Exhibit 10.1

Redactions with respect to certain portions hereof denoted with “***”

Joint Development and Option Agreement

Preamble

This Joint Development and Option Agreement (“JDA’’), effective and binding as of the last date of execution herein (“EFFECTIVE DATE”), is by and between The Cleveland Clinic Foundation (hereinafter referred to along with its AFFILIATEs as “CCF”), an Ohio non-profit corporation with offices located at 9500 Euclid Avenue, Cleveland, Ohio 44195; and Anixa Biosciences, Inc. (hereinafter referred to as “COMPANY”), a Delaware corporation having its principal office at 3150 Almaden Exp., Suite 250, San Jose, CA 95118.

Background

WHEREAS, the PARTIES have an interest in working together to develop vaccines for the prevention and treatment of different cancer types.

WHEREAS, the PARTIES entered the EXISTING LICENSE AGREEMENTS (as defined below).

WHEREAS, the project contemplated hereby is of mutual interest and benefit to CCF and COMPANY and will be consistent with the objectives of both PARTIES in a manner consistent with the status of CCF as a nonprofit institution.

NOW THEREFORE, in consideration of the mutual covenants and promises herein made, CCF and COMPANY agree as follows:

Agreement

1. Definitions

1.1. “AFFILIATE” means any corporation, association or other entity that directly or indirectly controls, is controlled by, or is under common control with the PARTY in question. As used in this definition, the term “control” means direct or indirect beneficial ownership of more than 50% of the voting or equity interest in such corporation or other business entity.

1.2. “BACKGROUND IP” means the CCF BACKGROUND IP or the COMPANY BACKGROUND IP, as the case may be.

1.3. “COLLABORATION FIELD” means vaccines for the prevention or treatment of cancers, including but not limited to breast, ovary, prostate, lung, colon and other cancers, as well as corresponding adjuvants and any companion diagnostics.

1.4. “CCF” is defined in the Preamble.

1.5. “CCF BACKGROUND IP” means any IP first conceived, developed, reduced to practice, acquired and/or otherwise controlled by CCF or its AFFILIATES either (i) prior to the EFFECTIVE DATE or (ii) outside of the scope of this JDA and during the TERM of this JDA, including rights arising in the course of prosecution and maintenance of such IP.

1.6. “CCF INVENTIONS” is defined in Paragraph 5.2.2.

1.7. “CCF PROJECT TEAM” shall mean the following individuals: Thaddeus Stappenbeck, MD, PhD, G. Thomas Budd, MD, Justin Johnson, PhD, and Holly Levengood and others as approved by CCF.

1.8. “CLINICAL TRIALS” is defined in Paragraph 2.6.

1.9. “COMPANY BACKGROUND IP” means any IP first conceived, developed, reduced to practice, acquired, and/ or otherwise controlled by COMPANY or its AFFILIATES either (i) prior to the EFFECTIVE DATE or (ii) outside of the scope of this JDA and during the TERM of this JDA, including rights arising in the course of prosecution and maintenance of such IP.

1.10. “COMPANY INVENTIONS” is defined in Paragraph 5.2.1.

1.11. “CONFIDENTIAL INFORMATION” means all non-public, confidential or proprietary information of a PARTY, or its AFFILIATES or REPRESENTATIVES, that is disclosed directly or indirectly from or on behalf of the DISCLOSING PARTY to the RECEIVING PARTY, whether in oral, written, electronic or other form or media, whether or not such information is marked, designated or otherwise identified as “confidential” and that, due to the nature of its subject matter or circumstances surrounding its disclosure, would reasonably be understood to be confidential or proprietary, including, without limitation, the terms and existence of this JDA.

CONFIDENTIAL INFORMATION does not include information that the RECEIVING PARTY can demonstrate by documentation or other evidence (i) was already known to the RECEIVING PARTY without restriction on use or disclosure prior to the receipt of such information directly or indirectly from or on behalf of the DISCLOSING PARTY; (ii) was independently developed by the RECEIVING PARTY without use of or reference to the DISCLOSING PARTY’s CONFIDENTIAL INFORMATION; (iii) is or becomes generally known to the public or otherwise becomes publicly available, other than through a breach of this JDA by the RECEIVING PARTY; or (iv) is or was made available to the RECEIVING PARTY on a non-confidential basis by a THIRD PARTY having the lawful right to do so without breaching any obligation of confidentiality to the DISCLOSING PARTY.

1.12. “DISPUTE” is defined in Paragraph 9.1.

1.13. “EFFECTIVE DATE” is defined in the Preamble.

1.14. “EXISTING BREAST CANCER LICENSE AGREEMENT” means the Exclusive License Agreement between the PARTIES dated July 8, 2019, as amended.

1.15. “EXISTING BREAST CANCER TECHNOLOGY” means the Licensed Technology as defined under the EXISTING BREAST CANCER LICENSE AGREEMENT.

1.16. “EXISTING LICENSE AGREEMENTS” means, collectively, the EXISTING BREAST CANCER LICENSE AGREEMENT and the EXISTING OVARIAN CANCER LICENSE AGREEMENT.

1.17. “EXISTING OVARIAN CANCER LICENSE AGREEMENT” means the Exclusive License Agreement between the PARTIES dated October 20, 2020, as amended.

1.18. “EXISTING OVARIAN CANCER TECHNOLOGY” means the Licensed Technology as defined under the EXISTING OVARIAN CANCER LICENSE AGREEMENT.

1.19. “INTELLECTUAL PROPERTY” is also referred to as “IP” and means any rights in INVENTIONS, patents, trademarks, copyrights or any other proprietary rights relating to intangible property anywhere in the world, and all registrations and applications related to any of the foregoing and analogous rights thereto anywhere in the world.

1.20. “INVENTION” means any creative or technical idea, design, development, discovery, drawing, data, analysis, trade secret, technology, process or method, know-how, material composition, article of manufacture, machine, or work result, including business and marketing plans, prototypes, specifications, developed or discovered in performing the PROJECT, whether or not patentable.

1.21. “JDA” means this Joint Development and Option Agreement, as amended from time to time.

1.22. “JOINT INVENTIONS” is defined in Paragraph 5.2.3.

1.23. “LOSSES” means all losses, damages, liabilities, deficiencies, claims, actions, judgments, settlements, interest, awards, penalties, fines, costs or expenses of whatever kind, including reasonable attorneys’ fees and the cost of enforcing any right to indemnification hereunder and the cost of pursuing any insurance providers.

1.24. “OPTION PERIOD” is defined in Paragraph 6.2.1.

1.25. “PARTY” means either CCF or COMPANY, and “PARTIES” means the two collectively.

1.26. “PATENT RIGHTS” means foreign and domestic patent and/or design application(s), including continuations, continuations-in-part, divisionals, reissues, reexaminations, extensions and renewals thereof, and patents/ registrations issuing therefrom.

1.27. “PRODUCT” means any embodiment of an INVENTION. PRODUCT may take the form of, but shall not be limited to, a formula, description or performance of a process, device, software program, or service.

1.28. “PROJECT” is defined in Paragraph 2.1.

1.29. “PROSECUTION” means preparing, filing, prosecuting, and/ or maintaining a subject patent application(s) and/or patent(s).

1.30. “TECHNICAL REPRESENTATIVE” is defined in Paragraph 2.3.

1.31. “TERM” is defined in Paragraph 8.1.

1.32. “THIRD PARTY” or “THIRD PARTIES” means any individual(s), corporation(s), association(s), government agencies, or other entity(ies), which is/are not a PARTY or any of its AFFILIATES.

1.33. “WORK PLAN” is defined in Paragraph 2.1.

2. Collaborative Project

2.1. PROJECT. The PARTIES will collaborate in efforts (undertaken jointly and individually) that are intended to result in the development of one or more products in the COLLABORATION FIELD as set forth in this JDA (such efforts referred to as the “PROJECT”). Particular goals of the PROJECT will be defined generally by the schedule of activities, responsibilities, milestones, and objectives (“WORK PLAN”), which shall be set forth in Schedule A-1 (“SOW 1”) and Schedule A-2 (“SOW 2”), attached hereto and incorporated herein. The PARTIES will review and may update the WORK PLAN by mutual agreement from time to time, provided that any amendment to the WORK PLAN made subsequent to the execution of this JDA shall be signed by both PARTIES in accordance with Paragraph 11.4.

2.2. Project Performance. Each PARTY will promptly undertake performance of the PROJECT. During the TERM of the JDA, the PARTIES will endeavor to perform their respective duties and to develop and submit to each other any deliverables identified in the WORK PLAN using reasonable efforts. COMPANY acknowledges and agrees that the PROJECT is a research project and successful completion of the research is not assured. Each PARTY acknowledges and agrees that as long as the other PARTY uses its reasonable efforts to perform its obligations under this JDA, including the WORK PLAN, such other PARTY shall not be in default under this JDA for any failure to achieve any particular result or deliverable. Each PARTY will ensure that its respective employees, contractors, and students who perform the PROJECT (including the CCF PROJECT TEAM) and/ or have access to the CONFIDENTIAL INFORMATION of the other PARTY (a) are bound by written non-disclosure and non-use agreements at least as restrictive as those set forth in Article 4 and (b) are contractually obligated to assign and transfer to such PARTY all right, title and interest to the INVENTIONS and all IP therein.

2.3. Technical Representative. Each PARTY will designate two of the PARTY’s employees as the principal technical representatives (“TECHNICAL REPRESENTATIVE”) for consultation and communications between the PARTIES. A PARTY may change a TECHNICAL REPRESENTATIVE at any time, upon written notice to the other PARTY.

2.4. Reports. The TECHNICAL REPRESENTATIVES will be reasonably available by telephone, e-mail, or in person to discuss the progress and results, as well as ongoing plans, or changes therein, of the work under the PROJECT.

2.5. Funding. Except as specifically provided to the contrary in this JDA, all costs, fees and/ or expenses incurred in connection with this JDA will be paid by the PARTY incurring such costs, fees and/or expenses.

2.6. Human Clinical Trials: If the PARTIES identify a need for which COMPANY desires to engage CCF to perform and/or coordinate research with human subjects (“CLINICAL TRIALS”), then the PARTIES will execute a clinical trial agreement to govern the CLINICAL TRIALS prior to proceeding.

2.7. Non-Employee Access. COMPANY, and its personnel, employees, or agents (“COMPANY STAFF”) may visit CCF’s facilities and interact with CCF’s employees only if such participation is mutually agreeable to COMPANY and CCF. Such visitations and interactions shall be at mutually agreed upon times, during normal business hours and subject to COMPANY STAFF’s compliance with CCF’s policies and credentialing procedures for non-employee access to its facilities, patients, and/ or records. COMPANY STAFF will at all times be under COMPANY’s direction and control and will not be deemed employees of CCF. COMPANY shall ensure that COMPANY STAFF are covered by general liability, worker’s compensation and unemployment insurance and will discharge all other obligations of an employer as applicable. Use of or access to any CCF facilities, equipment or materials (collectively “CCF Resources”) by COMPANY STAFF shall be at COMPANY’s sole risk and only with the prior written approval of the CCF PROJECT TEAM. COMPANY shall be solely liable for any damages, loss or harm caused by COMPANY STAFF while on CCF property, provided COMPANY shall not be liable to the extent such damage, loss or harm is directly attributable to the negligence or willful misconduct of CCF or CCF’s personnel. Use of or access by COMPANY STAFF cannot conflict with use required by CCF patients or CCF personnel (who shall always have first priority of use). There will be no use of radioactive materials by COMPANY STAFF. Restricted materials may be used or accessed only with the express written agreement of the CCF PROJECT TEAM and only under conditions that fully comply with CCF regulations and licenses, including full disclosure to CCF’s Facility Safety Officials. CCF shall not be liable for failure or interruption of utilities, equipment or other CCF Resources in connection with COMPANY’s access rights under this Paragraph 2.7. No COMPANY STAFF shall have any supervisory right or authority over any employee, agent or student of CCF. While on CCF’s campus and/or using CCF Resources, COMPANY STAFF shall abide by all applicable laws and CCF policies and procedures.

3. Confidentiality

3.1. Option Fee. COMPANY will pay CCF a non-refundable, option fee totaling $*** payable on or before May 23, 2024 (the “OPTION FEE”).

3.2. Development Funding. COMPANY will provide $*** in development funding to support CCF’s research activities outlined in the Work Plan attached hereto as Schedule A (the “DEVELOPMENT FEE”). The DEVELOPMENT FEE is payable in three (3) installments as follows:

| Installment Payment Amount | Payment Date | Contract Period | ||

| $*** | May 8, 2024 | Contract Period 1: Effective Date – January 31, 2025 | ||

| $*** | January 31, 2025 | Contract Period 2: February 1, 2025-January 31, 2026 | ||

| $*** | January 31, 2026 | Contract Period 3: February 1, 2026- completion by CCF of its activities under the WORK PLAN |

As used herein, “CONTRACT PERIOD” means each Contract Period set forth in the table above.

3.3. Time is of the essence with respect to this payment. All payments shall be due and payable in U.S. dollars. Any past due amounts shall accrue interest at an annual rate equal to the then prevailing prime rate of Citibank N.A., plus two percent (2%).

4. Confidentiality

4.1. Confidentiality Obligations. Each PARTY (the “RECEIVING PARTY”) acknowledges that in connection with this JDA it will gain access to CONFIDENTIAL INFORMATION of the other PARTY (the “DISCLOSING PARTY”). As a condition to being provided with CONFIDENTIAL INFOIUv1ATION, the RECEIVING PARTY shall:

4.1.1. not use the DISCLOSING PARTY’s CONFIDENTIAL INFORMATION other than as necessary to exercise its rights and perform its obligations under this JDA; and

4.1.2. maintain the DISCLOSING PARTY’s CONFIDENTIAL INFORMATION in strict confidence and, subject to Paragraph 4.2, not disclose the DISCLOSING PARTY’s CONFIDENTIAL INFORMATION without the DISCLOSING PARTY’s prior written consent, provided, however, the RECEIVING PARTY may disclose the CONFIDENTIAL INFORMATION to its employees, officers, directors, consultants and legal advisors (“REPRESENTATIVES”) who:

4.1.2.1. have a need to know the CONFIDENTIAL INFORMATION for purposes of the RECEIVING PARTY’s performance, or exercise of its rights concerning the CONFIDENTIAL INFORMATION, under this JDA;

4.1.2.2. have been apprised of this restriction; and

4.1.2.3. are themselves bound by written non-disclosure and non-use agreements at least as restrictive as those set forth in this Paragraph 4.1, provided further that the RECEIVING PARTY shall be responsible for ensuring its REPRESENTATIVES’ compliance with, and shall be liable for any breach by its REPRESENTATIVES of, this Paragraph 4.1.

The RECEIVING PARTY shall use reasonable care, at least as protective as the efforts it uses for its own confidential information, to safeguard the DISCLOSING PARTY’s CONFIDENTIAL INFORMATION from use or disclosure other than as permitted hereby.

4.2. Exceptions. If the RECEIVING PARTY becomes legally compelled to disclose any CONFIDENTIAL INFORMATION, the RECEIVING PARTY shall:

4.2.1. provide prompt written notice to the DISCLOSING PARTY so that the DISCLOSING PARTY may seek a protective order or other appropriate remedy or waive its rights pursuant to Paragraph 11.12; and

4.2.2. disclose only the portion of CONFIDENTIAL INFORMATION that it is legally required to furnish.

If a protective order or other remedy is not obtained, or the DISCLOSING PARTY waives compliance in accordance with Paragraphs 11.10 and 11.12, the RECEIVING PARTY shall, at the DISCLOSING PARTY’s expense, use reasonable efforts to obtain assurance that confidential treatment will be afforded the CONFIDENTIAL INFORMATION

4.3. Confidential Terms. Notwithstanding anything to the contrary herein, the PARTIES may disclose the terms and existence of this JDA to potential or actual investors, acquirers, sublicensees, collaboration partners, consultants, advisors and others on a reasonable need to know basis subject to customary confidentiality restrictions, or as required by securities or other applicable laws.

4.4. Scientific Publications. COMPANY recognizes and accepts the importance of communicating medical study and scientific data and the necessity of conveying such information in a timely manner, and, therefore, encourages their publication in reputable scientific journals and at seminars or conferences. COMPANY further recognizes and accepts that under CCF’s mission as an academic medical center, CCF and its investigators must have a meaningful right to publish without COMPANY’s approval or editorial control, provided that CCF shall comply with the requirements in this Paragraph 4.4. CCF shall submit to COMPANY for its review a copy of any proposed manuscript *** prior to the estimated date of submission for publication. Within *** of receiving such manuscript (the “REVIEW PERIOD”), if COMPANY reasonably determines that the proposed publication contains patentable subject matter which requires protection for COMPANY, COMPANY may require the delay of publication for a period of time not to exceed *** for the purpose of filing patent applications. Further, CCF and its investigators agree to remove from the proposed publication anything that COMPANY identifies within the REVIEW PERIOD as COMPANY’s CONFIDENTIAL INFORMATION. If no written response is received from COMPANY within the REVIEW PERIOD, it may be conclusively presumed that publication may proceed without delay. For avoidance of any doubt, CCF and the CCF PROJECT TEAM (while employees of CCF) retain the right to publish any medical study or scientific data arising from the PERMITTED RESEARCH (as defined in Paragraph 6.4), subject to compliance with this Paragraph 4.4.

5. INVENTION RIGHTS

5.1. BACKGROUND IP. Each PARTY’s BACKGROUND IP will remain the absolute unencumbered property of the respective PARTY. Except for the limited rights explicitly set forth in Paragraph 5.8 (Right to Use BACKGROUND IP & INVENTIONS), this JDA does not confer any rights under the BACKGROUND IP of either PARTY.

5.2. INVENTION Rights. INVENTIONS will be owned as follows:

5.2.1. COMPANY INVENTIONS. All INVENTIONS made solely by COMPANY employees or contractors in performance of the PROJECT and during the TERM and OPTION PERIOD together with all IP therein will, as between COMPANY and CCF, be owned solely by COMPANY (“COMPANY INVENTIONS”).

5.2.2. CCF INVENTIONS. All INVENTIONS made solely by CCF employees, contractors or students in performance of the PROJECT and during the TERM and OPTION PERIOD together with all IP therein will, as between COMPANY and CCF, be owned solely by CCF (“CCF INVENTIONS”).

5.2.3. JOINT INVENTIONS. All INVENTIONS made jointly by COMPANY employees or contractors and by CCF employees, contractors or students in performance of the PROJECT and during the TERM and OPTION PERIOD, in each case together with all IP therein, will be jointly owned by COMPANY and CCF (“JOINT INVENTIONS”). Subject to the rights granted under this JDA, with respect to JOINT INVENTIONS, each PARTY hereby confirms that nothing in this JDA shall operate in any way to limit the other PARTY’s indivisible, non-exclusive ownership interest in and to such JOINT INVENTIONS, including the right to use and exploit the JOINT INVENTIONS for all purposes on a worldwide basis, without consent of and without a duty of accounting to the other PARTY.

5.2.4. Cooperation in Transferring Title. The PARTIES will cooperate fully with each other and/ or the other PARTY’s attorneys in vesting title as provided in Article 5 (INVENTION Rights), including executing documents as necessary to effectuate the intent of the foregoing.

5.3. Notification of INVENTION. Each PARTY will provide the other PARTY with timely notification in writing of each INVENTION developed solely or jointly by such PARTY (“INVENTION DISCLOSURE”).

5.4. PROSECUTION of Patent Applications. During the TERM and the applicable OPTION PERIOD, CCF will have the exclusive responsibility to conduct PROSECUTION and enforcement of PATENT RIGHTS within the CCF INVENTIONS and JOINT INVENTIONS at CCF’s sole discretion (but using patent counsel reasonably acceptable to COMPANY), subject to Paragraph 5.6 (Abandonment), and COMPANY will be responsible for all documented, out-of-pocket costs associated with such PROSECUTION. CCF will keep COMPANY informed of such PROSECUTION, consider COMPANY’s comments and suggestions prior to taking material actions for the same, and consider actions reasonably recommended which would expand the scope of rights sought. COMPANY will provide written communication of items of commercial interest and CCF will cooperate to insure that the PROSECUTION of each CCF INVENTION and JOINT INVENTION reflects, and will reflect, to the extent practicable, these items of commercial interest. Final decisions on PROSECUTION of CCF INVENTIONS and JOINT INVENTIONS will be at CCF’s sole discretion, subject to Paragraph 5.6 (Abandonment). If COMPANY does not exercise the OPTION with respect to a particular CCF INVENTION or JOINT INVENTION during the corresponding OPTION PERIOD, then (i) in the case of a CCF INVENTION, COMPANY will thereafter no longer be responsible for any costs associated with PROSECUTION of PATENT RIGHTS within such CCF INVENTION, and (ii) in the case of a JOINT INVENTION, the PARTIES will discuss in good faith and mutually agree in writing as to which PARTY will have responsibility to conduct further PROSECUTION and enforcement of PATENT RIGHTS within such JOINT INVENTION, including the allocation of the costs and any recoveries associated with such PROSECUTION and enforcement.

5.5. Review of Patent Applications Prior to Filing. A PARTY will not file any patent application that discloses CONFIDENTIAL INFORMATION of the other PARTY and/or claims an INVENTION without prior notice to, and review by, the other PARTY. The reviewing PARTY will be given at least *** in which to review and comment on the patent application, unless the reviewing PARTY agrees on a term which is shorter than ***. The reviewing PARTY will have the right to require that any CONFIDENTIAL INFORMATION of the reviewing PARTY be removed from the patent application, in accordance with Article 4 (Confidentiality); with the limited exception that those portions of CONFIDENTIAL INFORMATION that are INVENTIONs owned by either PARTY pursuant to Article 5 (INVENTION Rights) and are required to be disclosed by the filing PARTY in the subject patent application to secure PATENT RIGHTS to which the filing PARTY is entitled under this JDA, may remain in the patent application.

5.5.1. Review of OFFICE ACTIONS. CCF will instruct its outside counsel to provide to COMPANY or its designated patent counsel copies of all materially relevant correspondence to and from the U.S. Patent and Trademark Office, and all correspondence related to counterpart foreign patent applications, including correspondence from foreign associates and from government agencies, in connection with CCF’s PROSECUTION of PATENT RIGHTS under this Article 5.

5.6. Abandonment. Notwithstanding Paragraph 5.4 (PROSECUTION of Patent Applications), CCF may elect to abandon PROSECUTION at any time, including prior to beginning PROSECUTION. If CCF chooses to abandon or not to begin PROSECUTION, then CCF will provide COMPANY at least *** prior written notice of such intended abandonment and the right to assume PROSECUTION of the PATENT RIGHTS that were to be abandoned. If COMPANY elects to assume PROSECUTION of such PATENT RIGHTS, then COMPANY will be responsible for all subsequent costs associated with the PROSECUTION of the subject PATENT RIGHTS; and CCF will assign the subject PATENT RIGHTS to COMPANY. Following any such assignment, during the TERM and the applicable OPTION PERIOD, to the extent necessary to carry out the PROJECT, COMPANY grants to CCF a worldwide, royalty-free, non-exclusive, license, without the right to sublicense, to practice the subject PATENT RIGHTS. CCF will use best efforts not to abandon patents of interest to COMPANY. If, within *** of providing such written notice of intended abandonment, CCF does not receive written notice from COMPANY electing to assume PROSECUTION, CCF may subsequently proceed with abandonment of the subject PATENT RIGHTS at its discretion. Failure to exercise commercially reasonable efforts to enforce PATENT RIGHTS shall be deemed abandonment thereof under this Paragraph.

5.7. PROSECUTION in Countries Not Elected by CCF. If COMPANY desires to file a patent application in countries other than those CCF desires to file in, then the subject PATENT RIGHTS (for such country) shall be deemed intended to be abandoned by CCF, and therefore treated as such under Paragraph 5.6 (Abandonment). COMPANY will be free to file such patent applications in the desired other countries at its own expense; and CCF will assign the subject PATENT RIGHTS for such country to COMPANY. Concurrent with CCF’s assignment of the patent application to COMPANY, COMPANY grants CCF during the TERM and OPTION PERIOD, to the extent necessary to carry out the PROJECT, a worldwide, royalty-free, non-exclusive, license, without the right to sublicense, to practice the subject PATENT RIGHTS.

5.8. Right to Use BACKGROUND IP & INVENTIONS.

5.8.1. During the TERM and OPTION PERIOD. The PARTIES shall have the following license rights.

5.8.1.1. CCFs Rights. During the TERM and OPTION PERIOD, to the extent necessary to carry out the PROJECT, COMPANY grants CCF a non-exclusive, royalty-free, non-transferable, worldwide license without the right to sublicense to practice COMPANY BACKGROUND IP and COMPANY INVENTIONS.

5.8.1.2. COMPANY’s Rights. During the TERM and OPTION PERIOD, to the extent necessary to carry out the PROJECT, CCF grants COMPANY a non-exclusive, royalty-free, non-transferable, worldwide license without the right to sublicense to practice CCF BACKGROUND IP and CCF INVENTIONS.

5.9. No Implied Rights. Except as expressly set forth herein, neither COMPANY nor CCF transfers to the other PARTY, by operation of this JDA, rights to any patent, copyright, trademark, or other IP of any kind.

6. Option to License

6.1. Option Grant. As consideration for the OPTION FEE, CCF grants COMPANY an exclusive option to take a license under certain IP of CCF in the COLLABORATION FIELD, as follows (“OPTION”):

6.1.1. Option for Patent License. CCF grants COMPANY an exclusive option to obtain an exclusive, royalty-bearing, worldwide license, with the right to sublicense, subject to the terms and conditions of: (a) in the case of CCF INVENTIONS and JOINT INVENTIONS which constitutes a modification of or improvement or enhancement to the EXISTING BREAST CANCER TECHNOLOGY, the EXISTING BREAST CANCER LICENSE AGREEMENT; (b) in the case of CCF INVENTIONS and JOINT INVENTIONS which constitutes a modification of or improvement or enhancement to the EXISTING OVARIAN CANCER TECHNOLOGY, the EXISTING OVARIAN CANCER LICENSE AGREEMENT; and (c) in the case of all other CCF INVENTIONS and JOINT INVENTIONS, a definitive agreement to be negotiated in good faith, and with terms generally consistent with the EXISTING LICENSE AGREEMENTS (the “License Agreement”), under any PATENT RIGHTS within the applicable CCF INVENTION or JOINT INVENTION.

6.1.2. Exercise of OPTION. On a CCF INVENTION-by-CCF INVENTION and JOINT INVENTION-by-JOINT INVENTION basis, COMPANY may exercise the OPTION with respect to the PATENT RIGHTS claiming the applicable INVENTION anytime during the OPTION PERIOD with respect to such INVENTION by providing CCF written notice specifically declaring COMPANY’s intent to exercise the OPTION. Upon providing such notice: (a) in the case of such an INVENTION which constitutes a modification of or improvement or enhancement to the EXISTING BREAST CANCER TECHNOLOGY, the PARTIES shall enter into an amendment to the EXISTING BREAST CANCER LICENSE AGREEMENT pursuant to which such INVENTION and all PATENT RIGHTS claiming such INVENTION will be added as Licensed Technology (and, specifically, such PATENT RIGHTS will be added to the list of Licensed Patents) under, and subject to the terms and conditions of, the EXISTING BREAST CANCER LICENSE AGREEMENT; (b) in the case of such an INVENTION which constitutes a modification of or improvement or enhancement to the EXISTING OVARIAN CANCER TECHNOLOGY, the PARTIES shall enter into an amendment to the EXISTING OVARIAN CANCER LICENSE AGREEMENT pursuant to which such INVENTION and all PATENT RIGHTS claiming such INVENTION will be added as Licensed Technology (and, specifically, such PATENT RIGHTS will be added to the list of Licensed Patents) under, and subject to the terms and conditions of, the EXISTING OVARIAN CANCER LICENSE AGREEMENT; and (c) in the case of any other such INVENTION, the PARTIES shall comply with Paragraph 6.3.1. For clarity, in the case of the foregoing clause (a) or (b), the PROSECUTION and enforcement of such PATENT RIGHTS will thereafter be governed by the terms and conditions of the applicable EXISTING LICENSE AGREEMENT (and no longer by Article 5 of this JDA). For avoidance of doubt, any CCF INVENTION or JOINT INVENTION developed or discovered in performing SOW 2 is deemed to constitute a modification of or improvement or enhancement to the EXISTING BREAST CANCER TECHNOLOGY.

6.1.3. Exclusive Option. The OPTION is exclusive in that during the applicable OPTION PERIOD, CCF will neither enter into a transaction nor negotiate with a THIRD PARTY for access to the applicable CCF INVENTION or JOINT INVENTION, or the underlying INTELLECTUAL PROPERTY (subject only to a reservation of rights for CCF to practice the subject INTELLECTUAL PROPERTY as described below in Paragraph 6.6).

6.1.4. Non-Payment of Fees. Notwithstanding the foregoing or anything to the contrary contained herein, if COMPANY fails to pay in full the OPTION FEE or any installment in respect of the DEVELOPMENT FEE within *** of such payment becoming due and payable and COMPANY’S receipt of written notice of such past-due payment, then the OPTION shall terminate and the OPTION PERIOD shall be deemed to have expired.

6.2. Option Period

6.2.1. Initial Option Period. With respect to each CCF INVENTION and JOINT INVENTION, the OPTION will remain in effect from COMPANY’s receipt of the corresponding INVENTION DISCLOSURE until the earlier of *** after the expiration of the TERM of the JDA or until the OPTION is exercised under Paragraph 6.1.2 (Exercise of OPTION) (“OPTION PERIOD”) unless terminated earlier under Paragraph 8.2 (Expiration/Termination of JDA and OPTION).

6.2.2. Extending the Option Period. The OPTION PERIOD may be extended by any extension of this JDA or any other agreement between the PARTIES.

6.2.3. DILIGENCE. At all times during the applicable OPTION PERIOD, COMPANY will exercise commercially reasonable diligence to determine if COMPANY desires to exercise the applicable OPTION (“DILIGENCE EFFORTS”). At the request of CCF but not more often than biannually, COMPANY agrees to report its DILIGENCE EFFORTS to CCF, and any such report will be deemed to be COMPANY’s CONFIDENTIAL INFORMATION. If CCF determines that COMPANY is failing to perform reasonable DILIGENCE EFFORTS and notifies COMPANY to such effect in writing, the TECHNICAL REPRESENTATIVES shall work together to identify and agree upon reasonable development milestones which will thereafter constitute reasonable DILIGENCE EFFORTS. Thereafter, if COMPANY fails to perform such reasonable DILIGENCE EFFORTS during the OPTION PERIOD, CCF may elect to terminate the applicable OPTION upon written notice to COMPANY as CCF’s sole and exclusive remedy for COMPANY’s failure to perform such DILIGENCE EFFORTS.

6.3. Negotiation of License.

6.3.1. Negotiation Period. Upon exercise of the OPTION pursuant to clause (c) of Paragraph 6.1.2, the PARTIES will negotiate in good faith with the objective of executing a definitive license agreement, such negotiation to be completed within *** from CCF’s receipt of COMPANY’s decision to exercise the OPTION pursuant to Paragraph 6.1.2 (Exercise of OPTION).

6.3.2. Good Faith Negotiations. Upon exercise of the OPTION pursuant to clause (c) of Paragraph 6.1.2, the PARTIES will endeavor to agree in good faith on the terms of a license in accord with the OPTION, such terms to be generally consistent with the EXISTING LICENSE AGREEMENTS. Failure to reach such an agreement within *** from the start of negotiations under Paragraph 6.3.1 shall be deemed a DISPUTE under Paragraph 9.1 without the need for further written notice. Upon one PARTY’s written request, once such a DISPUTE regarding license terms has arisen, the PARTIES will first seek agreement by non-binding mediation to be completed within *** after written request by either PARTY, and only thereafter will the PARTIES resort to arbitration pursuant to Article 9 (Arbitration). For such arbitration where the issue is limited to agreement on licensing terms, the arbitration pursuant to Article 9 (Arbitration) will further require that each PARTY submit to the arbitrators, and exchange with the other PARTY in accordance with a procedure to be established by the arbitrators, its best offer with respect to such licensing terms. In resolving the DISPUTE over license terms, the arbitrators will be limited to awarding only one or the other of the two best offers submitted, and COMPANY, at its discretion, shall not be obligated to enter into a license agreement on such terms if CCF’s offer prevails in such arbitration.

6.4. Commercial Terms for Inclusion in License Agreement. Upon COMPANY’s written election to exercise the option granted herein pursuant to clause (c) of Paragraph 6.1.2, which must be made during the TERM or the OPTION PERIOD, CCF and COMPANY will negotiate for up to the *** provided in Paragraph 6.3 to prepare and execute the License Agreement on mutually agreeable terms and conditions.

6.5. Reservation of Rights for CCF. Upon exercise of the OPTION with respect to any CCF INVENTION or JOINT INVENTION, any and all licenses granted pursuant to the License Agreement under the corresponding Licensed Patent(s) (as defined in the License Agreement) are subject to the right of CCF, on behalf of itself and its investigators, to practice and use such Licensed Patents and the subject matter described and/ or claimed therein, and to permit others at academic, government, and not-for-profit institutions to practice and use such Licensed Patents and the subject matter described and/ or claimed therein, for its and their own research (including without limitation, pre-clinical, non-clinical and clinical research), testing, educational, internal or patient-care purposes. For avoidance of any doubt, any research previously performed, currently being performed, or performed in the future by CCF, at CCF’s facilities or using CCF’s resources, or that CCF or the CCF PROJECT TEAM is in any way related to (whether as Principal Investigator, sponsor or otherwise) is subject to the retained rights in this Paragraph 6.4 (the “PERMITTED RESEARCH”). PERMITTED RESEARCH includes, without limitation, any research activities of CCF or the CCF PROJECT TEAM (while employees of CCF) that are funded in whole or in part by any governmental authorities or any philanthropic or similar sources. For clarity, CCF agrees and acknowledges that this Paragraph 6.3 does not give CCF the right to practice or use the Licensed Technology (as defined in the License Agreement) in connection with the commercial sale of any product or service.

6.6. No License Agreement. If this JDA expires without exercise by COMPANY of any OPTION pursuant to Paragraph 6.1.2 and CCF has complied with all of its obligations under Paragraphs 6.1 and 6.2, COMPANY will grant to CCF a non-exclusive, non-sublicensable, non-transferable, royalty-free, worldwide license to practice COMPANY INVENTIONS solely for the purpose of CCF’s own research and, for clarity, not in connection with the commercial sale of any product or service.

7. Work with THIRD PARTIES

7.1. Work with THIRD PARTIES. Neither COMPANY nor CCF will, during the TERM, subcontract any portion of its responsibilities under this JDA or the WORK PLAN to any THIRD PARTY without the prior written consent of the other PARTY. Either PARTY is otherwise free to enter into other collaborative and/ or service projects with THIRD PARTIES, provided that the confidentiality and invention rights provisions of Articles 4 and 5 hereof are not breached thereby and such arrangements do not otherwise conflict with the terms and conditions of this JDA. Each PARTY is responsible for the acts and omissions of its permitted subcontractors, including any breach of this JDA.

8. Term and Termination

8.1. Term. This JDA is effective from the EFFECTIVE DATE and terminates upon the later of (i) thirty-six (36) months thereafter and (ii) completion by CCF of its activities under the WORK PLAN, unless terminated earlier under Paragraph 8.2 (Expiration/Termination of JDA and OPTION) (“TERM”).

8.2. Expiration / Termination of JDA and OPTION.

8.2.1 COMPANY may terminate this JDA, or SOW 1 or SOW 2 (each, an “SOW”), at any time for any reason by giving written notice to CCF at least *** before the last day of the then-current CONTRACT PERIOD; provided, however, that COMPANY shall not have the right to terminate any SOW if CCF has substantially performed all work contemplated by such SOW. CCF may terminate this JDA if circumstances beyond its control preclude continuation of the PROJECT by giving written notice to COMPANY at least *** before such termination becomes effective. COMPANY may terminate any OPTION at any time for any reason by giving written notice to CCF. Termination of this JDA, or SOW 1 or SOW 2, by COMPANY under this Paragraph 8.2.1 shall not relieve COMPANY of its obligation to pay any then due or past-due installment payment amounts of the DEVELOPMENT FEE, nor shall COMPANY be entitled to any refund of any portion of the DEVELOPMENT FEE previously paid. . In the case of termination of SOW 1 or SOW 2 (assuming notice of termination is sent more than *** prior to the payment date of the next installment of the DEVELOPMENT FEE), without termination of this JDA in its entirety, this JDA and the SOW which has not been terminated shall remain in effect (for example, if SOW 1 is terminated then SOW 2 shall remain in effect), except that (i) if SOW 1 or SOW 2 is terminated then the OPTION with respect to such SOW and any rights of COMPANY to CCF INVENTIONS developed or discovered in performing such SOW shall terminate, and (ii) the DEVELOPMENT FEE installment shall be decreased for future years, in accordance with the table below.

Type of Termination |

Development Fee | |

| If SOW 1 is terminated more than *** prior to Contract Period 2 (and SOW 2 remains in effect for Contract Period 2) | Development Fee for Contract Period 2 (i.e., for SOW 2 only): $*** | |

| If SOW 1 is terminated more than *** prior to Contract Period 3 (and SOW 2 remains in effect for Contract Period 3) | Development Fee for Contract Period 3 (i.e., for SOW 2 only): $*** | |

| If SOW 2 is terminated more than *** prior to Contract Period 2 (and SOW 1 remains in effect for Contract Period 2) | Development Fee for Contract Period 2 (i.e., for SOW 1 only): $*** | |

| If SOW 2 is terminated more than *** prior to Contract Period 3 (and SOW 1 remains in effect for Contract Period 3) | Development Fee for Contract Period 3 (i.e., for SOW 1 only): $*** |

8.2.2 In the event that either PARTY (“Breach Party”) shall commit any material breach of or default in any of the terms or conditions of this JDA, the other PARTY may provide written notice (“BREACH NOTICE”) of such breach or default to the Breach Party. If the Breach Party fails to remedy said default or breach within *** after receipt of the Breach Notice, the other PARTY may terminate this JDA by sending written notice of termination (“TERMINATION NOTICE”) to the Breach Party to such effect, and such termination shall be effective as of the date of receipt of the Termination Notice.

8.2.3 If Dr. Stappenbeck becomes unavailable to oversee and support the performance of the WORK PLAN for any reason, CCF may propose another member of its faculty who is acceptable to COMPANY, in COMPANY’s sole discretion, to oversee the performance of the WORK PLAN. If a substitute faculty member acceptable to COMPANY has not been agreed upon within *** after Dr. Stappenbeck is no longer available to oversee and support the performance of the WORK PLAN, either PARTY may terminate this JDA upon written notice thereof to the other PARTY.

8.3. Tax Exempt Status. The PARTIES recognize that CCF is a non-profit, tax-exempt organization and agree that this JDA will take into account and be consistent with CCF’s tax-exempt status. If any part or all of this JDA is determined to jeopardize the overall tax-exempt status of CCF and/ or any of its tax exempt AFFILIATES, the PARTIES will negotiate in good faith an amendment of this JDA pursuant to Paragraph 11.13 so as to address such tax consideration while effecting the original intent of the PARTIES as closely as possible in a mutually acceptable manner. If the PARTIES are unable to amend the JDA to address such tax consideration within *** after COMPANY’s receipt of written notice that the JDA jeopardizes the overall tax-exempt status of CCF, CCF shall have the right to terminate the JDA immediately upon written notice to COMPANY.

8.4. Surviving Rights & Obligations. Except as expressly provided for herein, termination or expiration of this JDA will not relieve either PARTY of any obligations accruing prior to such termination or expiration, and the following provisions will survive any expiration or termination of this JDA and remain in effect: Articles 4 (Confidentiality), 5 (INVENTION Rights) (excluding Paragraph 5.8), 9 (Dispute Resolution) and 11 (Miscellaneous) and Paragraphs 8.4 (Surviving Rights & Obligations), 10.5 (Liability), 10.6 (Indemnity), 10.7 (DISCLAIMER OF WARRANTIES BY CCF), and 10.8 (DISCLAIMER OF WARRANTIES BY COMPANY). In addition, the OPTION with respect to each CCF INVENTION and JOINT INVENTION will survive any expiration or termination of this JDA for the duration of the applicable OPTION PERIOD, unless so terminated as provided for under Paragraphs 6.2.3 and 8.2.1.

9. Dispute Resolution

9.1. Exclusive Dispute Resolution Mechanism. The PARTIES shall resolve any dispute, controversy or claim arising out of or relating to this JDA, or the breach, termination or invalidity hereof (each, a “DISPUTE”), under the provisions of this Article 9. The procedures set forth in this Article 9 shall be the exclusive mechanism for resolving any DISPUTE that may arise from time to time, subject to Paragraph 9.5.

9.2. Good Faith Negotiations. If a PARTY believes that a DISPUTE exists, then such PARTY (the “DECLARING PARTY”) shall provide notice of such DISPUTE to the other PARTY (the “NOTICE”), which NOTICE shall specify the nature and cause of the DISPUTE and the action that the DECLARING PARTY deems necessary to resolve such DISPUTE. Following receipt of the NOTICE, the PARTIES shall use good faith efforts to resolve the DISPUTE, including making personnel with appropriate decision-making authority available to the other PARTY to discuss resolution of the DISPUTE. If a DISPUTE is not resolved within *** of the date of the non-DECLARING PARTY’s receipt of the NOTICE, then the DISPUTE shall be submitted to mandatory, final and binding arbitration before the American Arbitration Association, in accordance with the then-current rules of the American Arbitration Association, as modified herein.

9.3. Arbitration. The PARTIES shall use a panel of three arbitrators. The DECLARING PARTY shall select one arbitrator, and the other PARTY shall select a second arbitrator, and the two arbitrators so selected shall select a third arbitrator. The three arbitrators shall hear the DISPUTE. Such arbitrators shall be knowledgeable in intellectual property law and related matters. The arbitrators shall make each determination in a manner that is consistent with this JDA, including the PARTIES’ intent as expressed herein. Without limiting the foregoing, the PARTIES agree that the arbitrators are empowered to make determinations regarding the reasonableness of a PARTY’s acts or omissions. All decisions of the arbitrators shall be binding upon the PARTIES. Each PARTY shall be solely responsible for its own attorneys’ fees and expenses, legal expenses and witness fees and expenses. Any other usual and customary expenses incurred by the arbitrators, or the expense of such arbitration proceeding shall be equally divided between the PARTIES, irrespective of the outcome of such proceeding. The arbitration will be conducted in Cleveland, Ohio. The arbitrators are to apply the laws of the State of Ohio, without regard to its conflict of laws’ provisions. The PARTIES agree that any award, order, or judgment pursuant to the arbitration is final and may be entered and enforced in any court of competent jurisdiction. The PARTIES agree that all aspects of the dispute resolution process, including the arbitration, shall be conducted in confidence. The PARTIES agree that all statements made in connection with informal dispute resolution efforts shall not be considered admissions or statements against interest by any PARTY. The PARTIES further agree that they will not attempt to introduce such statements at any later trial, arbitration or mediation between the PARTIES.

9.4. Waiver of Jury Trial. Each PARTY irrevocably and unconditionally waives any right it may have to a trial by jury for any legal action arising out of or relating to this JDA or the transactions contemplated hereby.

9.5. Equitable Relief. Notwithstanding anything to the contrary herein, each PARTY acknowledges that a breach by the other PARTY of this JDA may cause the non-breaching PARTY irreparable harm, for which an award of damages would not be adequate compensation and, in the event of such a breach or threatened breach, the non-breaching PARTY shall be entitled to seek equitable relief, including in the form of a restraining order, orders for preliminary or permanent injunction, specific performance and any other relief that may be available from any court, and the PARTIES hereby waive any requirement for the securing or posting of any bond or the showing of actual monetary damages in connection with such relief. These remedies shall not be deemed to be exclusive but shall be in addition to all other remedies available under this JDA at law or in equity, subject to any express exclusions or limitations in this JDA to the contrary.

10. Representations, Warranties, Indemnity, Insurance & Compliance

10.1. Authority. Each of the PARTIES represents as of the EFFECTIVE DATE and warrants for the TERM that it has authority to enter into this JDA and to perform its obligations under this JDA and that it has been duly authorized to sign and to deliver this JDA.

10.2. Compliance with LAWS. The PARTIES will comply with all applicable laws, rules and regulations, including, but not limited to: (i) the federal anti-kickback statute (42 U.S.C. §1320a-7b) and the related safe harbor regulations and (ii) the Limitation on Certain Physician Referrals, also referred to as the “Stark Law” (42 U.S.C. §1395nn); (iii) The Federal Food, Drug, and Cosmetic Act (21 U.S.C. §§ 301 et seq.); (iv) the Public Health Service Act (42 U.S.C. § 201 et seq.); (v) the Health Insurance Portability and Accountability Act of 1996 and the Health Information Technology for Economic and Clinical Health Act (collectively, “HIPAA”); (vi) any and all applicable U.S. export control laws and regulations, as well any and all embargoes and/ or other restrictions imposed by the Treasury Department’s Office of Foreign Asset Controls; and (vii) all comparable state and local laws and regulations relating to the conduct of the PROJECT. No part of any consideration paid hereunder is a prohibited payment for the recommending or arranging for the referral of business or the ordering of items or services, nor are the payments intended to induce illegal referrals of business. In the event that any part of this JDA is determined to violate federal, state, or local laws, rules, or regulations, the PARTIES agree to negotiate in good faith revisions to the provision or provisions that are in violation. In the event the PARTIES are unable to agree to new or modified terms as required to bring the entire JDA into compliance, either PARTY may terminate this JDA on *** written notice to the other PARTY.

10.3. Conflict of Interest. COMPANY acknowledges that CCF maintains and adheres to a Conflict-of-Interest Policy. In that connection, COMPANY represents that, to COMPANY’s knowledge, no CCF employees, officers, or directors are owners, consultants, employees, officers or directors of COMPANY or any of its AFFILIATES or serve on any boards or committees of or in any advisory capacity with COMPANY or any of its AFFILIATES.

10.4. Insurance. COMPANY represents and warrants that it has and shall maintain comprehensive general liability insurance coverage on either a self-insured or indemnity basis to protect against liability under this provision in amounts equal to *** and, upon request, COMPANY agrees to furnish to CCF evidence of insurance acceptable to CCF indicating the required coverage. COMPANY agrees to give CCF at least *** prior written notice in the event of any material, adverse change in such insurance.

10.5. Liability. Except for damages arising from a breach pf Article 4, fraud, willful misconduct or gross negligence, or as may be payable pursuant to a PARTY’s indemnification obligations under Paragraph 10.6, neither PARTY shall be liable to the other PARTY for any special, indirect, consequential or punitive damages of any kind, including, but not limited to, loss of profits, arising in any manner from this JDA regardless of the foreseeability thereof.

10.6. Indemnity.

10.6.1. COMPANY Indemnification. Subject to Paragraph 10.6.3, COMPANY will indemnify, defend and hold harmless CCF and its respective trustees, directors, officers, medical and professional staff, employees, students, and agents and their respective successors, heirs, and assigns (each a “CCF Indemnitee”), against all LOSSES arising from any THIRD PARTY claim, suit, action or other proceeding (each, an “COVERED CLAIM”) which may be made or instituted against any CCF Indemnitee related to, arising out of or resulting from (a) COMPANY’s material breach of any representation, warranty, covenant or obligation under this JDA, (b) use by COMPANY or any of its transferees of any CCF INVENTION or JOINT INVENTION, (c) any use, sale, transfer or other disposition by COMPANY or its transferees of a PRODUCT or any other products made by use of CCF INVENTION or JOINT INVENTION, except to the extent any such COVERED CLAIM arises from any matter for which CCF is obligated to provide indemnification pursuant to Paragraph

10.6.2. CCF Indemnification. Subject to Paragraph 10.6.3, to the extent allowed under applicable laws, CCF will indemnify, defend and hold harmless COMPANY and its respective directors, officers, employees, consultants, and agents and their respective successors, heirs, and assigns (each a “COMPANY Indemnitee”), against all LOSSES arising from any COVERED CLAIM which may be made or instituted against any COMPANY Indemnitee related to, arising out of or resulting from (a) CCF’s material breach of any representation, warranty, covenant or obligation under this JDA, or (b) a CCF Indemnitee’s negligence, willful misconduct, or breach of any applicable law, except to the extent any such COVERED CLAIM arises from any matter for which COMPANY is obligated to provide indemnification pursuant to Paragraph 10.6.1.

10.6.3. Indemnification Procedure. An Indemnitee (whether a CCF Indemnitee or a COMPANY Indemnitee) that intends to claim indemnification under this Paragraph 10.6 will give notice to the indemnifying PARTY of any COVERED CLAIM which might be covered by this Paragraph 10.6. The indemnifying PARTY shall immediately take control of the defense and investigation of the COVERED CLAIM, including selection of counsel reasonably acceptable to the Indemnitee, at the indemnifying PARTY’s sole cost and expense; provided, however, that the indemnifying PARTY will not, without the prior written consent of the Indemnitee, settle or consent to the entry of any judgment with respect to such COVERED CLAIM (a) that does not release the Indemnitee from all liability with respect to such COVERED CLAIM, or (b) that may adversely affect the Indemnitee or under which the Indemnitee would incur any obligation or liability, other than one as to which the indemnifying PARTY has an indemnity obligation hereunder. The Indemnitee agrees to cooperate and provide reasonable assistance to such defense at the indemnifying PARTY’s expense. The Indemnitee at all times reserves the right to select and retain counsel of its own at its own expense to defend its interests, provided that the indemnifying PARTY will remain in control of the defense. The Indemnitee’s failure to perform any obligations under this Paragraph 10.6.3 shall not relieve the indemnifying PARTY of its obligation under Paragraph 10.6 except to the extent that the indemnifying PARTY can demonstrate that it has been materially prejudiced as a result of the failure.

10.7. DISCLAIMER OF WARRANTIES BY CCF. EXCEPT AS PROVIDED HEREIN AND TO THE EXTENT PERMITTED BY APPLICABLE LAW, CCF MAKES NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ANY MATTER WHATSOEVER, INCLUDING, WITHOUT LIMITATION, THE CONDITION OF THE PROJECT (INCLUDING ANY RESULTS THEREFROM) OR ANY IP (INCLUDING, BUT NOT LIMITED TO, CCF INVENTIONS, JOINT INVENTIONS OR BACKGROUND IP) OR ANY PRODUCT(S), WHETHER TANGIBLE OR INTANGIBLE, CONCEIVED, DISCOVERED, OR DEVELOPED UNDER THIS JDA; OR THE OWNERSHIP, MERCHANTABILITY, OR FITNESS FOR A PARTICULAR PURPOSE OF THE PROJECT OR ANY IP OR PRODUCT; OR FREEDOM FROM PATENT, TRADEMARK, OR COPYRIGHT INFRINGEMENT, INFORMATIONAL CONTENT, INTEGRATION, OR THEFT OF TRADE SECRETS AND DOES NOT ASSUME ANY LIABILITY HEREUNDER FOR ANY INFRINGEMENT OF ANY PATENT, TRADEMARK, OR COPYRIGHT ARISING FROM THE USE OF INFORMATION, RESULTS OR DELIVERABLES OR RIGHTS GRANTED OR

PROVIDED BY IT HEREUNDER. IN ADDITION, NOTHING IN THIS JDA MAY BE DEEMED A REPRESENTATION OR WARRANTY BY CCF AS TO THE VALIDITY OF ANY OF CCF’S PATENT RIGHTS OR THEIR REGISTRABILITY OR OF THE ACCURACY, SAFETY, EFFICACY, OR USEFULNESS, FOR At’-JY PURPOSE, OF ANY IP.

10.8. DISCLAIMER OF WARRANTIES BY COMPANY. EXCEPT AS PROVIDED HEREIN AND TO THE EXTENT PERMITTED BY THE APPLICABLE LAW, COMPANY MAKES NO WARRANTIES OF ANY KIND, EXPRESSED OR IMPLIED, AS TO ANY MATTER WHATSOEVER, INCLUDING WITH RESPECT TO ANY OF COMPANY’S TECHNOLOGIES THAT WILL BE SUBJECT TO THIS JDA. IN PARTICULAR, COMPANY MAKES NO EXPRESS OR IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE, OR THAT THE USE OF THE TECHNOLOGIES WILL NOT INFRINGE ANY PATENT, COPYRIGHT, TRADEMARK OR OTHER RIGHTS OF ANY THIRD PARTY. IN ADDITION, NOTHING IN THIS JDA MAY BE DEEMED A REPRESENTATION OR WARRANTY BY COMPANY AS TO THE VALIDITY OF ANY OF COMPANY’S PATENTS OR THEIR REGISTRABILITY OR OF THE ACCURACY, SAFETY, EFFICACY, OR USEFULNESS, FOR ANY PURPOSE, OF THE TECHNOLOGIES.

11. Miscellaneous

11.1. Agreement Negotiated. The form of this JDA has been negotiated by or on behalf of the respective PARTIES, each of which was represented by attorneys who have carefully negotiated the provisions hereof. Each PARTY acknowledges that it has been advised to, and has had the opportunity to consult with its attorney(s) prior to entering into this JDA. No law or rule relating to the construction or interpretation of contracts against the drafter of any particular clause should be applied with respect to this JDA.

11.2. Applicable Law. All matters arising under or relating to this JDA are governed by the laws of the State of Ohio, without regard to any principle of conflict or choice of laws that would cause the application of the laws of any other jurisdiction. Despite the above, the substantive law of the country of any PATENT RIGHTS governs the validity and enforceability of the subject PATENT RIGHTS.

11.3. Counterparts. This JDA may be executed in one or more counterparts, each of which will be deemed to be an original, but all of which will constitute one and the same instrument. A facsimile or .PDF copy of a signature of a PARTY will have the same effect and validity as an original signature.

11.4. Entire Agreement / Amendments. This JDA, including any attached Schedules, constitute the entire understanding between the PARTIES with respect to the subject matter contained herein and supersedes all prior agreements, understandings and arrangements whether oral or written between the PARTIES relating to the subject matter hereof, except as expressly set forth herein. Nothing in this JDA may be changed or modified, nor may anything be added to this JDA, except as may be specifically agreed to in a subsequent writing executed with the same formalities as this JDA.

11.5. Force Majeure. No PARTY will be responsible for delays or failures to perform resulting from events beyond its control but will have a responsibility to mitigate any damage which might arise as a result of any such event. Such events will include, but not be limited to: acts of nature, epidemics; fire; government restrictions or other government acts; insurrection; power failures; strike, union disturbance, or other labor problems; riots; terrorism or threats of terrorism; or war (whether or not declared); earthquakes, floods, or other disasters. Upon the occurrence of any event of the type referred to in this Paragraph 11.5, the affected PARTY will give prompt written notice to the other PARTY, together with a description of the event and the duration for which the affected PARTY expects its ability to comply with the provisions of this JDA to be affected. The affected PARTY will devote its commercially reasonable efforts to remedy to the extent possible the condition giving rise to the failure event and to resume performance of its obligations under this JDA as promptly as possible.

11.6. Headings. The headings or titles of Articles, Sections, Paragraphs, or Schedules appearing in this JDA are provided for convenience and are not to be used in construing this JDA. All references to Articles, Paragraphs, Sections and/or Schedules will be to Articles, Paragraphs, Sections, and/or Schedules of this JDA, unless specifically noted otherwise. Reference to an “Article,” “Section,” or “Paragraph” includes the referenced Article, Section or Paragraph, and all sub-sections and sub-paragraphs included within the referenced Article, Section or Paragraph.

11.7. Joint Research Agreement Statement for US Patent Prosecution. A PARTY desiring to invoke 35 USC §103(c)(2) and post American Invents Act 35 USC §102(c) during the PROSECUTION of PATENT RIGHTS, will be permitted to disclose the existence of this JDA and the names of the PARTIES thereto, and to make the statement required by 37 CFR §1.104(c)(4)(iii) on the record during PROSECUTION. Despite the foregoing, neither PARTY will be obligated to execute documents necessary for invoking 35 USC §103(c)(2) and post American Invents Act 35 USC §102(c).

11.8. No Other Rights Granted. Except as may be expressly set forth in this JDA, no PARTY grants, by implication, estoppel, or otherwise, any assignment, license or other rights in any of its or its AFFILIATES’ IP or CONFIDENTIAL INFORMATION to the other PARTY or its AFFILIATES.

11.9. No Third Party Beneficiaries. Despite anything in this JDA to the contrary, nothing in this JDA, expressed or implied, is intended to confer on any person or entity other than the PARTIES or their respective permitted successors and assigns, any rights, remedies, obligations or liabilities under or by reason of this JDA.

11.10. No Waiver. No omission or delay by either PARTY at any time to enforce any right or remedy reserved to it, or to require performance of any of the terms, covenants, or provisions of this JDA by another PARTY at any time designated, will be a waiver of any such right or remedy to which such PARTY is entitled, nor will it in any way affect the right of such PARTY to enforce such provisions thereafter.

11.11. Non-assignability. This JDA will be binding upon and inure to the benefit of the respective PARTIES and successors or assigns of all or substantially all of the relevant business or assets of either PARTY to which this JDA relates (whether by merger, consolidation, stock purchase, asset purchase or otherwise), and will otherwise be nontransferable and non-assignable to THIRD PARTIES without the prior express written consent of the other PARTY; provided, however, CCF may assign its reserved rights under Paragraph 6.4 to any academic, government, or not-for-profit institution without COMPANY’s consent.

11.12. Notices. All notices under this JDA will be sent to the respective PARTIES at the following addresses (or such other addresses as a PARTY designates to the other PARTY by written notice) by certified or registered mail, or sent by a nationally recognized overnight courier service; and will be deemed to have been given one day after being sent

| If to CCF: | The Cleveland Clinic Foundation | ||

| 9500 Euclid Avenue | |||

| Cleveland, OH 44195 | |||

| Attn: | CCF Innovations (Mail code: GCIC10) | ||

| Email: | ccilicense@ccf.org | ||

| with a copy to: | Law Department - (Mail Code: AC321) | ||

| Attn: | Research Contracts (Innovations) | ||

| The Cleveland Clinic Foundation | |||

| 3050 Science Park Drive Beachwood, OH 44122 | |||

| Attn: | Chief Legal Counsel, CC Innovations | ||

| Email: | legalcontracts@ccf.org | ||

| Payments to: | *** |

| If to COMPANY: | Anixa Biosciences, Inc. | ||

| 3150 Almaden Expressway, Suite 250 San Jose, CA 95118 | |||

| Attention: | Amit Kumar, CEO or Mike Catelani, President | ||

| Email: | ak@anixa.com, mcatelani@anixa.com | ||

11.13. Partial Invalidity. If any covenant, condition or other provision of this JDA is held invalid, void or illegal by any court of competent jurisdiction, then the same will be deemed severable from the remainder of the subject agreement and will in no way affect, impair or invalidate any other covenant, condition or provision, and will be deemed replaced by a provision which comes closest to such unenforceable provision in language and intent, without being invalid, void or illegal.

11.14. Use of Name and Press Releases. Neither PARTY shall use the name, logo, likeness, trademarks, or image of the other PARTY for advertising, marketing, endorsement or any other purposes without the specific prior written consent of an authorized representative of the other PARTY as to each such use. Neither PARTY shall make any public announcements, make any public statements, issue any press releases or otherwise communicate with any news media in respect of this JDA, or the transactions contemplated hereby without the specific prior written consent of an authorized representative of the other PARTY. COMPANY shall not be required to attain consent under this Paragraph 11.14 for use that is pursuant to applicable law or regulation, including COMPANY’s obligations under disclosure rules of the Securities and Exchange Commission (SEC). CCF’s specific prior written consent to one use shall apply only to other uses of substantially similar form and content (e.g.: various iterations of investor presentations) but not to any other uses. Notwithstanding anything to the contrary contained herein, CCF shall have the right to withdraw any consent previously provided (e.g., if CCF has previously consented to COMPANY’s use of CCF’s name and logo on COMPANY’s website or in investor presentations). For clarity, this Paragraph 11.14 shall not restrict COMPANY (or its AFFILIATES or sublicensees) from publicly disclosing information regarding the status of the development, or manufacture or commercialization of any PRODUCT, provided that any such disclosure does not use the name, logo, likeness, trademark or image of CCF.

11.15. Export Control. It is understood that CCF is subject to United States laws and regulations controlling the export of technical data, computer software, laboratory prototypes, and other commodities and that its obligations hereunder are contingent on compliance with applicable United States export laws and regulations. It is the expectation of CCF that the work done pursuant to this JDA will constitute fundamental research under the applicable export control laws and regulations. CCF does not wish to take receipt of export-controlled information except as may be knowingly and expressly agreed to in writing signed by an authorized representative of CCF and for which CCF has made specific arrangements. COMPANY acknowledges that CCF has foreign nationals on CCF’s campus who may have access to technical data, computer software, laboratory prototypes, and other commodities associated with this JDA. COMPANY agrees that it will not provide or make accessible to CCF any non-EAR 99 materials (including, without limitation, equipment, information and/or data) without first informing CCF of the export controlled nature of the materials and obtaining from CCF’s RESEARCH OFFICE its prior written consent to accept such materials as well as any specific instructions regarding the mechanism pursuant to which such materials should be passed to CCF. COMPANY agrees to comply with any and all applicable U.S. export control laws and regulations, as well any and all embargoes and/or other restrictions imposed by the Treasury Department’s Office of Foreign Asset Controls.

11.16. Relationship Between the PARTIES. Both PARTIES are independent contractors under this JDA. This JDA does not constitute making either PARTY the agent or legal representative of the other PARTY, for any purpose whatsoever. Neither PARTY is granted any right or authority to assume or to create any obligation or responsibility, expressed or implied, on behalf of or in the name of the other PARTY or to bind the other PARTY in any manner or thing whatsoever. No employment relationship, agency, joint venture or partnership between the PARTIES is intended nor will be inferred. Neither PARTY’s employees will represent themselves as being representatives of or otherwise employed by the other PARTY.

11.17. Mutual Drafting. Each PARTY hereby represents that it has been, or has had the opportunity to be, represented by legal counsel of its choice in connection with the negotiation and execution of this JDA. This JDA shall be construed as if drafted jointly by the PARTIES hereto and no presumption or burden of proof shall arise favoring or disfavoring any PARTY by virtue of the authorship of any provision of this JDA.

IN WITNESS WHEREOF, the PARTIES, by their authorized representatives, have evidenced their consent to the terms provided herein by signing below.

| The Cleveland Clinic Foundation | Anixa Biosciences, Inc. | |

| /s/ Serpil Erzurum | /s/ Amit Kumar | |

| Signature | Signature | |

| Serpil Erzurum, M.D. | Dr. Amit Kumar | |

| Printed Name | Printed Name: | |

| Chief Research and Academic Officer | ||

| Chari, Lerner Research Institute | ||

| Title | Title: CEO | |

| 5/1/2024 | 5/3/2024 | |

| Date | Date |

| /s/Avery Gottfred | |

| Avery Gottfred | |

| Sr. Director, Office of Sponsored | |

| Research & Programs |

Schedule A-1 and Schedule A-2 – WORK PLAN

Notwithstanding anything to the contrary contained herein, in no event will any work performed by CCF under any SOW involve human subjects. Accordingly, pursuant to Section 2.6 of this Agreement, if the PARTIES identify a need for CCF to perform and/or coordinate research with human subjects in connection with a SOW, then the PARTIES will execute a clinical trial agreement to govern the CLINICAL TRIALS prior to proceeding with the desired work.

Schedule A-1

| 1. | Development of new retired protein antigen targets for cancer vaccines | |

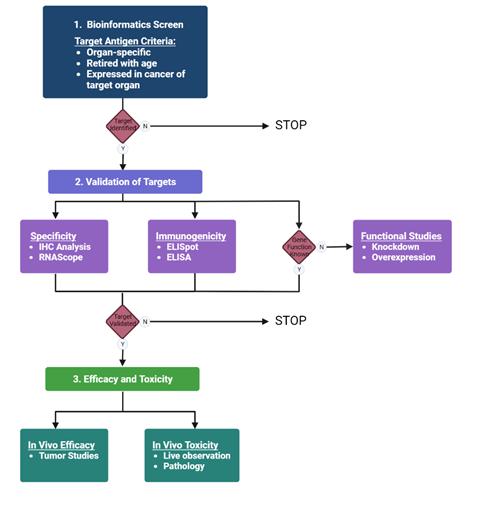

| The “retired protein hypothesis,” conceived by the late Dr. Vincent K. Tuohy, asserts that the most ideal cancer vaccine target antigens are those that are organ-specific and normally retired with age but expressed by emerging and established well-to moderately differentiated tumors. This method of vaccine design has proved successful in animal models and is currently being tested in a phase I clinical trial of the alpha-lactalbumin breast cancer vaccine, and pre-clinical studies to support a phase I clinical trial of the AMHR2-ED ovarian cancer vaccine are currently being conducted in collaboration with NCI. Applying Dr. Tuohy’s novel approach, targets for other cancers may be identified and tested. We intend to discover and test new retired protein targets for well to moderately differentiated adenocarcinoma of breast, prostate, lung, colon and ovary. Adenocarcinoma is the most common form of cancer of these 5 organs. We propose a multi-tiered study (Figure 1), with each aim dependent upon success of the previous aim: |

| a. | Aim 1A: Bioinformatics expression screen. In collaboration with our Bioinformatics experts in Inflammation & Immunity, we will use existing databases and algorithms to identify potential vaccine protein targets that meet the criteria of being organ-specific, with expression that is eliminated or reduced to non-immunogenic levels in normal tissues with advancing age, and significant expression of the protein in cancers of the targeted organ. | |

| We will initially focus on an ever-growing number of studies of human tissue transcriptomes at a single cell level. We will utilize studies that include target organs from individuals of various ages. We will focus our analysis on the epithelium in these studies. We will curate lists of genes that show detectable expression in specific epithelial cells of organs in young adults and loss of detection in older adults. We will pay close attention to gender – there are genes in all of these target tissues whose expression are affected by testosterone and estrogen. Single cell transcriptomic analysis does not routinely detect low expression levels for mRNA. Thus, we will carefully evaluate our candidate list below. | ||

| b. | Aim 1B: Validation of targets. Targets generated in Aim 1A will be validated in the laboratory. Validation of each target will consist of several steps that may be contingent on results from the previous step: |

| i. | RNA in situ expression testing of candidate using RNAScope. This methodology is closest to our screening method and is highly reliable. A successful candidate will show that the mRNA will be detectable in all or a subset of the epithelium of the target organ from young subjects but not in older subjects (defined here as >50 years old based on cancer susceptibility). |

| ii. | We will obtain a panel of monoclonal antibodies for each candidate proteins. We will perform IHC staining for each candidate protein using sections of normal human tissues obtained from individual of various ages. A successful candidate will show that the protein will be detectable in all or a subset of the epithelium of the target organ from young subjects but not in older subjects. | |

| iii. | We will perform RNAscope and IHC staining for candidate proteins using reagents from experiments i and ii using tissue sections of well to moderately differentiated adenocarcinomas of the target organ. A successful candidate will show the majority of the cases will show expression of the candidate mRNA and protein in the tumor cells. | |

| iv. | IHC staining of various normal human tissues outside the target organ to evaluate potential for off-target inflammation | |

| v. | Perform IHC and RNA scope of the candidate protein in mice to test if this model can be used for experiments. | |

| vi. | Purchase or production of the protein | |

| vii. | In vitro immunogenicity assessment using ELISPOT and ELISA of mice immunized with the antigen | |

| viii. | If the biologic function of the target is unknown or uncertain, functional studies will be performed using knockdown/overexpression techniques |

| c. | Aim 1C: Efficacy and toxicity. Targets that are validated in Aim 1B will be further tested for efficacy in the appropriate animal tumor models. Animals will be observed for signs of toxicity, and tissues will be harvested at endpoint for toxicologic analysis by an independent veterinary pathologist. |

Aim 1: Potential pitfalls and alternative approaches. If we do not find a validated candidate for a given tumor, we will consider evaluation of single cell transcriptomics data sets of cancer stem cells versus stem cells from young and old donors from that organ. A retired antigen expressed in a stem cell that is reactivated in cancer stem cells would be a valuable target.

If the single cell smRNA analysis does not yield targets in specific organs, we will also evaluate proteomic datasets where available or data sets from in vitro cultured epithelial cells (normal and tumors). We will also consider differential splicing of mRNA in an age/tumor dependent fashion.

Figure

1. Flow chart for development of new retired protein antigen targets. Each of the three aims will be contingent upon the success

of the previous aim for each candidate protein. The bioinformatics screen will focus on breast, ovary, prostate, lung, and colon.

Figure

1. Flow chart for development of new retired protein antigen targets. Each of the three aims will be contingent upon the success

of the previous aim for each candidate protein. The bioinformatics screen will focus on breast, ovary, prostate, lung, and colon.

Schedule A-2

| 1. | HLA typing study of Phase I trial subjects | |

| Based on interim results of the human phase I clinical trial of the alpha-lactalbumin breast cancer vaccine, we have observed that 4 of the 16 subjects tested to date (25%) failed to mount an antigen-specific T cell immune response to the vaccine that met the threshold defined in the clinical protocol (≥ 1/30,000 frequency of IFNγ of IL-17 secreting cells). There is no obvious explanation for this deficiency based on dose level or subject medical history. Therefore, we believe that the human leukocyte antigen (HLA) types of the subjects, which are extremely polymorphic in the human population, may play a substantial role in determining the magnitude of response to the vaccine in each subject. These data may be critical in predicting an individual’s likelihood of responding to the vaccine, and they may inform future improvements in the design and formulation of the vaccine. We propose to determine the HLA types of all previous, current, and future subjects in Phase I, which will include: |

| a. | Confirm or obtain IRB approval | |

| b. | Consent/re-consent subjects for the study | |

| c. | Perform a single peripheral blood draw from each subject | |

| d. | Process the blood samples and perform NGS sequencing | |

| e. | Analyze the data and determine any correlations with CTL immune response data and/or clinical outcomes |

| 2. | Epitope mapping of the human alpha-lactalbumin protein | |

| Based on the same rationale detailed for the HLA study, we propose to also perform epitope mapping for the human alpha-lactalbumin protein to offer additional insight into which T cell epitopes are present that may be widely recognized within the human population. This study will not only provide complementary data to the HLA study, but may also inform future single or pooled peptide-based designs of the vaccine, which could simplify production and save cost. The study will consist of the following steps: |

| a. | Synthesize two sets of overlapping peptide libraries to cover the entire 124 amino acid sequence of the recombinant human alpha-lactalbumin antigen with an offset of 5 residues: |

| a. | MHCI, 24 peptide 9-mer library | |

| b. | MHCII, 23 peptide 15-mer library |

| b. | Verify the functionality of the assay using laboratory mouse model | |

| c. | Identify trial subjects who have a robust immune response and are within six months of the final immunization | |

| d. | Confirm or obtain IRB approval | |

| e. | Consent/re-consent study subjects | |

| f. | Obtain subject HLA type, if not already performed | |

| g. | Perform IFNγ and IL-17 ELISPOT assays to peptide series on subject PBMCs | |

| h. | Identify the most commonly recognized immunogenic epitopes and compare the data to CTL immunologic study data and HLA types |

| 3. | In vivo alpha-lactalbumin drug product stability and potency testing for Phase II | |