long-term growth and success of the communities where we provide service, not only because it is the right thing to do, but also because we believe it positively impacts long-term shareholder value.

In response to our customers’ desire for clean, reliable and affordable energy, the company continues to develop our renewable energy portfolio to deliver energy in a way that reduces our impact on the environment. As of December 31, 2023, we had 2.5 GWs of solar generation capacity in operation across five states with projects representing another 7.6 GWs of potential generating capacity and storage in development. CVOW is the largest offshore wind project under development in the United States and is expected to provide clean energy to as many as 660,000 customers at peak output. With clean, renewable energy like our solar operations and CVOW, the company has diversified our energy grid with clean energy while keeping our customers supplied with reliable energy during peak usage. The company’s commitment to developing our renewable energy portfolio has helped it substantially reduce our environmental impact, including a 47% reduction in carbon dioxide emissions from electric generation from 2005 through 2022 led by clean energy innovations and growth. Likewise, we have reduced methane emissions from our natural gas business by 38% (2010 through 2022).1

Throughout our operations, the company seeks to understand and support our communities. The company engages with investors, non-profits, community associations, customer focus groups, business associations, civic organizations, tribal communities, members of the media, cultural and historic-resource stewardship organizations, the military, organizations that represent the needs of underrepresented communities, individual property owners and a host of other stakeholders to understand their needs. We put our beliefs into action through our environmental justice policies seeking purposeful, sincere, inclusive collaboration to ensure that communities have a meaningful voice in our development process regardless of race, color, national origin, or income. The company sources materials from a range of diverse suppliers that share our commitment to integrity, ethics and accountability because we believe it is a smart business decision that expands our supplier base and leads to improved supplier performance and pricing. We are committed to have 20% of our total procurement spending come from diverse suppliers by 2025.2 By supporting the communities where we do business, the company achieves better results for our shareholders, customers and the communities we serve.

You can read more about the company’s efforts in these areas in our Sustainability and Corporate Responsibility Report (available on our website at https://sustainability.dominionenergy.com/) and our Diversity, Equity and Inclusion Report (available on our website at https://dei.dominionenergy.com/).

Proponent’s request could create unnecessary cost and uncertainty, while providing shareholders and other stakeholders with limited, if any, benefit.

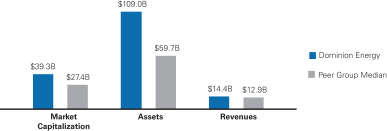

The benefit corporation model is novel, especially for large U.S. publicly-traded companies like Dominion Energy and few U.S. publicly-traded corporations are benefit corporations. To our knowledge, since 2011, when Article 22 of the Virginia Stock Corporation Act was enacted to allow for benefit corporations in Virginia, no existing Virginia publicly-traded corporation has elected to become a benefit corporation. As a result, it is difficult to predict the impact that converting to a benefit corporation would have on our long-term success. Conversion could result in operational and investor uncertainty, which could impact the company’s short-and long-term stock price, market capitalization, ability to attract investors and overall operational and financial performance. Uncertainty also exists as to how regulatory agencies and rating agencies would view conversion to a benefit corporation. Additionally, the legal costs, other expenses and administrative burden of converting to a benefit corporation, including the costs of inevitable lawsuits and derivative actions against the company that may result from such a conversion, could be significant. These risks and significant costs may be borne by shareholders with respect to their investment in our company. The risk and uncertainty surrounding conversion to a benefit corporation does not serve the interests of our shareholders, customers, employees and the communities that we serve and, therefore, is inappropriate for the company.

The proponent’s request is unlikely to succeed.

As a practical matter, Virginia law requires unanimous shareholder support for the benefit corporation amendment proposed by Ms. Amundsen. Therefore, even if this proposal were to receive majority support by shareholders, it would require unanimous shareholder approval of the amended articles. For a widely held, large publicly-traded corporation like us, this is highly unlikely to occur.

Overall, we believe that the company’s organizational structure and operations already promote the interests of our stakeholders and that converting to a benefit corporation poses unnecessary risks and expenses while delivering minimal benefit to our shareholders and stakeholders. For the reasons discussed above, we recommend you vote against this proposal.

| 1 |

Metrics are inclusive of assets owned in 2022, except Hope Gas, Inc., which was sold in August 2022. Dominion Energy expects future reporting will be adjusted to reflect the outcome(s) of the companywide business review announced in November 2022. |

| 2 |

In 2023, we spent $1.43 billion with diverse suppliers. |

90 DOMINION ENERGY | 2024 PROXY STATEMENT

How We Responded

How We Responded