|

Investment Objectives

|

inside front cover

|

|

Letter to Shareholders (Unaudited)

|

2

|

|

Management Discussion (Unaudited)

|

4

|

|

Performance Summaries (Unaudited)

|

8

|

|

Fund Expenses (Unaudited)

|

18

|

|

Management and Organization (Unaudited)

|

70

|

|

Board of Trustees Annual Approval of the Investment Advisory Agreement (Unaudited)

|

71

|

|

Important Notices Regarding Delivery of Shareholder Documents, Portfolio Holdings and Proxy Voting (Unaudited)

|

72

|

|

|

FINANCIAL STATEMENTS

|

|

The Wright Managed Equity Trust

|

The Wright Managed Income Trust

|

|||

|

Wright Selected Blue Chip Equities Fund

|

Wright Total Return Bond Fund

|

|||

|

Portfolio of Investments

|

20

|

Portfolio of Investments

|

45

|

|

|

Statement of Assets and Liabilities

|

22

|

Statement of Assets and Liabilities

|

50

|

|

|

Statement of Operations

|

22

|

Statement of Operations

|

50

|

|

|

Statements of Changes in Net Assets

|

23

|

Statements of Changes in Net Assets

|

51

|

|

|

Financial Highlights

|

24

|

Financial Highlights

|

52

|

|

|

Wright Major Blue Chip Equities Fund

|

Wright Current Income Fund

|

|||

|

Portfolio of Investments

|

25

|

Portfolio of Investments

|

53

|

|

|

Statement of Assets and Liabilities

|

26

|

Statement of Assets and Liabilities

|

58

|

|

|

Statement of Operations

|

26

|

Statement of Operations

|

58

|

|

|

Statements of Changes in Net Assets

|

27

|

Statements of Changes in Net Assets

|

59

|

|

|

Financial Highlights

|

28

|

Financial Highlights

|

60

|

|

|

Wright International Blue Chip Equities Fund

|

Notes to Financial Statements

|

61

|

||

|

Portfolio of Investments

|

29

|

|||

|

Statement of Assets and Liabilities

|

31

|

Report of Independent Registered Public Accounting Firm

|

68

|

|

|

Statement of Operations

|

31

|

|||

|

Statements of Changes in Net Assets

|

32

|

Federal Tax Information (Unaudited)

|

69

|

|

|

Financial Highlights

|

33

|

|||

|

Notes to Financial Statements

|

34

|

|||

|

Report of Independent Registered Public Accounting Firm

|

43

|

|||

|

Federal Tax Information (Unaudited)

|

44

|

| 2 |

| 3 |

| 4 |

|

Performance

|

Performance from 2Q

|

|

|

Stock

|

in 2Q 2012

|

to December 31, 2012

|

|

Fluor Corp

|

-17.5%

|

19.8%

|

|

Cisco Systems

|

-18.5%

|

16.7%

|

|

Cummins

|

-18.9%

|

12.9%

|

|

Helmerich & Payne

|

-19.3%

|

29.2%

|

|

J P Morgan Chase

|

-21.8%

|

25.0%

|

|

Western Digital*

|

-26.4%

|

41.2%

|

|

Kirby Exploration*

|

-28.4%

|

31.5%

|

|

S&P 500 Index

|

-2.8%

|

6.0%

|

| 5 |

| 6 |

| 7 |

|

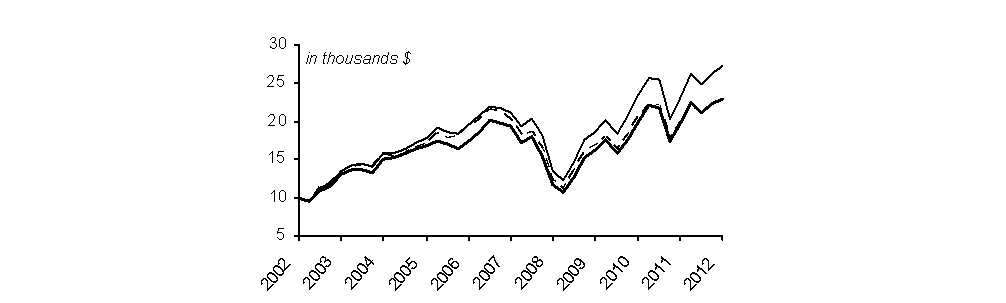

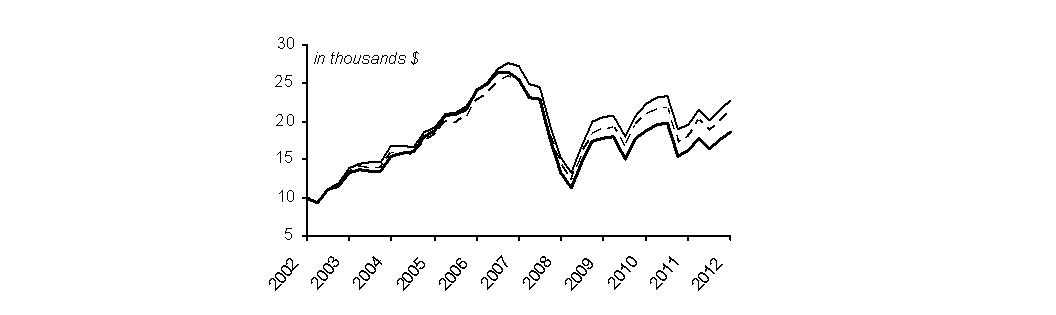

WRIGHT SELECTED BLUE CHIP EQUITIES FUND

|

||||||||||||||||||

|

Growth of $10,000 Invested 1/1/03 Through 12/31/12

|

||||||||||||||||||

|

Average Annual Total Return

|

||||||||||||||||||

|

Last 1 Yr

|

Last 5 Yrs

|

Last 10 Yrs

|

||||||||||||||||

|

— WSBC

|

||||||||||||||||||

|

- Return before taxes

|

16.02

|

%

|

3.47

|

%

|

8.67

|

%

|

||||||||||||

|

- Return after taxes on distributions

|

15.44

|

%

|

3.07

|

%

|

7.70

|

%

|

||||||||||||

|

- Return after taxes on distributions and sales of fund shares

|

11.18

|

%

|

2.91

|

%

|

7.49

|

%

|

||||||||||||

|

— S&P MidCap 400*

|

17.89

|

%

|

5.15

|

%

|

10.53

|

%

|

||||||||||||

|

----Average of Morningstar Mid Cap Value/Blend Funds**

|

15.84

|

%

|

2.47

|

%

|

8.62

|

%

|

||||||||||||

|

Investment Value as of 12/31/12 (in thousands $)

|

||||||||||||||||||

|

— WSBC

|

$

|

22.96

|

||||||||||||||||

|

— S&P MidCap 400*

|

$

|

27.23

|

||||||||||||||||

|

----Average of Morningstar Mid Cap Value/Blend Funds**

|

$

|

22.85

|

||||||||||||||||

| 8 |

|

WRIGHT SELECTED BLUE CHIP EQUITIES FUND

|

|||||||||||||

|

Industry Weightings

|

Ten Largest Stock Holdings

|

||||||||||||

|

% of net assets @ 12/31/12

|

% of net assets @ 12/31/12

|

||||||||||||

|

Capital Goods

|

11.9

|

%

|

Consumer Services

|

3.5

|

%

|

Alliance Data Systems Corp.

|

3.1

|

%

|

|||||

|

Materials

|

9.6

|

%

|

Transportation

|

3.3

|

%

|

Universal Health Services, Inc. –Class B

|

3.1

|

%

|

|||||

|

Retailing

|

8.8

|

%

|

Technology Hardware & Equipment

|

3.1

|

%

|

Valspar Corp.

|

3.0

|

%

|

|||||

|

Software & Services

|

8.7

|

%

|

Food, Beverage & Tobacco

|

3.1

|

%

|

AGCO Corp.

|

3.0

|

%

|

|||||

|

Insurance

|

7.1

|

%

|

Pharmaceuticals & Biotechnology

|

2.4

|

%

|

HollyFrontier Corp.

|

3.0

|

%

|

|||||

|

Health Care Equipment & Services

|

6.1

|

%

|

Commercial & Professional Services

|

2.3

|

%

|

Waddell & Reed Financial, Inc. –Class A

|

3.0

|

%

|

|||||

|

Diversified Financials

|

5.4

|

%

|

Real Estate

|

2.2

|

%

|

B/E Aerospace, Inc.

|

3.0

|

%

|

|||||

|

Utilities

|

5.2

|

%

|

Industrial

|

1.2

|

%

|

Advance Auto Parts, Inc.

|

2.8

|

%

|

|||||

|

Energy

|

5.1

|

%

|

Semiconductors & Semiconductor Equipment

|

0.9

|

%

|

HCC Insurance Holdings, Inc.

ValueClick, Inc.

|

2.6

2.5

|

%

%

|

|||||

|

Banks

|

5.0

|

%

|

Commercial Services & Supplies

|

0.5

|

%

|

||||||||

|

Consumer Durables & Apparel

|

3.5

|

%

|

|||||||||||

| 9 |

|

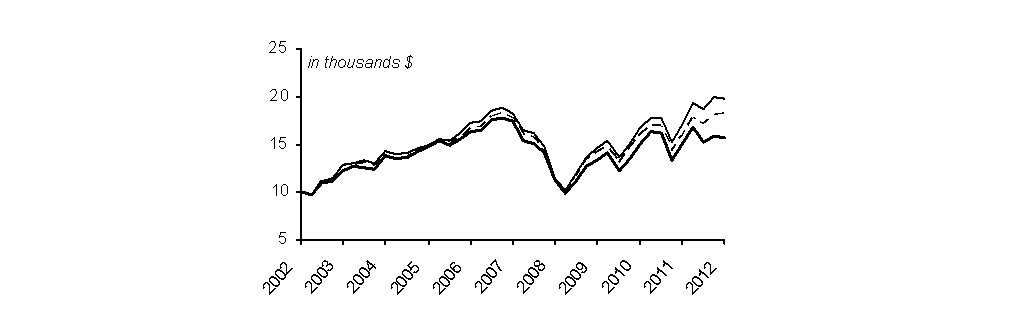

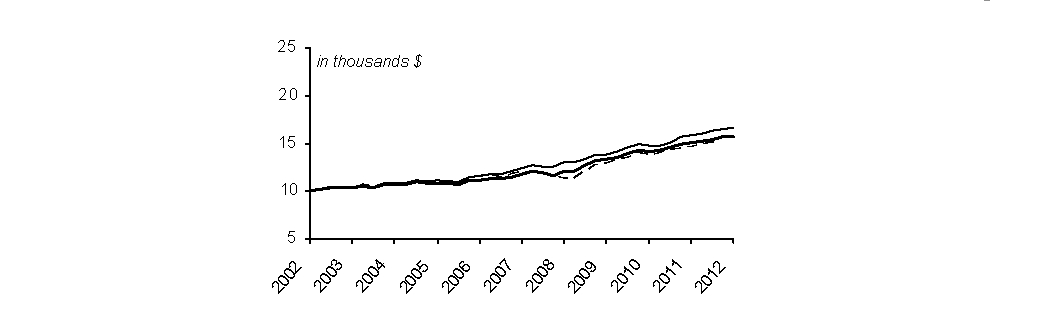

WRIGHT MAJOR BLUE CHIP EQUITIES FUND

|

||||||||||||||||||

|

Growth of $10,000 Invested 1/1/03 Through 12/31/12

|

||||||||||||||||||

|

Average Annual Total Return

|

||||||||||||||||||

|

Last 1 Yr

|

Last 5 Yrs

|

Last 10 Yrs

|

||||||||||||||||

|

— WMBC

|

||||||||||||||||||

|

- Return before taxes

|

4.23

|

%

|

-1.95

|

%

|

4.65

|

%

|

||||||||||||

|

- Return after taxes on distributions

|

4.13

|

%

|

-2.05

|

%

|

4.52

|

%

|

||||||||||||

|

- Return after taxes on distributions and sales of fund shares

|

2.90

|

%

|

-1.66

|

%

|

4.02

|

%

|

||||||||||||

|

— S&P 500*

|

15.98

|

%

|

1.66

|

%

|

7.10

|

%

|

||||||||||||

|

----Average of Morningstar Large Cap Value/Blend Funds**

|

14.84

|

%

|

0.58

|

%

|

6.17

|

%

|

||||||||||||

|

Investment Value on 12/31/12 (in thousands $)

|

||||||||||||||||||

|

— WMBC

|

$

|

15.75

|

||||||||||||||||

|

— S&P 500*

|

$

|

19.86

|

||||||||||||||||

|

----Average of Morningstar Large Cap Value/Blend Funds**

|

$

|

18.20

|

||||||||||||||||

| 10 |

|

WRIGHT MAJOR BLUE CHIP EQUITIES FUND

|

|||||||||||||

|

Industry Weightings

|

Ten Largest Stock Holdings

|

||||||||||||

|

% of net assets @ 12/31/12

|

% of net assets @ 12/31/12

|

||||||||||||

|

Software & Services

|

13.9

|

%

|

Materials

|

4.9

|

%

|

JPMorgan Chase & Co.

|

4.7

|

%

|

|||||

|

Capital Goods

|

12.1

|

%

|

Health Care Equipment & Services

|

4.8

|

%

|

Chevron Corp.

|

4.7

|

%

|

|||||

|

Pharmaceuticals & Biotechnology

|

12.1

|

%

|

Food & Staples Retailing

|

3.5

|

%

|

Microsoft Corp.

|

4.1

|

%

|

|||||

|

Energy

|

8.4

|

%

|

Insurance

|

3.3

|

%

|

Coca-Cola Co.

|

4.0

|

%

|

|||||

|

Diversified Financials

|

8.0

|

%

|

Semiconductors & Semiconductor Equipment

|

3.1

|

%

|

Cisco Systems, Inc.

Walgreen Co.

|

3.9

3.5

|

%

%

|

|||||

|

Retailing

|

7.9

|

%

|

Consumer Durables & Apparel

|

2.0

|

%

|

Amgen, Inc.

|

3.5

|

%

|

|||||

|

Food, Beverage & Tobacco

|

7.5

|

%

|

Consumer Services

|

0.5

|

%

|

General Dynamics Corp.

|

3.4

|

%

|

|||||

|

Technology Hardware & Equipment

|

7.0

|

%

|

Transportation

|

0.5

|

%

|

Aflac, Inc.

|

3.3

|

%

|

|||||

|

Precision Castparts Corp.

|

3.3

|

%

|

|||||||||||

| 11 |

|

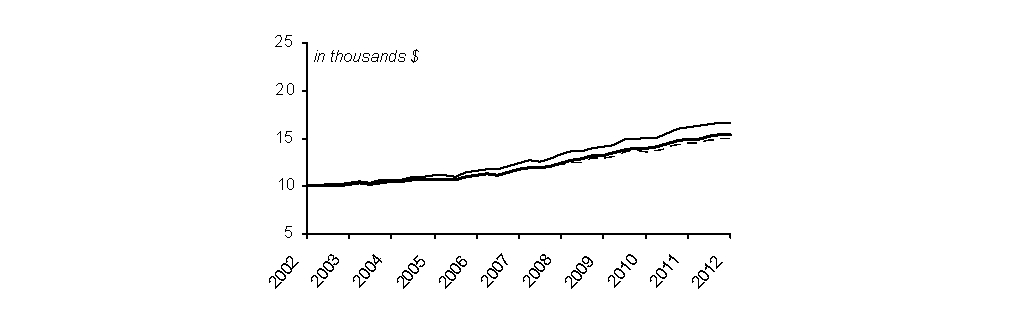

WRIGHT INTERNATIONAL BLUE CHIP EQUITIES FUND

|

||||||||||||||||||

|

Growth of $10,000 Invested 1/1/03 Through 12/31/12

|

||||||||||||||||||

|

Average Annual Total Return

|

||||||||||||||||||

|

Last 1 Yr

|

Last 5 Yrs

|

Last 10 Yrs

|

||||||||||||||||

|

— WIBC

|

||||||||||||||||||

|

- Return before taxes

|

14.45

|

%

|

-6.08

|

%

|

6.42

|

%

|

||||||||||||

|

- Return after taxes on distributions

|

14.52

|

%

|

-6.52

|

%

|

6.00

|

%

|

||||||||||||

|

- Return after taxes on distributions and sales of fund shares

|

10.23

|

%

|

-5.11

|

%

|

5.65

|

%

|

||||||||||||

|

— MSCI World ex U.S. Index*

|

16.41

|

%

|

-3.43

|

%

|

8.60

|

%

|

||||||||||||

|

----Average of Morningstar Foreign Large Blend Funds**

|

18.30

|

%

|

-3.57

|

%

|

7.85

|

%

|

||||||||||||

|

Investment Value as of 12/31/12 (in thousands $)

|

||||||||||||||||||

|

— WIBC

|

$

|

18.64

|

||||||||||||||||

|

— MSCI World ex U.S. Index*

|

$

|

22.81

|

||||||||||||||||

|

----Average of Morningstar Foreign Large Blend Funds**

|

$

|

21.29

|

||||||||||||||||

| 12 |

|

WRIGHT INTERNATIONAL BLUE CHIP EQUITIES FUND

|

|||||||||||||

|

Country Weightings

|

Ten Largest Stock Holdings

|

||||||||||||

|

% of net assets @ 12/31/12

|

% of net assets @ 12/31/12

|

||||||||||||

|

United Kingdom

|

21.5

|

%

|

Netherlands

|

3.0

|

%

|

Nestle SA

|

3.4

|

%

|

|||||

|

Japan

|

14.0

|

%

|

Singapore

|

2.9

|

%

|

Sanofi

|

3.3

|

%

|

|||||

|

Germany

|

11.5

|

%

|

Spain

|

2.7

|

%

|

BASF SE

|

3.1

|

%

|

|||||

|

France

|

9.7

|

%

|

Italy

|

2.4

|

%

|

AstraZeneca PLC

|

2.7

|

%

|

|||||

|

Switzerland

|

8.0

|

%

|

China

|

1.0

|

%

|

Legal & General Group PLC

|

2.6

|

%

|

|||||

|

Australia

|

6.3

|

%

|

Sweden

|

0.9

|

%

|

Toronto-Dominion Bank (The)

|

2.3

|

%

|

|||||

|

Canada

|

6.3

|

%

|

Denmark

|

0.7

|

%

|

KDDI Corp.

|

2.3

|

%

|

|||||

|

Norway

|

3.8

|

%

|

Luxembourg

|

0.4

|

%

|

BHP Billiton PLC

|

2.2

|

%

|

|||||

|

Hong Kong

|

3.4

|

%

|

Total SA

|

1.9

|

%

|

||||||||

|

Jardine Cycle & Carriage, Ltd.

|

1.9

|

%

|

|||||||||||

| 13 |

|

WRIGHT TOTAL RETURN BOND FUND

|

||||||||||||||||||

|

Growth of $10,000 Invested 1/1/03 Through 12/31/12

|

||||||||||||||||||

|

Average Annual Total Return

|

||||||||||||||||||

|

Last 1 Yr

|

Last 5 Yrs

|

Last 10 Yrs

|

||||||||||||||||

|

— WTRB

|

||||||||||||||||||

|

- Return before taxes

|

4.16

|

%

|

5.81

|

%

|

4.62

|

%

|

||||||||||||

|

- Return after taxes on distributions

|

2.91

|

%

|

4.26

|

%

|

3.06

|

%

|

||||||||||||

|

- Return after taxes on distributions and sales of fund shares

|

2.70

|

%

|

4.05

|

%

|

3.02

|

%

|

||||||||||||

|

— Barclays U.S. Aggregate Bond Index*

|

4.21

|

%

|

5.95

|

%

|

5.18

|

%

|

||||||||||||

|

----Average of Morningstar Intermediate Term Bond Funds**

|

6.83

|

%

|

5.56

|

%

|

4.57

|

%

|

||||||||||||

|

Investment Value as of 12/31/12 (in thousands $)

|

||||||||||||||||||

|

— WTRB

|

$

|

15.71

|

||||||||||||||||

|

— Barclays U.S. Aggregate Bond Index*

|

$

|

16.58

|

||||||||||||||||

|

----Average of Morningstar Intermediate Term Bond Funds**

|

$

|

15.63

|

||||||||||||||||

| 14 |

|

WRIGHT TOTAL RETURN BOND FUND

|

||||||||||||||||

|

Holdings by Security Type

|

Five Largest Bond Holdings

|

|||||||||||||||

|

% of net assets @ 12/31/12

|

% of net assets @ 12/31/12

|

|||||||||||||||

|

Asset-Backed Securities

|

0.8

|

%

|

U.S. Treasury Bond

|

3.13%

|

02/15/42

|

4.4

|

%

|

|||||||||

|

Corporate Bonds

|

48.7

|

%

|

GNMA, Series 2010-44, Class NK

|

4.00%

|

10/20/37

|

3.4

|

%

|

|||||||||

|

Mortgage-Backed Securities

|

36.6

|

%

|

U.S. Treasury Note

|

3.88%

|

05/15/18

|

3.1

|

%

|

|||||||||

|

U.S. Treasuries

|

10.4

|

%

|

FHLMC, Series 2627, Class MW

|

5.00%

|

06/15/23

|

2.5

|

%

|

|||||||||

|

FNMA Pool #888366

|

7.00%

|

04/01/37

|

2.1

|

%

|

||||||||||||

|

Holdings by Credit Quality

|

||||||||||||||||

|

% of net assets @ 12/31/12

|

||||||||||||||||

|

A

|

23

|

%

|

||||||||||||||

|

Aa

|

4

|

%

|

||||||||||||||

|

Aaa

|

52

|

%

|

||||||||||||||

|

BBB

|

20

|

%

|

||||||||||||||

|

<BBB

|

1

|

%

|

||||||||||||||

|

U.S. Government Agencies

|

0

|

%

|

||||||||||||||

|

U.S. Treasuries

|

0

|

%

|

||||||||||||||

| 15 |

|

WRIGHT CURRENT INCOME FUND

|

||||||||||||||||||

|

Growth of $10,000 Invested 1/1/03 Through 12/31/12

|

||||||||||||||||||

|

Average Annual Total Return

|

||||||||||||||||||

|

Last 1 Yr

|

Last 5 Yrs

|

Last 10 Yrs

|

||||||||||||||||

|

— WCIF

|

||||||||||||||||||

|

- Return before taxes

|

3.06

|

%

|

5.45

|

%

|

4.36

|

%

|

||||||||||||

|

- Return after taxes on distributions

|

1.66

|

%

|

3.82

|

%

|

2.64

|

%

|

||||||||||||

|

- Return after taxes on distributions and sales of fund shares

|

1.98

|

%

|

3.70

|

%

|

2.73

|

%

|

||||||||||||

|

— Barclays GNMA Backed Bond Index*

|

2.42

|

%

|

6.03

|

%

|

5.21

|

%

|

||||||||||||

|

----Average of Morningstar Government Mortgage Funds**

|

2.91

|

%

|

4.87

|

%

|

4.06

|

%

|

||||||||||||

|

Investment Value as of 12/31/12 (in thousands $)

|

||||||||||||||||||

|

— WCIF

|

$

|

15.33

|

||||||||||||||||

|

— Barclays GNMA Backed Bond Index*

|

$

|

16.63

|

||||||||||||||||

|

----Average of Morningstar Government Mortgage Funds**

|

$

|

14.89

|

||||||||||||||||

| 16 |

|

WRIGHT CURRENT INCOME FUND

|

||||||||||||

|

Holdings by Security Type

|

Five Largest Bond Holdings

|

|||||||||||

|

% of net assets @ 12/31/12

|

% of net assets @ 12/31/12

|

|||||||||||

|

GNMA, Series 2010-116, Class PB

|

5.00%

|

06/16/40

|

3.1

|

%

|

||||||||

|

Agency Mortgage-Backed Securities

|

97.4

|

%

|

GNMA II Pool #004828

|

4.50%

|

10/20/40

|

2.2

|

%

|

|||||

|

FNMA Pool #MA0641

|

4.00%

|

02/01/31

|

2.0

|

%

|

||||||||

|

GNMA, Series 2009-14, Class AG

|

4.50%

|

03/20/39

|

1.6

|

%

|

||||||||

|

FNMA Pool #689108

|

5.50%

|

02/01/33

|

1.5

|

%

|

||||||||

|

Weighted Average Maturity

|

||||||||||||

|

@ 12/31/12

|

4.3

|

Years

|

||||||||||

| 17 |

| 18 |

|

EQUITY FUNDS

|

FIXED-INCOME FUNDS

|

|||||||

|

Wright Selected Blue Chip Equities Fund

|

Wright Total Return Bond Fund

|

|||||||

|

Beginning

|

Ending

|

Expenses Paid

|

Beginning

|

Ending

|

Expenses Paid

|

|||

|

Account Value (7/1/12)

|

Account Value

(12/31/12)

|

During Period*

|

Account Value (7/1/12)

|

Account Value

(12/31/12)

|

During Period*

|

|||

|

(7/1/12-12/31/12)

|

(7/1/12-12/31/12)

|

|||||||

|

Actual Fund Shares

|

$1,000.00

|

$1,088.10

|

$7.35

|

Actual Fund Shares

|

$1,000.00

|

$1,017.50

|

$4.82

|

|

|

Hypothetical (5% return per year before expenses)

|

Hypothetical (5% return per year before expenses)

|

|||||||

|

Fund Shares

|

$1,000.00

|

$1,018.10

|

$7.10

|

Fund Shares

|

$1,000.00

|

$1,020.36

|

$4.82

|

|

|

*Expenses are equal to the Fund’s annualized expense ratio of 1.40% multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2012.

|

*Expenses are equal to the Fund’s annualized expense ratio of 0.95% multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2012.

|

|||||||

|

Wright Major Blue Chip Equities Fund

|

Wright Current Income Fund

|

|||||||

|

Beginning

|

Ending

|

Expenses Paid

|

Beginning

|

Ending

|

Expenses Paid

|

|||

|

Account Value (7/1/12)

|

Account Value (12/31/12)

|

During Period*

|

Account Value (7/1/12)

|

Account Value (12/31/12)

|

During Period*

|

|||

|

(7/1/12-12/31/12)

|

(7/1/12-12/31/12)

|

|||||||

|

Actual Fund Shares

|

$1,000.00

|

$1,029.73

|

$7.14

|

Actual Fund Shares

|

$1,000.00

|

$1,008.17

|

$4.54

|

|

|

Hypothetical (5% return per year before expenses)

|

Hypothetical (5% return per year before expenses)

|

|||||||

|

Fund Shares

|

$1,000.00

|

$1,018.10

|

$7.10

|

Fund Shares

|

$1,000.00

|

$1,020.61

|

$4.57

|

|

|

*Expenses are equal to the Fund’s annualized expense ratio of 1.40% multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2012.

|

*Expenses are equal to the Fund’s annualized expense ratio of 0.90% multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2012

|

|||||||

|

Wright International Blue Chip Equities Fund

|

||||||||

|

Beginning

|

Ending

|

Expenses Paid

|

||||||

|

Account Value (7/1/12)

|

Account Value (12/31/12)

|

During Period*

|

||||||

|

(7/1/12-12/31/12)

|

||||||||

|

Actual Fund Shares

|

$1,000.00

|

$1,141.33

|

$9.96

|

|||||

|

Hypothetical (5% return per year before expenses)

|

||||||||

|

Fund Shares

|

$1,000.00

|

$1,015.84

|

$9.37

|

|||||

|

*Expenses are equal to the Fund’s annualized expense ratio of 1.85% multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2012.

|

||||||||

| 19 |

|

Shares

|

Value

|

Shares

|

Value

|

|||||||||

|

MEDNAX, Inc.*

|

1,460

|

$

|

116,099

|

|||||||||

|

Omnicare, Inc.

|

3,980

|

143,678

|

||||||||||

|

BANKS - 5.0%

|

ResMed, Inc.

|

3,655

|

151,938

|

|||||||||

|

Commerce Bancshares, Inc.

|

11,337

|

$

|

397,475

|

Universal Health Services, Inc. - Class B

|

18,845

|

911,156

|

||||||

|

East West Bancorp, Inc.

|

16,570

|

356,089

|

$

|

1,818,556

|

||||||||

|

Fulton Financial Corp.

|

75,460

|

725,171

|

||||||||||

|

$

|

1,478,735

|

|||||||||||

|

INDUSTRIAL - 1.2%

|

||||||||||||

|

Gardner Denver, Inc.

|

5,200

|

$

|

356,200

|

|||||||||

|

CAPITAL GOODS - 11.9%

|

||||||||||||

|

AGCO Corp.*

|

18,440

|

$

|

905,773

|

|||||||||

|

Alliant Techsystems, Inc.

|

1,870

|

115,865

|

INSURANCE - 7.1%

|

|||||||||

|

B/E Aerospace, Inc.*

|

18,115

|

894,881

|

American Financial Group, Inc.

|

9,535

|

$

|

376,823

|

||||||

|

Hubbell, Inc. - Class B

|

3,330

|

281,818

|

Everest Re Group, Ltd.

|

2,195

|

241,340

|

|||||||

|

KBR, Inc.

|

18,355

|

549,181

|

HCC Insurance Holdings, Inc.

|

20,795

|

773,782

|

|||||||

|

Regal-Beloit Corp.

|

1,785

|

125,789

|

Reinsurance Group of America, Inc.

|

6,740

|

360,725

|

|||||||

|

Terex Corp.*

|

6,825

|

191,851

|

WR Berkley Corp.

|

9,992

|

377,098

|

|||||||

|

Timken Co.

|

5,850

|

279,805

|

$

|

2,129,768

|

||||||||

|

URS Corp.

|

5,360

|

210,434

|

||||||||||

|

$

|

3,555,397

|

|||||||||||

|

MATERIALS - 9.6%

|

||||||||||||

|

Albemarle Corp.

|

7,960

|

$

|

494,475

|

|||||||||

|

COMMERCIAL & PROFESSIONAL SERVICES - 2.3%

|

Ashland, Inc.

|

4,385

|

352,598

|

|||||||||

|

Deluxe Corp.

|

4,385

|

$

|

141,373

|

Domtar Corp.

|

2,435

|

201,861

|

||||||

|

FTI Consulting, Inc.*

|

6,010

|

198,330

|

NewMarket Corp.

|

975

|

255,645

|

|||||||

|

Towers Watson & Co. - Class A

|

6,335

|

356,090

|

Rock-Tenn Co. - Class A

|

9,505

|

664,495

|

|||||||

|

$

|

695,793

|

Valspar Corp.

|

14,540

|

907,296

|

||||||||

|

$

|

2,876,370

|

|||||||||||

|

COMMERCIAL SERVICES & SUPPLIES - 0.5%

|

||||||||||||

|

AECOM Technology Corp.*

|

5,850

|

$

|

139,230

|

PHARMACEUTICALS & BIOTECHNOLOGY - 2.4%

|

||||||||

|

Endo Health Solutions, Inc.*

|

20,225

|

$

|

531,311

|

|||||||||

|

United Therapeutics Corp.*

|

3,170

|

169,341

|

||||||||||

|

CONSUMER DURABLES & APPAREL - 3.5%

|

$

|

700,652

|

||||||||||

|

Jarden Corp.*

|

2,845

|

$

|

147,087

|

|||||||||

|

PVH Corp.

|

5,525

|

613,330

|

||||||||||

|

Tupperware Brands Corp.

|

4,630

|

296,783

|

REAL ESTATE - 2.2%

|

|||||||||

|

$

|

1,057,200

|

Jones Lang LaSalle, Inc.

|

5,360

|

$

|

449,919

|

|||||||

|

Rayonier, Inc. (REIT)

|

4,257

|

220,640

|

||||||||||

|

$

|

670,559

|

|||||||||||

|

CONSUMER SERVICES - 3.5%

|

||||||||||||

|

Brinker International, Inc.

|

23,635

|

$

|

732,449

|

|||||||||

|

Cheesecake Factory, Inc. (The)

|

9,830

|

321,637

|

RETAILING - 8.8%

|

|||||||||

|

$

|

1,054,086

|

Aaron's, Inc.

|

4,060

|

$

|

114,817

|

|||||||

|

Advance Auto Parts, Inc.

|

11,695

|

846,133

|

||||||||||

|

American Eagle Outfitters, Inc.

|

5,035

|

103,268

|

||||||||||

|

DIVERSIFIED FINANCIALS - 5.4%

|

Ascena Retail Group, Inc.*

|

13,970

|

258,305

|

|||||||||

|

Affiliated Managers Group, Inc.*

|

2,760

|

$

|

359,214

|

Dick's Sporting Goods, Inc.

|

2,435

|

110,768

|

||||||

|

Raymond James Financial, Inc.

|

9,420

|

362,953

|

Foot Locker, Inc.

|

8,855

|

284,423

|

|||||||

|

Waddell & Reed Financial, Inc. - Class A

|

25,750

|

896,615

|

PetSmart, Inc.

|

4,385

|

299,671

|

|||||||

|

$

|

1,618,782

|

Rent-A-Center, Inc.

|

6,500

|

223,340

|

||||||||

|

Ross Stores, Inc.

|

7,150

|

387,172

|

||||||||||

|

$

|

2,627,897

|

|||||||||||

|

ENERGY - 5.1%

|

||||||||||||

|

Helix Energy Solutions Group, Inc.*

|

23,960

|

$

|

494,534

|

|||||||||

|

HollyFrontier Corp.

|

19,379

|

902,093

|

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 0.9%

|

|||||||||

|

Superior Energy Services, Inc.*

|

6,580

|

136,338

|

Fairchild Semiconductor International, Inc.*

|

13,565

|

$

|

195,336

|

||||||

|

$

|

1,532,965

|

Skyworks Solutions, Inc.*

|

2,925

|

59,378

|

||||||||

|

$

|

254,714

|

|||||||||||

|

FOOD, BEVERAGE & TOBACCO - 3.1%

|

||||||||||||

|

Ingredion, Inc.

|

9,585

|

$

|

617,561

|

SOFTWARE & SERVICES - 8.7%

|

||||||||

|

Universal Corp.

|

6,090

|

303,952

|

Alliance Data Systems Corp.*

|

6,415

|

$

|

928,635

|

||||||

|

$

|

921,513

|

Cadence Design Systems, Inc.*

|

6,415

|

86,667

|

||||||||

|

DST Systems, Inc.

|

8,040

|

487,224

|

||||||||||

|

Jack Henry & Associates, Inc.

|

4,875

|

191,392

|

||||||||||

|

HEALTH CARE EQUIPMENT & SERVICES - 6.1%

|

MICROS Systems, Inc.*

|

1,625

|

68,965

|

|||||||||

|

Community Health Systems, Inc.

|

3,655

|

$

|

112,355

|

Synopsys, Inc.*

|

2,925

|

93,132

|

||||||

|

Cooper Cos., Inc. (The)

|

4,145

|

383,330

|

||||||||||

| See Notes to Financial Statements | 20 |

|

Shares

|

Value

|

||||

|

SOFTWARE & SERVICES (CONTINUED)

|

|||||

|

ValueClick, Inc.*

|

39,070

|

$

|

758,349

|

||

|

$

|

2,614,364

|

||||

|

TECHNOLOGY HARDWARE & EQUIPMENT - 3.1%

|

|||||

|

Arrow Electronics, Inc.*

|

4,465

|

$

|

170,027

|

||

|

Avnet, Inc.*

|

14,050

|

430,070

|

|||

|

QLogic Corp.*

|

9,830

|

95,646

|

|||

|

Tech Data Corp.*

|

3,005

|

136,818

|

|||

|

Vishay Intertechnology, Inc.*

|

9,505

|

101,038

|

|||

|

$

|

933,599

|

||||

|

TRANSPORTATION - 3.3%

|

|||||

|

Alaska Air Group, Inc.*

|

10,560

|

$

|

455,030

|

||

|

JB Hunt Transport Services, Inc.

|

1,460

|

87,177

|

|||

|

Kansas City Southern

|

5,360

|

447,453

|

|||

|

$

|

989,660

|

||||

|

UTILITIES - 5.2%

|

|||||

|

Cleco Corp.

|

7,635

|

$

|

305,476

|

||

|

NV Energy, Inc.

|

18,925

|

343,300

|

|||

|

ONEOK, Inc.

|

13,240

|

566,010

|

|||

|

UGI Corp.

|

10,720

|

350,651

|

|||

|

$

|

1,565,437

|

||||

|

TOTAL EQUITY INTERESTS - 98.9%

|

$

|

29,591,477

|

|||

|

(identified cost, $23,462,715)

|

|||||

|

TOTAL INVESTMENTS — 98.9%

|

$

|

29,591,477

|

|||

|

(identified cost, $23,462,715)

|

|||||

|

OTHER ASSETS, IN EXCESS OF LIABILITIES — 1.1%

|

330,919

|

||||

|

NET ASSETS — 100.0%

|

$

|

29,922,396

|

|||

|

REIT — Real Estate Investment Trust

|

|||||

|

* Non-income producing security.

|

|||||

| See Notes to Financial Statements | 21 |

|

STATEMENT OF ASSETS AND LIABILITIES

|

STATEMENT OF OPERATIONS

|

|||||||||

|

For the Year Ended December 31, 2012

|

||||||||||

|

ASSETS:

|

TRUE

|

TRUE

|

||||||||

|

Investments, at value

|

2.00E+07

|

Dividend income

|

$

|

569,748

|

||||||

|

(identified cost $23,462,715) (Note 1A)

|

$

|

29,591,477

|

Total investment income

|

$

|

569,748

|

|||||

|

Receivable for fund shares sold

|

2,014

|

|||||||||

|

Receivable for investment securities sold

|

806,583

|

Expenses –

|

||||||||

|

Dividends receivable

|

16,906

|

Investment adviser fee (Note 3)

|

$

|

205,973

|

||||||

|

Prepaid expenses and other assets

|

14,715

|

Administrator fee (Note 3)

|

41,195

|

|||||||

|

Total assets

|

$

|

30,431,695

|

Trustee expense (Note 3)

|

14,979

|

||||||

|

Custodian fee

|

3,458

|

|||||||||

|

LIABILITIES:

|

Accountant fee

|

38,638

|

||||||||

|

Outstanding line of credit (Note 8)

|

$

|

413,537

|

Distribution expenses (Note 4)

|

85,822

|

||||||

|

Payable for fund shares reacquired

|

79,861

|

Transfer agent fee

|

28,070

|

|||||||

|

Accrued expenses and other liabilities

|

15,901

|

Printing

|

130

|

|||||||

|

Total liabilities

|

$

|

509,299

|

Shareholder communications

|

5,664

|

||||||

|

NET ASSETS

|

$

|

29,922,396

|

Audit services

|

17,000

|

||||||

|

Legal services

|

16,798

|

|||||||||

|

NET ASSETS CONSIST OF:

|

Compliance services

|

6,066

|

||||||||

|

Paid-in capital

|

$

|

22,399,378

|

Registration costs

|

19,053

|

||||||

|

Accumulated net realized gain on investments

|

1,386,810

|

Interest expense (Note 8)

|

1,762

|

|||||||

|

Undistributed net investment income

|

7,446

|

Miscellaneous

|

24,670

|

|||||||

|

Unrealized appreciation on investments

|

6,128,762

|

Total expenses

|

$

|

509,278

|

||||||

|

Net assets applicable to outstanding shares

|

$

|

29,922,396

|

||||||||

|

Deduct –

|

||||||||||

|

SHARES OF BENEFICIAL INTEREST OUTSTANDING AT $0.000 PAR VALUE (UNLIMITED SHARES AUTHORIZED)

|

2,595,817

|

Waiver and/or reimbursement by the principal underwriter and/or investment adviser (Note 4)

|

$

|

(26,910

|

||||||

|

Net expenses

|

$

|

482,368

|

||||||||

|

NET ASSET VALUE, OFFERING PRICE, AND REDEMPTION PRICE PER SHARE OF BENEFICIAL INTEREST

|

$

|

11.53

|

Net investment income

|

$

|

87,380

|

|||||

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS:

|

||||||||||

|

|

Net realized gain on investment transactions

|

$

|

1,739,677

|

|||||||

|

|

Net change in unrealized appreciation (depreciation) on investments

|

3,290,176

|

||||||||

|

Net realized and unrealized gain on investments

|

$

|

5,029,853

|

||||||||

|

Net increase in net assets from operations

|

$

|

5,117,233

|

||||||||

| See Notes to Financial Statements | 22 |

|

Years Ended

|

||||||||||

|

STATEMENTS OF CHANGES IN NET ASSETS

|

December 31, 2012

|

December 31, 2011

|

||||||||

|

INCREASE (DECREASE) IN NET ASSETS:

|

||||||||||

|

From operations –

|

||||||||||

|

Net investment income (loss)

|

$

|

87,380

|

$

|

(50,448

|

)

|

|||||

|

0

|

Net realized gain on investment transactions

|

1,739,677

|

1,748,539

|

|||||||

|

Net change in unrealized appreciation (depreciation) on investments

|

3,290,176

|

(2,203,596

|

)

|

|||||||

|

Net increase (decrease) in net assets from operations

|

$

|

5,117,233

|

$

|

(505,505

|

)

|

|||||

|

Distributions to shareholders (Note 2)

|

||||||||||

|

From net investment income

|

$

|

(68,336

|

)

|

$

|

-

|

|||||

|

From net realized capital gains

|

(1,149,678

|

)

|

-

|

|||||||

|

Total distributions

|

$

|

(1,218,014

|

)

|

$

|

-

|

|||||

|

Net increase (decrease) in net assets resulting from fund share transactions (Note 6)

|

$

|

(6,338,582

|

)

|

$

|

4,496,809

|

|||||

|

Net increase (decrease) in net assets

|

$

|

(2,439,363

|

)

|

$

|

3,991,304

|

|||||

|

##

|

||||||||||

|

NET ASSETS:

|

||||||||||

|

At beginning of year

|

32,361,759

|

28,370,455

|

||||||||

|

At end of year

|

$

|

29,922,396

|

$

|

32,361,759

|

||||||

|

UNDISTRIBUTED NET INVESTMENT INCOME INCLUDED IN NET ASSETS AT END OF YEAR

|

$

|

7,446

|

$

|

-

|

||||||

| See Notes to Financial Statements | 23 |

|

These financial highlights reflect selected data for a share outstanding throughout each year.

|

|||||||||||||||||

|

Years Ended December 31,

|

|||||||||||||||||

|

FINANCIAL HIGHLIGHTS

|

2012

|

2011

|

2010

|

2009

|

2008

|

||||||||||||

|

Net asset value, beginning of year

|

$

|

10.280

|

$

|

10.400

|

$

|

8.400

|

$

|

6.060

|

$

|

11.100

|

|||||||

|

Income (loss) from investment operations:

|

|||||||||||||||||

|

Net investment income (loss) (1)

|

0.028

|

(0.018

|

)

|

(0.022

|

)

|

0.011

|

(0.013

|

)

|

|||||||||

|

Net realized and unrealized gain (loss)

|

1.616

|

(0.102

|

)

|

2.030

|

2.329

|

(4.121

|

)

|

||||||||||

|

Total income (loss) from investment operations

|

1.644

|

(0.120

|

)

|

2.008

|

2.340

|

(4.134

|

)

|

||||||||||

|

Less distributions:

|

|||||||||||||||||

|

From net investment income

|

(0.025

|

)

|

—

|

(0.008

|

)

|

—

|

—

|

||||||||||

|

From net realized gains

|

(0.369

|

)

|

—

|

—

|

—

|

(0.906

|

)

|

||||||||||

|

Total distributions

|

(0.394

|

)

|

—

|

(0.008

|

)

|

—

|

(0.906

|

)

|

|||||||||

|

Net asset value, end of year

|

$

|

11.530

|

$

|

10.280

|

$

|

10.400

|

$

|

8.400

|

$

|

6.060

|

|||||||

|

Total Return(2)

|

16.02

|

%

|

(1.15

|

)%

|

23.93

|

%

|

38.61

|

%

|

(39.81

|

)%

|

|||||||

|

Ratios/Supplemental Data(3):

|

|||||||||||||||||

|

Net assets, end of year (000 omitted)

|

$29,922

|

$32,362

|

$28,370

|

$16,763

|

$13,364

|

||||||||||||

|

Ratios (As a percentage of average daily net assets):

|

|||||||||||||||||

|

Net expenses

|

1.40

|

%

|

1.40

|

%

|

1.40

|

%

|

1.36

|

%

|

1.26

|

%

|

|||||||

|

Net expenses after custodian fee reduction

|

N/A

|

N/A

|

N/A

|

1.36

|

%

|

1.25

|

%

|

||||||||||

|

Net investment income (loss)

|

0.25

|

%

|

(0.17

|

)%

|

(0.24

|

)%

|

0.15

|

%

|

(0.15

|

)%

|

|||||||

|

Portfolio turnover rate

|

54

|

%

|

82

|

%

|

60

|

%

|

41

|

%

|

72

|

%

|

|||||||

|

For the years ended December 31, 2012, 2011, 2010, 2009 and 2008

|

For the years ended December 31, 2012, 2011, 2010, 2009 and 2008

|

||||||||||||||||

|

(1)

|

Computed using average shares outstanding.

|

||||||||||||||||

|

(2)

|

Total return is calculated assuming a purchase at the net asset value on the first day and a sale at the net asset value on the last day of each year reported. Dividends and distributions, if any, are assumed to be reinvested at the net asset value on the reinvestment date.

|

||||||||||||||||

|

(3)

|

For each of the years presented, the operating expenses of the Fund were reduced by a waiver of fees and/or allocation of expenses to the principal underwriter and/or investment adviser. Had such action not been undertaken, expenses and net investment income (loss) ratios would have been as follows:

|

||||||||||||||||

|

............................................................

|

2012

|

2011

|

2010

|

2009

|

2008

|

||||||||||||

|

Ratios (As a percentage of average daily net assets):

|

|||||||||||||||||

|

Expenses

|

1.48

|

%

|

1.46

|

%

|

1.79

|

%

|

2.15

|

%

|

1.90

|

%

|

|||||||

|

Expenses after custodian fee reduction

|

N/A

|

N/A

|

N/A

|

2.15

|

%

|

1.89

|

%

|

||||||||||

|

Net investment income (loss)

|

0.17

|

%

|

(0.23

|

)%

|

(0.63

|

)%

|

(0.64

|

)%

|

(0.79

|

)%

|

|||||||

|

............................................................

|

|||||||||||||||||

| See Notes to Financial Statements. | 24 |

|

Shares

|

Value

|

Shares

|

Value

|

|||||||||

|

Bristol-Myers Squibb Co.

|

12,495

|

$

|

407,212

|

|||||||||

|

Forest Laboratories, Inc.*

|

3,795

|

134,040

|

||||||||||

|

Gilead Sciences, Inc.*

|

4,465

|

327,954

|

||||||||||

|

CAPITAL GOODS - 12.1%

|

Johnson & Johnson

|

5,800

|

406,580

|

|||||||||

|

3M Co.

|

5,355

|

$

|

497,212

|

$

|

1,880,554

|

|||||||

|

Cummins, Inc.

|

895

|

96,973

|

||||||||||

|

Fastenal Co.

|

1,560

|

72,836

|

||||||||||

|

Fluor Corp.

|

1,560

|

91,634

|

RETAILING - 7.9%

|

|||||||||

|

General Dynamics Corp.

|

7,590

|

525,759

|

Amazon.com, Inc.*

|

380

|

$

|

95,433

|

||||||

|

Precision Castparts Corp.

|

2,680

|

507,646

|

Bed Bath & Beyond, Inc.*

|

6,250

|

349,437

|

|||||||

|

WW Grainger, Inc.

|

445

|

90,055

|

Dollar Tree, Inc.*

|

1,560

|

63,274

|

|||||||

|

$

|

1,882,115

|

priceline.com, Inc.*

|

135

|

83,862

|

||||||||

|

Ross Stores, Inc.

|

2,900

|

157,035

|

||||||||||

|

TJX Cos., Inc.

|

11,160

|

473,742

|

||||||||||

|

CONSUMER DURABLES & APPAREL - 2.0%

|

$

|

1,222,783

|

||||||||||

|

Coach, Inc.

|

1,340

|

$

|

74,384

|

|||||||||

|

Mattel, Inc.

|

2,455

|

89,902

|

||||||||||

|

NIKE, Inc. - Class B

|

1,700

|

87,720

|

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 3.1%

|

|||||||||

|

Ralph Lauren Corp.

|

445

|

66,714

|

Intel Corp.

|

23,655

|

$

|

488,003

|

||||||

|

$

|

318,720

|

|||||||||||

|

SOFTWARE & SERVICES - 13.9%

|

||||||||||||

|

CONSUMER SERVICES - 0.5%

|

Accenture PLC - Class A

|

1,115

|

$

|

74,148

|

||||||||

|

Starbucks Corp.

|

1,340

|

$

|

71,851

|

Google, Inc. - Class A*

|

670

|

475,278

|

||||||

|

Mastercard, Inc. - Class A

|

225

|

110,538

|

||||||||||

|

Microsoft Corp.

|

24,100

|

644,193

|

||||||||||

|

DIVERSIFIED FINANCIALS - 8.0%

|

Oracle Corp.

|

12,495

|

416,333

|

|||||||||

|

IntercontinentalExchange, Inc.*

|

3,345

|

$

|

414,144

|

Visa, Inc., Class A

|

2,900

|

439,582

|

||||||

|

JPMorgan Chase & Co.

|

16,515

|

726,165

|

$

|

2,160,072

|

||||||||

|

T. Rowe Price Group, Inc.

|

1,560

|

101,603

|

||||||||||

|

$

|

1,241,912

|

|||||||||||

|

TECHNOLOGY HARDWARE & EQUIPMENT - 7.0%

|

||||||||||||

|

Apple, Inc.

|

895

|

$

|

477,062

|

|||||||||

|

ENERGY - 8.4%

|

Cisco Systems, Inc.

|

30,795

|

605,122

|

|||||||||

|

Chevron Corp.

|

6,695

|

$

|

723,997

|

$

|

1,082,184

|

|||||||

|

Helmerich & Payne, Inc.

|

2,230

|

124,902

|

||||||||||

|

Murphy Oil Corp.

|

7,810

|

465,086

|

||||||||||

|

$

|

1,313,985

|

TRANSPORTATION - 0.5%

|

||||||||||

|

CH Robinson Worldwide, Inc.

|

1,115

|

$

|

70,490

|

|||||||||

|

FOOD & STAPLES RETAILING - 3.5%

|

TOTAL EQUITY INTERESTS - 99.5%

|

$

|

15,482,036

|

|||||||||

|

Walgreen Co.

|

14,730

|

$

|

545,157

|

(identified cost, $15,668,913)

|

||||||||

|

SHORT-TERM INVESTMENTS - 0.0%

|

||||||||||||

|

FOOD, BEVERAGE & TOBACCO - 7.5%

|

Fidelity Government Money Market Fund, 0.01% (1)

|

1,670

|

$

|

1,670

|

||||||||

|

Brown-Forman Corp. - Class B

|

6,472

|

$

|

409,354

|

|||||||||

|

Coca-Cola Co. (The)

|

17,185

|

622,956

|

TOTAL SHORT-TERM INVESTMENTS - 0.0%

|

$

|

1,670

|

|||||||

|

Monster Beverage Corp.*

|

2,680

|

141,719

|

(identified cost, $1,670)

|

|||||||||

|

$

|

1,174,029

|

|||||||||||

|

TOTAL INVESTMENTS — 99.5%

|

$

|

15,483,706

|

||||||||||

|

(identified cost, $15,670,583)

|

||||||||||||

|

HEALTH CARE EQUIPMENT & SERVICES - 4.8%

|

||||||||||||

|

Humana, Inc.

|

5,800

|

$

|

398,054

|

OTHER ASSETS, IN EXCESS OF LIABILITIES — 0.5%

|

75,474

|

|||||||

|

Stryker Corp.

|

6,470

|

354,685

|

||||||||||

|

$

|

752,739

|

NET ASSETS — 100.0%

|

$

|

15,559,180

|

||||||||

|

PLC — Public Limited Company

|

||||||||||||

|

INSURANCE - 3.3%

|

* Non-income producing security.

|

|||||||||||

|

Aflac, Inc.

|

9,595

|

$

|

509,686

|

(1) Variable rate security. Rate presented is as of December 31, 2012.

|

||||||||

|

MATERIALS - 4.9%

|

||||||||||||

|

CF Industries Holdings, Inc.

|

2,230

|

$

|

453,047

|

|||||||||

|

Freeport-McMoRan Copper & Gold, Inc.

|

1,785

|

61,047

|

||||||||||

|

Monsanto Co.

|

2,680

|

253,662

|

||||||||||

|

$

|

767,756

|

|||||||||||

|

PHARMACEUTICALS & BIOTECHNOLOGY - 12.1%

|

||||||||||||

|

Amgen, Inc.

|

6,250

|

$

|

539,500

|

|||||||||

|

Biogen Idec, Inc.*

|

445

|

65,268

|

||||||||||

| See Notes to Financial Statements. | 25 |

|

STATEMENT OF ASSETS AND LIABILITIES

|

STATEMENT OF OPERATIONS

|

|||||||||||||

|

ASSETS:

|

TRUE

|

INVESTMENT INCOME (Note 1C)

|

TRUE

|

|||||||||||

|

Investments, at value

|

2.00E+07

|

Dividend income

|

$

|

366,186

|

||||||||||

|

(identified cost $15,670,583) (Note 1A)

|

$

|

15,483,706

|

######

|

Total investment income

|

$

|

366,186

|

||||||||

|

Receivable for fund shares sold

|

1,781

|

|||||||||||||

|

Receivable for investment securities sold

|

101,639

|

Expenses –

|

||||||||||||

|

Dividends receivable

|

3,244

|

Investment adviser fee (Note 3)

|

$

|

107,547

|

||||||||||

|

Prepaid expenses and other assets

|

13,578

|

Administrator fee (Note 3)

|

21,510

|

|||||||||||

|

Total assets

|

$

|

15,603,948

|

Trustee expense (Note 3)

|

14,979

|

||||||||||

|

Custodian fee

|

5,000

|

|||||||||||||

|

LIABILITIES:

|

Accountant fee

|

37,378

|

||||||||||||

|

Outstanding line of credit (Note 8)

|

$

|

18,379

|

Distribution expenses (Note 4)

|

44,811

|

||||||||||

|

Payable for fund shares reacquired

|

13,670

|

Transfer agent fee

|

25,407

|

|||||||||||

|

Accrued expenses and other liabilities

|

12,719

|

Printing

|

70

|

|||||||||||

|

Total liabilities

|

$

|

44,768

|

Shareholder communications

|

4,688

|

||||||||||

|

NET ASSETS

|

$

|

15,559,180

|

Audit services

|

17,000

|

||||||||||

|

Legal services

|

6,747

|

|||||||||||||

|

NET ASSETS CONSIST OF:

|

Compliance services

|

5,605

|

||||||||||||

|

Paid-in capital

|

$

|

21,006,713

|

Registration costs

|

18,695

|

||||||||||

|

Accumulated net realized loss on investments

|

(5,263,319

|

)

|

Interest expense (Note 8)

|

1,203

|

||||||||||

|

Undistributed net investment income

|

2,663

|

Miscellaneous

|

18,716

|

|||||||||||

|

Unrealized depreciation on investments

|

(186,877

|

)

|

Total expenses

|

$

|

329,356

|

|||||||||

|

Net assets applicable to outstanding shares

|

$

|

15,559,180

|

||||||||||||

|

Deduct –

|

||||||||||||||

|

SHARES OF BENEFICIAL INTEREST OUTSTANDING AT $0.000 PAR VALUE (UNLIMITED SHARES AUTHORIZED)

|

1,226,306

|

Waiver and/or reimbursement by the principal underwriter and/or investment adviser (Note 4)

|

$

|

(77,210

|

)

|

|||||||||

|

Net expenses

|

$

|

252,146

|

||||||||||||

|

NET ASSET VALUE, OFFERING PRICE, AND REDEMPTION PRICE PER SHARE OF BENEFICIAL INTEREST

|

$

|

12.69

|

Net investment income

|

$

|

114,040

|

|||||||||

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS:

|

||||||||||||||

|

Net realized loss on investment transactions

|

$

|

(39,296

|

)

|

|||||||||||

|

Net change in unrealized appreciation (depreciation) on investments

|

746,759

|

|||||||||||||

|

Net realized and unrealized gain on investments

|

$

|

707,463

|

||||||||||||

|

Net increase in net assets from operations

|

$

|

821,503

|

||||||||||||

| See Notes to Financial Statements. | 26 |

|

Years Ended

|

||||||||||

|

STATEMENTS OF CHANGES IN NET ASSETS

|

December 31, 2012

|

December 31, 2011

|

||||||||

|

INCREASE (DECREASE) IN NET ASSETS:

|

||||||||||

|

From operations –

|

||||||||||

|

Net investment income (loss)

|

$

|

114,040

|

$

|

(18,177

|

)

|

|||||

|

0

|

Net realized gain (loss) on investment transactions

|

(39,296

|

)

|

2,830,519

|

||||||

|

Net change in unrealized appreciation (depreciation) on investments

|

746,759

|

(2,666,829

|

)

|

|||||||

|

Net increase in net assets from operations

|

$

|

821,503

|

$

|

145,513

|

||||||

|

Distributions to shareholders (Note 2)

|

||||||||||

|

From net investment income

|

$

|

(111,377

|

)

|

$

|

-

|

|||||

|

Total distributions

|

$

|

(111,377

|

)

|

$

|

-

|

|||||

|

Net decrease in net assets resulting from fund share transactions (Note 6)

|

$

|

(4,071,909

|

)

|

$

|

(2,900,561

|

)

|

||||

|

Net decrease in net assets

|

$

|

(3,361,783

|

)

|

$

|

(2,755,048

|

)

|

||||

|

##

|

||||||||||

|

NET ASSETS:

|

||||||||||

|

At beginning of year

|

18,920,963

|

21,676,011

|

||||||||

|

At end of year

|

$

|

15,559,180

|

$

|

18,920,963

|

||||||

|

UNDISTRIBUTED NET INVESTMENT INCOME INCLUDED IN NET ASSETS AT END OF YEAR

|

$

|

2,663

|

$

|

-

|

||||||

| See Notes to Financial Statements. | 27 |

|

These financial highlights reflect selected data for a share outstanding throughout each year.

|

|||||||||||||||||

|

Years Ended December 31,

|

|||||||||||||||||

|

FINANCIAL HIGHLIGHTS

|

2012

|

2011

|

2010

|

2009

|

2008

|

||||||||||||

|

Net asset value, beginning of year

|

$

|

12.260

|

$

|

12.250

|

$

|

10.870

|

$

|

9.340

|

$

|

14.520

|

|||||||

|

Income (loss) from investment operations:

|

|||||||||||||||||

|

Net investment income (loss) (1)

|

0.082

|

(0.012

|

)

|

0.044

|

0.099

|

0.104

|

|||||||||||

|

Net realized and unrealized gain (loss)

|

0.437

|

0.022

|

1.389

|

1.564

|

(5.169

|

)

|

|||||||||||

|

Total income (loss) from investment operations

|

0.519

|

0.010

|

1.433

|

1.663

|

(5.065

|

)

|

|||||||||||

|

Less distributions:

|

|||||||||||||||||

|

From net investment income

|

(0.089

|

)

|

—

|

(0.053

|

)

|

(0.133

|

)

|

(0.115

|

)

|

||||||||

|

Net asset value, end of year

|

$

|

12.690

|

$

|

12.260

|

$

|

12.250

|

$

|

10.870

|

$

|

9.340

|

|||||||

|

Total Return(2)

|

4.23

|

%

|

0.08

|

%

|

13.19

|

%

|

17.83

|

%

|

(34.85

|

)%

|

|||||||

|

Ratios/Supplemental Data(3):

|

|||||||||||||||||

|

Net assets, end of year (000 omitted)

|

$15,559

|

$18,921

|

$21,676

|

$27,337

|

$32,484

|

||||||||||||

|

Ratios (As a percentage of average daily net assets):

|

|||||||||||||||||

|

Net expenses

|

1.40

|

%

|

1.40

|

%

|

1.41

|

%

|

1.36

|

%

|

1.26

|

%

|

|||||||

|

Net expenses after custodian fee reduction

|

N/A

|

N/A

|

N/A

|

1.36

|

%

|

1.25

|

%

|

||||||||||

|

Net investment income (loss)

|

0.64

|

%

|

(0.09

|

)%

|

0.39

|

%

|

1.06

|

%

|

0.86

|

%

|

|||||||

|

Portfolio turnover rate

|

76

|

%

|

154

|

%

|

68

|

%

|

69

|

%

|

58

|

%

|

|||||||

|

For the years ended December 31, 2012, 2011, 2010, 2009 and 2008

|

For the years ended December 31, 2012, 2011, 2010, 2009 and 2008

|

||||||||||||||||

|

(1)

|

Computed using average shares outstanding.

|

||||||||||||||||

|

(2)

|

Total return is calculated assuming a purchase at the net asset value on the first day and a sale at the net asset value on the last day of each year reported. Dividends and distributions, if any, are assumed to be reinvested at the net asset value on the reinvestment date.

|

||||||||||||||||

|

(3)

|

For each of the years presented, the operating expenses of the Fund were reduced by a waiver of fees and/or allocation of expenses to the principal underwriter and/or investment adviser. Had such action not been undertaken, expenses and net investment income (loss) ratios would have been as follows:

|

||||||||||||||||

|

............................................................

|

2012

|

2011

|

2010

|

2009

|

2008

|

||||||||||||

|

Ratios (As a percentage of average daily net assets):

|

|||||||||||||||||

|

Expenses

|

1.84

|

%

|

1.70

|

%

|

1.68

|

%

|

1.55

|

%

|

1.37

|

%

|

|||||||

|

Expenses after custodian fee reduction

|

N/A

|

N/A

|

N/A

|

1.55

|

%

|

1.36

|

%

|

||||||||||

|

Net investment income (loss)

|

0.20

|

%

|

(0.39

|

)%

|

0.13

|

%

|

0.86

|

%

|

0.75

|

%

|

|||||||

|

............................................................

|

|||||||||||||||||

| See Notes to Financial Statements. | 28 |

|

Shares

|

Value

|

Shares

|

Value

|

|||||||||

|

HONG KONG - 3.4%

|

||||||||||||

|

Cheung Kong Holdings, Ltd.

|

38,000

|

$

|

593,516

|

|||||||||

|

AUSTRALIA - 6.3%

|

Power Assets Holdings, Ltd.

|

19,500

|

168,723

|

|||||||||

|

ALS, Ltd./Queensland

|

13,310

|

$

|

150,867

|

Techtronic Industries Co.

|

70,500

|

131,176

|

||||||

|

Australia & New Zealand Banking Group, Ltd.

|

6,534

|

173,282

|

Yue Yuen Industrial Holdings, Ltd.

|

71,500

|

245,923

|

|||||||

|

BHP Billiton, Ltd.

|

10,449

|

410,635

|

$

|

1,139,338

|

||||||||

|

Commonwealth Bank of Australia

|

6,396

|

420,560

|

||||||||||

|

Incitec Pivot, Ltd.

|

97,565

|

330,741

|

||||||||||

|

Orica, Ltd.

|

3,823

|

100,460

|

ITALY - 2.4%

|

|||||||||

|

Rio Tinto, Ltd.

|

3,060

|

211,994

|

Enel SpA

|

56,353

|

$

|

237,150

|

||||||

|

Westpac Banking Corp.

|

11,305

|

311,454

|

Eni SpA (Azioni Ordinarie)

|

23,475

|

574,392

|

|||||||

|

$

|

2,109,993

|

$

|

811,542

|

|||||||||

|

CANADA - 6.3%

|

JAPAN - 14.0%

|

|||||||||||

|

Agrium, Inc.

|

5,027

|

$

|

500,529

|

Bridgestone Corp.

|

10,000

|

$

|

258,063

|

|||||

|

Bank of Nova Scotia

|

5,813

|

335,457

|

Daito Trust Construction Co., Ltd.

|

4,100

|

388,438

|

|||||||

|

BCE, Inc.

|

2,914

|

124,760

|

Dena Co., Ltd.

|

5,400

|

179,428

|

|||||||

|

Catamaran Corp.*

|

3,165

|

148,698

|

ITOCHU Corp.

|

52,800

|

558,473

|

|||||||

|

CGI Group, Inc. - Class A*

|

2,986

|

68,795

|

JGC Corp.

|

3,000

|

94,034

|

|||||||

|

Magna International, Inc.

|

3,123

|

155,821

|

KDDI Corp.

|

10,700

|

751,502

|

|||||||

|

Toronto-Dominion Bank (The)

|

8,961

|

753,725

|

Mitsubishi Corp.

|

16,000

|

309,182

|

|||||||

|