|

|

|

138,352 |

|

|

Real estate

|

|

|

3,153 |

|

|

|

2,519 |

|

|

|

8,479 |

|

|

|

7,430 |

|

|

Depreciation and amortization

|

|

|

3,995 |

|

|

|

4,204 |

|

|

|

12,016 |

|

|

|

12,443 |

|

|

General and administrative

|

|

|

3,957 |

|

|

|

4,172 |

|

|

|

12,701 |

|

|

|

13,163 |

|

|

Total operating expense

|

|

|

59,777 |

|

|

|

59,538 |

|

|

|

174,666 |

|

|

|

171,388 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

4,157 |

|

|

|

7,016 |

|

|

|

14,647 |

|

|

|

16,170 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

148 |

|

|

|

466 |

|

|

|

541 |

|

|

|

1,307 |

|

|

Interest expense

|

|

|

(4,313 |

) |

|

|

(7,746 |

) |

|

|

(14,149 |

) |

|

|

(17,923 |

) |

|

Net gain (loss) on sale of assets

|

|

|

86 |

|

|

|

1 |

|

|

|

84 |

|

|

|

(66 |

) |

|

Other expense

|

|

|

182 |

|

|

|

6 |

|

|

|

202 |

|

|

|

79 |

|

|

Income (loss) before income tax expense and equity earnings of unconsolidated joint ventures and entities

|

|

|

260 |

|

|

|

(257 |

) |

|

|

1,325 |

|

|

|

(433 |

) |

|

Income tax benefit (expense)

|

|

|

100 |

|

|

|

38 |

|

|

|

(1,784 |

) |

|

|

13,177 |

|

|

Income (loss) before equity earnings of unconsolidated joint ventures and entities

|

|

|

360 |

|

|

|

(219 |

) |

|

|

(459 |

) |

|

|

12,744 |

|

|

Equity earnings of unconsolidated joint ventures and entities

|

|

|

277 |

|

|

|

454 |

|

|

|

1,090 |

|

|

|

1,087 |

|

|

Income before discontinued operations

|

|

|

637 |

|

|

|

235 |

|

|

|

631 |

|

|

|

13,831 |

|

|

Income (loss) from discontinued operations, net of tax

|

|

|

(241 |

) |

|

|

55 |

|

|

|

(121 |

) |

|

|

170 |

|

|

Gain on sale of discontinued operation

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

|

1,656 |

|

|

Net income

|

|

$ |

396 |

|

|

$ |

290 |

|

|

$ |

510 |

|

|

$ |

15,657 |

|

|

Net income attributable to noncontrolling interests

|

|

|

(33 |

) |

|

|

(253 |

) |

|

|

(149 |

) |

|

|

(667 |

) |

|

Net income attributable to Reading International, Inc. common shareholders

|

|

$ |

363 |

|

|

$ |

37 |

|

|

$ |

361 |

|

|

$ |

14,990 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic income per common share attributable to Reading International, Inc. shareholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from continuing operations

|

|

$ |

0.03 |

|

|

$ |

0.00 |

|

|

$ |

0.03 |

|

|

$ |

0.58 |

|

|

Earnings (loss) from discontinued operations, net

|

|

|

(0.01 |

) |

|

|

0.00 |

|

|

|

(0.01 |

) |

|

|

0.08 |

|

|

Basic income per share attributable to Reading International, Inc. shareholders

|

|

$ |

0.02 |

|

|

$ |

0.00 |

|

|

$ |

0.02 |

|

|

$ |

0.66 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted income per common share attributable to Reading International, Inc. shareholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from continuing operations

|

|

$ |

0.03 |

|

|

$ |

0.00 |

|

|

$ |

0.03 |

|

|

$ |

0.57 |

|

|

Earnings (loss) from discontinued operations, net

|

|

|

(0.01 |

) |

|

|

0.00 |

|

|

|

(0.01 |

) |

|

|

0.08 |

|

|

Diluted income per share attributable to Reading International, Inc. shareholders

|

|

$ |

0.02 |

|

|

$ |

0.00 |

|

|

$ |

0.02 |

|

|

$ |

0.65 |

|

|

Weighted average number of shares outstanding–basic

|

|

|

23,071,846 |

|

|

|

22,782,534 |

|

|

|

23,007,787 |

|

|

|

22,759,488 |

|

|

Weighted average number of shares outstanding–diluted

|

|

|

23,293,886 |

|

|

|

22,979,952 |

|

|

|

23,229,827 |

|

|

|

22,956,906 |

|

See accompanying notes to consolidated financial statements.

Reading International, Inc. and Subsidiaries

Condensed Consolidated Statements of Comprehensive Income (Loss) (Unaudited)

(U.S. dollars in thousands)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

Three Months Ended

September 30,

|

|

|

Nine Months Ended

September 30,

|

|

| |

|

2012

|

|

|

2011

|

|

|

2012

|

|

|

2011

|

|

|

Net income

|

|

$ |

396 |

|

|

$ |

290 |

|

|

$ |

510 |

|

|

$ |

15,657 |

|

|

Foreign currency translation gain (loss)

|

|

|

3,687 |

|

|

|

(18,218 |

) |

|

|

4,476 |

|

|

|

(6,781 |

) |

|

Realized (gain) loss on available for sale investments

|

|

|

-- |

|

|

|

15 |

|

|

|

(109 |

) |

|

|

(9 |

) |

|

Unrealized gain (loss) on available for sale investments

|

|

|

3 |

|

|

|

(138 |

) |

|

|

105 |

|

|

|

(29 |

) |

|

Amortization of pension prior service costs

|

|

|

76 |

|

|

|

82 |

|

|

|

228 |

|

|

|

246 |

|

|

Comprehensive income (loss)

|

|

|

4,162 |

|

|

|

(17,969 |

) |

|

|

5,210 |

|

|

|

9,084 |

|

|

Net loss attributable to noncontrolling interest

|

|

|

(33 |

) |

|

|

(253 |

) |

|

|

(149 |

) |

|

|

(667 |

) |

|

Comprehensive income (loss) attributable to noncontrolling interest

|

|

|

(9 |

) |

|

|

29 |

|

|

|

(5 |

) |

|

|

4 |

|

|

Comprehensive income (loss) attributable to Reading International, Inc.

|

|

$ |

4,120 |

|

|

$ |

(18,193 |

) |

|

$ |

5,056 |

|

|

$ |

8,421 |

|

See accompanying notes to consolidated financial statements.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(U.S. dollars in thousands)

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

Nine Months Ended

September 30,

|

|

| |

|

2012

|

|

|

2011

|

|

|

Operating Activities

|

|

|

|

|

|

|

|

Net income

|

|

$ |

510 |

|

|

$ |

15,657 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

(Gain) loss recognized on foreign currency transactions

|

|

|

(19 |

) |

|

|

14 |

|

|

Equity earnings of unconsolidated joint ventures and entities

|

|

|

(1,090 |

) |

|

|

(1,087 |

) |

|

Distributions of earnings from unconsolidated joint ventures and entities

|

|

|

1,163 |

|

|

|

598 |

|

|

Loss provision on impairment of asset

|

|

|

283 |

|

|

|

-- |

|

|

Gain on sale of assets

|

|

|

(84 |

) |

|

|

(1,590 |

) |

|

Change in valuation allowance on net deferred tax assets

|

|

|

(330 |

) |

|

|

(15,127 |

) |

|

Gain on sale of marketable securities

|

|

|

(109 |

) |

|

|

(8 |

) |

|

Depreciation and amortization

|

|

|

12,290 |

|

|

|

12,718 |

|

|

Amortization of prior service costs

|

|

|

228 |

|

|

|

246 |

|

|

Amortization of above and below market leases

|

|

|

314 |

|

|

|

302 |

|

|

Amortization of deferred financing costs

|

|

|

1,050 |

|

|

|

1,001 |

|

|

Amortization of straight-line rent

|

|

|

598 |

|

|

|

689 |

|

|

Stock based compensation expense

|

|

|

240 |

|

|

|

142 |

|

|

Changes in assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Decrease in receivables

|

|

|

288 |

|

|

|

753 |

|

|

(Increase) decrease in prepaid and other assets

|

|

|

(275 |

) |

|

|

142 |

|

|

Increase (decrease) in accounts payable and accrued expenses

|

|

|

839 |

|

|

|

(1,171 |

) |

|

Decrease in film rent payable

|

|

|

(1,255 |

) |

|

|

(1,323 |

) |

|

Increase (decrease) in taxes payable

|

|

|

(2,473 |

) |

|

|

1,911 |

|

|

Increase in deferred revenue and other liabilities

|

|

|

311 |

|

|

|

3,214 |

|

|

Net cash provided by operating activities

|

|

|

12,479 |

|

|

|

17,081 |

|

|

Investing Activities

|

|

|

|

|

|

|

|

|

|

Acquisition of property

|

|

|

(5,510 |

) |

|

|

(3,917 |

) |

|

Purchases of and additions to property and equipment

|

|

|

(4,960 |

) |

|

|

(4,761 |

) |

|

Change in restricted cash

|

|

|

44 |

|

|

|

(119 |

) |

|

Purchase of notes receivable

|

|

|

(1,800 |

) |

|

|

(2,784 |

) |

|

Sale of marketable securities

|

|

|

2,974 |

|

|

|

124 |

|

|

Distributions of investment in unconsolidated joint ventures and entities

|

|

|

315 |

|

|

|

-- |

|

|

Proceeds from sale of property

|

|

|

1,866 |

|

|

|

6,750 |

|

|

Cinema sale proceeds from noncontrolling shareholder

|

|

|

-- |

|

|

|

1,867 |

|

|

Purchase of time deposits

|

|

|

(8,000 |

) |

|

|

-- |

|

|

Net cash used in investing activities

|

|

|

(15,071 |

) |

|

|

(2,840 |

) |

|

Financing Activities

|

|

|

|

|

|

|

|

|

|

Repayment of long-term borrowings

|

|

|

(26,116 |

) |

|

|

(124,859 |

) |

|

Proceeds from borrowings

|

|

|

16,232 |

|

|

|

105,311 |

|

|

Capitalized borrowing costs

|

|

|

(445 |

) |

|

|

(774 |

) |

|

Repurchase of Class A Nonvoting Common Stock

|

|

|

-- |

|

|

|

(328 |

) |

|

Proceeds from the exercise of stock options

|

|

|

308 |

|

|

|

-- |

|

|

Noncontrolling interest contributions

|

|

|

3,350 |

|

|

|

163 |

|

|

Noncontrolling interest distributions

|

|

|

-- |

|

|

|

(655 |

) |

|

Net cash used in financing activities

|

|

|

(6,671 |

) |

|

|

(21,142 |

) |

|

Effect of exchange rate on cash

|

|

|

201 |

|

|

|

(910 |

) |

| |

|

|

|

|

|

|

|

|

|

Decrease in cash and cash equivalents

|

|

|

(9,062 |

) |

|

|

(7,811 |

) |

|

Cash and cash equivalents at the beginning of the period

|

|

|

31,597 |

|

|

|

34,568 |

|

|

Cash and cash equivalents at the end of the period

|

|

$ |

22,535 |

|

|

$ |

26,757 |

|

|

Supplemental Disclosures

|

|

|

|

|

|

|

|

|

|

Cash paid during the period for:

|

|

|

|

|

|

|

|

|

|

Interest on borrowings

|

|

$ |

11,296 |

|

|

$ |

12,907 |

|

|

Income taxes

|

|

$ |

4,618 |

|

|

$ |

1,881 |

|

|

Non-Cash Transactions

|

|

|

|

|

|

|

|

|

|

Foreclosure of a mortgage note to obtain title of the underlying property

|

|

|

-- |

|

|

|

1,125 |

|

|

Noncontrolling interest contribution from bonus accrual

|

|

|

255 |

|

|

|

-- |

|

See accompanying notes to consolidated financial statements.

Notes to Condensed Consolidated Financial Statements (Unaudited)

For the Nine Months Ended September 30, 2012

Note 1 – Basis of Presentation

Reading International, Inc., a Nevada corporation (“RDI” and collectively with our consolidated subsidiaries and corporate predecessors, the “Company,” “Reading” and “we,” “us,” or “our”), was founded in 1983 as a Delaware corporation and reincorporated in 1999 in Nevada. Our businesses consist primarily of:

|

·

|

the development, ownership and operation of multiplex cinemas in the United States, Australia, and New Zealand; and

|

|

·

|

the development, ownership, and operation of retail and commercial real estate in Australia, New Zealand, and the United States.

|

The accompanying unaudited condensed consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”) for interim reporting and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X of the Securities and Exchange Commission (“SEC”) for interim reporting. As such, certain information and disclosures typically required by US GAAP for complete financial statements have been condensed or omitted. The financial information presented in this quarterly report on Form 10-Q for the period ended September 30, 2012 (the “September Report”) should be read in conjunction with our Annual Report filed on Form 10-K for the year ended December 31, 2011 (our “2011 Annual Report”) which contains the latest audited financial statements and related notes. The periods presented in this document are the three (“2012 Quarter”) and nine (“2012 Nine Months”) months ended September 30, 2012 and the three (“2011 Quarter”) and nine (“2011 Nine Months”) months ended September 30, 2011.

In the opinion of management, all adjustments of a normal recurring nature considered necessary to present fairly in all material respects our financial position as of September 30, 2012 and our results of our operations and cash flows for the three and nine months ended September 30, 2012 and 2011 have been made. The results of operations for the three and nine months ended September 30, 2012 are not necessarily indicative of the results of operations to be expected for the entire year.

Liquidity Requirements

Liberty Theatre Term Loans

As our Liberty Theater Term Loans are due to mature on April 1, 2013, the September 30, 2012 outstanding balance of this debt of $6.5 million is classified as current on our balance sheet. We intend to refinance the property’s debt with similar financing.

Tax Settlement Liability

As indicated in our 2011 Annual Report, in accordance with the agreement between the U.S. Internal Revenue Service and our subsidiary, Craig Corporation, is obligated to pay $290,000 per month, $3.5 million per year, in settlement of our tax liability for the tax year ended June 30, 1997.

For the abovementioned liabilities, we believe that we have sufficient borrowing capacity under our various credit facilities, together with our $30.5 million of cash and time deposits, to meet our anticipated short-term working capital requirements for the next twelve months.

Time Deposits

Time deposits are cash depository investments in which the original maturity of the investments is greater than 90 days. During May 2012, we purchased $8.0 million in U.S. dollar time deposits in Australia which are scheduled to mature on January 3, 2013 having an interest rate of 1.26%. Should we have need to use these funds, the cost to break the time deposit agreement would result in a nominal loss in the amount of interest income that we are owed.

Marketable Securities

We had investments in marketable securities of $53,000 and $2.9 million at September 30, 2012 and December 31, 2011, respectively. We account for these investments as available for sale investments. We assess our investment in marketable securities for other-than-temporary impairments in accordance with Accounting Standards Codification (“ASC”) 320-10 for each applicable reporting period. These investments have a cumulative income (loss) of $7,000 and ($11,000) included in accumulated other comprehensive income at September 30, 2012 and December 31, 2011, respectively. For the three and nine months ended September 30, 2012, our net unrealized income (loss) on marketable securities was $3,000 and ($4,000), respectively. For the three and nine months ended September 30, 2011, our net unrealized gain (loss) on marketable securities was ($123,000) and ($38,000), respectively. During the nine months ended September 30, 2012, we sold $3.0 million of our marketable securities with a realized gain of $109,000.

Deferred Leasing Costs

We amortize direct costs incurred in connection with obtaining tenants over the respective term of the lease on a straight-line basis.

Deferred Financing Costs

We amortize direct costs incurred in connection with obtaining financing over the term of the loan using the effective interest method, or the straight-line method, if the result is not materially different. In addition, interest on loans with increasing interest rates and scheduled principal pre-payments, is also recognized using the effective interest method.

Accounting Pronouncements Adopted During 2012

FASB ASU No. 2011-05 - Comprehensive Income (Topic 220): Presentation of Comprehensive Income

ASU No. 2011-05 requires that all non-owner changes in stockholders’ equity be presented either in a single continuous statement of comprehensive income or in two separate but consecutive statements, eliminating the option to present other comprehensive income in the statement of changes in equity. Under either choice, items that are reclassified from other comprehensive income to net income are required to be presented on the face of the financial statements where the components of net income and the components of other comprehensive income are presented. This amendment is effective for our Company in 2012 and was applied retrospectively.

FASB ASU No. 2011-08 - Intangibles—Goodwill and Other

ASU No. 2011-08 relates to a change in the annual test of goodwill for impairment. The statement permits an entity to first assess qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount as a basis for determining whether it is necessary to perform the two-step goodwill impairment test described in Topic 350. This amendment is effective for annual and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011.

New Accounting Pronouncements

No new pronouncements were made pertaining to our Company’s accounting during the nine months ending September 30, 2012.

Note 2 – Equity and Stock Based Compensation

Stock-Based Compensation

During the nine months ended September 30, 2012 and 2011, we issued 155,925 and 174,825, respectively, of Class A Nonvoting shares to an executive employee associated with the vesting of his prior years’ stock grants, and, during the nine months ended September 30, 2012, we issued 9,680 as a one-time stock grant of Class A Nonvoting shares to our employees valued at $44,000 which we accounted for as compensation expense. During the three and nine months ended September 30, 2012, we accrued $238,000 and $714,000, respectively, in compensation expense associated with the vesting of executive employee stock grants. During the three and nine months ended September 30, 2011, we accrued $188,000 and $563,000, respectively, in compensation expense associated with the vesting of executive employee stock grants.

Employee/Director Stock Option Plan

We have a long-term incentive stock option plan that provides for the grant to eligible employees, directors, and consultants of incentive or nonstatutory options to purchase shares of our Class A Nonvoting Common Stock and Class B Voting Common Stock. Our 1999 Stock Option Plan expired in November 2009, and was replaced by our new 2010 Stock Incentive Plan, which was approved by the holders of our Class B Voting Common Stock in May 2010.

When the Company’s tax deduction from an option exercise exceeds the compensation cost resulting from the option, a tax benefit is created. FASB ASC 718-20 relating to Stock-Based Compensation (“FASB ASC 718-20”), requires that excess tax benefits related to stock option exercises be reflected as financing cash inflows instead of operating cash inflows. For the three and nine months ended September 30, 2012 and 2011, there was no impact to the unaudited condensed consolidated statement of cash flows because there were no recognized tax benefits from stock option exercises during these periods.

FASB ASC 718-20 requires companies to estimate forfeitures. Based on our historical experience and the relative market price to strike price of the options, we do not currently estimate any forfeitures of vested or unvested options.

In accordance with FASB ASC 718-20, we estimate the fair value of our options using the Black-Scholes option-pricing model, which takes into account assumptions such as the dividend yield, the risk-free interest rate, the expected stock price volatility, and the expected life of the options. As we intend to retain all earnings, we exclude the dividend yield from the calculation. We expense the estimated grant date fair values of options issued on a straight-line basis over the vesting period.

For the 90,000 options granted during 2012, we estimated the fair value of these options at the date of grant using a Black-Scholes option-pricing model with the following weighted average assumptions:

| |

|

2012

|

|

|

Stock option exercise price

|

|

$ |

5.56 |

|

|

Risk-free interest rate

|

|

|

1.630% |

|

|

Expected dividend yield

|

|

|

-- |

|

|

Expected option life

|

|

10 yrs

|

|

|

Expected volatility

|

|

|

32.12% |

|

|

Weighted average fair value

|

|

$ |

5.56 |

|

We did not grant any options during the three or nine months ended September 30, 2011.

Based on the above calculation and prior years’ assumptions, and, in accordance with the FASB ASC 718-20, we recorded compensation expense for the total estimated grant date fair value $27,000 and $197,000 for the three and nine months ended September 30, 2012, respectively, and $47,000 and $142,000 for the three and nine months ended September 30, 2011, respectively. At September 30, 2012, the total unrecognized estimated compensation cost related to non-vested stock options granted was $132,000, which we expect to recognize over a weighted average vesting period of 2.44 years. 95,000 options were exercised during the nine months ended September 30, 2012 having a realized value of $136,000 for which we received $308,000 of cash. Additionally, 41,000 options were exercised during the nine months ended September 30, 2012 having a realized value of $103,000 for which we did not receive any cash but the consultant elected to receive the net incremental number of in-the-money shares of 15,822 based on an exercise price of $4.01 and a market price of $6.53. There were no options exercised during the nine months ended September 30, 2011. The intrinsic, unrealized value of all options outstanding, vested and expected to vest, at September 30, 2012 was $477,000 of which 100.0% are currently exercisable.

Pursuant to both our 1999 Stock Option Plan and our 2010 Stock Incentive Plan, all stock options expire within ten years of their grant date. The aggregate total number of shares of Class A Nonvoting Common Stock and Class B Voting Common Stock authorized for issuance under our 2010 Stock Incentive Plan is 1,250,000. At the discretion of our Compensation and Stock Options Committee, the vesting period of stock options is usually between zero and four years.

We had the following stock options outstanding and exercisable as of September 30, 2012 and December 31, 2011:

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

Weighted

|

|

|

|

|

|

|

|

|

Weighted Average

|

|

| |

|

Common Stock

|

|

Average Exercise

|

|

|

Common Stock

|

|

|

Price of

|

|

| |

|

Options

|

|

Price of Options

|

|

|

Exercisable

|

|

|

Exercisable

|

|

| |

|

Outstanding

|

|

Outstanding

|

|

|

Options

|

|

|

Options

|

|

| |

|

Class A

|

|

|

Class B

|

|

Class A

|

|

Class B

|

|

|

Class A

|

|

|

Class B

|

|

Class A

|

|

Class B

|

|

|

Outstanding- January 1, 2011

|

|

|

622,350 |

|

|

|

185,100 |

|

|

$ |

5.65 |

|

|

$ |

9.90 |

|

|

|

449,750 |

|

|

|

150,000 |

|

|

$ |

6.22 |

|

|

$ |

10.24 |

|

|

No activity during the period

|

|

|

-- |

|

|

|

-- |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding-December 31, 2011

|

|

|

622,350 |

|

|

|

185,100 |

|

|

$ |

5.65 |

|

|

$ |

9.90 |

|

|

|

544,383 |

|

|

|

167,550 |

|

|

$ |

5.86 |

|

|

$ |

10.05 |

|

|

Granted

|

|

|

90,000 |

|

|

|

-- |

|

|

$ |

5.56 |

|

|

$ |

-- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exercised

|

|

|

(136,000 |

) |

|

|

-- |

|

|

$ |

4.68 |

|

|

$ |

-- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expired

|

|

|

(20,000 |

) |

|

|

-- |

|

|

$ |

3.75 |

|

|

$ |

-- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding-September 30, 2012

|

|

|

556,350 |

|

|

|

185,100 |

|

|

$ |

6.24 |

|

|

$ |

9.90 |

|

|

|

506,350 |

|

|

|

185,100 |

|

|

$ |

6.26 |

|

|

$ |

9.90 |

|

The weighted average remaining contractual life of all options outstanding, vested, and expected to vest at September 30, 2012 and December 31, 2011 was approximately 4.86 and 4.13 years, respectively. The weighted average remaining contractual life of the exercisable options outstanding at September 30, 2012 and December 31, 2011 was approximately 4.50 and 3.85 years, respectively.

Note 3 – Business Segments

We organize our operations into two reportable business segments within the meaning of FASB ASC 280-10 - Segment Reporting. Our reportable segments are (1) cinema exhibition and (2) real estate. The cinema exhibition segment is engaged in the development, ownership, and operation of multiplex cinemas. The real estate segment is engaged in the development, ownership, and operation of commercial properties. Incident to our real estate operations we have acquired, and continue to hold, raw land in urban and suburban centers in Australia, New Zealand, and the United States.

The tables below summarize the results of operations for each of our principal business segments for the three and nine months ended September 30, 2012 and 2011, respectively. Operating expense includes costs associated with the day-to-day operations of the cinemas and the management of rental properties including our live theater assets (dollars in thousands):

|

Three Months Ended September 30, 2012

|

|

Cinema Exhibition

|

|

|

Real Estate

|

|

|

Intersegment Eliminations

|

|

|

Total

|

|

|

Revenue

|

|

$ |

59,246 |

|

|

$ |

6,570 |

|

|

$ |

(1,882 |

) |

|

$ |

63,934 |

|

|

Operating expense

|

|

|

50,554 |

|

|

|

3,153 |

|

|

|

(1,882 |

) |

|

|

51,825 |

|

|

Depreciation and amortization

|

|

|

2,786 |

|

|

|

1,108 |

|

|

|

-- |

|

|

|

3,894 |

|

|

General and administrative expense

|

|

|

653 |

|

|

|

197 |

|

|

|

-- |

|

|

|

850 |

|

|

Segment operating income

|

|

$ |

5,253 |

|

|

$ |

2,112 |

|

|

$ |

-- |

|

|

$ |

7,365 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2011

|

|

Cinema Exhibition

|

|

|

Real Estate

|

|

|

Intersegment Eliminations

|

|

|

Total

|

|

|

Revenue

|

|

$ |

61,867 |

|

|

$ |

6,354 |

|

|

$ |

(1,667 |

) |

|

$ |

66,554 |

|

|

Operating expense

|

|

|

50,310 |

|

|

|

2,519 |

|

|

|

(1,667 |

) |

|

|

51,162 |

|

|

Depreciation and amortization

|

|

|

2,966 |

|

|

|

1,033 |

|

|

|

-- |

|

|

|

3,999 |

|

|

General and administrative expense

|

|

|

649 |

|

|

|

130 |

|

|

|

-- |

|

|

|

779 |

|

|

Segment operating income

|

|

$ |

7,942 |

|

|

$ |

2,672 |

|

|

$ |

-- |

|

|

$ |

10,614 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation to net income attributable to Reading International, Inc. shareholders:

|

|

2012 Quarter

|

|

|

2011 Quarter

|

|

|

Total segment operating income

|

|

$ |

7,365 |

|

|

$ |

10,614 |

|

|

Non-segment:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization expense

|

|

|

101 |

|

|

|

205 |

|

|

General and administrative expense

|

|

|

3,107 |

|

|

|

3,393 |

|

|

Operating income

|

|

|

4,157 |

|

|

|

7,016 |

|

|

Interest expense, net

|

|

|

(4,165 |

) |

|

|

(7,280 |

) |

|

Other income

|

|

|

182 |

|

|

|

6 |

|

|

Gain on sale of assets

|

|

|

86 |

|

|

|

1 |

|

|

Income tax benefit

|

|

|

100 |

|

|

|

38 |

|

|

Equity earnings of unconsolidated joint ventures and entities

|

|

|

277 |

|

|

|

454 |

|

|

Income (loss) from discontinued operations

|

|

|

(241 |

) |

|

|

55 |

|

|

Net income

|

|

$ |

396 |

|

|

$ |

290 |

|

|

Net loss attributable to noncontrolling interests

|

|

|

(33 |

) |

|

|

(253 |

) |

|

Net income attributable to Reading International, Inc. common shareholders

|

|

$ |

363 |

|

|

$ |

37 |

|

| Nine Months Ended September 30, 2012 |

|

Cinema Exhibition |

|

|

Real Estate |

|

|

Intersegment Eliminations |

|

|

Total |

|

|

Revenue

|

|

$ |

174,636 |

|

|

$ |

20,324 |

|

|

$ |

(5,647 |

) |

|

$ |

189,313 |

|

|

Operating expense

|

|

|

147,117 |

|

|

|

8,479 |

|

|

|

(5,647 |

) |

|

|

149,949 |

|

|

Depreciation and amortization

|

|

|

8,349 |

|

|

|

3,331 |

|

|

|

-- |

|

|

|

11,680 |

|

|

General and administrative expense

|

|

|

2,137 |

|

|

|

522 |

|

|

|

-- |

|

|

|

2,659 |

|

|

Segment operating income

|

|

$ |

17,033 |

|

|

$ |

7,992 |

|

|

$ |

-- |

|

|

$ |

25,025 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2011

|

|

Cinema Exhibition |

|

|

Real Estate |

|

|

Intersegment Eliminations |

|

|

Total |

|

|

Revenue

|

|

$ |

173,577 |

|

|

$ |

18,981 |

|

|

$ |

(5,000 |

) |

|

$ |

187,558 |

|

|

Operating expense

|

|

|

143,352 |

|

|

|

7,430 |

|

|

|

(5,000 |

) |

|

|

145,782 |

|

|

Depreciation and amortization

|

|

|

8,869 |

|

|

|

3,358 |

|

|

|

-- |

|

|

|

12,227 |

|

|

General and administrative expense

|

|

|

1,930 |

|

|

|

524 |

|

|

|

-- |

|

|

|

2,454 |

|

|

Segment operating income

|

|

$ |

19,426 |

|

|

$ |

7,669 |

|

|

$ |

-- |

|

|

$ |

27,095 |

|

|

Reconciliation to net income attributable

|

|

2012 Nine

|

|

|

2011 Nine

|

|

|

to Reading International, Inc. shareholders:

|

|

Months

|

|

|

Months

|

|

|

Total segment operating income

|

|

$ |

25,025 |

|

|

$ |

27,095 |

|

|

Non-segment:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization expense

|

|

|

336 |

|

|

|

216 |

|

|

General and administrative expense

|

|

|

10,042 |

|

|

|

10,709 |

|

|

Operating income

|

|

|

14,647 |

|

|

|

16,170 |

|

|

Interest expense, net

|

|

|

(13,608 |

) |

|

|

(16,616 |

) |

|

Other income

|

|

|

202 |

|

|

|

79 |

|

|

Gain (loss) on sale of assets

|

|

|

84 |

|

|

|

(66 |

) |

|

Income tax benefit (expense)

|

|

|

(1,784 |

) |

|

|

13,177 |

|

|

Equity earnings of unconsolidated joint ventures and entities

|

|

|

1,090 |

|

|

|

1,087 |

|

|

Income (loss) from discontinued operations

|

|

|

(121 |

) |

|

|

170 |

|

|

Gain on sale of discontinued operation

|

|

|

-- |

|

|

|

1,656 |

|

|

Net income

|

|

$ |

510 |

|

|

$ |

15,657 |

|

|

Net income attributable to noncontrolling interests

|

|

|

(149 |

) |

|

|

(667 |

) |

|

Net income attributable to Reading International, Inc. common shareholders

|

|

$ |

361 |

|

|

$ |

14,990 |

|

Note 4 – Operations in Foreign Currency

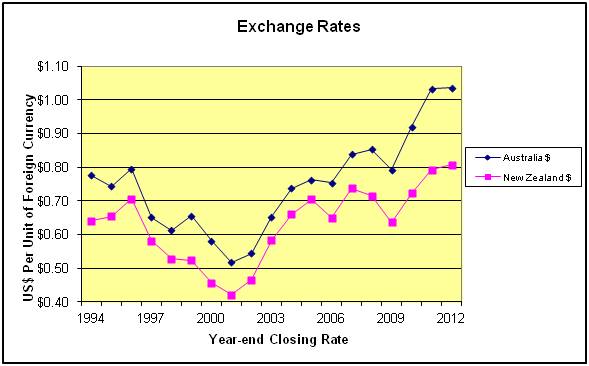

We have significant assets in Australia and New Zealand. To the extent possible, we conduct our Australian and New Zealand operations on a self-funding basis. The carrying value of our Australian and New Zealand assets and liabilities fluctuate due to changes in the exchange rates between the US dollar and the functional currency of Australia (Australian dollar) and New Zealand (New Zealand dollar). We have no derivative financial instruments to hedge against the risk of foreign currency exposure.

Presented in the table below are the currency exchange rates for Australia and New Zealand as of September 30, 2012 and December 31, 2011:

| |

US Dollar

|

| |

September 30, 2012

|

December 31, 2011

|

|

Australian Dollar

|

1.0388

|

1.0251

|

|

New Zealand Dollar

|

0.8293

|

0.7805

|

Note 5 – Earnings (Loss) Per Share

Basic earnings (loss) per share is computed by dividing the net income (loss) attributable to Reading International, Inc. common shareholders by the weighted average number of common shares outstanding during the period. Diluted earnings (loss) per share is computed by dividing the net income (loss) attributable to Reading International, Inc. common shareholders by the weighted average number of common shares outstanding during the period after giving effect to all potentially dilutive common shares that would have been outstanding if the dilutive common shares had been issued. Stock options and non-vested stock awards give rise to potentially dilutive common shares. In accordance with FASB ASC 260-10 - Earnings Per Share, these shares are included in the diluted earnings per share calculation under the treasury stock method. As noted in the table below, due to the small difference between the basic and diluted weighted average common shares, the basic and the diluted earnings (loss) per share are the same for each of the periods presented. The following is a calculation of earnings (loss) per share (dollars in thousands, except share data):

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

September 30,

|

|

|

Nine Months Ended

September 30,

|

|

| |

|

2012

|

|

|

2011

|

|

|

2012

|

|

|

2011

|

|

|

Income (loss) from continuing operations

|

|

$ |

604 |

|

|

$ |

(18 |

) |

|

$ |

482 |

|

|

$ |

13,164 |

|

|

Income (loss) from discontinued operations

|

|

|

(241 |

) |

|

|

55 |

|

|

|

(121 |

) |

|

|

1,826 |

|

|

Net income attributable to Reading International, Inc. common shareholders

|

|

|

363 |

|

|

|

37 |

|

|

|

361 |

|

|

|

14,990 |

|

|

Basic income per common share attributable to Reading International, Inc. shareholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from continuing operations

|

|

$ |

0.03 |

|

|

$ |

0.00 |

|

|

$ |

0.03 |

|

|

$ |

0.58 |

|

|

Earnings (loss) from discontinued operations, net

|

|

|

(0.01 |

) |

|

|

0.00 |

|

|

|

(0.01 |

) |

|

|

0.08 |

|

|

Basic income per share attributable to Reading International, Inc. shareholders

|

|

$ |

0.02 |

|

|

$ |

0.00 |

|

|

$ |

0.02 |

|

|

$ |

0.66 |

|

|

Diluted income per common share attributable to Reading International, Inc. shareholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from continuing operations

|

|

$ |

0.03 |

|

|

$ |

0.00 |

|

|

$ |

0.03 |

|

|

$ |

0.57 |

|

|

Earnings (loss) from discontinued operations, net

|

|

|

(0.01 |

) |

|

|

0.00 |

|

|

|

(0.01 |

) |

|

|

0.08 |

|

|

Diluted income per share attributable to Reading International, Inc. shareholders

|

|

$ |

0.02 |

|

|

$ |

0.00 |

|

|

$ |

0.02 |

|

|

$ |

0.65 |

|

|

Weighted average shares of common stock – basic

|

|

|

23,071,846 |

|

|

|

22,782,534 |

|

|

|

23,007,787 |

|

|

|

22,759,488 |

|

|

Weighted average shares of common stock – diluted

|

|

|

23,293,886 |

|

|

|

22,979,952 |

|

|

|

23,229,827 |

|

|

|

22,956,906 |

|

For the three and nine months ended September 30, 2012, the weighted average common stock – diluted included 222,040 of common stock compensation and in-the-money incremental stock options and for the three and nine months ended September 30, 2011, the weighted average common stock – diluted included 197,418 of common stock compensation and in-the-money incremental stock options. In addition, 682,827 of out-of-the-money stock options were excluded from the computation of diluted earnings (loss) per share for the three and nine months ended September 30, 2012, and 726,975 of out-of-the-money stock options were excluded from the computation of diluted earnings (loss) per share for the three and nine months ended September 30, 2011.

Note 6 – Property Acquired, Property Sold, Property Held for Sale, Property Held For and Under Development, and Property and Equipment

Properties Held for Sale

Indooroopilly Sale Agreement

Effective October 5, 2012, we entered into an agreement to sell our Indooroopilly property for $12.4 million (AUS$12.0 million) (See Note 18 – Subsequent Events). As the book value at September 30, 2012 was $12.5 million (AUS$12.1 million) for this property, we recorded an impairment expense of $283,000 (AUS$272,000) for the three and nine months ended September 30, 2012 including the cost to sell the property. We anticipate the sale of the property to close by the end of November 2012. The net book value of this property’s assets is included in assets held for sale on our Condensed Consolidated Balance Sheets at September 30, 2012 and December 31, 2011 and the operational results are included in income (loss) from discontinued operations on our Condensed Consolidated Statements of Operations for the three and nine months ended September 30, 2012 and 2011. The condensed statement of operations for Indooroopilly is as follows (dollars in thousands):

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

September 30,

|

|

|

Nine Months Ended

September 30,

|

|

| |

|

2012

|

|

|

2011

|

|

|

2012

|

|

|

2011

|

|

|

Revenue

|

|

$ |

210 |

|

|

$ |

207 |

|

|

$ |

627 |

|

|

$ |

619 |

|

|

Less: operating expense

|

|

|

168 |

|

|

|

152 |

|

|

|

465 |

|

|

|

449 |

|

|

Less: impairment expense

|

|

|

283 |

|

|

|

-- |

|

|

|

283 |

|

|

|

-- |

|

|

Income (loss) from discontinued operations, net of tax

|

|

$ |

(241 |

) |

|

$ |

55 |

|

|

$ |

(121 |

) |

|

$ |

170 |

|

Lake Taupo

The agreement to sell our Lake Taupo property for $3.9 million (NZ$4.9 million) entered into on July 20, 2012 has been terminated. As of June 30, 2012, the property had a book value of $2.1 million (NZ$2.6 million) and was classified as a property held for sale on our balance sheet as of that date. As the ultimate sale of the property and timing of the disposition of this property is in question, per ASU 360-10-45-9, the book value of this property is included as property held for development and property and equipment on our Condensed Consolidated Balance Sheets at September 30, 2012 and December 31, 2011.

Acquisitions

Coachella, California Land Acquisition

On January 10, 2012, Shadow View Land and Farming, LLC, a limited liability company owned by our Company, acquired a 202-acre property, zoned for the development of up to 843 single-family residential units, located in the City of Coachella, California. The property was acquired at a foreclosure auction for $5.5 million. The property was acquired as a long-term investment in developable land. Half of the funds used to acquire the land were provided by Mr. James J. Cotter, our Chairman, Chief Executive Officer and controlling shareholder. Upon the approval of our Conflicts Committee, these funds were converted on January 18, 2012 into a 50% interest in Shadow View Land and Farming, LLC. We are the managing member of this company. See Note 14 – Noncontrolling Interests.

Disposals

Taringa

On February 21, 2012, we sold our three properties in the Taringa area of Brisbane, Australia consisting of approximately 1.1 acres for $1.9 million (AUS$1.8 million).

Property Held For and Under Development

As of September 30, 2012 and December 31, 2011, we owned property held for and under development summarized as follows (dollars in thousands):

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Property Held For and Under Development

|

|

September 30, 2012

|

|

|

December 31, 2011

|

|

|

Land

|

|

$ |

94,255 |

|

|

$ |

86,667 |

|

|

Construction-in-progress (including capitalized interest)

|

|

|

4,533 |

|

|

|

4,032 |

|

|

Property Held For and Under Development

|

|

$ |

98,788 |

|

|

$ |

90,699 |

|

At the beginning of 2010, we curtailed the development activities of our properties under development and are not currently capitalizing interest expense. As a result, we did not capitalize any interest during the three and nine months ended September 30, 2012 or 2011.

Property and Equipment

As of September 30, 2012 and December 31, 2011, we owned investments in property and equipment as follows (dollars in thousands):

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Property and Equipment

|

|

September 30, 2012

|

|

|

December 31, 2011

|

|

|

Land

|

|

$ |

63,692 |

|

|

$ |

62,873 |

|

|

Building and improvements

|

|

|

138,611 |

|

|

|

134,967 |

|

|

Leasehold interests

|

|

|

42,137 |

|

|

|

40,855 |

|

|

Construction-in-progress

|

|

|

2,147 |

|

|

|

525 |

|

|

Fixtures and equipment

|

|

|

107,122 |

|

|

|

103,872 |

|

|

Total cost

|

|

|

353,709 |

|

|

|

343,092 |

|

|

Less: accumulated depreciation

|

|

|

(152,766 |

) |

|

|

(139,312 |

) |

|

Property and equipment, net

|

|

$ |

200,943 |

|

|

$ |

203,780 |

|

Depreciation expense for property and equipment was $3.6 million and $11.0 million for the three and nine months ended September 30, 2012, respectively, and $4.0 million and $11.7 million for the three and nine months ended September 30, 2011, respectively.

Note 7 – Investments in Unconsolidated Joint Ventures and Entities

Our investments in unconsolidated joint ventures and entities are accounted for under the equity method of accounting except for Rialto Distribution, which is accounted for as a cost method investment, and, as of September 30, 2012 and December 31, 2011, included the following (dollars in thousands):

| |

|

|

|

|

|

|

|

|

|

| |

|

Interest

|

|

|

September 30, 2012

|

|

|

December 31, 2011

|

|

|

Rialto Distribution

|

|

|

33.3% |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

Rialto Cinemas

|

|

|

50.0% |

|

|

|

1,564 |

|

|

|

1,586 |

|

|

205-209 East 57th Street Associates, LLC

|

|

|

25.0% |

|

|

|

33 |

|

|

|

33 |

|

|

Mt. Gravatt

|

|

|

33.3% |

|

|

|

6,035 |

|

|

|

6,220 |

|

|

Total investments

|

|

|

|

|

|

$ |

7,632 |

|

|

$ |

7,839 |

|

For the three and nine months ended September 30, 2012 and 2011, we recorded our share of equity earnings from our investments in unconsolidated joint ventures and entities as follows (dollars in thousands):

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

September 30,

|

|

|

Nine Months Ended

September 30,

|

|

| |

|

2012

|

|

|

2011

|

|

|

2012

|

|

|

2011

|

|

|

Rialto Distribution

|

|

$ |

24 |

|

|

$ |

234 |

|

|

$ |

137 |

|

|

$ |

346 |

|

|

Rialto Cinemas

|

|

|

27 |

|

|

|

(35 |

) |

|

|

84 |

|

|

|

(87 |

) |

|

205-209 East 57th Street Associates, LLC

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

|

33 |

|

|

Mt. Gravatt

|

|

|

226 |

|

|

|

255 |

|

|

|

869 |

|

|

|

795 |

|

|

Total equity earnings

|

|

$ |

277 |

|

|

$ |

454 |

|

|

$ |

1,090 |

|

|

$ |

1,087 |

|

Note 8 – Goodwill and Intangible Assets

In accordance with FASB ASC 350-20-35, Goodwill - Subsequent Measurement and Impairment, we perform an annual impairment review in the fourth quarter of our goodwill and other intangible assets on a reporting unit basis, or earlier if changes in circumstances indicate an asset may be impaired. No such circumstances existed during the 2012 Quarter. As of September 30, 2012 and December 31, 2011, we had goodwill consisting of the following (dollars in thousands):

| |

|

|

|

|

|

|

|

|

|

|

2012

|

|

Cinema

|

|

|

Real Estate

|

|

|

Total

|

|

|

Balance as of December 31, 2011

|

|

$ |

17,053 |

|

|

$ |

5,224 |

|

|

$ |

22,277 |

|

|

Foreign currency translation adjustment

|

|

|

650 |

|

|

|

-- |

|

|

|

650 |

|

|

Balance at September 30, 2012

|

|

$ |

17,703 |

|

|

$ |

5,224 |

|

|

$ |

22,927 |

|

We have intangible assets other than goodwill that are subject to amortization, which we amortize over various periods. We amortize our beneficial leases over the lease period, the longest of which is 30 years; our trade name using an accelerated amortization method over its estimated useful life of 45 years; and our other intangible assets over 10 years. For the three and nine months ended September 30, 2012, the amortization expense of intangibles totaled $638,000 and $1.8 million, respectively, and, for the three and nine months ended September 30, 2011, the amortization expense of intangibles totaled $525,000 and $1.8 million, respectively. The accumulated amortization of intangibles includes $817,000 and $406,000 of the amortization of acquired leases which are recorded in operating expense for the nine months ended September 30, 2012 and 2011, respectively.

Intangible assets subject to amortization consist of the following (dollars in thousands):

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

As of September 30, 2012

|

|

Beneficial Leases

|

|

|

Trade name

|

|

|

Other Intangible Assets

|

|

|

Total

|

|

|

Gross carrying amount

|

|

$ |

24,540 |

|

|

$ |

7,220 |

|

|

$ |

458 |

|