Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2013

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-8462

GRAHAM CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware |

16-1194720 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 20 Florence Avenue, Batavia, New York |

14020 | |

| (Address of principal executive offices) |

(Zip Code) | |

585-343-2216

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ |

Accelerated filer |

x | |||

| Non-accelerated filer |

¨ |

Smaller reporting company |

¨ | |||

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

As of October 25, 2013, there were outstanding 10,058,568 shares of the registrant’s common stock, par value $.10 per share.

Table of Contents

Graham Corporation and Subsidiaries

As of September 30, 2013 and March 31, 2013 and for the Three and Six-Month Periods

Ended September 30, 2013 and 2012

| Page | ||||

| Part I. |

||||

| Item 1. |

4 | |||

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

17 | ||

| Item 3. |

28 | |||

| Item 4. |

29 | |||

| Part II. |

||||

| Item 6. |

30 | |||

| 31 | ||||

| 32 | ||||

2

Table of Contents

GRAHAM CORPORATION AND SUBSIDIARIES

FORM 10-Q

September 30, 2013

PART I - FINANCIAL INFORMATION

3

Table of Contents

| Item 1. | Unaudited Condensed Consolidated Financial Statements |

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND RETAINED EARNINGS

(Unaudited)

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||||||||

| September 30, | September 30, | |||||||||||||||||||||||||||||||||

| 2013 |

2012 |

2013 |

2012 |

|||||||||||||||||||||||||||||||

| (Amounts in thousands, except per share data) | ||||||||||||||||||||||||||||||||||

| Net sales |

$ | 24,490 | $ | 25,902 | $ | 52,746 | $ | 48,435 | ||||||||||||||||||||||||||

| Cost of products sold |

16,201 | 17,989 | 34,442 | 34,286 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Gross profit |

8,289 | 7,913 | 18,304 | 14,149 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Other expenses and income: |

||||||||||||||||||||||||||||||||||

| Selling, general and administrative |

4,393 | 4,379 | 8,739 | 8,407 | ||||||||||||||||||||||||||||||

| Selling, general and administrative - amortization |

56 | 57 | 113 | 113 | ||||||||||||||||||||||||||||||

| Interest income |

(10 | ) | (14 | ) | (21 | ) | (25 | ) | ||||||||||||||||||||||||||

| Interest expense |

4 | (370 | ) | 9 | (290 | ) | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Total other expenses and income |

4,443 | 4,052 | 8,840 | 8,205 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Income before provision for income taxes |

3,846 | 3,861 | 9,464 | 5,944 | ||||||||||||||||||||||||||||||

| Provision for income taxes |

1,257 | 1,246 | 3,067 | 1,939 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Net income |

2,589 | 2,615 | 6,397 | 4,005 | ||||||||||||||||||||||||||||||

| Retained earnings at beginning of period |

88,139 | 75,573 | 84,632 | 74,383 | ||||||||||||||||||||||||||||||

| Dividends |

(302 | ) | (199 | ) | (603 | ) | (399 | ) | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Retained earnings at end of period |

$ | 90,426 | $ | 77,989 | $ | 90,426 | $ | 77,989 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Per share data: |

||||||||||||||||||||||||||||||||||

| Basic: |

||||||||||||||||||||||||||||||||||

| Net income |

$.26 | $.26 | $.64 | $.40 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Diluted: |

||||||||||||||||||||||||||||||||||

| Net income |

$.26 | $.26 | $.63 | $.40 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Weighted average common shares outstanding: |

||||||||||||||||||||||||||||||||||

| Basic: |

10,062 | 10,031 | 10,060 | 10,017 | ||||||||||||||||||||||||||||||

| Diluted: |

10,104 | 10,054 | 10,095 | 10,041 | ||||||||||||||||||||||||||||||

| Dividends declared per share |

$.03 | $.02 | $.06 | $.04 | ||||||||||||||||||||||||||||||

See Notes to Condensed Consolidated Financial Statements.

4

Table of Contents

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||||||||

| September 30, | September 30, | |||||||||||||||||||||||||||||||||

| 2013 |

2012 |

2013 |

2012 |

|||||||||||||||||||||||||||||||

| (Amounts in thousands) | ||||||||||||||||||||||||||||||||||

| Net income |

$2,589 | $2,615 | $6,397 | $4,005 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Other comprehensive income: |

||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment |

38 | 3 | 45 | (12 | ) | |||||||||||||||||||||||||||||

| Defined benefit pension and other postretirement plans net of income tax of $78 and $78 for the three months ended September 30, 2013 and 2012, respectively, and $156 and $157 for the six months ended September 30, 2013 and 2012, respectively |

143 | 144 | 286 | 287 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Total other comprehensive income |

181 | 147 | 331 | 275 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Total comprehensive income |

$2,770 | $2,762 | $6,728 | $4,280 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

See Notes to Condensed Consolidated Financial Statements.

5

Table of Contents

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| September 30, | March 31, | |||||||||

| 2013 |

2013 |

|||||||||

| (Amounts in thousands, except per share data) | ||||||||||

| Assets |

||||||||||

| Current assets: |

||||||||||

| Cash and cash equivalents |

$22,862 | $24,194 | ||||||||

| Investments |

31,999 | 27,498 | ||||||||

| Trade accounts receivable, net of allowances ($39 and $33 at September 30 and March 31, 2013, respectively) |

13,946 | 9,440 | ||||||||

| Unbilled revenue |

9,510 | 13,113 | ||||||||

| Inventories |

11,222 | 11,171 | ||||||||

| Prepaid expenses and other current assets |

1,226 | 783 | ||||||||

| Income taxes receivable |

2,067 | 2,635 | ||||||||

| Deferred income tax asset |

87 |

69 |

||||||||

| Total current assets |

92,919 | 88,903 | ||||||||

| Property, plant and equipment, net |

13,239 | 13,288 | ||||||||

| Prepaid pension asset |

2,745 | 2,349 | ||||||||

| Goodwill |

6,938 | 6,938 | ||||||||

| Permits |

10,300 | 10,300 | ||||||||

| Other intangible assets, net |

4,698 | 4,788 | ||||||||

| Other assets |

11 |

167 |

||||||||

| Total assets |

$130,850 |

$126,733 |

||||||||

| Liabilities and stockholders’ equity |

||||||||||

| Current liabilities: |

||||||||||

| Current portion of capital lease obligations |

$85 | $87 | ||||||||

| Accounts payable |

7,563 | 9,429 | ||||||||

| Accrued compensation |

5,141 | 5,018 | ||||||||

| Accrued expenses and other current liabilities |

2,906 | 3,051 | ||||||||

| Customer deposits |

5,662 | 6,919 | ||||||||

| Deferred income tax liability |

378 |

373 |

||||||||

| Total current liabilities |

21,735 | 24,877 | ||||||||

| Capital lease obligations |

85 | 127 | ||||||||

| Accrued compensation |

315 | 308 | ||||||||

| Deferred income tax liability |

7,374 | 7,131 | ||||||||

| Accrued pension liability |

250 | 227 | ||||||||

| Accrued postretirement benefits |

939 | 923 | ||||||||

| Other long-term liabilities |

149 |

145 |

||||||||

| Total liabilities |

30,847 |

33,738 |

||||||||

| Commitments and contingencies (Note 11) |

||||||||||

| Stockholders’ equity: |

||||||||||

| Preferred stock, $1.00 par value - |

||||||||||

| Authorized, 500 shares |

||||||||||

| Common stock, $.10 par value - |

||||||||||

| Authorized, 25,500 shares |

||||||||||

| Issued, 10,376 and 10,331 shares at September 30 and March 31, 2013, respectively |

1,038 | 1,033 | ||||||||

| Capital in excess of par value |

19,398 | 18,596 | ||||||||

| Retained earnings |

90,426 | 84,632 | ||||||||

| Accumulated other comprehensive loss |

(7,702) | (8,033) | ||||||||

| Treasury stock, 317 and 327 shares at September 30 and March 31, 2013, respectively |

(3,157) |

(3,233) |

||||||||

| Total stockholders’ equity |

100,003 |

92,995 |

||||||||

| Total liabilities and stockholders’ equity |

$130,850 |

$126,733 |

||||||||

See Notes to Condensed Consolidated Financial Statements.

6

Table of Contents

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Six Months Ended September 30, | ||||||||||||||||

| 2013 |

2012 |

|||||||||||||||

| (Amounts in thousands) | ||||||||||||||||

| Operating activities: |

||||||||||||||||

| Net income |

$ | 6,397 | $ | 4,005 | ||||||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||||||||||

| Depreciation |

986 | 927 | ||||||||||||||

| Amortization |

113 | 113 | ||||||||||||||

| Amortization of unrecognized prior service cost and actuarial losses |

442 | 444 | ||||||||||||||

| Discount accretion on investments |

(4 | ) | (6 | ) | ||||||||||||

| Stock-based compensation expense |

342 | 319 | ||||||||||||||

| Loss on disposal of property, plant and equipment |

- | (1 | ) | |||||||||||||

| Deferred income taxes |

220 | (58 | ) | |||||||||||||

| (Increase) decrease in operating assets: |

||||||||||||||||

| Accounts receivable |

(4,596 | ) | 40 | |||||||||||||

| Unbilled revenue |

3,640 | 2,909 | ||||||||||||||

| Inventories |

139 | (3,623 | ) | |||||||||||||

| Prepaid expenses and other current and non-current assets |

(457 | ) | (145 | ) | ||||||||||||

| Prepaid pension asset |

(397 | ) | (384 | ) | ||||||||||||

| Increase (decrease) in operating liabilities: |

||||||||||||||||

| Accounts payable |

(1,938 | ) | 2,233 | |||||||||||||

| Accrued compensation, accrued expenses and other current and non-current liabilities |

135 | 35 | ||||||||||||||

| Customer deposits |

(1,343 | ) | (1,765 | ) | ||||||||||||

| Income taxes payable/receivable |

568 | 1,186 | ||||||||||||||

| Long-term portion of accrued compensation, accrued pension liability and accrued postretirement benefits |

46 | 15 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Net cash provided by operating activities |

4,293 | 6,244 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Investing activities: |

||||||||||||||||

| Purchase of property, plant and equipment |

(898 | ) | (578 | ) | ||||||||||||

| Proceeds from disposal of property, plant and equipment |

- | 4 | ||||||||||||||

| Purchase of investments |

(54,997 | ) | (33,494 | ) | ||||||||||||

| Redemption of investments at maturity |

50,500 | 27,500 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Net cash used by investing activities |

(5,395 | ) | (6,568 | ) | ||||||||||||

|

|

|

|

|

|||||||||||||

| Financing activities: |

||||||||||||||||

| Principal repayments on capital lease obligations |

(44 | ) | (41 | ) | ||||||||||||

| Issuance of common stock |

259 | 14 | ||||||||||||||

| Dividends paid |

(603 | ) | (399 | ) | ||||||||||||

| Excess tax benefit (deficiency) on stock awards |

119 | (5 | ) | |||||||||||||

|

|

|

|

|

|||||||||||||

| Net cash used by financing activities |

(269 | ) | (431 | ) | ||||||||||||

|

|

|

|

|

|||||||||||||

| Effect of exchange rate changes on cash |

39 | (11 | ) | |||||||||||||

|

|

|

|

|

|||||||||||||

| Net decrease in cash and cash equivalents |

(1,332 | ) | (766 | ) | ||||||||||||

| Cash and cash equivalents at beginning of period |

24,194 | 25,189 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Cash and cash equivalents at end of period |

$ | 22,862 | $ | 24,423 | ||||||||||||

|

|

|

|

|

|||||||||||||

See Notes to Condensed Consolidated Financial Statements.

7

Table of Contents

GRAHAM CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(Amounts in thousands, except per share data)

NOTE 1 – BASIS OF PRESENTATION:

Graham Corporation’s (the “Company’s”) Condensed Consolidated Financial Statements include (i) its wholly-owned foreign subsidiary located in China and (ii) its wholly-owned domestic subsidiary located in Lapeer, Michigan. The Condensed Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the U.S. (“GAAP”) for interim financial information and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X, each as promulgated by the Securities and Exchange Commission. The Company’s Condensed Consolidated Financial Statements do not include all information and notes required by GAAP for complete financial statements. The unaudited Condensed Consolidated Balance Sheet as of March 31, 2013 presented herein was derived from the Company’s audited Consolidated Balance Sheet as of March 31, 2013. For additional information, please refer to the consolidated financial statements and notes included in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2013 (“fiscal 2013”). In the opinion of management, all adjustments, including normal recurring accruals considered necessary for a fair presentation, have been included in the Company’s Condensed Consolidated Financial Statements.

The Company’s results of operations and cash flows for the three and six months ended September 30, 2013 are not necessarily indicative of the results that may be expected for the fiscal year ending March 31, 2014 (“fiscal 2014”).

NOTE 2 – REVENUE RECOGNITION:

The Company recognizes revenue on all contracts with a planned manufacturing process in excess of four weeks (which approximates 575 direct labor hours) using the percentage-of-completion method. The majority of the Company’s revenue is recognized under this methodology. The percentage-of-completion method is determined by comparing actual labor incurred to a specific date to management’s estimate of the total labor to be incurred on each contract. Contracts in progress are reviewed monthly, and sales and earnings are adjusted in current accounting periods based on revisions in the contract value and estimated costs at completion. Losses on contracts are recognized immediately when evident. There is no reserve for credit losses related to unbilled revenue recorded for contracts accounted for on the percentage-of-completion method. Any reserve for credit losses related to unbilled revenue is recorded as a reduction to revenue.

Revenue on contracts not accounted for using the percentage-of-completion method is recognized utilizing the completed contract method. The majority of the Company’s contracts (as opposed to revenue) have a planned manufacturing process of less than four weeks and the results reported under this method do not vary materially from the percentage-of-completion method. The Company recognizes revenue and all related costs on these contracts upon substantial completion or shipment to the customer. Substantial completion is consistently defined as at least 95% complete with regard to direct labor hours. Customer acceptance is generally required throughout the construction process and the Company has no further material obligations under its contracts after the revenue is recognized.

8

Table of Contents

NOTE 3 – INVESTMENTS:

Investments consist solely of fixed-income debt securities issued by the U.S. Treasury with original maturities of greater than three months and less than one year. All investments are classified as held-to-maturity, as the Company has the intent and ability to hold the securities to maturity. The investments are stated at amortized cost which approximates fair value. All investments held by the Company at September 30, 2013 are scheduled to mature on or before January 9, 2014.

NOTE 4 – INVENTORIES:

Inventories are stated at the lower of cost or market, using the average cost method. For contracts accounted for on the completed contract method, progress payments received are netted against inventory to the extent the payment is less than the inventory balance relating to the applicable contract. Progress payments that are in excess of the corresponding inventory balance are presented as customer deposits in the Condensed Consolidated Balance Sheets. Unbilled revenue in the Condensed Consolidated Balance Sheets represents revenue recognized that has not been billed to customers on contracts accounted for on the percentage-of-completion method. For contracts accounted for on the percentage–of–completion method, progress payments are netted against unbilled revenue to the extent the payment is less than the unbilled revenue for the applicable contract. Progress payments exceeding unbilled revenue are netted against inventory to the extent the payment is less than or equal to the inventory balance relating to the applicable contract, and the excess is presented as customer deposits in the Condensed Consolidated Balance Sheets.

Major classifications of inventories are as follows:

| September 30, 2013 |

March 31, 2013 | |||||||||

| Raw materials and supplies |

$ 2,599 | $ 2,865 | ||||||||

| Work in process |

11,838 | 13,470 | ||||||||

| Finished products |

559 | 572 | ||||||||

|

|

|

|

|

|||||||

| 14,996 | 16,907 | |||||||||

| Less - progress payments |

3,774 | 5,736 | ||||||||

|

|

|

|

|

|||||||

| Total |

$11,222 | $11,171 | ||||||||

|

|

|

|

|

|||||||

9

Table of Contents

NOTE 5 – INTANGIBLE ASSETS:

Intangible assets are comprised of the following:

| Gross Carrying Amount |

Accumulated Amortization |

Net Carrying Amount | |||||||||||||

| At September 30, 2013 |

|||||||||||||||

| Intangibles subject to amortization: |

|||||||||||||||

| Backlog |

$ | 170 | $ | 170 | $ | - | |||||||||

| Customer relationships |

2,700 | 502 | 2,198 | ||||||||||||

|

|

|

|

|

|

|

||||||||||

| $ | 2,870 | $ | 672 | $ | 2,198 | ||||||||||

|

|

|

|

|

|

|

||||||||||

| Intangibles not subject to amortization: |

|||||||||||||||

| Permits |

$ | 10,300 | $ | - | $ | 10,300 | |||||||||

| Tradename |

2,500 | - | 2,500 | ||||||||||||

|

|

|

|

|

|

|

||||||||||

| $ | 12,800 | $ | - | $ | 12,800 | ||||||||||

|

|

|

|

|

|

|

||||||||||

| At March 31, 2013 |

|||||||||||||||

| Intangibles subject to amortization: |

|||||||||||||||

| Backlog |

$ | 170 | $ | 170 | $ | - | |||||||||

| Customer relationships |

2,700 | 412 | 2,288 | ||||||||||||

|

|

|

|

|

|

|

||||||||||

| $ | 2,870 | $ | 582 | $ | 2,288 | ||||||||||

|

|

|

|

|

|

|

||||||||||

| Intangibles not subject to amortization: |

|||||||||||||||

| Permits |

$ | 10,300 | $ | - | $ | 10,300 | |||||||||

| Tradename |

2,500 | - | 2,500 | ||||||||||||

|

|

|

|

|

|

|

||||||||||

| $ | 12,800 | $ | - | $ | 12,800 | ||||||||||

|

|

|

|

|

|

|

||||||||||

Intangible assets are amortized on a straight line basis over their estimated useful lives. Intangible amortization expense for each of the three-month periods ended September 30, 2013 and 2012 was $45. Intangible amortization expense for each of the six months ended September 30, 2013 and 2012 was $90. As of September 30, 2013, amortization expense is estimated to be $90 for the remainder of fiscal 2014 and $180 in each of the fiscal years ending March 31, 2015, 2016, 2017 and 2018.

NOTE 6 – STOCK-BASED COMPENSATION:

The Amended and Restated 2000 Graham Corporation Incentive Plan to Increase Shareholder Value provides for the issuance of up to 1,375 shares of common stock in connection with grants of incentive stock options, non-qualified stock options, stock awards and performance awards to officers, key employees and outside directors; provided, however, that no more than 250 shares of common stock may be used for awards other than stock options. Stock options may be granted at prices not less than the fair market value at the date of grant and expire no later than ten years after the date of grant.

10

Table of Contents

There were no stock option awards granted in the three months ended September 30, 2013 and 2012. Stock option awards granted in the six months ended September 30, 2013 and 2012 were 0 and 49, respectively. The stock option awards granted in fiscal 2013 vest 33 1⁄3% per year over a three-year term and have a term of ten years from their grant date.

There were no restricted stock awards granted in the three-month periods ended September 30, 2013 and 2012. Restricted stock awards granted in the six-month periods ended September 30, 2013 and 2012 were 32 and 26, respectively. Performance-vested restricted stock awards of 14 and 18 granted to officers in fiscal 2014 and fiscal 2013, respectively, vest 100% on the third anniversary of the grant date, subject to the satisfaction of the performance metrics for the applicable three-year period. Time-vested restricted stock awards of 12 granted to officers and key employees in fiscal 2014 vest 33 1⁄3% per year over a three-year period. Time-vested restricted stock awards of 6 and 8 granted to directors in fiscal 2014 and fiscal 2013, respectively, vest 100% on the first anniversary of the grant date.

During the three months ended September 30, 2013 and 2012, the Company recognized stock-based compensation costs related to stock option and restricted stock awards of $134 and $136, respectively. The income tax benefit recognized related to stock-based compensation was $47 and $48 for the three months ended September 30, 2013 and 2012, respectively. During the six months ended September 30, 2013 and 2012, the Company recognized stock-based compensation costs related to stock option and restricted stock awards of $314 and $292, respectively. The income tax benefit recognized related to stock-based compensation was $110 and $103 for the six months ended September 30, 2013 and 2012, respectively.

The Company has an Employee Stock Purchase Plan (the “ESPP”), which allows eligible employees to purchase shares of the Company’s common stock on the last day of a six-month offering period at a purchase price equal to the lesser of 85% of the fair market value of the common stock on either the first day or the last day of the offering period. A total of 200 shares of common stock were authorized for purchase under the ESPP. During the three months ended September 30, 2013 and 2012, the Company recognized stock-based compensation costs of $13 and $11, respectively, related to the ESPP and $4 and $4, respectively, of related tax benefits. During the six months ended September 30, 2013 and 2012, the Company recognized stock-based compensation costs of $28 and $26, respectively, related to the ESPP and $9 and $8, respectively, of related tax benefits.

NOTE 7 – INCOME PER SHARE:

Basic income per share is computed by dividing net income by the weighted average number of common shares outstanding for the period. Common shares outstanding include share equivalent units, which are contingently issuable shares. Diluted income per share is calculated by dividing net income by the weighted average number of common shares outstanding and, when applicable, potential common shares outstanding during the period. A reconciliation of the numerators and denominators of basic and diluted income per share is presented below:

11

Table of Contents

| Three Months Ended September 30, |

Six Months Ended September 30, | |||||||||||||||||||||||||||||||

| 2013 |

2012 |

2013 |

2012 |

|||||||||||||||||||||||||||||

| Basic income per share |

||||||||||||||||||||||||||||||||

| Numerator: |

||||||||||||||||||||||||||||||||

| Net income |

$ | 2,589 | $ | 2,615 | $ | 6,397 | $ | 4,005 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Denominator: |

||||||||||||||||||||||||||||||||

| Weighted common shares outstanding |

10,051 | 9,988 | 10,033 | 9,975 | ||||||||||||||||||||||||||||

| Share equivalent units (“SEUs”) |

11 | 43 | 27 | 42 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Weighted average common shares and SEUs |

10,062 | 10,031 | 10,060 | 10,017 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Basic income per share |

$.26 | $.26 | $.64 | $.40 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Diluted income per share |

||||||||||||||||||||||||||||||||

| Numerator: |

||||||||||||||||||||||||||||||||

| Net income |

$ | 2,589 | $ | 2,615 | $ | 6,397 | $ | 4,005 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Denominator: |

||||||||||||||||||||||||||||||||

| Weighted average shares and SEUs outstanding |

10,062 | 10,031 | 10,060 | 10,017 | ||||||||||||||||||||||||||||

| Stock options outstanding |

42 | 23 | 35 | 24 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Weighted average common and potential common shares outstanding |

10,104 | 10,054 | 10,095 | 10,041 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Diluted income per share |

$.26 | $.26 | $.63 | $.40 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

Options to purchase a total of 2 and 71 shares of common stock were outstanding at September 2013 and 2012, respectively, but were not included in the above computation of diluted income per share given their exercise prices as they would be anti-dilutive upon issuance.

NOTE 8 – PRODUCT WARRANTY LIABILITY:

The reconciliation of the changes in the product warranty liability is as follows:

| Three Months Ended September 30, |

Six Months Ended September 30, | |||||||||||||||

| 2013 |

2012 |

2013 |

2012 | |||||||||||||

| Balance at beginning of period |

$331 | $194 | $408 | $215 | ||||||||||||

| Expense (income) for product warranties |

78 | (3) | 58 | 8 | ||||||||||||

| Product warranty claims paid |

(110) |

(17) |

(167) |

(49) | ||||||||||||

| Balance at end of period |

$299 |

$174 |

$299 |

$174 | ||||||||||||

The income of $3 for product warranties in the three months ended September 30, 2012 resulted from the reversal of provisions made that were no longer required due to lower claims experience.

The product warranty liability is included in the line item “Accrued expenses and other current liabilities” in the Condensed Consolidated Balance Sheets.

12

Table of Contents

NOTE 9 - CASH FLOW STATEMENT:

Interest paid was $6 and $52 for the six-month periods ended September 30, 2013 and 2012, respectively. In addition, income taxes paid for the six months ended September 30, 2013 and 2012 were $2,161 and $39, respectively.

During the six months ended September 30, 2013 and 2012, respectively, stock option awards were exercised and restricted stock awards vested. In connection with such stock option exercises and vesting, the related income tax benefit realized exceeded (reduced) the tax benefit that had been recorded pertaining to the compensation cost recognized by $119 and $(5), respectively, for such periods. This excess tax benefit (deficiency) has been separately reported under “Financing activities” in the Condensed Consolidated Statements of Cash Flows.

At September 30, 2013 and 2012, respectively, there were $38 and $24 of capital purchases that were recorded in accounts payable and are not included in the caption “Purchase of property, plant and equipment” in the Condensed Consolidated Statements of Cash Flows. In the six months ended September 30, 2013 and 2012, capital expenditures totaling $0 and $11, respectively, were financed through the issuance of capital leases.

NOTE 10 – EMPLOYEE BENEFIT PLANS:

The components of pension cost are as follows:

| Three Months Ended September 30, |

Six Months Ended September 30, | |||||||||||||||||||||||||||||||

| 2013 |

2012 |

2013 |

2012 |

|||||||||||||||||||||||||||||

| Service cost |

$ | 144 | $ | 136 | $ | 288 | $ | 272 | ||||||||||||||||||||||||

| Interest cost |

339 | 356 | 679 | 713 | ||||||||||||||||||||||||||||

| Expected returns on assets |

(682 | ) | (685 | ) | (1,364 | ) | (1,369 | ) | ||||||||||||||||||||||||

| Amortization of: |

||||||||||||||||||||||||||||||||

| Unrecognized prior service cost |

1 | 1 | 2 | 2 | ||||||||||||||||||||||||||||

| Actuarial loss |

251 | 254 | 501 | 506 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Net pension cost |

$ | 53 | $ | 62 | $ | 106 | $ | 124 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

The Company made no contributions to its defined benefit pension plan during the six months ended September 30, 2013 and does not expect to make any contributions to the plan for the balance of fiscal 2014.

13

Table of Contents

The components of the postretirement benefit income are as follows:

| Three Months Ended September 30, |

Six Months Ended September 30, | |||||||||||||||||||||||||||||||

| 2013 |

2012 |

2013 |

2012 |

|||||||||||||||||||||||||||||

| Service cost |

$ - | $ - | $ - | $ - | ||||||||||||||||||||||||||||

| Interest cost |

8 | 10 | 16 | 19 | ||||||||||||||||||||||||||||

| Amortization of prior service benefit |

(42 | ) | (42 | ) | (83 | ) | (83 | ) | ||||||||||||||||||||||||

| Amortization of actuarial loss |

11 | 9 | 22 | 19 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Net postretirement benefit income |

$(23 | ) | $(23 | ) | $(45 | ) | $(45 | ) | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

The Company paid benefits of $2 related to its postretirement benefit plan during the six months ended September 30, 2013. The Company expects to pay benefits of approximately $105 during the balance of fiscal 2014.

NOTE 11 – COMMITMENTS AND CONTINGENCIES:

The Company has been named as a defendant in certain lawsuits alleging personal injury from exposure to asbestos allegedly contained in products made by the Company. The Company is a co-defendant with numerous other defendants in these lawsuits and intends to vigorously defend itself against these claims. The claims are similar to previous asbestos suits that named the Company as defendant, which either were dismissed when it was shown that the Company had not supplied products to the plaintiffs’ places of work or were settled for immaterial amounts.

As of September 30, 2013, the Company was subject to the claims noted above, as well as other legal proceedings and potential claims that have arisen in the ordinary course of business.

Although the outcome of the lawsuits to which the Company is a party cannot be determined and an estimate of the reasonably possible loss or range of loss cannot be made, management does not believe that the outcomes, either individually or in the aggregate, will have a material effect on the Company’s results of operations, financial position or cash flows.

NOTE 12 – INCOME TAXES:

The Company files federal and state income tax returns in several domestic and international jurisdictions. In most tax jurisdictions, returns are subject to examination by the relevant tax authorities for a number of years after the returns have been filed. During fiscal 2012, the Company reached a resolution with the U.S. Internal Revenue Service (the “IRS”) with regard to the research and development tax credits claimed during tax years 2006 through 2008. As a result of such resolution, the tax credits claimed during such years were reduced by approximately 40% and interest was assessed on the underpayment of tax. During fiscal 2013, the Company reached a resolution with the IRS that reduced the research and development tax credits claimed during tax years 2009 and 2010 by approximately 30%. In addition, in fiscal 2013, the Company paid all settlement amounts to the IRS for tax years 2006 through 2010.

14

Table of Contents

The liability for unrecognized tax benefits related to research and development tax credits was $134 at each of September 30, 2013 and March 31, 2013. The Company had one additional unrecognized tax benefit of $882 as of March 31, 2012 which was resolved with the IRS during the three months ended June 30, 2012, resulting in a reversal of the liability.

The Company is subject to examination in federal and state tax jurisdictions for tax years 2011 through 2012 and tax years 2008 through 2012, respectively. The Company is subject to examination in the People’s Republic of China for tax years 2010 through 2012. It is the Company’s policy to recognize any interest related to uncertain tax positions in interest expense and any penalties related to uncertain tax positions in selling, general and administrative expense. During the three and six months ended September 30, 2013, the Company recorded $2 and $4, respectively, for interest related to its uncertain tax positions. During the three months ended September 30, 2012, the Company reversed provisions that had been made in previous periods for interest related to its uncertain tax positions of $387 due to lower interest assessments by the IRS than expected. Including this reversal, the Company recorded $(325) for interest related to its uncertain tax positions during the six months ended September 30, 2012. No penalties related to uncertain tax positions were recorded in the three-month or six-month periods ended September 30, 2013 or 2012.

In September 2013, the IRS issued final regulations affecting costs to acquire, produce, or improve tangible property and re-proposed regulations affecting dispositions of tangible property. The final regulations are effective for taxable years beginning on or after January 1, 2014. The Company has evaluated the final regulations and does not expect the adoption of the regulations to have a material impact on its consolidated financial statements.

NOTE 13 – CHANGES IN ACCUMULATED OTHER COMPREHENSIVE LOSS:

The changes in accumulated other comprehensive loss by component for the six months ended September 30, 2013 are as follows:

| Pension and Other Postretirement Benefit Items |

Foreign Currency Items |

Total | |||||||||||||

| Balance at April 1, 2013 |

$ | (8,443 | ) | $ | 410 | $ | (8,033 | ) | |||||||

| Other comprehensive income before reclassifications |

- | 45 | 45 | ||||||||||||

| Amounts reclassified from accumulated other comprehensive loss |

286 | - | 286 | ||||||||||||

|

|

|

|

|

|

|

||||||||||

| Net current-period other comprehensive income |

286 | 45 | 331 | ||||||||||||

|

|

|

|

|

|

|

||||||||||

| Balance at September 30, 2013 |

$ | (8,157 | ) | $ | 455 | $ | (7,702 | ) | |||||||

|

|

|

|

|

|

|

||||||||||

The reclassifications out of accumulated other comprehensive loss by component for the three and six months ended September 30, 2013 are as follows:

| Details about Accumulated Other Comprehensive Loss Components |

Amount Reclassified from Accumulated Other Comprehensive Loss |

Affected Line Item in the Condensed Consolidated Statements of Operations and Retained Earnings | ||||||||||||||

| Three Months Ended September 30, 2013 |

Six Months Ended September 30, 2013 |

|||||||||||||||

| Pension and other postretirement benefit items: |

||||||||||||||||

| Amortization of unrecognized prior service benefit |

$ 41 | $ 81 | (1) | |||||||||||||

| Amortization of actuarial loss |

(262 | ) | (523 | )(1) | ||||||||||||

|

|

|

|

|

|||||||||||||

| (221 | ) | (442 | ) | Income before provision for income taxes | ||||||||||||

| (78 | ) | (156 | ) | Provision for income taxes | ||||||||||||

|

|

|

|

|

|||||||||||||

| $(143 | ) | $(286 | ) | Net income | ||||||||||||

|

|

|

|

|

|||||||||||||

| (1) | These accumulated other comprehensive loss components are included within the computation of net periodic pension and other postretirement benefit costs. See Note 10. |

15

Table of Contents

NOTE 14 – ACCOUNTING AND REPORTING CHANGES:

In the normal course of business, management evaluates all new accounting pronouncements issued by the Financial Accounting Standards Board (“FASB”), the Securities and Exchange Commission, the Emerging Issues Task Force, the American Institute of Certified Public Accountants or any other authoritative accounting body to determine the potential impact they may have on the Company’s consolidated financial statements.

In July 2012, the FASB amended its guidance related to periodic testing of indefinite-lived intangible assets for impairment. The amended guidance is intended to reduce cost and complexity by providing an entity with the option to make a qualitative assessment about the likelihood that an indefinite-lived intangible asset is impaired to determine whether it should perform a quantitative impairment test. The guidance also enhances the consistency of impairment testing among long-lived asset categories by permitting an entity to assess qualitative factors to determine whether it is necessary to calculate the asset’s fair value when testing an indefinite-lived intangible asset for impairment, which is equivalent to the impairment testing requirements for other long-lived assets. In accordance with the guidance, an entity will have an option not to calculate annually the fair value of an indefinite-lived intangible asset if the entity determines that it is not more-likely-than-not that the asset is impaired. The provisions of the amended guidance are effective for annual and interim impairment tests performed for fiscal years beginning after September 15, 2012. The Company will perform its annual impairment testing of indefinite-lived intangible assets pursuant to this guidance during the third quarter of fiscal 2014. The adoption of the amended guidance is not expected to have a material impact on its consolidated financial statements.

In February 2013, the FASB issued guidance related to the disclosure of amounts reclassified out of accumulated other comprehensive income. This guidance adds new disclosure requirements either in a single note or parenthetically on the face of the financial statements, the effect of significant amounts reclassified from each component of accumulated other comprehensive income (“AOCI”) based on its source and the income statement line items affected by the reclassification. This guidance gives companies the flexibility to present the information either in the notes or parenthetically on the face of the financial statements, provided that all of the required information is presented in a single location. This guidance is effective prospectively for annual and interim reporting periods beginning after December 15, 2012. The Company adopted this guidance during the first quarter of fiscal 2014 and such adoption did not have a material impact on the Company’s Condensed Consolidated Financial Statements as it only changed the disclosures surrounding AOCI (See Note 13).

Management does not expect any other recently issued accounting pronouncements, which have not already been adopted, to have a material impact on the Company’s consolidated financial statements.

16

Table of Contents

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

(Dollar amounts in thousands, except per share data)

Overview

We are a global business that designs, manufactures and sells equipment that is critical to the energy industry, which includes the oil refining, petrochemical, cogeneration, nuclear and alternative power markets. With world-renowned engineering expertise in vacuum and heat transfer technology and extensive nuclear code accredited fabrication and specialty machining experience, we design and manufacture custom-engineered ejectors, pumps, surface condensers and vacuum systems as well as supplies and components for utilization both inside the reactor vessel and outside the containment vessel of nuclear power facilities. Our equipment is also used in nuclear propulsion power systems for the defense industry and can be found in other diverse applications such as metal refining, pulp and paper processing, water heating, refrigeration, desalination, food processing, pharmaceutical, heating, ventilating and air conditioning.

Our corporate headquarters is located in Batavia, New York and we have production facilities in both Batavia, New York and at our wholly-owned subsidiary, Energy Steel & Supply Co. (“Energy Steel”), located in Lapeer, Michigan. We also have a wholly-owned foreign subsidiary, Graham Vacuum and Heat Transfer Technology (Suzhou) Co., Ltd. (“GVHTT”), located in Suzhou, China, which supports sales orders from China and provides engineering support and supervision of subcontracted fabrication.

Highlights

Highlights for the three and six months ended September 30, 2013 (the fiscal year ending March 31, 2014 is referred to as “fiscal 2014”) include:

| • | Net sales for the second quarter of fiscal 2014 were $24,490, a decrease of 5% compared with $25,902 for the second quarter of the fiscal year ended March 31, 2013, referred to as “fiscal 2013.” Net sales for the first six months of fiscal 2014 were $52,746, up 9% compared with net sales of $48,435 for the first six months of fiscal 2013. |

| • | Net income and income per diluted share for the second quarter of fiscal 2014 were $2,589 and $0.26, compared with net income of $2,615 and income per diluted share of $0.26 for the second quarter of fiscal 2013. Net income and income per diluted share for the first six months of fiscal 2014 were $6,397 and $0.63, respectively, compared with net income of $4,005 and income per diluted share of $0.40 for the first six months of fiscal 2013. |

| • | Orders booked in the second quarter of fiscal 2014 were $48,425, up 89% compared with the second quarter of fiscal 2013, when orders were $25,619. Orders booked in the first six months of fiscal 2014 were $81,208, up 79% compared with the first six months of fiscal 2013, when orders were $45,340. |

| • | Backlog increased to a record high of $114,392 on September 30, 2013, compared with $90,382 on June 30, 2013 and $85,768 on March 31, 2013. |

17

Table of Contents

| • | Gross profit margin and operating margin for the second quarter of fiscal 2014 were 34% and 16%, compared with 31% and 13%, respectively, for the second quarter of fiscal 2013. Gross profit margin and operating margin for the first six months of fiscal 2014 were 35% and 18% compared with 29% and 12%, respectively, for the first six months of fiscal 2013. |

| • | Cash and cash equivalents and investments at September 30, 2013 were $54,861, compared with $53,192 on June 30, 2013 and $51,692 at March 31, 2013. |

Forward-Looking Statements

This report and other documents we file with the Securities and Exchange Commission include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

These statements involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any future results implied by the forward-looking statements. Such factors include, but are not limited to, the risks and uncertainties identified by us under the heading “Risk Factors” in Item 1A of our Annual Report on Form 10-K for fiscal 2013.

Forward-looking statements may also include, but are not limited to, statements about:

| • | the current and future economic environments affecting us and the markets we serve; |

| • | expectations regarding investments in new projects by our customers; |

| • | sources of revenue and anticipated revenue, including the contribution from the growth of new products, services and markets; |

| • | expectations regarding achievement of revenue and profitability expectations; |

| • | plans for future products and services and for enhancements to existing products and services; |

| • | our operations in foreign countries; |

| • | our ability to continue to pursue our acquisition and growth strategy; |

| • | our ability to expand nuclear power work, including into new markets; |

| • | our ability to successfully execute our existing contracts; |

| • | estimates regarding our liquidity and capital requirements; |

| • | timing of conversion of backlog to sales; |

| • | our ability to attract or retain customers; |

| • | the outcome of any existing or future litigation; and |

| • | our ability to increase our productivity and capacity. |

Forward-looking statements are usually accompanied by words such as “anticipate,” “believe,” “estimate,” “may,” “might,” “intend,” “interest,” “appear,” “expect,” “suggest,” “plan,” “encourage,” “potential,” and similar expressions. Actual results could differ materially from historical results or those implied by the forward-looking statements contained in this report.

18

Table of Contents

Undue reliance should not be placed on our forward-looking statements. Except as required by law, we undertake no obligation to update or announce any revisions to forward-looking statements contained in this report, whether as a result of new information, future events or otherwise.

Current Market Conditions

We have continued to see strong bidding activity during the first half of fiscal 2014. We believe that bidding activity is a leading indicator of the direction and health of our markets. We believe the business environment is continuing to improve and that our customers are becoming more inclined to procure the equipment needed for their projects. This supports our belief that the oil refining, petrochemical and related markets we serve are continuing to move toward a stronger part of the business cycle. The current activity level within our pipeline continues to be more positive than in the past few years.

We believe the following demand trends that are influencing our customers’ investments include:

| • | Lower natural gas cost and a significant increase in supply has occurred over the past few years and has been driven by technology advancements in drilling. The dramatic change in natural gas costs and expectation of steady supply in the U.S. has led to a revival in the U.S. petrochemical market and recent movements toward potential major investment. There are numerous projects in planning, initial engineering, or construction phases for the new petrochemical producing facilities, including ethylene, methanol, ammonia and urea facilities. In addition, existing petrochemical facilities are evaluating restarting idled process units or debottlenecking existing operations to increase throughput. We currently have a number of these projects in our pipeline and have begun to add new orders into backlog associated with the North American petrochemical/chemical markets. We historically have had strong market share within U.S. petrochemical facilities. Lower natural gas cost has also made the U.S. production of ethane, which is a by-product of natural gas production, favorably competitive with naphtha, which is a by-product of crude oil refining, as a feedstock for ethylene production. Proposed ethylene capacity expansion and re-opening of mothballed facilities in the U.S., as well as downstream products, are being discussed by petrochemical producers for the first time in well over a decade. We believe investment in U.S. petrochemical markets could be significant over the next several years. |

| • | The U.S. refining market has recently exhibited improvement. We do not expect this market to return to the order levels experienced during the last upcycle, but anticipate that this market will improve compared with its order levels over the past few years. We expect that the U.S. refining markets will continue to be an important aspect of our business. |

| • | We are beginning to see renewed signs of planned investments in the U.S. to convert greater percentages of crude oil to transportation fuels, such as revamping distillation columns to extract residual higher-value components from the low-value waste stream. We are also seeing renewed investment to expand the flexibility of facilities to allow them to utilize multiple feed stocks. Moreover, a trend to upgrade existing equipment in order to extend on-stream operation duration between planned shutdowns has emerged which has resulted in an increase in demand for our equipment. |

| • | Investments, including foreign investments, in North American oil sands extraction projects have occurred over the past few years. These investments suggest that downstream spending involving our equipment might increase in the next several years. |

19

Table of Contents

| • | The expansion of the economies of oil-producing Middle Eastern countries, their desire to extract greater value from their oil and gas resources, and the continued global growth in demand for oil and refined products has renewed investment activity in that region. Moreover, the planned timeline of refinery and petrochemical projects in the major oil-producing Middle Eastern countries is encouraging. |

| • | Emerging economies, especially in Asia, continue to have relatively strong economic growth. We believe that this expansion is driving growing energy requirements and the need for more energy and energy related products. In most countries, such as India for example, renewed demand for energy products such as transportation fuel and consumer products derived from petrochemicals is spurring demand. This renewed demand is driving increased investment in petrochemical and refining capacity. |

| • | Although China has many of the characteristics of other Asian countries, there appears to be a near-term slowdown in spending in the refining and petrochemical markets as the government is moderating its near-term investment to attempt to control inflation. A number of projects, which were expected to move forward in the first half of this fiscal year, have been pushed out six to twelve months. This appears to be a delay in projects moving forward rather than project cancellations. Moreover, the Chinese government’s most recent five year plan called for ongoing investment in the energy markets. |

| • | South America, specifically Brazil, Venezuela and Colombia, is seeing increased refining and petrochemical investments that are driven by their expanding economies, and increased local demand for transportation fuels and other products that are made from oil as the feedstock. South American countries are also working to extract more value from their natural resources by supplying energy products into the global markets. However, the South American market can be unpredictable and has historically been slower to invest than other emerging markets. |

| • | The continued progress at the new U.S. nuclear reactor projects planned for the Summer (South Carolina) and Vogtle (Georgia) facilities suggest some growth in the domestic nuclear market. However, investment in new nuclear power capacity in the U.S. and internationally remains uncertain due to political and social pressures, which were augmented by the tragic earthquake and tsunami that occurred in Japan in March 2011. In addition, the low cost of domestic natural gas may shift investment away from the nuclear market in North America. |

| • | The need for additional safety and back-up redundancies at existing domestic nuclear plants driven by new regulatory requirements could increase demand for our products in the near-term. |

| • | The desire to extend the life of the existing nuclear plants including new operating licenses and expanded output (re-rating) of the facilities will require investment and could increase demand for our products. |

20

Table of Contents

We believe that the consequences of the trends described above may drive revenue growth for us. As we look forward at margin potential in this cycle, we expect growth in emerging markets to result in continued pressure on pricing and gross margins, as these markets historically provided lower margins than North American refining markets. We believe investments in new petrochemical capacity expected to be built in North America may provide a partial offset to this margin pressure, however, based on the mix of customers, the margin benefit from North American activity may be tempered. Adding these pieces together, we believe peak margins in the current cycle may be somewhat less than the previous cycle, which was driven by the domestic refining market.

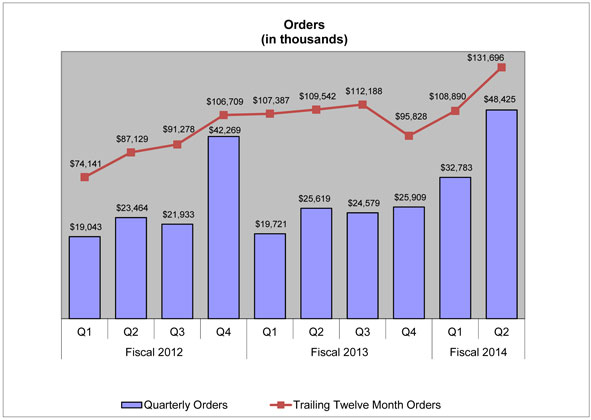

Because of continued global economic and financial uncertainty and the risk associated with growth in emerging economies, we also expect that we will continue to experience volatility in our order pattern. We continue to expect our new order levels to remain volatile, resulting in both relatively strong and weak quarters. As the chart below indicates, quarterly order levels can vary significantly.

Looking at our order level in any one quarter does not provide an accurate indication of our future expectations or performance. Rather, we believe that looking at our orders and backlog over a trailing twelve-month period provides a better measure of our business. Good examples of this variation are the first and second quarters of fiscal 2014, where orders from the U.S. were 87% and 61%, respectively, of total orders. We believe that the increase in domestic orders during the first half of the year resulted from the timing of projects, and that it is premature to suggest a longer term trend or shift toward the U.S. market.

Our quarterly order levels and trailing twelve-month order levels for the first quarter and second quarters of fiscal 2014, and the four quarters of fiscal 2013 and fiscal year ended March 31, 2012 (which we refer to as “fiscal 2012”), respectively, are set forth in the chart below.

21

Table of Contents

Expected International Growth in Refining and Chemical Processing and Domestic Growth in

Chemical Processing, Nuclear Power and U.S. Navy Projects

We expect growth in refining capacity to be driven by emerging markets. We also expect incremental investments in the domestic market for existing refining facilities. Investment in the chemical and petrochemical processing markets is expected to be split between North America and the international market. Accordingly, we believe our revenue opportunities in chemicals and petrochemicals will be balanced between the domestic and international markets. This compares with the previous cycle, which was almost exclusively driven by the international markets. We have also expanded our addressable markets with the expansion of our capabilities in the power market and our focus on the U.S. Navy nuclear propulsion projects.

Over the long-term, we expect our customers’ markets to regain their strength and, while remaining cyclical, continue to grow. We believe the long-term growth trend remains strong and that the drivers of future growth include:

| • | Global consumption of crude oil is estimated to expand significantly over the next two decades, primarily in emerging markets. This is expected to offset estimated flat to slightly declining demand in North America and Europe. In addition, an increased trend toward export supply of finished product from the Middle East to Europe is expected. |

| • | Global oil refining capacity is projected to increase, and is expected to be addressed through new facilities, refinery upgrades, revamps and expansions. |

| • | Increased demand is expected for power, refinery and petrochemical products, stimulated by an expanding middle class in Asia and the Middle East. |

| • | More domestic refineries are expected to convert their facilities to use heavier, more readily available and lower cost crude oil as a feedstock. |

| • | Shale gas development and the resulting availability and abundance of affordable natural gas as feedstock to U.S.-based chemical/petrochemical facilities is expected to lead to renewed investment in chemical/petrochemical facilities in the U.S. |

| • | Lower costs and increased supply are expected to drive increased domestic use of natural gas in the U.S., as well as the ability to export liquefied natural gas to serve other regions. |

| • | Construction of new petrochemical plants in the Middle East is expected to meet local demand. |

| • | Increased investments in new power generation projects are expected in Asia and South America to meet projected consumer demand increases. |

| • | Long-term growth potential is expected in alternative energy markets, such as geothermal, coal-to-liquids, gas-to-liquids and other emerging technologies, such as biodiesel, and waste-to-energy. Increased development of geothermal electrical power plants in certain regions is also expected to address projected growth in demand for electrical power. |

22

Table of Contents

| • | Increased regulation worldwide, impacting the refining, petrochemical and nuclear power industries is expected to continue to drive requirements for capital investments. |

| • | Increased focus on safety and redundancy is anticipated in existing nuclear power facilities. |

| • | Long-term increased project development of nuclear facilities may occur internationally. |

We believe that all of the above factors offer us long-term growth opportunities to meet our customers’ expected capital project needs. In addition, we believe we can continue to grow our less cyclical smaller product lines and aftermarket businesses.

Our domestic sales, as a percentage of aggregate product sales, were 58% in the second quarter of fiscal 2014 and 55% in the first six months of fiscal 2014. This is compared with 59% and 58% in the comparable periods of fiscal 2013. In fiscal 2012 and fiscal 2013, domestic sales were 54% and 53%, respectively. We expect domestic sales to continue to comprise slightly more than half of our total sales, however, if domestic orders continue to be strong over the remaining part of fiscal 2014, the percentage of domestic business could increase compared with the prior two fiscal years.

Results of Operations

For an understanding of the significant factors that influenced our performance, the following discussion should be read in conjunction with our condensed consolidated financial statements and the notes to our condensed consolidated financial statements included in Part I, Item 1, of this Quarterly Report on Form 10-Q.

The following table summarizes our results of operations for the periods indicated:

| Three Months Ended September 30, |

Six Months Ended September 30, |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Net sales |

$24,490 | $25,902 | $52,746 | $48,435 | ||||||||||||

| Net income |

$2,589 | $2,615 | $6,397 | $4,005 | ||||||||||||

| Diluted income per share |

$0.26 | $0.26 | $0.63 | $0.40 | ||||||||||||

| Total assets |

$130,850 | $119,791 | $130,850 | $119,791 | ||||||||||||

23

Table of Contents

The Second Quarter and First Six Months of Fiscal 2014 Compared With the Second Quarter and First Six Months of Fiscal 2013

Sales for the second quarter of fiscal 2014 were $24,490, a 5% decrease as compared with sales of $25,902 for the second quarter of fiscal 2013. The lower sales were a result of the relatively low order levels seen in the first two quarters of fiscal 2013. International sales year-over-year decreased $264, or 2%, driven by lower sales in Middle East, offset by higher sales in Canada. Domestic sales decreased $1,148, or 8%, in the second quarter of fiscal 2014 compared with the second quarter of fiscal 2013. Sales in the three months ended September 30, 2013 were 43% to the refining industry, 16% to the chemical and petrochemical industries, 23% to the power industry, including the nuclear market and 18% to other commercial and industrial applications. Sales in the three months ended September 30, 2012 were 22% to the refining industry, 32% to the chemical and petrochemical industries, 26% to the power industry, including the nuclear market and 20% to other commercial and industrial applications. Fluctuations in sales among markets, products and geographic locations can vary measurably from quarter-to-quarter based on timing and magnitude of projects. See “Current Market Conditions,” above. For additional information on future sales and our markets, see “Orders and Backlog” below.

Sales for the first six months of fiscal 2014 were $52,746, an increase of 9% compared with sales of $48,435 for the first six months of fiscal 2013. The increase in year-to-date sales was primarily due to higher international sales. International sales accounted for 45% and 42% of total sales for the first six months of fiscal 2014 and fiscal 2013, respectively. International sales in the year-over-year six month periods increased $3,080, or 15%, driven by higher sales in Asia. Domestic sales increased $1,231, or 4%, in the six months ended September 30, 2013 compared with the six months ended September 30, 2012. Sales in the first six months of fiscal 2014 were 44% to the refining industry, 16% to the chemical and petrochemical industries, 25% to the power industry, including the nuclear market, and 15% to other commercial and industrial applications. Sales in the first six months of fiscal 2013 were 23% to the refining industry, 29% to the chemical and petrochemical industries, 24% to the power industry, including the nuclear market and 24% to other commercial and industrial applications.

Our gross profit margin for the second quarter of fiscal 2014 was 34% compared with 31% for the second quarter of fiscal 2013. Gross profit for the second quarter of fiscal 2014 increased to $8,289 from $7,913, or 5%, compared with the same period in fiscal 2013. Gross profit percentage and dollars increased primarily due to improved product mix and volume of short cycle products in the current year’s second quarter.

Our gross profit margin for the first six months of fiscal 2014 was 35% compared with 29% for the first six months of fiscal 2013. Gross profit dollars for the first six months of fiscal 2014 increased 29% to $18,304, compared with the same period in fiscal 2013, which had gross profit of $14,149. The increase in gross profit was due to a greater level of sales driven by both short cycle sales which had stronger pricing levels and the conversion of projects during the first half of fiscal 2014 which had more favorable pricing compared with the projects converted in the same period of fiscal 2013.

Selling, general and administrative (“SG&A”) expense in the three and six-month periods ended September 30, 2013 increased $13, or 0%, and $332, or 4%, respectively, compared with the same periods of the prior year. The increase in SG&A expenses for the six-month period was primarily due to compensation related costs and sales commissions, particularly in Asia, driven by higher volume.

SG&A expense as a percent of sales for the three and six-month periods ended September 30, 2013 was 18% and 17%, respectively. This compared with 17% and 18%, respectively for the same periods of the prior year.

Interest income was $10 and $21 for the three and six-month periods ended September 30, 2013, compared with $14 and $25 for the same periods ended September 30, 2012. The low level of interest income relative to the amount of cash invested reflects the persistent low level of interest rates on short term U.S. government securities.

24

Table of Contents

Interest expense was $4 and $9 for the three and six-month periods ended September 30, 2013, compared with $(370) and $(290) for the same periods ended September 30, 2012. It is our policy to recognize any interest related to uncertain tax positions in interest expense. In the second quarter of the prior year, fiscal 2013, we reversed provisions that had been made in earlier periods for interest related to uncertain tax positions, due to lower than expected assessments by the IRS. See Note 12 to our Unaudited Condensed Consolidated Financial Statements included in Item 1 of this Quarterly Report on Form 10-Q.

Our effective tax rate in fiscal 2014 is projected to be between 33% and 34%. The tax rate used to reflect income tax expense in the current quarter was 33%, and the tax rate for the first six months of fiscal 2014 was 32%. The tax rate for the comparable three and six month periods of fiscal 2013 was 32% and 33%, respectively.

Net income for the three and six months ended September 30, 2013 was $2,589 and $6,397, respectively, compared with $2,615 and $4,005, respectively, for the same periods in the prior fiscal year. Income per diluted share in fiscal 2014 was $0.26 and $0.63 for the three and six-month periods, compared with $0.26 and $0.40 for the same three and six-month periods of fiscal 2013.

Liquidity and Capital Resources

The following discussion should be read in conjunction with our Condensed Consolidated Statements of Cash Flows included in Item 1 of this Quarterly Report on Form 10-Q:

| September 30, 2013 |

March 31, 2013 |

|||||||

| Cash and cash equivalents and investments |

$54,861 | $51,692 | ||||||

| Working capital |

71,184 | 64,026 | ||||||

| Working capital ratio(1) |

4.3 | 3.6 | ||||||

(1) Working capital ratio equals current assets divided by current liabilities.

Net cash generated by operating activities for the first six months of fiscal 2014 was $4,293, compared with $6,244 generated by operating activities for the first six months of fiscal 2013. The decrease in cash generated was due to increased working capital needs, specifically accounts receivable, accounts payable and lower customer deposits, partly offset by improved net income and lower unbilled revenue.

Dividend payments and capital expenditures in the first six months of fiscal 2014 were $603 and $898, respectively, compared with $399 and $578, respectively, for the first six months of fiscal 2013.

Capital expenditures for fiscal 2014 are expected to be between $6,000 and $7,000 as we expand our Batavia, NY facility to address expected growth in demand. In excess of 90% of our fiscal 2014 capital expenditures are expected to be for facilities, machinery and equipment, with the remaining amounts to be used for information technology and other items.

Cash and cash equivalents and investments were $54,861 on September 30, 2013 compared with $51,692 on March 31, 2013, up $3,170, or 6%.

We invest net cash generated from operations in excess of cash held for near-term needs in either a money market account or in U.S. government instruments, generally with maturity periods of up to 180 days. Our money market account is used to securitize our outstanding letters of credit and allows us to pay a lower cost on those letters of credit.

25

Table of Contents

Our revolving credit facility with Bank of America, N.A. provides us with a line of credit of $25,000, including letters of credit and bank guarantees. In addition, the agreement allows us to increase the line of credit, at our discretion, up to another $25,000, for total availability of $50,000. Borrowings under our credit facility are secured by all of our assets. Letters of credit outstanding under our credit facility on September 30, 2013 and March 31, 2013 were $11,150 and $12,354, respectively. There were no other amounts outstanding on our credit facility at September 30, 2013 and March 31, 2013. Our borrowing rate as of September 30 and March 31, 2013 was Bank of America’s prime rate, or 3.25%. Availability under the line of credit was $13,850 at September 30, 2013. We believe that cash generated from operations, combined with our investments and available financing capacity under our credit facility, will be adequate to meet our cash needs for the immediate future.

Orders and Backlog

Orders for the three month period ended September 30, 2013 were $48,425, compared with $25,619 for the same period last year, an increase of 89%. For the three months ended September 30, 2013, orders increased in chemical and petrochemical, which was up $9,252, refining orders, which was up $8,024, and other, which was up $8,236, including additional U.S. Navy work. These were partially offset by lower power orders, which were down $2,706. Orders represent communications received from customers requesting us to supply products and services.

During the first six months of fiscal 2014, orders were $81,208, compared with $45,340 for the same period of fiscal 2013, an increase of 79%. For the first six months of fiscal 2014, orders increased in chemical and petrochemical, up $23,554, driven by the strong domestic petrochemical market, refining, up $4,460 and other up, $11,903. These were partially offset by lower power orders, down $4,049.

Domestic orders were 61%, or $29,633, while international orders were 39%, or $18,792, of total orders in the current quarter compared with the same period in the prior fiscal year, when domestic orders were 66%, or $17,031, and international orders were 34% of total orders, or $8,588.

For the first half of fiscal 2014, domestic orders were 72% of total orders or $58,267, while international orders were 28%, or $22,941. During the first six months of fiscal 2013, domestic orders were 55% of total orders, or $25,037, and international orders were 45%, or $20,303. The strength in the domestic market has been driven by the petrochemical markets as well as additional U.S. Navy orders.

Backlog was at a record level of $114,392 at September 30, 2013, compared with $85,768 at March 31, 2013, an increase of 33%. Backlog is defined as the total dollar value of orders received for which revenue has not yet been recognized. All orders in backlog represent orders from our traditional markets in established product lines. Approximately 70% to 75% of orders currently in backlog are expected to be converted to sales within the next twelve months, 15% to 20% will convert in the subsequent twelve months and 10% will convert beyond 24 months. The current backlog contains U.S. Navy projects as well as certain petrochemical and new U.S. nuclear plants orders with longer lead times. These projects have multi-year conversion cycles and typically have significant stops and starts during the manufacturing process.

At September 30, 2013, 29% of our backlog was attributable to equipment for refinery project work, 27% for chemical and petrochemical projects, 14% for power projects, including nuclear, and 30% for other industrial or commercial applications (including the U.S. Navy). At September 30, 2012, 34% of our backlog was attributable to equipment for refinery project work, 13% for chemical and petrochemical projects, 26% for power projects, including nuclear, and 27% for other industrial or commercial applications (including the U.S. Navy).

26

Table of Contents

Outlook

We believe that the refinery and petrochemical markets we serve continue to be in the early stages of a global recovery. We also believe that we are experiencing the re-emergence of investment in the North American petrochemical market. Our pipeline has continued to expand throughout the last twelve months and appears to have stabilized at a historically high level, approximately double the size that it was at the start of the last cycle. We believe that the order levels in the first and second quarter of fiscal 2014 of $32,783 and $48,425, respectively, reflect the improved pipeline. The first two quarters of fiscal 2014 exhibited very strong order activity, including a wave of domestic petrochemical orders. While our pipeline continues to be strong, we do not expect the order level of the first half of fiscal 2014 to be replicated in the second half of fiscal 2014.