| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| |

| Title of each class |

Outstanding as of March 31, 2024*** | |

Common Stock |

| Accelerated filer ☐ | Non-accelerated filer ☐ |

Emerging growth company |

| * | for trading purposes, but only in connection with the registration of American Depositary Shares, each representing three shares of Common Stock. |

| ** | American Depositary Receipts evidence American Depositary Shares, each American Depositary Share representing three shares of Common Stock. |

| *** | Unless otherwise indicated in this Form 20-F, “outstanding shares” excludes the number of shares held by the BIP Trust (as defined under Item 6.B. “Compensation-The Board Incentive Plan”). |

| **** | Shares of Common Stock include |

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 52 | ||||

| 53 | ||||

| 55 | ||||

| 55 | ||||

| 55 | ||||

| 75 | ||||

| 78 | ||||

| 83 | ||||

| 83 | ||||

| 84 | ||||

| 84 | ||||

| 105 | ||||

| 112 | ||||

| 112 | ||||

| 113 | ||||

| 115 | ||||

| 115 | ||||

| 115 | ||||

| 115 | ||||

| 116 | ||||

| 116 | ||||

| 116 | ||||

| 117 | ||||

| 117 | ||||

| 117 | ||||

| 117 | ||||

| 117 | ||||

| 117 | ||||

| 117 | ||||

| 118 | ||||

| 118 | ||||

| 118 | ||||

| 118 | ||||

| 119 | ||||

| 119 | ||||

| 119 | ||||

| 123 | ||||

| 123 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| 127 | ||||

| 127 | ||||

| 127 | ||||

| 128 | ||||

| 128 | ||||

| 128 | ||||

| 129 | ||||

| 129 | ||||

| 130 | ||||

| 130 | ||||

| 134 | ||||

| 134 | ||||

| 134 | ||||

| 134 | ||||

| 136 | ||||

| 136 | ||||

| 137 | ||||

| • | the political, economic and social conditions in Japan and throughout the world including North America, Europe and Asia, including economic slowdowns, recessions, changes in consumer preferences, rising fuel prices, financial crises, exchange rates and other factors, as well as the relevant |

governments’ specific policies with respect to economic growth, inflation, taxation, currency conversion, imports and sources of supplies and the availability of credit, particularly to the extent such current or future conditions and policies affect the automobile, motorcycle and power product industries and markets in Japan and other markets throughout the world in which Honda conducts its business, and the demand, sales volume and sales prices for Honda’s automobiles, motorcycles and power products; |

| • | the effects of competition in the automobile, motorcycle and power product markets on the demand, sales volume and sales prices for Honda’s automobiles, motorcycles and power products; |

| • | Honda’s ability to finance its working capital and capital expenditure requirements, including obtaining any required external debt or other financing upon favorable interest rates or other terms; |

| • | the effects of environmental, personal information and other governmental regulations and legal proceedings; and |

| • | the effects of events such as environmental or man-made disasters, pandemics, cyber-attacks or other events affecting Honda, its suppliers, customers or the economy as a whole. |

Fiscal years ended March 31, |

||||||||||||

2022 |

2023 |

2024 |

||||||||||

Yen (billions) |

||||||||||||

Motorcycle Business |

¥ | 2,185.2 | ¥ | 2,908.9 | ¥ | 3,220.1 | ||||||

Automobile Business |

9,147.4 | 10,593.5 | 13,567.5 | |||||||||

Financial Services Business |

2,820.6 | 2,954.0 | 3,248.8 | |||||||||

Power Products and Other Businesses |

399.2 | 451.1 | 392.2 | |||||||||

Total |

¥ | 14,552.6 | ¥ | 16,907.7 | ¥ | 20,428.8 | ||||||

Fiscal years ended March 31, |

||||||||||||

2022 |

2023 |

2024 |

||||||||||

Yen (billions) |

||||||||||||

Japan |

¥ | 1,943.6 | ¥ | 2,013.0 | ¥ | 2,242.2 | ||||||

North America |

7,624.7 | 8,945.9 | 11,713.6 | |||||||||

Europe |

611.8 | 690.6 | 961.1 | |||||||||

Asia |

3,711.4 | 4,335.7 | 4,313.8 | |||||||||

Other Regions |

660.8 | 922.2 | 1,197.9 | |||||||||

Total |

¥ | 14,552.6 | ¥ | 16,907.7 | ¥ | 20,428.8 | ||||||

Fiscal years ended March 31, |

||||||||||||||||||||||||||||||||||||

2022 |

2023 |

2024 |

||||||||||||||||||||||||||||||||||

Honda Group Unit Sales* |

Consolidated Unit Sales* |

Revenue |

Honda Group Unit Sales* |

Consolidated Unit Sales* |

Revenue |

Honda Group Unit Sales* |

Consolidated Unit Sales* |

Revenue |

||||||||||||||||||||||||||||

Units (thousands) |

Units (thousands) |

Yen (billions) |

Units (thousands) |

Units (thousands) |

Yen (billions) |

Units (thousands) |

Units (thousands) |

Yen (billions) |

||||||||||||||||||||||||||||

Japan |

244 | 244 | ¥ | 105.0 | 246 | 246 | ¥ | 109.3 | 241 | 241 | ¥ | 113.7 | ||||||||||||||||||||||||

North America |

437 | 437 | 230.7 | 459 | 459 | 306.7 | 498 | 498 | 335.5 | |||||||||||||||||||||||||||

Europe |

317 | 317 | 202.2 | 347 | 347 | 250.0 | 440 | 440 | 351.8 | |||||||||||||||||||||||||||

Asia |

14,589 | 8,283 | 1,309.9 | 16,108 | 9,512 | 1,739.7 | 16,016 | 9,416 | 1,793.3 | |||||||||||||||||||||||||||

Other Regions |

1,440 | 1,440 | 337.2 | 1,597 | 1,597 | 503.0 | 1,624 | 1,624 | 625.6 | |||||||||||||||||||||||||||

Total |

17,027 | 10,721 | ¥ | 2,185.2 | 18,757 | 12,161 | ¥ | 2,908.9 | 18,819 | 12,219 | ¥ | 3,220.1 | ||||||||||||||||||||||||

Motorcycle revenue as a percentage of total sales revenue |

15 | % | 17 | % | 16 | % | ||||||||||||||||||||||||||||||

| * | Honda Group Unit Sales is the total unit sales of completed products of Honda, its consolidated subsidiaries and its affiliates and joint ventures accounted for using the equity method. Consolidated Unit Sales is the total unit sales of completed products corresponding to consolidated sales revenue to external customers, which consists of unit sales of completed products of Honda and its consolidated subsidiaries. |

Fiscal years ended March 31, |

||||||||||||||||||||||||||||||||||||

2022 |

2023 |

2024 |

||||||||||||||||||||||||||||||||||

Honda Group Unit Sales* |

Consolidated Unit Sales* |

Revenue |

Honda Group Unit Sales* |

Consolidated Unit Sales* |

Revenue |

Honda Group Unit Sales* |

Consolidated Unit Sales* |

Revenue |

||||||||||||||||||||||||||||

Units (thousands) |

Units (thousands) |

Yen (billions) |

Units (thousands) |

Units (thousands) |

Yen (billions) |

Units (thousands) |

Units (thousands) |

Yen (billions) |

||||||||||||||||||||||||||||

Japan |

547 | 476 | ¥ | 1,340.7 | 550 | 484 | ¥ | 1,385.8 | 595 | 525 | ¥ | 1,600.6 | ||||||||||||||||||||||||

North America |

1,283 | 1,283 | 4,884.9 | 1,195 | 1,195 | 5,990.5 | 1,628 | 1,628 | 8,510.2 | |||||||||||||||||||||||||||

Europe |

100 | 100 | 319.3 | 84 | 84 | 332.9 | 103 | 103 | 506.7 | |||||||||||||||||||||||||||

Asia |

2,022 | 443 | 2,321.7 | 1,744 | 505 | 2,523.8 | 1,651 | 468 | 2,449.8 | |||||||||||||||||||||||||||

Other Regions |

122 | 122 | 280.7 | 114 | 114 | 360.3 | 132 | 132 | 500.1 | |||||||||||||||||||||||||||

Total |

4,074 | 2,424 | ¥ | 9,147.4 | 3,687 | 2,382 | ¥ | 10,593.5 | 4,109 | 2,856 | ¥ | 13,567.5 | ||||||||||||||||||||||||

Automobile revenue as a percentage of total sales revenue |

63 | % | 63 | % | 66 | % | ||||||||||||||||||||||||||||||

| * | Honda Group Unit Sales is the total unit sales of completed products of Honda, its consolidated subsidiaries and its affiliates and joint ventures accounted for using the equity method. Consolidated Unit Sales is the total unit sales of completed products corresponding to consolidated sales revenue to external customers, which consists of unit sales of completed products of Honda and its consolidated subsidiaries. Certain sales of automobiles that are financed with residual value type auto loans and others by our Japanese finance subsidiaries and provided through our consolidated subsidiaries are accounted for as operating leases in conformity with International Financial Reporting Standards (“IFRS”) and are not included in consolidated sales revenue to the external customers in our Automobile business. Accordingly, they are not included in Consolidated Unit Sales, but are included in Honda Group Unit Sales of our Automobile business. |

Fiscal years ended March 31, |

||||||||||||

2022 |

2023 |

2024 |

||||||||||

Yen (billions) |

||||||||||||

Japan |

¥ | 418.3 | ¥ | 428.2 | ¥ | 440.7 | ||||||

North America |

2,356.9 | 2,466.5 | 2,729.1 | |||||||||

Europe |

10.8 | 13.2 | 18.1 | |||||||||

Asia |

15.7 | 16.5 | 14.7 | |||||||||

Other Regions |

18.6 | 29.4 | 46.0 | |||||||||

Total |

¥ | 2,820.6 | ¥ | 2,954.0 | ¥ | 3,248.8 | ||||||

Financial Services revenue as a percentage of total sales revenue |

19 | % | 17 | % | 16 | % | ||||||

Fiscal years ended March 31, |

||||||||||||||||||||||||

2022 |

2023 |

2024 |

||||||||||||||||||||||

Honda Group Unit Sales / Consolidated Unit Sales* |

Revenue |

Honda Group Unit Sales / Consolidated Unit Sales* |

Revenue |

Honda Group Unit Sales / Consolidated Unit Sales* |

Revenue |

|||||||||||||||||||

Units (thousands) |

Yen (billions) |

Units (thousands) |

Yen (billions) |

Units (thousands) |

Yen (billions) |

|||||||||||||||||||

Japan |

353 | ¥ | 79.4 | 376 | ¥ | 89.6 | 302 | ¥ | 87.0 | |||||||||||||||

North America |

2,738 | 152.1 | 2,274 | 182.1 | 1,083 | 138.7 | ||||||||||||||||||

Europe |

1,189 | 79.3 | 1,168 | 94.3 | 794 | 84.4 | ||||||||||||||||||

Asia |

1,487 | 64.0 | 1,408 | 55.5 | 1,294 | 55.9 | ||||||||||||||||||

Other Regions |

433 | 24.3 | 419 | 29.4 | 339 | 26.0 | ||||||||||||||||||

Total |

6,200 | ¥ | 399.2 | 5,645 | ¥ | 451.1 | 3,812 | ¥ | 392.2 | |||||||||||||||

Power Products and Other businesses revenue as a percentage of total sales revenue |

3 | % | 3 | % | 2 | % | ||||||||||||||||||

| * | Honda Group Unit Sales is the total unit sales of completed power products of Honda, its consolidated subsidiaries and its affiliates and joint ventures accounted for using the equity method. Consolidated Unit Sales is the total unit sales of completed power products corresponding to consolidated sales revenue to external customers, which consists of unit sales of completed power products of Honda and its consolidated subsidiaries. In Power products business, there is no discrepancy between Honda Group Unit Sales and Consolidated Unit Sales since no affiliate and joint venture accounted for using the equity method was involved in the sale of Honda power products. |

| + | Amendment to electric vehicles safety requirements. |

| + | Motor vehicles – Devices for indirect vision – Requirements of performance and installation |

| + | Amendment to connection set for conductive charging of electric vehicles – Part 1: General requirements |

| + | Amendment to test methods for power performance of fuel cell electric vehicles |

| + | Amendment to fuel cell electric vehicles – Onboard hydrogen system specifications |

| + | Establishment of security requirements for automobile data collection and requirements for cross-border data transfers |

| + | Establishment of technical requirements related to cyber security, and |

| + | General technical requirements for software updates of vehicles |

| + | Amendment to battery electric passenger cars-specifications. |

| + | Amendment to measurement methods of net power for automotive engines and electric drive trains |

| + | Amendment to hybrid electric vehicles – Power performance – Test method |

| + | Amendment to battery electric vehicles – Power performance – Test method |

| + | Protective device against unauthorized use of motor vehicles |

| + | Intelligent and connected vehicle – Data storage system for automated driving |

| + | Technical requirements and testing methods for advanced emergency braking system (AEBS) of light-duty vehicles |

| + | Technical requirements related to cyber security. |

| + | Security requirements for automotive data collection. |

Region |

EV lineup: current and to be released | |

North America |

• Launched the PROLOGUE ZDX co-developed with General Motors Company (GM)• Plan to launch a mid- to large-size EV incorporating a new E&E architecture based on Honda’s proprietary EV platform in 2025• Plan to launch the first model of the Honda 0 Series | |

China |

• Launched the e:NS2 e:NP2 • Plan to launch, at the end of 2024 or thereafter, the Ye P7 Ye S7 Ye In addition, plan to launch production models based on the Ye GT CONCEPT • Plan to introduce a total of 10 EV models, including the above 5 models by 2027 | |

Japan |

• Plan to launch N-VAN e:N-VAN-based • Plan to launch an N-ONE-based | |

Europe |

• Launched e:Ny1 e:N |

*1 |

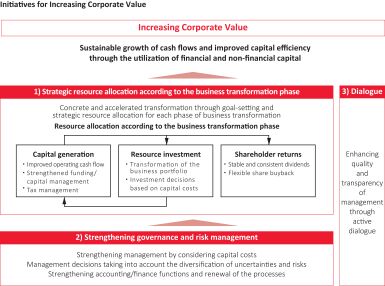

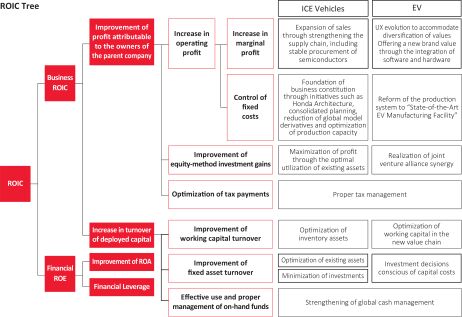

[Profit for the year attributable to owners of the parent + Interest expenses (excluding financial businesses)] /Deployed Capital *2 |

*2 |

Equity attributable to owners of the parent + Interest-bearing liabilities (excluding those from the financial business sector). Deployed capital is calculated using the average of the beginning and end of the period. |

*1 |

ABS : Antilock Brake System |

*2 |

CBS : Combined Brake System |

Target for 2030 |

Target for 2050 | |||||

Reduction rate of total CO 2 emissions from corporate activities (compared to FY2020) |

46% | Net zero CO 2 emissions | ||||

Sales ratio of electrified products |

Motorcycles | 15% | ||||

| Automobiles | 30% | |||||

| Power products | 36% | |||||

Reduction rate of CO 2 emissions intensity of product use (compared to FY2020) |

Motorcycles | 34.0% | ||||

| Automobiles | 27.2% | |||||

| Power products | 28.2% | |||||

Reduction rate of total waste generation in corporate activities (compared to BAU*) |

14.5% | Zero industrial waste | ||||

Reduction rate of total water intake in corporate activities (compared to BAU*) |

14.5% | Zero industrial water intake | ||||

* |

The estimated result for 2030 based on our production plans but without implementing our reduction strategies. |

Target for 2030 | ||||

Advanced Safety Equipment Application Rate |

Automobiles in developed countries* 2 Honda SENSING 360 |

100% | ||

Automobiles in emerging countries* 3 Honda SENSING |

100% | |||

Motorcycles in emerging countries* 4 Advanced Braking (ABS/CBS) |

100% | |||

*1 |

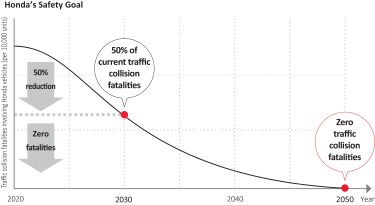

Halve the number of traffic collision fatalities per 10,000 vehicles involving Honda motorcycles and automobiles worldwide in 2030 compared to 2020. |

*2 |

Japan, USA, China, Europe |

*3 |

Representative measurement countries India, Indonesia, Malaysia, Thailand and Brazil. |

*4 |

Representative measurement countries India, Indonesia, Vietnam, Thailand and Brazil. |

* |

Scope: The Company and its subsidiaries in Japan subject to labor contracts with our union (see Item 6. D. “Employees”) |

* |

Scope: The Company and its subsidiaries in Japan subject to labor contracts with our union (see Item 6. D. “Employees”) |

Risk |

Opportunity |

Response | ||||||||

| Transition Risk | 1.5°C | Policy and Regulation | • Payment of fines for failure in complying with fuel efficiency regulations • Drop in unit sales of internal-combustion engine (ICE) vehicles due to more stringent fuel efficiency regulations • Increased costs due to carbon tax and Emissions Trading System (ETS), etc. |

• Increase in sales due to a sales expansion of electrified products and services • Reduction of business operation costs through introducing the higher energy efficiency production facilities and utilization of renewable energy |

• Introduce innovative environmental technologies, such as electrification, to become carbon neutral, diversifying energy sources and implementing total energy management initiatives • Promote the improvement of production efficiency, implementation of energy-saving measures, shifting to low-carbon energy and use of renewable energy | |||||

| Changes in Market | • Increase in energy purchase prices due to cleaner energy in the market | |||||||||

| Physical Risk | 4°C | Acute/Chronic | • Suspension of production resulting from natural disasters, which will damage Honda’s production bases and disrupt its supply chain |

• Increase in sales of electrified products that can be used as an emergency power source when the need for power supply increases during a disaster |

• Formulation and revise of business continuity planning (BCP) , Implementation of countermeasures by conducting trainings • Promote the establishment of a stable production structure via a robust supply chain | |||||

* |

This list is not intended to be exhaustive and does not cover all risks and opportunities or Honda’s measures with respect thereto. |

Company |

Country of Incorporation |

Function |

Percentage Ownership and Voting Interest |

|||||

Honda R&D Co., Ltd. |

Japan | Research & Development | 100.0 | |||||

Honda Finance Co., Ltd. |

Japan | Finance | 100.0 | |||||

American Honda Motor Co., Inc. |

U.S.A. | Coordination of Subsidiaries Operation, Research & Development, Manufacturing and Sales |

100.0 | |||||

American Honda Finance Corporation |

U.S.A. | Finance | 100.0 | |||||

| Honda Development and Manufacturing of America, LLC | U.S.A. | Research & Development and Manufacturing |

100.0 | |||||

Honda Canada Inc. |

Canada | Manufacturing and Sales | 100.0 | |||||

Honda Canada Finance Inc. |

Canada | Finance | 100.0 | |||||

Honda de Mexico, S.A. de C.V. |

Mexico | Manufacturing and Sales | 100.0 | |||||

Honda Motor Europe Limited |

U.K. | Coordination of Subsidiaries Operation and Sales |

100.0 | |||||

Honda Finance Europe plc |

U.K. | Finance | 100.0 | |||||

Honda Motor (China) Investment Co., Ltd. |

China | Coordination of Subsidiaries Operation and Sales |

100.0 | |||||

Honda Auto Parts Manufacturing Co., Ltd. |

China | Manufacturing | 100.0 | |||||

Honda Motorcycle & Scooter India (Private) Ltd. |

India | Manufacturing and Sales | 100.0 | |||||

Honda Cars India Limited |

India | Manufacturing and Sales | 100.0 | |||||

P.T. Honda Prospect Motor |

Indonesia | Manufacturing and Sales | 51.0 | |||||

Honda Malaysia Sdn Bhd |

Malaysia | Manufacturing and Sales | 51.0 | |||||

Asian Honda Motor Co., Ltd. |

Thailand | Coordination of Subsidiaries Operation and Sales |

100.0 | |||||

Honda Automobile (Thailand) Co., Ltd. |

Thailand | Manufacturing and Sales | 89.0 | |||||

Thai Honda Co., Ltd. |

Thailand | Manufacturing and Sales | 72.5 | |||||

Honda Vietnam Co., Ltd. |

Vietnam | Manufacturing and Sales | 70.0 | |||||

Honda South America Ltda. |

Brazil | Coordination of Subsidiaries Operation |

100.0 | |||||

Moto Honda da Amazonia Ltda. |

Brazil | Manufacturing and Sales | 100.0 | |||||

Location |

Number of Employees |

Principal Products Manufactured | ||||

Yorii-machi, Osato-gun, Saitama, Japan |

4,075 | Automobiles | ||||

Hamamatsu, Shizuoka, Japan |

1,925 | Power products and transmissions | ||||

Suzuka, Mie, Japan |

5,516 | Automobiles | ||||

Ozu-machi, Kikuchi-gun, Kumamoto, Japan |

2,460 | Motorcycles, all-terrain vehicles, power products and engines | ||||

Greensboro, North Carolina, U.S.A. |

795 | Aircraft | ||||

Burlington, North Carolina, U.S.A. |

96 | Aircraft engines | ||||

Marysville, Ohio, U.S.A. |

5,912 | Automobiles | ||||

Anna, Ohio, U.S.A. |

2,469 | Engines | ||||

East Liberty, Ohio, U.S.A. |

2,556 | Automobiles | ||||

Lincoln, Alabama, U.S.A. |

4,544 | Automobiles and engines | ||||

Greensburg, Indiana, U.S.A. |

2,380 | Automobiles | ||||

Alliston, Canada |

5,049 | Automobiles and engines | ||||

El Salto, Mexico |

491 | Motorcycles | ||||

Celaya, Mexico |

4,853 | Automobiles | ||||

Gurugram, India |

1,936 | Motorcycles | ||||

Alwar, India |

2,765 | Motorcycles and automobiles | ||||

Narasapura, India |

2,054 | Motorcycles | ||||

Ahemdabad, India |

1,020 | Motorcycles | ||||

Karawang, Indonesia |

2,643 | Automobiles and engines | ||||

Melaka, Malaysia |

2,172 | Automobiles | ||||

Batangas, Philippines |

1,390 | Motorcycles | ||||

Ayutthaya, Thailand |

2,306 | Automobiles | ||||

Prachinburi, Thailand |

1,168 | Automobiles | ||||

Bangkok, Thailand |

3,824 | Motorcycles and power products | ||||

Phuc Yen, Vietnam |

4,752 | Motorcycles and automobiles | ||||

Duy Tien, Vietnam |

761 | Motorcycles | ||||

Buenos Aires, Argentina |

681 | Motorcycles | ||||

Itirapina, Brazil |

1,370 | Automobiles | ||||

Manaus, Brazil |

7,797 | Motorcycles and power products | ||||

Fiscal years ended March 31, |

||||||||||||

2023 |

2024 |

Increase (Decrease) |

||||||||||

Yen (millions) |

||||||||||||

Motorcycle Business |

¥ | 44,818 | ¥ | 57,244 | ¥ | 12,426 | ||||||

Automobile Business |

438,469 | 315,524 | (122,945 | ) | ||||||||

Financial Services Business |

1,543,664 | 2,449,030 | 905,366 | |||||||||

Financial Services Business (Excluding Equipment on Operating Leases) |

216 | 561 | 345 | |||||||||

Power Products and Other Businesses |

10,405 | 14,657 | 4,252 | |||||||||

Total |

¥ | 2,037,356 | ¥ | 2,836,455 | ¥ | 799,099 | ||||||

Total (Excluding Equipment on Operating Leases) |

¥ | 493,908 | ¥ | 387,986 | ¥ | (105,922) | ||||||

Fiscal year ending March 31, 2025 |

||||

Yen (millions) |

||||

Motorcycle Business |

¥ | 68,000 | ||

Automobile Business |

593,200 | |||

Financial Services Business |

1,500 | |||

Power Products and Other Businesses |

7,300 | |||

Total |

¥ | 670,000 | ||

* |

Source: JAMA (Japan Automobile Manufacturers Association) |

* |

Source: MIC (Motorcycle Industry Council) |

The total includes motorcycles and ATVs, but does not include side-by-sides |

*1 |

Based on Honda research. Only includes the following 10 countries: the United Kingdom, Germany, France, Italy, Spain, Switzerland, Portugal, the Netherlands, Belgium, and Austria. The total includes ICE vehicles, but does not include EVs, EMs and EBs *2 . |

*2 |

EM: Electric Moped with a maximum speed ranging from 25km/h to 50km/h |

*1 |

Based on Honda research. The total includes ICE vehicles, but does not include EVs, EMs and EBs. |

*2 |

Based on Honda research. Only includes the following seven countries: Thailand, Indonesia, Malaysia, the Philippines, Vietnam, Pakistan, and China. The total includes ICE vehicles, but does not include EVs, EMs and EBs. |

* |

Source: ABRACICLO (the Brazilian Association of Motorcycle, Moped, and Bicycle Manufacturers) |

Fiscal year ended March 31, |

||||||||

2023 |

2024 |

|||||||

Passenger cars: |

42 | % | 39 | % | ||||

ACCORD, CITY, CIVIC, FIT, INTEGRA, JAZZ |

||||||||

Light trucks: |

50 | % | 54 | % | ||||

BREEZE, CR-V, FREED, HR-V, ODYSSEY, PILOT, VEZEL, ZR-V |

||||||||

Mini vehicles: |

8 | % | 7 | % | ||||

N-BOX |

||||||||

*1 |

Source: JAMA (Japan Automobile Manufacturers Association), as measured by the number of regular vehicle registrations (661cc or higher) and mini vehicles (660cc or lower) |

*2 |

Certain sales of automobiles that are financed with residual value type auto loans and others by our Japanese finance subsidiaries and provided through our consolidated subsidiaries are accounted for as operating leases in conformity with IFRS and are not included in consolidated sales revenue to external customers in the Automobile business. Accordingly, they are not included in consolidated unit sales. |

* |

Source: Autodata |

* |

Source: ACEA (Association des Constructeurs Europeens d’Automobiles (the European Automobile Manufacturers’ Association)) New passenger car registrations cover 27 EU countries, three EFTA countries, and the U.K. |

*1 |

The total is based on Honda research and includes the following eight countries: Thailand, Indonesia, Malaysia, the Philippines, Vietnam, Taiwan, India, and Pakistan. |

*2 |

Source: CAAM (China Association of Automobile Manufacturers) |

*3 |

The total includes the following seven countries: Thailand, Indonesia, Malaysia, Vietnam, Taiwan, India, and Pakistan. |

* |

Source: ANFAVEA (Associação Nacional dos Fabricantes de Veiculos Automotores (the Brazilian Automobile Association)) The total includes passenger cars and light commercial vehicles. |

* |

OEM (Original Equipment Manufacturer) engines refer to engines installed on products sold under a third-party brand. |

Yen (millions) |

||||||||||||||||||||||||||||||||

Japan |

North America |

Europe |

Asia |

Other Regions |

Total |

Reconciling Items |

Consolidated |

|||||||||||||||||||||||||

Sales revenue |

¥ | 4,548,002 | ¥ | 9,416,252 | ¥ | 703,718 | ¥ | 4,857,837 | ¥ | 819,615 | ¥ | 20,345,424 | ¥ | (3,437,699 | ) | ¥ | 16,907,725 | |||||||||||||||

Operating profit (loss) |

¥ | 25,821 | ¥ | 258,805 | ¥ | (2,556 | ) | ¥ | 408,728 | ¥ | 58,935 | ¥ | 749,733 | ¥ | 31,036 | ¥ | 780,769 | |||||||||||||||

Yen (millions) |

||||||||||||||||||||||||||||||||

Japan |

North America |

Europe |

Asia |

Other Regions |

Total |

Reconciling Items |

Consolidated |

|||||||||||||||||||||||||

Sales revenue |

¥ | 5,392,760 | ¥ | 12,073,777 | ¥ | 966,320 | ¥ | 5,009,961 | ¥ | 1,081,946 | ¥ | 24,524,764 | ¥ | (4,095,962 | ) | ¥ | 20,428,802 | |||||||||||||||

Operating profit (loss) |

¥ | 151,070 | ¥ | 694,940 | ¥ | 60,340 | ¥ | 397,804 | ¥ | 153,957 | ¥ | 1,458,111 | ¥ | (76,134 | ) | ¥ | 1,381,977 | |||||||||||||||

| Explanatory | notes: |

| 1. | Major countries in each geographic area: |

North America |

United States, Canada, Mexico | |

Europe |

United Kingdom, Germany, Belgium, Italy, France | |

Asia |

Thailand, China, India, Vietnam, Indonesia | |

Other Regions |

Brazil, Australia |

| 2. | Operating profit (loss) of each geographical region is measured in a consistent manner with consolidated operating profit, which is profit before income taxes before share of profit of investments accounted for using the equity method and finance income and finance costs. |

| 3. | Reconciling items are elimination of inter-geographic transactions. |

* |

Source: JAMA (Japan Automobile Manufacturers Association) |

* |

Source: MIC (Motorcycle Industry Council) The total includes motorcycles and ATVs, but does not include side-by-sides |

* |

Based on Honda research. Only includes the following 10 countries: the United Kingdom, Germany, France, Italy, Spain, Switzerland, Portugal, the Netherlands, Belgium, and Austria. |

*1 |

Based on Honda research. |

*2 |

Based on Honda research. Only includes the following seven countries: Thailand, Indonesia, Malaysia, the Philippines, Vietnam, Pakistan, and China. |

* |

Source: ABRACICLO (the Brazilian Association of Motorcycle, Moped, and Bicycle Manufacturers) |

Fiscal year ended March 31, |

||||||||

2022 |

2023 |

|||||||

Passenger cars: |

42 | % | 42 | % | ||||

ACCORD, BRIO, CITY, CIVIC, FIT, INTEGRA, JAZZ |

||||||||

Light trucks: |

52 | % | 50 | % | ||||

BREEZE, CR-V, FREED, HR-V, ODYSSEY, PILOT, VEZEL, XR-V, ZR-V |

||||||||

Mini vehicles: |

6 | % | 8 | % | ||||

N-BOX |

||||||||

*1 |

Source: JAMA (Japan Automobile Manufacturers Association), as measured by the number of regular vehicle registrations (661cc or higher) and mini vehicles (660cc or lower) |

*2 |

Certain sales of automobiles that are financed with residual value type auto loans and others by our Japanese finance subsidiaries and provided through our consolidated subsidiaries are accounted for as operating leases in conformity with IFRS and are not included in consolidated sales revenue to external customers in the Automobile business. Accordingly, they are not included in consolidated unit sales. |

* |

Source: Autodata |

* |

Source: ACEA (Association des Constructeurs Europeens d’Automobiles (the European Automobile Manufacturers’ Association)) New passenger car registrations cover 27 EU countries, three EFTA countries, and the U.K. |

*1 |

The total is based on Honda research and includes the following eight countries: Thailand, Indonesia, Malaysia, the Philippines, Vietnam, Taiwan, India, and Pakistan. |

*2 |

Source: CAAM (China Association of Automobile Manufacturers) |

*3 |

The total includes the following seven countries: Thailand, Indonesia, Malaysia, Vietnam, Taiwan, India, and Pakistan. |

* |

Source: ANFAVEA (Associação Nacional dos Fabricantes de Veiculos Automotores (the Brazilian Automobile Association)) The total includes passenger cars and light commercial vehicles. |

* |

OEM (Original Equipment Manufacturer) engines refer to engines installed on products sold under a third-party brand. |

Yen (millions) |

||||||||||||||||||||||||||||||||

Japan |

North America |

Europe |

Asia |

Other Regions |

Total |

Reconciling Items |

Consolidated |

|||||||||||||||||||||||||

Sales revenue |

¥ | 4,359,286 | ¥ | 8,090,187 | ¥ | 701,211 | ¥ | 4,055,447 | ¥ | 593,139 | ¥ | 17,799,270 | ¥ | (3,246,574 | ) | ¥ | 14,552,696 | |||||||||||||||

Operating profit (loss) |

¥ | 6,411 | ¥ | 501,073 | ¥ | 26,681 | ¥ | 339,129 | ¥ | 22,899 | ¥ | 896,193 | ¥ | (24,961 | ) | ¥ | 871,232 | |||||||||||||||

Yen (millions) |

||||||||||||||||||||||||||||||||

Japan |

North America |

Europe |

Asia |

Other Regions |

Total |

Reconciling Items |

Consolidated |

|||||||||||||||||||||||||

Sales revenue |

¥ | 4,548,002 | ¥ | 9,416,252 | ¥ | 703,718 | ¥ | 4,857,837 | ¥ | 819,615 | ¥ | 20,345,424 | ¥ | (3,437,699 | ) | ¥ | 16,907,725 | |||||||||||||||

Operating profit (loss) |

¥ | 25,821 | ¥ | 258,805 | ¥ | (2,556 | ) | ¥ | 408,728 | ¥ | 58,935 | ¥ | 749,733 | ¥ | 31,036 | ¥ | 780,769 | |||||||||||||||

| Explanatory | notes: |

| 1. | Major countries in each geographic area: |

| North America | United States, Canada, Mexico | |

| Europe | United Kingdom, Germany, Belgium, Italy, France | |

| Asia | Thailand, China, India, Vietnam, Indonesia | |

| Other Regions | Brazil, Australia |

| 2. | Operating profit (loss) of each geographical region is measured in a consistent manner with consolidated operating profit, which is profit before income taxes before share of profit of investments accounted for using the equity method and finance income and finance costs. |

| 3. | Reconciling items are elimination of inter-geographic transactions. |

Credit ratings for |

||||||||

Short-term unsecured debt securities |

Long-term unsecured debt securities |

|||||||

Moody’s Investors Service |

P-2 |

A3 | ||||||

Standard & Poor’s Global Ratings |

A-2 |

A- | ||||||

Rating and Investment Information |

a-1+ |

AA | ||||||

Yen (millions) |

||||||||||||||||||||

Payments due by period |

||||||||||||||||||||

Total |

Within 1 year |

1-3 years |

3-5 years |

Thereafter |

||||||||||||||||

Financing liabilities |

¥ | 10,941,618 | ¥ | 4,379,834 | ¥ | 4,050,714 | ¥ | 1,824,995 | ¥ | 686,075 | ||||||||||

Other financial liabilities |

736,378 | 239,112 | 166,843 | 104,716 | 225,707 | |||||||||||||||

Purchase and other commitments *1 |

108,440 | 101,068 | 7,152 | 220 | — | |||||||||||||||

Contributions to defined benefit pension plans *2 |

38,252 | 38,252 | — | — | — | |||||||||||||||

Total |

¥ | 11,824,688 | ¥ | 4,758,266 | ¥ | 4,224,709 | ¥ | 1,929,931 | ¥ | 911,782 | ||||||||||

*1 |

Honda had commitments for purchases of property, plant and equipment as of March 31, 2024. |

*2 |

Since contributions beyond the next fiscal year are not currently determinable, contributions to defined benefit pension plans reflect only contributions expected for the next fiscal year. |

*1 |

according to Honda research (as of October 2023) |

*2 |

Fédération Internationale de Motocyclisme |

*3 |

operated by manufacturer |

*1 |

in the “compact SUV” class, according to Honda research (as of December 2023) |

*2 |

a basic approach to Honda car design, an approach to increase the efficiency of the vehicle interior by maximizing space for people and minimizing the space required for mechanical components. |

*3 |

according to Honda research (as of February 2024) |

*1 |

according to Honda research (as of January 2024) |

*2 |

The percentage of departures within 15 minutes of the scheduled operation time. In the airline industry, it is used as an index of aircraft reliability. |

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

Director and Representative Executive Officers |

||||||||||

Toshihiro Mibe (July 1, 1961) |

Joined Honda Motor Co., Ltd. in April 1987 | *3 | 94,500 | |||||||

Operating Officer, appointed in April 2014 |

||||||||||

| Executive in Charge of Powertrain Business for Automobile Operations, appointed in April 2014 |

||||||||||

| Head of Powertrain Production Supervisory Unit of Automobile Production for Automobile Operations, appointed in April 2014 |

||||||||||

| Executive in Charge of Powertrain Business and Drivetrain Business for Automobile Operations, appointed in April 2015 |

||||||||||

| Head of Drivetrain Business Unit in Automobile Production for Automobile Operations, appointed in April 2015 |

||||||||||

| Senior Managing Officer and Director of Honda R&D Co., Ltd., appointed in April 2016 |

||||||||||

| Managing Officer of the Company, appointed in April 2018 |

||||||||||

| Executive Vice President and Director of Honda R&D Co., Ltd., appointed in April 2018 |

||||||||||

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

| President and Representative Director of Honda R&D Co., Ltd., appointed in April 2019 |

||||||||||

In Charge of Intellectual Property and Standardization of the Company, appointed in April 2019 |

||||||||||

Senior Managing Officer, appointed in April 2020 |

||||||||||

| In Charge of Mono-zukuri (Research & Development, Production, Purchasing, Quality, Parts, Service, Intellectual Property, Standardization and IT), appointed in April 2020 |

||||||||||

| Risk Management Officer, appointed in April 2020 |

||||||||||

Senior Managing Director, appointed in June 2020 |

||||||||||

| Director in Charge of Mono-zukuri (Research & Development, Production, Purchasing, Quality, Parts, Service, Intellectual Property, Standardization and IT), appointed in June 2020 |

||||||||||

| President and Representative Director, appointed in April 2021 |

||||||||||

| Chief Executive Officer, appointed in April 2021 (presently held) |

||||||||||

Director, President and Representative Executive Officer, appointed in June 2021 (presently held) |

||||||||||

Nominating Committee Member, appointed in June 2021 (presently held) |

||||||||||

Chairman of the Board of Directors, appointed in April 2024 (presently held) |

||||||||||

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

Shinji Aoyama (December 25, 1963) |

Joined Honda Motor Co., Ltd. in April 1986 | *3 | 107,900 | |||||||

Operating Officer, appointed in April 2012 |

||||||||||

| Chief Officer for Motorcycle Operations, appointed in April 2013 |

||||||||||

| Operating Officer and Director, appointed in June 2013 |

||||||||||

| Chief Officer for Regional Operations (Asia & Oceania), appointed in April 2017 |

||||||||||

| President and Director of Asian Honda Motor Co., Ltd., appointed in April 2017 |

||||||||||

| Operating Officer of the Company (resigned from position as Director), appointed in June 2017 |

||||||||||

| Managing Officer, appointed in April 2018 |

||||||||||

| Vice Chief Officer for Regional Operations (North America), appointed in April 2018 |

||||||||||

Senior Executive Vice President, Chief Operating Officer and Director of Honda North America, Inc., appointed in April 2018 |

||||||||||

Senior Executive Vice President, Chief Operating Officer and Director of American Honda Motor Co., Inc., appointed in April 2018 |

||||||||||

President, Chief Operating Officer and Director of Honda North America, Inc., appointed in November 2018 |

||||||||||

President, Chief Operating Officer and Director of American Honda Motor Co., Inc., appointed in November 2018 |

||||||||||

Chief Officer for Regional Operations (North America) of the Company, appointed in April 2019 |

||||||||||

President, Chief Executive Officer and Director of Honda North America, Inc., appointed in April 2019, |

||||||||||

President, Chief Executive Officer and Director of American Honda Motor Co., Inc., appointed in April 2019, |

||||||||||

Managing Officer in Charge of Electrification of the Company, appointed in July 2021 |

||||||||||

Managing Executive Officer, appointed in October 2021 |

||||||||||

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

Senior Managing Executive Officer, appointed in April 2022 |

||||||||||

Chief Officer for Business Development Operations, appointed in April 2022 |

||||||||||

Corporate Brand Officer, appointed in April 2022 |

||||||||||

Chief Officer for Automobile Operations, appointed in June 2022 |

||||||||||

Director, Senior Managing Executive Officer, appointed in June 2022 |

||||||||||

Director, Executive Vice President and Representative Executive Officer, appointed in April 2023 (presently held) |

||||||||||

| Chief Operating Officer, appointed in April 2023 |

||||||||||

| Compensation Committee Member, appointed in April 2023 |

||||||||||

| Risk Management Officer, appointed in April 2023 (presently held) |

||||||||||

| In Charge of Government and Industry Relations, appointed in April 2023 |

||||||||||

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

Noriya Kaihara (August 4, 1961) |

Joined Honda Motor Co., Ltd. in April 1984 | *3 | 92,400 | |||||||

General Manager of Automobile Quality Assurance Division, appointed in April 2012 |

||||||||||

| Operating Officer, appointed in April 2013 |

||||||||||

| Chief Quality Officer, appointed in April 2013 |

||||||||||

| Operating Officer and Director, appointed in June 2013 |

||||||||||

| Chief Officer for Customer Service Operations, appointed in April 2014 |

||||||||||

| Head of Service Supervisory Unit for Automobile Operations, appointed in April 2014 |

||||||||||

| Chief Officer for Customer First Operations, appointed in April 2016 |

||||||||||

| Operating Officer (resigned from position as Director), appointed in June 2017 |

||||||||||

Managing Officer, appointed in April 2018 |

||||||||||

Chief Officer for Purchasing Operations, appointed in April 2018 |

||||||||||

Head of Business Supervisory Unit for Automobile Operations, appointed in April 2020 |

||||||||||

Chief Officer for Customer First Operations, appointed in April 2021 |

||||||||||

Risk Management Officer, appointed in April 2021 |

||||||||||

Managing Executive Officer, appointed in June 2021 |

||||||||||

Managing Officer, appointed in October 2021 |

||||||||||

Chief Officer for Regional Operations (North America), appointed in October 2021 |

||||||||||

President, Chief Executive Officer and Director of American Honda Motor Co., Inc., appointed in October 2021 |

||||||||||

Senior Managing Executive Officer of the Company, appointed in April 2023 |

||||||||||

Director, Senior Managing Executive Officer, appointed in June 2023 |

||||||||||

Director, Executive Vice President and Representative Executive Officer, appointed in April 2024 (presently held) |

||||||||||

Compliance and Privacy Officer, appointed in April 2024 (presently held) |

||||||||||

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

Director, Managing Executive Officer |

||||||||||

Eiji Fujimura (September 1, 1970) |

Joined Honda Motor Co., Ltd. in April 1993 | *3 | 9,000 | |||||||

General Manager of Finance Division for Business Management Operations, appointed in April 2017 |

||||||||||

General Manager of Regional Operation Planning Division for Regional Operations (North America), appointed in April 2019 |

||||||||||

| Operating Executive, appointed in April 2021 |

||||||||||

| Chief Officer for Business Management Operations, appointed in April 2021 |

||||||||||

Head of Accounting and Finance Supervisory Unit, appointed in April 2022 |

||||||||||

Executive Officer, appointed in April 2023 |

||||||||||

Chief Financial Officer, appointed in April 2023 (presently held) |

||||||||||

Chief Officer for Corporate Management Operations, appointed in April 2023 (presently held) |

||||||||||

Managing Executive Officer, appointed in April 2024 |

||||||||||

Director, Managing Executive Officer, appointed in June 2024 (presently held) |

||||||||||

Compensation Committee Member, appointed in June 2024 (presently held) |

||||||||||

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

Directors |

||||||||||

Asako Suzuki (January 28, 1964) |

Joined Honda Motor Co., Ltd. in April 1987 | *3 | 78,800 | |||||||

President of Dongfeng Honda Automobile Co., Ltd., appointed in April 2014 |

||||||||||

Operating Officer of the Company, appointed in April 2016 |

||||||||||

Vice Chief Officer for Regional Operations (Japan), appointed in April 2018 |

||||||||||

Chief Officer for Human Resources and Corporate Governance Operations, appointed in April 2019 |

||||||||||

Operating Executive, appointed in April 2020 |

||||||||||

Director, appointed in June 2021 (presently held) |

||||||||||

Full-time Audit Committee Member, appointed in June 2021 (presently held) |

||||||||||

Jiro Morisawa (February 24, 1967) |

Joined Honda Motor Co., Ltd. in April 1989 | *3 | 29,700 | |||||||

General Manager of Regional Operation Planning Office for Regional Operations (Japan), appointed in April 2016 |

||||||||||

General Manager of Accounting Division for Business Management Operations, appointed in April 2017 |

||||||||||

Vice Chief Officer for Business Management Operations and General Manager of Accounting Division for Business Management Operations, appointed in April 2018 |

||||||||||

| Operating Officer, appointed in April 2019 |

||||||||||

Chief Officer for Business Management Operations, appointed in April 2019 |

||||||||||

Operating Executive, appointed in April 2020 |

||||||||||

Chief Officer for Business Management Operations, appointed in April 2020 |

||||||||||

President and Director of American Honda Finance Corporation, appointed in April 2021 |

||||||||||

Director of the Company, appointed in June 2024 (presently held) |

||||||||||

Full-time Audit Committee Member, appointed in June 2024 (presently held) |

||||||||||

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

Kunihiko Sakai (March 4, 1954) |

Public Prosecutor of Tokyo District Public Prosecutors’ Office, appointed in April 1979 |

*3 | 6,100 | |||||||

Superintending Prosecutor of Takamatsu High Public Prosecutors’ Office, appointed in July 2014 |

||||||||||

Superintending Prosecutor of Hiroshima High Public Prosecutors’ Office, appointed in September 2016 (resigned in March 2017) |

||||||||||

| Registered with the Dai-Ichi Tokyo Bar Association in April 2017 |

||||||||||

Advisor Attorney to TMI Associates, appointed in April 2017 (presently held) |

||||||||||

Audit and Supervisory Board Member (Outside) of Furukawa Electric Co., Ltd., appointed in June 2018 (presently held) |

||||||||||

Director (Audit and Supervisory Committee Member) of the Company, appointed in June 2019 |

||||||||||

Director, appointed in June 2021 (presently held) |

||||||||||

Nominating Committee Member, appointed in June 2021 (presently held) |

||||||||||

Audit Committee Member, appointed in June 2021 (presently held) |

||||||||||

Fumiya Kokubu (October 6, 1952) |

Joined Marubeni Corporation in April 1975 | *3 | 4,500 | |||||||

President and CEO, Member of the Board of Marubeni Corporation, appointed in April 2013 |

||||||||||

Chairman of the Board of Marubeni Corporation, appointed in April 2019 (presently held) |

||||||||||

Outside Director of Taisei Corporation, appointed in June 2019 (presently held) |

||||||||||

Director of the Company, appointed in June 2020 (presently held) |

||||||||||

Nominating Committee Member (Chairperson), appointed in June 2021 (presently held) |

||||||||||

Compensation Committee Member, appointed in June 2021 (presently held) |

||||||||||

Chairman of Japan Machinery Center for Trade and Investment, appointed in May 2022 (presently held) |

||||||||||

Chairman of Japan Foreign Trade Council, Inc., appointed in May 2022 (presently held) |

||||||||||

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

Yoichiro Ogawa (February 19, 1956) |

Joined Tohmatsu & Aoki Audit Corporation (currently Deloitte Touche Tohmatsu LLC) in October 1980 | *3 | 3,100 | |||||||

Registered as Japanese Certified Public Accountant in March 1984 |

||||||||||

Deputy CEO of Deloitte Touche Tohmatsu LLC, appointed in October 2013 |

||||||||||

Deputy CEO of Tohmatsu Group (currently Deloitte Tohmatsu Group), appointed in October 2013 |

||||||||||

Global Managing Director for Asia Pacific of Deloitte Touche Tohmatsu Limited (United Kingdom), appointed in June 2015 (resigned in May 2018) |

||||||||||

CEO of Deloitte Tohmatsu Group, appointed in July 2015 |

||||||||||

Senior Advisor of Deloitte Tohmatsu Group, appointed in June 2018 (resigned in October 2018) |

||||||||||

| Founder of Yoichiro Ogawa CPA Office in November 2018 (presently held) | ||||||||||

Outside Audit & Supervisory Board Member of Recruit Holdings Co., Ltd., appointed in June 2020 (presently held) |

||||||||||

Director of the Company, appointed in June 2021 (presently held) |

||||||||||

Audit Committee Member (Chairperson), appointed in June 2021 (presently held) |

||||||||||

Compensation Committee Member, appointed in June 2021 (presently held) |

||||||||||

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

Kazuhiro Higashi (April 25, 1957) |

Joined Resona Group in April 1982 | *3 | 3,100 | |||||||

Director, President and Representative Executive Officer of Resona Holdings, Inc., appointed in April 2013 |

||||||||||

| Representative Director, President and Executive Officer of Resona Bank, Limited, appointed in April 2013 |

||||||||||

| Chairman of Osaka Bankers Association, appointed in June 2013 (resigned in June 2014) |

||||||||||

Chairman of the Board, President, and Representative Director of Resona Bank, Limited, appointed in April 2017 |

||||||||||

| Chairman of Osaka Bankers Association, appointed in June 2017 (resigned in June 2018) |

||||||||||

Chairman of the Board, President, Representative Director and Executive Officer of Resona Bank, Limited, appointed in April 2018 |

||||||||||

Chairman and Director of Resona Holdings, Inc., appointed in April 2020 (resigned in June 2022) |

||||||||||

Chairman and Director of Resona Bank, Limited, appointed in April 2020 (resigned in June 2022) |

||||||||||

Outside Director of Sompo Holdings, Inc., appointed in June 2020 (presently held) |

||||||||||

Director of the Company, appointed in June 2021 (presently held) |

||||||||||

Nominating Committee Member, appointed in June 2021 (presently held) |

||||||||||

Compensation Committee Member (Chairperson), appointed in June 2021 (presently held) |

||||||||||

Senior Advisor of Resona Holdings, Inc., appointed in June 2022 (presently held) |

||||||||||

Senior Advisor of Resona Bank, Limited., appointed in June 2022 (presently held) |

||||||||||

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

Ryoko Nagata (July 14, 1963) |

Joined Japan Tobacco Inc. in April 1987 | *3 | 3,100 | |||||||

Executive Officer of Japan Tobacco Inc., appointed in June 2008 |

||||||||||

Standing Audit & Supervisory Board Member of Japan Tobacco Inc., appointed in March 2018 (resigned in March 2023) |

||||||||||

Director of the Company, appointed in June 2021 (presently held) |

||||||||||

Audit Committee Member, appointed in June 2021 (presently held) |

||||||||||

External Corporate Auditor of Medley, Inc., appointed in March 2023 (presently held) |

||||||||||

Outside Director of UACJ Corporation, appointed in June 2023 (presently held) |

||||||||||

Mika Agatsuma (June 8, 1964) |

Joined IBM Japan, Ltd. in April 1987 | *3 | — | |||||||

Vice President of IBM Japan, Ltd., appointed in August 2017 |

||||||||||

In charge of Cloud Application Innovation for Global Business Services of IBM Japan, Ltd., appointed in August 2017 |

||||||||||

Managing Partner of IBM Japan, Ltd., appointed in October 2022 (resigned in March 2024) |

||||||||||

In charge of Hybrid Cloud Services for IBM Consulting of IBM Japan, Ltd., appointed in October 2022 |

||||||||||

| In charge of Hybrid Cloud Platform for IBM Consulting of IBM Japan, Ltd., appointed in June 2023 |

||||||||||

Director of the Company, appointed in June 2024 (presently held) |

||||||||||

Nominating Committee Member, appointed in June 2024 (presently held) |

||||||||||

| *1 | Effective on June 23, 2021, Honda adopted the Three Committees system under the Company Law. |

| *2 | Directors Mr. Kunihiko Sakai, Mr. Fumiya Kokubu, Mr. Yoichiro Ogawa, Mr. Kazuhiro Higashi, Ms. Ryoko Nagata and Ms. Mika Agatsuma are Outside Directors. |

| *3 | The term of office of a Director is until at the close of the ordinary general meeting of shareholders of the fiscal year ending March 31, 2025 after his/her election to office at the close of the ordinary general meeting of shareholders on June 19, 2024. |

Director’s Name |

Nominating Committee |

Audit Committee |

Compensation Committee | |||

| Toshihiro Mibe | ○ |

|||||

| Eiji Fujimura | ○ | |||||

| Asako Suzuki | ○ |

|||||

| Jiro Morisawa | ○ |

|||||

| Kunihiko Sakai | ○ |

○ |

||||

| Fumiya Kokubu | · |

○ | ||||

| Yoichiro Ogawa | · |

○ | ||||

| Kazuhiro Higashi | ○ |

· | ||||

| Ryoko Nagata | ○ |

|||||

| Mika Agatsuma | ○ |

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

Senior Managing Executive Officer |

||||||||||

Katsushi Inoue (October 22, 1963) |

Joined Honda Motor Co., Ltd. in April 1986 | *4 | 58,400 | |||||||

President and Chief Executive Officer of Honda Cars India Ltd., appointed in April 2015 |

||||||||||

Operating Officer of the Company, appointed in April 2016 |

||||||||||

Chief Officer for Regional Operations (Europe), appointed in April 2016 |

||||||||||

President and Director of Honda Motor Europe Ltd., appointed in April 2016 |

||||||||||

Managing Officer of the Company, appointed in April 2020 |

||||||||||

Chief Officer for Regional Operations (China), appointed in April 2020 |

||||||||||

President of Honda Motor (China) Investment Co., Ltd., appointed in April 2020 |

||||||||||

President of Honda Motor (China) Technology Co., Ltd., appointed in April 2020 |

||||||||||

Senior Managing Executive Officer of the Company, appointed in April 2023 (presently held) |

||||||||||

Chief Officer for Electrification Business Development Operations, appointed in April 2023 (presently held) |

||||||||||

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

Managing Executive Officers |

||||||||||

Keiji Ohtsu (July 7, 1964) |

Joined Honda R&D Co., Ltd. in April 1983 | *4 | 61,400 | |||||||

Managing Officer of Honda R&D Co., Ltd., appointed in April 2014 |

||||||||||

Operating Officer of the Company, appointed in April 2018 |

||||||||||

Chief Quality Officer, appointed in April 2018 |

||||||||||

Operating Executive, appointed in April 2020 |

||||||||||

Chief Officer for Quality Innovation Operations, appointed in April 2020 |

||||||||||

In Charge of Certification & Regulation Compliance Division, appointed in April 2020 |

||||||||||

In Charge of Quality & Compliance Audit Division, appointed in April 2020 |

||||||||||

Managing Officer, appointed in April 2021 |

||||||||||

President and Representative Director of Honda R&D Co., Ltd., appointed in April 2021 (presently held) |

||||||||||

Managing Executive Officer of the Company, appointed in June 2021 (presently held) |

||||||||||

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

Masayuki Igarashi |

Joined Honda Motor Co., Ltd. in April 1988 | *4 | 87,800 | |||||||

(July 6, 1963) |

Director of Asian Honda Motor Co., Ltd., appointed in April 2014 |

|||||||||

Operating Officer of the Company, appointed in April 2015 |

||||||||||

Chief Operating Officer for Power Product Operations, appointed in April 2015 |

||||||||||

Operating Officer and Director, appointed in June 2015 |

||||||||||

Executive Vice President and Director of Honda North America, Inc., appointed in April 2017 |

||||||||||

Executive Vice President and Director of American Honda Motor Co., Inc., appointed in April 2017 |

||||||||||

Operating Officer of the Company, appointed in June 2017 |

||||||||||

Chief Officer for Regional Operations (Asia & Oceania), appointed in April 2018 |

||||||||||

President and Chief Executive Officer of Asian Honda Motor Co., Ltd., appointed in April 2018 |

||||||||||

Operating Executive of the Company, appointed in April 2020 |

||||||||||

Managing Officer, appointed in April 2022 |

||||||||||

Managing Executive Officer, appointed in April 2023 (presently held) |

||||||||||

Chief Officer for Regional Operations (China), appointed in April 2023 (presently held) |

||||||||||

President of Honda Motor (China) Investment Co., Ltd., appointed in April 2023 (presently held) |

||||||||||

President of Honda Motor (China) Technology Co., Ltd., appointed in April 2023 (presently held) |

||||||||||

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

Kensuke Oe |

Joined Honda Motor Co., Ltd. in April 1990 |

*4 | 9,000 | |||||||

| (May 11, 1967) | In charge of Manufacturing of Honda Canada Inc., appointed in April 2018 |

|||||||||

Operating Executive of the Company, appointed in April 2020 |

||||||||||

General Manager of Saitama Factory in Production Supervisory Unit for Automobile Operations, appointed in April 2020 |

||||||||||

Head of Production Engineering Supervisory Unit in Mono-zukuri Center for Automobile Operations, appointed in April 2021 |

||||||||||

Managing Officer, appointed in April 2022 |

||||||||||

Head of Production Unit for Automobile Operations, appointed in April 2022 |

||||||||||

Managing Executive Officer, appointed in April 2023 (presently held) |

||||||||||

President and Director, Honda Development & Manufacturing of America, LLC, appointed in April 2024 (presently held) |

||||||||||

Manabu Ozawa |

Joined Honda Motor Co., Ltd. in April 1989 |

*4 | 9,000 | |||||||

| (May 12, 1965) | Managing Director of Honda R&D Co., Ltd., appointed in April 2019 |

|||||||||

Operating Executive of the Company, appointed in April 2020 |

||||||||||

Head of Corporate Planning Supervisory Unit, appointed in April 2020 |

||||||||||

Director for Honda Innovation Inc., appointed in April 2020 |

||||||||||

Managing Executive Officer of the Company, appointed in April 2023 (presently held) |

||||||||||

Chief Officer for Corporate Strategy Operations, appointed in April 2023 (presently held) |

||||||||||

Chief Officer for Traffic Safety Promotion Operations, appointed in April 2024 (presently held) |

||||||||||

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

Hironao Ito |

Joined Honda Motor Co., Ltd. in April 1989 |

*4 | 9,600 | |||||||

| (December 27, 1966) | Managing Director of Honda R&D Co., Ltd., appointed in April 2019 |

|||||||||

Operating Executive of the Company, appointed in April 2020 |

||||||||||

Head of Digital Transformation Supervisory Unit, appointed in April 2020 |

||||||||||

Head of IT Operations, appointed in April 2021 |

||||||||||

Head of Digital Supervisory Unit, appointed in April 2022 |

||||||||||

Deputy General Manager of Mono-zukuri Center for Automobile Operations, appointed in April 2022 |

||||||||||

Vice Chief Officer for Automobile Operations, appointed in June 2022 |

||||||||||

Managing Executive Officer, appointed in April 2023 (presently held) |

||||||||||

Head of BEV Development Center for Electrification Business Development Operations, appointed in April 2023 |

||||||||||

Head of Automobile Development Center for Automobile Operations, appointed in April 2023 |

||||||||||

Director of Honda R&D Co., Ltd., appointed in April 2023 (presently held) |

||||||||||

Chief Development Officer of the Company, appointed in April 2024 (presently held) |

||||||||||

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

Executive Officers |

||||||||||

Ayumu Matsuo (September 28, 1965) |

Joined Honda Motor Co., Ltd. in April 1991 | *4 | 7,800 | |||||||

Managing Director of Honda R&D Co., Ltd., appointed in April 2020 |

||||||||||

Operating Executive of the Company, appointed in April 2021 |

||||||||||

Chief Officer, Quality Innovation Operations, appointed in April 2021 |

||||||||||

Executive in Charge of Certification & Regulation Compliance Division, appointed in April 2021 |

||||||||||

Executive in Charge of Quality & Compliance Audit Division, appointed in April 2021 |

||||||||||

Head of Quality Innovation Unit, appointed in April 2022 |

||||||||||

Executive in Charge of Certification & Regulation Compliance Division, appointed in April 2022 |

||||||||||

Executive in Charge of Quality & Compliance Audit Division, appointed in April 2022 |

||||||||||

Head of Supply Chain & Purchasing Unit, Automobile Operations, appointed in April 2023 |

||||||||||

Executive Officer, appointed in April 2024 (presently held) |

||||||||||

Chief Officer for Supply Chain & Purchasing Operations, appointed in April 2024 (presently held) |

||||||||||

Minoru Kato |

Joined Honda Motor Co., Ltd. in April 1988 |

*4 | — | |||||||

| (December 17, 1965) | President of Honda Motorcycle and Scooter India Pvt. Ltd., appointed in April 2017 |

|||||||||

Operating Executive of the Company, appointed in April 2020 |

||||||||||

Chief Officer for Life Creation Operations, appointed in May 2020 |

||||||||||

Head of Power Products Business Supervisory Unit, Motorcycle and Power Products Operations, appointed in April 2022 |

||||||||||

Head of Motorcycle Business Unit, Motorcycle and Power Products Operations, appointed in April 2023 (presently held) |

||||||||||

Executive Officer, appointed in April 2024 (presently held) |

||||||||||

Chief Officer for Motorcycle and Power Products Operations, appointed in April 2024 (presently held) |

||||||||||

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

Yutaka Tamagawa |

Joined Honda Motor Co., Ltd. in April 1990 |

*4 | — | |||||||

| (April 23, 1966) | Operating Officer of Honda R&D Co., Ltd., appointed in April 2018 |

|||||||||

Operating Executive of the Company, appointed in April 2020 |

||||||||||

Electronic Control Development Supervisory Unit of Mono-zukuri Center for Automobile Operations, appointed in April 2020 |

||||||||||

Head of Software Defined Mobility Development Supervisory Unit for Business Development Operations, appointed in April 2022 |

||||||||||

Head of Quality Innovation Unit, appointed in April 2023 |

||||||||||

Executive in Charge of Certification & Regulation Compliance Division, appointed in April 2023 |

||||||||||

Executive in Charge of Quality & Compliance Audit Division, appointed in April 2023 |

||||||||||

Executive Officer, appointed in April 2024 (presently held) |

||||||||||

Chief Officer for Quality Innovation Operations, appointed in April 2024 (presently held) |

||||||||||

Kazuhiro Takizawa |

Joined Honda Motor Co., Ltd. in April 1990 |

*4 | — | |||||||

| (March 29, 1968) | General Manager of Europe Automobile Division for Regional Operations (Europe, Africa and the Middle East), appointed in April 2022 |

|||||||||

Operating Executive, appointed in April 2023 |

||||||||||

Vice Chief Officer for Regional Operations (North America), appointed in April 2023 |

||||||||||

EVP of American Honda Motor Co., Inc., appointed in April 2023 |

||||||||||

Executive Officer of the Company, appointed in April 2024 (presently held) |

||||||||||

Chief Officer for Regional Operations (North America), appointed in April 2024 (presently held) |

||||||||||

President, Chief Executive Officer and Director of American Honda Motor Co., Inc., appointed in April 2024 (presently held) |

||||||||||

Name (Date of birth) |

Current Positions and Biographies with Registrant |

Term |

Number of Shares Owned |

|||||||

Katsuto Hayashi (October 20, 1969) |

Joined Honda Motor Co., Ltd. in April 1992 |

*4 | — | |||||||

General Manager of Business Strategy Division for Business Supervisory Unit for Automobile Operations, appointed in October 2021 |

||||||||||

Operating Executive, appointed in April 2022 |

||||||||||

Head of Automobile Business Strategy Unit for Electrification Business Development Operations, appointed in April 2023 |

||||||||||

Executive Officer, appointed in April 2024 (presently held) |

||||||||||

Chief Officer for Automobile Operations, appointed in April 2024 (presently held) |

||||||||||

Chief Officer for Regional Operations (Associated Regions), appointed in April 2024 (presently held) |

||||||||||

Takashi Onuma (September 11, 1973) |

Joined Honda Motor Co., Ltd. in July 2000 |

*4 | — | |||||||

Senior Vice President, Honda Development & Manufacturing of America, LLC, appointed in April 2021 |

||||||||||

| Operating Executive of the Company, appointed in April 2022 |

||||||||||

EVP of Honda Development & Manufacturing of America, LLC, appointed in April 2022 |

||||||||||

| Deputy Head of Automobile Development Center for Automobile Operations of the Company, appointed in April 2023 |

||||||||||

Head of Production Engineering Unit, appointed in April 2023 |

||||||||||

Head of ICE Automobile Development Unit, appointed in April 2023 |

||||||||||

Executive Officer, appointed in April 2024 (presently held) |

||||||||||

Chief Officer for Automobile Production Operations, appointed in April 2024 (presently held) |

||||||||||

| *4 | The term of office of an Executive Officer is until at the close of the first Board of Directors meeting held after the ordinary general meeting of shareholders of the fiscal year ending March 31, 2025 after his/her appointment to office. |

| *5 | The Company introduced the Operating Executive position effective April 1, 2020, with the aim of advancing its corporate executive structure and enabling the Company to address changes in the business environment with greater speed and flexibility. Operating Executives will engage in company operations, with responsibility for business execution in their respective areas under the direction and supervision of management. Operating Executives are not statutory positions under the Company Law and do not conform to the definition of “Directors and Senior Management” as defined in Form 20-F. |

| 1. | The Company’s remuneration structure for Directors and Executive Officers is designed to motivate officers to contribute to the improvement of the Company’s business performance not only over the short-term, but also over the mid- to long-term, so that the Company can continuously enhance its corporate value, and it consists of monthly remuneration, a fixed amount paid each month as remuneration for the execution of duties, STI (Short Term Incentive) based on business performance for the relevant fiscal year, and LTI (Long Term Incentive) based on the mid- to long-term business performance. |

| 2. | Monthly remuneration shall be paid as a fixed amount each month based on remuneration standards resolved by the Compensation Committee. |

| 3. | STI shall be determined and paid by resolution of the Compensation Committee, taking into consideration the business performance of each fiscal year. |

| 4. | Based on standards and procedures approved by the Compensation Committee, LTI is based on the mid- to long-term performance and paid in the form of the Company’s shares and cash, in order to function as a sound incentive for sustainable growth. |

| 5. | Remuneration paid to Directors who concurrently serve as Executive Officers and Executive Officers shall consist of monthly remuneration, STI and LTI, and the composition rate shall be determined based on the remuneration standards resolved by the Compensation Committee. The composition ratio of variable compensation is increased according to the weight of management responsibility attributed to each position. |

| 6. | Remuneration paid to Outside Directors and other Directors who do not concurrently serve as Executive Officers shall consist only of monthly remuneration. |

| 7. | In order to advance the Company’s sustainable growth and enhance its corporate value over the mid-to long-term by achieving the management from the perspective of shareholders through having a shareholding in the Company, even Directors and Executive Officers who are not eligible for LTI shall acquire the Company’s stock by contributing a certain portion of their remuneration to the Officers Shareholding Association. |

| 8. | Directors and Executive Officers shall continuously hold, throughout their term of office and for one year after their retirement, any stock of the Company acquired as LTI or acquired through the Officers Shareholding Association. |

| 1. | Outline of remuneration system for Executive Officers |

Type of remuneration |

Based on performance |

Fluctuation |

Payment method |

Payment timing |

Remuneration composition ratio (When STI/LTI are paid at the base amount) | |||||||||||||

President and Executive Officer |

Executive Vice President and Executive Officer |

Senior Managing Executive Officer |

Managing Executive Officer |

Executive Officer | ||||||||||||||

Monthly remuneration |

Fixed |

— |

Cash |

Monthly |

25% | 35% | 40% | 50% | ||||||||||

STI |

Short-term performance-based remuneration |

0 to 180% |

Cash |

Annually |

25% | 30% | 30% | 25% | ||||||||||

LTI |

Medium- to long-term performance-based remuneration |

50 to 150% |

Stock |

Three years after the annual stock points are granted with restriction on transfer until retirement |

50% | 35% | 30% | 25% | ||||||||||

| 2. | Monthly remuneration |

| 3. | STI |

KPIs (Consolidated accounting) |

Evaluation method |

Weight of each KPI | ||

| Operating profit margin | Degree of achievement of targets | 50% | ||

| Profit attributable to owners of the parent | 50% |

KPIs |

Evaluation method |

Weight of each KPI | ||

| Individual targets set according to role | Degree of achievement of individual targets | 100% |

STI payment |

= | Standard STI |

x | Company’s performance coefficient |

x | Individual performance coefficient |

| 4. | LTI |

KPIs |

Evaluation method |

Weight |

Fluctuation | |||||

| Financial indicators | Consolidated operating profit margin | Evaluated based on growth over the past three fiscal years |

35% |

50 to 150% | ||||

| Consolidated profit before income taxes | 35% | |||||||

| Non-financial indicators | Brand value | Evaluated based on degree of achievement of targets |

30% | |||||

| SRI index | ||||||||

| Associate Engagement | ||||||||

| * | Non-financial indicators are evaluated based on the following indicators: |

| - | Brand value: Survey of motorcycle/automobile/power products businesses by a third-party research firm |

| - | SRI index: Dow Jones Sustainability World Index |

| - | Associate Engagement: Survey of employee activeness in each region by a third-party research firm |

KPIs |

Evaluation method |

Weight |

Fluctuation | |||||

| Financial indicators | Consolidated operating profit margin | Evaluated based on degree of achievement of targets |

60% |

40 to 240% | ||||

| Profit for the year attributable to owners of the parent | ||||||||

Non-financial indicators |

Brand value | 20% | ||||||

| Total CO 2 emissions | ||||||||

| Associate engagement | ||||||||

| Stock indicator | Total Shareholder Return | Evaluation based on relative comparison with the dividend-inclusive TOPIX growth rate for the fiscal year |

20% | |||||

| * | Non-financial indicators are evaluated based on the following indicators: |

| - | Brand value: Survey of the Company’s brand value by a third-party research firm |

| - | Total CO 2 emissions: The amount of CO2 emissions from corporate activities and products based on CO2 emissions calculation methods used commonly in Japan (and globally) |

| - | Associate Engagement: Survey of employee activeness in each region by a third-party research firm |

| - | Basic policies and annual activity plans |

| - | Compensation evaluation for Directors and Executive Officers |

| - | LTI and share delivery rules |

| - | Policy to recover erroneously awarded compensation |

Fixed remuneration |

Performance-based remuneration |

Total |

||||||||||||||||||||||||||

Remuneration |

STI |

LTI |

||||||||||||||||||||||||||

Number of persons |

Yen (millions) |

Number of persons |

Yen (millions) |

Number of persons |

Yen (millions) |

Yen (millions) |

||||||||||||||||||||||

Directors excluding Outside Directors |

4 | ¥ | 287 | — | ¥ | — | 1 | ¥ | 12 | ¥ | 300 | |||||||||||||||||

Outside Directors |

5 | 90 | — | — | — | — | 90 | |||||||||||||||||||||

Executive Officers |

13 | 829 | 13 | 612 | 10 | 440 | 1,882 | |||||||||||||||||||||

Total |

22 | ¥ | 1,209 | 13 | ¥ | 612 | 11 | ¥ | 453 | ¥ | 2,274 | |||||||||||||||||

| * | Directors excluding Outside Directors do not include three directors who concurrently serve as Executive Officers. |

Type of trust |

An individually-operated specified trust of money other than cash trust (third party beneficiary trust) |

Purpose of trust |

To further enhance mindfulness of Executive Officers Etc. toward contributing to the sustained improvement of corporate value of the Company over the mid- to long-term |

Trustor |

The Company |

Trustee |

Mitsubishi UFJ Trust and Banking Corporation |

Beneficiaries |

Executive Officers Etc. who satisfy the beneficiary requirements |

Trust administrator |

A third party which has no interests in the Company (a certified public accountant) |

Date of trust agreement |