UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2012

Commission File Number 001-15877

| GERMAN AMERICAN BANCORP, INC. |

| (Exact name of registrant as specified in its charter) |

| INDIANA | 35-1547518 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 711 Main Street, Box 810, Jasper, Indiana | 47546 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (812) 482-1314

Securities registered pursuant to Section 12(b) of the Act

| Title of Each Class | Name of each exchange on which registered |

| Common Shares, no par value | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | ¨ Yes | þ No |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | ¨ Yes | þ No |

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | þ Yes | q No |

| Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | þ Yes | q No |

| Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K: | ¨ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company:

| Large accelerated filer ¨ | Accelerated filer þ | Non-accelerated filer ¨ | Smaller reporting company ¨ |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | ¨ Yes | þ No |

The aggregate market value of the registrant’s common shares held by non-affiliates as of June 30, 2012 was approximately $234,036,000. This calculation does not reflect a determination that persons are (or are not) affiliates for any other purpose.

As of March 1, 2013, there were outstanding 12,636,656 common shares, no par value, of the registrant.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement of German American Bancorp, Inc., for the Annual Meeting of its Shareholders to be held May 16, 2013, to the extent stated herein, are incorporated by reference into Part III.

GERMAN AMERICAN BANCORP, INC.

ANNUAL REPORT ON FORM 10-K

For Fiscal Year Ended December 31, 2012

Table of Contents

| PART I | ||

| Item 1. | Business | 3-11 |

| Item 1A. | Risk Factors | 11-15 |

| Item 1B. | Unresolved Staff Comments | 15 |

| Item 2. | Properties | 15 |

| Item 3. | Legal Proceedings | 15 |

| Item 4. | Mine Safety Disclosures | 15 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 16-17 |

| Item 6. | Selected Financial Data | 18 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 19-36 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 37 |

| Item 8. | Financial Statements and Supplementary Data | 38-84 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 85 |

| Item 9A. | Controls and Procedures | 85 |

| Item 9B. | Other Information | 85 |

| PART III | ||

| Item 10. | Directors, Executive Officers, and Corporate Governance | 86 |

| Item 11. | Executive Compensation | 86 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 86-87 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 87 |

| Item 14. | Principal Accounting Fees and Services | 87 |

| PART IV | ||

| Item 15. | Exhibits, Financial Statement Schedules | 88 |

| SIGNATURES | 89 | |

| INDEX OF EXHIBITS | 90-94 | |

| 2 |

Information included in or incorporated by reference in this Annual Report on Form 10-K, our other filings with the Securities and Exchange Commission and our press releases or other public statements, contain or may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Please refer to a discussion of our forward- looking statements and associated risks in Item 1, “Business – Forward-Looking Statements and Associated Risks” and our discussion of risk factors in Item 1A, “Risk Factors” in this Annual Report on Form 10-K.

PART I

Item 1. Business.

General

German American Bancorp, Inc., is a NASDAQ-traded (symbol: GABC) financial services holding company based in Jasper, Indiana. German American, through its banking subsidiary German American Bancorp, operates 35 retail and commercial banking offices in 13 southern Indiana counties. The Company also owns a trust, brokerage, and financial planning subsidiary (German American Financial Advisors & Trust Company) and a full line property and casualty insurance agency (German American Insurance, Inc.).

Throughout this report, when we use the term “Company”, we will usually be referring to the business and affairs (financial and otherwise) of German American Bancorp, Inc. and its consolidated subsidiaries as a whole. Occasionally, we will refer to the term “parent company” or “holding company” when we mean to refer to only German American Bancorp, Inc. and the term “Bank” when we mean to refer only to the Company’s bank subsidiary.

The Company’s lines of business include retail and commercial banking, mortgage banking, comprehensive financial planning, full service brokerage and trust administration, and a full range of personal and corporate insurance products. Financial and other information by segment is included in Note 15 – Segment Information of the Notes to the Consolidated Financial Statements included in Item 8 of this Report and is incorporated into this Item 1 by reference. Substantially all of the Company’s revenues are derived from customers located in, and substantially all of its assets are located in, the United States.

Subsidiaries

The Company’s principal operating subsidiaries are described in the following table:

| Name | Type of Business | Principal Office Location | ||

| German American Bancorp | Commercial Bank | Jasper, IN | ||

| German American Insurance, Inc. | Multi-Line Insurance Agency | Jasper, IN | ||

| German American Financial Advisors & Trust Company | Trust, Brokerage, Financial Planning | Jasper, IN |

Business Development

The Company opened a loan production office in Columbus, Indiana, during the second quarter of 2012 as an entry point into the Columbus market. Currently, construction is underway on the Company’s first full service retail and commercial branch location in Columbus, with completion expected in the third quarter of 2013.

The Company acquired by merger (effective January 1, 2011) American Community Bancorp, Inc., and its subsidiary, Bank of Evansville. Bank of Evansville provided a full range of commercial and consumer banking services in the Evansville, Indiana, area, from three banking offices located on the east, west and north sides of the city, each of which is now a branch office of the Bank. American Community reported on its balance sheet consolidated assets and deposits (unaudited) as of December 31, 2010 that totaled $340.3 million and $302.4 million, respectively. The Company continues its focus on growing its base of operations in the Evansville, Indiana, market.

The Company has in recent years also focused on growing its base of operations in the Bloomington, Indiana, market. The Company opened a new downtown financial services center in Bloomington in July 2011.

The Company expects to continue to evaluate opportunities to expand its business through opening of new banking, insurance or trust, brokerage and financial planning offices, and through acquisitions of other banks, bank branches, portfolios of loans or other assets, and other financial-service-related businesses and assets in the future.

| 3 |

Office Locations

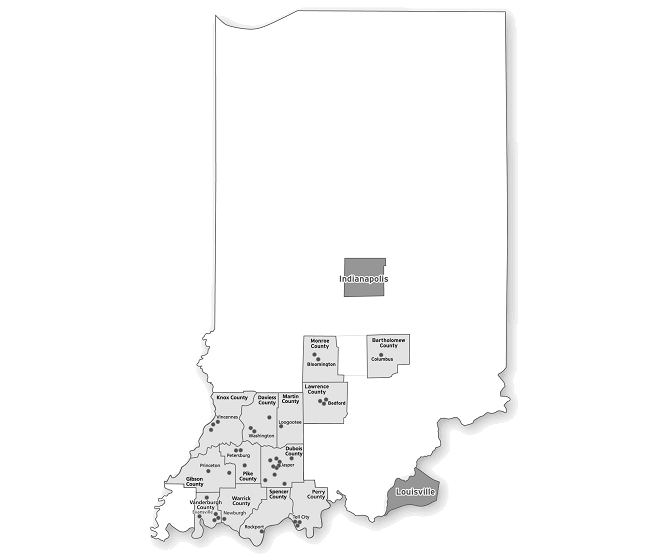

The Indiana map below illustrates the locations of the Company’s 38 retail and commercial banking, insurance and investment offices as of March 1, 2013.

Competition

The industries in which the Company operates are highly competitive. The Bank competes for commercial and retail banking business within its core banking segment not only with financial institutions that have offices in the same counties but also with financial institutions that compete from other locations in Southern Indiana and elsewhere. Further, the Bank competes for loans and deposits not only with commercial banks but also with savings and loan associations, savings banks, credit unions, production credit associations, federal land banks, finance companies, credit card companies, personal loan companies, investment brokerage firms, insurance agencies, insurance companies, lease finance companies, money market funds, mortgage companies, and other non-depository financial intermediaries. There are numerous alternative providers (including national providers that advertise extensively via television and the Internet and that provide their services through direct mail, telephone and the Internet) for the insurance products and services offered by German American Insurance, Inc., and the trust, brokerage and financial planning products and services offered by German American Financial Advisors & Trust Company. Many of these competitors have substantially greater resources than the Company.

Employees

At March 1, 2013 the Company and its subsidiaries employed approximately 440 full-time equivalent employees. There are no collective bargaining agreements, and employee relations are considered to be good.

| 4 |

Regulation and Supervision

Overview

The Company is subject to regulation and supervision by the Board of Governors of the Federal Reserve System (“FRB”) under the Bank Holding Company Act of 1956, as amended (“BHC Act”), and is required to file with the FRB annual reports and such additional information as the FRB may require. The FRB may also make examinations or inspections of the Company. The Bank is under the supervision of and subject to examination by the Indiana Department of Financial Institutions (“DFI”), and the Federal Deposit Insurance Corporation (“FDIC”). Regulation and examination by banking regulatory agencies are primarily for the benefit of depositors rather than shareholders.

Under FRB policy and the Dodd-Frank Wall Street Reform and Consumer Protection Act, a complex and wide-ranging statute that was enacted by Congress and signed into law during July 2010 (the “Dodd-Frank Act”), the Company is required to act as a source of financial and managerial strength to the Bank, and to commit resources to support the Bank, even in circumstances where the Company might not do so absent such a requirement. Under current federal law, the FRB may require a bank holding company to make capital injections into a troubled subsidiary bank. It may charge the bank holding company with engaging in unsafe and unsound practices if the bank holding company fails to commit resources to such a subsidiary bank or if it undertakes actions that the FRB believes might jeopardize the bank holding company’s ability to commit resources to such subsidiary bank.

With certain exceptions, the BHC Act prohibits a bank holding company from engaging in (or acquiring direct or indirect control of more than 5 percent of the voting shares of any company engaged in) nonbanking activities. One of the principal exceptions to this prohibition is for activities deemed by the FRB to be “closely related to banking.” Under current regulations, bank holding companies and their subsidiaries are permitted to engage in such banking-related business ventures as consumer finance; equipment leasing; credit life insurance; computer service bureau and software operations; mortgage banking; and securities brokerage.

Under the BHC Act, certain well-managed and well-capitalized bank holding companies may elect to be treated as a “financial holding company” and, as a result, be permitted to engage in a broader range of activities that are “financial in nature” and in activities that are determined to be incidental or complementary to activities that are financial in nature. These activities include underwriting; dealing in and making a market in securities; insurance underwriting, and merchant banking. Banks may also engage through financial subsidiaries in certain of the activities permitted for financial holding companies, subject to certain conditions. The Company has not elected to become a financial holding company and its subsidiary bank has not elected to form financial subsidiaries.

The Bank and the subsidiaries of the Bank may generally engage in activities that are permissible activities for state chartered banks under Indiana banking law, without regard to the limitations that might apply to such activities under the BHC Act if the Company were to engage directly in such activities at the parent company level or through parent company subsidiaries that were not also bank subsidiaries.

Indiana law and the BHC Act restrict certain types of expansion by the Company and its bank subsidiary. The Company and its subsidiaries may be required to apply for prior approval from (or give prior notice and an opportunity for review to) the FRB, the DFI, and/or other bank regulatory or other regulatory agencies, as a condition to the acquisition or establishment of new offices, or the acquisition (by merger or consolidation, purchase or otherwise) of the stock, business or properties of other banks or other companies.

The earnings of commercial banks and their holding companies are affected not only by general economic conditions but also by the policies of various governmental regulatory authorities. In particular, the FRB regulates money and credit conditions and interest rates in order to influence general economic conditions, primarily through open-market operations in U.S. Government securities, varying the discount rate on bank borrowings, and setting reserve requirements against bank deposits. These policies have a significant influence on overall growth and distribution of bank loans, investments and deposits, and affect interest rates charged on loans and earned on investments or paid for time and savings deposits. FRB monetary policies have had a significant effect on the operating results of commercial banks in the past and this is expected to continue in the future. The general effect, if any, of such policies upon the future business and earnings of the Company cannot accurately be predicted.

Capital Requirements

The FRB has issued risk-based capital ratio and leverage ratio guidelines for bank holding companies. Under the guidelines and related policies, bank holding companies must maintain capital sufficient to meet both a risk-based asset ratio test and a leverage ratio test on a consolidated basis. The risk-based ratio is determined by allocating assets and specified off-balance sheet commitments into four weighted categories, with higher weighting assigned to categories perceived as representing greater risk. The risk-based ratio represents total capital divided by total risk-weighted assets. The leverage ratio is core capital divided by total assets adjusted as specified in the guidelines. The Bank is subject to substantially similar capital requirements.

| 5 |

Generally, under the currently applicable guidelines, a financial institution’s capital is divided into two tiers. Institutions that must incorporate market risk exposure into their risk-based capital requirements may also have a third tier of capital in the form of restricted short-term subordinated debt. These tiers are:

| · | Tier 1, or core capital, includes total equity plus qualifying capital securities and minority interests, excluding unrealized gains and losses accumulated in other comprehensive income, and non-qualifying intangible and servicing assets. |

| · | Tier 2, or supplementary capital, includes, among other things, cumulative and limited-life preferred stock, mandatory convertible securities, qualifying subordinated debt, and the allowance for credit losses, up to 1.25% of risk-weighted assets. |

| · | Total Capital is Tier 1 plus Tier 2 capital. |

The FRB and the other federal banking regulators require that all intangible assets (net of deferred tax), except originated or purchased mortgage servicing rights, nonmortgage servicing assets, and purchased credit card relationships, be deducted from Tier 1 capital. However, the total amount of these items included in capital cannot exceed 100% of its Tier 1 capital.

Under the risk-based guidelines to remain “adequately-capitalized,” financial institutions are required to maintain a total risk-based ratio of 8%, with 4% being Tier 1 capital. The appropriate regulatory authority may set higher capital requirements when they believe an institution’s circumstances warrant.

Under the leverage guidelines, financial institutions are required to maintain a Tier 1 leverage ratio of at least 3%. The minimum ratio is applicable only to financial institutions that meet certain specified criteria, including excellent asset quality, high liquidity, low interest rate risk exposure, and the highest regulatory rating. Financial institutions not meeting these criteria are required to maintain a minimum Tier 1 leverage ratio of 4%.

Failure to meet applicable capital guidelines could subject the financial institution to a variety of enforcement remedies available to the federal regulatory authorities. These include limitations on the ability to pay dividends, the issuance by the regulatory authority of a directive to increase capital, and the termination of deposit insurance by the FDIC. In addition, the financial institution could be subject to the measures described below under a regulatory program known as Prompt Corrective Action as applicable to Under-capitalized institutions.

The risk-based capital standards of the FRB and the FDIC specify that evaluations by the banking agencies of a bank’s capital adequacy will include an assessment of the exposure to declines in the economic value of a bank’s capital due to changes in interest rates. These banking agencies issued a joint policy statement on interest rate risk describing prudent methods for monitoring such risk that rely principally on internal measures of exposure and active oversight of risk management activities by senior management.

The Federal Deposit Insurance Corporation Improvements Act (enacted in 1991) (FDICIA) requires federal banking regulatory authorities to take regulatory enforcement actions known as Prompt Corrective Action with respect to depository institutions that do not meet minimum capital requirements. For these purposes, FDICIA establishes five capital tiers: Well-capitalized, Adequately-capitalized, Under-capitalized, Significantly under-capitalized, and Critically under-capitalized.

Throughout 2012, the Company’s consolidated regulatory capital ratios and those of the Bank were in excess of the levels established for Well-capitalized institutions for purposes of the Prompt Corrective Action provisions under FDICIA. An institution is deemed to be Well-capitalized if it has a total risk-based capital ratio of 10% or greater, a Tier 1 risk-based capital ratio of 6% or greater, and a Tier 1 leverage ratio of 5% or greater and is not subject to a regulatory order, agreement, or directive to meet and maintain a specific capital level for any capital measure. For a tabular presentation of our regulatory capital ratios and those of the Bank as of December 31, 2012, see Note 8 to the Company’s consolidated financial statements that are presented in Item 8 of this Report, which Note 8 is incorporated herein by reference.

FDICIA generally prohibits a depository institution from making any capital distribution, including payment of a cash dividend or paying any management fee to its holding company, if the depository institution would become Under-capitalized after such payment. Under-capitalized institutions are also subject to growth limitations and are required by the appropriate federal banking agency to submit a capital restoration plan. If any depository institution subsidiary of a holding company is required to submit a capital restoration plan, the holding company would be required to provide a limited guarantee regarding compliance with the plan as a condition of approval of such plan.

| 6 |

Depending upon the severity of the under capitalization, the Under-capitalized institutions may be subject to a number of requirements and restrictions, including orders to sell sufficient voting stock to become Adequately-capitalized, requirements to reduce total assets, cessation of receipt of deposits from correspondent banks, and restrictions on making any payment of principal or interest on their subordinated debt. Critically under-capitalized institutions are subject to appointment of a receiver or conservator within 90 days of becoming so classified.

Under FDICIA, a depository institution that is not Well-capitalized is generally prohibited from accepting brokered deposits and offering interest rates on deposits higher than the prevailing rate in its market. Since the Bank is Well-capitalized, the FDICIA brokered deposit rule did not adversely affect its ability to accept brokered deposits. The Bank had no such brokered deposits at December 31, 2012. Further, a depository institution or its holding company that is not Well-capitalized will generally not be successful in seeking regulatory approvals that may be necessary in connection with any plan or agreement to expand its business, such as through the acquisition (by merger or consolidation, purchase or otherwise) of the stock, business or properties of other banks or other companies.

Under the Dodd-Frank Act, important changes will be implemented concerning the capital requirements for financial institutions. The Dodd-Frank Act requires U.S. regulators to reform the system under which the safety and soundness of banks and other financial institutions, individually and systemically, are regulated. That reform effort will include the regulation of capital and liquidity. An organization of international banking industry regulators, commonly known as the Basel Committee, published in December 2010 and January 2011 the final texts of reforms on capital and liquidity generally referred to as “Basel III.”

In June 2012, the U.S. federal banking agencies issued three notices of proposed rulemaking, including rulemaking based on Basel III’s framework, that would revise and replace the current regulatory capital rules. The proposals were initially intended to be effective on January 1, 2013, but the agencies have deferred implementation due to the volume of comments related to the proposed rules. In the Basel III notice of proposed rulemaking, the agencies’ proposal included the implementation of a new common equity Tier 1 minimum capital requirement and a higher minimum Tier 1 capital requirement. Common equity is the highest quality equity and most loss absorbing form of capital and establishes the base of Tier 1 common equity as adjusted for minority interests and various deductions. The minimum Tier 1 common equity ratio under Basel III is 4.5%. Depending on the final form of the Basel III capital standards, the outcome of this rulemaking as it affects the Company and its subsidiary bank will likely be a higher capital requirement, greater volatility in the amounts that the Company may record as regulatory capital under the applicable standards, and the elimination (potentially not immediately in the case of the Company but under a multi-year phase-out) of trust preferred instruments (such as certain outstanding subordinated debentures of the Company) in regulatory capital. It is expected that final rules will be issued in 2013.

Future rulemaking and regulatory changes on capital requirements may impact the Company as it continues to grow and evaluate potential mergers and acquisitions.

Restrictions on Bank Dividends or Loans to, or other Transactions with, the Parent Company, and on Parent Company Dividends

German American Bancorp, Inc., which is the publicly-held parent of the Bank (German American Bancorp), is a corporation that is separate and distinct from the Bank and its other subsidiaries. Most of the parent company’s revenues historically have been comprised of dividends, fees, and interest paid to it by the Bank, and this is expected to continue in the future. There are, however, statutory limits under Indiana law on the amount of dividends that the Bank can pay to its parent company without regulatory approval. The Bank may not, without the approval of the DFI, pay a dividend in an amount greater than its undivided profits. In addition, the prior approval of the DFI is required for the payment of a dividend by an Indiana state-chartered bank if the total of all dividends declared in a calendar year would exceed the total of its net income for the year combined with its retained net income for the two preceding years, unless such a payment qualifies under certain exemptive criteria that exempt certain dividend payments by certain qualified banks from the prior approval requirement. At December 31, 2012, the Bank was eligible for payment of dividends under the exemptive criteria established by DFI policy for this purpose, and could have declared and paid to the holding company $26,000,000 of its undivided profits without approval by the DFI in accordance with such criteria. See Note 8 of the Notes to Consolidated Financial Statements included in Item 8 of this Report for further discussion.

In addition, the FRB and other bank regulatory agencies have issued policy statements or advisories that provide that insured banks and bank holding companies should generally only pay dividends out of current operating earnings.

In addition to these statutory restrictions, if, in the opinion of the applicable regulatory authority, a bank under its jurisdiction is engaged in, or is about to engage in, an unsafe or unsound practice, such authority may require, after notice and hearing, that such bank cease and desist from such practice. Accordingly, if the Bank were to experience financial difficulties, it is possible that the applicable regulatory authority could determine that the Bank would be engaged in an unsafe or unsound practice if the Bank were to pay dividends and could prohibit the Bank from doing so, even if availability existed for dividends under the statutory formulae.

| 7 |

Further, the Bank is subject to affiliate transaction restrictions under federal laws, which limit certain transactions generally involving the transfer of funds by a subsidiary bank or its subsidiaries to its parent corporation or any nonbank subsidiary of its parent corporation, whether in the form of loans, extensions of credit, investments, or asset purchases, or otherwise undertaking certain obligations on behalf of such affiliates. Furthermore, covered transactions that are loans and extensions of credit must be secured within specified amounts. In addition, all covered transactions and other affiliate transactions must be conducted on terms and under circumstances that are substantially the same as such transactions with unaffiliated entities.

Other Aspects of the Dodd-Frank Act

The Dodd-Frank Act (in addition to the regulatory changes discussed elsewhere in this “Regulation and Supervision” discussion and below under “Federal Deposit Insurance Premiums and Assessments”) made a variety of changes that will affect the business and affairs of the Company and the Bank in other ways. For instance, the Dodd-Frank Act alters the authority and duties of the federal banking and securities regulatory agencies, implements certain corporate governance requirements for all public companies including financial institutions with regard to executive compensation, proxy access by shareholders, and certain whistleblower provisions; restricts certain proprietary trading and hedge fund and private equity activities of banks and their affiliates; and eliminated the former statutory prohibition against the payment of interest on business checking accounts.

The Dodd-Frank Act also established a new Consumer Financial Protection Bureau (“CFPB”). The CFPB was granted broad rulemaking, supervisory and enforcement powers under various federal consumer financial protection laws, including the Equal Credit Opportunity Act, Truth in Lending Act, Real Estate Settlement Procedures Act, Fair Credit Reporting Act, Fair Debt Collection Act, the Consumer Financial Privacy provisions of the Gramm-Leach-Bliley Act and certain other statutes. The CFPB has examination and primary enforcement authority with respect to depository institutions with $10 billion or more in assets. Smaller institutions are subject to rules promulgated by the CFPB but continue to be examined and supervised by federal banking regulators for consumer compliance purposes. The CFPB has authority to prevent unfair, deceptive or abusive practices in connection with the offering of consumer financial products. The Dodd-Frank Act authorized the CFPB to establish certain minimum standards for the origination of residential mortgages including a determination of the borrower’s ability to repay. In addition, Dodd-Frank allows borrowers to raise certain defenses to foreclosure if they receive any loan other than a “qualified mortgage” as defined by the CFPB. The Dodd-Frank Act permits states to adopt consumer protection laws and standards that are more stringent than those adopted at the federal level and, in certain circumstances, permits state attorneys general to enforce compliance with both the state and federal laws and regulations.

The Dodd-Frank Act requires the issuance of many implementing regulations that will take effect over several years, making it difficult to anticipate the overall impact to us, our customers, or the financial industry more generally. For instance, the FRB is directed by the Dodd-Frank Act to adopt regulations that will limit the amount of interchange fees that can be charged to a consumer in an electronic debit card transaction to the “reasonable and proportionate” incremental cost of the transaction. As required by the Dodd-Frank Act, the FRB adopted a rule, effective October 1, 2011, which limits interchange fees on debit card transactions to a maximum of 21 cents per transaction plus 5 basis points of the transaction amount. A debit card issuer may recover an additional one cent per transaction for fraud prevention purposes if the issuer complies with certain fraud-related requirements prescribed by the Federal Reserve Board. Although banks under $10 billion in asset size (like the Bank) are exempt from the interchange fee limit of this FRB rule, the Bank contracts with large debit card processors with which management of the Bank will have relatively weak bargaining power. It is therefore possible that these processors will earn lower revenues, leaving less revenue per transaction for the Bank.

While the overall impact of the Dodd-Frank Act on the banking industry in general, and on the Company and the Bank in particular, cannot be predicted with any degree of certainty, we believe that the Company and the Bank are likely to be negatively impacted by the Dodd-Frank Act primarily in the areas of capital requirements and, restrictions on fees, and other charges to customers.

Certain Other Laws and Regulations

In November 2009, the FRB amended its Regulation E under the Electronic Fund Transfer Act to prohibit banks from charging overdraft fees for ATM or point-of-sale debit card transactions that overdrew the account unless the customer opt-in to the discretionary overdraft service and to require banks to explain the terms of their overdraft services and their fees for the services. Compliance with this Regulation E amendment was required by July 1, 2010.

The Community Reinvestment Act of 1977, or the CRA, requires depository institutions to assist in meeting the credit needs of their market areas consistent with safe and sound banking practice. Under the CRA, each depository institution is required to help meet the credit needs of its market areas by, among other things, providing credit to low- and moderate-income individuals and communities. These factors are also considered in evaluating mergers, acquisitions and applications to open a branch or facility. The applicable federal regulators regularly conduct CRA examinations to assess the performance of financial institutions and assign one of four ratings to the institution’s records of meeting the credit needs of its community. During its last examination, a rating of “satisfactory” was received by the Bank.

| 8 |

In accordance with the Gramm-Leach-Bliley Financial Modernization Act of 1999, or the GLB Act, federal banking regulators adopted rules that limit the ability of banks and other financial institutions to disclose non-public information about consumers to nonaffiliated third parties. These limitations require disclosure of privacy policies to consumers and, in some circumstances, allow consumers to prevent disclosure of certain personal information to a nonaffiliated third party. The privacy provisions of the GLB Act affect how consumer information is transmitted through diversified financial companies and conveyed to outside vendors.

A major focus of governmental policy on financial institutions over the past decade has been combating money laundering and terrorist financing. The USA PATRIOT Act of 2001, or the USA Patriot Act, substantially broadened the scope of United States anti-money laundering laws and regulations by imposing significant new compliance and due diligence obligations, creating new crimes and penalties and expanding the extra-territorial jurisdiction of the United States. The U.S. Treasury Department has issued a number of regulations that apply various requirements of the USA Patriot Act to financial institutions such as the Bank. These regulations impose obligations on financial institutions to maintain appropriate policies, procedures and controls to detect, prevent and report money laundering and terrorist financing and to verify the identity of their customers. Failure of a financial institution to maintain and implement adequate programs to combat money laundering and terrorist financing, or to comply with all of the relevant laws or regulations, could have serious legal and reputational consequences for the institution.

The United States has imposed economic sanctions that affect transactions with designated foreign countries, nationals and others. These are typically known as the “OFAC” rules based on their administration by the U.S. Treasury Department Office of Foreign Assets Control (“OFAC”). The OFAC-administered sanctions targeting countries take many different forms. Generally, however, they contain one or more of the following elements: (i) restrictions on trade with or investment in a sanctioned country, including prohibitions against direct or indirect imports from and exports to a sanctioned country and prohibitions on “U.S. persons” engaging in financial transactions relating to making investments in, or providing investment-related advice or assistance to, a sanctioned country; and (ii) a blocking of assets in which the government or specially designated nationals of the sanctioned country have an interest, by prohibiting transfers of property subject to U.S. jurisdiction (including property in the possession or control of U.S. persons). Blocked assets (e.g., property and bank deposits) cannot be paid out, withdrawn, set off or transferred in any manner without a license from OFAC. Failure to comply with these sanctions could have serious legal and reputational consequences.

Federal Deposit Insurance Premiums and Assessments

The Bank’s deposits are insured up to applicable limits by the Deposit Insurance Fund, or the DIF, of the FDIC and are subject to deposit insurance premiums and assessments to maintain the DIF. Like every other insured institution, the Bank’s deposit insurance premium assessment rate depends on the capital category and supervisory category to which it is assigned. The FDIC has authority to raise or lower assessment rates on insured banks in order to achieve statutorily required reserve ratios in the DIF and to impose special additional assessments.

In addition, the Deposit Insurance Fund Act of 1996 authorizes the Financing Corporation (“FICO”) to impose assessments on all DIF assessable deposits in order to service the interest on FICO’s bond obligations. The amount assessed each FDIC-insured institution is in addition to the amount, if any, paid for deposit insurance under the FDIC’s risk-related assessment rate schedule. FICO assessment rates may be adjusted quarterly to reflect a change in assessment base. These assessments will continue until the FICO bonds mature in 2019.

With the enactment of the Dodd-Frank Act, major changes were introduced to the FDIC deposit insurance system. The Dodd-Frank Act permanently increased the basic FDIC insurance coverage for deposit accounts to a maximum amount of $250,000. Further, under the Dodd-Frank Act, (1) the minimum “designated reserve ratio” for the DIF (a measure of the adequacy of the DIF’s reserves) was increased to 1.35 percent (from the former minimum of 1.15 percent, thereby almost certainly requiring that the FDIC increase assessments on the banking industry to obtain the additional reserves for the DIF) and the upper limit on the designated reserve ratio (which was formerly capped at 1.5 percent and therefore operated as a cap on the size of the DIF) was removed; (2) the DIF reserve ratio was required to reach 1.35 percent by September 30, 2020 (rather than 1.15 percent by the end of 2016, as formerly required); (3) the FDIC was required, in setting future assessments, to “offset the effect of [requiring that the reserve ratio reach 1.35 percent by September 30, 2020 rather than 1.15 percent by the end of 2016] on insured depository institutions with total consolidated assets of less than $10,000,000,000”; and (4) the FDIC was required to amend its regulations to redefine the assessment base used for calculating deposit insurance assessments from a deposit-based formula to a formula that, with some possible exceptions, would assess insured institutions on the basis of an assessment base that would equal average consolidated total assets minus average tangible equity.

| 9 |

As required by the Dodd-Frank Act, the FDIC adopted rules effective April 1, 2011, under which insurance premium assessments are now based on an institution’s total assets minus its tangible equity (defined as Tier 1 capital) instead of its deposits. Under these rules, an institution with total assets of less than $10 billion will be assigned to one of four risk categories based on its capital, supervisory ratings and other factors. Well-capitalized institutions that are financially sound with only a few minor weaknesses are assigned to Risk Category I. Risk Categories II, III and IV present progressively greater risks to the DIF. A range of initial base assessment rates applies to each Risk Category, subject to adjustment downward based on unsecured debt issued by the institution and, except for an institution in Risk Category I, adjustment upward if the institution’s brokered deposits exceed 10% of its domestic deposits, to produce total base assessment rates. Total base assessment rates under the final rules range from 2.5 to 9 basis points for Risk Category I, 9 to 24 basis points for Risk Category II, 18 to 33 basis points for Risk Category III, and 30 to 45 basis points for Risk Category IV, all subject to further adjustment upward if the institution holds more than a de minimis amount of unsecured debt issued by another FDIC-insured institution. The FDIC may increase or decrease its rates by 2.0 basis points without further rulemaking. In an emergency, the FDIC may also impose a special assessment.

Internet Address; Internet Availability of SEC Reports

The Company’s Internet address is www.germanamerican.com.

The Company makes available, free of charge through the Investor Relations – Financial Information section of its Internet website, the Company’s annual report on Form 10-K, its quarterly reports on Form 10-Q, its current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after those reports are filed with or furnished to the SEC.

Forward-Looking Statements and Associated Risks

The Company from time to time in its oral and written communications makes statements relating to its expectations regarding the future. These types of statements are considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements can include statements about the Company’s net interest income or net interest margin; adequacy of allowance for loan losses, and the quality of the Company’s loans, investment securities and other assets; simulations of changes in interest rates; litigation results; dividend policy; acquisitions or mergers; estimated cost savings, plans and objectives for future operations; and expectations about the Company’s financial and business performance and other business matters as well as economic and market conditions and trends. All statements other than statements of historical fact included in this report, including statements regarding our financial position, business strategy and the plans and objectives of our management for future operations, are forward-looking statements. When used in this report, words such as “anticipate”, “believe”, “estimate”, “expect”, “intend”, and similar expressions, as they relate to us or our management, identify forward-looking statements.

Such forward-looking statements are based on the beliefs of our management, as well as assumptions made by and information currently available to our management, and are subject to risks, uncertainties, and other factors.

Actual results may differ materially and adversely from the expectations of the Company that are expressed or implied by any forward-looking statement. The discussions in Item 1A, “Risk Factors,” and in Item 7 of this Form 10-K, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” list some of the factors that could cause the Company’s actual results to vary materially from those expressed or implied by any forward-looking statements. Other risks, uncertainties, and factors that could cause the Company’s actual results to vary materially from those expressed or implied by any forward-looking statement include but not limited to:

| · | the unknown future direction of interest rates and the timing and magnitude of any changes in interest rates; |

| · | changes in competitive conditions; |

| · | the introduction, withdrawal, success and timing of asset/liability management strategies or of mergers and acquisitions and other business initiatives and strategies; |

| · | changes in customer borrowing, repayment, investment and deposit practices; |

| · | changes in fiscal, monetary and tax policies; |

| · | changes in financial and capital markets; |

| 10 |

| · | continued deterioration in general economic conditions, either nationally or locally, resulting in, among other things, credit quality deterioration; |

| · | capital management activities, including possible future sales of new securities, or possible repurchases or redemptions by the Company of outstanding debt or equity securities; |

| · | risks of expansion through acquisitions and mergers, such as unexpected credit quality problems of the acquired loans or other assets, unexpected attrition of the customer base of the acquired institution or branches, and difficulties in integration of the acquired operations; |

| · | factors driving impairment charges on investments; |

| · | the impact, extent and timing of technological changes; |

| · | litigation liabilities, including related costs, expenses, settlements and judgments, or the outcome of matters before regulatory agencies, whether pending or commencing in the future; |

| · | actions of the FRB; |

| · | changes in accounting principles and interpretations; |

| · | potential increases of federal deposit insurance premium expense, and possible future special assessments of FDIC premiums, either industry wide or specific to the Company’s banking subsidiary; |

| · | actions of the regulatory authorities under the Dodd-Frank Act and the Federal Deposit Insurance Act and other possible legislative and regulatory actions and reforms; and |

| · | the continued availability of earnings and excess capital sufficient for the lawful and prudent declaration and payment of cash dividends. |

Such statements reflect our views with respect to future events and are subject to these and other risks, uncertainties and assumptions relating to the operations, results of operations, growth strategy and liquidity of the Company. Readers are cautioned not to place undue reliance on these forward-looking statements. It is intended that these forward-looking statements speak only as of the date they are made. We do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect future events or circumstances or to reflect the occurrence of unanticipated events.

Item 1A. Risk Factors.

While we have a history of profitability and operate with capital that exceeds the requirements of bank regulatory agencies, the financial services industry in which we operate was adversely affected by the severe recession that commenced in 2008, and our industry is continuing to be affected by continuing weak economic conditions throughout the United States. The following describes some of the principal risks and uncertainties to which our industry in general, and we and our assets and businesses specifically, are subject; other risks are briefly identified in our cautionary statement that is included under the heading “Forward-Looking Statements and Associated Risks” in Part I, Item 1, “Business.” Although we seek ways to manage these risks and uncertainties and to develop programs to control those that we can, we ultimately cannot predict the future. Future results may differ materially from past results, and from our expectations and plans.

Risks Related to the Financial Services Industry

Banks will be burdened by implementation of the Dodd-Frank Act but the impact on banks will be uneven and uncertain.

Although it is difficult to predict the extent to which the Dodd-Frank Act or the resulting rules and regulations will impact our business, compliance with these new laws and regulations has already resulted in additional costs for banks and may result in additional costs, which could be significant. Further, the proposed new capital adequacy and liquidity requirements proposed to be adopted by the federal regulatory agencies during 2013 under the Dodd-Frank Act may adversely affect banks. Further, Dodd-Frank Act’s restrictions on permissible customer fees (including electronic bank debit card interchange fees) and other charges to customers have impacted and are expected to continue to impact banking organizations. While we believe that the burdens of the Dodd-Frank Act will fall more heavily on large banks than on smaller community banking organizations like the Company, we expect that the Company will also feel these burdens to some degree.

| 11 |

Changes in regulations may increase the amount of capital that banks must maintain which could hurt our profitability and have other adverse effects.

If a significant tightening of U.S. capital requirements is made by the FRB and the other banking agencies (whether in 2013, as proposed, or in the years that follow) under the Dodd-Frank Act, and if that tightening significantly affects America’s smaller community banks as well as the large “money center banks,” one effect might be to increase our cost of capital, which in turn might have adverse impacts on the profitability of many of our products, the types of products we could offer profitably, our overall profitability, and our overall growth opportunities, among other things. Other potential effects could include less ability to pay cash dividends and repurchase our common shares, higher dilution of common shareholders, and a higher risk that we might fall below regulatory capital thresholds in an adverse economic cycle.

We operate in a highly regulated environment and changes in laws and regulations to which we are subject may adversely affect our results of operations.

The banking industry in which we operate is subject to extensive regulation and supervision under federal and state laws and regulations. The restrictions imposed by such laws and regulations limit the manner in which we conduct our business, undertake new investments and activities and obtain financing. These regulations are designed primarily for the protection of the deposit insurance funds and consumers and not to benefit our shareholders. Financial institution regulation has been the subject of significant legislation in recent years, including the Dodd-Frank Act, and may be the subject of further significant legislation, none of which is in our control. Significant new laws or changes in, or repeals of, existing laws (including changes in federal or state laws affecting corporate taxpayers generally or financial institutions specifically) could have a material adverse effect on our business, financial condition, results of operations or liquidity. Further, federal monetary policy, particularly as implemented through the Federal Reserve System, significantly affects credit conditions, and any unfavorable change in these conditions could have a material adverse effect on our business, financial condition, results of operations or liquidity.

Our FDIC insurance premiums may increase, and special assessments could be made, which might negatively impact our results of operations.

High levels of insured institution failures have significantly increased losses to the Deposit Insurance Fund of the FDIC since 2008. Further, the basic amount of deposit insurance per deposit account was permanently increased by the Dodd-Frank Act, and the Dodd-Frank Act mandates the FDIC to increase the level of its reserves for future losses in its Deposit Insurance Fund. Since the Deposit Insurance Fund is funded by premiums and assessments paid by insured banks, our FDIC insurance premium expense may increase in future years depending upon the FDIC’s actual loss experience, changes in our Bank’s financial condition or capital strength, and future conditions in the banking industry.

Risks Related to Our Operations and Business and Financial Strategies

Continuing economic weakness could negatively affect us.

Our performance could be negatively affected to the extent that continuing weaknesses in business and economic conditions have direct or indirect material adverse impacts on us, or on our customers or on the financial institutions with whom we deal as counterparties to financial transactions. These conditions could result in one or more of the following:

| · | a decrease in the demand for loans and other products and services offered by us; |

| · | a decrease in customer savings generally and in the demand for savings and investment products offered by us; and |

| · | an increase in the number of customers and counterparties who become delinquent, file for protection under bankruptcy laws, or default on their loans or other obligations to us. |

Continued weakness or deterioration in the economy, real estate markets or unemployment rates, particularly in the Southern Indiana markets in which we operate, might place downward pressure on the credit worthiness of our Bank’s customers and their inclinations to borrow. A continued or worsening disruption and volatility could negatively impact customers’ ability to obtain new loans or to repay existing loans, diminish the values of any collateral securing such loans and could cause increases in the number of the Company’s customers experiencing financial distress and in the levels of the Company’s delinquencies, non-performing loans and other problem assets, charge-offs and provision for credit losses, all of which could materially adversely affect our financial condition and results of operations. The underwriting and credit monitoring policies and procedures that we have adopted cannot eliminate the risk that we might incur losses on account of factors relating to the economy like those identified above, and those losses could have a material adverse effect on our business, financial condition, results of operations and cash flows.

| 12 |

If our actual loan losses exceed our estimates, our earnings and financial condition will be impacted.

A significant source of risk for any bank or other enterprise that lends money arises from the possibility that losses will be sustained because borrowers, guarantors and related parties may fail (because of financial difficulties or other reasons) to perform in accordance with the terms of their loan agreements. In our case, we originate many loans that are secured, but some loans are unsecured depending on the nature of the loan. With respect to secured loans, the collateral securing the repayment of these loans includes a wide variety of real and personal property that may be insufficient to cover the obligations owed under such loans, due to adverse changes in collateral values caused by changes in prevailing economic, environmental and other conditions, including declines in the value of real estate and other external events.

We could be adversely affected by changes in interest rates.

Our earnings and cash flows are largely dependent upon our net interest income. Interest rates are highly sensitive to many factors that are beyond our control, including general economic conditions, demand for loans, securities and deposits, and policies of various governmental and regulatory agencies and, in particular, the monetary policies of the FRB. If the interest rates paid on deposits and other borrowings increase at a faster rate than the interest rates received on loans and other investments, our net interest income, and therefore earnings, could be adversely affected. Earnings could also be adversely affected if the interest rates received on loans and other investments fall more quickly than the interest rates paid on deposits and other borrowings. Any substantial, unexpected, prolonged change in market interest rates could have a material adverse effect on our financial condition, results of operations, and cash flows.

Our success is tied to the economic vitality of our Southern Indiana markets.

We conduct business from offices that are exclusively located in thirteen Southern Indiana counties, from which substantially all of our customer base is drawn. Because of the geographic concentration of our operations and customer base, our results depend largely upon economic conditions in this area. If current levels of market disruption and volatility worsen in our primary service areas, the quality of our loan portfolio, and the demand for our products and services, could be adversely affected, and this could have a material adverse effect on our business, financial condition, results of operations or liquidity.

We face substantial competition.

The banking and financial services business in our markets is highly competitive. We compete with much larger regional, national, and international competitors, including competitors that have no (or only a limited number of) offices physically located within our markets, many of which compete with us via Internet and other electronic product and service offerings. In addition, banking and other financial services competitors (including newly organized companies) that are not currently represented by physical locations within our geographic markets could establish office facilities within our markets, including through their acquisition of existing competitors. Developments increasing the nature or level of our competition, or decreasing the effectiveness by which we compete, could have a material adverse effect on our business, financial condition, results of operations or liquidity. See also Part I, Item 1, of this Report, “Business – Competition,” and “Business – Regulation and Supervision.”

The manner in which we report our financial condition and results of operations may be affected by accounting changes.

Our financial condition and results of operations that are presented in our consolidated financial statements, accompanying notes to the consolidated financial statements, and selected financial data appearing in this report, are, to a large degree, dependent upon our accounting policies. The selection of and application of these policies involve estimates, judgments and uncertainties that are subject to change, and the effect of any change in estimates or judgments that might be caused by future developments or resolution of uncertainties could be materially adverse to our reported financial condition and results of operations. In addition, authorities that prescribe accounting principles and standards for public companies from time to time change those principles or standards or adopt formal or informal interpretations of existing principles or standards. Such changes or interpretations (to the extent applicable to us) could result in changes that would be materially adverse to our reported financial condition and results of operations.

Liquidity risk could impair our ability to fund operations and jeopardize our financial condition.

Liquidity is essential to our business. An inability to raise funds through deposits, borrowings, the sale of securities or loans and other sources could have a substantial negative effect on our liquidity. Our access to funding sources in amounts adequate to finance our activities or the terms of which are acceptable to us could be impaired by factors that affect us specifically or the financial services industry or economy in general. Although we have historically been able to replace maturing deposits and borrowings as necessary, we might not be able to replace such funds in the future if, among other things, our results of operations or financial condition or the results of operations or financial condition of our lenders or market conditions were to change.

| 13 |

The value of securities in our investment securities portfolio may be negatively affected by disruptions in securities markets.

Prices and volumes of transactions in the nation’s securities markets can be affected suddenly by economic crises, such as that experienced in the United States and internationally in 2008, or by other national or international crises, such as national disasters, acts of war or terrorism, changes in commodities markets, or instability in foreign governments. Disruptions in securities markets may detrimentally affect the value of securities that we hold in our investment portfolio, such as through reduced valuations due to the perception of heightened credit and liquidity risks. There can be no assurance that declines in market value associated with these disruptions will not result in other than temporary impairments of these assets, which would lead to accounting charges that could have a material adverse effect on our net income and capital levels.

The soundness of other financial institutions could adversely affect us.

Our ability to engage in routine funding transactions could be adversely affected by the actions and commercial soundness of other financial institutions. Financial services companies are interrelated as a result of trading, clearing, counterparty, or other relationships. We have exposure to many different industries and counterparties, and we routinely execute transactions with counterparties in the financial services industry, including brokers and dealers, commercial banks, investment banks, mutual and hedge funds, and other institutional clients. As a result, defaults by, or even rumors or questions about, one or more financial services companies, or the financial services industry generally, have led to market-wide liquidity problems and could lead to losses or defaults by us or by other institutions. Many of these transactions expose us to credit risk in the event of default of our counterparty or client. In addition, our credit risk may be exacerbated when the collateral held by us cannot be realized or is liquidated at prices not sufficient to recover the full amount due us.

We are dependent on key personnel and the loss of one or more of those key personnel could harm our business.

Competition for qualified employees and personnel in the financial services industry (including banking personnel, trust and investments personnel, and insurance personnel) is intense and there are a limited number of qualified persons with knowledge of and experience in our local Southern Indiana markets. Our success depends to a significant degree upon our ability to attract and retain qualified loan origination executives, sales executives for our trust and investment products and services, and sales executives for our insurance products and services. We also depend upon the continued contributions of our management personnel, and in particular upon the abilities of our senior executive management, and the loss of the services of one or more of them could harm our business.

Our controls and procedures may fail or be circumvented.

Management regularly reviews and updates our internal controls, disclosure controls and procedures, and corporate governance policies and procedures. Any system of controls, however well designed and operated, is based in part on certain assumptions and can provide only reasonable, not absolute, assurances that the objectives of the system are met. Any failure or circumvention of our controls and procedures or failure to comply with regulations related to controls and procedures could have a material adverse effect on our business, results of operations, cash flows and financial condition.

We are subject to security and operational risks relating to our use of technology that could damage our reputation and our business.

We rely heavily on communications and information systems to conduct our business. Any failure, interruption or breach in security of these systems could result in failures or disruptions in our customer relationship management, general ledger, deposit, loan and other systems. The occurrence of any failures, interruptions or security breaches of information systems used to process customer transactions could damage our reputation, result in a loss of customer business, subject us to additional regulatory scrutiny, or expose us to civil litigation and possible financial liability.

We are exposed to risk of environmental liabilities with respect to properties to which we take title.

In the course of our business, we may own or foreclose and take title to real estate, and could be subject to environmental liabilities with respect to these properties (including liabilities for property damage, personal injury, investigation and clean-up costs incurred by these parties in connection with environmental contamination), or may be required to investigate or clean up hazardous or toxic substances, or chemical releases at a property.

| 14 |

Any acquisitions of banks, bank branches, or loans or other financial service assets pose risks to us.

We may buy banks, bank branches and other financial-service-related businesses and assets in the future. Acquiring other banks, businesses, or branches involves various risks commonly associated with acquisitions, including, among other things:

| · | potential exposure to unknown or contingent liabilities of the acquired assets, operations or company; |

| · | exposure to potential asset quality issues of the acquired assets, operations or company; |

| · | environmental liability with acquired real estate collateral or other real estate; |

| · | difficulty and expense of integrating the operations, systems and personnel of the acquired assets, operations or company; |

| · | potential disruption to our ongoing business, including diversion of our management’s time and attention; |

| · | the possible loss of key employees and customers of the acquired operations or company; |

| · | difficulty in estimating the value of the acquired assets, operations or company; and |

| · | potential changes in banking or tax laws or regulations that may affect the acquired assets, operations or company. |

We may not be successful in overcoming these risks or any other problems encountered in connection with mergers or acquisitions.

Acquisitions typically involve the payment of a premium over book and market values, and, therefore, some dilution of the Company’s tangible book value per common share or net income per common share (or both) may occur in connection with any future transaction. Furthermore, failure to realize the expected revenue increases, cost savings, increases in geographic or product presence, and/or other projected benefits from an acquisition could have a material adverse effect on our financial condition and results of operations.

We may participate in FDIC-assisted acquisitions, which could present additional risks to our financial condition.

We may make opportunistic whole or partial acquisitions of troubled financial institutions in transactions facilitated by the FDIC. In addition to the risks frequently associated with acquisitions, an acquisition of a troubled financial institution may involve a greater risk that the acquired assets underperform compared to our expectations. Because these acquisitions are structured in a manner that would not allow us the time normally associated with preparing for and evaluating an acquisition, including preparing for integration of an acquired institution, we may face additional risks including, among other things, the loss of customers, strain on management resources related to collection and management of problem loans and problems related to integration of personnel and operating systems. Additionally, while the FDIC may agree to assume certain losses in transactions that it facilitates, there can be no assurances that we would not be required to raise additional capital as a condition to, or as a result of, participation in an FDIC-assisted transaction. Any such transactions and related issuances of stock may have dilutive effect on earnings per share and share ownership.

Item 1B. Unresolved Staff Comments. None.

Item 2. Properties.

The Company’s executive offices are located in the main office building of the Bank at 711 Main Street, Jasper, Indiana. The main office building, which is owned by the Bank and also serves as the main office of the Company’s other subsidiaries, contains approximately 23,600 square feet of office space. The Bank and the Company’s other subsidiaries also conduct their operations from 38 other locations in Southern Indiana of which 30 are owned by the Company and eight are leased from third parties.

Item 3. Legal Proceedings.

There are no material pending legal proceedings, other than routine litigation incidental to the business of the Company’s subsidiaries, to which the Company or any of its subsidiaries is a party or of which any of their property is the subject.

Item 4. Mine Safety Disclosures.

Not applicable.

| 15 |

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market and Dividend Information

German American Bancorp, Inc.’s stock is traded on NASDAQ’s Global Select Market under the symbol GABC. The quarterly high and low closing prices for the Company’s common stock as reported by NASDAQ and quarterly cash dividends declared and paid are set forth in the table below.

| 2012 | 2011 | |||||||||||||||||||||||

| Cash | Cash | |||||||||||||||||||||||

| High | Low | Dividend | High | Low | Dividend | |||||||||||||||||||

| Fourth Quarter | $ | 24.10 | $ | 19.98 | $ | 0.14 | $ | 19.49 | $ | 15.28 | $ | 0.14 | ||||||||||||

| Third Quarter | $ | 24.89 | $ | 19.76 | $ | 0.14 | $ | 17.50 | $ | 14.65 | $ | 0.14 | ||||||||||||

| Second Quarter | $ | 20.50 | $ | 17.94 | $ | 0.14 | $ | 17.58 | $ | 15.61 | $ | 0.14 | ||||||||||||

| First Quarter | $ | 21.74 | $ | 18.43 | $ | 0.14 | $ | 18.88 | $ | 16.00 | $ | 0.14 | ||||||||||||

| $ | 0.56 | $ | 0.56 | |||||||||||||||||||||

The Common Stock was held of record by approximately 3,438 shareholders at March 1, 2013.

Cash dividends paid to the Company’s shareholders are primarily funded from dividends received by the parent company from its bank subsidiary. The declaration and payment of future dividends will depend upon the earnings and financial condition of the Company and its subsidiaries, general economic conditions, compliance with regulatory requirements affecting the ability of the bank subsidiary and the Company to declare dividends, (for further discussion of such requirements, see Item 1, “Business - Regulation and Supervision - Restrictions on Bank Dividends or Loans to, or other Transactions with, the Parent Company and Parent Company Dividends”), and other factors.

| Transfer Agent: | Computershare | Shareholder | Terri A. Eckerle | |

| Priority Processing | Information and | German American Bancorp, Inc. | ||

| 250 Royall St | Corporate Office: | P. O. Box 810 | ||

| Canton, MA 02021 | Jasper, Indiana 47547-0810 | |||

| Contact: Shareholder Relations | (812) 482-1314 | |||

| (800) 884-4225 | (800) 482-1314 |

| 16 |

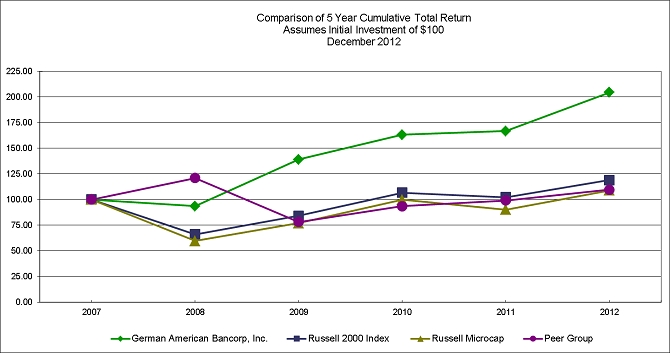

Stock Performance Graph

The following graph compares the Company’s five-year cumulative total returns with those of the Russell 2000 Stock Index, Russell Microcap Stock Index, and the Indiana Bank Peer Group. The Indiana Bank Peer Group (which is a custom peer group identified by Company management) includes all Indiana-based commercial bank holding companies (excluding companies owning thrift institutions that are not regulated as bank holding companies) that have been in existence as commercial bank holding companies throughout the five-year period ended December 31, 2012, the stocks of which have been traded on an established securities market (NYSE, AMEX, NASDAQ) throughout that five-year period. The companies comprising the Indiana Bank Peer Group for purposes of the December 2012 comparison were: 1st Source Corp., Community Bank Shares of IN, First Financial Corp., First Merchants Corp., Lakeland Financial Corp., MainSource Financial Group, Old National Bancorp, Horizon Bancorp, and Tower Financial Corp. The returns of each company in the Indiana Bank Peer Group have been weighted to reflect the company’s market capitalization. The Russell 2000 Stock Index, which is designed to measure the performance of the small-cap segment of the U.S. equity universe, is a subset of the Russell 3000 Index (which measures the performance of the largest 3,000 U.S. companies) that includes approximately 2,000 of the smallest securities in that index based on a combination of their market cap and current index membership, and is annually reconstituted at the end of each June. The Russell Microcap Stock Index is an index representing the smallest 1,000 securities in the small-cap Russell 2000 Index plus the next 1,000 securities, which is also annually reconstituted at the end of each June. The Company’s stock is currently included in the Russell 2000 Index and Russell Microcap Index.

Stock Repurchase Program Information

The following table sets forth information regarding the Company’s purchases of its common shares during each of the three months ended December 31, 2012.

| Total | Maximum Number | |||||||||||||||

| Number | Total Number of Shares | (or Approximate Dollar | ||||||||||||||

| of Shares | Average Price | (or Units) Purchased as Part | Value) of Shares (or Units) | |||||||||||||

| (or Units) | Paid Per Share | of Publicly Announced Plans | that May Yet Be Purchased | |||||||||||||

| Period | Purchased | (or Unit) | or Programs | Under the Plans or Programs (1) | ||||||||||||

| October 2012 | — | — | — | 272,789 | ||||||||||||

| November 2012 | — | — | — | 272,789 | ||||||||||||

| December 2012 | — | — | — | 272,789 | ||||||||||||

(1) On April 26, 2001, the Company announced that its Board of Directors had approved a stock repurchase program for up to 607,754 of its outstanding common shares, of which the Company had purchased 334,965 common shares through December 31, 2012 (both such numbers adjusted for subsequent stock dividends). The Board of Directors established no expiration date for this program. The Company purchased no shares under this program during the quarter ended December 31, 2012.

| 17 |

Item 6. Selected Financial Data.

The following selected data should be read in conjunction with the consolidated financial statements and related notes that are included in Item 8 of this Report, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which is included in Item 7 of this Report (dollars in thousands, except per share data). Year-to-year financial information comparability is affected by the acquisition accounting treatment for mergers and acquisitions, including but not limited to the Company’s acquisitions of two branches of another bank in May 2010 and the Company’s acquisition of American Community Bancorp, Inc., effective January 1, 2011.

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| Summary of Operations: | ||||||||||||||||||||

| Interest Income | $ | 77,160 | $ | 80,161 | $ | 64,193 | $ | 63,736 | $ | 67,845 | ||||||||||

| Interest Expense | 10,912 | 16,180 | 15,522 | 19,223 | 26,908 | |||||||||||||||

| Net Interest Income | 66,248 | 63,981 | 48,671 | 44,513 | 40,937 | |||||||||||||||

| Provision for Loan Losses | 2,412 | 6,800 | 5,225 | 3,750 | 3,990 | |||||||||||||||

| Net Interest Income after Provision | ||||||||||||||||||||

| For Loan Losses | 63,836 | 57,181 | 43,446 | 40,763 | 36,947 | |||||||||||||||

| Non-interest Income | 21,811 | 21,576 | 16,943 | 15,859 | 18,210 | |||||||||||||||

| Non-interest Expense | 50,923 | 50,782 | 41,361 | 40,391 | 36,716 | |||||||||||||||

| Income before Income Taxes | 34,724 | 27,975 | 19,028 | 16,231 | 18,441 | |||||||||||||||

| Income Tax Expense | 10,669 | 7,726 | 5,623 | 4,013 | 5,638 | |||||||||||||||

| Net Income | $ | 24,055 | $ | 20,249 | $ | 13,405 | $ | 12,218 | $ | 12,803 | ||||||||||

| Year-end Balances: | ||||||||||||||||||||

| Total Assets | $ | 2,006,300 | $ | 1,873,767 | $ | 1,375,888 | $ | 1,242,965 | $ | 1,190,828 | ||||||||||

| Total Loans, Net of Unearned Income | 1,204,866 | 1,120,993 | 917,236 | 877,822 | 890,436 | |||||||||||||||

| Total Deposits | 1,640,931 | 1,556,198 | 1,087,286 | 969,643 | 941,750 | |||||||||||||||

| Total Long-term Debt | 89,472 | 90,974 | 81,016 | 113,320 | 105,608 | |||||||||||||||

| Total Shareholders’ Equity | 185,026 | 167,610 | 121,534 | 113,549 | 105,174 | |||||||||||||||

| Average Balances: | ||||||||||||||||||||

| Total Assets | $ | 1,934,123 | $ | 1,823,703 | $ | 1,330,540 | $ | 1,230,596 | $ | 1,174,583 | ||||||||||

| Total Loans, Net of Unearned Income | 1,147,891 | 1,114,181 | 906,127 | 891,322 | 880,630 | |||||||||||||||

| Total Deposits | 1,618,712 | 1,521,204 | 1,046,295 | 963,928 | 922,137 | |||||||||||||||

| Total Shareholders’ Equity | 177,207 | 159,765 | 119,867 | 109,887 | 99,711 | |||||||||||||||

| Per Share Data (1): | ||||||||||||||||||||

| Net Income | $ | 1.91 | $ | 1.61 | $ | 1.21 | $ | 1.10 | $ | 1.16 | ||||||||||

| Cash Dividends | 0.56 | 0.56 | 0.56 | 0.56 | 0.56 | |||||||||||||||

| Book Value at Year-end | 14.64 | 13.31 | 10.94 | 10.25 | 9.54 | |||||||||||||||

| Other Data at Year-end: | ||||||||||||||||||||

| Number of Shareholders | 3,105 | 3,221 | 3,194 | 3,364 | 3,684 | |||||||||||||||

| Number of Employees | 439 | 417 | 359 | 332 | 348 | |||||||||||||||

| Weighted Average Number of Shares (1) | 12,622,049 | 12,581,646 | 11,098,836 | 11,065,917 | 11,029,519 | |||||||||||||||

| Selected Performance Ratios: | ||||||||||||||||||||

| Return on Assets | 1.24 | % | 1.11 | % | 1.01 | % | 0.99 | % | 1.09 | % | ||||||||||

| Return on Equity | 13.57 | % | 12.67 | % | 11.18 | % | 11.12 | % | 12.84 | % | ||||||||||

| Equity to Assets | 9.22 | % | 8.95 | % | 8.83 | % | 9.14 | % | 8.83 | % | ||||||||||

| Dividend Payout | 29.38 | % | 34.80 | % | 46.36 | % | 50.71 | % | 48.25 | % | ||||||||||

| Net Charge-offs to Average Loans | 0.19 | % | 0.43 | % | 0.32 | % | 0.25 | % | 0.29 | % | ||||||||||