In November 2021, President Biden signed Infrastructure Investment and Jobs Act (H.R.3684). The Act requires government agencies in the United States to enact various rules and regulations. In particular, the Act mandates agencies to implement rules regarding vehicle safety, mandatory installation of collision avoidance systems and drunk driving prevention technology, as well as surveys on connected vehicles. The content of each rule to be implemented is expected to be considered by the NHTSA and Department of Transportation (DOT) in the future.

In February 2022, the NHTSA issued a final rule to revise FMVSS108 “Lamps, Reflective Devices, and Associated Equipment”. This amendment enables the adoption of adaptive driving beam (ADB) systems, an advanced headlamp technology that optimizes the beam pattern without driver action, specifies track testing requirements for vehicles and lab testing requirements at the component level.

In March 2022, the NHTSA issued a final rule to revise FMVSS200 series (201/203/204/205/206/207/208/212/214/216a/219/225/226) for occupant protection in

ADS-equipped

vehicles. ADS-equipped

vehicles without seats that are not intended to carry people are excluded from the application of the FMVSS200 series for occupant protection in the event of a collision. ADS-equipped

vehicles without conventional steering control systems are partially excluded from the application of the FMVSS200 series (as it relates to protection from steering control systems), and new requirements for occupant protection in the event of a collision have been added. In June 2022, the NHTSA issued a proposed rule that amends time series data requirements of 49 CFR Part 563 EDR (Event Data Recorders). The proposed regulation would change the recording time of EDR time-series measurement data from 5 seconds to 20 seconds for

pre-collision

data, and change the data sampling frequency from 2 Hz to 10 Hz. This revision proposes to increase the recording time and recording frequency of pre-collision

data in order to analyze the behavior of the vehicle before a collision occurs. The application applies to the vehicles manufactured after the first September 1st of the year following the publication of the final rule. In September 2022, the NHTSA issued a final version of “Cybersecurity Best Practices for the Safety of Modern Vehicles (2022 update)” to update

non-binding

and voluntary guidance. This 2022 revision reflects comments received on the 2020 version of the Guidance, and clarifies and adds terminology in the scope, updated reference ISO/SAE 21434, and general cybersecurity best practices. In the United States, state laws stipulate privacy protection laws aimed at protecting the privacy of consumers within the state, and as of April 2023, California, Virginia, Colorado, Utah, and Connecticut have enacted such privacy protection laws.

In May 2023, the NHTSA proposed a new FMVSS that would require all new light vehicles to be equipped with automatic emergency braking systems. It proposed mandatory installation of forward collision alarms and automatic emergency braking for lead vehicles and pedestrians by newly establishing FMVSS 127 “Automatic emergency braking systems for light vehicles” and 49 CFR Part 596 “Automatic Emergency Braking Test Devices”. The application is planned in 2 phases for vehicles manufactured on or after September 1, three years and four years after the publication of the final rule.

Europe

In August 2018, the EU commission issued a regulation to significantly revise the legal framework for the EU type-approval. This regulation introduces a market surveillance system for managing the conformity of motor vehicles available on the market and adds a requirement of an expiration date for vehicle type approval. This EU type-approval came into effect on September 1, 2020.

In March 2019, the Committee of the Permanent Representatives of the Governments of the Member States to the European Union approved amendments to the “General Safety Regulation”. Road traffic safety in the EU has improved during the last decade, but recently the decrease in the number of road fatalities has stagnated.

21

To address this issue, the revised General Safety Regulation came into force in January 2020 and will be applied to vehicles from July 2022, which is 30 months after the enforcement. The revised General Safety Regulation include mandatory equipment such as advanced driver assistance systems (ADAS).

In addition to making ADAS equipment mandatory, the revised General Safety Regulation will also enact legislation for self-driving cars in 2026. As a response, rules for cyber security management systems formulated by UNECE WP29 in June 2020 has been incorporated into the revised General Safety Regulation, and it will be mandatory from July 2022 as with other items of the revised General Safety Regulation. In addition, software updates will become more important with advanced electronic controls, so software update management systems will also be required from July 2022 to check whether appropriate updates have been made to the vehicle.

For the first time, process approval has been introduced into cyber security management systems and software update management systems for vehicle type approval. This is not only for vehicles, but for everything from development to production and sales. This is to ensure that manufacturers are taking protective measures against cyber-attacks in the scene.

As an important block of the European Data Strategy of February 2020, the Data Act was announced as the primary regulation governing the assurance of data value and management. This Data Act applies to manufacturers and service

co-owners,

users and providers of products in the EU market with the aim of ensuring data management and accessibility of data between the private and public sectors. For vehicles, the European Commission has issued an impact assessment on access to vehicle data, features and resources. With regards to access to in-vehicle

data for the purpose of providing vehicle related mobility services, the European Commission started public consultation for the revision of “Whole Vehicle Type Approval (WVTA) and market surveillance” (EU) 2018/858 in March 2022, a proposed regulation for which was issued in February 2022. China

Vehicle safety regulations in China were drafted with reference to the UNECE standards and cover almost the same matters as the UNECE standards. However, these regulations also include unique provisions that take into account the distinctive characteristics of the Chinese market environment and the rules differ from the latest UNECE regulations. In addition, as rulemaking related to autonomous vehicles accelerates, multiple ICV (Intelligent Connecting Vehicle) standards will be promulgated in the future.

In June 2022, the Shenzhen Special Economic Zone ICV Management Ordinance has been issued, and local standards for ICV introduction are being considered in Shenzhen.

Future safety regulations are described as follows:

Newly published GB and GB/T standards (Chinese national standards issued by the Standardization Administration of China) include:

| + | Event Data Recorder (EDR), |

| + | Amendment to electric vehicles traction battery safety requirements, and |

| + | Amendment to electric vehicles safety requirements. |

| + | Motor vehicles-Devices for indirect vision-Requirements of performance and installation |

Newly established GB and GB/T standards (not yet published) include:

| + | Establishment of technical requirements related to cyber security, and |

| + | Establishment of security requirements for automobile data collection and requirements for cross-border data transfers, and |

| + | Amendment to battery electric passenger cars – specifications. |

22

| + | Amendment to connection set for conductive charging of electric vehicles-Part 1: General requirements |

| + | Amendment to test methods for Power performance of fuel cell electric vehicles |

| + | Amendment to fuel cell electric vehicles Onboard hydrogen system specifications |

| + | Amendment to measurement methods of net power for automotive engines and electric drive trains |

| + | Amendment to hybrid electric vehicles-Power performance-Test method |

| + | Amendment to battery electric vehicles-Power performance-Test method |

India

In December 2022, the Ministry of Road Transport and Highways (MoRTH) issued the 25th amendment of the Central Motor Vehicles Rules (CMVR), which requires traction battery for electric power train vehicles manufactured on and from April 1, 2023 to be approved by the Annex

IX-K

to Automotive Industry Standards (AIS)-038.

Brazil

In April and December 2020, The National Traffic Department (DENATRAN) issued an ordinance regarding the vehicle safety labelling program. The ordinance was implemented from July 1, 2021.

In October 2020, the National Institute of Metrology, Standardization and Industrial Quality (INMETRO) issued an ordinance amending quality technical regulations for new tires. The ordinance was implemented from April 21, 2022 for new tire type and is scheduled to be implemented from October 21, 2025 for existing tire type.

In October 2020, the Brazil transport authority (CONTRAN) issued a resolution to postpone those applicable dates of some safety items due to

COVID-19

impact. In November 2020, INMETRO issued an ordinance, which amended “Regulation for Technical Quality on Child Restraint Systems” and “Requirements for assessment of compliance for Child Restraint Systems.” The ordinance was implemented from May 23, 2021.

In January 2021, an Act of cyber security related to the products listed in the Reference List of Telecommunications Products published by the National Telecommunications Agency that have the function of terminal equipment with an Internet connection or telecommunications network infrastructure equipment was announced. The Act was implemented from July 4, 2021.

CONTRAN announced a second proposal regarding the obligation to install and technical requirements for the Automatic Emergency Braking System (AEBS) installed in vehicles in November 2022. For moving obstacles, it is scheduled to be implemented from January 1, 2026 (new models) and January 1, 2029 (all models). For fixed obstacles, it is scheduled to be implemented from January 1, 2029 (new models) and January 1, 2031 (all models).

CONTRAN announced a proposal regarding the obligation to install and technical requirements for the Lane Departure Warning System (LDWS) installed in vehicles in November 2022. It is scheduled to be implemented from January 1, 2026 (new models) and January 1, 2029 (all models).

CONTRAN issued a regulation that establishes requirements for occupant protection and fuel system integrity in vehicle collisions in December 2018. It is scheduled to be implemented from January 1, 2024 (new models) and January 1, 2026 (all models).

CONTRAN issued a regulation to establish pedestrian protection requirements in the event of a collision in December 2018. It is scheduled to be implemented from January 1, 2025 (new models) and January 1, 2030 (all models)

.

23

CONTRAN issued a regulation to establish requirements for rear warning and monitoring systems installed in vehicles in December 2018. It is scheduled to be implemented from January 1, 2025 (new models) and January 1, 2027 (all models).

CONTRAN issued a regulation to establish vehicle performance requirements in the event of pole side impact in December 2018. It is scheduled to be implemented from January 1, 2026 (new models) and January 1, 2030 (all models).

Outline of Environmental and Safety Regulation for Motorcycles

1. Emissions

Europe

Euro 5 requirements other than catalyst monitoring of OBD (Onboard Diagnostics Regulation) started to apply to new vehicle models from January 2020 and started to apply to all vehicles registered from January 2021. Catalyst monitoring will apply to new vehicle models from January 2024 and will apply to all vehicles registered from January 2025.

On December 11, 2019, the European Commission released its communication on the EU Green Deal. See “—Outline of Environmental and Safety Regulation for Automobiles—1. Emissions—Europe”.

India

India published BS VI regulation (Euro 5 level exhaust emission regulation), which became effective from April 2020. OBD II is introduced in two stages, Stage

II-A

and II-B.

Stage II-A

became effective from April 2023 and Stage II-B

will become effective from April 2025. China

China is considering the introduction of Euro 5 level emission regulation.

Other Asian Countries

Thailand published the 7th phase (Euro 4) level emission regulation to be implemented from March 2020.

Indonesia, Vietnam and the Philippines are implementing emission regulations based on European regulations (Euro 3). In addition, consideration of the introduction of Euro 4 has started.

Brazil

Brazil published a new emission regulation called PROMOT 5 (Euro 5 level exhaust emission regulation), which applies to new motorcycles from January 2023 and will apply to all motorcycles registered from January 2025. The OBD stage 2 requirement will apply to new models of motorcycles from January 2025 and will apply to all motorcycles registered from January 2027.

2. Recycling / Chemicals and hazardous substances

Europe

The same REACH compliance required for motor vehicles is required for motorcycles.

The European Union has a plan to implement motorcycle recycling laws in near future.

24

The European Union has issued a proposed regulation amending the EU Battery Directive to the EU Battery Regulation. The proposed regulation would add requirements related to carbon footprints and information disclosure of remaining life for recycling, among others. The EU Battery Regulation is currently scheduled to come into force in 2024.

China

China has a plan to implement motorcycle recycling laws in near future.

India

India has announced a plan to implement motorcycle recycling laws in near future.

India has issued a final regulation called Battery Waste Management Rules on August 22, 2022. This final regulation requires the achievement of certain recovery targets for waste batteries and sets targets for value of use of recycled materials in new batteries.

Vietnam

Vietnam implemented motorcycle recycling laws on January 1, 2018.

3. Safety

Europe

In January 2019, the EU Commission issued a regulation complementing Union type-approval legislation with regard to Brexit.

India

In India, the Auto Headlight On (AHO) function, which automatically turns on the head lamps when the engine is running, shall be installed on all

two-wheelers

manufactured on and after April 1, 2017. New vehicle models certified on and after April 1, 2018, all vehicles manufactured on and after April 1, 2019 shall be equipped with an advanced brake system. For advanced brake system, two-wheeled

vehicles with engine capacity of not more than 125cc, continuous rated or net power not more than 11kW and power/weight ratio not more than 0.1 kW/kg shall be equipped with ABS or CBS. All other categories of two-wheeled

vehicles shall be equipped with ABS. Furthermore, the Automotive Industry Standard Committee (AISC) published AIS 146, 147 and 148. These are the standards for stand, external projection and footrest strength. These standards became closer to those required by the European regulations. The Ministry of Road Transport and Highways, Government of India, has promulgated technical requirements for batteries that include India’s own requirements called

AIS-156

(Amd3). The standard was enforced in two phases, item by item, with Phase 1 coming into effect on December 1, 2022, and Phase 2 on March 31, 2023. China

China introduced a requirement for an advanced brake system, which shall be installed on new vehicle models manufactured on and after July 1, 2019, and also on all motorcycles manufactured on and after July 1, 2020. Motorcycles with engine capacity of more than 150cc and not exceeding 250cc shall be equipped with ABS or CBS. Motorcycles with engine capacity of more than 250cc shall be equipped with ABS.

25

Electric motorcycle safety regulations were introduced in January 2021.

Newly established GB standards (mandatory national standards) and GB/T standards (voluntary national standards) include:

| + | Technical requirements related to cyber security. |

| + | Security requirements for automotive data collection. |

Other Asian Countries

In Thailand, regulations for brakes (UN R78) came effective in January 2022 and regulations for the safety of electric motorcycles (UN R136) became effective in January 2023, while regulations for lighting installation (UN R53) will become effective in January 2024.

Indonesia and Vietnam have been introducing various regulations regarding lighting and braking based on UN Regulations. Recently, Indonesia is considering the introduction of various regulations based on UN regulations, including horns (UN R28), speedometers (UN R39), lighting installation (UN R53), and brake systems (UN R78).

The Philippines has begun considering additional regulations to include an AHO function that automatically turns on the headlamps when the engine is running (From June 2023).

Brazil

The Brazil transport authority (CONTRAN) issued a standard concerning motorcycle braking based on the UNECE Brake regulation (R78.03) as well as a new regulation mandating ABS/CBS installation. The Brazilian standardization authority (INMETRO) currently mandates parts certification for tires and batteries, but added drive/driven sprocket, drive chain and muffler to the scope of application from March 24, 2019 at customs clearance. Brazilian government issued lighting regulation based on previous UNECE regulations; these regulations were implemented from January 1, 2019.

On January 31, 2020, CONTRAN implemented new requirements for license plates based on the Mercosur standards. In addition, the requirements for holes for sealing of license plates have been repealed, since QR codes are printed on the plates instead.

Outline of Environmental and Safety Regulation for Power Products

1. Emissions

The United States

In April 2016, CARB has published an evaporative emission regulation applicable to outboard engines implementing from the 2018 model year and later.

In December 2020, the “Portable Generator Safety Standard Bill” was submitted to the House of Representatives. It would require, if passed, a CO safety shutoff system and CO emissions restrictions for portable generators.

In September 2022, CARB published a final regulation to accelerate the transition of equipment using small

off-road

engines to zero-emission

equipment, requiring most small off-road

engines sold in California on or after January 1, 2024 to be zero emissions. In accordance with this, the evaporative (EVAP) emission standard value has also been changed. 26

In April 2023, the U.S. Consumer Product Safety Commission (CPSC) initiated a rule-making process to establish safety standards regulations, including CO emissions (g/h) limits for portable generators.

Europe

The European Commission has finalized strengthened exhaust emission regulation for

non-road

small spark-ignition engines (commonly known as Stage 5 regulation). Its limit values of exhaust emission follow the U.S. EPA phase 3 and the effective date is January 2018 for new certifications and January 1, 2019 for the engines newly placed in the market. On December 11, 2019, the European Commission released its communication on the EU Green Deal. See “—Outline of Environmental and Safety Regulation for Automobiles—1. Emissions—Europe”.

In December 2022, the European Commission published an amendment to Delegated Reg. Monitoring

Non-Road

Mobile Machinery (NRMM) in service engines of less than 56kW or more than 560kW. China

An exhaust emission standard was introduced in China on March 1, 2011. Its requirements are based on the European exhaust emission regulations and are applicable to small spark-ignition engines for

non-road

mobile machinery with 19 kW or less. The phase 2 regulation with durability requirement started from January 1, 2014. The phase 3 regulation is under development. Thailand

In February 2022, the Ministry of Industry of Thailand issued standards for the environmental performance of small

air-cooled

gasoline engines as a general standard. 2. Recycling / Chemicals and hazardous substances

The United States

The Toxic Substances Control Act (TSCA) is the US hazardous substances legislation restricting Phenol, Isopropylated Phosphate (PIP) (3:1) for the first time in the world. PIP (3:1) is mainly used as a flame retardant. The first rule implementing this restriction was issued in January 2021, but relevant industrial associations objected that the transitional period, which was to last only 60 days, would make it impossible to comply in a timely manner. As a result, the compliance date has been extended to November 2024. Currently, “Motor vehicles” are exempted from this rule; however, PIP (3:1) can no longer be used for power products from 2024.

Europe

The same REACH compliance required for motor vehicles is required for power products. In June 2011, the European Union Directive on the restriction of the use of certain hazardous substances in electrical and electronic equipment (RoHS) had been wholly revised and most power products were within its scope after 2019.

The European Union has issued a proposed regulation amending the EU Battery Directive to the EU Battery Regulation. The proposed regulation would add requirements related to carbon footprints and information disclosure of remaining life for recycling, among others. The EU Battery Regulation is currently scheduled to come into force in 2024.

China

On July 1, 2016, a regulation similar to European RoHS has entered into force. The first list of target products was published on March 12, 2018.

27

India

India has issued a final regulation called Battery Waste Management Rules on August 22, 2022. This final regulation requires the achievement of certain recovery targets for waste batteries and sets targets for value of use of recycled materials in new batteries.

3. Safety

Japan

The Agricultural Technology Innovation Engineering Research Center of National Agriculture and Food Research Organization has decided to conduct safety inspection of agricultural machinery that has replaced agricultural machinery safety appraisal from July 31, 2018.

In July 2020, the Snow Thrower Safety Council has revised the safety standard for labeling and safety manuals to include warnings regarding the invalidated deadman clutch mechanism for operating levers on snow throwers.

In June 2021, the Snow Thrower Safety Council revised safety standards to add performance criteria allowing snow throwers to stop safely when moving backwards.

In April 2023, the MLIT expanded the certified output of shipbuilding businesses to 92 kW based on the provisions of the Ship Safety Act.

The United States

In November 2016, the CPSC promulgated a notice of proposed rule-making in the Federal Register, which proposes to restrict the carbon monoxide emission from portable generator rated 19kW and below. This regulation was proposed to address the carbon monoxide poisoning injuries occurring from portable generators.

In April 2018, an American National Standard Institute (ANSI) Standard for portable generators were amended.

In January 2023, the Portable Generator Manufacturers’ Association (PGMA), a trade association that seeks to develop and influence safety and performance standards for the industry, announced that it is in the process of revising PGMA G300-2018 in order to change the standard value of the CO

shut-off

system, expand the scope of application and other matters. Europe

The EU Commission plans to enhance existing noise regulation applicable to equipment intended to be used outdoors. This is a comprehensive rulemaking including expansion of the scope of regulation, enhanced noise limits, change to the conformity assessment system, among other things.

In 2019, the EU Commission began discussions for a revision of the Machinery Directive.

In 2020, discussions to revise the Low Voltage Directive, Battery Directive and Recreational Craft Directive have been initiated.

In January 2022, the European Commission issued a regulation on cybersecurity to supplement the Radio Equipment Directive.

28

China

In 2019, a recommended standard for lawn mower safety requirements was issued by the State Administration for Market Regulation (SAMR).

The publication of a new “Safety technical specification for agricultural machinery”, which specifies safety requirements for agricultural machinery in general, is under consideration.

Preparing for the Future

Please note that the forward-looking statements contained herein are judgments made by Honda as of the date of submission of this Annual Report (June 23, 2023) and may differ materially from actual results because of uncertainties that may arise in the future, including those discussed under “Item 3. Key Information—D. Risk Factors.”

Management Policies and Strategies

Honda has two fundamental beliefs: “Respect for the Individual” and “The Three Joys” (the Joy of Buying, the Joy of Selling, and the Joy of Creating). “Respect for the Individual” calls on Honda to nurture and promote these characteristics in Honda by respecting individual differences and trusting each other as equal partners. “The Three Joys” is based on “Respect for the Individual”, and is the philosophy of creating joy with everyone involved in Honda’s activities, with the joy of our customers as the driving force.

Based on these fundamental beliefs, Honda strives to improve its corporate value by sharing joy with all people, and with our shareholders in particular, by practicing its mission statement: “Maintaining a global viewpoint, we are dedicated to supplying products of the highest quality, yet at a reasonable price for worldwide customer satisfaction”.

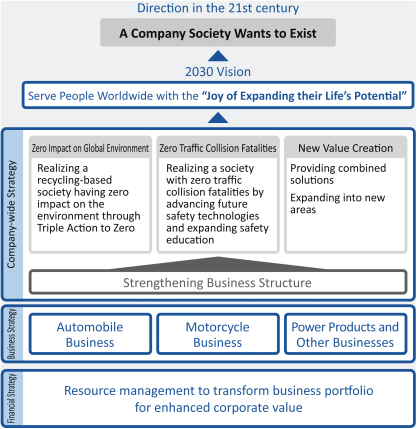

To remain “a company society wants to exist”, Honda is undertaking corporate activities to “serve people worldwide with the ‘joy of expanding their life’s potential’”, as stated in its 2030 Vision. As the world’s largest power unit manufacturer with annual sales of approximately 30 million units, Honda has been fully focusing on the environment and safety, and for the creation of new value, making company-wide efforts to expand its combined solutions business while taking on challenges in new areas. We will also strengthen our business structure further to generate the investment resources needed for the transformation of our business portfolio.

29

Management Challenges

The business environment surrounding Honda has come to a major turning point. Values are diversifying, the population is aging, urbanization is accelerating, climate change is worsening, and the industrial structure is changing due to progress in technologies such as the use of electric-powered motors, autonomous driving and IoT, all on a global basis. Daily living environment and customs have changed dramatically due to the impact of

COVID-19,

while global fragmentation has accelerated and geopolitical risks have also become apparent. Furthermore, Honda needs to build positive relationships with all stakeholders involved in our corporate activities to solve long-term social issues. Working to improve the quality of the value we provide is essential to achieve future growth. In the Automobile business, Honda has entered a transformation period that occurs only once in a century through technological innovations in connectivity, automation, shared & services and electrification. Even automobiles are required to offer integrated services and new, customized experiences in addition to their universal value, namely, the freedom of mobility with a sense of security. With increasingly tighter environmental regulations being adopted across the world, an expansion of the EV (electric vehicle) business in the automobile industry is expected to intensify competition for resources. Under such an uncertain environment, we will take more concerted efforts to strengthen our business structure in order to steadily promote electrification and initiatives for safety.

With more stringent environmental regulations being enforced across the world, some emerging countries have followed the move in developed countries and announced their respective governmental targets of electrification, and accordingly, the Motorcycle business is beginning to show signs of change. Facing such changes in the business environment and regional characteristics, Honda needs to take a multifaceted and multidimensional approach aiming to achieve carbon neutrality in the area of motorcycles. In addition, for safety,

30