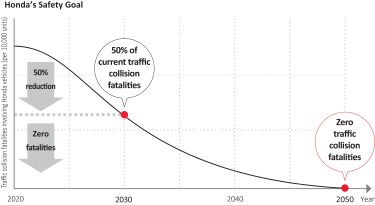

As a mobility company, we must sincerely address the difficult challenges of achieving “zero environmental impact” and “absolute safety.” By realizing the future mobility Honda dreams of and a mobility society people desire, while addressing societal values in the areas of the “environment and safety”, Honda aspires to chart a new trajectory of growth as a company.

Amidst this era of significant transformation in the business environment, we believe that we need to proactively change, and so we have made progress toward various initiatives. However, in order for all of us at Honda to work together cohesively toward a common purpose at an accelerated speed, we recognized the importance of

re-clarifying

“direction what we aim for” and “what value we offer.” Thus, we have redefined the Honda Global Brand Slogan—The Power of Dreams—.

“Redefinition of the Honda Global Brand Slogan”

Honda seeks to offer two value propositions Honda wants to continue offering—One is to enable people to “transcend the constraints of time and place,” and the other is to enable people to “augment of all human possibilities.” The future mobility we dream of and a mobility society people desire lie ahead of us as we continue to thoroughly pursue these value propositions. Therefore, we defined the two values we provide as “Transcend” and “Augment.”

Transcend: “Go beyond the limits”

Honda aims to create the significant value of “transcending the constraints of time” and “transcending the constraints of place” via mobility.

Augment: “Making something greater”

Honda aims to provide the value of “augmenting people’s possibilities” to enable people to become capable of doing something that they could not do before through the use of various mobility products and services.

Furthermore, it is the creativity of each and every one of us at Honda that becomes the key to creating the value proposition of Honda. With the key word of “Create,” all of us who work together at Honda will set high goals and take on challenges without being afraid of changes, to “create” something which will generate new value for our customers.

By “moving people physically” as a mobility company and “moving people’s hearts”—How we move you.—through the value we provide, Honda aims to become “the power that supports people around the world who are trying to do things based on their own initiative” in order to continue to be “a company society wants to exist.”

Management Challenges

The business environment surrounding Honda has come to a major turning point. Values are diversifying, the population is aging, urbanization is accelerating, climate change is worsening, and the industrial structure is changing due to progress in technologies such as the use of electric-powered motors, autonomous driving and IoT, all on a global basis. Additionally, geopolitical risks have emerged, where the outlook for the international situation remains uncertain, including the situations in Ukraine and the Middle East. Furthermore, Honda needs to build positive relationships with all stakeholders involved in our corporate activities to solve long-term social issues. Working to improve the quality of providing value is essential to achieve future growth.

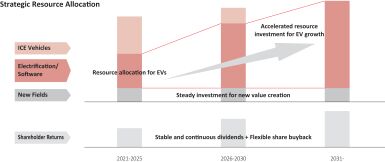

In Automobile business, a wide variety of products have been introduced in the EV (electric vehicle) market. It is becoming increasingly challenging for Honda to differentiate its products based on traditional strengths such as performance of engines. With electrification on the rise, we anticipate increased demand for

31